- Why Are Chatbots in Banking Becoming Core Service Channels?

- What Are the Adoption Challenges of Chatbots in Banking?

- Customer Trust and Adoption

- Integration with Core Banking Systems

- Security and Regulatory Compliance

- Language and Context Accuracy

- Internal Change Management

- What Are the Enterprise Applications of AI Chatbots in Banking?

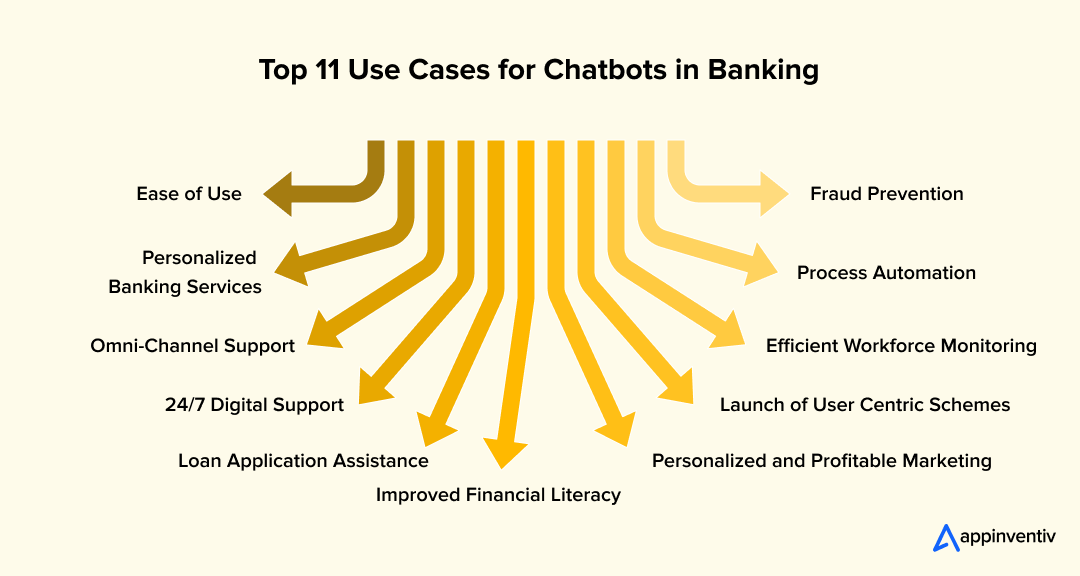

- What Are the Potential Use Cases for Chatbots in Banking?

