- How Digital Transformation is Powering FinTech’s Explosive Growth

- Key Benefits of Digital Transformation in FinTech

- Greater Lending Flexibility

- Channeling Digital FinTech Offerings

- Processing Data for Operational Efficiency

- Simplifying Complexities

- Accelerated Innovation with Cloud Adoption

- Enhanced Customer Personalization

- Digital Transformation Trends in Financial Services

- Growing Enterprise Agility

- Big Data for Driving Innovation

- Mobile Pay Utilities

- Using RPA for Streamlining Operations

- Embedded Finance Integration

- Decentralized Finance (DeFi) Growth

- AI-Powered Chatbots and Virtual Assistants

- Green FinTech and ESG Integration

- RegTech for Compliance Automation

- Generative AI in Financial Services

- Regulatory Compliance: The Bedrock of FinTech Digital Transformation

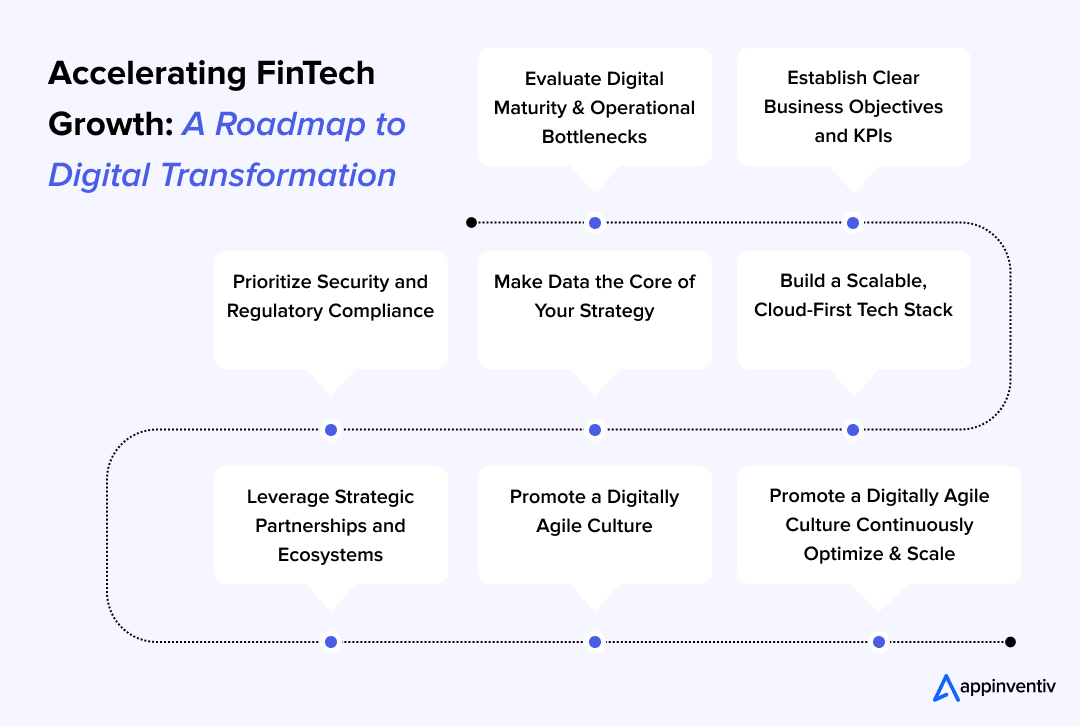

- The Essential Roadmap for FinTech Digital Transformation

