- What are the Different Types of Payment Gateway Integration?

- Steps to Setup Payment Gateway Integration For Mobile App

- Identify Business Needs & Payment Preferences

- Choose a Payment Gateway Provider

- Ensure Legal Compliance & Banking Setup

- Implement Secure Payment Gateway Integration

- Test the Payment Integration

- Deploy & Monitor Transactions

- Optimize Payment Operations & Scaling

- Key Considerations for Setting Up an Online Payment Gateway Integration

- Top Use Cases of Payment Gateway Integration with Real-Life Examples

- Must-Adhere Compliance Regulations for Online Payment Gateway Integration

- Challenges in Payment Gateway Integration and Solutions

- What’s Next in the World of Online Payment Gateway Integration?

- Initiate Your Payment System Integration Journey with Appinventiv

- FAQs

- Q. How to integrate a payment gateway?

- Q. How much does it cost to integrate a payment gateway?

- Q. How to integrate a custom payment gateway into a website?

- Q. What are some of the top benefits of payment gateway integration?

One small inconvenience, one big loss: A user browses your app, finds exactly what they need, adds it to their cart, and heads to checkout—ready to pay. They enter their details, excited to complete the purchase… and then frustration hits.

Their preferred payment method isn’t supported. Within seconds, they abandon the process, and just like that, you’ve lost a sale.

85% of business buyers leave their carts because there aren’t enough payment options. (Source: Forbes).

That’s not just a minor inconvenience; it’s a massive revenue leak.

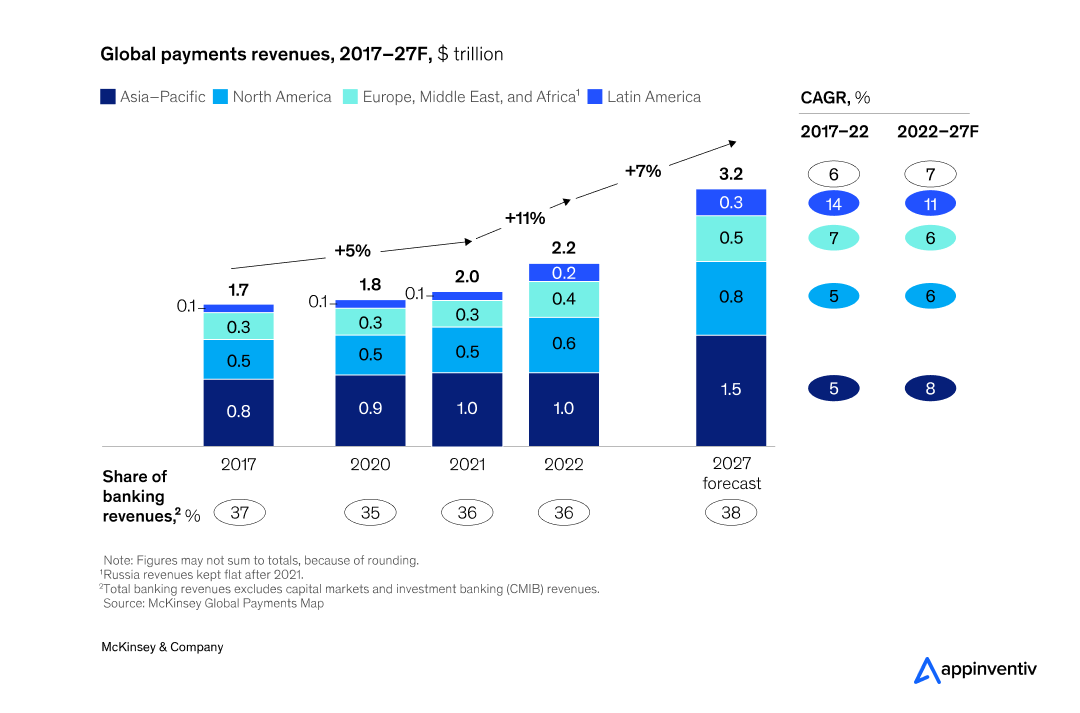

This means you will lose $23.65 billion in the coming years. Yes! The global mobile payments market will skyrocket to $3.2 trillion by 2027. (Source – McKinsey)

The data suggests a strong upward trend fueled by digital adoption, FinTech innovations, and evolving consumer payment preferences, reinforcing the need for businesses to integrate seamless and scalable payment solutions.

Whether you’re developing a FinTech app, integrating in-app purchases, or launching a digital marketplace, how you handle payments directly influences user trust, engagement, and long-term retention.

How can you create a frictionless, secure, and conversion-driven payment experience?

This blog covers all the essential steps to set up a payment gateway integration. You can also explore popular integration methods, key use cases, crucial considerations, regulatory requirements, potential challenges, and future trends to meet evolving consumer expectations.

Upgrade your app with a secure and fast payment integration system.

