- Types of Investment Apps Businesses Can Develop

- Education-Centered Investment Apps

- Apps for Conducting Trades

- Apps for Brokers

- Banking Apps

- Tax Optimization Apps

- Retirement Planning Apps

- Socially Responsible Investing (SRI) Apps

- Automated Financial Advisor Apps

- Commodity Trading Apps

- What Are the Benefits of Building an Investment Platform for Businesses?

- Wider Market Reach

- Enhanced User Experience

- Increased Revenue Opportunities

- Real-Time Data Access

- Customization and Personalization

- Operational Efficiency

- Improved Security

- How to Create an Investment App?

- 2. Establish Business Model

- 3. Abide by the Laws and the Regulations

- 4. Understand Compliance Requirements

- 5. Find the Appropriate Development Team

- 6. Develop the Main App

- 7. Test and Improve

- 8. Upkeep and Support your App

- Examples of Successful Investment Apps

- Must-Have Features of Investment Apps

- 1. Onboarding and Registration

- 2. Personal Profiles

- 3. Tools for Managing Money

- 4. Money Withdrawal Capabilities

- 5. Safety and Security

- 6. Push Notifications

- 7. Electronic Wallet

- How Much Does it Cost to Develop an Investment App?

- Complexity and Type of Features

- App Platform

- Custom Design and User Experience

- Backend Infrastructure and App Administration

- Security Measures

- Maintenance and Updates

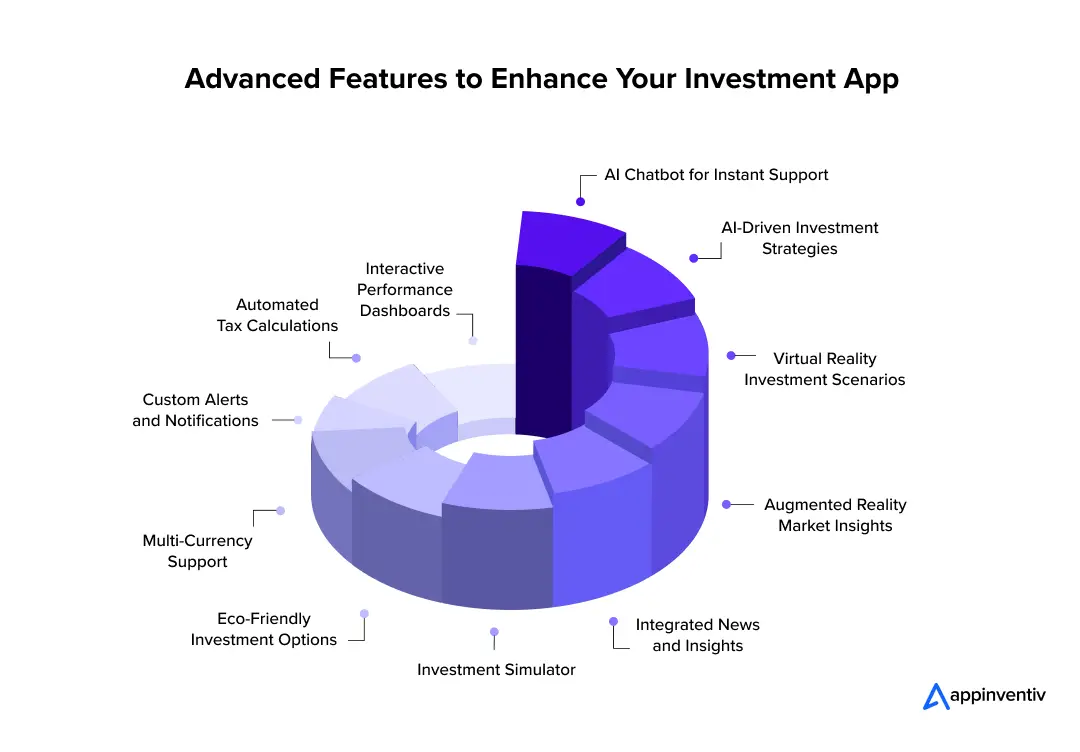

- What features should your investment app have?

