- Why To Modernize the Mortgage Lending Space?

- The Many Advantages of Using AI in Mortgage Lending

- Key AI Technologies Improving Mortgage Lending

- Use Cases of AI in Mortgage Lending

- How is AI Impacting Key Mortgage Lending Players

- How to Get Started with AI in Mortgage Lending

- Role of Appinventiv in Mortgage Lending

- FAQs

In an era where technological advancements are revolutionizing every sector, mortgage lending has been slow to embrace change. The industry has been bogged down by outdated processes, increasing operational costs, and regulatory pressures.

However, with the introduction of AI in mortgage lending industry, a shift is occurring that promises to address these pain points while unlocking efficiencies, enhancing customer experiences, and mitigating risk.

The global mortgage market, valued in the trillions, has long been ripe for disruption. Yet, the traditional model, which relies heavily on manual processes, human interventions, and legacy systems, has often resisted change. But with AI at the forefront of this much-awaited transformation, this resistance is beginning to fade.

By integrating mortgage AI-powered technologies, lenders can automate cumbersome tasks, reduce human error, and enhance decision-making, leading to faster, more accurate, and cost-effective services.

This article explores the key areas where AI significantly impacts mortgage lending, from improving underwriting processes to personalizing customer interactions. By examining real-world applications and use cases, we’ll uncover how AI can be a game-changer for mortgage lenders, helping them stay competitive in an increasingly digital world.

But before we dive deeper into the AI for mortgage lending domain, let’s highlight why it’s time for the domain to embrace the technology for improved processes and efficiency.

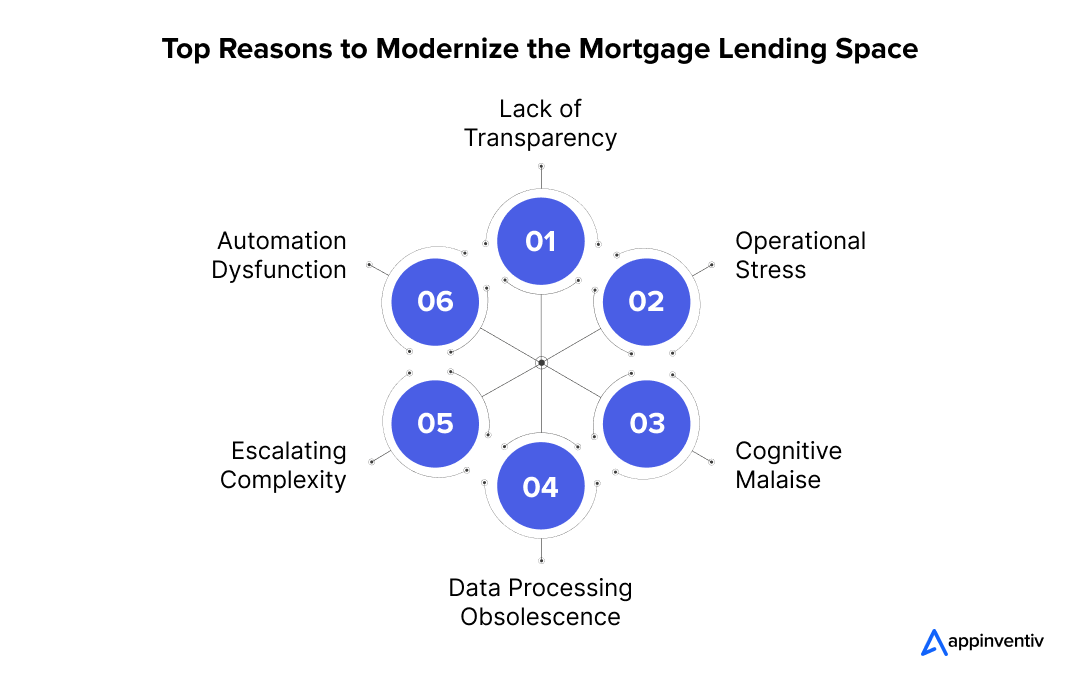

Why To Modernize the Mortgage Lending Space?

The mortgage lending industry is one of the largest financial sectors globally, yet it remains mired in inefficiencies, regulatory hurdles, and outdated technology. Below are the critical reasons why it’s high time for the industry to modernize and adopt AI mortgage lending.

1. Lack of Transparency

Traditionally, the mortgage lending process has been opaque, with borrowers struggling to understand their loans’ terms and conditions fully. This lack of transparency leads to confusion, mistrust, and inefficiencies. The role of AI in the mortgage lending industry can be seen as providing lenders with powerful analytics and reporting tools that foster clearer communication, better risk assessments, and more transparent loan terms for borrowers.

