- Key Features of DeFi

- DeFi Stack

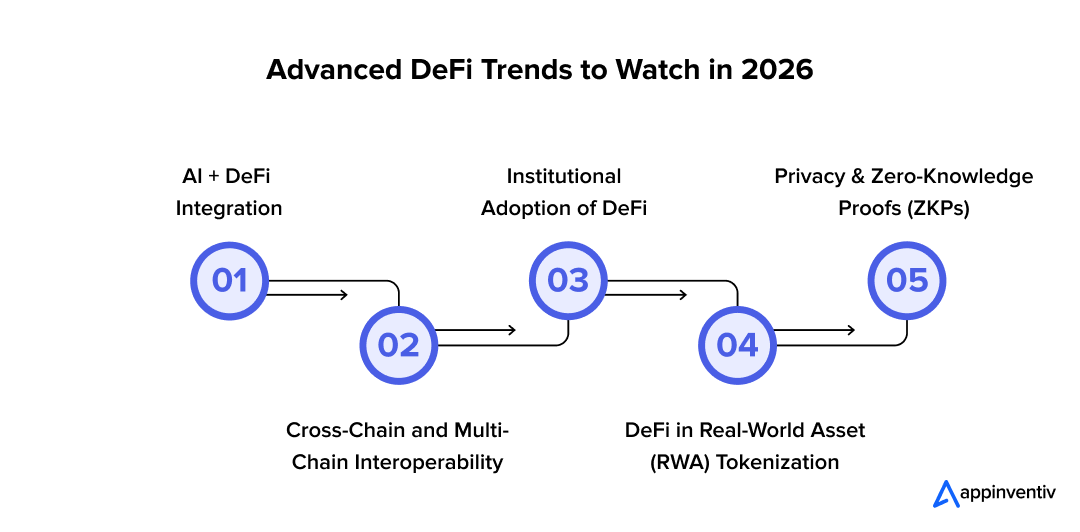

- Top 5 Advanced DeFi Trends to Watch in 2026

- AI + DeFi Integration

- Cross-Chain and Multi-Chain Interoperability

- Institutional Adoption of DeFi

- DeFi in Real-World Asset (RWA) Tokenization

- Privacy & Zero-Knowledge Proofs (ZKPs)

- Leading DeFi Trends to Follow in 2026

- Sustainable Finance Initiatives

- NFT Integration

- Traditional Finance Integration

- DeFi Insurance Protocols

- Synthetic Asset Protocols

- Algorithmic Stablecoins Evolution

- Layer 2 Scaling Solution

- Decentralized Asset Management Platforms

- Crypto Bridges

- DEX and AMM Innovations

- Decentralized Autonomous Organizations (DAOs)

- DeFi Gaming and Virtual Economies

- Decentralized Physical Infrastructure Networks (DePIN)

- DeFi App Development Process: Crafting the Future of Finance

- Navigating DeFi Solutions with Appinventiv: Your Path to Success

- FAQs

Key Takeaways:

- DeFi is Transforming Business Finance: DeFi is making transactions faster, cheaper, and more transparent, helping businesses unlock capital and simplify payments.

- 2026 DeFi Trends to Watch: Key trends like AI integration, cross-chain compatibility, and tokenizing real-world assets are creating new opportunities for businesses to grow and innovate.

- Institutional DeFi Adoption is Growing: Traditional finance is embracing DeFi, offering businesses more reliable entry points and clearer regulations for growth.

- Building DeFi Apps for the Future: Creating a DeFi app involves strategic planning, smart design, and seamless integration with blockchain, shaping the future of business finance.

The financial landscape is undergoing a revolution. Blockchain enables direct transactions between people and businesses, cutting out banks and payment processors, speeding things up, and reducing costs. For companies, this is a game-changer. Need capital without the hassle of traditional loans? Decentralized finance platforms and DeFi trading platforms offer reliable alternatives. Sending cross-border payments? These systems are faster and cheaper. Even internal tasks like supply chain tracking and contract management can be automated, simplifying operations and saving time through innovative DeFi strategies.

The numbers support what is happening on the ground. According to Mordor Intelligence, the DeFi platform growth market is projected to reach $51.22 billion this year, growing at roughly 8.9% annually to $78.49 billion by 2030. That is not hype; that is adoption.

