- Market Diagnostic: Why FinTech is Poised for Growth

- Why FinTech is the Future of Investment

- Top FinTech Technology Trends to Watch For in 2026

- 1. Digital Banking

- 2. P2P Payment Solutions

- 3. Personal Finance Management App

- 4. Robo Advising Software

- 5. Loan Lending App

- 6. RegTech App

- 7. Stock Trading App

- 8. Digital Wallets

- 9. Blockchain Applications

- 10. Crowdfunding Solutions

- 11. Insurtech Solution

- 12. Crypto Exchange Platform

- 13. Payday Loan App

- 14. Bill Reminder App

- 15. Financial Record Maintenance

- 16. E-mortgage Apps

- 17. Financial Copilots with Artificial Intelligence

- 18. Wealth-as-a-Service (WaaS) Platforms

- 19. Quantum-Safe Security Solutions

- 20. Embedded Finance Solution for Non-Financial Businesses

- Start With a Defined Market Gap

- Define Your Niche

- Find Your Startup USP

- Create a Sustainable Business Structure

- Design for Agility and Regulation

- Build Around Intelligent Automation

- Launch an MVP

- Plan Deployment and Market Launch

- Secure Funding and Scale Strategically

- Focus on Continuous Innovation and User Experience

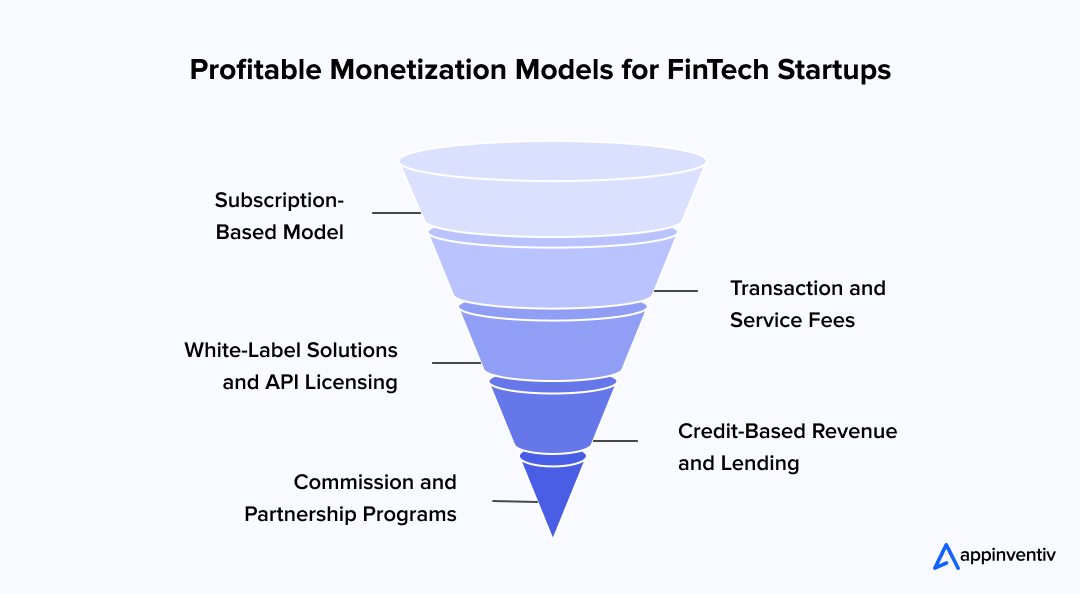

- Monetization Strategies for FinTech Startups

- Subscription-Based Model

- Transaction and Service Fees

- White-Label Solutions and API Licensing

- Credit-Based Revenue and Lending

- Commission and Partnership Programs

- Build Your FinTech Product with Appinventiv

- FAQs

Key Takeaways

- The future of financial services is being propelled by FinTech, which leads to greater convenience and openness in the use of digital banking, P2P payment, and AI-based solutions by users and businesses.

- The best, most profitable FinTech startup ideas address clear market gaps—think new concepts in embedded finance, RegTech, or customized wealth management.

- With rapid advances in AI, automation, blockchain, and other advanced technologies, FinTech companies can now build products that are scalable, very secure, and genuinely resilient.

- To actually succeed in FinTech, you have to be strategic. The core focus must be building an application that delivers a seamless user experience and maintains a commitment to continuous innovation.

Stripe made headlines a year back, announcing a record-breaking revenue of more than $18 billion. Stripe, which started as a small payments business, is today an essential part of online commerce, supporting millions of businesses and providing evidence of how scalable FinTech business models can transform online finance worldwide. The success it has had is indicative of a larger trend in the industry, whether payment infrastructure, neobanking, or AI-enabled financial products.

This achievement simply confirms that global momentum behind FinTech innovation is completely unstoppable. We see similar massive growth stories everywhere: Revolut, Wise, and Chime all show how companies that started out to fix small problems like making transactions easier or improving cross-border transfers have quickly become billion-dollar enterprises redefining finance globally.

These milestones prove something critical: FinTech isn’t just a side piece of traditional banking anymore, it’s become the bedrock of modern financial infrastructure. Whether we’re talking about instant digital payments, risk assessment powered by AI, or even blockchain-based lending, FinTech is the engine driving better economic transparency, agility, and inclusion.

