- How Does the CashNow App Work?

- What Makes the CashNow App Unique?

- A Comprehensive Overview of CashNow App Development Costs in the UAE

- Breakdown of Costs Based on Complexity

- Breakdown of Costs by Development Stages

- The Formula for Calculating Total Development Costs

- Time and Effort Estimates for Development

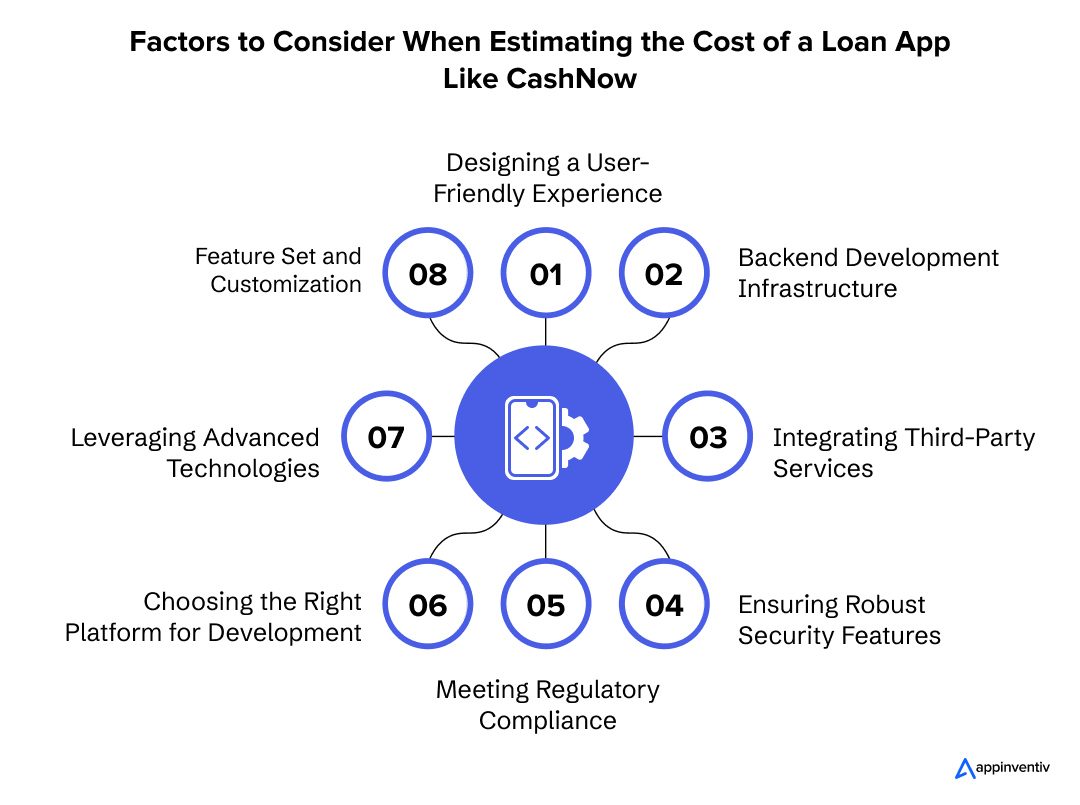

- Factors Affecting the Cost to Build a Loan App Like CashNow

- Designing a User-Friendly Experience

- Backend Development Infrastructure

- Integrating Third-Party Services

- Ensuring Robust Security Features

- Meeting Regulatory Compliance

- Choosing the Right Platform for Development

- Leveraging Advanced Technologies

- Feature Set and Customization

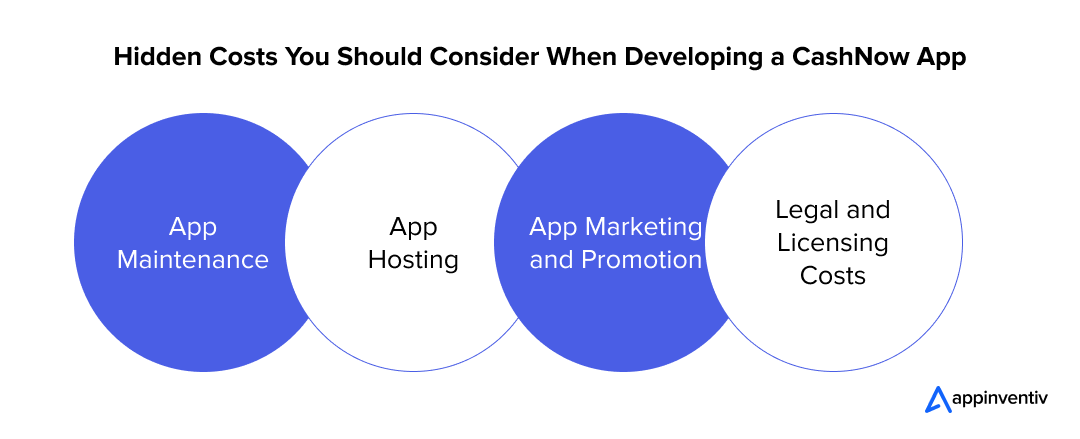

- Uncovering the Hidden Costs of CashNow App Development

- App Maintenance

- App Hosting

- App Marketing and Promotion

- Legal and Licensing Costs

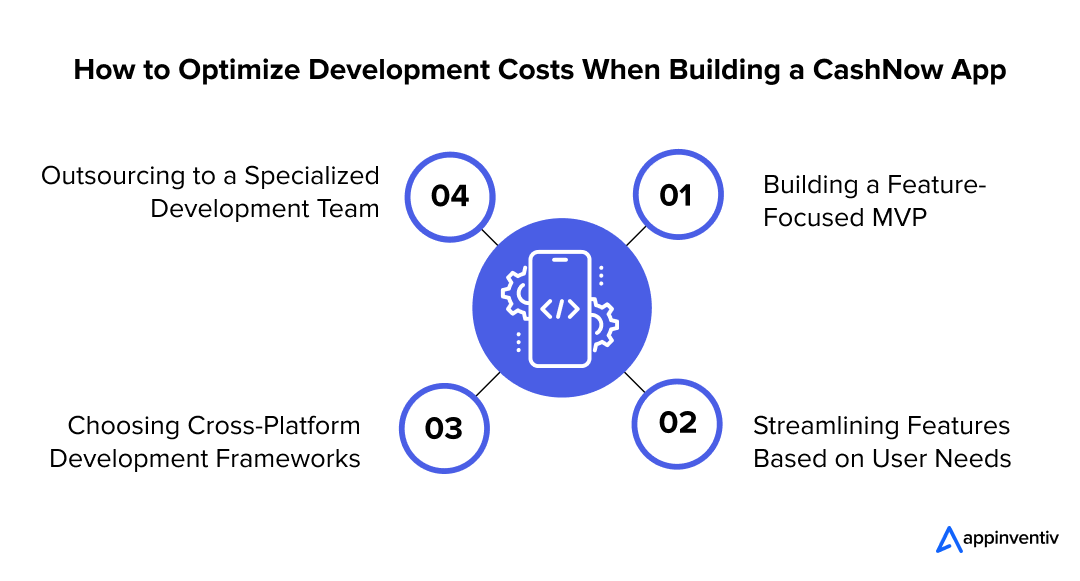

