- Human Stock Trading vs. AI Stock Trader - Key Differences

- AI Stock Trading Use Cases - Redefining the Markets

- Data Mining

- Predictive Analytics and Market Forecasting

- Algorithmic Trading and Automated Execution

- Sentiment Analysis

- Risk Modeling

- Stress Testing

- Real-Time Market Analysis

- Backtesting

- Comparative Performance Analysis (Benchmarking)

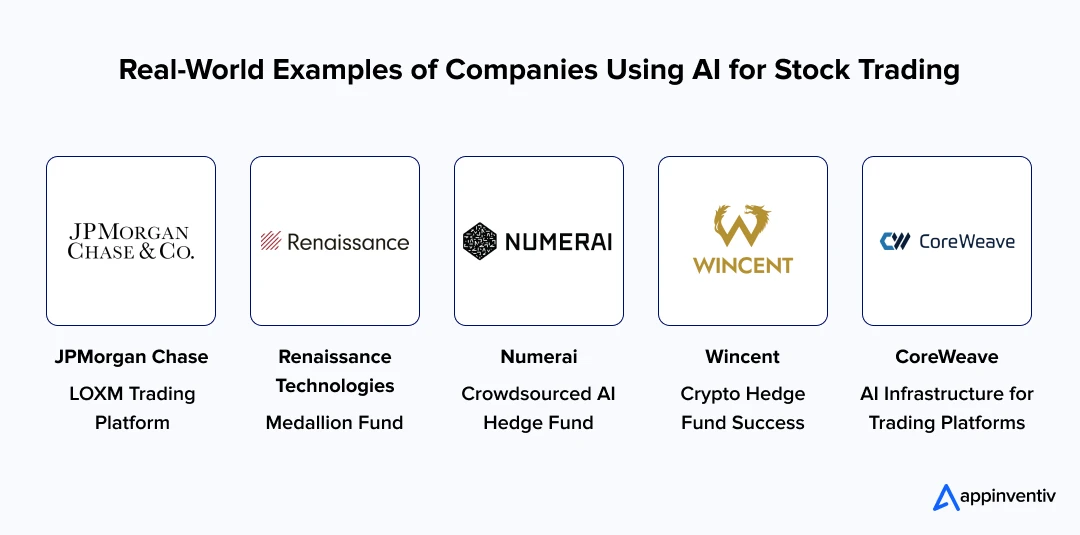

- Real-World Examples of AI Stock Trading Companies

- JPMorgan Chase: LOXM Trading Platform

- Renaissance Technologies – Medallion Fund

- Numerai – Crowdsourced AI Hedge Fund

- Wincent – Crypto Hedge Fund Success

- CoreWeave: AI Infrastructure for Trading Platforms

- Leverage ChatGPT for Stock Trading: A Quick & Easy Way to Use AI in Your Investing

