- Understanding P2P Lending Platforms: The Digital Finance Revolution

- The Core Model of P2P Platforms

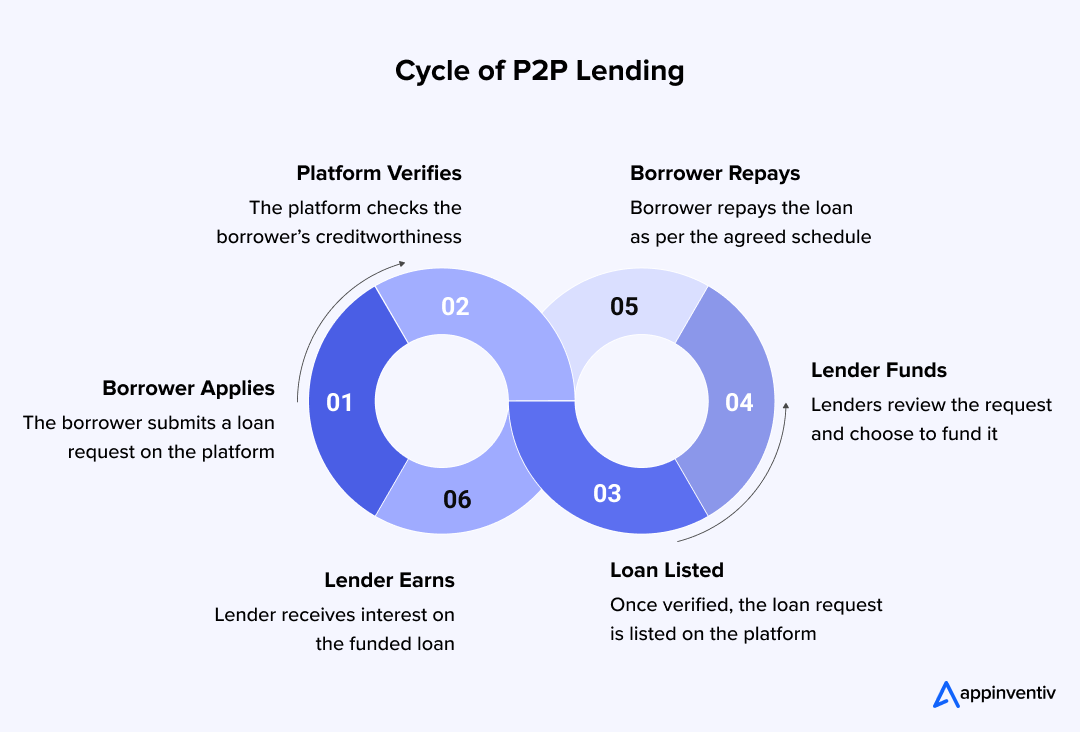

- How Peer-to-Peer Lending Software Works

- Revenue Streams for P2P Platform Operators

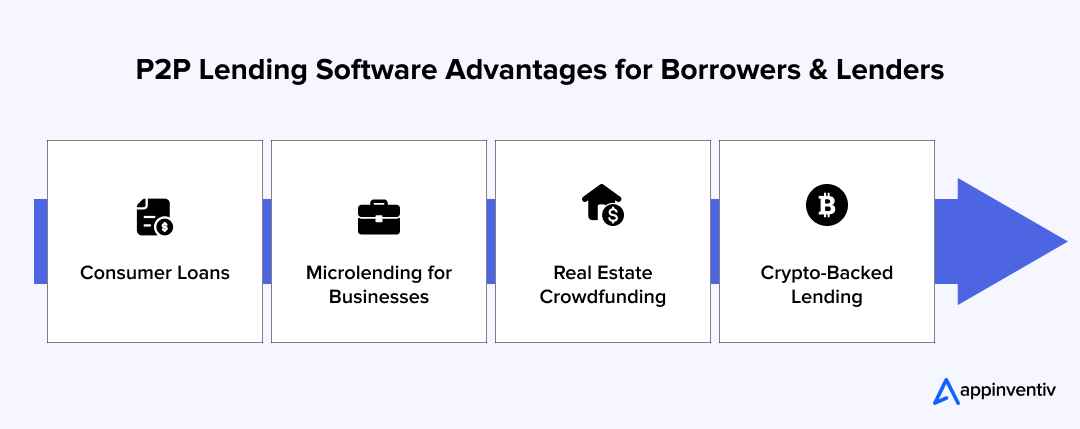

- Types of Platforms

- Differences Between Traditional Lenders and P2P Lending Platforms

- Benefits of P2P Lending Software Development

- 1. Consumer Loans

- 2. Microlending for Businesses

- 3. Real Estate Crowdfunding

- 4. Crypto-Backed Lending

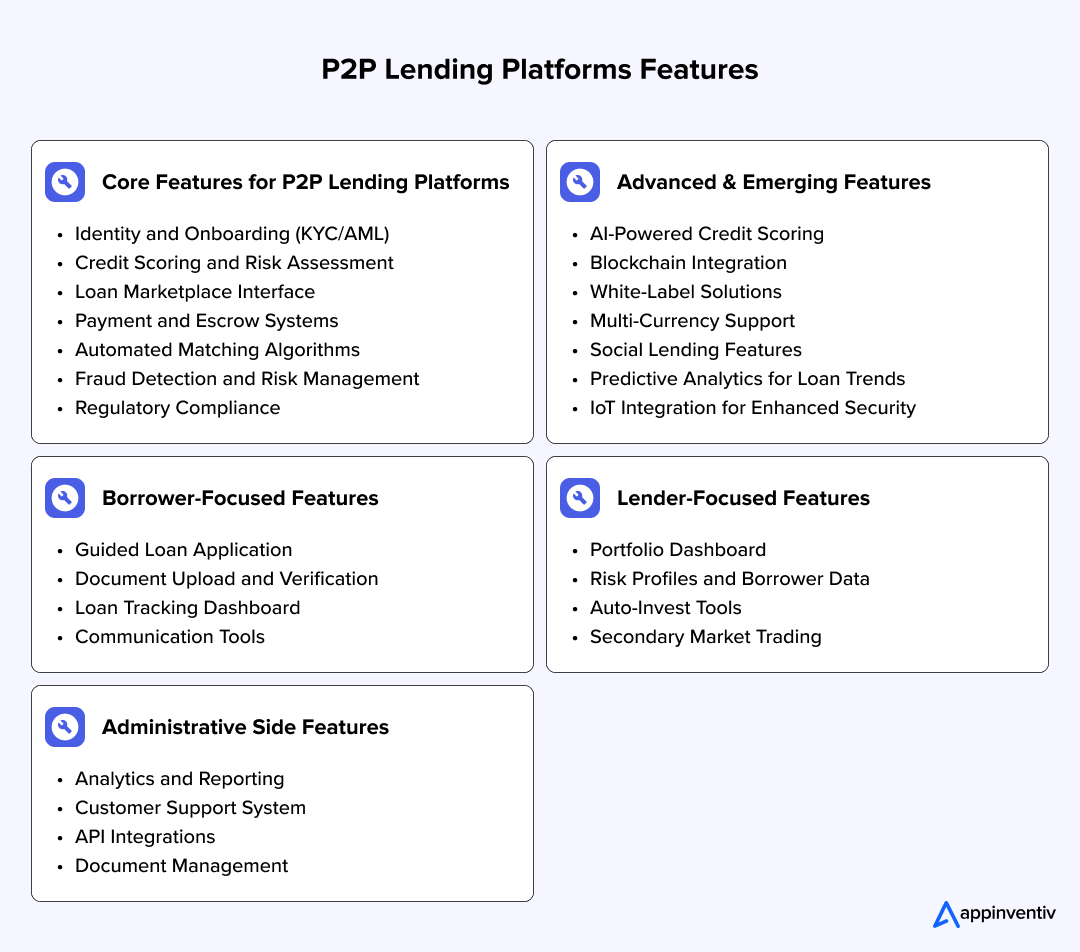

- Must-Have Features in P2P Lending Platforms

