- Why Build An App Like eToro: Understanding User Trends & Market Demand

- eToro App Development: Cost Estimates and Timeline Expectations

- Factors Affecting eToro-Like Trading App Development Cost and Timeline

- App Complexity and Features

- Platform Choice (iOS, Android, Web)

- UI/UX Design Sophistication

- Backend Architecture

- Security and Compliance Requirements

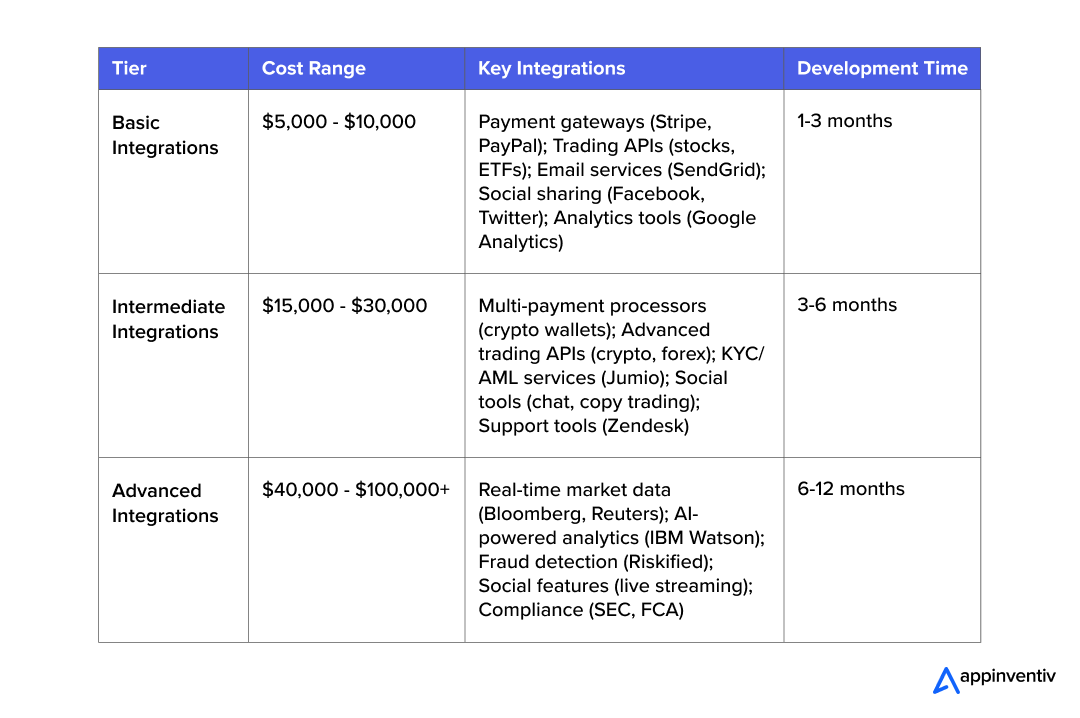

- Third Party Integrations

- Essential Features of a Trading Platform Like eToro: Complete Cost Analysis

- Core Trading Infrastructure

- Social Trading & Copy Trading Features

- Smart Portfolios & Automated Investing

- Mobile-First User Experience

- Security & Compliance Infrastructure

- Educational & Onboarding System

- Analytics & Reporting Tools

- Integration & API Development

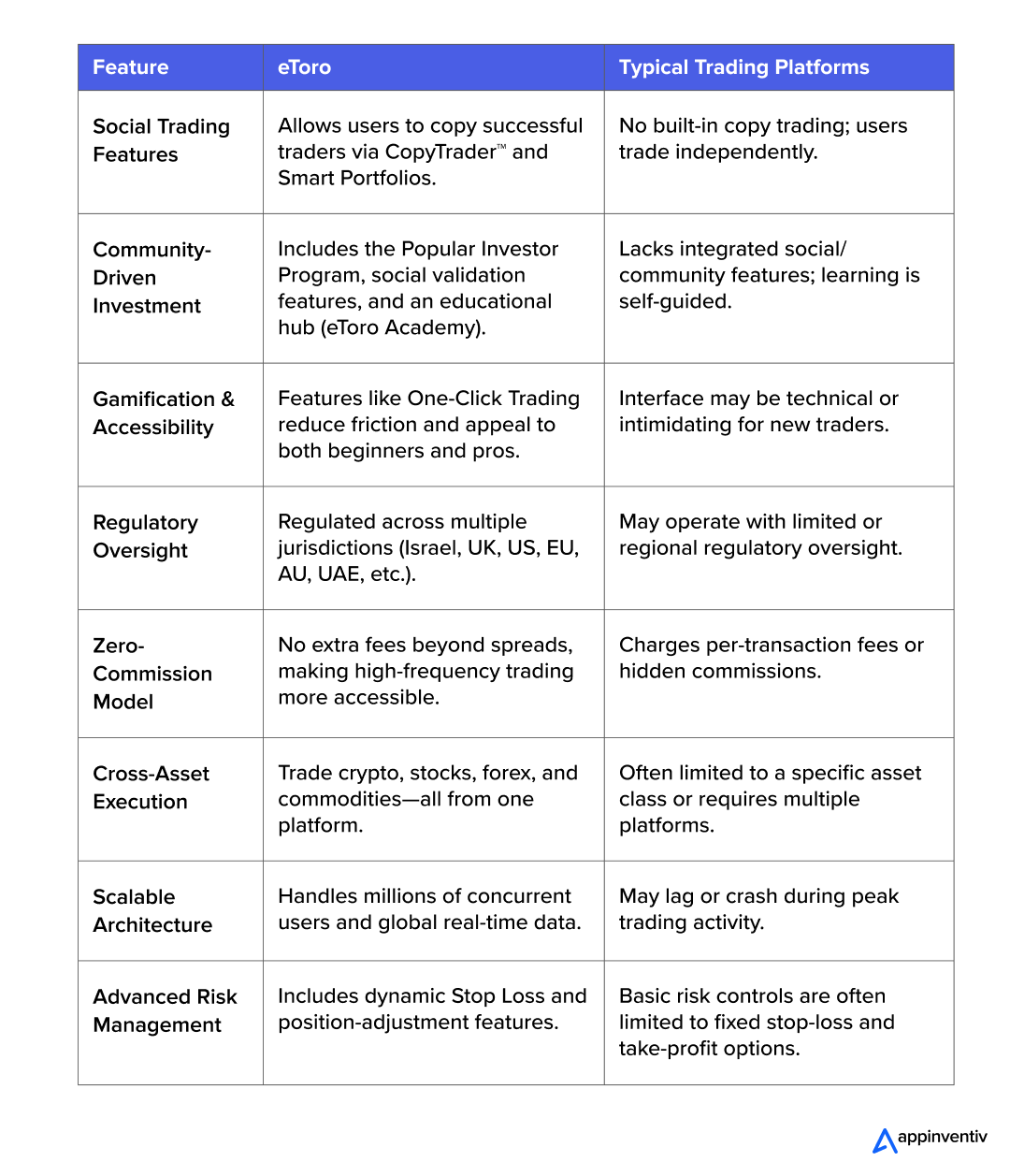

- Advanced Features of a Trading Platform Like eToro vs Basic Platforms

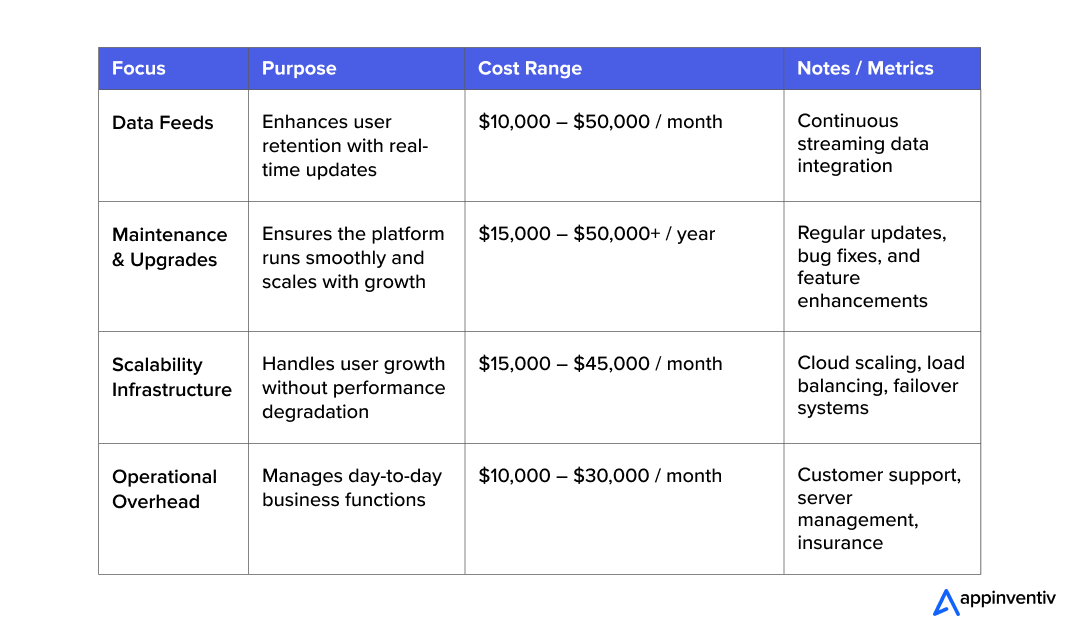

- Hidden App Development Costs: What Actually Kills Your Budget

- Making and Breaking Your Budget

- How Long Does It Take to Build an eToro-Like App?

- Monetization Strategies of Apps Like eToro: Revenue Models That Work

- Freemium Model with Premium Subscriptions

- Spread-Based Trading Fees

- In-App Advertising and Sponsored Content

- White-Label API Licensing

- Gamified Microtransactions

- Tips to Optimize Development Costs for eToro App Development

- Start with an MVP

- 2. Prioritize Core Features & Phase Development

- 4. Leverage Open-Source & Third-Party Tools

- 5. Adopt Agile Development Practices

- 6. Minimize Regulatory Overhead Early

- How Appinventiv Can Help You with eToro-like App Development

- FAQs

Key takeaways:

- Social Trading Surge: Platforms like eToro are reshaping investing with copy trading and community-led strategies.

- Cost & Timeline: Building a trading app ranges from $30K (MVP) to $400K+, taking 3–18 months based on complexity.

- Must-Have Features: Real-time market data, multi-asset support, analytics dashboards, and AI-powered tools are critical for competitive positioning.

- Budget Planning: Factor in ongoing costs like compliance, security, data feeds, and maintenance beyond initial development.

Financial trading markets changed drastically across fifteen years. Institutional-dominated spaces once required traditional brokerage access exclusively, but now individual investors trade directly from mobile phones in consumer-focused ecosystems. The 2008 financial crisis accelerated this shift considerably, as retail investors wanted more control over financial choices while tech companies spotted disruption opportunities among established firms.

eToro became a notable success within this environment. Founded in 2007, it separated itself through social trading capabilities that allow users to follow and copy experienced trader strategies seamlessly. Social networking combined with financial trading created an innovative approach, making them a market leader while inspiring entrepreneurs to build competing platforms.