- How to Develop an AI-Powered Stock Trading Platform - A Step-by-Step Process

- 1. Requirement Analysis & Planning

- 2. Data Collection & Preparation

- 3. Algorithm Selection & Model Training

- 4. Simulation & Backtesting

- 5. Platform Architecture & Development

- 6. Integration & Security Implementation

- 8. Deployment & Live Testing

- 9. Continuous Monitoring & Model Updating

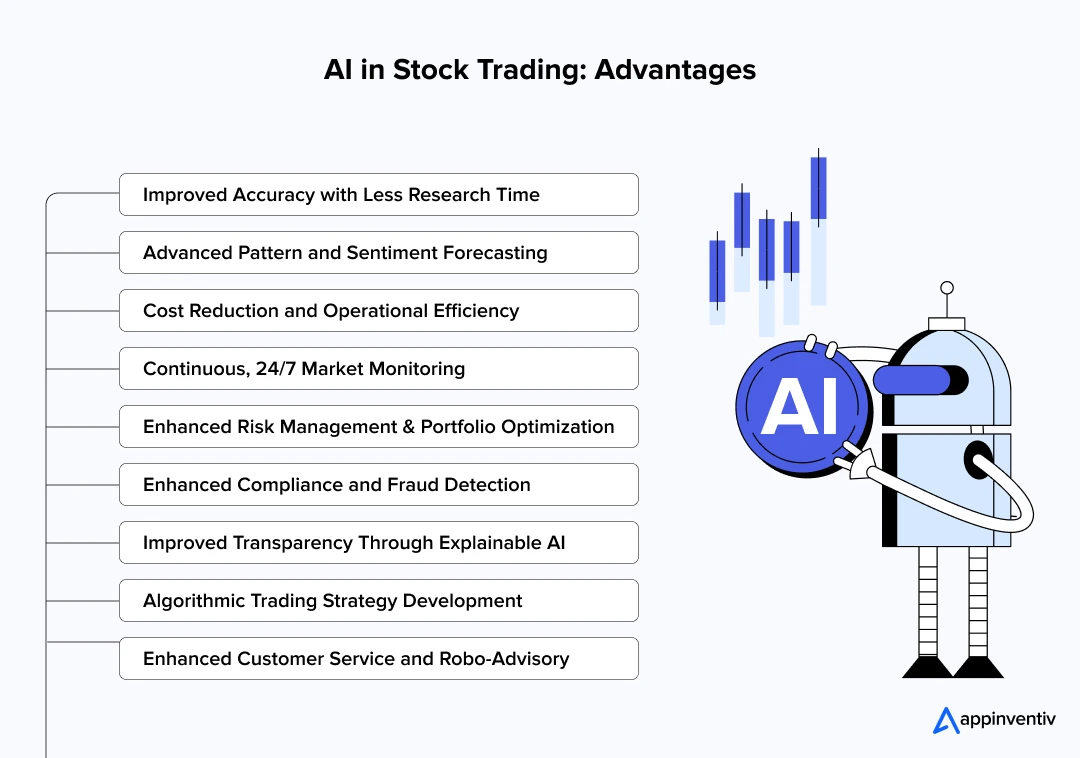

- Benefits of Using AI in Stock Trading: Unleashing Its Immense Potential

- Improved Accuracy with Less Research Time

- Advanced Pattern and Sentiment Forecasting

- Cost Reduction and Operational Efficiency

- Continuous, 24/7 Market Monitoring

- Enhanced Risk Management and Portfolio Optimization

- Enhanced Compliance and Fraud Detection

- Improved Transparency Through Explainable AI

- Algorithmic Trading Strategy Development

- Enhanced Customer Service and Robo-Advisory

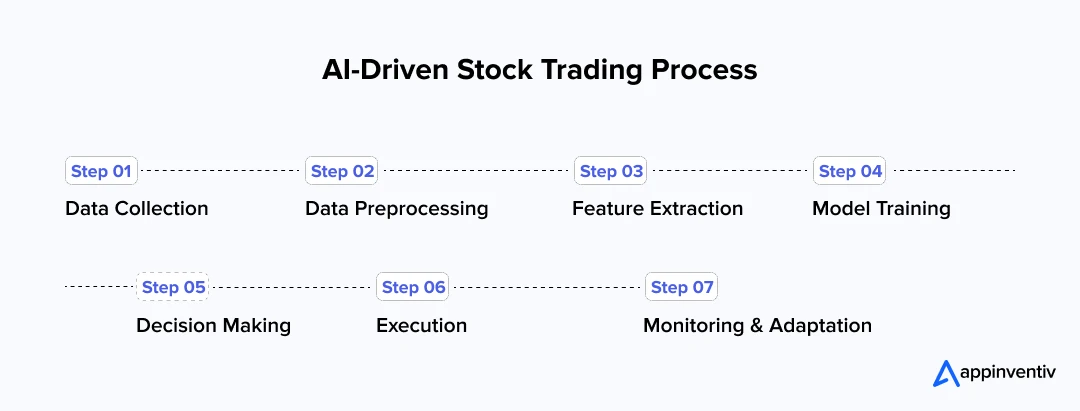

- How AI Stock Trading Works?

- How Artificial Intelligence Stock Trading Transforms the Markets?

- Risks of Using AI to Trade Stocks and How to Overcome Them

- Systemic Vulnerabilities

- Data Security Concerns

- Regulatory Hurdles

- Market Manipulation

- Overfitting Models

- Best Practices for Developing Artificial Intelligence Software for Stock Trading

- The Future of AI in Stock Trading

- Appinventiv: Your Trusted Tech Partner for AI and Stock Trading Platform Development

- FAQs

Key takeaways:

- Advanced AI tools like Tickeron’s AI Trading Bot can spot winning trades with speed and precision far beyond manual human capabilities, boosting returns significantly.

- Unlike human traders, AI operates 24/7 without fatigue or emotional bias, reducing errors and impulsive trades.

- AI enhances everything from data mining and predictive analytics to sentiment analysis and automated execution, revolutionizing trading strategies with speed and accuracy.

- While AI transforms stock trading, human oversight remains essential for navigating risks, adapting to market changes, and ensuring ethical and compliant trading practices.

It’s no secret that the stock market holds the potential to create massive wealth, but only for those who know how to play the game. For most of us, it feels like a high-stakes roulette wheel: one wrong move and your gains vanish. But what if you could trade like one of the world’s most successful hedge funds?

Sounds pleasing? This is not a distant dream but a reality. Welcome to the age of AI in stock trading.

For instance, Tickeron’s AI Trading Bot recently boosted returns on Tesla (TSLA) stock by over 60%, using advanced technical indicators to spot winning trades, something nearly impossible to do manually at that speed.

