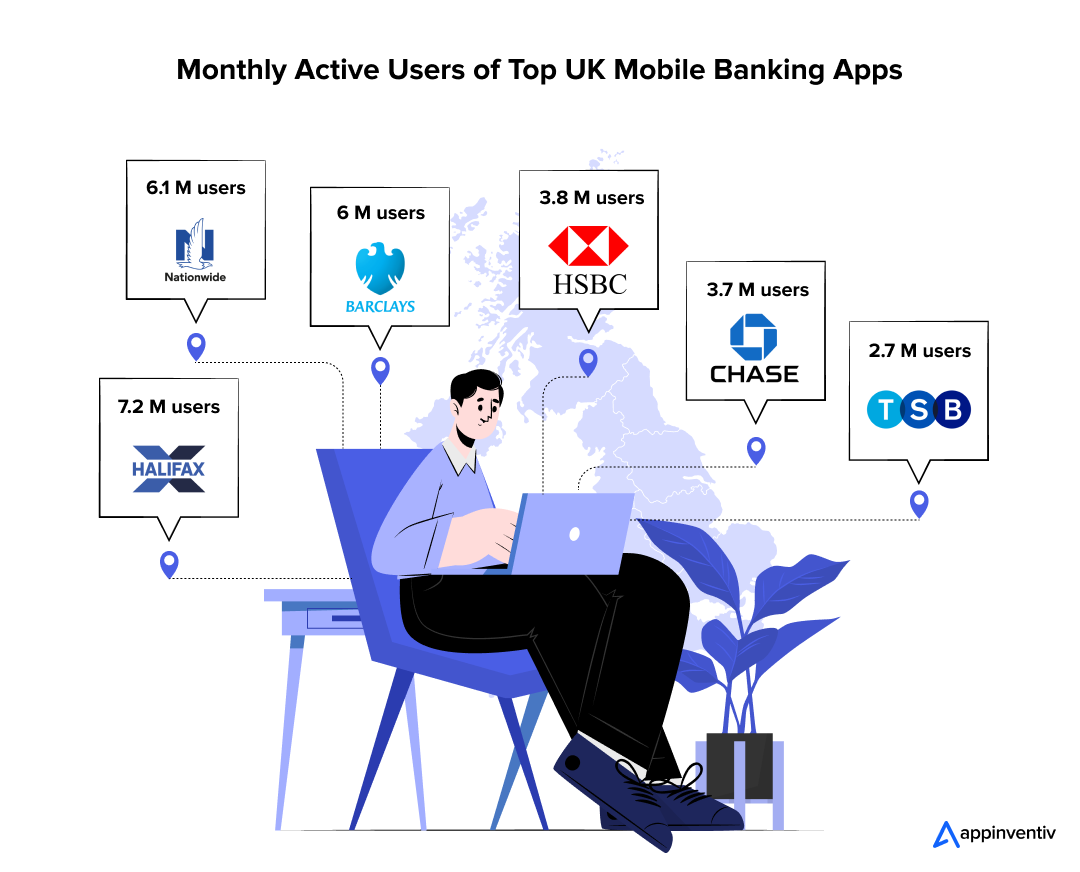

- Halifax Banking App: Why It’s a UK Favourite in 2025

- Why is the Halifax Banking App Popular in the UK?

- Halifax-like Banking App Development Cost in the UK

- Basic Banking App

- Medium Complexity Banking App

- High-End Banking App

- How to Lower the Cost to Develop a Banking App Like Halifax

- Key Features of a Halifax-Like Banking App

- Everyday Banking & Financial Management

- Home & Mortgage Management

- Borrowing & Credit Management

- Savings & Investments

- Insurance & Protection

- Security & Authentication

- Profile & App Customization

- Payments & Transfers

- Statements & Document Management

- Design Considerations for a High User Adoption-Friendly Banking App

- Intuitive Navigation & Information Architecture

- Visual Hierarchy & Readability

- Personalized User Experience

- Motion Design & Micro-Interactions

- Seamless Cross-Platform Consistency

- Accessibility & Inclusive Design

- Security-First UI & Trust Signals

- Technology Stack for a Halifax-Like Banking App

- Frontend Development

- Backend Development

- Database Management

- Security & Compliance

- Payment & Banking Integrations

- Cloud & Infrastructure

- AI & Analytics

- Development Process for a Halifax-Like Banking App

- Discovery & Planning (2-4 Weeks)

