- FinTech Investment Landscape: Key Stats and Growth Trajectory

- 20 FinTech Trends You Must Act On in 2026

- 1. WealthTech

- 2. Next-Gen Digital-Only Banks

- 3. Voice Commerce

- 4. Enhancements in AI-Powered Banking Chatbots

- 5. Incorporation of Big Data in FinTech Processes

- 6. Enhanced ‘A’ Rated Life Insurance Carriers

- 7. Public Cloud to be the New Infrastructure Model

- 8. Cybersecurity as a Pillar of FinTech Domain

- 9. Rise of Financial Regulations and RegTech Companies

- 10. Advanced Banking-as-a-Service (BaaS) Ecosystems

- 11. Personalized Embedded Finance

- 12. Quantum Computing for Financial Modeling

- 13. Decentralized Stablecoins for Global Commerce

- 14. Hyper-Automated Conversational Banking

- 15. Green and Ethical FinTech Solutions

- 16. DeFi 2.0: Institutional Integration

- 17. Digital Asset Tokenization

- 18. Biometric Payment Innovations

- 19. Financial Health-as-a-Service (FHaaS)

- 20. Rise of Buy Now, Pay Later (BNPL) Solutions

- Emerging Technologies in the Financial Services Industry

- Machine Learning and Artificial Intelligence

- Blockchain and Distributed Ledger Technology (DLT)

- Cloud Computing and API Ecosystems

- Cybersecurity and Quantum Computing

- Edge Analytics and Internet of Things (IoT)

- Autonomous Financial Systems and Agentic AI

- AI Copilots for Finance

- How FinTech Leaders are Adopting the Latest Financial Trends: Top Use Cases

- JP Morgan’s Use of Quantum Computing for Advanced Financial Modeling

- Klarna’s Redefinition of Consumer Credit with Flexible BNPL Solutions

- Aave’s Innovation in DeFi Lending for the Future of Finance

- Securitize’s Leadership in Digital Asset Tokenization

- How Emerging FinTech Technologies Solve Executive-Level Challenges

- Increasing Compliance and Risk Complexity

- Difficulty in Accessing Capital and Credit

- Fraud Exposure and Cybersecurity

- Customer and Partner Erosion of Trust

- Maximize FinTech Possibilities with Appinventiv’s Support

- FAQs

“Banking is necessary, banks are not,” declared Bill Gates in 1994.

Almost 30 years later, his words sound even more poignant. FinTech has not only disrupted the traditional banking system but also redefined how people transact with money. Nowadays, it is as simple as a few clicks on a smartphone to manage loans, invest, and take out insurance.

Before 2025, the pace of FinTech innovation will continue to accelerate. Emerging FinTech trends such as AI-powered wealth management are transforming financial advisory services through personalized insights, while embedded finance is integrating payment and lending capabilities directly into non-financial platforms. Together, these advancements are making financial transactions more seamless, accessible, and convenient than ever before.

Sustainability also comes into the limelight as FinTech firms are becoming more dedicated to actions that ensure environmental and social accountability. The future of FinTech is not only about change but also about creating a more inclusive and efficient financial ecosystem for all.

This blog will explore the best FinTech trends transforming the industry and explain how leading FinTech giants are using these innovations. However, we shall start by having a closer look at some of the statistics that define the FinTech environment.

Seize the moment to innovate and drive your business forward!

