- User Intent Behind Currency Converter App Adoption

- Travelers and Tourists

- Online Shoppers and Freelancers

- Business Owners and Accountants

- Investors and Forex Traders

- General Users

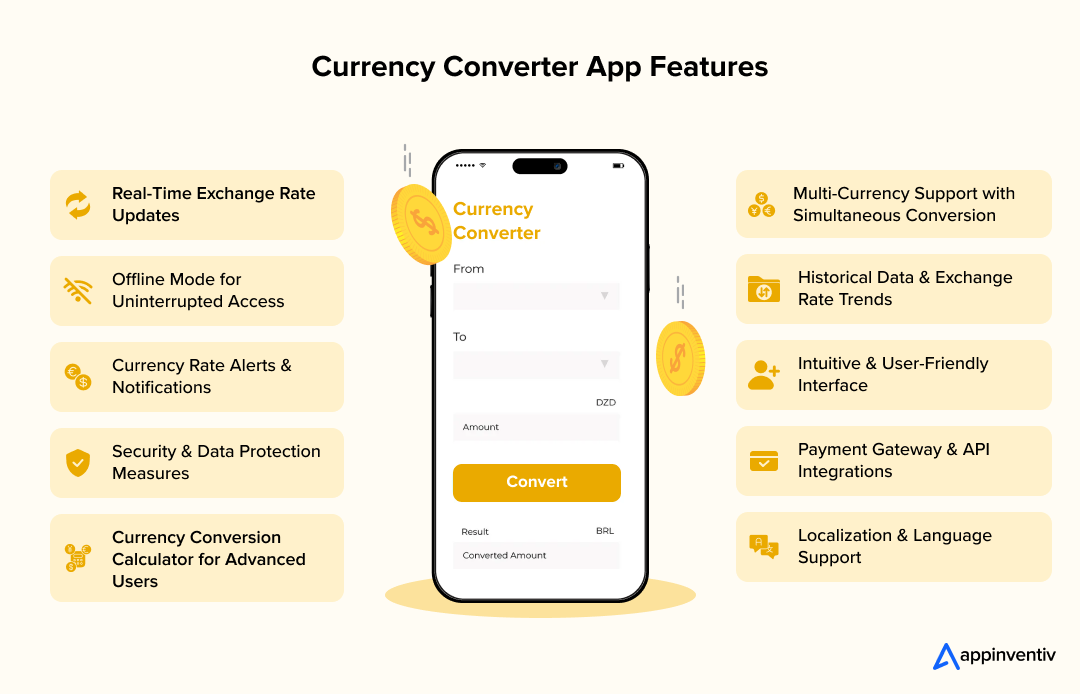

- The Must-have Features of Currency Converter Apps

- Real-Time Exchange Rate Updates

- Multi-Currency Support with Simultaneous Conversion

- Offline Mode for Uninterrupted Access

- Historical Data and Exchange Rate Trends

- Currency Rate Alerts and Notifications

- Intuitive and User-Friendly Interface

- Currency Conversion Calculator for Advanced Users

- Payment Gateway and API Integrations

- Security and Data Protection Measures

- Localization and Language Support

- The Design Aspect of Currency Conversion Apps

- Minimalist Yet Informative Design

- Smooth and Intuitive Navigation

- Visually Distinct Currency Selection and Display

- Real-Time Updates Without Interruptions

- Dark Mode and Customization Options

- Responsive and Adaptive Layout

- Visual Cues and Microinteractions for Better Engagement

- Accessibility for a Wider Audience

- Choosing the Right Tech Stack for Currency Converter App Development

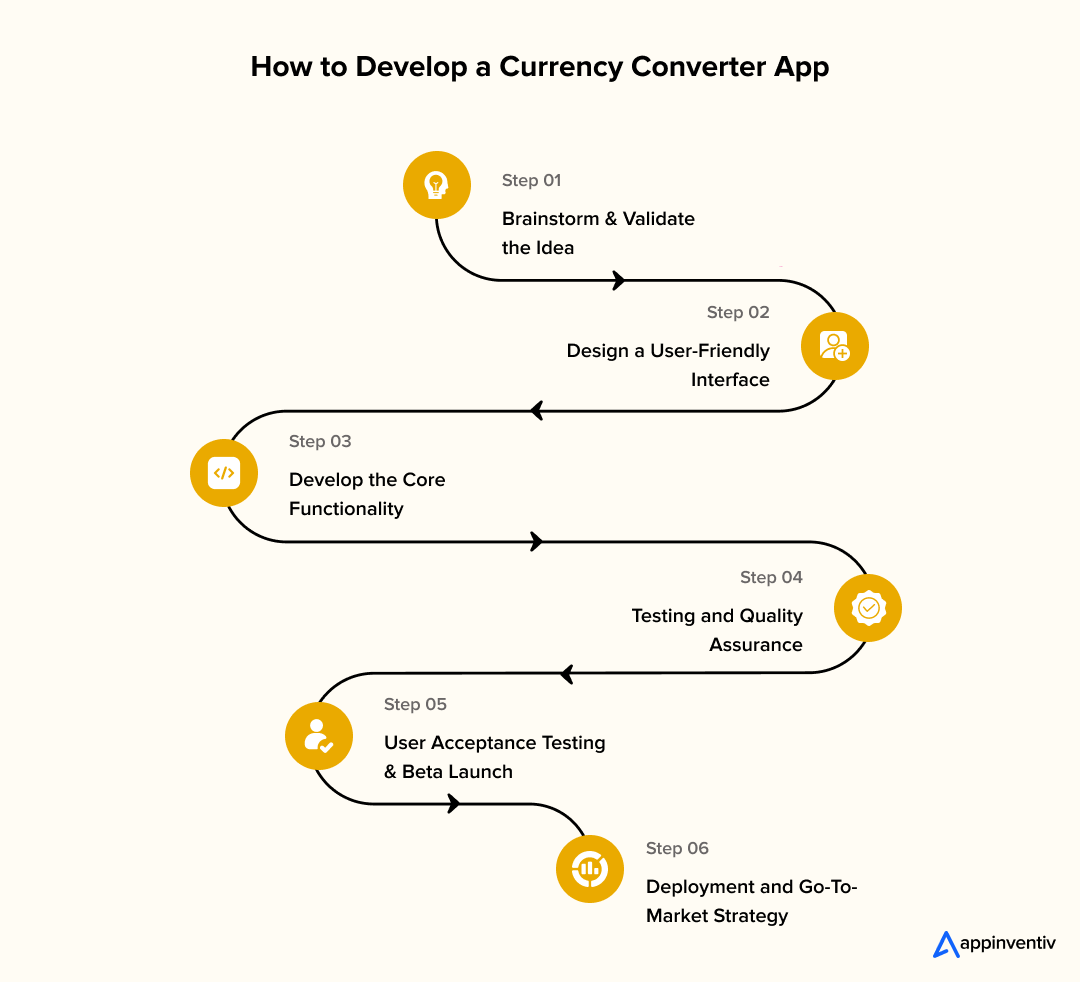

- Steps to Develop a Currency Converter App

- Step 1 - Brainstorm and Validate the Idea

- Step 2 - Design a User-Friendly Interface

- Step 3: Develop the Core Functionality

- Step 4: Testing and Quality Assurance

- Step 5: User Acceptance Testing & Beta Launch

- Step 6: Deployment and Go-To-Market Strategy

- How Much Does Currency Converter App Development Costs?

- Additional Cost Factors

- How to Save on the Currency Converter App Development Cost

- How to Use Your Currency Exchange App to Make Money?

- In-App Advertisements (Freemium Model)

- Subscription Plans (Premium Features)

- Affiliate Marketing & Partner Integrations

- Transaction Fees (If Integrated with Payment Systems)

- Selling API Access to Other Businesses

- Data Monetization (With User Consent)

- Appinventiv’s Role in Building a High-Performing Currency Converter App

- 1. End-to-End Fintech App Development for Entrepreneurs

- 2. Cutting-Edge Tech Stack & Real-Time API Integrations

