- UPI Market Growth Statistics

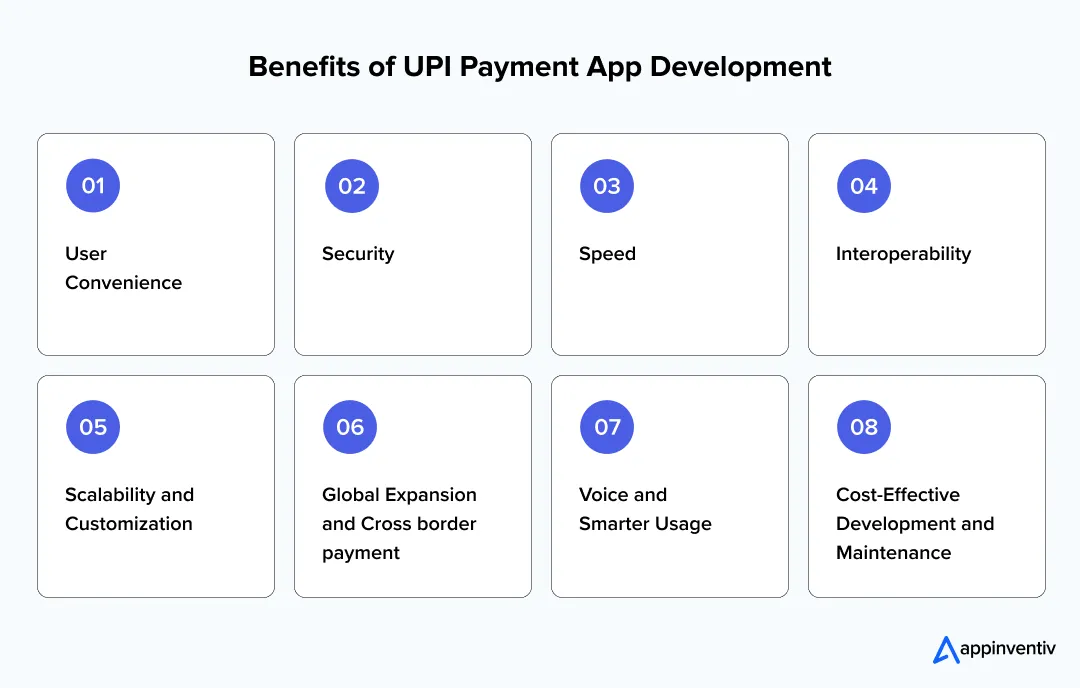

- Benefits of UPI Payment App Development

- User Convenience

- Security

- Speed

- Interoperability

- Scalability and Customization

- Global Expansion and Cross-Border Payments

- Voice and Smarter Usage

- Cost-Effective Development and Maintenance

- How Secure are UPI Apps and the Transactions?