- Interactive Performance Dashboards

- Automated Tax Calculations

- Custom Alerts and Notifications

- Multi-Currency Support

- Eco-Friendly Investment Options

- Investment Simulator

- Integrated News and Insights

- Augmented Reality Market Insights

- Virtual Reality Investment Scenarios

- AI-Driven Investment Strategies

- AI Chatbot for Instant Support

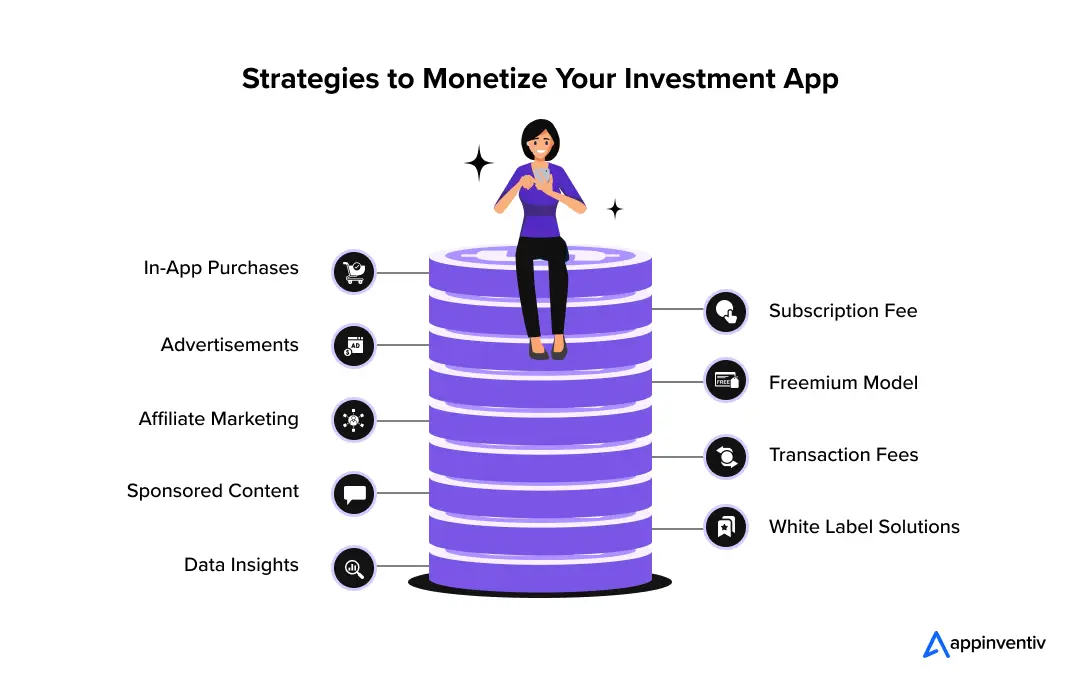

- How to Monetize the Investment App?

- App Purchases

- Subscription Fee

- Advertisements

- Freemium Model

- Affiliate Marketing

- Transaction Fees

- Sponsored Content

- White Label Solutions

- Data Insights

- Why Appinventiv is the Right Partner for Building a Robust Investment App

- FAQs

Gone are the days when investing was confined to the elite few, with barriers like high entry costs and complex brokerage systems. A recent survey highlights that nearly 63% of smartphone users have at least one financial application installed, demonstrating the shift towards mobile-based investment solutions.

This transformation has been largely driven by the advent of investment apps, which offer easy access to financial markets, making it feasible for everyone, from millennials to retirees, to engage in trading and investing at their fingertips.

Investment apps have simplified the process and introduced a level of convenience and efficiency that was not possible before. With features that allow users to buy, sell, and monitor stocks in real-time, these apps cater to the growing demand for quick and easy financial management tools.

This shift towards digital investment solutions significantly changes how individuals interact with financial markets, emphasizing user-friendly design and accessibility.

According to a report from Statista, the Digital Investment market is set to experience significant growth in the coming years. By 2025, the total transaction value is projected to reach $3.10 trillion. The market is expected to grow at a CAGR of 2.80% from 2025 to 2029, reaching a valuation of $3.46 trillion by the end of 2029.

Thus, building an investment platform now could position businesses at the forefront of this lucrative industry, enhancing brand visibility and engagement.

With that settled, let’s guide you through how to build an investment platform tailored to today’s dynamic market. From initial planning and understanding regulatory requirements to choosing the right development team and effective monetization strategies, we will cover essential aspects to help you enter and succeed in the investment app ecosystem.

Let us build a standout investment app that empowers users and delivers real returns.

