- A Glimpse into the HSBC App: A Benchmark for Digital Banking Excellence

- How Much Does It Cost to Develop a Banking App Like HSBC in the UK?

- Key Factors Influencing the Cost to Build a Banking App Like HSBC in the UK

- 1. Feature Complexity

- 2. Platform Choice

- 3. Security & Compliance

- 4. Integration with Existing Systems

- 5. Scalability & Infrastructure

- 6. Customization & Personalization

- 7. UI/UX Design

- 8. Maintenance & Support

- 9. Technology Stack

- 10. Geographic Targeting & Localization

- 11. Testing & Quality Assurance

- Hidden Factors Affecting the Cost to Develop an App Like HSB

- 1. App Store Compliance and Fees

- 2. Third-Party API and SDK Licensing

- 3. Customer Onboarding and Support Tools

- 4. Downtime Management and SLAs

- 5. Data Storage and Backups

- 6. Continuous Testing and Updates

- 7. Localization and Legal Compliance

- 8. Marketing and User Acquisition

- Strategies to Optimize the Cost of Developing a Banking App Like HSBC

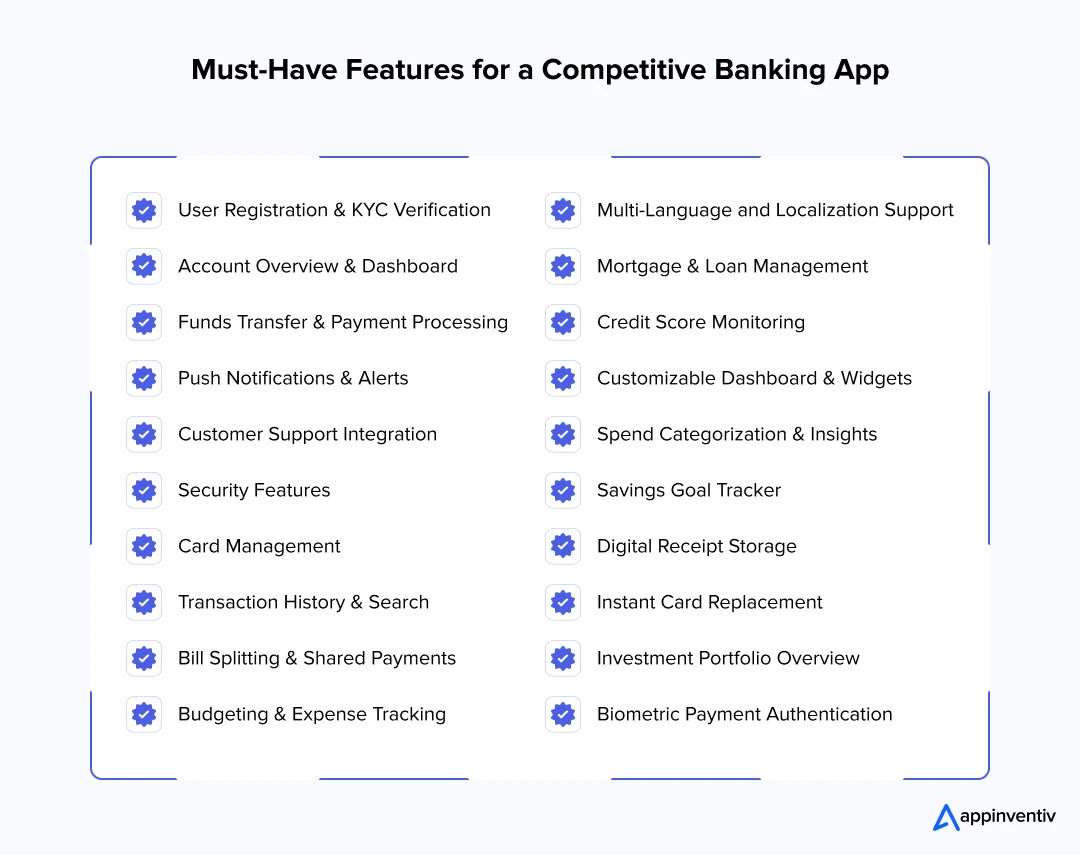

- Core Features of a Banking App Like HSBC

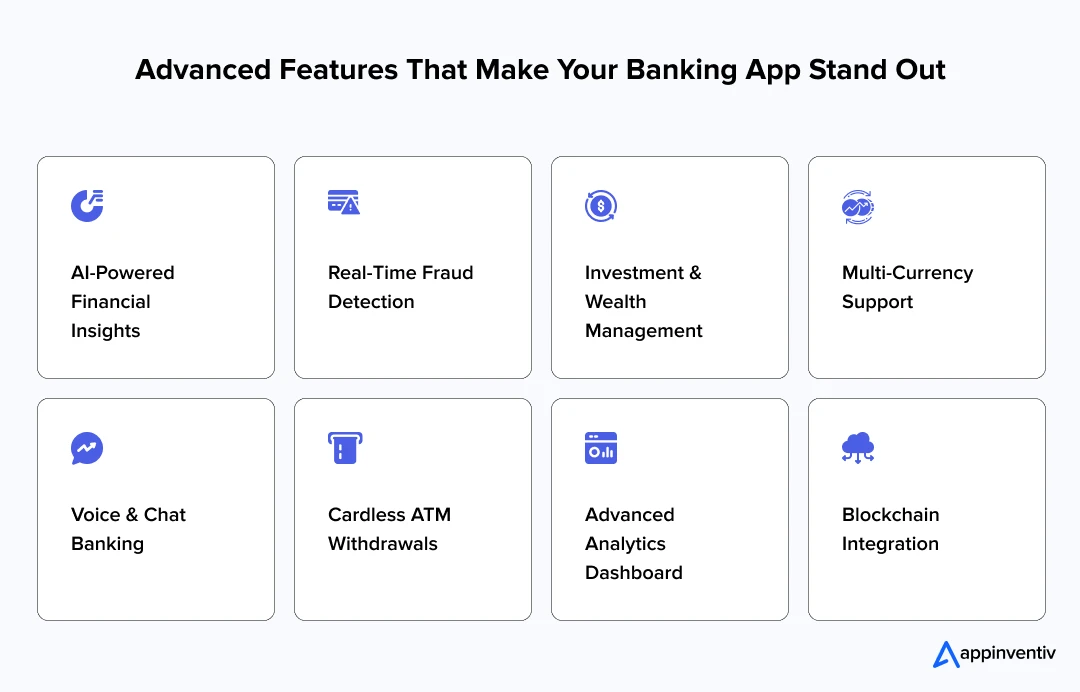

- Advanced Features to Elevate Your Banking App

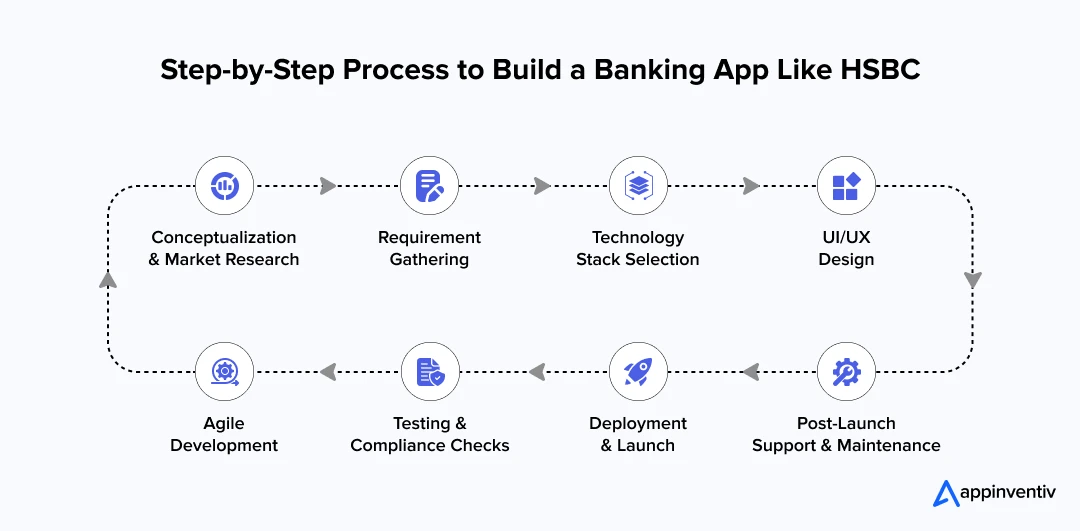

- Step-by-Step Guide to Developing a Banking App Like HSBC

- 1. Conceptualization & Market Research

- 2. Requirement Gathering

- 3. Technology Stack Selection

- 4. UI/UX Design

- 5. Agile Development

- 6. Testing & Compliance Checks

- 7. Deployment & Launch

- 8. Post-Launch Support & Maintenance

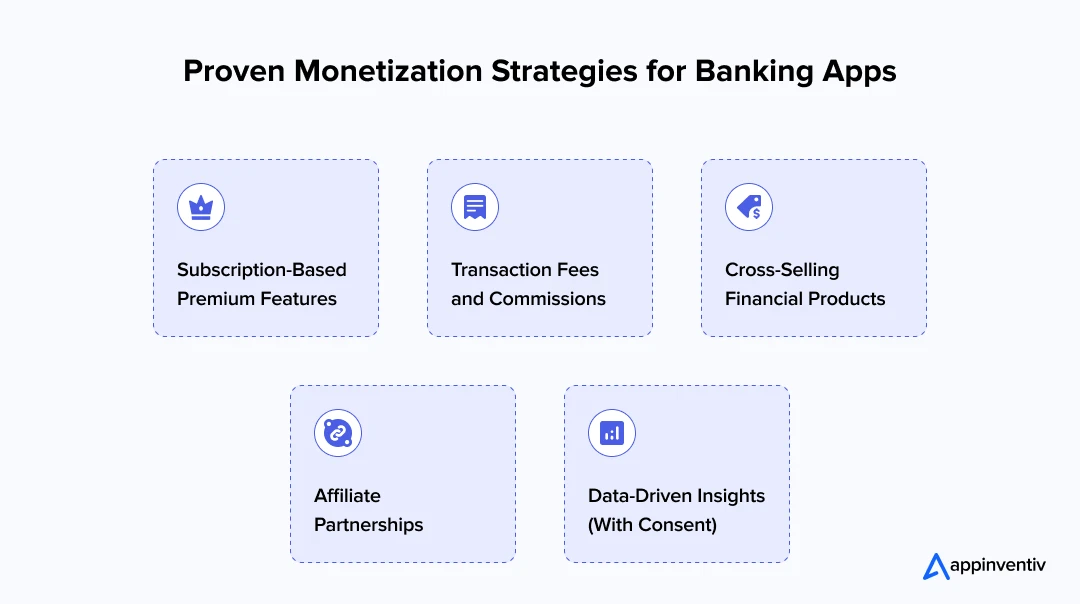

- Monetization Strategies for Banking Apps Like HSBC

- 1. Subscription-Based Premium Features

- 2. Transaction Fees and Commissions

- 3. Cross-Selling Financial Products

- 4. Affiliate Partnerships

