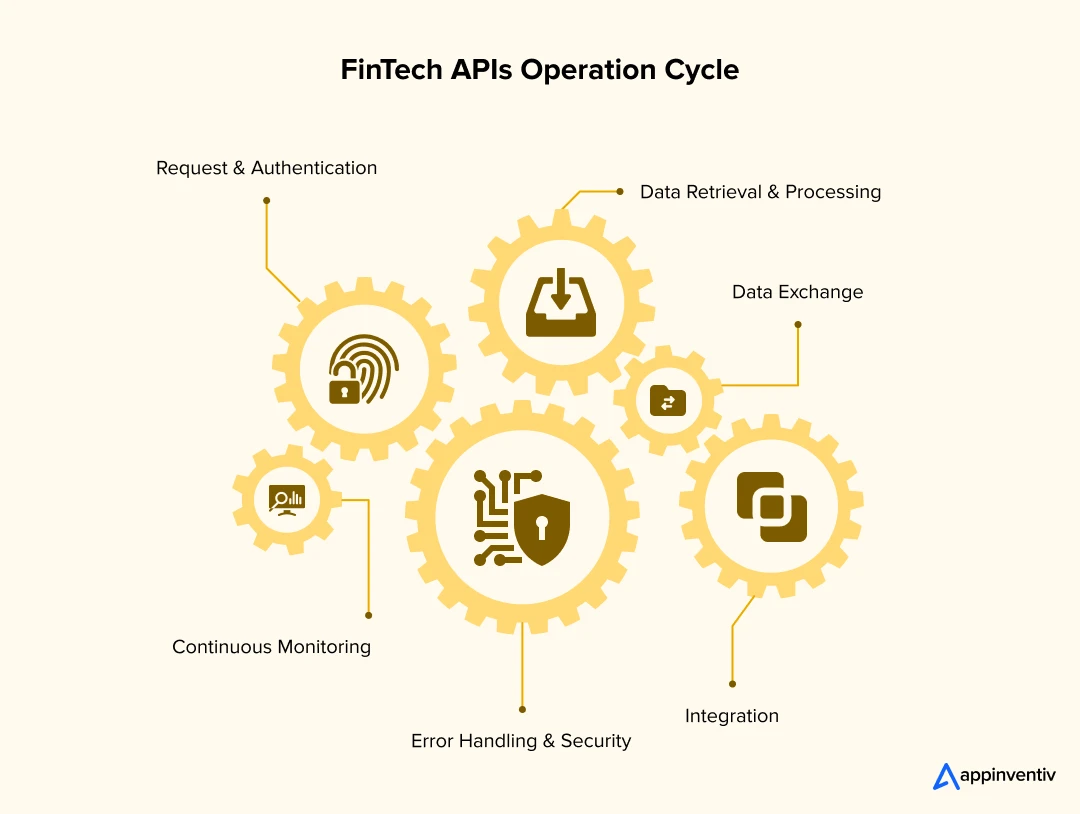

- How Do FinTech APIs Work?

