- How Banks Put AI to Work

- Four Archetypes of AI in Banking Services

- 1. Highly Centralized

- 2. Centrally Led, Business Unit Executed

- 3. Business Unit Led, Centrally Supported

- 4. Highly Decentralized

- Applications of AI in Banking and Finance

- Cybersecurity and Fraud Detection

- Chatbots

- Loan and Credit Decisions

- Tracking Market Trends

- Data Collection and Analysis

- Customer Experience

- Risk Management

- Regulatory Compliance

- Predictive Analytics

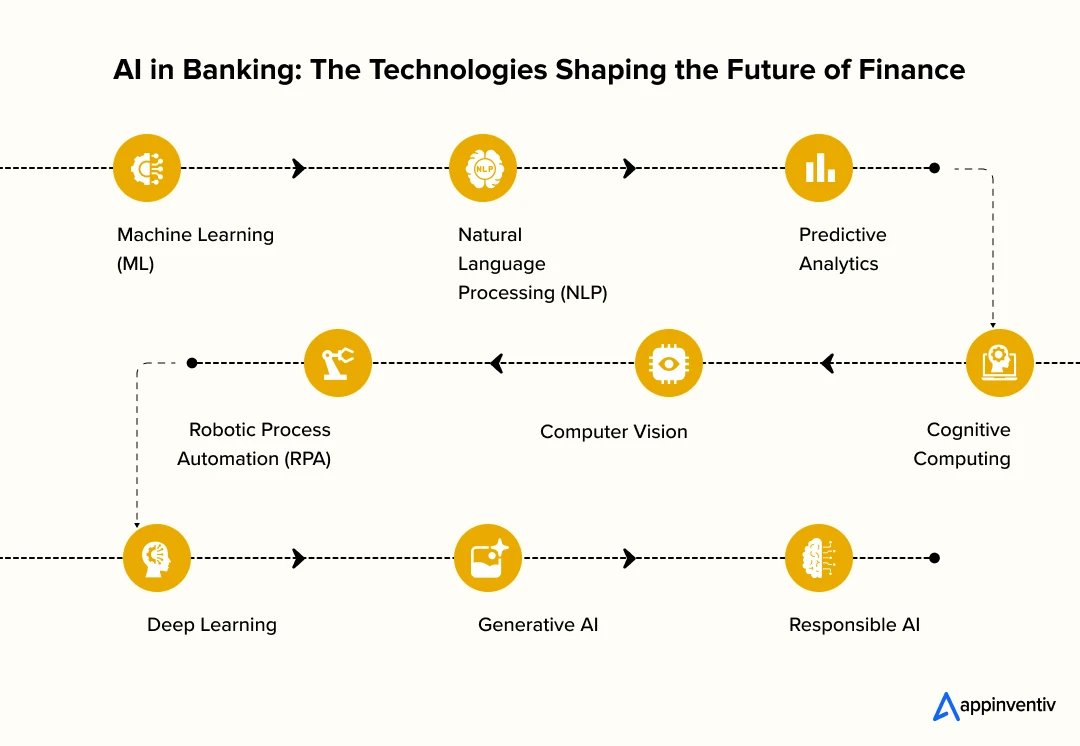

- Transforming Banking with AI: Key Technologies and Their Impact

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Predictive Analytics

- Robotic Process Automation (RPA)

