- Overview: Anti-Money Laundering Software

- Market Overview of AML Software

- Key Benefits of AML Software

- Types of AML Software Development

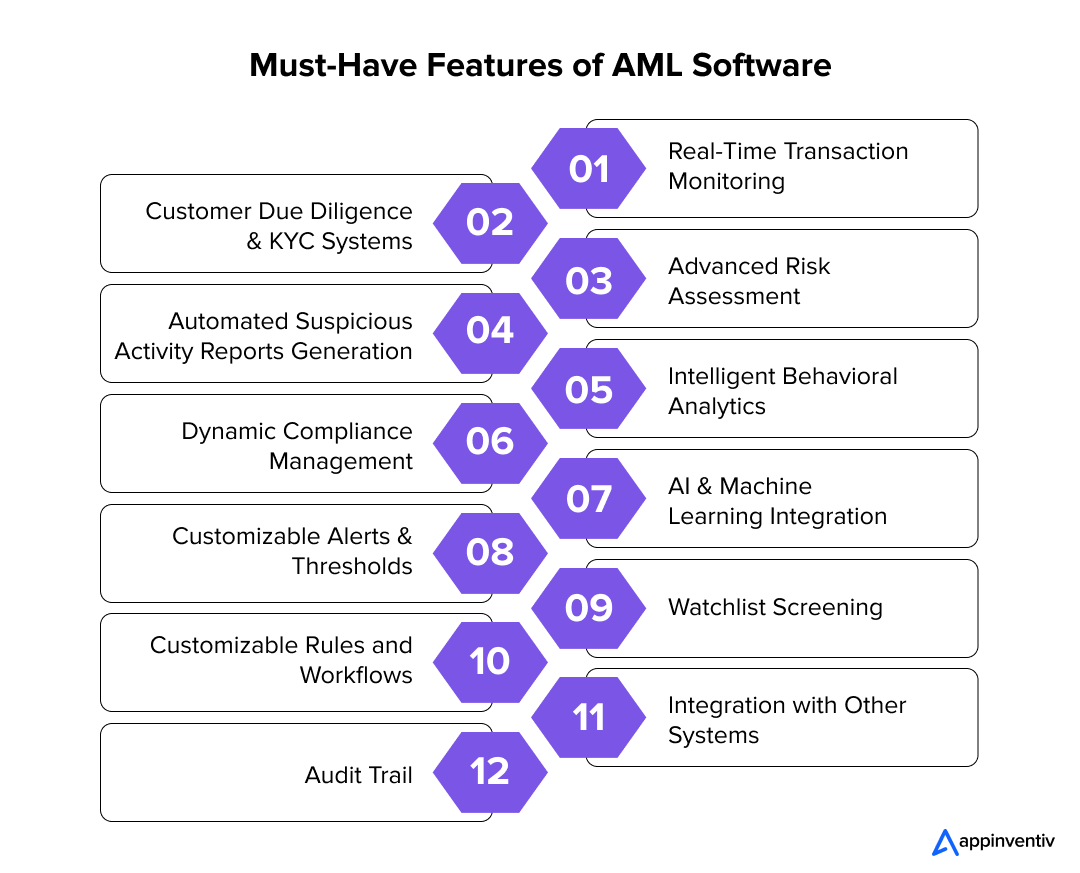

- Key AML Software Features

- 1. Real-Time Transaction Monitoring

- 2. Customer Due Diligence & KYC Systems

- 3. Advanced Risk Assessment

- 4. Automated Suspicious Activity Reports Generation

- 5. Intelligent Behavioral Analytics

- 6. Dynamic Compliance Management

- 7. AI & Machine Learning Integration

- 8. Customizable Alerts & Thresholds

- 9. Watchlist Screening

- 10. Customizable Rules and Workflows

- 11. Integration with Other Systems

- 12. Audit Trail

- Emerging Technologies Driving AML Software Innovation

- 1. Cognitive Computing

- 2. Graph Analytics

- 3. Machine Learning

- 4. Cloud Computing

- 5. Robotic Process Automation

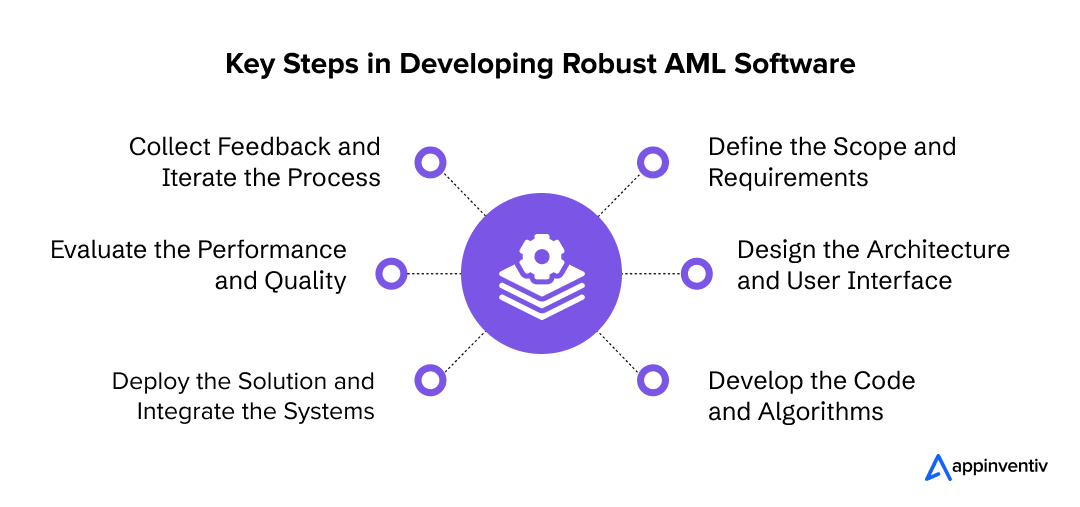

- AML Software Development Process

- 1. Define the Scope and Requirements

