- How to Hire Fintech Software Developers

- Define Your Project Requirements

- Look for Specialized Skills in Fintech

- Evaluate Experience and Portfolio

- Assess Regulatory Knowledge

- Conduct In-Depth Interviews

- Consider Security Expertise

- Check for Strong Communication Skills

- Ensure a Strong Cultural Fit

- Offer Competitive Compensation Packages

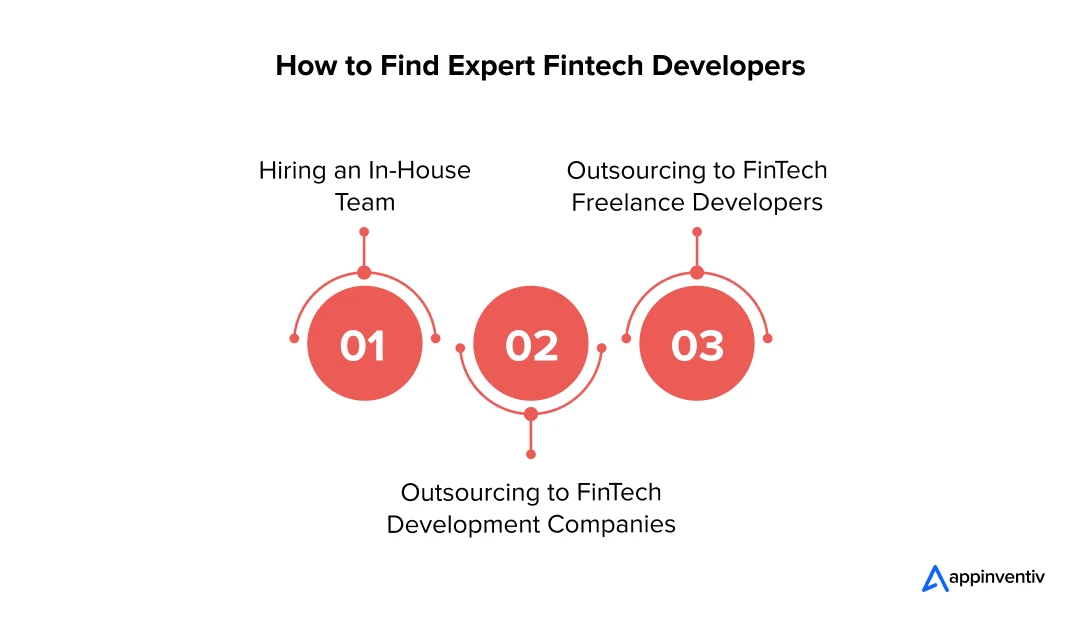

- Where to Find the Best Fintech Software Developers?

