- Business Benefits of Healthcare Payment System Development

- How Digital Healthcare Payment Systems Benefit Healthcare Providers

- How Digital Healthcare Payment Solutions Development Benefits Insurers

- How Digital Payments in the Healthcare Market Enhance Patient Experience

- Healthcare Payment System Development: A Step-by-Step Process

- Understand Business Needs and Challenges

- Conduct Regulatory and Compliance Analysis

- Choose the Right Payment Infrastructure

- Design a User-Centric Interface

- Develop and Integrate Core Modules

- Implement Security Measures

- Test for Accuracy, Compliance, and Scalability

- Monitor, Maintain, and Scale

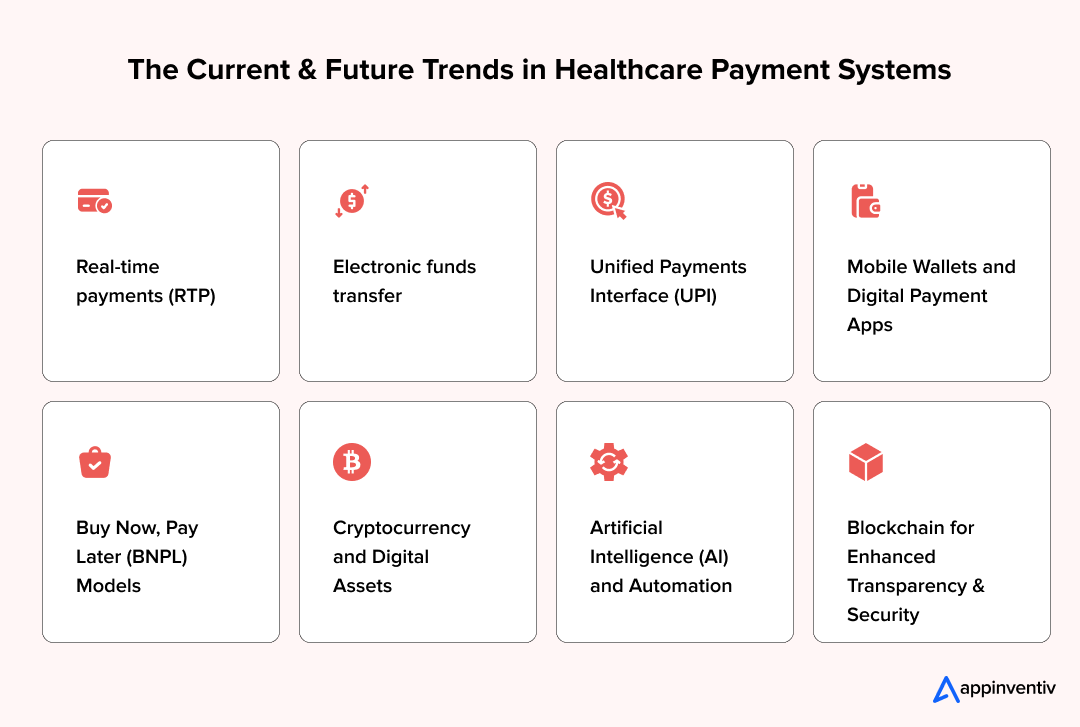

- The Present & Future of Healthcare Payment Systems: Emerging Trends

- Electronic Funds Transfer

- Real-Time Payments (RTP)

- Unified Payments Interface (UPI)

- Mobile Wallets and Digital Payment Apps

- Buy Now, Pay Later (BNPL) Models

- Cryptocurrency and Digital Assets

- Artificial Intelligence (AI) and Automation

- Blockchain for Enhanced Transparency and Security

- Predictive Analytics

- Essential Technologies Stack that Enhances the Efficacy of Digital Payments in Healthcare

- Biometric Authentication

- Open Bank APIs

- EMV Codes

- Cost of Healthcare Payment System Development

- How Appinventiv Helps You Build Next-Gen Healthcare Payment System

- FAQs

- Q. Why does my healthcare business need digital payments?

- Q. What are the economic trends of the healthcare payment system?

- Q. What are modern healthcare payment systems?

- Q. Why is HIPAA compliance important in healthcare payment systems?

- Q. How is AI transforming healthcare payment solutions?

Let’s imagine a scenario: Sarah, a busy working mom, just had a routine check-up with her doctor. She’s expecting a quick and simple bill after the appointment, but instead, she receives a confusing, paper-heavy statement days later. She spends hours deciphering the charges, navigating insurance jargon, and calling the billing department for clarity. It is frustrating, time-consuming, and far from the seamless experience patients expect in today’s digital age.