What makes this shift compelling is not just the technology. It’s what the technology enables: anyone with an internet connection can access financial services that used to require intermediaries, paperwork, and geographic proximity. Small businesses in emerging markets can transact with customers in developed economies. Freelancers can receive payment instantly, rather than waiting days for wire transfers to clear. The cost savings are real, too. When you remove the middlemen, you remove their fees. When you automate verification and settlement, you cut processing time from days to minutes.

This blog delves into the top DeFi trends of 2026 and essential aspects, offering valuable insights and opportunities for businesses looking to navigate the evolving landscape of decentralized finance and understand what a DeFi protocol is through DeFi examples.

Key Features of DeFi

Decentralized finance development is changing the game with features that bring more control, transparency, and security to businesses:

- Immutable records: Once a transaction is recorded on the blockchain technology, it cannot be altered.

- Open Access: Anyone, anywhere with an internet connection can get involved, no gatekeepers.

- Interoperability: DeFi platforms support cross-chain communication.

- See how it works. Smart contracts run automatically, and the code’s right there if you want to check it.

- Enhanced security: The entire distributed setup makes breaking in a real challenge for anyone with malicious intent.

- Build what you need. Stop forcing your business into someone else’s template. Create tools that actually fit.

- Your stuff stays yours. No bank holds your assets. No intermediary can lock you out.

DeFi Stack

The DeFi stack is a layered architecture that outlines the components and technologies enabling decentralized financial services on blockchain platforms. It consists of several layers, each serving a specific function to build a comprehensive DeFi ecosystem.

Top 5 Advanced DeFi Trends to Watch in 2026

DeFi is still figuring itself out, but the direction is clear. Businesses that pay attention now will have options their competitors don’t, whether that’s moving money faster, accessing capital that traditional banks won’t provide, or cutting out middlemen who add cost without adding value.

The next few years won’t just be about new technology. They’ll be about which companies recognize the shift early and which ones wake up too late.

AI + DeFi Integration

Machine learning is changing how DeFi platforms operate. Companies are using AI-powered DeFi protocols to spot market patterns they’d otherwise miss, automate the boring stuff, and make faster calls on where to allocate resources.

The practical benefit? Fewer human errors and better risk assessment when things get volatile.

Cross-Chain and Multi-Chain Interoperability

DeFi becomes interesting only when different networks can actually talk to each other. Cross-chain compatibility means you’re no longer trapped within a single ecosystem when moving assets.

You can shift funds between networks, access services that weren’t available before, and tap into liquidity wherever it exists, not just where your initial platform allows.

Institutional Adoption of DeFi

Traditional finance ignored DeFi for years. That’s shifting now. As central banks experiment with digital currencies and institutions realize they’re losing ground, we’re seeing established players test the waters.

This growing DeFi legacy finance integration signals a major turning point, one where decentralized systems and traditional financial models begin to work together. For businesses, this means more legitimate on-ramps, better regulatory clarity, and alternatives to the legacy banking system that’s been calling the shots.

DeFi in Real-World Asset (RWA) Tokenization

Tokenization sounds abstract until you realize what it means practically. Take a commercial property worth $10 million. Instead of needing a single buyer with deep pockets, you can split ownership into tradable tokens.

The same goes for commodities, art, and even revenue streams. This creates liquidity where none existed and lets smaller players into markets that used to require massive capital.

Privacy & Zero-Knowledge Proofs (ZKPs)

In healthcare or finance, you can’t just throw sensitive data around. Zero-Knowledge Proofs solve a real problem: proving something’s true without revealing the underlying information.

A hospital can verify a patient’s insurance eligibility without exposing their medical history. A lender can confirm creditworthiness without seeing your full financial picture. For regulated industries, this makes DeFi viable instead of a compliance nightmare.

Leading DeFi Trends to Follow in 2026

Let’s delve into the cutting-edge trends in decentralized finance for 2026, empowering businesses to refine their strategies and achieve unprecedented profitability.

