- Why is FinTech Cybersecurity Important for Businesses?

- Key Aspects of Cybersecurity in the Fintech Industry

- Data Encryption

- Strong Authentication

- Secure APIs

- Regulatory Compliance

- Real-Time Threat Monitoring

- Secure Coding and Code Reviews

- Vendor and Third-Party Risk Management

- Incident Response and Recovery

- How to Build a Secure FinTech App?

- Define Your App’s Purpose

- Outline the Features and Functionalities

- Design Intuitive User Interface

- Develop, Test and Deploy the App to the Market

- Analyze, Monitor, and Iterate

- App Development Cost for Cybersecurity In FinTech Industry

- Best Practices to Ensure Cybersecurity in Fintech Industry

- Comply with Industry Standards and Regulations

- Secure Data Storage

- Write Secure App Code

- Implement Secure APIs, Data Encryption, Two-Factor Authentication

- Find a Trusted Tech Partner with Cybersecurity Policies

- Real-World Examples of Top-Notch Fintech Applications

- PayPal

- Robinhood

- Mint

- Common cand Solutions of FinTech in Cybersecurity

- Future Trends of Cybersecurity in the Fintech Industry

- 1. AI-Driven Threat Detection

- 2. Zero Trust Architecture Becomes Standard

- 3. Quantum-Resistant Encryption

- 4. Biometric Authentication Expansion

- 5. Increased Regulation and Compliance Technology

- 6. Cybersecurity-as-a-Service (CSaaS) Adoption

- 7. Blockchain for Enhanced Security

- 8. Cloud-Native Cybersecurity Solutions

- Consider Appinventiv as Your Trusted Tech Partner for Fintech App Development

- FAQs

Picture a landscape where all your financial transactions are done in a blink of an eye, investments are managed with a swipe, loans are approved with a tap, and where financial technology is transforming the way we manage money. Welcome to the world of cybersecurity in FinTech industry!

With new platforms and applications developed every day, the fintech (financial technology) industry has grown exponentially over the past few decades. Statista reveals, as of May 2024, there were nearly 12000 fintech companies in the US (the highest in the world), followed by 6,365 in the Asia Pacific and 9,200 in the EMEA (Europe, the Middle East, and Africa).