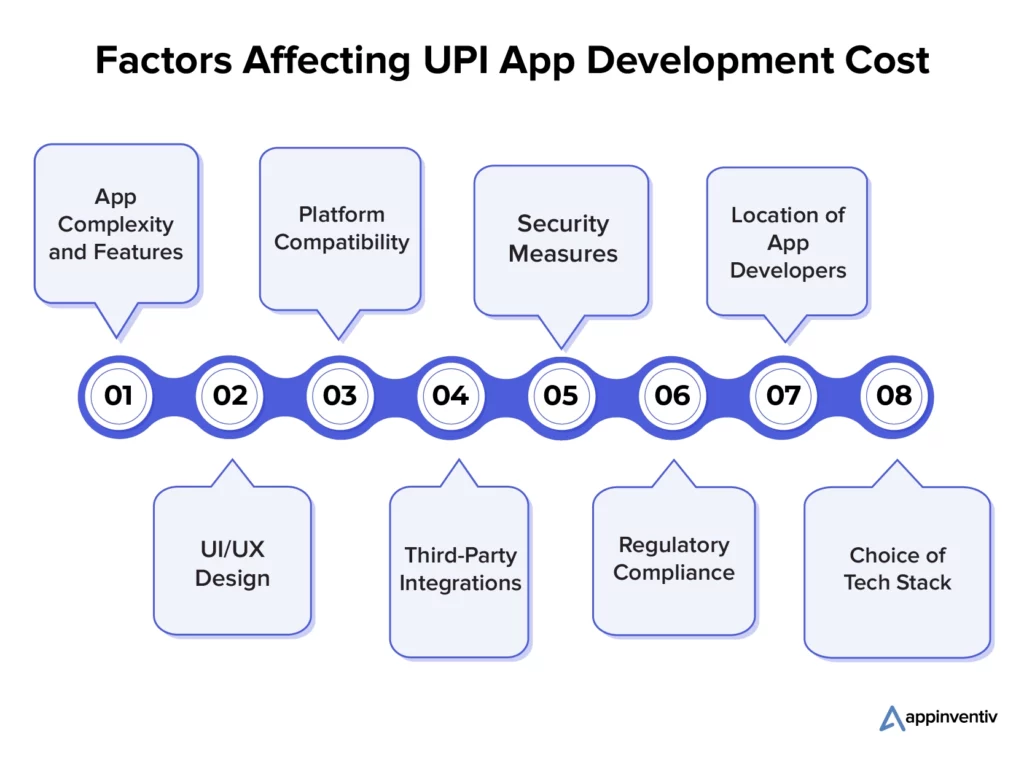

- Analysis of UPI Payment App Development Costs – Considerable Factors

- App Complexity and Features

- UI/UX Design

- Platform Compatibility

- Third-Party Integrations

- Security Measures

- Regulatory Compliance

- Location of UPI App Developers

- Choice of Tech-Stack

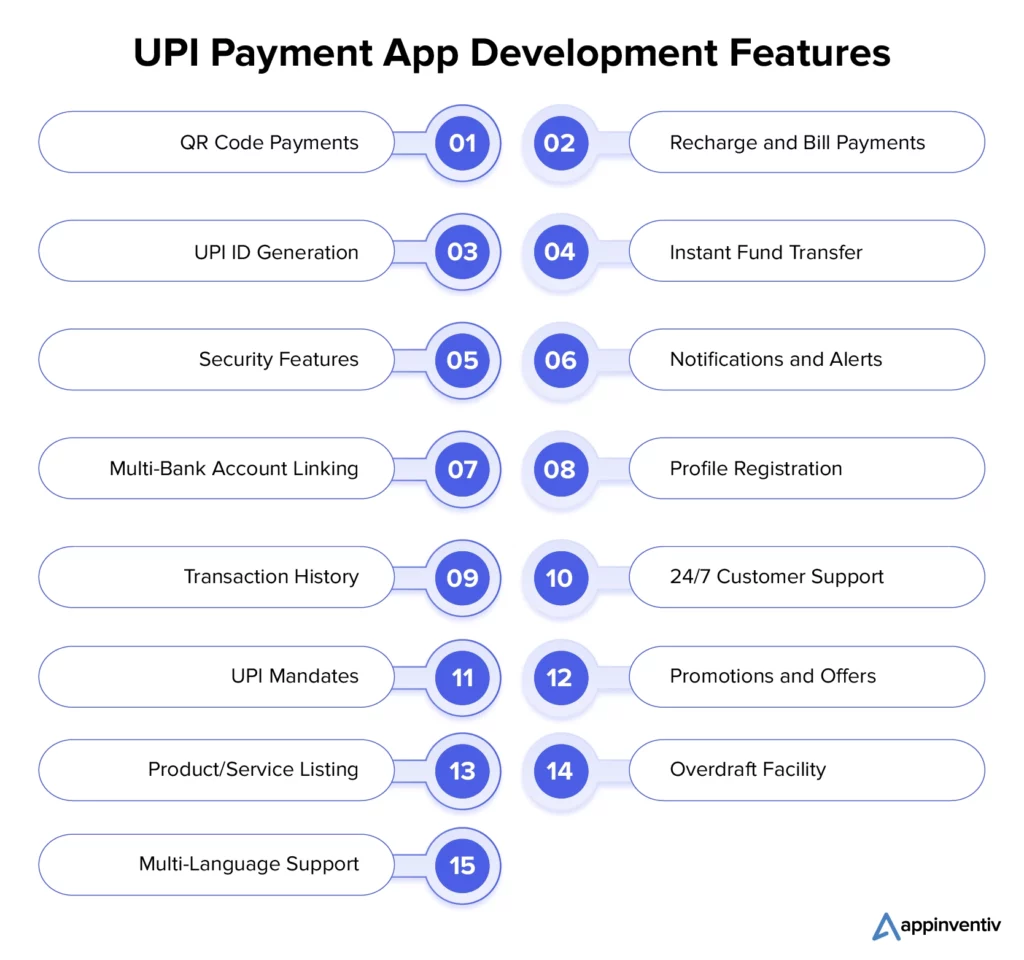

- Must-Have Features in a UPI Payment App

- UPI Payment App Development Process

- Build Secure and Scalable UPI Apps with Appinventiv

- FAQs

Key Takeaways

- Global UPI Growth: UPI processes over 20 billion monthly transactions, with countries such as the US, UAE, and Singapore adopting it for real-time payments.

- Development Costs: UPI payment app development ranges from $30,000 to $300,000, depending on complexity and features.

- Business Benefits: UPI apps offer convenience, security, faster transactions, and scalability, making them an efficient solution for businesses.

- Innovative UPI Features: UPI Lite, One World wallet, AI, and voice integrations enhance payment capabilities and user experiences.

- Security & Compliance: UPI apps must ensure strong security (encryption, 2FA) and comply with regulations (RBI, NPCI, GDPR) for trusted transactions.

UPI (Unified Payments Interface) took the world by surprise when it was first launched at the Eiffel Tower during the Republic Day Reception, quickly becoming a game-changer in the digital payments space. Introduced in 2016 by the National Payments Corporation of India (NPCI) in collaboration with the RBI, it was a breakthrough in simplifying money transfers with speed, security, and ease. Initially, only a few banks adopted it, but within a year, the world saw its potential, with banks globally jumping on board to create their own UPI apps.

By August 2025, UPI hit new milestones, processing over 20 billion transactions worth ₹24.85 lakh crore in just a month. It’s now the go-to platform for everything, from transferring money to paying bills to booking tickets to even recharging your phone. All done in a few seconds with just a tap on your screen.

The new UPI 2.0 and UPI Lite have taken things further by adding features like overdrafts, one-time mandates, and making small transactions even simpler. As UPI’s reach grows, businesses everywhere are developing their own UPI payment apps. While costs vary, developing a UPI application typically ranges from $30,000 to $300,000, depending on complexity.

