- Exploring the Various Types of Money Lending Apps

- Business Loan Apps

- Digital Credit Card Apps

- Personal Loan Apps

- Peer-to-Peer Lending Apps

- Student Loan Apps

- Microloan Apps

- Auto Loan Apps

- Payday Loan Apps

- Loan Aggregator Apps

- Mortgage Loan Apps

- Factors Affecting Loan Lending App Development Costs

- UI/UX Design

- Complexity of Backend Development

- Third-Party Integrations

- Security Measures

- Regulatory Compliance

- Platform Selection

- Tech Stack

- Features Complexity

- Hidden Factors Driving the Costs to Create a Money Lending App

- Game Changing Features of Loan Lending Apps

- Chat Support

- Loan Calculation

- Document Management

- Reports & Analytics

- Transactions Record

- Integration of Cloud Storage

- Convenient Payment Plans

- Auto Debit for EMI Payments

- How to Optimize Loan Lending App Development Costs?

- Revenue Models for Mobile Loan App Development

- How to Create a Money Lending Mobile App

- Leverage the Expertise of Appinventiv to Develop a Successful Loan Lending App

- FAQs

Key takeaways:

- The average cost for loan lending app development ranges from $40,000 to $400,000+, depending on project requirements.

- Development cost is calculated by multiplying total development hours by the hourly rates of developers.

- The type of loan lending app and the complexity of features are critical factors influencing the development cost.

- Hidden costs like app maintenance, hosting, marketing, and legal fees significantly impact the overall investment.

- Strategies like building an MVP, prioritizing essential features, and cross-platform development can optimize costs.

Digital innovation has reshaped nearly every aspect of our lives, and financial services are no exception. Whether it’s P2P (peer-to-peer) lending platforms or AI-powered loan approvals, technology simplifies how people borrow and how lenders do business.

Let’s take a trip to the past and remember the times when getting a loan meant endless paperwork, long queues at the bank, and weeks of waiting for approval. Now, fast forward to today, and the entire process has been turned on its head.

Thanks to the rise of loan lending apps. This has made securing funds as easy as tapping your smartphone screen. This is why borrowers and lenders enthusiastically embrace this ground-breaking business strategy for all the right reasons.

Gone are the days of tedious documentation and follow-ups. Instead, users can apply for loans, get approvals, and manage repayments anytime, anywhere, with just a few clicks. For lenders, these platforms offer a streamlined, automated way to manage borrower data, track repayments, and make informed decisions without the overhead of traditional methods.

According to Grand View Research, the market for digital lending platforms worldwide was worth $8,576.3 million in 2023 and is expected to reach $$44,497.5 million by 2030, growing at a CAGR of 26.5% between 2024 and 2030.

So, what’s fueling this rapid growth? And if you are considering entering this booming market, how will you develop a state-of-the-art money lending app, and what will the loan lending app development cost be?

While there is no pre-defined formula to quote the exact cost to create a money lending app, you can get a precise estimate using this formula.

| Total Development Hours × Hourly Rates of Developers = Total Cost of App Development |

|---|

For example, if a development team charges $40/hour to create a money lending app and the project takes 2,500 hours, the cost would be approximately $100,000, excluding post-launch maintenance and future upgrades.

| $40/hour x 2,500 hours = $100,000 |

|---|

On average, loan lending app development cost ranges from $40,000 to $400,000 or more, depending on your unique project requirements and several other components (details later).

So, without further ado, let’s discuss the details of loan lending app development cost, factors, app types, and the features required to build a cutting-edge loan lending app.

Discuss your project requirements with us and get a more precise cost estimate.