A recent study revealed that one-third of healthcare consumers are dissatisfied with their provider’s digital billing process, a challenge that directly impacts payment collections (Source: Healthcare Finance News).

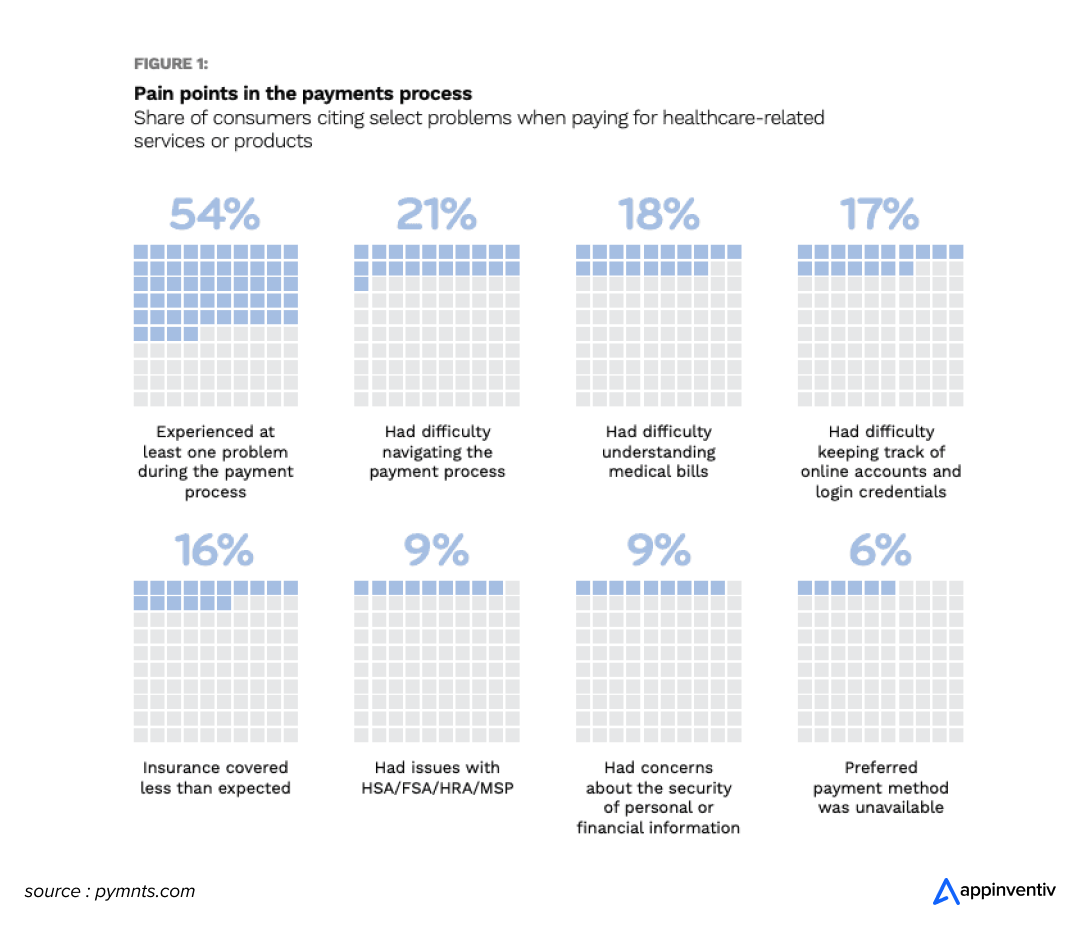

According to PYMNTS, 54% of consumers surveyed said they “experienced at least one pain point during the payment process in the past 12 months.”

The most effective way to address these issues is to modify the types and trends in healthcare payments.

This is where healthcare payment system development emerges as a game-changing solution. By investing in medical payment systems development, organizations can:

- Drastically reduce billing errors

- Accelerate revenue cycles

- Address patient frustrations and rebuild patient trust through transparency and convenience.

That’s why 64% of consumers are highly satisfied with tracking their medical bills and insurance payments through a digital portal.

Now, Interested in healthcare virtual payment software development?

Well, here is a detailed blog that uncovers how the rise of digital payments is reshaping medical services. We will also walk you through how to develop a secure, HIPAA-compliant healthcare payment system tailored to your organization’s needs.

Ride a wave with the next-gen payment solution.