- 3. Cost-Effective & Scalable Development Strategies

- 4. Security-First Approach for Financial Transactions

- 5. Ongoing Support & Growth-Driven Maintenance

- FAQs

Imagine you’re about to travel abroad and need to quickly check how much your local currency is worth in another country, or perhaps you run an international business and constantly deal with multiple currencies. In both cases, a currency converter app is an indispensable tool.

With global transactions becoming the norm and forex markets fluctuating by the second, businesses and individuals rely on real-time, accurate exchange rate calculations. This increasing demand makes currency exchange app development a lucrative investment – whether as a standalone solution or a feature within a larger fintech application.

However, building a robust currency converter app is more than fetching exchange rates and displaying numbers. It requires a well-thought-out approach to API integration, UX design, real-time data processing, and security. The technical stack, monetization strategy, and regulatory compliance are crucial to the app’s success.

In this guide, we’ll walk through the steps to develop a currency converter app, breaking it down into essential steps – from defining core features to choosing the right technologies and ensuring seamless user experience. You’ll have a clear roadmap to transform this idea into a fully functional, market-ready application by the end.

User Intent Behind Currency Converter App Adoption

Before diving into currency converter App development, it’s crucial to understand why people use these apps in the first place. The diverse user base – travelers, businesses, investors, and even casual users who need quick exchange rate calculations – each group has distinct needs, shaping the features and functionalities and even the types of currency converter apps.

Travelers and Tourists

Frequent travelers rely on currency converters to avoid overspending or getting shortchanged. Whether shopping, dining, or booking services abroad, they need quick and accurate exchange rates. Developing a currency converter app with offline access is important for them since mobile data may be expensive or unavailable in foreign locations.

