- Why Regulatory Compliance is a Non-Negotiable for Fintech

- Must-Have Features of Financial Services-Compliant Software

- Cost to Build a Financial Regulatory Compliance Software

- Key Factors Fintech Entreprises Look for in Regulatory Compliance Software

- How to Ensure Seamless Integration with Fintech Apps

- Overcoming Common Challenges in Developing Compliance Software

- Global Fintech Compliance Standards to Consider

- Emerging Trends in Regulatory Compliance Software Development

- Transform Compliance into a Growth Enabler with Appinventiv

- FAQs

A fast-growing fintech startup launches an innovative app that disrupts the market, attracting thousands of users within weeks. But amidst the euphoria, they miss a critical detail – a non-compliance issue with anti-money laundering regulations. The result? Heavy fines, app suspension, and a tarnished reputation.

This scenario, while hypothetical, reflects the challenges fintech companies face daily. In an industry where innovation often outpaces regulation, staying compliant is no longer optional. It’s a survival strategy. Financial compliance software typically emerges as the solution to this dilemma, offering fintech firms financial security services to navigate the complex web of financial regulations while scaling operations securely.

Financial compliance software has become the cornerstone of trust in the fintech industry. Fintech companies must prioritize compliance to stay competitive with regulators’ increasing scrutiny and customers’ growing expectations around data security and transparency.

This article explores the essentials of financial services compliance software development tailored for the fintech space, from understanding its importance to integrating it seamlessly into the ecosystem.

Why Regulatory Compliance is a Non-Negotiable for Fintech

Regulations like the Bank Secrecy Act (BSA), Dodd-Frank Act, and Payment Card Industry Data Security Standard (PCI DSS) are more than legal mandates—they safeguard the financial ecosystem by ensuring ethical operations and protecting consumer data. Non-compliance can result in penalties running into millions, operational disruptions, and erosion of customer trust.

But investing in compliance software financial services isn’t just about avoiding penalties; it’s about unlocking growth:

- Fosters trust: Customers are likelier to use services prioritizing security and transparency.

- Eases expansion: Regulatory compliance, as different jurisdictions have varying requirements, paves the way for smoother entry into new markets.

- Improves efficiency: Automation of compliance processes reduces manual effort, streamlining operations.

- Boosts investor confidence: Demonstrating compliance can attract more funding by showing that the company is future-proof.

Fintech companies can turn a regulatory burden into a competitive advantage by building compliance into their core operations.

Ensuring that your fintech software meets local and global legal compliance requires integrating feature-rich compliance readiness software. Let us look into MVP-level features that power valuable financial services regulatory compliance software.

Must-Have Features of Financial Services-Compliant Software

Developing financial regulator software isn’t just about ticking boxes—it’s about creating a solution that brings resiliency to financial services, anticipates risks, simplifies adherence, and ensures scalability.

Below are the essential features your financial compliance software solutions must include, with each playing a critical role in safeguarding fintech operations while driving efficiency:

Automated Compliance Monitoring

Automation ensures compliance processes operate without human oversight, minimizing errors and inefficiencies. Real-time monitoring tools constantly scan financial transactions, operational workflows, and customer interactions to identify potential violations. For example, compliance management software development services can detect anomalies in transaction patterns that might indicate money laundering, issuing automatic alerts before a breach occurs.

Risk Assessment & Management

A robust risk management system evaluates potential vulnerabilities across various compliance domains. This feature, which also cements the role of regulatory compliance software in the financial industry, leverages predictive analytics and machine learning to analyze historical data, enabling the identification of trends that could lead to regulatory violations. AI in risk management allows fintech businesses to prioritize and address issues proactively, safeguarding their operations and reputation.

Audit Trails & Reporting

Every compliance action and decision must leave a transparent record. Audit trails document every interaction, update, or modification within the software, ensuring an indisputable log for internal audits or regulatory inspections. Post this, comprehensive analytics & reporting for ERP finance transform these logs into digestible reports, making demonstrating compliance to stakeholders and authorities easier.

Workflow Automation

Manual compliance processes can be time-consuming and error-prone. Workflow automation eliminates redundancies by digitizing tasks such as document verification, approvals, and regulatory submissions. For example, one use case of financial regulatory compliance software is the system’s ability to automatically update and distribute policy changes across teams, ensuring everyone remains informed without manual intervention.

Continuous Regulatory Updates

Regulations in the fintech space are constantly evolving, often differing by country or region. Standout compliance software for financial services integrates a dynamic updating mechanism, which tracks regulatory changes globally and updates the system in real-time. This ensures businesses always stay compliant, regardless of the jurisdiction in which they operate.

