- What Factors are Driving Transformations in the Digital Consumer Lending Landscape?

- Benefits of Digital Lending Technology in the Banking and Finance Industry

- Increased Efficiency and Speed

- Enhanced Accessibility

- Better Customer Experience

- Cost Savings

- Greater Security

- Regulatory Compliance Adherence

- How Technological are Fueling Transformation in Digital Lending Landscape

- 1. Data Analytics Transforming Applicant Vetting Processes

- 2. AI-Powered Tools Driving Efficiency in Sales Operations

- 3. Blockchain: Enhancing Transparency and Reducing Dependence on Intermediaries

- 4. Cloud Computing: Ensuring Reliability in Digital Lending

- 5. NLP: Enhancing Customer Experience in Digital Lending

- Digital Lending Trends in 2025 and Beyond

- 1. Neo-Banks: Revolutionizing Customer Engagement

- 2. Regulatory Sandboxing: Balancing Innovation and Security

- 3. Omnichannel Capabilities: Enhancing Borrowing Experiences

- 4. Non-Banking Institutions will Continue Entering the Space

- How Will You Transit from a Traditional Bank to a Digital Lender?

- Embrace the Future of Lending with Appinventiv

- FAQs

Have you ever wondered how technology is reshaping the way we borrow money and manage loans? The future of consumer lending is rapidly evolving, driven by technological innovation and customer demand. These advancements merge, drastically changing the consumer-facing financial service sector. For instance, when The Motley Fool, eTrade, and Intuit came into the digital lending market, consumers took it upon themselves to personally manage their finances and invest their savings in places that would get them maximum returns.

In 2025, the financial services industry will experience another wave of disruption. Technological advancements and economic shifts will redefine how individuals manage payments, finance assets like cars or homes, pay for goods and services, and access credit.

Many tech-driven consumer-facing financial services companies have entered the market to address these changes and shape the future of finance. These entrants are the reason why digital consumer lending has become one of the most profitable FinTech startup ideas.

In this article, we will explore the transformative changes reshaping the lending-focused consumer financial services landscape and the role of digital lending technology in driving transformation within FinTech. But before that, let’s understand consumer lending in the banking sector.

What Factors are Driving Transformations in the Digital Consumer Lending Landscape?

The changing space of digital lending transformation is bringing a remarkable shift in credit analysis and bank loans. The rise of technological progress and data analytics has led to a series of alternatives coming into the market, questioning the credibility of credit scores – a prime factor driving the consumer lending industry.

When we examine the changes occurring in the financial sector, we find four factors fueling the digitalization of consumer lending trends.

- Changing consumer behaviors, largely influenced by the global COVID-19 pandemic.

- Rapid technological advancements

- Changes in compliance and regulations

- Innovations focused on simplifying operating models.

These four factors have created a time when consumer insights are blended with product innovations to make digital consumer lending much more inclusive. Instead of serving only highly credit-worthy consumers, the future of lending will now involve consumer segments with low credit histories (low-income households, students, freelancers, etc.)

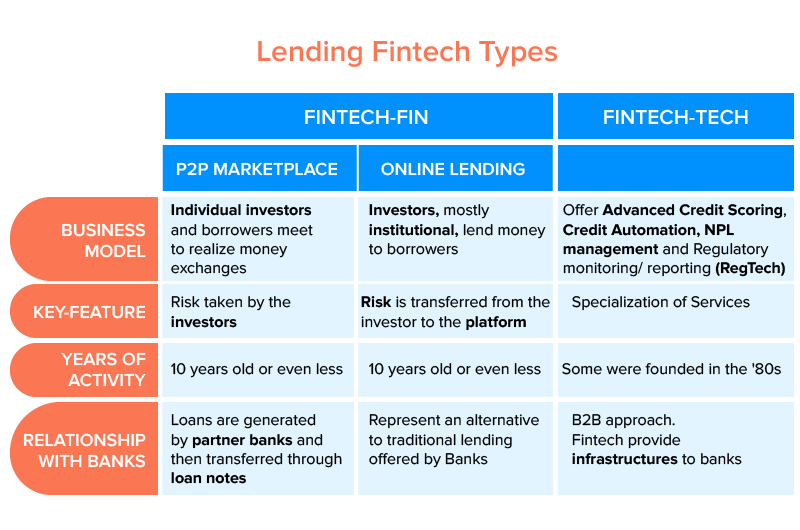

Digital consumer lending in FinTech has grown to the extent that segments it into two subsets–

The primary goal of technology-driven digitalization in bank lending across its subsets is to digitize the entire customer journey (from KYC to reporting) at speed and at a level that traditional consumer lending systems could never reach.

