- Overview: Mashreq NEOBiz Online Banking App

- Cost to Build a Digital Banking App Like Mashreq NEOBiz

- Cost Analysis Based on App Complexity

- Cost Analysis Based on Multiple Phases of App Development

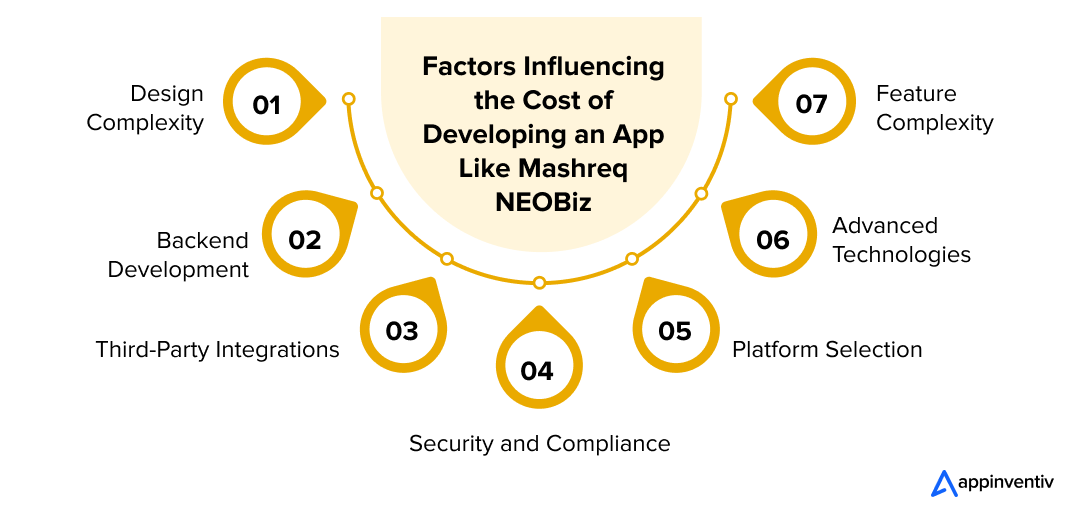

- Factors Affecting the Cost to Develop an App Like Mashreq NEOBiz

- Design Complexity

- Backend Development

- Third-Party Integrations

- Security and Compliance

- Platform Selection

- Advanced Technologies

- Feature Complexity

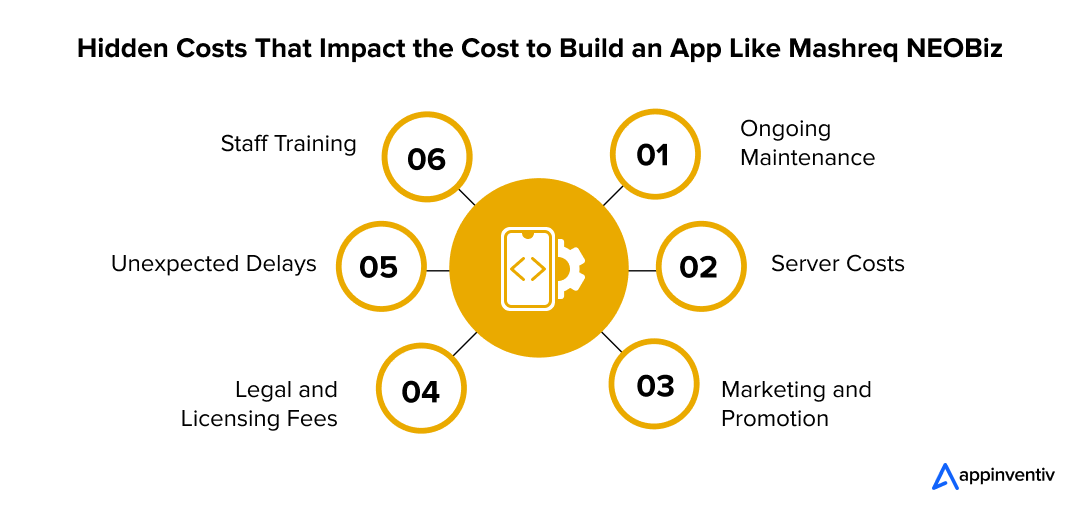

- Hidden Costs That Affect the Cost to Build an App Like Mahsreq NEOBiz

- Ongoing Maintenance

- Server Costs

- Marketing and Promotion

- Legal and Licensing Fees