- Computer Vision

- Cognitive Computing

- Deep Learning

- Generative AI

- Responsible AI

- Real-World Examples of AI in Banking

- JPMorgan Chase

- Capital One

- An European Bank

- Bank of America

- Wells Fargo

- HSBC

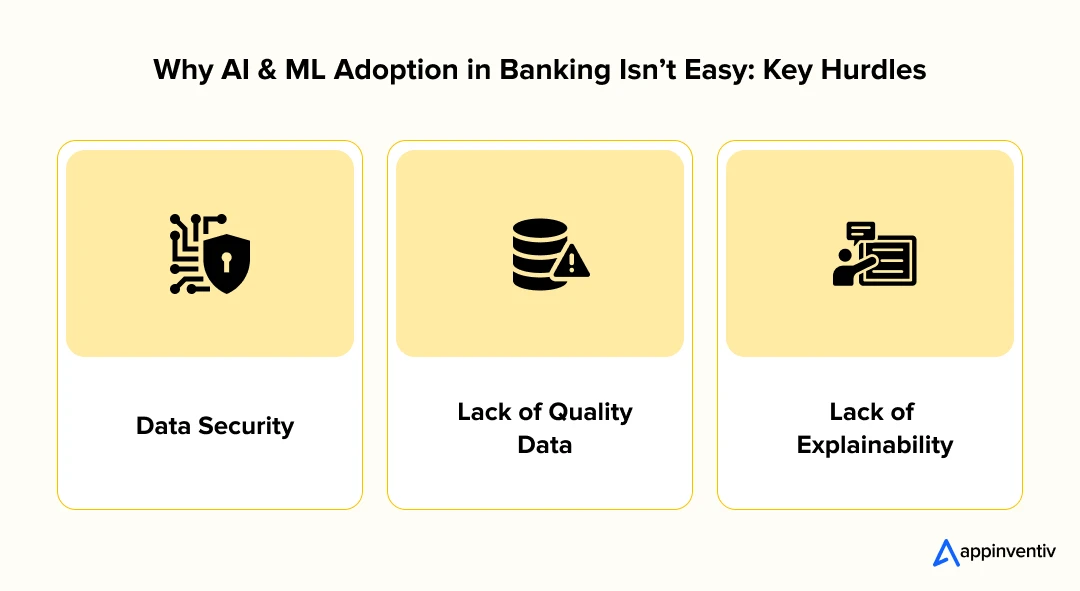

- Challenges in Adopting AI & ML in Banking

- Data Security

- Lack of Quality Data

- Lack of Explainability

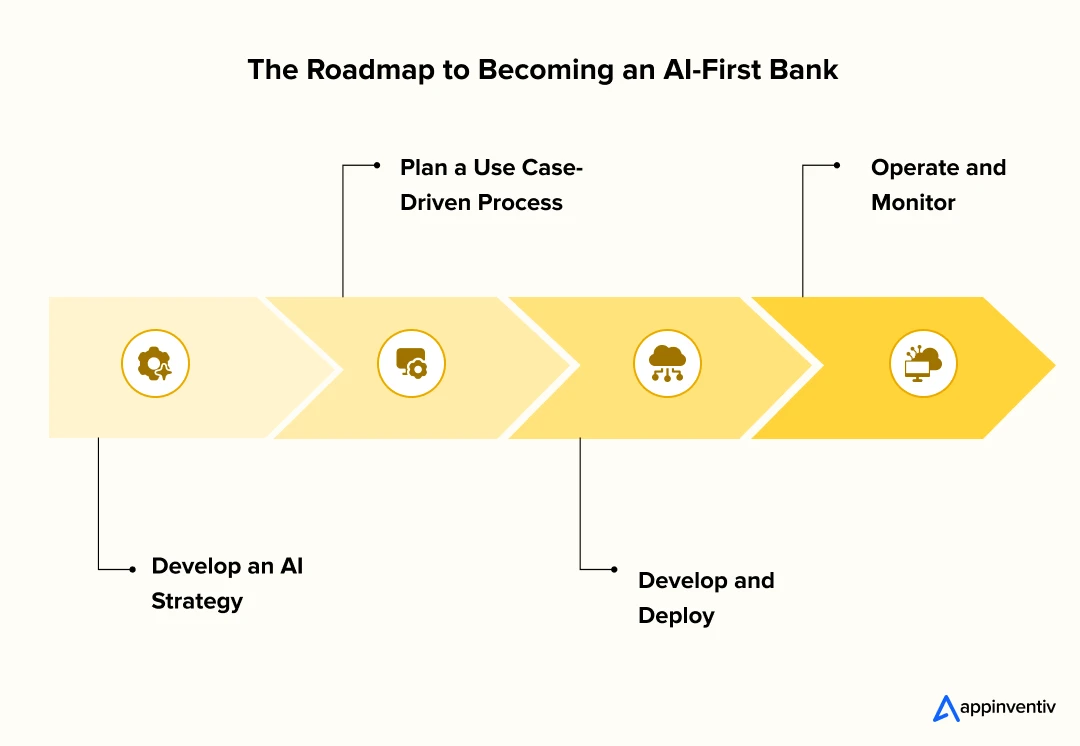

- Steps to Become an AI-First Bank

- Step 1: Develop an AI Strategy

- Step 2: Plan a Use Case-Driven Process

- Step 3: Develop and Deploy

- Step 4: Operate and Monitor

- Future Trends of AI in Banking

- Advanced Predictive Analytics

- Autonomous Finance

- Deeper Integration with IoT

- Enhanced Regulatory Compliance

- Ethical AI Implementation

- Expansion of AI-Enabled Cybersecurity

- Partnering with Appinventiv for AI-Driven Banking Transformation

- FAQs

- From fraud detection to personalized experiences, artificial intelligence is now fundamental to modern banking operations.

- The adoption of AI in banking could boost the sector’s productivity by up to $340 billion annually, with 86% of financial firms recognizing its critical role.

- AI tools like chatbots and personalized recommendations are reshaping how banks interact with customers, offering tailored services around the clock.

- Despite challenges around data security and explainability, the future of banking points to stronger predictive analytics and finance automation capabilities.

Artificial Intelligence has quietly moved from a futuristic concept to reality, and nowhere is this transformation more evident than in banking. Over the past few years, financial institutions have embraced AI not as a desirable feature, but as essential infrastructure that powers everything from mobile apps to fraud detection systems.

What started as experimental technology has become the backbone of modern banking operations. AI solutions for banking now drive personalized customer experiences, automate complex processes, and protect against sophisticated cyber threats. The application of artificial intelligence in banking spans from chatbots that handle routine inquiries to machine learning algorithms that assess loan risk in seconds rather than weeks.

The numbers paint a compelling picture of this shift:

- 60% of banking CEOs recognize they must take calculated risks with automation to maintain their competitive edge. (Source: IBM)

- In 2024, 78% of banks experimented with generative AI tactically, though only 8% implemented it systematically across their entire organization. (Source: IBM)

- Despite digital advances, just 16% of customers worldwide feel comfortable using a completely branchless bank as their primary provider. (Source: IBM)

- However, 86% of financial services companies using AI believe it will be crucial to their success over the next two years. (Source: Deloitte)

- The use of AI in banking and finance could generate $200 billion to $340 billion annually for the global banking sector through improved productivity alone. (Source: McKinsey)

These statistics reveal an industry in transition—one where traditional banking meets cutting-edge technology to create more efficient, secure, and customer-focused financial services. Let’s explore how AI is reshaping every corner of banking and finance, from customer interactions to back-office operations.

Take the first step toward smarter banking.

How Banks Put AI to Work

Banks have transformed their customer relationships by using artificial intelligence to deliver personalized experiences that actually matter. Instead of generic offerings, they analyze spending habits and preferences to recommend the perfect credit card or investment strategy.

This personal touch fosters genuine loyalty, as customers feel understood rather than just another account number. Meanwhile, AI solutions for banking have revolutionized fraud detection, with systems that monitor millions of transactions simultaneously to catch suspicious activity before it causes damage.