- Request and Authentication

- Data Retrieval and Processing

- Data Exchange

- Integration

- Error Handling and Security

- Continued Monitoring

- Various Types of APIs in FinTech, Their Uses and Examples

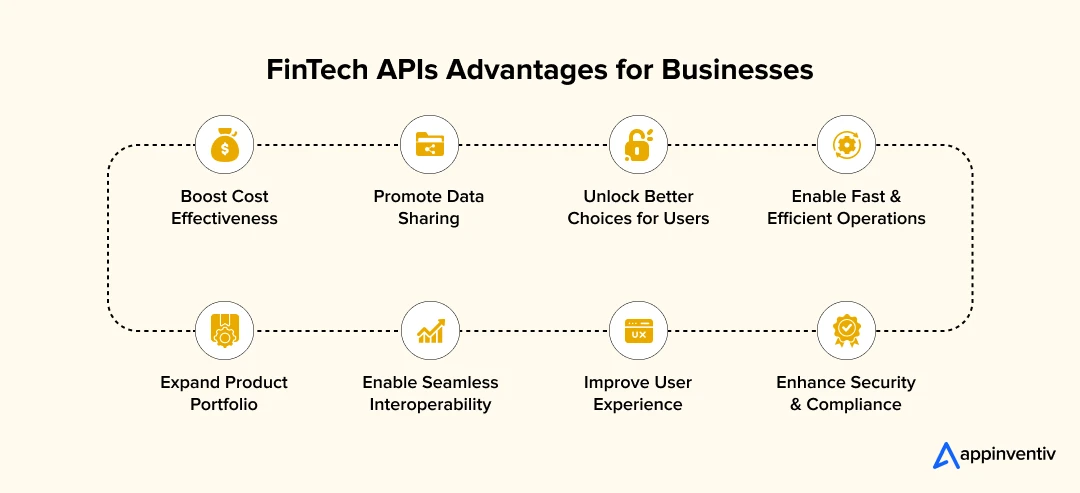

- Benefits of Using APIs in Fintech

- Boost Overall Cost-Effectiveness

- Promote Data Sharing

- Unlock Better Choices for Users

- Enable Fast and Efficient Operations

- Expand Product Portfolio

- Enable Seamless Interoperability

- Enhance User Experiences

- Enhance Security and Compliance

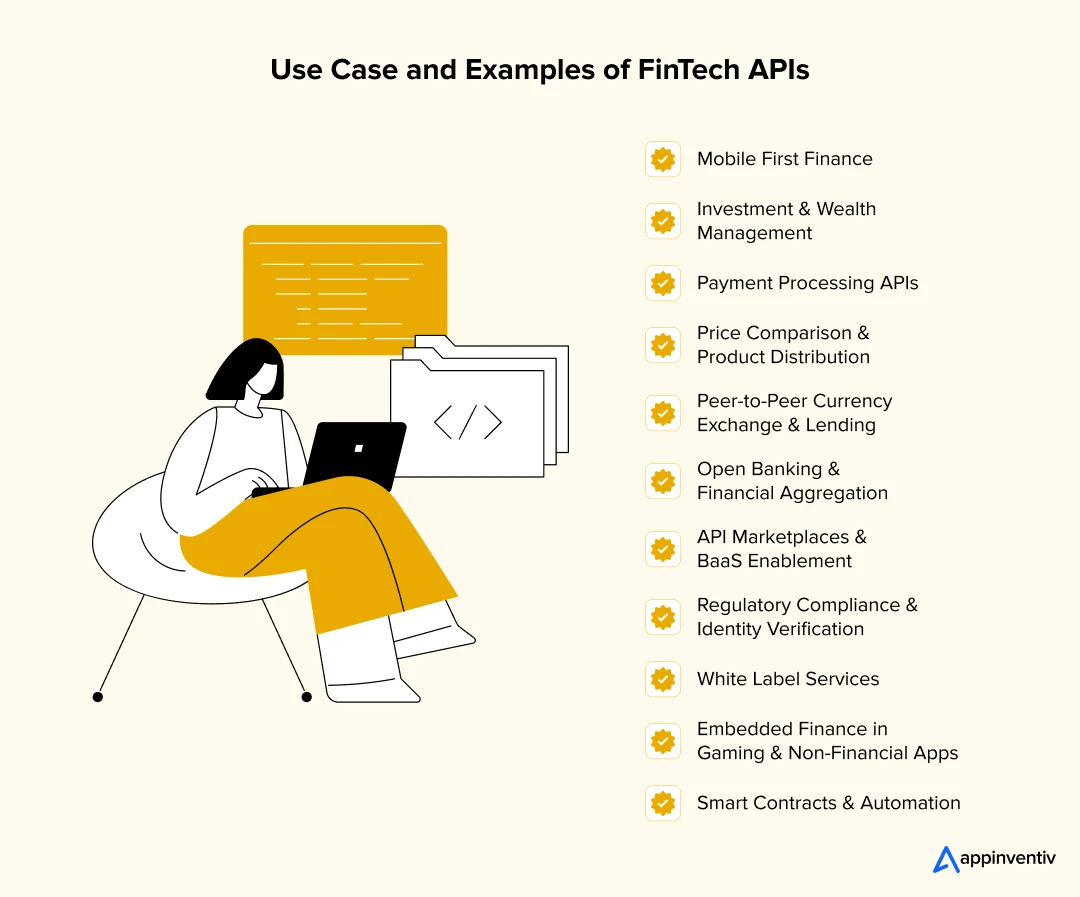

- Game-Changing Use Cases of APIs in FinTech

- Mobile First Finance

- Investment and Wealth Management

- Payment Processing APIs

- Price Comparison and Product Distribution

- Peer-to-Peer Currency Exchange and Lending

- Open Banking and Financial Aggregation

- API Marketplaces and BaaS Enablement

- Regulatory Compliance and Identity Verification (RegTech)