- 1. Ease of Use

- 2. Personalized Banking Services

- 3. Omni-Channel Support

- 4. 24x7 Digital Support

- 5. Efficient Loan Application Assistance

- 6. Fraud Prevention

- 7. Personalized and Profitable Marketing

- 8. Launch of User-centric Schemes

- 9. Efficient Workforce Functioning

- 10. Process Automation

- 11. Improved Financial Literacy

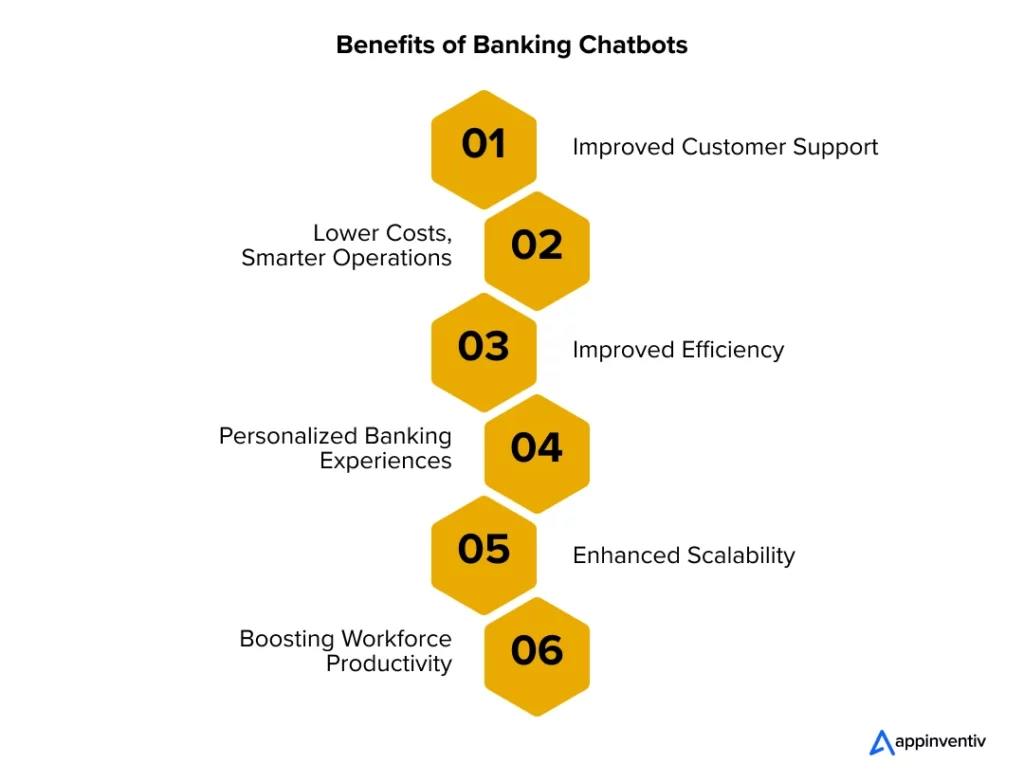

- What Are the Key Benefits of Chatbots in Banking for Enterprises?

- Improved Customer Support

- Lower Costs, Smarter Operations

- Operational Efficiency at Scale

- Personalized Banking Experiences

- Enterprise-Grade Scalability

- Workforce Productivity Enablement

- How Should Banks Implement AI Chatbots in Banking Successfully?

- 1. Start With Business And Service Objectives

- 2. Prepare Data And System Access

- 3. Design Conversational Journeys Before Technology

- 4. Select The Right Ai And Deployment Architecture

- 5. Embed Compliance And Security From Day One

- 6. Measure, Learn, And Improve Continuously

- How Do LLM-Powered Banking Chatbots Scale Securely?

- Contextual Understanding Layer

- Enterprise Data Retrieval Layer

- Response Governance and Risk Controls

- Continuous Learning and Performance Monitoring

- Security and Compliance Enforcement

- What ROI Can Enterprises Expect from AI Chatbots in Banking?