- 2. Design the Architecture and User Interface

- 3. Develop the Code and Algorithms

- 4. Deploy the Solution and Integrate the Systems

- 5. Evaluate the Performance and Quality

- 6. Collect Feedback and Iterate the Process

- AML Software Development Cost Estimation

- 1. Simple AML Solutions

- 2. Moderately Complex AML Solutions

- 3. Advanced AML Solutions

- Additional Factors Influencing AML Software Development Costs

- Cost vs. Long-Term Value

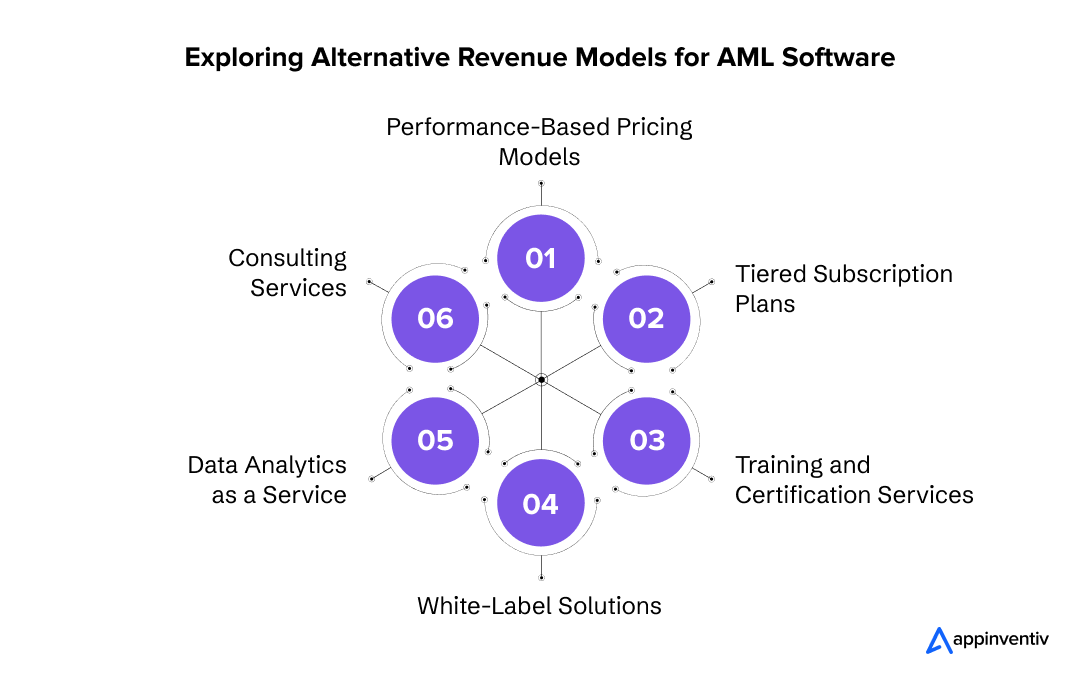

- Alternative Revenue Models for AML Software

- 1. Performance-Based Pricing Models

- 2. Tiered Subscription Plans

- 3. Training and Certification Services

- 4. White-Label Solutions

- 5. Data Analytics as a Service

- 6. Consulting Services

- FAQs

In 2024 alone, financial institutions worldwide have reported trillions of suspicious transactions linked to illicit activities – a staggering figure that reveals the pervasive nature of money laundering.