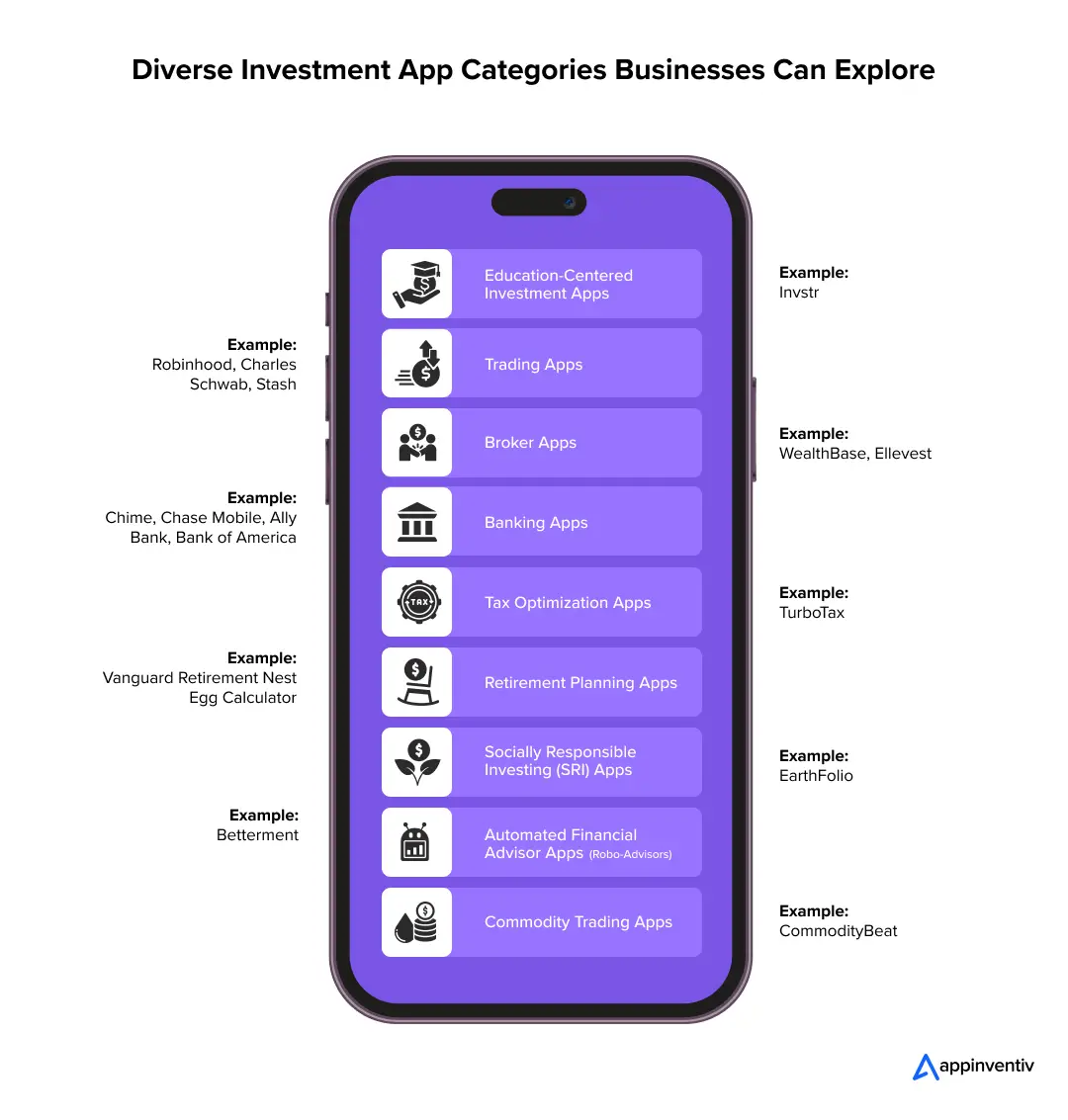

Types of Investment Apps Businesses Can Develop

Before you understand how to build an investment platform, you must prepare yourself for the type of app you wish to create. Based on your finalization of the kind of application, you will be required to develop the features and decide on the team size, structure, and technology to be used. Listed below are some of the commonly used investment apps.

Education-Centered Investment Apps

Beginners can acquire the fundamentals of financial literacy with the aid of this investment app category.

Example: Invstr

Apps for Conducting Trades

This type of investment app permits stock trading and can make investments on your behalf.

Example: Robinhood, Charles Schwab, Stash

Apps for Brokers

These apps cater to customers who already understand what they want to buy. Typically, you can trade both fiat money and cryptocurrency here.

Example: WealthBase, Ellevest

Banking Apps

These numerous online banking services and apps let users manage their accounts and carry out transactions, deposits, investments, loans, and more. Such apps normally belong to licensed financial institutions.

Example: Chime, Chase Mobile, Ally Bank, Bank of America

Tax Optimization Apps

These apps help users manage and optimize their investments for tax purposes. They can provide insights into tax-efficient investing strategies and help users understand the impact of taxes on their returns.

Example: TurboTax

Retirement Planning Apps

These apps focus on long-term investment strategies designed to aid retirement planning. They often include tools for forecasting pension benefits, managing retirement accounts, and simulating future savings.

Example: Vanguard Retirement Nest Egg Calculator

Socially Responsible Investing (SRI) Apps

Catering to investors who want to ensure their investments align with their ethical values, these apps focus on funds and stocks that meet specific ethical standards, such as environmental responsibility.

Example: EarthFolio

Automated Financial Advisor Apps

Also known as robo-advisors, but with a broader scope, these apps provide personalized financial advice based on algorithms and machine learning.

Example: Betterment

Commodity Trading Apps

These specialized apps allow trading commodities like gold, oil, or agricultural products. They provide market data, trends, and tools for successful commodity investments.