- Ways to Optimize Development Costs for the CashNow App

- Building a Feature-Focused MVP

- Streamlining Features Based on User Needs

- Choosing Cross-Platform Development Frameworks

- Outsourcing to a Specialized Development Team

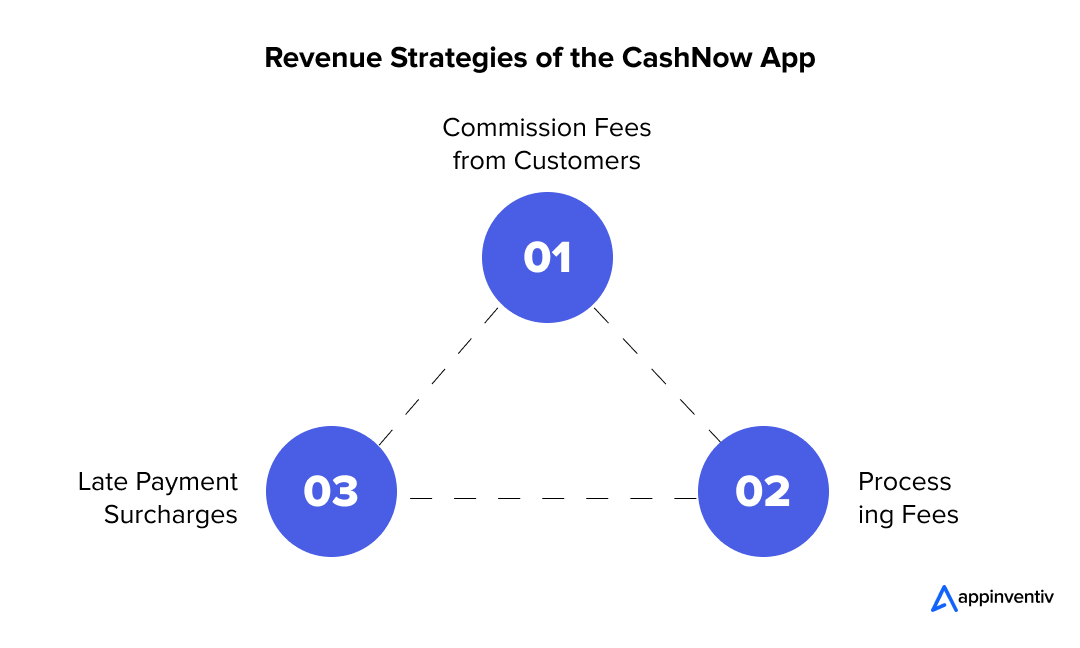

- Revenue Strategies That Power the CashNow App’s Growth

- Commission Fees from Customers

- Processing Fees

- Late Payment Surcharges

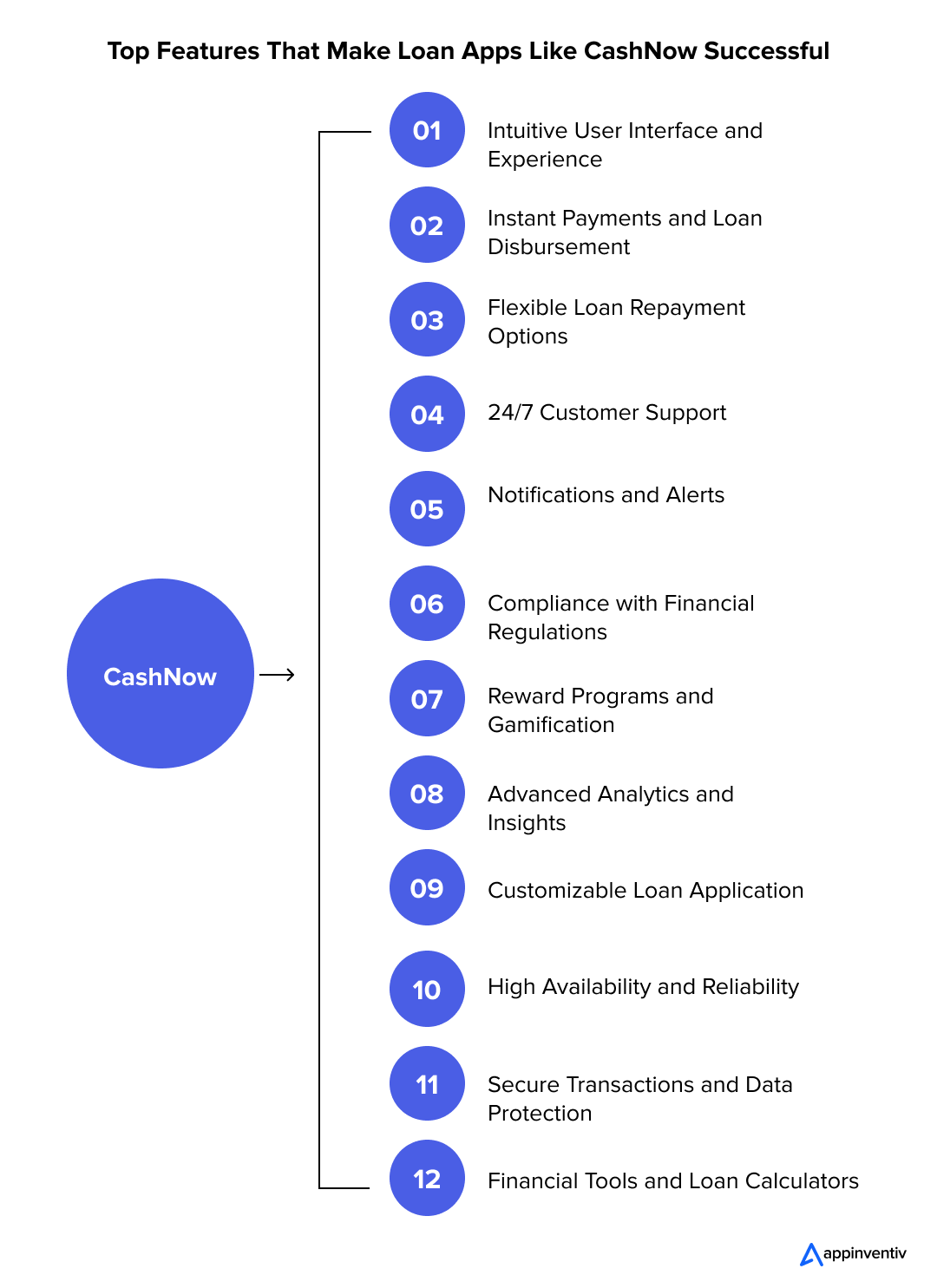

- Key Features to Look for in a Loan App Like CashNow

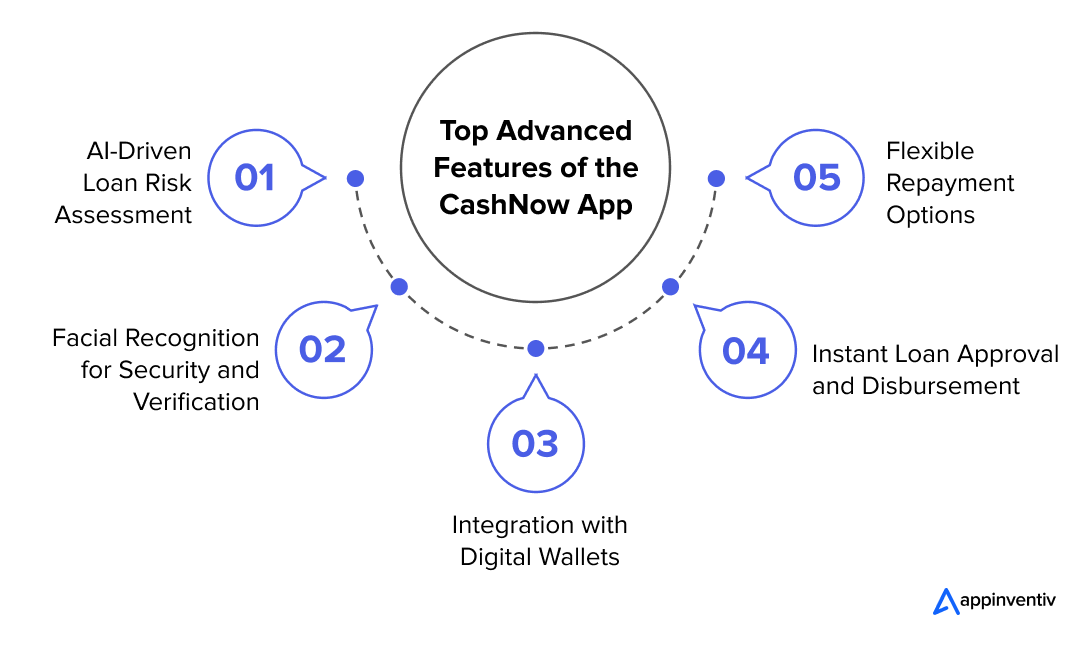

- Advanced Features of the CashNow App

- AI-Driven Loan Risk Assessment

- Facial Recognition for Security and Verification

- Integration with Digital Wallets

- Instant Loan Approval and Disbursement

- Flexible Repayment Options

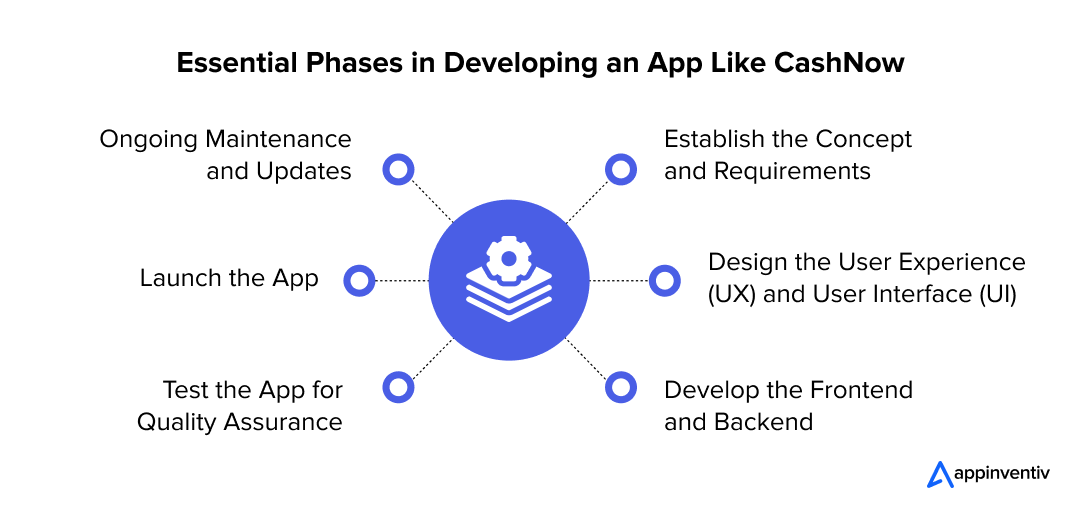

- Steps to Develop an App Like CashNow

- Establish the Concept and Requirements

- Design the User Experience (UX) and User Interface (UI)