- Core Features for P2P Lending Platforms

- Borrower-Focused Features

- Lender-Focused Features

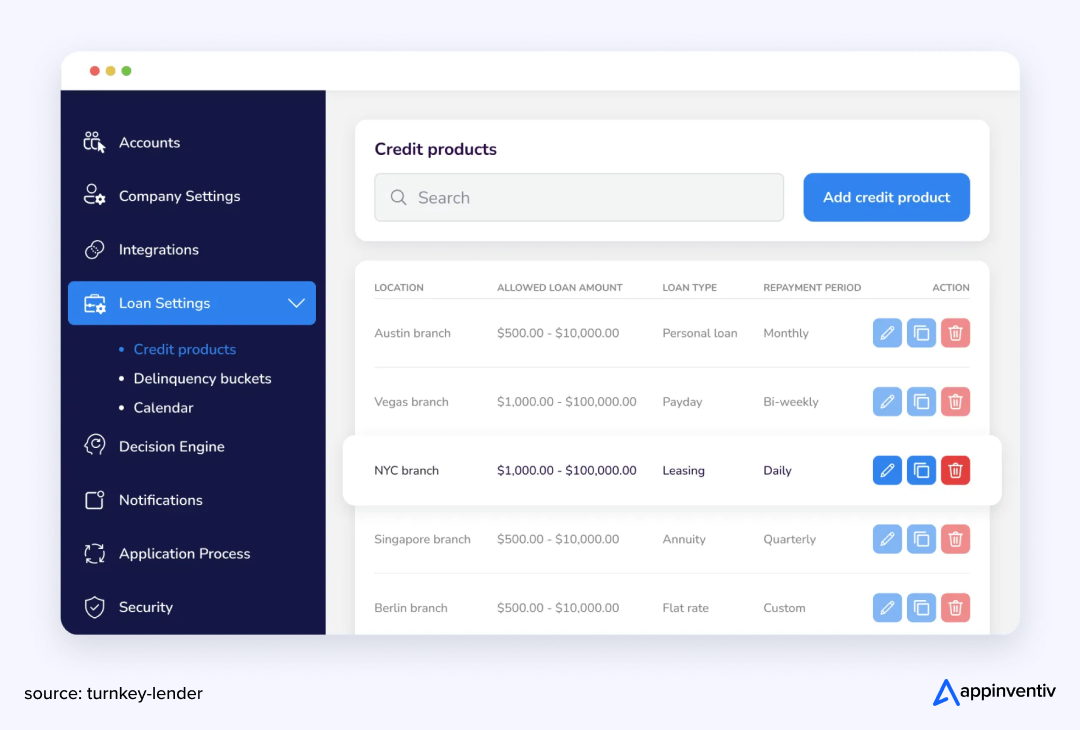

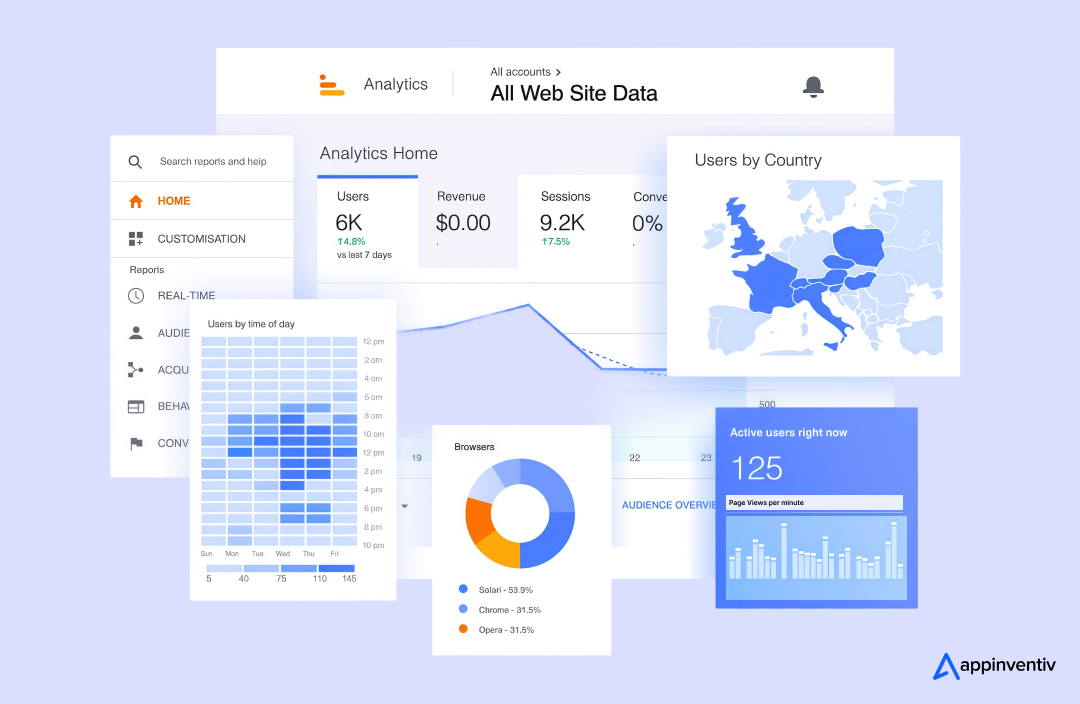

- Administrative Side Features

- Advanced & Emerging Features

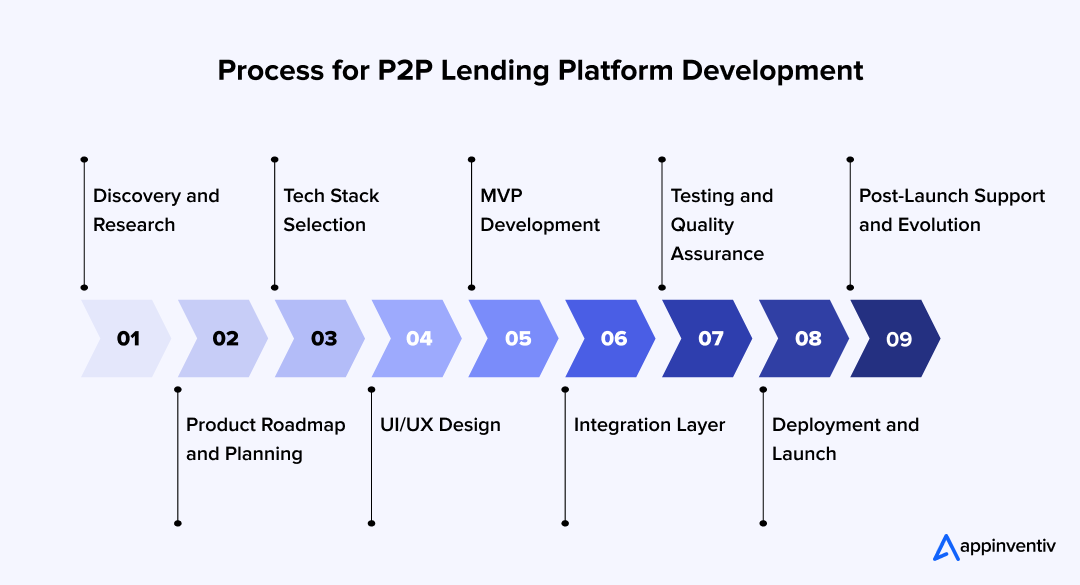

- How to Build a P2P Lending Platform: A Step-by-Step Process

- 1. Discovery and Research

- 2. Product Roadmap and Planning

- 3. Tech Stack Selection

- 4. UI/UX Design

- 5. MVP Development

- 6. Integration Layer

- 7. Testing and Quality Assurance

- 8. Deployment and Launch

- 9. Post-Launch Support and Evolution