Benefits of Digital Lending Technology in the Banking and Finance Industry

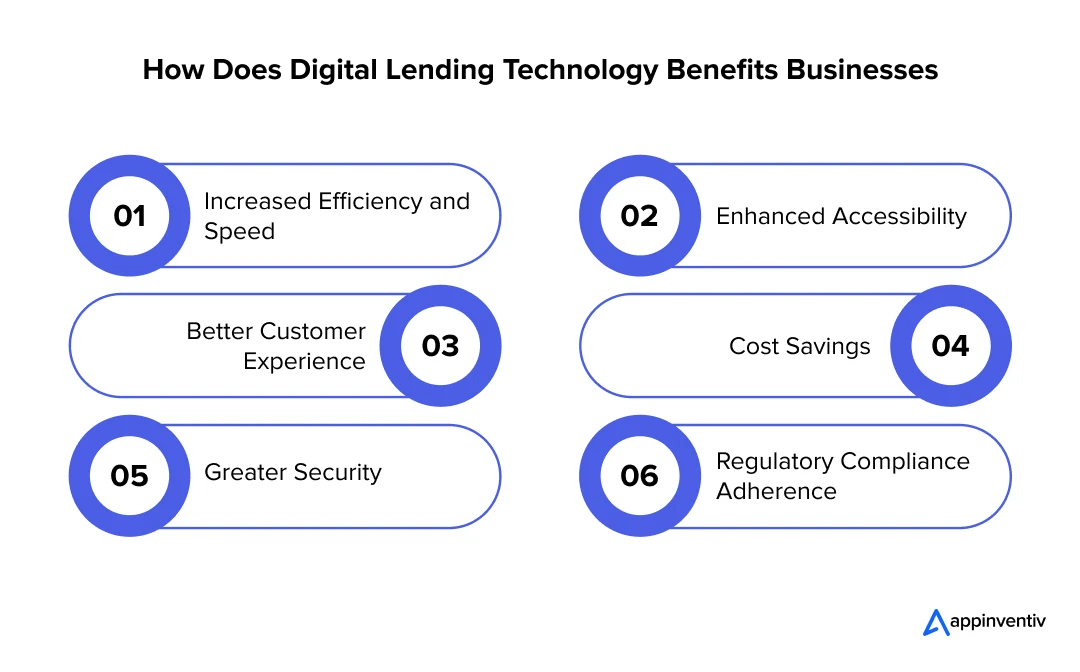

Digital lending has revolutionized the financial services landscape, offering numerous advantages to lenders and borrowers. Let’s get a deeper look at some of the most revolutionary benefits of digital lending:

Increased Efficiency and Speed

Traditional lending involves a lengthy approval process and a lot of paperwork. However, digital lending platforms automate the entire process, from application submission to disbursement, reducing manual errors and loan approval times, sometimes to just a few minutes. This speed benefits borrowers by providing quicker access to funds and helps lenders process more applications in less time.

Enhanced Accessibility

Traditional lending requires in-person visits to banks, which can be a barrier for many potential borrowers. Digital lending platforms remove these obstacles, allowing users to apply for loans anywhere and anytime through online portals or mobile apps. This makes lending services more accessible to a broader audience, including those in underserved or remote areas.

Better Customer Experience

With digital lending, borrowers can enjoy a more streamlined and user-friendly experience. The entire process is simplified, with intuitive interfaces, transparent communication, and 24/7 access to loan information. Additionally, AI-powered chatbots and customer service tools provide instant support, ensuring borrowers’ questions are answered quickly.

