- Klarna BNPL App: Enhancing Experiences

- How Much Does It Cost To Develop An App Like Klarna

- A Simple Formula to Estimate the Cost of Developing a BNPL App

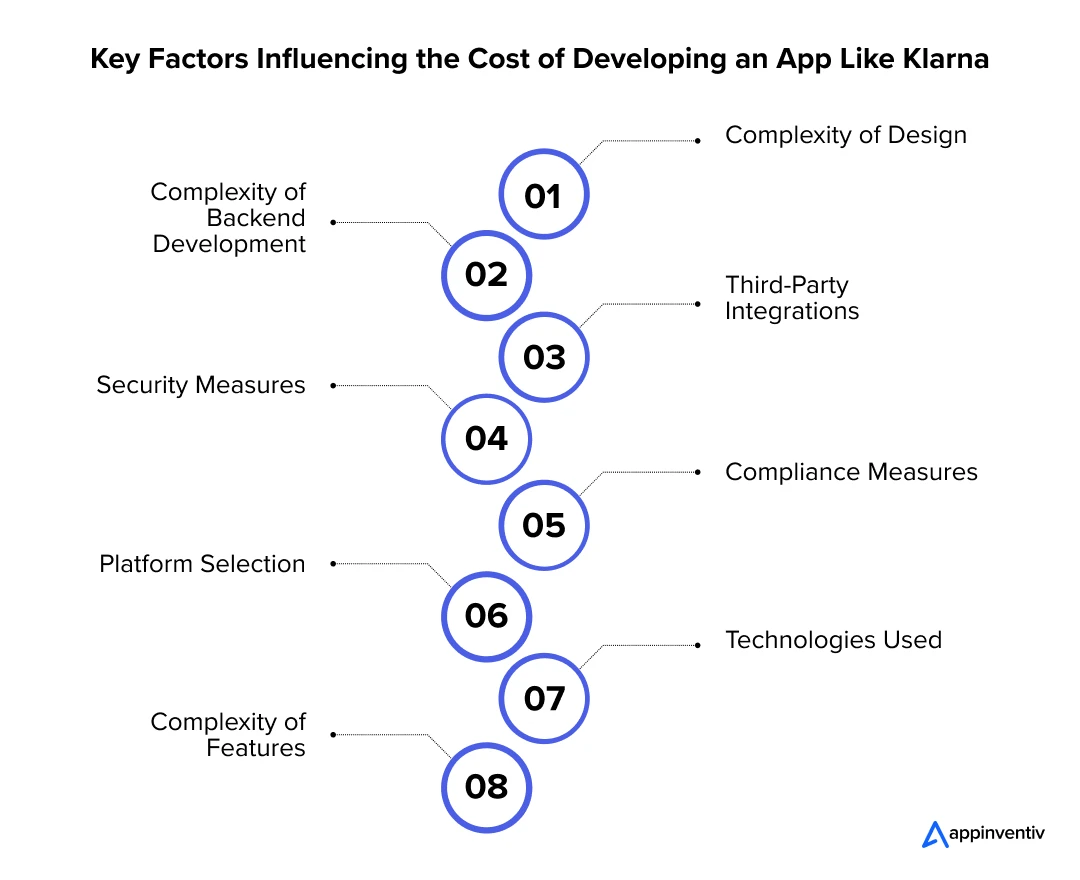

- Factors That the Cost of Developing An Ap Like Klarma

- Complexity of Design

- Complexity of Backend Development

- Third-Party Integrations

- Security Measures

- Compliance Measures

- Platform Selection

- Technologies Used

- Complexity of Features

- Disclosing the Hidden Cost to Develop a BNPL App

- App Maintenance

- App Hosting

- App Promotion and Marketing

- Legal and Licensing Fees

- How To Optimize BNPL App Development Cost

- Developing an MVP

- Prioritizing Necessary Features

- Leveraging Cross-Platform Development

- Outsourcing to Cost-Effective Regions

- Best Features to Consider For Making Your BNPL App Better Than Klarma

- Intuitive UI/UX

- Advanced Features

- Robust and Scalable Technologies

