- FinTech Investment Landscape: Key Stats and Growth Trajectory

- 20 FinTech Trends You Must Act On in 2025

- 1. WealthTech

- 2. Next-Gen Digital-Only Banks

- 3. Voice Commerce

- 4. Enhancements in AI-Powered Banking Chatbots

- 5. Incorporation of Big Data in FinTech Processes

- 6. Enhanced ‘A’ Rated Life Insurance Carriers

- 7. Public Cloud to be the New Infrastructure Model

- 8. Cybersecurity as a Pillar of FinTech Domain

- 9. Rise of Financial Regulations and RegTech Companies

- 10. Advanced Banking-as-a-Service (BaaS) Ecosystems

- 11. Personalized Embedded Finance

- 12. Quantum Computing for Financial Modeling

- 13. Decentralized Stablecoins for Global Commerce

- 14. Hyper-Automated Conversational Banking

- 15. Green and Ethical FinTech Solutions

- 16. DeFi 2.0: Institutional Integration

- 17. Digital Asset Tokenization

- 18. Biometric Payment Innovations

- 19. Financial Health-as-a-Service (FHaaS)

- 20. Rise of Buy Now, Pay Later (BNPL) Solutions

- How FinTech Leaders are Adopting the Latest Financial Trends: Top Use Cases

- JP Morgan’s Use of Quantum Computing for Advanced Financial Modeling

- Klarna’s Redefinition of Consumer Credit with Flexible BNPL Solutions

- Aave’s Innovation in DeFi Lending for the Future of Finance

- Securitize’s Leadership in Digital Asset Tokenization

- Maximize FinTech Possibilities with Appinventiv’s Support

- FAQs

“Banking is necessary, banks are not,” declared Bill Gates in 1994.

Nearly three decades later, his words resonate louder than ever. FinTech has not just disrupted traditional banking; it has reimagined how we interact with money. Today, managing loans, making investments, and securing insurance is as easy as a few taps on a smartphone.

As we move into 2025, the pace of FinTech innovation is picking up steam. New trends like AI-powered wealth management transform financial advice through personalized experiences, while embedded finance seamlessly integrates payment and lending solutions into non-financial platforms. This makes transactions smoother and more convenient than ever before.

Sustainability is also a key focus, with FinTech companies increasingly committing to practices promoting environmental and social responsibility.

The future of FinTech isn’t just about change; it’s about building a more inclusive and efficient financial ecosystem for everyone.

In this blog, we’ll dive into the top FinTech trends to reshape the industry and explore how top FinTech giants leverage these innovations. But first, let’s take a closer look at some key statistics shaping the FinTech landscape.

