- Understanding Fintech Integration in the Enterprise

- What Are Enterprise Fintech Solutions Integration?

- Types of Fintech Software Integration Businesses Must Know Of

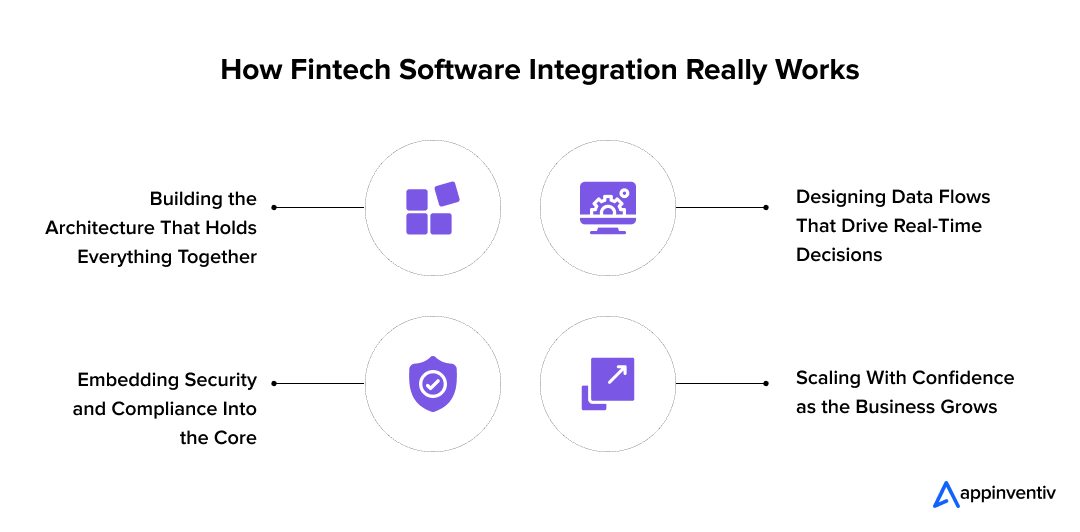

- How Fintech Software Integration Works?