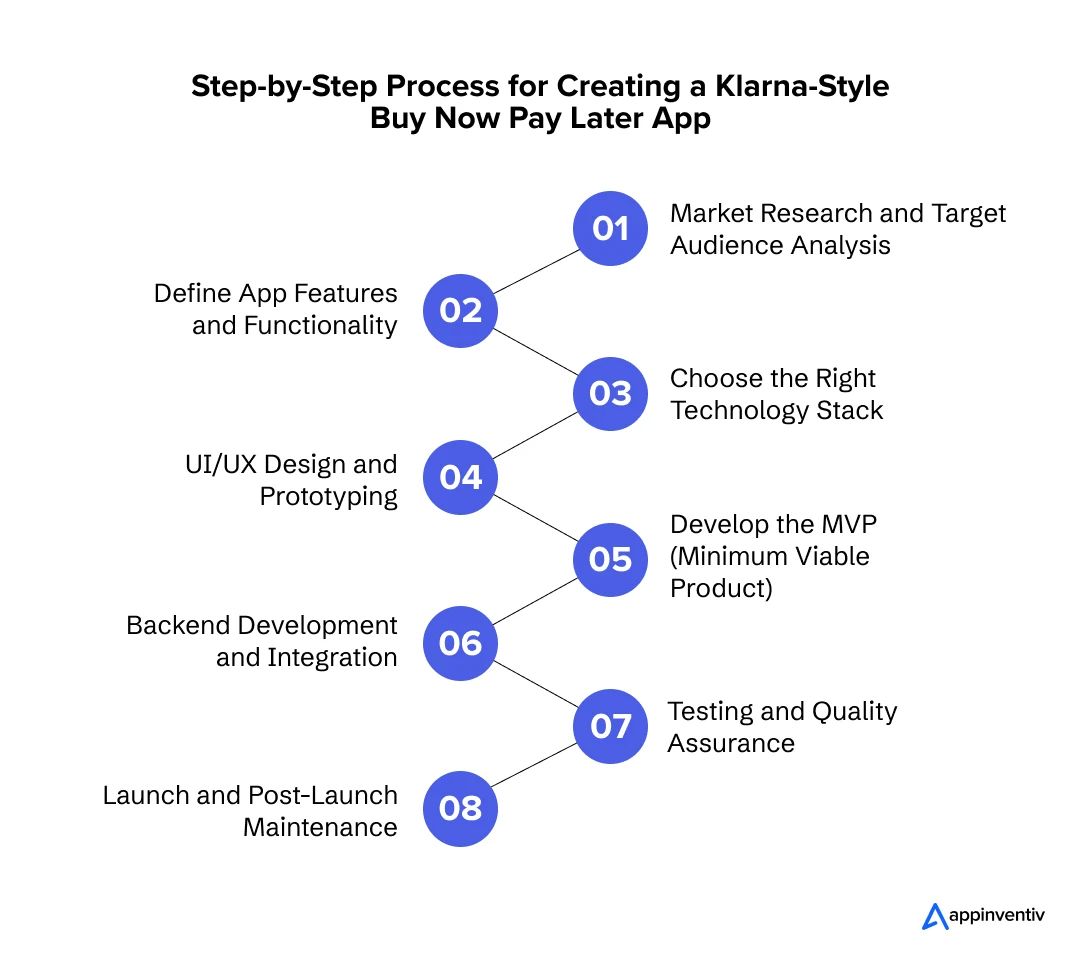

- Step-by-Step Guide to Build An App Like Klarna

- 1. Market Research and Target Audience Analysis

- 2. Define App Features and Functionality

- 3. Choose the Right Technology Stack

- 4. UI/UX Design and Prototyping

- 5. Develop the MVP (Minimum Viable Product)

- 6. Backend Development and Integration

- 7. Testing and Quality Assurance

- 8. Launch and Post-Launch Maintenance

- Effective Monetization Strategies for An App Like Klarna

- Merchant Fees

- Late Payment Fees

- Interest on Installments

- Subscription Plans

- Collaborate With Appinventiv to Build a Cutting-Edge BNPL App Like Klarna

- FAQs

Customer experience is essential in today’s competitive market, where convenience and flexibility determine a brand’s success. Among the many innovations transforming consumers’ shopping, Buy Now, Pay Later (BNPL) apps like Klarna have emerged as a game-changer.