- Unexpected Delays

- Staff Training

- Strategies to Minimize the Cost of Developing an App Like Mashreq NEOBiz

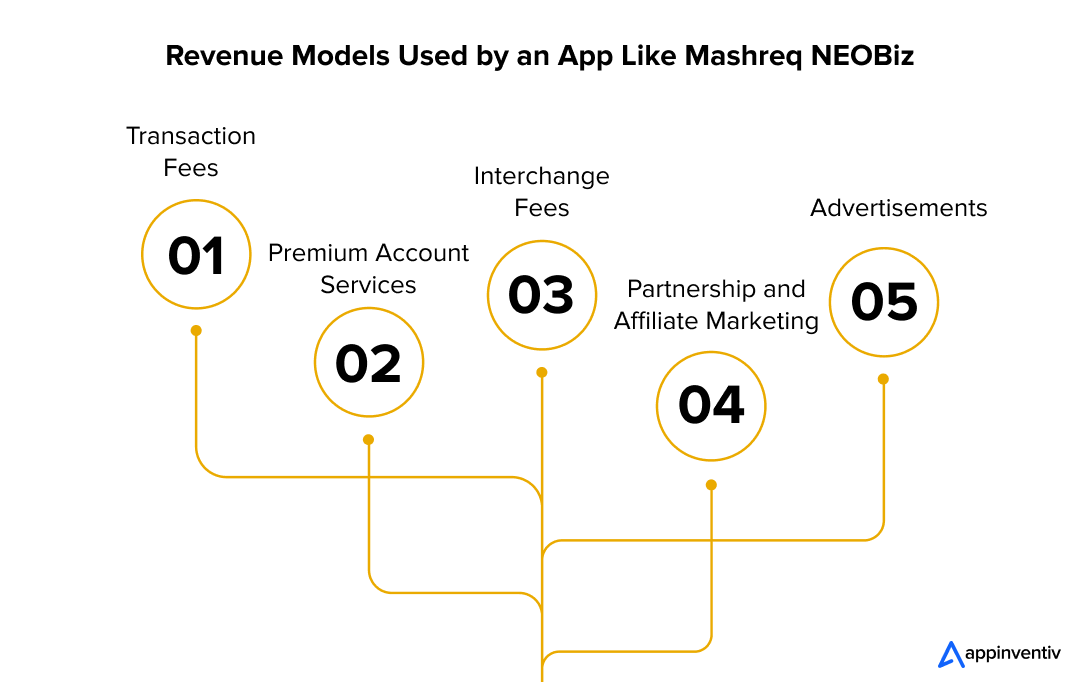

- Monetization Strategies Used by an App like Mashreq NEOBiz

- Transaction Fees

- Premium Account Service

- Interchange Fees

- Partnership and Affiliate Marketing

- Advertisements

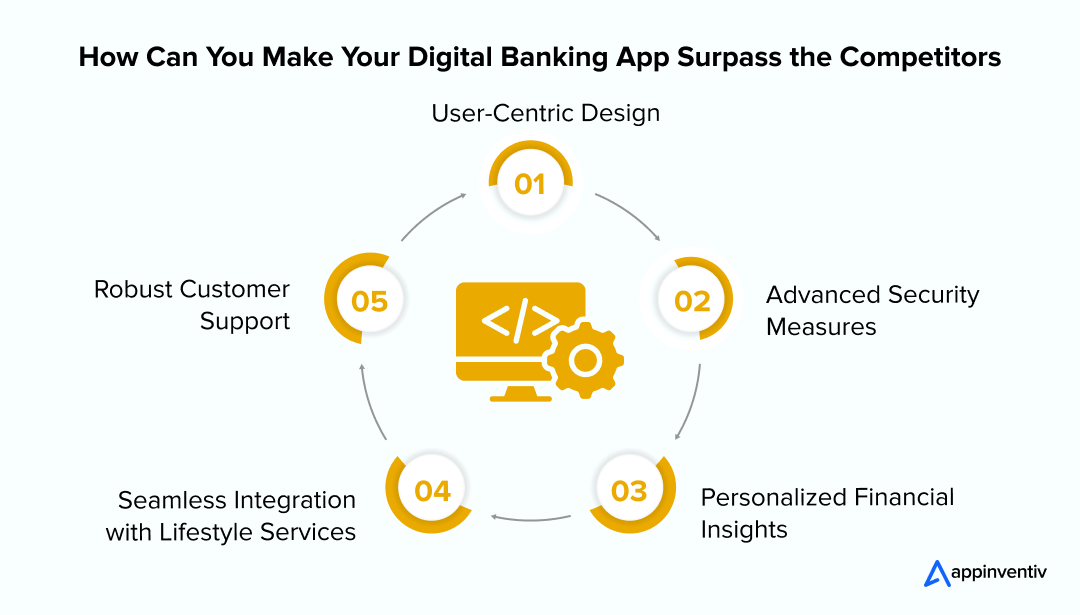

- How Can You Make Your Digital Banking App Surpass the Competitors

- User-Centric Design

- Advanced Security Measures

- Personalized Financial Insights

- Seamless Integration with Lifestyle Services

- Robust Customer Support

- Step-by-Step Guide: How to Build a Digital Banking App like Mashreq NEOBiz (2025)