- Building the Architecture That Holds Everything Together

- Designing Data Flows That Drive Real-Time Decisions

- Embedding Security and Compliance Into the Core

- Scaling With Confidence as the Business Grows

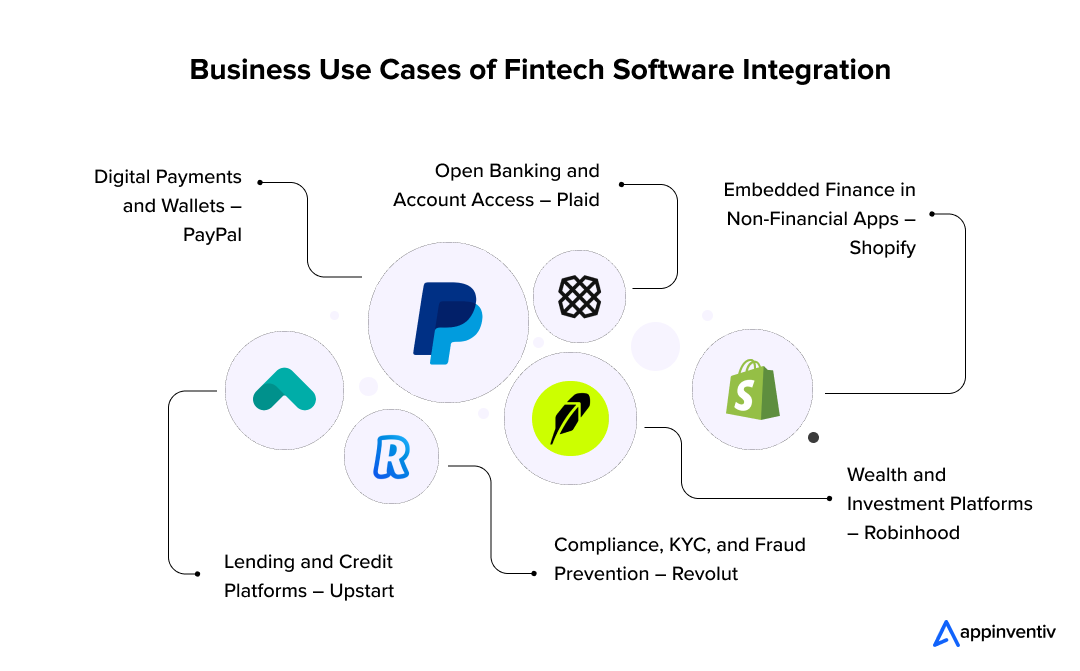

- Applications of Fintech Software Integration for Businesses

- Digital Payments and Wallets

- Lending and Credit Platforms

- Open Banking and Account Access

- Compliance, KYC, and Fraud Prevention

- Wealth and Investment Platforms

- Embedded Finance in Non-Financial Apps

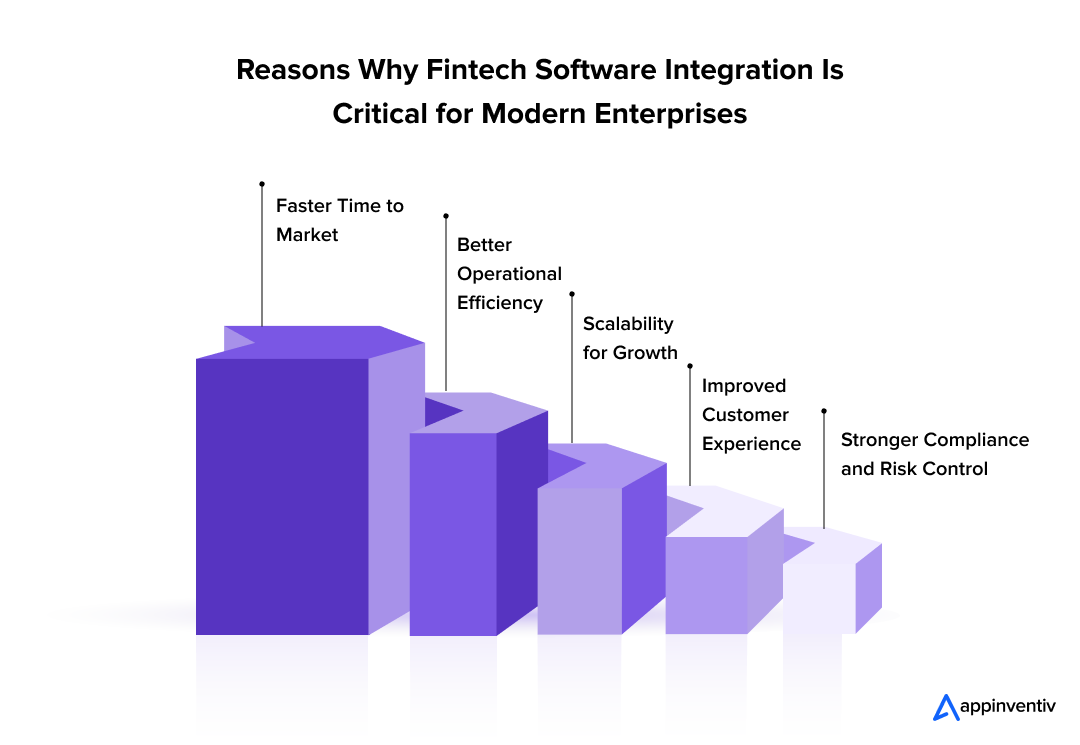

- Why Fintech Software Integration Matters More Than Ever

- Faster Time to Market

- Better Operational Efficiency

- Stronger Compliance and Risk Control

- Improved Customer Experience

- Scalability for Growth

- The Real Challenges of Fintech Software Integration that Businesses Face

- The Role of Artificial Intelligence in Fintech Software Integration

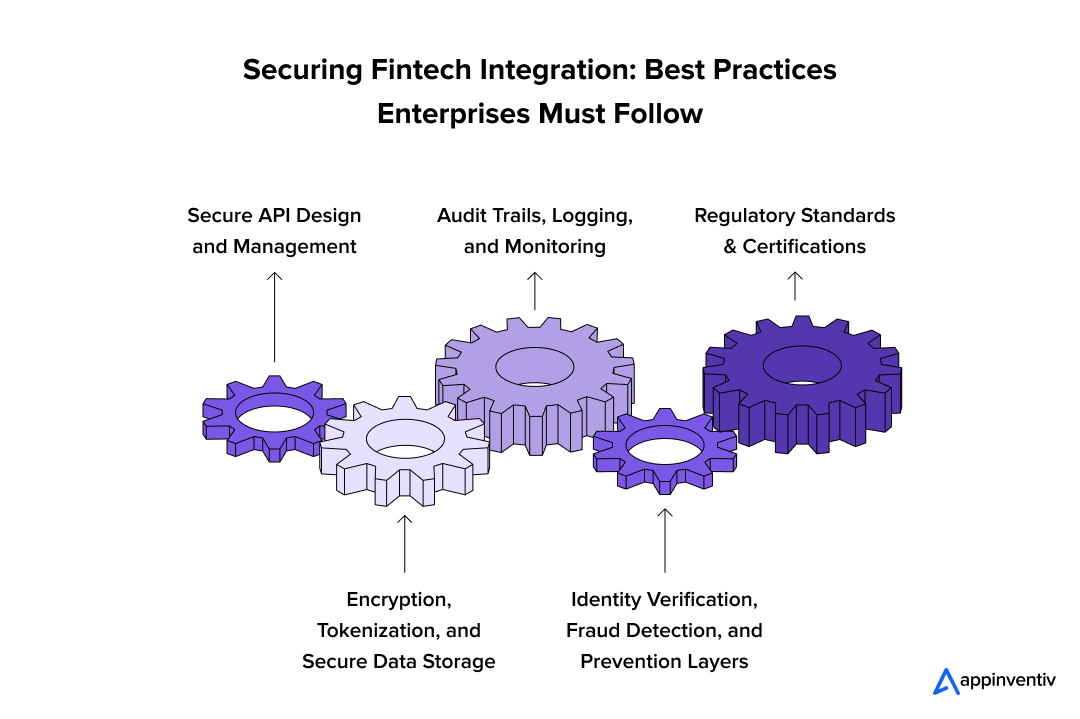

- Locking Down Trust: Best Practices for Secure Fintech Integration

- Secure API Design and Management

- Encryption, Tokenization, and Secure Data Storage

- Identity Verification, Fraud Detection, and Prevention Layers

- Audit Trails, Logging, and Monitoring

- Regulatory Standards and Certifications

- Counting the Spend, Proving the Return: Cost and ROI in Fintech Integration

- What Drives Costs

- Estimating Timeframes and Budgets

- How to Measure ROI and Business Value

- What’s Next: Future Trends in Fintech Software Integration

- Deeper Use of AI in Integrations

- Rise of Real-Time Everything

- Stronger Push for Open Finance

- Cloud-Native as the Default

- Security and Compliance by Design

- DeFi, ESG, and Sustainability

- Why Work With Appinventiv on Fintech Software Integration

- Real Fintech Experience

- Security From the Start

- Custom Fit, Not Cookie-Cutter

- Cross-Platform Know-How

- Support that Doesn’t Stop at Launch

- FAQs

Key takeaways:

- Fintech software integration creates unified systems that drive speed, compliance, and trust.

- Enterprise fintech solutions integration connects payments, lending, KYC/AML, and core banking.

- API-first, microservices, and cloud platforms enable secure fintech integration for businesses.

- Real-world leaders like PayPal, Upstart, Plaid, Revolut, Robinhood, and Shopify prove the impact.

- Benefits include faster launches, lower costs, stronger compliance, and scalability.

- Integration ROI comes from efficiency gains, customer growth, and reduced risk.

Your team ships new features every sprint, yet customers still hit friction at checkout, onboarding, and payouts. Risk flags fire too late. Reporting takes days. Every improvement needs three different vendors to talk to each other and your core systems. Meanwhile, rivals move money in real time and close partnerships faster. That gap is not about talent. It is about how your stack fits together.