These apps simplify purchasing by allowing customers to split their payments into manageable installments, creating a seamless shopping journey that enhances satisfaction.

However, developing such an intuitive and feature-rich app involves various considerations, from designing user-friendly interfaces to integrating secure payment gateways and advanced analytics. Each of these factors subtly contributes to the overall investment required, making it crucial to approach the process strategically.

Typically, the cost to develop an app like Klarna falls between $40,000 and $300,000, depending on features, platform, and development approach.

Let’s explore the key factors, strategies, and considerations shaping this investment.

Klarna BNPL App: Enhancing Experiences

Klarna, a global leader in the Buy Now, Pay Later (BNPL) industry, has transformed the way consumers shop and pay.

- With an impressive 4.6-star rating, over 650,000 reviews, and more than 50 million downloads, Klarna stands out as one of the most trusted and widely used BNPL apps.

- Founded in 2005, the app operates in more than 45 countries and collaborates with over 500,000 retailers, including top brands like Adidas, H&M, and IKEA.

- Klarna offers users the flexibility to split payments into interest-free installments, along with features like one-click checkout, personalized shopping recommendations, and real-time order tracking.

- Its innovative approach to simplifying payments and enhancing the shopping journey has made Klarna a go-to platform for millions of users worldwide.

How Much Does It Cost To Develop An App Like Klarna

Developing an app like Klarna (Buy Now, Pay Later – BNPL app) involves multiple cost factors, depending on the app’s features, complexity, platform, and development team. Below is a comprehensive breakdown of what contributes to the development cost.

Typically, the cost to develop buy now pay later apps like Klarna varies between $40,000 and $300,000, depending on several factors such as the app’s complexity, the features you want to include, the choice of platform (iOS, Android, or both), and the location of the development team.

| App Complexity Levels | Features | Duration |

|---|---|---|

| Basic ($40,000 to $60,000) | Simple UI, Basic Navigation Limited Functionality, Standard Security Measures, Basic Database Integration, Push Notifications, Single Platform Compatibility | 2 to 4 months |

| Moderate ($60,000 to $120,000) | Enhanced UI, Improved Navigation Experience, Expanded Functionality, Security Features Integration with External APIs, Cross-Platforms, Social Media Integration | 4 to 6 months |

| Complex ($120,000 to $300,000) | Advanced Navigation Features, Rich Functionality with Custom Features, Robust Security Protocols, Advanced Offline Capabilities, Real-time Updates, Advanced Analytics, Multi-language Support, etc. | 6 to 9 months |

A Simple Formula to Estimate the Cost of Developing a BNPL App

The cost to build a BNPL app like Klarna is primarily influenced by two key factors: the total number of development hours and the hourly rate of the development team. By combining these elements, you can use a simple formula to estimate the overall cost of developing a BNPL app tailored to your business needs.

Factors That the Cost of Developing An Ap Like Klarma

Building a BNPL app like Klarna involves various factors directly influencing the development cost. Each element plays a significant role, from the complexity of the app’s design to the technologies for developing an app like Klarna. Here’s a breakdown of the key factors that determine the overall expense.

Complexity of Design

The design of an app like Klarna involves creating a seamless user interface and experience, ensuring ease of navigation and engagement. Advanced designs with custom animations or unique layouts significantly increase the cost to develop an app like Klarna. A simple design, on the other hand, reduces both time and expense.

- Basic UI/UX Design: $6,000 – $30,000

- Custom/Advanced UI/UX Design: $30,000 – $50,000+

Complexity of Backend Development

The backend of a Klarna-like app requires robust architecture to manage financial data, transactions, and user accounts securely. The more complex the backend functionalities, such as real-time data synchronization and AI-driven insights, the higher the development cost. Scalable and reliable backend systems also add to the cost to develop an app like Klarna.

- Simple Backend: $5,000 – $15,000

- Medium Complexity Backend: $15,000 – $40,000

- High Complexity Backend: $40,000 – $100,000+

Third-Party Integrations

Klarna, like app development, relies heavily on third-party APIs for payment gateways, banking systems, and user authentication. Each integration requires compatibility checks and customization, which can drive up costs. Frequent updates to these APIs may also incur maintenance expenses over time.