2. Operational Stress

Mortgage lenders face immense pressure from rising operational costs, long processing times, and the need to ensure compliance with ever-evolving regulations. Mortgage AI helps to automate many of these tasks, significantly reducing the manual effort required and enabling lenders to reallocate resources to more strategic initiatives. By streamlining operations, AI alleviates organizational stress, allowing lenders to process more loans in less time.

3. Cognitive Malaise

The sheer volume of data mortgage lenders need to process can overwhelm traditional methods. Loan applications, credit histories, income verifications, and property valuations generate vast amounts of data that must be reviewed manually. Artificial intelligence in mortgage lending can quickly and accurately process these massive datasets, reducing cognitive overload for lenders and improving decision-making speed and accuracy.

4. Data Processing Obsolescence

Legacy systems, still prevalent in many mortgage lenders’ operations, are not designed to handle modern data’s sheer scale and complexity. However, AI in the mortgage industry can be implemented to seamlessly integrate with these systems, enhancing data processing capabilities, improving data accuracy, and reducing the risk of human error. Moreover, modern AI tools can also make sense of unstructured data, such as text, images, and voice data, helping lenders gather more relevant insights from various sources.

5. Escalating Complexity

As lending regulations become stricter and consumer expectations rise, mortgage lenders face increasing complexity in their day-to-day operations. AI can help lenders keep up by automating regulatory compliance checks, improving data organization, and providing more sophisticated risk models. This allows lenders to manage complex workflows efficiently and remain compliant without dedicating significant resources to manual checks.

6. Automation Dysfunction

While automation has been a buzzword in the mortgage industry for years, many organizations have struggled to implement it effectively. Manual processes continue to dominate due to fragmented systems, siloed data, and a lack of integration between various technologies.

AI incorporation can enable a more holistic approach to automation, providing end-to-end solutions that can be deployed seamlessly across the entire mortgage lifecycle, leading to better workflow automation, improved accuracy, and faster decision-making.

Now that it has been established how AI for mortgage lending has become the default mode of improved efficiency and increased profitability let us cement this further by looking into the benefits of AI in the mortgage industry.