- UI/UX Design (4-6 Weeks)

- Core Development (4-8 Months)

- Security Implementation (Ongoing During Development)

- Testing & Compliance (2-3 Months)

- Deployment & Maintenance (Ongoing Costs)

- Challenges & Solutions: How to Get an Edge Over Halifax

- Ensure App Reliability and Accessibility

- Improve Customer Support Responsiveness

- Optimize App Performance Across Devices

- Strengthen Security and Authentication

- Enhance Accessibility for a Wider Audience

- Appinventiv’s Role in Your Banking Journey

- Smart Development Planning to Minimize Costs

- Pre-Built Fintech Solutions for Faster and Cost-Efficient Development

- Optimizing Infrastructure for Long-Term Cost Savings

- Security-First Approach to Avoid Expensive Fixes Later

- Post-Launch Maintenance and Cost Control

- Global Talent Pool for Cost-Effective Development

- FAQs

The way people bank has changed dramatically. Gone are the days of waiting in long queues or rushing to a branch before closing hours. Today, mobile banking apps like Halifax have redefined convenience, allowing users to check balances, transfer funds, pay bills, and even apply for loans from their smartphones, anytime and anywhere.

This shift presents an exciting opportunity for entrepreneurs and fintech innovators. The demand for secure, feature-rich banking apps is higher than ever, but so is the complexity of building one. Developing a financial app isn’t just about coding an interface; it involves regulatory compliance, advanced security measures, seamless third-party integrations, and a user experience that meets high customer expectations.

So, what does it take to build an app like Halifax? And more importantly, how much does it cost to develop a banking app like Halifax?

The answer is £300,000 – £600,000+ ($400,000 – $800,000+), depending on several factors: the features you include, the technology stack you choose, the security protocols required, and whether you build in-house or outsource to an experienced fintech app development company in the UK.

In this article, we break down the development process, key cost drivers, and strategic considerations you need to keep in mind when you are out to build a banking app like Halifax in the UK. Whether you’re an established financial institution or a startup looking to disrupt the industry, understanding these elements is crucial before investing.

Halifax Banking App: Why It’s a UK Favourite in 2025

The official Halifax App comes straight from one of the top UK banks, Halifax, which is part of the Lloyds Banking Group family. You can get it whether you’re Team iOS or Team Android, and it lets you tackle almost all your regular bank stuff without ever having to walk into an actual bank branch.

Why is the Halifax Banking App Popular in the UK?

In our world of “if you need something, there’s an app for it,” Halifax didn’t just create any old app – they crafted a top-notch one. Here’s why UK users can’t get enough:

- Smooth, Straightforward User Experience: This app has a sleek, easy-to-understand layout. Forget about complicated menus, delays, or digital migraines. Zip in, handle your finances, and zip out—you’re done before a minute’s up.

- Instant Alerts on Spending: Every transaction triggers an instant alert on your device. Forget those “what happened to my cash?” panics. Every purchase, sneaky snack, or big bill payment pops up without delay.

- Quick Biometric Sign-in: The sweet blend of tight security and speedy access. Halifax brings in Touch ID and Face ID for signing in, speeding things up while keeping your details on lockdown. For folks fed up with keeping long passwords in their heads, it’s a score.

- Immediate Card Controls: Misplaced your card at a music fest? Chill out. Lock your card using the app, and unlocking it is a breeze if you spot it under your car seat afterwards.

- Peek at Your Balance Quick: Want to check how much dough you’ve got? Use the “Balance Peek” and do it hassle-free—no need to sign in. It’s super useful when you’re about to grab another oat milk latte and need to know if you’ve got the funds.