- Develop the Frontend and Backend

- Test the App for Quality Assurance

- Launch the App

- Ongoing Maintenance and Updates

- Strategies to Surpass the CashNow App

- Revolutionize the Loan Application Process

- Elevate Personalization with Advanced AI

- Enhance Security with Multi-Tiered Authentication

- Introduce Next-Level Financial Features

- Bring Your CashNow-Inspired App to Life with Appinventiv

- FAQs

- Q. How do you build a loan app like CashNow?

- Q. How much does it cost to develop a loan app like CashNow?

- Q. How long does it take to develop a loan app?

The demand for quick, reliable, and secure loan services is leading to the development of instant loan apps like CashNow in the FinTech sector. These apps have made securing loans easy and swift without compromising security and getting into lengthy document work and waiting periods.

The usability and success of your loan or financial services largely depend on how easily customers can secure loans or access services. A secure, user-friendly instant loan app like CashNow is the perfect platform to ensure your customers can seamlessly utilize your services.

However, building an app like CashNow requires a strategic investment.

In the UAE, development costs vary based on app complexity, features, and the development team’s expertise. A simple app with essential features typically ranges from AED 70,000 to AED 150,000.

However, if you want to develop a more advanced platform with features like AI-driven credit scoring and blockchain for secure transactions, the cost to build a loan app like CashNow could exceed AED 250,000, potentially reaching AED 500,000 or more.

Is it worth the investment?

Absolutely!

Let’s dive into what makes an app like CashNow a game-changer and explore the cost breakdown in detail.

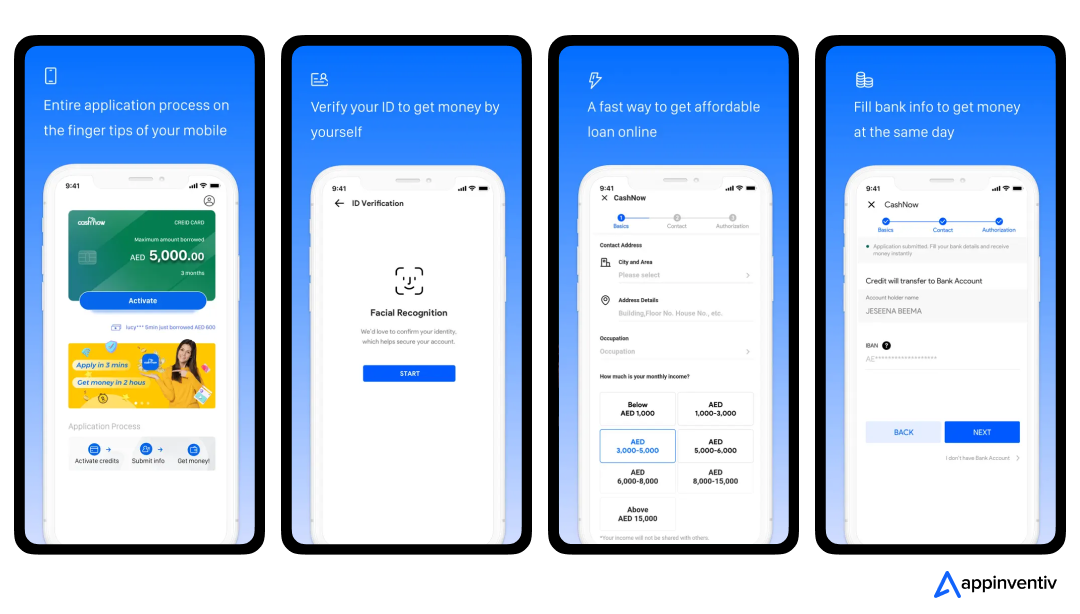

How Does the CashNow App Work?