- Real-World Examples of Banking Chatbots

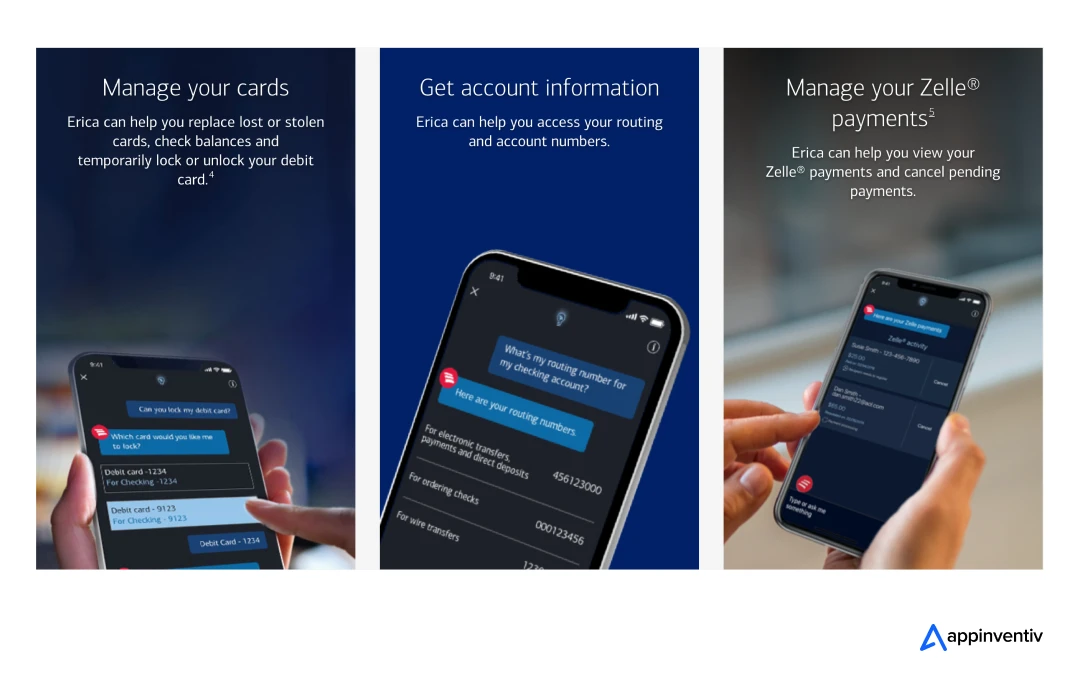

- Erica

- Ally Assist

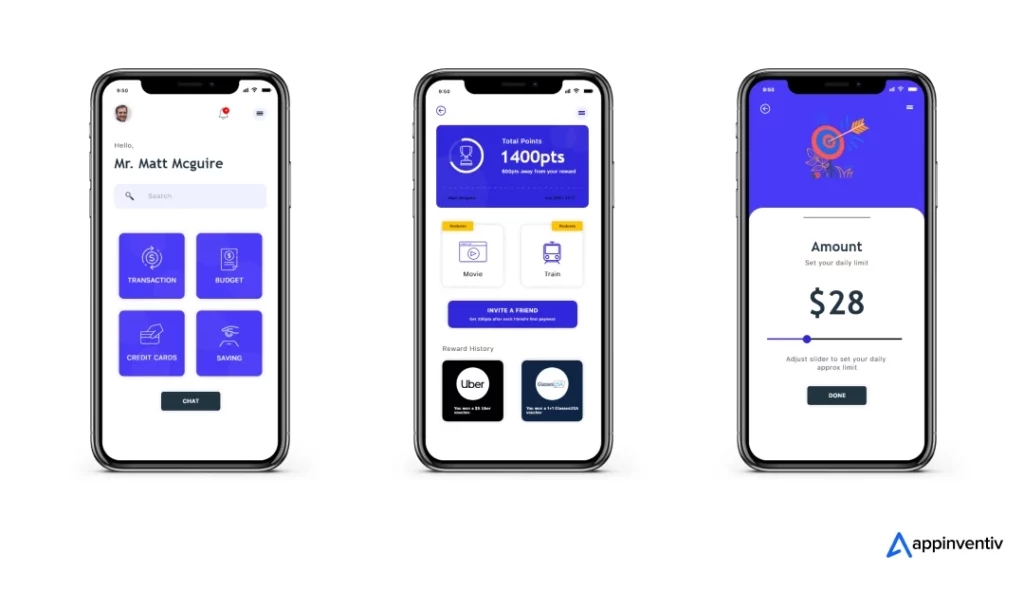

- Mudra

- What is the Banking Chatbot Development Cost

- What are the Key Chatbot Trends in Banking?

- How Can Appinventiv Help You with Banking Chatbot Development?

- FAQs

Key Takeaways

- AI banking chatbots transform customer service into always-available, compliant digital engagement channels.

- Conversational AI integrates with core banking systems to scale secure, personalized service delivery.

- Enterprise chatbots reduce operational costs while improving response speed and customer trust.

- LLM-powered architectures enable accurate, context-aware banking assistance with built-in risk controls.

The banking industry faces growing pressure to manage high customer query volumes while delivering round-the-clock service without inflating operational costs. Traditional support models often struggle to keep pace with rising expectations for instant, always-on assistance.

Customers want answers immediately. Delays or rigid IVR systems quickly lead to frustration and erode trust.

For context, a Deloitte survey of 2,027 U.S. banking customers found that 37% have never interacted with a banking chatbot, indicating considerable room for broader adoption. Among users, 60% rely on chatbots for technical support and 53% for questions about existing accounts, but only 27% trust bots for financial advice. Despite availability, 74% still prefer human agents for routine service, highlighting that many deployments remain frustrating rather than delightful.

Now imagine your customers navigating a clunky menu system while trying to solve a simple problem. In a competitive market, poor digital experiences are not an option. At the same time, repetitive service requests consume resources that could be better applied to complex, high-value interactions.

This is where chatbots in banking step in.

Powered by AI, conversational chatbots replace rigid menu-based systems with instant, contextual support, making financial chatbots a core digital service layer. They resolve routine queries, maintain service continuity, and free human teams to focus on complex needs. Today, conversational banking is moving from a convenience feature to a core service channel.

Banking AI chatbots mark the next phase in digital transformation, unlocking new opportunities for efficiency, engagement, and scalable customer experience across chatbots for banks. Let’s explore them in detail.

Modernize customer service, reduce operational load, and deploy conversational AI aligned with banking compliance standards.

Why Are Chatbots in Banking Becoming Core Service Channels?

Open a mobile banking app during a busy afternoon. A card limit needs adjusting. A transaction looks unfamiliar. A quick answer is required. Customers expect these moments to resolve instantly.

That expectation is reshaping how banks design digital services and deploy AI chatbot banking capabilities.

What Customer Behavior Signals Show

- Self-service digital support is now the preferred channel for routine banking requests

- IVR and email-based service still drive higher session drop-offs

- Chat-based interfaces keep customers engaged through continuous conversations

- Users expect to stay in one channel without repeating information

What Is Driving the Shift

- Demand for immediate answers

- Preference for contextual conversations over ticket-based support

- Growing comfort with AI-driven self-service

How Enterprise Adoption Is Evolving

- Chatbots integrated into core banking and CRM systems across chatbots for banks

- Expansion from customer support into internal employee service

- Voice-enabled banking assistants are gaining adoption

- Proactive alerts replacing reactive service models

What This Means for Banking Leaders

- Conversational AI is now part of the core service infrastructure

- Experience design is the key competitive differentiator

- Frictionless interactions build digital trust and loyalty

The race is no longer about launching a chatbot. It is about delivering banking conversations that feel effortless at scale.

What Are the Adoption Challenges of Chatbots in Banking?

Let us be realistic for a moment. Launching a banking chatbot is not only a technology decision. It is a trust-and-operations decision. Many institutions discover this after early pilots struggle to gain adoption.