This is why entrepreneurs and investors now see FinTech not just as a passing technology trend, but as a resilient, high-ROI sector capable of fundamentally changing how businesses and people manage money.

The demand for new FinTech apps is exploding, primarily because users simply expect financial experiences to be secure, intelligent, and available 24*7. For anyone planning to jump into this thriving sector, the real key is identifying the perfect niche and the right technology to back it up.

In this blog post, we’re going to look at the top 20 FinTech startup ideas that are currently setting new standards for both profitability and innovation, and each one represents a unique chance to build a scalable, future-ready solution in today’s rapidly changing digital economy.

Let’s have a quick look at those.

Investing in FinTech today means building solutions that redefine convenience, trust, and access for the next generation of financial users

Market Diagnostic: Why FinTech is Poised for Growth

Before diving into startup ideas, any entrepreneur needs to start with a serious diagnostic check of the market. Even the most creative business hypothesis will likely fail without a solid grounding in facts. So, we need to look at context and the current numbers first.

Building a FinTech startup remains one of the most lucrative and resilient moves an entrepreneur can make in 2026 and beyond. The huge surge in digital adoption following the pandemic has permanently changed how consumers spend, save, invest, and borrow money. Today, FinTech doesn’t just represent innovation in finance; it’s essentially become the foundation of the world’s entire digital economy.

Several startup-friendly patterns are driving this growth:

- Revenues are climbing fast: In 2025, some of the top global FinTech firms saw an impressive 40% revenue growth and 39% profit growth. This marks one of the strongest years the sector has ever recorded (Source: World Economic Forum).

- Investment remains strong: Even with some market corrections, KPMG’s Pulse of FinTech 2025 found that the U.S. market alone attracted $20.9 billion in FinTech investment across $889 deals during the first half of the year.

- FinTech-as-a-Service (FaaS) is booming: The FaaS market reached $1.6 trillion by 2034, clearly reflecting massive, untapped demand for modular, API-driven solutions (Source: Precedence Research).

- Digital banking dominates transactions: Almost 3 out of every 4 global banking transactions now happen through digital channels. This clearly signals an irreversible shift toward FinTech-driven infrastructure (Source: McKinsey).

These compelling figures demonstrate precisely why betting on FinTech is no longer speculative. It’s an established, mature ecosystem built on proven scalability, technological readiness, and sustained investor confidence. Understanding these core dynamics lays the essential groundwork for exploring the top 20 FinTech startup ideas that we’ll discuss next.

Why FinTech is the Future of Investment

FinTech is no longer a niche in the startup ecosystem; it is redefining the flow of capital, the interaction between consumers and money, and how businesses create value. A new wave of innovation will be inspired not by AI or blockchain in its traditional forms but agentic AI systems, autonomous financial copilots, on-the-fly predictive analytics engines making complex investment decisions. The technologies will establish smart ecosystems capable of operating portfolios, negotiating smart contracts, and optimizing transactions without human supervision.

In 2026, the FinTech industry will transform, enabling digital payments to lead to complete financial independence. The agentic AI will serve as decision-making models and will process unstructured information like market sentiment and regulatory cues to predict opportunities. In the meantime, AI-based copilots will help analysts and fund managers by converting vast amounts of data into actionable insights.

This level of technology accuracy will minimize human error, shorten deal cycles, and expand access to markets previously unpenetrated, all of which can lead to more robust and predictable returns.

To investors, scalability and resilience would be attractive. FinTech startups based on intelligent AI systems are also designed to respond well to market instability and regulatory shifts, with a consistent focus on ROI. These systems also learn and correct themselves, which reduces the operational costs and increases the profit margins. Ideally, it is not merely the world that is changing the way money moves around; FinTech is now becoming one of the smartest and most interesting areas of investment of the decade.