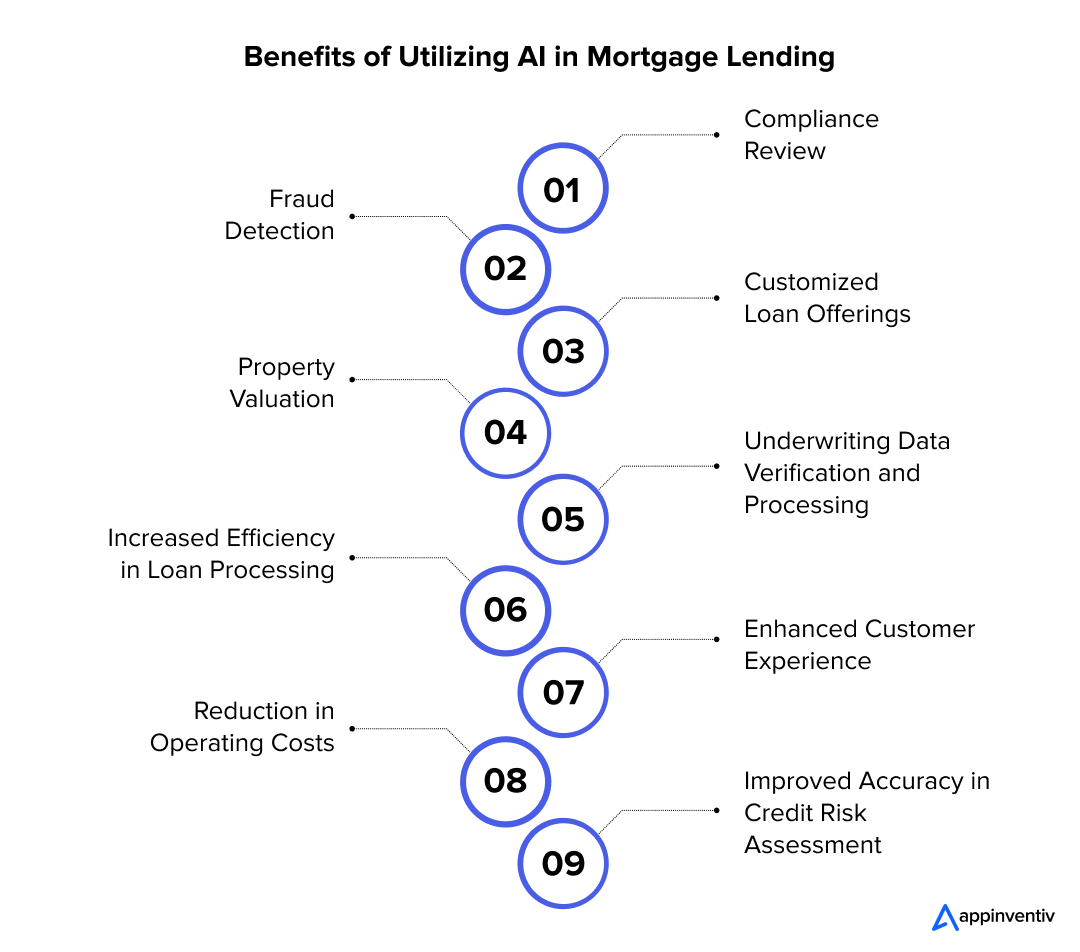

The Many Advantages of Using AI in Mortgage Lending

AI has numerous advantages for mortgage lenders. Here is a rundown of AI’s key benefits to the mortgage domain.

1. Compliance Review

Regulatory compliance is one of the most challenging aspects of the mortgage lending process. AI for mortgage lending can automate AI regulations and compliance checks, ensuring that all necessary documents are in place, that loan terms comply with local regulations, and lenders can quickly adapt to law changes. Moreover, the AI mortgage lending platforms can perform real-time audits, identify potential compliance issues, and provide alerts to mitigate risks.

2. Fraud Detection

Mortgage lending has long been a target for fraud, with dishonest actors manipulating data or providing false information to secure loans. AI can help detect financial fraud patterns using machine learning to analyze historical data and identify discrepancies in borrower information. These AI systems are usually built to flag suspicious activities in real-time, assisting lenders to prevent fraud before it happens.

3. Customized Loan Offerings

One of the most compelling benefits of AI in the mortgage industry is its ability to deliver highly personalized services. Using data analytics and machine learning algorithms, mortgage lenders can offer customized loan products tailored to individual borrower profiles. AI, here, enables lenders to assess a borrower’s financial situation, creditworthiness, and borrowing history to recommend the most appropriate loan options.

4. Property Valuation

Accurate property valuation is critical in the mortgage industry. Traditional valuation methods rely on appraisers, which can introduce human error and inconsistencies. To solve this, property valuation models of AI in mortgage lending industry can leverage data from multiple sources, including market trends, property conditions, and historical sales, ultimately providing more accurate, real-time valuations.

Also Read: Real Estate – 16 Applications and Real-World Examples

5. Underwriting Data Verification and Processing

Underwriting is one of the most crucial processes in mortgage lending. AI can significantly speed up and improve the underwriting process by automating data verification and analyzing borrower risk in real-time.

Additionally, algorithms built for artificial intelligence in mortgage lending can evaluate thousands of data points in a fraction of the time it takes for a human underwriter to do so manually, helping lenders make faster, more accurate decisions.

6. Increased Efficiency in Loan Processing

Another use case of AI for mortgage brokers can be seen through the technology automating many repetitive, time-consuming loan processing tasks. This includes document verification, data entry, and communication with borrowers. By automating these processes, lenders can reduce the time it takes to process a loan, improve operational efficiency, and reduce human error. For this, businesses are dedicatingly investing in Loan Lending App Development.

7. Enhanced Customer Experience

AI-powered chatbots, virtual assistants, and automated document processing tools can significantly enhance the customer experience. Borrowers can interact with these systems at any time of day to ask questions, submit documents, and receive real-time loan updates. These improvements in accessibility and responsiveness lead to higher borrower satisfaction and improved customer retention.

8. Reduction in Operating Costs

Automating manual processes through AI reduces labor costs and improves operational efficiency. Lenders can reallocate resources to more critical tasks, such as customer engagement and loan servicing, while AI handles the heavy lifting of routine processes. As a result, lenders can lower operational costs and increase profitability.

9. Improved Accuracy in Credit Risk Assessment

Using machine learning in mortgage industry, AI systems can analyze borrower data, including credit scores, employment history, and financial statements, to generate more accurate credit risk models.

Machine learning algorithms and AI in risk management continually improve these models, enabling lenders to make better, data-driven decisions when evaluating a borrower’s creditworthiness, ultimately reducing default rates and improving lenders’ profitability.

With the benefits now clear, you must wonder how one technology can bring such huge improvements in an otherwise traditional, manual-heavy industry. The answer to this lies in the many sub-AI technologies changing the domain’s landscape together.