- White Label Services

- Embedded Finance in Gaming and Non-Financial Apps

- Smart Contracts and Automation

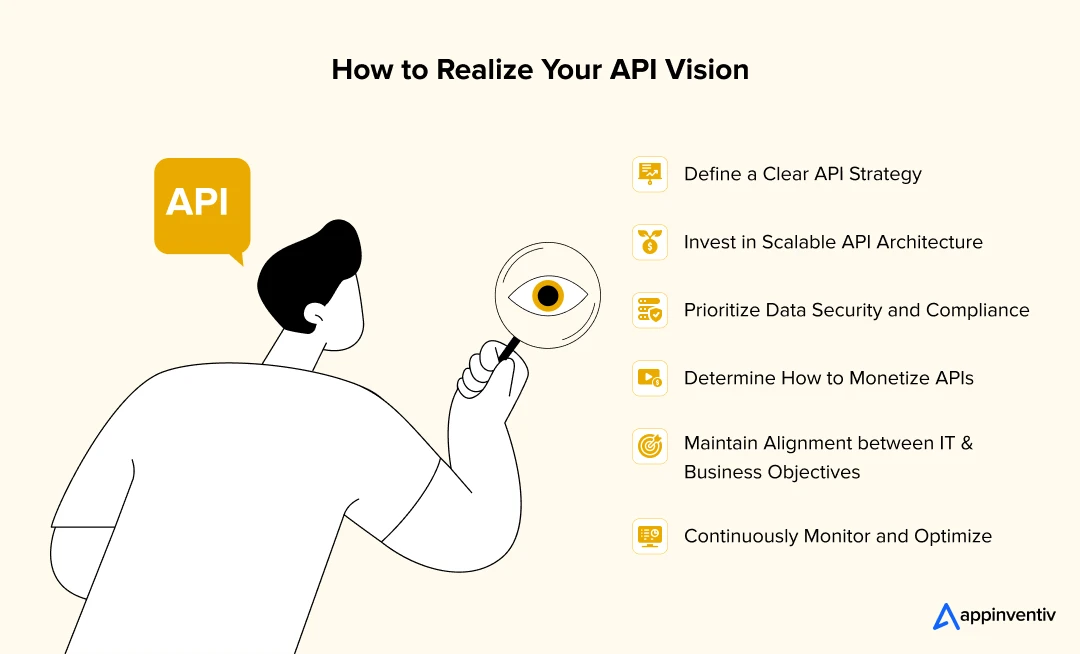

- How Can Companies Unlock the Full Potential of Banking APIs?

- Define a Clear API Strategy

- Invest in Scalable API Architecture

- Implement Security Measures to Protect API Data

- Determine How to Monetize APIs

- Maintain Alignment Between IT and Business Objectives

- Continuously Monitor and Optimize

- Challenges of Implementing Fintech APIs and How to Overcome Them

- Security and Data Privacy Risks

- Technical Complexity

- Regulatory Compliance

- Glorious Future of API in FinTech

- Unlock the Business Potential of FinTech APIs with Appinventiv

- FAQs

The FinTech sector has undergone a remarkable transformation in recent years, with global industry revenue projected to exceed $141.18 billion by 2028. Ever wonder what contributes to this revolutionary rise? It integrates emerging technologies like AI, blockchain, digital transformation strategies, and FinTech APIs (Application Programming Interface). All these measures, particularly FinTech APIs, have redefined how financial services are created, delivered, and consumed.

According to a global McKinsey survey, 88% of organizations believe APIs have gained immense importance in the past few years, with over 81% making them a top business and IT priority. In addition, some large banks allocate nearly 14% of their IT budgets to API initiatives, signaling how central embedded finance for enterprises has become.

