- Understanding the Types of Fraud Modern Businesses Face

- An Overview of Cost to Develop a Fraud Detection Software

- Cost of Planning, Designing, Development, Testing, Deployment, and Maintenance

- Cost of Technology Integrations

- Build vs Buy: Choosing the Right Fraud Detection Path

- How to Decide

- What Are the Benefits of Embracing Fraud Detection Software

- Preventing Financial Loss

- Boosting Your Business’s Efficiency

- Building Unbreakable Trust with Your Customers

- Keeping You on the Right Side of the Law

- What Are the Key Features of Fraud Detection Software

- Technology Stack for Fraud Detection Software Development

- Implementation Roadmap: From MVP to Enterprise Scale

- Use Cases of Fraud Detection Software

- 1. American Express: Real-Time Fraud Detection at Scale

- 2. TickPick x Riskified: Reducing False Declines in E-Commerce

- 3. LexisNexis Risk Solutions: Fraud Prevention for Global Merchants

- What These Use Cases Teach

- The Probable Business Model for Elevating the Role of Fraud Detection Software

- Compliance and Data Protection by Region

- Gaining a Competitive Edge in the Fraud Detection Market

- Future Trends in Fraud Detection Software

- Collaborate with Appinventiv for expert-driven Fraud Detection Software Services

- FAQs

Key Takeaways

- Real-time fraud detection uses AI algorithms to monitor transactions instantly and prevent potential threats.

- AI and behavioral analytics accurately detect anomalies by learning from user patterns, enhancing fraud detection efficiency.

- Multi-channel monitoring ensures that fraud detection covers both online and offline transaction methods seamlessly.

- Integration with existing financial systems helps streamline processes and ensures minimal disruption.

- Clear communication and accountability turn challenges into lasting partnerships.

- The solution helps comply with financial regulations, safeguarding both user data and institutional integrity.

It has become sad that the rise in cyber development takes the bad with the good—Cyber Fraud. This monster poses a serious threat to businesses, banks, and governments. Organizations operating without planning for fraud detection software development or integration are vulnerable to massive financial losses, data breaches, and irreversible reputational damage.

For instance, without fraud detection tools, a retailer might unknowingly process thousands of fraudulent transactions in a month, ultimately costing millions. When breached, a healthcare system can leave hundreds and thousands of very private medical data at the hackers’ disposal.

Fraud detection system development can shift this scenario by automating the identification of suspicious patterns, alerting teams in real-time, and learning from historical data to improve accuracy.

These software, which will soon reach USD 272.34 Billion by 2031, are built to enable businesses to analyze transaction volumes, detect anomalies, and flag high-risk actions before any serious damage is done. While the benefits of fraud detection software are fairly evident, entrepreneurs or CTOs looking to invest in fraud detection software tools are often concerned about the cost of obtaining these innumerable returns.

Let us explore several other factors that would add to the fraud detection software development cost.

Build a system that protects your revenue.

Understanding the Types of Fraud Modern Businesses Face

Before planning an enterprise fraud management software development strategy, it helps to know what kind of threats you’re up against. Fraud today is smarter, faster, and constantly changing — mixing digital tricks with human manipulation to slip past old defenses.

1. Payment Fraud

This one hits most industries, especially e-commerce and fintech. Stolen cards, fake refunds, and false merchant accounts can drain revenue before teams even notice. For companies building financial fraud detection software, tracking unusual transaction patterns in real time is often the first line of defense.

2. Identity and Synthetic Identity Fraud

Sometimes fraudsters don’t steal, they invent. By blending real and fake details, they create synthetic identities that pass verification checks. Banks and telecom companies face this often. Embedding AI fraud detection software development into verification systems helps catch these small inconsistencies that humans might miss.

3. First-Party and Account Takeover Fraud

Not every fraudster is an outsider. First-party fraud happens when real users game the system through fake chargebacks or false claims. Account takeover, on the other hand, involves stolen credentials used to hijack genuine accounts. Machine learning in fraud prevention can learn how real users behave, flagging suspicious logins or transactions before they escalate.

4. Industry-Specific Threats

Fraud doesn’t look the same everywhere:

- E-commerce: Refund abuse, fake listings, coupon misuse.