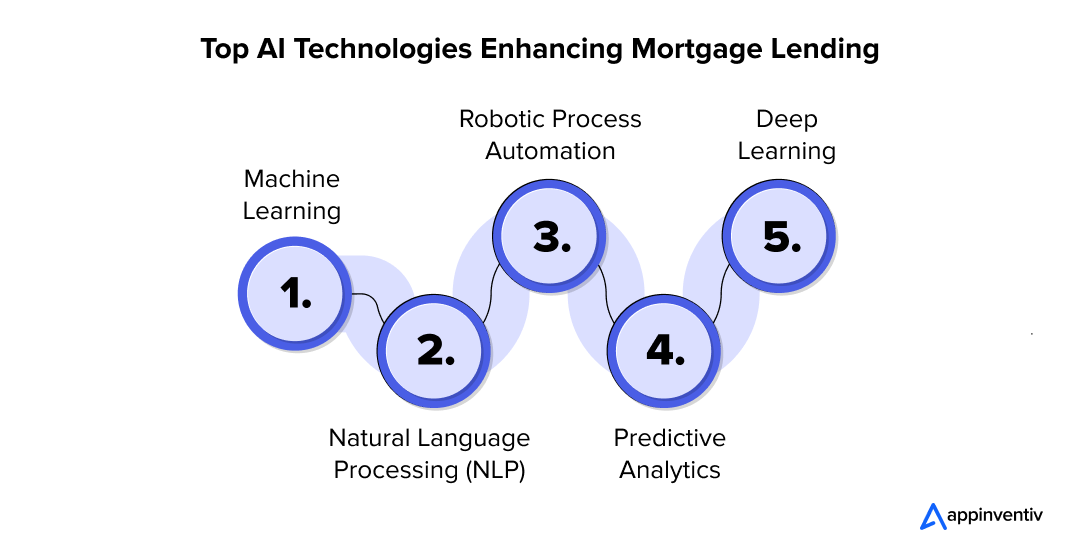

Key AI Technologies Improving Mortgage Lending

Several technologies focused on AI in the mortgage industry contribute to the domain’s modernization, each playing a vital role in optimizing different aspects of the lending process. Here’s a closer look at the primary AI technologies reshaping the industry:

1. Machine Learning

Machine Learning is the foundation of the present and future of AI in mortgage lending industry. ML algorithms are designed to learn from vast datasets, identify patterns, and make predictions. When integrated into the mortgage lending industry, Machine Learning App development helps in risk assessment, credit scoring, and fraud detection by analyzing historical data and providing more accurate predictions about borrower behavior.

Example in Action: Lenders use ML to assess whether a borrower is likely to default based on various factors, such as credit history, income levels, and even behavioral data like spending patterns. The machine learning model better predicts loan performance as more data is processed.

2. Natural Language Processing (NLP)

Natural Language Processing enables machines to understand, interpret, and generate human language. In mortgage lending, NLP plays a crucial role in automating document analysis. Instead of manually reviewing mortgage applications, the technology can extract relevant data from documents like bank statements, tax returns, and employment records.

Example in Action: NLP reads through and categorizes mortgage-related documents automatically, significantly speeding up the processing time. It can also identify key phrases and data points, such as income or employment status, which might be overlooked in manual processing.

3. Robotic Process Automation

RPA automates repetitive tasks that would otherwise require human intervention. In the context of AI in the mortgage lending industry, it is often used to handle administrative tasks like data entry, application verification, and compliance checks. Robotic Process Automation allows mortgage lenders to focus on more strategic functions by automating these processes.

Example in Action: An RPA bot can automatically verify a borrower’s identity by pulling data from a central registry or credit bureau and matching it with the information submitted in the application, reducing manual checks.

4. Predictive Analytics

Predictive analytics uses historical data, statistical algorithms, and machine learning to identify the likelihood of future outcomes. This technology is used in mortgage lending to assess borrower risk, predict loan defaults, and optimize pricing models.

Example in Action: Predictive analytics can forecast a borrower’s future financial behavior, enabling lenders to understand their risk exposure better and adjust their loan offerings accordingly.

5. Deep Learning

A subset of machine learning, deep learning, is designed to simulate the human brain’s neural network. Deep learning is ideal for processing unstructured data like images, voice, and video. When it comes to establishing the advantages of AI in mortgage lending, deep learning can be used to analyze documents that contain non-textual elements or require advanced interpretation, such as scanned handwritten documents or images of property listings.

Example in Action: A deep learning model can scan a scanned document of a borrower’s handwritten signature and verify its authenticity by comparing it with previously provided signatures.