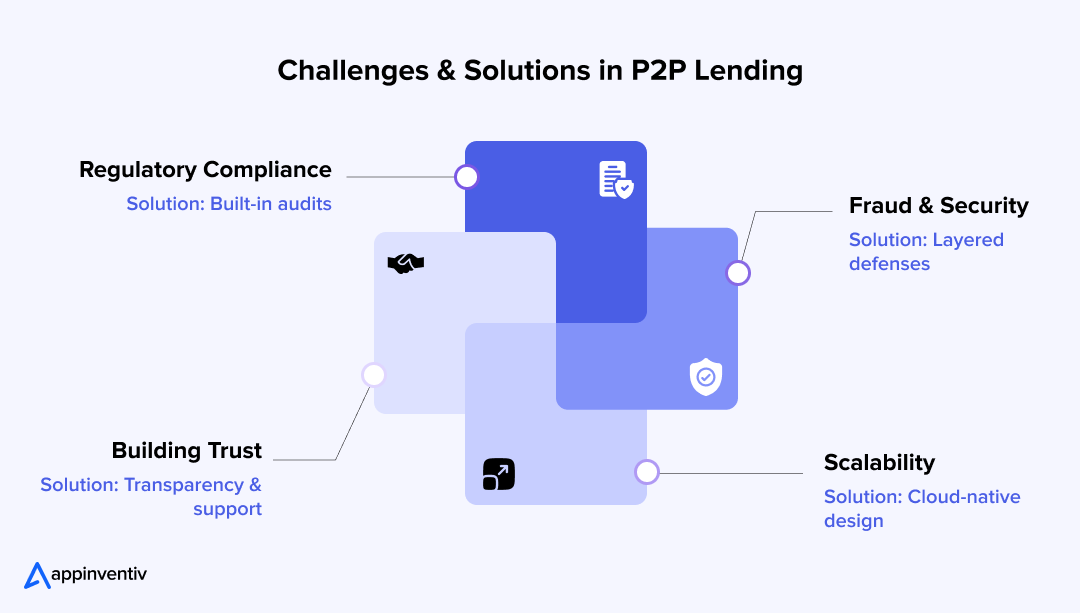

- Challenges in P2P Lending Software Development and How to Solve Them

- Regulatory Compliance

- Fraud and Security

- Scalability

- Building Trust

- Costs and Timeline of Developing P2P Lending Software

- Ongoing Costs

- Cost Optimization Strategies for P2P Lending Platform Development

- Start with an MVP

- Reuse Frameworks and Libraries

- Offshore Where It Makes Sense

- Phase Complexity

- Why Partner with Appinventiv for P2P Lending Software Development

- FAQS

Key takeaways:

- P2P lending platforms thrive on efficiency, but compliance and trust are non-negotiable.