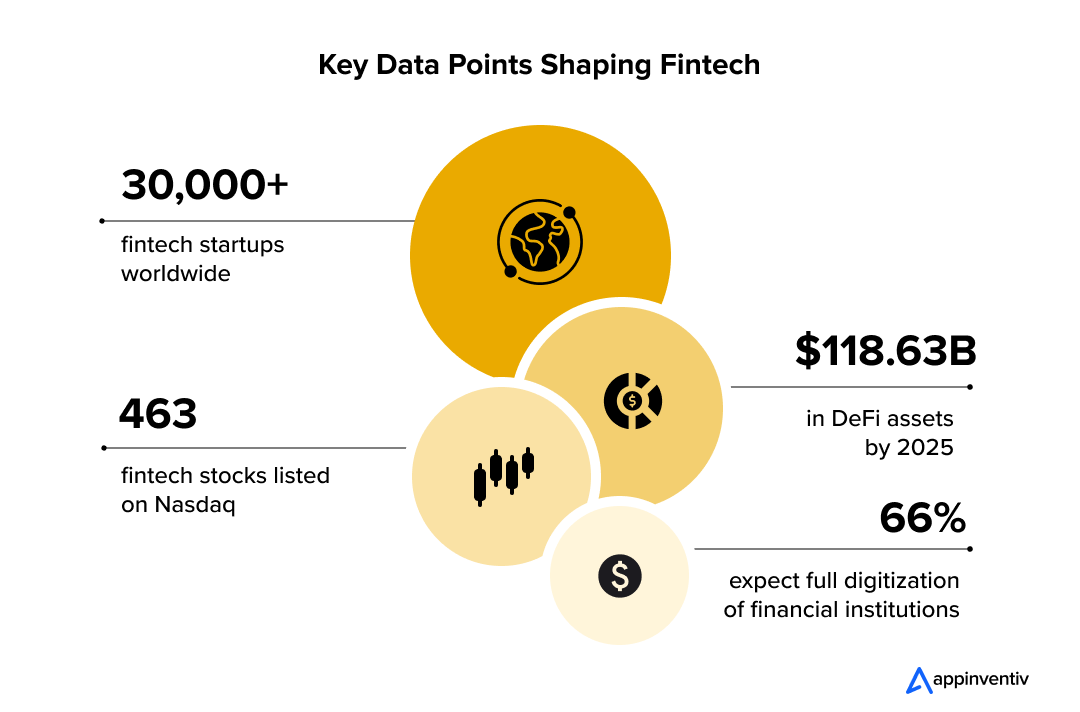

FinTech Investment Landscape: Key Stats and Growth Trajectory

The FinTech investment landscape is undergoing a revolutionary shift, fueled by a surge in digital adoption and cutting-edge technologies transforming the financial sector. According to PwC, With global FinTech investments anticipated to surpass $37 billion by 2026, the focus is rapidly moving toward breakthrough innovations like blockchain, AI-driven solutions, and seamless digital payments.

The growth of neobanks, decentralized finance (DeFi), and embedded finance is challenging traditional financial structures and unlocking new avenues for emerging startups and established players. As FinTech progresses, trends such as financial inclusion, smart contracts, and real-time transactions pave the way for next-generation financial ecosystems.

Let’s check out some of the recent statistics on the FinTech industry trends:

With such extraordinary FinTech developments and innovation, what does the future hold?

Which emerging global FinTech trends will revolutionize how businesses and consumers engage with financial services? Let’s dive into the transformative technologies and trends reshaping the economic landscape and paving the way for a smarter, more connected tomorrow.

20 FinTech Trends You Must Act On in 2025

As we move into 2025, the world of FinTech is set to experience unprecedented transformations, redefining how we interact with financial services. Staying ahead means understanding the transformative trends that are revolutionizing the delivery of financial services. Let’s have a look at those. Let’s have a look at those.

1. WealthTech

WealthTech or FinTech in wealth management leverages technology to enhance and democratize wealth management, offering innovations like digital investment platforms and AI-powered financial planning tools. These platforms use financial data analytics and algorithms to help individual investors make informed decisions aligned with their financial goals and risk tolerance. With lower fees and user-friendly interfaces, WealthTech makes managing investments accessible to a broader audience.

The WealthTech trend is growing as traditional wealth management firms adapt to new technologies. These platforms provide investment advice and tools for financial planning, tax optimization, and retirement.

2. Next-Gen Digital-Only Banks

A rapid increase has been witnessed in partnerships among FinTech companies and banking institutions, promoting the emergence of new financial intermediaries. Now, digital-only banks are gaining unprecedented popularity, which was not anticipated in this decade.

With an additional time economy option, these Digital-only banks offer their customers an even more diverse array of services. Disruptive technologies like blockchain and cryptocurrency heavily influence digital-only banking FinTech trends for the year.

Also Read: Digital Transformation in Banking Applications and Benefits

3. Voice Commerce

Voice commerce, driven by voice-activated assistants like Amazon Alexa, Google Assistant, and Siri, allows consumers to make purchases, manage finances, and access services using voice commands. This FinTech technology trend transforms consumer behavior by offering a convenient, hands-free shopping and banking experience, improving accessibility for those with disabilities, and providing a faster, more intuitive way to interact with technology.