Although we have already looked into the benefits of AI for mortgage brokers and the technologies that work in the backend to help achieve those advantages, let us take the discussion up a notch by looking into the different applications of the technology in the domain.

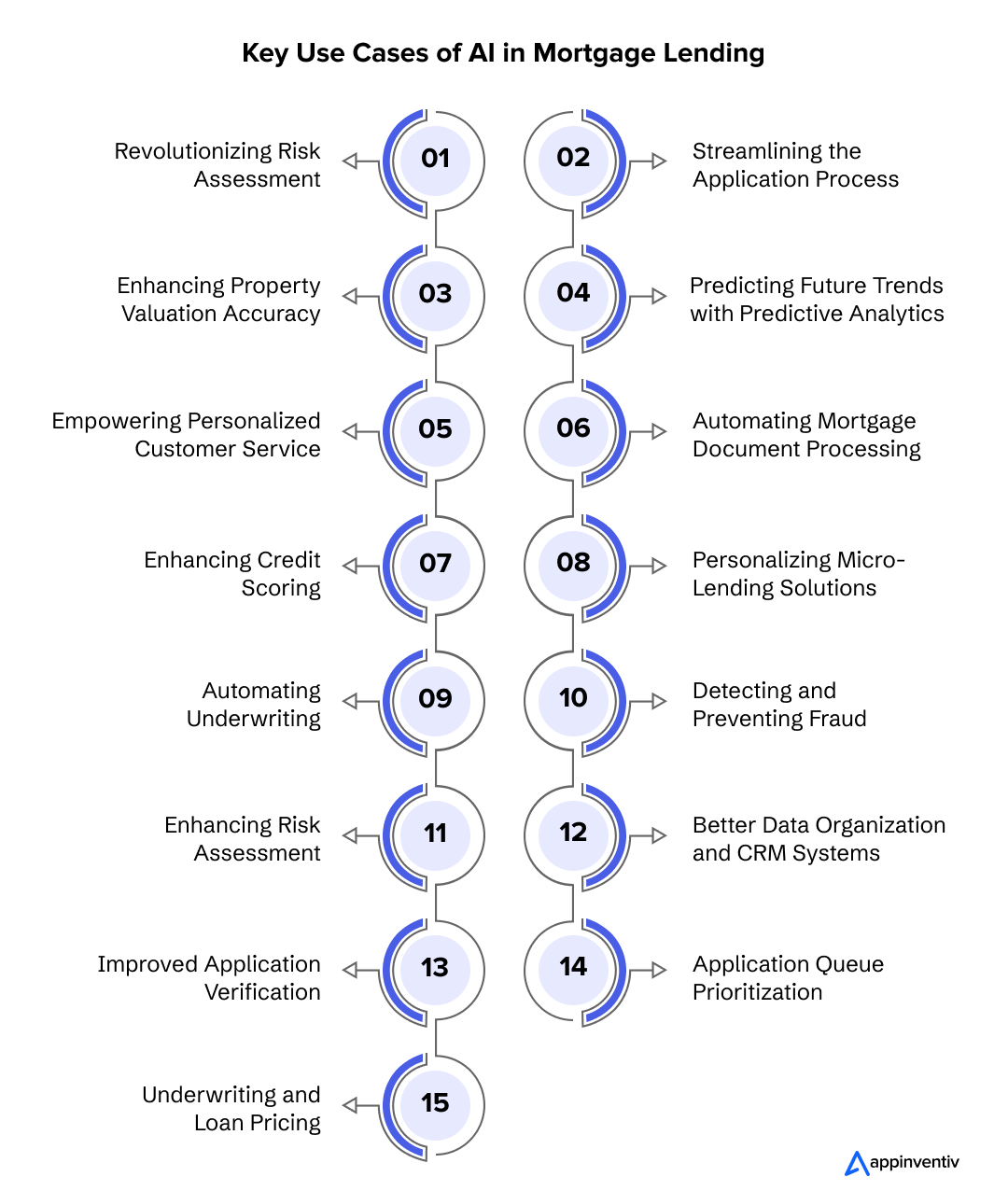

Use Cases of AI in Mortgage Lending

With every instance of poor efficiency or delayed processing, the role of AI in the mortgage lending industry is coming to the forefront. Here are some practical use cases where AI has established itself as a must-have in the domain.

1. Revolutionizing Risk Assessment

AI in mortgage lending helps lenders assess the risk of a mortgage loan more accurately by analyzing vast amounts of data. It can identify patterns in borrower behavior, predict future risks, and enable lenders to make informed decisions. This helps mitigate the risk of defaults and ensures that the right borrowers are approved for loans.