Whether you are a beginner looking to boost returns or a seasoned investor exploring smarter strategies, artificial intelligence stock trading is changing the game.

This blog will delve into the ins and outs of using AI for stock trading, including its applications, advantages, development process, challenges, solutions, and best practices for leveraging artificial intelligence in stock trading software. Because yes—AI is powerful, but it’s not a crystal ball.

Tap into this power today!

Human Stock Trading vs. AI Stock Trader – Key Differences

There are several differences between AI-driven stock trading and traditional human-led approaches. Artificial intelligence in trading enables merchants to manage multiple markets simultaneously while maintaining discipline throughout their operations. Conversely, human-led strategies present several challenges that hinder successful trades, including psychological barriers, breaking established guidelines, and an inability to maintain constant vigilance over market developments.

Here are the key differences between the stock trading methods.

| Aspect | Human Stock Trading | AI Stock Trading |

|---|---|---|

| Emotional Influence | Prone to irrational emotions like fear, greed, and revenge trading that impair judgment and lead to poor decisions. | Emotion-free; strictly data-driven and objective, eliminating emotional biases. |

| Rule Adherence | Can impulsively break trading rules or deviate from strategies under stress or uncertainty. | Rigidly follows predefined rules and algorithms without deviation, ensuring discipline. |

| Round-the-Clock Consistency | Inconsistent due to fatigue, distraction, or psychological biases; cannot monitor markets continuously. | Operates 24/7 with constant vigilance, ensuring consistent and timely trade execution. |

| Market Monitoring | Limited capacity to track multiple markets and asset classes simultaneously. | Simultaneously monitors and analyzes multiple markets and assets in real-time. |

| Processing Speed | Slower decision-making due to manual data analysis and emotional hesitation. | Rapidly processes vast datasets and executes trades at high speeds. |

| Handling Complex Data | Difficulty processing large volumes of structured and unstructured data. | Excels at analyzing big data, including news, social media, and market signals. |

| Psychological Biases | Susceptible to biases like overtrading, loss aversion, and confirmation bias. | Eliminates human biases, adhering strictly to logic and statistical patterns. |

| Adaptability | Can adapt intuitively but may react emotionally to unexpected market shifts. | Continuously learns and updates models based on new data, adapting systematically. |

| Risk Management | Often inconsistent, emotions can lead to excessive risk-taking or undue caution. | Uses predictive analytics to balance risk and optimize portfolio allocation objectively. |

AI Stock Trading Use Cases – Redefining the Markets

AI stock trading has significantly revolutionized the way the market operates. It has introduced unprecedented levels of efficiency and insight that were once unimaginable. Through the automation of intricate decision-making processes, artificial intelligence for stock trading has improved the speed and precision of trading activities. Let’s examine some of the key scenarios where AI applications in trading help transform the financial landscape.

Data Mining

This technique involves the comprehensive analysis of massive datasets to identify hidden patterns and trends that are not immediately obvious. AI enhances data mining in stock trading by enabling faster processing and more complex analysis, allowing traders to uncover profitable opportunities based on historical data patterns.

Predictive Analytics and Market Forecasting

This use case involves the comprehensive analysis of massive datasets to identify hidden patterns and trends that are not immediately obvious. AI in stock trading enhances this by enabling faster processing and more complex analysis, allowing traders to uncover profitable opportunities based on historical data patterns and forecast future market movements, prices, and volatility.

Algorithmic Trading and Automated Execution

AI in stock trading uses advanced algorithms to automate the execution of trades based on real-time market data and pre-defined strategies. This use case enables traders to anticipate market movements and make informed decisions, often at speeds that are unachievable by humans. Predictive modeling can enhance the accuracy of forecasts and aid in developing strategies that align with projected market scenarios.

Sentiment Analysis

It is an AI trading technique that utilizes natural language processing (NLP) to analyze public sentiment from various online sources, including news articles, social media platforms, and financial blogs. This technique enables traders to understand the public’s feelings and opinions about specific stocks or the market as a whole.

Risk Modeling

Through risk modeling, AI for stock market assesses the potential outcomes and risks associated with different trading strategies. It uses historical data to simulate various market conditions and predict the impact on investment portfolios. This allows traders to understand potential risks and tailor their investment strategies to mitigate losses.

Stress Testing

AI-driven stress testing involves applying various hypothetical scenarios to determine how an investment strategy holds up under extreme market conditions. This method is crucial for identifying vulnerabilities in investment strategies and helps refine them to ensure their robustness against market downturns.

Real-Time Market Analysis

AI excels in processing vast amounts of data in real time, which is crucial for stock trading, where market conditions can change rapidly. By utilizing real-time data analysis, traders can instantly react to market movements, adjust their strategies on the fly, and capitalize on short-term events before they become common knowledge.