Here is the shift we see with top performers. They treat fintech software integration as a discipline, not a project. They map value streams end to end. They design APIs first. They decouple products from legacy systems. They invest once in secure building blocks and reuse them across lines of business. The result is speed without losing control.

Leaders start small and scale with intent. A clean layer for API integration for fintech sits between partners, banks, and internal services. Consent, identity, and risk controls live in that layer. Product teams build on it to launch new offerings without reworking compliance every time. This is enterprise fintech solutions integration in practice. It is boring architecture that quietly unlocks growth.

Financial software implementation also looks different at these firms. They run phased rollouts. They test with real customers and measure outcomes in cycle time, approval rates, chargebacks, and unit economics. When a metric moves the wrong way, they can swap a provider or model because the platform is modular. That is the advantage of thoughtful fintech platform integration.

Security is built in by default, with encryption at rest and in transit, strong authentication across services, fine-grained permissions, and continuous monitoring. These teams treat secure fintech integration for businesses as a board topic. It lowers risk and speeds up audits while also strengthening trust with partners, who view your systems as reliable and easy to integrate with.

This blog is for CEOs and CTOs who want a clear path from messy point-to-point connections to a resilient, scalable integration layer. We will cover the why and the how of fintech software integration, the main types and use cases, the benefits and common challenges, and real examples you can benchmark against. We will also outline a practical playbook to plan, execute, and measure integration work that moves business metrics.

The question is, can your systems keep up?

Understanding Fintech Integration in the Enterprise

When leaders talk about scaling fintech, the conversation often moves from product features to infrastructure. You can build the smartest lending app or digital wallet, but if it can’t talk to banking partners, payment rails, identity systems, and compliance engines seamlessly, the business will stall. That’s where enterprise fintech solutions integration comes in.

At its core, it’s about stitching together financial software, APIs, and compliance frameworks so your business can move money, process risk, and serve customers in real time, without reinventing the wheel every quarter.

What Are Enterprise Fintech Solutions Integration?

Enterprise fintech solutions integration refers to the process of connecting various financial systems, applications, and third-party services into one cohesive ecosystem. Instead of running siloed apps for payments, lending, compliance, and reporting, integration builds a connected layer where data flows securely, APIs interact seamlessly, and new services can plug in without major disruption.