Online Shoppers and Freelancers

Cross-border eCommerce has made currency conversion a daily necessity. Shoppers purchasing from international stores must know the final cost in their local currency before checking out. Similarly, freelancers working with clients worldwide want real-time conversions to understand their earnings. For this user segment, integration with payment gateways or invoicing systems can enhance the value when you develop an app for converting currency.

Business Owners and Accountants

Businesses that deal with international suppliers, partners, or customers must stay updated on exchange rate fluctuations. For them, a currency converter is not just about quick calculations but financial planning. They may need historical data, trend analysis, and multi-currency support to manage invoices, payroll, and pricing strategies.

Investors and Forex Traders

Currency traders, stock market investors, and crypto enthusiasts closely monitor exchange rates, often down to the second. For this audience, real-time updates, advanced charts, and integration with financial news sources can turn a basic converter into a powerful trading tool.

Also Read: AI in Stock Trading Unlocking Value for the Fintech Industry

General Users

Some users don’t fit into any specific category but need occasional currency conversion. Whether they’re curious about an exchange rate or planning a future purchase, a simple, fast, and ad-free experience keeps them engaged.

By identifying these user intents early, you can invest in multi-currency conversion app development that goes beyond just converting numbers – it becomes a tailored solution for real-world needs.

The Must-have Features of Currency Converter Apps

When you create a currency converter app, it should go more than just display exchange rates – it delivers a seamless user experience, ensures data accuracy, and caters to different use cases. Whether users are travelers checking conversions on the go, businesses managing multi-currency transactions, or traders monitoring forex fluctuations, the app must be built to handle their needs efficiently.

Below are the key features of currency converter apps make it functional, user-friendly, and competitive.

Real-Time Exchange Rate Updates

Currency values fluctuate throughout the day due to economic factors, geopolitical events, and market demand. The conversion currency app development process should integrate with reliable financial data providers such as Open Exchange Rates, XE, or Forex APIs to provide users with the most up-to-date rates.

The frequency of updates will depend on the target audience – casual users may not require second-by-second changes, but forex traders and businesses need real-time accuracy. Balancing API calls with caching mechanisms that prevent unnecessary data requests while ensuring users see the latest rates is essential to optimize performance.

Multi-Currency Support with Simultaneous Conversion

A basic currency converter may allow users to switch between a handful of major currencies. Still, the app should support a broad range, including emerging and cryptocurrency options, to stand out.

For added convenience, enabling multi-currency conversions – where users can convert a single amount into multiple currencies simultaneously – can define the many benefits of creating a currency converter app and make it especially useful for businesses and frequent travelers dealing with various exchanges.

Offline Mode for Uninterrupted Access

Since many users rely on currency converters while traveling, an offline mode is a crucial feature. This ensures users can access the last updated exchange rates without an internet connection.

Some apps allow users to manually save rates for selected currencies, while others automatically store recent conversions for offline retrieval. Implementing a smart synchronization system in conversion currency app development would ensure the app refreshes the data without manual intervention as soon as the user returns online.

Historical Data and Exchange Rate Trends

Knowing past exchange rate trends can be as important for users’ financial decisions as checking the current rate. By offering historical data with interactive charts and comparisons over different time frames – such as daily, weekly, monthly, or yearly trends – the app can be a valuable tool for businesses, investors, and forex traders.

When you build a currency exchange app, this feature also allows users to predict potential fluctuations, helping them determine the best time to convert money or make international transactions.

Currency Rate Alerts and Notifications

Exchange rates can change significantly within hours or even minutes, and some users prefer to convert currency only when rates hit a favorable level. A notification system that allows users to set custom exchange rate alerts can make a huge difference.

When a target rate is reached, the app can send a push notification or email, eliminating users’ need to check manually. When building a currency exchange app, this feature is particularly useful for forex traders, international shoppers, and businesses making large transactions.

Intuitive and User-Friendly Interface

A clean, well-structured user interface enhances the overall experience, ensuring users can quickly find what they need without unnecessary distractions. The design should prioritize ease of use, allowing users to input an amount, select currencies, and view conversion results within seconds.

Multi-currency conversion app development, such as a one-tap currency swap, search functionality for quickly finding specific currencies, and a minimalist layout with clear typography, improve accessibility. Including dark mode support and customizable themes can further enhance usability, catering to user preferences.

Currency Conversion Calculator for Advanced Users

While basic currency converter software development displays simple exchange rate results, some users require more detailed calculations.

Adding a built-in calculator that allows users to factor in extra charges, such as taxes, transaction fees, or commissions, ensures they receive a more accurate estimate of their final cost. This feature particularly benefits online shoppers, businesses handling international transactions, and freelancers managing cross-border payments.