So, let’s dive into how UPI payment app development can open up a world of growth and efficiency for your business.

UPI Market Growth Statistics

Now, before we delve into the intricacies of Unified Payments Interface payment app development, let’s look at some interesting UPI app market trends that show the huge wave of global adoption, helping you make an informed decision.

- Daily Transactions: UPI now processes over 650 million transactions daily, surpassing Visa to become the world’s largest real-time payment system.

- Monthly Transaction Volume: In August 2025, UPI handled more than 20 billion transactions, with a total value exceeding ₹24.85 lakh crore.

- Year-on-Year Growth: Between January and June 2025, UPI transactions grew by 35%, totaling ₹143.34 lakh crore.

- Global Adoption: UPI is now accepted in 13 countries, including the US, UAE, Singapore, France, and Qatar.

- Participating Banks: As of September 2025, 686 banks are live on the UPI platform.

Benefits of UPI Payment App Development

UPI payment app development offers numerous benefits for businesses, merchants, and users, making it an ideal choice for anyone seeking to leverage payment gateways and digital wallets. Here are some of the key benefits of Unified Payments Interface payment app development as a whole:

User Convenience

UPI fits into everyday habits. Users can send money, pay bills, or scan and pay using their phones, without carrying cash or cards. There’s no dependency on bank timings or physical branches for routine payments.

Features like UPI Lite and the One World wallet make small, frequent payments easier. This matters in real situations, such as local purchases, transport, or subscriptions. For businesses, it usually means fewer failed payments and faster checkouts.

Security

People trust UPI because it doesn’t expose sensitive information during transactions. Payments are protected through advanced encryption technology and 2FA (double-factor authentication) steps such as PINs, biometrics, and tokenization.

Most platforms also monitor transaction patterns in the background. Suspicious activity can be flagged early, often without the user noticing anything different in the payment flow.