The operational benefits extend far beyond customer-facing services. AI handles routine tasks that once consumed entire departments—loan processing, compliance reporting, and risk assessments now happen automatically, freeing employees to focus on strategic initiatives.

Banks can identify market opportunities more quickly and adjust their services accordingly. AI applications in banking continue expanding into voice-activated support, predictive maintenance, and automated investment advice. This isn’t just about keeping pace with competitors; it’s fundamentally reshaping how banks operate, making them more efficient, secure, and responsive to customer needs.

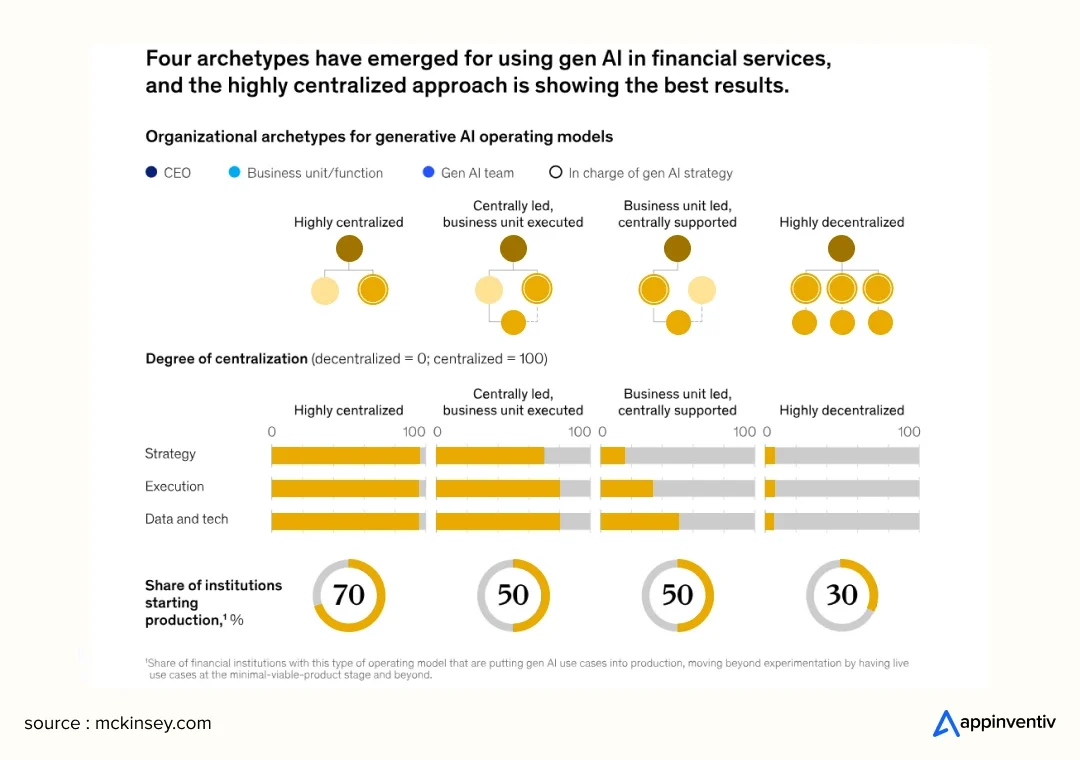

Four Archetypes of AI in Banking Services

When banks decide to implement AI technology, selecting the right operating model can make or break their entire digital transformation. The way organizations structure their AI teams and distribute responsibilities directly impacts how quickly they can innovate, scale solutions, and deliver value to customers. Each archetype offers distinct advantages depending on a bank’s size, culture, and strategic priorities. Understanding these models helps leadership teams avoid common pitfalls and choose an approach that aligns with their existing capabilities and long-term vision.

1. Highly Centralized

This model places all AI decision-making power in the hands of a specialized central team that operates like a technology command center. The team controls everything from strategic planning to technical implementation, working independently from traditional business units to maintain focus and expertise. Banks using this approach often see faster adoption of cutting-edge technologies because the central team can move quickly without navigating complex departmental politics.

However, the trade-off comes in the form of a potential disconnect between AI solutions and real-world business needs, since the central team may lack deep operational knowledge of specific banking functions. The role of artificial intelligence in banking becomes highly standardized, but may miss nuanced requirements from different departments.

2. Centrally Led, Business Unit Executed

Here, strategic vision flows from a central AI team while actual implementation happens at the business unit level, creating a hybrid approach that balances expertise with practical application. The central team establishes overarching AI policies, provides technical resources, and ensures compliance standards, while individual departments adapt these frameworks to their specific operational needs.

This model works particularly well for large banks with diverse service offerings because it allows specialized teams to customize AI solutions for lending, wealth management, or retail banking while maintaining organizational consistency. The central team acts as both a resource hub and quality control mechanism, ensuring that ai use in banking remains aligned with corporate strategy while allowing for necessary flexibility in execution.

3. Business Unit Led, Centrally Supported

This approach inverts the previous model, placing business units in the driver’s seat while the central team provides guidance, best practices, and technical support as needed. Individual departments identify their own AI opportunities, develop solutions, and drive implementation with minimal interference from corporate headquarters. The central team functions more like an internal consulting service, offering expertise and ensuring that different units don’t duplicate efforts or create conflicting systems.

Banks that choose this model typically have strong departmental leadership and want to encourage innovation at the grassroots level. The artificial intelligence in banking sector develops organically based on real operational challenges rather than top-down mandates, though this can sometimes lead to inconsistent approaches across the organization.

4. Highly Decentralized

In the most distributed model, each business unit operates its own AI initiatives with complete autonomy and minimal central oversight or coordination. Departments function almost like independent companies, making their own technology decisions, hiring their own AI talent, and developing solutions that fit their immediate needs. This approach maximizes innovation speed and allows units to respond quickly to market changes or customer demands without waiting for corporate approval.