Document and Regulatory Management

AI ensures intelligent processing of compliance-related documentation, such as licenses, contracts, and customer agreements, which is often chaotic. A centralized repository can allow all stakeholders to access, upload, and update documents in one secure location. Additionally, version control and automated renewal reminders can make this feature indispensable for meeting documentation requirements efficiently.

Training and Certification Tracking

Regulations often require employees to undergo compliance training. This feature of financial regulatory compliance software development should help track employee training completion, certification validity, and renewal schedules. Automated notifications can remind staff of upcoming deadlines, ensuring your workforce meets regulatory requirements.

Incident Management

Even with preventive measures, compliance breaches can occur. Incident management tools enable businesses to respond quickly and effectively. This includes automated workflows for breach identification, escalation protocols, and corrective actions. By integrating this feature into the financial regulatory compliance software development process, companies can mitigate damage and demonstrate their commitment to accountability.

User Access Controls

Not all employees need access to sensitive customer data or compliance dashboards. User access controls enforce strict permissions based on roles, ensuring data is only accessible to authorized personnel. This would protect sensitive information and align with regulations like the GDPR and GLBA.

Also Read: How to Develop a GDPR-Compliant Software for Your Business?

Alerts and Notifications

Timely alerts are crucial for maintaining compliance. This financial services compliance software development feature can deliver customizable notifications for critical events, such as policy changes, upcoming deadlines, or detected anomalies. Based on the severity of the issue, alerts can be configured to reach specific team members or stakeholders.

Scalability and Customization

As fintech companies grow, their compliance needs evolve. The software should be scalable enough to accommodate increased transaction volumes, new regulatory requirements, and expanded geographical operations. Additionally, customization options ensure the solution aligns with unique business processes and goals.

Data Analytics and Insights

Compliance doesn’t just involve reacting to issues; it also consists of anticipating them. Advanced analytics tools provide deep insights into compliance data, enabling businesses to identify inefficiencies, predict risks, and improve decision-making. For example, one of the most commonly applied use cases of financial regulatory compliance software can be seen through the visual dashboards highlighting high-risk areas, guiding proactive measures to mitigate potential violations.

Cost to Build a Financial Regulatory Compliance Software

These features give the C-suite a roadmap for making their product compliant and influence the cost of building financial regulatory compliance software. A fee typically ranges between $50,000 and $400,000 (or even higher), depending on complexity, feature sets, team composition, etc.

The table below provides a detailed breakdown of the development process and its corresponding costs:

| Cost Component | Estimated Range |

|---|---|

| Initial Development | $15,000 – $100,000 |

| UI/UX Design | $10,000 – $75,000 |

| Backend Development | $10,000 – $1,00,000 |

| Testing and Quality Assurance | $5,000 – $25,000 |

| Maintenance and Updates (Annual) | $5,000 – $25,000 |

| Marketing and Launch | $5,000 – $75,000 |

| Total Estimated Cost | $50,000 – $400,000 |

But before you invest such a huge amount as the cost to build financial compliance software, it is important to know what elements the fintech app owners are looking for—after all, they are your primary client base.

At Appinventiv, we have worked on more than 10+ fintech applications, each complying with every possible global and local regulation in the market. The extent of our service scope has given us a deep-level understanding of what the industry expects from compliance software financial services. Here’s a comprehensive view of the expectations we have seen our partners have from a compliance-readiness system.