2. Streamlining the Application Process

AI streamlines the application process by automating document verification, background checks, and credit score evaluations. It can also integrate with other systems to speed up the approval process, providing a seamless experience for borrowers. Additionally, AI-powered chatbots and virtual assistants can guide borrowers through the application process, answering their questions and reducing friction.

3. Enhancing Property Valuation Accuracy

Mortgage AI platforms can analyze data points like market conditions, property features, and neighborhood trends to provide an accurate and real-time property valuation. This eliminates the need for manual appraisals and helps lenders make decisions based on accurate data.

Also Read: Cost of developing real estate apps like Zillow or Trulia

4. Predicting Future Trends with Predictive Analytics

AI’s predictive capabilities help mortgage lenders anticipate market trends, such as interest rate fluctuations, property price changes, and borrower behavior. By leveraging predictive analytics, lenders can make data-driven decisions, plan for future scenarios, and gain a competitive advantage in the market.

5. Empowering Personalized Customer Service

AI in mortgage lending enables lenders to offer highly personalized customer service by analyzing borrower data and providing tailored loan offerings. AI in CRM can track borrowers’ preferences and financial status, allowing the lenders to recommend the most suitable loan products. Additionally, AI-driven chatbots and virtual assistants can answer borrower queries instantly, improving overall customer satisfaction.

6. Automating Mortgage Document Processing

AI can automate the processing of mortgage documents, such as income statements, tax returns, and bank statements. AI in the documenting process speeds up the approval process and reduces human error. Additionally, AI-driven document recognition systems can extract relevant data from documents, validate information, and flag discrepancies in real-time.

7. Enhancing Credit Scoring

AI can improve credit scoring by analyzing a broader range of data points, including social behavior, spending habits, and online activity. This provides a more accurate and holistic picture of a borrower’s financial health, enabling lenders to assess risk more effectively.

8. Personalizing Micro-Lending Solutions

AI can create micro-lending solutions catering to borrowers with limited credit histories or unconventional financial situations. By analyzing non-traditional data, such as mobile phone usage or payment history, tools built on AI for mortgage lending can provide lenders with insights into borrowers who would otherwise be considered high-risk.

9. Automating Underwriting

AI can automate underwriting processes by analyzing borrower data and determining creditworthiness based on predefined criteria. This speeds up the approval process and reduces the risk of human error in underwriting decisions.

10. Detecting and Preventing Fraud

Fraud detection software, when integrated into AI for mortgage lending, can analyze borrower data in real-time, identifying patterns and anomalies that may indicate fraudulent activity. These systems can flag suspicious applications, allowing lenders to investigate and prevent fraudulent transactions before they occur.

11. Enhancing Risk Assessment

AI can provide more accurate risk assessments by analyzing various factors, including borrower behavior, market trends, and macroeconomic indicators. This enables lenders to make better decisions when assessing credit risk, reducing the chances of loan defaults.

12. Better Data Organization and CRM Systems

AI can enhance data organization and improve customer relationship management systems. Using AI to analyze customer data, lenders can provide more personalized services and enhance customer engagement. AI-driven Mortgage CRM systems can track customer interactions, predict borrower needs, and suggest relevant loan products.

13. Improved Application Verification

AI in mortgage lending industry can also automate application verification by cross-referencing borrower data with third-party sources, such as credit bureaus, employment records, and financial institutions. This ensures that all information is accurate and up-to-date, reducing the risk of fraud and improving decision-making.

14. Application Queue Prioritization

AI can prioritize mortgage applications based on predefined criteria, such as the applicant’s creditworthiness, loan amount, or application completeness. This ensures that the most critical applications are processed first, reducing wait times for borrowers.

15. Underwriting and Loan Pricing

AI can automate underwriting and loan pricing decisions based on borrower data, market conditions, and lender risk preferences. This helps ensure that loans are priced accurately and consistently, improving profitability for lenders while offering fair terms to borrowers.

Now, when we talk about the role of applications of AI in mortgage lending, the discussion will be incomplete unless we look into the impact of technology on the ground-level stakeholders.

How is AI Impacting Key Mortgage Lending Players

1. Lending Originators

AI enables mortgage originators to streamline the application process, enhance borrower risk assessments, and provide personalized loan offerings. This allows originators to reduce processing times, improve accuracy, and offer better products to customers.

2. Lending Insurers

AI helps insurers assess risk more accurately, reduce fraud, and improve underwriting decisions. AI-powered systems can analyze borrower data and provide insurers with insights that help them create more accurate pricing models.