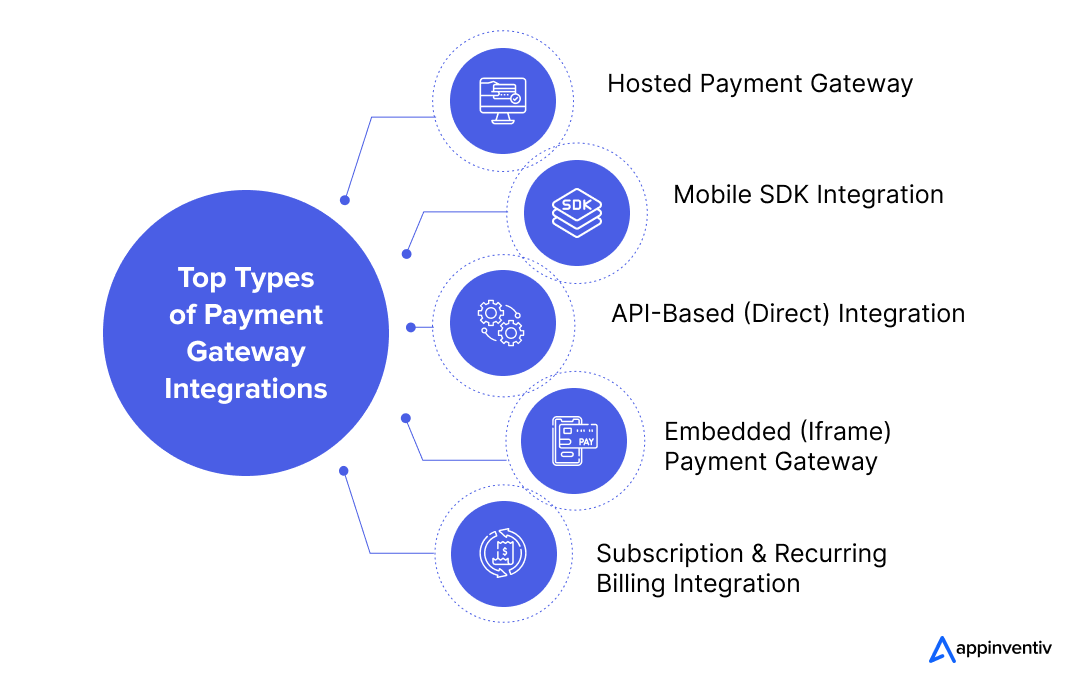

What are the Different Types of Payment Gateway Integration?

Implementing payment gateway integration is crucial in providing your users a seamless and secure payment experience. That is why selecting the right payment gateway integration type depends on security, user experience, and your business’s needs. Here are the most widely used types:

- Hosted Payment Gateway: The hosted payment gateway redirects customers to a secure third-party payment page for transaction processing. However, it reduces PCI DSS compliance responsibilities it may add friction to the checkout process. It is ideal for businesses looking for a simple and secure solution.

- Mobile SDK Integration: The mobile SDK integration enables secure in-app payments through SDKs without redirecting users to an external browser. It ensures compliance while providing a smooth mobile checkout experience and is essential for businesses with mobile-first customers.

- API-Based (Direct) Integration: The API-based integration allows payments to be processed directly on the merchant’s website or app via an API. It provides full control over the checkout experience but requires stringent security measures and PCI DSS compliance. It is best for businesses wanting a fully branded payment flow.

- Embedded (Iframe) Payment Gateway: This integrated payment gateway uses an iframe within the website, ensuring sensitive data remains within the provider’s system while delivering a seamless user experience. Embedded payment integration is a great balance between security and usability for online businesses.

- Subscription & Recurring Billing Integration: The subscription system automates recurring payments for subscription-based businesses. It manages billing cycles, ensures secure storage of payment details, and minimizes manual invoicing efforts. Ideal for SaaS, streaming, and membership platforms.