Here’s how it looks in practice:

| Aspect | What It Means for Enterprises |

|---|---|

| Scope | Covers payments, lending, KYC/AML, identity, compliance, core banking, and partner APIs |

| Goal | Create a unified, secure, and scalable infrastructure for financial operations |

| Outcome | Faster innovation, better compliance, lower costs, and improved customer experience |

Types of Fintech Software Integration Businesses Must Know Of

There isn’t a one-size-fits-all approach. Depending on your product, regulatory environment, and legacy stack, you may need one or more of these integration types:

API Integration for Fintech & Fintech API Integrations

APIs are the backbone of modern fintech. They allow apps to exchange data instantly and securely, whether it’s checking account balances, verifying identity, or executing payments.

| What It Covers | Why It Matters |

|---|---|

| REST, GraphQL, gRPC APIs for financial data | Enables real-time updates and seamless customer experiences |

| Partner integrations (banks, credit bureaus, regulators) | Reduces manual effort and compliance delays |

| Standardization & monitoring | Makes scaling across regions easier |

Open Banking / Open Finance Integration

Open banking APIs mandated by regulators (PSD2 in Europe, UPI in India, Open Banking UK, etc.) are creating a new baseline.

| What It Covers | Why It Matters |

|---|---|

| Secure data sharing between banks and fintech apps | Unlocks customer-authorized access to account, credit, and payment data |

| Expands to Open Finance (insurance, investments) | Enables broader financial ecosystems beyond banking |

| Regulatory compliance baked in | Builds trust and widens customer reach |

Embedded Finance & Fintech-as-a-Service (FaaS)

This is where non-financial brands embed financial services into their offerings. For instance, they can be ride-hailing apps offering wallets, or e-commerce platforms offering credit at checkout.

| What It Covers | Why It Matters |

|---|---|

| Lending, payments, insurance inside non-financial apps | New revenue streams and higher customer stickiness |

| FaaS providers offering pre-built modules | Speeds up time to market for enterprises |

| Scalable with API-first design | Lets you focus on customer experience while the infra is handled |

Payment Gateway, Compliance, Identity (KYC/AML) Integrations

Every fintech firm needs strong rails for moving money and verifying users.

| What It Covers | Why It Matters |

|---|---|

| Payment gateways, wallets, card processors | Ensures reliable, real-time transactions |

| Digital KYC/AML tools | Reduces fraud and meets regulator expectations |

| Identity verification, e-signatures | Smooth onboarding and global compliance |

For many enterprises, this is also the starting point for structured KYC automation, where verification moves from manual reviews to rule based, scalable workflows.

Legacy System / Core Banking System Integration

Not every enterprise starts fresh. Banks and large financial firms still run on decades-old core systems. Integration here is about bridging the gap.

| What It Covers | Why It Matters |

|---|---|

| Middleware & connectors for core banking | Prevents costly rip-and-replace strategies |

| Data synchronization & reconciliation | Keeps compliance and reporting accurate |

| Gradual modernization with APIs & microservices | Lowers risk while enabling innovation |

Now businesses must understand that FinTech integration is not a theoretical debate anymore but it is actually driving the winners ahead. Many enterprises taking integration seriously are also considering building a fintech super app to deliver banking, payments, lending, and compliance under one roof, which comes with its own cost structure.

PwC’s 2025 Global Compliance Study shows that 82% of financial firms plan to invest more in technology to automate compliance activities. The finding underlines a larger shift: compliance is no longer just about avoiding fines, it is about building trust and speed into financial operations. And none of that is possible without strong fintech software integration that connects systems, embeds controls, and makes compliance seamless across the enterprise.

For CEOs and CTOs, the message is clear: the window for experimenting is closing. Customers, partners, and regulators expect seamless, secure, real-time financial software implementation. Those who build on fragmented systems will find themselves slower, costlier, and less trusted. To say the lease, now is the time to invest, not just to keep up, but to lead.

Since you’ve seen the main types of fintech software integration, the next step is to look at how it actually works in practice. Because let’s be honest, knowing the theory is one thing, but making it work inside a real business is where the real challenge begins. So, let’s begin.

How Fintech Software Integration Works?

Finance software integration isn’t just about wiring a couple of APIs together and hoping it all works. It’s about making sure your technology, compliance needs, and business goals actually move in the same direction. For leaders, the real value is in knowing the flow because that’s what shows you where the money goes, where the risks sit, and how you can grow without breaking the system.

Here, we’re going to break it down step by step. We’ll start with the architecture that holds everything up, then look at how data moves across systems, how security and compliance are built in from the start, and finally, how the whole setup scales when volumes spike.

Building the Architecture That Holds Everything Together

If the foundation is weak, everything else falls apart. That’s true for buildings, and it’s just as true for software integration. The firms that scale don’t rely on point-to-point fixes that snap under pressure. They use API-first frameworks, microservices, and cloud platforms so each part of the stack can run on its own and grow when needed. At the center is an integration layer that keeps fintech product, apps, banks, and third-party services working together without friction.

Designing Data Flows That Drive Real-Time Decisions

Speed in fintech comes down to how data moves. If payment updates or loan decisions lag, the customer notices immediately. Modern fintech platform integration solves this by using event-driven flows and then updates travel across all systems the moment they happen. Add global standards like ISO 20022 or JSON, and suddenly expansion into new regions or partnerships doesn’t require rebuilding the pipes from scratch.