- 5. Data-Driven Insights (With Consent)

- Why Choose Appinventiv to Develop Your Banking App?

- FAQs

Key Takeaways

- Building a banking app like HSBC in the UK costs between $30,000 and $200,000.

- Mobile banking adoption is surging, especially among Gen Z and Millennials.

- Success hinges on blending security, user experience (UX), and feature-rich functionality.

- Advanced features, such as AI insights and cardless withdrawals, are becoming industry standards.

- Regulatory compliance (GDPR, PSD2, PCI DSS) is essential from day one.

- Choosing the right tech partner can optimize costs and accelerate time to market.

The banking industry is navigating a seismic shift. Traditional banks face immense pressure from digital-first challengers, fintech startups, and evolving customer expectations. If you’re a CEO or CTO in the banking sector, you already know the harsh truth—business as usual won’t cut it anymore. Customers demand instant access, flawless security, and personalized services at their fingertips, 24/7.

This is where developing a robust, user-centric banking app becomes not just an option but a necessity. It’s your digital storefront, your customer engagement hub, and your trust builder rolled into one sleek, secure package.

Among the giants leading this digital charge is HSBC. Their app has set industry benchmarks, combining security, rich functionality, and a seamless user experience that keeps millions engaged daily. But before you dive into building your banking app, the big question looms—how much does it cost to develop a banking app like HSBC in the UK?

To give you a quick idea, developing a banking app like HSBC can range anywhere from $30,000 to $200,000 (22213.50 GBP- 148090.01 GBP), depending on complexity, platform, and features.