Backtesting

Backtesting with AI involves applying trading strategies to historical data to evaluate their effectiveness before deploying them in live markets. This provides insights into how a strategy would have performed in the past, allowing traders to fine-tune their approaches based on solid empirical evidence.

Comparative Performance Analysis (Benchmarking)

In benchmarking, AI for stock trading compares the performance of specific trading strategies against established market benchmarks or indexes. This is critical for evaluating a strategy’s relative success and understanding how it compares to broader market movements. Benchmarking enables traders to adjust their approach and achieve superior performance.

Real-World Examples of AI Stock Trading Companies

The integration of AI agents in stock trading has moved from experimental prototypes to production-ready systems powering billions of dollars in trades. Here are the most compelling real-world examples that demonstrate how artificial intelligence in stock trading is revolutionizing investment management and trading operations.

JPMorgan Chase: LOXM Trading Platform

JPMorgan Chase revolutionized trading operations with LOXM, an AI-driven platform designed to optimize trade execution in global equity markets using Deep Reinforcement Learning. The system draws lessons from billions of historic and simulated trades, bringing significant improvements in execution efficiency and representing a substantial leap toward dominance in high-frequency trading.

Renaissance Technologies – Medallion Fund

Renaissance Technologies, founded by mathematician Jim Simons, is renowned for its Medallion Fund, which employs sophisticated AI and quantitative models for trading. Between 1988 and 2018, the fund achieved an average annual return of 39.1% after fees, amassing over $100 billion in trading profits. This success is attributed to the firm’s use of AI to analyze vast datasets and identify non-random market movements.

Numerai – Crowdsourced AI Hedge Fund

Numerai is a San Francisco-based hedge fund that leverages AI models developed by a global network of data scientists. In 2022, despite a significant downturn in the cryptocurrency market, Numerai’s fund returned 20% to investors. This performance showcases the effectiveness of AI-driven strategies in navigating volatile markets.

Wincent – Crypto Hedge Fund Success

Wincent, a crypto-focused hedge fund, posted an 11.3% gain through April 2025 and plans to expand its team significantly. The firm’s transition from manual to automated trading systems, powered by AI, has been instrumental in capitalizing on market swings, especially during periods of high volatility in the cryptocurrency market.

CoreWeave: AI Infrastructure for Trading Platforms

CoreWeave became the first pure-play artificial intelligence company to go public in March 2025, with revenue soaring over 700% to $1.9 billion in 2024. The company reported 420% revenue growth in its first earnings report as a public company, with shares jumping 56% in a single week.

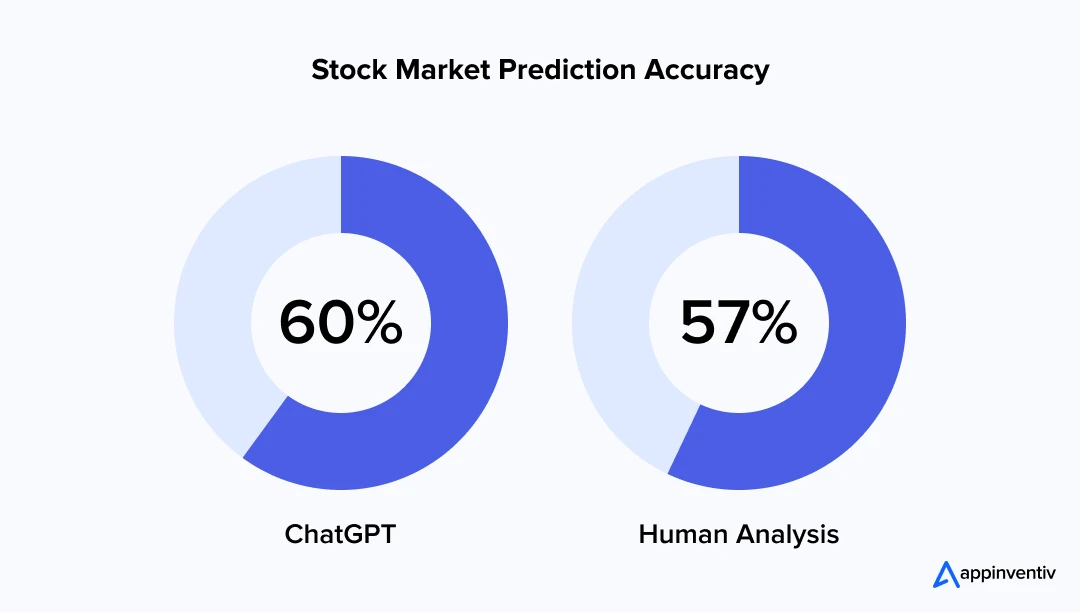

Leverage ChatGPT for Stock Trading: A Quick & Easy Way to Use AI in Your Investing

While advanced AI trading platforms leverage sophisticated machine learning and deep learning models for automated execution and complex predictive analytics, LLM models like ChatGPT carve out a distinct and valuable niche in the stock trading landscape. These conversational AIs serve primarily as powerful assistants and research aids, rather than direct trading agents.