Speed

UPI transactions happen instantly. Money moves directly between bank accounts, and confirmation is immediate. Users don’t wait, and businesses don’t deal with pending settlements. This improves cash flow and reduces follow-ups around payment status.

Interoperability

UPI doesn’t lock users into a single bank or app. A payment works regardless of which UPI platform the other person is using. That flexibility removes a lot of friction, especially in markets where customers and merchants use different banking providers.

Scalability and Customization

From a product standpoint, UPI payment apps are easy to build on. Businesses can start with core payment features and add reporting, integrations, or new services over time. Growth doesn’t require rebuilding the system from scratch.

Global Expansion and Cross-Border Payments

UPI is slowly moving beyond domestic use. Adoption in countries like Singapore, the UAE, and Bhutan is making cross-border payments simpler, particularly for travelers and international merchants.

Support from platforms such as Google Pay, PhonePe, and Amazon Pay also helps UPI-based apps reach users across regions without adding complexity.

Voice and Smarter Usage

Payments are also becoming easier to trigger. Voice-based UPI transactions are gaining traction, allowing users to make payments without touching their screens. This improves accessibility and works well in hands-free situations.

Some apps also offer basic spending summaries to help users keep track of payments without overwhelming them with data.

Cost-Effective Development and Maintenance

Compared to traditional banking or card systems, UPI payment app development is relatively affordable. Transaction fees are low, operational effort is limited, and regular ecosystem updates reduce long-term maintenance. This makes UPI practical for both startups and large businesses.

How Secure are UPI Apps and the Transactions?

UPI did not become India’s default payment rail by accident. The system works because security is treated as a daily operating reality rather than a marketing promise. Every transaction passes through multiple checks, most of which users never see, but would immediately notice if they failed.

For anyone building or maintaining a UPI app, security is shaped largely by regulation and operational discipline. The following compliance layers define how safe UPI transactions actually are in practice.

- RBI guidelines form the foundation. These rules control transaction limits, authentication requirements, settlement cycles, and customer dispute handling. If an app fails here, it does not move forward, regardless of how polished the interface looks.

- NPCI guidelines exist to keep the ecosystem stable. They ensure that payments work reliably across banks, apps, and networks, even during peak traffic. Interoperability and uptime are taken seriously because any weak link affects the entire network.

- Data protection laws govern how user information is stored and accessed. UPI apps are expected to respect frameworks such as GDPR for global exposure and India’s evolving data protection rules, especially when handling identity and transaction metadata.

- PCI DSS compliance becomes relevant when card data is involved. Many UPI apps offer cards as a secondary payment option, which means that secure handling of card information remains part of the responsibility.

- AML and KYC regulations reduce misuse at scale. Identity checks using Aadhaar, PAN, or equivalent documents help prevent fraud, money laundering, and account misuse before transactions even begin.

- Accessibility standards are gaining real attention now. Compliance with WCAG ensures that users with visual, motor, or cognitive limitations can complete payments without assistance, which is increasingly expected of public-facing financial apps.

- Best security practices sit outside formal regulation but matter just as much. Two-factor authentication, encrypted data flows, periodic audits, and regular vulnerability testing help catch issues early, long before users are affected.

- NPCI certification acts as the final gate. Before launch, apps must clear the NPCI’s certification process to demonstrate they meet technical, security, and interoperability requirements.

When these requirements are followed consistently, UPI apps continue to perform reliably even under heavy load. For businesses, compliance is not about paperwork. It is what keeps transactions flowing, users confident, and systems running without disruption.

You may like reading: How enterprises can ensure compliance using blockchain

Analysis of UPI Payment App Development Costs – Considerable Factors

To give you a rough estimate, the cost to develop a UPI payment app can range from $30,000 to $300,000, but various factors affect the final cost. App complexity, feature list, UI/UX design, location of FinTech app developers, and the technological stacks used in development are key factors affecting the cost of UPI payment app development.

Let’s discuss these cost-determining factors in detail to better understand the cost of developing a UPI wallet.

App Complexity and Features

The complexity and the list of features incorporated into the app directly impact UPI wallet development costs. Basic features such as account linking, fund transfers, transaction history, and QR code scanning are essential and can be implemented on a low budget. However, additional functionalities such as bill payments, in-app chat support, biometric authentication, and multi-bank account linking require additional resources and efforts, thus increasing development time and costs.