In FinTech, voice commerce is integrated into retail, banking, and financial management applications. Consumers can pay bills, track spending, and get investment advice through voice commands. As voice recognition and security features like voice biometrics improve, voice commerce is becoming a secure and increasingly popular transaction method, particularly in smart homes and connected devices.

4. Enhancements in AI-Powered Banking Chatbots

AI-powered chatbots are transforming banking by delivering 24/7 support, reducing costs, and enhancing customer experiences, and is considered one of the top trends in financial technology. Leveraging machine learning (ML) and natural language processing (NLP), these chatbots go beyond answering queries, offering personalized financial advice, real-time updates, and fraud alerts. Leading banks like Commonwealth Bank of Australia (Ceba), Bank of America (Erica), and HDFC Bank (Eva) are setting industry standards with their innovative chatbot applications.

In the future, chatbots will evolve into proactive financial assistants, predicting customer needs, offering tailored solutions, and detecting transaction anomalies to mitigate risks. They will also play a crucial role in regulatory compliance, analyzing data to flag potential issues. As the adoption rate grows, AI chatbots will redefine banking with greater personalization, transparency, and efficiency.

At Appinventiv, we developed an AI chatbot application, Mudra, an innovative chatbot-based platform that redefines personal budget management. After six months of careful design and development, Mudra is prepared for a global launch across more than 12 countries.

This cutting-edge solution is equipped with interactive features to enhance user engagement and deliver personalized financial insights, offering a seamless and intuitive approach to budgeting. With Mudra, we aim to transform how individuals manage their finances, setting a new benchmark in the FinTech sector.

Also Read: AI Chatbots in Banking: Application & Advantages

5. Incorporation of Big Data in FinTech Processes

In 2025, big data, one of the latest FinTech trends, is revolutionizing FinTech by enhancing customer segmentation, risk management, and fraud detection. FinTech companies use data to segment customers based on age, location, and spending habits, allowing them to offer highly personalized financial products and services tailored to individual needs.

Big data also plays a crucial role in improving risk management through predictive analytics, helping companies assess credit risk and avoid poor investments. Additionally, it strengthens fraud detection techniques by analyzing user behavior patterns to identify suspicious activities in real-time. As big data continues to shape FinTech, it will drive more personalized, secure, and efficient financial services.

6. Enhanced ‘A’ Rated Life Insurance Carriers

The insurance industry continues to embrace technological advancements, with enhanced ‘A’ rated life insurance carriers at the forefront. Through data analytics and AI in insurance, providers can now offer term coverage of up to $1 million without requiring medical exams. Instead, they rely on data-driven insights from customer profiles, including prescription history and medical questionnaires, to streamline the approval process.

This evolution is revolutionizing how life insurance is written, making it faster, more efficient, and accessible for a wider range of consumers. With these advancements, obtaining life insurance is no longer a lengthy or invasive process, marking a significant shift in the industry toward data-centric, customer-friendly solutions.

7. Public Cloud to be the New Infrastructure Model

Public cloud infrastructure has become the financial services industry’s cornerstone, revolutionizing core and non-core functions. Financial institutions now rely on cloud solutions for essential services like consumer payments, credit scoring, and financial statements, transforming these into utilities that drive efficiency and innovation.

The adoption of the public cloud has allowed banks and FinTech companies to scale faster, cut costs, and improve service delivery, all while maintaining strong security and compliance. As the industry becomes increasingly digital, the public cloud continues to power agility and seamless user experiences across the financial landscape.