Example: CommodityBeat

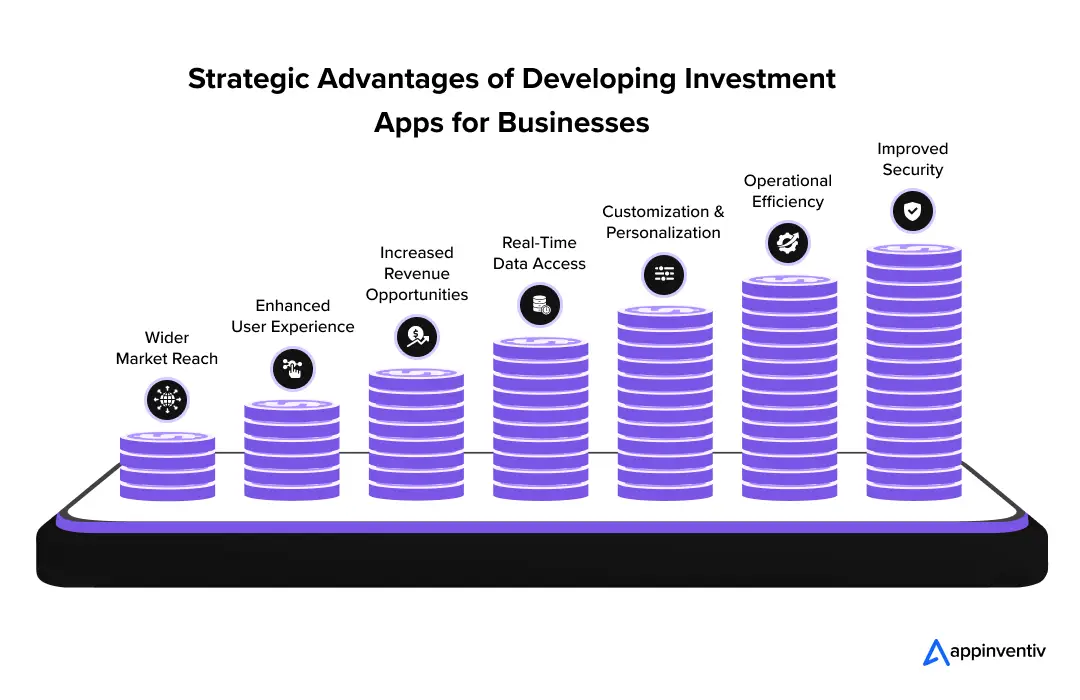

What Are the Benefits of Building an Investment Platform for Businesses?

An investment app provides you with real-time information about publicly traded companies. This mobile application lets you stay updated on the stock market and other financial sector investments. Having a hawk’s eye on the investment market helps you capitalize on the readily available information at your fingertips at nominal application fees. Here are a few reasons you should consider building an investment app.

Also Read: Capital Structuring and Tech Investments- What Enterprises Must Consider in 2026

Wider Market Reach

Investment apps break down geographical barriers, allowing businesses to reach a broader audience. Users from various regions can access the services, expanding the customer base significantly.

Enhanced User Experience

Investment apps provide a seamless and intuitive user experience, making financial management more accessible. This user-friendliness increases customer satisfaction and retention.

Increased Revenue Opportunities

With features like in-app purchases and subscription models, investment apps offer businesses various revenue sources. This can include fees for premium services or commissions from trades.

Real-Time Data Access

One of the major benefits of building an investment platform is that it will give the users real-time access to market data and trends. This immediacy allows businesses to offer timely advice and helps users make informed decisions quickly.

Customization and Personalization

Apps can be tailored to meet the specific needs of individual users, providing personalized investment advice based on their financial goals and risk tolerance. This customization enhances user engagement and loyalty.

Operational Efficiency

Automating the investment process reduces the need for manual interventions, decreases operational costs, and increases the efficiency of financial transactions and management.

Improved Security

Investment apps can incorporate advanced security measures to protect sensitive financial information. This builds trust and assures users that their investments are safe.

[Also Read: Cybersecurity in FinTech Industry: How to Build a Financial App With Proactive Security Measures]

How to Create an Investment App?

With growing market demand and users’ expectations, a robust and sophisticated mobile investment app has become a must-have in their list of handheld applications. To stay relevant, competitive, or better ahead in the race of most used and liked apps, developing a functional and user-friendly app necessitates following a structured approach. Here are the five steps to restate your worries about creating an investment platform.

1. Plan

1. Plan

Before building an investment platform, give yourself ample time to consider and plan the app you’re about to create. You should now ask yourself questions about your company’s goals. What specific benefits and performance enhancements can you anticipate? Is this the best course of action for your company’s growth? Evaluate your company’s tolerance for risk in several situations if something goes wrong.

2. Establish Business Model

A business model must be developed during financial planning. What will the cost of your services be? What percentage of the commission do you hope to receive? Let’s use Acorn as one of the investment platform examples for your reference. To use their services, users must pay $1 per month. In addition, it enables users to profit from the transaction through pockets and recommendations.

3. Abide by the Laws and the Regulations

Any laws and regulations that apply to your operations in the countries where you propose to conduct business must be strictly observed while creating any FinTech application. The privacy of your users may be subject to laws and regulations (such as GDPR) and your company’s operations.

4. Understand Compliance Requirements

Before starting the core development process of the investment app, it is critical to understand the legal and regulatory requirements of the region.

Every country has a regulatory body that sets the rules for internet space and financial environment. However, the basic frameworks remain somewhat similar and are primarily related to – end-user privacy, intellectual property, marketing and advertising, and money laundering detection.

Mentioned below is the list of regulatory bodies and legal compliance of the corresponding countries:

| USA | The Anti-Money Laundering Act 2020, Security Exchange Act 1934 |

|---|---|

| UK | UK Industry Act, The Rule Book of London Stock Exchange |

| Canada | Commodity Futures Act |

5. Find the Appropriate Development Team

Choosing the right development team is the most vital phase of building an investment platform. Several methods exist for hiring a robust team that can offer it all. Let’s quickly go over them and talk about their benefits and drawbacks.