In this blog, we’ll unpack this cost to build a banking app like HSBC in the UK in detail, explore why 2025 is the perfect time to invest in a banking app, dissect HSBC’s winning formula, break down the costs and features, and share smart strategies to optimize your investment while building a secure, scalable app tailored for your business goals.

Let’s build an app that not only meets modern expectations but sets new ones.

A Glimpse into the HSBC App: A Benchmark for Digital Banking Excellence

With over 17 million customers worldwide, HSBC has been a pioneer in digitizing banking services, offering its mobile app as a one-stop solution for managing accounts, payments, investments, and personal financial planning. Its success boils down to a few core pillars:

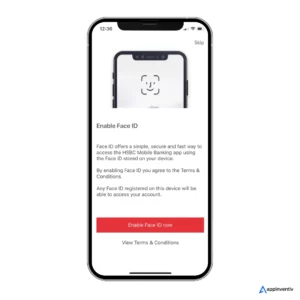

- Security & Compliance: HSBC implements multi-layered encryption technology due to its benefits and biometric logins, adhering strictly to global regulatory standards to give users peace of mind.

- Feature-Rich Ecosystem: From instant transfers and international payments to wealth management tools, their app meets varied user needs in one platform.

- User-Centric Design: Smooth navigation, clear workflows, and intelligent notifications make banking easy, even for less tech-savvy customers.

- Omnichannel Integration: Synchronization across devices and channels (mobile, web, branches) ensures seamless user journeys.

Now, fast forward to 2025, the global digital banking market is booming and if you don’t keep pace, you risk losing relevance.

Here’s what top research tells us for 2024–2025:

- According to Statista, the UK mobile banking user base was projected to reach 20 million by the end of 2024, driven by smartphone penetration and increasing comfort with digital payments. The user base is expected to expand further to 28 million by 2028.

- McKinsey reports that mobile banking interactions have increased by 72%, with customers now engaging in approximately 150 digital banking actions each year, surpassing many online shopping platforms.

- Statista reports that 73% of UK bank account holders used mobile devices for banking in 2024, up from 63% in 2019, highlighting a strong shift toward digital-first financial experiences.

- According to McKinsey, Banks around the world are spending approximately $600 billion every year to improve their technology.

- Forrester reports that in 2024, 65% of adults used a mobile app to complete some financial task.

Thus, considering all the statistics above, digital banking is no longer optional—it’s a strategic necessity. HSBC’s success shows what’s possible when banks invest in intuitive, high-performing apps that truly serve today’s customers.

With strong market demand and advancing tech infrastructure, the timing is ideal. If your bank wants to lead the digital transformation wave, now is the time to act.

How Much Does It Cost to Develop a Banking App Like HSBC in the UK?

Developing a banking app on the scale and sophistication of HSBC’s offering is a complex undertaking that involves numerous stages, technical requirements, and strategic decisions. Because of this complexity, the cost to build such an app isn’t fixed—it varies widely based on what features you want, the platforms you want to target, and the level of security and scalability you require.

To put it simply, the cost to build a banking app like HSBC in the UK can range from as low as $30,000 if you’re building a basic, minimal viable product (MVP) with essential features, all the way up to $200,000 or more for a fully featured, enterprise-grade, secure, and scalable app with advanced functionalities like AI-powered insights, biometric authentication, and seamless integration with core banking systems.

Now, a straightforward way to estimate your banking app’s development cost is to use this formula:

Development Time × Hourly Rate = Total Development Cost to Develop a Banking App like HSBC in the UK

Development Time: This is the total number of hours your development team will spend designing, coding, testing, and deploying your app. It depends heavily on the complexity and number of features.

Hourly Rate: The hourly rate charged by mobile app developers in the UK varies based on the expertise, experience, and reputation of the development team or agency you choose to work with.

To give you a better idea of where the time—and thus cost—goes, the development of a banking app like HSBC typically follows these phases:

| Phase | Timeline | Estimated Cost to Develop an App like HSBC |

|---|---|---|

| Research & Planning | 2–4 weeks | $3,000 – $10,000 |

| UI/UX Design | 3–6 weeks | $5,000 – $20,000 |

| Core Development | 3–6 months | $20,000 – $120,000 |

| Security & Compliance | Ongoing | $10,000 – $40,000 |

| Testing & QA | 1–2 months | $8,000 – $25,000 |

| Deployment & Launch | 2–4 weeks | $2,000 – $10,000 |

| Maintenance & Updates | Ongoing (monthly) | $1,000 – $10,000/month |

Now that we have a ballpark idea of the overall costs to build an app like HSBC, it’s crucial to understand the various factors that drive these costs up or down. Each decision in your app’s design, features, and infrastructure directly influences the budget and timeline.

Key Factors Influencing the Cost to Build a Banking App Like HSBC in the UK

When budgeting for your banking app, several critical cost drivers come into play. Let’s explore these in detail to help you understand how each factor impacts the overall cost to build a banking app like HSBC in the UK:

1. Feature Complexity

The scope and sophistication of features significantly impact development time and HSBC app development cost in the UK. Basic functions like account viewing or transfers are quicker to build, but advanced capabilities such as AI-powered financial insights, multi-currency management, or real-time fraud detection require specialized skills, extended development cycles, and more rigorous testing. The more complex the features, the more resources you’ll need, which will increase the costs to build an app like HSBC accordingly.

Let us offer you a quick insight into the time frame and development costs to make an app like HSBC, as per the app complexity.

| Complexity Level | Estimated Development Time | Estimated Cost (USD) |

|---|---|---|

| Basic | 2–3 months | $30,000 – $50,000 |

| Moderate | 4–6 months | $50,000 – $100,000 |

| Advanced | 6–9 months | $100,000 – $150,000 |

| Enterprise | 9+ months | $150,000 – $200,000+ |

2. Platform Choice

Choosing to develop native apps for both iOS and Android ensures optimal performance and better utilization of device-specific capabilities, but this approach essentially doubles the development efforts. Cross-platform frameworks like React Native can reduce costs to make an app like HSBC by enabling shared codebases, though sometimes at the expense of customization and fine-tuning. Deciding your platform strategy early on can therefore have a significant financial impact.

3. Security & Compliance

Banking apps operate under strict regulatory landscapes such as PCI DSS for payment security, GDPR for data privacy, and PSD2 in Europe for open banking compliance. Ensuring adherence involves implementing robust encryption, secure authentication mechanisms, regular audits, and ongoing updates—all of which add to development complexity and banking app development cost in the UK, but are non-negotiable to protect user data and avoid hefty penalties.