Building a trading app like eToro presents significant technical and financial obstacles. Understanding these trading app development challenges proves essential before project initiation:

- Performance Requirements: Trading applications demand ultra-fast execution where microsecond delays affect trade outcomes

- Data Integration: Live market data integration requires robust APIs plus costly licensing agreements

- Security Measures: Sensitive financial data protection makes comprehensive security measures mandatory

- Regulatory Compliance: Financial regulation adherence creates additional technical complexity and resource demands

These obstacles directly influence development expenses. The estimated cost to build a trading app like eToro spans $30,000 to $400,000+. MVP versions might cost approximately $30,000, while enterprise-level applications could demand $400,000 or higher, depending on the chosen technology stack and functionality integration. The eToro trading app represents the social trading platform benchmark, establishing feature complexity and user experience standards that shape these cost factors.

Bonus Read: Stock Trading App Development Cost

Why Build An App Like eToro: Understanding User Trends & Market Demand

Market forces are converging to drive social trading platform expansion significantly. The timing for making an app like eToro couldn’t be better for capturing this exceptional market opportunity. Traditional financial market barriers continue dissolving as younger demographics seek accessible, community-focused investment experiences.

This opportunity gains strength from sustainable underlying trends. The demographic shift toward digital-native investors represents a permanent change in financial service consumption patterns, unlike temporary market cycles.

The social trading platform market demonstrates remarkable consistency in growth projections across multiple authoritative research frameworks, indicating robust underlying demand fundamentals. According to the latest Business Research Insights report, the market presents the following trajectory:

- Market Value 2024: $ 1.77 billion (baseline measurement)

- Forecast 2033: $ 2.69 billion (representing a near-doubling over nine years)

- Compound Annual Growth Rate: 4.8% (2024-2033)

The benefits of developing a trading app like eToro are clear from these market projections, offering entrepreneurs a lucrative opportunity in the rapidly expanding social trading ecosystem.

- Sustained Retail Trading Growth: Retail investors now drive 21% of daily trading volume on the Nasdaq, up from 10% in 2020, demonstrating the continued momentum in individual investor participation.

- Technology-Driven Adoption: AI-powered tools assist 36% of investors in making trading decisions using predictive analytics and real-time trends, while fractional share trading rose by 52% in 2025, allowing access to high-priced stocks like Amazon and Tesla for under $5

- Generational Shift in Investing: 30% of Gen Z start investing in early adulthood – compared to 9% of Gen X and 6% of Baby Boomers, with 86% of Gen Z having learned about personal investing by the time they enter the workforce, versus 47% of Boomers

Tap into the $2.69 Billion Social Trading Market by 2033 – Let’s Build the Future of Investment Platforms Together!

eToro App Development: Cost Estimates and Timeline Expectations

When planning your eToro like app development cost, you’re essentially choosing between three distinct investment levels, each delivering different market capabilities and user experiences.

Basic/MVP Level ($30,000 – $50,000 3-4 months) This entry-level approach focuses on core functionality to validate your concept quickly. You’ll get essential buy/sell order execution, basic portfolio tracking, and limited asset coverage, focusing primarily on stocks. The social features remain minimal, featuring simple user profiles and basic activity feeds. This tier works perfectly for testing market demand without major financial commitment.

| Tier | Features | Cost Range | Timeframe |

|---|---|---|---|

| Basic/MVP | – Buy/sell execution – Portfolio tracking – Limited asset coverage (stocks) – Simple user profiles | $30,000 – $50,000 | 3-4 months |

Moderate Complexity ($50,000 – $150,000, 6-9 months) This sweet spot offers serious competitive potential. You’ll unlock multi-asset trading across stocks, crypto, and forex, plus automated copy trading that makes your platform genuinely social. Advanced order types, mobile optimization, and basic analytics give users professional-grade tools. This level mirrors early eToro’s approach – substantial social trading capabilities without overwhelming complexity.

| Tier | Features | Cost Range | Timeframe |

|---|---|---|---|

| Moderate Complexity | – Multi-asset trading (stocks, crypto, forex) – Automated copy trading – Advanced order types – Mobile optimization – Basic analytics | $50,000 – $150,000 | 6-9 months |

Advanced/Enterprise ($200,000 – $500,000+, 9-14 months) This premium level provides market-leading capabilities. Real-time market feeds, AI-driven portfolio building, advanced copy trading systems, and enterprise security standards create platforms competing directly with the eToro trading app plus other industry frontrunners. You’re developing solutions comparable to current eToro or TD Ameritrade mobile experiences.

| Tier | Features | Cost Range | Timeframe |

|---|---|---|---|

| Advanced/Enterprise | – Real-time market data – AI-powered portfolios – Sophisticated copy trading – Enterprise-grade security | $200,000 – $500,000 | 9-14 months |

Factors Affecting eToro-Like Trading App Development Cost and Timeline

Building a social trading platform like eToro requires merging sophisticated financial technology with social networking capabilities. Your selected features of a trading platform like eToro will primarily dictate development timeline and budget parameters. eToro like app development cost spans $30,000 for basic viable products up to $400,000+ for comprehensive enterprise solutions. Early planning around these cost factors ensures realistic budgeting plus successful market positioning.

App Complexity and Features

The complexity and features of a social trading app play a crucial role in determining its development cost, typically accounting for 40-60% of the total budget. Feature scope represents one of the primary factors affecting eToro-like trading app development costs and delivery timelines. Understanding your cost to build a trading app like eToro requires evaluating this range, which spans from basic trading tools to advanced AI-driven ecosystems with comprehensive social features.

Impact on Total Cost: 40-60% of Development Budget

Basic Features Tier ($8,000 – $40,000)

This tier focuses on essential trading functionality, suitable for a minimal viable product (MVP) with limited scope.