However, it can also lead to redundant investments, incompatible systems, and missed opportunities for sharing valuable insights across the organization. The success of AI and machine learning in banking under this model depends heavily on having strong leaders in each unit who understand both technology and business strategy, as there’s little safety net from central expertise.

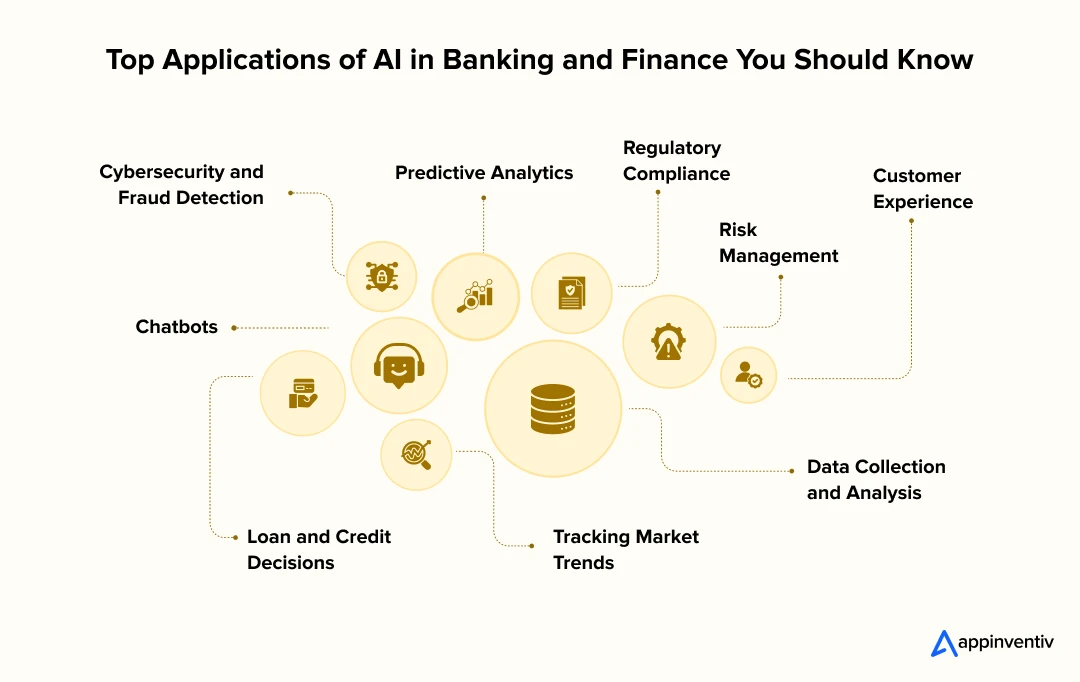

Applications of AI in Banking and Finance

AI in modern banking has become an integral part of our world, and banks have already started integrating this technology into their products and services. Here are some major AI applications in the banking industry:

Cybersecurity and Fraud Detection

Digital transactions have exploded in recent years, from paying bills to transferring money and managing accounts online. This surge has made fraud detection absolutely critical for financial institutions. Banks now turn to AI digital banking solutions and machine learning to stay ahead of criminals targeting their customers.

These smart systems operate around the clock, identifying suspicious behavior as it occurs and flagging unusual transaction patterns that might evade traditional security measures.

They also hunt for weak spots in banking systems before fraudsters can exploit them. The application of artificial intelligence in banking has transformed how institutions protect their customers, reducing financial losses while making online banking safer for everyone.

Chatbots

Banking chatbots have become incredibly popular, and it’s easy to see why. While human customer service reps clock out at the end of their shifts, these digital assistants never sleep. They’re there at 2 AM when you need to check your balance or at midnight when you’re worried about a suspicious charge.

What makes modern banking chatbots impressive is how they get smarter over time. They remember your preferences, learn from every conversation, and become better at helping you specifically. This personalized approach, powered by AI ML in banking technology, means customers get faster answers to their questions while banks can focus their human staff on more complex issues that really need that personal touch.

At Appinventiv, we built Mudra, an advanced chatbot-driven budget management platform crafted to solve everyday personal finance challenges.

After six months of focused design and development, Mudra successfully launched across 12+ countries. Packed with interactive features, the app redefines user engagement and sets a new benchmark in the FinTech space.

Loan and Credit Decisions

The use of AI in banking and finance is revolutionizing loan and credit decisions by enabling banks to analyze a wider range of data beyond traditional credit scores. AI systems can assess customers with limited credit history, identifying patterns that indicate creditworthiness. These systems send alerts to banks about behaviors that could lead to defaults, making the process safer and more accurate.

As a result, AI-driven decision-making enhances the efficiency and accuracy of lending processes, mitigating risks while expanding opportunities for a broader customer base. These are prime use cases of AI in banking that help banks make more informed and profitable credit decisions.

Tracking Market Trends

AI-ML in financial services helps banks to process large volumes of data and predict the latest market trends. Advanced mobile apps powered by machine learning in banking help evaluate market sentiments and suggest investment options.

AI solutions for banking also suggest the best time to invest in stocks and warn when there is a potential risk. Due to its high data processing capacity, this emerging technology also helps speed up decision-making and makes trading convenient for banks and their clients.

Data Collection and Analysis

Banking and finance institutions record millions of transactions every single day. Since the volume of information generated is enormous, its collection and registration become overwhelming for employees. Structuring and recording such a huge amount of data without any error becomes impossible.

Innovative AI and banking software development company help in efficient data collection and analysis in such scenarios. This, in turn, improves the overall user experience. The information can also be used for detecting fraud or making credit decisions.

