- SoFi and the Rise of Neobanking: Revolutionizing Personal Finance

- Factors Affecting SoFi-like Neobanking App Development Cost

- Features and App Complexity

- User Experience and Design

- Development Team

- Safety and Adherence to Compliances

- Opting for the Right Technology Stack

- Integrations with Third Parties

- Regulatory and Legal Expenses

- Infrastructure and Hosting

- Key Features of Neobank App Like SoFi

- Exploring Advanced Features in a Neobank App Like SoFi: Unveiling Cutting-Edge Functionality

- How to Develop a Neobank App Like SoFi: A Step-by-Step Process

- Conduct Thorough Market Research

- Develop Concept and Design

- Build Your Neobanking App

- Integrate Third-Party Services Efficiently

- Adhere to Legal and Regulatory Standards

- Perform Comprehensive Testing

- Launch Your Neobank App

- Provide Ongoing Maintenance and Support

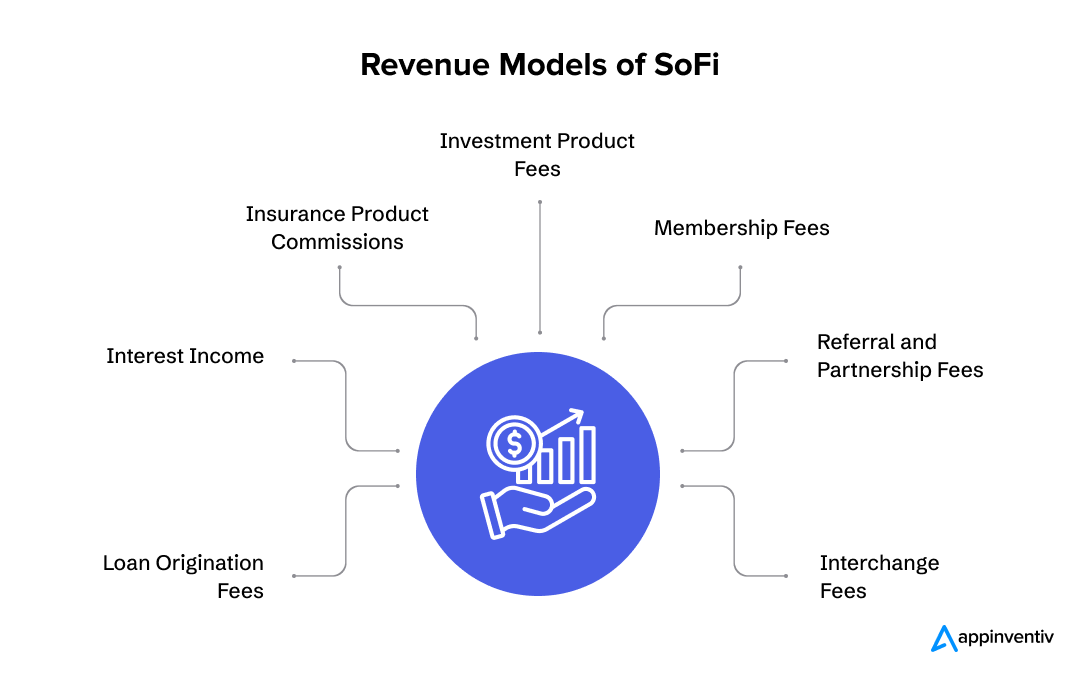

- Exploring Revenue Models of a Neobanking App Like SoFi

- Loan Origination Fees

- Interest Income

- Insurance Product Commissions

- Investment Product Fees

- Membership Fees

- Referral and Partnership Fees

- Interchange Fees

- Craft a SoFi-Like Neobank With Appinventiv's Innovative Development Approach

- FAQs

In this rapidly transforming financial ecosystem, neobanking apps like SoFi have emerged as pioneers, fundamentally altering the user’s relationship with money management. These innovative FinTech companies have redefined traditional banking by prioritizing convenience and transparency. With a strong focus on customer satisfaction and innovation, neobanks provide a wide range of services, including payments, transfers, investments, and loans, accessible through mobile devices.

SoFi, an early leader in this sector, initially specialized in student loan refinancing but has since expanded its services to become a comprehensive financial services provider. This evolution reflects a larger trend toward digital-first banking, emphasizing seamless experiences and tailored solutions.

Other than SoFi, neobanks like Chime, Monzo, and Revolut are also transforming the financial landscape. These digital-first banks provide innovative banking services, focusing on user-friendly interfaces, low fees, and personalized financial management tools to meet the evolving needs of modern consumers.

While neobanking apps offer unparalleled convenience, developing one involves significant costs due to the need for advanced technology integration and strict adherence to regulatory compliance. The cost to build an app like SoFi can range from $40,000 to $300,000 or more; depending on the app’s complexity and scale. However, the potential for innovation and disruption in the financial industry makes this investment worthwhile for many companies.