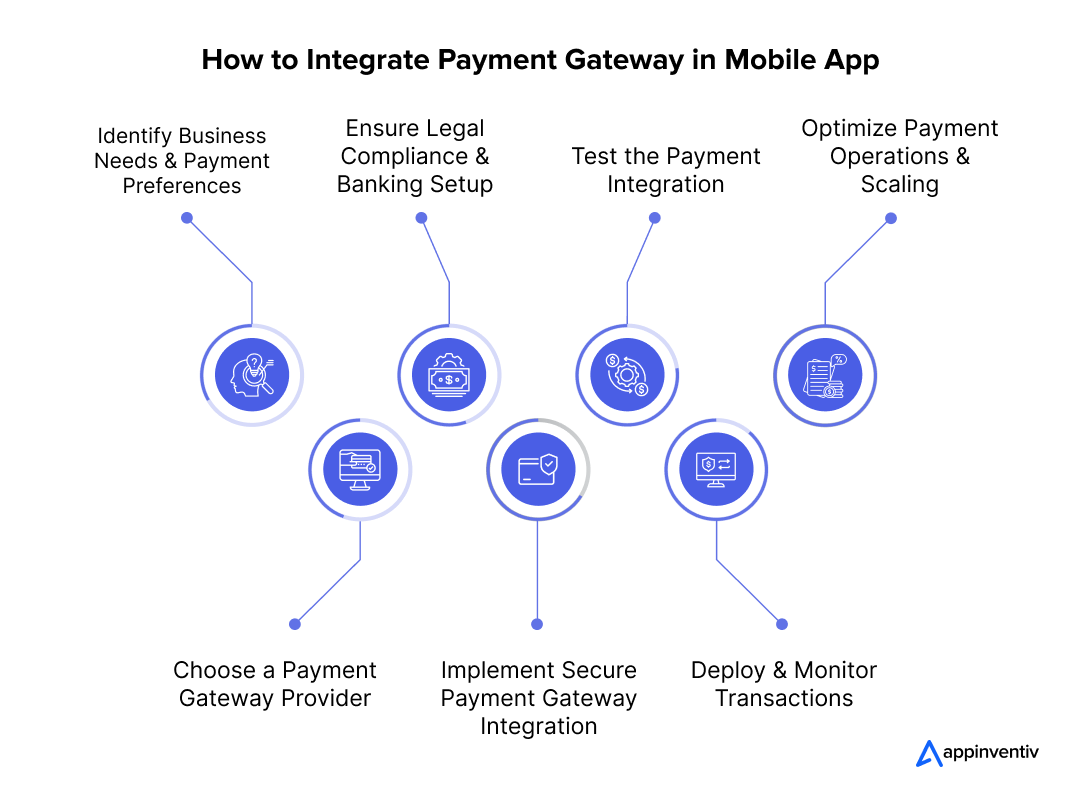

Steps to Setup Payment Gateway Integration For Mobile App

Integrating a payment gateway into a mobile app ensures seamless transactions while maintaining security and compliance. Below is a structured guide to integrating a payment gateway into Android and iOS applications.

Identify Business Needs & Payment Preferences

The first step is to define business objectives and determine the ideal payment structure based on the business model: eCommerce, subscription-based services, or a multi-vendor marketplace.

Understanding customer payment preferences is equally important, as well as ensuring support for credit/debit cards, digital wallets, bank transfers, and emerging payment options like Buy Now, Pay Later (BNPL). Businesses operating globally should also consider multi-currency support and localized payment methods to cater to regional consumer behavior and maximize transaction success rates.

Key Takeaways

- Define your business model: E-commerce, subscription, or marketplace

- It supports multiple payment methods, such as credit/debit cards, digital wallets, BNPL, and bank transfers in a centralized system through a payment orchestration platform.

- Enable global transactions: Multi-currency and regional payment options

Also Read: BNPL App Development Costs – Factors, Features, Process

Choose a Payment Gateway Provider

Choosing a payment gateway provider requires evaluating transaction fees, setup costs, payout cycles, security compliance, and dispute resolution mechanisms. Global providers like Stripe, PayPal, Braintree, and Adyen offer broad coverage, while others such as Razorpay, PayU, Mollie, Checkout.com, PayTabs, and Telr cater to specific markets or industry needs.

Businesses expanding internationally should prioritize providers with low foreign exchange conversion rates and local acquiring capabilities to reduce cross-border fees. Careful selection ensures an optimal balance between cost-effectiveness, reliability, and seamless transaction processing.

Key Takeaways

- Compare transaction fees, payout cycles, and security compliance

- Choose a provider with regional coverage based on business needs

- Optimize costs by selecting gateways with low FX conversion rates

Ensure Legal Compliance & Banking Setup

To integrate a payment gateway, businesses must be legally registered, obtain tax identification numbers, and comply with financial regulations. A dedicated business bank account is essential for handling settlements and automating reconciliation with accounting software.

Additionally, payment gateways require KYC (Know Your Customer) verification, including business registration documents, tax IDs, and identity verification for company owners. Meeting these requirements streamlines the onboarding process and prevents disruptions in payment operations.

Partnering with an experienced financial technology consulting firm can simplify this process further. From setting up banking integrations to ensuring full compliance with KYC and financial regulations, the right consulting partner can help businesses navigate the complexities with ease and speed.

Key Takeaways

- Register your business and obtain tax IDs (TIN, GST/VAT)

- Open a business bank account for seamless transaction settlements

- Complete KYC verification with the necessary documents

Implement Secure Payment Gateway Integration

Integrate the payment gateway SDK or REST API into your mobile app. For Android, add dependencies in Gradle (build.gradle), and for iOS, use CocoaPods or Swift Package Manager. The SDK provides pre-built UI components and payment-handling methods. Using an API-based approach, ensure secure HTTPS communication and implement proper request authentication.

A well-optimized checkout experience is key to reducing cart abandonment. Features like embedded payment forms, one-click payments, and diverse payment options improve conversion rates. Setting up webhooks for real-time transaction tracking ensures smooth payment processing and automated notifications. Hiring top-rated payment gateway integration services can help streamline the process, ensure compliance, enhance security, and deliver a seamless user experience for both businesses and customers.