- Hiring an In-house Team

- Outsourcing to Fintech Development Companies

- Outsourcing to Fintech Freelance Developers

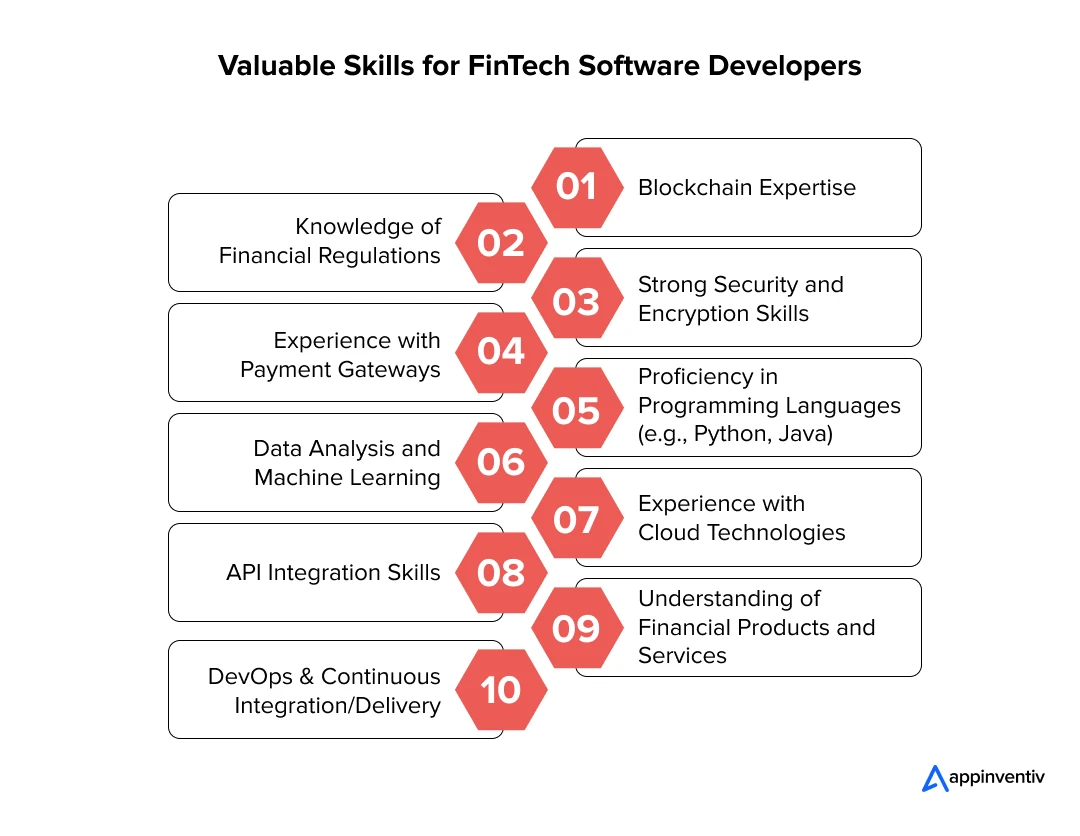

- Which Skills Make a FinTech Software Developer Stand Out?

- Blockchain Expertise

- Knowledge of Financial Regulations

- Strong Security and Encryption Skills

- Experience with Payment Gateways

- Proficiency in Programming Languages (e.g., Python, Java)