- Simple buy/sell order execution

- Basic portfolio view and balance tracking

- Limited asset coverage (stocks and ETFs only)

- Simple user profiles and basic social feed

- Elementary copy trading (manual following)

- Development Time: 2-4 months

Intermediate Features Tier ($40,000 – $120,000)

This tier enhances the platform with robust social trading and multi-asset capabilities, appealing to a broader user base.

- Multi-asset trading (stocks, crypto, forex, commodities)

- Advanced order types (limit, stop-loss, trailing stops)

- Automated copy trading with proportional scaling

- Social networking features (feeds, comments, sharing)

- Basic analytics and performance tracking

- Simple risk management tools

- Mobile-optimized responsive design

- Development Time: 4-8 months

Advanced Features Tier ($120,000 – $250,000+)

This tier delivers a comprehensive social trading ecosystem with professional-grade tools and AI-driven features.

- Real-time market data and advanced charting

- AI-powered smart portfolios and robo-advisory

- Sophisticated copy trading algorithms

- Advanced social features (live streaming, video content)

- Professional-grade analytics and reporting

- Multi-currency support and international markets

- Advanced risk management and compliance tools

- Educational content management system

- API ecosystem for third-party integrations

- Development Time: 8-15 months

Platform Choice (iOS, Android, Web)

Platform selection significantly impacts both your initial budget and long-term success. When evaluating online trading app development cost, consider how your platform choice affects user reach, ongoing maintenance requirements, and overall user experience. These factors collectively influence the total cost to build a trading app like eToro throughout the entire development lifecycle.

Impact on Total Cost: 15-25% of Development Budget

Single Platform Development

| Platform | Estimated Cost Range | Key Advantages | Key Disadvantages |

|---|---|---|---|

| iOS Only | $15,000 – $80,000 | Faster time to market, higher-value, more engaged demographic, streamlined testing and maintenance | Limited market reach (only iOS users), which restricts global growth potential |

| Android Only | $12,000 – $70,000 | Larger global user base; cost-effective market entry in Android-dominant regions | Device fragmentation requires extensive testing; lower ARPU than iOS; challenges with monetization |

| Web Only | $10,000 – $60,000 | Universal accessibility across devices, easier maintenance and updates, SEO advantages | Lack of mobile-specific features (push notifications, offline access); less engaging user experience |

Cross-Platform Solution

| Platform | Estimated Cost Range | Key Advantages | Key Disadvantages |

|---|---|---|---|

| React Native/Flutter | $25,000 – $120,000 | 60-70% code sharing; faster development; single team managing both platforms | Performance limitations for complex features; user experience may not be as seamless as native |

| Native iOS + Android | $35,000 – $180,000 | Best performance, platform-specific features, optimized user experience | Expensive; requires separate teams for each platform; higher long-term costs |

| Progressive Web App (PWA) | $20,000 – $90,000 | Single codebase; cost-effective for MVPs; rapid prototyping | Limited access to device-specific features; inferior user experience compared to native apps |

UI/UX Design Sophistication

When it comes to the user interface (UI) and user experience (UX) design for a trading platform, the sophistication of the design can significantly impact both the development budget and the overall user engagement. A well-designed UI/UX not only enhances user satisfaction but also plays a crucial role in customer retention and engagement. Here’s an in-depth look at the different design tiers and how they affect eToro like app development cost and timelines.

Impact on Total Cost: 10-20% of Development Budget

The Basic Design Tier ($3000 – $10,000)

It offers a straightforward, cost-effective solution ideal for businesses looking to minimize upfront costs. It uses standard UI elements and templates, with minimal customization and a basic color scheme. The design prioritizes functionality over aesthetics, with simple navigation and limited user research.

Professional Design Tier ($15,000 – $30,000)

This tier offers a unique visual identity, including original iconography and illustrations, advanced micro-interactions, and animations to enhance user engagement. It includes comprehensive user journey mapping to align the design with user needs and expectations, as well as a responsive design for seamless use across various devices. Basic user testing and iteration refine the design based on feedback, further adding to the total online trading app development cost.

Backend Architecture

When building the backend infrastructure for a trading platform, it’s crucial to understand how the complexity and scalability of your architecture impact the overall online trading app development cost, particularly the cost to build a trading app like eToro. The backend not only supports the trading engine but also manages user data, processes transactions in real-time, and ensures security and scalability.

Impact on Total Cost: 20-35% of Development Budget

Basic Backend Architecture ($8,000 – $30,000)

The basic backend architecture is designed for platforms needing essential functionality with limited scalability, focusing on cloud-based solutions with core features but fewer advanced functionalities.

Key Features:

- Basic user authentication and management.

- Simple database structure (PostgreSQL/MySQL).

- Basic REST API for frontend-backend communication.

- Real-time data handling with limitations.

- Standard cloud hosting (AWS/Azure basic tier).

- Limited scalability, which can hinder growth during periods of high traffic.

Infrastructure Features:

- Supports 1,000-5,000 concurrent users.

- Basic data backup and recovery.

- Standard SSL encryption for secure data transmission.

- Simple monitoring and logging.

Scalable Backend Architecture ($30,000 – $80,000)

For platforms with larger user bases, a scalable backend is crucial. This setup includes advanced features for real-time data processing and optimized performance for trading activities, further affecting eToro like app development cost.

Key Features:

- Advanced user management and authentication for secure access.

- Microservices architecture for flexibility and fault tolerance.

- Real-time trading data processing to handle high transaction volumes.

- Advanced caching and performance optimization for improved responsiveness.

- Load balancing and auto-scaling to manage traffic spikes.

- Comprehensive API gateway for managing traffic and integrations.

- Advanced monitoring and analytics for efficient troubleshooting.

Infrastructure Features:

- Supports 10,000-50,000 concurrent users.

- Automated backup and disaster recovery for reliability.

- Advanced security protocols (multi-factor authentication, data encryption).