CashNow is a user-friendly instant loan app that offers UAE residents quick, hassle-free financial assistance during emergencies. It simplifies the loan process by minimizing paperwork, allowing users to apply directly from their smartphones.

With fast approval and loan disbursement, CashNow covers everything from medical expenses to unforeseen bills. The app has flexible repayment options and no hidden fees, ensuring transparency and trust.

Unique features of CashNow:

- 24/7 availability, enabling users to apply for loans anytime.

- The app employs advanced security measures to protect personal and financial data and complies fully with UAE regulations, guaranteeing a safe and reliable service.

What Makes the CashNow App Unique?

The CashNow app offers fast, hassle-free loans with minimal paperwork, leveraging innovative technologies like AI for credit scoring. Its user-friendly interface and flexible repayment options make it a go-to solution for quick financial assistance in emergencies. Here’s a breakdown of what you need to know about the CashNow app:

- Interest Rates: Ranging from 25% to 35.9% annually, depending on the user’s qualifications.

- Processing Fees: A straightforward fee of 5% on the net loan proceeds.

- Loan Amounts: Borrowers can access loans ranging from $5,000 to $30,000.

- Loan Terms: Flexible terms between 91 to 180 days, including the option for loan renewal.

- Repayment Periods: Loan repayment periods vary from a minimum of 65 days to a maximum of 120 days.

- Transaction Fees: CashNow ensures complete transparency with no hidden fees or charges.

This transparent, flexible structure makes CashNow a user-friendly platform for those needing instant loans while maintaining a clear understanding of costs and repayment expectations.

A Comprehensive Overview of CashNow App Development Costs in the UAE

The cost to build a loan app like CashNow can vary widely, depending on factors like the app’s complexity, design, and the technology stack utilized. Development costs typically range between AED 70,000 and AED 150,000 for a basic app with essential features.

However, more sophisticated apps integrating advanced features, such as real-time data processing and enhanced security measures, could push costs beyond AED 500,000.

To provide a clear understanding, here is a detailed breakdown of the cost estimation process, considering complexity levels, development stages, timelines, and the formulas used to calculate overall pricing.

Breakdown of Costs Based on Complexity

The cost to build a loan app like CashNow in the UAE depends on its complexity. A basic app with limited features costs less, while a highly advanced app incorporating AI and facial recognition involves a higher investment.

| Complexity Level | Estimated Cost Range (AED) |

|---|---|

| Simple (Basic Features) | AED 55,000 – AED 100,000 |

| Medium (Additional Features, API Integration) | AED 100,000 – AED 250,000 |

| Complex (Advanced Features, AI/ML, Facial Recognition) | AED 250,000 – AED 5000,000+ |

Breakdown of Costs by Development Stages

App development comprises various stages, from ideation to deployment. Each stage contributes to the overall cost to develop a loan app like CashNow depending on its scope and the level of customization involved.

| Development Stage | Cost Range (AED) |

|---|---|

| Ideation & Planning | AED 7,500 – AED 18,500 |

| UI/UX Design | AED 15,000 – AED 37,000 |

| Development (Frontend + Backend) | AED 75,000 – AED 185,000 |

| Quality Assurance & Testing | AED 18,500 – AED 37,000 |

| Deployment & Maintenance | AED 11,000 – AED 37,000 annually |

The Formula for Calculating Total Development Costs

The cost to develop a loan app like CashNow depend on several factors including the number of development hours and hourly rates. The formula below offers an estimation approach:

Total Cost = Development Hours* × Hourly Rate

*Development hours vary by app complexity, and hourly rates depend on the development team’s location and expertise.

For instance, 1,000 hours × AED 185/hour = AED 185,000.

Time and Effort Estimates for Development

Developing an app like CashNow typically takes 4 to 9 months, depending on its complexity and features. Simpler apps may be quicker to develop, while advanced apps with AI, facial recognition, and multi-platform support take more time for design, development, and testing.

Key stages and estimated time allocations:

- Planning & Research (2-4 weeks): Defining project objectives and user needs.

- UI/UX Design (4-6 weeks): Creating intuitive, user-friendly interfaces.

- Frontend & Backend Development (3-6 months): Core development, including integrations.

- Quality Assurance & Testing (3-5 weeks): Testing for performance, security, and compliance.

- Deployment & Feedback (1-2 weeks): App launch and user feedback collection for future updates.

Factors Affecting the Cost to Build a Loan App Like CashNow

Several factors affect loan app development cost, including app complexity, features, security measures, and development team expertise. Understanding these factors helps estimate the cost to build a loan app in the UAE.

Designing a User-Friendly Experience

Creating a seamless, intuitive interface that ensures a smooth user experience is key for apps like CashNow. The more complex and customized the design (e.g., custom animations or adaptive UIs), the higher the cost to build a loan app like CashNow. Factors like color schemes, layout structures, and responsive elements contribute to the overall design complexity.

Backend Development Infrastructure

A robust backend is essential for the app’s operations, especially for a platform dealing sensitive financial transactions. The integration of APIs, server infrastructure, and database architecture required to handle real-time data processing and secure transactions can substantially raise loan app development costs like CashNow, depending on the level of sophistication and scalability required.

Integrating Third-Party Services

CashNow’s integration with external services like payment gateways, GPS, or social media platforms adds significant complexity. The need for secure data transmission between multiple systems, licensing fees, and maintaining smooth interaction between these third-party systems can all contribute to the cost to build a loan app in the UAE.