4. Integration with Existing Systems

Most banks have legacy core systems, third-party payment gateways, Know Your Customer (KYC) verification services, and analytics platforms. Seamlessly integrating your app with these diverse systems often requires custom connectors, middleware, and extensive testing to ensure reliability and security, increasing both time and cost.

Bonus Read: Blockchain: The Solution to Inefficient KYC Process

5. Scalability & Infrastructure

Planning for user growth and transaction volume from the outset necessitates scalable backend infrastructure. Whether you choose cloud providers like Google Cloud, AWS, or Azure, the architecture must support load balancing, high availability, disaster recovery, and database scaling. The complexity of this infrastructure translates directly into higher hosting and HSBC app development cost in the UK.

6. Customization & Personalization

Providing tailored experiences such as AI-driven budgeting advice, personalized offers, and investment suggestions requires integrating machine learning models and advanced analytics. These features not only need more sophisticated development but also continuous data management and model training, increasing the ongoing costs to create an app like HSBC in the UK.

7. UI/UX Design

Banking apps must be intuitive and trustworthy to encourage adoption and reduce errors. Crafting such experiences involves user research, prototyping, iterative testing, and accessibility compliance. Investing in high-quality design upfront prevents costly redesigns and builds customer confidence but can increase initial banking app development cost in the UK.

8. Maintenance & Support

Launching your app is just the beginning. Maintaining security patches, updating features to meet evolving regulations, and providing responsive customer support require a dedicated budget. Neglecting maintenance can lead to vulnerabilities and poor user experiences, potentially increasing the overall app maintenance costs in the long run, such as for a banking app like HSBC in the UK.

9. Technology Stack

Choosing the right tech stack for apps, a combination of programming languages, frameworks, and databases, affects development efficiency and scalability. Cutting-edge technologies may initially increase costs due to developer scarcity, but can reduce long-term expenses through improved performance and easier maintenance.

10. Geographic Targeting & Localization

If your app targets multiple countries, you need localization for languages, currencies, and regulatory compliance in each market. This adds layers of complexity to development, content creation, and legal review, thereby increasing costs.

11. Testing & Quality Assurance

Comprehensive testing—functional, security, performance, and usability—is critical in banking apps. Automated testing tools and manual audits both require time and skilled resources, influencing the overall HSBC app development cost in the UK.

After looking into the major factors that impact the overall budget and a simple banking app development cost breakdown in the UK, let us offer you a quick insight into how you can optimize this overall investment.

Hidden Factors Affecting the Cost to Develop an App Like HSB

While major development costs are easy to estimate, several hidden expenses often go unnoticed until later stages. These costs can affect your overall budget, especially during scaling, launch, and post-launch support.

1. App Store Compliance and Fees

Submitting your app to the Apple App Store or Google Play requires following specific guidelines and paying annual developer fees. Delays during approval can also slow down your launch timeline.

2. Third-Party API and SDK Licensing

If your app uses third-party tools like payment gateways, chatbots, or analytics, you may need to pay licensing or usage-based fees regularly.

3. Customer Onboarding and Support Tools

Integrating tools like video KYC, live chat, or automated onboarding assistants adds to development and ongoing operational costs.

4. Downtime Management and SLAs

To ensure 24/7 availability, especially during high-traffic periods, you may need premium cloud services or backup systems covered under service level agreements (SLAs).

5. Data Storage and Backups

Securely storing customer data, along with regular backups and disaster recovery plans, adds extra cloud storage costs over time.

6. Continuous Testing and Updates

Post-launch testing, performance monitoring, and frequent updates for security patches or compliance changes require an ongoing development budget.

7. Localization and Legal Compliance

If you plan to launch in multiple regions, you’ll need to localize the app for different languages, currencies, and financial regulations, which increases content and legal review costs.

8. Marketing and User Acquisition

Even the best banking app needs marketing. Budgeting for user acquisition campaigns, app store optimization, and promotions is essential but often forgotten during planning.

Strategies to Optimize the Cost of Developing a Banking App Like HSBC

Building a secure, feature-rich banking app like HSBC can be a significant investment. However, strategic planning and smart development choices can help you optimize costs without compromising quality or security. Leveraging proven approaches enables you to deliver value efficiently while maintaining a competitive edge.

Below is a breakdown of key cost optimization strategies that industry leaders use to balance quality, speed, and budget effectively:

| Strategy | How It Optimizes Cost |

|---|---|

| Start with an MVP | Focus on essential features first to launch quickly, gather real user feedback, and avoid spending on unused functions early on. |

| Cross-Platform Development | Utilize frameworks like React Native or Flutter to build for iOS and Android simultaneously, thereby reducing duplication of effort and shortening the overall timeline. |

| Leverage Open-Source Tools | Incorporate trusted open-source libraries and components to accelerate development and lower licensing fees. |

| Prioritize Security Early | Integrate security and compliance requirements from the start to avoid costly rework and ensure regulatory adherence. |

| Automate Testing & Deployment | Use Continuous Integration/Continuous Deployment (CI/CD) pipelines and automated tests to speed releases and reduce manual errors. |

| Modular Architecture | Build your app with modular, reusable components that simplify updates and reduce the cost to develop a banking app like HSBC in the UK over time. |

| Cloud Infrastructure | Opt for scalable cloud solutions to pay only for the resources you use and easily adjust capacity based on demand. |

| Iterative Development | Develop in phases with regular user feedback loops to refine features efficiently and avoid building unnecessary functionality. |

| Outsource Strategically | Partner with specialized development teams or vendors for complex components to leverage expertise and reduce overhead. |

Having covered the factors affecting banking app development cost and how to optimize the overall budget, let’s now focus on the essential features that a banking app like HSBC must include. These features form the foundation for a secure and user-friendly digital banking experience.

Core Features of a Banking App Like HSBC

A successful banking app combines usability, security, and rich functionality to meet modern customer expectations. Below are the fundamental features that form the backbone of any competitive digital banking platform:

1. User Registration & KYC Verification

Secure onboarding with identity checks, document uploads, biometrics, and multi-factor authentication to comply with regulations and prevent fraud.