Business Benefits of Healthcare Payment System Development

Streamlining payments is one of the simplest yet most effective ways to enhance the healthcare experience for all service providers, patients, and insurers. Traditional billing methods often slow down operations and create unnecessary complexities in an already sensitive environment. But with the rise of digital healthcare payment systems, these inefficiencies are being replaced by faster, more secure, and more transparent transactions.

Let’s explore how implementing a robust digital payment infrastructure can unlock real value for your healthcare business.

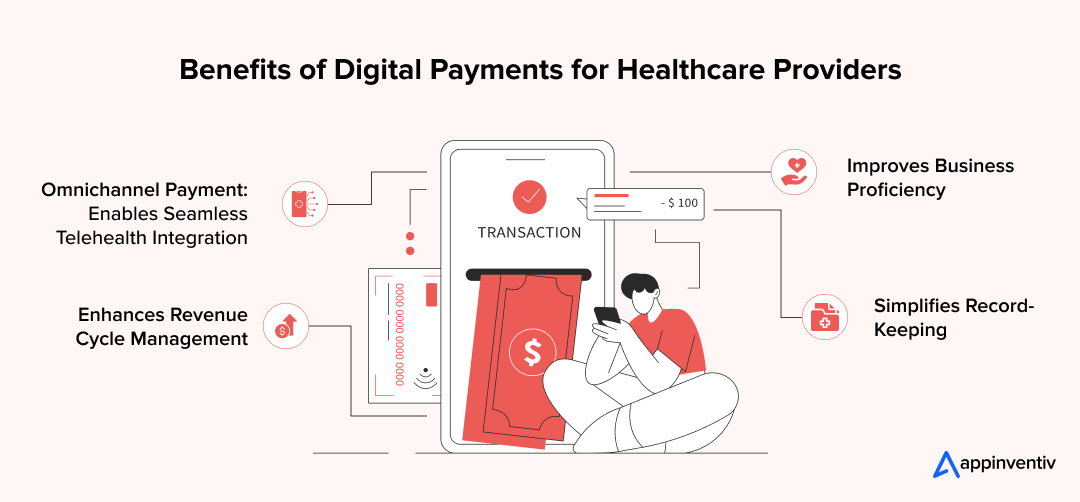

How Digital Healthcare Payment Systems Benefit Healthcare Providers

Digital payment systems can significantly enhance operational efficiency and patient trust for healthcare providers. From improving revenue cycles to reducing billing errors, digital payments have emerged as a crucial component in the healthcare payments industry.

Improves Business Proficiency

Digital operations minimize manual intervention, reducing human error and streamlining payment workflows. Providers can send bills via text or email, enabling patients to view and pay digitally.

This paperless approach frees administrative staff to focus on high-value tasks like enhancing patient service, analyzing performance metrics, and refining internal processes.

Additionally, digital healthcare payment solutions development makes it simple to forecast, customize, and manage inventories while securely storing a large amount of data.

Simplifies Record-Keeping

Healthcare deals with a ton of paperwork each day. With healthcare digital payment solutions, one can create a digital invoice, send it to a patient immediately, and receive online payment, all in one simple transaction. It saves you and the patient from the hassle of endless billing.

By doing this, you can also avoid the need to manually track patients who have received invoices, who have made payments, and who still need to be contacted about unpaid balances.

Furthermore, billing administrators can easily access patient invoices and take action on unpaid bills using healthcare online payment solutions. This practice supports a healthy expansion strategy for smaller healthcare institutes and helps increase efficiency at every stage of the patient experience.

[Also Read: Ways Electronic Health Records Will Continue to Improve in 2022]

Omnichannel Payment: Enables Seamless Telehealth Integration

Telemedicine usage surged nearly 38x post-pandemic. Yet, fragmented payment systems initially slowed its adoption.

Now, digital payment platforms offer a variety of methods—cards, UPI transactions, and online banking, making it easy for patients to access online consultations and pay for them using their preferred digital payment methods.

This seamless billing integration allows providers to deliver remote care with secure, convenient transactions.

Also Read: How Much Does Telemedicine App Development Cost?

Enhances Revenue Cycle Management

Manual billing often delays payments by 60+ days. Digital healthcare payment system development can shrink this gap with real-time invoicing and automated reminders.

In many instances, a business merely needs to enhance the procedure with a straightforward method of creating invoices, promptly billing patients, and accepting electronic healthcare payments.

Faster collections and fewer outstanding receivables lead to better revenue cycle management. For emerging startups, this efficiency supports expansion and long-term sustainability.