Ensuring Robust Security Features

Ensuring robust security features of loan apps like CashNow is critical for building user trust and safeguarding financial transactions. Implementing security measures such as encryption protocols, two-factor authentication, biometric logins, and real-time fraud detection systems comes with a price tag. Higher security protocols demand additional development and testing, impacting the overall cost of building a loan app like CashNow.

Meeting Regulatory Compliance

Regulatory requirements like data protection laws impose additional responsibilities during app development. Ensuring compliance with these laws adds a layer of complexity to the development process, as it necessitates regular audits, secure data handling procedures, and potential changes to app features to adhere to new or evolving laws.

Choosing the Right Platform for Development

The choice of platform (iOS, Android, or both) significantly affects the cost. Developing multiple platforms requires separate codebases (unless using cross-platform frameworks), which increases both development time and costs. Partnering with an app development company in Abu Dhabi can help you create cost-effective, cross-platform apps that deliver better results. Each platform requires specific adjustments for performance, user interface, and optimization, impacting the overall cost to build a loan app like CashNow.

Leveraging Advanced Technologies

Using AI, machine learning, blockchain, and other advanced technologies in the app requires specialized expertise and additional development time. Integrating these advanced technologies for features like loan risk assessment, fraud detection, and user verification increases development complexity, resulting in higher costs due to the need for skilled developers, testing, and potential integration services.

Feature Set and Customization

The complexity of features—such as real-time loan approvals, AI-driven credit scoring, personalized payment plans, and push notifications, directly impacts development time and cost. More intricate features require more time to develop, test, and optimize, especially when customized to provide a unique user experience.

Uncovering the Hidden Costs of CashNow App Development

To make an app like CashNow, several costs that aren’t immediately apparent can emerge after the app is launched. These hidden expenses are crucial to the app’s continued success and must be factored into the total budget. Here are some of the most significant ongoing costs to consider:

App Maintenance

Ongoing maintenance ensures the app remains functional and secure after launch. This includes fixing bugs, rolling out new updates, ensuring compatibility with updated operating systems, and addressing security issues. Depending on the app’s complexity and update frequency, the maintenance cost can typically account for 20% or more of the initial development costs each year.

App Hosting

Hosting services are another ongoing cost, particularly for apps like CashNow that rely on cloud infrastructure. Hosting fees are influenced by server usage, storage capacity, and the amount of traffic the app generates. Hosting providers like AWS, Google Cloud, and Azure offer scalable solutions, but these costs rise as the app expands and attracts more users.

App Marketing and Promotion

Marketing is essential to drive user acquisition and maintain engagement. The custom loan app development cost in UAE in this area can be substantial and include expenses for digital advertising (SEO, pay-per-click ads, social media campaigns), influencer partnerships, and broader marketing strategies. For many apps, the marketing budget can surpass the initial development costs, especially if there is a need for wide-scale promotion and user base growth.

Legal and Licensing Costs

Legal and licensing fees are necessary to ensure the app adheres to relevant regulations. These costs include obtaining intellectual property protection (trademarks, patents), securing the required licenses for third-party software or services, and ensuring compliance with data protection laws and user privacy.

For financial apps like CashNow, legal costs for ensuring compliance with financial regulations and drafting user agreements are particularly important and can be costly.

Ways to Optimize Development Costs for the CashNow App

Developing a financial app like CashNow requires careful budgeting and resource allocation. Here are specific strategies tailored to optimizing development costs for CashNow:

Building a Feature-Focused MVP

Create a Minimum Viable Product (MVP) with essential cost management features. By launching with a focused set of functionalities, CashNow can gather user feedback early, prioritize improvements, and avoid unnecessary spending on less impactful features.

Streamlining Features Based on User Needs

Instead of including all advanced functionalities upfront, CashNow can prioritize features that drive the most value, like AI-driven loan risk assessments and flexible repayment options. Secondary features, such as integration with digital wallets or multi-language support, can be added in later iterations.

For example, EDFundo approached us at Appinventiv to develop a feature-packed app that would provide personalized learning, practical tips, and real-time tracking of financial goals while ensuring the app was user-friendly and visually appealing.

We Developed an app powered by robust features that delivers personalized content based on user progress and financial interests. We also integrated real-time analytics to track user performance, enabling EDFundo to improve the learning experience continuously.

EDFundo App helped the client:

- Increased user retention by 40%.

- A 30% improvement in user knowledge and confidence in managing personal finances.

- Over 90% of users rated the app 4.5 stars or higher.

Choosing Cross-Platform Development Frameworks

Developing the CashNow app using frameworks like Flutter or React Native ensures compatibility across Android and iOS without duplicating efforts. This reduces development time and costs and provides a consistent platform user experience.

Outsourcing to a Specialized Development Team

Collaborating with a cost-effective development team specializing in financial applications can help CashNow balance affordability with high-quality outcomes. Teams experienced in FinTech development can navigate complexities such as regulatory compliance and payment gateway integrations efficiently.

Revenue Strategies That Power the CashNow App’s Growth

The revenue models of a loan app like CashNow typically focus on generating consistent income while providing value to users. By implementing multiple streams of revenue, such apps can ensure long-term sustainability while offering users efficient financial services. Let’s have a look at those.

Commission Fees from Customers

Your app can generate a steady income by charging a commission on every successful transaction. This fee, collected from borrowers and lenders, ensures consistent revenue while maintaining the platform’s financial viability. It provides a seamless way to monetize without adding significant upfront costs for users.