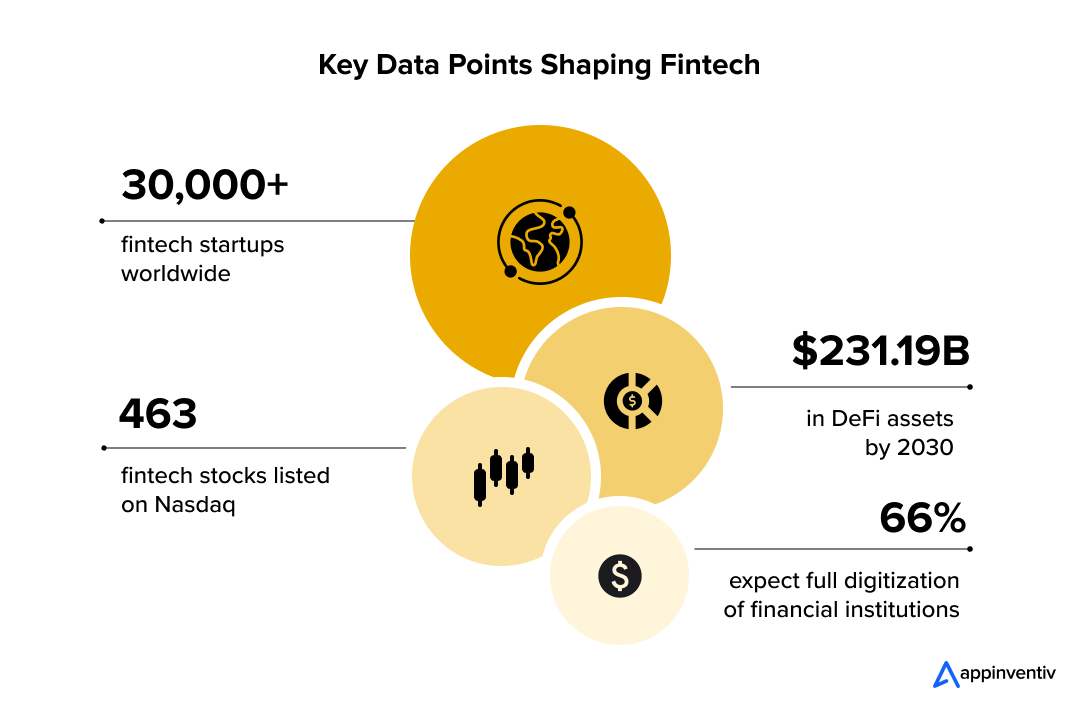

FinTech Investment Landscape: Key Stats and Growth Trajectory

The FinTech investment landscape is undergoing a revolutionary shift, fueled by a surge in digital adoption and cutting-edge technologies transforming the financial sector. According to PwC, with global FinTech investments anticipated to surpass $37 billion by 2026, the focus is rapidly moving toward breakthrough innovations like blockchain, AI-driven solutions, and seamless digital payments.

As digital payments continue to attract capital, enterprises are increasingly exploring how to create a money transfer app that can scale securely across regions.

The growth of neobanks, decentralized finance (DeFi), and embedded finance is challenging traditional financial structures and unlocking new avenues for emerging startups and established players. As FinTech progresses, trends such as financial inclusion, smart contracts, and real-time transactions pave the way for next-generation financial ecosystems.

Let’s check out some of the recent statistics on the FinTech industry trends:

With such extraordinary FinTech developments and innovation, what does the future hold?

Which emerging global FinTech trends will revolutionize how businesses and consumers engage with financial services? Let’s dive into the transformative technologies and trends reshaping the economic landscape and paving the way for a smarter, more connected tomorrow.

20 FinTech Trends You Must Act On in 2026

As we move into 2026, the world of FinTech is set to experience unprecedented transformations, redefining how we interact with financial services. Staying ahead means understanding the transformative trends that are revolutionizing the delivery of financial services. Let’s have a look at those. Let’s have a look at those.

1. WealthTech

FinTech In wealth management, WealthTech uses technology to optimize and democratize wealth management by providing new technologies such as digital investment platforms and AI-assisted financial planning tools. These services apply financial data analytics and algorithms to guide individual investors in making informed decisions in line with their financial objectives and risk tolerance. WealthTech allows more people to manage their investments thanks to the reduced fees and easy interfaces.

The WealthTech trend is expanding as traditional wealth management companies are changing to new technologies. Those platforms will offer investment guidance and financial planning, tax optimization, and retirement.

Beyond digital banking and payments, wealth management technology is transforming how traditional firms deliver personalized investment guidance, automate portfolio management, and expand access to sophisticated financial planning tools.

2. Next-Gen Digital-Only Banks

There has been a rapid growth in collaborations between FinTech firms and banking organizations, which favors the development of new financial intermediaries. The digital-only banks are now becoming more popular than ever, and it was not expected in this decade.

These digital-only banks also provide their clients with an even wider range of services, with an additional time-based option available. Digital-only banking FinTech trends in the year are strongly affected by disruptive technologies such as blockchain and cryptocurrency.

Also Read: Digital Transformation in Banking Applications and Benefits

3. Voice Commerce

Voice commerce is voice-based technology that enables consumers to shop, check their finances, and obtain services through voice-activated assistants such as Amazon Alexa, Google Assistant, and Siri. This FinTech technology trend is reshaping shopping, banking, and other consumer activities by making them easier to use hands-free, more accessible to people with disabilities, and simpler and more enjoyable to engage with technology.

Voice commerce is increasingly integrated into FinTech retail, banking, and financial management apps, enabling users to pay bills, track expenses, and access personalized investment advice through simple voice commands. With the advancement of voice recognition and security systems such as voice biometrics, voice commerce is a secure and growing form of transactions, especially in smart homes and interconnected devices.

4. Enhancements in AI-Powered Banking Chatbots

AI-driven chatbots are changing banking by providing 24/7 services, reducing costs, and improving customer experiences, making it one of the most popular financial technology trends. These chatbots are based on machine learning (ML) and natural language processing (NLP) and can go beyond query answers by providing tailored financial recommendations, real-time updates, and fraud notifications. The innovative chatbot applications provided by the leading banks, such as Commonwealth Bank of Australia (Ceba), Bank of America (Erica), and HDFC Bank (Eva) are becoming the industry standards.

Chatbots will evolve into proactive financial assistants that anticipate customer needs, provide solutions, and detect anomalies in transactions to reduce risk. They will also be instrumental in compliance regulation, as they analyze data to identify potential issues. As AI chatbots become more widely adopted, banking will become more personalized, transparent, and efficient.