- Evaluate Digital Maturity and Operational Bottlenecks

- Establish Clear Business Objectives and KPIs

- Build a Scalable, Cloud-First Tech Stack

- Make Data the Core of Your Strategy

- Prioritize Security and Regulatory Compliance

- Leverage Strategic Partnerships and Ecosystems

- Promote a Digitally Agile Culture

- Continuously Optimize and Scale

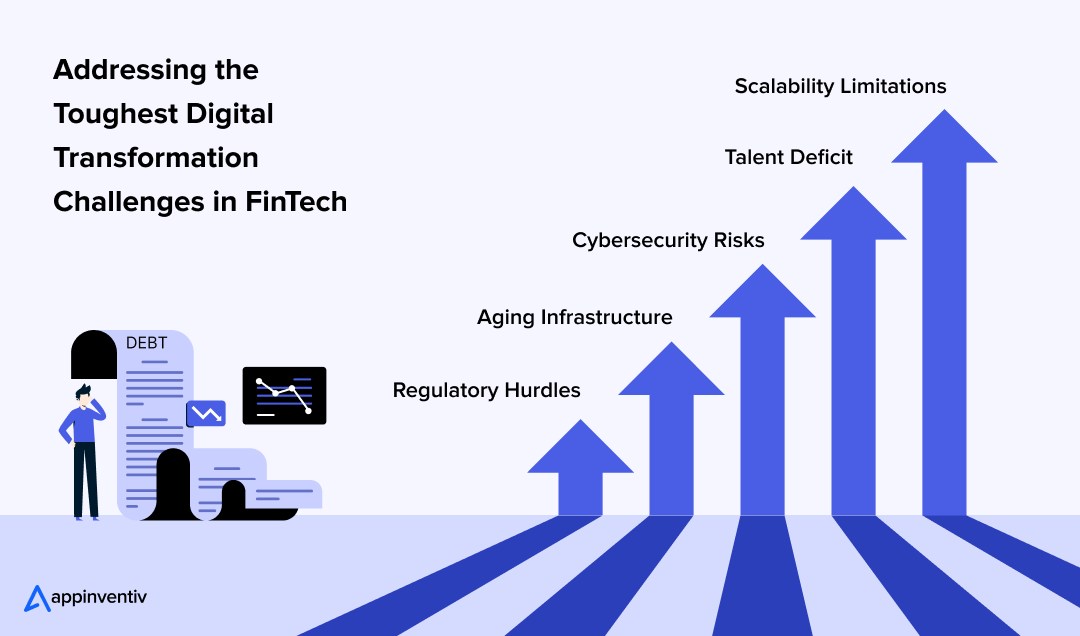

- Challenges of Digital Transformation in FinTech and Solutions to Overcome Those

- Regulatory Hurdles

- Aging Infrastructure

- Cybersecurity Risks

- Talent Deficit

- Scalability Limitations

- Initiate Your Digital FinTech Transformation With Appinventiv’s Expertise

- FAQs

Key takeaways:

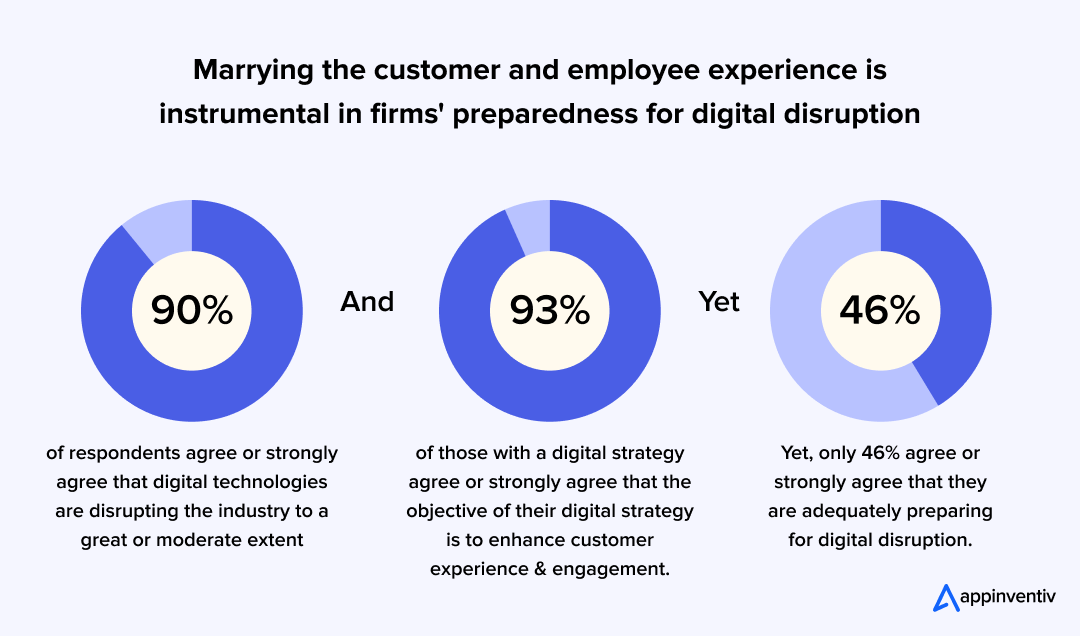

- About 90% of financial services respondents agree that digital tech is disrupting the industry, driving widespread FinTech digital transformation.