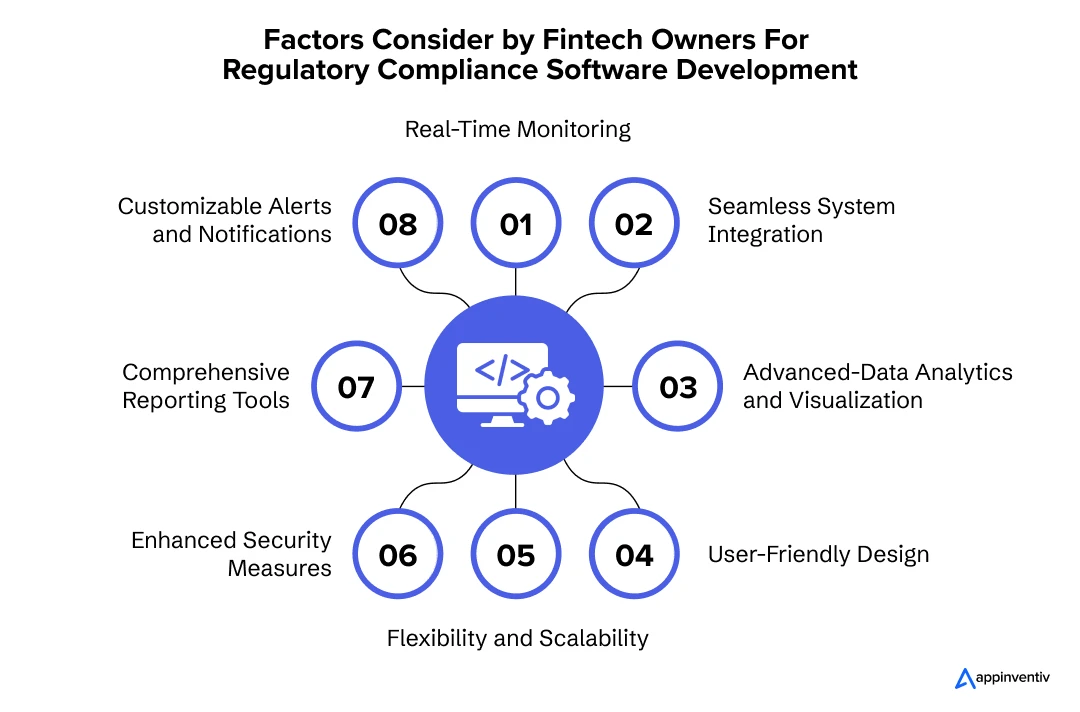

Key Factors Fintech Entreprises Look for in Regulatory Compliance Software

While developing financial services regulatory compliance software, understanding the priorities of fintech owners is crucial. The solution must not only meet regulatory mandates but also align with the operational goals of the business. Below are the critical features and functionalities that fintech stakeholders tend to prioritize:

Real-Time Risk Monitoring

Fintech operations are fast-paced and involve thousands of transactions per second. Owners demand a system capable of monitoring risks in real-time, flagging suspicious activities, and generating instant alerts. For example, the financial services regulatory compliance software should identify unusual transaction spikes that could indicate fraud, ensuring immediate intervention.

Seamless System Integration

Most fintech businesses rely on a complex ecosystem of tools and softwares, including Custom CRM software development, payment gateways, and analytics software. Financial regulator software must seamlessly integrate with these existing systems, enabling seamless data flow. APIs and modular architectures are also particularly valued here, as they facilitate smooth interoperability without disrupting operations.

Advanced-Data Analytics and Visualization

Data is at the heart of fintech compliance. Fintech owners seek financial compliance software solutions that don’t just store and process compliance data but also provide actionable insights through advanced analytics. Interactive dashboards, data visualization practices, and tools make it easier for stakeholders to track performance metrics, identify trends, and make informed decisions.

User-Friendly Design

No matter how advanced the software is, its usability can make or break its success. Fintech owners prioritize intuitive interfaces that simplify complex compliance tasks. A user-friendly design ensures that technical teams and non-technical stakeholders can easily navigate the system, reducing training costs and enhancing efficiency.

Flexibility and Scalability

As fintech companies scale, regulatory compliance software’s compliance requirements and role in the financial industry evolve. Owners look for software that can adapt to growing transaction volumes, changing regulatory landscapes, and expanding geographical footprints. A solution that supports both horizontal and vertical scalability provides long-term value.

Enhanced Security Measures

With sensitive financial data at stake, robust security is non-negotiable. Important features include encryption technologies and protocols, multi-factor authentication, and secure access controls. Financial compliance software must also align with regulations like the GDPR to safeguard customer data and prevent breaches.

Comprehensive Reporting Tools

Regulators often require detailed reports during audits or investigations. Fintech owners demand compliance software financial services with robust reporting capabilities that can generate accurate, comprehensive, and customizable reports. These tools reduce manual effort and ensure compliance documentation is always audit-ready.

Customizable Alerts and Push Notifications

Timeliness is crucial in compliance. Customizable alerts allow stakeholders to receive updates based on their preferences, such as policy changes, suspicious transactions, or upcoming deadlines. Push notifications can be configured across channels like email, SMS, or in-app, ensuring no critical updates are missed.

Also Read: How to Build a Push Notification Strategy For Higher Conversions

By addressing these needs, financial services regulatory compliance software becomes more than just a tool – it becomes a strategic asset that supports growth and operational excellence.