How Digital Healthcare Payment Solutions Development Benefits Insurers

For insurers, healthcare payment system development helps streamline claims processing, reduce administrative overhead, and minimize fraud risks. These systems enable real-time data exchange and faster reimbursements, improving provider relationships and customer satisfaction.

Streamlines Payments

The growing demand for digital payment solutions also benefits insurers. By automating payment workflows, insurers can easily streamline the claims process, ensuring that reimbursements are processed more efficiently. This not only improves the overall efficiency of the system but also fosters stronger relationships among insurers, healthcare providers, and patients.

Speeds Up Claim Settlement

Digital systems accurately capture billing data, enabling insurers to automate reminders and streamline reimbursements. Just like loan alerts, platforms notify patients of dues using stored preferences.

The result? Quicker claims processing and faster settlements, supported by readily available patient and billing histories.

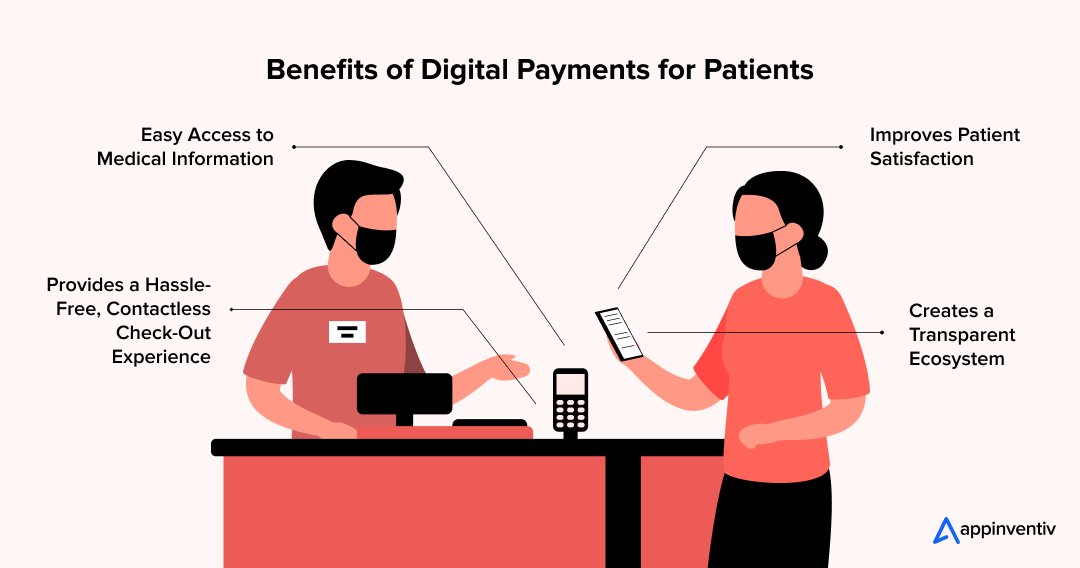

How Digital Payments in the Healthcare Market Enhance Patient Experience

Medical payment systems development offers a win-win situation for both businesses and patients. Patients are more likely to seek medical attention and receive the best care, while providers can provide better care and reliably collect payments. Here are some effective ways how digitalizing your healthcare business can transform your patient experience:

Easy Access to Medical Information

In the digital age, patients desire quick, easy access to all their information, including test results and unpaid balances. Integrating payments with patient portals meets these digital-first expectations.

The US Centers for Medicare and Medicaid Services’ Hospital Price Transparency Rule mandates clear pricing. Digital systems help meet compliance by presenting upfront, digestible cost breakdowns.

A US bank survey reveals that 44% of patients confirmed paying their medical bills more quickly when they receive digital or phone billing reminders.

Improves patient satisfaction

Digital payment in healthcare was broadened during the COVID-19 pandemic, but now it has become the new norm. Adding digital payment options to medical practices encourages more devoted and satisfied patients.

Patients dislike the poor digital billing process associated with uncollected payments, making them switch to another healthcare provider. Independent healthcare startups cannot afford to lose clients because of slow billing and payment procedures in an era of escalating competition.

Therefore, digitizing operations might be a great solution if you are setting up a healthcare business or struggling to hold back your customers as an established practice.

Provides a Hassle-Free, Contactless Check-Out Experience

Imagine having a patient at your office who receives a text message while waiting for their doctor in the exam room. The message would contain an invoice for their co-pay that can be paid at the time of their appointment or shortly after. These customers won’t waste time at the register paying for something they could easily send from their phone in the waiting area or at home. Patients can continue with their day immediately after seeing their provider with a modern check-out procedure.