Also Read: Cloud Computing in Banking: All You Need to Know Before Moving to the Cloud

8. Cybersecurity as a Pillar of FinTech Domain

The future sees cybersecurity as a critical pillar of the FinTech industry in 2025 and beyond. With the rapid progress in financial technology trends, the threat of cybercrime has grown exponentially, pushing financial institutions to prioritize protecting sensitive data and digital assets. In response, advanced security systems and next-generation tools have been developed to counter these risks and ensure the integrity of financial operations.

Integrating AI in FinTech trends has further strengthened cybersecurity efforts, particularly through cyber risk analytics that enable real-time threat detection and mitigation. As the FinTech landscape evolves, these innovations will remain essential in maintaining robust security and safeguarding customer trust, making cybersecurity a key driver of future success in the industry.

9. Rise of Financial Regulations and RegTech Companies

With tightening regulations surrounding data sharing and financial transparency, RegTech firms are stepping up to offer innovative solutions that streamline compliance processes. These technologies are transforming key areas such as transaction monitoring, risk management, KYC (Know Your Customer), and AML (Anti-Money Laundering) compliance, providing financial institutions with the tools to meet regulatory requirements more efficiently.

As financial institutions face increasingly complex regulatory environments, the demand for automated compliance and risk management solutions continues to surge. RegTech is helping to improve efficiency and fostering greater transparency and consumer trust, solidifying its role as an essential pillar of the evolving FinTech sector.

10. Advanced Banking-as-a-Service (BaaS) Ecosystems

Banking-as-a-Service (BaaS) is evolving from simple integrations to full-fledged ecosystems where businesses can launch branded financial products without the burden of building and maintaining complex financial infrastructures. These ecosystems, powered by modular APIs, enable seamless integration of services like loans, credit cards, and digital wallets, making them accessible to startups, e-commerce platforms, and non-financial businesses.

In 2025, BaaS providers are expected to offer niche solutions tailored to specific industries, such as specialized lending products for small businesses or crypto wallets for tech-savvy consumers. This trend democratizes access to financial innovation, allowing smaller companies to compete with established financial institutions.

11. Personalized Embedded Finance

Embedded finance for enterprises is transforming, where hyper-personalized financial services are seamlessly woven into non-financial platforms, enhancing user experiences and driving greater efficiency. By utilizing AI and big data, businesses can now provide customized financial offerings such as tailored insurance policies, savings plans, and real-time credit options based on user preferences and behavior. For instance, fitness apps could recommend health insurance policies or reward programs, while eCommerce platforms offer dynamic installment payment plans based on a customer’s purchase history and credit profile.

This trend promises to deepen customer engagement, enhance convenience, and create new revenue streams for businesses across various sectors. As more companies adopt personalized embedded finance, they can differentiate themselves by offering financial services that cater specifically to the unique needs of their customers.

12. Quantum Computing for Financial Modeling

Quantum computing is making strides in transforming financial modeling by solving complex calculations beyond classical computers’ capabilities. FinTech companies are exploring quantum algorithms to optimize investment portfolios, enhance risk management, and price financial derivatives with unprecedented accuracy. This technological leap is particularly significant for high-frequency trading and fraud detection, where real-time data processing is critical.

As one of the top FinTech trends, Quantum computing is expected to disrupt the financial sector further, offering innovative solutions for regulatory compliance, market simulations, and liquidity management. Its integration into the FinTech ecosystem will give early adopters a competitive advantage in delivering sophisticated financial services.

13. Decentralized Stablecoins for Global Commerce

Stablecoins, pegged to fiat currencies, are poised to revolutionize cross-border trade and eCommerce by offering a decentralized, cost-effective alternative to traditional payment systems. Unlike volatile cryptocurrencies, stablecoins provide price stability, making them an ideal medium for international transactions. By eliminating intermediaries and reducing conversion fees, stablecoins can significantly lower transaction costs while improving speed and transparency.

Retailers, manufacturers, and exporters can leverage stablecoins for instant settlements and streamlined supply chain financing. Additionally, stablecoins can enhance financial inclusion in emerging markets by providing businesses and individuals access to secure, stable currencies without traditional banking infrastructure.