- Banking & Fintech: Transaction laundering, phishing-driven ATOs.

- Healthcare: False claims, misuse of medical data.

- Telecom: SIM swaps, fraudulent account setups.

Every industry has its own weak spots. That’s why a custom fraud detection system for enterprises needs to be tailored — from data inputs to model design. There’s no single formula that works for all. Pairing predictive analytics for fraud detection with domain expertise helps build systems that adapt, scale, and protect as threats evolve.

Next, let’s look at what goes into building and budgeting a strong fraud detection solution for your business.

An Overview of Cost to Develop a Fraud Detection Software

Creating fraud detection software tends to involve a range of cost factors influenced by the complexity of the solution, technology stack, and integration needs. Here’s a high-level breakdown of the different elements divided in the process to build a real-time fraud detection system.

Cost of Planning, Designing, Development, Testing, Deployment, and Maintenance

1. Planning and Ideation – $5,000 – $15,000

This stage, also known as discovery workshop, includes creativity, project scoping, which helps define the fraud detection requirements, and designing core workflows. Here, several things get finalized: Stakeholders will determine what kind of fraud detection (e.g., transaction fraud, identity fraud) is needed, a definite fraud detection software development cost range is formed, fraud detection technology stacks are fixed, teams are finalized, etc.

2. Design and Prototyping – $10,000 – $20,000

At this stage, the UX/UI design for dashboards, user flows, and visualization of fraud alerts is prepared. To elevate this further, at Appinventiv, we use prototyping tools like Figma or Adobe XD to create interactive, shareable mockups for you.

3. Core Development – $50,000 – $150,000

The development process typically involves front-end development, backend development, and machine-learning model integration. The cost is highly dependent on the complexity of AI algorithms, data processing capabilities, and real-time analysis requirements.

4. Integration with Databases and Third-Party APIs – $10,000 – $30,000

Fraud detection software often needs access to extensive datasets. For example, banking fraud detection software integrates with banking APIs, transaction processors, and identity verification services, which may add to the cost to develop a fraud detection software.

5. Testing and Quality Assurance – $10,000 – $25,000

Quality Assurance is crucial in fraud detection to ensure that legitimate transactions aren’t erroneously flagged, which can impact user experience. The cost to develop a fraud detection software here includes model validation, accuracy testing, and security assessments.

6. Deployment and Maintenance – $5,000 – $15,000 per month

Deployment in a cloud computing environment (like AWS or Azure) can incur ongoing costs for hosting, model retraining, and updates.

In addition to these stages-wise costs, there is something else that entrepreneurs need to account for – new-gen tech integrations.

Cost of Technology Integrations

1. Artificial Intelligence and Machine Learning – $15,000 to $40,000

Artificial Intelligence and Machine Learning are needed for real-time data analysis, pattern recognition, and anomaly detection. Depending on the complexity of the model, AI fraud detection software costs can range from $15,000 to $40,000.

2. Blockchain for Fraud Traceability – $20,000 – $50,000

Integrating blockchain can offer a tamper-proof audit trail, increasing security in sensitive transactions, but its integration can cost an additional $20,000 – $50,000.

3. Biometrics and Behavioral Analytics – $10,000- $30,000

Advanced solutions may require adding biometric verification or behavior analysis for user authentication, which can increase the cost by $10,000- $30,000.

4. Cloud Storage and Processing – $5,000 to $15,000

Real-time fraud detection requires robust cloud resources, which can cost from $5,000 to $15,000 per month, depending on transaction volume.

Now that we have examined the different fraud detection software development cost ranges, it’s time to reverse engineer and examine the intricate details that would add to the total cost range.

Build vs Buy: Choosing the Right Fraud Detection Path

When a business decides to invest in enterprise fraud management software development, one of the toughest questions to answer early on is — should you build your own system or buy one that’s already made? Both options work, but the right choice depends on how much control, customization, and long-term flexibility you want.