- Data Analysis and Machine Learning

- Experience with Cloud Technologies

- API Integration Skills

- Understanding of Financial Products and Services

- DevOps and Continuous Integration/Delivery

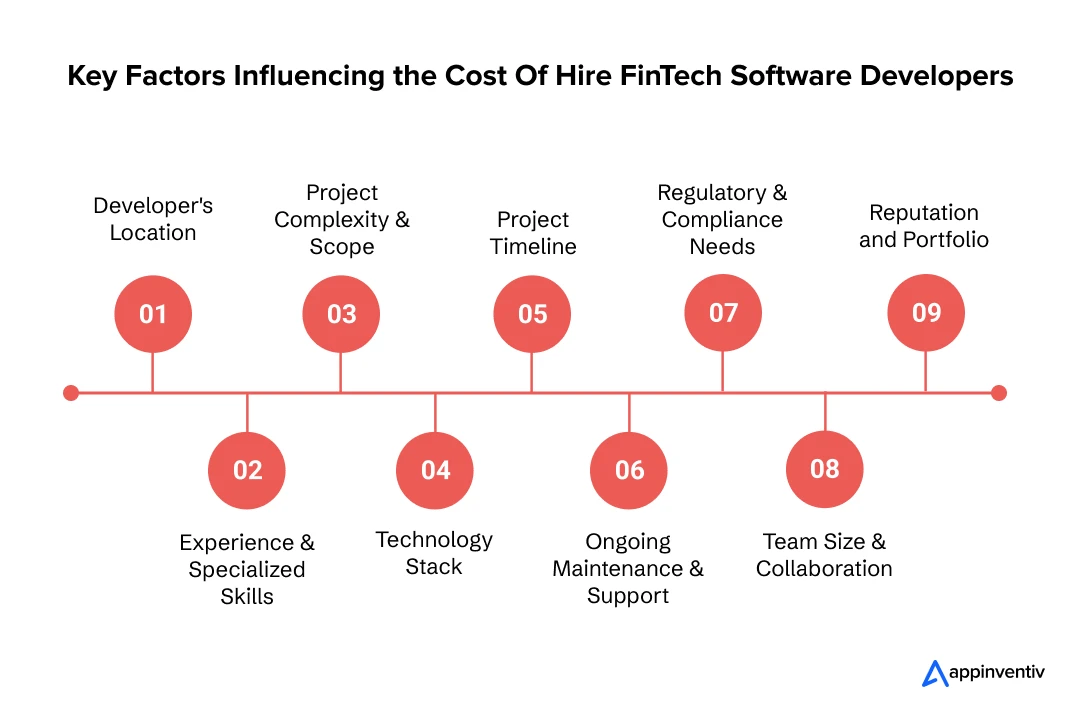

- How Much Does It Cost To Hire FinTech Software Developers

- Developer’s Location

- Experience & Specialized Skills

- Project Complexity & Scope

- Technology Stack

- Project Timeline

- Ongoing Maintenance & Support

- Regulatory & Compliance Needs

- Team Size & Collaboration

- Reputation and Portfolio

- Challenges & Solutions For Hiring Fintech Developers

- Discover Top Fintech Software Developers with Appinventiv's Expertise

- Why Appinventiv is the Best Fintech Software Development Company

- FAQs

The world of finance is no longer confined to traditional methods—fintech has burst onto the scene, breaking barriers and reshaping how we manage money globally. But as this digital revolution accelerates, so do the complexities.

Issues like data privacy, cybersecurity threats, and regulatory pressures are growing alongside the innovations, casting a shadow over the industry’s rapid progress.

Addressing these challenges in financial software development requires expertise, foresight, and a balance of technology and strategy.

This is where fintech software developers excel.

When you hire FinTech software developers, you’re investing in professionals who design secure, cutting-edge solutions that enable the industry to stay ahead in a dynamic and fast-evolving environment.

So, without further ado, let’s explore the hiring process for fintech developers, costs, and how you can tap into this growing wave of innovation.

How to Hire Fintech Software Developers

Finding professionals with expertise in cutting-edge technologies, financial systems, and regulatory compliance is crucial. Let’s understand the steps to hire Fintech developers who can deliver secure, scalable, and innovative solutions tailored to your business needs.

Define Your Project Requirements

Understanding your project’s goals and the problems you aim to solve is one of the first steps to hire fintech developers. Reflect on what features, platforms, and technologies would best serve your audience, and outline your vision clearly to ensure alignment with potential candidates.

Points to Note:

- Specify the problem your software aims to solve.

- Identify essential features, technology stacks, and platforms.

- Determine your budget, timeline, and scalability needs.

Look for Specialized Skills in Fintech

Fintech software development is unique, requiring expertise in financial protocols, blockchain in fintech, and AI. Understanding ways to hire FinTech developers is crucial for finding the right talent with specialized skills. When evaluating candidates, focus on their technical capabilities and ability to adapt to the dynamic needs of financial technology.

Points to Note:

- Focus on candidates with experience in blockchain, AI, or API development.

- Verify their familiarity with fintech industry standards and tools.

- Ensure they can handle high-performance, data-intensive environments.

Evaluate Experience and Portfolio

Every project tells a story of problem-solving, innovation, and technical skill. Reviewing a developer’s portfolio provides insights into their approach. This highlights the importance of strategic hiring in the FinTech industry, ensuring that you hire financial software developers with the right expertise to meet the unique challenges of financial technology.

Points to Note:

- Look for similar projects in their portfolio to understand their expertise in hiring fintech developers.

- When hiring fintech developers, ask for case studies or testimonials from previous clients to assess their expertise and track record.

- Review software usability, performance, and user feedback.

Assess Regulatory Knowledge

The fintech industry operates under stringent regulations to ensure security and transparency. Fintech software developers with strong regulatory knowledge can help you avoid potential legal pitfalls by embedding compliance into your software’s foundation.

Points to Note:

- Check for understanding of frameworks like PCI DSS, AML, and GDPR.

- Discuss how they integrate compliance features during development.

- Ask about their experience in adapting to region-specific financial laws.

Conduct In-Depth Interviews

Interviews offer more than just a skill assessment; they provide an opportunity to gauge a developer’s problem-solving mindset, collaboration style, and adaptability. Thoughtful questions can reveal how well they align with your project’s goals.

Points to Note:

- Include real-world scenarios or fintech-specific challenges to assess their approach.

- Ask about their preferred tools and development practices.

- Test their ability to align technical solutions with business objectives.

Consider Security Expertise

Security is a cornerstone of fintech software development. Finance software developers should understand data encryption and secure coding and actively work to prevent potential vulnerabilities from the earliest stages of the project.

Points to Note:

- Look for experience with encryption protocols like AES or TLS.

- When evaluating fintech developers for hire, discussing their approach to securing sensitive customer data is essential.

- Confirm their expertise in threat assessment and mitigation strategies.