- Benefits of digital transformation in FinTech include greater lending flexibility, improved operational efficiency, simplified customer journeys, cloud-enabled innovation, and enhanced personalization.

- Key trends include the growth of mobile banking, embedded finance, AI chatbots, decentralized finance, robotic process automation (RPA), green FinTech, and regulatory technology (RegTech) compliance.

- Challenges include regulatory complexity, legacy infrastructure, cybersecurity risks, talent gaps, and the need for scalability.

In 2024, FinTech Federal Credit Union in Austin, Texas, significantly revamped its mobile banking platform by integrating biometric authentication and contactless payment options.

This digital transformation resulted in a remarkable 60% increase in monthly active users and a 40% reduction in fraudulent transactions within just six months, thereby enhancing both security and customer trust. This example reflects a broader industry trend in which FinTech companies are leveraging cutting-edge technologies to improve user experience and security.

According to a recent Deloitte report, around 90% of FinTech leaders agreed or strongly agreed that digital technologies are fundamentally disrupting the financial services sector. Such disruption is driving widespread digital transformation FinTech initiatives, as financial institutions strive to innovate and stay ahead.

This transformation goes beyond just adopting new technologies; it’s about creating smarter, faster, and more personalized financial services. From AI-driven customer service platforms to blockchain-powered payments, FinTech innovations are transforming the way financial services operate and interact with users.

In this blog, we’ll dive into the key drivers fueling digital transformation in FinTech, explore how it’s reshaping the industry’s future, and highlight its benefits and real-world applications. We’ll also cover essential compliance requirements and discuss the opportunities and challenges that lie ahead for both businesses and consumers. Let’s explore together.

How Digital Transformation is Powering FinTech’s Explosive Growth

While the financial services industry has traditionally been cautious and slow to embrace innovation, the pandemic dramatically reshaped this landscape. It accelerated tangible change through rapid physical and digital transformation FinTech initiatives, compelling the industry to rise to the challenge of providing businesses with powerful computing systems.

These shifts are also driven by evolving consumer behavior and new trends favoring cashless and contactless transactions. The following stats highlight the swift adoption of digital transformation in FinTech worldwide:

- By 2029, over 79% of the U.S. population is expected to use digital banking, reflecting the sector’s accelerating adoption. (Source: Statista)

- Deloitte’s 2024 report reveals that the top 10% of banks are setting benchmarks in digital maturity, leading in innovation and tech adoption. (Source: Deloitte)

- In 2025, 96% of banks plan to invest in online banking, with similar commitments to mobile (95%) and SMS/email banking (95%). (Source: KPMG)