Cost Savings

Digital lending platforms reduce operational costs by automating many aspects of the lending process and eliminating the need for physical branches or intermediaries. These savings are often passed on to borrowers through lower interest rates and fewer overhead costs. Moreover, lenders can scale their operations efficiently without significant additional resources.

Greater Security

Digital lending platforms leverage advanced security measures such as data encryption techniques, multi-factor authentication, biometrics, and blockchain technology. These security mechanisms help protect sensitive customer data, identify security risks, and prevent cyber fraud, offering peace of mind to both lenders and borrowers.

Regulatory Compliance Adherence

Digital lending platforms are built with compliance in mind, incorporating automated tools to ensure adherence to regulatory requirements. These platforms can easily integrate with regulatory reporting systems, track compliance with data protection laws, and securely collect and store all required documentation. This helps build trust with regulators and customers while avoiding costly fines or legal issues.

Also Read: Loan Management Software Development – Benefits, Features, Process, Costs

How Technological are Fueling Transformation in Digital Lending Landscape

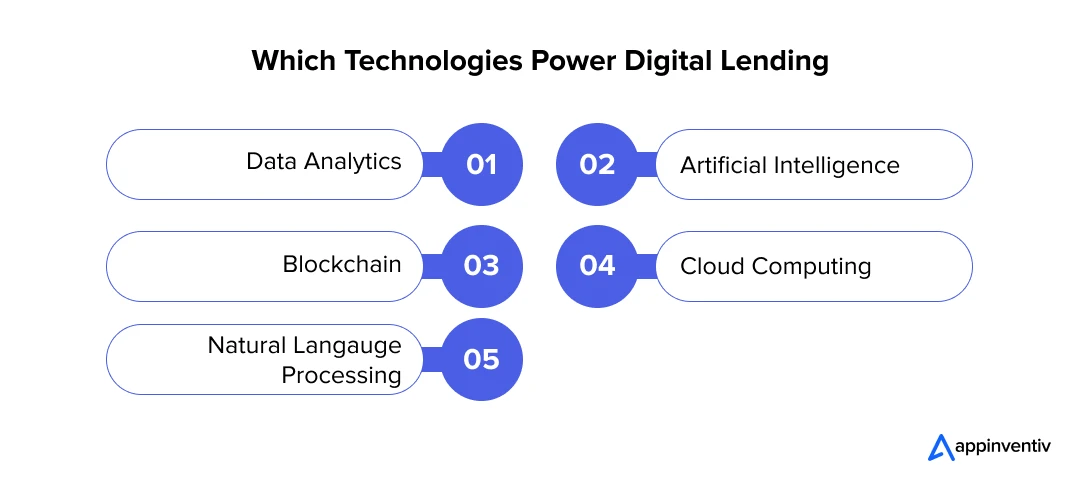

Technology is fueling the lending revolution. Not too long ago, getting a loan was a lengthy and time-consuming process. There were tedious forms to fill out, and approval times from lending firms stretched to weeks. The changing technological landscape has proven to be a game changer in the banking and financial services industry. With the rise of fintech firms using digital lending technologies, borrowers can get instantaneous loan approvals and money in their bank accounts in a couple of hours.

Let us now uncover which technologies are powering digital transformation in the banking and FinTech sectors and how:

1. Data Analytics Transforming Applicant Vetting Processes

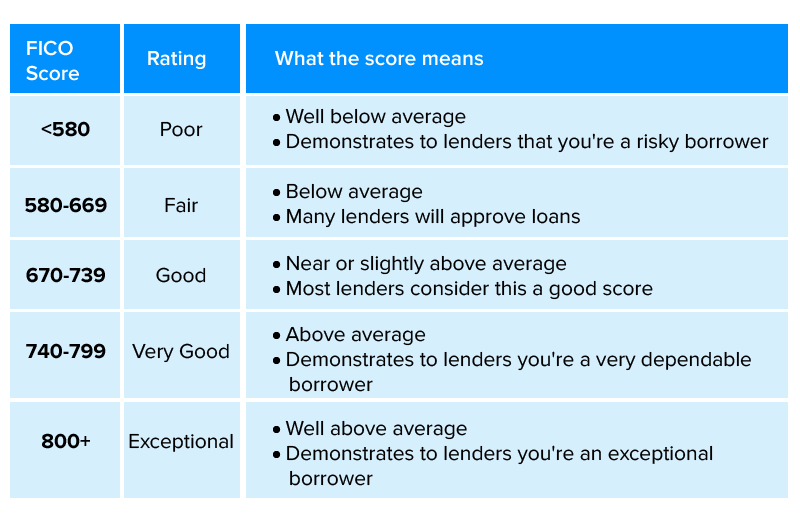

New credit mechanisms are building on the proposition that the traditional way of approval based on FICO credit score is an incomplete sign of applicants’ creditworthiness.

With the integration of AI and advanced analytics, innovative Debt Collection Software now analyzes thousands of data points—like employment history, education, and spending habits—to verify an applicant’s ability to repay debts. These AI-driven analytics, embedded in cutting-edge Debt Collection Software, are paving the way for a more comprehensive credit scoring system, shaping the future of lending.

2. AI-Powered Tools Driving Efficiency in Sales Operations

Digital lenders increasingly integrate machine learning and artificial intelligence into banking, improving the loan experience by automating underwriting decisions. These AI and ML algorithms help validate key data, such as if the applicants are telling the truth about their income level, thus reducing fraud.

This technology is particularly valuable for individuals with limited credit history, lower income, or who face higher interest rates due to a lack of financial data. Additionally, machine learning plays a crucial role in fraud detection by analyzing customer behavior, such as time spent answering application questions and reviewing pricing options. Thus, machine learning offers greater security and efficiency in the lending process.

3. Blockchain: Enhancing Transparency and Reducing Dependence on Intermediaries

Blockchain technology allows digital lending companies to build secure, low-cost platforms that facilitate trust and transparency. With the complete loan process existing online, users can keep a record of documents and transactions on an immutable, anonymous digital ledger. This eliminates the need for third parties and intermediaries and ensures transparency and security, as each transaction is recorded and visible to all authorized parties, preventing fraud and enhancing accountability.

4. Cloud Computing: Ensuring Reliability in Digital Lending

The most common corners of the lending sector are – security, storage, and 24*7 upkeep time. Cloud computing solves all these issues in addition to offering a series of additional benefits like:

- Secure connections

- Cost-effective and time-efficient management

- Disaster recovery

- Simplified online processes

- Automation of processes

5. NLP: Enhancing Customer Experience in Digital Lending

Smart lending systems integrate Natural Language Processing (NLP) to improve customer interactions by understanding and converting queries into actionable insights. There are multiple applications of NLP that digital lending companies can consider in 2025:

- NLP-driven chatbots provide instant answers to basic customer queries.

- They can use NLP to analyze customers’ feedback and get insights that can help them improve the customer experience.

- Lenders can leverage NLP to analyze the data to improve credit scoring accuracy.

These advancements enable lenders to offer personalized and efficient services while improving customer satisfaction.