Additionally, switching every process to a contactless alternative will result in more patient satisfaction points. Front desk staff will have more time to focus on improving the patient experience by immediately addressing any questions or notes patients leave, rather than transacting payments on registers.

Creates a Transparent Ecosystem

A typical medical bill includes a lot of information that might be hard for a layman to grasp. This can confuse the patient or his/her family. But through healthcare virtual payment software development, every dollar spent is monitored and verified, making money misappropriation next to impossible.

This builds a great deal of trust and confidence because the patient agrees with the bill’s totality and receives all the information transparently. If there are any errors or misunderstandings, changes can be made immediately and will be reflected in real-time.

Digital Frontdoor and Interoperability

The concept of a digital front door in healthcare, when combined with interoperability, significantly enhances the benefits of digital payments. By integrating payment systems into a single, user-friendly platform, patients can easily manage their financial transactions—from booking appointments to settling bills.

This system ensures smooth data flow between healthcare providers, payers, and patients, improving payment accuracy and reducing administrative burdens. The seamless exchange of information through interoperable systems also enables better coordination of care, leading to enhanced patient satisfaction and more efficient revenue cycle management.

Healthcare Payment System Development: A Step-by-Step Process

Building a robust healthcare payment system is more critical than ever as the industry moves towards streamlined, secure, and patient-centric financial processes. However, developing an effective healthcare payment system is a complex and challenging process.

It requires the right mix of careful planning, technology integration, and proven expertise of healthcare payment processing companies. To help you go ahead in your venture confidently, here is a clear step-by-step process to build a healthcare payment system that meets modern demands:

Understand Business Needs and Challenges

Medical payment systems development starts with identifying your healthcare organization’s unique payment challenges and goals.

- Will the system serve hospitals, telehealth platforms, clinics, or pharmacy networks?

- What are the key use cases for healthcare payment system development that you aim to address? Are you streamlining insurance claims, patient billing, or have any specific pain points to address?

- Which core features should your solution include to enhance patient experience and streamline operations?

By gaining a clear understanding of your requirements, you can plan a better roadmap and execute a successful digital payments transformation process.

Conduct Regulatory and Compliance Analysis

One of the biggest challenges in hospital payment processing is ensuring full compliance with regulations. Adhering to essential standards like GDPR, HIPAA, PCI DSS, and local healthcare laws is not only a best practice but a dire necessity. Therefore, you must conduct a thorough assessment of applicable laws to ensure your system architecture, data handling, and payment processing meet all security and privacy standards.

Related Article: A Complete Guide to Healthcare Compliance

Choose the Right Payment Infrastructure

The next step is to choose the right payment trends your platform will support, such as mobile wallets, UPI, credit/debit cards, real-time payments, etc. Based on your users’ preferences, integrate a secure payment gateway and determine whether you will support one-time payments, subscriptions, or installment models.

Design a User-Centric Interface

Create a simple yet intuitive UI/UX that can accommodate both tech-savvy and less experienced patients. Ensure that your user interface provides quick access to payment history, insurance details, and billing breakdowns. This will increase engagement and eliminate hassle.

Develop and Integrate Core Modules

Now, it’s time to develop the essential parts of your healthcare payment system, such as invoice creation, payment tracking, claims processing, and automated billing. Ensure the system integrates seamlessly with EHR or EMR platforms for improved workflow. At this stage, your healthcare payment processing companies also integrate relevant APIs to connect with third-party platforms like insurance systems, accounting software, or government health portals.

Implement Security Measures

Security is paramount in handling patient payment information. Thus, the next step is to define strong security measures that you need to integrate into your digital payment system. Consider building your system with strong encryption protocols, tokenization, secure APIs, multi-factor authentication, and fraud detection mechanisms.

This will help protect patient and payment data from breaches. You can also prefer cloud-based architectures to handle high transaction volumes during peak periods without lag or downtime.

Test for Accuracy, Compliance, and Scalability

Now, before you finally bring your digital payment system into action, test it thoroughly against various parameters to validate transaction accuracy, error handling, regulatory compliance, and uninterrupted performance under load. Simulate real-world scenarios to ensure the system performs flawlessly in high-pressure environments.

Monitor, Maintain, and Scale

After deployment, you need to continuously monitor the performance of your medical pay solutions, analyze user behavior, track billing cycles, and evaluate technical metrics to optimize workflows and introduce upgrades. As your operations expand, ensure the system is scalable to handle growing volumes and new functionalities.

Let’s build your digital healthcare payment platform together.