- Transfers & Splitting Bills Is a Snap: Do you need to repay your buddies? Want to set up a regular transfer? The Halifax app makes shuffling cash a breeze—even when your pals bank elsewhere.

- Money Management Gadgets: Keep an eye on what you’re shelling out for, like food, trips, or dining out. The app breaks it down so you can see where your dough is draining. It gives you a heads-up if you start going overboard with spending. It’s as if you’ve got a finance guru chilling in your pocket.

- Customizable Notifications and Spending Limits: Set up spending caps and notifications. Fancy a heads-up when your grub expenses touch £500? The app’s got your back, nudging you without being too pushy.

- Talk Help Anytime: Stuck at 2 a.m. and need a hand? The Halifax app has chat built right in, and snagging support is a breeze—forget hanging on the line or wrestling with pesky IVR prompts.

Halifax-like Banking App Development Cost in the UK

The cost to develop a mobile banking app like Halifax is directly tied to its complexity. A simple app with basic banking features costs significantly less than a high-end app with AI-driven analytics and fraud detection. Let’s break down each complexity level in detail.

Basic Banking App

When you build a Halifax-like mobile banking app at its basic stage, it will be deemed ideal for startups or financial institutions looking to launch a simple, secure digital banking solution. Estimated Cost of Building a Mobile Banking App in the Basic Category:

UK: £80,000 – £150,000

US: $100,000 – $180,000

Development Time: 4 – 6 months

The efforts would include:

- User Registration & Login – Secure sign-up using email, phone number, or social authentication.

- Account Management – Users can check balances, view transactions, and update account details.

- Fund Transfers – Transfers between accounts within the same bank or external accounts.

- Bill Payments – Ability to pay utility, phone, or credit card dues.

- Basic Security Features – Password protection, encrypted transactions, and simple authentication.

Medium Complexity Banking App

Investing in custom mobile banking app development with more sophisticated features is suggested for businesses looking to compete with established banking apps. Banking App Development Cost:

UK: £150,000 – £300,000

US: $180,000 – $400,000

Development Time: 6 – 10 months

Features include:

- Multi-Factor Authentication – Banking uses multifactor authentication systems in different ways. Login verification uses SMS, biometrics (fingerprint/Face ID), or authentication apps.

- Personal Finance Management – Budgeting tools, spending analytics, and transaction categorization.

- In-App Customer Support – Chat support, FAQs, and AI-powered helpdesk features.

- Push Notifications & Alerts – Banking uses push notifications strategically to get real-time updates on transactions, low balances, and security alerts.

- Card Management – Users can freeze/unfreeze cards, request new cards, or manage limits.

High-End Banking App

When you aim to build a mobile Banking app in the high-end category, it should integrate cutting-edge technology, providing a superior digital banking experience with automation, personalization, and enhanced fraud detection. Estimated Development Cost:

UK: £300,000 – £600,000+

US: $400,000 – $800,000+

Development Time: 10 – 18 months

Features include:

- AI-Powered Financial Insights – AI in banking ensures functionalities like smart budgeting, predictive analytics, and automated investment suggestions.

- Chatbots & Virtual Assistants – AI-driven chatbots for instant query resolution and transaction assistance.

- Biometric & Behavioral Authentication – Voice recognition, keystroke dynamics, and other advanced identity verification methods.

- Fraud Detection & Risk Analysis – AI-based monitoring of transactions to flag suspicious activities in real time.

- Open Banking API Integration – Allows users to connect external bank accounts and manage finances across multiple providers.

- Cryptocurrency & Digital Payments – Support for crypto transactions and digital wallets.

This level of app is best suited for major banks or fintech companies aiming to provide a next-gen digital banking experience with high-end security and AI-driven features.

[Also Read: How Much Does It Cost to Develop a Banking App Like HSBC]

How to Lower the Cost to Develop a Banking App Like Halifax

While you build a banking app like Halifax in the UK, it would require a significant investment, but the costs can be optimized with smart planning:

- Start with an MVP – Launch with core features like account management and transfers, then expand based on user feedback. You can also build an AI MVP for Your Product.