- Performance monitoring and alerting for proactive management.

Enterprise Backend Architecture ($80,000 – $200,000+)

For high-performance platforms requiring top-tier infrastructure to handle massive user bases and low-latency trading, enterprise-level software architecture is essential. This tier ensures real-time transaction management with high availability and security.

Key Features:

- High-frequency trading capabilities for fast, real-time transactions.

- Advanced microservices with a service mesh for secure, efficient communication.

- Real-time market data streaming for up-to-the-second updates.

- Advanced caching strategies (e.g., Redis clusters) for quick data access.

- Multi-region deployment and CDNs for fast global access.

- Advanced DevOps and CI/CD pipelines for continuous integration.

- Comprehensive monitoring and observability for uptime and performance.

Infrastructure Features:

- Supports 100,000+ concurrent users.

- Sub-millisecond latency for high-performance standards.

- 99.99% uptime guarantees with minimal downtime.

- Advanced security and compliance to meet global regulatory standards.

- Global data distribution for widespread availability.

Security and Compliance Requirements

When it comes to building a trading platform, security and compliance are not just optional, they’re fundamental. Implementing comprehensive trading app security features is essential for user trust and regulatory compliance, further adding to the overall eToro-like app development cost. From safeguarding user data to adhering to regulatory standards, security requirements can significantly influence both the development budget and the long-term operational costs.

Impact on Total Cost: 10-25% of Development Budget

| Security Tier | Key Features | Compliance Level | Cost Range |

|---|---|---|---|

| Basic Security Implementation | – Basic authentication (email/password) – SSL/TLS encryption – Simple data validation – Basic fraud detection – Standard backups | Basic data protection | $4,000 – $15,000 |

| Enhanced Security Framework | – Multi-factor authentication (MFA) – AES-256 encryption – PCI DSS prep – Basic KYC/AML – Advanced fraud detection | Regional financial regulations | $15,000 – $50,000 |

| Enterprise Security Suite | – Biometric authentication – End-to-end encryption – Advanced threat detection – KYC/AML automation – SOC 2 & GDPR compliance | Multi-jurisdictional compliance | $50,000 – $120,000+ |

Third Party Integrations

When it comes to building a top-tier trading app like eToro, third-party integrations are far more than just add-ons, they’re the backbone of a competitive, scalable, and secure platform. These integrations allow your platform to leverage the expertise of trusted service providers to deliver real-time data, secure transactions, high-quality compliance, and feature-rich user experiences. However, while they can significantly speed up development, they also bring with them a complex array of costs that need to be meticulously planned.

Essential Features of a Trading Platform Like eToro: Complete Cost Analysis

Building a successful social trading platform like eToro and estimating eToro like app development cost requires integrating sophisticated financial technology with social networking capabilities. This analysis examines essential features and their development costs, targeting a total budget range of $30,000 to $400,000, depending on complexity and market requirements.

Core Trading Infrastructure

| Component | Details |

|---|---|

| Multi-Asset Trading Engine | Essential trading functionality supporting multiple assets (stocks, crypto, forex, ETFs, CFDs). |

| Real-Time Order Execution | Sub-second latency with order routing and portfolio management. |

| Cost Breakdown | – Basic: $8,000 – $15,000 (limited assets, basic execution) – Standard: $25,000 – $50,000 (advanced orders) – Enterprise: $80,000 – $120,000 (institutional-grade execution) |

Social Trading & Copy Trading Features

| Component | Details |

|---|---|

| CopyTrader System | Automated trade copying with proportional scaling, risk management, and performance tracking. |

| Cost Breakdown | Basic: $12,000 – $25,000 (simple copying); Advanced: $40,000 – $80,000 (sophisticated algorithms); Enterprise: $100,000 – $150,000 (advanced analytics) |

| Social Networking Features | Community tools including user profiles, feeds, discussion forums, and content sharing. |

Smart Portfolios & Automated Investing

| Component | Details |

|---|---|

| AI-Powered Portfolio Construction | Machine learning-based portfolio optimization, dynamic rebalancing, and risk management. |

| Cost Breakdown | Basic: $5,000 – $12,000 (simple rebalancing); AI-Enhanced: $20,000 – $40,000 (machine learning); Advanced Robo-Advisory: $40,000 – $60,000 (personalized recommendations) |

Mobile-First User Experience

| Component | Details |

|---|---|

| Cross-Platform Mobile App | Native iOS and Android apps with a responsive web interface. |

| Cost Breakdown | Basic: $6,000 – $15,000 (single platform); Cross-Platform: $15,000 – $25,000 (iOS + Android + Web); Premium: $25,000 – $40,000 (advanced features) |

Security & Compliance Infrastructure

| Component | Details |

|---|---|

| Multi-Layer Security | Includes encryption, authentication, and regulatory compliance systems. |

| Cost Breakdown | Basic: $4,000 – $10,000 (standard encryption); Enhanced: $15,000 – $30,000 (KYC/AML automation); Enterprise: $30,000 – $50,000 (advanced fraud detection) |

Educational & Onboarding System

| Component | Details |

|---|---|

| Learning Management System | Interactive tutorials, demo trading, educational content, and progress tracking. |

| Cost Breakdown | Basic: $3,000 – $8,000 (simple tutorials); Interactive: $8,000 – $15,000 (gamification); Comprehensive: $15,000 – $25,000 (advanced simulations) |

Analytics & Reporting Tools

| Component | Details |

|---|---|

| Performance Analytics Engine | Metrics for performance, risk-adjusted returns, and portfolio analysis. |

| Cost Breakdown | – Basic: $4,000 – $10,000 (simple performance tracking) – Advanced: $10,000 – $20,000 (benchmarking) – Professional: $20,000 – $30,000 (institutional reporting) |

Integration & API Development

| Component | Details |

|---|---|

| Third-Party Integrations | Payment processing, market data feeds, and API framework. |

| Cost Breakdown | – Basic: $3,000 – $8,000 (simple integrations) – Comprehensive: $8,000 – $20,000 (multiple banks) – Enterprise: $20,000 – $35,000 (full ecosystem) |

Advanced Features of a Trading Platform Like eToro vs Basic Platforms

The eToro trading app stands out from basic trading platforms with its unique social trading features, allowing users to copy the trades of successful investors in real-time. Its intuitive interface, combined with tools like CopyTrader and Smart Portfolios, makes it accessible for beginners while offering advanced features like leverage and CFD trading for experienced users.