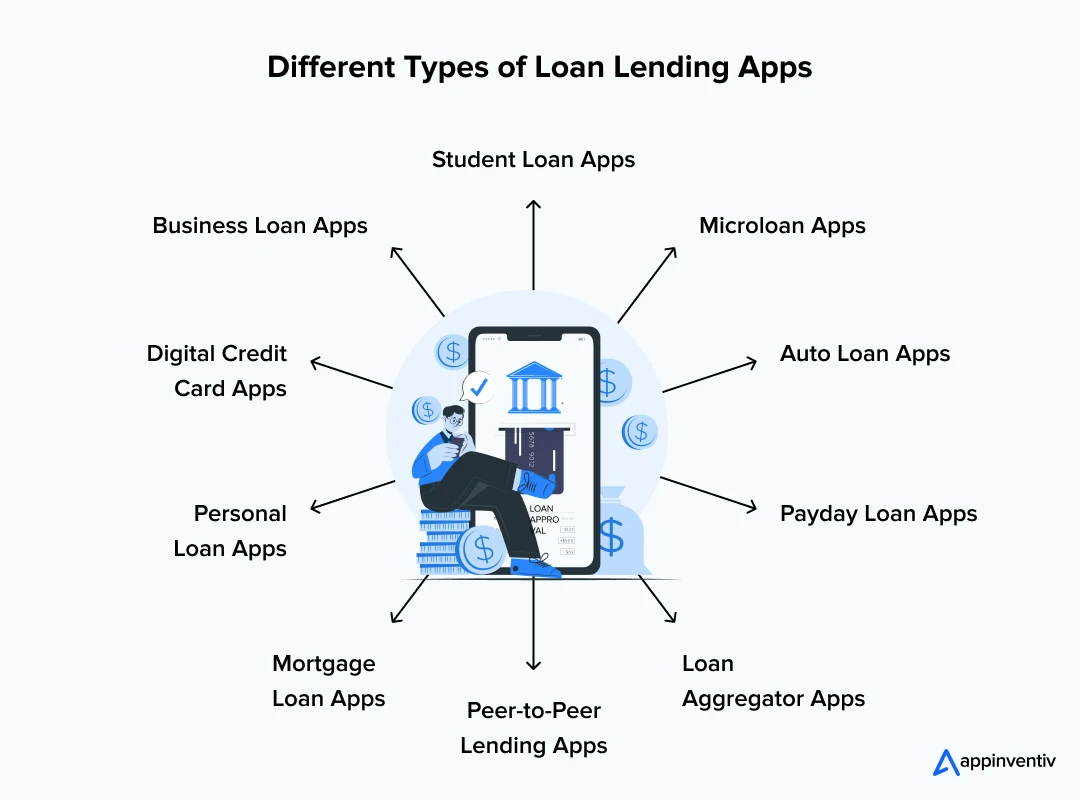

Exploring the Various Types of Money Lending Apps

The loan lending app type is one of the most critical components impacting the lending app development cost. Thus, understanding the diverse options available in the financial technology landscape is essential to setting the right budget for loan lending app development. Each app caters to specific borrowing needs, offering unique features and benefits. Let’s have a look at some of the most common types of money lending apps:

Business Loan Apps

Provide financing solutions for businesses seeking funds for expansion, working capital, or equipment, with features designed for business needs.

Digital Credit Card Apps

Offer credit card services with features like instant approval, balance management, and credit monitoring integrated with other financial tools.

Personal Loan Apps

Deliver loans for various personal needs like medical expenses, home improvements, or debt consolidation, tailored to individual borrowers, and pair it with Debt Collection Software to streamline repayment tracking and boost recovery rates.

Peer-to-Peer Lending Apps

Peer-to-peer loan lending app development enables direct lending between individuals and investors, offering competitive rates and flexible terms for both parties.

Also Read: A Comprehensive Guide to P2P Payment App Development

Student Loan Apps

Assist students and parents in applying, managing, and tracking educational loans, including tools for repayment planning and consolidation.

Microloan Apps

Offer small, short-term loans to individuals or businesses, especially targeting underserved or low-income populations.

Auto Loan Apps

Specializing in financing vehicle purchases, featuring tools for comparing rates, calculating payments, and managing loan applications.

Payday Loan Apps

Provide short-term, high-interest loans to cover immediate expenses, with quick approval and fast disbursement—typically repaid by the borrower’s next paycheck.

Loan Aggregator Apps

Aggregate and compare loan offers from multiple lenders, helping users find the best rates and terms for various types of loans.

Mortgage Loan Apps

Help users apply and manage home mortgages, providing tools for rate comparison, payment calculations, and tracking application progress.

Also Read: 15 Explorative Use Cases of AI in Mortgage Lending

Factors Affecting Loan Lending App Development Costs

The cost of developing a loan lending app can vary significantly depending on several key factors. Understanding these critical components will help you make informed decisions and plan your budget effectively.

UI/UX Design

A user-friendly, intuitive UI/UX design is crucial for attracting and retaining users. The more refined and personalized the user experience, the more time and resources are required. Accordingly, the higher be loan lending app development costs.

Estimated Cost: $5,000 – $40,000

Complexity of Backend Development

The complexity of setting up servers, managing databases, and developing APIs for loan processing, user management, and transaction handling directly impacts development time and costs. The more scalable and secure the backend, the higher the investment.