Key Takeaways

- Integrate SDKs or APIs based on your platform (Android, iOS, Web)

- Secure payments with HTTPS, tokenization, and authentication

- Optimize checkout with one-click payments and embedded form

Test the Payment Integration

Use the sandbox/test mode the payment gateway provides to simulate transactions without real money. Test scenarios, including successful payments, failed transactions, expired cards, and network issues. Validate webhook notifications if your integration depends on real-time transaction updates. Ensure the UI works smoothly across different devices and screen sizes.

Also, load testing should be conducted to ensure the integrated payment gateway can handle peak transaction volumes without failures. Regression testing should be performed after every update to ensure new features or security patches do not disrupt existing payment flows.

Key Takeaways

- Test transactions in sandbox mode before going live

- Simulate multiple scenarios: success, failure, expired cards, and network issues

- Conduct load and regression testing to ensure system stability

Deploy & Monitor Transactions

Once testing is successful, switch to live API keys and deploy the payment integration in production. Monitor transaction logs, payment success rates, and failed transactions using the provider’s dashboard.

Implement analytics and fraud detection tools to track unusual payment behavior. Regularly update SDKs and security patches to maintain compliance and protect user data.

Key Takeaways

- Deploy with live API keys after successful testing

- Monitor payment analytics and fraud detection alerts

- Regularly update security patches to maintain compliance

Optimize Payment Operations & Scaling

To maximize efficiency and profitability, businesses must continuously monitor transaction analytics, optimizing payment success rates and checkout experiences through A/B testing. Negotiating lower processing fees for high transaction volumes and using local payment gateways can significantly reduce costs.

Expanding into new markets requires integrating region-specific payment methods and considering emerging options like cryptocurrency payments. Automated retries for failed transactions can improve revenue recovery and customer retention for subscription-based models.

Key Takeaways

- Track transaction analytics & optimize success rates.

- Reduce costs with local payment gateways & fee negotiations

- Expand with region-specific & emerging payment methods

- Automate retries for failed subscription payments

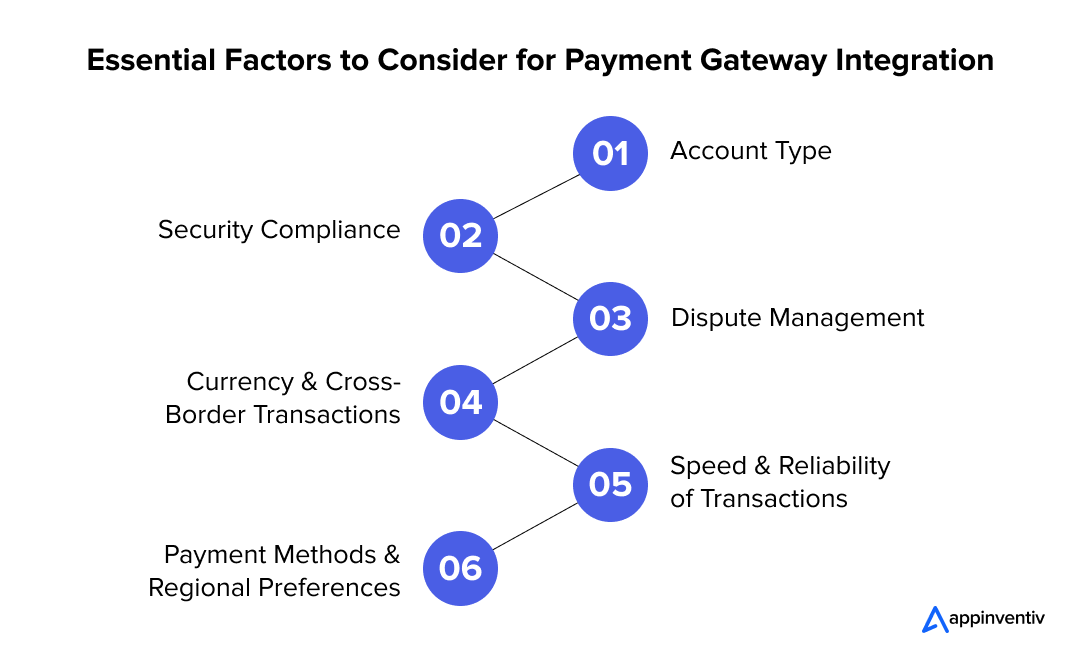

Key Considerations for Setting Up an Online Payment Gateway Integration

Understanding the key aspects of the payment system integration process can help you create a seamless and efficient payment experience. Here’s what you need to know about the requirements for mobile payment gateway integration before getting started.

- Account Type: Businesses can choose between dedicated accounts (exclusive to one business, with higher control but costly) and aggregate accounts (shared by multiple merchants, with lower cost and quicker approval). Dedicated accounts (e.g., PayLeap, Authorize.net) allow full customization but require more resources. Aggregate accounts (e.g., PayPal, Stripe) are cost-effective but offer limited customization.

- Security Compliance: To process payments securely, businesses must comply with PCI DSS standards, even when using gateways like Stripe or PayPal. This involves implementing secure data storage, encryption, and fraud prevention measures. A PCI Security Standards Council audit is required before certification.