The Present & Future of Healthcare Payment Systems: Emerging Trends

As patient expectations evolve and digital payments transformation accelerates across industries, the healthcare sector rapidly embraces new payment models to meet the demands for transparency, convenience, and speed. With digital payments gaining acceptance in both B2B and B2C sectors, several models can be useful to the healthcare industry for accelerating digital payments. Here are some of the most influential digital payment trends shaping the future of healthcare financial systems:

Electronic Funds Transfer

EFT allows users to transfer funds digitally from one bank account to another without the manual intervention of bank workers. Because it is a digital transaction, no paper documentation is required. Due to its ease of use, accessibility, and directness, EFT has surpassed other money transfer methods as the most popular choice.

EFT has rapidly replaced paper checks in hospitals as clinicians prefer this healthcare payment processing trend due to its cheaper, faster, and less labor-intensive nature.

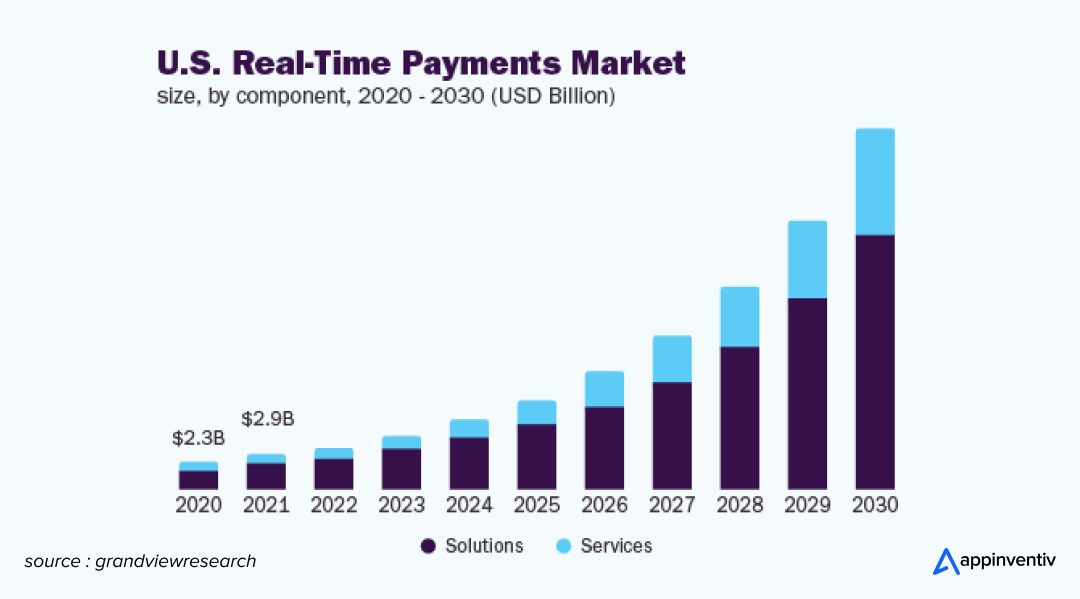

Real-Time Payments (RTP)

Real-time payments (RTP) transactions are initiated and settled nearly instantaneously. The funds are instantly transferred, and all transaction information is settled almost immediately. Real-time payment networks ideally offer 24/7/365 accessibility, meaning they are always available to handle transfers, including weekends and holidays.

This can be particularly beneficial for healthcare providers, especially those in emergency departments. This model is poised to expand in the worldwide market at a CAGR of 35.5% from 2023 to 2030.

Unified Payments Interface (UPI)

UPI has revolutionized peer-to-peer and consumer-to-business transactions. Its fast, real-time settlement, zero transaction fees, and interoperability across banks and healthcare apps make it one of the most popular digital healthcare payment models. With the growing acceptance of UPI payment, even small clinics and diagnostic centers are integrating UPI into their billing systems to offer patients a convenient, cashless experience.

Also Read: UPI Payment App Development Cost – A Complete Guide

Mobile Wallets and Digital Payment Apps

Patients now expect the same level of ease and speed in healthcare that they experience in retail. This makes mobile wallets, such as Apple Pay and Google Pay, one of the most preferred modes of payment in healthcare. These wallets process payments using bank account, debit, or credit card information. The payment details are stored securely and encrypted in a mobile wallet. These wallets eliminate fraud, speed up payment processing, and incur no additional costs. With this type of payment system, customers can “tap-and-pay” and use a single wallet for both online and offline payments.

Buy Now, Pay Later (BNPL) Models

Inspired by FinTech innovation, many healthcare providers are exploring flexible payment models, such as healthcare subscriptions or buy-now-pay-later (BNPL) plans. These models make treatments more accessible while increasing the likelihood of timely payments from patients. In the coming years, Buy Now, Pay Later (BNPL) models are anticipated to receive broader adoption in healthcare.