Traders are increasingly using ChatGPT for stock trading tasks such as summarizing vast financial news articles, analyzing market sentiment from diverse textual sources, generating initial drafts of company analysis, or even formulating basic Pine Script code for technical indicators. This capability significantly reduces manual research time and helps surface insights that might otherwise be overlooked.

A study by the University of Chicago highlighted ChatGPT’s potential to outperform human analysts in predicting stock earnings. By analyzing anonymized financial data, ChatGPT achieved a prediction accuracy of 60%, surpassing the accuracy of human analysts at 57%. Based on ChatGPT’s high-confidence predictions, portfolios demonstrated significant outperformance compared to the stock market in backtests.

However, it’s essential to note that ChatGPT has limitations. It lacks access to real-time data and may not always accurately interpret market nuances. Therefore, while it can be a valuable aid in research and strategy development, it should complement, rather than replace, human judgment and traditional analytical methods.

How to Develop an AI-Powered Stock Trading Platform – A Step-by-Step Process

Building a successful AI agent for stock trading goes beyond integrating cutting-edge technology; it demands a meticulous, multi-stage process. This ensures the platform aligns with specific investment goals and delivers tangible results. Each phase is critical for developing a robust, transparent, and high-performing system.

1. Requirement Analysis & Planning

Every effective platform starts with a clear vision. This initial phase involves thoroughly defining the platform’s objectives, target users (whether retail, institutional, or quant traders), desired trading strategies, and key performance indicators like alpha or Sharpe ratio.

2. Data Collection & Preparation

AI’s intelligence is directly tied to the quality of its data. This stage focuses on establishing robust pipelines to collect and meticulously prepare vast amounts of financial information. This includes historical price movements, trading volumes, real-time news feeds, and even alternative datasets.

3. Algorithm Selection & Model Training

With clean data in place, the focus shifts to the AI engine’s core. At this stage, your trusted AI developers carefully select and develop the most suitable AI and machine learning algorithms, tailoring them to the defined trading strategies. This involves extensive model training, where algorithms learn to identify complex patterns, make predictions, and optimize trading decisions based on the prepared data.

4. Simulation & Backtesting

Before live deployment, models undergo extensive testing in simulated environments. Backtesting against historical data evaluates performance, highlights weaknesses, and enables refinement of strategies to optimize trading outcomes.

5. Platform Architecture & Development

Developing the digital infrastructure is the next vital step in the AI trading platform development process. This involves designing and building a robust, scalable, and high-performance platform architecture that ensures a user-friendly interface and seamless operation.

6. Integration & Security Implementation

An AI agent for stock trading must connect securely with the broader financial ecosystem. This phase involves seamlessly integrating with brokerage APIs, exchanges, and other essential financial services. Alongside this, multi-layered security protocols are implemented to safeguard investments and sensitive information against evolving cyber threats.

8. Deployment & Live Testing

Once thoroughly validated in simulations, the AI trading platform is ready for deployment. This typically involves a controlled rollout, which allows monitoring of system performance and user interactions in real market conditions. Feedback gathered during this phase informs necessary adjustments prior to full-scale launch.

9. Continuous Monitoring & Model Updating

The market is constantly evolving, and so must the stock market AI. Thus, post-deployment, you must continuously monitor the platform for its performance, algorithms, and market conditions. This ongoing oversight facilitates timely model updates and refinements, ensuring AI strategies remain adaptive and continue to deliver optimal results in an ever-changing financial landscape.

Benefits of Using AI in Stock Trading: Unleashing Its Immense Potential

AI for stock trading provides unprecedented analytical capabilities, speed, and automation. By leveraging vast datasets and sophisticated algorithms, AI empowers traders to make more informed decisions, mitigate risks, minimize human limitations, and potentially achieve higher returns. Let’s dive deeper to understand how artificial intelligence stock trading benefits the markets and investors.

Improved Accuracy with Less Research Time

AI automates extensive data gathering and analysis, saving investors valuable time while enhancing the quality of trade decisions. By leveraging historical financial data, AI trading platforms reduce human error and bias, delivering more precise predictions and recommendations.

JPMorgan revealed that AI-driven high-frequency trading now accounts for over 50% of US stock market trades (Source: 2023 CNBC report).

This lightning-fast execution enables AI agents to seize market opportunities well before most human traders can react.

Advanced Pattern and Sentiment Forecasting

Beyond traditional numeric data, AI employs sentiment analysis on news, social media, and other textual sources to detect market moods and emerging trends. This holistic insight enables the anticipation of price swings and market fluctuations earlier than conventional methods.