At Appinventiv, we created Mudra, an AI chatbot application that transforms personal budget management. Six months of meticulous design and development are complete, and Mudra is ready to be launched in over 12 countries worldwide.

The interactive features of this innovative solution make it user-friendly and provide a smooth and easy budgeting experience, providing users with personalized financial insights and making it engaging. Mudra will change the way people handle their money, establishing a new standard in the FinTech industry.

Also Read: AI Chatbots in Banking: Application & Advantages

5. Incorporation of Big Data in FinTech Processes

One of the current FinTech trends is big data, revolutionizing FinTech in terms of customer segmentation, risk management, and fraud detection in 2026. Data enables FinTech companies to segment customers by age, location, and spending patterns, resulting in extremely personalized financial products and services being provided to individual customers on the basis of those segments.

The use of big data analytics in FinTech also contributes to a better risk management approach based on predictive analytics, as it is expected to assist the company in evaluating the credit risk and preventing risky investments. It also enhances fraud detection methods by using user behavior patterns to detect suspicious activities in real time. With big data still defining FinTech, it will bring additional customized, safe, and effective financial solutions.

6. Enhanced ‘A’ Rated Life Insurance Carriers

The insurance sector is still welcoming technological changes, with the top A-rated life insurance companies improving. Through data analytics and AI in insurance, providers can now offer term coverage of up to $1 million without requiring medical exams. Rather, they use objective information based on the customer profile, such as prescription history and medical questionnaire, to simplify the approval process.

Such development is transforming how life insurance is written, making it quicker, more efficient, and more affordable for more consumers. These developments make taking out life insurance no longer a cumbersome or invasive affair, and this is a great move in the direction that the industry is taking towards being data-focused and customer-friendly.

7. Public Cloud to be the New Infrastructure Model

The financial services industry has adopted public cloud infrastructure as its backbone, transforming core and non-core functions. Clouds have become essential services for financial institutions, such as consumer payments, credit ratings, and financial statements, and have enabled them to create efficiency and innovation.

With the adoption of public cloud, banks and FinTech enterprises have expanded faster, reduced costs, enhanced services, and remained highly secure and compliant. As the industry becomes more digital, the financial sector’s agility and smooth user experience remain driven by the public cloud.

Also Read: Cloud Computing in Banking: All You Need to Know Before Moving to the Cloud

8. Cybersecurity as a Pillar of FinTech Domain

Cybersecurity is one of the key pillars of the FinTech sector in 2026 and beyond. As the trends in financial technology advance rapidly, the risk of cybercrime has increased many times over and made financial institutions focus on the security of sensitive data and digital resources. To mitigate them, there has been the formation of sophisticated security mechanisms and new generation tools to counter this risk and promote integrity in financial activities.

The application of AI in the FinTech trend has also enhanced cybersecurity processes, especially through cyber risk analytics, which enables the detection and mitigation of threats in real time. In the constantly changing FinTech environment, these innovations will continue to play a crucial role in maintaining high security levels and customer confidence, making cybersecurity a major bet for the industry’s future success.

Appinventiv’s Insights

True cybersecurity in FinTech goes beyond firewalls and encryption. The next frontier is adaptive security; systems that learn user behavior, detect anomalies in real time, and self-adjust to neutralize risks before they escalate.

9. Rise of Financial Regulations and RegTech Companies

As the laws on data sharing and financial transparency tighten, RegTech companies are rising to the occasion to provide new solutions that will make the process of compliance less cumbersome. Such technologies are redefining key sectors of transaction monitoring, risk management, KYC (Know Your Customer), and AML software development, and giving financial institutions the means to comply with regulations more effectively.

The need for automated compliance and risk management systems is on the rise as financial institutions face increasingly complex regulatory landscapes. RegTech is facilitating compliance, increasing efficiency, enhancing transparency and consumer trust, and cementing its place as a key pillar of the changing FinTech industry.

10. Advanced Banking-as-a-Service (BaaS) Ecosystems

Banking-as-a-Service (BaaS) is changing to more complex integrations in the realm of ecosystems, where enterprise-owned financial products can be introduced without the need to develop and maintain highly sophisticated economic systems. These ecosystems are modular-powered, enabling easy integration with services such as loans, credit cards, and digital wallets, and, as a result, are accessible to startups, e-commerce platforms, and non-financial businesses.

BaaS providers will start offering industry-specific solutions in 2026, e.g., specialized lending products for small businesses and crypto wallets for tech-savvy consumers. This movement liberalizes access to financial innovation, enabling small companies to compete with existing financial institutions.

11. Personalized Embedded Finance

Enterprise embedded finance is changing, with hyper-personalized financial services subtly integrated into non-financial experiences that enhance user experience and drive greater efficiency. With AI and big data, businesses can now offer customizable financial services, such as tailored insurance policies, savings plans, and real-time credit offers, based on a user’s preferences and behavior.