- Basic Integration (Single Payment Gateway): $2,000 – $10,000

- Complex Integration (GPS, Multiple APIs, Real-Time Analytics): $5,000 – $15,000+

Security Measures

Developing an app like Klarna demands top-notch security features, such as encryption, multi-factor authentication, and fraud detection mechanisms. Implementing advanced security protocols can significantly increase the cost to develop an app like Klarna. Ensuring data privacy and safeguarding user transactions is a non-negotiable priority.

- Basic Security Measures (SSL, Data Encryption): $5,000 – $8,000

- Advanced (Biometrics, Multi-Factor Authentication, Encryption): $15,000 – $100,000+

Compliance Measures

Adhering to industry-specific regulations like GDPR, PCI-DSS, or PSD2 is crucial for financial apps. Compliance measures require thorough audits, certifications, and legal consultations, adding to overall costs. Non-compliance risks legal penalties and loss of user trust, making this investment essential.

- Basic Compliance Features: $15,000 – $30,000

- Advanced Compliance (industry-specific): $30,000 – $100,000+

Platform Selection

Developing for a single platform (iOS or Android) costs less compared to building a cross-platform app. However, a cross-platform app offers a wider reach and better market penetration, albeit with higher expenses. Each platform may also have unique requirements that impact the cost to develop buy now pay later apps like Klarna.

- Single Platform (iOS or Android): $30,000 – $100,000

- Cross-Platform (iOS and Android): $100,000 – $300,000+

Technologies Used

The choice of technologies for developing an app like Klarna, such as frameworks, programming languages, and tools, affects the development cost. Advanced technologies like AI, ML, and blockchain can add functionality but increase expenses. Using cutting-edge tools ensures scalability and efficiency, justifying the investment.

- Basic Tech Stack (React Native, Flutter, PHP): $50,000 – $120,000

- Advanced Tech Stack (Python, AI, Blockchain): $120,000 – $250,000+

Complexity of Features

Features like buy-now-pay-later, real-time notifications, and personalized offers require advanced algorithms and integrations. The more complex and feature-rich the app, the higher the time and cost to develop buy now pay later apps like klarna involved. Prioritizing must-have features can help optimize the budget while maintaining app quality.

- Basic Features (Account setup, Secure logins, balance tracking): $30,000–$50,000

- Advanced Features (AI investment advice, real-time analytics): $100,000–$200,000

Disclosing the Hidden Cost to Develop a BNPL App

While the upfront development costs of a BNPL app are often discussed, several hidden expenses can arise post-launch. These include ongoing maintenance, hosting fees, marketing efforts, and compliance with legal regulations. Recognizing these costs early can help you plan your budget effectively by evaluating the right steps to create an app like Klarna.

App Maintenance

App Maintenance

Maintaining a BNPL app involves regular updates to fix bugs, improve performance, and ensure compatibility with the latest devices and operating systems. This ongoing process requires a dedicated budget for developing Buy Now Pay Later apps like Klarna, including development, thorough testing, and deployment. Neglecting maintenance can lead to decreased user satisfaction and security risks.

Action Plan:

- Regular Updates: Schedule bug fixes and performance improvements.

- Performance Monitoring: Track app speed, uptime, and crashes to enhance Klarna-app performance.

- Compatibility: Ensure compatibility with new devices and OS versions to build payment apps like klarna.

- User Feedback: Implement a feedback system for continuous improvements.

App Hosting

Hosting a BNPL app requires robust servers to handle large amounts of user data and financial transactions securely. Cloud hosting solutions, such as Google Cloud, AWS or Azure, come with monthly or annual fees depending on usage. Scaling up the hosting infrastructure as the user base grows can further increase the cost to develop an app like Klarna.

Action Plan:

- Choose Hosting Providers: Use reliable cloud services (AWS, Azure) to develop apps similar to Klarna.

- Monitor Resource Needs: Regularly assess server capacity for growth to develop buy now pay later apps like Klarna.

- Load Balancing: Implement auto-scaling for peak traffic.

- Backup: Ensure regular data backups and disaster recovery plans.