Here are the most common challenges in banking chatbots and how leading organizations address them.

Customer Trust and Adoption

When money is involved, customers hesitate. If a chatbot feels confusing or unreliable, they quickly abandon the interaction.

How banks solve it

- Design conversational flows that feel natural and guided

- Offer clear identity verification steps

- Provide a visible handoff to a human agent when needed

- Communicate how customer data is protected

The goal is simple. Make customers feel in control, not tested.

Integration with Core Banking Systems

A chatbot is only as strong as the data it can access. Legacy systems and fragmented platforms often limit real-time responses.

How banks solve it

- Use API orchestration layers to connect core banking, CRM, and payment systems

- Build middleware that standardizes data access

- Start with high-impact integrations, such as balance queries and transaction history

- Expand capability in controlled phases

This approach avoids disruption while gradually improving depth.

Security and Regulatory Compliance

Chatbots handle sensitive financial data. Any security gap creates risk.

How banks solve it

- Implement end-to-end encryption across conversations

- Apply multi-factor authentication for sensitive actions

- Maintain audit logs for every interaction

- Align chatbot operations with GDPR, PCI-DSS, and internal risk frameworks

- Conduct regular security and penetration testing

Security becomes part of the design, not a final checkbox.

Language and Context Accuracy

Financial queries are complex. If a chatbot misunderstands intent or gives incomplete answers, trust erodes fast.

How banks solve it

- Train models on domain-specific banking data

- Use contextual memory to retain conversation history

- Apply validation rules for high-risk responses

- Continuously retrain models based on real interactions

Accuracy improves through ongoing learning, not one-time deployment.

Internal Change Management

Even strong technology fails without organizational readiness. Teams may resist automation or struggle to adapt workflows.

How banks solve it

- Involve frontline teams early in chatbot design

- Train staff to manage escalations and oversight

- Define ownership across IT, compliance, and customer service

- Track performance metrics to show operational value

Adoption inside the organization is as important as adoption outside.

Banks that treat these challenges as design priorities launch chatbots that scale, earn trust, and deliver measurable impact. Those that ignore them often remain stuck in perpetual pilots.

What Are the Enterprise Applications of AI Chatbots in Banking?

Banking AI chatbots are becoming a core banking service layer, supporting customer experience, internal operations, and risk workflows through conversational interfaces. They enable always-on digital service, faster employee support, guided verification processes, and continuous customer engagement without increasing operational load.

This foundation allows banks to embed conversational intelligence directly into daily banking activities. The following use cases show how these capabilities translate into real banking interactions.

What Are the Potential Use Cases for Chatbots in Banking?

There are endless use cases for chatbots in banking and for chatbots for financial services operating at enterprise scale. Let’s explore some of them in detail to understand how a finance AI chatbot works to redefine the sector and enhance customer experience.

1. Ease of Use

Customers often get frustrated and leave the banking platform if asked to fill in their details repeatedly. Here, banking chatbots come to their rescue without compromising authenticity and security. The bot interacts with the customer and uses conversational elements to ensure authenticity. Besides, it lets the customers repeat their previous transactions/activities with a single command.

2. Personalized Banking Services

The AI-powered chatbots have simplified the process of account management. Standing in long queues at the bank and doing tedious paperwork to access banking services is history now. Today, users can check their bank balance, get a statement, transfer money, update their banking details, and perform many such processes with just a few taps on their phones. A user must answer a few questions, and the bot will complete the whole process. Isn’t it easy?

AI chatbots for FinTech allow customers to view a graphical representation of their transactions and give budget management advice to take their next financial step wisely. In a nutshell, a chatbot for finance empowers your customers to leverage the benefits of your different banking services without putting much effort and time into them.

3. Omni-Channel Support

With a wide range of communication channels available around, it is quite tricky for banks and financial institutions to reach their target audience and cater to their needs. They find it hard to plan for each communication channel – messaging service, website, app, emails, call – and get higher value from each platform. However, it is possible with chatbot development.

A bot can act effectively across all the platforms without having to be reprogrammed individually. They can even be integrated across social networking platforms such as WhatsApp, Instagram, Meta Messenger, etc. It can offer a holistic communication medium across all the platforms, providing ultimate services to customers in a way that fits their lifestyle. In other words, chatbots empower banks to offer omnichannel support without making a hole in their pocket.

4. 24×7 Digital Support

Unlike humans, AI chatbots for finance do not feel fatigued and enable the sector to deliver 24×7 assistance to their customers. The bots help customers with different tasks like updating their KYC details, getting familiar with new schemes and services, troubleshooting account-related issues, etc. The chatbots resolve the user queries in minimal time, acknowledge them about the same, and ask for the next command, which enables the users to ask multiple queries in a single conversation.