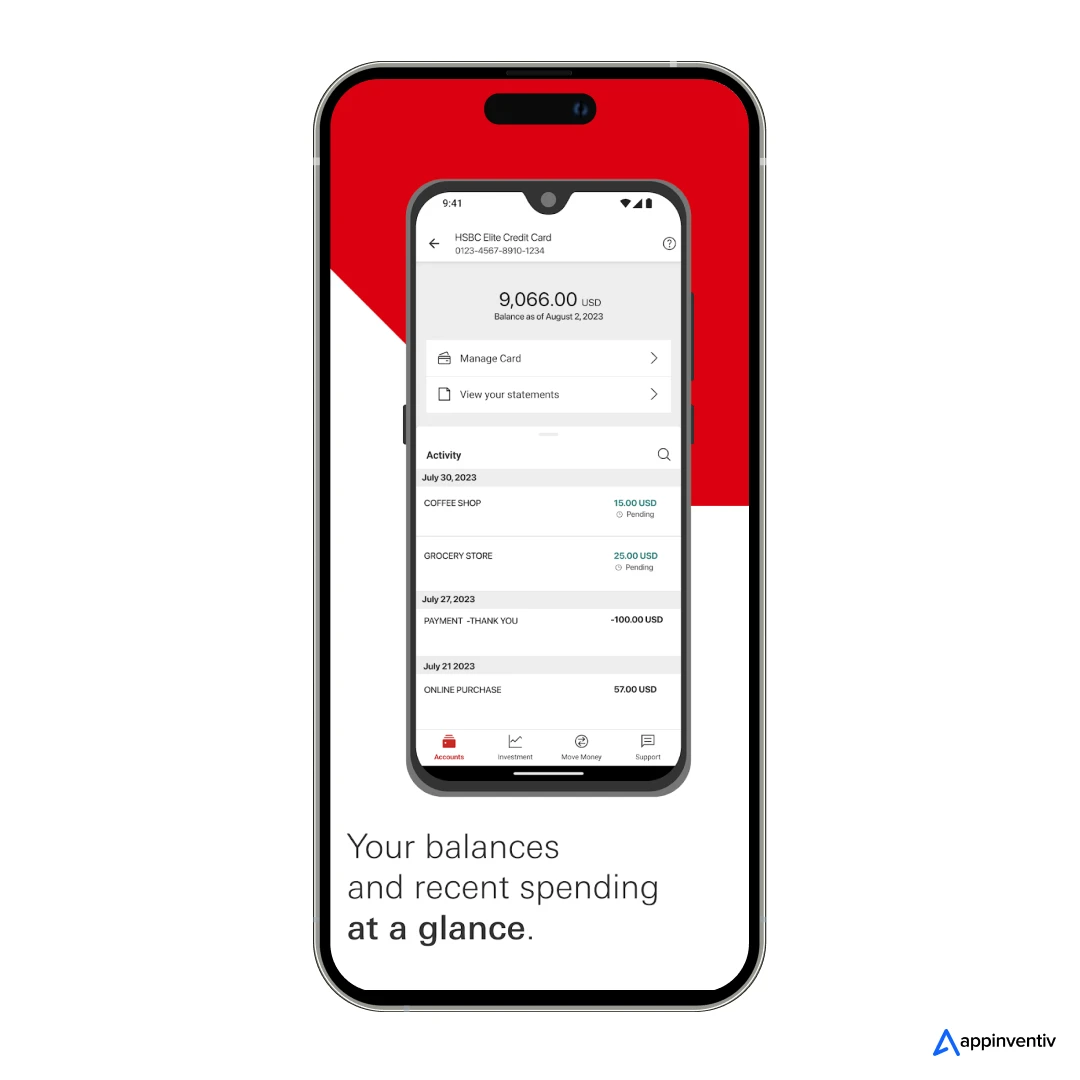

2. Account Overview & Dashboard

Real-time display of balances, recent transactions, and statements, helping users track their finances easily.