Payment Gateway and API Integrations

Integrating payment gateways can take it to the next level if your app aims to provide more than just currency conversions. By allowing users to make international transactions directly from the app, you can cater to businesses, freelancers, and frequent travelers who need a streamlined way to send and receive money.

Additionally, integrating with third-party financial platforms, such as digital wallets, banking apps, and invoicing software, can position the currency exchange app development output as a comprehensive financial tool rather than just a standalone converter.

Security and Data Protection Measures

Since financial data is involved, ensuring app security is non-negotiable. Implementing secure encryption protocols, two-factor authentication (2FA), and compliance with financial regulations such as GDPR or PCI DSS can safeguard user information.

Partnerships with trusted payment providers can further enhance security and trust if payment processing is integrated into currency converter app development. Users should also have options to clear their conversion history and manage app permissions to protect their privacy.

Localization and Language Support

To cater to a global audience, offering multi-language support and region-specific settings is crucial. Users should be able to choose their preferred language, date format, and currency symbol display.

Localization also includes adjusting the user interface for different cultural expectations – for example; some regions may use commas instead of decimal points in numeric values. By making these small yet impactful adjustments, the currency converter app developers create a product that is more accessible to users worldwide.

When you develop a feature-rich app for converting currency, it should do more than just display numbers; it helps users make informed financial decisions, whether for travel, business, or investments. You can create an app that stands out in a competitive market by focusing on real-time updates, offline usability, security, and user experience.

The Design Aspect of Currency Conversion Apps

A tell-tale sign that you have designed and are going to develop a currency converter app that is highly efficient is that the app isn’t just about functionality – it’s about usability as well. After all, users expect a smooth, intuitive experience where they can perform conversions in seconds without unnecessary distractions. A cluttered interface, slow interactions, or confusing navigation can lead to user frustration and high abandonment rates.

To maximize adoption and engagement, the app’s UI/UX must prioritize simplicity, speed, and accessibility.

Minimalist Yet Informative Design

The most effective multi-currency conversion app development follows a minimalist approach, ensuring that users see only the most relevant information at a glance. The main screen should display key elements: input fields for entering amounts, dropdowns for selecting currencies, and a clear, instant conversion result. Also, you should avoid overwhelming users with excessive details – keep secondary features accessible but non-intrusive.

At the same time, users who need additional data, such as historical trends or fee calculations, should be able to access them quickly. This balance between minimalism and functionality ensures that casual and power users get the desired experience.

Smooth and Intuitive Navigation

Navigation plays a critical role in usability. Users should be able to perform a conversion with minimal taps, ideally within three steps:

- Enter the amount.

- Select the currencies.

- View the result.

To achieve this, consider implementing features like:

- Auto-detection of frequently used currencies based on the user’s location or previous activity.

- One-tap currency swap to quickly switch between the base and target currency.

- Predictive search functionality that allows users to type a country name or currency code instead of scrolling through a long list.

- Smart recent conversions so users don’t have to re-enter frequently used pairs.

By streamlining the currency exchange app development process, you can ensure that even first-time users can navigate the app effortlessly.

Visually Distinct Currency Selection and Display

Currency symbols and country flags should be displayed next to currency names to prevent confusion. Since many currencies share similar abbreviations (e.g., AUD and USD), using flag icons helps users quickly identify the correct option. Ensuring that text, numbers, and UI elements have proper contrast makes the app more readable, especially in different lighting conditions.

Real-Time Updates Without Interruptions

Exchange rates fluctuate constantly, but updating them should not disrupt the user experience. Instead of forcing users to refresh the page, implement smooth background updates. A small, unobtrusive label like “Updated just now” or “Last synced: 2 min ago” reassures users that they see the most recent rates without requiring manual action.

For users who need second-by-second accuracy (such as forex traders), a toggle option for high-frequency updates can be included, allowing them to receive updates without unnecessary distractions.

Dark Mode and Customization Options

Providing a dark mode option during design and currency converter software development not only enhances accessibility but also reduces eye strain, especially for users who frequently check exchange rates. Customization options, such as font size adjustments and theme choices, further improve user comfort. Giving users control over their visual experience ensures they stay engaged with the app longer.

Responsive and Adaptive Layout

Currency exchange app development should provide a seamless experience across different devices – smartphones, tablets, and even smartwatches. A responsive layout ensures elements adjust properly to various screen sizes without breaking functionality.

For mobile-first optimization, prioritize:

- Thumb-friendly design – placing frequently used buttons and inputs within easy reach.

- Gesture support – such as swipe to delete recent conversions or long-press to favorite a currency pair.

- Compact yet readable tables and charts for users who need historical data analysis.

By optimizing for various screen sizes, you ensure a consistent experience across all devices.