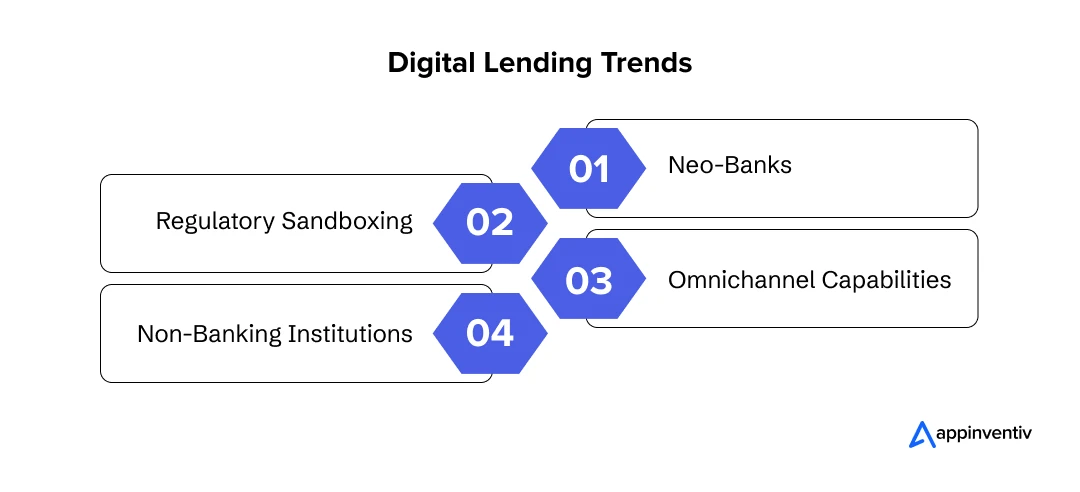

Digital Lending Trends in 2025 and Beyond

The lending landscape continuously evolves and will only improve in 2025 and beyond. With the rise of disruptive technologies and the development of innovative use cases, FinTech companies are poised to outpace traditional lending channels. This section will discuss the key market trends shaping the future of finance and online consumer lending. So, let’s dive in!

1. Neo-Banks: Revolutionizing Customer Engagement

As internet penetration is increasing and more and more people are getting comfortable with handling transactions over their phones, the prospects of app-only ‘neo banks’ are growing.

Neo Bank is a digital bank with no physical branches. Neo-banking is entirely online rather than being physically present at a specific location. As the modern financial landscape focuses more on enhancing customer experience, a gap has developed between what traditional banks offer and what customers expect. Neo bank is a way to fill that gap.

2. Regulatory Sandboxing: Balancing Innovation and Security

While the consumer lending industry needs constant innovation to develop and grow, it also needs regulation to ensure security, safety, and ethics. Sandboxing is a way that allows regulators to assess innovative products before they are fully launched, with protection from liability during testing, as outlined in the Compliance Assistance Sandbox (CAS) Policy.

3. Omnichannel Capabilities: Enhancing Borrowing Experiences

The future of consumer lending will be shaped by omnichannel technology that enables borrowers to seamlessly switch between platforms, such as mobile phones and laptops, without disrupting their experience. This self-service, holistic digital experience will become essential for lenders who wish to offer their customers a smooth and efficient journey.

4. Non-Banking Institutions will Continue Entering the Space

Companies like Amazon and Apple have already made their mark in consumer lending, offering loans and credit cards to individuals and emerging entrepreneurs. These entrants in the consumer lending space highlight the companies’ capabilities and how they help their customers reach their goals. As more non-banking institutions enter the market, they will challenge traditional banks and drive competition in consumer financing.

How Will You Transit from a Traditional Bank to a Digital Lender?

Many brands have positioned themselves as leaders in the future of consumer finance by embracing digital lending technology. However, shifting from a traditional lending mindset to a digital-first approach is not without challenges. There will be resistance to change, fear of risk, and other barriers that can impede the road to digital advancements.

Your traditional lending organization needs a solid strategic foundation supported at every level to undergo a successful digital transformation. As a digital lender, you must focus on offering your consumers an exceptional digital experience, as a poor experience or failure to comply with regulations can undermine trust.

Here are some key things you should consider implementing for a successful transition

- Ensure your customers clearly understand the criteria for loan approval to build trust and minimize confusion.

- Develop new training material that resonates with Gen Z and tech-savvy generations, making it easier for them to navigate your digital offerings.

- Avoid forcing customers to visit physical branches. Offer alternative digital channels for an easier and more convenient experience.

- Be transparent and maintain open communication. The more upfront your business is about your policies and processes, the more likely consumers will trust and engage with your platform.

- The secret sauce of your lending business success depends on transparency and open communication. The more upfront your business is about your policies and processes, the more likely consumers will trust and engage with your platform.

Embrace the Future of Lending with Appinventiv

The future of consumer lending is undeniably intertwined with the advancements in digital lending technology. As emerging technologies like AI, ML, blockchain, cloud computing, and NLP continue to transform the landscape, lenders are becoming more efficient, transparent, and customer-centric. From enhancing the loan application process to monitoring repayment behavior, digital lending technology is the next big thing in banking and finance.

Advanced digital lenders offer faster, more convenient, and transparent consumer lending services, setting new standards for customer experience. To match the standards and remain competitive, traditional banks and lending institutions must adapt to provide similar services and keep pace with the lending technology trends.