In this blog, we will explore how a neobanking app like SoFi operates, its cost factors, key features, development steps, and monetization strategies. Let’s dive in!

SoFi and the Rise of Neobanking: Revolutionizing Personal Finance

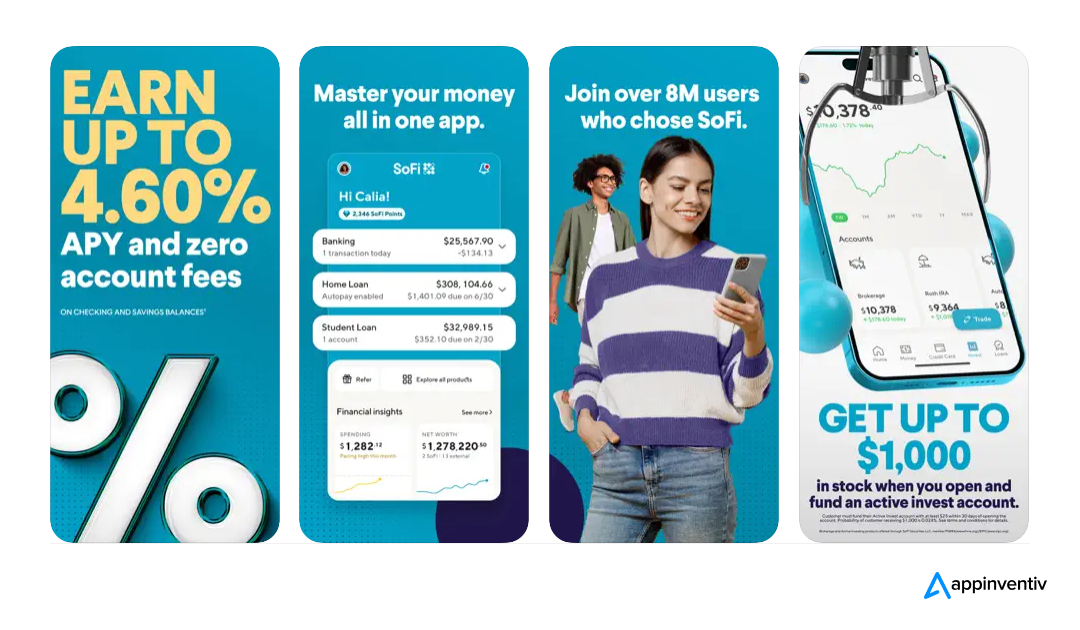

SoFi, short for Social Finance, is a one-stop finance app that provides an array of financial products and services. Established in 2011, SoFi has revolutionized the traditional banking by leveraging technology to offer enhanced financial solutions for its customers.

It utilizes AI-driven algorithms for personalized financial advice and leverages blockchain for enhanced transaction security, setting new standards in digital banking. Users can conveniently create accounts via the app, which includes features like mobile check deposits, bill payments, and budget management tools. These digital banks often offer better interest rates on savings and reduced fees, attributed to their lack of physical branches.

They prioritize user experience, providing intuitive interfaces and tailored financial guidance. The goal of neobanking apps like SoFi is to streamline banking processes and offer a more personalized and user-friendly financial management experience.