- Costs range from $40,000 for an MVP to $600,000+ for enterprise platforms, with timelines varying from 4 to 18 months.

- Scalability and fraud prevention should be designed early, not patched later.

- AI, automation, and blockchain are shaping the next generation of features.

- Partnering with an experienced FinTech Software Development Company like Appinventiv reduces risk and speeds execution.

Not long ago, getting a personal loan meant sitting in a bank lobby, filling out forms, and waiting days (sometimes weeks) for approval. Today, the same loan can be funded in hours, not by a bank, but by a group of individual investors connected through a digital marketplace. That’s the essence of peer-to-peer (P2P) lending: faster, more transparent, and built on technology rather than paperwork.

For instance, platforms like LendingClub in the US or Funding Circle in the UK redefined borrowing and lending by bypassing traditional banks, creating direct value for both lenders and borrowers.

The appeal is obvious. Borrowers get quicker access to capital and more flexible terms. Investors gain a chance to earn higher yields by funding loans directly. And operators, the ones running the platforms, make money by charging origination and servicing fees without carrying the credit risk themselves.

This shift isn’t just about convenience; it’s about control. A well-built P2P lending platform puts borrowers, lenders, and administrators on equal footing, powered by software that handles identity checks, loan matching, payments, and compliance in the background. That’s why P2P lending software development has become one of the most active areas in fintech.

The challenge? Building software that stays secure, follows regulations, and delivers a smooth user journey, all while being scalable enough to grow with the market. Balancing these priorities with realistic costs and timelines is often where ideas reach heights or fall flat.

Of course, building the software that makes all this work is challenging. You’re handling sensitive data, chasing regulatory approvals, fighting fraud, and trying to create an experience that customers will actually trust with their money. Balancing these priorities with realistic costs and timelines is often where ideas reach heights or fall flat. That’s where P2P lending platform software development comes in.

This blog breaks it all down: how the platforms work, what features really matter, the steps to develop a P2P lending platform, the cost and timeline you should plan for, and the common traps first-time builders fall into.

Stop planning. Start building. Let’s launch your P2P lending MVP in just 90 days (a little less or more).

Understanding P2P Lending Platforms: The Digital Finance Revolution

At its heart, peer-to-peer lending is simple. One person needs money, another has spare capital, and the platform makes the introduction. Yet what looks straightforward on the surface hides a complex engine of risk checks, contracts, and digital plumbing that keeps the money flowing and everyone protected.

The Core Model of P2P Platforms

Strip away the technology and regulations, and the model is straightforward: borrowers on one side, investors on the other, and a digital platform in the middle. What separates peer-to-peer lending from a bank isn’t the purpose of the loan; it’s the structure.

A bank lends its own money and takes the credit risk. A P2P platform doesn’t. It provides the rails: the checks, the contracts, the payment systems, and the marketplace where both sides meet. The business earns from fees, not from lending its own balance sheet. That distinction makes the model lighter, faster, and often more flexible.

How Peer-to-Peer Lending Software Works

Picture a small café owner in Manchester looking for £20,000 to upgrade kitchen equipment. Instead of queuing at a bank, she applies online. The platform verifies her identity, runs credit checks, and assigns an interest rate. That loan request appears in the marketplace, where dozens of investors can pledge slices of the total.

Within a short time, the full amount is raised. Funds go to the café; repayments flow back to each investor every month, minus the platform’s fee. In practice, peer to peer lending software is nothing more and nothing less than a disciplined system for making this cycle safe, quick, and transparent.

Revenue Streams for P2P Platform Operators

Most platforms monetize in three ways:

- Origination fees, charged to borrowers when the loan is approved.

- Servicing fees, deducted from repayments to cover administration.

- Secondary market fees, for platforms that allow loan trading between investors.

For larger operators, data services and premium investor dashboards are becoming additional revenue lines.

Types of Platforms

There are different types of P2P lending software solutions, each targeting a specific market gap. Let’s explore them one by one:

Consumer Lending Platforms for Personal Loans

These handle personal loans for debt consolidation, home improvements, and major purchases. LendingClub, which processed over $90 billion in loans before transitioning to a full banking model, exemplifies the potential scale of this category.

Business Lending Solutions for SMEs Seeking Working Capital

Small and medium enterprises (SMEs) represent a massive addressable market. The number of small businesses is increasing globally. However, most businesses do not have previous financial account statements to gather more funding through proper channels, like bank loans. This gap creates opportunities for specialized B2B lending platforms.

Real Estate Crowdfunding for Property Developments

Property-backed loans offer secured lending opportunities with typically lower default rates but higher capital requirements. For investors, the appeal lies in tangible collateral, while developers gain quicker access to funding without relying solely on banks.

Invoice Financing for Companies Waiting on Receivables

Short-term working capital solutions help businesses bridge payment gaps, representing a growing sector within P2P lending markets. It gives SMEs breathing room while offering investors predictable, short-duration returns.

Each category requires its own underwriting rules. A consumer loan might rely on credit scores and income verification, while real estate platforms assess collateral and property valuations.