Don’t lag in providing similar benefits to your digital customers. Upgrade your bank lending technology now and enjoy the benefits of digital lending.

Appinventiv, a trusted lending software development company, is here to help if needed. Our team of 1600+ tech experts has delivered several groundbreaking FinTech solutions for businesses worldwide. With our expertise in providing top-notch FinTech software development services and a deep understanding of emerging technologies, we build next-gen consumer lending systems that empower businesses to elevate their digital transformation journey.

For instance, we developed Mudra, an AI-powered FinTech app that revolutionized millennial budget management. Similarly, we created Edfundo, a smart financial literacy platform that helps children learn finance management early on.

Whether you need to build AI consumer lending solutions from scratch or upgrade an existing one, we are your one-stop solution for making the future of lending smarter, faster, and more accessible.

Contact us today to become a leading digital lender in this competitive financial landscape.

FAQs

Q. What is digital lending in banking?

A. Digital consumer lending uses digital platforms and technologies to provide personal loans, mortgages, credit cards, and other financial products directly to individual consumers for personal or household use. The lender may be a bank financial institution or a company that offers in-house credit in exchange for the consumer’s business.

This process of digital consumer lending leverages online applications, automated underwriting, AI-driven credit assessments, and digital interfaces to simplify and accelerate consumer lending services. It aims to enhance customer experience, reduce operational costs, and improve access to financial products through digital channels.

Embracing the advanced bank lending technology doesn’t mean sacrificing the valuable human element. Instead, it allows banks to enhance visibility and automate repetitive tasks without fully replacing human-driven processes.

The key is to determine which aspects to automate. This will allow your institution to leverage digital lending technology for a more streamlined and efficient lending process.

Q. How is digital lending changing banking?

A. Digital lending is revolutionizing banking by streamlining loan processes, enhancing customer experiences, and improving operational efficiency. By leveraging digital lending technology like AI, blockchain, and cloud computing, banks can automate underwriting, reduce loan approval times, save costs, enhance accessibility, and offer personalized services.

This shift enables banks to provide seamless, transparent, and secure consumer lending services, making borrowing more accessible and efficient for individuals and businesses.

Q. What are some popular consumer lending trends trends?

A. The consumer lending industry is driven by many remarkable digital lending trends, including:

- Embedded Finance: Lending will blend effortlessly into everyday products and services, making credit more accessible when needed.

- Open Banking: Borrowers can safely share their financial data to unlock better loan options from multiple lenders.

- Increased Competition: FinTechs and neobanks are shaking up the market, offering innovative solutions and better customer experiences.

- Hyper personalization: AI tailors loan products to meet individual financial goals, creating more meaningful borrower experiences.

- Real-Time Lending: Approvals and fund disbursements are becoming near-instantaneous, thanks to intelligent automation and digital lending software development.

- Improved Security: Cutting-edge digital lending technology like blockchain ensures safer platforms for lenders and borrowers.

- Financial Inclusion: Digitalisation in consumer lending brings credit to underserved communities, including rural and emerging markets.

How Much Does it Cost to Build a Personal Finance App like Pocketsmith?

Imagine an app that knows when your rent is due, reminds you of upcoming bills, forecasts your savings 12 months ahead, and tells you if that third coffee this week is wrecking your budget. That’s the kind of experience apps like PocketSmith deliver, and it’s exactly why personal finance apps are becoming a must-have for…

How Much Does it Cost to Build a Mobile Banking App Like Halifax in the UK?

The way people bank has changed dramatically. Gone are the days of waiting in long queues or rushing to a branch before closing hours. Today, mobile banking apps like Halifax have redefined convenience, allowing users to check balances, transfer funds, pay bills, and even apply for loans from their smartphones, anytime and anywhere. This shift…

How to Approach Currency Converter App Development?

Imagine you’re about to travel abroad and need to quickly check how much your local currency is worth in another country, or perhaps you run an international business and constantly deal with multiple currencies. In both cases, a currency converter app is an indispensable tool. With global transactions becoming the norm and forex markets fluctuating…