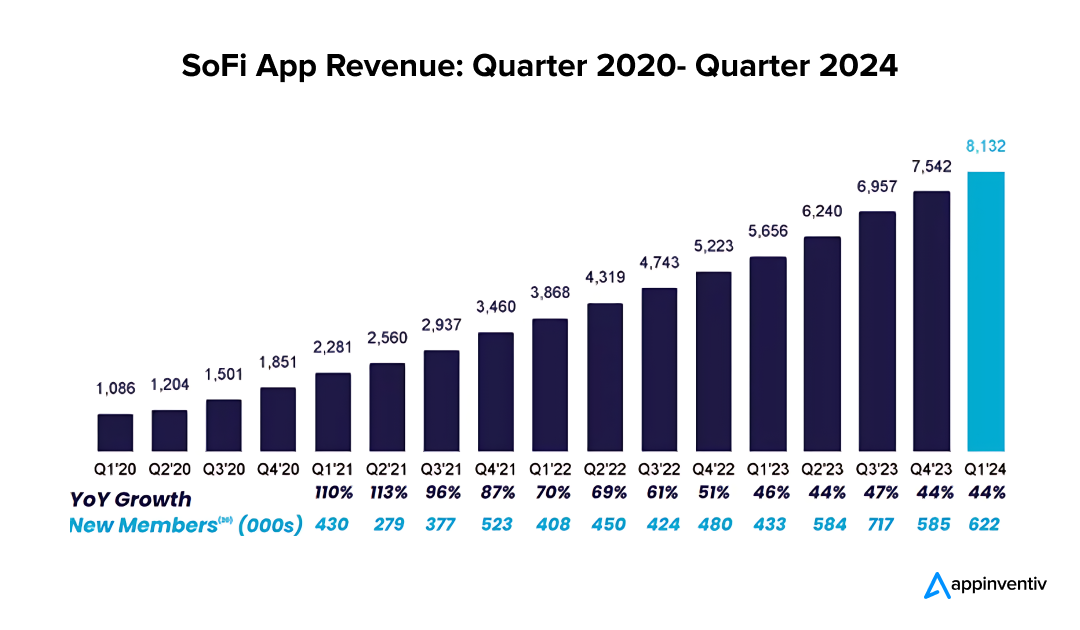

SoFi has achieved impressive market growth, driven by its diverse range of financial products and innovative banking approach throughout these years. The company’s revenue is bolstered by services such as student loan refinancing, personal loans, mortgages, investing, and banking.

As per the Nasdaq report, a key factor in SoFi’s success is its expanding customer base, which grew to 8.1 million in the recent quarter, a 44% increase from the previous year. Additionally, deposits rose by 16%, owing to the appealing 4.6% annual percentage yield offered by SoFi Money.

By focusing on user experience with intuitive interfaces and personalized financial guidance, SoFi effectively attracts and retains customers. The company expects to add 2.3 million new members this year, representing a 30% growth. These factors together drive SoFi’s market revenue and reinforce its position as a leading neobank.

A Gartner report projects that in the next few years, more than 30% of high-revenue banks will introduce their own Banking-as-a-Service (BaaS) platforms, including neobanks, to generate additional income. The appeal and significance of neobanks are demonstrated by the success of the UK-based Zopa, which recently secured $93 million in funding, elevating its valuation to over $1 billion. Such substantial financial support highlights the strong trust and profitability potential in the neobanking sector.

This presents a great opportunity for stakeholders to invest in SoFi mobile banking app development. Developing a neobanking app could result in significant rewards due to the FinTech industry’s rapid expansion and consumer demand for digital banking solutions. New players can get a large market share and prosper in the changing financial landscape by utilizing cutting-edge technologies, emphasizing user experience, and providing competitive financial products.

Factors Affecting SoFi-like Neobanking App Development Cost

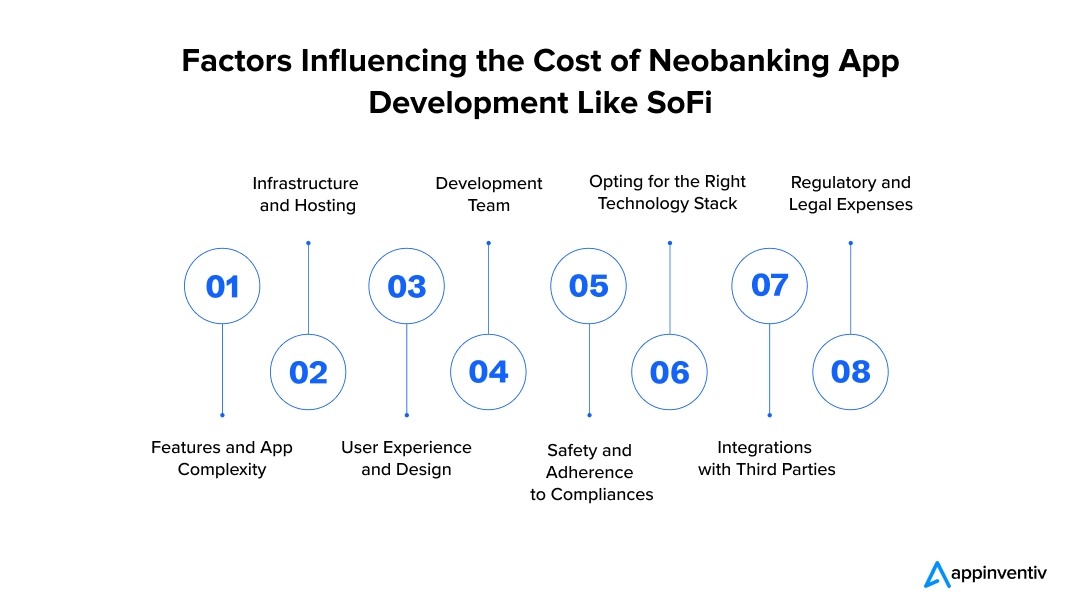

As revealed earlier, the cost to build an app like SoFi can range from $40,000 to $300,000 or more. Let’s check out what factors influence the overall cost of neobanking app like SoFi development cost.

Features and App Complexity

The neobank app development cost increases with the number of services you add, such as bill payments, investment options, mobile cheque deposits, and customized financial counseling. More effort and experience are needed for the development of complex functionality. Careful planning, meticulous creation, and thorough testing of each feature are essential to ensure seamless integration and optimal performance.

Advanced features such as AI-powered financial advising or real-time transaction monitoring can raise original development and ongoing maintenance expenses. The application’s intricacy increases the demand for specialist knowledge and resources, which raises the total cost even more.