Processing Fees

Processing fees are a common revenue stream for loan apps, charging a one-time or recurring fee for processing loans. Depending on the platform’s business model, this fee is typically either a fixed amount or a percentage of the total loan amount. It covers administrative costs and helps generate consistent income for the app.

Late Payment Surcharges

Penalizing late payments through surcharges boosts profitability and encourages timely repayments. This revenue stream is a deterrent for defaulters while contributing to the app’s financial health, ensuring sustained operations and user accountability.

Key Features to Look for in a Loan App Like CashNow

A loan app should be designed with features that provide a smooth user experience while addressing security and compliance concerns in the financial sector. Let’s explore some of the key features of loan apps like CashNow.

Intuitive User Interface and Experience: Design a visually appealing, user-friendly interface with simple navigation and helpful tooltips. Simplify the user journey by using clear language and modern layouts.

Instant Payments and Loan Disbursement: Ensure fast and seamless transactions with loan disbursements processed within minutes. Support multiple payment methods for flexibility, including bank transfers and mobile wallets.

Flexible Loan Repayment Options: Offer repayment plans that cater to varied needs, such as fixed installments, flexible terms, or early payment options. Provide automated payment setups with timely reminders to ease the repayment process.

24/7 Customer Support: Provide round-the-clock assistance through live chat, email, and phone support. Use AI-powered chatbots for quick responses to routine inquiries, ensuring reliable and efficient service.

Notifications and Alerts: Send personalized notifications about loan applications, repayment schedules, and special offers. Keep users informed with timely alerts tailored to their preferences.

Compliance with Financial Regulations: Adhere to regional regulations like data privacy, anti-money laundering, and consumer protection laws in the UAE. Build trust by ensuring legal compliance and maintaining user data security.

Reward Programs and Gamification: Incorporate referral rewards and achievements for actions like timely payments or improving credit scores. Gamify user interactions to make the borrowing experience engaging and enjoyable.

Advanced Analytics and Insights: Provide users with dashboards to track loan amounts, repayments, and credit scores. Equip administrators with detailed analytics on loan performance, user behavior, and default trends.

Customizable Loan Application: Let users select loan terms, amounts, and interest rates to suit their needs. Use AI-powered credit scoring for quick approvals, making borrowing effortless and accessible.

High Availability and Reliability: Ensure the app is always accessible with robust infrastructure and redundancy measures. Minimize downtime to deliver a reliable user experience.

Secure Transactions and Data Protection: Safeguard sensitive data with encryption, tokenization, and biometric authentication. Protect users against fraud with cutting-edge security measures.

Financial Tools and Loan Calculators: Help users make informed decisions with tools for expense tracking, budgeting insights, and EMI calculators. Offer clear projections of interest and repayment costs.

Advanced Features of the CashNow App

The advanced features of the CashNow app go beyond simplifying the borrowing process. These features enhance user experience, promote security, and ensure quick loan approvals. Here’s a look at some of its key functionalities:

AI-Driven Loan Risk Assessment

The CashNow app uses advanced AI and machine learning algorithms to assess borrowers’ risk. It evaluates traditional credit scores and alternative data such as transaction patterns, social behavior, and job stability. This leads to more accurate loan approvals and dynamic interest rate adjustments.

Facial Recognition for Security and Verification

The app integrates facial recognition technology for identity verification. This advanced feature enhances security while streamlining the loan application process, offering a faster and more secure user experience. It also reduces the chances of fraud by ensuring that only authorized users can access and operate their accounts.

Integration with Digital Wallets

The app allows loan payments and fund disbursements through digital wallets. This integration caters to a broader audience, particularly in regions with limited access to traditional banking services. It also offers a faster and cheaper transaction method, benefiting tech-savvy users.

Instant Loan Approval and Disbursement

CashNow enables instant loan approval by utilizing AI-driven algorithms that assess a user’s creditworthiness in real-time. Once approved, the loan amount is quickly disbursed to the user’s bank account or digital wallet, ensuring a fast and smooth transaction.

Flexible Repayment Options

CashNow offers tailored repayment terms, with loan amounts ranging from AED 300 to AED 10,000 and repayment periods between 14 days to six months. Multiple repayment options and automated reminders help users stay on track with their payments.

Steps to Develop an App Like CashNow

Building a loan app requires careful consideration of multiple factors that ensure the app’s functionality, scalability, and user satisfaction. With the right approach, your loan app can meet users’ needs while providing a secure and efficient financial experience. Let’s check out the steps to build a loan app like CashNow in the UAE.

Establish the Concept and Requirements

Clearly define the core idea behind the app, its features, and its intended users. For an app like CashNow, this includes offering services like instant loan approval, secure payment methods, biometric verification, and flexible repayment options.

Design the User Experience (UX) and User Interface (UI)

The design is crucial for retaining users. The app should feature an intuitive interface with easy navigation and seamless functionality. For an app like CashNow, the UI must balance simplicity with functionality to ensure a smooth user experience, especially for financial transactions.

Develop the Frontend and Backend

Frontend Development: Focus on creating a responsive and engaging user interface that functions smoothly across devices.

Backend Development: Develop the server-side architecture, including APIs for payment processing, user authentication, and real-time loan approval, along with databases for secure storage.

Test the App for Quality Assurance

Thorough testing is key to ensuring your app operates smoothly and securely. This includes functional testing, performance testing, and security audits. Use beta testing to gain user feedback and fix bugs before the official launch.