- Idea Incubation: A Comprehensive Conceptualization

- Blueprint for Success: Project Planning

- Crafting a Digital Experience: UI/UX Design

- Bringing Code to Life: App Development

- Quality Assurance: Ensuring Seamless Functionality

- Go Live: Launch The App

- Evolving and Enhancing: App Maintenance

- Why Appinventiv is the Ideal Partner for Developing a Digital Banking App Like Mashreq NEOBiz

- FAQs

In an era where a user’s smartphone is almost an extension of his wallet, neobanks like Mashreq NEOBiz are not just participating in the digital banking revolution but are leading it. In the UAE, a hub of innovation, Mashreq NEOBiz has carved out a significant niche by simplifying banking with a tap and swipe.

But what does it actually take to build a standout digital banking app? Whether you are looking to launch the next big fintech startup or a traditional bank getting ready to go digital, understanding the cost is as crucial as the technology itself.

Well, let’s talk numbers. The cost to build a digital banking app like Mashreq NEOBiz can vary anywhere from $50,000 to over $300,000. But why such a wide range? It all comes down to the scope and scale of your project.

Are you aiming for a simple app with basic functionalities, or do you envision a more complex system with custom features tailored to specific customer needs? Each choice you make adds layers to the development process and the overall cost.

Moreover, it’s also essential for businesses like yours to consider several critical factors when budgeting for a digital banking app. The complexity of the app’s design, the security measures required to protect user data, integration with existing banking systems, and compliance with financial regulations all play pivotal roles in determining the final cost. Additionally, the choice between native app development and cross-platform solutions can significantly influence the initial expense and long-term maintenance costs.

This blog will unpack the layers of investment needed to develop an app like Mashreq NEOBiz. We will also look into the factors that can escalate development costs and explore cost-effective strategies for building a high-quality app that not only meets modern banking demands but also enhances user engagement and retention.

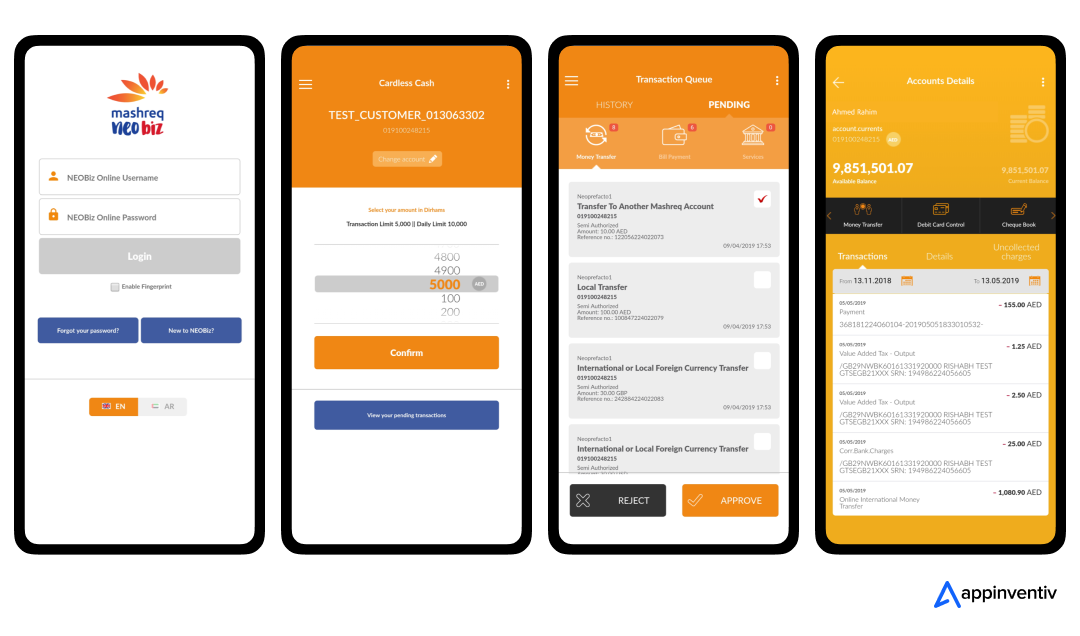

Overview: Mashreq NEOBiz Online Banking App

Over the past few years, we’ve witnessed the unprecedented rise of banking app development in the UAE. One of them is the Mashreq NEOBiz Online Banking App.

Mashreq NEOBiz is a digital banking app launched by Mashreq Bank, one of the leading financial institutions in the UAE. Designed specifically for the dynamic needs of startups, entrepreneurs, and small to medium-sized enterprises (SMEs), NEOBiz aims to streamline and enhance the financial operations essential for business growth in today’s digital age.