Customer Experience

Integrating AI in banking services significantly enhances customer experience by automating tasks like KYC registration and loan approvals, reducing processing times and errors. AI-powered chatbots and virtual assistants are available 24/7, providing quick and personalized responses.

With AI, customers can access services like account opening and loan applications from their smartphones, making banking more convenient. Additionally, AI solutions for banks enable the release of new products and offers on time, ensuring that customers have access to timely and relevant services. This seamless experience not only boosts customer satisfaction but also strengthens loyalty.

Integrating artificial intelligence in banking and finance services further enhances the consumer experience and increases the level of convenience for users. AI technology reduces the time taken to record Know Your Customer (KYC) information and eliminates errors. Additionally, new products and financial offers are released on time.

Risk Management

External global factors such as currency fluctuations, natural disasters, or political unrest seriously impact the banking and financial industries. During such volatile times, taking business decisions extra cautiously is crucial. Generative AI services in banking offer analytics that give a reasonably clear picture of what is to come and help you stay prepared and make timely decisions.

AI for banking also helps find risky applications by evaluating the probability of a client failing to repay a loan. It predicts this future behavior by analyzing past behavioral patterns and smartphone data. Read the given blog to learn how technology is shaping the future of digital lending.

Regulatory Compliance

Regulatory compliance is a prominent application of AI in banking, as it helps institutions efficiently monitor and adhere to complex legal standards. Banking is one of the highly regulated sectors of the economy worldwide. Governments utilize their regulatory authority to ensure that banking customers are not using banks to perpetrate financial crimes and that banks maintain acceptable risk profiles to prevent large-scale defaults.

Banks typically maintain an internal compliance team to address these issues, but these processes are time-consuming and require significant investments when done manually. Compliance regulations are also subject to frequent changes, and banks must continually update their processes and workflows to comply with these regulations.

AI and ML in banking use deep learning and NLP to read new compliance requirements for financial institutions and improve their decision-making process. Even though AI in the banking sector can’t replace compliance analysts, it can make their operations faster and more efficient.

Predictive Analytics

One of the most common use cases of AI in the banking industry includes general-purpose semantic and natural language applications and broadly applied predictive analytics. AI can detect specific patterns and correlations in the data, highlighting the role of AI in banking, which traditional technology could not previously identify.

These patterns could indicate untapped sales opportunities, cross-sell opportunities, or metrics related to operational data, all of which could lead to a direct revenue impact.

Transforming Banking with AI: Key Technologies and Their Impact

AI technologies are reshaping the banking sector, enhancing efficiency, security, and customer experience. With AI’s growing role, banks are better equipped to manage risks, enhance decision-making, and provide personalized, real-time services to their customers. Here’s how key AI technologies are transforming the banking sector:

Machine Learning (ML)

Machine learning algorithms process extensive datasets to identify patterns, trends, and anomalies that would be difficult to detect manually. Financial institutions leverage these sophisticated systems for fraud detection, analyzing transaction histories to identify suspicious activities in real-time. ML also enhances credit assessment processes by examining spending behaviors and financial patterns beyond conventional credit reports, providing more comprehensive risk evaluations for lending decisions.

Natural Language Processing (NLP)

NLP technology enables machines to comprehend and respond to human language with remarkable accuracy. Banks implement this technology through chatbots and virtual assistants that provide continuous customer support, handling inquiries and transactions around the clock. NLP also streamlines document processing for applications such as loan approvals, significantly reducing manual data entry errors while accelerating customer onboarding and approval workflows.

Predictive Analytics

Predictive analytics leverages historical data to forecast future market trends and customer behaviors. Banks utilize these analytical capabilities to anticipate market fluctuations, understand customer preferences, and identify potential risks before they materialize. These predictive models enable institutions to identify customers who may face payment difficulties, allowing for proactive intervention strategies and more informed investment decision-making.

Robotic Process Automation (RPA)

RPA deploys AI-driven automation to handle repetitive, rule-based processes with precision and efficiency. Banking institutions utilize RPA for data entry, account reconciliation, and processing of Know-Your-Customer documentation. This technology enhances operational efficiency, minimizes human error, and enables staff to concentrate on strategic initiatives that require human expertise and decision-making capabilities.

Computer Vision

Computer vision technology enables machines to interpret and analyze visual information with high accuracy. Banks implement this artificial intelligence in banking sector applications for document verification, facial recognition authentication, and automated check processing. This technology strengthens security protocols by ensuring authorized access to financial services while improving the reliability of mobile banking platforms.

Cognitive Computing

Cognitive computing systems simulate human thought processes to support data-driven decision-making. Banks apply this technology to deliver personalized customer experiences, analyzing individual preferences and behaviors to recommend appropriate financial products. Cognitive analysis handles complex customer inquiries efficiently while providing sophisticated responses that enhance customer satisfaction and engagement.

Deep Learning

Deep learning represents an advanced form of machine learning that utilizes neural networks to analyze complex datasets. Financial institutions implement these systems for sophisticated fraud detection and voice recognition capabilities, where algorithms identify intricate fraud patterns in transactions and authenticate customers through voice analysis during phone banking interactions.

Generative AI

Generative AI solutions for finance and banking create new content based on learned patterns, including text, images, and analytical data. Banks utilize this technology to generate personalized financial reports, develop targeted marketing materials, and automate the creation of legal documents. These systems also simulate various financial scenarios, enabling institutions to predict market conditions and customer behavior patterns better.

Responsible AI

The role of artificial intelligence in banking necessitates careful consideration of its ethical implementation. Responsible AI use in banking ensures that AI systems operate with fairness, transparency, and accountability. This approach is particularly critical for applications such as credit scoring and loan approvals, where bias prevention is essential.