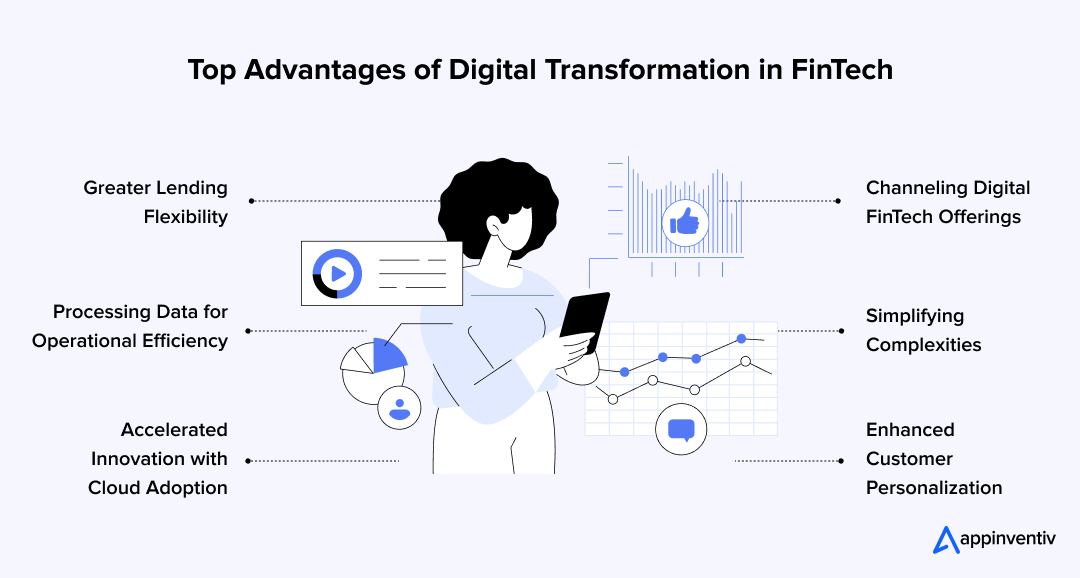

Key Benefits of Digital Transformation in FinTech

If you want to keep your finance firm competitive in the industry and meet consumer demands, you must implement digital finance initiatives to keep pace with today’s innovation. Keeping that in mind, here are the key benefits of digital transformation in financial services:

Greater Lending Flexibility

In the current system, traditional lending models make themselves ineffective because they are not built to scale, designed to measure, and therefore, seem to impose a barrier on SMEs to earn money. Legacy application modernization services offer a compelling solution by enabling a seamless transition to automated, paperless systems, bringing the agility and efficiency that modern lending demands.

A cloud-based lending approach can be a game-changer, enabling the development of APIs that seamlessly integrate with asset systems to deliver a scalable, sustainable, and digitally optimized lending solution.

Channeling Digital FinTech Offerings

The rapid adoption of digital platforms during the pandemic has fueled growing demand for digital payment systems, wallets, and credit cards. At the same time, SMEs and FinTech startups worldwide are leveraging fast, secure, and infrastructure-backed FinTech solutions to access digital profits and loans with greater ease and efficiency.

With increasing consumer awareness and SMEs warming up to the idea of using digital finance solutions to drive their financial operations, the FinTech industry is poised to make the most of digital transformation.

Processing Data for Operational Efficiency

With digital lending platforms getting equipped with innovative features, such as video-based or social security-based and personal identity, financial consultants can easily access customer data and get their approval, ensuring better efficiency.

Outsourcing FinTech data analytics services can help improve the understanding of customer portfolios to enable better credit processing. Another useful area where data can be utilized is in detecting fraudulent activity, where customer behavior is recorded and analyzed to identify potential fraud.

Simplifying Complexities

In this competitive financial landscape, ensuring that online processes are highly secure, simple, and effective is crucial. This is where digital transformation in FinTech services comes into play. Advanced digital solutions not only simplify the complexities of the financial sector but also make processes more customer-friendly for users.

For instance, a feature-rich FinTech application can serve multiple purposes while automating processes and enhancing the customer experience. Therefore, digital transformation in the financial sector is essential.

Accelerated Innovation with Cloud Adoption

One of the biggest enablers of digital transformation in FinTech is cloud technology. Migrating core operations to the cloud gives FinTech companies the flexibility to scale infrastructure on demand and roll out new digital financial products at speed.

Cloud-based platforms also enable agile-based development, expedited deployment cycles, and seamless integration of third-party services. This shift improves team collaboration, supports real-time updates, and ensures business continuity even in dynamic market environments.

Enhanced Customer Personalization

A key driver of digital transformation in FinTech is the ability to deliver deeply personalized customer experiences. By leveraging big data, AI, and behavioral analytics, financial institutions can gain real-time insights into individual user preferences, financial habits, and risk profiles.

This enables them to offer hyper-personalized products such as custom loan plans, spending insights, or investment advice that meet unique customer needs. With digital transformation for banking and FinTech services at the core, companies can elevate customer engagement, build lasting relationships, and drive higher conversion rates.