Mashreq NEOBiz isn’t just another player in the digital banking field but a trailblazer in the UAE’s fintech landscape. What sets the app apart is its tailored solutions specifically designed for entrepreneurs and small to medium-sized businesses.

The platform simplifies accounting, payroll, and banking operations with features such as easy invoicing, automated expense tracking, and quick business account opening procedures. Its commitment to providing a seamless user experience is evident in its intuitive mobile and web interfaces, allowing business owners to manage their finances efficiently and on the go.

Since its launch, Mashreq NEOBiz has made significant strides in the UAE’s banking sector, indicating robust market performance. With over 50K+ users, the digital banking app has solidified Mashreq Bank’s overall position while helping the company reduce the overall time to open and activate an SME account by 36%. This further led to the bank witnessing an increased customer acquisition rate of 37%.

Simply put, the platform’s growing popularity among SMEs now hints at a positive reception from thousands of users. The future of banking is not just digital but fully embedded in the user’s life, and neobanks are the pioneers in this change.

Also Read: How PWAs Drive Business for SMEs?

NEOBiz has contributed to digital banking growth in the UAE region, pushing more traditional banks to accelerate their digital transformation initiatives. Its impact extends beyond customer numbers and reshapes how financial services are delivered in a digitally driven marketplace.

Mashreq NEOBiz utilizes state-of-the-art technology to provide a superior banking experience that is secure, efficient, and tailored to meet the needs of modern businesses. Below is a breakdown of the features of digital banking apps like Mashreq NEOBiz:

| Feature | Description |

|---|---|

| Real-time Notifications | Receive instant push notifications and alerts on transactions and account changes, keeping you up-to-date with your financial activity. |

| Multi-currency Accounts | Manage multiple currencies in a single account, simplifying international business transactions. |

| Integrated Payment Solutions | Seamless integration with various payment systems for hassle-free transactions. |

| Biometric Authentication | Biometric authentication enhances security with the help of technologies like fingerprint scanning and facial recognition |

| End-to-end Encryption | Encryption protects all data transmissions to secure your financial information from cyber threats. |

| Artificial Intelligence (AI) | AI-driven analysis and insights to offer personalized financial advice and proactive account management. |

| Machine Learning (ML) | Utilize ML algorithms for predictive analytics to accurately forecast cash flows and assess financial health. |

If you are a business aiming to dominate the rapidly expanding digital banking ecosystem, you must develop an app that meets and surpasses current market standards in functionality, security, and user experience.

How exactly can you achieve this? We will explore the strategic and technical nuances further in this blog. For now, let’s focus on an essential component of app development: the budget.

Cost to Build a Digital Banking App Like Mashreq NEOBiz

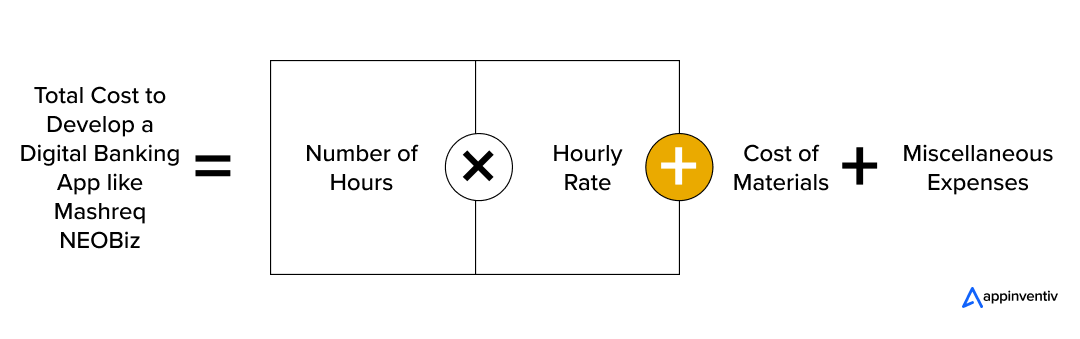

As revealed earlier, the overall cost to develop an app like Mashreq NEOBiz can vary from $50,000 to $300,000. When planning to create a similar digital banking app, it’s essential to understand the various cost factors that will impact your budget. These costs vary widely depending on the app’s complexity and development phases.

Typically, costs are calculated by multiplying the hours expected for each task by the development team’s hourly rate plus any additional fees for materials and miscellaneous expenses.

Quick Formula to Estimate the Cost of Digital Banking app like Mashreq NEOBiz

Let us look into the multiple cost analysis that provides a clearer perspective on what to expect financially when undertaking such a project:

Cost Analysis Based on App Complexity

The app’s complexity plays a major role in determining its overall cost to build a digital banking app in Dubai, UAE. A simple app focuses on core functionalities like account viewing, basic transactions, and customer support.