Build vs Buy at a Glance

Build vs Buy: Choosing the Right Fraud Detection Path

| Factor | Build In-House | Buy / License SaaS |

|---|---|---|

| Initial Cost | Higher upfront, but you save over time with no recurring fees. | Lower initial cost, but subscription fees keep adding up. |

| Customization | Tailored custom fraud detection system for enterprises that fits internal workflows and data. | Limited to what the vendor offers — less room to adapt. |

| Development Time | Slower; needs a full fraud detection software development lifecycle from design to launch. | Quick to deploy; great for teams that need an immediate fix. |

| Scalability | Easy to scale across platforms and transaction volumes. | Bound by vendor plans and infrastructure. |

| Maintenance | Needs your in-house data and tech team for updates. | Vendor manages it, but with less visibility into how models evolve. |

| Data Privacy | Full control and compliance with standards like GDPR and PCI DSS. | Data may be stored or processed externally, depending on vendor policy. |

How to Decide

If your organization handles complex data, runs multiple systems, or needs fraud models specific to your domain, building financial fraud detection software in-house is often worth the effort. It gives more freedom to add real-time transaction fraud monitoring solutions and fine-tune machine learning in fraud prevention for your exact needs.

But if you’re a growing business looking for faster setup and predictable costs, going with a pre-built fraud prevention software integration can be the smarter move. It gets you started quickly while keeping the initial investment low.

Whatever the choice, the goal stays the same, protecting your business with a solution that scales with it.

Let’s design it together.

What Are the Benefits of Embracing Fraud Detection Software

Integrating a robust fraud detection solution into your business operations is not just about preventing losses. It fortifies your entire ecosystem. Beyond the immediate financial safeguards, these systems offer a cascade of advantages that enhance efficiency, customer trust, and overall business resilience.

Preventing Financial Loss

The most immediate pain point fraud addresses is financial loss. This software acts as your vigilant guard, actively safeguarding your revenue and assets. It means fewer agonizing chargebacks, less revenue leaking away from cunning schemes, and better protection for everything you’ve built. It’s about ensuring your bottom line stays strong, without the constant threat of depletion.

Boosting Your Business’s Efficiency

Imagine a world where you’re not constantly chasing shadows or manually sifting through mountains of data. That’s what intelligent fraud detection offers. It automates the heavy lifting, spotting anomalies and suspicious patterns in real-time. This frees up your team to focus on growth and innovation, not endless investigations. You get instant alerts, sharper insights, and the ability to make quick, confident decisions, propelling your operations forward with newfound agility.

Building Unbreakable Trust with Your Customers

In today’s digital world, trust is gold. When customers feel secure doing business with you – knowing their data and transactions are protected – they become loyal advocates. Robust fraud detection shows them you take their security seriously. It transforms their experience from one of potential worry to one of confidence, strengthening your brand’s reputation and ensuring they keep coming back.

Keeping You on the Right Side of the Law

Navigating the maze of financial regulations can be daunting. Fraud detection software is your ally here, helping you effortlessly comply with critical standards like GDPR, PCI DSS, and AML laws. It significantly reduces your legal risks, minimizes the chances of hefty fines, and ensures you’re always ready for an audit, proving your commitment to best practices.