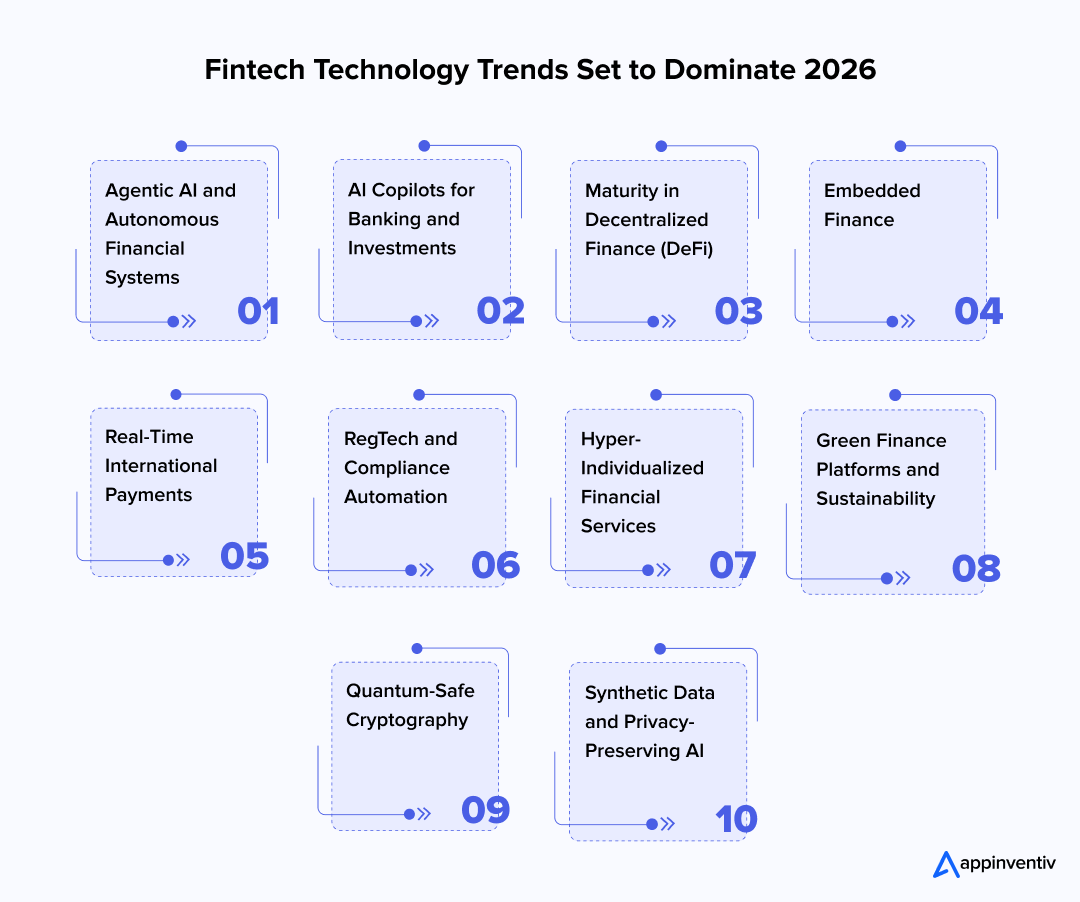

Top FinTech Technology Trends to Watch For in 2026

The FinTech landscape is advancing faster than any other digital sector, powered by breakthroughs in artificial intelligence, automation, and decentralized technologies. Here are some of the key technology-backed FinTech startup trends shaping the future of financial services:

Agentic AI and Autonomous Financial Systems: Models of AI capable of making independent decisions are moving to the core financial services functions, automating credit evaluation, investment strategy, and customer management with minimal human involvement.

AI Copilots for Banking and Investments: Intelligent assistants assist analysts, advisors, and consumers in real time, provide data-driven recommendations, and automate workflows in financial institutions.

Maturity in Decentralized Finance (DeFi): DeFi is becoming institutional-grade and is embedded into regulatory frameworks, providing secure, transparent alternatives to traditional banking products.

Embedded Finance: Finance is being smoothly incorporated into non-financial platforms, e-commerce checkouts to ride-hailing apps, and frictionless customer experiences are being built.

Real-Time International Payments: International transactions are becoming cheap and real-time with the use of blockchain interoperability and central bank digital currencies (CBDCs).

RegTech and Compliance Automation: The role of AI and machine learning is transforming compliance with regulations, risk detection, reporting, and governance, making the process for financial institutions less burdensome.

Hyper-Individualized Financial Services: Behavioral modeling and predictive analytics are helping financial platforms to customize products in a unique way to individual spending habits and investment objectives.

Green Finance Platforms and Sustainability: Sustainable investing through FinTech is enabled by integrating ESG metrics into investment algorithms and digital lending platforms.

Quantum-Safe Cryptography: With quantum computing on the verge of commercial availability, FinTech companies are creating encryption standards safeguarding financial data against the infrastructure of the next generation of threats.

Synthetic Data and Privacy-Preserving AI: FinTech startups are adopting synthetic datasets and federated learning to protect user data and improve algorithm.

Appinventiv’s Insights

The next wave of FinTech innovation won’t come from adopting every new technology, it will come from combining the right ones. Founders who align AI-driven intelligence with transparency, security, and sustainability will lead 2026’s financial revolution. Keep your tech stack adaptable, your data strategy ethical, and your customer trust uncompromised.

Top 20 Profitable FinTech Startup Ideas for Businesses

Since mobile phones have been deeply embedded in our everyday lives, we have been leveraging their capabilities to increase convenience and productivity. The adoption of mobile phones in the finance sector has revolutionized various financial processes. Let’s delve deeper into the realm of FinTech startup app ideas in 2026 and beyond.

1. Digital Banking

It is one of the most common and profitable FinTech app ideas that can help you establish a successful startup. The demand for digital banking has reached unprecedented heights in recent years due to the ever-increasing penetration of advanced technologies. With these facilities, the market has seen exponential growth in investment in digital banking apps.

Over the past few years, a dramatic shift has been seen in how people interact with their banks and how they use banking services. Now, users no longer need to visit their local banks or ATMs for money transfers and other purposes. They can enjoy the various advantages of digital banking from the comfort of their homes. These advantages include, but are not limited to, the ease of making transactions, investing, opening accounts and deposits, blocking cards, adding beneficiaries, and much more with a few taps on their devices.