Customers need not get into the hassle of calling customer care centers and waiting for hours on the phone to get their common queries answered, such as:

- What is my current balance?

- What are the bank’s operating hours?

- How do I apply for a credit card?

- What is the interest rate on my loan?

- How do I open a savings account?

- What are the EMI options for personal loans?

- What is my eligibility to get a business loan?

Do you know that approximately 65% of customer queries are repetitive? This makes it practical to implement a voice-enabled bot to handle them efficiently. An AI chatbot for banks can quickly address these FAQs at any time of the day, no matter where you are.

5. Efficient Loan Application Assistance

Chatbots streamline the loan application process by offering step-by-step guidance, from eligibility checks to document submission. They answer user queries in real-time, reducing the need for manual intervention and ensuring clarity. Chatbots provide timely updates on application status and repayment schedules, creating a seamless and transparent experience for borrowers.

Also Read: Loan Lending App Development: Features & Costs

6. Fraud Prevention

Another reason behind the rising popularity of Chatbot banking apps is their functionality for fraud prevention. Chatbots constantly monitor the actions taken related to financial services, like withdrawing money, swiping a card, etc., in real-time. When suspecting an anomaly in the user’s banking behavior, they instantly notify the account holder, acknowledging the activities and allowing them to stop the transactions using a pre-customized command. This way, banking chatbot development empowers banks to prevent fraud and build customer loyalty. Thanks to AI chatbots in banking!

7. Personalized and Profitable Marketing

Banks provide a myriad of facilities. However, not all customers are familiar with all their banks’ perks and privileges. A chatbot understands human behavior and pushes the related banking service/products at the right time. This way, it promotes the banking services and increases the conversation rates without annoying users.

8. Launch of User-centric Schemes

Intranet-based chatbots learn from the user behavior and prompt them to share their feedback. With the insights obtained from all the branches, the chatbot helps the banking management to study the impact of their existing schemes and refine them or introduce new plans, if necessary.

9. Efficient Workforce Functioning

Employees are no longer required to log in to HRMS and request to access/update their details or apply for a leave. With the help of AI-powered chatbots, they can easily apply for leave, view their personal and payroll details, request overtime payments, check their compensation history, and much more. They can also interact with bots to get their doubts clear and work more efficiently. In short, the chatbot assists the employees and encourages them to work to their fullest potential without third-party intervention.

10. Process Automation

Finance AI chatbots also automate repetitive and time-consuming banking tasks like transaction monitoring, account updates, and bill payments. By leveraging AI, they handle these processes with precision and speed, reducing the workload on human staff. This enhances operational efficiency and minimizes errors, ensuring a smooth and reliable customer banking experience.

11. Improved Financial Literacy

Chatbots empower users with knowledge by breaking down complex financial concepts into easy-to-understand explanations. They provide personalized savings, investments, and credit management guidance, helping users make informed decisions. Chatbots facilitate a deeper understanding of financial products by engaging users with interactive tools and real-time assistance, promoting better money management habits.

A great example is EdFundo, a financial literacy app Appinventiv developed to educate young users about budgeting and saving through gamified learning. The app simplifies financial concepts by incorporating chatbot-driven interactions and encourages smarter money management from an early age.

$500K

Bagged Pre-Seed Funding

$3 Million

Prepared for seed funding

What Are the Key Benefits of Chatbots in Banking for Enterprises?

Banking chatbots have become a dire necessity for the financial sector, especially chatbots for financial services handling high-volume interactions, offering numerous advantages that address the needs of both banks and their customers. Here are some of the most common benefits of banking chatbots transforming the industry with their intelligent automation capabilities.

Improved Customer Support

Customers want immediate answers, especially when finances are involved. AI chatbots provide always-on assistance while offering clear paths to human agents when conversations require empathy or complex resolution. This balance between automation and human support is what builds long-term trust.

Lower Costs, Smarter Operations

Routine requests like balance checks, card status queries, and transaction confirmations no longer need manual handling. Chatbots absorb this volume, allowing service teams to focus on high-value cases. The result is lower service costs without sacrificing experience quality.

Operational Efficiency at Scale

As query volumes grow, human-only support models strain quickly. Conversational AI scales instantly, handles simultaneous conversations, and maintains consistent response quality. This ensures service continuity during peak demand periods.

Personalized Banking Experiences

Modern chatbots use customer context to deliver relevant guidance, product suggestions, and financial insights. When personalization is grounded in secure data access and transparent consent, it enhances engagement without compromising trust.

Enterprise-Grade Scalability

Chatbots that integrate with core banking systems, CRM platforms, and identity layers become true service channels, not isolated tools. This architecture allows banks to expand conversational services across mobile apps, web portals, and voice assistants seamlessly.

Workforce Productivity Enablement

Internal banking teams also benefit. Chatbots streamline HR requests, IT support, compliance queries, and knowledge access. Employees spend less time navigating systems and more time solving meaningful problems.