These schemes infiltrate banks, fintech companies, and even cryptocurrency platforms, creating risks that ripple through the global economy. For businesses, the stakes are higher than ever; failing to detect and prevent such activities will not just result in hefty fines – it will erode customer trust and tarnish brand reputation.

Picture a multinational bank grappling with an investigation into money laundering allegations. Despite its best efforts to maintain all US compliance regulations, its outdated manual processes and fragmented systems failed to identify the warning signs. As a result, regulatory penalties crippled the organization, while its shareholders demanded accountability. The scariest part is that this is slowly becoming a reality for financial organizations across the globe.

This is where advanced Anti-Money Laundering Software for Banks becomes indispensable. By leveraging cutting-edge technologies like AI and blockchain, modern solutions go beyond compliance to actively detect, monitor, and mitigate financial crimes. For organizations looking to protect their interests and maintain credibility, these tools are no longer optional – they’re mission-critical.

Overview: Anti-Money Laundering Software

Anti-Money Laundering (AML) software is an essential business tool that helps businesses prevent, detect, and report activity associated with money laundering, fraud, or terrorist financing. As part of an integrated AML compliance, this software enables businesses to screen customers and transactions, monitor unusual activities, minimize compliance risks, and identify individuals or entities committing illegal practices.

Market Overview of AML Software

The growing sophistication of financial crimes has pushed organizations to rethink their approach to regulatory compliance. Traditional methods are no longer effective in identifying complex laundering techniques. To solve this, anti-money laundering software development steps in as robust solutions, automating processes, minimizing human error, and strengthening defenses against financial fraud.

Beyond compliance, these platforms empower institutions to stay ahead of ever-evolving threats. By adopting a proactive stance, they protect their assets, enhance operational efficiency, and uphold their reputation in the face of increasing regulatory scrutiny.

Key Benefits of AML Software

AML software has benefits that help automate transaction monitoring, identify suspicious activities, and ensure compliance with regulatory requirements. Let’s have a look at those.

- Real-Time Detection and Prevention: Advanced algorithms identify suspicious transactions in real-time, enabling institutions to intervene before financial crimes escalate.

- Regulatory Compliance Made Easy: Another one of the benefits of AML software lies in the platform ensuring adherence to complex and ever-changing regulations, thus reducing the risk of non-compliance penalties.

- Enhanced Operational Efficiency: Automating labor-intensive tasks like customer due diligence and transaction monitoring frees up resources for strategic activities.

- Reduced False Positives: AI-driven analytics, when integrated in the AML software development process, can improve the accuracy of alerts, reducing the time and costs associated with investigating non-threatening transactions.

- Global Coverage and Scalability: These solutions adapt to cross-border regulations, making them ideal for international financial institutions with diverse compliance requirements.

- Data Security and Integrity: Built-in encryption and secure data management are other benefits of AML software that can protect sensitive customer information.

- Reputation Management: Organizations can safeguard their credibility and build customer trust by preventing high-profile money laundering cases.

- Future-Ready Technology Integration: Seamless integration with blockchain and AI tools enables businesses to effectively combat emerging financial crime techniques. This helps enterprises to navigate regulatory compliance with blockchain easily.

Understanding the critical role of anti-money laundering platforms underscores the need for tailored solutions. These platforms are generally not a one-size-fits-all solution; their effectiveness and probability of achieving the expected benefits of AML software centers in how well they address specific challenges within financial institutions.

Each type of anti-money laundering system development plays a unique role in fortifying compliance efforts and combating money laundering activities. Together, they form a cohesive framework that empowers organizations to detect, assess, and mitigate risks proactively.

Types of AML Software Development

Organizations rely on specialized anti-money laundering software solutions to combat the complexities of financial crimes. Each type addresses a specific compliance and risk management aspect, forming a comprehensive defense system. When you develop AML software strategically, these tools can play a crucial role in streamlining processes, enhancing detection accuracy, ensuring regulatory adherence, and empowering institutions to stay ahead of evolving threats.