Visual Cues and Microinteractions for Better Engagement

Microinteractions, small visual or haptic feedback responses, can enhance the user experience without overwhelming the interface. Subtle animations when switching currencies, slight button color changes when a conversion is successful, or a vibration when setting a currency alert can make the app more responsive and engaging.

Visual cues such as:

- A progressive loading bar when fetching new exchange rates.

- A confirmation tick after a successful conversion.

- A gentle bounce effect when a currency pair is swapped.

As highlighted by several notable examples of currency converter apps, while these details seem minor, they significantly improve perceived responsiveness and create a polished user experience.

Accessibility for a Wider Audience

A truly adoption-friendly currency converter app development must cater to users with different accessibility needs. This includes:

- Voice input and text-to-speech for visually impaired users.

- Keyboard shortcuts for power users who prefer quick input methods.

- Colorblind-friendly mode with alternative contrast settings to accommodate users with color vision deficiencies.

Designing with accessibility in mind ensures that the app reaches a broader audience while adhering to inclusivity standards.

A well-designed currency converter app is more than just a number-crunching tool- it’s an intuitive, visually appealing, and engaging experience. So when you hire a developer for a currency converter app, ensure that they prioritize simplicity, speed, and accessibility to ensure that users not only download the app but continue using it over time.

Choosing the Right Tech Stack for Currency Converter App Development

Selecting the right technology stack is crucial for building a reliable, high-performing, and scalable currency converter app. Your tech choices will determine the app’s functionality and responsiveness and its ability to handle real-time data, security requirements, and future scalability.

Below, we break down the key components of the tech stack, covering front-end and back-end development, databases, APIs, and additional tools needed to enhance the app’s performance.

1. Front-End

- For Web Applications:

- React.js

- Vue.js

- Angular

- For Mobile Applications:

- Flutter (Dart)

- React Native

- Swift (for iOS) and Kotlin (for Android)

Since the app will deal with numerical data, the UI should be optimized for seamless input and display. Libraries like Chart.js (for web) or Flutter Charts (for mobile) can be used here to visualize historical exchange rate trends.

2. Back-End

- Node.js with Express.js

- Django (Python)

- Spring Boot (Java)

- Ruby on Rails

Since real-time currency data updates are critical, the back end should support WebSockets for instant updates without requiring constant API polling. This reduces unnecessary server load while ensuring users always see the latest rates.

3. Database

- Relational Databases (SQL):

- PostgreSQL

- MySQL

- NoSQL Databases (For Scalability and High-Speed Access):

- MongoDB

- Redis

Using a combination of SQL (for structured user data) and NoSQL (for fast data retrieval of exchange rates) can enhance both speed and efficiency.

4. API Integrations

- Open Exchange Rates

- Fixer.io

- XE API

- CurrencyLayer

- Alpha Vantage.

To reduce reliance on external APIs, implementing a caching system ensures that the app stores the latest rates and minimizes unnecessary API requests.

5. Security Measures

- SSL/TLS Encryption

- OAuth 2.0 & JWT (JSON Web Token)

- AES Encryption

- Rate Limiting & API Key Authentication

- GDPR & PCI Compliance

A well-secured app not only protects users but also builds credibility and trust.

6. Performance Optimization Tools

- CDN (Content Delivery Network)

- Load Balancers

- Background Jobs & Queue Systems

- Error Monitoring & Logging

The app can handle thousands of requests without delays by optimizing performance from the ground up.

A successful currency exchange app development requires the right combination of front-end frameworks, back-end architecture, databases, and third-party APIs. When used by a skilled currency converter app development company, the right mix of this well-structured tech stack can ensure fast response times, real-time updates, and security – all of which contribute to a seamless user experience.

Steps to Develop a Currency Converter App

Currency exchange app development isn’t just about coding – crafting a product that delivers real value to users while being scalable and profitable. Whether you’re a fintech entrepreneur or an investor looking to enter the market, here’s a structured approach to how you can create a currency converter app that stands out.

Step 1 – Brainstorm and Validate the Idea

Every successful app starts with an idea, but validation determines whether that idea has real business potential.

Key Questions to Ask:

- Who is your target audience? Are you building for travelers, forex traders, businesses, or digital nomads?

- What pain points will your app solve? Will it just show exchange rates or offer additional features like alerts, multi-currency wallets, or historical trends?

- How will your app stand out? Research competitors like XE, Revolut, and CurrencyFair to identify gaps in the market and finalize the best types of currency converter apps.

- What is your monetization strategy? Will the app be free with ads, offer premium features, or integrate with financial services for commissions?

At this stage, conducting surveys, analyzing competitor weaknesses, and testing the concept with a small audience can help refine your vision.

Step 2 – Design a User-Friendly Interface

Once the idea is validated, the next step is conceptualizing the app’s design and user experience. A smooth, intuitive interface is key to adoption, especially for financial apps where trust and clarity are essential.