As an example, the recommendation of health insurance and reward schemes might take place in fitness apps, whereas installment plans with dynamic payments are offered by eCommerce platforms depending on a customer’s purchase history and credit profile.

The trend is set to increase customer engagement and convenience, and to generate additional revenue for businesses across different industries. The more companies move towards personalized embedded finance, the more companies will have a chance to stand out with their financial services that meet the individual needs of their customers.

12. Quantum Computing for Financial Modeling

Quantum computing is also advancing financial modeling by solving complex calculations that classical computers cannot. FinTech firms are examining quantum algorithms to optimize investment portfolios and improve risk management, and price financial derivatives with more accuracy than previously possible. This technological advancement seems especially important to high-frequency trading and fraud detection, where real-time data processing is paramount.

Quantum computing, one of the best trends in the FinTech industry, is likely to further impact the financial sector by enabling new ways to check compliance with regulations, simulate markets, and manage liquidity. Early adopters will have an edge in providing advanced financial services due to their inclusion in the FinTech ecosystem.

13. Decentralized Stablecoins for Global Commerce

To introduce a decentralized solution to existing payment systems that is cost-effective, efficient, and stable, stablecoins pegged to fiat currencies are set to transform cross-border trade and eCommerce. Stablecoins offer price stability, unlike volatile cryptocurrencies, making them the best medium for international transactions. Stablecoins can significantly reduce transaction costs by removing middlemen and reducing conversion costs, thereby enhancing speed and transparency.

Stablecoins can facilitate instant settlements and provide manufacturers, exporters, and retailers with the benefits of a simplified supply chain financing. Besides, stablecoins can expand financial access in developing markets by enabling businesses and users to access stable, secure currencies without banking infrastructure.

14. Hyper-Automated Conversational Banking

Conversational banking is moving toward hyper-automation, where advanced AI and natural language processing (NLP) enable virtual assistants to handle more complex financial tasks. But in addition to answering basic customer questions, these AI-powered assistants will be able to run transactions, perform financial portfolio analysis, and offer custom investment advice.

Also, conversational banking will transform customer interactions between banks and FinTech companies in the near term, providing 24/7 support and human-like interactions. This will not only increase customer satisfaction but also improve operational efficiency and reduce costs. Also, conversational banking will be crucial to financial inclusion, as it offers conveniently accessible multilingual banking services to users in remote locations where physical banking facilities are scarce.

ATM service levels by 92%

Increasing customer retention by 20%

Cutting manual processes by 35%

15. Green and Ethical FinTech Solutions

Sustainability-focused FinTech is gaining momentum as businesses and consumers prioritize eco-friendly and ethical practices. Green finance platforms are integrating features like carbon offset calculators, ESG (Environmental, Social, and Governance) investment options, and peer-to-peer renewable energy funding. By enabling individuals and organizations to track their carbon footprint and invest in sustainable projects, FinTech is empowering users to make conscious financial decisions.

In 2026 and beyond, ethical FinTech trends are expected to expand further into areas such as green bonds and impact investing. These platforms will leverage blockchain for transparency, ensuring accountability in allocating funds toward environmentally and socially responsible initiatives.

Businesses will be seeing outsourcing in fintech software development as a practical response to growing technical complexity, regulatory scrutiny, and the need to build transparent, trust-driven financial platforms at scale.

16. DeFi 2.0: Institutional Integration

Decentralized Finance (DeFi) is in its second wave of development as banks and asset managers are becoming some of the most important participants. Being one of the latest trends in FinTech, DeFi 2.0 helps overcome significant challenges such as scalability, security, and regulatory compliance to establish decentralized systems that can be trusted by big organizations.

Most institutions are currently exploring DeFi to deliver automated lending, staking, and liquidity-provisioning solutions that offer greater efficiency and lower costs than conventional approaches. The innovations usher in a new era of FinTech application trends, as the trend in collaboration between FinTech organizations and traditional institutions is to develop new revenue models and broaden decentralized adoption.

17. Digital Asset Tokenization

The tokenization of digital assets is transforming the way individuals invest by turning physical and digital property into tokens on the blockchain. This movement is one of the most radical FinTech technology trends, which allows sharing high-value items such as real estate, art, and intellectual property, among others, as well as enjoying fractional ownership.

With the emergence of friendly regulations, tokenization will be one of the pillars of existing FinTech trends, making entry less challenging and more financially inclusive. Investors around the globe are being redefined by tokenization, which promotes transparency, reduces transaction costs, and also simplifies the management of assets.

18. Biometric Payment Innovations

Biometric authentication is transforming the financial ecosystem by providing a more secure, faster way to conduct payments. It also reduces fraud and removes the use of passwords or cards through fingerprint scanning, facial recognition, as well as voice-based verification.

This development aligns with B2B FinTech trends, where companies have resolved to use biometric-based solutions to increase user trust and simplify transaction processes. As AI and edge computing enable real-time authentication, biometric payments will become the foundation of future FinTech trends, simplifying financial access, enhancing safety, and increasing inclusivity.