Check for Strong Communication Skills

Clear communication bridges the gap between technical expertise and project success. Hiring financial software developers who effectively explain their approach and understand your requirements contributes to a smoother development process.

Points to Note:

- Assess their responsiveness and willingness to clarify doubts.

- Look for their ability to explain complex technical terms in simple language.

- Ensure they are comfortable with collaboration tools and processes.

Ensure a Strong Cultural Fit

Collaboration becomes seamless when fintech software engineers align with your company’s values and work culture. This ensures they adapt to your processes and work effectively with your team.

Points to Note:

- Evaluate their adaptability and willingness to work in a team.

- Discuss their preferred work style to match your company culture.

- Look for examples of how they’ve handled teamwork in the past.

Offer Competitive Compensation Packages

Top-tier fintech software engineers are highly sought after, especially in the industry. By offering attractive compensation along with growth opportunities, you can ensure you attract and retain the best talent for your project.

Points to Note:

- Benchmark salaries against industry standards.

- Provide additional benefits like flexible hours or learning opportunities.

- Highlight the potential for career growth within your organization.

Where to Find the Best Fintech Software Developers?

Finding the best finance software developers can be done through several channels, such as building an in-house team, outsourcing to specialized agencies, or hiring freelancers. Each approach offers distinct advantages depending on your project needs, budget, and timeline. Let’s explore these options to hire fintech developers holistically.

Hiring an In-house Team

Hiring an in-house team of fintech software developers allows businesses more direct control over the development process and fosters closer collaboration. Dedicated developers make it easier to ensure alignment with company goals and address issues as they arise. However, building and maintaining an in-house team requires a significant investment in recruitment, training, and retention, which can be resource-intensive for businesses.