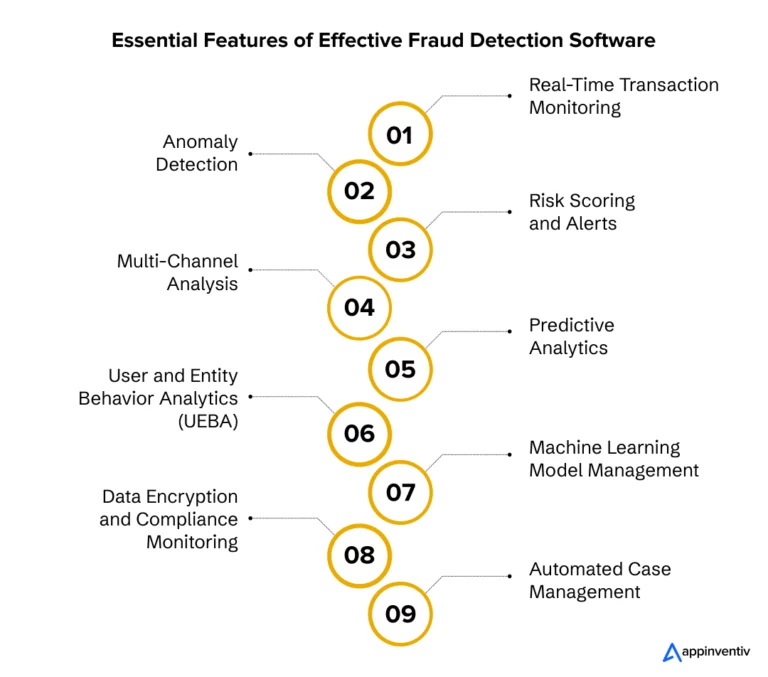

What Are the Key Features of Fraud Detection Software

The fraud detection system development process merges several features and functionalities. For ease of planning, we have divided these features into two segments: MVP and Good-to-have.

1. Real-Time Transaction Monitoring

The software should be able to monitor each transaction in real-time, analyzing data points like transaction location, frequency, and amount to detect potential fraud.

Also Read: A Complete Guide on Data Science & Analytics for Businesses

2. Anomaly Detection

A key outcome expected from the fraud app detection software development efforts is real-time anomaly detection. We suggest using machine learning to identify unusual patterns or deviations in user behavior that indicate fraudulent activity in real-time.

3. Risk Scoring and Alerts

The software should be built to assign transactions a risk score based on factors like user history, IP address, and transaction type, triggering alerts for high-risk activities.

4. Multi-Channel Analysis

When you build a fraud detection software, it becomes critical to analyze multiple customer touch points (e.g., online, mobile, in-store) to identify and correlate suspicious patterns across platforms.

While these are the key functionalities to consider when you build a real-time fraud detection system, some active underlined features include a dashboard, behavioral, transactional, and operational analytics, customization of fraud detection rules, and automation friendliness.

The fraud detection software features we have covered up until now make up the MVP list. Some additional features can also be incorporated to make your application a leader in the fraud detection space. Let us look into those features.

5. Predictive Analytics

The fraud detection software tools should be built to capitalize on historical data, turning your software into a predictive analytics platform that predicts potential fraud and adjusts algorithms based on emerging trends in fraudulent behavior.

6. User and Entity Behavior Analytics (UEBA)

Another key feature to be added to the software is tracking user behavior (e.g., log-in times, location) to detect deviations that signal possible fraud.

7. Machine Learning Model Management

Automation of model updates, ensuring that detection algorithms adapt over time as new fraud tactics emerge, can also be considered a good addition to the functionalities set.

8. Data Encryption and Compliance Monitoring

Your software can also be designed to protect sensitive transaction data, ensuring compliance with industry regulations like PCI DSS or GDPR.

9. Automated Case Management

Lastly, your fraud app detection software development efforts can also include managing flagged transactions and providing investigation, resolution, and case documentation tools.

With the fraud detection software features part now addressed, let us look at the other key factor when deciding on the fraud detection software development cost – the technology stack.

Technology Stack for Fraud Detection Software Development

Fraud app detection software development requires a robust technology stack that helps businesses manage their processes and transactions under multiple concurrency levels. Here’s what our fraud detection software developers recommend.

- Programming Languages: Python, Java, or C++ for building core functionalities and machine learning models.

- Machine Learning Frameworks: TensorFlow, PyTorch, or Scikit-Learn to develop and deploy predictive models.

- Data Analytics Tools: Apache Spark and Hadoop for large-scale data processing.

- Blockchain Platforms: Ethereum or Hyperledger for fraud traceability and immutable audit logs.

- Cloud Platforms: AWS, Google Cloud, or Azure for hosting, with scalable resources for high-transaction environments.

- Database Management: PostgreSQL, MongoDB, or MySQL for transaction data storage, with encryption and access controls.

- User Authentication Libraries: Auth0, Okta, or custom biometric integration for secure user verification.

- Data Visualization: Power BI, Tableau, or D3.js for real-time data dashboards, making it easier for teams to monitor suspicious activity.

We have looked into the technical and financial aspects of fraud detection system development until this point. While these are good to get you going on the product development front, what about post-development? This is especially true when a number of platforms, such as Feedzai, SEON, and Riskified, are already active in the space.

As an end-to-end technology and digital solution provider, Appinventiv helps you prepare the solution for mass launch, which entails helping you create a business model.