How Should Banks Implement AI Chatbots in Banking Successfully?

A banking chatbot project succeeds or fails long before the first line of code is written for any chatbot for financial services. The difference lies in preparation. Banks that treat conversational AI as a core service channel scale faster and avoid costly rework.

Here is a practical path enterprise teams follow when moving from concept to deployment.

1. Start With Business And Service Objectives

Every successful implementation begins with clarity on purpose. When goals are defined upfront, technology decisions become simpler and measurable.

- Reducing call center load

- Improving digital self-service

- Accelerating fraud response

- Supporting internal banking teams

Clear objectives shape conversation flows, integration needs, and success metrics from day one.

2. Prepare Data And System Access

A chatbot cannot deliver value without access to real banking data. This step ensures the assistant operates with accuracy, security, and context.

- Connect core banking and CRM systems

- Establish secure API and data access layers

- Define identity verification and permission controls

This foundation allows chatbots to respond with relevant, real-time information while remaining compliant.

3. Design Conversational Journeys Before Technology

Customers judge chatbots by experience, not algorithms. Planning conversation journeys first prevents frustration and builds confidence in automated support.

- Map high-frequency customer intents

- Create clear escalation paths to human agents

- Design transparent security confirmation steps

- Align chatbot tone with brand trust expectations

Thoughtful conversation design is where customer trust is earned.

4. Select The Right Ai And Deployment Architecture

Technology choices determine whether your chatbot remains a pilot or becomes a scalable service channel. Architecture must support growth, accuracy, and governance.

- NLP and LLM models adapted for financial language

- Secure cloud or on-prem deployment options for AI chatbot banking platforms

- Continuous learning and monitoring pipelines

- Accuracy, bias, and risk management controls

Strong architecture ensures reliability as conversation volumes increase.

5. Embed Compliance And Security From Day One

In banking, security is not an add-on. It is part of the design fabric and must be addressed before launch.

- GDPR and PCI-DSS alignment

- Encrypted data transmission and storage

- Secure authentication mechanisms

- Full audit trails and activity logging

Early compliance integration prevents costly redesign later.

6. Measure, Learn, And Improve Continuously

Conversational banking evolves with customer behavior. Ongoing measurement keeps performance high and experience consistent.

- Track resolution and containment rates

- Monitor escalation and failure patterns

- Review conversation transcripts

- Retrain models on emerging intents

Continuous improvement turns chatbots into long-term strategic assets.

Banks that follow this path move beyond experimentation. They deploy enterprise-grade conversational platforms that earn customer trust, reduce operational load, and scale across digital channels.

How Do LLM-Powered Banking Chatbots Scale Securely?

A modern banking chatbot is no longer a scripted decision tree but a foundation for financial chatbots operating in regulated environments. It is an intelligent conversational system that must understand financial language, access secure data, and respond with precision. This requires an architecture designed specifically for large language models.

Below is how leading banks structure LLM-powered conversational platforms.

Contextual Understanding Layer

For a banking chatbot to feel intelligent and trustworthy, it must understand not only what the customer is asking, but also who is asking and what financial context surrounds the request.

- Intent recognition tuned for banking terminology

- Context retention across multi-step conversations

- Identity and session awareness for secure continuity

Enterprise Data Retrieval Layer

Accurate answers in banking cannot come from public knowledge. They must come from verified internal systems that reflect real customer and transaction data.

- Retrieval-augmented generation using secure data sources

- API connections to core banking, CRM, and transaction systems

- Permission-based access to sensitive records

Response Governance and Risk Controls

In financial services, a single incorrect response can create operational or compliance risk. This layer ensures LLM outputs remain controlled, explainable, and safe.

- Guardrails to filter restricted actions and content

- Confidence scoring for response reliability

- Automated escalation to human agents when risk thresholds are met

Continuous Learning and Performance Monitoring

Customer needs change, banking products evolve, and language patterns shift. Ongoing learning keeps chatbot performance accurate and relevant.

- Conversation log analysis

- Intent drift detection

- Controlled retraining pipelines

- Ongoing accuracy and bias evaluation

Security and Compliance Enforcement

Every conversation in banking involves sensitive information. This layer ensures each interaction meets security expectations and regulatory obligations.

- Encrypted data exchange

- Tokenized identity verification

- Full audit trails of model responses

- Regulatory alignment with GDPR and PCI-DSS

Banks investing in LLM-powered chatbots gain more than automation. They build intelligent service platforms capable of scaling across customer service, fraud response, sales assistance, and internal operations. This architecture becomes a strategic digital asset, not a single-use tool.

What ROI Can Enterprises Expect from AI Chatbots in Banking?