1. AML Screening

This software screens individuals and entities against global sanctions lists, politically exposed persons (PEPs), and other watchlists to identify high-risk customers. Automated screening ensures institutions avoid engaging with individuals or organizations linked to financial crimes.

2. Transaction Monitoring

Another primary type of money laundering detection software development is – transaction monitoring systems – which analyze customer transactions in real-time to detect suspicious activities that may indicate money laundering.

By establishing customer risk profiles and monitoring for anomalies, these systems enable timely intervention and reporting of potential illicit activities.

3. KYC and KYB Verification

Know Your Customer (KYC) and Know Your Business (KYB) software verify the identities of individuals and businesses during the onboarding process and throughout the customer relationship. Advanced technologies like Blockchain ensure a quick KYC process and authenticate information such as names, addresses, and identification documents, ensuring institutions engage only with legitimate parties.

4. Risk Assessment

Risk assessment tools evaluate the potential risk associated with customers, transactions, and business relationships. These tools help institutions implement appropriate due diligence measures and allocate resources effectively by analyzing various factors, including customer behavior and transaction patterns.

5. Compliance Reporting

The last anti-money laundering software development type is compliance reporting software that assists institutions in generating and managing reports required by regulatory bodies. These tools make analytics and reporting easy for fintech enterprises. It also ensures that all necessary documentation is accurately prepared and submitted, facilitating adherence to legal obligations and reducing the risk of penalties.

Understanding the different types of custom AML software development is only the beginning. The true value of these solutions lies in their features – the core functionalities that allow organizations to combat money laundering with precision and efficiency. These AML software features ultimately come together to ensure compliance, streamline operations, and adapt to evolving regulatory demands, making them indispensable for financial institutions.

Key AML Software Features

Anti-money laundering software is powered by various advanced features that address different aspects of compliance, detection, and prevention. These functionalities streamline operations, enhance decision-making, and ensure financial institutions remain resilient against money laundering threats.

Here is the list of those must-have features of AML software

1. Real-Time Transaction Monitoring

This feature tracks transactions as they occur, analyzing patterns and identifying anomalies that may indicate illicit activity. Financial institutions can intervene promptly with real-time insights, minimizing the risk of fraudulent transactions slipping through undetected.

2. Customer Due Diligence & KYC Systems

Robust KYC systems verify customer identities and perform due diligence by collecting and validating information such as identification documents, addresses, and transaction histories. This set of features of AML software ensures that businesses only onboard legitimate customers while meeting regulatory requirements.

3. Advanced Risk Assessment

Risk assessment tools assign scores to customers and transactions based on their behavior, geographical location, and historical activity. These scores help prioritize high-risk cases for deeper investigation, optimizing resource allocation and strengthening compliance.

4. Automated Suspicious Activity Reports Generation

By automating the creation of SARs, this feature eliminates manual processes and reduces the time spent on compliance reporting. The system collects relevant data, compiles the report, and submits it to regulatory bodies, ensuring accuracy and timeliness.

5. Intelligent Behavioral Analytics

Leveraging AI, behavioral analytics tools study customer habits over time to identify subtle, non-obvious changes that may indicate money laundering or other financial crimes. These proactive AML software features enhance the detection of emerging threats.

6. Dynamic Compliance Management

This set of features of AML software ensures the software stays updated with changing global and local regulations. Dynamically adapting to new rules helps financial institutions maintain compliance without manual intervention or costly system overhauls.

7. AI & Machine Learning Integration

AI-driven models analyze vast amounts of data to identify patterns and improve detection accuracy. Financial fraud detection using Machine Learning enables the system to adapt to new money laundering techniques, making it smarter and more effective.

8. Customizable Alerts & Thresholds

Institutions can set thresholds and customize alerts based on their specific risk appetite. This flexibility reduces the number of false positives while ensuring genuine threats are promptly flagged for review.

9. Watchlist Screening

Continuous screening of customers against global sanctions lists, politically exposed persons (PEPs), and adverse media ensures organizations avoid high-risk associations. Updates are performed automatically to maintain accuracy.

10. Customizable Rules and Workflows

This feature allows businesses to create workflows and compliance rules tailored to their operational needs, ensuring seamless integration into existing processes while addressing unique challenges.