Differences Between Traditional Lenders and P2P Lending Platforms

Banks and P2P platforms both serve borrowers, but their engines run on very different mechanics. Where banks rely on balance sheets and layers of process, P2P platforms thrive on digital efficiency and fee-based models. Here is a brief table outlining the key differences between traditional lenders and P2P lending platforms

| Aspect | Traditional Lenders (Banks) | P2P Lending Platforms |

|---|---|---|

| Source of Funds | Lend from their own capital reserves | Match borrowers with individual or institutional investors |

| Revenue Model | Interest income, service fees, cross-selling | Origination and servicing fees, secondary market fees |

| Approval Speed | Days to weeks due to paperwork and manual checks | Hours to a few days with automated KYC and scoring |

| Risk Bearing | Bank assumes credit risk | Investors bear credit risk; platform manages the process |

| Accessibility | Often limited to borrowers with strong credit history | Broader reach, including SMEs and underserved borrowers |

| Regulation | Heavily regulated as deposit-taking institutions | Regulated differently, usually as financial intermediaries |

| Technology Backbone | Legacy systems, branch-led operations | Cloud-first, API-driven, designed for scalability |

Benefits of P2P Lending Software Development

P2P lending platforms aren’t one-size-fits-all. The software is designed to serve different lending contexts: from small consumer loans to crypto-backed financing. Each use case for P2P lending software shapes how the platform benefits the users. For instance, it speeds up access to capital for borrowers, opens new yield opportunities for investors, and gives operators scalable revenue without holding credit risk.

It’s fast, transparent, and built to adapt across consumer, business, and even crypto lending contexts. Here are some of the key benefits of P2P lending software for businesses.

1. Consumer Loans

Borrower’s view: For someone facing an unexpected medical bill or planning a home upgrade, speed matters more than anything. P2P platforms often deliver approvals within hours instead of days. The experience feels less intimidating than a bank branch.

Lender’s view: Retail investors get access to hundreds of small loan fractions, spreading risk across multiple borrowers. Instead of locking money into a single borrower, they build a portfolio that mirrors their appetite for risk and return.

2. Microlending for Businesses

Borrower’s view: Small businesses often struggle to secure working capital from banks. A café needing new equipment or a local retailer preparing for holiday demand can turn to a P2P platform for quick access to funds. The process is lighter on paperwork and faster on disbursement.

Lender’s view: Investors tap into a segment that banks frequently overlook. The returns are attractive, and the risk can be balanced through automated allocation tools that diversify across many small businesses.

3. Real Estate Crowdfunding

Borrower’s view: Property developers use P2P platforms to raise funds for construction or renovation projects. Instead of relying on a single bank loan, they attract multiple backers and disburse funds in stages as milestones are completed.

Lender’s view: Investors gain visibility into collateral, loan-to-value ratios, and project timelines. Unlike abstract consumer loans, these investments are tied to tangible assets, which adds a layer of comfort for certain profiles of investors.

4. Crypto-Backed Lending

Borrower’s view: For digital asset holders, liquidating tokens isn’t always desirable. Crypto-backed lending platforms allow them to access liquidity without selling holdings.

Lender’s view: Investors earn yield on crypto assets they might otherwise keep idle. The platform enforces strict collateralization rules to protect lenders from volatility, showing how applications of peer to peer lending software can extend beyond traditional finance.

Must-Have Features in P2P Lending Platforms

Building a P2P platform is not about stacking flashy add-ons. It is about creating a system users can trust with their money. That trust rests on three foundations: a smooth borrower journey, a reliable investor experience, and an administrative layer strong enough to handle compliance and fraud. Here is a breakdown of the features that matter most, and why they separate strong platforms from fragile experiments.

Core Features for P2P Lending Platforms

1. Identity and Onboarding (KYC/AML)

Every regulated market demands KYC and AML features in software, and for good reason. If your platform allows borrowers or lenders through without proper screening, you aren’t just risking fraud; you are risking your license.

Effective onboarding uses tiered checks: simple ID verification for retail investors, enhanced due diligence for high-value participants. The user experience must be tight but not hostile; too much friction and users drop off, too little and compliance gaps open.

2. Credit Scoring and Risk Assessment

This is where many new entrants underestimate the challenge. The credit scoring feature is not just pulling a bureau report. It is combining structured bureau data with alternative signals: cash-flow history, invoice patterns, and even digital behavior.

Some platforms are using AI and automation in P2P lending software to refine models, but black-box decisions invite regulatory scrutiny. The best platforms make their risk models explainable, with clear rejection reasons and override options.

3. Loan Marketplace Interface

This feature is like your trading floor. Borrowers are listing requests, and investors are browsing options. A clunky interface kills engagement. What works well is a marketplace that balances detail with clarity: credit grade, loan purpose, term length, risk indicators, and projected returns. Investors should be able to filter quickly, compare loans side by side, and commit funds without excessive clicks.

4. Payment and Escrow Systems

Moving money safely is non-negotiable. Funds must sit in segregated escrow accounts, never mixed with the platform’s operating funds. Disbursements need reconciliation routines, so every pound or dollar can be tracked.

For repayments, the system has to handle partial payments, late fees, and automatic distributions back to dozens or even thousands of investors. A missed reconciliation here can destroy confidence overnight.

5. Automated Matching Algorithms

Smart matching keeps the marketplace liquid without letting risk pile up in the wrong places. A good engine respects lender rules (risk band, term, sector, max-per-loan) while honoring platform guardrails like exposure caps, concentration limits, and fair-access sequencing.

6. Fraud Detection and Risk Management

Fraud is a matter of when, not if. Strong systems with strong security measures, such as biometrics track device fingerprints, flag velocity patterns (multiple applications in minutes), and block suspicious flows before disbursement. Administrators need dashboards with case queues and escalation paths.

7. Regulatory Compliance

Regulators will ask for audit trails, suspicious activity reports, and KYC/AML evidence. If your compliance tools are scattered across spreadsheets, you’re in trouble. Embedding compliance in P2P lending software development means building workflows that generate evidence automatically.

Borrower-Focused Features

1. Guided Loan Application

Most borrowers are not financial experts. A guided workflow, breaking complex forms into smaller steps, showing progress indicators, reduces abandonment. Clear explanations of what data is being collected and why it matters also build trust.

2. Document Upload and Verification

Mobile-first borrowers should be able to snap photos of IDs or bank slips. Verification should be quick, preferably automated. The key here is not just speed but transparency: borrowers should see the status of their uploads (pending, verified, rejected) without chasing support.