19. Financial Health-as-a-Service (FHaaS)

Financial Health-as-a-Service (FHaaS) enhances consumers’ financial well-being through personalized financial wellness tools. Positioned among the latest trends in FinTech, FHaaS platforms offer automated savings, tailored budgets, and debt management solutions to help users take control of their money.

As a rising force in current trends in FinTech, FHaaS creates long-term interaction by relying on gamification and behavioral analytics to transform financial wellness into a routine. In the case of FinTech companies and banks, this model will increase commitment and promote inclusive, customer-centered finance.

20. Rise of Buy Now, Pay Later (BNPL) Solutions

Buy Now, Pay Later (BNPL) apps are changing the face of modern finance, enabling users to split payments into easy-to-make installments with no interest. Being one of the most powerful FinTech app trends, BNPL has grown in the spheres of healthcare, traveling, and education, and has reconstructed the notion of convenience and flexibility in payments.

As the rules change and consumers become more confident, the future of BNPL is closely tied to B2B FinTech trends, with merchants and platforms working together to enhance the checkout experience and encourage responsible lending. This is a sustainable model that still defines the upcoming age of financial accessibility.

Get expert guidance to adopt emerging trends and stay ahead in digital finance

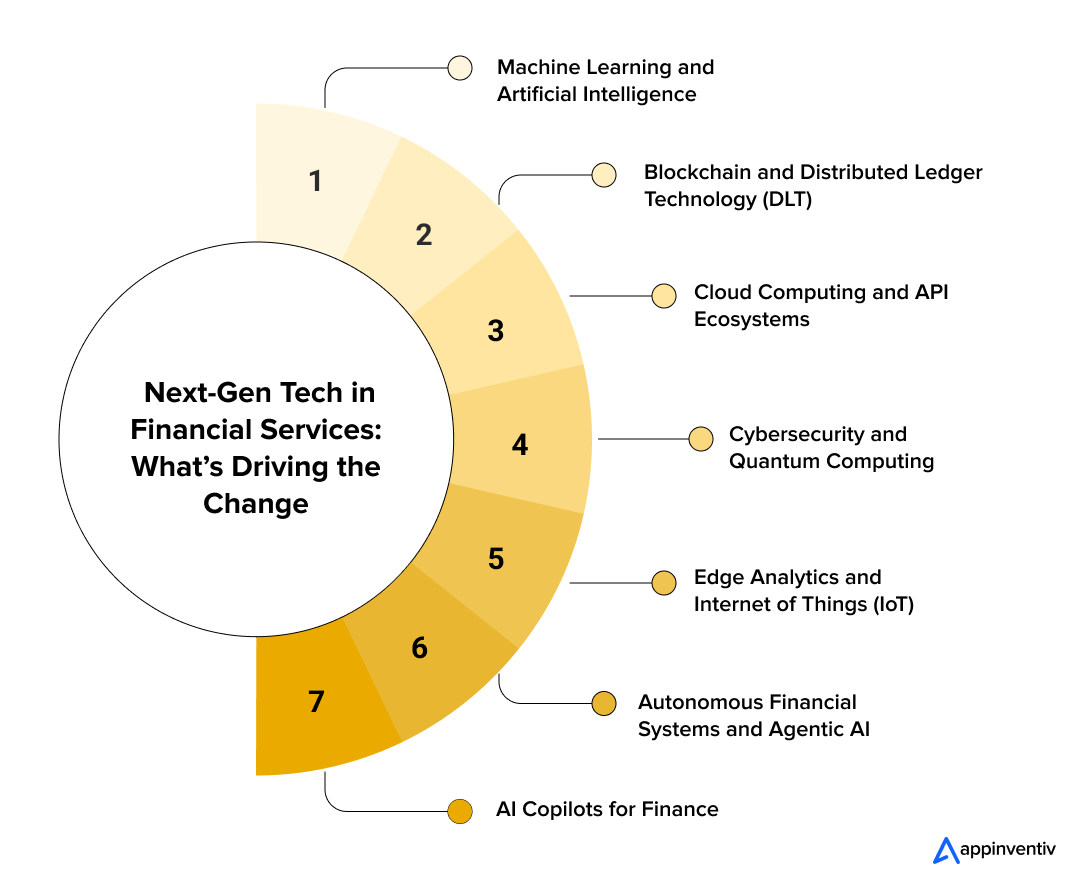

Emerging Technologies in the Financial Services Industry

The financial industry is headed towards a fast-digital age where technology not only aids business but also determines competitiveness. Ever since the advent of automation, quantum computing, and other innovations, these technologies have been transforming the way financial institutions provide secure, efficient, and personalized service.

Machine Learning and Artificial Intelligence

AI has been at the forefront of the top FinTech trends due to its ability to optimize decision-making, forecast customer behavior, and automate complex financial processes. Credit score to fraud detection AI/ML models are becoming more precise, reducing costs, and developing smarter financial ecosystems.