Estimated Cost: $5,000 – $80,000

Third-Party Integrations

Loan lending apps often rely on third-party services for payment gateways, credit score checks, KYC verifications, GPS location services, and social media logins. Each integration adds functionality but also increases the complexity and cost of development.

Estimated Cost: $5,000 – $30,000

Security Measures

Considering the sensitive nature of financial data, implementing robust security measures like data encryption, multi-factor authentication, biometrics, and AI-driven fraud detection systems are non-negotiable element. These advanced security measures add to the overall loan app development cost.

Estimated Cost: $5,000 – $30,000

Regulatory Compliance

Adhering to FinTech industry regulations like PCI-DSS, GDPR, and local lending laws requires additional development effort. Though complying with these regulatory guidelines can influence costs, avoiding hefty fines, legal penalties, and reputational damages is essential.

Estimated Cost: $5,000 – $40,000

Platform Selection

Creating a money lending app for iOS, Android, or both (cross-platform) significantly defines your investment. Developing a native app for each platform typically costs more but offers better performance, while cross-platform development is a more budget-friendly option.

Estimated Cost: $10,000 – $50,000.

Tech Stack

The choice of tech stacks, like programming languages, frameworks, and other emerging technologies, directly impacts loan lending app development costs. For example, incorporating advanced technologies like AI and ML for automated loan approvals, credit risk assessment, and chatbots enhances user experience and efficiency but increases development costs.

Estimated Cost: $5,000 – $80,000

Features Complexity

The range and complexity of your app’s features, such as real-time loan tracking, push notifications, EMI calculators, digital signatures, customer support, etc., play a big role in determining loan lending app development costs. The more complex the range, the higher the development time and costs will be.

Estimated Cost: $5,000 – $50,000

| Cost Driving Components | Loan Lending App Development Cost | Loan Lending App Development Timeline |

|---|---|---|

| UI/UX Design | $5,000 – $40,000 | 3 – 5 weeks |

| Backend Development | $5,000 – $80,000 | 6 – 12 weeks |

| Third-Party Integrations | $5,000 – $30,000 | 3 – 6 weeks |

| Security Measures | $5,000 – $30,000 | 4 – 8 weeks |

| Compliance Measures | $5,000 – $40,000 | 4 – 10 weeks |

| Platform Selection | $10,000 – $50,000 | 8 – 16 weeks |

| Technologies Used | $5,000 – $80,000 | 6 – 12 weeks |

| Features Complexity | $5,000 – $50,000 | 4 – 14 weeks |

Hidden Factors Driving the Costs to Create a Money Lending App

While the upfront factors influencing loan lending software development costs take center stage, several hidden factors can also impact your investment decision. These ongoing operational expenses ensure the app’s long-term success and smooth user experience. Overlooking these aspects can lead to unforeseen costs down the line. Interested in unveiling these hidden factors that impact your loan lending app development budget? Well, here is a concise table that gives you a brief overview of the hidden cost-determining factors:

| Hidden Cost Factors | Description | Estimated Cost |

|---|---|---|

| App Maintenance |

| $10,000 – $50,000 annually |

| App Hosting |

| $5000 – $50,000 per month |

| App Marketing |

| $10,000 – $50,000+ per year |

| Legal and Licensing Fees |

| $5,000 – $40,000 (one-time and ongoing) |

Also Read: CashNow-style fast wallet loan app development

Now that we have an in-depth understanding of the critical elements influencing loan lending app development cost, let’s explore the essential features you must focus on when discovering ›how to build a loan app.

Game Changing Features of Loan Lending Apps

There are certain essential and advanced features that you must keep in account if you want your loan application to stand out in the loan lending market. Even though every loan application is different and shares distinct traits, some common features are fundamental for delivering a seamless user experience, regardless of the types of money lending apps or the issues they target. These include:

Chat Support

Although lending apps are excellent at eliminating the need for direct interaction with a clerk, users will probably still need AI chatbot assistance. Additionally, having a live chat with your agents might be a terrific approach to handling these circumstances.

Also Read: Rising Popularity of Chatbot Banking App

Loan Calculation

Your lending app should provide a loan calculator. Don’t leave the hassle of loan calculation on your users. Instead, include a calculator to assist users in calculating loan-related data. Customers should be able to grasp key information about their loans through your loan app, including the rate of interest, the monthly payment, and other pertinent details.