3. Loan Tracking Dashboard

Once a loan is active, borrowers want certainty. A dashboard showing outstanding balance, due dates, and repayment history becomes their financial anchor. Missed this, and you’ll flood your support team with “how much do I owe?” tickets.

4. Communication Tools

Borrowers often want clarity about terms, rescheduling, or hardship programs. Having an in-app chatbot or structured messaging channels avoids misunderstandings and keeps communication auditable.

Also Read: AI Chatbots in Banking: Application & Advantages

Lender-Focused Features

1. Portfolio Dashboard

Investors are putting real money at stake. They expect a dashboard that shows allocations by risk grade, expected versus actual returns, and upcoming repayments, giving investors confidence and reducing reliance on support teams.

2. Risk Profiles and Borrower Data

Investors won’t commit blindly. Profiles should surface risk scores, loan purpose, repayment history, and collateral (if any). Sophisticated lenders want CSV or API exports to run their own models.

3. Auto-Invest Tools

Retail investors rarely have time to browse listings daily. Auto-invest settings, such as choosing risk bands, loan sizes, and sectors, allow for passive participation. This feature also stabilizes liquidity by ensuring demand flows automatically into new loans.

4. Secondary Market Trading

Liquidity is one of the biggest barriers for investors. A secondary market, where loan parts can be resold, addresses this. But it requires strict rules: disclosures about loan performance, transfer restrictions, and clear fee structures.

Administrative Side Features

1. Analytics and Reporting

Operators need visibility at three levels: loan performance, investor activity, and system health. Customizable reports help teams spot early warning signs, like rising defaults in a particular segment.

2. Customer Support System

Support is not a side feature; it is part of trust. Borrowers disputing fees or lenders questioning payouts expect fast, clear answers. Ticketing systems with role-based access ensure no sensitive information is mishandled.

3. API Integrations

No platform runs in isolation. You’ll need smooth P2P lending software integration with fintech systems: payment gateways, KYC vendors, accounting tools, tax software, and so on. Clean APIs reduce manual work and lower the risk of reconciliation errors.

4. Document Management

Borrowers need to upload IDs, financial statements, and invoices; lenders require contracts and tax forms. Without a secure, searchable repository, operations may bog down. A strong system supports encrypted uploads, automated verification (OCR/liveness checks), and structured tagging so administrators can retrieve evidence instantly during audits.

Advanced & Emerging Features

AI-Powered Credit Scoring

AI in credit scoring helps platforms judge borrowers on more than bureau scores. They look at spending habits, income flows, and even repayment behavior across different accounts. The upside is sharper risk detection; the risk is opacity, which is why explainability and reason codes are essential.

Blockchain Integration

Blockchain can take over routine but critical steps such as disbursing loans, tracking repayments, or releasing collateral. Records become tamper-proof, which builds trust. But adoption has to be cautious since regulators are still testing how far they’ll allow it.

Also Read: How Does DeFi Lending Work

White-Label Solutions

Some operators skip the long build and license an existing platform. White-label versions come with the core already built, but allow branding, UI changes, and feature tweaks. The real work lies in keeping tenant data airtight and avoiding cross-contamination.

Multi-Currency Support

Cross-border lending doesn’t work if a platform can’t handle multiple currencies. The feature covers FX conversion at the time of disbursement or repayment, plus generating compliant reports for each region. Without it, scaling outside one market is almost impossible.

Social Lending Features

Not every borrower wants the open marketplace. Some prefer raising money within trusted networks like alumni groups, associations, or local communities. The P2P platform should support this by offering private lending spaces where reputation and relationships matter as much as credit scores.

Predictive Analytics for Loan Trends

Predictive analytics-powered software looks ahead instead of waiting for defaults. By spotting stress signals in repayment behavior or external market data, the system can flag risks early. That helps operators tighten credit rules and guide investors before losses mount.

IoT Integration for Enhanced Security

IoT isn’t just for smart homes; it can also tighten lending security. IoT adds a physical check to digital lending. IoT-powered wearables or smart devices can confirm collateral status or add biometric checks for borrowers, making fraud much harder to slip through.

In other words, must-have features in P2P lending platforms are about control and reliability, while advanced digital lending technologies and future trends in P2P lending platform development help differentiate and scale.

How to Build a P2P Lending Platform: A Step-by-Step Process

Launching a P2P lending platform is not just a coding exercise. It is closer to orchestrating a financial institution on digital rails. The process is best understood as a sequence of disciplined steps, each with its own deliverables and risk considerations. Skipping one often leads to expensive rework later.

1. Discovery and Research

The process begins with mapping out the business goals, compliance needs, and user expectations. Before writing a single line of code, map the market. Which borrower segments will you serve: consumers, SMEs, or real estate developers? What regulatory permissions apply in your target jurisdictions? At this stage, product ideas often collide with compliance reality.

A platform built for small-ticket consumer loans in the US may need state-by-state licenses; a business-focused product in Europe may fall under different supervisory rules. Discovery also includes competitor benchmarking and identifying gaps in borrower or lender experience that you can realistically close.

2. Product Roadmap and Planning

Here, priorities are set. This is the stage where business ambition meets engineering capacity. The roadmap defines your initial scope: which loan types, which geographies, which features are must-haves versus nice-to-haves.

For example, launching with a full secondary market sounds attractive, but without enough liquidity, it backfires. Planning also covers governance: who decides when credit models are updated, who signs off on fee changes, and who manages dispute resolution. Treat these not as “policies to write later” but as part of your core product design.

3. Tech Stack Selection

The best tech stack for P2P lending software development is the one your team can operate safely for years, not the one with the flashiest frameworks. Many successful platforms rely on a stable web front-end (React/Next.js), strong mobile apps (Swift/Kotlin), service layers in Node.js or Java, and Python for risk and analytics jobs.