User Experience and Design

In order to create an app like SoFi, you need to consider implementing aesthetically pleasing designs to attract and retain customers. Although it can greatly raise the cost to build an app like SoFi, investing in UI/UX design is necessary to deliver a flawless user experience. An effective design improves usability, making it simpler for users to ensure easy navigation and complete transactions without difficulty.

Extensive research, wireframing, and user testing are required to ensure the interface satisfies user needs and expectations. Furthermore, continuous design updates that enhance user support are essential for maintaining client loyalty and satisfaction. Investing in top-tier design skills is justified by the need to stand out in the competitive neobanking industry with eye-catching visuals and user-friendly interactions.

Development Team

The cost of assembling a skilled development team varies depending on their location and expertise. Developers, designers, quality assurance testers, and project managers all contribute to the overall cost to build an app like SoFi. Outsourcing to regions with lower cost of labor can significantly reduce expenses and provide access to a broader talent pool. However, managing potential challenges such as quality control and communication barriers is crucial.

Effective outsourcing to an Asian region like India can balance cost-efficiency and high-quality output, ensuring the successful implementation of advanced features like AI integration and enhanced security measures. With careful management, outsourcing can provide a robust solution without compromising the project’s standards or collaborative efficiency.

Safety and Adherence to Compliances

Financial apps must adhere to strict regulations and security standards. Implementing robust security measures, like multi-factor authentication (MFA) and encryption, and ensuring compliance with financial regulations can be expensive. However, implementing these safety measures is essential for preserving confidence and safeguarding private user information.

Regular security audits, penetration tests, and compliance checks are required to remain ahead of potential risks and regulatory changes. The price of acquiring the required licenses and certificates and the cost of educating employees on security procedures raise the total cost to build an app like SoFi. These investments are essential since not meeting these requirements can lead to harsh penalties and harm to the app’s brand value.

Opting for the Right Technology Stack

The selection of technology stacks significantly influences development expenses. Modern, scalable technologies may cost more upfront, but they can save money over time by improving performance and requiring less maintenance.

Advanced technologies are more efficient, enabling the app to accommodate expanding user bases and intricate features without compromising reliability or performance. Furthermore, a well-selected technology stack can save continuing development and maintenance costs by making service integrations and upgrades easier.

Integrations with Third Parties

Integrating with third-party services, such as identity verification services, financial data providers, and payment gateways, involves additional costs. However, these integrations are often necessary to provide comprehensive financial services. To guarantee flawless operation within the app, meticulous planning, development, and testing are needed for each integration.

The potentially large license fees associated with using these third-party services increase the entire SoFi app development cost. To keep these integrations remain current with emerging technologies and security standards, ongoing updates and troubleshooting are also necessary for maintenance. These integrations are essential for providing comprehensive capabilities that satisfy customer demands and legal requirements, even when they require hefty investments.

Regulatory and Legal Expenses

Sifting through the financial sector legal maze requires paying hefty legal and consulting expenses. Ensuring the app complies with all legal regulations is crucial, which may raise the final neobank app development cost. This procedure entails getting the required permits, abiding by data protection laws, and adhering to financial standards unique to each market in which the app is used.

The development team must always monitor how the law changes and modify the app’s features and policies accordingly. To ensure compliance, thorough paperwork and frequent audits are also necessary, which raises SoFi like app development costs even more. The app’s profitability and long-term viability depend on these legal and regulatory efforts since non-compliance carries heavy fines.

Infrastructure and Hosting

The app’s availability and performance depend on reliable hosting and infrastructure. Ongoing operating expenses include server maintenance and cloud services. Securing and effectively managing massive amounts of user data and transactions requires top-notch hosting solutions. Additionally, scalability is essential because the infrastructure needs to support the expanding user population and rising demand.

The necessity of regular upgrades, security patches, and system monitoring to preserve peak performance and avoid downtime increases the neobanking app like SoFi development costs. Furthermore, investing in reliable disaster recovery solutions is essential to guard against data loss and service disruptions, although it can raise the cost to build an app like SoFi.

Also Read: How Much Does it Cost to Build a Digital Banking App in UAE like Mashreq NEOBiz