2. P2P Payment Solutions

Developing a P2P payment application is one of the most popular financial app ideas, facilitating users with ease of sending money to different merchants, families, and friends. P2P payment apps like Venmo, Google Pay, Zelle, and PayPal provide consumers with an unmatched facility to instantly transfer money to different bank accounts – even when registered with different banks and payment systems. They are reducing the need for third-party intermediaries and eliminating commission fees for transactions.

Also, these FinTech mobility solutions use the latest technologies like NFC and face and voice biometric technology to streamline POS processing, enhance risk management, and deliver an optimal customer experience.

3. Personal Finance Management App

The personal finance management application is another best financial app idea to drive efficiency into this market effortlessly. With consumers getting more conscious about their earnings and savings, these applications are gaining traction in the market, making both investors and startups look ahead to leverage business ideas in finance.

These applications act as a weapon, allowing app users to categorize their expenses and income while tracking them in real time to better understand how to manage their finances effectively. Similarly, accounting software like Xero is in great demand today due to the financial transparency and convenience it provides. These personal finance and accounting software ideas also facilitate users to connect all bank and credit card accounts to update the data, along with automatic payment reminders.

Our experts at Appinventiv worked on a budget management application, Mudra, that transforms the manual nature of the financial budget management process. Mudra is a next-generation chatbot that can make budget management easier and more personalized. After six months of concentrated design and development, it is finally prepared to be rolled out internationally in over 12 countries.

Mudra is an intelligent, interactive platform that provides real-time financial data and offers a user-friendly experience, making it easy for customers to manage their finances. The mission of the platform is to transform digital budgeting and to create a new level of innovation and functionality in FinTech.

4. Robo Advising Software

Robo-advising, one of the proven ways FinTech is attracting millennials, is also one of the best finance startup ideas for 2026. These machine-learning-driven software are serving users with the finest personalized, future-centric financial advice at a lower cost. They are also analyzing their expenditures and investments to aid them in increasing their after-tax returns, which they can later analyze through a tax preparation app like TurboTax. In addition to this, they are adding convenience to the process with minimal-to-no human intervention.

For businesses looking to invest in the Robo-advisors market, these digital platforms present numerous benefits. Automated investment management, personalized portfolio recommendations, and lower fees compared to traditional financial planning advisors position Robo-advisors as an attractive option. They are becoming an increasingly popular choice among investors seeking convenient and cost-effective wealth management solutions.

For entrepreneurs exploring the investment advisory space, understanding how wealth management technology solutions leverage AI, robo-advisors, and data analytics can reveal untapped opportunities in automated portfolio management and personalized financial planning.

5. Loan Lending App

Creating a finance app for P2P lending is also one of the trending startup ideas in the FinTech industry. A loan lending app (also called a P2P lending app) acts as a marketplace where lenders and borrowers can connect and cater to each other’s needs without any intervention from a financial institution.

While these applications enable borrowers to set the maximum loan rates they can manage, they also allow lenders to bargain with each other to offer funds at the lowest rate. And this way, you get more customers or borrowers.

Also Read: How is Technology Changing the Future of Consumer Lending?

6. RegTech App

RegTech (Regulatory Technology) applications are also considered one of the best FinTech startup ideas for emerging institutions in the industry. RegTech is the use of information technology that helps manage regulatory processes within the financial industry to comply with all the regulatory and compliance standards worldwide.

They enable organizations to automate a major fraction of their processes, including customer identity verification, report compilation and submission, transaction monitoring and reporting, and more, thereby increasing customer retention rates.

7. Stock Trading App

Developing a stock trading app is yet another decision that can help you establish your business in the FinTech industry. Users, these days, are increasingly getting engaged with the platforms that let them get a comprehensive knowledge of shares, stocks, forex, and funds, and invest in them efficiently. They pay more attention to applications that gather investment data from different sources and utilize it to calculate the asset valuation and make the right decision.

By combining real-time market updates, AI-based stock trading advice, and educational features, you can create an experience that fosters trust and long-term engagement. With this idea, the investment will enable you to ride this trend of financial freedom, in which customers will enjoy the ease of managing their portfolios via easy-to-use mobile applications.

8. Digital Wallets

The digital wallets are becoming a necessity in a rapidly thriving cashless world. They offer their customers a convenient, secure, and immediate payment option, minimizing reliance on plastic cards or cash. This space has significant potential for businesses, as digital transactions are still replacing traditional payment methods in day-to-day life.

With digital wallet app development, you can provide users with ease of use and predictability while enabling loyalty programs, merchant connections, and service integrations, all of which will contribute to recurring revenue and customer retention.

9. Blockchain Applications

Seeing the growing impact of blockchain in FinTech, embracing this technology for starting a financial business is also a profitable FinTech startup idea. Its ability to offer safe, transparent, and decentralized systems has altered the way financial transactions and records are processed.