Form an internal team

The advantages of this choice include complete control over the app development process and easier communication. However, you must invest time in recruiting and onboarding, pay salaries comparable to those in your industry, and provide benefits that will keep your employees on board. Knowing the team structure required to develop an investment app is important.

| Required Team Members | Role Description |

|---|---|

| Project Manager | The role involves managing the complete project, coordinating with the development team, and making strategic decisions. |

| UI/UX Designer | The designer must first create a wireframe and an actionable product prototype to examine the product and its functionalities. |

| Backend Programmer | Self-described – The backend programmer is responsible for coding features and functionalities at the backend. |

| Mobile Developer | With the interface designed by the UI/UX designer, the mobile developer helps translate the code into the mobile application. |

| QA Tester | Ensuring that the app aligns with the expectations set in the discovery phase. Check for bugs and loopholes by testing the initial application to ensure no breaches are happening. |

| DevOps | By bringing together operations and development, DevOps helps automate various aspects of the coding process. |

Additionally, to create an investment app, the team should be adept with the below-listed tech stacks:

| Aspect | Tech Stack to Build Secure Investment Software |

|---|---|

| Mobile Programming Language | React Native or Flutter for a hybrid app, JAVA, Kotlin for an Android app, or Objective-C and Swift for an iOS app. |

| Backend Development | LAMP, NodeJS, Laravel |

| Database Management | MongoDB, MySQL |

| UI/UX Design | Balsamiq, Principle, Figma |

| Product Management | Confluent, Jira Software |

Involve freelancers

You won’t be able to create the best online investment app with just one or two employees because it is a very complex process. The team requires many experts, including designers, QA engineers, project managers, and investment app developers.

While you can recruit freelancers, it’s tricky to handle a freelance team, fulfill deadlines, and stay within budget at the same time.

Outsource development to a dedicated software development company

With this choice, you get the best of both worlds: you only pay for the work delivered, you can grow or reduce your team as needed, and you receive a project manager to ensure your spending is within reason.

Partnering with a trusted fintech consulting company can make the outsourcing process even smoother. Experienced consultants help you define clear project goals, set realistic budgets, and align development efforts with your business needs.

[Also Read: Glimpse of the Advantages of Outsourcing to a Mobile App Development Company]

6. Develop the Main App

Initiate the app development with the software development company you hired. Simply put, it involves creating an MVP for the best mobile investment app. You can add more functionality once your mobile app has the bare minimum capabilities required to function. For instance, you may invest in next-layer security and add gamification and enhanced UI/UX components.

7. Test and Improve

You have an MVP to launch during this phase of building an investment platform. Here, the programmers and QA engineers keep testing and enhancing the app’s functionality, eventually releasing all features as their priority. This stage ends with a finished app made available for purchase and download.

8. Upkeep and Support your App

You’ll need to keep the current features up-to-date and create new ones. Maintenance, which includes upgrades to support the new operating system editions, library, third-party service updates, and other tasks, often consumes 20% to 50% of the original app budget annually.

It’s crucial to upgrade library and framework versions to prevent security flaws. Additionally, routinely test your app for speed and security flaws.

Naturally, not every investment app development fully adheres to this process, particularly when creating the best mobile investment apps. However, these steps to develop an investment app can work as a solid foundation to guarantee the best outcomes. You may move on with the development processes methodically and resolve conflicts that arise along the way by focusing on the Agile methodology.

After looking into how to build an investment platform, let’s move ahead and look into the various examples of investment apps that have made it big in the sector.

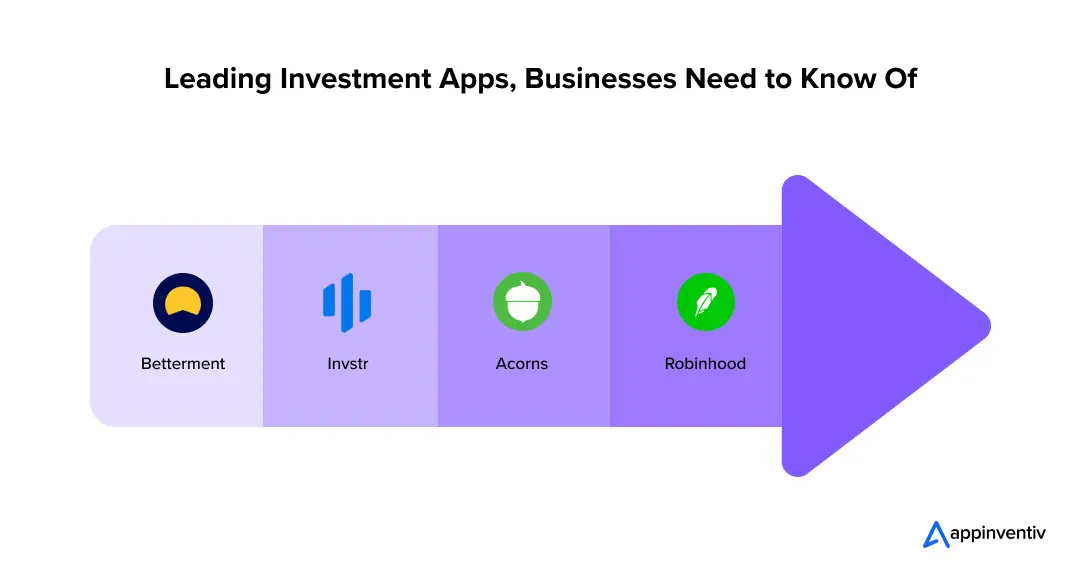

Examples of Successful Investment Apps

Now that we have learned about the types of investment apps and the steps to make a robust one let us look at some examples of successful investment apps.

Betterment – With negligible management fees of 0.25-0.40% of the assets annually, this investment app is apt for someone who likes having a professionally managed portfolio and a cash management account. The app provides the facility for selecting ETFs calibrated against your risk tolerance. It caters to different clients, from risk-taking portfolios to safer portfolio management. It also lets you set up your investment goals without minimum account requirements.