Achieving these expectations and the presumed benefits of financial regulatory compliance software development depends on how well it is integrated into the FinTech app. Here are some strategies that our team of fintech software development services providers has applied and benefited from over the course of the development journey.

How to Ensure Seamless Integration with Fintech Apps

Integration is the linchpin of a financial regulatory compliance software development process. A poorly integrated solution can lead to data silos, operational inefficiencies, and compliance gaps. To ensure a seamless fit with fintech apps, here are some best practices we follow:

- Prioritize API-Driven Architectures

APIs (Application Programming Interfaces) enable different systems to communicate effectively. When building compliance management software financial services, ensure it offers robust APIs for integration with CRMs, payment systems, fraud detection tools, and analytics platforms.

- Adopt Modular Design Principles

A modular architecture allows fintech companies to integrate only the needed features while leaving room for expansion. This reduces implementation complexity and ensures that the financial services-compliant software aligns with existing workflows.

- Conduct Compatibility Testing

Conduct rigorous testing before deploying the financial compliance software to ensure compatibility with the FinTech app’s infrastructure. This includes evaluating how the solution handles data exchanges, transaction volumes, and operational workflows.

- Ensure Data Synchronization

Integration must support real-time data synchronization to ensure accuracy and consistency across platforms. For instance, customer data updated in the CRM should instantly reflect in the compliance system, minimizing errors.

- Offer Custom Integration Support

Every fintech company operates differently. However, by providing custom integration services, you can ensure that the software adapts to unique workflows and enhances user adoption and satisfaction.

Building a feature-rich, market-ready, and strategically implemented financial services compliance software development process doesn’t come without challenges. Understanding or pre-planning for these can guarantee a high ROI—both in terms of revenue and usability—from your financial regulatory compliance software development cycle.

Overcoming Common Challenges in Developing Compliance Software

Although highly rewarding, financial services compliance software development has its own hurdles. Addressing these challenges head-on ensures a smoother development process and a more effective end product:

Challenges in Developing Compliance Software

- Keeping Up with Regulatory Changes

- Balancing Security and Usability

- Ensuring Global Compliance

1. Keeping Up with Regulatory Changes

The fintech regulatory landscape evolves rapidly, making it challenging to stay updated. Incorporating AI-driven regulatory intelligence can help ensure that the software can adapt to new laws without requiring constant manual updates.

2. Balancing Security and Usability

While robust security measures are essential, they shouldn’t compromise user experience. Striking the right balance would require integrating features like single sign-on (SSO) and user-friendly authentication processes.

3. Ensuring Global Compliance

For fintech companies operating across borders, the cost to build financial regulatory compliance software must address varying regulatory requirements, especially since creating a scalable framework that supports multi-jurisdictional compliance is crucial.

4. Managing Data Privacy

With regulations like GDPR and CCPA, ensuring customer data privacy is a top priority. Implementing advanced encryption and anonymization techniques can help safeguard sensitive information.

When we talk about challenges or even the efforts and ROI of financial regulatory compliance software development, the discussion will be incomplete unless we look into the list of compliance that fintech companies should follow and your software must adhere to.

Global Fintech Compliance Standards to Consider

Fintech companies operating in the USA and beyond must adhere to numerous regulatory frameworks. Here’s a list of some critical compliance standards:

- Bank Secrecy Act (BSA): Mandates AML measures to prevent financial crimes.

- Dodd-Frank Act: Focuses on transparency in financial services and consumer protection.

- Payment Card Industry Data Security Standard (PCI DSS): Governs secure handling of credit card information.

- Gramm-Leach-Bliley Act (GLBA): Protects consumer financial data.

- General Data Protection Regulation (GDPR): Applies to data protection for companies dealing with EU residents.

- California Consumer Privacy Act (CCPA): This act focuses on data privacy for Californian residents.

- Fair Credit Reporting Act (FCRA): Regulates consumer credit information handling.

- Sarbanes-Oxley Act (SOX): Imposes compliance requirements on publicly traded companies.

Building software that aligns with these standards requires a comprehensive understanding of global regulatory landscapes.

In addition to the ever-growing regulatory landscape, the industry is constantly upgrading its software. Tracking these market movements can prepare your software for the unplanned future. As we conclude the article, let us look at the future of financial regulatory compliance software.

Emerging Trends in Regulatory Compliance Software Development

The regulatory tech landscape is evolving rapidly, driven by the need for faster, smarter, and more adaptable solutions. Here are some emerging trends shaping the future of financial regulatory compliance software:

- Cloud-Based Solutions: Cloud platforms enable real-time compliance management with secure, scalable infrastructures.