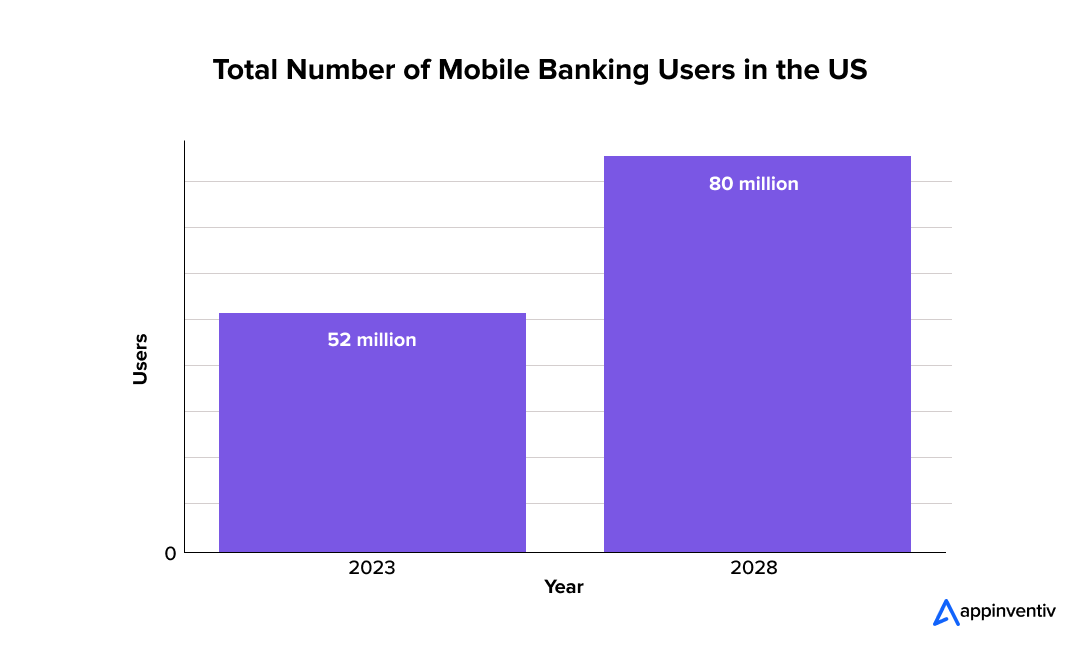

With the rapid growth of fintech companies, the number of mobile banking users is also increasing at an unprecedented rate. According to Statista, the number of digital banking users in the US are projected to reach 80 million by 2028. With the ease and convenience mobile banking offers to users, this number may go even beyond the estimation.

With the unprecedented escalated number of users embracing the digital financial revolution, there exists a pressing need to bolster fintech cybersecurity.

Why is FinTech Cybersecurity Important for Businesses?

Data breaches and cyber-attacks are frequently in the news as hackers are constantly active in tampering with vulnerable data and breaching security protocols. A successful attempt by such hackers can not only cost millions of dollars to companies but also tarnish their overall brand reputation and credibility in the market.

For instance, Equifax, an American multinational consumer credit reporting company, faced one of the biggest data breaches of the century, which cost them nearly $4 billion in just a few days. The loss far outweighed the cost of putting strong security measures in place. It has proven to be true, as two years after the breach, the company spent around $1.4 billion on cleanup costs, which included improving app and data security costs and transforming IT infrastructure costs. Conversely, a secure fintech app development costs only $50,000 to $200,000 (more details later).

- Here are some other examples of fintech cyber attacks reported recently:

LoanDepot, one of the largest U.S. mortgage lenders, suffered a ransomware hit in January 2024 that exposed data for 16.9 million customers. - BtcTurk saw attackers drain roughly $90 million from multiple hot wallets in June 2024, prompting an emergency shutdown and forensic review.

- Finastra, a global core‑banking provider, revealed in February 2025 that unauthorized access to its secure file‑transfer platform exposed 400 GB of client data.

- DMM Bitcoin lost $305 million in a hot‑wallet hack in May 2024. It was the biggest crypto‑exchange theft of the year.

So, what are your security protocols to stay safe from such incidents and not fall prey to any malicious cyber attacks? What are your best practices to make a highly secure and compliant financial platform for your customers?

Well, fintech and cybersecurity must go hand in hand for businesses like yours. With the swift growth in mobile banking users, building a custom fintech app with strong security measures can be your ultimate rescue against such threats. Let’s dive in to understand key aspects of cybersecurity in the FinTech industry and how to build a secure financial application.

We can help you safeguard every transaction with enterprise‑grade security for your fintech app.

Key Aspects of Cybersecurity in the Fintech Industry

Cybersecurity in fintech is all about keeping money and personal data safe while staying compliant with strict regulations. Below are the core areas every fintech company should focus on to build strong, reliable protection.

Data Encryption

All sensitive financial and personal data should be encrypted both during transmission and while stored. Strong encryption standards help prevent unauthorized access, even if a breach occurs.

Strong Authentication

Implement multi-factor authentication and role-based access controls to ensure that only verified users and authorized employees can access critical systems and customer data.

Secure APIs

Fintech platforms rely heavily on APIs for banking integrations and third-party services. APIs must be designed, tested, and secured carefully to prevent vulnerabilities and unauthorized access points.

Regulatory Compliance

Meeting regulations like PCI DSS, GDPR, and more is critical not just to avoid fines, but to build long-term customer and investor confidence in your fintech product.

Real-Time Threat Monitoring

Continuous monitoring systems should be in place to detect suspicious activities immediately, enabling faster responses to potential breaches and reducing the impact of attacks.

Secure Coding and Code Reviews

Fintech and cybersecurity applications should be built following secure development practices, with regular peer code reviews and security audits to catch vulnerabilities before they reach production.

Vendor and Third-Party Risk Management

Fintech firms must carefully assess and monitor the security posture of cloud providers, API vendors, and other third-party partners to avoid introducing hidden risks into their environment.