Here is a brief estimate of the UPI wallet development cost and time frame based on the app’s complexity and features.

| App Complexity | Estimated Cost | Time Frame |

|---|---|---|

| Simple app with basic features | $30,000 to $60,000 | 4 to 6 months |

| Moderate app with essential features | $60,000 to $120,000 | 6 to 10 months |

| UPI 2.0 app with ultra-advanced features | $120,000 to $300,000 | 10+ months |

UI/UX Design

The UI/UX design is a critical factor in determining the overall cost of a UPI payment app. A well-designed UPI wallet with intuitive navigation, appealing visuals, and seamless interactions enhances user engagement and satisfaction, thus requiring more time and affecting development costs.

Platform Compatibility

UPI payment apps need to be compatible with multiple platforms, including iOS, Android, and web browsers, to reach a broader audience. Ensuring compatibility across different device types, screen sizes, and operating system versions increases the app’s complexity and development costs.

Developing distinct app versions tailored to different platforms may initially seem like a cost-saving measure. Still, when estimating the cumulative costs of multiple versions, the overall investment can escalate significantly.

Third-Party Integrations

Integrating the app with banks’ APIs and payment gateways is complex and time-consuming, as each party has its own set of APIs and protocols. Accordingly, the complexity of integration and the number of third-party services involved significantly affect the UPI payment app development cost.

Security Measures

Security is paramount in UPI payment app development to protect users’ sensitive financial information, prevent fraud, and build trust. Implementing security measures such as multi-factor authentication, data encryption, and biometric techniques, as well as compliance with regulatory standards such as GDPR, incurs additional development costs. When you create a UPI payment gateway, these security features are crucial in ensuring safe transactions and fostering user confidence in the platform.

Regulatory Compliance

White-label UPI solutions must comply with data protection laws (GDPR), payment processing protocols (PCI DSS), and other regulatory guidelines issued by authorities such as the RBI and NPCI. Activities related to UPI payment app development compliance, such as obtaining necessary licenses, implementing essential measures, and conducting compliance audits, entail additional expenses and increase development costs.

Location of UPI App Developers

The geographical location of app developers can also affect the UPI wallet development costs. For instance, hiring a development team from regions with higher living costs and wages, such as North America or Western Europe, costs more than hiring from regions with lower labor costs, such as Eastern Europe, India, or Southeast Asia.

| Region | Hourly Rate of Development |

|---|---|

| UAE | $60-$65 |

| US | $95-$100 |

| Western Europe | $80-$90 |

| Australia | $70-$90 |

| Eastern Europe | $50-$55 |

| Asia | $25-$40 |

Choice of Tech-Stack

The selection of technological stacks for UPI app development, including programming languages, frameworks, and front- and back-end tools, affects the overall cost of developing UPI payment apps. Opting for widely used technologies, such as React Native or Flutter, for cross-platform development may streamline development and reduce costs.

Here is an estimate of technological stacks commonly used in UPI app development:

| Technology Stack | Cost Estimation |

|---|---|

| APIs | $5000-$8000 |

| Frameworks | $6000-$9000 |

| Programming Languages | $7000-$12000 |

| Database | $8000-$12000 |

| Operating system | $10000-$14000 |

| Artificial Intelligence and other technologies | $10000-$20000 |

| Cloud storage | $12000-$15000 |

Must-Have Features in a UPI Payment App

A UPI payment app is meant to deliver an unparalleled user experience and support sustainability. Therefore, when planning your UPI app development, you must focus on integrating features that not only ensure a secure and convenient user experience but also promote sustainable practices. Here is a list of key features of a UPI payment app that enable a secure and sustainable app, such as Paytm, Google Pay, or Amazon Pay.

QR Code Payments

QR code scanning is a convenient way to make payments at retail stores, restaurants, or individuals. The app should support QR code scanning for payments, reducing paper waste by eliminating printed receipts or invoices.

Recharge and Bill Payments

This feature makes the UPI app a one-stop solution to multiple problems. Electricity, water, gas, credit card, phone bills – you name it, the UPI app does it. These key features of UPI payment app ensure that users can seamlessly handle all their utility payments and daily transactions in one place, making it incredibly convenient for both businesses and users alike.