- Use Pre-Built APIs and SDKs – Integrate third-party solutions for payments, authentication, and fraud detection instead of developing from scratch.

- Choose Cross-Platform Development – Frameworks like Flutter or React Native reduce development time and costs by supporting iOS and Android.

- Outsource Strategically – Hiring developers from Eastern Europe or South Asia can cut costs by 40-50% while maintaining quality.

- Opt for Cloud-Based Infrastructure – Using AWS, Google Cloud, or Azure eliminates expensive on-premise server costs.

- Automate Testing & Deployment – CI/CD pipelines and automated testing reduce development time and minimize bugs.

- Consider White-Label Solutions – Platforms like Mambu or Finastra offer customizable banking solutions at a lower cost than full custom development.

By focusing on these efficient strategies to lower the banking app development cost in the UK, businesses can build a secure and scalable banking app. However, the key here is to ensure that quality doesn’t get affected – something that would require a proper choice of features, design system, technology, and a cost-effective development process.

Key Features of a Halifax-Like Banking App

The process to create a mobile banking app must go beyond basic transactions, offering an intuitive, feature-rich experience that enhances financial management. The best solutions provide real-time insights, seamless money movement, and top-tier security, all while maintaining a user-friendly interface. Below are the core functionalities that make a Halifax-like banking app both powerful and indispensable, while having a role in the fintech app development pricing in the UK.

Everyday Banking & Financial Management

- At-a-Glance Account Overview – Displays all linked bank accounts, credit cards, and balances in one place.

- Transaction Insights & Spending Summaries – Categorizes spending patterns and offers budgeting tools.

- Payment Reminders & Alerts – Notifies users of upcoming bills, due payments, and low balances.

- Cashback & Rewards Integration – Provides access to cashback offers and personalized rewards.

Home & Mortgage Management

- Mortgage Overview & Payment Management – AI in the mortgage lending industry enables you to track mortgage balances, equity, and repayment schedules.

- Property Valuation & Home Insights – Offers real-time home value estimation and ecosystem monitoring.

- Green Home Initiatives & Energy Savings – Suggests eco-friendly home upgrades and exclusive green offers.

Borrowing & Credit Management

- Centralized Loan & Credit Tracking – Manages credit cards, personal loans, and overdrafts in one place.

- Real-Time Credit Score Monitoring – Displays credit score trends with tips to improve ratings.

- Pre-Approved Loan Offers & Calculators – Provides personalized borrowing options based on financial history.

Savings & Investments

- Easy Money Transfers Between Savings & Current Accounts – Enables one-tap transfers.

- Multi-Bank Savings Overview – Aggregates savings data from different banks for a complete financial picture.

- Investment Portfolio Tracking – Displays stocks, mutual funds, and other accounts.

- Goal-Based Savings & Automated Round-Ups – Helps users save towards specific goals with automated deposits.

Insurance & Protection

- Integrated Insurance Management – Centralized home, auto, life, and travel insurance access.

- Coverage Insights & Renewal Reminders – Notifies users about upcoming policy renewals.

- Gap Analysis & Personalized Insurance Offers – Insurance data analytics suggest additional coverage based on financial standing.

Security & Authentication

- Biometric Login & Multi-Factor Authentication (MFA) – Supports Face ID, fingerprint login, and two-step authentication.

- Card & PIN Management – Users can freeze/unfreeze cards, request PIN reminders, or set spending limits.

- Fraud Detection & Real-Time Alerts – Fraud detection using machine learning makes it easy to detect suspicious activities quickly.

Profile & App Customization

- Personalized Dashboard & Themes – Allows users to customize app layout, widgets, and themes.

- Notification & Alert Preferences – Let users tailor push notifications, SMS alerts, and email updates.

- Accessibility & Multi-Language Support – Includes voice control, text-to-speech, and language customization.

Payments & Transfers

- Faster Payments & Direct Debits – AI in the payments industry supports bank-to-bank transfers, standing orders, and one-off payments.

- Contactless & QR Code Payments – Enables instant transactions using NFC or QR-based payments.

- Recurring Payment Management – Allows users to view, modify, or cancel subscriptions and standing orders.