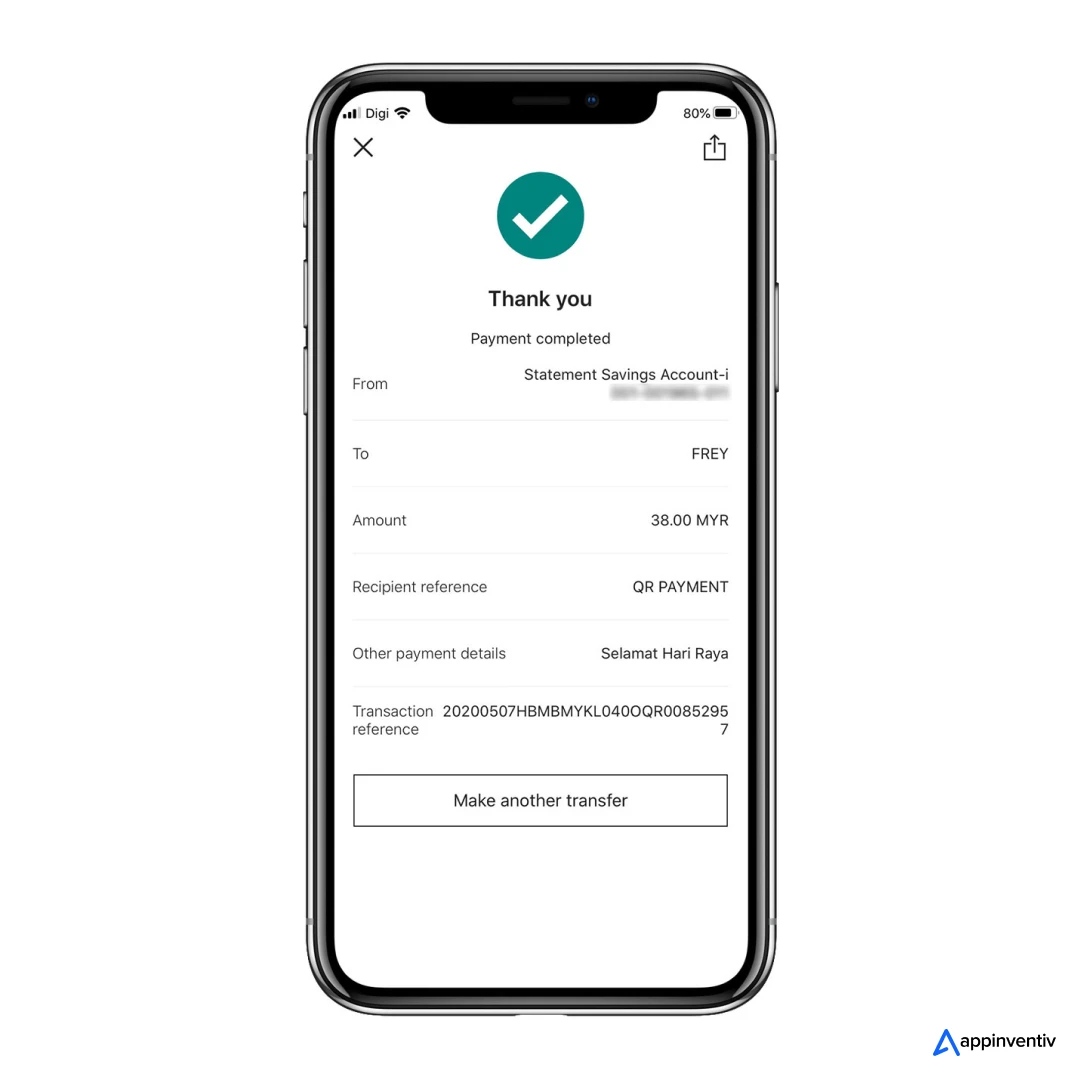

3. Funds Transfer & Payment Processing

Fast domestic and international transfers, bill payments, and scheduled transactions through various secure payment systems.

4. Push Notifications & Alerts

Instant updates on transactions, security alerts, payment reminders, and account activity to keep users informed.

5. Customer Support Integration

In-app chatbots and live support options for quick help and issue resolution.

6. Security Features

Biometric logins, two-factor authentication, session timeouts, and encryption to protect sensitive data.

7. Card Management

Enable users to activate, freeze, set limits, and manage physical and virtual cards directly from the app.

8. Transaction History & Search

Detailed, categorized transaction logs with search and filter options for easy tracking.

9. Bill Splitting & Shared Payments

Allows users to split expenses and send payment reminders within the app for group payments.

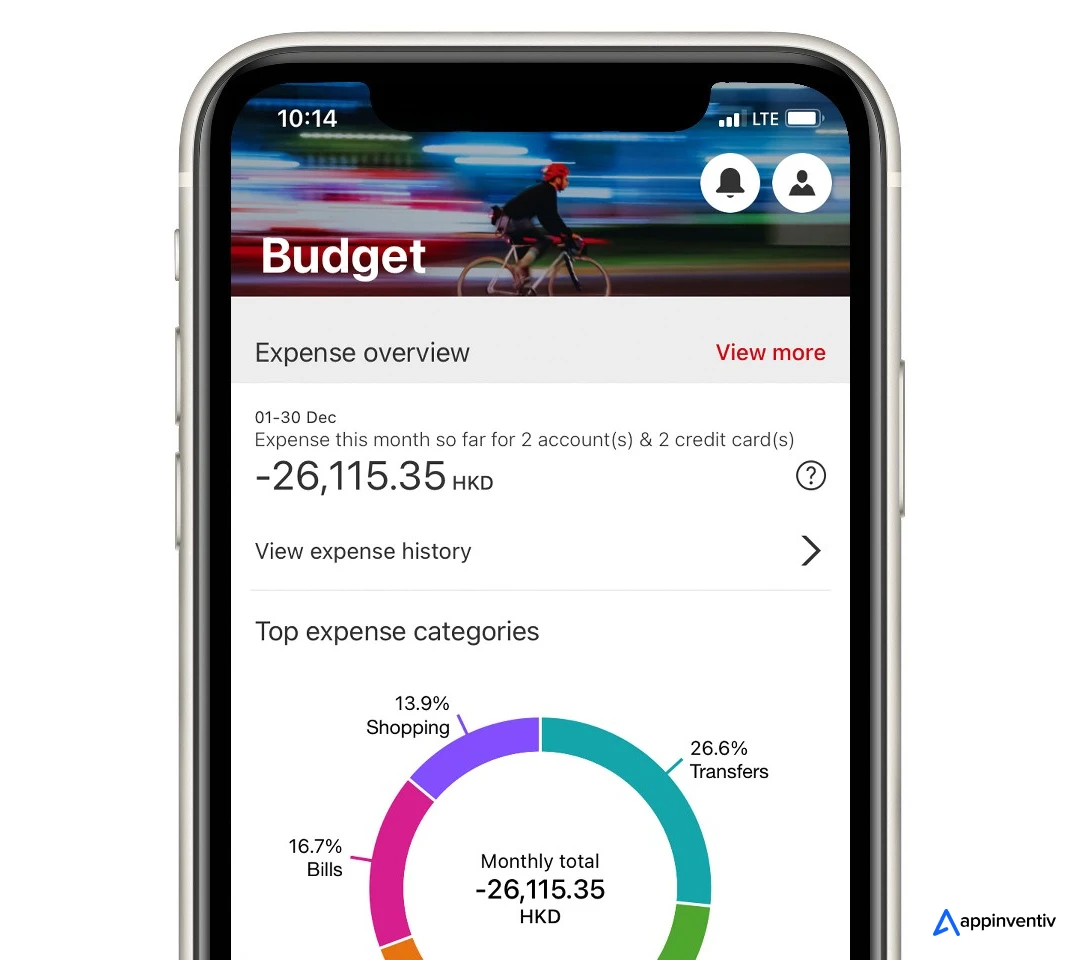

10. Budgeting & Expense Tracking

Tools for setting spending limits, tracking expenses, and getting financial insights to promote smart money management.

11. Multi-Language and Localization Support

Support for different languages, currencies, and regional compliance for a global user base.

12. Mortgage & Loan Management

View and manage mortgage and loan accounts, make repayments, and get payment reminders—all within the app for easy loan handling.

13. Credit Score Monitoring

Access real-time credit scores with personalized tips to help users improve and maintain good credit health.

14. Customizable Dashboard & Widgets

Personalize the app dashboard by selecting widgets that display the most relevant financial information and provide quick insights.

15. Spend Categorization & Insights

Automatically categorize transactions and provide clear spending summaries to help users track and control expenses.

16. Savings Goal Tracker

Set, track, and receive notifications on progress toward specific savings goals to encourage consistent saving habits.

17. Digital Receipt Storage

Store and link digital copies of receipts to transactions, simplifying expense tracking and returns.

18. Instant Card Replacement

Quickly request a replacement card directly through the app to minimize downtime and prevent fraud.