These basic features require minimal integrations and simpler security protocols. In contrast, a moderate app includes enhanced features such as multi-currency support, integrated payment systems, and improved security, adding more functionality and security.

A complex app takes it further by integrating advanced technologies like AI and ML for predictive analytics, implementing rigorous mobile app security measures, and ensuring multi-platform compatibility, significantly broadening its scope and impact.

| App Complexity | Features Included | Estimated Cost to Make an App Like Mashreq NEOBiz |

|---|---|---|

| Simple | Basic account management, transactions, customer support | $50,000 – $100,000 |

| Moderate | Includes Simple features + Multi-currency, integrated payments, enhanced security | $100,000 – $200,000 |

| Complex | Includes Moderate features + AI, ML, advanced security, multi-platform support | $200,000 – $300,000+ |

Cost Analysis Based on Multiple Phases of App Development

Each app development phase comes with its own set of costs, from the very start to the ongoing maintenance after the app goes live. During the planning phase, you will engage in market research and secure the necessary licenses. Next, the design phase is all about crafting a user-friendly and visually appealing interface.

The development phase is where the app is constructed. After development, the launch phase covers marketing and the app’s initial release. Finally, the maintenance phase ensures the app stays up-to-date and runs smoothly with regular updates and technical support.

| Development Phase | Activities | Estimated Cost | Time and Effort |

|---|---|---|---|

| Planning | Market research, licensing | $10,000 – $20,000 | 1-2 months |

| Design | UI/UX design, prototyping | $20,000 – $50,000 | 2-4 months |

| Development | Coding, backend, integration | $80,000 – $200,000 | 4-6 months |

| Launch | Marketing, deployment | $10,000 – $30,000 | 1-2 months |

| Maintenance | Updates, server costs, customer support | $10,000 – $50,000/year | Ongoing, varies annually |

Factors Affecting the Cost to Develop an App Like Mashreq NEOBiz

Several factors can significantly impact the overall development cost to build a digital banking app like Mashreq NEOBiz. Understanding these factors is crucial for accurate budgeting and efficient resource allocation. Let’s explore each of the factors affecting Mashreq NEOBiz-like app development cost in detail below:

Design Complexity

The complexity of the design impacts the cost of the app. Simple designs with basic features are cheaper to create. Intricate designs, including animations and interactive elements, require more work, increasing the cost. A well-designed UI/UX can enhance user engagement, simplify navigation, and create a seamless experience that keeps users returning.

Backend Development

The backend is where all the app’s main operations happen, including data storage and how the app connects to the internet. Simple setups cost less, while more complex ones that handle lots of user data and traffic are more expensive due to the need for stronger security and faster performance.

The backend technology stack for digital banking apps like Mashreq NEOBiz must include robust frameworks, secure servers, scalable databases, and efficient APIs to ensure seamless functionality, enhanced performance, and high-level security for handling sensitive financial data.

| Backend Requirement | Cost |

|---|---|

| Simple API Integration | Low |

| Complex Server Setup | Moderate to High |

| Advanced Database Management | High |

Third-Party Integrations

Adding third-party integrations, like payment systems or social media sharing, can affect the overall cost to build a digital banking app like Mashreq NEOBiz directly. Simple integrations, like adding a Facebook share button, are cheaper. More complex integrations, such as a full payment gateway that needs to be secure and reliable, cost more due to higher fees and more setup time.

Security and Compliance

There is no doubt that security is paramount for a banking app. Implementing basic security measures is cost-effective, but the associated digital banking app development costs escalate as requirements intensify, such as incorporating encryption and conducting regular audits. Compliance with financial regulations like PCI-DSS is also critical and adds to the additional costs, but these are necessary to meet legal and safety standards.

Platform Selection

The choice of platform, such as iOS, Android, or both, can significantly impact the cost to develop an app like Mashreq NEOBiz. iOS development may be costlier due to Apple’s stringent app requirements, while Android may require additional effort to ensure compatibility across various devices. Opting for cross-platform development can sometimes reduce overall costs, though it may restrict some native functionalities.

| Platform | Development cost to build a digital banking app | Reason |

|---|---|---|

| iOS | High | Stringent app store requirements |

| Android | Moderate to High | Fragmentation across devices |

| Cross-platform | Variable | Can reduce costs if well-planned |

Advanced Technologies

Incorporating advanced technologies like artificial intelligence not only enhances the app’s capabilities by enabling personalized services and predictive analytics but also increases development expenses due to the need for specialized expertise.