Once a banking chatbot is live, leadership teams need clear performance signals. The metrics below reflect typical impact ranges observed in enterprise conversational AI deployments across financial services operations.

| Business Function | Key KPI | Typical Enterprise Impact |

|---|---|---|

| Customer Support Operations | Query containment rate | 60% to 85% of inbound queries handled without human intervention |

| Service Cost Optimization | Cost per customer interaction | 30% to 60% reduction compared to human-only support |

| Resolution Efficiency | Average query handling time | 50% to 90% faster response and closure |

| Customer Experience | Customer satisfaction score (CSAT) | 15% to 30% improvement after chatbot adoption |

| Call Center Load | Live agent workload | 40% to 70% reduction in repetitive requests |

| Fraud and Risk Operations | Fraud alert response time | 40% to 70% faster intervention cycles |

| Digital Engagement | Self-service usage rate | 25% to 50% increase in digital channel adoption |

| Internal Workforce Support | Employee query resolution time | 50% to 80% faster HR and IT request handling |

Banks typically use these KPIs to build internal business cases, forecast ROI timelines, and define chatbot performance dashboards post-launch. Actual results vary based on integration depth, data readiness, and conversation design maturity.

Real-World Examples of Banking Chatbots

An AI chatbot in banking is a game-changing technology that redefines the industry with its intelligent automation capabilities. These intelligent chatbots for banking offer real-world value through instant assistance and personalized interactions. Here are some leading examples of AI chatbots for banks and financial services:

Erica

One of the best examples of banking chatbots is Erica, a voice- and text-enabled BofA (Bank of America) bot that helps customers make smarter and faster banking decisions. The digital assistant sends personalized notifications, studies customer transactions, and identifies the areas where they could save money, facilitate bill pay service, and much more.

Ally Assist

Ally Assist – the personal digital assistant of Ally Bank is another example that proves the impact of AI-based chatbot services on the financial industry. Using natural language processing technology, the bot helps users monitor their accounts, pay bills, make transactions, track transactional patterns, etc. This way, the bot uplifts the customer experience by acting upon common customer service queries and making the bank representative free to perform complicated tasks.

Mudra

Mudra is another head-turning example of a banking AI chatbot that revolutionizes budget management for millennials. Appinventiv developed Mudra, which tracks user expenses and provides real-time alerts when spending exceeds set budgets. By incorporating interactive elements and gamified experiences, Mudra transforms traditional budgeting into an engaging and user-friendly process, making financial management both accessible and enjoyable for the younger generation.

Chatbot technology and Artificial Intelligence in banking make the sector efficient and effective by delivering contextual and personalized responses. Also, the AI-powered voicebots are now taking conversational banking a step further by enabling seamless, voice-driven customer experiences. The growing adoption of fintech app development in the banking sector proves the competitive benefit of investing in the technology over those who are still wondering about their next move.

What is the Banking Chatbot Development Cost

The cost of developing a banking AI chatbot varies widely, depending on various factors such as the product’s complexity, features, integrations, and the development approach. Additionally, the choice of a development team—an in-house team, a local agency, or an experienced offshore partner—also impacts costs. Other considerations like the chatbot’s deployment platform (mobile apps, web portals, or both), the geographical location of the AI chatbot development company, ongoing maintenance, and scalability requirements also influence the banking chatbot development costs.

The cost to develop an AI chatbot for banks ranges between $30,000 to $300,000 or more. Remember, it is just a rough estimate; banking chatbot development costs depend on your unique project requirements.

Here is a table outlining the banking chatbot development cost and timeline based on the product’s complexity and features:

| App Complexity | Average Cost | Average Timeline |

|---|---|---|

| Simple chatbot for finance with basic features | $30,000-$50,000 | 4-6 months |

| Medium complex finance AI chatbot with moderate features | $50,000-$120,000 | 4-9 months |

| Highly complex AI chatbot for banks with advanced features | $120,000-$300,000 or more | 9 months to 1 year or more |

Get a tailored cost estimate, compliance checklist, and architecture roadmap for your AI chatbot implementation.

What are the Key Chatbot Trends in Banking?

Banking chatbots are no longer experimental add-ons. They are becoming intelligent service platforms that shape how customers interact with financial institutions and how internal teams operate. As customer expectations rise and AI capabilities mature, conversational banking is entering a new phase of adoption.

The following chatbots in banking trends define the industry’s direction.

Conversational AI As A Service Hub

Banks are replacing rule-based bots with assistants that understand context, retain conversation history, and act on customer intent across channels. Chatbots are evolving into core digital service layers rather than isolated support tools.

Trust And Human-Centered Interaction

Early chatbot deployments often felt rigid and impersonal. Leading banks are now investing in empathetic conversation design, transparent responses, and seamless handoff to human agents to strengthen trust and sustained usage.

Enterprise-Scale Adoption

Chatbots are now embedded across mobile apps, web banking, and voice channels. Adoption has expanded beyond customer service into employee support, compliance workflows, and operational assistance.