Embedding Security and Compliance Into the Core

Trust makes or breaks financial software implementation. That’s why the smartest firms don’t treat fintech cybersecurity as a bolt-on. Encryption, strong authentication, and monitoring are designed into the flow from day one. KYC, AML, and fraud checks sit alongside transactions, not outside them. The result is secure fintech integration for businesses that keeps regulators satisfied and gives customers confidence.

Scaling With Confidence as the Business Grows

The final test is what happens when volume spikes like salary day, year-end, or a new product launch. Cloud-native systems can flex automatically, while load balancing and monitoring keep services running even when one piece fails. For leaders, this means growth without constant firefighting and the ability to take new products to market faster, knowing the backbone will hold.

Applications of Fintech Software Integration for Businesses

When we talk about integration of fintech software, it’s easy to think of it as a back-office project. In reality, it shows up in the way customers pay, how fast a loan is approved, or whether fraud is caught before it hits the bottom line. Below are some of the most common fintech software integration use cases.

Digital Payments and Wallets

Payments are the simplest proof point. If your checkout is slow or fails too often, you lose customers. By linking wallets, payment gateways, and banks into one flow, transactions clear faster and more reliably. It’s one of the direct examples of fintech software integration improving both customer experience and revenue.

When building out enterprise fintech integrations, many firms ask for a custom ACH transfers solution that plugs into their core banking stack.

Example: PayPal’s integrations with global banks and card networks allowed it to scale across more than 200 markets. The company turned a simple digital wallet into a universal payment option, which became a key factor in building user trust and driving massive adoption worldwide.

Lending and Credit Platforms

Approving a loan today has to be quick and data-driven. Enterprise fintech solutions integration lets lenders pull bureau scores, bank statements, and ID checks into one process instead of handling them separately. That cuts decision time from days to minutes and reduces manual costs.

Example: Upstart relies on integrated bureau data and banking APIs to process millions of applications quickly. This approach helped it expand from personal loans into auto financing, proving that its model could scale into multiple lending products without slowing down approvals.

Also Read: How is Technology Changing the Future of Consumer Lending?

Open Banking and Account Access

Open banking has made customer-consented data sharing a standard. With the right APIs in place, fintech apps can show balances, pull transactions, or even start payments on the customer’s behalf. This kind of financial software implementation opens doors for budgeting tools, robo-advisors, and multi-bank services.

Example: Plaid’s deep integrations with thousands of banks gave it a central role in the open banking ecosystem. That reach made it the go-to partner for apps like Venmo and Robinhood, positioning Plaid as the infrastructure layer powering much of modern fintech.

Compliance, KYC, and Fraud Prevention

Secure fintech integration for businesses isn’t only about speed but about protecting the system. Integrated KYC and AML modules can check identities and flag suspicious activity in real time, so compliance isn’t a bottleneck. This is what regulators expect and customers trust.

Example: Revolut’s integration with Onfido enabled it to onboard new users in minutes, even as the company scaled across dozens of countries. This ability to combine speed with compliance was critical in helping Revolut grow its customer base past 30 million while still satisfying regulators.

Also Read: How Much Does It Cost to Build A FinTech App Like Revolut?

Wealth and Investment Platforms

Investors expect instant updates and smooth execution. By integrating broker APIs, market data feeds, and banking rails, wealth apps can give users a single place to manage portfolios, trade, and move funds.

Example: Robinhood’s direct integrations with clearing systems and data providers allowed it to offer commission-free trading at scale. This model reshaped the brokerage industry and became the company’s biggest differentiator, fueling its rise to tens of millions of active users.

Embedded Finance in Non-Financial Apps

The fastest-growing area is embedded finance. Retailers and platforms outside traditional banking are adding payments, credit, or insurance inside their own apps. Strong fintech platform integration makes this possible, connecting merchants with banks and compliance systems behind the scenes.

Example: Shopify embedded payments and lending directly into its platform, which turned it from a pure e-commerce tool into a full financial partner for merchants. This move increased merchant retention and opened up new revenue streams, helping Shopify expand its role in the retail ecosystem.

Why Fintech Software Integration Matters More Than Ever

When leaders talk about digital transformation in fintech, system integration usually sits in the background. But in reality, it is what makes everything else work. If systems don’t talk to each other, you end up with delays, compliance headaches, and frustrated customers. Done right, fintech platform integration gives enterprises speed, control, and the freedom to scale without constantly patching things together.

Faster Time to Market

In financial services, being late to launch can mean losing the market altogether. With proper fintech platform integration, new services don’t require months of custom coding. APIs and pre-built modules make it possible to test, roll out, and refine products much faster. That could mean adding a new payment method, embedding finance into an app, or building a lending flow without starting from zero each time. Speed here isn’t just about technology but about capturing customers before a competitor does.

Better Operational Efficiency

Most enterprises know the pain of data trapped in silos. Teams spend hours reconciling numbers because payment, compliance, and reporting systems don’t align. Enterprise fintech solutions integration cuts that waste. Data moves automatically between systems, reducing errors and lowering back-office costs. It doesn’t just save money but frees teams to focus on customer growth instead of manual clean-up. Over time, the business runs leaner and decisions are based on better information.