UPI ID Generation

The app allows users to make and manage their UPI IDs (virtual payment addresses) linked to their bank accounts. This simplifies payment receipt and eliminates the need to share sensitive bank information, improving data security and reducing the risk of paper-based identity theft.

Instant Fund Transfer

It is indeed the most integral feature of a mobile wallet app, enabling users to transfer funds instantly, anywhere, anytime. All they need to do is specify the recipient’s UPI ID, phone number, or QR code, enter the amount, and authorize the payment using their UPI PIN.

Security Features

Implementing robust security features, such as biometrics, MPIN (Mobile PIN), and multi-factor authentication, not only protects users’ financial data but also reduces the need for physical documents and signatures used for authentication.

Notifications and Alerts

Real-time push notifications and alerts keep users informed about account activity, transaction status, payment reminders, and promotional offers. This feature enhances user engagement and ensures timely communication.

Multi-Bank Account Linking

This feature allows users to link and manage multiple bank accounts within a single interface for seamless fund management. It reduces the need for physical visits to multiple bank branches or ATMs, thereby saving time, resources, and fuel consumption.

Profile Registration

The app should make it easy for users to register and manage their profiles. This includes verifying their mobile number, linking their bank account(s), and setting up a UPI PIN for authentication.

Transaction History

A UPI app must-have feature is to provide a comprehensive history of past payments, wallet balances, etc. It should include details of all past transactions, including date, time, amount, and recipient/sender information. Keeping track of past payment history has never been easier!

24/7 Customer Support

The app should offer round-the-clock customer support to address users’ queries, issues, or concerns promptly. This includes an AI chatbot, FAQs section, helpline numbers, and email support.

UPI Mandates

UPI mandates allow users to schedule recurring payments or authorize future transactions in advance. This feature is useful for businesses with periodic payment requirements or subscription-based services.

For instance, users can authorize Netflix subscriptions to be automatically debited from their bank accounts using UPI mandates. Or users can renew their periodical reading plans automatically using UPI. The UPI app allows users to create, manage, and cancel UPI mandates for pre-authorized transactions at any time. Also, it notifies them in advance before auto-debiting the payment for the associated service.

Promotions and Offers

The UPI app provides users with access to promotional deals, discounts, and cashback offers from partner merchants and service providers. Also, some UPI apps offer lucrative rewards and cashback to users for making payments on their platform. This feature incentivizes digital transactions and encourages users to adopt sustainable payment methods.

Also Read: Customer loyalty app development – Benefits, process, costs

Product/Service Listing

Businesses can create their own virtual store within the app by listing their products or services, allowing users to browse and buy them directly in the app. This feature enhances users’ shopping experience and promotes eco-friendly digital transactions.

Overdraft Facility

Providing users with access to overdraft facilities allows for temporary extensions of credit beyond the available account balance, providing financial flexibility when needed. This feature promotes responsible spending and helps users avoid short-term loans or credit cards.

Multi-Language Support

It is one of the most essential features of a UPI payment app, ensuring inclusivity and accessibility for users from diverse linguistic backgrounds. This feature allows users to navigate the app, make payments, and access support services in their preferred language, enhancing the user experience and promoting broader adoption worldwide.

UPI Payment App Development Process

As highlighted earlier, the number of countries accepting UPI payments is growing rapidly, driving exponential growth in the UPI market. Seeing the global trend towards UPI, businesses are increasingly turning to building a UPI payment app.

However, building a UPI payment app is a complex and challenging endeavor that requires the assistance of a professional UPI app development guide and service.

The UPI wallet app development process involves several steps, including thorough market research, project analysis, planning, UI/UX design, seamless feature integration, rigorous testing, and ongoing maintenance.

For an in-depth insight into the UPI payment app development process and to understand how to create a UPI payment app, refer to our detailed guide on Mobile App Development for Businesses.

Build Secure and Scalable UPI Apps with Appinventiv

UPI payment app development is rarely just a technical exercise. Teams have to balance regulatory compliance, security standards, and everyday usability, all at the same time. If any one of these slips, users notice quickly. That is why choosing a UPI or FinTech app development company with real experience in GDPR, PCI-DSS, and other regulatory standards is not optional. It directly affects whether a UPI app scales smoothly or struggles after launch.