Digital Transformation Trends in Financial Services

The finance sector has undergone one of the most significant shifts due to the rise of digital transformation. Traditionally reliant on manual processes and face-to-face interactions, the FinTech industry is now embracing a new era of digital innovation. This evolution has become a strategic imperative, enabling companies to enhance customer experiences through the development of modern, tech-driven products and services.

On that note, below are a few FinTech trends that are revolutionizing the future of this sector:

Growing Enterprise Agility

After numerous experiences gained from the previous financial crisis, an organization’s ability to expand its agility has become a vital trend in the industry. However, to support the type of constant advancement and improvement that shapes the foundation of agility, financial organizations need quick, reliable access to growing amounts of information without tedious manual work processes.

Big Data for Driving Innovation

The financial sector has already realized the potential of big data analytics. Financial institutions and banks are now thinking up new ways to market their services and use big data to offer more personalized services to their customers.

One of the most crucial ways the FinTech sector can leverage the vast amounts of consumer data is by using it to train machine learning (ML) algorithms to automate their processes, thereby saving staff hours of work.

Mobile Pay Utilities

A decade ago, there was a time when mobile wallets were a totally new concept to people. With time, the methods of putting away riches and making payments are also changing. Mobile wallets have become the norm for payment. Whether it’s merchants, shopping malls, or other sellers, they like to utilize mobile payments over traditional cash and checks.

Other than that, we also have “Buy Now Pay Later” apps, like Tabby, that offer users great convenience for making purchases and paying later. All thanks to the comfort, security, and ease of availability offered by mobile wallets, which have provided a route to digital development in the finance sector over the years.

Also Read: How much does it cost to build an app like Tabby?

Using RPA for Streamlining Operations

Financial institutions are under immense pressure to optimize their costs, generate higher ROI, and boost productivity. RPA has become their saving grace, already driving greater efficiency and increasing productivity business-wide.

RPA helps streamline businesses by automating repetitive and manual office tasks typically performed by bank staff. It also helps reduce common errors and inefficiencies. According to Gartner, around 80% of finance leaders have implemented or plan to implement RPA. Thus, RPA is playing a major role in bringing digitalization to the finance sector.

Embedded Finance Integration

Embedded finance allows non-financial platforms like eCommerce stores, logistics apps, or travel portals to integrate financial services such as payments, lending, insurance, or even investment tools directly into their user interface.

For example, businesses are now offering buy-now-pay-later (BNPL) options or one-click insurance without needing a separate app. This seamless integration enhances the customer experience, increases conversions, and provides SMEs with new revenue channels. It’s reshaping the way financial services are consumed, making them more contextual, real-time, and accessible.

Decentralized Finance (DeFi) Growth

DeFi’s popular trends are the game-changers in the FinTech space, offering financial services such as lending, borrowing, trading, and saving without relying on traditional banks or intermediaries. Instead, these services operate on blockchain networks, utilizing smart contracts that are transparent, immutable, and accessible to anyone with an internet connection.

For SMEs, DeFi platforms provide easy access to funding, facilitate cross-border transactions, and offer investment opportunities. With lower transaction fees and greater transparency, DeFi opens up inclusive and democratized finance for emerging markets.

AI-Powered Chatbots and Virtual Assistants

The role of AI in the digital transformation of the FinTech sector is reshaping how companies engage with their customers. AI banking chatbots and voice-enabled virtual assistants are enhancing processes like customer support, onboarding, loan processing, and handling FAQs. By utilizing machine learning and natural language processing (NLP), these tools enable human-like interactions, offer 24/7 availability, and provide instant query resolution.

They also personalize conversations based on past customer behavior and preferences, resulting in higher satisfaction and retention. For SMEs, these AI-driven solutions significantly reduce support costs while ensuring consistent service quality at scale.

At Appinventiv, we partnered with Mudra to create an innovative, AI-powered budgeting application designed to transform personal finance management. The platform is centered around an intelligent, chatbot-driven interface that guides users in tracking expenses, setting financial goals, and managing their budgets with ease.

After six months of careful design and development, Mudra is now poised for deployment across 12+ countries, offering users an intuitive and efficient way to manage their budgets.