Stronger Compliance and Risk Control

Financial software implementation comes with rules that can’t be ignored. Regulators expect clear audit trails, consistent monitoring, and fast reporting. With secure fintech integration for businesses, these checks happen in the background. KYC and AML tools are built into the process, fraud detection runs in real time, and reporting is generated without extra manual work. That means fewer compliance gaps and less risk of fines or reputational damage.

Improved Customer Experience

Customers don’t care how many systems you run behind the scenes but care about speed and simplicity. Integration of fintech systems is what allows an account to update instantly after a transfer, or a card to be verified in seconds. When systems connect properly, customers experience fewer errors and smoother journeys. And in a market where switching apps is easy, that reliability is what keeps them from leaving.

Scalability for Growth

Every business wants growth, but not every system can handle it. Patchwork integrations usually break under pressure, whether it’s a holiday spending spike or a new product launch. Fintech platform integration, built on cloud-native systems and modular design, scales as demand grows. It’s the difference between scrambling during peak volume and handling it as a normal day. For CEOs and CTOs, this scalability is what makes expansion sustainable.

Appinventiv’s Insight

What we see across financial enterprises is that fintech software integration has shifted from a back-office IT task to a boardroom priority. It’s no longer just about cutting manual work but is becoming the foundation for compliance, customer experience, and future growth. Firms that treat integration as strategic, not tactical, are the ones scaling faster and with fewer risks.

The Real Challenges of Fintech Software Integration that Businesses Face

Even though the benefits of fintech software integration are clear, they are not without roadblocks. Many enterprises underestimate the complexity of connecting legacy systems, handling regulations, or keeping customer data secure at scale. CEOs and CTOs need to be aware of the challenges faced with fintech software integration early on so they can plan for them instead of reacting later.

| Challenge | How It Impacts the Business | Practical Solution |

|---|---|---|

| Legacy Systems That Don’t Connect | Old core banking systems or siloed apps slow down new product launches and make it expensive to maintain integrations. | Use middleware and API layers to bridge old systems with modern fintech platform integration, allowing gradual modernization instead of full replacement. |

| Data Silos and Inconsistent Flows | Information stuck in separate tools leads to errors, delays in reporting, and a poor customer experience. | Standardize data formats and build centralized data pipelines so all teams and apps access the same accurate information in real time. |

| Rising Compliance Demands | New regulations (KYC, AML, open banking rules) increase the risk of fines if systems aren’t aligned. | Embed compliance checks directly into the integration workflow to create audit-ready processes and reduce manual oversight. |

| Security Risks | Poorly designed integrations create weak points that hackers can exploit, leading to breaches or loss of customer trust. | Design secure fintech integration for businesses with encryption, strong authentication, and continuous monitoring as part of the architecture. |

| Limited Scalability | Patchwork integrations fail under heavy transaction spikes, leading to downtime and customer churn. | Adopt cloud-native infrastructure and microservices so the system can scale automatically and stay resilient during peaks. |

After looking at the common roadblocks, the natural next question is: how do you protect your systems from these risks? The answer lies in building security into the very fabric of fintech platform integration.

The Role of Artificial Intelligence in Fintech Software Integration

Artificial Intelligence is already shaping how financial systems connect and operate. When embedded into fintech software integration, AI helps automate compliance checks, reduce fraud, streamline onboarding, and deliver personalized customer experiences. The result is faster decision-making, stronger security, and more adaptive platforms that keep pace with changing business needs.

| AI Application | How It Enhances Integration | Business Impact |

|---|---|---|

| Fraud Detection & Risk Scoring | AI models monitor transactions across integrated payment gateways and banking APIs in real time | Blocks suspicious activity instantly, reducing losses and regulatory exposure |

| Predictive Analytics | Algorithms analyze historical data within integrated fintech platforms to forecast behavior | Improves credit approvals, demand forecasting, and portfolio management |

| Automated Onboarding | AI streamlines KYC and AML checks by verifying documents and identities across integrated systems | Cuts onboarding time from days to minutes while ensuring compliance |

| Personalized Recommendations | Integrated AI engines analyze user data to deliver tailored offers or financial advice | Boosts engagement, retention, and cross-sell opportunities across digital channels |

| Process Automation | AI agents automate repetitive tasks in multi-system workflows (ERP, CRM, compliance platforms) | Frees human teams, accelerates cycle time, and lowers operational costs |

Locking Down Trust: Best Practices for Secure Fintech Integration

When money and sensitive data move between systems, security can’t come at the end of the project. One gap in the chain is enough to shake customer trust or trigger a regulator’s audit. Here are the best practices businesses can follow:

Secure API Design and Management

APIs are what hold fintech platform integration together. They also happen to be a favorite target for attackers. That’s why authentication and access rules need to be strict from the start. Keeping APIs patched, tested, and monitored isn’t optional but it is what stops small oversights from turning into expensive breaches.

Encryption, Tokenization, and Secure Data Storage

Customer information should never sit exposed. Encrypt it when it’s stored, encrypt it again when it’s moving. Tokenization helps too by swapping out sensitive details with safe placeholders. These measures don’t just protect data; they also make audits and compliance checks much easier to pass.