The major issues in the industry, including the lack of trust, slow settlements, and fraud, can be overcome by entrepreneurs who invest in blockchain-based solutions. Blockchain applications provide a basis for innovative products that are both transparent and scalable over time, whether it is a cross-border payment, smart contract, or asset verification. Investing in this field is to follow the future of the trust-based financial systems.

10. Crowdfunding Solutions

Crowdfunding is also emerging as one of the most successful FinTech startup ideas for entrepreneurs, serving as the best alternate funding model. They help them raise funds for their new or existing enterprises via collective efforts from different individual contributors and venture capitalists.

A variety of fundraising platforms are available, each with its own benefits and areas of expertise. Kickstarter, Indiegogo, and GoFundMe are among the largest and most versatile options, boasting sizable user bases.

11. Insurtech Solution

Insurance has always been intertwined with banking in the finance sector, operating in synchronization with each other in various cases. And now that finance has turned into ‘FinTech,’ insurance has also embraced its enhanced iteration known as ‘Insurtech.’

Insurance mobile app development is a strong solution to increase your customer base and scale your business. Incorporated with the power of the latest technologies like AI, IoT, Blockchain, Open API, and Machine learning, it empowers insurance companies to deliver impeccable customer experience. It helps analyze a heap of user data, check the market trends, understand user emotions and needs, offer customized yet quick policy comparison options, manage risks, and much more, without relying upon any third-party insurance broker.

12. Crypto Exchange Platform

Developing a crypto exchange platform like Coinbase is also one of the best finance startup ideas to work on. These platforms allow users to enter the decentralized market by trading cryptocurrencies for assets like fiat money or other digital currencies.

In other words, they allow users to exchange one cryptocurrency for another, get crypto tokens in return for fiat money, and even buy/sell their crypto coins. All while enjoying perks like transparency, lower fees, higher security, and faster processing.

13. Payday Loan App

Another fascinating application idea that one can invest and earn money is the payday loan application. Through this financial application, you can provide app users with a specific sum as a loan in their crises, like bill payments, hospital expenses, or EMIs.

App users simply need to add data about their work and connect the bank account. The application monitors the working hours, so users can cash when needed. Also, your application will deduct the cash once the users get the paycheck.

14. Bill Reminder App

One of the most typical financial pains, missed payments, can be addressed rather simply and effectively with the help of the bill reminder app. Some people have to cope with various bills every month utilities, credit cards, subscriptions, and insurance fees, and the number of late fees is going to grow. A properly designed application can automatically monitor billing periods, issue timely alerts, and even interoperate with a payment gateway to enable one-tap settlement.

The entrepreneurs can improve their functionality by adding smart budgeting systems or reward systems that incentivize on-time payments. The investment in this concept will be suitable for a broad range of users, including students, professionals, and families, making it a viable FinTech solution with the potential to retain users in the long term.

15. Financial Record Maintenance

Financial document management is not taken seriously, and, nevertheless, it is a major component of personal and business finances. The financial records maintenance app can automate the process of gathering, sorting, and archiving receipts, invoices, and tax records in a single, secure digital location. With the incorporation of AI-based scanning and classification, this platform could be used to eliminate manual errors and provide easy access during audits or tax filings.

This idea can be of great interest to freelancers, small business owners, and self-employed professionals who work with fragmented financial information. Investing in this concept not only makes the task of compliance easier, but also assists users in having better control over their financial health and planning.

16. E-mortgage Apps

This trending FinTech app startup idea gained immense popularity after the COVID-19 pandemic. Getting a mortgage used to be hard for people a few years back. Now, electronic loan applications have simplified the loan approval and disbursement process, facilitating applicants to get contactless loans rapidly without much hassle. The use of AI in mortgage lending processes is further enhancing efficiency, helping lenders assess risk, verify documents, and offer personalized loan options in real time.

Now that you know the types of finance business ideas you can work on, you might wonder where to start. Considering the same, here are some crucial steps you must follow to establish a successful business in the FinTech industry.

17. Financial Copilots with Artificial Intelligence

The financial copilot is one of the most advanced FinTech business ideas based on AI, which is a significant advancement in intelligent automation. Such copilots can break down financial data, handle budgets, and predict cash flows with near-human accuracy, and are virtual CFOs to both startups and the enterprise.

They can be used to interpret intricate datasets, thereby allowing organizations to make sound decisions related to credit, taxes, and investments, and reduce human error. Their capability to learn the real-time performance measures can enable businesses to adjust to the changing market conditions promptly. This means that, as AI advances, the strategic management and operational efficiency of the FinTech ecosystem will be redefined by financial copilots.

18. Wealth-as-a-Service (WaaS) Platforms

The Wealth-as-a-Service is fast changing the way wealth management products are sold and consumed. Placed among the most scalable FinTech business ideas for startup founders, WaaS platforms create investment capabilities in their digital products as ready-to-use APIs.

This will reduce infrastructure expenses and enable the quicker implementation of customized wealth products for end users. WaaS brings financial planning to the masses, whether through automated portfolios or real-time advisory tools. The modular nature of it also facilitates repeat B2B relationships, resulting in predictable revenue patterns among innovators in this field.