App Promotion and Marketing

Promoting a BNPL app includes costs for digital advertising, social media campaigns, influencer partnerships, and app store optimization. A well-planned marketing strategy is crucial to attract and retain users. These promotional expenses can add up quickly, especially in competitive markets.

Action Plan:

- Target Audience: Conduct market research on user demographics to develop apps similar to Klarna.

- Advertising: Run digital ads (Google, Facebook) for visibility, which increases the cost to develop an app like Klarna.

- Social Media: Engage users through campaigns and influencers.

- ASO: Optimize app store listings for better discoverability.

- Referral Program: Launch incentives for user referrals to develop buy now pay later apps like Klarna.

Legal and Licensing Fees

Complying with financial regulations requires securing necessary licenses and adhering to regional laws. Legal consultations, audits, and ongoing compliance monitoring add to the hidden cost to develop an app like klarna. Failure to meet legal requirements can lead to hefty fines and reputational damage.

Action Plan:

- Understand Regulations: Comply with local financial regulations.

- Obtain Licenses: Apply for necessary financial licenses.

- Legal Review: Have contracts and policies reviewed by legal experts.

- Ongoing Compliance: Continuously monitor and update to stay compliant.

- Audit: Conduct regular audits to ensure legal adherence

How To Optimize BNPL App Development Cost

Optimizing the cost of developing a BNPL app requires careful planning and strategic decisions throughout the development process. Here, we will explore effective approaches to managing expenses while ensuring the app meets business and user expectations.

Developing an MVP

Building a Minimum Viable Product (MVP) helps focus on core functionalities while saving time and resources. It allows businesses to test the app’s viability and gather user feedback before scaling up. This approach minimizes initial costs and reduces the risk of expensive rework.

Quick Tips:

- Focus on core features for early market testing in order to build payment apps like Klarna.

- Validate app viability before scaling to build a BNPL app like Klarna.

- Save time and resources by minimizing initial features for Klarna-like apps development.

Prioritizing Necessary Features

Instead of integrating all possible features at once, focus on must-have functionalities that meet user expectations. Adding advanced features can be planned for future updates based on user demand. This approach keeps development costs manageable while ensuring a user-friendly experience.

Quick Tips:

- Start with must-have functionalities to develop a BNPL app similar to Klarna.

- Add advanced features in future updates while focusing Klarna-like apps development.

- Ensure user-friendly experience with essential features for Klarna-like apps development.

Leveraging Cross-Platform Development

Using cross-platform development frameworks like Flutter or React Native reduces the need for separate codebases for iOS and Android. This saves both time and money while maintaining consistent performance across platforms. It’s an ideal choice for BNPL apps targeting a diverse user base.

Quick Tips:

- Use frameworks like Flutter or React Native to develop a BNPL app similar to Klarna.

- Develop for both iOS and Android with one codebase.

- Save time and costs while ensuring platform consistency to develop buy now pay later apps like Klarna.

Outsourcing to Cost-Effective Regions

Partnering with development teams in cost-effective regions can significantly lower expenses without compromising quality. Countries with competitive pricing, like India or Eastern Europe, often provide access to skilled developers. Outsourcing also eliminates the need for in-house team investments.

Quick Tips:

- Partner with teams from regions like India or Eastern Europe to develop a BNPL app similar to Klarna.

- Reduce costs without compromising quality to develop apps similar to Klarna.

- Access skilled developers without in-house team investments to develop buy now pay later apps like Klarna.

Our app development team will provide a tailored cost breakdown, giving you the clarity and confidence to take your app from concept to reality.

Best Features to Consider For Making Your BNPL App Better Than Klarma

To create an app better than Klarna, focus on offering superior user experience, seamless integrations, and advanced features like personalized payment plans and enhanced security. Continuously innovate by leveraging cutting-edge technologies to stay ahead of market trends and customer expectations.

Intuitive UI/UX

An exceptional BNPL app starts with a user-friendly UI/UX design that ensures seamless navigation and an engaging experience. Prioritize simplicity, clarity, and accessibility to make financial transactions stress-free for users of all backgrounds and build a BNPL app like Klarna.