- Dispute Management: A clear dispute resolution system is essential for handling failed transactions, incorrect charges, and refund delays. Businesses can use dispute management solutions like FSS and ACI Worldwide or develop custom systems to enhance customer trust and ensure compliance.

- Currency & Cross-Border Transactions: For global businesses, multi-currency support and seamless exchange rate handling are crucial. With automatic currency conversion and localized processing, payment gateways help simplify cross-border transactions, reducing friction for international customers.

- Speed & Reliability of Transactions: Slow payment processing can frustrate customers and lead to cart abandonment. A high-uptime, real-time processing gateway ensures smooth transactions, reducing payment failures and improving customer experience.

- Payment Methods & Regional Preferences: Offering multiple payment options, including credit/debit cards, mobile wallets (Apple Pay, Google Pay), and region-specific methods (Alipay, UPI), enhances user experience. Supporting local payment preferences increases conversions and boosts customer retention.

Top Use Cases of Payment Gateway Integration with Real-Life Examples

Integrating a payment gateway streamlines transactions, enhances security, and ensures smooth payment processing for businesses. Below are key use cases with real-life payment gateway integration examples.

| Categories | Payment Integration For | Example & Integration |

|---|---|---|

| Billing Software | Automated invoicing, renewals, late fees, fraud prevention, tax compliance | FreshBooks – Integrates with Stripe & PayPal for secure payments |

| eCommerce Website | Secure transactions, multi-payment support, fraud prevention, PCI compliance | Shopify – Works with PayPal, Stripe & Klarna for smooth checkouts |

| SaaS & XaaS Products | Subscription management, trial-to-paid conversion, dunning, AI-driven analytics | Netflix – Uses Adyen & Stripe for recurring payments & churn prediction. |

| Accounting Software | Automated reconciliation, tax compliance, cash flow tracking, custom reports | QuickBooks – Integrates with Stripe & Square for automated invoicing |

| Mobile Banking App | Secure transfers, bill payments, biometric authentication, fraud detection | Revolut – Leverages online gateways for instant transactions |

| Telemedicine App | Secure payments for consultations, insurance claims, compliance, subscriptions | Teladoc Health – Integrates with Stripe & PayPal for transactions |

| Marketplace Platforms | Multi-vendor payments, escrow, automated payouts, international transactions | Etsy – Uses Adyen & Payoneer for seamless vendor payments. |

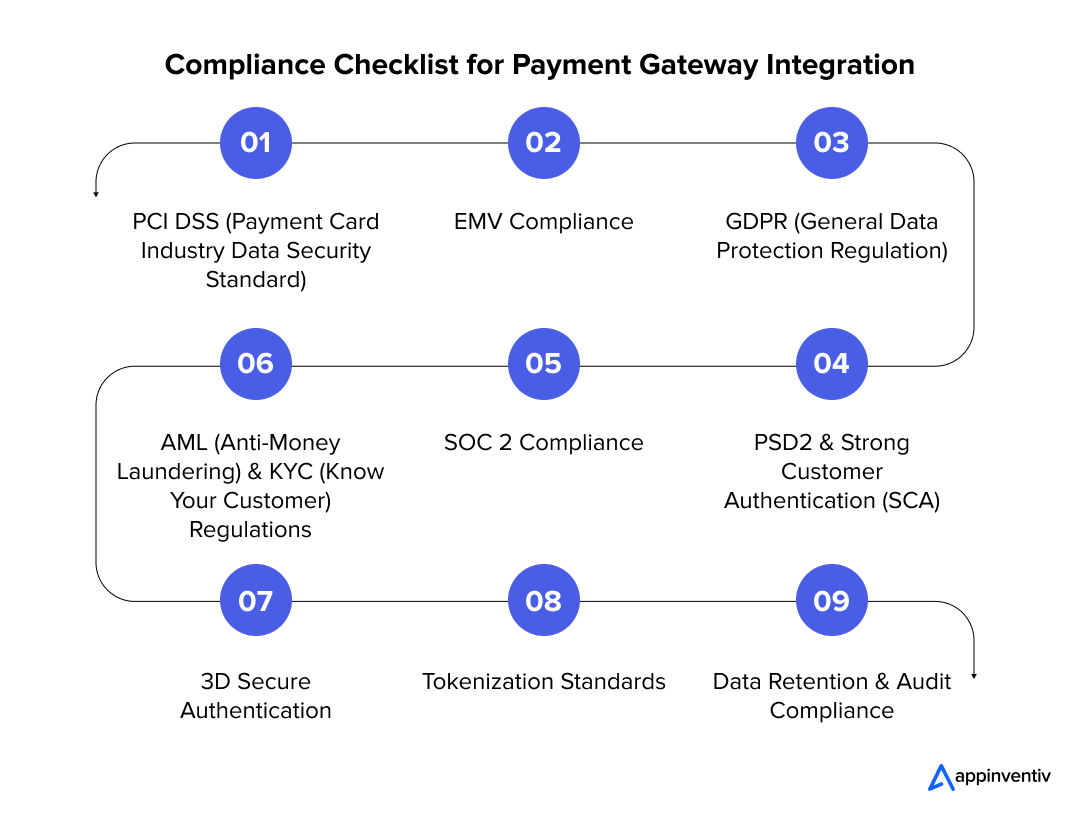

Must-Adhere Compliance Regulations for Online Payment Gateway Integration

Integrating a payment gateway requires strict adherence to industry regulations to ensure security, data protection, and seamless transactions. Here are the essential compliance requirements:

- PCI DSS (Payment Card Industry Data Security Standard): PCI DSS is the most critical compliance standard for securing credit card transactions. It enforces encryption, tokenization, secure network configurations, and regular security assessments to protect sensitive payment data and prevent fraud. PCI-Compliant mobile app development mitigates data breach risks, builds customer trust, and ensures businesses can securely process card payments.

- EMV Compliance: Compliance with EMV (Europay, Mastercard, and Visa) is mandatory for in-person transactions. EMV chip technology significantly reduces fraud risks by making counterfeit card transactions nearly impossible, replacing vulnerable magnetic stripe-based systems.

- GDPR (General Data Protection Regulation): For businesses handling payments in the EU, GDPR compliance is essential. It mandates strict data privacy measures, including user consent, data encryption, and the right for individuals to access or delete their data, ensuring greater consumer control over information security.

- AML (Anti-Money Laundering) & KYC (Know Your Customer) Regulations: Payment processors and financial institutions must comply with AML and KYC regulations to prevent fraud, money laundering, and illicit transactions. This involves customer identity verification, transaction monitoring, and reporting suspicious activities.

- SOC 2 Compliance: Businesses providing payment processing services must adhere to SOC 2 standards to ensure strong data security, availability, and confidentiality controls. Compliance reassures customers and partners that their financial data is highly secure and reliable.

- PSD2 & Strong Customer Authentication (SCA): The Payment Services Directive 2 (PSD2) is a mandatory regulation for payment processing in the EU. It requires Strong Customer Authentication (SCA), enforcing multi-factor authentication for online transactions to reduce fraud and unauthorized access.

- 3D Secure Authentication: Implementing 3D Secure (such as Visa Secure or Mastercard Identity Check) adds an extra verification step for online payments. This reduces chargebacks and prevents unauthorized transactions, enhancing the overall security of digital purchases.

- Tokenization Standards: Asset tokenization enhances security by replacing sensitive payment data with encrypted tokens. This ensures that even if data is intercepted, it remains unreadable, reducing fraud risks and protecting stored payment information in databases.

- Data Retention & Audit Compliance: Businesses must comply with industry-specific data retention policies and maintain comprehensive logging, auditing, and reporting mechanisms. This ensures financial transactions are transparent, legally compliant, and secure from potential fraud.

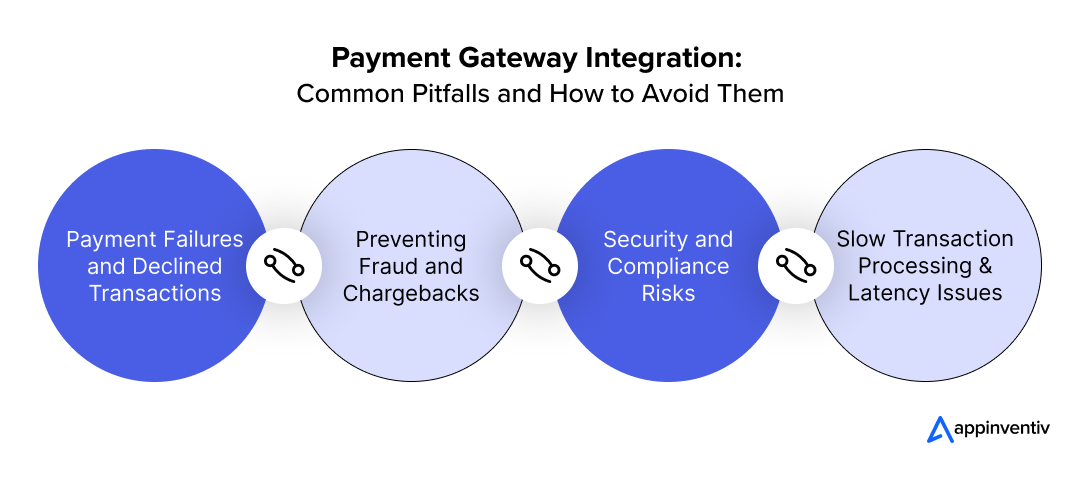

Challenges in Payment Gateway Integration and Solutions

Integrating a payment gateway into a mobile app isn’t always smooth sailing. You might run into security concerns, technical issues, or even user experience hiccups that can impact transactions. Here’s a look at the key challenges and practical ways to overcome them.