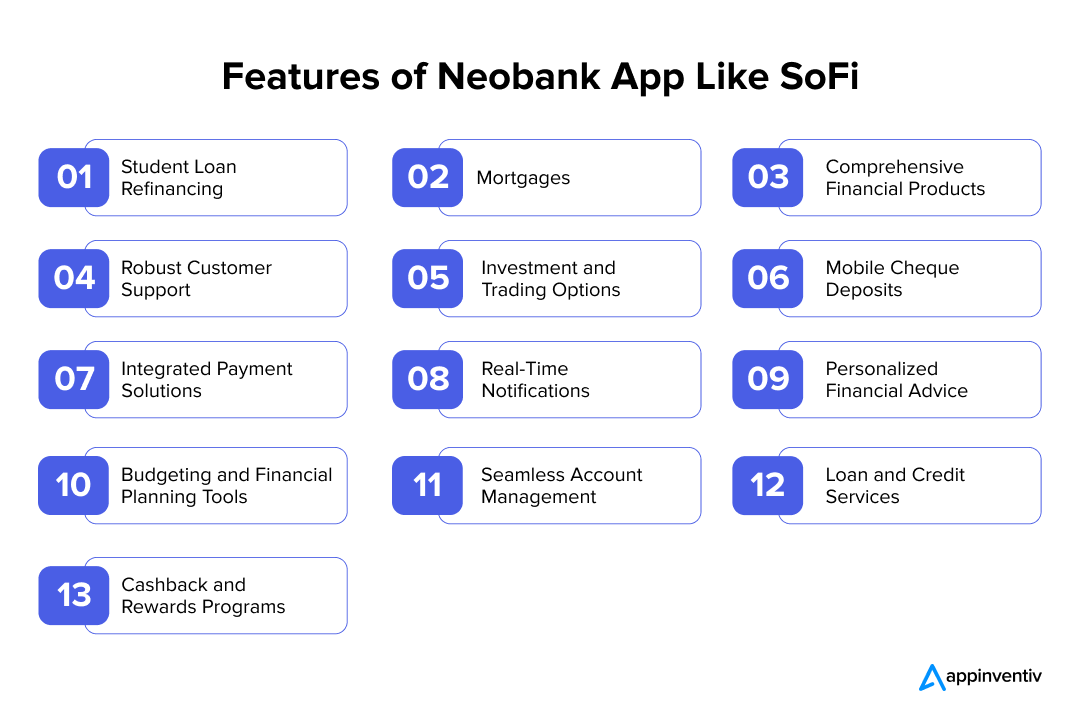

Key Features of Neobank App Like SoFi

An app like SoFi features are specially meant for enhancing user experience, offer personalized financial insights, provide advanced security measures, and cater to the diverse needs of modern customers. Let’s have a look at some of the top features.

Loan Refinancing

Offers flexible terms and affordable interest rates to make refinancing loans easier. If accepted, borrowers can quickly pay off their loans or reduce their monthly payments by completing an easy online application.

Mortgages

Provides users with an easy application process for home loans and mortgage refinancing. In addition to selecting from a range of loan alternatives, borrowers can get individualized advice from the app’s mortgage consultants.

Robust Customer Support

Ensures excellent customer service through multiple channels such as chat, phone, and email to promptly address user queries and concerns.

Investment and Trading Options

Offers users the ability to swiftly invest in stocks, ETFs, and cryptocurrencies with professional portfolio management services and automated tools.

Mobile Cheque Deposits

Allows users to deposit cheques using their smartphone camera for a quick and convenient way to add funds.

Integrated Payment Solutions

Supports seamless payments and transfers, accommodating various payment methods for user convenience.

Real-Time Notifications

Delivers instant alerts or push notifications on transactions, account activities, and significant financial events to keep users updated.

Personalized Financial Advice

Provides tailored financial recommendations based on individual user profiles and personalized financial objectives.

Budgeting and Financial Planning Tools

An app similar to SoFi includes features for budgeting, expense tracking, and financial planning to help users manage their finances effectively.

At Appinventiv, we created Mudra, an AI-powered budget management app tailored for millennials to monitor their daily spending. This chatbot-centric solution tracks user expenses and notifies them when they exceed their budget.

Our dedicated efforts have resulted in a powerful application launched in over 12 countries globally.

Seamless Account Management

Offers comprehensive account management features, enabling users to monitor balances, track spending, and manage multiple accounts effortlessly.

Loan and Credit Services

Access various loan products and credit services with competitive rates and flexible terms.

Cashback and Rewards Programs

Offers cashback on purchases and rewards programs to incentivize spending and saving.