Cost Reduction and Operational Efficiency

AI streamlines routine tasks that typically require large teams of brokers and analysts, lowering operational costs over time. Despite upfront investments, long-term savings are achieved by automating repetitive work and minimizing human resource overhead.

Continuous, 24/7 Market Monitoring

Unlike human traders, artificial intelligence stock trading software works nonstop, analyzing global markets around the clock. This constant vigilance ensures no opportunity is missed and allows for immediate response to sudden market shifts.

Enhanced Risk Management and Portfolio Optimization

AI-driven stock trading predicts potential downturns and simulates different scenarios, enabling smarter risk mitigation and optimized portfolio allocation. This leads to more balanced investment strategies that align with individual risk tolerance and goals.

Enhanced Compliance and Fraud Detection

AI-based stock trading continuously monitors trading activities to detect anomalies and suspicious patterns that may indicate fraud or market manipulation. This proactive oversight enables firms to comply with complex financial regulations, thereby minimizing the risk of costly penalties and safeguarding market integrity.

Improved Transparency Through Explainable AI

Advanced AI for stock trading increasingly offers explainability features that clarify how trading decisions and predictions are made. This transparency fosters investor trust by demystifying “black-box” models, allowing users to understand and validate AI-driven recommendations with confidence.

Algorithmic Trading Strategy Development

AI platforms enable traders to design and implement sophisticated, AI-driven stock trading algorithms. These systems leverage deep learning and real-time market analysis to execute trades automatically, optimizing for speed and precision. This dual benefit maximizes profit potential through rapid decision-making and frees up traders from constant market monitoring

Enhanced Customer Service and Robo-Advisory

AI-powered customer service bots and robo-advisors are transforming client interactions in stock trading. These advanced systems provide investors with immediate access to portfolio management tools, market trend analysis, and stock price queries, eliminating traditional wait times. This automation creates efficient workflows, allowing human operators to focus on more complex issues and offering clients seamless, multi-channel support for an enhanced experience.

Related Article: AI for Investing: Key Benefits & Practical Use Cases

How AI Stock Trading Works?

AI in stock trading operates by analyzing massive amounts of financial data to make informed trading decisions. Here’s a simplified breakdown of the process:

- Data Collection: AI gathers diverse data from historical price trends, financial reports, news articles, social media sentiment, and more.

- Data Preprocessing: The collected data is cleaned and organized to ensure accuracy and consistency for analysis.

- Feature Extraction: Key indicators, such as price movements, trading volume, and sentiment scores, are identified to help predict market behavior.

- Model Training: Machine learning algorithms are trained on historical data to recognize patterns and forecast future stock prices.

- Decision Making: Based on predictions, the AI system generates buy, hold, or sell recommendations tailored to market conditions and investor goals.

- Execution: Trades can be executed automatically through brokerage platforms or suggested to human traders for approval.

- Monitoring & Adaptation: The AI continually tracks its performance and updates its models to adjust to evolving market dynamics.

Also read: How Much Does Robinhood Like Trading App Development Costs?

How Artificial Intelligence Stock Trading Transforms the Markets?

With unparalleled computational power and advanced decision-making capabilities derived from processing vast amounts of data, the role of AI in stock trading is immeasurable. It unlocks immense potential for rapidly optimizing profit margins far beyond what traditional methods can achieve.

Quote

“We are standing on the brink of a new era in human invention, and the choices we make today around the development and use of artificial intelligence will shape the future.”

By Ariane Bucaille, Global TMT Industry Leader, Deloitte.

In today’s fast-paced and dynamic stock markets, where every second counts for traders and investors alike, AI-driven stock trading applications enable the identification of profitable opportunities while effectively managing and minimizing risks.

Financial firms benefit from deep insights into complex market patterns that facilitate real-time buy and sell decisions. This is achieved by continuously analyzing stock prices and processing enormous volumes of unstructured data.

Risks of Using AI to Trade Stocks and How to Overcome Them

While AI stock trading offers numerous advantages, it also comes with certain risks that traders and firms must manage proactively. Understanding these challenges and implementing effective strategies to overcome them is essential to harness AI’s full potential safely and sustainably.

Systemic Vulnerabilities

Risk: When many traders rely heavily on similar AI systems, the market could become more susceptible to cascading issues. A single glitch could potentially impact the entire system, amplifying even minor errors.

Solution: Implement diverse and independently developed AI models across trading platforms. Regularly stress-test systems and establish robust fail-safes to isolate and contain faults before they propagate.

Data Security Concerns

Risk: AI relies on massive volumes of sensitive financial data, increasing exposure to cyberattacks and data breaches.

Solution: Employ advanced encryption, multi-factor authentication, and continuous security audits. Adopt strict data governance policies and ensure compliance with global data protection regulations.