By incorporating ethical principles into AI and machine learning in banking systems, institutions maintain customer trust while ensuring compliance with regulatory standards and industry best practices.

Real-World Examples of AI in Banking

As highlighted above, few big banks have already started leveraging artificial intelligence technologies to improve their quality of service, detect fraud and cybersecurity threats, and enhance customer experience.

Here are a few real-world examples of banking institutions utilizing AI to their full advantage.

JPMorgan Chase

Researchers at JPMorgan Chase have developed an early warning system using AI and deep learning techniques to detect malware, trojans, and phishing campaigns. Researchers say it takes around 101 days for a trojan to compromise company networks.

The early warning system provides ample warning before the attack occurs. It also sends alerts to the bank’s cybersecurity team as hackers prepare to send malicious emails to employees to infect the network. This is one of the most advanced examples of artificial intelligence applications in banking.

Capital One

Capital One’s Eno, the intelligent virtual assistant, is the best example of AI in personal banking. Besides Eno, Capital One also uses virtual card numbers to prevent credit card fraud. Meanwhile, they are working on computational creativity that trains computers to be creative and explainable, an innovative direction among artificial intelligence banking use cases.

An European Bank

Appinventiv worked with a leading European bank that wanted an AI-based solution to resolve customer queries in real-time. Within 10 weeks, the team deployed an AI-based chatbot assistant in the bank’s web and mobile apps capable of handling complex tasks such as resolving real-time customer complaints and reporting stolen credit card cases.

With support for seven languages, the AI chatbot was ready to assist customers worldwide. This resulted in a 20% hike in customer retention and reflects how artificial intelligence in banking sector is improving customer experience.

Bank of America

Bank of America introduced its AI-powered virtual assistant, Erica, to help customers manage everyday banking tasks like checking balances, tracking expenses, viewing credit report updates, and even getting financial advice. Since its launch, Erica has handled over 1.5 billion interactions, demonstrating the scalability and engagement capabilities of AI.

By utilizing natural language processing and machine learning, the assistant can comprehend complex queries and provide proactive insights, such as alerts for unusual activity or spending patterns. Erica’s smooth integration with the mobile app reflects how artificial intelligence banking solutions are becoming core to digital customer experiences.

Wells Fargo

Wells Fargo utilizes AI and machine learning to identify and analyze customer transactions for unusual patterns or potential fraud. This real-time detection system helps reduce risk and protect users more effectively.

The bank also utilizes predictive analytics to better understand customer needs and suggest tailored financial products, ranging from home loans to investment plans. These efforts not only boost customer satisfaction but also support cross-selling. It’s a strong example of how AI ML use cases in banking are driving both security and personalization forward.

HSBC

HSBC has embedded AI into its anti-money laundering framework to detect and prevent financial crime more efficiently. Working with Ayasdi, the bank utilizes machine learning to uncover hidden relationships in large transaction datasets. This system significantly reduces false positives, enabling compliance teams to focus on genuine threats rather than wasting time on non-issues.

The improved accuracy has strengthened regulatory compliance and cut down operational costs. It’s a clear reflection of the practical benefits of artificial intelligence in banking.

Now that we have looked into the real-world examples of AI in banking let’s dive into the challenges for banks using this emerging technology.

Challenges in Adopting AI & ML in Banking

The wide implementation of high-end technology like AI is not without challenges. Several challenges exist for banks using AI technologies, from a lack of credible and quality data to security issues.

So, without further ado, let’s take a look at them:

Data Security

The amount of data collected in the banking industry is vast and requires robust security measures to prevent breaches or violations. Therefore, finding the right technology partner who understands AI and banking well and offers various security options to ensure your customer data is handled appropriately is crucial.

Lack of Quality Data

Banks need structured and quality data for training and validation before deploying a full-scale AI-based banking solution. Quality data is required to ensure the algorithm applies to real-life situations.

Also, if data is not in a machine-readable format, it may lead to unexpected AI model behavior. So, banks accelerating toward the adoption of AI need to modify their data policies to mitigate all privacy and compliance risks.

Lack of Explainability

AI-based systems are widely applicable in decision-making processes as they eliminate errors and save time. However, they may be influenced by biases learned from previous cases of poor human judgment. Minor inconsistencies in AI systems can escalate quickly and create significant problems, potentially jeopardizing the bank’s reputation and operations.

To avoid calamities, banks should offer an appropriate level of explainability for all decisions and recommendations presented by AI models. Banks need to understand, validate, and explain how the model makes decisions.

Steps to Become an AI-First Bank

Now that we have seen how AI is used in banking and the impact of artificial intelligence in the banking sector, we will look into the steps that banks can take to adopt AI on a broad scale and evolve their processes while paying due attention to the four critical factors: people, governance, process, and technology.

Step 1: Develop an AI Strategy

The AI implementation process begins with developing an enterprise-level AI strategy, taking into account the organization’s goals and values.

It’s crucial to conduct internal market research to find gaps among the people and processes that AI technology can fill. Ensure that the AI strategy aligns with industry standards and regulations. Banks can also evaluate the current international industry standards.

The final step in AI strategy formulation is to refine the internal practices and policies related to talent, data, infrastructure, and algorithms to provide clear directions and guidance for adopting AI across the bank’s various functional units.

Step 2: Plan a Use Case-Driven Process

The next step involves identifying the highest-value AI opportunities, aligning with the bank’s processes and strategies.

Banks must also evaluate the extent to which they need to implement AI banking solutions within their current or modified operational processes.

After identifying the potential AI in banking use cases, the QA team should run checks to test feasibility. They must look into all aspects and identify the gaps for implementation. Based on their evaluation, they must select the most feasible cases.