Advanced Features

Integrate innovative features of an app like Klarna, such as AI-driven personalized offers, real-time credit scoring, and multi-currency support. These advanced functionalities can set your app apart, providing added value and convenience to users and providing a strategic approach to develop a BNPL app similar to Klarna.

Here are some prominent features of an app like Klarna. Let’s explore!

Admin Side Features:

- Dashboard Analytics: Admins can track real-time transactions, user activity, and financial data for performance insights and decision-making.

- User Management: Admins can manage user accounts, approve or deny applications, and set personalized credit limits based on financial history.

- Payment Plan Customization: Admins can design flexible payment options for users, allowing varied interest rates and durations based on user profiles.

- Risk Assessment & Credit Scoring: Admins can assess user creditworthiness with built-in algorithms, setting borrowing limits and approvals accordingly.

- Fraud Detection & Security Monitoring: Real-time fraud detection tools allow admins to monitor suspicious activities and mitigate risks.

- Merchant Integration & Management: Admins can onboard new merchants, manage partnerships, and track merchant transactions within the app.

- Notifications & Alerts Management: Admins can customize alerts and push notifications for user payments, due dates, and special offers.

- Financial Reporting & Compliance: Admins can generate reports for tax filing, audit trails, and compliance with regulatory requirements.

User Side Features:

- Instant Credit Approval & Flexible Payment Options: Users can receive instant BNPL credit approval with the ability to choose from flexible payment plans based on their needs.

- Personalized Spending Limits: Users get customized credit limits based on their spending history and creditworthiness for better financial control.

- Transaction History & Payment Tracking: Users can view detailed transaction history, check payment status, and track upcoming dues for better management.

- In-App Payments & Reminders: Users can make payments directly within the app and set up reminders or auto-pay to stay on top of their dues.

- Rewards & Offers: Users can earn rewards, discounts, or cashbacks for timely payments and shopping with partnered merchants.

- Credit Score Insights: Users can track their credit score over time and get insights into how BNPL usage affects their creditworthiness.

- Expense Management Tools: Users can use built-in budgeting tools to track and manage BNPL payments alongside other expenses.

- Referral Program: Users can earn rewards or bonuses by referring new users, encouraging app adoption and engagement.

Robust and Scalable Technologies

Choose scalable technologies and a strong backend to handle growing user demands without compromising performance. Implementing secure payment gateways and cloud infrastructure ensures your app’s reliability, security, and future-proofing.

- Artificial Intelligence (AI): Leverage AI for credit risk assessment, fraud detection, and personalized user experiences. AI algorithms analyze user behavior and financial history to provide tailored payment solutions while streamlining the approval process for faster transactions.

- Blockchain Technology: Integrate blockchain to enhance transaction transparency and security. It ensures secure data exchange and protects sensitive financial information from cyber threats, making the entire payment ecosystem more reliable and trustworthy.

- Cloud Computing: Adopt cloud infrastructure to scale your app effortlessly with increasing user demands. Cloud solutions also provide enhanced reliability, data accessibility, and cost efficiency, enabling your app to stay agile and future-proof in a dynamic market.

Step-by-Step Guide to Build An App Like Klarna

Let’s understand how to build a BNPL (Buy Now, Pay Later) app like Klarna. From identifying market needs to launching and maintaining your app, this guide breaks down each step to help you create a seamless, secure, and user-friendly application. Let’s dive in the steps to create an app like Klarna!

1. Market Research and Target Audience Analysis

The first step in building a BNPL app like Klarna is conducting in-depth market research. Analyze current trends, competitors, and user preferences within the BNPL industry.

Understand your target audience’s needs, such as flexibility in payments or interest-free installment options, to create a solution that resonates with them. This step ensures your app addresses real user pain points and differentiates itself in the competitive market, strengthen Klarna-app development process.

2. Define App Features and Functionality

Your app’s success depends on offering features that meet user expectations while being innovative. Core functionalities should include user registration, secure payment gateways, installment payment options, credit scoring, and transaction history.

Additional features like loyalty rewards, personalized offers, and AI-driven shopping suggestions can enhance user engagement and retention. Clearly defining these features will help streamline development and build a BNPL app like Klarna.