Incident Response and Recovery

Having a clear, documented, and regularly tested incident response plan is essential for quick containment, transparent communication, and fast recovery from cyber incidents.

How to Build a Secure FinTech App?

There has never been a greater way to ensure cybersecurity in the fintech industry than building a custom mobile application with strong security measures. However, building a secure fintech application is a complex and time-consuming task that requires relevant experience, expertise, and awareness of fintech security compliances such as PCI-DSS and GDPR.

While the steps to build a fintech app are similar to any other mobile app development, understanding the fintech cybersecurity best practices is crucial to ensure the ongoing success of your fintech application. Thus, here is a step-by-step guide on how to build a secure fintech app:

Define Your App’s Purpose

The first step to fintech app development starts with defining the purpose of your fintech app. Figure out what type of fintech app will best serve your needs. Would you require a cybersecurity solution for mobile banking, peer-to-peer lending, investment management, loan sanction, or any other financial service? Gaining a clear understanding of your app’s purpose will help you build the right type of app that will cater to the needs of your target audience.

Outline the Features and Functionalities

Now, based on your product’s purpose, outline the core features and functionalities of your fintech app. No matter what specific purpose your app serves, you must consider adding the basic security features like user authentication, secure transactions, account management, personalized notifications, real-time data updates, and analytics; and build a roadmap for development.

Design Intuitive User Interface

An intuitive interface is the lifeblood of any application, and a fintech app is no exception. So, build an easy-to-navigate and visually appealing interface that guides users through various functions. Pay attention to convenience, accessibility, security, and transaction flows to ensure a seamless UI/UX design.

Develop, Test and Deploy the App to the Market

Now, it is time to begin with the development process. Use the right tech stack and follow agile methodologies to develop a cutting-edge, secure, and robust fintech application. Once developed, conduct thorough testing to identify and resolve any bugs or glitches before launching it to the market.

Analyze, Monitor, and Iterate

Your fintech app development process does not end at its successful deployment. You need to constantly monitor your app’s performance, feedback, user engagement, scalability, and security to ensure its ongoing success in the fintech industry. You can use analytics tools to gain insights into user behavior and stay up-to-date with the security standards to iterate and enhance the app’s performance based on market trends and user feedback.

App Development Cost for Cybersecurity In FinTech Industry

The cost of developing a secure financial app varies depending on several factors, such as the platform(s) the app will be created for, the type of app, the app’s features and complexity, the level of security it provides, and the location of the fintech app development company.

Each of these factors significantly contributes to the overall app development cost. Therefore, it is challenging to provide an exact cost of fintech app development without knowing your specific requirements. To give a rough estimate, fintech app development cost can range somewhere from $50,000 to $300,000 or more, depending on the factors mentioned above.

Now that you know the basic steps to build a secure fintech app and its associated costs, let’s discover the best practices to keep your application safe from cybercrime and gain a competitive advantage.

(Also read: How Much Does It Cost to Build A FinTech App Like Revolut)

Best Practices to Ensure Cybersecurity in Fintech Industry

With the ever-increasing risk of data breaches and cybercrime, the importance of integrating proactive security measures into fintech applications has become higher than ever. A small incident of a security breach in a fintech app can result in major financial losses, legal implications, and reputational damage. So, you must incorporate the best practices when building a fintech app security solution.

Comply with Industry Standards and Regulations

The fintech industry is highly regulated. Therefore, to protect users’ data and ensure cybersecurity, you need to familiarize yourself with the regulatory standards. Ensure your app adheres to general regulations such as Anti-Money Laundering (AML), Know Your Customer (KYC), PCI-DSS, and General Data Protection Regulation (GDPR) to build trust and compliance.

Secure Data Storage

Building a secure solution that fully protects fintech data security means integrating security at every stage of the application. Therefore, when building a fintech cybersecurity app, you need to ensure what data to store, where to store it, who will access your app, and more. Try to keep your app’s architecture simple and store only the minimal crucial data so that hackers can’t steal sensitive information from your system. For instance, build a secure payment gateway that does not ask for the customers’ card numbers. Regularly testing the data restoration process is also essential to ensure data integrity.