The last step in the planning stage is to map out the AI talent. Banks require several experts, including algorithm programmers or data scientists, to develop and implement AI solutions. They can outsource or collaborate with a technology provider if they lack in-house experts.

Step 3: Develop and Deploy

After planning, the next step for banks is to execute the process. Before developing a full-fledged AI system, they need to build prototypes to understand the shortcomings of the technology. To test the prototypes, banks must compile relevant data and feed it to the algorithm. The AI model trains and builds on this data; therefore, the data must be accurate.

Once the AI model is trained and ready, banks must test it to interpret the results. A trial like this will help the development team understand how the model will perform in the real world.

The last step is to deploy the trained model. Once deployed, production data starts pouring in. As more and more data starts coming in, banks can regularly improve and update the model.

Step 4: Operate and Monitor

The implementation of AI banking solutions requires continuous monitoring and calibration. Banks must design a comprehensive review cycle to monitor and evaluate the AI model’s functioning. This, in turn, will help banks manage cybersecurity threats and execute operations robustly.

The continuous flow of new data will affect the AI model at the operation stage. Therefore, banks should take appropriate measures to ensure the quality and fairness of the input data.

Partner with us to future-proof your financial services.

Future Trends of AI in Banking

The future of AI in banking is set to bring significant advancements that will reshape the industry in exciting ways. Here’s what to expect:

Advanced Predictive Analytics

AI will improve in delivering accurate predictions about customer behavior, market trends, and financial risks. This will enable banks to make more informed decisions in advance, tailor services more effectively, and mitigate potential risks.

Autonomous Finance

AI will automate many financial services like investing and budgeting, tailored to each customer’s habits and goals. This shift towards automated financial advice and management is both efficient and personalized.

[Also Read: Autonomous Agents: From Theory to Practical Applications and Implementation Techniques in Business]

Deeper Integration with IoT

As AI integrates more with the Internet of Things (IoT), banks will offer services that respond to real-time data from connected devices. This means banking services that are more responsive and personalized than ever before.

Enhanced Regulatory Compliance

AI will help banks navigate complex regulations by automating compliance monitoring and reporting. This ensures faster adaptation to regulatory changes and reduces human error.

Ethical AI Implementation

The focus will also be on the ethical use of AI, ensuring fairness, transparency, and accountability. Banks will develop frameworks to handle these moral considerations, maintaining trust and integrity in their AI applications.

Expansion of AI-Enabled Cybersecurity

AI will enhance cybersecurity by instantly detecting and responding to threats. This advanced security will better protect against fraud and cyberattacks, keeping customer data safe.

Partnering with Appinventiv for AI-Driven Banking Transformation

The future of AI in banking promises unprecedented opportunities for institutions willing to embrace technological innovation. Financial organizations that integrate artificial intelligence into their core operations will gain significant competitive advantages through enhanced decision-making capabilities, improved customer experiences, and streamlined operational efficiency. As AI continues evolving, banks must position themselves at the forefront of this transformation rather than risk falling behind competitors who are already leveraging these powerful technologies.

Banks face unique challenges when implementing AI solutions, ranging from regulatory compliance and data security to customer trust and integrating legacy systems. This is where Appinventiv’s expertise becomes invaluable. As a leading AI development company specializing in FinTech software solutions, we understand the intricate balance between innovation and stability that banking institutions require.

Our team works closely with banks and financial institutions to develop custom AI and machine learning models tailored to specific business needs. We help organizations improve revenue streams, reduce operational costs, and mitigate risks across multiple departments through intelligent automation and predictive analytics. Whether you need fraud detection systems, customer service chatbots, or risk assessment algorithms, our solutions are designed to integrate seamlessly with existing banking infrastructure.

What sets us apart as a trusted fintech software development services provider is our deep understanding of both artificial intelligence capabilities and the unique regulatory landscape that governs financial services. We create comprehensive strategies that ensure long-term success while maintaining compliance with industry standards.

Ready to transform your banking operations with AI?

Connect with our experts today to develop a customized AI strategy that aligns with your institution’s goals and delivers measurable results in the most efficient way possible.

FAQs

Q. How is artificial intelligence used in banking?

A. Artificial Intelligence has fundamentally changed how banks operate, transforming everything from fraud detection and credit assessment to personalized customer service experiences. Real-time transaction monitoring systems can spot suspicious activity within milliseconds, while virtual assistants handle routine customer inquiries around the clock, freeing human staff for more complex problem-solving.

Predictive analytics helps banks make informed lending decisions and anticipate market shifts with greater accuracy than ever before. The diverse uses of AI in banking also include customizing financial products based on individual spending patterns and goals, creating genuinely personalized banking relationships. This technology processes enormous datasets quickly, identifying patterns and opportunities that would overwhelm human analysts working with traditional methods.

Q. How can AI strengthen fraud detection and enhance security in banking?

A. Here are some ways in which AI can help banks reduce the possibilities of fraud and ensure enhanced security.

- Data analysis: AI systems analyze vast amounts of data to spot trends and abnormalities that could be signs of danger.

- Real-time monitoring: AI in digital banking keeps track of account activity and transaction data in real-time to quickly identify and address risks.

- Fraud detection: AI algorithms spot fraudulent actions by examining transactional data and customer behavior patterns.

- Compliance and regulatory requirements: The use of AI in banking helps banks ensure compliance with rules by automatically tracking transactions and producing reports

- Predictive analytics:The use of AI in banking allows for the creation of risk models and enables predictive analytics to calculate the likelihood of defaults and market volatility.

Q. Which are the most important Generative AI use cases in banking?

A. Here are some of the most significant Generative AI use cases in banking:

- Enhanced Fraud Detection: Generative AI models can simulate various fraudulent scenarios to improve detection algorithms, making fraud prevention systems more robust and responsive.