14. Hyper-Automated Conversational Banking

Conversational banking is transitioning into hyper-automation, where advanced AI and natural language processing (NLP) enable virtual assistants to handle more complex financial tasks. Beyond simple customer queries, these AI-powered assistants will be capable of executing transactions, analyzing financial portfolios, and providing personalized investment advice.

Also, in the near future, conversational banking will redefine customer engagement for banks and FinTech firms by offering 24/7 support with human-like interactions. This shift will enhance operational efficiency, reduce costs, and improve customer satisfaction. Additionally, conversational banking will play a pivotal role in financial inclusion by providing accessible, multilingual services to users in remote areas with limited access to physical banking infrastructure.

ATM service levels by 92%

Increasing customer retention by 20%

Cutting manual processes by 35%

15. Green and Ethical FinTech Solutions

Sustainability-focused FinTech is gaining momentum as businesses and consumers prioritize eco-friendly and ethical practices. Green finance platforms are integrating features like carbon offset calculators, ESG (Environmental, Social, and Governance) investment options, and peer-to-peer renewable energy funding. By enabling individuals and organizations to track their carbon footprint and invest in sustainable projects, FinTech is empowering users to make conscious financial decisions.

In 2025 and beyond, ethical FinTech trends are expected to expand further into areas such as green bonds and impact investing. These platforms will leverage blockchain for transparency, ensuring accountability in allocating funds toward environmentally and socially responsible initiatives.

16. DeFi 2.0: Institutional Integration

Decentralized Finance (DeFi) is entering its next phase of evolution, where institutions like banks and asset managers are becoming key players. Known as DeFi 2.0, this phase addresses major challenges such as scalability, security, and regulatory compliance, making decentralized financial systems more appealing and trustworthy for larger organizations.

Many institutions are now exploring DeFi for solutions like automated lending, staking, and liquidity provisioning, which offer higher efficiency and lower costs than traditional financial methods. Also, innovations in DeFi 2.0 are set to drive collaboration between FinTech companies and traditional financial institutions. These partnerships will create new revenue opportunities and drive wider adoption of decentralized systems.

17. Digital Asset Tokenization

Digital asset tokenization changes how people invest by transforming physical and digital assets into blockchain-based tokens. This technology allows for fractional ownership, meaning individuals can own small portions of high-value assets such as real estate, artwork, or intellectual property without requiring significant upfront capital.

Tokenization is expected to go mainstream, owing to the advancements in blockchain technology and supportive regulations. FinTech platforms specializing in tokenization will play a crucial role in breaking down barriers to investment, making it easier for everyone to participate and driving financial inclusion. Additionally, the process ensures greater transparency, reduces transaction costs, and offers a modern alternative to conventional trading methods, transforming how assets are bought, sold, and managed.

18. Biometric Payment Innovations

Biometric authentication is reshaping the FinTech industry, offering a quicker, more secure alternative to traditional payment methods. Innovations like fingerprint scanning, facial recognition, and voice authentication enable seamless transactions while minimizing fraud risk. By eliminating the need for passwords and physical cards, biometric payments are becoming increasingly popular in the FinTech sector.

With the continuous advancement of AI and edge computing, biometric payments are poised to become a staple in the financial ecosystem. These technologies will enhance the speed and security of transactions, delivering an improved customer experience. Moreover, biometric payment systems drive greater financial inclusion, enabling individuals in underserved regions to complete transactions securely using easily accessible technology.

19. Financial Health-as-a-Service (FHaaS)

Financial Health-as-a-Service (FHaaS) is quickly becoming a key trend, emphasizing holistic financial well-being. These platforms are designed to go beyond standard banking by providing tools that help with automated savings, customized budget management, and debt reduction strategies.