Related Article: BNPL App Development Costs – Factors, Features, Process

Cryptocurrency and Digital Assets

Some healthcare providers are cautiously exploring cryptocurrency as a mode of payment processing in hospitals, particularly for cross-border transactions or medical tourism. While regulatory uncertainty remains a challenge, these digital assets continue to gain traction in the healthcare payments industry due to their speed, security, and potential to reduce transaction costs.

Although it is still early, cryptocurrency could become an alternative for international payments in the coming years, providing a more secure and efficient option than traditional banking methods.

Artificial Intelligence (AI) and Automation

As healthcare payments become more complex, AI plays an increasingly indispensable role in simplifying payment workflows. AI technologies in healthcare can automate tasks such as claims processing, payment reminders, and fraud detection, thereby improving both accuracy and speed.

Furthermore, by integrating machine learning algorithms, payment systems can predict patient behavior, track payments, and identify discrepancies in real-time, ultimately enhancing revenue cycle management.

Blockchain for Enhanced Transparency and Security

Blockchain is gaining immense traction in healthcare as a secure, transparent solution for managing healthcare payments. Its decentralized nature ensures that all payment transactions are immutable, traceable, and auditable, minimizing the risk of fraud. Blockchain technology also supports smart contracts, which help automate healthcare payments once certain conditions are met, reducing administrative costs and ensuring timely payments.

Although still in early adoption stages, blockchain promises to improve transparency in medical billing and cross-border payments, especially for global healthcare providers.

Predictive Analytics

AI-driven predictive analytics is transforming the way healthcare organizations manage payments, offering powerful tools to forecast patient payment behaviors and reduce billing errors. By analyzing historical payment data, patient demographics, and treatment costs, AI algorithms can predict the likelihood of timely payments, potential defaults, or delays. This enables healthcare providers to proactively address billing issues before they arise, offering tailored payment plans or reminders to patients who may be at risk of non-payment.

Also Read: Top Healthcare Trends to Leverage in 2025

Essential Technologies Stack that Enhances the Efficacy of Digital Payments in Healthcare

Whether you are building a new payment model from scratch or upgrading your existing one, choosing the right technologies is essential for improving financial workflows and ensuring compliance. Thus, you should cautiously select the most suitable healthcare payment technology for your project.

Biometric Authentication

Biometric authentication is a type of verification that analyzes a person’s biological and physical traits using various technologies, including heartbeat analysis, vein mapping, facial recognition, iris identification, and fingerprint scanners. Medical pay solutions and mHealth apps can utilize biometric verification to authenticate transactions in the healthcare sector.

Open Bank APIs

Application programming interface (API) development enables legacy banks to exchange data and information easily and instantly. APIs also allow any business (B2B, B2B2C, or BaaS) to incorporate its products onto a platform of a nonfinancial company.

Also Read: Why Healthcare APIs are a Crucial Digital Asset For You?

EMV Codes

Europay, Mastercard, and Visa (EMV) technology has progressively gained traction, providing clients with a more automated and secure payment method. The EMV system is well known for utilizing unique transaction-specific codes. These temporary codes significantly enhance the security of bank accounts and impact how we manage banking systems. These codes will soon replace plastic cards as a more practical and safe way to transact money.

Cost of Healthcare Payment System Development

The cost of developing a healthcare payment system typically ranges from $30,000 to $300,000+, depending on various vital factors. Key cost drivers include AI-driven analytics, HIPAA-compliant architecture, real-time billing automation, multi-party payment routing, integration with EMR and EHRs, and robust data security layers.

Additionally, your specific business goals, the features of healthcare payment systems, the level of security involved, and other critical components can influence the cost of healthcare payment system development.

Discuss your project idea with a reputed digital healthcare development service provider to get a more precise estimate, tailored to your unique needs.

Get a custom quote for your Healthcare Payment System in a snap!

How Appinventiv Helps You Build Next-Gen Healthcare Payment System

Building a state-of-the-art medical payment solution and navigating the complexities of the healthcare landscape demands more than just technical know-how. It calls for domain expertise, regulatory compliance foresight, and a deep understanding of healthcare payment system development.

That is exactly where Appinventiv makes a difference. Our team of 1600+ tech evangelists excels at delivering the best healthcare software development services.