Partnering with an experienced AI development team like Appinventiv is crucial for efficiently integrating AI, which can improve customer satisfaction, streamline operations, and reduce costs over time. Investing in AI can position your business as a leader in the digital banking space, making the initial higher costs worthwhile for the strategic advantages gained.

| Technology | Integration Cost | Benefits |

|---|---|---|

| Artificial Intelligence (AI) | $20,000 – $100,000 | Personalized customer experiences, automated customer support, and predictive analytics. |

| Machine Learning (ML) | $25,000 – $120,000 | Enhanced data analysis for behavior prediction, risk assessment, and financial forecasting. |

| Blockchain | $30,000 – $150,000 | Increased security for transactions, reduced fraud, and improved compliance. |

| Natural Language Processing (NLP) | $15,000 – $80,000 | Improved customer interaction through chatbots, voice assistants, and customer service automation. |

| Internet of Things (IoT) | $10,000 – $70,000 | Enhanced security features of personalized banking services based on customer behavior and location data. |

| Robotic Process Automation (RPA) | $10,000 – $50,000 | Streamlined operations, reduced operational costs, and minimized human errors in repetitive tasks. |

Feature Complexity

The complexity of features directly influences the cost of the app. Simple functionalities such as account balance checks are less expensive to develop. In contrast, more sophisticated mobile banking app features, like providing customized financial advice or supporting multiple account and currency management, demand more extensive development time and higher levels of expertise, thus raising overall costs.

Hidden Costs That Affect the Cost to Build an App Like Mahsreq NEOBiz

When developing a digital banking app like Mashreq NEOBiz, several hidden costs can arise unexpectedly, affecting the overall budget. Understanding these can help with better financial planning and management.

Ongoing Maintenance

Regular maintenance is essential but often overlooked in budget planning. It includes updates, fixing bugs, and enhancing app performance to maintain functionality and security. Regular maintenance is crucial for user retention and compliance with updated security standards.

Server Costs

Server-related expenses cover data storage, bandwidth, and energy consumption. These costs tend to rise as the app attracts more users and requires more resources to effectively manage the increased data flow.

Marketing and Promotion

Considerable investment in marketing and promotion is necessary to launch and maintain visibility successfully. These aspects of digital banking app development costs include budgets for advertising, event sponsorships, and promotions to encourage new sign-ups, which are vital for growing the user base.

Legal and Licensing Fees

Legal compliance and licensing can be expensive, especially in the regulated banking sector. Costs include legal consultations to ensure the app meets all regulatory requirements and fees for obtaining and renewing necessary licenses.

Unexpected Delays

Delays in development can increase the cost of building a digital banking app like Mashreq NEOBiz. This often results from technical issues, scope changes, or problems with third-party services. These delays extend the development timeline and increase the overall expense.

Staff Training

Implementing the app also requires staff training to ensure effective management and operation. Training costs depend on the app’s complexity and the number of employees involved, covering everything from customer support to technical maintenance.

Strategies to Minimize the Cost of Developing an App Like Mashreq NEOBiz

Minimizing the digital banking app development cost requires strategic planning and efficient resource management. Implementing cost-effective strategies can significantly reduce expenses without compromising the app’s quality. Let us look at them in more detail below:

| Strategy | What It Means | How It Saves Costs | How to Apply |

|---|---|---|---|

| Developing an MVP | Start with a basic app version to test key features before full-scale development. | High | Focus on core features that solve user needs and can be expanded later. |

| Prioritizing Features | Only develop essential features initially and add others over time. | Moderate | Identify and include features most valued by users for the first release. |

| Leveraging Open Source | Use free, open-source tools and frameworks to reduce software costs. | Moderate to High | Select open-source options that are reliable and supported by a strong community. |

| Dedicated Development Team | Hire a dedicated team of developers with optimized hourly rates to build the app. | High | Work with trusted companies or teams that have experience in similar projects. |

| Cross-platform Development | Use a single codebase to develop apps for multiple platforms like iOS and Android. | High | Use frameworks like React Native or Flutter for faster and more cost-effective development. |

| Agile Development Practices | Use an agile approach to development with regular testing and feedback. | Moderate | Break the project into smaller iterative cycles to ensure efficiency and adapt to changes. |

Monetization Strategies Used by an App like Mashreq NEOBiz

Mashreq NEOBiz online banking app involves various strategies that can help generate revenue while providing value to users. Below, we explore some effective monetization strategies that an app like Mashreq NEOBiz could employ to enhance profitability.

Transaction Fees

Charging fees on certain transactions is a direct way to generate revenue. This could include fees for wire transfers, foreign currency exchanges, etc. The app can maintain user satisfaction by keeping these charges competitive yet profitable while ensuring a steady income stream.

Premium Account Service

Offering different levels of premium accounts that charge a monthly or yearly fee is one of the effective monetization strategies used by the Mashreq NEOBiz online banking app. These accounts provide special benefits like allowing for more transactions, charging lower fees, offering exclusive deals, or giving better customer support. Users who want these extra services are often willing to pay more, which helps increase the app’s overall earnings.