Launch the App

Once development and testing are complete, it’s time to launch CashNow on app stores. We prepare thoroughly for user feedback and potential issues arising after launch. A smooth launch is supported by active monitoring, ensuring that any user concerns or problems are swiftly addressed for optimal performance and user satisfaction.

Ongoing Maintenance and Updates

After the app goes live, we continuously update CashNow based on user feedback and the latest technological advancements. Regular app maintenance is crucial to keep the app secure, functional, and competitive in the UAE’s evolving FinTech market.

Strategies to Surpass the CashNow App

To truly stand out from the CashNow app, focus on delivering a distinctive value proposition tailored to the unique needs of your target audience. Here’s what you need to know to outperform your competitors.

Revolutionize the Loan Application Process

CashNow simplifies loan applications, but you can innovate further by introducing AI-powered real-time document scanning and smart form autofill. Enhance the process with instant eligibility assessments through predictive analytics for a smoother, faster user experience.

Elevate Personalization with Advanced AI

CashNow provides essential financial tools, but your app can stand out with hyper-personalized features such as tailored savings strategies and detailed expenditure insights. Leverage AI to continuously learn user preferences, delivering recommendations that align with their unique financial goals.

Enhance Security with Multi-Tiered Authentication

While CashNow employs facial recognition, it amplifies security with multi-layered authentication. Incorporate voice biometrics and device encryption to provide users with a highly secure environment, building trust in your app’s safety standards.

Introduce Next-Level Financial Features

CashNow covers the basics, but you can differentiate by offering credit score tracking, peer-to-peer lending platforms, and engaging gamified incentives for timely loan repayments. These additional tools empower users to control their financial health more, setting your app apart.

Bring Your CashNow-Inspired App to Life with Appinventiv

The future of loan apps is poised for rapid growth, driven by technological advancements and the increasing demand for seamless financial services. Features such as AI-powered credit scoring, blockchain-backed secure transactions, and real-time loan processing are shaping the next generation of lending solutions.

As consumers seek faster, more transparent, and accessible financial tools, loan apps must innovate continuously to remain competitive. The market is also witnessing a rise in hyper-personalization, with apps leveraging big data to tailor financial solutions to individual user needs.

Appinventiv UAE, a leading mobile apps development company in Dubai, is a trusted partner for businesses looking to revolutionize the loan app landscape.

With extensive experience in FinTech app development services, the company crafts apps that align with evolving market expectations, combining exceptional functionality with user-centric designs. Appinventiv’s expertise ensures the creation of scalable, secure, and compliant solutions tailored to meet global financial standards.

By collaborating with us, businesses can access innovative approaches and strategic insights that empower them to deliver next-generation loan solutions that resonate with modern users and drive sustained growth.

FAQs

Q. How do you build a loan app like CashNow?

A. The process to develop a loan app like CashNow requires following a strategic approach:

- Market Research: Understand your target audience and competitors to define a unique value proposition.

- Feature Prioritization: Focus on core features like loan calculators, instant approvals, and secure payments.

- Design & Development: Create an intuitive app with expert UI/UX design and robust development.

- Integration & Testing: Add APIs for payments and credit scoring; thoroughly test for functionality and security.

- Launch & Maintenance: Publish and continuously improve the app based on user feedback.

Q. How much does it cost to develop a loan app like CashNow?

A. Here’s an estimate of the cost to build a loan app like CashNow:

- Basic Loan Apps: Range between AED 70,000 to AED 150,000, offering fundamental features such as loan calculators and user-friendly interfaces.

- Advanced Loan Apps: Fall between AED 250,000 and AED 500,000, incorporating sophisticated functionalities like AI-driven approvals, advanced security measures, and seamless integrations.

If you’re still wondering how to estimate the cost of loan app development in the UAE, connect with our experts now.

Q. How long does it take to develop a loan app?

A. Developing a loan app typically spans 4 to 9 months, with the duration heavily influenced by the app’s complexity and features. For basic apps, the development process may take 4-6 months, while more complex apps featuring advanced functionalities like AI-powered approvals or robust security measures could require 8-9 months or longer.

The timeline varies across different development stages, including planning, UI/UX design, coding, testing, and deployment, each requiring specialized expertise and attention to detail to ensure the app’s quality and readiness for the market.

How Much Does It Cost to Build a Crypto Exchange App Like BitOasis in the UAE?

Key takeaways: The cost to build a crypto exchange app in the UAE ranges from $50,000 to $200,000. UAE regulations (VARA and Central Bank) impact development costs due to compliance needs. Advanced features like AI fraud detection increase development costs. The UAE crypto market is expected to grow significantly, offering huge potential. MVP and cross-platform…

How Much Does It Cost to Build An App Like Kayo Sports in Australia?

Key takeaways: Wide Cost Range: Developing a Kayo Sports-like app in Australia can cost between AUD 45,000 (MVP) and over AUD 750,000 for a full-featured, scalable platform. Feature Complexity Impacts Budget: High-end features, such as multi-view streaming, AI personalization, and multi-device support, significantly increase development costs. Ongoing Hidden Costs: Content licensing, cloud infrastructure, compliance, and…

How Much Does It Cost To Build An App in Singapore?

Key takeaways: Mobile app development costs in Singapore range from SGD 40,000 to over SGD 530,000, depending on complexity, platform, and features. Basic apps start at: SGD 40,000. High-end apps using advanced technologies like AI or blockchain can exceed SGD 530,000. Key factors such as platform selection (iOS, Android, Cross-Platform), app complexity (basic, medium, high),…