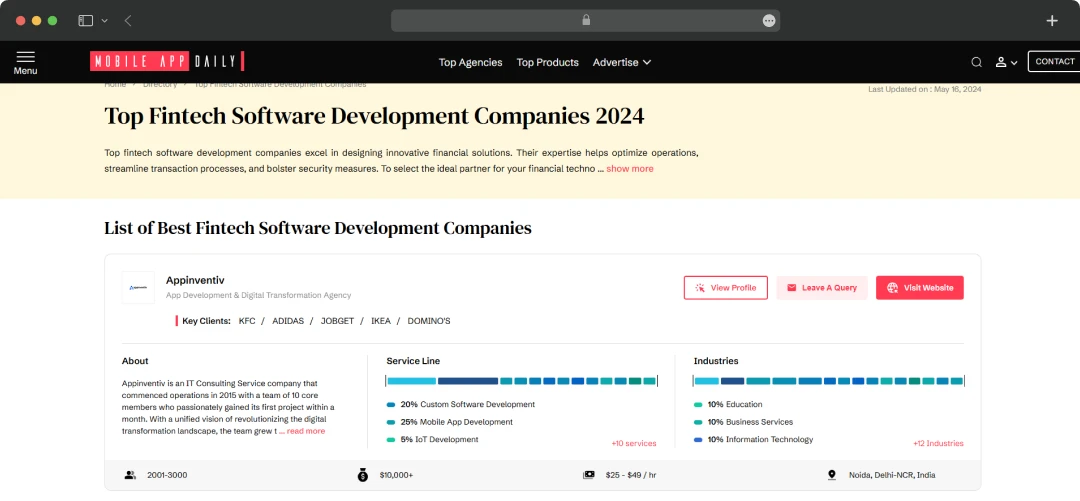

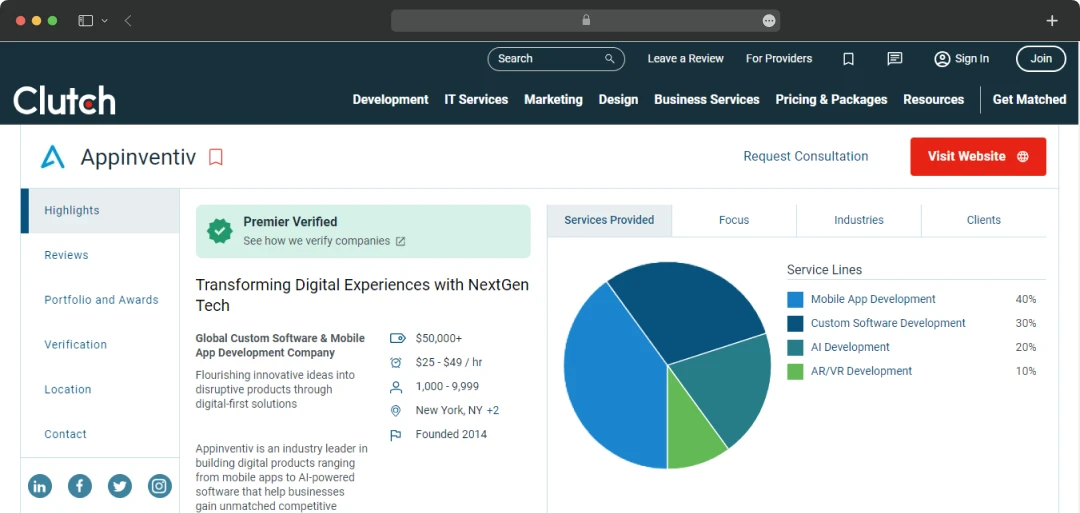

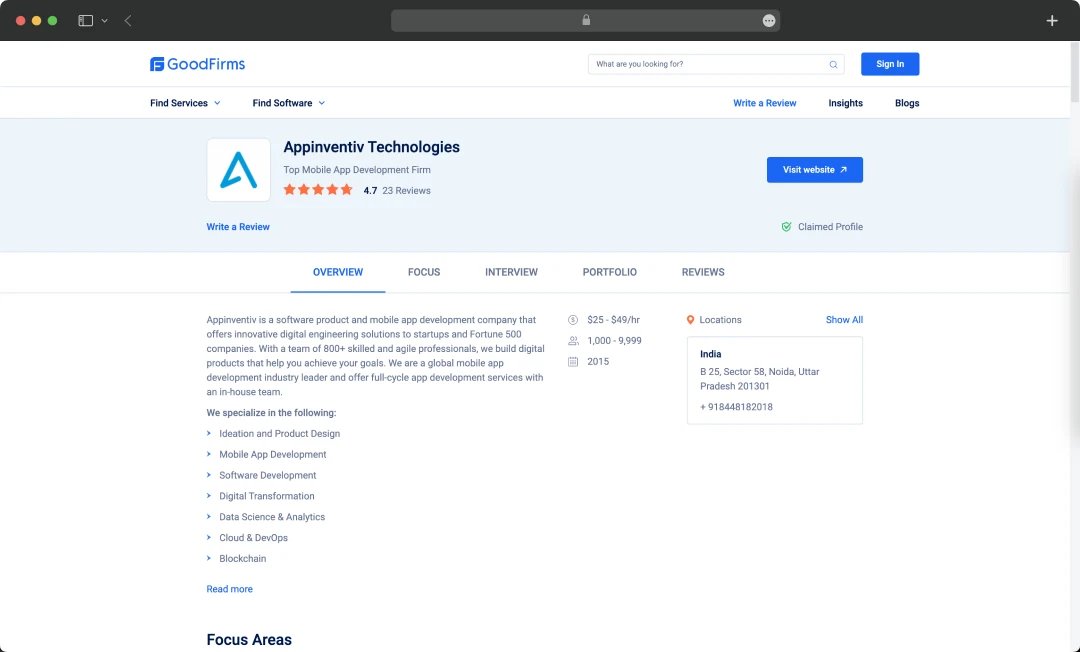

Outsourcing to Fintech Development Companies

Outsourcing to fintech development companies through platforms like MobileAppDaily, Clutch, and GoodFirms can offer businesses a streamlined way to find top-tier fintech software developers. Here’s how these platforms can help:

Mobile App Daily: This platform provides insights, reviews, and rankings of fintech development companies, making it easier to identify trusted firms based on their expertise and past projects. Businesses can explore company profiles, client feedback, and case studies to make informed decisions.

Clutch: Clutch offers detailed client reviews and ratings for fintech development companies. By browsing through verified feedback and success stories, businesses can assess the reputation and reliability of potential partners. It also allows users to filter companies by location, expertise, and industry focus, helping businesses find the best match for their fintech projects.

GoodFirms: GoodFirms provides a comprehensive list of top fintech development companies, client reviews, service offerings, and project portfolios. This platform helps businesses compare different providers, ensuring they select a company with the right technical skills and experience for their fintech needs.

Leveraging these platforms enables businesses to hire fintech app developers, ensuring the success of their outsourcing initiatives.