FHaaS will be a critical driver of customer loyalty for FinTech companies and banks and one of the most regarded current FinTech trends. Consumers are increasingly seeking tools that help them take control of their financial health, and these platforms are rising to meet the demand. Features like gamification and behavioral analytics will make these tools more engaging and effective, turning financial health management into a seamless part of everyday life.

20. Rise of Buy Now, Pay Later (BNPL) Solutions

Buy Now, Pay Later (BNPL) applications transform consumer financing by allowing customers to split payments into manageable, interest-free installments at purchase. While initially dominating the retail and eCommerce sectors, BNPL is now branching out into areas like healthcare, travel, and education, offering greater financial flexibility to a diverse range of consumers. As one of the top trends in FinTech, this model has gained significant traction among younger generations who prefer modern alternatives to traditional credit cards.

Partnerships between BNPL platforms and merchants will continue enhancing the checkout experience online and in physical stores. As regulatory oversight increases and consumer awareness grows, the focus will shift toward greater transparency and responsible lending practices, paving the way for sustainable expansion in the BNPL ecosystem.

How FinTech Leaders are Adopting the Latest Financial Trends: Top Use Cases

FinTech leaders stay ahead of the curve by embracing the latest financial trends that drive innovation and enhance business outcomes. By adopting advanced technologies and evolving strategies, they are reshaping the financial services industry to meet the dynamic needs of today’s consumers. Let’s have a deeper look at those.

JP Morgan’s Use of Quantum Computing for Advanced Financial Modeling

Quantum computing transforms financial modeling by tackling challenges like portfolio optimization, derivative pricing, and comprehensive risk assessment. These advanced algorithms enable institutions to optimize investment strategies, assess risks more accurately, and enhance decision-making for complex financial systems.

JPMorgan uses quantum algorithms, including the Harrow-Hassidim-Lloyd (HHL) algorithm, to explore portfolio optimization and risk analysis. This algorithm solves linear systems of equations, enabling the bank to identify key properties of optimal portfolios. Collaborating with leading quantum computing providers, JPMorgan stays ahead of financial innovation through quantum solutions.

Klarna’s Redefinition of Consumer Credit with Flexible BNPL Solutions

Buy Now, Pay Later (BNPL) solutions are reshaping industries like eCommerce, retail, and travel by enabling consumers to split purchases into manageable, interest-free installments. These services bypass traditional credit checks, making flexible payment options more accessible without the hassle of conventional loans.

Klarna is a global leader in the BNPL space, allowing users to split their payments across multiple installments at no additional cost. By integrating directly with retail platforms, Klarna enhances the shopping experience, allowing consumers to purchase items they may not have otherwise been able to afford upfront. Its user-friendly app and wide-reaching partnerships have positioned Klarna as a dominant player in the BNPL industry, offering flexible, interest-free payment plans.

Also Read: How Much Does it Cost to Build a BNPL App like Klarna?

Aave’s Innovation in DeFi Lending for the Future of Finance

Decentralized Finance (DeFi) leverages blockchain technology and smart contracts to offer transparent, permissionless financial services without intermediaries. DeFi platforms enable services like lending, borrowing, and staking directly between users by removing traditional financial institutions. These systems provide greater financial inclusion, lower costs, and increased security, ensuring trustless and immutable transactions.

Aave is a leading platform in the DeFi space, offering decentralized lending and borrowing services with innovative features like flash loans, which allow users to borrow funds without collateral. This platform empowers individuals to access liquidity directly, bypassing traditional intermediaries and demonstrates DeFi’s disruptive potential in transforming the financial landscape.

Securitize’s Leadership in Digital Asset Tokenization

Tokenization converts real-world assets like real estate, art, or intellectual property into digital tokens on a blockchain, enabling fractional ownership. This process opens up investment opportunities to a broader audience, allowing more individuals to invest in assets once reserved for high-net-worth individuals. Blockchain ensures security, transparency, and liquidity, creating new ways to buy and trade these assets.