3. Lending Service Providers

Mortgage servicers can use AI to automate the loan servicing process, improve customer engagement, and streamline payment collection. AI can also help servicers identify at-risk loans and take proactive measures to prevent defaults.

4. Lending Solutions Providers

Lending solutions providers benefit from AI by offering more efficient, scalable, and accurate software platforms. AI-powered solutions can automate complex workflows, improve data accuracy, and enhance decision-making, helping providers provide better client services.

With this, we have looked into the multiple facets of AI in mortgage lending through the lens of its use cases and micro-level impact; it’s time to take the next step – incorporate AI in your mortgage lending business.

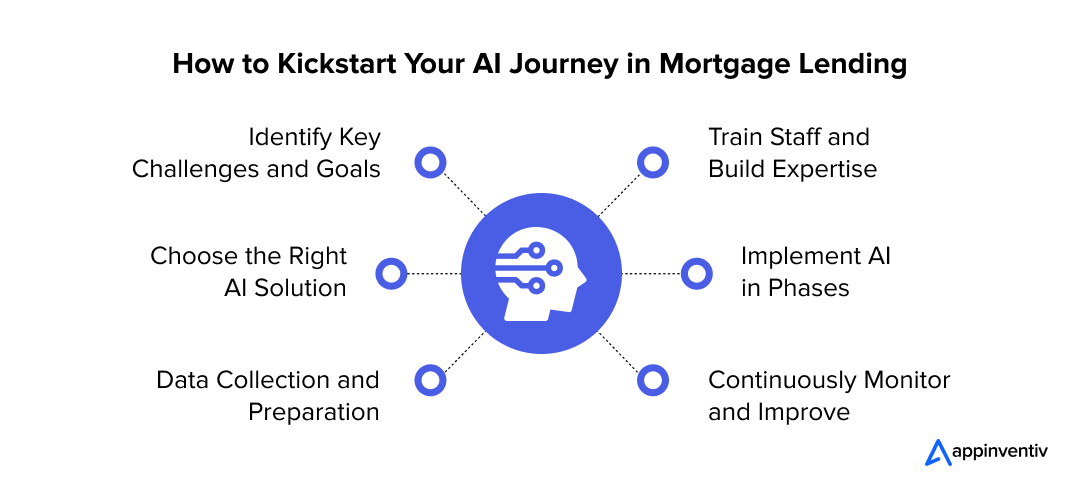

How to Get Started with AI in Mortgage Lending

The process may seem overwhelming for mortgage lenders looking to integrate AI into their operations. However, breaking it down into manageable steps will simplify the journey.

1. Identify Key Challenges and Goals

Before diving into AI adoption, lenders should identify the specific challenges they want to address. Whether improving underwriting accuracy, speeding up the loan approval process, or enhancing customer service, understanding these goals will help prioritize AI initiatives and guide the overall strategy.

2. Choose the Right AI Solution

Not all AI technologies are created equal. Lenders should choose AI tools that align with their specific needs. For example, if customer experience is a priority, chatbots and NLP-powered solutions might be a good fit.

On the other hand, if risk management is the focus, machine learning and predictive analytics might be more appropriate. However, it is also critical to note the challenges of AI in mortgage industry. Only when you understand places where the current AI technology lacks will you be able to prepare for solutions.

3. Data Collection and Preparation

AI models require clean, structured, and high-quality data to deliver accurate results. Mortgage lenders should improve data collection practices, ensuring that all relevant data points (credit scores, loan history, etc.) are available and well-organized.

This can be achieved through extensive data preparation, which involves cleaning the data and eliminating any inconsistencies or missing values.

4. Train Staff and Build Expertise

While AI technology can automate many tasks, employees must understand how to work alongside AI tools. Lenders should invest in training staff on how to use AI effectively and how to interpret its results. This stage is solved when they partner with an AI software development company with a proven track record of successful lending solutions deployment.

5. Implement AI in Phases

Lenders should implement AI in phases rather than overhauling entire systems at once. Starting small with one or two tools – such as an automated document review system or an AI-powered underwriting platform – can provide quick wins and allow lenders to adjust their approach before full-scale implementation.

6. Continuously Monitor and Improve

AI systems are not “set and forget” solutions. Lenders should regularly monitor the performance of their AI tools, identify any issues, and make improvements over time. Additionally, with every new data gathered, AI models should be retrained to improve accuracy and keep up with changing market conditions.

By taking these steps, mortgage lenders can successfully integrate AI in mortgage lending processes and begin reaping the benefits of enhanced efficiency, better customer experience, and more accurate decision-making.