Your traders expect speed, insight, and community. Why settle for less? Bring together multi-asset trading, AI portfolio magic, and social copy trading, all in one platform

Hidden App Development Costs: What Actually Kills Your Budget

Let’s get straight to the point – building a trading app isn’t just about the upfront development price tag. Sure, you’ll see quotes ranging from $30,000 to $400,000, but here’s what nobody talks about until it’s too late: those numbers barely scratch the surface.

Making and Breaking Your Budget

Building a trading app is one of the most exciting ventures you can undertake right now. But here’s the thing: success in this space requires understanding the full investment picture, not just the surface costs.

Think of this like building a Formula 1 race car. Sure, you could build a basic car, but to win races, every component needs to be precision-engineered. That’s exactly what separates successful trading platforms from the rest.

- Real-time data feeds are your competitive edge. Yes, they cost $10,000-$50,000 monthly, but this is where the magic happens. Instant market updates aren’t just a feature – they’re what keep your users profitable and loyal. When your users make money because of split-second timing, that monthly investment pays for itself through user retention and growth.

- Maintenance and Upgrades. Maintenance and continuous upgrades are often overlooked when building a trading app, but they can quickly add up and eat into your budget. This is the cost of staying relevant in a fast-changing market. Every bug fix, feature update, and platform enhancement requires development time and resources.

- Scalability infrastructure future-proofs your success. When you invest $15,000-$45,000 monthly in cloud scaling and load balancing, you’re not just handling growth – you’re creating a platform that thrives under pressure. In an industry where one crash during market volatility can lose thousands of users overnight, this investment protects your entire user base.

- Operational Overhead. Operational overhead refers to the day-to-day costs of running your platform, many of which are hidden until you’re scaling your business. Customer support costs, server management, and even insurance are often neglected in initial budgeting. These costs are ongoing and essential to keep your platform running smoothly and securely, ensuring that your users have an uninterrupted experience.

How Long Does It Take to Build an eToro-Like App?

Social trading platform development like eToro demands thorough planning plus realistic timeline expectations. Early identification of key trading app development challenges during planning phases prevents expensive delays while ensuring smoother development cycles.

Industry experience suggests 10-15 months of development time, varying with feature requirements and team capabilities. Understanding each development phase enables effective resource planning and appropriate stakeholder expectation management.

The initial planning phase typically consumes your first month. This involves comprehensive market research, competitor analysis, and regulatory consultation; activities that are often underestimated but prove critical for avoiding costly pivots later. Technical architecture decisions emerge during this period, where you’ll define your database structure, API frameworks, and scalability approach.

Once you begin the journey to create a trading app like eToro, the MVP phase presents both opportunities and challenges:

- User authentication and security foundation: 2-3 weeks

- Core trading engine development: 6-8 weeks of intensive backend work

- Social networking features with modern UI expectations: 4-6 weeks

- Security protocols and compliance framework: 3-4 weeks

- Comprehensive testing and bug resolution: 3-4 weeks

Monetization Strategies of Apps Like eToro: Revenue Models That Work

The foundation of your revenue model starts with understanding user psychology. Successful monetization strategies of apps like eToro combine multiple revenue streams – active traders generate revenue through spreads and commissions, while passive investors prefer subscription models for premium features. Social elements create entirely new monetization avenues through content and community-driven services. Your platform becomes more valuable as network effects strengthen, allowing you to capture value from both individual trading activity and social interactions.

Freemium Model with Premium Subscriptions

A freemium model offers basic features for free to attract users while reserving advanced tools for paying subscribers. This approach strikes a balance between accessibility and revenue generation, encouraging users to upgrade for enhanced functionality.

- Free Tier: Basic trading (stocks, ETFs), limited copy trading, and simple portfolio tracking.

- Premium Tier ($5-$20/month): Access to multi-asset trading (crypto, forex), advanced order types, automated copy trading, and premium analytics dashboards.

- Elite Tier ($20-$50/month): AI-powered robo-advisory, real-time market data, exclusive social features (e.g., live streams with top traders), and priority support.

- Value-Add: Offer annual subscriptions with discounts (e.g., 15% off) to boost long-term retention.

Spread-Based Trading Fees

Charging a small spread (the difference between buy and sell prices) on trades is a standard revenue model for trading apps. This method is transparent and scales with user activity.

- Dynamic Spreads: 0.1%-0.5% per trade, adjusted based on asset volatility (e.g., lower for stocks, higher for crypto).

- Zero-Commission Trades: Offer commission-free trading for select assets (e.g., ETFs) to attract new users, offsetting costs with spreads.

- Volume Discounts: Reduce spreads for high-volume traders (e.g., >$50,000/month) to incentivize active trading.

In-App Advertising and Sponsored Content

Targeted advertising and sponsored content can generate revenue without compromising the user experience, especially for users on the free tier. Financial brands and educational platforms are ideal partners.

- Sponsored Social Feeds: Promote brokerages or trading tools in the app’s social feed, labeled clearly as ads.

- Educational Content: Partner with financial education providers to offer sponsored courses or webinars (e.g., “Learn Forex with [Partner]”).