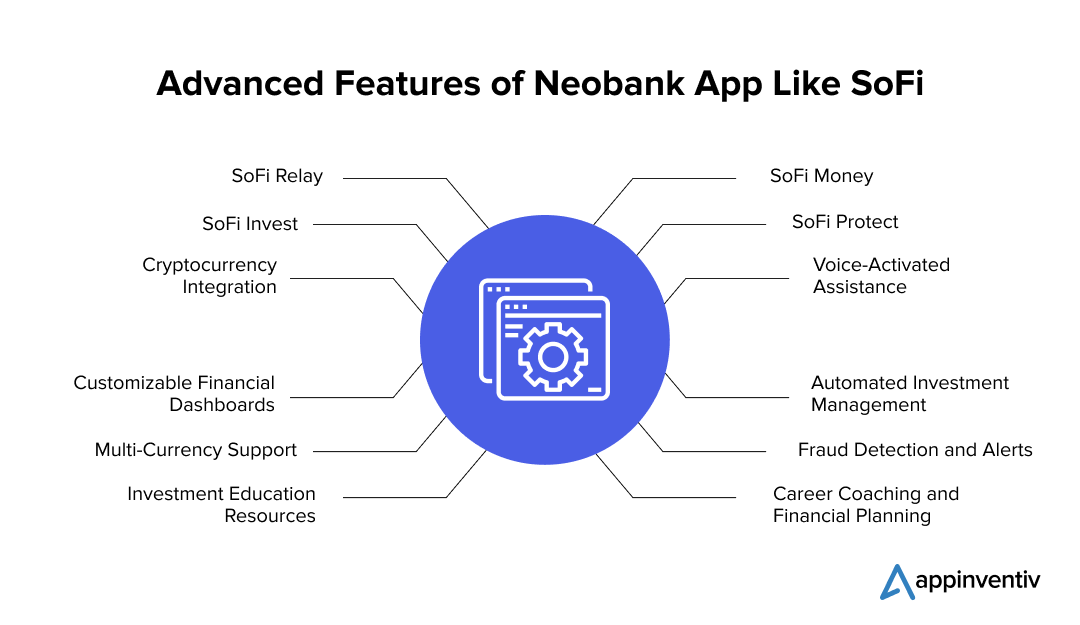

Exploring Advanced Features in a Neobank App Like SoFi: Unveiling Cutting-Edge Functionality

SoFi offers advanced features that provide a comprehensive and user-friendly banking experience while ensuring robust security measures. However, implementing these advanced features can also influence the cost to build an app like SoFi, although they are necessary for a better user experience.

SoFi Money

It combines checking and savings into a single cash management account, offering high interest rates and no account fees.

SoFi Protect

Provides access to different types of insurance products, including life, auto, and homeowners insurance.

SoFi Relay

It grants users access to their credit scores, financial insights, and tools to monitor their spending and savings goals.

SoFi Invest

Features commission-free trading, automated investing (robo-advisory services), and cryptocurrency trading.

Voice-Activated Assistance

Integrates with voice assistants like Siri and Alexa, enabling users to perform banking tasks using voice commands for hands-free convenience.

Cryptocurrency Integration

Supports the buying, selling, and tracking of cryptocurrencies directly within the app, catering to users interested in digital assets.

Automated Investment Management

Provides robo-advisory services automatically managing and rebalancing investment portfolios according to user-defined strategies.

Customizable Financial Dashboards

Enables users to create personalized dashboards displaying key financial metrics, trends, and goals in an easy-to-understand format.

Career Coaching and Financial Planning

Offers members career coaching services and financial planning sessions.

Multi-Currency Support

This feature allows users to hold and transact in multiple currencies, simplifying financial management while traveling or dealing with international transactions.

Fraud Detection and Alerts

Utilizes advanced machine learning algorithms to identify suspicious activities and immediately alerts users to potential fraud, ensuring enhanced security.

Investment Education Resources

Offers access to webinars, educational content, and tutorials to help users learn more about the complexities of investing.