Critical UI Elements to Focus On:

- Simple Currency Selection – Users should be able to swap between currencies effortlessly.

- Minimalistic Dashboard – Display exchange rates clearly without unnecessary clutter.

- Instant Results – Conversions should be shown in real-time, without extra steps.

- Dark & Light Mode – Many users prefer dark mode, especially for financial apps.

- Localization & Multi-Language Support – A must-have for global adoption.

At this stage, hiring a UX/UI designer or using tools like Figma, Adobe XD, or Sketch to create wireframes and prototypes is essential before the currency exchange app development process begins.

Step 3: Develop the Core Functionality

With the design finalized, your currency exchange app development company begins coding. As an entrepreneur, you don’t need to dive into technical details, but you should be aware of the key components:

1. Currency Exchange API Integration

The app needs real-time exchange rates. Instead of building this from scratch, integrate third-party APIs like:

- Fixer.io (affordable, reliable for startups)

- Open Exchange Rates (great for larger apps)

- Currency Layer (fast and accurate)

2. Secure Data Handling

Financial apps handle sensitive data, so encryption and authentication must be a priority. Ensure your app uses SSL encryption, two-factor authentication (2FA), and secure API calls.

3. Multi-Platform Support

Decide whether you’ll launch on iOS, Android, or Web. A cross-platform approach using React Native or Flutter can reduce development costs.

When you hire a developer for a currency converter app, ensure that your development team follows an Agile methodology for iterative improvements and faster market readiness.

Also Read: How to Hire Cross-Platform App Developers

Step 4: Testing and Quality Assurance

Before the app reaches real users, rigorous testing is necessary to avoid performance issues or security vulnerabilities.

Essential QA Processes:

- Functional Testing: Ensures currency conversions are accurate and APIs work correctly.

- UI/UX Testing: Check if the navigation is smooth and the design meets user expectations.

- Security Testing: Identifies vulnerabilities like weak encryption or unauthorized access.

- Performance Testing: Ensures the app loads quickly, even with heavy traffic.

Testing automation tools like Selenium (for web) or Appium (for mobile) can speed up this process.

Step 5: User Acceptance Testing & Beta Launch

Before the full launch, a beta version should be released to a select group of users for real-world feedback.

What Happens During UAT?

- A small user base tests the app under real-world conditions.

- Feedback on usability, accuracy, and any issues is gathered.

- Final tweaks are made before the official launch.

This phase helps identify last-minute refinements, ensuring a polished final product.

Step 6: Deployment and Go-To-Market Strategy

With the app refined and tested, it’s time for your currency converter app developers to prepare for launch.

Where to Deploy?

- App Stores (Google Play & Apple App Store): Ensure compliance with store policies before submission.

- Web Version: If you have a web-based currency converter, deploy on AWS, DigitalOcean, or Vercel for scalability.

Marketing and Customer Acquisition:

A strong launch strategy determines how quickly your app gains traction. Consider:

- SEO & App Store Optimization – Optimize keywords to rank higher in search results.

- Influencer & Partner Collaborations – Work with travel bloggers, forex experts, or financial influencers.

- Referral Programs – Offer incentives for users who invite friends.

- Paid Ads & Social Media – Target users on Google, Facebook, and LinkedIn.

Currency converter app development isn’t just about designing or even perfectly coding an app; it’s about creating a business. You can launch a profitable and widely-used fintech product by taking a strategic approach, focusing on user needs, and ensuring a seamless experience.

How Much Does Currency Converter App Development Costs?

The cost of developing a currency converter app depends on its complexity and features. Here’s a breakdown:

| App Complexity | Cost Range | Features Included |

|---|---|---|

| Basic | $10k – $20k | Basic UI, Real-time exchange rates, Currency selection, API integration. |

| Mid-Level | $20k – $50k | Advanced UI, Historical data, Rate alerts, Offline mode, High-security measures |

| High-End | $50k – $100k | AI-driven rate prediction, Multi-currency wallets, Payment gateway integration, Enterprise-grade security |

Additional Cost Factors

- Cross-platform development (iOS & Android): +20-30%

- Third-party API costs (currency exchange APIs, payment integrations): $50–$500/month

- Ongoing maintenance & updates: 15–20% of the initial development cost per year

How to Save on the Currency Converter App Development Cost

Building a high-quality currency converter app doesn’t have to break the bank. Strategic planning, smart tech choices, and efficient design and development practices can significantly cut costs when you develop an app for converting currency without sacrificing performance. Here’s how:

Start with an MVP

Instead of launching a full-featured app immediately, begin with a basic version of currency exchange app development that includes core functionalities like real-time exchange rates and simple currency conversions. Once you gain users and feedback, you can invest in additional features.