Outsourcing to Fintech Freelance Developers

When outsourcing to fintech freelance developers, you can explore several effective methods, including LinkedIn and hiring portals. Here’s how these options can help you to hire fintech developers.

LinkedIn connects businesses directly with freelancers through detailed profiles, advanced search filters, and networking opportunities. Businesses can easily hire fintech app developers, post job openings, and engage with potential candidates, making the hiring process faster and more efficient.

Hiring Portals

Hiring portals like Upwork and Toptal offer curated freelance talent pools, streamlining the hiring process with features like skill filters, freelancer vetting, and flexible contract options. These platforms provide security through ratings, reviews, and payment protection, ensuring a reliable and safe hiring experience.

Which Skills Make a FinTech Software Developer Stand Out?

Let’s explore the valuable skills that fintech software developers bring. These skills include expertise in advanced programming languages, a deep understanding of financial systems, and proficiency in integrating technologies like blockchain and AI. These skills ensure the development of secure, scalable, and innovative financial solutions.

Blockchain Expertise

A solid understanding of blockchain technology is essential for secure and transparent transactions. Developers must implement decentralized applications (dApps) that ensure integrity and trust in financial transactions.

Knowledge of Financial Regulations

FinTech developers must stay updated on financial regulations such as GDPR, PSD2, and anti-money laundering (AML) requirements. Ensuring compliance with these regulations is crucial to avoid legal repercussions.

Strong Security and Encryption Skills

Protecting sensitive financial data is a top priority in FinTech. Expertise in cryptography and encryption protocols ensures that transactions and user data remain secure.

Experience with Payment Gateways

Integrating payment gateways is fundamental to processing digital payments in FinTech apps. Developers should know popular gateways like PayPal, Stripe, and Square.

Proficiency in Programming Languages (e.g., Python, Java)

Mastery of programming languages like Python, Java, or JavaScript is vital for building scalable FinTech applications. These languages help developers create robust back-end systems, handle large datasets, and ensure high performance.

Data Analysis and Machine Learning

FinTech solutions increasingly rely on data analytics and machine learning to make informed financial decisions. Developers skilled in data analysis can extract insights to improve user experience and business operations.

Experience with Cloud Technologies

Cloud computing platforms like AWS, Azure, or Google Cloud offer scalability, security, and flexibility for FinTech applications. Developers with experience in cloud technologies can build distributed systems, manage resources efficiently, and ensure high service availability.

API Integration Skills

Many FinTech applications rely on third-party services and data providers. Strong API integration skills are necessary for connecting financial services, such as banking, credit scores, and trading platforms, into a cohesive system.

Understanding of Financial Products and Services

It is essential to have a deep understanding of various financial products, such as loans, insurance, mortgages, and investments. Developers must create solutions that align with these products’ complexities and user needs.

DevOps and Continuous Integration/Delivery

DevOps practices enable continuous integration and delivery, enhancing development speed and quality. In FinTech, this helps rapidly deploy new features, security patches, and updates.

How Much Does It Cost To Hire FinTech Software Developers

The cost of hiring FinTech software developers can vary widely depending on several factors, including the developer’s location, experience, skill set, and project complexity. Here’s a general breakdown:

Developer’s Location

The geographic location of FinTech developers plays a pivotal role in determining their rates. Developers in high-cost regions such as North America, Western Europe, and Australia generally charge more due to higher living expenses and demand for talent. On the other hand, developers in regions like Eastern Europe, Latin America, and Asia offer more cost-effective rates.

| Region | Hourly Rates of Development |

|---|---|

| UAE | $60-$65 |

| US | $95-$100 |

| Western Europe | $80-$90 |

| Australia | $70-$90 |

| Eastern Europe | $50-$55 |

| Asia | $25-$40 |

Experience & Specialized Skills

Developers with advanced experience and specialized blockchain, AI, or financial regulation skills often command higher salaries. Junior developers may offer more affordable rates but require more oversight and training, while senior developers bring efficiency and expertise that justify the increased cost.

Project Complexity & Scope

When you hire FinTech developers, the complexity of your project significantly influences the overall development cost. Projects requiring advanced features like real-time financial data processing, machine learning, or multi-layered security measures tend to be more expensive. The larger the scope, the more resources will be required, thus increasing the development costs.