- Non-Intrusive Ads: Display banner ads for free users in non-critical areas (e.g., portfolio summary), removable via subscription.

White-Label API Licensing

Trading and social infrastructure licensing to fintech startups or brokers generates B2B revenue streams. This approach monetizes platform technical expertise while protecting the core user base.

- API Offerings: License real-time market feeds, copy trading algorithms, or social networking components to third parties.

- Pricing Model: Usage-based charges ($0.01 per API call) or fixed monthly rates ($5,000-$20,000), depending on client needs.

- Target Clients: Smaller brokers, robo-advisors, or crypto exchanges wanting social trading capabilities integrated quickly.

Gamified Microtransactions

Gamifying the app with microtransactions taps into user engagement, offering cosmetic or functional enhancements for small fees. This strategy appeals to younger, socially active traders.

- Profile Customizations: Sell badges, themes, or profile flair (e.g., “Top Trader” badge for $1.99).

- Boosted Visibility: Charge $0.99-$4.99 for temporary profile boosts in social feeds or copy trading leaderboards.

- Virtual Rewards: Offer in-app currency (e.g., “TradeCoins”) earned via activity or purchased, redeemable for premium features.

Successful apps don’t just trade, they monetize every interaction. From freemium tiers to gamified add-ons, we’ll help you build revenue streams that grow with your community

Tips to Optimize Development Costs for eToro App Development

Start with an MVP

When you create a trading app like eToro, launching with a Minimum Viable Product validates your concept quickly and affordably. This strategy works exceptionally well for eToro clone app development since it enables social trading feature testing before advanced functionality commitments. Core features should include buy/sell trading, portfolio tracking, basic copy trading, and minimal social feeds. Real user feedback collection happens without premature advanced feature investments.

- Core Features: Buy/sell execution, basic portfolio tracking, manual copy trading, simple social feed.

- Cost Range: $8,000 – $40,000

- Timeline: 2-4 months

- Validation Strategy: Launch to a small group (1,000 beta testers) for feedback to prioritize features.

2. Prioritize Core Features & Phase Development

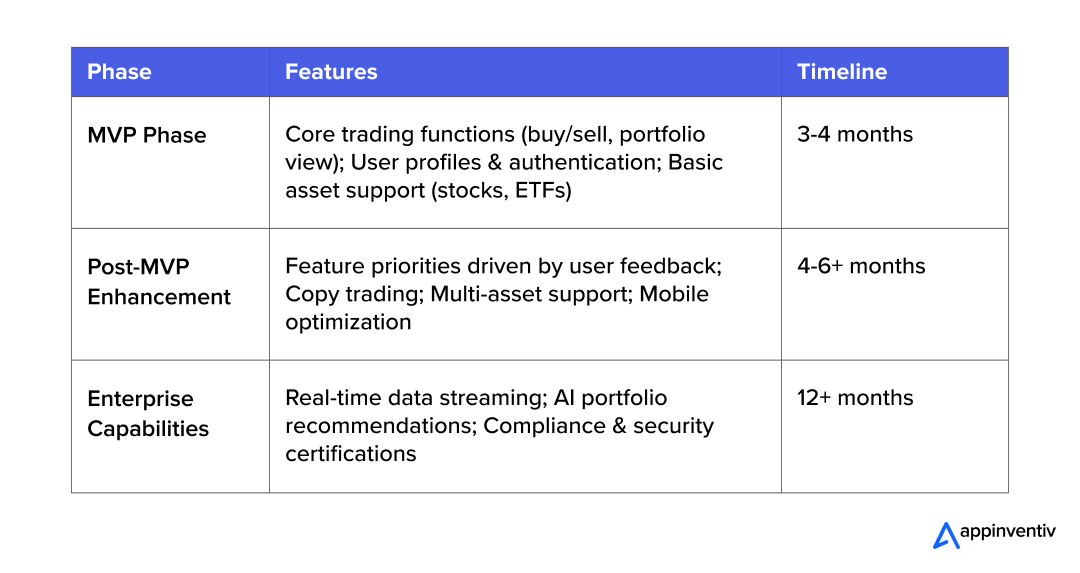

When you create a trading app like eToro, focus on delivering high-impact features first to ensure you provide value early, while deferring complex additions to later development phases. This phased approach helps spread out development costs and aligns with funding milestones.

Learning how to create a trading app like eToro involves these critical phases:

- Phase 1 (MVP): Basic trading, copy trading, and social feed.

- Phase 2 (Intermediate): Add multi-asset trading, advanced order types, and basic analytics (4-8 months after MVP).

- Phase 3 (Advanced): AI-powered tools, real-time data, and API integrations (8+ months).

Roadmap Alignment: Use user feedback to guide each phase, ensuring features are based on real user demand rather than speculative additions.

4. Leverage Open-Source & Third-Party Tools

When selecting your tech stack for trading apps like eToro, utilizing open-source frameworks and third-party APIs can save both development time and licensing costs. For example, using APIs for market data or KYC compliance saves a significant amount of effort compared to building these components from scratch.

- Open-Source Frameworks: React Native (for cross-platform mobile), Node.js (backend), PostgreSQL (database).

- Third-Party APIs: Alpha Vantage or Yahoo Finance (market data), Plaid (bank integrations), Onfido (KYC/AML).

- Cost Savings: APIs can cost as little as $0 to $500 per month, while building a custom solution could exceed $50,000.

Caution: Ensure the APIs are reliable and compliant with financial regulations before integrating them.

5. Adopt Agile Development Practices

Agile methodologies, such as Scrum, allow for iterative progress and flexibility. You can adjust your scope based on user feedback and budget constraints, thereby preventing costly rework and ensuring that development aligns with your goals.