Here is the ideal tech stack you can consider when building a P2P lending platform:

| Layer | Recommended Options | Why It Matters |

|---|---|---|

| Frontend | React.js, Angular | Delivers a fast, responsive interface for borrowers and lenders. |

| Backend | Node.js, Python, Ruby on Rails | Powers business logic, handles transactions, and scales with user growth. |

| Database | PostgreSQL (relational), MongoDB (NoSQL) | Supports both structured financial data and flexible user activity records. |

| Blockchain | Ethereum, Solana | Enables smart contracts, transparent ledgers, and secure decentralized processes. |

| Cloud Hosting | AWS, Google Cloud | Provides scalable infrastructure with high security and compliance readiness. |

4. UI/UX Design

The next step is to design a clean, clear, and easy-to-navigate interface. Financial services succeed when the UI/UX looks simple and intuitive. A borrower applying for a loan should move through a guided flow that makes regulatory data collection painless. A lender exploring investment options should feel as comfortable as they do using a brokerage platform.

Copywriting matters here; disclosures must be legally accurate, but also human-readable. In P2P lending, trust is built as much through the clarity of screens and words as it is through contracts.

5. MVP Development

Resist the urge to build everything. Begin with an MVP initially. An MVP should cover only the essentials: borrower onboarding, credit assessment, loan listing, funding, disbursement, and repayment tracking.

This version gives you something to test with real users and regulators. It also validates whether your credit policies and liquidity assumptions hold. Adding advanced features such as auto-invest, secondary trading, and AI investing comes later, once your operational base is stable.

6. Integration Layer

At this stage of development, integrations come into play. No P2P platform is an island. You will need to plug into KYC vendors, payment processors, credit bureaus, accounting systems, and notification providers. P2P lending software integration with FinTech systems works best when abstracted through a clean contract layer.

That way, if your KYC vendor fails audits or your payment partner hikes fees, you can switch without rewriting half the system. Integration testing is critical: failed callbacks or duplicate payments destroy both trust and books.

7. Testing and Quality Assurance

Every function, from credit scoring to payment reconciliation, must be tested under real conditions. Here, testing means more than functional bug checks. You are validating regulatory workflows, data privacy, financial accuracy, and system resilience.

Can your ledger survive a payment reversal? Does your loan schedule recalculate correctly if a borrower prepays? Are audit logs tamper-proof? Is the software bug-free? Remember, bugs at this stage are cheaper than failures post-launch.

8. Deployment and Launch

Once stable, the platform is deployed on cloud infrastructure. The launch is often phased, starting with controlled rollouts before opening to the public.

Rate limits, credit caps, and liquidity buffers are tools to prevent early instability. At launch, real-time dashboards should show the health of your credit funnel, payment flows, and support queues.

9. Post-Launch Support and Evolution

The process doesn’t end at launch. Post-launch support is essential and ongoing. Once live, you will face bug fixes, feature requests, compliance updates, and new regulatory demands. Thus, continuous monitoring of fraud patterns and credit performance is essential.

Also, as volume grows, scalability becomes the next frontier: optimizing database queries, adding caching layers, or migrating to stronger infrastructure becomes mandatory.

Together, we’ll launch a P2P platform that grows and gains competitive advantages.

Challenges in P2P Lending Software Development and How to Solve Them

Building a lending platform is not just an engineering project. You’re entering a heavily regulated space where mistakes can cost licenses, investors, and reputations. Here are the biggest hurdles and how experienced teams deal with them.

Regulatory Compliance

Every jurisdiction has its own rules. Some require lending licenses; others enforce caps on rates or strict disclosure formats. Then there’s KYC/AML, GDPR, PCI DSS, and other compliance. The mistake many startups make is treating compliance as a “later” problem. By the time regulators knock, it’s too late.

Solution: Bake compliance into design. Store audit logs for every transaction, version your disclosures, and run KYC/AML checks at onboarding and periodically after. Weave compliance at every stage of development; it’s cheaper than defending enforcement later.

Fraud and Security

Fraudsters target new platforms because controls are often weak in the first months. Fake borrowers, stolen identities, and account takeovers are quite common. Data security is just as pressing: one leak of borrower documents and trust evaporates.

Solution: Use layered defenses. Use tools like device fingerprinting, velocity checks, and anomaly detection on the fraud side. On the security side, it includes encryption, multi-factor authentication, and strict access controls. Test like an attacker before launch.

Scalability

A system that works for 500 loans a month may collapse at 5,000. Slow dashboards, delayed payouts, and missed reconciliations create panic among users. Growth amplifies every inefficiency.

Solution: Design for scalability from the start. Containerized services, message queues for loan events, and a ledger that scales without lag. Monitor performance in real time and fix bottlenecks before they snowball.

Building Trust

Even if the tech is perfect, users won’t lend unless they believe the platform will protect them. Trust is earned through transparency, consistent communication, and fair handling of disputes.

Solution: Show investors their money flow in detail. Provide borrowers with clear repayment schedules and accessible support. Publish default rates honestly. Trust takes years to build and minutes to lose.

Costs and Timeline of Developing P2P Lending Software

There’s no fixed price tag for a lending platform. On average, the cost to build P2P lending software ranges between $40,000 and $600,000 or more. But this is just a rough estimate. What it actually costs depends on multiple factors like where you build, what you include, and how tightly you run the project.

Some teams start lean with a barebones MVP; others want polished enterprise-grade P2P lending software features from day one. The gap between those two approaches can be hundreds of thousands of dollars and months of extra work.

Factors Affecting P2P Lending Software Development Costs

To know the cost to build P2P lending software, you first need to understand the different factors affecting the investment because the actual cost of development can increase or decrease depending on these factors.

Scope of Features

An MVP handles simple loans and repayments. A full-featured platform adds auto-invest, secondary markets, AI scoring, and compliance dashboards. Each new layer multiplies the effort, timeline, and costs.

Regulatory Compliance

Regulations aren’t negotiable. Designing KYC, AML, and data handling into the system early is cheaper than re-architecting later. Teams that treat compliance as an afterthought almost always burn more money down the road.

Integrations

Payment gateways, credit bureaus, and KYC vendors; each partner adds contracts, testing, and monitoring. Miss one connection, and your platform stalls at launch. The more platforms you integrate, the higher the costs.

Design and User Experience

Borrowers want a smooth loan application; investors expect dashboards as polished as a brokerage app. Getting that polished platform takes time and needs good designers, which affects costs.