Statements & Document Management

- Digital Statements & Transaction History – Provides downloadable bank statements and categorized transaction records.

- Tax & Expense Reports – Generates financial summaries for tax filing or business expense tracking.

- Document Vault for Secure Storage – Stores scanned copies of essential documents like ID proofs and tax returns.

Design Considerations for a High User Adoption-Friendly Banking App

A banking app’s success isn’t just about features—it’s about how effortlessly users interact with them. This is what defines the success of the efforts you take to build a Halifax-like mobile banking app.

App design process should prioritize clarity, accessibility, and engagement while maintaining a professional and trustworthy aesthetic. Moreover, on the UI front, every touchpoint, from navigation to micro-interactions, should enhance user confidence and experience.

Intuitive Navigation & Information Architecture

One way to create a mobile banking app is to ensure users can access key functions without friction. The interface should be minimalistic yet informative, presenting a clean dashboard with categorized financial insights. Navigation should follow a three-tap rule, meaning any critical action, like checking balances, transferring money, or viewing statements, should be accessible within three taps.

A bottom navigation bar with clearly defined sections (Accounts, Payments, Insights, Profile) improves usability, while a search function allows quick access to transactions and settings.

Visual Hierarchy & Readability

Finance apps handle dense information, making typography and contrast essential. A well-spaced, scalable font (like Montserrat or Lato) ensures readability, even in low-light settings. High-contrast UI elements – such as dark backgrounds with light text or vice versa – enhance accessibility. Color coding is also crucial; for instance, green for income, red for expenses, and neutral shades for balances help users quickly interpret data.

Personalized User Experience

A modern banking app should adapt to user preferences. Features like customizable dashboards, theme selection (dark/light mode), and AI-driven insights that adjust based on spending habits can improve engagement. Widgets offering real-time spending insights, savings progress, and upcoming payments add personalization without cluttering the interface.

Motion Design & Micro-Interactions

Motion design makes your app experience-grade. Subtle animations enhance the user experience without overwhelming functionality. Smooth transitions, such as a slight bounce when swiping between accounts, make interactions feel natural. Micro-interactions, like a checkmark animation when a payment is successful or a visual cue when setting spending limits, create an intuitive and rewarding experience. However, animations must be optimized to avoid delays in loading times.

Seamless Cross-Platform Consistency

Users switch between devices, so the app should deliver a consistent experience across mobile, tablet, and web interfaces. When you build a mobile banking app, focus on a responsive design framework that ensures elements adjust dynamically, whether viewed on a 5-inch phone screen or a desktop monitor. Maintaining UI uniformity across platforms strengthens brand recognition and user trust.

Accessibility & Inclusive Design

A banking app must cater to all users, including those with disabilities. This means offering:

- Voice navigation for visually impaired users.

- Color-blind friendly palettes with sufficient contrast.

- Dynamic text resizing to accommodate different visual needs.

- Haptic feedback for users who rely on touch-based interactions.

Security-First UI & Trust Signals

Users need to feel secure when handling finances digitally. The design should incorporate visual trust cues, such as:

- Lock icons for encrypted transactions.

- Biometric authentication prompts are placed conveniently at login screens.

- A persistent security status bar that confirms a secure session.

Technology Stack for a Halifax-Like Banking App

Building a secure, high-performance banking app requires a carefully selected technology stack. From frontend frameworks to security protocols, every choice impacts scalability, speed, and reliability. Below is a breakdown of the key technologies needed to build a banking app like Halifax in the UK.

Frontend Development

A banking app’s UI must be fast, responsive, and visually engaging across multiple devices. Technologies include:

- Mobile Development: Swift (iOS), Kotlin (Android), React Native (cross-platform), Flutter (cross-platform)

- Web Interface (if applicable): React.js, Angular, Vue.js

- UI Frameworks: Material Design (Android), UIKit (iOS), Tailwind CSS

Backend Development

The backend powers the app’s functionality, handling transactions, authentication, and real-time data processing. Recommended technologies:

- Programming Languages: Node.js, Python (Django, Flask), Java (Spring Boot), .NET Core

- API Development: RESTful APIs, GraphQL, gRPC

- Frameworks for Microservices: Spring Boot, Express.js, FastAPI

Database Management

A secure, high-speed database is critical for handling financial data and transaction histories.