11. Integration with Other Systems

AML software integrates effortlessly with core banking, such as ERP software integration and other enterprise systems integration, creating a unified compliance and operational efficiency platform. This connectivity reduces data silos and enhances workflow collaboration.

12. Audit Trail

A robust audit trail records all system activities, from user actions to transaction monitoring outcomes. This transparency ensures accountability and facilitates smooth audits and investigations.

These features of AML software lay the groundwork for robust compliance, efficient monitoring, and effective risk mitigation. However, as financial crimes become more sophisticated, the tools used to combat them must also evolve.

This is where innovative digital and analytical technologies come into play, pushing the boundaries of what AML solutions can achieve. By integrating cutting-edge advancements, this anti-money laundering software enhances banks’ functionality and gives institutions a competitive edge in staying compliant and secure.

Emerging Technologies Driving AML Software Innovation

After understanding the core features involved in anti-money laundering software development, it is crucial to explore how advanced digital and analytical technologies can redefine their capabilities. These innovations enhance detection accuracy and improve efficiency, making AML solutions more adaptable to the evolving landscape of financial crimes. Here are five groundbreaking technologies driving this transformation in AML software development services.

1. Cognitive Computing

Cognitive computing enables AML systems to analyze vast amounts of unstructured data by mimicking human decision-making. It helps uncover hidden relationships and patterns that traditional systems may miss, improving the accuracy of risk assessments.

2. Graph Analytics

When you develop AML software with graph analytics, you get a solution that visualizes and analyzes connections between entities to identify suspicious relationships or networks. It is especially useful in uncovering layered transactions often used in money laundering schemes.

3. Machine Learning

Machine learning algorithms enhance the adaptability of AML software by learning from historical data to predict and detect suspicious activities. This minimizes false positives and sharpens the accuracy of alerts.

4. Cloud Computing

Cloud-based custom AML software development offers scalability, faster processing speeds, and seamless integration. They are particularly beneficial for organizations that require real-time data access and compliance updates across multiple jurisdictions.

5. Robotic Process Automation

Robotic Process Automation (RPA) simplifies repetitive and rule-based tasks, such as data entry and report generation, allowing compliance teams to focus on high-value investigations. It also accelerates processes, reducing the time required for compliance tasks.

While the features and tech integrations of the software outline its capabilities, building a robust solution requires a meticulous AML software development process.

Let’s look at what our custom AML software development experts suggest regarding the system’s planning and execution journey.

AML Software Development Process

The process to build an AML software calls for a systematic approach to ensure precision, scalability, and compliance. From initial planning to deployment and continuous improvement, every stage contributes to creating a tool that can adapt to the evolving complexities of financial crime.

1. Define the Scope and Requirements

The development of anti-money laundering software begins with understanding the specific needs of financial institutions. This includes identifying target users, compliance requirements, and the types of money laundering risks the software should address. A clear scope ensures the development aligns with the institution’s objectives.

2. Design the Architecture and User Interface

A robust architecture ensures the software can handle high transaction volumes and complex workflows. Simultaneously, the user interface is designed for simplicity, enabling compliance teams to navigate the system effortlessly and act on insights efficiently.

3. Develop the Code and Algorithms

Banking software development experts build core functionalities at this stage, including risk assessment algorithms, transaction monitoring modules, and AI analytics for business. Ensuring code quality and security minimizes vulnerabilities and enhances system performance.

4. Deploy the Solution and Integrate the Systems

Once you finish money laundering detection software development, it gets deployed and integrated with existing enterprise systems like core banking or ERP platforms. Seamless integration ensures data flows uninterrupted, enabling a unified compliance ecosystem.

5. Evaluate the Performance and Quality

Rigorous testing evaluates the software’s functionality, scalability, and accuracy. This step in developing anti-money laundering systems ensures the solution operates as intended, detects potential risks, and generates actionable insights without errors.

6. Collect Feedback and Iterate the Process

Post-deployment, user feedback is collected to identify areas for improvement. Continuous iteration ensures the software evolves with emerging threats, new regulations, and user needs, maintaining its relevance and effectiveness over time.

This comprehensive AML software development process guarantees that the solution meets current demands and remains trusted for years.

In our role as a reliable fintech software development company, we follow a meticulous approach that is designed to not only deliver on its promises but also align with the specific needs of financial institutions – something that is visible in our dedicated efforts behind building highly secure, viral fintech products like Mudra and EdFundo.