With over 3,000 digital solutions delivered globally, we have helped healthcare leaders build secure, scalable, and compliant payment systems that streamline operations and enhance patient experience. From empowering Soniphi to providing personalized health insights through biometric resonance and supporting Health-e-people in redefining proactive health assessments to helping DiabeticU users take control of diabetes through real-time tracking and care coordination, we specialize in building HIPAA-compliant healthcare platforms that solve real-world challenges.

Whether you are looking to reduce billing errors, integrate real-time insurance verification, or build AI-powered revenue cycle management tools, we are here to turn your complex project requirements into seamless digital experiences.

The future of healthcare is digital, and payments are at the heart of that transformation. Let Appinventiv be your partner in success in building a next-gen healthcare payment system that’s secure, efficient, and built to scale.

Reach out to us now to create a secure, speedy, and scalable digital healthcare payment platform.

FAQs

Q. Why does my healthcare business need digital payments?

A. As a customer-centric service, you will need to adapt your business to the needs and preferences of your customers. If you want your business to survive in the increasingly competitive market of online consultation portals, online pharmacies, and labs, you must offer seamless and flexible digital payment options. Digital payments reduce billing friction, speed up transactions, minimize paperwork, and improve cash flow. They also align with patient expectations for convenience, transparency, and mobile-first experiences, helping you build long-term trust and loyalty.

Q. What are the economic trends of the healthcare payment system?

A. The digital payment in the healthcare market is experiencing steady growth. This growth trend is fueled by increased digitalization, rising healthcare spending, and growing demand for value-based care.

In this ever-evolving market, economic trends such as real-time payments, AI-powered billing, and Buy Now Pay Later (BNPL) models are gaining immense traction. Additionally, healthcare providers are shifting towards integrated platforms that reduce administrative overhead and enhance financial transparency.

Q. What are modern healthcare payment systems?

A. Modern healthcare payment systems are digital platforms designed to handle everything from patient billing and insurance claims to real-time transactions and data integration. Some of the most common features of healthcare payment systems are mobile wallets, automated invoicing, claims processing, EHR/EMR integration, and payment gateway support, which help improve efficiency and enhance patient satisfaction.

Q. Why is HIPAA compliance important in healthcare payment systems?

A. HIPAA compliance in healthcare payment system development is critical because it handles sensitive patient information, including financial and medical data. Failure to comply with this regulation can result in data breaches, legal penalties, and loss of patient trust.

Apart from this, there are several other benefits of HIPAA-compliant healthcare payment processing. For instance, a HIPAA-compliant system ensures that data is encrypted, access is restricted, and all transactions meet strict privacy and security standards, protecting both your business and your patients from cyber threats and regulatory risks.

Q. How is AI transforming healthcare payment solutions?

A. AI in medical billing technologies and payment solutions is revolutionizing the sector by introducing automation, speed, and intelligence into every stage of the payment lifecycle. For instance, AI in healthcare payment:

- Automates claims adjudication, reducing manual errors and processing time.

- Detects fraudulent billing patterns early through real-time monitoring.

- Streamlines payment reconciliation and improves cash flow visibility.

- Offers personalized billing suggestions based on patient history.

- Uses predictive analytics to flag delayed payments and minimize revenue leakage.

- AI healthcare chatbots like Google’s AMIE, assist patients with real-time billing queries, thereby improving service quality.

- Machine learning identifies underpayments and optimizes reimbursement cycles.

- Enhances operational efficiency while improving overall financial outcomes.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Change Management in Healthcare: Principles, Processes, and Models

Key Takeaways Change in healthcare fails quietly when ownership, workflow alignment, and follow-through are missing. Successful change management in healthcare focuses on adoption, not just system implementation. Clinical workflows and workforce capacity determine whether transformation sticks or stalls. Governance, clear accountability, and post-go-live support matter more than the model used. Sustainable healthcare transformation depends on…

A Practical Guide to Building Your Mental Health Chatbot - Use Cases, Cost, & ROI

Key takeaways: Mental health chatbots work when they know their limits. They’re most useful as a gentle first step, not as a stand-in for real care. Good chatbot design is more about judgment than AI. Clear boundaries, calm responses, and safety matter more than smart language models. Enterprises invest in chatbots to make support easier…

How To Hire the Right Healthcare Developers As Per Your Business Needs?

Key Takeaways The guide to the step-by-step approach to recruiting the right healthcare software developers to meet your business requirements. In-depth dissection of the major technical skills, certifications and healthcare-specific expertise required in developers. Guidelines for carrying out the evaluation of candidates using portfolios, technical interviews, and trial projects. Industry-specific ERM approaches help address regulatory,…