Invstr – No minimum balance is required to set up a portfolio with Invstr. For novice investors, this application helps provide a learning platform by allowing them to hear from experts about why and which stocks are their favorite. The app combines the fantasy stock game for managing virtual portfolios that will help you learn about the stocks in a fun way. They have recently started offering commission-free trading in cryptocurrency.

Acorns – This investment app is meant for investors who like getting automatic investments while spending them without worry or if you want retirement investments without hassle. It is considered to be one of the best apps for savings.

Robinhood – The Robinhood investment app is best for active trading. With zero commission and no required minimum balance, you get a smooth interface for trading stocks, ETFs, or cryptocurrency. Visually appealing statistics in the form of charts on the stock page provide an analytical view and facilitate quick trading.

Must-Have Features of Investment Apps

Let’s now discuss the features to integrate while building an investment platform, particularly those your MVP will unquestionably require. These are merely the fundamental elements found in the most well-liked investment applications; you can alter this list according to your investment app ideas, finances, and marketing approach.

1. Onboarding and Registration

Users can sign up using their phone number, email address, or other details. An investment tracking app must have a feature to verify documents to ensure users are authentic. You should provide users with a walkthrough of your app after they register. Point out the important characteristics and the investment pipelines as you show them around.

2. Personal Profiles

A personal profile should include a user’s portfolio, chosen payment methods, and personal information. Personal profiles can also have setting options added to them. Make sure creating a personal account is as easy and intuitive as possible to avoid putting off your users when they use your service.

3. Tools for Managing Money

Money management tools have a unique place on this list that you need to add if you intend to launch an investing platform.

Why? People frequently look for the best approach to managing their money. Therefore, you should provide your users with robust dashboards that include tools for managing money, savings, and credit. Use interactive bars, pie charts, infographics, and other visual aids. The information should be insightful and visually appealing throughout. Deliver daily, monthly, and quarterly reports to give your users a consistent impression of their financial and investing activity. It is a great way to boost user retention for your investment app.

Discover how we created EdFundo, an app that teaches kids financial literacy and money management early on. It’s making waves with $500,000 in pre-seed funding and key partnerships like Visa and NymCard.

4. Money Withdrawal Capabilities

According to trade regulations, your users should be given the functionality to withdraw their investments into their bank accounts. To do this, you must incorporate a bank account into your investment app development.

5. Safety and Security

Any investment app must have data protection as a standard feature. A strong IDPS should be added to handle DDoS attacks and encryption techniques, as well as anti-spam, two-factor authentication, and phishing protection. The user experience improves as you add more security measures.

6. Push Notifications

Don’t forget to include push notifications, real-time alerts, and personalized reminders when developing an investment application. With their assistance, the system can alert clients about intriguing deals, discounts, promotions, their current account status, and the rising or falling value of specific assets.

7. Electronic Wallet

In essence, this is where the funds for upcoming investments are kept. The key requirements are utmost security and simple accessibility for an individual qualified to oversee the valuables kept there. The best online investment app should be able to connect to the bank and credit card networks to receive timely updates and to protect user data on the phone securely.

[Also Read: How to create a digital wallet: All you need to know]