3. Choose the Right Technology Stack

Selecting the right technology stack is crucial for building a scalable and secure app. For the front end, use frameworks like Flutter or React Native to ensure cross-platform compatibility. A robust backend powered by Node.js or Python can efficiently manage user data and transactions.

For the database, opt for scalable solutions like MongoDB or PostgreSQL. Additionally, integrating payment gateways such as Stripe or PayPal ensures smooth and secure payment processing and focuses to build a BNPL app like Klarna.

4. UI/UX Design and Prototyping

A seamless user experience is essential for a BNPL app. Design an intuitive interface that prioritizes simplicity and easy navigation for users of all demographics. Use tools like Figma or Adobe XD to create prototypes and test user flows before development.

A visually appealing design and functionality will encourage users to interact with the app more effectively.

5. Develop the MVP (Minimum Viable Product)

Building an MVP allows you to test the app’s core functionality in the market with minimal resources. This includes essential features such as account creation, linking payment methods, and installment payment processing.

Launching an MVP helps gather user feedback, validate your concept, and guide the addition of advanced features based on user demands.

6. Backend Development and Integration

The backend is the backbone of your BNPL app, ensuring seamless operation and data security. Focus on creating a backend infrastructure capable of handling sensitive user information, managing transactions, and integrating APIs for payment gateways, credit scoring, and shopping platforms. Prioritize encryption protocols to protect user data and comply with regulatory requirements.

7. Testing and Quality Assurance

Before launching the app, thorough testing is crucial to eliminate bugs and enhance performance. Test the app’s security, payment processing, and responsiveness across various devices. Use manual and automated testing methods to ensure the app performs reliably under different scenarios. A well-tested app boosts user trust and satisfaction, build payment apps like Klarna.

8. Launch and Post-Launch Maintenance

Once the app is ready, it can be deployed to app stores like Google Play and the Apple App Store. Monitor its performance using analytics tools to track user behavior and identify areas for improvement. Actively collect user feedback, fix bugs, and introduce new features through regular updates. Post-launch maintenance ensures your app remains competitive and relevant in the evolving BNPL market.

Transform your customers’ payment journeys with tailor-made features that redefine convenience and set you apart. Start now!

Effective Monetization Strategies for An App Like Klarna

Monetization Strategies for an App Like Klarna involve multiple revenue streams that can generate consistent income. Key strategies include charging merchants a transaction fee, earning interest from users on longer-term installments, and implementing late payment penalties.

Additionally, premium subscription plans and value-added services can further enhance revenue opportunities for your app.

Merchant Fees

Charge merchants a commission or transaction fee for every sale made through your BNPL app. Merchants benefit from increased sales, higher cart conversions, and customer retention, making this a win-win strategy. Highlight these advantages to attract more merchants to your platform.

You can also provide merchants with advanced analytics tools to track consumer spending patterns and optimize their offerings. Building strong partnerships with merchants can lead to long-term collaborations and stable revenue.

Late Payment Fees

Implement a penalty structure for users who miss their payment deadlines. While this should not be the primary focus, it can serve as an additional revenue stream. Ensure transparency when applying these fees to maintain user trust and encourage timely payments.

You can introduce reminders and grace periods before applying penalties to balance user satisfaction. Offering alternative payment solutions to struggling users can also help retain their loyalty while ensuring compliance.

Interest on Installments

Offer flexible payment plans with varying interest rates. For instance, interest-free payments can be provided for short-term plans, while nominal interest can be charged on longer installment periods.

This caters to diverse user needs and creates a sustainable source of revenue. Clear communication about interest rates and repayment terms can boost user confidence in using your app. Additionally, offering personalized interest rates based on credit scores can make the service more appealing to a broader audience.

Subscription Plans

Introduce a premium subscription model where users can access exclusive benefits like extended installment periods, lower interest rates, or personalized offers. This creates a recurring revenue stream, enhancing user loyalty and encouraging frequent app usage.

Subscription plans can also include perks like cashback rewards, priority customer support, or early access to sales. You can target various user segments by offering multiple subscription tiers and maximizing revenue potential.