19. Investment Portfolio Overview

Monitor investment accounts with real-time updates and performance summaries for smarter portfolio management.

20. Biometric Payment Authentication

Use fingerprint or facial recognition to authorize payments quickly and reduce fraud risks securely.

To let your banking app stand out from the rest, it’s time to look at the advanced features that truly set leaders apart.

Advanced Features to Elevate Your Banking App

To truly stand out in today’s competitive banking landscape, your app needs more than just basic functionalities. Advanced features not only enhance security and usability but also deliver personalized experiences that deepen customer engagement and loyalty. Though, keep in mind that integrating these advanced features can ultimately increase the overall cost to develop a banking app like HSBC in the UK.

- AI-Powered Financial Insights

Uses artificial intelligence to analyze spending habits and transaction data, offering personalized budgeting advice and tailored investment suggestions to help users manage money smarter.

[Also Read: AI in Banking – How Artificial Intelligence is Used in Banks]

Confused about how AI-powered financial insights benefit your banking app? Well, let’s look into it in detail below:

| Benefit | How Does It Help? |

|---|---|

| Personalized Financial Advice | AI analyzes spending, income, and financial goals to provide personalized budgeting tips and investment recommendations, helping users manage their money effectively. |

| Increased User Engagement | Customized insights and alerts encourage users to interact with the app more frequently, deepening their financial awareness. |

| Improved Customer Retention | Proactive, relevant advice keeps users returning, boosting loyalty and long-term app usage. |

| Enhanced Risk Management | AI identifies unusual spending or potential financial risks early, enabling users to take preventive action. |

| Targeted Product Recommendations | AI-driven segmentation enables banks to offer personalized loan, insurance, or investment products, thereby enhancing marketing effectiveness. |

| Competitive Differentiation | Providing smart, data-driven insights distinguishes your app from competitors, attracting tech-savvy customers. |

- Real-Time Fraud Detection

Employs AI and ML algorithms to monitor transactions continuously, identifying unusual behavior instantly and alerting users to suspicious activity before damage occurs.

- Investment & Wealth Management

Enables users to view and manage their investment portfolios, buy/sell stocks, and receive automated financial advice—all within the app for seamless wealth growth.

[Also Read: FinTech in Wealth Management – The Forefront of Financial Transformation]

- Multi-Currency Support

Facilitates transactions in various currencies, offering currency conversion and international payment features that are essential for global customers and travelers.

- Voice & Chat Banking

Allows users to interact with the app via voice commands or AI chatbots, making banking tasks and customer support accessible without typing or navigating menus.

- Cardless ATM Withdrawals

Let users generate secure, one-time codes within the app to withdraw cash at ATMs, eliminating the need for their physical debit or credit cards and enhancing both convenience and security.

- Advanced Analytics Dashboard

Provides users with detailed visual insights into their spending, saving, and investment patterns, while offering banks backend analytics to monitor app performance and customer behavior.

- Blockchain Integration

Uses decentralized ledger technology to increase transaction transparency, reduce fraud risks, and improve the security and traceability of financial operations.

[Also Read: How Blockchain Is Revolutionizing Mobile App Security]

With a clear understanding of the features your banking app needs—both core and advanced—it’s time to look at how to bring your vision to life. Developing a banking app requires a structured approach to ensure security, compliance, and user satisfaction.

Step-by-Step Guide to Developing a Banking App Like HSBC

Developing a sophisticated banking app like HSBC’s requires meticulous planning and execution. Here’s a step-by-step guide outlining the key phases involved in bringing your banking app to life.

1. Conceptualization & Market Research

Begin by clearly defining your app’s core purpose, identifying your target users, and outlining your unique value proposition. Conduct in-depth competitor analysis and thoroughly review regulatory requirements to ensure your app is both market-relevant and compliant from the outset.

2. Requirement Gathering

Translate your vision into detailed functional and technical specifications, carefully prioritizing essential features and security measures. This phase establishes a clear blueprint that guides designers, developers, and stakeholders throughout the project.

3. Technology Stack Selection

Select the most suitable technologies for your app’s backend, frontend, database, and cloud infrastructure, keeping scalability, security, and integration capabilities at the forefront. The right stack ensures long-term performance and easier maintenance.

4. UI/UX Design

Design user journeys and wireframes that prioritize ease of use and build trust, focusing on simple navigation and accessibility. Develop visual elements that are consistent across devices, ensuring a seamless and engaging user experience.

5. Agile Development

Adopt an agile approach, breaking the development into manageable sprints that allow for continuous testing and feedback. Start with core functionalities to validate the product early, then incrementally add advanced features to refine the app.

6. Testing & Compliance Checks

Conduct comprehensive testing—including functional, security, and load testing—to identify and fix issues. Simultaneously, verify that the app meets all relevant regulatory and compliance standards before proceeding to launch.

7. Deployment & Launch

Prepare all necessary assets for app store submissions and set up the backend infrastructure for a smooth launch. Coordinate marketing and onboarding efforts to drive user adoption and generate momentum from day one.

8. Post-Launch Support & Maintenance

Offer continuous support with regular bug fixes, security updates, and feature enhancements. Monitor user feedback and app performance closely to implement improvements that keep your banking app competitive and secure.

With your banking app developed, tested, and launched, the next critical focus is monetization. Creating a sustainable revenue model ensures that your app not only delivers value to customers but also generates meaningful returns for your business.

Let’s build your new standard: Smarter, Secure, and Seamless Banking.

Monetization Strategies for Banking Apps Like HSBC

Now that you have an idea of how the cost to develop a banking app like HSBC in the UK varies as per multiple factors, you must understand the successful monetization techniques major banking apps follow. They employ various methods to diversify their income streams while enhancing the user experience. Here are key strategies that experts recommend:

1. Subscription-Based Premium Features

Offer tiered subscription plans that unlock advanced tools such as personalized financial planning, exclusive investment insights, or priority customer support. This model creates a steady revenue flow while incentivizing users to upgrade for enhanced value.

2. Transaction Fees and Commissions

Charge fees on specific services such as international money transfers, currency conversions, or expedited payments. Transparent, competitive fee structures can generate significant income without deterring users when communicated.

3. Cross-Selling Financial Products

Leverage user data and AI analytics to recommend relevant products like loans, credit cards, insurance, or investment plans. Personalized cross-selling enhances customer lifetime value by addressing evolving financial needs within the app ecosystem.