- Sprint Planning: Break work into 2-week sprints with clear deliverables (e.g., trading UI, backend APIs).

- Regular Reviews: Conduct sprint demos to catch issues early and reprioritize features as needed.

- Automation: Use CI/CD pipelines (e.g., GitHub Actions) for automated testing and deployment, saving QA time.

6. Minimize Regulatory Overhead Early

Financial regulation compliance proves costly and time-intensive. MVP phases benefit from simplified compliance through single-market targeting or limited asset type support. This strategy postpones complex compliance expenses while enabling product validation.

- Single-Market Launch: Begin with less regulated markets (crypto-only) to postpone compliance investments.

- Modular Compliance: Develop scalable KYC/AML systems that expand alongside platform growth.

- Legal Consultation: Engage fintech lawyers for 10-20 hours mapping regulatory requirements upfront ($3,000-$6,000).

- Avoid Overcompliance: Postpone multi-currency support or international market features until post-MVP validation.

Additional Cost-Saving Tips

- Cloud Infrastructure: Use scalable cloud providers like AWS or Google Cloud with pay-as-you-go pricing to avoid high upfront server costs.

- User Feedback Loops: Integrate analytics early (e.g., Mixpanel) to track feature usage and prioritize high-value additions.

- Cross-Platform Development: Use React Native or Flutter to build both iOS and Android apps simultaneously, saving 30-40% on mobile development.

- Negotiate Rates: Secure fixed-price contracts for predictable tasks (e.g., UI design) to cap costs.

How Appinventiv Can Help You with eToro-like App Development

While many firms can talk about trading app development, we deliver it. For a prominent European crypto brokerage, Appinventiv architected a multi-asset cryptocurrency trading platform supporting both retail traders and institutional crypto investors. By building a scalable microservices backend architecture, we achieved sub-100ms latency for crypto trade execution, ensuring instant order processing during peak market volatility. The crypto trading platform onboarded 500,000+ users within its first year and processes millions in daily cryptocurrency transaction volume.

Why Appinventiv Delivers Results:

- Proven Track Record: Portfolio companies raised $950 million in funding

- ISO 9001:2008 Certified: Maintaining the highest quality management standards

- Scale Expertise: Successfully built FinTech platforms supporting 10M+ users

- Technical Excellence: 900+ tech experts trusted by global brands

Appinventiv’s fintech app development services transform complex social trading requirements into market-ready solutions. Our proven methodology focuses on rapid MVP deployment followed by strategic feature enhancement, crucial when you decide to make an app like eToro that competes in today’s demanding social trading market.

Core Strategic Advantages:

- Complete development ecosystem covering backend infrastructure, mobile applications, and web platforms

- Deep regulatory compliance expertise spanning US, European, and emerging market requirements

- Advanced AI/ML implementation for sophisticated copy trading algorithms

- High-performance real-time architecture with demonstrated sub-100ms execution speeds

This approach significantly reduces time-to-market while ensuring your platform scales to support millions of concurrent users.

Ready to build your eToro-like trading platform? Contact Appinventiv today for a detailed project consultation and cost analysis.

FAQs

Q. How much does it cost to build a trading app like eToro?

A. Building a trading app like eToro requires a substantial investment ranging from $30,000 to $400,000, depending on complexity and features. A basic MVP with core trading functionality starts at $30,000, while a comprehensive platform with social trading, multi-asset support, real-time data, and enterprise-grade security reaches $400,000. Don’t forget ongoing costs, such as data feeds and compliance, which can significantly impact your budget over time.

Q. What enterprise tech stack is ideal for a scalable trading app like etoro?

A. Scalable trading applications like eToro need robust enterprise technology stacks designed for high-frequency transactions. Backend systems should employ a microservices architecture with Node.js or Java, plus Redis for caching and PostgreSQL for data management. Real-time processing requires Apache Kafka for streaming, while AWS or Azure delivers cloud infrastructure. Security implementations include OAuth 2.0, AES-256 encryption, and comprehensive API gateways managing millions of concurrent users effectively.

Q. What are the essential features of a trading platform like etoro that drive user engagement?

A. Trading platforms like eToro require several essential features, including social trading capabilities, copy trading functionality, multi-asset support, real-time market data, advanced analytics, and community-driven investment tools that separate them from traditional trading platforms. These capabilities allow users to connect with broader networks, learn from successful traders, and make informed decisions effectively. AI integration plus advanced risk management tools enhance user experience and platform reliability significantly.

Q. What tech stack for trading apps like eToro ensures optimal performance?

A. Trading apps like eToro require robust technology stacks for optimal performance. Frontend development should utilize React or Angular for responsive and dynamic user interfaces. Backend systems need Node.js or Python ensuring scalability plus high transaction processing performance. Efficient data management works best with PostgreSQL or MongoDB databases. Real-time data processing gets achieved through WebSocket connections for low-latency updates. Security remains crucial, requiring SSL/TLS encryption and multi-factor authentication for comprehensive user data protection.

Q. How long does it take to develop an app like etoro?

A. Developing an app like eToro typically takes 12-15 months, depending on complexity and team size. A basic MVP with core trading features can launch in 3-4 months, while a feature-complete platform with social trading, multi-asset support, and enterprise security requires 12-16 months. Most successful platforms launch their MVP early and continuously iterate based on user feedback.

Q. How trading apps like etoro make money?

A. Trading applications like eToro generate revenue through multiple channels. Primary income derives from spreads (0.5-3% per trade) and trading commissions. Subscription models provide premium features for $10 to $100 monthly. Social trading creates unique opportunities via performance fees (10% to 20% of follower profits) plus creator revenue sharing. Additional income includes overnight fees, withdrawal charges, premium educational content, and financial service partnerships, establishing diversified revenue scaling with user activity.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…