Technology Stack

Another critical factor in pricing is the choice of technology stack. Common stacks, such as Java and Python, are more widely used and often come at a lower cost. However, more advanced or niche technologies, such as blockchain, AI, or cloud computing, require developers with specialized expertise and often result in higher rates.

Project Timeline

Urgency can significantly increase the cost of hiring FinTech developers. Tight deadlines require developers to allocate more resources or work overtime, leading to higher hourly or project rates. Projects with extended timelines allow developers to work at a more comfortable pace and often result in more competitive pricing.

Ongoing Maintenance & Support

FinTech applications require ongoing maintenance and security updates to remain functional and compliant with evolving regulations. Some developers may offer packages that include post-launch support, but these can add substantial costs. Maintenance and future updates, especially for applications dealing with sensitive financial data, can continue to add to the overall project cost.

Regulatory & Compliance Needs

Financial technology solutions must meet strict legal requirements and industry standards, such as PCI-DSS for payment systems or GDPR for data protection. Developers with experience in these regulations are typically in higher demand and can charge more for their services. Building a solution that adheres to multiple regulatory frameworks adds complexity and raises development costs.

Team Size & Collaboration

The size and structure of your development team will also influence costs. For large and complex projects, a collaborative team involving front-end and back-end developers, UI/UX designers, QA testers, and project managers is often necessary. A larger team with specialized roles means a higher budget, but it also leads to better management, faster delivery, and potentially higher-quality outcomes.

| App Development Team | Hourly Rates (Approx) |

|---|---|

| Project Manager | $25 to $30 |

| Tech Lead (Backend / Frontend) | $28 to $30 |

| Sr. Mobile App Developer | $24 to $30 |

| Sr. Web & Backend Developer | $24 to $30 |

| DevOps | $25 to $30 |

| Business Analyst | $20 to $25 |

| UX/UI | $20 to $25 |

| QA | $20 to $25 |

Reputation and Portfolio

Developers with a strong reputation and proven track record in FinTech can often charge a premium for their services. A well-established developer or agency with a portfolio of successful projects in the financial sector brings credibility and reliability to the table. These developers are likely to produce high-quality, secure, and efficient solutions.

Challenges & Solutions For Hiring Fintech Developers

The process to hire financial software developers involves navigating a range of complexities, including ensuring regulatory compliance and integrating with legacy systems. Overcoming these obstacles is crucial for developing secure and efficient financial technology solutions.

Challenge 1: Ensuring Security and Compliance

Fintech apps must comply with strict financial regulations and protect sensitive user data from cyber threats.

Solution: Fintech developers must prioritize data security and comply with financial regulations like GDPR, PCI DSS, and PSD2.

To tackle this challenge, hire developers with proven experience in secure coding practices and regulatory knowledge. Additionally, conduct regular security audits, implement end-to-end encryption, and stay updated on evolving regulations.

Challenge 2: Complex Integration with Legacy Systems

Many financial institutions use legacy systems, which can be difficult to integrate with modern fintech solutions.

Solution: Engage with finance software developers with expertise in API development and integration frameworks. A modular architecture approach can also make it easier to integrate and scale as needed.

Challenge 3: Handling Large Data Volumes

Fintech apps often deal with massive amounts of data, from transactions to user profiles, which can overwhelm traditional systems.

Solution: Hire developers skilled in cloud computing and big data technologies to scale data storage and processing capabilities. Adopting microservices architecture helps manage large datasets while maintaining performance and reliability.

Challenge 4: High Transaction Speed and Low Latency

Fintech applications must process transactions quickly with minimal delay to ensure user satisfaction.

Solution: Dedicated fintech developers should optimize code for performance, employ caching strategies, and use low-latency databases. A robust infrastructure with load balancing and distributed systems can ensure the app handles high transaction volumes seamlessly.

Challenge 5: User Experience and Accessibility

Fintech apps require a user-friendly interface that simplifies complex financial services and is accessible to all users, including those with disabilities.

Solution: Dedicated FinTech developers can address this by conducting regular user testing, optimizing for mobile platforms, and following the best UX/UI design practices. Accessibility features like voice commands and screen readers can enhance the user experience for diverse audiences.

Discover Top Fintech Software Developers with Appinventiv’s Expertise

When it comes to creating cutting-edge fintech solutions, Appinventiv stands as a leading fintech software development company renowned for delivering innovative, secure, and scalable products. With a proven track record of collaborating with global brands and startups, we specialize in crafting bespoke financial applications that address unique business needs.