Banking organizations that are making early investments in AI-based analytics are gaining a competitive advantage through better understanding and quicker service provision.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain remains one of the pillars of digital finance transformation, offering transparency, traceability, and decentralized trust. In addition to cryptocurrency, it supports smart contracts, cross-border payments, and tokenizing assets.

The adoption increase can be attributed to trends in FinTech investments, where companies are seeking safe, effective solutions to minimize reliance on intermediaries and improve operational integrity.

Also Read: Blockchain in FinTech: Revolutionizing Finance with Security

Cloud Computing and API Ecosystems

Cloud computing enables FinTech start-ups and long-established banks to expand rapidly, save on maintenance expenses, as well as enhance data accessibility. The API ecosystems also promote rapid innovation by enabling the free integration of banks, payment gateways, and third-party services. They jointly promote open banking and enable customer-centric and flexible service models.

Cybersecurity and Quantum Computing

The financial transactions are becoming increasingly complicated, and quantum computing is coming out as a breakthrough in high-speed data processing and encryption. Quantum-safe cryptography is already being explored by industry to ensure data security in the future. The movement is one of the top future trends in FinTech, as security and performance merge to recreate the financial structure.

Edge Analytics and Internet of Things (IoT)

Commercial lending with IoTs can readily enable real-time asset tracking, usage-based insurance, and predictive maintenance by integrating IoT devices with financial platforms. Edge analytics enables data processing instantly and locally, enhancing transaction response time and reducing latency in financial transactions.

Autonomous Financial Systems and Agentic AI

Agentic AI in FinTech is redefining the nature of financial operations. Such advanced models can think, strategize, and act autonomously, driving self-directed credit systems, automated trading systems, and intelligent portfolios. With the advancement of this technology, it is likely to enable scalability, reduce human error, and expand the capabilities of entirely autonomous financial ecosystems.

AI Copilots for Finance

AI copilots are emerging as inalienable facilitators for financial analysts, advisors, and customers. They are built into banking systems and investment platforms and analyze data, create insights, and automate daily work with accuracy.

Such development is an indicator of a new era in which human knowledge will be aided by smart technology and resulting in more intelligent, quicker, and tailored financial decisions.

Appinventiv’s Insights

Few realize that AI copilots in FinTech can be trained on an organization’s own proprietary transaction patterns, not just public data. This allows them to uncover hidden inefficiencies, predict liquidity shifts, and even simulate regulatory outcomes, essentially acting as a live financial strategist rather than a passive assistant.

How FinTech Leaders are Adopting the Latest Financial Trends: Top Use Cases

FinTech leaders are at the frontline to adopt the new trends in the financial sector that motivate innovation and business performance. They are transforming the financial services industry by incorporating modern technologies and changing approaches to the industry to address the dynamic needs of current consumers. Let’s have a deeper look at those.

JP Morgan’s Use of Quantum Computing for Advanced Financial Modeling

Quantum computing transforms financial modeling by addressing issues such as portfolio optimization, derivative pricing, and overall risk analysis. These are superior algorithms and allow institutions to design investment strategies in the most optimal way, gauge risks more precisely, and improve decision-making of complex financial systems.

JPMorgan applies quantum algorithms, such as the Harrow-Hassidim-Lloyd (HHL) algorithm, to portfolio optimization and risk analysis. The algorithm is used to solve linear equations, which allows the bank to discover the most important properties of optimal portfolios. JPMorgan keeps pace with financial innovation, collaborating with the major quantum computing providers to remain ahead of the trend.

Klarna’s Redefinition of Consumer Credit with Flexible BNPL Solutions

Using Buy Now, Pay Later (BNPL) solutions, industries such as eCommerce, retail, and travel are transforming to allow consumers to divide purchases into easy, interest-free payments. The services do not require conventional credit checks, so the flexibility in payment options is more convenient without the inconvenience of traditional loans.

Klarna is a powerhouse in the BNPL space, enabling customers to split their purchases into multiple installments at no cost. Klarna actively participates in retail to improve the consumer experience, enabling them to buy things they would not have been able to afford immediately. The ease of use of its application and extensive network of partners have also made Klarna a heavy hitter in the BNPL sector, providing flexible interest-free payment plans.

Also Read: How Much Does it Cost to Build a BNPL App like Klarna?

Aave’s Innovation in DeFi Lending for the Future of Finance

Decentralized Finance (DeFi) is an approach that uses smart contracts to provide transparent, permissionless financial services by utilizing blockchain technology. DeFi services such as lending, borrowing, and staking can be operated directly among the users without the involvement of traditional financial institutions. These systems are more financially inclusive, cost-effective, and secure, and offer trustless and immutable transactions.

Aave is one of the most popular DeFi platforms, a decentralized lending and borrowing platform that offers features such as flash loans, which enable people to take loans without collateral. This platform allows people to get liquidity without going through the traditional intermediaries and indicates the disruptive nature of DeFi in revolutionizing the financial environment.