4. Affiliate Partnerships

Form strategic alliances with fintech firms, insurance providers, or investment platforms to earn referral commissions. Integrating third-party services expands offerings and generates new revenue without incurring significant development costs.

5. Data-Driven Insights (With Consent)

Aggregate anonymized user data to generate market insights for financial institutions or research firms. When handled ethically and transparently, this can be a valuable revenue source that respects user privacy and ensures compliance with relevant regulations.

Why Choose Appinventiv to Develop Your Banking App?

We hope this blog has helped you gain a clear understanding of the cost to develop a banking app like HSBC in the UK. Now, turning that understanding into a successful app requires partnering with a development firm that combines deep industry knowledge with technical expertise. That’s where Appinventiv comes in.

As a trusted fintech app development company in the UK, Appinventiv specializes in delivering secure, scalable, and feature-rich banking apps tailored to meet the unique needs of global clients. Here’s why leading financial institutions choose us to create a banking app like HSBC in the UK :

- Fintech Expertise: We bring proven experience in building sophisticated banking and financial apps that comply with strict regulatory standards, ensuring your app performs reliably under heavy user loads and complex transactions.

- Security-First Approach: As one of the leading mobile app developers in the UK, our development process prioritizes security at every stage, backed by a thorough understanding of compliance requirements, including PCI DSS, GDPR, and PSD2. We build apps designed to protect sensitive data and minimize risks.

- Customized Solutions: Every business is unique, and so are our solutions. We collaborate closely with your team to tailor the app’s features, design, and integrations, ensuring alignment with your strategic goals and customer expectations.

- Cross-Platform Capabilities: Whether you require native iOS and Android apps or efficient cross-platform solutions, our experts deliver high-performance apps that provide a consistent experience across mobile and web platforms.

- Ongoing Support & Maintenance: Post-launch, our dedicated teams continue to monitor your app’s performance, provide timely updates, and implement new features to keep your app competitive and secure in a rapidly evolving market.

- End-to-End Partnership: From initial ideation and market research to development, launch, and beyond, Appinventiv serves as your comprehensive technology partner, guiding you every step of the way to ensure your banking app’s success. From tackling challenges to develop a banking app like HSBC to ensuring long-term scalability, compliance, and innovation, we’re with you at every step.

Partner with Appinventiv to transform your banking vision into a secure, future-ready digital experience that stands out in the UK market and beyond.

FAQs

Q. How much does it cost to make a Banking app like HSBC?

A. The cost to develop a banking app like HSBC in the UK varies significantly based on the app’s features, platform choices, security requirements, and integration complexity. On the lower end, a basic MVP with essential functionalities might start around $30,000.

At the same time, a fully featured, enterprise-grade app with advanced AI-driven insights, biometric security, and multi-system integration can exceed $200,000. The total investment to create a banking app like HSBC in the UK also depends on the level of compliance and scalability required, as well as ongoing maintenance and support.

Q. How long does it take to develop a Banking app like HSBC?

A. Timelines to develop an app like HSBC typically range between 4 to 12 months, influenced by the app’s complexity and feature set. A streamlined MVP focusing on core functions might be ready in about 4 months.

In contrast, comprehensive apps that incorporate advanced security layers, AI modules, and multi-platform support often require a year or more. Adopting an agile development process with iterative sprints allows for earlier releases and continuous enhancements based on user feedback.

Q. What is the future of banking app development for businesses?

A. The future of banking app development is centered around enhanced personalization, AI integration, and seamless omnichannel experiences. Businesses can expect:

- Increasing use of AI for predictive analytics and personalized financial advice.

- Stronger focus on biometric security and real-time fraud detection.

- Growing adoption of blockchain for transparency and transaction security.

- Expansion of integrated financial ecosystems offering cross-selling of loans, insurance, and investment products.

Q. What compliance standards should an enterprise app like HSBC meet in the UK?

A. Enterprise banking apps in the UK must adhere to stringent regulatory frameworks to ensure data security and consumer protection, including:

- PCI DSS (Payment Card Industry Data Security Standard): For secure handling of payment card information.

- GDPR (General Data Protection Regulation): Governing user data privacy and consent.

- PSD2 (Payment Services Directive 2): Enforcing strong customer authentication and open banking protocols.

- FCA (Financial Conduct Authority) Regulations: Ensuring fair treatment of consumers and operational resilience.

- AML (Anti-Money Laundering) Requirements: For detecting and preventing financial crimes.

| Aspect | In-House Development | Outsourcing |

|---|---|---|

| Cost | Higher fixed costs (salaries, benefits) | Lower upfront and flexible based on scope |

| Expertise | Limited to available internal skills | Access to specialized fintech experts |

| Speed to Market | Often slower due to recruitment | Faster with experienced teams and processes |

| Scalability | Harder to scale quickly | Easily scalable based on project needs |

| Focus | Diverts internal resources | Allows focus on core business activities |

| Risk Management | Full control but resource-intensive | Risk shared with trusted partners |

For most businesses, outsourcing development to a specialized fintech firm like Appinventiv offers a strategic advantage, bringing deep industry expertise, proven development frameworks, and cost efficiency. This approach accelerates time to market while ensuring compliance and quality, making it the preferred choice for delivering complex banking apps today.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does It Cost To Build a Chat App Like Arattai?

Key takeaways: Creating a chat app like Arattai will cost you anywhere from $40,000 to $400,000, depending on how complex you want it to be. The essential features you need are real-time messaging, multimedia sending, and user authentication. Layering advanced features such as voice/video calls, group messaging, AI-driven bots, and end-to-end encryption takes the app…

How Much Does It Cost to Build a Car Rental App like Hertz?

Key takeaways: The cost to build a Hertz-like app ranges roughly $40,000–$300,000+. Complexity, automation, and scale matter more than just the number of features. Real costs continue after launch: infra, maintenance, support, and compliance. Smart planning and MVP-first approach help keep budgets under control. Revenue comes from rentals, add-ons, subscriptions, partnerships, and fleet sales. You…

How Much Does It Cost to Build a Banking App like Barclays?

Key takeaways: Barclays sets the bar: Its speed, security, and money management tools show what EU users expect from modern banking apps. Costs vary a lot: A basic, compliant app can start around $40,000 (≈€30,000), while a feature-rich build can reach $400,000+ or more (≈€298,000+). Rules add real work: Meeting PSD2, GDPR, and instant payment…