Sustainable Finance Initiatives

Sustainable finance within DeFi is gaining momentum as the industry seeks to align with global environmental, social, and governance (ESG) standards. DeFi’s energy consumption problem isn’t going away, so the sector’s adapting. More protocols are building in carbon offsets and prioritizing eco-friendly validation methods. This isn’t just good PR, it’s responding to real pressure from investors who now screen for ESG compliance before committing capital.

Competitive advantages of prioritizing sustainability:

- Credibility with institutional money: When you can demonstrate sustainable practices, you’re speaking the language that larger investors and partners now require. It opens doors that remain closed to platforms that ignore environmental impact.

- Regulatory preparation: Governments are tightening rules around carbon footprints and environmental standards. Getting ahead of this now means you won’t be scrambling to comply later when enforcement actually hits.

NFT Integration

NFTs are opening doors in DeFi that didn’t exist before. When you can tokenize unique assets, whether that’s artwork, property titles, or collectibles, you suddenly have collateral that traditional finance never recognized. Some platforms now let businesses borrow against these assets, which means liquidity isn’t just about what’s sitting in your bank account anymore.

This matters because it expands what counts as valuable in financial transactions. A company holding digital assets can put them to work rather than just store them.

Why businesses are exploring this:

- Additional income sources. Creating and selling digital assets generates revenue from previously unmarketable assets. Limited-edition releases, branded collectibles, and membership tokens all become tradable assets.

- Stronger customer relationships. NFTs tied to exclusive access or rewards give people reasons to stay engaged with your brand beyond typical transactions. It’s ownership that means something, not just another loyalty program they’ll forget about.

Traditional Finance Integration

DeFi and traditional finance are starting to overlap in ways that matter. You’re seeing tokenized securities, asset management on blockchain rails, and trading platforms that offer familiar financial instruments through decentralized infrastructure. The goal is straightforward: give businesses access to both worlds without having to choose one or the other.

This matters because it brings institutional money to the table. Large investors who’ve stayed on the sidelines due to regulatory uncertainty or unfamiliarity now have entry points that look more like what they already understand.

What this actually means for businesses:

- More funding options: When DeFi platforms connect with established markets, you’re not limited to either crypto-native investors or traditional banks. You can access both pools of capital depending on what makes sense for your situation.

- Credibility that helps adoption: Traditional finance has spent decades building trust and regulatory frameworks. DeFi brings innovation and efficiency. Combining them means you get the speed and transparency of blockchain with the legitimacy that makes CFOs and compliance teams comfortable enough to actually use it.

DeFi Insurance Protocols

Insurance protocols in DeFi are designed to mitigate risks associated with smart contracts, yield farming, and other DeFi activities. These protocols offer decentralized insurance solutions that provide coverage against hacking, smart contract failures, and other vulnerabilities. As the DeFi market size increases, the demand for robust insurance solutions is expected to grow, augmenting the security and reliability of DeFi platforms.

DeRisking Decentralized Finance – Advantages of Integrating Insurance in DeFi:

- Risk Mitigation: Companies can protect themselves against various risks through decentralized insurance solutions.

- Cost Efficiency: Lower premiums and faster claim processes than traditional insurance services.

Synthetic Asset Protocols

Synthetic asset protocols let you trade tokenized versions of real-world assets, stocks, commodities, and currencies, without actually owning the underlying thing. You get the price exposure without the hassle of custody, regulatory paperwork, or minimum investment thresholds that come with traditional markets.

This matters because it opens doors that were previously closed to most businesses. Want exposure to gold prices but don’t want to deal with physical storage or futures contracts? Synthetic assets handle that. Need to hedge against currency fluctuations in a market you don’t directly operate in? Now you can.

What this means practically:

- Broader access to markets. You’re not limited to assets you can physically acquire or meet qualification requirements for. If there’s a tokenized version, you can trade it.

- Easier portfolio balance. Spread risk across different asset classes without the operational complexity of managing each one separately. Everything lives in the same DeFi environment.

- Protection when markets swing. Synthetic derivatives work as hedging tools, letting you offset potential losses in one area with gains in another, all without leaving the blockchain ecosystem.

The real shift here is removing barriers. Traditional finance makes you jump through hoops to access certain markets. Synthetic protocols just ask if you’ve got the tokens to trade.