- Risk Assessment and Credit Scoring: Generative AI is reshaping risk assessment and credit scoring in the banking sector. By creating detailed simulations of financial scenarios, generative AI tools provide deeper insights into credit risks. This helps the financial institutions improve the accuracy of their credit scoring models, leading to smarter lending decisions.

- Document Processing Automation: Generative AI excels in automating the generation and processing of complex banking documents, reducing errors and increasing efficiency.

- Personalized Customer Experience: Applications of generative AI in banking are pivotal in revolutionizing customer experiences. By leveraging generative AI, banks can analyze extensive customer data to craft personalized marketing campaigns that are aligned with individual customer preferences and behaviors, significantly enhancing the effectiveness of marketing efforts.

Q. What are the top AI trends in banking?

A. The impact of AI in banking is immense, which has made different banking and financial companies keep themselves updated with the recent ai trends:

- In banking, AI-powered chatbots and virtual assistants are being utilized to enhance customer service, provide personalized support, and efficiently address common inquiries.

- RPA automates routine manual operations, such as data input and document processing, thereby boosting operational effectiveness and reducing banking procedure errors.

- By analyzing massive volumes of data, identifying trends, and detecting fraudulent activities in real-time, AI is increasingly utilized to identify and prevent fraud.

- With the help of AI, banks can use consumer information and preferences to provide personalized product suggestions, tailored offers, and specialized services.

- Due to the significant advantages of AI in banking, FinTech companies are now investing in AI for banking that facilitates complex data analysis, market trend forecasting, and risk assessment, enabling more precise risk management and informed decision-making.

Q. What are the key benefits of AI in banking?

A. AI is revolutionizing the banking industry by enhancing efficiency, reducing costs, and improving customer experiences. Let’s take a look at how AI is revolutionizing the banking sector:

- Fraud Detection and Prevention: AI systems analyze transaction patterns in real time to identify anomalies that could indicate fraud. By learning from historical data, AI can quickly spot unusual behaviors, reducing false positives and helping to prevent fraudulent activities before they occur.

- Customer Service Enhancement: AI-powered chatbots and virtual assistants provide customers with immediate responses to inquiries and assistance with banking transactions. These tools are available 24/7, offering a consistent and reliable service experience that can handle a high volume of queries efficiently.

- Credit Decision Making: AI algorithms can process vast amounts of data, including non-traditional data sources, to assess credit risk more accurately. This leads to faster credit decisions, personalized lending rates, and increased access to credit for customers with limited credit history.

- Operational Efficiency: AI automates routine tasks such as data entry, compliance checks, and report generation. This automation not only speeds up processes but also frees up human employees to focus on more complex and strategic activities, enhancing overall productivity.

- Personalized Banking: AI analyzes customer data to understand individual behaviors and preferences. Banks can use this information to tailor products, services, and communications to fit the unique needs of each customer, enhancing satisfaction and loyalty.

- Enhanced Content Creation: Generative AI enables the creation of realistic text, voices, and images, enhancing personalized marketing campaigns and customer interactions. This technology allows banks to deliver more engaging and customized content, which can significantly improve customer engagement and education, ultimately enhancing the overall customer experience.

Q. How does AI enhance customer service in banking?

A. AI dramatically transforms customer service in banking by providing round-the-clock support through intelligent chatbots that can handle routine inquiries instantly. The use of AI and ML in banking allows institutions to analyze customer data and deliver personalized financial advice tailored to individual needs and spending patterns. These systems speed up query resolution through smart automation, reducing wait times and improving overall satisfaction.

Beyond basic support, AI banking use cases extend to real-time fraud detection that protects customers from suspicious activities. Banks can now offer proactive services like spending alerts, loan recommendations, and detailed account insights based on user behavior patterns. This creates a more responsive banking experience where customers receive relevant suggestions and warnings before they even realize they need them.

Q. What are the risks and challenges of implementing AI in banking?

A. Here are some of the risks and challenges associated with the implementation of AI technology in banking:

- Data Privacy Concerns: Protecting sensitive financial information requires strict security protocols and compliance measures

- Regulatory Compliance: AI applications in banking must meet evolving industry standards and financial regulations

- Algorithmic Bias: Risk of unfair lending decisions or discriminatory practices affecting certain customer groups

- High Investment Costs: Uses of AI in banking require significant spending on infrastructure, talent, and change management

- Over-reliance Risks: Lack of human oversight can damage customer trust during complex or sensitive interactions

- Implementation Complexity: Requires a skilled workforce and comprehensive training to ensure successful deployment.

10 Ways AI is Transforming the Healthcare Sector in Australia

Key takeaways: Generative AI could add $13 billion annually to Australia’s healthcare sector by 2030. AI is already transforming operations across diagnostics, admin tasks, and patient care. Healthcare in remote areas is improving with AI-powered virtual assistants and monitoring tools. AI can help address workforce shortages by automating routine tasks and supporting clinical decisions. Major…

Exploring the Power of AI in Creating Dynamic & Interactive Data Visualizations

Key takeaways: AI transforms data visualization by providing automated insights, interactive dashboards, and NLP, thereby tackling revenue loss and improving data quality. Key features include predictive analytics, real-time data integration, and user-friendly visualizations, enabling faster and more informed decisions. Top 2025 tools, such as Tableau, Power BI, and Julius AI, offer NLP and real-time analytics…

Practical Applications of AI as a Service for Your Business

Key takeaways: AIaaS enables fast, infrastructure-free AI adoption. Used across industries for automation and insights. Real-world examples show proven business impact. Pilot-first approach ensures smooth implementation. Key challenges include data, cost, and scaling. Trends include ethical AI, edge, and SME growth Imagine being able to cut down your operational costs while simultaneously improving decision-making and…