Write Secure App Code

Secure coding is the backbone of a fintech application. If your code has even the smallest vulnerabilities, your entire effort of building a secure application may go in vain, bringing your business at risk. Therefore, the tech experts who deploy the code should consider proper logging, input validation, password management, handling of errors, authentication, cryptography practices, and secured communication.

Implement Secure APIs, Data Encryption, Two-Factor Authentication

The success of the fintech industry heavily relies on the security and scalability of financial solutions. Therefore, when building a fintech app, integrate strong security measures such as biometric identification, two-factor authentication, data encryption, and secure APIs.

Biometric Identification: The biometric technology adds an extra layer of security to the application by allowing users to access the fintech solution only with their unique biometric data, such as facial recognition or fingerprints.

Multi-Factor Authentication: Multi-factor authentication asks users to provide two or more forms of identification to access the application. For instance, users need to use a password and an OTP sent to their mobile device before accessing their accounts.

Data Encryption: Data encryption is one of the best practices to secure financial information. Add a strong data encryption feature to protect sensitive user data at rest and during transmission, ensuring that hackers can’t gain unauthorized access and interpret the information.

Application Programming Interfaces (APIs): Fintech app security solutions interact with various third-party services through APIs. Therefore, your fintech cybersecurity strategies must include the security of these APIs to prevent dubious access and potential data breaches.

By integrating these cybersecurity solutions and security features into the fintech applications, businesses can successfully face the fintech cybersecurity risks while building a secure and resilient digital financial ecosystem.

Also Read: IoT in Fintech – How It’s Transforming the BFSI Sector

Find a Trusted Tech Partner with Cybersecurity Policies

Building a secure fintech app is a nerve-wracking ordeal. Your in-house team might face a tough time following the above-listed steps and best practices successfully. So, to ensure easy and successful app development, you can consider partnering with a trusted fintech software development company that has essential certifications and robust cybersecurity standards to build secure fintech apps. Even if finding the right tech partner is a challenging chore, once you find it, it will pay you off in the long run.

You can follow the below practices to find the right tech partner:

- Research various tech vendors and evaluate their commitment to cybersecurity.

- Look for a company with a proven record of delivering successful financial applications and software solutions.

- Ask about their security practices, team, policies, and certifications.

- Check if the company complies with your industry regulations and has essential certifications like ISO 27001, SOC 2, and PCI DSS.

- You can also check its past clients’ reviews, testimonials, and portfolio.

Now that we have talked about all the essential elements that can ensure fintech cybersecurity, it’s time to look at a few examples of financial applications that are ruling the industry with their top-notch security features.

Real-World Examples of Top-Notch Fintech Applications

The fintech industry has many different types of applications, each with its unique features and functionalities catering to the diverse needs of users. Here are some real-world applications that demonstrate the best examples of cybersecurity in fintech industry with their seamless performance and user experience.

PayPal

PayPal is a globally recognized P2P payment app helping users make online purchases, send and receive money, and manage their finances. Thai fintech solution allows users to link their credit cards, debit cards, and bank accounts with the application to facilitate safe and smooth transactions. The widespread acceptance and user-friendly interface of PayPal offer convenient and safe payment solutions for both individuals and businesses, ensuring secure transactions and peace of mind.

Robinhood

Robinhood is a leading stock trading application in the fintech industry that provides users with a secure platform to buy and sell stocks, cryptocurrencies, and ETFs. With two-Factor Authentication (2FA), device monitoring, and other security features, Robinhood is considered a safe option for investors’ securities and cash for various reasons, resulting in the platform acquiring more than 12.2 million monthly active users. Also, Robinhood is a member of the Securities Investor Protection Corp. (SIPC) and also has FDIC insurance, which ensures robust cybersecurity in fintech industry.

Know: How Much Does Robinhood Like Trading App Development Costs?

Mint

Mint is a comprehensive personal finance app that allows users to track their expenses and finance efficiently. It seamlessly syncs with users’ credit cards, debit cards, bank accounts, and bills to offer personalized insights, helping customers make informed financial decisions. The app’s intuitive interface, robust security measures, and best practices of leveraging IoT, AI, blockchain, and other fintech cybersecurity trends, make it a secure solution for its millions of users worldwide, helping them stay on top of their finances.