- Relational Databases (Structured Data): PostgreSQL, MySQL, Microsoft SQL Server

- NoSQL Databases (Scalability & Speed): MongoDB, Firebase, Firestore

- Caching for Performance: Redis, Memcached

Security & Compliance

Security is non-negotiable in a financial app. Implementing robust security frameworks is essential for user trust.

- Encryption Standards: AES-256, SSL/TLS encryption

- Authentication & Authorization: OAuth 2.0, OpenID Connect, JWT (JSON Web Tokens)

- Biometric Authentication: Apple Face ID/Touch ID, Android Biometrics API

- Fraud Detection & AI Security: IBM Trusteer, Feedzai, Socure

Payment & Banking Integrations

When you build a Halifax-like mobile banking app, it must integrate with various third-party payment gateways and financial APIs.

- Payment Gateways: Stripe, PayPal, Adyen, Worldpay

- Open Banking APIs (UK Market): TrueLayer, Yapily, OpenWrks

- Card Processing: Visa Developer API, Mastercard API

Cloud & Infrastructure

A scalable cloud infrastructure ensures uninterrupted performance and real-time processing.

- Cloud Providers: AWS (EC2, S3, Lambda), Google Cloud, Microsoft Azure

- Containerization & Orchestration: Docker, Kubernetes

- Serverless Computing: AWS Lambda, Google Cloud Functions

AI & Analytics

Choosing the right AI tech stack is crucial in enhancing financial tracking and fraud prevention.

- Data Processing & Analytics: Apache Spark, BigQuery, Snowflake

- AI for Customer Insights: TensorFlow, PyTorch

- Chatbots & Virtual Assistants: Google Dialogflow, Amazon Lex

A well-chosen tech stack ensures app security and compliance. It lays the foundation for a seamless and future-proof digital banking experience, preventing the long-term fintech app development pricing in the UK from spiraling.

Development Process for a Halifax-Like Banking App

Developing a banking app is a multi-stage process that requires meticulous planning, secure coding practices, and rigorous testing. Each phase affects the final cost to develop a banking app like Halifax, and strategic decisions can significantly impact the overall budget. Below is a structured breakdown of the development process and its impact on the cost of building a mobile banking app.

Discovery & Planning (2-4 Weeks)

Before development begins, a thorough discovery phase is crucial. This includes:

- Defining core functionalities, integrations, and compliance requirements.

- Conducting market research and competitor analysis.

- Wireframing and UI/UX prototyping.

- Creating a development roadmap and budget estimation.

Cost Impact: Early planning prevents costly scope changes later. A well-defined roadmap can reduce unnecessary rework and save up to 20-30% of additional expenses.

UI/UX Design (4-6 Weeks)

A well-designed banking app should be visually appealing and intuitive. Key tasks include:

- Designing wireframes, high-fidelity UI mockups, and user flows.

- Testing prototypes for usability and accessibility.

- Ensuring brand consistency across platforms.

Cost Impact: Depending on complexity, a sophisticated UI/UX design can cost between £15,000 and £30,000 ($18,000 and $38,000). However, investing in user experience early reduces drop-off rates and redesign costs.

Core Development (4-8 Months)

This is the most resource-intensive stage where front-end and back-end development takes place.

- Frontend Development: Building responsive, accessible interfaces.

- Backend Development: Setting up secure databases, APIs, and business logic.

- Third-Party Integrations: Payment gateways, open banking APIs, and fraud detection tools.

Cost Impact:

- A basic banking app with essential features costs around £70,000-£120,000 ($85,000-$150,000).

- A mid-range app with AI insights and open banking APIs can reach £150,000-£250,000 ($180,000-$310,000).

- A full-fledged app with complex AI, investment tracking, and real-time analytics may exceed £300,000 ($370,000+).