19. Quantum-Safe Security Solutions

With an increasingly digital global financial system, it is necessary to secure sensitive data against quantum attacks. B2B FinTech ideas undertaken as startups in post-quantum cryptography are helping institutions prepare to face the next generation of cybersecurity challenges. These systems ensure that encryption covering transactions, blockchain records, and customer information remains invulnerable even in the era of quantum computing.

By implementing this type of solution, the financial institutions may have compliance preparedness and enduring customer confidence. As an investor, this area has great potential because it is cross-sectoral, and the necessity of data protection in international FinTech infrastructure is growing.

20. Embedded Finance Solution for Non-Financial Businesses

Embedded finance is among the most dynamic FinTech-based business ideas, enabling non-financial organizations to add payment, lending, or insurance services to their online infrastructure. Retailers, travel providers, and logistics companies can now provide banking-like experiences without becoming financial institutions.

These integrations enhance engagement, retention, and average revenue per user by enabling transactions within existing customer journeys. Commissions and lending margins are additional sources of revenue generated by the model. As digital ecosystems mature, embedded finance will emerge as the foundation for monetization across industries, transforming how all businesses engage with money.

Appinventiv’s Insights

Treat each FinTech idea as a hypothesis. Build prototypes, collect feedback, and align your product with measurable market gaps. The strongest FinTech ventures combine innovation, compliance, and adaptability to stay profitable in changing markets.

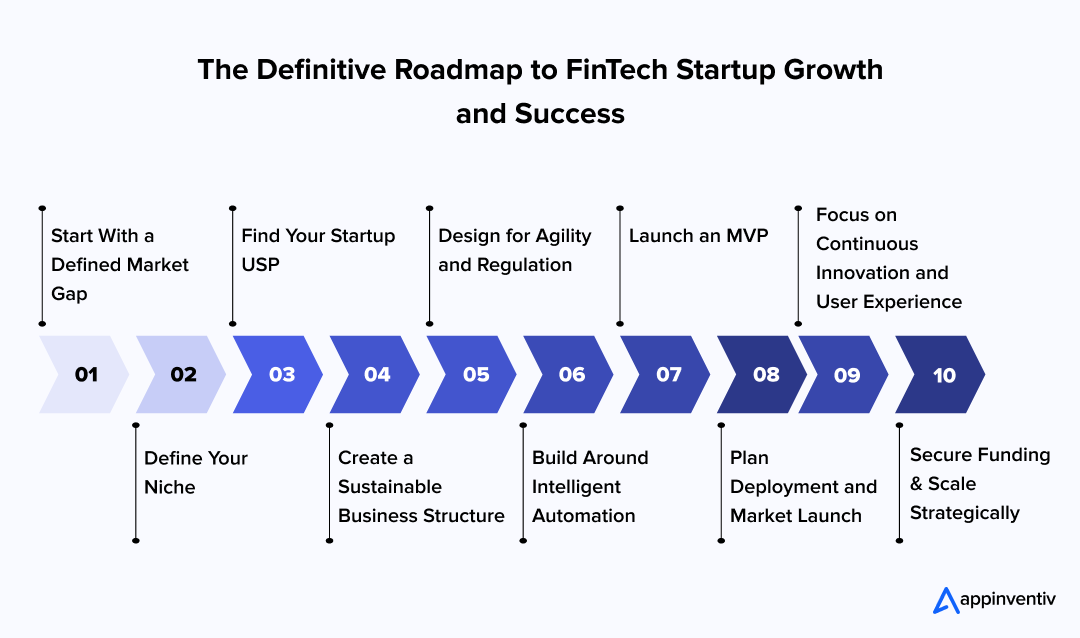

A Strategic Roadmap to FinTech Startup Success

Establishing a FinTech startup can be an exciting venture, but it also requires careful planning and seamless execution. With that said, in this segment, we will discover a step-by-step process to start a FinTech startup, covering considerations and best practices that will take you on the path to success.

Start With a Defined Market Gap

All successful ventures are initiated by addressing a real, measurable problem. The most successful FinTech business ideas arise when there is tension in the financial services industry, such as slow credit application processing, high remittance rates, or limited access to investment products.

Successful ventures emerge when they address a tangible market gap such as inefficient loan approvals, limited financial inclusion, or high transaction costs. A clear problem definition leads to more targeted, scalable solutions and positions your startup for early traction.

Define Your Niche

FinTech is a big sphere to explore. Striving to rule the entire finance world at once can be tricky. So, it is advisable to pick a particular niche among the different subcategories of the market, which are as follows:

- Payment and international money transfer

- Mobile banking

- Personal finance management

- Insuretech

- Trading and lending

- Crowdfunding and

- Data analysis and financial decision-making.

Once you have chosen the niche, conduct market research to find out the specific audience your product/service will target. It will help you launch your top FinTech startup locally and then enter the global market with better success ratios.

Find Your Startup USP

Due to the ever-increasing set of opportunities, the FinTech market is becoming competitive day by day. In such a scenario, it has become crucial for anyone coming up with a new finance app development idea to ensure it will beat the existing ones. They need to ensure their app idea is not generic and offers better functionalities than existing ones, which could be their brand’s USP.