The journey from concept to deployment in AML software development is intricate, involving multiple stages of planning, coding, testing, and refinement, with each phase impacting the overall AML software development costs, which vary depending on the complexity, features, and technologies integrated into the solution. Understanding these cost factors helps organizations plan budgets effectively and make informed decisions about the type of AML software they need.

AML Software Development Cost Estimation

Developing anti-money laundering software is a complex yet crucial investment for financial institutions. It ensures compliance with global regulations, enhances operational efficiency and reduces exposure to economic crime. The AML software development costs vary significantly based on software complexity, feature set, integration needs, and the technology stack employed.

1. Simple AML Solutions

These systems focus on essential features like basic customer screening and static transaction monitoring. They are ideal for small to medium-sized institutions with limited compliance requirements. AML software development costs typically range between $50,000 and $80,000, depending on the extent of customization.

2. Moderately Complex AML Solutions

Medium-range solutions include robust transaction monitoring, advanced risk assessment, and customizable workflows. These systems cater to institutions requiring enhanced compliance mechanisms and better fraud detection capabilities. Costs generally fall between $80,000 and $150,000.

3. Advanced AML Solutions

High-end AML platforms integrate sophisticated technologies such as AI, machine learning, and blockchain to provide features like real-time analytics, automated SARs, and adaptive compliance management. These systems are designed for large financial institutions and cost $150,000 to $300,000 or more, reflecting their scalability and advanced functionality.

Additional Factors Influencing AML Software Development Costs

- Geographic Compliance Requirements: Adapting software to meet specific regulatory standards across multiple jurisdictions can significantly increase costs.

- Integration Needs: The effort required to integrate with existing enterprise systems, such as ERP or core banking platforms, impacts the budget.

- Scalability Requirements: Building software that supports growing user bases or expanding features often requires additional investment.

- Data Security Protocols: Implementing advanced security measures to protect sensitive data from breaches adds to development expenses.

Cost vs. Long-Term Value

Although the upfront anti-money laundering software development cost might seem steep, it’s a long-term investment that saves financial institutions from potential fines, reputational damage, and operational inefficiencies. Moreover, scalable and adaptive custom AML software development helps organizations stay ahead of evolving financial crime tactics, providing compliance and strategic advantage.

The cost to develop AML software represents a significant upfront investment, but the potential for long-term financial gains is substantial. Once the system is deployed and operational, businesses can tap into various revenue models that help offset the initial costs and create sustainable income streams.

Beyond just selling the software, numerous ways exist to capitalize on the growing demand for AML solutions, turning compliance into a profitable venture.

Alternative Revenue Models for AML Software

As the demand for Anti-Money Laundering software grows, businesses can explore a variety of revenue models to turn compliance solutions into profitable ventures. These models help recover the cost to build an AML software and provide opportunities for long-term growth.

Here are several effective revenue models that can help organizations capitalize on their AML software solutions:

1. Performance-Based Pricing Models

Instead of a flat fee, businesses could adopt a performance-based model, where clients pay based on the effectiveness of the software in detecting suspicious activity. This incentivizes AML software development services’ providers to create highly accurate and efficient solutions while offering a more flexible pricing structure for financial institutions.

2. Tiered Subscription Plans

Offering tiered pricing based on features and usage is another way to generate consistent revenue. Basic subscriptions could include essential compliance features, while premium plans provide access to advanced analytics, real-time monitoring, and AI-powered detection. This allows businesses to cater to different sizes of financial institutions and adjust to their varying needs.

3. Training and Certification Services

AML software users must stay updated with compliance protocols and software functionalities. Offering training programs or certifications can be a valuable source of revenue. Post anti-money laundering software development, businesses can even charge for one-time training sessions, ongoing workshops, or certification courses, ensuring that clients maximize the software’s capabilities.

4. White-Label Solutions

Providing white-label AML software allows other companies, such as fintech firms, banks, or third-party providers, to rebrand and sell the software as their own. When incorporated in money laundering detection software development, this approach enables businesses to expand their reach without directly selling the product to end-users while benefiting from licensing agreements and long-term partnerships.

5. Data Analytics as a Service

AML software often collects vast amounts of valuable financial data. Businesses can create a new revenue stream by offering advanced analytics and reporting as a standalone service. Clients can access in-depth analysis of transaction patterns, risk assessments, and regulatory compliance insights beyond basic AML functionality.

6. Consulting Services

Many financial institutions may need additional guidance to optimize their compliance practices. Offering consulting services, such as helping clients set up efficient workflows, fine-tuning software configurations, or navigating complex regulatory landscapes, can provide ongoing revenue opportunities to recover the anti-money laundering software development investment.