So, why are APIs becoming essential in the FinTech sector? The reason is obvious. APIs for FinTech enable the concept of embedded finance for enterprises, facilitating them to integrate services like payments, lending, and insurance into non-financial platforms.

This allows businesses to offer banking-like features into their non-banking apps taht their users already trust. From digital wallets accessing and managing funds in your bank accounts to eCommerce stores offering “Buy Now, Pay Later” options, these everyday conveniences are made possible by APIs working quietly in the background.

In this blog, we will help you understand the world of APIs in FinTech, uncover how APIs help FinTech, and break down the benefits they bring to businesses. Let’s dive in.

How Do FinTech APIs Work?

FinTech APIs act as digital intermediaries to facilitate communication and data exchange between multiple financial technology systems and external applications. They empower customers to engage with banking personnel via the bank app with just a simple internet connection.

For instance, consider your personal finance app. It uses the Open Banking APIs to connect to your bank and fetch your account balance in real time. Here is a detailed description of how financial services APIs work:

Request and Authentication

Every interaction within a FinTech app, initiating a payment or fetching account details, triggers an API request. Building a FinTech API usually demands authentication to ensure secure access, which may involve tokens, keys, or other credentials to verify the user’s identity and permissions.

Data Retrieval and Processing

The API forwards the request to the FinTech system or server, which undergoes processing. This processing can include accessing databases, performing calculations, or interacting with third-party services like banks or payment processors.

Data Exchange

Once the FinTech system has processed the request and obtained the necessary data, it sends a response back through the API. Depending on the request type, this response could include financial information, transaction confirmations, or other relevant data.

Integration

The mobile application on the receiving end then integrates this data into its user interface and displays it to the user. This enables users to view results or perform subsequent actions without any visibility into the backend complexity.

Error Handling and Security

Building a FinTech API means having strong error-handling mechanisms to address validation errors, server failures, incorrect requests, and unauthorized access. Fintech API integration also requires the implementation of various security measures, like data encryption, to ensure sensitive financial data remains protected throughout the exchange.

Continued Monitoring

Continuous monitoring of API-based banking usage is essential to guarantee optimal performance, maintain security standards, and adhere to regulatory requirements. This includes tracking response times, detecting anomalies, and ensuring alignment with regulatory standards such as GDPR or PSD2.

Various Types of APIs in FinTech, Their Uses and Examples

There are several types of financial APIs available for your business. Whether it is enabling secure payments, automating compliance, personalizing investment strategies, or anything you imagine, there is nearly an API for it. Thus, choosing the right types of APIs for FinTech is essential to build next-gen platforms that are functional and future-ready. Here is a table outlining some of the most common types of FinTech APIs and noticeable fintech api examples:

| API Type | Purpose | FinTech API Examples |

|---|---|---|

| Payment Processor APIs | Facilitate real-time, secure money transfers and transactions | Stripe, PayPal, Razorpay |

| Open Banking APIs | Allow third-party apps to access banking data with user consent | TrueLayer, Tink, Nordigen |

| Financial Data Aggregator APIs | Consolidate financial data from multiple sources to provide unified views | MX, Salt Edge, Envestnet |

| KYC APIs | Verify user identity for onboarding and compliance | Onfido, Jumio, Trulioo |

| RegTech APIs | Support regulatory compliance, transaction monitoring, and audit trails | Alloy, ComplyAdvantage, IDnow |

| Credit Scoring & Lending APIs | Evaluate creditworthiness and streamline lending workflows | Experian, CredoLab, FinBox |

| Investment APIs | Enable portfolio management, trading, and market data access | Alpaca, Robinhood, DriveWealth |

| Currency & Crypto Exchange APIs | Support crypto trading, real-time pricing, and multi-currency ops | CoinMarketCap, Coinbase, CurrencyLayer |

| Insurance APIs | Connect with insurers for policy details, quotes, and claims | Lemonade, Trov, Cover Genius |

| Fraud Detection APIs | Monitor behavior and flag suspicious activities to prevent fraud | Sift, Socure, Riskified |

| Accounting APIs | Automate bookkeeping, tax calculations, and reporting | QuickBooks, Xero, Zoho Books |

Benefits of Using APIs in Fintech

APIs for FinTech offer worthwhile opportunities for businesses and users alike, delivering a range of advantages for each. For banks, payment providers, and enterprises, API integrations for FinTech unlock new revenue streams, enhance customer experience, and accelerate digital innovation. For consumers, it delivers speed, convenience, and on-the-go access to financial services. Let’s dive deeper into the multiple benefits of Using APIs in Fintech:

Boost Overall Cost-Effectiveness

Offering diverse financial services often requires substantial investment in infrastructure, compliance, and operations. This is where FinTech APIs prove invaluable for both traditional financial institutions and modern FinTech companies. By leveraging FinTech API integrations, companies can offer their users a wide range of services without the need for extensive infrastructure investments.