Identity Verification, Fraud Detection, and Prevention Layers

A secure fintech integration for businesses has to know who’s on the other side of a transaction. Real-time KYC and AML tools confirm identity while fraud systems watch for behavior that looks off. Done well, this balance stops bad actors without slowing down genuine customers.

Audit Trails, Logging, and Monitoring

If something goes wrong, you need a record of what happened. Audit trails and logs give that visibility. Continuous monitoring adds another safeguard, flagging unusual activity before it spreads. For leaders, it’s about having proof for regulators and clarity for the tech team when incidents arise.

Regulatory Standards and Certifications

Every financial system has to meet the rules of the market it operates in. Standards like PCI DSS, GDPR, or ISO are more than paperwork- they’re signals that the company can be trusted. Keeping certifications current also makes expanding into new markets smoother, since the groundwork for compliance is already in place.

Now, the safest way forward is to partner with a FinTech software development company that can design security into every layer of fintech software integration including APIs, data handling, user checks, and compliance.

Before committing to enterprise fintech integration, leaders always circle back to two questions: what will it cost, and what will it return? Both need to be clear before budgets are signed off. Let’s look into the intricacies you need to understand below:

Appinventiv’s Insight

In our work with global fintechs, one pattern is clear: secure fintech integration for businesses isn’t a “nice to have” anymore. Regulators, customers, and partners all expect systems to be connected, auditable, and resilient. Companies that build this strength now avoid costly firefighting later and gain the trust needed to expand into new markets.

Counting the Spend, Proving the Return: Cost and ROI in Fintech Integration

Integration of fintech systems is a strategic investment, not a simple IT bill. Understanding what drives cost, how long projects realistically take, and what returns to expect helps leaders make better decisions and defend the spend at the board level.

What Drives Costs

Before diving into budgets, leaders need to know what actually pushes costs up. It’s not just the technology stack but the mix of features, compliance needs, and the scale of the rollout.

| Driver | Why It Matters | Impact on Budget |

|---|---|---|

| Features | Advanced capabilities like multi-currency payments, real-time dashboards, or AI-driven risk checks require more build time. | Expands development hours and vendor costs. |

| Compliance | Meeting KYC, AML, PCI DSS, and GDPR adds security layers and audit systems. | Increases spend on specialized tools and skilled teams. |

| Scale | Connecting a few APIs is cheaper than enterprise financial technology solutions integration across global systems. | Larger integrations mean higher infrastructure and testing costs. |

Estimating Timeframes and Budgets

One of the biggest mistakes is underestimating how long integration takes. Businesses should plan timelines and budgets based on the scope of work, not optimistic estimates.

| Project Scope | Typical Timeline | Budget Consideration |

|---|---|---|

| Basic integrations | 2–4 months | Covers core APIs and minimal compliance checks. |

| Moderate scope | 4–6 months | Involves multiple partners, added security, and partial legacy system connection. |

| Complex enterprise builds | 6–12 months+ | Heavy compliance, global operations, and deep legacy integration make this costly. |

How to Measure ROI and Business Value

Spending is easier to justify when leaders tie it to measurable business outcomes. ROI in fintech platform integration isn’t just about IT savings but also about speed, compliance, and customer growth.

| ROI Driver | What to Track | Business Value |

|---|---|---|

| Speed to market | Time to launch new products | Faster launches bring in revenue earlier. |

| Operational savings | Drop in manual processing or reconciliation hours | Lower costs and leaner teams. |

| Compliance readiness | Number of audit issues flagged or avoided | Fewer fines, stronger regulator trust. |

| Customer impact | Retention rates, transaction growth, adoption of new features | Better experience drives loyalty and revenue growth. |

What’s Next: Future Trends in Fintech Software Integration

End-to-end fintech connectivity is not standing still. The way enterprises connect platforms today will look very different in the next few years. CEOs and CTOs should keep an eye on these shifts, because they will shape how fast businesses scale, how safe transactions remain, and how new services reach customers.

Deeper Use of AI in Integrations

AI in fintech will move from being an add-on to being part of the integration layer itself. Fraud detection, predictive routing, and smarter data flows will run automatically, reducing manual oversight and making fintech platform integration faster and more reliable.

Rise of Real-Time Everything

Customers already expect instant payments, but real-time processing will expand into lending approvals, compliance checks, and cross-border transfers. Enterprise fintech solutions integration will need to handle this demand without breaking under pressure.

Stronger Push for Open Finance

Open banking is just the start. Open finance will extend integrations to insurance, investments, and even payroll. For businesses, this means financial software integration will become a gateway to offering broader financial ecosystems inside a single app.

Cloud-Native as the Default

Cloud-native architecture will stop being optional. Enterprises that still rely on heavy on-prem systems will struggle to keep up. Modern financial software implementation will be designed for flexibility and scale, with cloud services as the standard.