1. Payment Failures & Declined Transactions

- The challenge: Payments can fail due to expired cards, insufficient funds, network errors, or gateway issues, frustrating users

- How to fix it: Show clear error messages explaining why a payment failed and suggest alternative methods. Enable auto-retries for temporary failures and allow users to switch payment modes easily

2. Preventing Fraud & Chargebacks

- The challenge: Fraudulent transactions and chargebacks can lead to revenue loss and legal trouble.

- How to fix it: Use fraud detection tools that flag suspicious transactions. Multi-factor authentication (MFA) is required for large payments, and each transaction must be validated on the server side before confirming orders.

3. Security & Compliance Risks

- The challenge: Handling sensitive payment data comes with risks like fraud, data breaches, and compliance requirements (PCI DSS, GDPR, etc.).

- How to fix it: Use encryption and tokenization to secure transactions. Choose a PCI DSS-compliant payment provider, enable 3D Secure authentication, and always use HTTPS to protect user data

4. Slow Transaction Processing & Latency Issues

- The challenge: Delays in payment processing can make users think their transaction failed, leading to duplicate payments or abandoned carts.

- How to fix it: Choose a gateway known for fast processing and high uptime. Implement asynchronous payment handling and send real-time status updates via push notifications or webhooks.

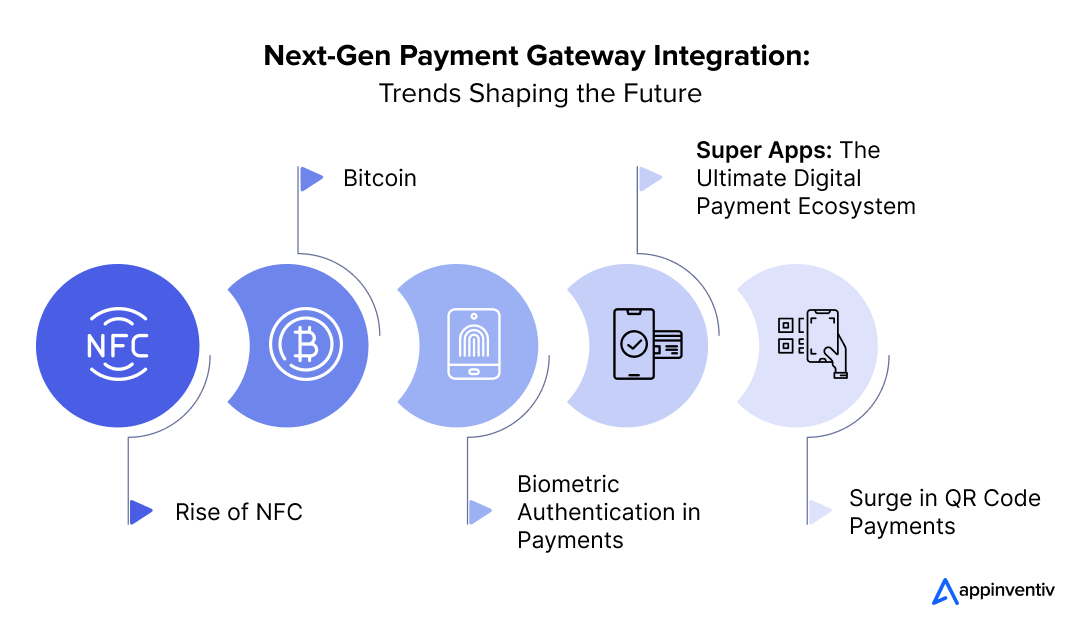

What’s Next in the World of Online Payment Gateway Integration?

The future of online payment gateway integration is set to bring faster transactions, enhanced security, and frictionless user experiences. Exciting innovations lie ahead—let’s see what’s next!

- Rise of NFC: Some of the most famous mobile wallets, such as Apple Pay and Samsung Pay, rely on NFC technology to initiate payments. The technology allows users to make purchases only by holding their mobile devices to an NFC-enabled device. It’s not just convenient, but it also speeds up the checkout time drastically.

- Bitcoin: Bitcoin is the biggest innovation ready to hit the payment industry this year. It will be introduced to mobile apps to a greater extent now, making the sector cashless and secure. The fact that the monetary value of cryptocurrency is on a continuous rise indicates how fast the industry is evolving and the role it is set to play in the future of mobile app payment integration.

- Biometric Authentication in Payments: Over 3 billion people are expected to use biometrics for payments by 2026; with this, biometric authentication is becoming a game-changer. Payment apps now incorporate fingerprint scanning, facial recognition, and voice authentication to enhance security while delivering a seamless user experience.

- Super Apps: Apps like WeChat, Paytm, and Grab are reshaping mobile payment integration by consolidating multiple financial services into a single platform. These all-in-one applications provide features such as peer-to-peer (P2P) transfers, mobile banking, e-commerce, and ride-hailing, eliminating the need for users to juggle multiple apps.

- Surge in QR Code Payments: QR code-based payments are experiencing tremendous growth, particularly in emerging markets like China, India, and Southeast Asia. Platforms such as WeChat Pay, Alipay, and Google Pay drive adoption, allowing users to make instant transactions simply by scanning a QR code—eliminating contactless cards or NFC-enabled devices.