Algorithmic Stablecoins Evolution

Algorithmic stablecoins work differently from their collateral-backed cousins. Instead of holding reserves, they use programmatic rules to maintain their dollar peg. The early versions had issues, some spectacularly so, but newer designs are getting better at staying stable when markets get rough. As governance models improve and algorithms become more sophisticated, these stablecoins are starting to look like viable options for people who need price stability without the baggage of traditional backing.

What this means for businesses:

- Predictable pricing. When your operating currency isn’t swinging 10% in a day, you can actually plan. When invoicing a client, know what you’re getting paid. Budget for expenses without constantly hedging against volatility.

- Reaching new markets. Plenty of businesses operate where local currency is unstable or banking infrastructure is spotty. Stable digital currencies give them a way into global commerce without needing correspondent banks or currency controls getting in the way.

Layer 2 Scaling Solution

DeFi platforms hit a wall when too many people try using them at once. Ethereum is a perfect example. When the network gets congested, transactions slow down and fees spike. That’s where Layer 2 solutions come in.

These technologies, rollups, sidechains, and similar approaches, handle transactions off the main blockchain, then settle the final results back on it. Think of it as processing credit card transactions in batches rather than calling the bank for approval on every single swipe.

What this means for your business:

- Lower fees. When you’re not paying $50+ per transaction during peak times, your margins actually make sense. Those savings add up fast if you’re processing hundreds or thousands of transactions.

- Speed that works. Nobody wants to wait ten minutes for a payment to confirm. Layer 2 solutions bring that down to seconds, which matters when you’re delivering a smooth customer experience or managing time-sensitive operations.

Decentralized Asset Management Platforms

Watch this space, decentralized asset management is gaining real traction. These platforms handle investment strategies, optimize yields, and manage portfolios without traditional intermediaries. Smart contracts and algorithms do the heavy lifting, which means you’re not relying on a fund manager making calls from their desk.

What’s actually changing is access. Financial management tools that used to require serious capital or institutional connections are now available to smaller players. That shift matters.

What this means practically:

- Less hands-on management. Algorithms handle the day-to-day decisions, so you’re not constantly adjusting positions or second-guessing timing. This frees up time and reduces staffing costs.

- Strategies that fit your situation. Cookie-cutter investment approaches rarely work well. These platforms let you set parameters based on your actual risk tolerance and business goals, not someone else’s template.

The barrier to entry keeps dropping, which is why businesses that couldn’t afford traditional asset management are now exploring these options.

Crypto Bridges

Crypto bridges let you transfer digital assets between blockchains. It’s become pretty important as more companies realize they can’t just stick to one blockchain; different networks have different strengths, and bridges help you take advantage of that.

Right now, we’re seeing significant development in this space. Better bridges mean the whole DeFi world works more smoothly. Instead of isolated blockchain islands, we’re moving toward a system that actually functions as a connected whole.

Why This Matters for Your Business:

- Getting Different Blockchains to Work Together – You’re not locked into one network anymore. Need to move assets around? Bridges make that happen. It gives you room to adapt your strategy based on what’s actually working, not just what’s available on your current chain.

- Growing Beyond One Ecosystem – Here’s the practical benefit: you can reach users on Ethereum, Solana, Polygon, or whatever network makes sense for your use case. Each blockchain has its own community and market dynamics. Bridges open those doors.

The bottom line? If you’re serious about blockchain, you’ll probably need to work across multiple networks at some point. Bridges are how you do that without creating headaches for your operations team.

DEX and AMM Innovations

If you checked out decentralized exchanges a year or two ago and weren’t impressed, it might be time for another look. The teams building these platforms have been busy solving real problems, providing better liquidity, smoother trades, and interfaces that don’t make you want to pull your hair out.

Take concentrated liquidity, for example. Instead of spreading funds thin across every possible price point, liquidity providers can now focus their capital where trades actually happen. Dynamic fees are another game-changer; they shift based on market conditions, helping keep things stable when volatility picks up. The result? Less slippage, better prices, and trading that starts to feel more like what you’d get on a traditional exchange.

Why Businesses Are Paying Attention:

Your Money Goes Further – Centralized exchanges need to cover their overhead, their staff, and their infrastructure. DEXs cut out much of that middle layer, and those savings get passed along as lower fees. If you’re moving serious volume, that difference shows up in your quarterly numbers.