Data-Driven Personalization

Modern chatbots analyze customer behavior and transaction patterns to deliver proactive notifications, tailored recommendations, and timely financial insights.

Rise Of Autonomous AI Agents

Banks are beginning to explore next-generation AI agents capable of handling multi-step tasks, executing actions, and supporting more complex service journeys.

These trends set the foundation for understanding the practical challenges banks face when deploying conversational AI at scale.

How Can Appinventiv Help You with Banking Chatbot Development?

Appinventiv specializes in creating intelligent and secure chatbots for banking and financial institutions that are tailored to your unique business requirements. With a proven track record of delivering 3000+ successful projects and AI chatbots for businesses, we are your trusted banking software development company.

From automating customer queries to enabling personalized financial assistance, our chatbots are designed to enhance operational efficiency and user satisfaction. Our ability to integrate the finance chatbot with your existing banking infrastructure sets us apart. Whether it is connecting with core banking systems, payment gateways, or fraud detection platforms, we ensure that the chatbot performs optimally and aligns with your organization’s goals.

By partnering with us, you gain access to a dedicated team of 1600+ tech experts who prioritize security and compliance at every step, ensuring that sensitive customer data is handled with the utmost care.

So what are you waiting for? Contact us now to build an AI chatbot to elevate your digital transformation journey and keep your bank ahead in today’s competitive world.

FAQs

Q. How does a chatbot for banking work?

A. Banking chatbots use artificial intelligence (AI) and machine learning (ML) technologies to understand and respond to customer queries. They rely on natural language processing (NLP) to interpret and analyze customer text or voice input and then deliver relevant responses. Depending on their complexity, they can handle customers’ queries like account balance checks, transaction histories, loan application status, personalized financial recommendations, etc. What’s more? Modern AI chatbots in the banking industry constantly learn from past interactions, improving their ability to provide more precise responses over time.

Q. How are chatbots used in banking?

A. Chatbots in banking are used to automate banks’ operational processes and enhance customers’ experiences. Some of the most common applications of AI chatbots in financial services are:

- Personalized Banking Services

- Omni-Channel Support

- Improved Financial Literacy

- 24/7 Digital Support

- Loan Application Assistance

- Fraud Prevention

- Personalized and Profitable Marketing

- Launch of User Centric Schemes

- Efficient Workforce Monitoring

- Process Automation

Q. Is it secure to integrate AI chatbots into banking financial infrastructure?

A. Yes, it is completely safe to integrate chatbots into the financial infrastructure. An AI chatbot for banks is designed with high levels of security to ensure that sensitive customer data is protected. They employ data encryption, secure authentication, and fraud detection techniques to keep transactions and communications safe.

Additionally, chatbots follow stringent compliance regulations, such as GDPR and PCI-DSS, to handle customer information responsibly. Banks also implement regular security updates to protect against potential vulnerabilities or cyber threats, ensuring a secure user environment.

Q. How do AI banking chatbots integrate with existing infrastructure?

A. AI banking chatbots rely on Application Programming Interfaces (APIs) to integrate with core banking systems and CRM platforms. These APIs allow the chatbot to access real-time business and customer data such as new schemes, account balances, transaction histories, and other account-specific information. Based on the accessed data, the chatbot generates relevant responses.

Q. What services can banking chatbots offer?

A. Banking chatbots provide instant support for balance inquiries, payments, fund transfers, loan assistance, fraud alerts, and account servicing. They also deliver personalized financial guidance, proactive notifications, and internal employee support, while securely integrating with core banking systems to ensure fast, compliant, and always-available service.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Banking Technology Consulting: A Strategic Roadmap for Core Modernization and Guaranteed ROI

Key takeaways: Banking modernization is now a strategic necessity, not a technology upgrade. Most banks lose value due to legacy complexity, fragmented data, and slow compliance response. Structured banking technology consulting delivers measurable gains in cost, stability, and governance. Core modernization succeeds when roadmaps, risk, and regulatory alignment are clearly defined. ROI comes from reduced…

How Gamification in Banking Helps Enterprises Build Lasting Customer Loyalty

Key takeaways: A winning banking gamification strategy isn't about badges; it’s about using behavioral psychology to form daily financial habits. Industry leaders like DBS Bank and Revolut prove the concept works, driving higher savings and millions in user acquisition. The cost to implement gamification in banking and financial services ranges between $40,000 and $400,000 or…

KYC Automation - Benefits, Use Cases, Steps, Tools and Best Practices

Key takeaways: KYC automation cuts verification from days to minutes and keeps checks consistent across teams. AI and ML reduce manual errors, catch risk earlier, and make compliance far easier to scale. Manual KYC drains time, increases cost, and slows onboarding — automation fixes all three. Automated workflows handle spikes in customer volume without compromising…