Common cand Solutions of FinTech in Cybersecurity

Cybersecurity in fintech faces unique challenges because of the sensitivity of financial transactions and strict regulatory environments. Below are some of the most common challenges and how businesses can effectively address them.

| Name | Explanation | Solution |

|---|---|---|

| Data Breaches | Hackers target fintech apps to steal sensitive customer and financial data, causing major financial and reputation loss. | Use advanced encryption, secure databases, and real-time threat detection systems to protect data. |

| Weak Authentication | Simple login systems make it easy for attackers to gain unauthorized access to user accounts or internal systems. | Implement multi-factor authentication and biometric login options for stronger user verification. |

| Third-Party Vulnerabilities | APIs, cloud vendors, and third-party tools can introduce security gaps if not properly vetted and monitored. | Perform strict vendor assessments, apply security certifications, and monitor all third-party access continuously. |

| Regulatory Compliance Pressure | Meeting multiple, evolving regulations like PCI DSS and GDPR laws can overwhelm fintech teams. | Work with dedicated FinTech firms that have complete knowledge of compliances and integrate regulatory frameworks into your system from day one. |

| Cloud Security Risks | Poorly secured cloud infrastructure can lead to data leaks, service disruptions, or unauthorized access. | Design secure cloud architectures, enforce access controls, and perform regular vulnerability assessments. |

| Phishing | Cybercriminals trick employees or customers into giving up credentials or clicking malicious links. | Conduct regular cybersecurity awareness training and deploy email security tools to detect and block attacks. |

| Rapid Technology Changes | Fast adoption of new tech (AI, blockchain, mobile payments) often outpaces the security measures in place. | Build flexible, modular security frameworks that can quickly adapt to emerging technologies and threats. |

Future Trends of Cybersecurity in the Fintech Industry

As fintech continues to evolve, so do the methods of securing sensitive financial data. Emerging technologies and rising threats are shaping a new era of cybersecurity, where innovation and adaptability will be key to survival.

Emerging Trends Shaping the Future of Cybersecurity in the Fintech Industry

- AI-Driven Threat Detection

- Zero Trust Architecture Becomes Standard

- Quantum-Resistant Encryption

- Biometric Authentication Expansion

- Increased Regulation and Compliance Technology

- Cybersecurity-as-a-Service (CSaaS) Adoption

- Blockchain for Enhanced Security

- Cloud-Native Cybersecurity Solutions

1. AI-Driven Threat Detection

Artificial Intelligence will take a larger role in detecting cyber threats in real-time. Advanced AI models will be able to identify unusual activities faster, helping prevent potential breaches. Automated threat detection will also allow fintech companies to strengthen their security with quicker response times.

2. Zero Trust Architecture Becomes Standard

Fintech companies will increasingly move towards a “never trust, always verify” model. Every access request, whether from inside or outside the organization, will need verification. This approach will significantly lower the risk of both external attacks and insider threats.

3. Quantum-Resistant Encryption

As quantum computing advances, traditional encryption methods may become vulnerable. Fintech firms will need to adopt quantum-resistant algorithms to protect sensitive financial data. Preparing for this transition early will be critical for long-term security.

4. Biometric Authentication Expansion

Traditional passwords will be replaced with biometric methods such as fingerprint scanning, facial recognition, and voice authentication. Fintech platforms will increasingly use multi-layered biometric security to offer both convenience and stronger protection to users.

5. Increased Regulation and Compliance Technology

With governments tightening cybersecurity regulations, fintech companies will need to invest in compliance technologies. Regulatory Technology (RegTech) tools will help automate compliance processes, manage risks, and ensure real-time reporting to regulatory bodies.

6. Cybersecurity-as-a-Service (CSaaS) Adoption

Many fintechs will turn to specialized external providers for cybersecurity support instead of building large in-house teams. Cybersecurity-as-a-Service will offer flexible, scalable security solutions, helping companies access high-level protection without significant infrastructure costs.