Through open API development, businesses can integrate a wide range of financial services without building them from scratch. For instance, users can link their bank accounts to third-party bookkeeping tools to monitor transactions and manage their finances in one place, enhancing convenience and transparency.

This efficient collaboration allows the banks and FinTech providers to optimize resource allocation and minimize operational costs.

Promote Data Sharing

Previously, banks were reluctant to share user information and were rather selective when it came to sharing data. However, due to PSD2 guidelines, this has changed in recent years. Now, users with full control of their data can demand the banks to share their data with their desired third-party provider. And how is this facilitated? With the help of open APIs.

Unlock Better Choices for Users

The rise of APIs has intensified competition in the financial services landscape, ultimately benefiting consumers. With greater transparency and accessibility, users can now compare rates, products, and services across FinTech platforms. For instance, users can use financial services APIs to compare offers between banks and other institutions. Moreover, they now have access to the facilities only available in branches.

Enable Fast and Efficient Operations

By adopting an API-empowered methodology, banks can serve their clients quickly and provide them with a seamless experience. APIs empower clients to manage banking transactions through mobile banking, online banking, and wallet services on their devices safely, anywhere, anytime. So, the clients need not physically visit the banks to conduct the transactions, thus saving their valuable time.

Expand Product Portfolio

APIs enable FinTechs, banks, and non-financial institutions to diversify their product offerings by seamlessly integrating complementary and co-created solutions. From insurance add-ons to cross-industry collaborations, APIs provide the flexibility to connect with different systems and frameworks. This allows businesses to expand beyond their traditional boundaries.

This integration does not stop at financial services only, as many institutions leverage APIs to offer lifestyle-related products as part of their digital ecosystem. For instance, Emirates NBD, a bank owned by the Dubai government, empowers its cardholders to access hospitality, entertainment, and retail items through its API-driven e-shop.

Enable Seamless Interoperability

APIs act as digital bridges, enabling various systems such as banks, payment processors, accounting software, and CRMs to exchange data and functions seamlessly. This helps businesses eliminate data silos, simplify workflows, and drive innovation by allowing new services to plug into existing infrastructure effortlessly.

Enhance User Experiences

FinTech APIs allow real-time access to critical services like payments, identity verification, credit scoring, and account aggregation—all from within a single app interface. This ensures users can complete complex financial tasks without switching between platforms or dealing with manual inputs. This results in a frictionless digital experience, enhancing customer experience, engagement, and retention rates.

Bonus Read: 10 Use Cases of AI in the Fintech Industry

Enhance Security and Compliance

APIs in FinTech are designed with robust security protocols such as OAuth, tokenization, and end-to-end encryption to protect sensitive financial data during transmission. These mechanisms help prevent unauthorized access, data breaches, and fraudulent transactions. Beyond security, APIs also simplify compliance with regulatory frameworks like PCI DSS, GDPR, and PSD2 by enabling transparent data sharing, user consent management, and activity logging.

Related Article: The Top API Security Risks and How to Mitigate Them

Now that we know the FinTech industry’s API banking benefits, let’s move on to API banking use cases. We will also help you understand multiple examples of FinTech APIs for utmost clarity.

“With open APIs, we’ve shifted from gatekeeping to groundbreaking in financial services.”

By Jack Dorsey, Co-founder, Block/Square & Twitter

Game-Changing Use Cases of APIs in FinTech

APIs in FinTech unveil multiple practical situations where they make a big difference. They are the engines powering innovation across the financial ecosystem. From seamless payments to smarter lending, financial services APIs are completely transformed how it built and delivered. Let us look at the various use cases of APIs in FinTech with their respective real-world examples in detail below:

Mobile First Finance

APIs are the cornerstone to building mobile-first financial platforms. This enables real-time account management, transaction processing, and personalized insights within banking apps. This digital banking approach helps drive higher engagement, especially among digital-native users.