Collaborate With Appinventiv to Build a Cutting-Edge BNPL App Like Klarna

Appinventiv is a pioneering fintech application development company renowned for delivering cutting-edge solutions tailored to your business needs. Whether you’re looking to create an online payment app or a BNPL app like Klarna, we offer expert payment gateway development services that ensure your app provides a seamless, secure, and hassle-free payment experience.

- Proven Success With 3000+ Projects Delivered: Having successfully delivered over 3000 projects across various industries, Appinventiv demonstrates unmatched expertise and a commitment to excellence.

- A Global Team of 1600+ Experts: Our team of over 1600 highly skilled professionals combines creativity, technical expertise, and industry knowledge to create cutting-edge solutions.

- Innovative and Efficient Development Approach: As a leading fintech application development company, we prioritize transparency, timely delivery, and tailored solutions that align with your business objectives, making us the ideal choice for BNPL app development.

- Awarded for Excellence: Recognized as the ‘Tech Company of the Year’ at the Times Business Awards 2023, we are pioneers in mobile app innovation.

Partner with Appinventiv to build a BNPL app that meets and exceeds expectations, setting new benchmarks in the industry.

FAQs

Q. What is the cost of developing a BNPL app like Klarna?

A. The cost of developing a BNPL app like Klarna depends on several factors, including app complexity, features, platform (iOS, Android, or both), development team location, and design requirements. The development cost can range between $40,000 and $300,000 or more. This includes expenses for UI/UX design, backend development, integration of secure payment gateways, and advanced features like AI-based credit scoring. Consulting with an experienced app development company is best to get an accurate estimate.

Q. How does a BNPL app like Klarna earn money?

A. BNPL apps like Klarna generate revenue through several monetization strategies:

- Merchant Fees: Merchants pay a percentage of each sale made through the app as a commission.

- Late Payment Fees: Users are charged penalties for missing payment deadlines.

- Interest on Installments: Revenue is earned by charging interest on longer-term installment plans while offering interest-free options for shorter durations.

- Subscription Plans: Premium plans provide users with exclusive benefits, such as lower interest rates, extended payment options, and personalized offers.

These monetization strategies enable BNPL apps to sustain profitability while offering value to both users and merchants.

Q. What are the benefits of a BNPL app?

A. BNPL apps, like Klarna, offer consumers the flexibility to split their purchases into manageable installments, often with interest-free options. This makes it easier to purchase higher-ticket items without paying the full amount upfront. For businesses, the benefits of BNPL apps like Klarna include boosting sales, increasing average order values, and improving cash flow. Additionally, BNPL solutions help users manage their finances more effectively and sometimes provide opportunities to build a BNPL app like Klarna or enhance their credit scores. Ultimately, BNPL apps elevate the shopping experience for consumers and drive business growth.

Q. What are the challenges in developing an app like Klarna?

A. Developing an app like Klarna involves several challenges. Ensuring robust security for sensitive payment data, such as encryption and compliance with regulations, is crucial for building user trust. Scalability is key to smoothly handling high transaction volumes, while seamless integration with merchants and financial institutions is essential for functionality. The app must offer an intuitive user experience and adhere to various financial regulations across different regions. Fraud prevention, fast transaction processing, data privacy, and proper localization for diverse markets are vital. Lastly, efficient customer support is necessary for user satisfaction and trust.

How Much Does it Cost to Build a Personal Finance App like Pocketsmith?

Imagine an app that knows when your rent is due, reminds you of upcoming bills, forecasts your savings 12 months ahead, and tells you if that third coffee this week is wrecking your budget. That’s the kind of experience apps like PocketSmith deliver, and it’s exactly why personal finance apps are becoming a must-have for…

How Much Does it Cost to Build a Mobile Banking App Like Halifax in the UK?

The way people bank has changed dramatically. Gone are the days of waiting in long queues or rushing to a branch before closing hours. Today, mobile banking apps like Halifax have redefined convenience, allowing users to check balances, transfer funds, pay bills, and even apply for loans from their smartphones, anytime and anywhere. This shift…

How to Approach Currency Converter App Development?

Imagine you’re about to travel abroad and need to quickly check how much your local currency is worth in another country, or perhaps you run an international business and constantly deal with multiple currencies. In both cases, a currency converter app is an indispensable tool. With global transactions becoming the norm and forex markets fluctuating…