Green FinTech and ESG Integration

Sustainability is becoming increasingly central to FinTech strategies, with a growing focus on ESG (Environmental, Social, and Governance) goals. Green FinTech platforms are emerging to help businesses and consumers measure carbon footprints, track ESG performance, and invest in sustainable assets.

Some FinTech apps now let users round up spare change to support green projects or display the environmental impact of their spending. For SMEs, aligning with ESG principles can attract impact investors, reduce risk exposure, and contribute to a more responsible financial ecosystem.

RegTech for Compliance Automation

RegTech is helping FinTech firms manage compliance efficiently using automation, AI, and data analytics. These tools monitor regulatory changes, flag non-compliance risks, and automate KYC (Know Your Customer) and AML (Anti-Money Laundering) processes in real time.

With regulatory demands increasing across regions, RegTech provides financial firms with a cost-effective and agile way to stay compliant while reducing manual errors. This mitigates risk and builds trust with customers and regulators alike.

Generative AI in Financial Services

Generative AI in finance is revolutionizing the creation of financial content, documents, and interactions. From automating personalized investment reports to generating tailored loan offers or simulating economic scenarios, GenAI brings powerful new capabilities to FinTech products.

It enables faster innovation cycles, enhanced customer communication, and intelligent decision-making. For SMEs, generative AI can unlock cost-effective ways to deliver highly customized financial products and experiences without large-scale infrastructure.

Regulatory Compliance: The Bedrock of FinTech Digital Transformation

Regulatory compliance stands as a paramount challenge and a non-negotiable aspect of FinTech digital transformation. Unlike many other industries, financial services are inherently characterized by stringent regulations to safeguard consumers, prevent financial crime, and maintain market stability.

As FinTech innovations push the boundaries of traditional finance, they often encounter regulatory frameworks that are not yet fully adapted to new technologies and business models. Let’s have a look at the top regulatory compliances in FinTech digital transformation:

- AML (Anti-Money Laundering) & KYC (Know Your Customer): These regulations require financial institutions to verify customer identities and monitor transactions to detect and prevent financial crimes, such as money laundering and terrorist financing.

- PCI DSS (Payment Card Industry Data Security Standard): A global standard mandating security controls for organizations that store, process, or transmit cardholder data. Adherence to PCI DSS ensures secure handling of credit and debit card information.

- ISO 27001 (Information Security Management System): An international standard that provides a framework for organizations to establish, implement, maintain, and continually improve their information security management system.

- SOC 2 (System and Organization Controls 2): A report evaluating an organization’s internal controls related to security, availability, processing integrity, confidentiality, and customer data privacy.

- Dodd-Frank Act: A comprehensive US federal law enacted in response to the 2008 financial crisis, aiming to promote financial stability by increasing accountability and transparency in the financial system.

- CCPA (California Consumer Privacy Act): A California state law granting consumers extensive rights regarding their data, including the right to know, delete, and opt out of the sale of their information.

- NYDFS Cybersecurity Regulation (23 NYCRR 500): A specific regulation from the New York Department of Financial Services that requires financial institutions operating in New York to implement robust cybersecurity programs.

- FFIEC (Federal Financial Institutions Examination Council) Compliance: Guidelines for US financial institutions on cybersecurity, IT risk management, and consumer compliance, ensuring sound operations and consumer protection.

- SOX (Sarbanes-Oxley Act): A US federal law that set new or expanded requirements for all US public company boards, management, and public accounting firms, primarily focused on financial reporting and internal controls.

The Essential Roadmap for FinTech Digital Transformation

To stay competitive in the ever-evolving financial landscape, FinTech firms must embrace a structured and scalable approach to digital transformation. Here’s a step-by-step FinTech digital transformation roadmap or strategy that can help guide your digitalization journey:

Evaluate Digital Maturity and Operational Bottlenecks

Begin by assessing your current digital infrastructure, workflows, and service delivery methods. Identify inefficiencies and legacy systems that hinder scalability or negatively impact the customer experience. This evaluation lays the groundwork for setting transformation priorities and aligns with broader corporate FinTech digital transformation goals.