Security Implementation (Ongoing During Development)

Since banking apps deal with sensitive data, robust security layers must be integrated at every stage:

- End-to-end encryption, multi-factor authentication, and biometric login.

- AI-driven fraud detection and real-time transaction monitoring.

- Compliance with UK banking regulations like PSD2 and FCA guidelines.

Cost Impact: Security accounts for 10-20% of total banking app development cost in the UK. Cutting corners here can lead to compliance fines and reputational damage, making security a non-negotiable investment.

Testing & Compliance (2-3 Months)

A banking app must undergo extensive testing to ensure performance, security, and compliance:

- Unit & Integration Testing: Ensuring all components work as expected.

- Penetration Testing: Identifying and fixing security vulnerabilities.

- Compliance Audits: Meeting the UK’s financial regulations.

- Beta Testing: Gathering user feedback before launch.

Cost Impact: Comprehensive testing can add £20,000-£50,000 ($25,000-$60,000) to the budget but prevents costly post-launch fixes and security breaches.

Deployment & Maintenance (Ongoing Costs)

After launch, continuous monitoring, updates, and customer support are essential.

- Server Scaling: Handling increasing user loads.

- Regular Security Patches: Protecting against new cyber threats.

- Feature Updates: Enhancing functionality based on user feedback.

Cost Impact:

- Monthly maintenance costs range from £5,000-£20,000 ($6,000-$25,000), depending on the app’s complexity.

By strategically planning each development phase, entrepreneurs can optimize the banking app cost estimate without compromising security and functionality.

Challenges & Solutions: How to Get an Edge Over Halifax

To develop a banking app that outperforms Halifax, it’s crucial to address the issues users commonly face with the former and introduce strategic improvements.

Ensure App Reliability and Accessibility

Issue:

Halifax users frequently report service outages, making accessing accounts and performing transactions difficult.

Improvements:

- Invest in a scalable cloud infrastructure to handle high traffic and minimize downtime.

- Implement real-time monitoring to detect and fix issues before they impact users.

- Improve outage communication by sending timely updates through push notifications and emails.

Improve Customer Support Responsiveness

Issue:

Many users complain about unresponsive or ineffective customer service.

Improvements:

- Provide 24/7 customer support via in-app chat, phone, and email.

- Train support teams to offer quick, informed, and empathetic assistance.

- Use AI-powered chatbots for instant responses to common queries.

Optimize App Performance Across Devices

Issue:

Users report frequent glitches, crashes, and slow load times.

Improvements:

- Conduct extensive device and OS compatibility testing before every update.

- Roll out incremental updates to fix minor bugs without disrupting user experience.

- Implement performance monitoring tools to track and improve speed and responsiveness.

Strengthen Security and Authentication

Issue:

Users experience issues with biometric login failures and security inconsistencies.

Improvements:

- Ensure biometric authentication (Face ID, fingerprint) remains stable across updates.

- Conduct frequent security audits to eliminate vulnerabilities.

- Communicate security changes transparently to users to maintain trust.

Enhance Accessibility for a Wider Audience

Issue:

The Halifax app lacks comprehensive accessibility features for users with disabilities.

Improvements:

- Integrate screen reader compatibility, voice navigation, and customizable text sizes.

- Follow WCAG (Web Content Accessibility Guidelines) for inclusive app design.

- Conduct usability testing with diverse user groups to refine accessibility features.

By implementing these strategies, your app can offer a superior, more reliable, and user-friendly banking experience compared to Halifax.

Appinventiv’s Role in Your Banking Journey

Building a banking app with Halifax’s level of functionality and security can be costly. However, with the right development strategy and an experienced fintech development partner, this banking app development cost in the UK can be optimized without sacrificing performance, security, or user experience.

Appinventiv, a renowned UK-based financial app development services provider, specializes in creating scalable, feature-rich fintech solutions tailored to modern business needs. We prioritize both cost-effectiveness and technical precision throughout every phase of the development lifecycle.