Potential Savings: 30-40% on initial development

Also Read: An Entrepreneur’s Guide on Minimum Viable Product (MVP)

Use Open-Source & Third-Party APIs

Instead of whether you develop a currency converter app from scratch, integrate affordable APIs like:

- Fixer.io – Free for basic usage, premium plans start at $10/month

- Open Exchange Rates – Starts at $12/month

- Currency Layer – Plans start at $14/month

Potential Savings: $5,000–$10,000

Choose Cross-Platform Development Over Native

Building separate apps for iOS and Android doubles development time and cost. Instead, opt for cross-platform frameworks like Flutter or React Native, which allow a single codebase to work on both platforms.

Potential Savings: 30-40% on currency converter app development cost

Outsource to Cost-Effective Development Teams

Instead of hiring an in-house team, consider outsourcing to experienced developers in Eastern Europe, India, or Southeast Asia, where hourly rates are lower.

- US/UK developers: $80–$150/hour

- Eastern Europe developers: $40–$70/hour

- India/Southeast Asia developers: $20–$50/hour

Potential Savings: 50% or more on labor costs

Use No-Code/Low-Code Platforms for MVPs

If you’re testing the market, you don’t need a full-fledged custom app. Platforms like Adalo, Bubble, or OutSystems can help create a working prototype without heavy development costs.

Potential Savings: Up to 60% on early-stage development

Implement Cloud-Based Backend Services

Using serverless computing (AWS Lambda, Firebase, or Supabase) instead of maintaining a dedicated server reduces infrastructure costs. You only pay for what you use, scaling automatically as your app grows.

Potential Savings: 20-30% on hosting and server costs

Automate Testing to Reduce QA Expenses

Instead of relying solely on manual testers, automated testing tools like Selenium, Appium, or TestComplete can catch bugs early and reduce the need for extensive manual testing.

Potential Savings: 25-35% on testing costs

Use Pre-Built UI Components

Designing an app from scratch increases costs. Instead, use pre-built UI kits and frameworks like Material UI (for React), Tailwind CSS, or Bootstrap to accelerate development.

Potential Savings: $5,000–$15,000 in design & frontend costs

The multi-currency conversion app development process can be efficient by making the right cost-saving choices. By starting with an MVP, leveraging third-party APIs, outsourcing strategically, and using modern cloud and automation tools, entrepreneurs can cut costs by 50% or more while still delivering a high-quality product.

How to Use Your Currency Exchange App to Make Money?

A well-designed currency converter app can be more than just a utility; it can generate consistent revenue. Here are some of the ways to use your currency exchange app to make money to turn your app into a profitable venture:

In-App Advertisements (Freemium Model)

One of the most common ways to make money and get the most ROI on the currency converter app development cost is by displaying banner ads, interstitial ads, or rewarded ads using ad networks like:

- Google AdMob – CPM (Cost per 1,000 impressions): $1–$5 in the US

- Facebook Audience Network – CPM: $2–$10 based on user engagement

- Unity Ads & AppLovin – Suitable for apps with a global user base

Subscription Plans (Premium Features)

Offer a free version with basic features and a paid subscription for advanced functionalities, such as:

- Live exchange rate alerts

- Offline currency conversion

- Ad-free experience

- Historical data & trends

Pricing Models:

- Monthly Subscription: $2.99 – $9.99/month

- Annual Subscription: $19.99 – $49.99/year

Affiliate Marketing & Partner Integrations

Partner with banks, forex trading platforms, or travel booking sites and earn commissions when users sign up or complete transactions through your app. Some options include:

- Currency exchange services (Wise, Revolut, OFX, PayPal, Western Union)

- Travel platforms (Expedia, Booking.com, Skyscanner)

- Forex & crypto trading platforms (Binance, Coinbase, eToro)

Potential Earnings: $5–$50 per successful referral

Transaction Fees (If Integrated with Payment Systems)

If your app allows direct currency exchange or payments, you can charge a small transaction fee (0.5%–3%) on each conversion.

Example: If a user converts $1,000 and the app charges a 1% fee, you earn $10 per transaction.

Selling API Access to Other Businesses

If your app has a robust currency exchange API, you can sell access to financial apps, travel platforms, and e-commerce businesses that need real-time exchange rates.

Potential Pricing:

- Basic API Access: $10–$50/month

- Premium API Access: $200–$500/month

Data Monetization (With User Consent)

Aggregated, anonymized currency conversion data can be valuable to financial analysts, forex traders, and economic research firms. If you collect enough usage data, you can sell insights to interested parties.

After the currency exchange app development process, the best monetization strategy will depend on your target audience, app features, and user engagement levels. While a combination of ads, subscriptions, and affiliate marketing often works best, start with one or two models and scale as your user base grows.

Appinventiv’s Role in Building a High-Performing Currency Converter App

Our fintech app development company specializes in building secure, scalable, and feature-rich fintech applications that cater to modern financial needs. With the rise of digital transactions and global commerce, a well-built currency converter app can become an essential tool for users, businesses, and financial institutions.