Interchange Fees

Every time a user uses the app’s debit or credit card to make a purchase, the app earns a small cut of the transaction, known as an interchange fee. This fee is paid by the stores where purchases are made. As more people use the app for shopping, these fees can add up to a significant amount of revenue for the app.

Partnership and Affiliate Marketing

Working with other companies to offer special promotions or services can be quite profitable for your app. For example, if the app gives users cashback or discounts for shopping at certain stores, it makes users happy and brings in money through commissions paid by these partner stores.

Advertisements

Including advertisements within the app is another way to earn revenue. The app can charge other businesses to display their ads. It’s important to place these ads carefully and ensure they are relevant to the users so they don’t negatively affect how people feel about the app.

How Can You Make Your Digital Banking App Surpass the Competitors

Above in the blog, we helped you glimpse into the basic features of a digital banking app like Mashreq NEOBiz. To ensure your digital banking app meets and surpasses its competitors, you must focus on innovation, user engagement, and robust security features. Below are strategic suggestions on how to elevate your app above others:

User-Centric Design

Design a visually appealing and intuitive interface that prioritizes the user experience. Consider incorporating features that simplify navigation and streamline banking tasks.

| Feature | Benefit | Example |

|---|---|---|

| Customizable Dashboard | Allows users to personalize their views based on their preferences. | Enable widgets or shortcuts for common transactions. |

| Gesture-Based Navigation | Reduces the learning curve and enhances user engagement. | Implement swipe actions to check balances or schedule payments. |

Advanced Security Measures

Given the sensitivity of banking data, integrating advanced security protocols can significantly distinguish your app from competitors.

| Security Feature | Advantage | Example |

|---|---|---|

| Biometric Authentication | Provides a seamless yet secure login experience. | Use fingerprint scanning or facial recognition to access accounts. |

| Real-Time Fraud Detection | Protects users from potential threats as they occur. | Integrate AI to analyze transaction patterns and alert users of suspicious activities. |

Personalized Financial Insights

Use data analytics to give users insights into their spending habits, investment opportunities, and financial forecasts. This feature helps users better manage their finances by giving spending analysis that categorizes transactions and visualizes them with easy-to-understand graphs. Additionally, it offers investment suggestions tailored to users’ financial goals and risk profiles, enhancing their decision-making process and engagement with the app.

Seamless Integration with Lifestyle Services

Extend the app’s functionality with other lifestyle services like eCommerce platforms, utility payments, or travel bookings. This creates a holistic ecosystem, making the banking app a central part of users’ daily lives.

Robust Customer Support

Ensuring that users can get help whenever needed is crucial for customer satisfaction. Incorporate AI-driven chatbots for 24/7 assistance and have a well-trained customer service team for more complex queries.

Also Read: How Much Does It Cost to Build an AI Chatbot App Like Ask AI?

After examining the major factors affecting the cost of building a digital banking app like Mashreq NEOBiz, the steps involved in developing one, and the features that can help you stand out, let’s move ahead and examine the multiple revenue models used by Mashreq NEOBiz online banking app.

Step-by-Step Guide: How to Build a Digital Banking App like Mashreq NEOBiz (2025)

Developing a digital banking app involves several critical steps, each crucial for ensuring the app is effective, secure, and user-friendly. Here’s a step-by-step process to develop a digital banking app like Mashreq NEOBiz:

Idea Incubation: A Comprehensive Conceptualization

Begin by defining your app’s target audience and core functionalities. Conduct thorough market research to identify existing banking solutions and potential gaps your app could fill. This foundational step is crucial for aligning the app’s development with real user needs and market opportunities.

Blueprint for Success: Project Planning

Develop a comprehensive project plan that outlines timelines, budget, resources, and the technology stack. Decisions made during this phase, such as choosing between native or cross-platform development, will significantly impact the cost and scope of the project.

Crafting a Digital Experience: UI/UX Design

Focus on creating a user interface and experience that emphasizes simplicity and ease of use. Develop wireframes and prototypes to visualize the app’s layout and test functionalities early in the process. This step ensures the app’s intuitive design aligns with user expectations.

Bringing Code to Life: App Development

Start coding the application, ensuring the front-end elements integrate seamlessly with back-end systems. Implementing key functionalities include account management, transaction processing, and customer support features. This phase requires close collaboration between developers to ensure the app functions smoothly and securely.

Quality Assurance: Ensuring Seamless Functionality

Conduct comprehensive testing across multiple stages, including functional testing to ensure the app works as intended, performance testing to assess its responsiveness, and security testing to protect user data. Incorporating feedback from beta testers can also provide valuable insights into the user experience and highlight potential issues before the public launch.

Go Live: Launch The App

Prepare for deployment by setting up the necessary server infrastructure and ensuring the app complies with all relevant regulations and app store requirements. Launch the app with a strategic marketing campaign to attract and retain initial users.