Infrastructure and Scalability

Platforms handling thousands of concurrent users and millions in monthly transactions require robust infrastructure. Cloud-native deployments, security hardening, and high-availability setups all influence cost.

Here is a brief table estimating typical cost ranges and timelines for P2P software development

| Platform Type | Cost Estimate | Typical Timeline |

|---|---|---|

| MVP | $40,000 – $100,000 | 4–6 months |

| Moderate Software | $100,000 – $200,000 | 6–8 months |

| Full-Featured Platform | $200,000 – $400,000+ | 8–12 months |

| Enterprise-Grade Platform | $400,000 – $600,000+ | 12–18 months |

Ongoing Costs

The cost to build p2p lending software is only the start. Expect recurring expenses in:

- Maintenance: Bug fixes, feature updates, and security patches.

- Infrastructure: Hosting, monitoring, backups, scaling.

- Compliance updates: New KYC requirements, reporting formats, or data laws.

- Customer support: Borrowers miss payments, investors ask questions—support doesn’t scale without people and tools.

- Vendor fees: Every ID check, bureau pull, or payment transaction has a cost attached.

Cost Optimization Strategies for P2P Lending Platform Development

Though P2P lending software development costs seem substantial at first, not every platform has to launch with a million-dollar budget. The smartest teams cut scope, reuse what already exists, and phase their rollouts. Here are some cost optimization strategies that matter.

Start with an MVP

It’s tempting to build the “ideal” marketplace on day one. That’s how budgets spiral. A focused MVP proves three things first: borrowers show up, lenders commit funds, and compliance works in production. Once those hold true, layering on advanced features becomes justifiable.

Reuse Frameworks and Libraries

There’s no sense in writing your own KYC system, payment gateway, or dashboard charts from scratch. Mature vendors exist for each. Pick ones with solid APIs and clear pricing. The custom code should focus only on what makes your lending model unique.

Offshore Where It Makes Sense

High-touch work like architecture and legal consultancy for compliance often stays onshore. Routine engineering, QA, UX design, development, and integrations can be offshored safely if you have tight specs and oversight. This mixed approach reduces cost without compromising on quality.

Phase Complexity

Don’t open with auto-invest, a secondary market, and blockchain integration all at once. Release in waves. A clear product roadmap: MVP, then investor automation, then liquidity tools, spreads cost over time, and keeps risk manageable.

Why Partner with Appinventiv for P2P Lending Software Development

Launching a lending marketplace is exciting, but also daunting. You’re asking people to trust you with their money, their data, and their reputation. That kind of responsibility doesn’t leave much room for trial and error. In this exciting yet challenging venture, choosing the right lending software development company can make all the difference.

This is where we come in. At Appinventiv, we’ve spent more than a decade building FinTech solutions for emerging startups and large enterprises around the world.

Our team of 1,600+ tech specialists has delivered 3,000+ digital products, and along the way, we’ve picked up several industry awards like Deloitte’s Consecutive Tech Fast 50 Awards in 2023 & 2024, Economic Times’ Leader in AI Product Engineering & Digital Transformation award, and so on. These recognitions reflect our unmatched excellence in technology and innovation.

What matters more than these numbers, though, is that we know how to turn ambitious Fintech ideas into products that earn trust. Here are a few of our projects that reflect our excellence in building FinTech and P2P lending platforms

- Mudra – A chatbot-led budget management platform designed for young users. It balances playful UX with serious privacy controls.

- Edfundo – A financial literacy platform that introduces money management to kids in a safe, intuitive way.

Here’s how we approach P2P lending projects:

- Compliance first: From KYC and AML to GDPR and PCI DSS, we embed compliance workflows into the product architecture. You don’t end up patching gaps later.

- Scalability by design: We build cloud-native, modular platforms that are ready to scale; whether that means supporting higher loan volumes or expanding into new markets.

- Support beyond launch: A lending platform is never “done”; it evolves with regulation and market demand. So, we stay involved after go-live with maintenance, monitoring, and feature upgrades.

The Value of Partnership

P2P lending platform development projects don’t fail because of bad ideas; they fail because execution falters on compliance, scalability, or user trust. With Appinventiv, you get a trusted FinTech software development company that understands these pitfalls and helps you avoid them. If your aim is to build a platform that’s not just functional but future-proof, we know how to get you there. Partner with us now.

FAQS

Q. How much does it cost to develop P2P lending software?

A. It depends on scope and compliance depth. In P2P lending software development, most budgets fall into these bands:

- MVP: $40,00–$100,000

- Mid-range: $100,000–$200,000

- Full platform: $200,000–$400,000+

- Enterprise Grade: $400,000–$600,000+

Q. What compliance requirements must be considered for P2P lending platforms?

A. Here are the key compliance regulations you must consider for P2P lending platform development:

- Licensing & permissions laws for lending/servicing licenses.

- KYC/AML & sanctions

- Data protection laws like GDPR and CCPA

- Consumer disclosures & fair lending awareness

- Payments & card data compliance like PCI DSS

Q. How long does it take to build a P2P lending software?

A. Here is a breakdown of the P2P lending platform software development timeline based on the various project complexities:

- MVP: 4-6 months

- Mid-range: 6-8 months

- Full platform: 8-12+ months

- Enterprise Grade: 12-18+ months

Q. How do you manage security in P2P lending software to prevent breaches and fraud?

A. Security management requires multi-layered approaches including end-to-end encryption, multi-factor authentication, real-time fraud detection using machine learning, regular security audits, and compliance with standards like PCI DSS.

Advanced platforms implement biometric verification, behavioral analysis, and automated threat detection systems to protect user data and prevent financial crimes.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does Accounting Practice Management Software Development Cost in Australia 2026?

Key takeaways: Custom accounting practice management software development in Australia for mid-to-large firms generally falls between AUD 70,000 and AUD 700,000. Adherence to the Privacy Act 1988 and ATO operational frameworks is a primary cost driver, not an add-on. A modular architecture and structured development approach ensure that the platform evolves with changing laws and…

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…