7. Blockchain for Enhanced Security

Blockchain will expand beyond payments and into cybersecurity applications. Fintech companies will use blockchain’s decentralized and tamper-proof structure to secure transactions, contracts, and sensitive data against unauthorized changes.

8. Cloud-Native Cybersecurity Solutions

As cloud adoption grows, cybersecurity strategies will become increasingly cloud-native. Cloud tools will help fintechs maintain secure and compliant operations across multiple cloud environments.

Consider Appinventiv as Your Trusted Tech Partner for Fintech App Development

In today’s technology-driven age, where handling finances online has become the first preference of tech-savvy individuals, building secure fintech apps should be the prime concern of fintech companies. However, with fintech cybersecurity making news frequently, developing fintech security solutions is not an easy feat. Navigating the complexities of cybersecurity requires the expertise and proficiency of a reliable fintech app development company like Appinventiv.

With a team of 350+ fintech professionals, we have a proven track record of delivering more than 500 custom fintech solutions globally. Our seasoned cybersecurity services experts can build high-grade and secure fintech apps from scratch based on your needs.

For instance, we built a chatbot-based fintech app, Mudra, that revolutionized budget management for millennials. Since it is a budget management app, it had to process financial data. Therefore, we leveraged AI to its maximum potential and adhered to fintech cybersecurity best practices to integrate cybersecurity at every phase of the project’s life cycle.

For another client, Bajaj Finserv, we created a secure and resilient digital platform, helping them secure 300+ merchant onboarding and 3+ lakh transactions per day. While building this digital platform, we used advanced security practices and walls to prevent financial fraud and secure sensitive information.

With our efficient team of fintech experts, you can confidently embark on your fintech cybersecurity journey and bring your app idea to life. Interested in building a secure and robust fintech app and improve your cybersecurity in FinTech Industry? Contact us now.

FAQs

Q. What is cybersecurity in fintech?

A. Cybersecurity in fintech industry means integrating robust security measures and best practices into fintech security solutions to protect users’ sensitive data and finance from unauthorized access, data breaches, and cyber threats. It involves the use of advanced technologies such as artificial intelligence, big data, blockchain, etc., to ensure data protection.

Q. Why is cybersecurity crucial in fintech?

A. Fintech cybersecurity is crucial to ensure the security of users’ information, financial data, and transactions in the digital landscape. It aims to prevent cyber criminals and hackers from gaining unauthorized access to your fintech system and executing their malicious attempts to tamper with your digital infrastructure.

Consult with an IT consulting services provider to learn more about the best cybersecurity strategies.

Q. What are common cybersecurity threats in fintech?

A. Some common cybersecurity threats that you must be aware of are:

- Ransomware

- Data breach

- Phishing

- Hacking

- Insider threats

Q. What are the benefits of cybersecurity in fintech?

A. Cybersecurity in fintech offers a wide range of benefits against evolving cyber threats. It helps protect users’ sensitive data and financial records from being hacked, stolen, or breached by potential cyber-attacks. By preventing cybercrime, it helps avoid financial losses, regulatory penalties, and reputational damages.

How Much Does it Cost to Build a Personal Finance App like Pocketsmith?

Imagine an app that knows when your rent is due, reminds you of upcoming bills, forecasts your savings 12 months ahead, and tells you if that third coffee this week is wrecking your budget. That’s the kind of experience apps like PocketSmith deliver, and it’s exactly why personal finance apps are becoming a must-have for…

How Much Does it Cost to Build a Mobile Banking App Like Halifax in the UK?

The way people bank has changed dramatically. Gone are the days of waiting in long queues or rushing to a branch before closing hours. Today, mobile banking apps like Halifax have redefined convenience, allowing users to check balances, transfer funds, pay bills, and even apply for loans from their smartphones, anytime and anywhere. This shift…

How to Approach Currency Converter App Development?

Imagine you’re about to travel abroad and need to quickly check how much your local currency is worth in another country, or perhaps you run an international business and constantly deal with multiple currencies. In both cases, a currency converter app is an indispensable tool. With global transactions becoming the norm and forex markets fluctuating…