Smart Development Planning to Minimize Costs

A significant part of the cost to develop a mobile banking app like Halifax comes from inefficient planning. Appinventiv follows a structured development approach, ensuring that no resources are wasted. We conduct:

- In-depth requirement analysis to define must-have and good-to-have features, preventing unnecessary expenses.

- MVP development to test the market with essential functionalities before scaling further.

- Iterative development cycles allow you to gradually optimize costs by adding features based on user feedback.

Pre-Built Fintech Solutions for Faster and Cost-Efficient Development

Instead of building everything from scratch, we utilize pre-built fintech modules for essential banking functionalities, which brings the banking app development cost in the UK further down:

- User authentication & biometric login

- Secure payments & transactions

- AI-driven customer support chatbots

- Personalized financial dashboards

We significantly cut down development costs and time-to-market by leveraging these pre-developed components.

Optimizing Infrastructure for Long-Term Cost Savings

The operational cost to develop a banking app like Halifax is fairly high due to inefficient cloud and backend management. At Appinventiv, we:

- Choose the right cloud service (AWS, Azure, or Google Cloud) based on your scalability needs and budget.

- Optimize database architecture to ensure your app runs smoothly while reducing storage costs.

- Implement serverless computing where applicable, reducing infrastructure maintenance costs.

Security-First Approach to Avoid Expensive Fixes Later

Banking apps require top-tier security due to the sensitive nature of financial transactions. Fixing security vulnerabilities post-launch can be costly and damage your reputation. Through our mobile app development services in the UK, we ensure:

- End-to-end encryption for all transactions and sensitive data storage.

- Multi-layer authentication systems that are both user-friendly and hacker-proof.

- Regular penetration testing to identify and resolve security gaps before they turn into costly threats.

Post-Launch Maintenance and Cost Control

The answer to how much does it cost to make a banking app doesn’t end at deployment. Ongoing maintenance, feature updates, and security patches can drive up costs. Our team helps you:

- Reduce long-term expenses by implementing an efficient DevOps strategy.

- Monitor app performance using advanced analytics, helping prevent costly downtime.

- Automate updates to fix bugs and introduce improvements without unnecessary manual intervention.

Global Talent Pool for Cost-Effective Development

We offer access to a diverse team of fintech experts across different regions, ensuring world-class development at a competitive cost. Whether you need end-to-end development or specific expertise, we tailor our engagement model to fit your budget and project needs.

With Appinventiv, you get a Halifax-like banking app and a cost-optimized, future-ready fintech solution that balances performance, security, and scalability. Our expertise in fintech app development ensures that you maximize value while staying within budget, so your answer to how much it cost to create a mobile banking app is always less than that of your counterparts.

FAQs

Q. How much does a fintech app cost in the UK?

A. The banking app development cost in UK depends on various factors, including app complexity, security requirements, and compliance with financial regulations. Here’s a rough estimate:

- Basic fintech app (e.g., budgeting app, expense tracker): £40,000 – £80,000

- Mid-range fintech app (e.g., digital wallets, personal finance management tools): £80,000 – £150,000

- Advanced fintech app (e.g., investment platforms, lending apps, challenger banks): £150,000 – £400,000+

Additional costs may arise for third-party integrations, cloud infrastructure, and ongoing maintenance.

Q. How much does it cost to develop a banking app like Halifax in the UK?

A. A full-scale banking app like Halifax requires secure transactions, AI-powered features, fraud prevention systems, and compliance with UK financial regulations, making it a high-investment project. Approximate cost to develop a banking app like Halifax:

- MVP (Minimum Viable Product) version: £120,000 – £200,000

- Full-scale banking app with advanced features: £250,000 – £600,000+

Pre-built fintech modules, cloud-based infrastructure, and an experienced fintech development partner can streamline the process and optimize costs.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does Accounting Practice Management Software Development Cost in Australia 2026?

Key takeaways: Custom accounting practice management software development in Australia for mid-to-large firms generally falls between AUD 70,000 and AUD 700,000. Adherence to the Privacy Act 1988 and ATO operational frameworks is a primary cost driver, not an add-on. A modular architecture and structured development approach ensure that the platform evolves with changing laws and…

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…