Our currency converter app developers ensure that your app is not just another conversion tool but a market leader with seamless performance, robust security, and a monetization strategy tailored to your goals.

1. End-to-End Fintech App Development for Entrepreneurs

Creating a successful currency converter app requires more than coding; it demands a deep understanding of fintech trends, user behavior, and compliance standards. We help entrepreneurs at every stage, from conceptualization and UI/UX design to full-scale development, testing, and deployment. Our approach ensures your app isn’t just functional, engaging, intuitive, and optimized for business growth.

2. Cutting-Edge Tech Stack & Real-Time API Integrations

Accuracy is everything in currency conversion. We integrate top-tier exchange rate APIs like Fixer.io, Open Exchange Rates, and Currency Layer to ensure your app provides real-time, reliable data. Beyond that, we leverage:

- AI-driven forecasting to predict currency trends

- Blockchain integration for secure and transparent transactions

- Cloud-based architecture to enhance speed and scalability

- Cross-platform frameworks (Flutter, React Native) to reduce costs

Every integration optimizes performance and user experience, ensuring your app stays ahead of the curve.

3. Cost-Effective & Scalable Development Strategies

We understand that cost efficiency is crucial for startups and growing businesses. Our team follows agile-lev currency converter software development methodologies to optimize resources, reduce time-to-market, and ensure your app is built with the most effective tech stack for long-term scalability.

Whether you’re launching an MVP to test market demand or a full-scale enterprise solution, we tailor development to match your budget and growth trajectory.

4. Security-First Approach for Financial Transactions

When dealing with currency exchange, security is non-negotiable. We implement:

- End-to-end encryption to protect sensitive financial data

- Two-factor authentication (2FA) for secure logins

- Fraud detection algorithms to prevent suspicious transactions

- Regulatory compliance with standards like GDPR, PCI DSS, and PSD2

Our security-first mindset ensures your app builds user trust and meets global financial regulations.

5. Ongoing Support & Growth-Driven Maintenance

A fintech app requires continuous monitoring and updates to stay competitive. Beyond the initial launch, our currency converter app development company provides the following:

- Real-time performance tracking & issue resolution

- Feature enhancements based on user feedback

- Compliance updates as financial regulations evolve

- Scalability planning for growing user demand

With our currency exchange app development company as your technology partner, you don’t just get an app – you get a long-term fintech solution designed for success.

The fintech space is evolving rapidly, and a powerful currency converter app can become a key revenue driver when built strategically. Whether you need real-time currency conversion, advanced analytics, or seamless third-party integrations, Appinventiv has the expertise to turn your vision into reality.

Let’s discuss your custom fintech solution. Get in touch with us today!

FAQs

Q. What is a Currency Converter App?

A. A currency converter app is a digital tool that allows users to instantly check real-time exchange rates and convert one currency to another. These apps are widely used by travelers, businesses, forex traders, and e-commerce platforms to get accurate currency values. Advanced currency converter apps offer historical exchange data, rate trend analysis, multi-currency support, and integration with payment systems for seamless transactions.

Q. How Do Currency Converter Apps Make Money?

A. Currency converter apps can generate revenue through multiple monetization strategies, including:

- Advertisements – Displaying banner ads or sponsored content within the app.

- Subscription Plans – Offering premium features such as ad-free usage, historical data, or forex predictions.

- Affiliate Partnerships – Collaborating with financial institutions, forex trading platforms, or travel agencies.

- Transaction Fees – Charging small fees on currency exchange or international transactions.

- API Monetization – Providing exchange rate APIs to third-party businesses for a fee.

A well-planned revenue model ensures the app remains profitable while delivering user value.

Q. How to Develop a Currency Converter App?

A. Building a currency converter app involves several key steps:

- Brainstorm & Research – Define the app’s target audience, features, and unique value proposition.

- Create UI/UX Design – Develop an intuitive, user-friendly interface that ensures seamless navigation.

- Select the Tech Stack – Choose APIs for real-time exchange rates, cloud infrastructure, and security protocols.

- Develop the App – Build the backend, integrate features, and ensure multi-platform compatibility.

- Testing & QA – Conduct thorough testing to identify and fix bugs before launch.

- Deployment & Maintenance – Launch the app on app stores and continuously update it for improved performance.

Partnering with an experienced fintech app development company can ensure a smooth development process and a market-ready product.

Q. How Much Does It Cost to Develop a Currency Converter App?

A. The development cost of a currency converter app depends on factors like app complexity, features, tech stack, and development team location. On average, the cost breakdown is:

- Basic App (simple conversion, real-time rates) – $10,000 – $25,000

- Mid-Level App (historical data, offline mode, multi-currency support) – $25,000 – $50,000

- Advanced App (AI-driven insights, forex trading integration, payment gateway) – $50,000 – $100,000+

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…