Document Management

Make it simple for users to manage their documents in the app; they should be able to delete or upload documents as needed. A document management feature in the app ensures borrowers can submit necessary files like ID proofs, income statements, and address verifications quickly and securely.

Reports & Analytics

Integrate an analytics dashboard that provides administrators with comprehensive reports and in-depth insights to enhance productivity. This feature enables admins to easily track key metrics, such as the total amount disbursed and the total repayments collected over a specific period, enabling improved loan management.

Transactions Record

Provide users with a clear and accessible transaction history. This feature will allow them to view all completed and pending payments in one place. Borrowers can easily track their outstanding loan balance, repayment schedules, and past transactions, helping them manage their finances more effectively.

Integration of Cloud Storage

Cloud storage enhances the app’s ability to store and manage large volumes of sensitive user data. With growing concerns around data privacy, cloud integration ensures encrypted storage, easy accessibility, and reliable backups, providing a robust layer of security for users’ personal and financial information.

Convenient Payment Plans

Offer users flexible and transparent payment plans that align with their approved loan amounts. This feature empowers borrowers to manage their repayments more effectively, ensuring they only pay what they owe.

Auto Debit for EMI Payments

By setting up this auto-debit feature, lenders can automatically deduct loan EMIs from borrowers’ accounts. This feature ensures timely repayments, reduces the risk of missed or delayed payments, and provides a hassle-free experience for lenders and borrowers.

How to Optimize Loan Lending App Development Costs?

While there are several upfront and hidden costs associated with money lending app development, the good news is that you can optimize these cost-driving factors significantly by making smart choices. Not sure how to do it? Well, here are some tried and tested strategies that will ensure your budget cannot overrun and you get the best app built with the least investment.

| Strategy | Impact on Development Cost |

|---|---|

| Build an MVP | 25-50% reduction in initial costs |

| Prioritize only essential features | 20-50% reduction in unnecessary costs |

| Use a cross-platform development approach | 20-40% reduction in costs |

| Outsource to an experienced loan lending app development company | 30-60% lower hourly rates |

Revenue Models for Mobile Loan App Development

Choosing the right revenue model is crucial to ensure the long-term success and profitability of your loan lending mobile app development effort. While the primary income typically comes from interest rates, several additional monetization strategies can maximize your app’s ROI. Here is a look at the most effective revenue models for micro lending app development:

- Interest Rates: Earn revenue by charging borrowers interest on the principal loan amount.

- Origination Fees: Charge a one-time fee for processing and approving new loans.

- Service Fees: Collect fees for ongoing services such as account maintenance or loan management.

- Subscription Models: Offer premium features or benefits through a monthly or annual subscription plan.

- Late Payment Fees: Impose additional charges on borrowers who miss repayment deadlines.

- Penalty Fees: Charge extra fees for violations of loan terms, such as early repayment penalties.

- Cross-Selling Financial Products: Promote and sell additional financial products like insurance or investment services.

- Affiliate Marketing: Partner with third parties and earn commissions by referring users to their services.

- In-App Advertising: Generate revenue by displaying targeted advertisements within the app interface.

- Data Monetization: Sell anonymized user insights and data analytics to third-party companies (with user consent).

How to Create a Money Lending Mobile App

Developing a loan lending app involves a series of well-planned steps to ensure a secure, scalable, and user-friendly platform. Each phase plays a critical role, from defining business objectives and designing intuitive interfaces to building robust backend architecture and ensuring compliance with regulatory standards. Here is a table outlining the loan lending app development steps and the costs associated with each stage:

| Loan Lending App Development Steps | Key Activities Performed at Each Stage | Estimated Cost |

|---|---|---|

| Discovery & Planning | Conduct market research, competitor analysis, define app objectives, and gather essential requirements to form the foundation for loan app development. | $30,000 |

| UI/UX Design | Design user-centric wireframes and interactive prototypes focused on intuitive navigation and branding. | $40,000 |

| Frontend Development | Develop responsive user interfaces for web and mobile platforms to ensure seamless interaction across all devices. | $60,000 |

| Backend Development | Build scalable server-side architecture, set up databases, and create APIs for core app functionality. | $90,000 |

| Third-Party Integrations | Integrate payment gateways, KYC/AML verification, credit scoring, notification systems, and other APIs. | $40,000 |

| Security and Compliance | Implement data encryption, multi-factor authentication, etc. and ensure adherence to regulatory and legal standards. | $50,000 |

| Testing and Quality Assurance | Conduct functional, security, performance, and usability testing to ensure a flawless, high-performing application. | $30,000 |

| Deployment | Deploy the app on iOS and Android platforms, configure cloud servers, and handle app store submissions. | $20,000 |

| Post-Launch Support and Maintenance | Regularly update the app, fix bugs, and add new features to ensure seamless and uninterrupted app performance. | $40,000 (first year) |