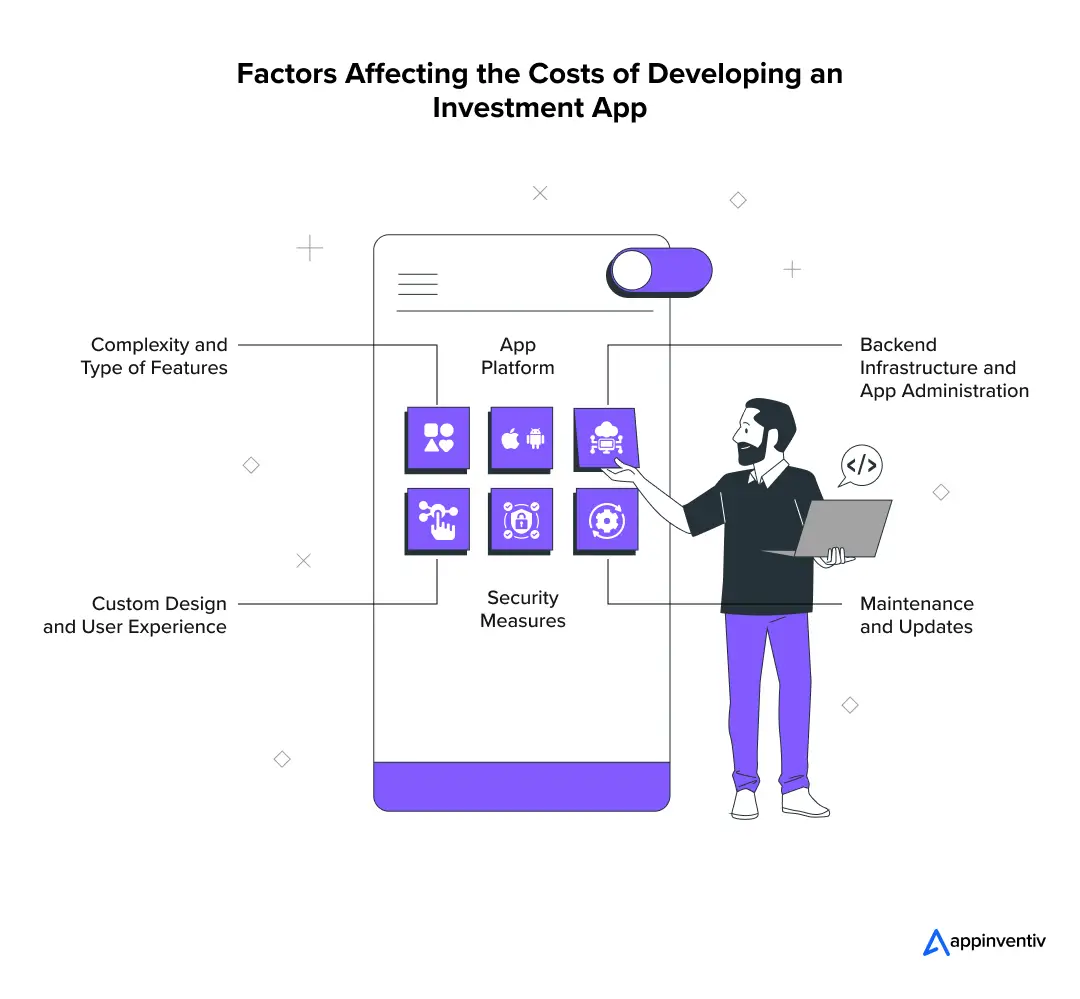

How Much Does it Cost to Develop an Investment App?

A typical investment app development costs between $30,000 and $150,000. The cost of developing an investment app can vary based on how complex the app is, the features you want to include, and any technical challenges that might come up. Let’s break down the main factors that can influence the cost of building an investment app, helping you get a clearer idea of where your money will go.

Complexity and Type of Features

The more complex features your platform includes, such as real-time trading, automated advising, or integration with external financial systems, the higher the cost of building an investment platform. Complex features require more development time and advanced skills.

| Complexity Level | Feature Examples | Cost Range |

|---|---|---|

| High | Real-Time Trading, Automated Advising | $100,000 – $150,000 |

| Medium-High | Integration with External Financial Systems | $90,000 – $140,000 |

| Medium | Advanced Security Features, Multi-Currency Support | $50,000 – $100,000 |

| Medium-Low | Social Trading Features, Virtual Portfolio Management | $60,000 – $110,000 |

App Platform

Developing for multiple platforms can increase costs. iOS and Android platforms may require different skills and tools, influencing the cost of investment software development. Cross-platform solutions might reduce costs but could also affect performance and user experience.

Custom Design and User Experience

A custom user interface design tailored to enhance user experience can also increase the investment in software systems development costs. High-quality, intuitive design is crucial for user engagement but requires skilled UI/UX designers, which increases the budget.

Backend Infrastructure and App Administration

The backend infrastructure, which includes servers, databases, and app integration with various APIs, forms a significant part of the cost of building an investment platform. Robust backend systems are essential for handling user data securely and efficiently.

Security Measures

Investment apps require stringent security protocols to protect sensitive financial information. Implementing advanced security measures such as encryption, multi-factor authentication, and secure payment gateways adds to the development cost.

Maintenance and Updates

Post-launch maintenance and regular updates to ensure the app remains compatible with new mobile OS versions, add new features, or fix bugs require ongoing investment.

What features should your investment app have?

To truly differentiate your investment app in a crowded market, integrating advanced features can significantly help you enhance its overall appeal and functionality. Going beyond the basics, you can provide a more engaging user experience that retains attention and encourages active participation and investment. Here are some advanced features for an investment platform that can make it stand out.

Interactive Performance Dashboards

Provide dynamic dashboards that allow users to visualize their investments and returns through interactive charts and graphs.

Automated Tax Calculations

Integrate a feature that automatically calculates potential tax implications for various investment decisions, simplifying user tax management.

Custom Alerts and Notifications

Offer customizable alerts for market changes, investment opportunities, or personal milestones, keeping users informed and engaged.

Multi-Currency Support

Enable transactions and displays in multiple currencies, catering to a global user base and facilitating international investments.

Eco-Friendly Investment Options

Highlight green and sustainable investment choices within the app, appealing to socially conscious investors.

Investment Simulator

Include a simulator feature that allows users to test investment strategies in a risk-free environment using virtual money.

Integrated News and Insights

Provide real-time financial news and insights directly within the app, helping users make informed decisions based on the latest market trends.

Augmented Reality Market Insights

Use AR to overlay real-time financial data and market statistics onto users’ real-world views, offering an immersive and interactive way to engage with market dynamics.

[Also Read: 10 Use Cases of How AR is Changing the Way Consumers Interact with Banking and Financial Services]

Virtual Reality Investment Scenarios

Implement VR features that allow users to experience different investment scenarios in a simulated environment. This can help users understand complex financial concepts or visualize potential investment outcomes.

AI-Driven Investment Strategies

Incorporate AI to analyze user behavior and market conditions, offering personalized investment strategies and automated asset management.

AI Chatbot for Instant Support

Deploy an AI-powered chatbot that provides instant support and advice, answers queries, and guides users through investment processes, enhancing user experience and support.

From AI-driven insights to real-time trading, we will help you integrate cutting-edge features that put you ahead of the competition.

How to Monetize the Investment App?