This is where Appinventiv fits into UPI payment app development in a practical way. As a payment app development company, the focus stays on building UPI payment solutions that work under real conditions, high transaction volumes, compliance audits, and evolving NPCI requirements.

Regulatory expectations such as NPCI UPI compliance and certification do not sit outside the product. They influence architecture, security design, and even how simple actions like onboarding or payments are handled. By accounting for these early, businesses can avoid costly rework later and release UPI wallet apps that remain stable over time.

Appinventiv’s team of 1500+ tech experts has delivered more than 3000 projects across different domains. This includes products like Edfundo, a financial literacy platform; Slice, built with GDPR compliance in mind; Mudra, a personal finance and budget management app; and USA MedPremium, developed to meet PCI DSS standards. Each project came with its own regulatory and security challenges.

The approach to UPI integration and development stays practical. Proven technologies, clean coding practices, and necessary security controls are applied where they matter most. The goal is to meet compliance requirements, protect user data, and keep the user experience simple rather than overloaded.

Let’s join hands and contribute to a greener future with UPI payment app development. With this advancement, we can create a UPI payment app that not only meets the growing demand for faster, more secure payments but also contributes to a sustainable future in financial technology.

FAQs

Q. How does UPI payment achieve sustainability?

A. UPI payment helps a business achieve sustainability by reducing reliance on cash transactions, minimizing paper-based processes such as receipts and invoices, and promoting digital financial inclusion. By enabling seamless digital transactions on devices, UPI reduces the environmental impact associated with printing, transportation, and the disposal of paper currency and receipts.

Additionally, UPI’s interoperability and accessibility contribute to financial inclusion by providing convenient, secure banking services to PWD populations, thereby promoting economic empowerment and sustainable development.

Q. How long does it take to build a UPI payment app?

A. The time required for UPI payment app development varies depending on various factors such as the complexity of features, design requirements, UPI integration with banks and payment gateways, compliance with regulatory standards, and so on.

Typically, developing a basic UPI wallet app with essential features takes 4 to 6 months, while more complex UPI 2.0 apps with advanced features take 6 months to a year or more.

To know the exact time required to make a UPI app, discuss your project idea with our FinTech development team.

Q. What makes a UPI app successful?

A. A seamless user experience, robust security features, widespread adoption, interoperability with various banks, and efficient payment systems are some of the most common features that make a successful UPI app stand out from the crowd.

It also offers convenience, speed, and cost-efficiency in transactions while complying with regulatory standards and fostering user trust.

Q. How much does it cost to develop and maintain a UPI payment app?

A. Developing a UPI payment app typically costs between $40,000 and $300,000, depending on its features and complexity. Maintenance, including updates and security patches, usually costs 15-20% of the initial development cost annually.

Q. How to choose the right UPI technology stack for scalability and performance?

A. To build a scalable UPI app, choose:

- Backend technologies like Node.js or Java for speed and performance.

- Reliable databases such as MongoDB or PostgreSQL.

- Secure cloud platforms like AWS or Azure for hosting.

- UPI-compliant payment APIs and strong encryption for security.

Q. What are the key security and regulatory considerations for UPI app development?

A. The following are the security and regulatory considerations for UPI app development

- Data Encryption: Use AES-256 encryption to protect transactions.

- Multi-Factor Authentication (MFA) for secure access.

- Regulatory Compliance with RBI, GDPR, and ISO 27001 standards.

- Secure APIs to meet PCI-DSS standards and protect payment data.

Q. Key development steps in building a UPI app.

A. Building a UPI app involves several key development steps to ensure functionality, security, and user-friendliness. Know how to build a UPI payment app here:

- Research & Planning: Understand market needs and define key features.

- Technology Selection: Choose the right backend, frontend, and database.

- Design: Create a user-friendly interface for seamless experiences.

- Integration: Add UPI APIs for payments and transactions.

- Security: Implement strong encryption and MFA.

- Testing: Ensure the app works flawlessly across all devices.

- Launch & Maintenance: Deploy on app stores and update regularly for compliance

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…