Establish Clear Business Objectives and KPIs

Every phase of your transformation should support tangible business goals, be it faster loan processing, better fraud detection, or broader customer acquisition. Define key performance indicators to measure progress, optimize outcomes, and ensure alignment with your broader digital transformation FinTech roadmap.

Build a Scalable, Cloud-First Tech Stack

Invest in modular, cloud-based technologies that can grow with your business. Open FinTech APIs, artificial intelligence, and automation tools help speed up innovation while keeping costs under control. A future-ready tech stack is essential for enabling digital transformation for FinTech services at scale.

Make Data the Core of Your Strategy

Use real-time data analytics to personalise customer experiences, evaluate credit risks, and detect fraudulent activity. Data-driven decisions help FinTechs improve accuracy, reduce costs, and tailor products more effectively to user needs, critical components of a successful digital transformation FinTech approach.

Prioritize Security and Regulatory Compliance

Secure digital growth requires strong data protection and adherence to financial regulations like GDPR, AML, and PSD2. Automating compliance processes and using advanced threat detection ensures both customer trust and regulatory alignment during your transformation journey.

Leverage Strategic Partnerships and Ecosystems

Rather than developing everything internally, forge alliances with API providers, neobanks, and FinTech platforms to expand capabilities rapidly. This ecosystem approach accelerates corporate FinTech digital transformation by introducing innovation and reducing time-to-market.

Promote a Digitally Agile Culture

Encourage a digital-first mindset throughout your organization by driving agility, continuous learning, and team-wide adoption of new tools. Building this internal capability is essential for sustaining long-term innovation and aligning people with the goals of digital transformation for FinTech services.

Continuously Optimize and Scale

Digital transformation is not a one-time event; it’s a continuous journey. Regularly assess the performance of your digital initiatives, gather feedback, and iterate on your offerings. This adaptive approach ensures that corporate FinTech digital transformation efforts remain relevant, scalable, and aligned with evolving market dynamics.

Challenges of Digital Transformation in FinTech and Solutions to Overcome Those

Digital transformation in the FinTech industry is a dynamic process, fraught with specific challenges that demand innovative solutions. Here’s a look at the key hurdles and how they can be overcome:

Regulatory Hurdles

The highly regulated nature of finance complicates FinTech digital transformation. Evolving laws on data privacy, AML, and KYC create a complex compliance landscape across different regions, slowing innovation.

Solution: Proactively engage with regulators and leverage RegTech solutions to automate compliance. Build products with “privacy by design” from the outset to embed compliance seamlessly.

Aging Infrastructure

Many traditional financial institutions contend with outdated IT systems. These legacy platforms are rigid, tough to integrate with new digital solutions, and costly to maintain, leading to data silos.

Solution: Opt for a phased legacy modernization. Use APIs to connect old systems with new digital apps. Consolidate fragmented data into data warehouses for unified analytics and better customer insights.

Cybersecurity Risks

Digital transformation for FinTech services inherently expands the attack surface. Handling sensitive financial data makes these companies prime targets for evolving cyber threats like ransomware and data breaches.

Solution: Implement multi-layered security like strong encryption technology, multi-factor authentication, and continuous threat detection. Utilize AI for anomaly detection and conduct regular security audits.

Talent Deficit

There’s a significant shortage of professionals skilled in emerging technologies crucial for FinTech digital transformation, such as AI, blockchain, and cloud computing. This, coupled with cultural resistance to change, hinders adoption.

Solution: Invest in upskilling existing staff through training. Collaborate with universities to build a talent pipeline and foster a culture of innovation and offer competitive incentives to attract top tech talent.

Scalability Limitations

As FinTech apps gain traction, they must handle rapidly increasing transaction volumes and users without performance dips. Building systems that can scale efficiently without costly re-architecture is a key challenge.

Solution: Embrace cloud-native architectures like microservices and serverless computing for inherent flexibility. Implement robust load balancing and auto-scaling. Conduct regular performance testing and capacity planning to manage growth effectively.