Real Example: Neobanks

Neobanks like Revolut and GoCardless use APIs to deliver seamless, mobile-centric experiences, offering users full control over their finances from their smartphones.

Investment and Wealth Management

APIs allow investment platforms and advisors to access real-time portfolio data, risk profiles, and asset distribution from multiple banks or custodians. This makes it easier to personalize advice and improve financial planning accuracy, eliminating the need to guess or cobble together a picture of clients’ assets and net worth from numerous sources.

Real Example: Plaid

Plaid’s Investments API allows companies to get a comprehensive view of a user’s investment accounts, including account balances, transactions, and more.

Payment Processing APIs

Since it is the age of complete globalization, where even startups are reaching out to an international clientele, there is a high need for more developed modes of accepting payments. In this regard, the APIs for payment processing increase merchants’ options to accept payments easily. This facilitates the payment process and streamlines the checkout process for online shopping.

Real Example: Adyen

Adyen’s API replaced PayPal on eBay, enabling a seamless, embedded checkout experience. Unlike PayPal, Adyen APIs allow users to stay on the page while navigating the checkout process.

Price Comparison and Product Distribution

Price comparison websites integrate APIs in financial services to fetch real-time offers, rates, and services from various providers. This enables companies to have a single view of their customers across their key interactions, allowing them to provide better services and experiences to the customers.

Real Example: MoneySuperMarket

MoneySuperMarket uses APIs to become a direct online distributor of financial products, creating personalized customer journeys and expanding distribution reach.

Peer-to-Peer Currency Exchange and Lending

APIs empower platforms like P2P2 apps to facilitate direct user transactions without traditional intermediaries. This includes peer-to-peer currency exchange, micro-lending, and credit scoring.

Real Example: TransferWise (now Wise)

TransferWise (now Wise) APIs allow banks and partners to offer low-cost international transfers by eliminating currency conversion intermediaries.

Open Banking and Financial Aggregation

Open Banking APIs allow third-party apps to access user financial data (with consent), powering personal finance management tools, spending insights, and financial dashboards.

Real Example: ING

ING has launched ventures like Yolt (a personal finance aggregator) and Payconiq (a digital wallet), all built to integrate via APIs.

“APIs allow financial institutions to plug into ecosystems where value creation happens faster and at scale.”

By Imran Gulamhuseinwala, Trustee of the UK’s Open Banking Implementation Entity

API Marketplaces and BaaS Enablement

Banking-as-a-Service (BaaS) platforms use APIs to give third parties, such as startups, developers, or enterprises, access to core banking infrastructure. This enables them to create and launch customized financial products without building everything from scratch.

Real Example: BBVA

BBVA’s API Market offers several kinds of APIs, tools, and various other services, making it easy for developers to build services like payments, identity verification, or account aggregation, seamlessly integrating with established banking systems.

Regulatory Compliance and Identity Verification (RegTech)

FinTech and RegTech go hand in hand nowadays, especially when it comes to involving third-party open APIs. APIs simplify KYC/AML processes and enable real-time identity verification, document validation, and risk profiling, reducing onboarding friction and ensuring compliance.

Real Example: Trulioo

Trulioo’s API allows instant KYC checks across global data sources via a JSON interchange, improving speed and regulatory alignment.

White Label Services

FinTech companies can integrate white-label APIs to deliver branded financial services like payments, digital wallets, or banking interfaces without developing their platforms and programs from scratch.

Real Example: Starling Bank

Starling Bank ’s APIs provide access to payment schemes and a marketplace ecosystem for small businesses to connect their apps with banking services.

Embedded Finance in Gaming and Non-Financial Apps

A critical part of non-financial platforms like gaming is to ensure winners get rewards quickly. APIs allow these platforms to seamlessly embed payments, lending, and rewards into their ecosystems.

Real Example: RazorpayX

RazorpayX empowers gaming apps like Mobile Premier League, RummyCulture, Pokersaints, and many others to transfer rewards promptly and easily.