You Stay in Control – Here’s the thing about centralized exchanges: you’re trusting them with your assets. They hold the keys. With DEXs, your funds stay in your wallet until the exact moment a trade executes. No custody risk, no worrying about whether the exchange will be there tomorrow. For businesses handling sensitive transactions, that peace of mind matters.

Decentralized Autonomous Organizations (DAOs)

DAOs are reshaping how organizations govern themselves in DeFi by giving communities a real voice in managing protocols and shaping strategy. Smart contracts handle the mechanics, but what makes DAOs compelling is their ability to bring clarity and fairness to decision-making. Everyone can see how choices get made, which matters when you’re putting resources on the line. For businesses, this means moving beyond passive investment; you can actually help steer the projects you believe in.

Why DAOs Make Sense for Business Engagement:

- Democratic Governance: There’s something powerful about having a seat at the table. When stakeholders can genuinely influence decisions, they care more about results. It’s not just about voting rights, it’s about fostering the kind of engagement that turns participants into partners.

- Operational Transparency: With DAOs, there’s nowhere to hide. Every transaction and vote lives on the blockchain for anyone to review. This level of openness does more than build trust; it signals to investors and partners that you’re running things above board. In an environment where credibility matters, transparency becomes a competitive advantage.

DeFi Gaming and Virtual Economies

We’re witnessing something interesting happen at the crossroads of decentralized finance and gaming. Players can now own, trade, and actually monetize their in-game items and currencies in ways that weren’t possible before. These DeFi gaming platforms have changed the dynamic; what you earn through gameplay now has tangible, real-world value thanks to blockchain technology.

This evolution is doing more than just transforming games. It’s introducing people to DeFi who might never have explored it otherwise, because let’s face it, earning. At the same time, your play is a compelling proposition that makes financial technology feel less intimidating and more engaging.

Why This Matters for Businesses:

- Real Revenue from Virtual Goods Companies has a genuine opportunity here to develop and market virtual items in a massive, growing gaming market. It’s not just about selling entertainment anymore; it’s about creating assets that hold actual value.

- Building Authentic Connections When brands establish a presence in these virtual spaces, they’re meeting customers where they already spend their time. This creates opportunities for more meaningful interactions that go beyond traditional advertising, fostering loyalty through shared experiences rather than just transactions.

Also read: How Much Does It Cost To Build a Web3 Game App Like Axie Infinity?)

Decentralized Physical Infrastructure Networks (DePIN)

Decentralized Physical Infrastructure Networks (DePINs) leverage blockchain technology to manage real-world infrastructure, from telecommunications systems to energy grids. By distributing ownership and operational control, these networks create more efficient systems while lowering operational costs. Essentially, DePINs extend the principles of decentralized finance beyond the digital realm into the physical infrastructure that businesses rely on daily.

Business Benefits of DePIN Implementation

Organizations implementing DePIN solutions typically experience two key advantages:

- Cost Efficiency: By decentralizing infrastructure management, companies can significantly reduce overhead expenses while improving operational workflows. This distributed approach eliminates many traditional inefficiencies associated with centralized infrastructure control.

- Enhanced Scalability: DePINs make it considerably easier to expand and maintain infrastructure as business needs evolve. This flexibility allows companies to adapt quickly to changing market conditions and growth opportunities.

With a solid understanding of the emerging DeFi trends shaping the industry, you’re ready to explore the practical aspects of developing a DeFi application tailored to your business requirements.

DeFi App Development Process: Crafting the Future of Finance

Building a DeFi app takes patience and a lot of on-the-go learning. It’s not just about smart contracts or tokens; it’s about trust, usability, and solving real problems for real people. Every stage matters, from the first idea to the updates that come months after launch.

- Research and Groundwork

Before you dive in, take a step back.

- Look at what’s already in the market, what works, what doesn’t, and what feels half done.

- Talk to users, maybe on forums or Discord, to understand what frustrates them most.

- Define your goal clearly. If you can’t explain what your app fixes in one line, it’s not clear enough yet.

Good research helps you avoid building something that people don’t need.

- Shaping the Concept and Design

Once you have a direction, start turning it into something people can see.