Initiate Your Digital FinTech Transformation With Appinventiv’s Expertise

As digital transformation for FinTech services continues to accelerate, the emphasis shifts from simply digitizing existing processes to fundamentally rethinking financial interactions. This evolution is shaping a future where financial services are more accessible, personalized, efficient, and secure than ever before. The journey involves not just creating digital solutions but fostering a culture of agility, compliance by design, and proactive risk management.

As industry leaders in digital transformation services, Appinventiv has been instrumental in guiding their clients through this intricate landscape, demonstrating how effective digital FinTech transformation can lead to tangible success.

For instance, Appinventiv’s work with Edfundo focused on building an intuitive digital platform that simplified financial education and money management for students, directly addressing the need for accessible and user-friendly financial tools.

These FinTech digital transformation examples highlight how a FinTech software development company like Appinventiv, armed with deep regulatory knowledge and cutting-edge technologies helps financial businesses stay resilient and future-ready.

Still playing catch-up with your digital transformation? Let’s change that.

Get in touch with our experts now!

FAQs

Q. What is the role of digital transformation in the FinTech sector?

A. Digital transformation in the FinTech sector helps modernize financial services by using technologies like AI, cloud computing, and data analytics. It streamlines operations, enhances security, and enables faster, more customer-focused services such as automated lending and real-time payments.

It also supports better scalability, compliance, and innovation. With digital transformation in FinTech, companies can offer personalized experiences, improve risk management, and stay agile in a rapidly evolving market.

Q. How much does digital transformation in FinTech costs?

A. The cost of digital transformation in FinTech can vary significantly based on factors such as the size of the organization, project scope, and the technologies being implemented. For startups or small FinTech firms, the investment typically ranges between $50,000 to $500,000. This generally covers essentials like basic app development, cloud migration, and limited AI or data analytics integration.

However, for mid-sized to large enterprises, a comprehensive digital transformation initiative can cost anywhere from $500,000 to several million dollars. These higher costs often reflect the complexity of integrating legacy systems, meeting strict regulatory requirements, deploying enterprise-grade infrastructure, and incorporating advanced technologies such as AI, machine learning, and cybersecurity solutions.

To get a detailed cost breakdown of digital transformation in FinTech, connect with our experts now.

Also Read: Cost to Build a FinTech App: What You Need to Know

Q. Which tech stack do you leverage for digital transformation in FinTech?

A. For ensuring smooth digital transformation in the FinTech industry, the choice of technology stack is crucial to ensure scalability, security, and seamless user experience. The tech stack used for digital transformation in FinTech typically includes a combination of modern programming languages like Python, Java, and JavaScript for backend and frontend development. Cloud platforms such as AWS, Microsoft Azure, and Google Cloud provide the necessary infrastructure for flexible and scalable operations.

Q. What are some of the top digital transformation trends in the FinTech?

A. Here are some of the top digital transformation trends in the FinTech sector as of 2025:

- Generative AI and Automation

- Open Banking and Open Finance

- Embedded Finance

- Hybrid Cloud Adoption

- Blockchain and Distributed Ledger Technology

- Cybersecurity and Compliance

- Personalized Customer Experiences

- Digital Identity Verification

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How To Build a Digital Twin App? All You Need To Know

Key takeaways: IoT, AI, cloud computing, and data analytics are the main technologies for making real-time, predictive digital twins. Digital twins are revolutionizing the manufacturing, healthcare, and energy sectors and providing significant operational efficiency and cost reduction. 5G, edge computing, and AR/VR not only lift digital twin performance but also provide fast data processing and…

How Enterprises Can Successfully Integrate Emerging Technologies into Their Workflows

Key Takeaways Big changes fail when rushed. Begin with small pilots, measure results, and use emerging tech to scale without breaking what works today. Clean, connected data and strong security are the backbone of successful technology integration. Get those right before layering on AI, IoT, or automation. Don’t chase every new tool. Match tech to…

Digital Transformation Strategies You’ll Wish You Knew Sooner

Key takeaways: Think Big, Not Small: Digital transformation market will reach USD 3,289.4 billion by 2030. Update Legacy Tech: Outdated systems? Modernize them now to boost efficiency and save costs. Go Cloud and API First: Focus on flexible, scalable cloud solutions and APIs for faster, more efficient operations. Make Tech Work for Business: Your tech…