Securitize leads in tokenizing real estate and private equity, facilitating seamless trading while ensuring regulatory compliance. This platform enables fractional ownership with lower capital requirements, transforming how assets are bought and sold by offering a transparent, secure transaction process.

Maximize FinTech Possibilities with Appinventiv’s Support

The future of FinTech is marked by continuous innovation, with technologies such as blockchain, artificial intelligence, and decentralized finance shaping the next generation of financial services. As the latest trends in the FinTech industry evolve, it promises to make financial systems more accessible, efficient, and secure, revolutionizing how businesses and consumers engage with money and financial services globally.

Appinventiv, as your ally for FinTech application development services, is globally reputed for crafting FinTech solutions that deliver measurable success. Our extensive experience spans a variety of projects, helping businesses transform fintech startup ideas into reality while ensuring growth, scalability, and user satisfaction.

Clients around the globe trust us to deliver exceptional results, as evidenced by their testimonials and our portfolio of successful projects. From tailored strategies to seamless implementation, we offer end-to-end services for businesses of all sizes.

Connect with our experts and learn how Appinventiv can help you take charge of the FinTech revolution.

FAQs

Q. What are the top FinTech trends for 2025?

A. Here are some of the top current FinTech trends that are all set to revolutionize 2025 and beyond:

- Artificial Intelligence (AI) and Machine Learning

- Decentralized Finance (DeFi)

- Embedded Finance

- Digital Currencies (Cryptocurrencies)

- Blockchain Technology

- Open Banking

- Neobanks

- RegTech (Regulatory Technology)

- Peer-to-Peer (P2P) Lending

- Robo-Advisors

- Smart Contracts

- Buy Now, Pay Later (BNPL) Services

- Mobile Payments

- Cross-Border Payments

- Digital Wallets

- Quantum Computing

- Voice Commerce

- Biometric Authentication

- Digital Identity Verification

- Financial Inclusion Solutions

- InsurTech (Insurance Technology)

- Sustainable Finance

Q. What is the future of FinTech?

A. The future of FinTech is set for transformative growth, driven by technological innovations like open banking, neobanks, and AI-powered solutions that will enhance customer experiences and broaden access to financial services. Financial inclusion will be a key focus, with FinTech reaching underserved populations globally in the future.

Digital payment systems will become faster, more secure, and seamless, enabling smoother cross-border transactions. Increased collaboration between traditional financial institutions and startups will create a more integrated and user-friendly financial ecosystem.

Additionally, the growing demand for sustainable and ESG (Environmental, Social, and Governance) investment strategies will significantly influence FinTech’s evolution as consumers seek more socially responsible options.

Q. How are FinTech companies advancing financial inclusion?

A. FinTech companies promote financial inclusion by delivering cost-effective and accessible banking services to underserved communities through mobile solutions, micro-lending, and affordable financial products that help close the gap for the unbanked and underbanked.

How Much Does it Cost to Build a Personal Finance App like Pocketsmith?

Imagine an app that knows when your rent is due, reminds you of upcoming bills, forecasts your savings 12 months ahead, and tells you if that third coffee this week is wrecking your budget. That’s the kind of experience apps like PocketSmith deliver, and it’s exactly why personal finance apps are becoming a must-have for…

How Much Does it Cost to Build a Mobile Banking App Like Halifax in the UK?

The way people bank has changed dramatically. Gone are the days of waiting in long queues or rushing to a branch before closing hours. Today, mobile banking apps like Halifax have redefined convenience, allowing users to check balances, transfer funds, pay bills, and even apply for loans from their smartphones, anytime and anywhere. This shift…

How to Approach Currency Converter App Development?

Imagine you’re about to travel abroad and need to quickly check how much your local currency is worth in another country, or perhaps you run an international business and constantly deal with multiple currencies. In both cases, a currency converter app is an indispensable tool. With global transactions becoming the norm and forex markets fluctuating…