By diversifying revenue streams and exploring new business models, companies can ensure that their investment to develop AML software continues to generate income long after the initial deployment. These strategies provide clients with greater flexibility and position the software as a long-term, value-driven solution for businesses seeking to stay compliant while maximizing profitability.

In today’s financial world, it’s more important than ever for your business to build AML software that is robust and scalable. With regulatory pressures increasing and financial crimes becoming more sophisticated, AML solutions help you detect suspicious activities, ensure compliance, and protect your organization’s reputation. By utilizing technologies like AI, machine learning, and real-time monitoring, we can help you stay ahead of the curve, reduce risks, and explore new revenue streams.

At Appinventiv, we specialize in custom anti-money laundering software development and other custom banking software development services to meet your unique needs and ensure compliance.

Contact us today to discover how we can help you build a secure, efficient, and scalable AML system that drives your business forward.

FAQs

Q. What is AML software?

A. Anti-Money Laundering software is designed to help businesses, particularly financial institutions, detect and prevent money laundering activities and economic crimes. The software monitors transactions, screens customers, and identifies suspicious patterns that could indicate illegal activity. By automating these processes, AML software ensures compliance with regulatory requirements, reduces the risk of fines, and protects the organization from being used for illegal financial operations. It typically includes transaction monitoring, KYC (Know Your Customer), risk assessment, and reporting functionalities.

Q. How much does AML software cost?

A. The cost of AML software can vary depending on the solution’s complexity, the organization’s size, and the required features. Basic AML software costs range from $10,000 to $50,000 for small institutions or startups. More advanced, feature-rich systems for larger financial institutions can cost between $100,000 to $500,000 or more. In addition to upfront costs, ongoing subscription or licensing fees, maintenance, and customization services can contribute to the total expense. It’s important to consider long-term operational costs and potential savings from automated compliance processes when evaluating the total cost of ownership.

Q. How long does it take to develop AML software?

A. The development timeline for banks’ anti-money laundering software depends on the complexity and scope of the project. On average, it takes between 6 to 12 months to develop a comprehensive AML solution, including all necessary features such as transaction monitoring, KYC, and risk assessment tools. This timeline can vary based on factors such as customization, integration with existing systems, and the size of the development team. Additionally, post-launch updates and system optimizations may continue for several months or even years, depending on regulatory changes and emerging threats in the financial sector.

Q. What are some top AML software development best practices?

A. Top best practices for anti-money laundering systems development include:

- Data Security: Implement strong encryption and secure access controls to protect sensitive financial data.

- Regulatory Compliance: Ensure the software is aligned with global and regional AML regulations, with regular updates.

- Scalability: Build a system that can grow with your business, handling increasing transaction volumes.

- AI Integration: Use AI and machine learning to detect suspicious activities and adapt to emerging threats.

- User-Friendly Design: Create an intuitive interface for easy monitoring and reporting.

- Continuous Improvement: Lastly, one of the critical AML software development best practices can be found in gathering user feedback and regularly monitoring software performance to enhance its effectiveness.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Custom Development or White Label Solutions: Which is Right for Your Business?

Key takeaways: 77% of companies are prioritizing digital transformation; the right tech approach is crucial for staying competitive. Custom development offers tailored solutions for unique needs, flexibility, and long-term scalability. Whereas, white-label solutions provide quick market entry, cost-efficiency, and easy customization for standard needs. Appinventiv’s expertise helps you navigate custom development vs white-label to choose…

ERP Integration in Australia - Why It Is Essential and How to Do It Right

Key takeaways: ERP integration enables operational efficiency, reduced costs, and enhanced decision-making. Healthcare, finance, manufacturing, retail, and all the other sectors are benefiting from ERP integrations in Australia. While ERP integration can be costly, ranging from AUD 45,000 - AUD 450,000, it leads to significant long-term savings and scalability. Compliance with Australian regulations is critical,…

Predictive Analytics Software Development - Features, Benefits, Use Cases, Process, and Cost

Key Takeaways Predictive analytics helps businesses shift from “what has happened” to "what will happen," enabling proactive strategies rather than reactive ones. Real-time analytics and AI integration are driving the growth of predictive analytics, making it more accurate, accessible, and critical for business success. Custom predictive analytics solutions can enhance customer satisfaction, reduce costs, and…