At this point, I am sure you must be wondering how exactly we can help you in this journey. Well, here’s how.

Role of Appinventiv in Mortgage Lending

At Appinventiv, we specialize in developing cutting-edge lending software solutions powered by AI – an expertise that has made us a trusted lending software development company.

By leveraging the latest advancements in AI technology, we help mortgage lenders transform their operations, improve customer satisfaction, and stay ahead of the competition. Our solutions automate routine tasks, enhance risk assessments, and provide personalized loan offerings, helping lenders streamline processes and make data-driven decisions.

Whether you are a mortgage originator, servicer, or insurer, our AI-driven solutions are designed to meet your unique needs and help you thrive in a rapidly changing market.

If you’re ready to embrace the power of AI in mortgage lending, contact us today to learn how we can help you revolutionize your operations.

FAQs

Q. How is AI changing mortgage lending?

A. AI transforms mortgage lending by automating and streamlining processes, enhancing decision-making accuracy, and improving customer experience. With AI-powered tools, lenders can quickly analyze vast amounts of data to assess risk and creditworthiness, reducing processing time and enhancing loan approval accuracy. AI also enables personalized recommendations for customers, helping to match them with suitable mortgage options. Additionally, predictive analytics and machine learning can identify potential risks or fraud early, making mortgage lending safer and more efficient.

Q. How is artificial intelligence used in mortgage lending?

A. In mortgage lending, artificial intelligence automates tasks like data entry, document verification, and application processing, significantly reducing time and errors. AI-powered algorithms analyze applicants’ financial histories, credit scores, and other data points to assess creditworthiness accurately. Chatbots and virtual assistants provide round-the-clock customer service, answering questions and guiding borrowers through the process. Machine learning models also identify patterns to predict loan repayment risks, helping lenders make informed decisions while offering competitive interest rates.

Q. How can AI help mortgage brokers?

A. AI can assist mortgage brokers by simplifying the loan matching process, automating routine tasks, and enhancing client insights. AI tools analyze borrower data to suggest suitable mortgage options faster and more precisely. Brokers can also use AI-driven customer relationship management (CRM) systems to track interactions, predict client needs, and personalize outreach. Moreover, AI-driven market analysis gives brokers insights into trends and potential opportunities, helping them stay competitive and improve client service.

Q. How can AI be used in lending?

A. AI can be used in lending to streamline loan processing, assess creditworthiness, detect fraud, and enhance customer service. Machine learning models evaluate applicant profiles by analyzing historical and real-time data, improving the accuracy of risk assessments. Automated document verification speeds up processing, while AI-powered chatbots handle customer inquiries, providing quick, accurate responses. Additionally, AI tools monitor transactions and flag suspicious behavior, helping to mitigate fraud and enhance compliance with regulatory standards.

Q. What is the future of AI in the mortgage lending industry?

A. AI’s future in mortgage lending will likely focus on increased automation, personalization, and data-driven decision-making. AI will continue to improve underwriting accuracy, accelerate loan processing, and offer more tailored mortgage products to meet individual customer needs.

As AI advances, you can expect more sophisticated predictive analytics to identify potential defaults early and automated risk management solutions. Additionally, AI may enable end-to-end digital lending platforms, offering borrowers a seamless, fully online mortgage experience from application to closing.

How Much Does It Cost to Build an App like Janitor AI?

Key takeaways: Cost Breakdown: The cost of app development varies, with an MVP App costing $40,000 to $90,000, a Mid-Tier App costing $100,000 to $200,000, and an Enterprise Grade App costing $300,000 to $ 500,000 or more, depending on features, complexity, and the expertise of the development team. Key Factors: Platform choice, AI integration, and…

10 Ways AI is Transforming the Healthcare Sector in Australia

Key takeaways: Generative AI could add $13 billion annually to Australia’s healthcare sector by 2030. AI is already transforming operations across diagnostics, admin tasks, and patient care. Healthcare in remote areas is improving with AI-powered virtual assistants and monitoring tools. AI can help address workforce shortages by automating routine tasks and supporting clinical decisions. Major…

Exploring the Power of AI in Creating Dynamic & Interactive Data Visualizations

Key takeaways: AI transforms data visualization by providing automated insights, interactive dashboards, and NLP, thereby tackling revenue loss and improving data quality. Key features include predictive analytics, real-time data integration, and user-friendly visualizations, enabling faster and more informed decisions. Top 2025 tools, such as Tableau, Power BI, and Julius AI, offer NLP and real-time analytics…