Regulatory Hurdles

Risk: Financial regulations are complex and evolving, making compliance for AI trading systems challenging across different jurisdictions.

Solution: Maintain close collaboration with legal and compliance experts to keep AI systems updated. Integrate regulatory requirements into AI algorithms and adopt transparent reporting practices to satisfy regulatory bodies.

Also Read: Why and How to Develop Legally Compliant AI Products

Market Manipulation

Risk: There is a risk that AI systems could be used to create false market trends or manipulate market conditions to the advantage of certain parties, thereby undermining market integrity.

Solution: Deploy anomaly detection AI to monitor for suspicious trading patterns. Regulators and firms should collaborate to enforce strict penalties for manipulation and increase transparency of AI trading activities.

Overfitting Models

Risk: AI models often excel on historical data due to being overly tailored to past events, a concept referred to as overfitting. However, this can result in poor performance in live trading scenarios, as the model may struggle to adjust to unexpected market conditions.

Solution: Use cross-validation and regular retraining with diverse datasets. Incorporate adaptive learning techniques that allow models to evolve with changing market dynamics and prevent reliance on outdated patterns.

Businesses using AI to trade stocks must be aware of these risks and challenges of AI in Stock Trading so taht they can implement essential measures to mitigate them, ensuring that their trading strategies are both resilient and compliant.

Best Practices for Developing Artificial Intelligence Software for Stock Trading

Leveraging artificial intelligence software for stock trading goes beyond just integrating artificial intelligence into trading. It requires a careful balance of ethical considerations, regulatory compliance, and leveraging the right technologies to ensure both effectiveness and trustworthiness.

Here are the key guidelines to follow for developing responsible and successful artificial intelligence stock trading software.

- Prioritize ethical AI practices by ensuring fairness, transparency, and accountability in algorithms.

- Adhere strictly to financial regulations and data privacy laws across jurisdictions.

Incorporate explainable AI features to make AI decisions understandable to users and regulators. - Leverage cutting-edge technologies like cloud computing, big data analytics, deep learning, machine learning, natural language processing, and real-time processing for scalability and speed.

- Implement robust security frameworks to protect sensitive financial data from breaches and cyber threats.

- Design responsible AI models to minimize bias and prevent market manipulation risks.

- Maintain ongoing auditing and monitoring to ensure model integrity and compliance with relevant regulations.

The Future of AI in Stock Trading

The stock trading landscape is undergoing a profound transformation as artificial intelligence continues to advance. Projections indicate a significant expansion, with the global AI for stock market size valued at $11.23 billion in 2024 expected to grow at a CAGR of 20.0% from 2025 to 2030 (Source: Grand View Research).

This explosive growth is fueled by AI’s unparalleled ability to process and analyze vast datasets, identify intricate patterns, and execute trades at speeds beyond human capability, leading to enhanced decision-making and operational efficiency.

Experts widely agree that AI agents are becoming central to market dynamics. As Clayton Allison, portfolio manager at Prime Capital Financial, states, “AI agents are front and center in the market right now, and this is a pivotal moment.”

This is precisely why major financial institutions are actively exploring and leveraging the use of agentic AI.

For instance, firms like JPMorgan Chase are integrating AI-driven systems to enhance customer service, while others are focusing on automating complex workflows and improving service delivery. This strategic adoption by industry leaders highlights the profound impact AI is already having on operational efficiency and competitive advantage.

Looking ahead, the future of AI in stock trading promises even more sophisticated applications. We anticipate further advancements in areas such as hyper-personalized AI advisors, which can tailor investment strategies to individual preferences and risk tolerances with unprecedented precision.

The continued integration of alternative data sources, deeper insights from sentiment analysis, and the evolution of AI-driven risk mitigation tools that predict and counter market volatility more effectively will also play crucial roles, leading to more automated, data-driven, and potentially more profitable market participation.

Appinventiv: Your Trusted Tech Partner for AI and Stock Trading Platform Development

In an increasingly dynamic and competitive market, leveraging artificial intelligence for stock trading is no longer just a trend; it is a necessity for those seeking an edge in investment strategies. However, it’s crucial to be aware of the potential downsides of relying solely on AI for stock trading. We need to maintain a balance between AI technology and human assessment. The blend of these two intelligence methods can be highly valuable for market adaptation and lucrative trading outcomes.

Appinventiv stands at the forefront of AI development services, bringing deep expertise in both artificial intelligence and financial technology to help businesses build next-generation trading platforms.

As a leading FinTech app development company, we understand the unique challenges of the financial markets and have the technical prowess to create scalable, secure, and intelligent trading platforms.

Our diverse portfolio also includes successful AI-powered projects like Mudra and Edfundo, which showcase our ability to deliver innovative AI solutions for the FinTech and other industries. This demonstrates the adaptability and effectiveness of our AI expertise beyond stock trading.