Security and Compliance by Design

Regulators will continue to raise the bar. Secure fintech integration for businesses will require compliance baked in from the start, with automated audit trails and stronger encryption as baseline, not extras. Firms that lag here risk losing both customers and licenses.

DeFi, ESG, and Sustainability

The next wave of fintech software integration will also be shaped by decentralized finance (DeFi) platforms and the growing demand for ESG-focused solutions. From integrating blockchain protocols for decentralized lending to embedding sustainability metrics into reporting systems, enterprises will need integration strategies that meet both investor expectations and regulatory goals around transparency and responsible finance.

Why Work With Appinventiv on Fintech Software Integration

Bringing fintech systems together isn’t just another IT job. It means handling regulation, customer trust, and complex tech at the same time. If the integration fails, the business feels it immediately in payments, compliance, or customer experience. That’s why choosing the right FinTech consulting services partner matters.

Real Fintech Experience

We’ve worked with banks and fintech companies long enough to know the traps. Integrations that look simple on paper usually get messy once legacy systems and compliance rules come in. Our teams are used to solving that.

Here are some of the major Fintech projects that we have worked on:

Mudra

We built an AI-powered budgeting app that simplifies money management for millennials through smart insights and personalized savings goals. Today, it’s used across 12+ countries, helping users stay financially disciplined without the complexity.

A Smart AI-Based Banking Solution

For a leading European bank, we engineered an AI-driven platform that automates workflows, accelerates query resolution, and strengthens compliance. The result: faster service, 20% higher retention, and a 35% cut in manual effort.

Edfundo

We partnered with Edfundo to launch an interactive financial literacy platform for kids, blending gamified learning with real-world money skills. Backed by $500K in pre-seed funding, it was named FinTech Startup of the Year.

Security From the Start

PCI DSS, GDPR, AML, KYC- these aren’t buzzwords for us, they’re the baseline. We design every project with those requirements built in so you don’t have to retrofit later.

Custom Fit, Not Cookie-Cutter

Every enterprise runs on its own mix of platforms. Instead of forcing a one-size-fits-all model, we shape the integration to match your workflows and future growth plans.

Cross-Platform Know-How

Web, mobile, or back-end banking systems, our focus is on making them talk to each other smoothly, so you get one connected environment instead of scattered tools.

Support that Doesn’t Stop at Launch

Secure fintech integration for businesses needs upkeep. Regulations shift, data volumes grow, and systems need updates. We stay involved so you don’t hit roadblocks six months down the line.

Here’s what our clients have to say about us:

In short, we work as a partner, not a vendor. The goal is to leave you with fintech software integration that actually scales with your business and earns trust in the market. Get in touch with us now!

FAQs

Q. What’s the ROI of integrating fintech software into existing systems?

A. ROI from fintech software integration is not only about saving costs, it is about long-term value. Here are some things businesses can expect:

- Faster time to market — Launching products sooner means revenue starts earlier and market share is protected.

- Lower operational costs — Automation replaces manual reconciliation, reducing staffing hours and errors.

- Compliance readiness — Built-in checks reduce audit risks, saving both fines and reputational damage.

- Customer loyalty — Smoother experiences keep users engaged, driving adoption and repeat usage.

Q. What role does fintech integration play in future-proofing financial operations?

A. Fintech platform integration gives enterprises flexibility to adapt, which is key for the future. It also helps with:

- Regulatory changes — Compliance rules evolve constantly, integrated systems adapt faster without rework.

- Scalability — Cloud-native systems expand when demand spikes, avoiding downtime or costly rebuilds.

- Service expansion — API-first designs make it easier to embed lending, payments, or insurance in weeks.

- Competitiveness — Integrated operations let you respond quickly to market shifts and customer needs.

Q. How to choose the right fintech software integration partner?

A. Picking the right partner for enterprise financial technology solutions integration comes down to four essentials:

- Fintech expertise — proven experience with financial software implementation, not just general IT builds.

- Security-first approach — PCI DSS, GDPR, AML, and KYC requirements included from the start, not later.

- Customization — integrations shaped around your workflows and goals, not off-the-shelf templates.

- Long-term support — secure fintech integration for businesses needs updates, monitoring, and compliance refreshes over time.

Q. Can fintech integration reduce operational costs for enterprises?

A. Yes, secure fintech integration for businesses can drive cost savings across the board. Here’s how:

- Manual work drops — Automated flows replace repetitive processes, freeing teams for higher-value tasks.

- Errors are reduced — Consistent data lowers the cost of corrections and failed transactions.

- Compliance becomes simpler — Integrated reporting saves time during audits and regulator checks.

- Infrastructure costs fall — Cloud-based fintech platform integration scales resources without big upfront spend.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does Accounting Practice Management Software Development Cost in Australia 2026?

Key takeaways: Custom accounting practice management software development in Australia for mid-to-large firms generally falls between AUD 70,000 and AUD 700,000. Adherence to the Privacy Act 1988 and ATO operational frameworks is a primary cost driver, not an add-on. A modular architecture and structured development approach ensure that the platform evolves with changing laws and…

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…