Why Appinventiv is the Best Fintech Software Development Company

- Extensive Domain Expertise: Deep understanding of the fintech sector, from payment solutions to blockchain-based platforms.

- Innovative Solutions: Leveraging cutting-edge technologies like AI, blockchain, and IoT to create future-ready applications.

- Secure Development Practices: Ensuring compliance with financial regulations and integrating robust security measures.

- Tailored Approach: Customizing solutions to address unique business needs and user demands.

- Global Recognition: Trusted by leading brands and startups worldwide for delivering high-quality fintech applications.

- Scalable Products: Developing solutions designed to grow alongside your business.

- Exceptional UI/UX: Creating user-friendly, intuitive interfaces that enhance user engagement.

Partner with Appinventiv to redefine financial innovation and build fintech solutions that transform your business.

FAQs

Q. How much does it cost to hire fintech software developers?

A. The cost to hire fintech software developers varies depending on their experience, location, and project complexity. On average, hourly rates range from $60 to $65. Developers with specialized skills in blockchain or financial regulations may charge higher rates. While freelancers may offer more competitive pricing, agencies can provide a broader range of services. It’s essential to clearly define your project needs to align with the developers’ expertise and budget.

Q. How long does it take to develop fintech software?

A. The development duration depends on the scope and complexity of the software. For a basic MVP (Minimum Viable Product), the timeline typically ranges from 3 to 6 months. However, for more advanced fintech solutions with intricate features like AI-driven analytics, blockchain integration, or robust security measures, it may take 6 to 12 months or longer. Clear requirements and agile development practices can help streamline the timeline.

Q. What are the key benefits of working with a fintech software development company?

A. Partnering with a fintech software development company offers numerous benefits:

- Domain Expertise: Access to professionals skilled in fintech technologies and regulatory compliance.

- Tailored Solutions: Custom software designed to meet your unique business requirements.

- Advanced Security: Implementation of top-tier encryption and fraud prevention measures to safeguard sensitive financial data.

- Scalability: Solutions that can grow with your business, accommodating increased users and transactions.

- Faster Time-to-Market: Efficient development processes to launch your product quickly while maintaining quality.

Q. What are the benefits of hiring Fintech software developers?

A. Let’s explore how hiring FinTech software developers can help businesses gain specialized expertise to create secure and innovative financial solutions. With their expertise, businesses can achieve long-term scalability and remain competitive.

- Expertise in Financial Technologies

- Compliance with Financial Regulations

- Improved Security and Risk Management

- Customization of Financial Solutions

- Faster Development and Time-to-Market

Q. What technologies are commonly used in fintech software development?

A. Fintech software development utilizes diverse advanced technologies to create secure and efficient solutions. Common technologies include:

- Blockchain: For secure transactions and decentralized ledgers.

- Artificial Intelligence (AI) and Machine Learning (ML): For fraud detection, credit scoring, and personalized financial recommendations.

- Cloud Computing: For scalable and cost-efficient infrastructure.

- APIs: To enable seamless integration with third-party services like payment gateways.

- Data Analytics Tools: For real-time insights and predictive analysis.

- Cybersecurity Protocols: These include two-factor authentication and data encryption for robust security.

The choice of technology depends on your fintech solution’s specific goals and features.

How Much Does it Cost to Build a Personal Finance App like Pocketsmith?

Imagine an app that knows when your rent is due, reminds you of upcoming bills, forecasts your savings 12 months ahead, and tells you if that third coffee this week is wrecking your budget. That’s the kind of experience apps like PocketSmith deliver, and it’s exactly why personal finance apps are becoming a must-have for…

How Much Does it Cost to Build a Mobile Banking App Like Halifax in the UK?

The way people bank has changed dramatically. Gone are the days of waiting in long queues or rushing to a branch before closing hours. Today, mobile banking apps like Halifax have redefined convenience, allowing users to check balances, transfer funds, pay bills, and even apply for loans from their smartphones, anytime and anywhere. This shift…

How to Approach Currency Converter App Development?

Imagine you’re about to travel abroad and need to quickly check how much your local currency is worth in another country, or perhaps you run an international business and constantly deal with multiple currencies. In both cases, a currency converter app is an indispensable tool. With global transactions becoming the norm and forex markets fluctuating…