We chose Appinventiv to build our financial literacy and money management app from start to finish. From the first call, we were very impressed with Appinventiv’s professionalism, expertise, and commitment to delivering top-notch results. Their developers were extremely talented and delivered an amazing final product that exceeded our expectations.

Whether you are looking to build a fully automated trading system or integrate advanced AI features into your existing platform, our skilled team of 1600+ tech experts knows how to do it right and can meet today’s needs and anticipate tomorrow’s opportunities.

Whether you are an emerging startup or an established enterprise, Appinventiv ensures that your platform remains competitive in the fast-evolving world of AI and stock trading.

Let us join hands to harness the full potential of AI in stock trading and achieve a significant competitive edge in today’s dynamic financial markets.

FAQs

Q. What is an AI trading system?

A. AI trading systems are powerful tools that use state-of-the-art technology, such as machine learning, to analyze huge datasets, enabling them to make well-informed decisions on executing trades. The advanced tech in AI stock trading helps improve decision-making processes and boost efficiency through the detection of patterns and the generation of trading signals.

AI trading systems are capable of providing sophisticated solutions based on an analysis of past data as well as the present market trends to assist in buying/selling stocks or maintaining them for the future.

Q. How to build a stock trading AI?

A. Building an AI stock trading app is challenging, as it requires a proper execution plan.

Gather large sets of important data, including historical price movements, financial statements, news articles, and social media sentiment.

- Process and refine the data for analysis purposes.

- Employ machine learning techniques to predict stock price patterns accurately.

- Integrate the AI system into a trading platform.

- Monitor and improve the AI system’s performance over time.

Q. How will AI affect stock trading?

A. The potential impact of AI on stock trading is immense. With its ability to analyze massive amounts of data quickly and accurately, AI has the potential to enhance predictions and trading strategies significantly. By utilizing its proficiency in identifying complex patterns that humans can miss, AI can provide traders with valuable market insights that lead to informed decision-making.

Furthermore, using AI to trade stocks introduces a level of precision and speed unattainable by human traders alone. Also, AI-driven systems have the advantage of eliminating human biases and emotions for more objective trading approaches.

Despite these benefits, it’s essential to recognize that while AI in stock trading offers many advantages, it still requires human monitoring to adapt to ever-changing market conditions effectively and mitigate potential risks. In the context of AI for stock trading, this human oversight ensures that the strategies and decisions driven by AI are constantly evaluated against real-world outcomes and market shifts.

Q. How is AI used in stock trading?

A. AI in stock trading uses machine learning to analyze market trends and predict price movements, automating trades based on data-driven insights. It helps identify patterns in real-time, optimize investment strategies, and improve decision-making speed. This enables traders to execute precise and timely trades while minimizing human errors.

Q. Is it legal for AI to trade stocks?

A. Yes, it is generally legal for AI to trade stocks. However, using AI for stock trading is subject to strict regulations in most major financial markets. These regulations focus on areas such as:

- Systemic Risk: Ensuring algorithms don’t destabilize markets (e.g., flash crashes).

- Fairness and Manipulation: Preventing manipulative practices or unfair advantages.

- Transparency and Disclosure: Requirements for firms to register and monitor their algorithms, and disclose their use to regulators.

- Risk Controls: Mandates for pre-trade risk checks and “kill switches” to halt malfunctioning algorithms.

While the core act of AI making trading decisions is permitted, it operates within a complex and evolving regulatory framework designed to ensure market integrity and investor protection.

10 Ways AI is Transforming the Healthcare Sector in Australia

Key takeaways: Generative AI could add $13 billion annually to Australia’s healthcare sector by 2030. AI is already transforming operations across diagnostics, admin tasks, and patient care. Healthcare in remote areas is improving with AI-powered virtual assistants and monitoring tools. AI can help address workforce shortages by automating routine tasks and supporting clinical decisions. Major…

Exploring the Power of AI in Creating Dynamic & Interactive Data Visualizations

Key takeaways: AI transforms data visualization by providing automated insights, interactive dashboards, and NLP, thereby tackling revenue loss and improving data quality. Key features include predictive analytics, real-time data integration, and user-friendly visualizations, enabling faster and more informed decisions. Top 2025 tools, such as Tableau, Power BI, and Julius AI, offer NLP and real-time analytics…

Practical Applications of AI as a Service for Your Business

Key takeaways: AIaaS enables fast, infrastructure-free AI adoption. Used across industries for automation and insights. Real-world examples show proven business impact. Pilot-first approach ensures smooth implementation. Key challenges include data, cost, and scaling. Trends include ethical AI, edge, and SME growth Imagine being able to cut down your operational costs while simultaneously improving decision-making and…