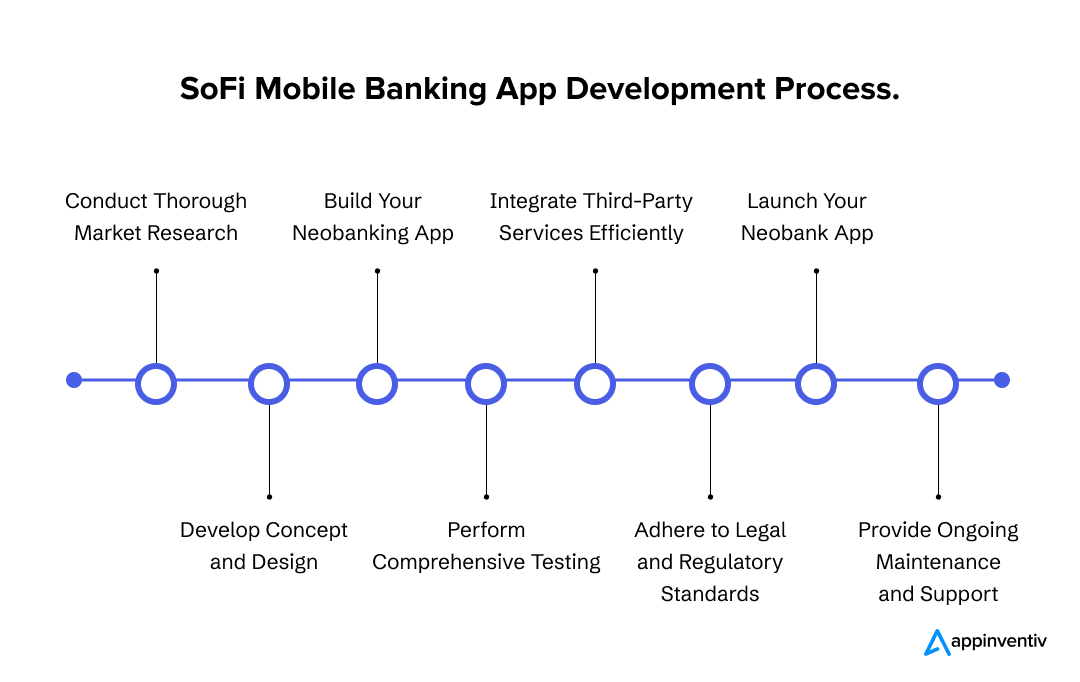

How to Develop a Neobank App Like SoFi: A Step-by-Step Process

SoFi-like neobanking app development process involves several key steps, meticulously crafted to align with the latest technological standards and user expectations. Every step is designed to optimize functionality and enhance user satisfaction, ensuring that each phase of the development is aligned with business goals and market demands. Here’s an overview of the typical app like SoFi development process:

Conduct Thorough Market Research

Perform thorough market research to grasp your target audience, market trends, and competitors. This exploration will aid in defining your app’s distinct value proposition and essential features. Based on this research, create a detailed plan outlining your user acquisition, retention, monetization, and scalability strategy.

Consider factors such as user demographics, behavior, preferences, market demand, and competition analysis. Use this information to tailor your app’s features and marketing strategies to line up with your target audience’s needs and expectations effectively.

Develop Concept and Design

Create wireframes in the concept and design phase to visualize your app’s user interface and experience. It is vital to develop a clean, intuitive interface that reflects your brand’s identity. Utilize user feedback and usability testing to refine the design, ensuring it meets user expectations while also addressing security and compliance requirements.

Consider the user journey from onboarding to performing key tasks, and design each interaction to be seamless and intuitive. Also, consider color schemes, typography, and iconography to craft an attractive and unified design, as these elements can have a notable impact on the overall SoFi like app development costs.

Build Your Neobanking App

During development, code your app using the chosen technology stack. Follow best practices, such as modular design and code reusability, to ensure efficient development. Implement features like account creation, transaction processing, and real-time notifications focusing on performance, scalability, and security.

Regularly review and test your code to catch and address bugs promptly. Consider implementing agile development methodologies to adapt to changing requirements and deliver updates more efficiently.

Integrate Third-Party Services Efficiently

Integrate third-party services, such as payment gateways and KYC verification, to enhance your app’s functionality. This integration should be done carefully, following service providers’ guidelines and APIs. Conduct thorough integration testing to ensure it works correctly and does not compromise security or performance.

Implement fallback mechanisms and monitoring tools to detect and resolve integration issues promptly. Consider the scalability and reliability of the third-party services you integrate, as they can impact your app’s overall performance, user experience, and also the overall cost breakdown of an app like SoFi.

Adhere to Legal and Regulatory Standards

Ensure compliance with regulatory requirements related to fintech software development services, data protection, and consumer rights. Obtain necessary licenses and certifications and implement security measures to protect user data and transactions.

Update your app regularly to comply with changing regulations and industry standards, ensuring ongoing compliance and user trust. Stay informed and updated about regulatory changes and other industry best practices to maintain a secure and reliable app environment for your users.

Perform Comprehensive Testing

Thorough testing ensures your app functions correctly and meets quality standards. Perform various tests, including functional, usability, security, and performance testing. Automated testing tools are used to streamline the process and detect issues efficiently, ensuring a high-quality app.

Consider performing beta testing with a select group of users to collect feedback and pinpoint any remaining issues prior to the official launch. Regularly update your testing strategy to include new features and address emerging threats and vulnerabilities.

Launch Your Neobank App

Plan a strategic launch for your neobank app, considering factors such as timing, target audience, and marketing channels. Ensure all technical aspects are in place for a smooth deployment and adherence to app store guidelines.

Establish a comprehensive launch timeline, including pre-launch activities, launch day procedures, and post-launch follow-ups. Conduct thorough testing and QA to identify and resolve any last-minute issues before the launch.

Provide Ongoing Maintenance and Support

Continuously monitor and update your app to fix bugs, improve performance, and add new features. Provide excellent customer support to address user queries and issues promptly, ensuring a positive user experience.

Implement a feedback loop to gather user input and prioritize feature updates and bug fixes. Regularly analyze user feedback and app performance metrics to identify areas for improvement. Collaborate with your development team to implement updates and enhancements based on user needs and industry trends.

Exploring Revenue Models of a Neobanking App Like SoFi

SoFi’s business strategy revolves around its extensive range of financial services and products. This strategy enables businesses to diversify their revenue streams, leveraging their portfolio to meet diverse customer needs and drive profitability while also managing the overall SoFi app development costs. Key revenue models include:

Loan Origination Fees

SoFi levies origination fees for certain loan schemes, which are one-time costs that borrowers must pay when the loan is disbursed.