- Draw rough sketches of screens and user journeys or app wireframes, even simple ones, help.

- Keep testing those early drafts with friends or colleagues who weren’t part of the project.

- Focus on ease, not beauty. If someone can use your app without thinking too hard, you’ve nailed the design.

Design is mostly about understanding how people move, not how pixels align.

- Choosing the Right Tech Stack

This part decides how stable your app will be.

- Pick a blockchain platform that fits your use case, not just follow the hype.

- Plan how the smart contracts, backend systems, APIs, and wallets will connect.

- Make sure the tech can grow with you; scaling later is much harder than planning now.

Once you make these decisions, changing them mid-way can be painful.

- Development and Implementation

Now comes the long stretch, the actual build.

- Developers start bringing the front and back ends together.

- Wallet integration, lending modules, staking pools, all the big parts take shape here.

- Keep looping in your auditors and security folks as you go. It saves time later.

Expect a lot of trial and error. That’s normal.

- Testing Everything (Then Testing Again)

Testing is where things get real.

- Push the app hard and see where it breaks.

- Test on different devices, networks, and with other wallets.

- Keep fixing, no matter how small the issue seems.

Users won’t give you a second chance if something fails with their money.

- Security and Compliance

This part isn’t optional; it’s everything.

- Encrypt data properly, set access limits, and check every layer.

- Follow regional KYC or AML laws where applicable.

- Keep updating your security as threats change.

DeFi moves fast, but one weak point can undo everything you’ve built.

- Launch and Integration

Launch day feels exciting, but stay cautious.

- Deploy slowly and monitor each step.

- Have a rollback plan just in case something doesn’t go as expected

- Write simple guides so new users can get started without help.

The smoother this stage feels, the better first impression you make.

- Maintenance and Continuous Growth

Once the app is out, your real job begins.

- Watch how people use it, and data tells you where they get stuck.

- Fix small problems quickly, plan bigger upgrades over time.

- Keep the community close. Their feedback is worth more than analytics.

DeFi changes constantly. The apps that stay relevant are the ones that keep evolving with their users.

A good DeFi app isn’t built in one go. People, feedback, mistakes, and patience shape it. The ones that last keep learning.

Navigating DeFi Solutions with Appinventiv: Your Path to Success

The future of DeFi is entering an interesting phase over the next couple of years. New technologies are reshaping how decentralized finance works, and we’re seeing real momentum toward financial systems that actually work better for more people, are more transparent and accessible, and are built to last.

At Appinventiv, we’ve spent years helping businesses navigate blockchain development services. It is not just about writing code, it’s about understanding what you’re trying to achieve and building something that genuinely serves that purpose. Every project has different needs, and we tailor our approach accordingly.

We handle everything from those early brainstorming sessions where ideas are still rough, through designing an interface people will actually enjoy using, to the technical heavy lifting of development, testing, launch, and keeping things running smoothly afterward.

Over the years, we’ve built more than a thousand apps, projects like Edfundo, Mudra, NOVA, Empire, etc, among them. About 95% of our clients tell us they’re happy with what we’ve built together, which matters a lot to us.

If you’re thinking about launching a DeFi app and want a team that’s been through this before, let’s talk. We’re happy to walk through what you’re planning and figure out how we can help make it happen.

FAQs

Q. What is the future of decentralized finance?

A. DeFi is witnessing several groundbreaking advancements, including the rise of decentralized autonomous organizations (DAOs) governing financial protocols, the integration of artificial intelligence and machine learning for risk management and trading strategies, the emergence of cross-chain interoperability solutions, and the adoption of Layer 2 scaling solutions to alleviate network congestion and reduce transaction costs.

Decentralized FinTech marks a paradigm shift in the financial industry, reshaping traditional finance with decentralized technologies to democratize access, enhance transparency, and foster innovation. As DeFi continues to mature, it is poised to revolutionize financial services, democratizing access to financial tools and services while fostering greater financial inclusion and empowerment.

Q. How can you stay updated on the latest decentralized finance trends and solutions?

A. To stay informed about the rapidly evolving DeFi landscape in 2026, you can follow reputable cryptocurrency news websites, subscribe to DeFi-focused newsletters and podcasts, participate in online forums such as Reddit’s r/defi or Discord communities, join DeFi-related social media groups on platforms like Twitter and Telegram, and attend virtual or physical conferences and meetups dedicated to decentralized finance.