Securitize’s Leadership in Digital Asset Tokenization

Fractional ownership is achieved by tokenizing real-world assets such as real estate, art, or intellectual property into digital tokens on a blockchain. This process will make investment opportunities available to a larger audience, enabling more people to invest in assets previously accessible only to high-net-worth individuals. Blockchain provides security, transparency, and liquidity, and develops new modalities to purchase and trade these assets.

Securitize is the leader in real estate and private equity securitization, enabling easy trading with regulatory compliance. It is a platform that allows the purchase and sale of assets in a fractional manner, which has reduced capital requirements and provides a transparent, safe, and secure way of doing transactions.

How Emerging FinTech Technologies Solve Executive-Level Challenges

Financial C-suite leaders are operating in a complex environment characterized by rapid change, increased regulation, and evolving customer expectations. As financial operations are transformed by global FinTech trends, executives are seeking technologies that not only streamline operations but also protect trust and ensure compliance.

Increasing Compliance and Risk Complexity

Challenge: Regulatory evolution has been accelerating, and CFOs and Chief Risk Officers are challenged by fragmented systems, manual reporting, and cross-border anomalies.

Solution: Advances in financial services technology trends, particularly RegTech automation, are streamlining compliance. AI-based FinTech applications can now identify anomalies, generate real-time reports, and maintain blockchain-based audit trails to ensure complete transparency. The capabilities reduce administrative workload and enable proactive, data-driven risk management.

Difficulty in Accessing Capital and Credit

Challenge: Conventional credit evaluation systems often lead to protracted approval processes, restricting access to established funds for startups and small organizations. Such a lag may hamper innovation and liquidity.

Solution: A major driver of AI in FinTech trends is intelligent credit scoring powered by machine learning. Together with decentralized lending networks, it enables many loan approvals within minutes and more precise risk profiling. This kind of innovation speeds up the process of financial inclusion and provides more expedited and trusted funding sources to CFOs.

Fraud Exposure and Cybersecurity

Challenge: With the growth of digital transactions, the possibility of cyber threats, identity fraud, and data breaches also grows. Those problems could result in significant financial losses and reputational damage.

Solution: Companies are capitalizing on the latest FinTech trends to enhance transaction security through biometric authentication, behavioral detection, and quantum-resistant encryption. The technologies enhance the institution’s defense posture and ensure continuity in service delivery and consumer confidence.

Customer and Partner Erosion of Trust

Challenge: Loss of trust is usually caused by non-transparency or misuse of customer information, and this will result in lost loyalty and investor trust.

Solution: Privacy-saving AI and blockchain are some of the key FinTech industry trends that will help in regaining trust. Such systems will guarantee transparency, verifiable transactions, and ethical data governance, enabling leadership to restore credibility and long-term stakeholder relationships.

Maximize FinTech Possibilities with Appinventiv’s Support

The future of FinTech is marked by continuous innovation, with technologies such as blockchain, artificial intelligence, and decentralized finance shaping the next generation of financial services. As the latest trends in the FinTech industry evolve, it promises to make financial systems more accessible, efficient, and secure, revolutionizing how businesses and consumers engage with money and financial services globally.

Appinventiv, as your ally in FinTech application development, is globally reputed for crafting FinTech solutions that deliver measurable success. Our extensive experience spans a variety of projects, helping businesses transform ideas into reality while ensuring growth, scalability, and user satisfaction.