Smart Contracts and Automation

Smart contracts are automating agreements by eliminating paperwork and intermediaries. With just a device and an API, businesses can securely exchange services, sign contracts, and verify transactions in real time.

Real Example: Hotel Lock card Reader

A hotel lock card reader connects with an API to confirm the customer’s credentials and trigger a blockchain smart contract for automatic room access and billing.

How Can Companies Unlock the Full Potential of Banking APIs?

Unlocking the full potential of APIs requires careful consideration in several key areas. Here is how companies can weave the right strategy to leverage their full potential:

Define a Clear API Strategy

Organizations should craft a clear roadmap that aligns FinTech API platform development and implementation with business goals, whether it is enhancing customer experience or enabling third-party collaborations.

Invest in Scalable API Architecture

Build APIs on a flexible, modular architecture that supports seamless integration, high performance, and future scalability as user demands grow.

Implement Security Measures to Protect API Data

Ensure all APIs follow industry standards for data encryption, authentication, and regulatory compliance (such as PSD2 and GDPR) to protect sensitive financial data.

Determine How to Monetize APIs

Explore different monetization models such as subscription access, pay-per-use, or partner-based pricing to turn your API investment into profitable business assets.

Maintain Alignment Between IT and Business Objectives

Organizations should maintain alignment between technical and business teams to ensure API development supports real-world use cases, customer needs, and organizational KPIs.

Continuously Monitor and Optimize

You must regularly track API performance, usage metrics, and feedback to refine its functionality, enhance security, and respond swiftly to evolving market needs.

Challenges of Implementing Fintech APIs and How to Overcome Them

Even if APIs are proven techniques to unlock immense value in FinTech, implementing them in businesses is not easy. FinTech API integration often comes with technical and regulatory hurdles. But worry not; there are proven ways to overcome those hurdles. Let’s explore some common obstacles that come in the way of financial API integration and unveil strategies to overcome them:

Security and Data Privacy Risks

APIs are known to exchange sensitive financial information. This makes them a prime target for cyberattacks. A little vulnerability or loophole in FinTech APIs can expose critical data like account details or payment credentials to cyber theft.

Solution: Implement robust security measures like data encryption, multi-factor authentication, rate limiting, and OAuth 2.0 to protect APIs from unauthorized access.

Technical Complexity

Integrating APIs built on diverse tech stacks can be time-consuming and technically challenging. This becomes even more complex when dealing with legacy infrastructure or inconsistent documentation.

Solution: Collaborate with experienced API financial solutions or fintech API providers who develop custom APIs and provide technical support. Partnering with experts that also offer fintech consulting services makes integration easier, more secure, and better aligned with long-term business goals.

Regulatory Compliance

APIs often involve third-party integrations that require meeting strict industry regulations like GDPR, PCI-DSS, or PSD2. Non-compliance with these laws can result in hefty fines and reputational damage.

Solution: Conduct a comprehensive compliance audit of your API financial solutions and align with regulatory frameworks from the outset. You can also use financial API integration for RegTech to automate compliance checks and reporting.

Glorious Future of API in FinTech

Considering the current reception and usage of APIs in FinTech, it is evident that APIs will become the backbone of an open, modular financial ecosystem in the coming years. As FinTechs and legacy institutions deepen collaboration, APIs will power greater innovation, from AI-driven personalization to embedded finance experiences. They will blur the lines between financial services and everyday apps.

For instance, future banking APIs are poised to help banks connect with eCommerce websites, facilitating online payments. Moreover, they might integrate with brick-and-mortar banks and stores to help offer financing and lending options at physical retail points of sale.

What’s more? The advancements in emerging technologies like Blockchain and AI, open banking, real-time data sharing, and regulatory tech will further expand API capabilities. They will continue to enhance user control, unlock new revenue streams, and accelerate time-to-market for digital financial innovations.

Artificial intelligence in FinTech APIs will serve as a key enabler. AI will leverage data accessed through APIs to deliver hyper-personalized services, automate financial decisions, and create richer user experiences.

As we move towards a more interconnected digital economy, embracing API-led innovation will be essential for financial enterprises wishing to lead in agility and remain competitive.

“The future of fintech is composable. APIs are how that future is built.”