- Regulatory Sandboxes: Many governments now allow fintech companies to test compliance software in controlled environments before deployment.

- Blockchain Integration: Blockchain ensures immutable audit trails, boosting transparency and trust in compliance processes.

- RegTech-as-a-Service (RaaS): Subscription-based models are being incorporated into financial regulatory compliance software development to make it more accessible for startups and small businesses.

- Focus on ESG Compliance: Environmental, social, and governance (ESG) factors are becoming critical in compliance strategies, reflecting global priorities.

Staying ahead of these trends can help fintech companies build future-proof compliance strategies and invest in a well-strategized financial services compliance software development process.

Transform Compliance into a Growth Enabler with Appinventiv

Regulatory compliance software is not just necessary; it invests in your fintech company’s growth and resilience. By embedding compliance into your core operations, you can build trust, mitigate risks, and unlock new market opportunities.

At Appinventiv, we understand the intricacies of fintech regulations and have a proven track record of delivering compliance solutions that exceed expectations.

Our professional fintech software development services and tailored approach ensure that your software meets current needs and scales to future challenges. Whether it’s integrating advanced analytics, ensuring seamless compatibility, or staying ahead of regulatory changes, we’re your partner in navigating the fintech compliance journey.

Take the first step towards regulatory excellence – connect with Appinventiv today and future-proof your fintech business.

FAQs

Q. What is financial regulatory compliance software?

A. Financial regulatory compliance software is a specialized tool designed to help financial institutions adhere to industry regulations, standards, and laws. It automates the tracking, reporting, and management of compliance requirements, reducing the risk of fines and legal complications. These platforms often include real-time monitoring, audit trail management, reporting capabilities, and risk assessment to ensure organizations comply with regulatory bodies like the SEC, FCA, or Basel III.

Q. What is the cost to build regulatory compliance software for the financial industry?

A. The cost of building regulatory compliance software for the financial industry can vary widely based on factors such as the complexity of features, integration with existing systems, the development team’s location, and regulatory requirements specific to the region. Typically, a basic compliance solution may start at $50,000, while enterprise-grade software with advanced AI capabilities and extensive customization can cost upwards of $250,000. Maintenance updates and compliance changes may add to the ongoing expenses.

Q. How do we develop regulatory compliance software for the financial industry?

A. Developing regulatory compliance software involves several steps:

- Requirement Analysis: Understand the specific regulations (e.g., GDPR, AML, Basel III) and operational needs of the financial industry.

- Design and Architecture: Create a scalable and secure architecture with user-friendly interfaces and robust back-end systems.

- Integration: Ensure seamless integration with CRMs, ERPs, or financial reporting tools.

- Features Development: Include key features such as compliance tracking, risk assessment, data encryption, and real-time reporting.

- Testing and Validation: Perform rigorous testing to ensure the software meets regulatory standards and operates flawlessly.

- Deployment and Training: Roll out the software and train teams on its use.

- Maintenance and Updates: Regularly update the software to adapt to evolving regulations.

Q. What are some examples of financial compliance software?

A. Some of the prominent examples of financial compliance software include:

- MetricStream: A governance, risk, and compliance (GRC) platform tailored for financial institutions.

- Thomson Reuters Regulatory Intelligence: Offers real-time regulatory updates and compliance tools.

- NAVEX Global: Focuses on compliance management and risk assessment.

- LogicGate: Provides flexible solutions for enterprise risk management and compliance workflows.

- ComplyAdvantage: Specializes in AML compliance and financial crime detection.

How Much Does it Cost to Build a Personal Finance App like Pocketsmith?

Imagine an app that knows when your rent is due, reminds you of upcoming bills, forecasts your savings 12 months ahead, and tells you if that third coffee this week is wrecking your budget. That’s the kind of experience apps like PocketSmith deliver, and it’s exactly why personal finance apps are becoming a must-have for…

How Much Does it Cost to Build a Mobile Banking App Like Halifax in the UK?

The way people bank has changed dramatically. Gone are the days of waiting in long queues or rushing to a branch before closing hours. Today, mobile banking apps like Halifax have redefined convenience, allowing users to check balances, transfer funds, pay bills, and even apply for loans from their smartphones, anytime and anywhere. This shift…

How to Approach Currency Converter App Development?

Imagine you’re about to travel abroad and need to quickly check how much your local currency is worth in another country, or perhaps you run an international business and constantly deal with multiple currencies. In both cases, a currency converter app is an indispensable tool. With global transactions becoming the norm and forex markets fluctuating…