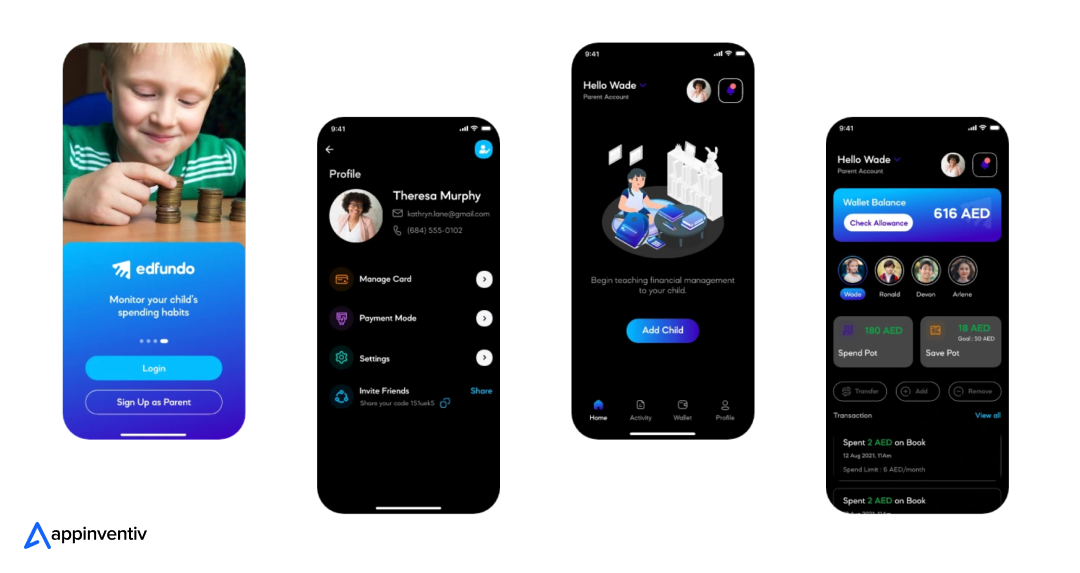

One such example is of Edfundo, whom we helped build the world’s first financial intelligence hub for children. This platform combines a prepaid debit card with an interactive learning app to promote early financial literacy.

From concept to launch, our team handled every stage of development, creating an intuitive and secure solution that gained strong user adoption and investor confidence, helping Edfundo raise $500,000 in pre-seed funding and prepare for a $3 million seed round.

Clients around the globe trust us to deliver exceptional results, as evidenced by their testimonials and our portfolio of successful projects. From tailored strategies to seamless implementation, we offer end-to-end services for businesses of all sizes.

Connect with our FinTech consultants and learn how Appinventiv can help you take charge of the FinTech revolution.

FAQs

Q. What are the most relevant FinTech market trends in 2026?

A. Here are some of the top current FinTech trends that are all set to revolutionize 2026 and beyond:

- Artificial Intelligence (AI) and Machine Learning

- Decentralized Finance (DeFi)

- Embedded Finance

- Digital Currencies (Cryptocurrencies)

- Blockchain Technology

- Open Banking

- Neobanks

- RegTech (Regulatory Technology)

- Peer-to-Peer (P2P) Lending

- Robo-Advisors

- Smart Contracts

- Buy Now, Pay Later (BNPL) Services

- Mobile Payments

- Cross-Border Payments

- Digital Wallets

- Quantum Computing

- Voice Commerce

- Biometric Authentication

- Digital Identity Verification

- Financial Inclusion Solutions

- InsurTech (Insurance Technology)

- Sustainable Finance

Q. What is the future of FinTech?

A. The future of FinTech is set for transformative growth, driven by technological innovations like open banking, neobanks, and AI-powered solutions that will enhance customer experiences and broaden access to financial services. Financial inclusion will be a key focus, with FinTech reaching underserved populations globally in the future.

Digital payment systems will become faster, more secure, and seamless, enabling smoother cross-border transactions. Increased collaboration between traditional financial institutions and startups will create a more integrated and user-friendly financial ecosystem.

Additionally, the growing demand for sustainable and ESG (Environmental, Social, and Governance) investment strategies will significantly influence FinTech’s evolution as consumers seek more socially responsible options.

Q. How are FinTech companies advancing financial inclusion?

A. FinTech companies promote financial inclusion by delivering cost-effective and accessible banking services to underserved communities through mobile solutions, micro-lending, and affordable financial products that help close the gap for the unbanked and underbanked.

Q. How is AI transforming financial services?

A. The emergence of AI in FinTech trends is transforming the way data is handled, risk is evaluated, and customers are interacted with by institutions. Artificial intelligence is making decisions easier, smarter, and more personalized with intelligent copilots that help financial advisors and agentic AI that automates credit scoring and fraud detection. It is not merely an increase in efficiency but the rebirth of the role technology plays in the financial industry.

Q. How can financial industries stay competitive in the FinTech era?

A. As top predictions for FinTech show, competitiveness now depends on how rapidly companies adapt to digital transformation. Financial institutions need to be agile through open banking, API integration, and AI-driven insights to provide personalized customer experiences. The ones that are fast to innovate and keep abreast of regulatory demands will keep ahead in this dynamic ecosystem.

Q. How can businesses prepare for these FinTech trends?

A. Organizations need a proactive roadmap to keep up with emerging FinTech industry trends. This will include spending on automation, cybersecurity, and exploring new technology, such as tokenization, decentralized finance, and AI copilots. It is imperative to achieve future-proof business models through continuous learning, pilot testing, and cross-functional collaboration to achieve resilience in an ever-changing financial market.

Q. What role does sustainability play in the future of FinTech?

A. Sustainability is one of the latest trends in FinTech as it becomes a factor of choice both to investors and customers. Green finance platforms are embedding ESG analytics into the lending and investment decision-making processes and encouraging transparency and accountability. A more profitable chain of purpose-driven FinTech firms is likely to experience increased customer loyalty and longevity in the market.

Q. What are the technology-driven trends in FinTech?

A. The current trends in FinTech reveal a surge in technologies, including:

- AI Copilots

- Quantum-Safe Encryption

- Embedded Payments

- Agentic AI Systems

- Digital Asset Tokenization

- Biometric Authentication

- Cloud-Native Core Banking

- Predictive Analytics and Automation

- RegTech and Compliance Intelligence

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…