Now, you should also conduct a competitive market analysis while conducting customer surveys and reviewing various reports. This approach will help you identify the common success factors among the top players, their business and revenue models, and the pain points they miss, thereby refining your idea.

Create a Sustainable Business Structure

A good FinTech business model will be a mixture of technology and revenue streams. They can be subscription-based systems, API-based licensing, or profit-sharing models, which enable predictable revenue and make user fees affordable.

Startups need to determine the location of value generation, whether in data insights, transaction facilitation, or embedded services, and price that value. The powerful model can guarantee stable, scalable growth.

Design for Agility and Regulation

There is a highly valuable FinTech-based startup idea that aims to develop platforms to ensure a balance between innovation and compliance. Regulatory changes are also uncontrollable, and how well a startup adapts to them determines its long-term survival.

Compliance tools and audit capabilities built to support systems, in addition to open reporting, not only minimize risk but also enhance investor confidence. Our capacity to make a swift turn without losing trust is the next characteristic of the new generation of FinTech leaders.

Build Around Intelligent Automation

Modern FinTech-related startup ideas are based on smart automation. Automation speeds up lending decisions and makes them more accurate, improves cash flow management, and anticipates customer risk.

These machine learning models can handle data in ways humans cannot, and form a foundation for products that will work continuously and evolve over time. It is aimed at minimizing manual workload and enabling quick, more trustworthy service delivery across industries.

Launch an MVP

Lastly, do not feel tempted to develop a full-fledged FinTech mobile application. Rather, look ahead to testing the water with a Minimal Viable Product (MVP) first. An MVP allows you to enter the market at a cost-effective rate and helps raise funding.

In addition to cost-effectiveness and feedback gathering, an MVP allows startups to expedite their time-to-market. Businesses can streamline the development process by focusing on essential features and functionalities, accelerating the launch timeline. This rapid deployment helps in seizing early market opportunities and allows for quicker iteration and improvement based on user insights.

Plan Deployment and Market Launch

Once validated, focus on secure deployment. Be cloud-based, high availability, and end-to-end encrypted. Build a rollout plan in stages, starting with pilot areas or user groups. Powerful launching campaigns with an effective message, driving the importance of your product, make people trust and seek early adoptions. Deployment can be aligned to compliance milestones so that it is regulatory-ready at the start.

Secure Funding and Scale Strategically

Finding capital is a milestone for any startup. Raise capital, be it venture capital, crowdfunding, or strategic alliances, which match your vision of growth. Offer hard figures, such as CAC, lifetime value, churn rates, and ROI estimates, to appeal to serious investors. Diversify in a more efficient way, enter neighboring markets, or increase services like cross-border payments or wealth management APIs.

Focus on Continuous Innovation and User Experience

The most competitive FinTech product ideas go beyond functionality to deliver a high user experience. FinTech app users require transparency, simplicity, and customization at each level.

Apps with intuitive design and intelligent analytics keep the users better and create brand loyalty. The business will remain relevant as the market continues to change, as product iteration will be driven by feedback, data trends, and new technologies.

Let our experts guide you through each step of building a high-growth FinTech startup

Monetization Strategies for FinTech Startups

In the context of developing a FinTech company, the right revenue model can be a determinant of long-term success. The most successful existing models balance user experience, compliance, and profitability and can be extended in the future.

Subscription-Based Model

Money FinTech apps with premium tools, analytics, or automation are best suited to use subscription plans. This method will provide a consistent monthly revenue and stimulate retention. A FinTech startup consultant can help determine pricing levels that suit both B2B and B2C markets without compromising customer satisfaction.

Transaction and Service Fees

Charging per-transaction or per-service fees is a reliable monetization path. For many FinTech business ideas for startup founders, a small percentage of payments, trades, or lending creates steady revenue while remaining transparent to users. This model suits P2P payments, neobanks, and marketplaces because it scales with volume and keeps customer acquisition friction low.

White-Label Solutions and API Licensing

White-label FinTech infrastructure or API licensing can help startups generate stable B2B revenue. This model enables others to build on your technology, making your system a scalable revenue engine. Such a flexible FinTech business model helps you grow faster and build a trusted ecosystem partner.

Credit-Based Revenue and Lending

Online lending is also among the most viable avenues of steady revenue. Small business lending platforms, peer-to-peer lending, and credit analytics receive interest and service fees. This approach can be applied to teams building a FinTech startup as they seek to leverage financial inclusion and sustainable profitability.

Commission and Partnership Programs

The development of strategic alliances with banks, insurers, and investment companies provides various sources of income in terms of commissions and referrals. Adapting such partnerships to your FinTech product ideas enhances exposure, attracts investors, and minimizes dependence on a single revenue source.

Build Your FinTech Product with Appinventiv

Now that you know the trending FinTech startup ideas and have explored various finance startup ideas across different market segments, it is time to partner with the right FinTech app development firm like Appinventiv to realize your idea.

Recognized by The Economic Times as a Leader in AI Product Engineering & Digital Transformation, we specialize in designing and developing scalable, secure, and user-centric FinTech applications. We bring a wealth of experience and technical competence to build custom FinTech solutions for startups and enterprises. Our skilled team works closely with each of our clients to understand their business objectives and develop a well-aligned application.