Q. What are the potential risks associated with cutting-edge DeFi trends?

A. Cutting-edge DeFi trends come with inherent risks that stakeholders must consider. Smart contract vulnerabilities pose a significant threat, as flaws in these contracts can lead to financial losses or asset theft. Additionally, the evolving regulatory landscape introduces uncertainties, potentially resulting in compliance challenges or legal issues. Market volatility is another concern, with DeFi assets susceptible to rapid price fluctuations that can trigger substantial losses. Liquidity risks are also prevalent, particularly during periods of market stress, where insufficient liquidity may hinder users from executing trades or withdrawing funds.

Partnering with a dedicated blockchain development firm can help you mitigate risks in DeFi by auditing smart contracts and providing regulatory guidance. Their expertise ensures enhanced security, compliance, and governance, which is crucial for the resilience of DeFi projects.

Q. What Is DeFi’s Role in Changing the Financial World?

A. DeFi is rewriting how money moves. Removing intermediaries like banks and payment processors, it allows people and businesses to interact directly using blockchain-based smart contracts. This shift brings faster transactions, lower fees, and greater transparency. Beyond speed and savings, DeFi also democratizes access, letting small businesses and individuals tap into financial tools that were once reserved for major institutions. It’s not just an upgrade to traditional finance; it’s a complete redesign of how value is exchanged globally.

Q. What Are the Key Drivers of Institutional Adoption of Decentralized Finance (DeFi), and How Should CFOs Evaluate Them?

A. Institutional adoption is accelerating as DeFi matures and becomes more secure. Three main drivers stand out:

- Regulatory clarity that helps institutions operate within defined frameworks.

- DeFi–legacy finance integration, where decentralized systems complement existing banking infrastructure.

- AI-powered DeFi protocols that improve transparency, risk modeling, and compliance.

For CFOs, evaluation should focus on how these systems align with corporate governance, liquidity goals, and risk appetite. Partnering with experienced blockchain teams can help balance innovation with financial control.

Q. What Are the Main Cross-Chain Interoperability Trends in DeFi?

A. The biggest trend shaping DeFi right now is cross-chain and multi-chain interoperability, the ability for different blockchains to communicate and transfer assets seamlessly. Businesses no longer have to operate within a single ecosystem. Instead, they can move assets across networks, access broader liquidity pools, and adopt DeFi strategies that match their operational needs. This evolution is turning once-isolated DeFi platforms into a connected financial web that mirrors, and often outperforms, traditional systems.

Q. How big will DeFi be by 2030?

A. By 2030, the global DeFi market is projected to grow substantially, reaching around US $231 billion, according to one forecast, with a compound annual growth rate (CAGR) of roughly 53.7% between 2025 and 2030(Grand View Research).

This reflects how businesses and financial institutions are increasingly turning to decentralized finance for everything from lending and payments to asset tokenization and treasury management.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Step-by-Step Guide to Crypto Trading Bot Development in 2026

Key takeaways: Crypto trading bot development in 2026 functions as full-scale trading systems, not experimental scripts. They require the same engineering discipline as any financial platform. Execution quality drives results more than strategy logic. Latency control, order handling, and risk limits shape real-world performance. AI-based strategies work only when supported by reliable data flows, controlled…

Decentralized Exchange (DEX) Development: Features, Implementation Cost, and Enterprise ROI

Key Takeaways The development of a decentralized exchange will enable businesses to provide secure and user-controlled trading, improve transparency, and minimize the use of intermediaries. The cost of DEX development can vary depending on the platform's features, the chosen network, and regulatory requirements, and the approximate cost is about $50,000, with higher costs for customization,…

Key takeaways: Dubai's VARA framework mandates strict compliance protocols for blockchain enterprises. To comply with VARA in Dubai, enterprise blockchain systems should use private networks that only approved members can join. Choosing between Hyperledger Fabric, private Ethereum, Corda platforms, etc., significantly impacts long-term scalability, compliance automation, and maintenance costs. Enterprises implementing VARA enterprise blockchain development…