Here’s what we would plan for your fraud detection software applications.

Implementation Roadmap: From MVP to Enterprise Scale

Building an effective fraud detection system is a journey. It starts small and becomes smarter with each phase. Here’s how an enterprise fraud management software development project typically grows:

Phase 1: Rule-Based MVP

Start with simple rules that flag suspicious actions like unusual spending or repeated login attempts. It’s quick to launch and helps set a baseline for future intelligence.

Phase 2: Machine Learning Integration

Add machine learning in fraud prevention to make the system self-learning. It studies past data and detects patterns human analysts might miss, reducing false alarms over time.

Phase 3: Behavioral Analytics and Automation

Next comes behavior tracking. With AI fraud detection software development, the system understands how users normally act and catches anything that looks off. Automated alerts speed up action.

Phase 4: Predictive Intelligence

Finally, use predictive analytics for fraud detection to stop fraud before it happens. The software anticipates risky behavior based on trends across channels, making detection proactive.

At Appinventiv, we follow a phased approach through the fraud detection software development lifecycle, ensuring every stage adds measurable intelligence, scalability, and real-world value.

Use Cases of Fraud Detection Software

Fraud detection software has evolved from a defensive tool into a strategic advantage for enterprises. Real brands across industries are using AI, machine learning, and behavioral analytics to prevent fraud, protect customers, and build trust. These examples highlight practical use cases of fraud detection software, the common challenges of fraud detection software, and what to expect when working with a fraud detection software development company.

1. American Express: Real-Time Fraud Detection at Scale

American Express processes millions of card transactions every day, which makes speed and accuracy critical. To handle this scale, AmEx adopted deep learning models using NVIDIA’s GPU technology to identify and block fraudulent transactions in real time.

The result was faster fraud identification and fewer false positives, a significant improvement over older rule-based systems. However, this also brought new challenges of fraud detection software, including the need for constant model retraining, data synchronization across global systems, and compliance with country-specific regulations.

2. TickPick x Riskified: Reducing False Declines in E-Commerce

E-commerce platform TickPick partnered with Riskified to fight chargeback fraud and reduce false declines. Within three months of implementing Riskified’s AI-driven checkout system, TickPick recovered over $3 million in legitimate transactions that were previously blocked.

This example shows how a custom fraud detection system for enterprises can directly impact revenue. Yet, one of the biggest challenges here was maintaining a seamless customer experience while tightening fraud controls. It highlights how businesses must balance risk management with customer convenience, a recurring theme across most fraud detection software development services.

3. LexisNexis Risk Solutions: Fraud Prevention for Global Merchants

A global e-commerce merchant operating across 100 countries turned to LexisNexis Risk Solutions Emailage platform for cross-channel fraud detection.

By leveraging minimal customer data for quick verification, the system provided faster fraud scoring across both online and in-store transactions. The merchant significantly reduced fraudulent activity without slowing down the checkout process. The main challenges of fraud detection software here were scaling across multiple regions, managing diverse data inputs, and maintaining compliance with international privacy standards such as GDPR and PCI DSS.

What These Use Cases Teach

Each of these brands shows a different side of fraud detection — from real-time transaction monitoring in finance to behavioral analytics in retail. What they all share is the recognition that fraud is an evolving threat that needs continuous innovation.

For businesses exploring fraud detection software development services, these examples underline a few key takeaways:

- There’s no one-size-fits-all solution — every sector requires its own detection logic and datasets.

- Accuracy is only half the battle; maintaining speed and user experience is equally vital.

- Choosing a reliable fraud detection software development company ensures that the solution scales, adapts, and complies with global security standards.

In the end, modern fraud prevention isn’t just about stopping bad actors, it’s about designing systems that help genuine customers move freely while keeping businesses safe.

The Probable Business Model for Elevating the Role of Fraud Detection Software

The business model of your fraud detection software is one vital piece of the puzzle that helps create the complete ecosystem of your project, from internal branding to profitable partnerships. Here’s a brief overview of a business model we suggest to our partners for building post fraud detection software applications development efforts.