By Ben Horowitz, Co-founder, Andreessen Horowitz

Unlock the Business Potential of FinTech APIs with Appinventiv

The power of APIs largely drives the digital transformation shaping the FinTech sector today. These interfaces bridge innovation and execution, expanding the usability, functionality, and scalability of fintech solutions without overhauling legacy systems or spending months in the development process.

So, businesses wishing to leverage the full potential of APIs in FinTech must partner with the best fintech API providers. At Appinventiv, we offer end-to-end FinTech development services that go far beyond API integration. Whether you are looking to launch a banking-as-a-service platform, scale a digital wallet, or embed financial services into non-fintech apps, we build and integrate custom APIs that are secure, scalable, and aligned with your business goals.

We understand that each FinTech venture is distinct and has its attributes. Thus, we tailor API ecosystems to unique requirements, ensuring seamless financial API integration, data security, and enhanced functionality.

Being one of the most trusted FinTech API companies, we have worked with various financial businesses worldwide, like Edfundo, Mudra, etc., and thus have a proven track record in driving successful API-led transformations. As a trusted FinTech app development company with 1600+ skilled professionals, we are here to future-proof your product in a rapidly evolving financial landscape.

Get in touch with us now to empower your business to thrive in the ever-evolving world of finance.

FAQs

Q. What is Open Banking?

A. Open banking is a system in which financial institutions open their APIs (Application Programming Interfaces) to allow third parties to access users’ data. It is then used to design new services and applications around it, offering transparency options to account holders.

Q. What is API in FinTech?

A. APIs are the connective tissue between financial institutions, third-party service providers, and end-users. It is a collection of rules and protocols that enable software applications to communicate and exchange data. API in FinTech facilitates the integration of financial services and applications, resulting in enhanced customer experiences and operational efficiency.

Q. How does API work in FinTechs?

A. APIs in FinTechs act as a standardized means for secure communication and data exchange between multiple software systems, including banking applications and third-party services. APIs in FinTech enable banks to provide customers with account access, payments, and financial data sharing through multiple channels. APIs also facilitate collaboration with FinTech partners to enhance service offerings.

Q. What are some real-world fintech API examples used by leading companies?

A. Fintech API examples from leading companies include Stripe for payment processing, Plaid for secure financial data aggregation, and Robinhood for investment and trading functionalities. These APIs enable developers to integrate complex financial services—like ACH transfers, budgeting tools, or real-time stock trading—into their apps with ease.

As you evaluate fintech APIs for payouts and transfers, you should also consider how an ACH API payment software architecture fits into your design.

Q. What challenges should businesses expect when implementing API integrations for fintech?

A. While API integrations for fintech offer immense benefits, they can also come with challenges such as data security concerns, regulatory compliance, and system compatibility. Choosing the right API providers, ensuring robust encryption, and staying up-to-date with financial regulations like PSD2 or GDPR are key to overcoming these hurdles.

Q. What are some of the most common features of financial APIs development, and how do FinTechs use APIs?

A. APIs in Financial services typically include features that enable secure, scalable, and real-time data exchange across financial platforms. Some of the most common features of financial APIs that help businesses perform a variety of tasks proficiently include:

- Account Information Access: It allows the retrieval of bank account balances, transactions, and user details.

- Payment Initiation: This feature facilitates direct fund transfers and bill payments via third-party platforms.

- KYC and Identity Verification: The KYC API feature in financial services automates user authentication and regulatory checks.

- Data Aggregation: This helps collect financial data from multiple sources to get a unified customer view.

- Fraud Detection and Risk Scoring: APIs for FinTech are built with fraud detection features to provide real-time alerts and risk analytics to enhance security in financial APIs.

- Investment and Portfolio APIs: This FinTech APIs feature enables access to trading data, asset management, and real-time stock prices.

Regulatory Reporting: Building a FinTech API with this feature helps financial apps stay compliant through automated reporting and audit trails.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does Accounting Practice Management Software Development Cost in Australia 2026?

Key takeaways: Custom accounting practice management software development in Australia for mid-to-large firms generally falls between AUD 70,000 and AUD 700,000. Adherence to the Privacy Act 1988 and ATO operational frameworks is a primary cost driver, not an add-on. A modular architecture and structured development approach ensure that the platform evolves with changing laws and…

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…