Also Read: UPI Payment App Development Cost – A Complete Guide

Initiate Your Payment System Integration Journey with Appinventiv

As digital transactions become the norm, businesses need more than just payment integration; they need intelligent, frictionless, and future-proof solutions. AI, biometric authentication, and cashless ecosystems are shaping the financial industry, and those who embrace innovation will thrive.

As a leading payment gateway development company, we at Appinventiv specialize in building cutting-edge FinTech applications loaded with power-packed features. For example, we collaborated with Mudra to develop an AI-powered budgeting app to simplify personal finance management through a chatbot-driven platform.

After six months of careful design and development, Mudra is now set for deployment across 12+ countries, providing users with an intuitive and efficient way to manage their budgets.

Also, we partnered with EdFundo to create a feature-rich financial literacy app with personalized learning, real-time goal tracking, and an intuitive user experience. Our dedication and commitment to this project resulted in 40% higher user retention, a 30% boost in financial confidence, and 90%+ users rating it 4.5 stars or higher.

As leaders in FinTech mobile app development services, we empower businesses to integrate advanced technologies, ensuring they stay ahead of the curve. From seamless payment platform integrations to next-generation financial platforms, we provide tailored FinTech solutions that drive innovation and growth.

Let’s build a smarter, safer, and more connected future for digital payments.

Connect with our experts today!

FAQs

Q. How to integrate a payment gateway?

A. Integrating a payment gateway into your website or app ensures secure and seamless transactions. Follow these steps:

- Choose a Payment Gateway: The first step in the payment gateway integration process is to select a provider like Stripe, PayPal, Razorpay, or a custom gateway based on fees, payment methods, and business needs.

- Create a Merchant Account: Sign up with the provider and complete verification.

- Obtain API Keys: Get the required API keys or SDKs to connect your platform.

- Integrate via API or SDK: Use the provider’s tools to enable payment processing.

- Enable Multiple Payment Methods: Support credit/debit cards, digital wallets, UPI, or BNPL as needed.

- Ensure Security Compliance: Follow PCI DSS standards to protect transactions.

- Test & Deploy: Use a sandbox for testing before going live, then monitor transactions for performance and fraud prevention.

Q. How much does it cost to integrate a payment gateway?

A. The payment gateway integration cost varies based on the provider, transaction fees, and development complexity. Here’s an overview:

- Custom Development Costs – Based on the complexity, custom payment gateway API integration can cost $5,000 to $25,000.

- Setup Fees – Some providers charge a one-time fee ($50–$500), while others offer free onboarding.

- Transaction Fees – Typically range from 1.5% to 3.5% per transaction, depending on the provider, region, and payment method.

- Maintenance Costs – Ongoing upkeep, security updates, and compliance may range from $100 to $1,000 per month.

Q. How to integrate a custom payment gateway into a website?

A. Payment gateway integration in website gives businesses more control over transactions but requires careful implementation for security and compliance. Follow these steps:

- Define Requirements: Decide on supported payment methods and ensure compliance with financial regulations.

- Set Up a Merchant Account: Register with a bank or payment processor and obtain payment gateway API integration credentials.

- Develop the Payment API: Build a secure API to handle transactions, refunds, and status updates.

- Integrate with the Website: Connect the gateway using backend languages like Node.js, PHP, or Python.

- Handle Transactions Securely: Use encryption, tokenization, and fraud detection measures.

- Test in a Sandbox Environment: Run test transactions to identify and fix issues before going live.

- Go Live & Monitor Transactions: The last step of the payment gateway integration process is to deploy, track payments, and optimize for performance and security.

Q. What are some of the top benefits of payment gateway integration?

A. Payment platform integration enhances security, speed, and convenience, making transactions seamless for both businesses and customers. Here’s why it matters:

- Global reach & multi-currency support

- Better customer trust

- Subscription & recurring payments

- Faster & smoother transactions

- Enhanced security

- Multiple payment options

- Quick settlements & cash flow management

- Seamless business integration

- Real-time analytics

- Scalability & reliability

How Much Does it Cost to Build a Personal Finance App like Pocketsmith?

Imagine an app that knows when your rent is due, reminds you of upcoming bills, forecasts your savings 12 months ahead, and tells you if that third coffee this week is wrecking your budget. That’s the kind of experience apps like PocketSmith deliver, and it’s exactly why personal finance apps are becoming a must-have for…

How Much Does it Cost to Build a Mobile Banking App Like Halifax in the UK?

The way people bank has changed dramatically. Gone are the days of waiting in long queues or rushing to a branch before closing hours. Today, mobile banking apps like Halifax have redefined convenience, allowing users to check balances, transfer funds, pay bills, and even apply for loans from their smartphones, anytime and anywhere. This shift…

How to Approach Currency Converter App Development?

Imagine you’re about to travel abroad and need to quickly check how much your local currency is worth in another country, or perhaps you run an international business and constantly deal with multiple currencies. In both cases, a currency converter app is an indispensable tool. With global transactions becoming the norm and forex markets fluctuating…