1. Customer Segments

The financial fraud detection software development process typically results in software that serves sectors highly vulnerable to fraud, such as financial services, e-commerce, insurance, and telecommunications. Each segment may have unique requirements; for example, banks might prioritize real-time transaction monitoring, while e-commerce businesses need robust account protection and chargeback prevention tools.

By segmenting your market, you can develop features and pricing strategies that address each industry’s specific pain points.

2. Value Proposition

While the main appeal of fraud detection software development for banks is its ability to reduce financial losses and enhance trust in customer transactions, you can pick a technology like AI and make that the core USP, probably by employing AI-driven detection of fraudulent behavior, predictive analytics, and customizable risk thresholds.

For instance, Stripe Radar offers fraud prevention as part of its payment processing suite, helping e-commerce sites filter out suspicious transactions and manage disputes. Their value proposition is clear: reduced fraud risk with minimal disruption to legitimate users.

Other USPs that you can discuss with your partnered fraud detection software developers can be:

- White-Labeling: License the software to banks, insurance companies, and payment processors, allowing them to brand it.

- API Access for Developers: API access is provided to other software providers, enabling integration with various e-commerce and banking platforms.

- Consulting Services: Offer consulting for customized implementations, helping clients tailor the software to specific industry needs.

3. Channels

Distribution channels post credit card fraud detection system development could include direct sales to enterprise customers, partnerships with financial institutions, and integrations with payment gateways like PayPal or Square.

Additionally, fraud detection software could be delivered through cloud platforms for scalability or via API integrations so businesses can easily add fraud detection features to their existing systems.

Read Also: Credit Card Fraud Detection with Machine Learning

4. Customer Relationships

Building strong customer relationships is crucial in fraud detection, as companies require support to configure, optimize, and respond to new fraud trends. This usually can be achieved through 24/7 customer support, onboarding services, and fraud pattern insights and analytics that help customers continuously improve their security.

Kount, for example, offers a comprehensive dashboard and real-time insights, assisting customers to stay proactive in managing fraud risk.

5. Revenue Streams

Revenue models in fraud detection software often include subscription-based pricing, which could be tiered based on transaction volume or additional features like advanced analytics.

Another model you can explore when build a fraud detection software is usage-based pricing, where customers pay per transaction or scan. Companies like Sift offer a pay-as-you-go structure, allowing businesses to pay based on usage. This can be appealing for startups or smaller businesses scaling up.

6. Key Resources

Essential resources can include an experienced data science and engineering team, a robust machine learning framework, and access to massive datasets for training AI models. Many fraud detection solutions, like Darktrace, rely on real-time data processing and analysis, which requires significant computing power and cloud infrastructure.

7. Key Partnerships

Partnerships are crucial for data sharing and expanding functionality. For instance, collaborating with payment processors or credit bureaus can provide access to relevant data, enriching fraud detection algorithms.

After fraud detection system development, you can also plan to partner with cybersecurity firms for shared intelligence, similar to how Experian collaborates with other agencies to improve detection across financial networks.

8. Cost Structure

Some key planned expenses can include R&D (especially in machine learning and AI), cloud infrastructure for real-time data processing, and customer acquisition. Compliance, especially for solutions dealing with sensitive data in highly regulated industries, can also be a significant cost.

However, fraud detection software companies can scale more cost-effectively by leveraging cloud platforms like AWS or Google Cloud, paying only for the resources they use. Knowing these different ranges will come in handy when planning for the cost of a subscription or partnership.

While on one side, you now have an idea of how your brand will be positioned, one critical element remains. How would you get an ROI on your cost to develop fraud detection software, especially by getting a leg ahead of the competition? Well, our fraud detection software developers have some ideas for that as well.

Compliance and Data Protection by Region

Fraud prevention tools do more than block suspicious activity, they also help companies follow the rules that protect customer data. Since every region sets its own standards, a single global setup rarely fits all.

United States

In the US, laws such as PCI DSS, SOX, and GLBA demand strict control over how financial data is stored and shared. A reliable enterprise fraud management software development approach should include strong encryption, clear access permissions, and complete audit trails so that every transaction can be verified if needed.

European Union

Europe’s frameworks like GDPR, PSD2, and AMLD6 put data privacy and consent at the center. Systems built for this region need to process information responsibly, allowing real-time fraud checks without exposing personal details or moving data across borders unnecessarily.