Our comprehensive knowledge in the realm of cutting-edge technologies and deep understanding of the FinTech industry have helped entrepreneurs with successful launches. Other than budget management apps like Mudra, we also worked with a global bank, helping them create an AI-based banking solution and another financial literacy platform Edfundo.

Our collaboration with Edfundo helped the platform secure $500,000 in pre-seed funding, paving the way for its next milestone, a $3 million seed round that will accelerate its growth and market expansion.

As a forward-thinking FinTech consulting company, we offer deep expertise in key areas: compliance, security, and emerging technologies. This combination ensures that every product we build is both highly attractive to investors and genuinely ready for the future.

Our clients consistently point to a few core reasons they trust us: our strategic approach, our transparent process, and our constant commitment to innovation. You can view our client testimonials to see exactly how we’ve helped FinTech pioneers successfully turn their initial ideas into thriving digital products.

Ready to take the next step and shape the future of finance?

Talk to our FinTech experts today, and let’s start building your vision for tomorrow.

FAQs

Q. What are some of the top FinTech business ideas for startups?

A. The FinTech industry offers a wide range of finance business opportunities that leverage technology to disrupt traditional financial services. Here are some startup ideas for FinTech:

- Digital Payments and Mobile Wallets

- Peer-to-Peer Lending

- Insurtech

- Robo-Advisory

- Personal Finance Management

- RegTech

- Blockchain and Cryptocurrency Solutions

- Digital Wallets

To get a detailed insight into these trending FinTech startup ideas, please refer to the above blog.

Q. How to start a FinTech startup?

A. Starting a FinTech startup requires a clear vision, compliance readiness, and the right technology foundation. Here’s a quick guide to help you get started:

Find Your Niche – Find a niche based on a particular issue in such fields as payments, lending, or insurtech. Early FinTech business opportunities are also useful in positioning your audience and product orientation.

Determine Your Value Propositions – Research competitors and develop something different. Your concept must enhance efficiency, trust, or user experience in a quantifiable manner.

Develop a Scalable Model – Develop a stable revenue system, e.g,. subscriptions or transactional rates, and be sure that your system is capable of scaling smoothly as your demand increases.

Concentrate on Compliance and Security – Every FinTech-related business must comply with stringent financial and data regulations. Include security and reporting capabilities from the start to build user confidence.

Create and Test an MVP – Develop a minimum viable product to test your idea, get feedback, and refine it before full launch.

Launch and Grow– Repurpose phased launch, fundraise, and never-ending innovation to grow sustainably.

Q. What technologies are disrupting the FinTech industry?

A. Blockchain, Robotic Process Automation (RPA), Augmented Reality (AR), Prescriptive Security, Artificial Intelligence (AI), and Quantum Computing are some of the technologies revolutionizing the FinTech space.

Q. What are the best programming languages to build a FinTech app?

A. FinTech application development is often based on Python, Java, C++, C#, and Ruby, and the current technologies of Node.js, React, and Flutter that allow them to be scaled to high performance. Cloud computing, including GCP, AWS and Azure, AI/ML systems, like TensorFlow, and blockchain applications, like Ethereum and Hyperledger, make financial applications more secure, automated, and transparent.

Q. How do FinTech apps make money?

A. A few of the FinTech app monetization strategies that Entrepreneurs are focusing on are in-app advertising and referrals, business collaborations, subscriptions, and introducing API as a product.

Q. How to validate FinTech application ideas?

A. One of the easiest yet effective ways to validate your FinTech app ideas is to launch the MVP version. This app version, with the least possible features and functionalities, will help you test the competition in the market as well as raise funds while preparing the audience for the future.

Also Read: Valuable Business Lessons That FinTech Startups Can Teach You

Q. What are some examples of financial apps?

A. There are various financial apps available in the FinTech industry, catering to the various aspects of personal finance, investing, budgeting, and more. Here are some real-world examples of financial apps gaining momentous traction in the FinTech industry.

Mint: Mint is one of the most popular budgeting apps, allowing users to manage all their financial records in one place. With intriguing features like bill alerts, custom budgets, investment tracking, etc., Mint has secured a spot on Forbes Advisors’ Best Budgeting Apps of 2023.

Acorns: Acorns is an investment app that helps users invest and save for their future. It offers automated investing and provides tools to help users save for retirement. With more than 20 million downloads, Acorns has been an ultimate investing and money-saving app.

Robinhood: Robinhood is a commission-free stock trading app that allows users to buy and sell stocks, ETFs, and cryptocurrencies, helping them save their financial future. The app makes investing accessible and offers a user-friendly interface.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does Accounting Practice Management Software Development Cost in Australia 2026?

Key takeaways: Custom accounting practice management software development in Australia for mid-to-large firms generally falls between AUD 70,000 and AUD 700,000. Adherence to the Privacy Act 1988 and ATO operational frameworks is a primary cost driver, not an add-on. A modular architecture and structured development approach ensure that the platform evolves with changing laws and…

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…