Now that you have understood how to build an investment platform, the end goal of creating any application usually is to make it profitable. Thus, it is vital to include the monetization strategies during planning. There are many ways to make money from the application. Let us discuss some of the commonly used methods.

App Purchases

When the user becomes familiar with the interface and the application while looking for enhanced features and better control of investment decisions, these add-ons are chargeable.

Subscription Fee

Investment apps might allow you to create your account for free. However, they may charge a subscription fee to facilitate you with trading options.

Advertisements

Partner companies may run ads on your app. Users see these ads to keep the app free of subscription fees.

Freemium Model

Start by offering basic app features for free. Then, charge users for access to more advanced features. This encourages them to try the app and possibly upgrade for more functionality.

Affiliate Marketing

Earn money by promoting products or services from financial institutions on your app. You get a commission whenever users sign up or make a purchase through these referrals.

Transaction Fees

Charge a small fee for transactions like buying or selling stocks. Make sure these fees are reasonable to keep your users happy.

Sponsored Content

Allow experts or companies to publish paid articles or videos on your app. This gives them a platform while you earn revenue from their sponsorships.

White Label Solutions

Sell a customizable version of your app to other businesses. This lets them use your technology under their brand, which can be a lucrative deal for you.

Data Insights

Collect and sell user trends and market behavior data to financial analysts or companies. Always ensure user privacy by only using anonymous data.

Why Appinventiv is the Right Partner for Building a Robust Investment App

We hope this blog has made you understand how to create an investing app that guarantees maximum RoI and the related investment platform development costs.

While creating a mobile application might seem straightforward, it requires expertise across multiple areas, from innovation and industry knowledge to a skilled and experienced technical team. Thus, you must put up diligent efforts when you plan to build an investment platform.

Appinventiv is here to assist if you’re looking for a skilled and reliable fintech app developers. Our team combines deep knowledge of financial markets with cutting-edge technology skills to build apps that are not only functional but also innovative. We understand the critical role that user experience plays in the success of digital financial tools and prioritize intuitive design and seamless functionality in each project.

Building on our expertise in app development and digital strategy, we can tailor these monetization strategies to fit your unique business model and market needs. As a leading investment software development services provider, our team has a proven track record of creating intuitive, secure, and highly functional apps that meet the expectations of modern users and also excel at generating revenue. We leverage the latest technologies and industry insights to ensure your app remains competitive and ahead of market trends.

Our approach goes beyond the initial launch. We provide continuous support and utilize advanced analytics to monitor your app’s performance and engagement. This data-driven strategy allows us to make informed adjustments to improve the app, ensuring it remains relevant as market conditions and technology evolve.

We have a sizable portfolio of completed projects for businesses of various sizes operating in multiple industries, including FinTech.

For instance, we recently developed Mudra, a budget management app that uses AI to make financial planning engaging for millennials. It features a chatbot that tracks spending and sends fun alerts when users exceed budget. Ready to launch in over 12 countries, Mudra aims to simplify finance management for the younger generation.

By partnering with us, you can be confident that we’ll give your investment app our full attention and enhance its usefulness with a vast array of high-performing tools and components.

FAQs

Q. What is an investment app?

A. An investment app is a mobile application that provides information about publicly traded companies. The investment tracking app allows novice and experienced investors to keep tabs on their stock market and other financial sector investments. These investment applications offer a variety of flexible resources at minimal application fees, helping investors increase their investments and save money.

Q. How much does it cost to build an investment app?

A. Building an investment platform typically costs between $30,000 and $150,000, but the price can vary widely depending on the app’s complexity, features, and specific requirements. Factors like the choice between native or cross-platform development, the sophistication of security measures, and the integration with external financial systems can all significantly influence the final cost.

Q. How long does it take to create an investment app?

A. The time required for investment management software development can vary significantly based on several factors, including the app’s complexity, the number of features, and the platform it is being developed for. Generally, building a basic investment app with standard features might take 3 to 6 months. However, more complex apps with advanced features such as real-time trading, automated advising, or integration with multiple financial systems could take 6 to 12 months or longer. Partnering with a dedicated investment software development company can help you get the exact time and cost estimates per your business requirements.

Q. How to create an investment platform that stands out?

A. To create an investment platform that stands out, focus on delivering a unique user experience combined with robust functionality. Start by thoroughly understanding your target audience’s needs and financial behaviors to tailor your platform’s features, such as personalized investment advice, real-time trading capabilities, and interactive financial dashboards. Incorporate cutting-edge technologies like AI for customized portfolio management and blockchain for enhanced security.

Additionally, ensure your platform is user-friendly with intuitive navigation and visually appealing design. Differentiate your service with unique offerings like social trading options, educational resources for investors of all levels, and exceptional customer support. Finally, stay compliant with financial regulations to build trust and ensure a secure investment environment for your users.

Q. How do investment apps make money?

A. Investment apps generate revenue through several strategies:

- Transaction Fees: Charging users for each trade executed within the app, such as buying or selling stocks or other securities.

- Subscription Fees: Offering premium memberships that provide access to enhanced features like detailed analytics or exclusive investment advice.

- Freemium Model: Providing basic app functionality for free, while advanced features are available at a cost.

- Affiliate Marketing: Earning commissions by promoting other financial products or services within the app.

- Advertisements: Generating revenue from displaying ads or sponsored content from third-party financial institutions.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…