Evolving and Enhancing: App Maintenance

Post-launch, it’s important to continuously update the app to address any emerging bugs, enhance features based on user feedback, and update security measures as needed. Regular updates improve functionality and help maintain user trust and engagement over time.

Why Appinventiv is the Ideal Partner for Developing a Digital Banking App Like Mashreq NEOBiz

We hope this blog has helped you understand the cost of developing a platform similar to the Mashreq NEOBiz online banking app. Partnering with a seasoned development firm like Appinventiv can be pivotal when building such a digital banking app. As a trusted mobile app development company in Dubai, we can bring expertise and experience to ensure your app meets industry standards and user expectations. We are your ideal partner to develop a robust digital banking app, all thanks to our:

Proven Fintech Expertise: Appinventiv has a strong track record of delivering successful Fintech solutions. As a leading banking software company Dubai, our team understands the nuances of financial regulations and can craft innovative and compliant solutions.

Advanced Technical Skills: With proficiency in the latest technologies, such as AI, blockchain, and machine learning, we are equipped to implement advanced features that enhance security, user engagement, and overall functionality.

User-Centric Design Philosophy: We prioritize user experience in our development process, ensuring our apps are intuitive, engaging, and easy to navigate. This approach significantly boosts user retention and satisfaction.

Agile Development Methodology: We employ agile methodologies that allow flexibility, rapid prototyping, and iterative testing to ensure the product evolves in line with user feedback and emerging market trends.

Global Reach and Scalability: Our apps are designed to scale and cater to a global audience, capable of growing and adapting to various markets and user bases without compromising on performance.

Dedicated Support and Maintenance: We provide ongoing support and maintenance post-launch to ensure the app remains updated with the latest features and security enhancements, which is crucial for maintaining a competitive edge.

Contact us to discuss your project needs and discover how we can help you transform your vision into a robust and innovative digital banking app that stands out in the market.

FAQs

Q. How much does it cost to develop an app like Mashreq NEOBiz?

A. The cost to build a digital banking app like Mashreq NEOBiz can vary significantly based on several factors, including the app’s complexity, the technology used, and the features you decide to include. Generally, development costs in the UAE can range from $50,000 for a basic app with core functionalities to over $300,000 for a highly sophisticated app incorporating advanced technologies like AI and blockchain.

Q. What makes a successful digital banking app?

A. A successful digital banking app combines user-friendly design, robust security measures, and personalized features. It should offer seamless navigation, reliable transaction processing, and tailored financial insights. Integrating advanced technologies like artificial intelligence for enhanced customer service and predictive analytics can significantly improve user engagement and satisfaction. A leading app development firm with similar expertise in the field can help you build an app that meets your user expectations and stands out in a competitive market with innovative features and top-notch functionality.

Q. How long does it take to develop a digital banking app?

A. The time to develop a digital banking app depends on its complexity and features. A basic app may take 4 to 6 months, while one with advanced features and integrations can take over a year. This includes planning, design, development, testing, and launch.

Q. What tech stack is needed to build a digital bank in the UAE?

A. To build a digital bank in the UAE, you need a secure cloud platform (AWS or Azure), a core banking engine (like Temenos or Mambu), APIs for KYC/AML, payment gateways (SWIFT, Mastercard), mobile frameworks (Flutter, React Native), and strong data encryption protocols.

Q. What are the benefits of digital banking app development for businesses?

A. Developing a digital banking app offers several advantages for businesses:

- Gives customers access to banking services anytime, improving satisfaction.

- Makes processes faster and reduces mistakes by using automation.

- Helps businesses understand customers better through data insights.

- Keeps transactions secure, building customer trust.

- Allows businesses to grow and reach more people easily.

- Helps stand out in the market with useful features and services.

Why Does Your Bank Need a Business Banking App?

The demand for digital solutions has become paramount in today's rapidly evolving financial landscape. Regardless of size, businesses increasingly seek efficient, secure, and accessible banking services that align with their dynamic operational needs. This shift has propelled the development of business banking applications, which offer a comprehensive suite of services tailored to the unique requirements…

26 Best Mobile Banking App Features to Stand Out in the Market

Mobile banking apps have become the heartbeat of modern living, seamlessly orchestrating our personal, professional, and financial worlds with unmatched convenience. This is pretty obvious in today’s tech-savvy scenario. How? We live in a digitally connected world where we rely on mobile devices not just to do our daily tasks but also to manage business…

Have you ever wondered how banks handle increasingly complex tasks while keeping services smooth and responsive? It’s no coincidence—many financial institutions are adopting technologies like Robotic Process Automation (RPA). By automating repetitive processes such as loan approvals, customer onboarding, and fraud detection, Robotic process automation in banking empowers the sector to operate faster and more…