Interest Income

SoFi receives payment from the interest accumulated on its loans, including mortgages, personal loans, and student loan refinancing. SoFi draws many borrowers with attractive interest rates, generating a sizable interest.

Insurance Product Commissions

Through SoFi Protect, the company offers a range of insurance products, such as homeowners, vehicles, and life insurance. Every policy sold generates commissions or referral fees for SoFi.

Investment Product Fees

SoFi earns money from its investment platform in various ways, such as transaction fees in cryptocurrency trading and management fees for automated investing (robo-advisory services).

Membership Fees

SoFi uses a membership model in which customers pay a subscription fee or other premium charges to access extra services and advantages, including financial planning sessions and career coaching.

Referral and Partnership Fees

SoFi collaborates with various partners and earns referral fees or partnership commissions to direct customers to third-party services or products.

Interchange Fees

SoFi Money, the company’s cash management account, generates revenue through interchange fees, which are small fees paid by merchants whenever customers use their SoFi debit card for purchases.

Craft a SoFi-Like Neobank With Appinventiv’s Innovative Development Approach

Neobanking applications such as SoFi are transforming the financial landscape by providing consumers with unprecedented accessibility and ease. They offer users access to a holistic financial environment in addition to banking services, changing the standards for traditional banking with their competitive interest rates and lower fees.

This revolutionary change in banking is about more than convenience; it’s about giving people the power to take charge of their financial destiny and establishing a new benchmark for what digital banking ought to be.

Appinventiv’s innovative and strategic approach empowers businesses to develop neobanking apps that rival SoFi’s success. By harnessing cutting-edge technologies and industry best practices, Appinventiv facilitates the creation of user-centric neobank solutions tailored to modern financial needs.

With a steadfast commitment to innovation and enhancing customer experiences, Appinventiv ensures that neobanking apps developed under their guidance are functional, scalable, and adaptable to future market trends. Partnering with a banking software development services provider like Appinventiv can thus be the catalyst for unlocking the full potential of neobanking, enabling businesses to flourish in the FinTech landscape.

Connect with our experts today for the complete SoFi app development cost estimation and tips on how to build one.

FAQs

Q. How much does it cost to build app like SoFi?

A. Cost to build an app like SoFi is affected by factors like the app’s complexity, features, platform (iOS, Android, or both), development team’s rates, and location. A rough estimate for a basic neobanking app can range from $40,000 to $150,000, while a more advanced app with additional features and functionalities can cost more than $300,000. Connect with the best SoFi app developers today to get a complete cost estimation.

Q. What are the top benefits of developing a neobanking app?

A. Some of the top benefits of neobanking app like SoFi include:

- Greater accessibility

- Personalized banking services

- Enhanced user experience

- Advanced security features

- Cutting-edge innovation

- Increased customer engagement

- Real-time transaction tracking

- Lower costs

- Scalability for future growth

- Seamless integration with other financial tools

Q. What are some of the top neobank market trends?

A. Some of the top neobank market trends include:

New market expansion: To provide their services to a larger clientele, neobanks are reaching out into new areas and markets.

Partnerships with traditional banks: A few neobanks are forming relationships with traditional banks to expand their services and take advantage of existing infrastructure.

Personalized banking experiences: Neobanks are utilizing AI and data analytics more and more to provide individualized banking experiences based on each unique customer’s requirements.

Emphasis on financial health: By providing resources for financial education, savings objectives, and budgeting tools, neobanks are progressively concentrating on assisting their clientele in enhancing their financial well-being.

Q. How long does it take to develop an app like SoFi?

A. To develop an app like SoFi, it would typically take between 6 months to over a year, depending on factors like how complex its features are, meeting regulatory requirements, integrating financial services, and ensuring it’s secure and reliable through thorough testing.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Banking Technology Consulting: A Strategic Roadmap for Core Modernization and Guaranteed ROI

Key takeaways: Banking modernization is now a strategic necessity, not a technology upgrade. Most banks lose value due to legacy complexity, fragmented data, and slow compliance response. Structured banking technology consulting delivers measurable gains in cost, stability, and governance. Core modernization succeeds when roadmaps, risk, and regulatory alignment are clearly defined. ROI comes from reduced…

How Gamification in Banking Helps Enterprises Build Lasting Customer Loyalty

Key takeaways: A winning banking gamification strategy isn't about badges; it’s about using behavioral psychology to form daily financial habits. Industry leaders like DBS Bank and Revolut prove the concept works, driving higher savings and millions in user acquisition. The cost to implement gamification in banking and financial services ranges between $40,000 and $400,000 or…

KYC Automation - Benefits, Use Cases, Steps, Tools and Best Practices

Key takeaways: KYC automation cuts verification from days to minutes and keeps checks consistent across teams. AI and ML reduce manual errors, catch risk earlier, and make compliance far easier to scale. Manual KYC drains time, increases cost, and slows onboarding — automation fixes all three. Automated workflows handle spikes in customer volume without compromising…