Leverage the Expertise of Appinventiv to Develop a Successful Loan Lending App

It requires more than just a simple checklist when learning how to create a loan app. Thus, it is wise to leave the technical complexities in the hands of an experienced lending software development company that knows what it takes to build a next-gen FinTech app that stands out in this highly regulated market.

Appinventiv, a leading FinTech app development company, has helped businesses across the globe turn complex ideas into innovative digital platforms. For example, our team collaborated with Mudra to build an AI-driven budget management app that allows users track expenses, set savings goals, and manage budgets efficiently.

Similarly, for Edfundo, we partnered with the founders to bring their vision of a financial literary app to life. Our experts built a secure and intuitive platform that helps children and teens learn smart money management habits while giving parents custom features to guide them.

With a team of 1,600+ digital experts and over 3,000 projects delivered, we understand what it takes to build future-ready FinTech systems. We follow strict security-first approach in all projects and take note of all your requirements to come up with a secure and scalable platform that meets your objectives.

Contact us today to build a range of FinTech platforms, including KYC platforms, fraud prevention mechanisms, intuitive payment systems, mortgage software, and loan lending app development.

FAQs

Q. How to create a money lending mobile app?

A. Building a loan lending app requires following a few crucial steps. Here’s a detailed breakdown of the steps you should know when looking at how to build a loan app:

- Conduct market research and competitor analysis

- Define the app’s features and scope

- Plan and design the UI & UX

- Develop the frontend & backend infrastructure

- Integrate financial services and APIs

- Implement security measures

- Test and debug

- Launch and deploy

- Monitor and update

Q. What are the key features of the loan lending app?

A. Here are the main features of a robust loan lending app:

- Loan management and monitoring

- Risk evaluation

- Loan repayment reminders

- Rate of interest calculation

- Document upload and verification

- Push notifications

- Secure payment gateway integration

- Statement generation and loan history

- Customer support and assistance

- Analytics and Reporting

Together, these features offer borrowers a complete solution for loan applications, loan tracking, repayment management, and receiving notifications and support throughout the loan lifecycle. This results in enhanced user experience and improved business.

Q. How long does it take for money lending app development?

A. Building a loan lending app takes around 4 months to a year or more. However, a minimum viable product (MVP) can be created in just one month. It takes longer to develop a feature-rich final product because the end product involves more programming work.

Get in touch with a trusted provider of loan lending app development services to get a more precise estimate for timeline

Q. How much does it cost to develop a loan lending app?

A. The loan lending app development cost can range from $40,000 to $400,000 or more, depending on the features you need, the complexity level of the platform, choice of the technology stack, UI/UX design, frontend and backend infrastructure development, and various other factors. To know more about accurate cost estimate of a loan lending application, connect with a trusted lending software development company like ours.

Q. What type of development model to choose for loan lending app development?

A. When choosing a development model for your loan lending app, you must evaluate your project’s scope, timeline, and budget. Generally, businesses opt for one of the following models:

- Dedicated Development Team

- Fixed-Price Model

- Time and Material Model

Q. What is a loan lending mobile app, and how can it benefit your business?

A. Loan lending apps are a kind of shared platform where loan seekers and money lenders can meet each other’s needs. These loan lending apps are a perfect solution for those who don’t have the time to visit a local bank to submit their loan application and track the approval process.

Loan lending software is a fantastic way to boost your bottom line, whether your business is an emerging startup or an established enterprise. It will let your business connect with clients in a variety of ways. On the other hand, not having a loan lending app can cause you to lose significant business possibilities that may ultimately have an influence on the company’s brand and growth.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does Accounting Practice Management Software Development Cost in Australia 2026?

Key takeaways: Custom accounting practice management software development in Australia for mid-to-large firms generally falls between AUD 70,000 and AUD 700,000. Adherence to the Privacy Act 1988 and ATO operational frameworks is a primary cost driver, not an add-on. A modular architecture and structured development approach ensure that the platform evolves with changing laws and…

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…