Asia-Pacific (APAC)

Markets like India and Singapore follow the RBI and MAS TRM guidelines, which emphasize secure handling and local storage of sensitive information. When building financial fraud detection software for APAC, teams must design with these regional rules in mind to avoid compliance gaps.

Compliance isn’t an extra layer, it’s part of how a custom fraud detection system for enterprises earns user trust. Keeping up with these laws ensures that fraud detection tools stay ethical, transparent, and ready for global use.

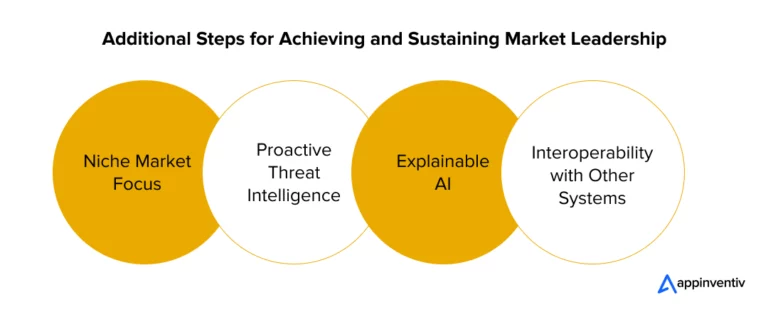

Gaining a Competitive Edge in the Fraud Detection Market

With the first step of getting market success addressed through a robust, scalable fraud detection software development process, there are some additional elements that you will need to take care of to truly become a market leader.

1. Niche Market Focus: Specialize in fraud detection for specific industries, for example, e-commerce or through insurance fraud detection software development to provide a more customized, high-performance solution.

2. Proactive Threat Intelligence: During fraud detection software development process, you can also Incorporate threat intelligence feeds that can provide real-time updates on emerging fraud tactics, helping clients stay one step ahead.

3. Explainable AI: With increasing scrutiny on AI, offer transparency by using models that can explain why a transaction was flagged, enhancing trust and regulatory compliance.

4. Interoperability with Other Systems: Invest in fraud app detection software development that easily integrates your software with other platforms like CRM or ERP systems, providing a seamless business experience.

Future Trends in Fraud Detection Software

As the fight against fraud evolves, so do organizations’ technologies and strategies. Understanding the future trends in fraud detection software can provide entrepreneurs with insights into what to expect and how to stay ahead of potential threats.

1. Enhanced Utilization of AI and Machine Learning

AI and machine learning are becoming increasingly vital in developing fraud detection systems. These technologies allow for real-time data analytics, helping identify patterns and adapt to new fraudulent behaviors as they occur.

2. Growing Importance of Behavioral Analytics

Behavioral analytics focuses on understanding customer behavior rather than merely looking at transactional data. By identifying anomalies in user behavior, fraud detection systems can improve their accuracy and minimize false positives.

3. Integration of Blockchain Technology

Blockchain technology offers an immutable record of transactions, enhancing transparency and traceability. This integration can help create more secure environments and deter fraudsters from manipulating data.

4. Transition to Cloud-Based Solutions

The shift to cloud computing continues to influence fraud detection software development. Cloud solutions offer scalability and accessibility, allowing organizations of all sizes to leverage advanced fraud detection technologies.

5. Focus on Regulatory Compliance and Security

As regulatory requirements become more stringent, future fraud detection systems will need to seamlessly incorporate compliance mechanisms. This includes adhering to data protection laws and implementing enhanced security measures.

Also Read: How can enterprises protect their data in cloud environments?

6. Collaborative Efforts Among Financial Institutions

Future fraud detection strategies will likely involve greater collaboration between financial institutions and technology providers. Sharing data and insights can enhance collective defenses against fraud.

7. Proactive Approaches to Fraud Prevention

The emphasis is shifting from reactive measures to proactive strategies. In this situation, predictive analytics and machine learning anticipate fraud before it occurs, enabling organizations to implement preventive measures.

Get a tailored solution for your stack, data, and timelines.

Collaborate with Appinventiv for expert-driven Fraud Detection Software Services

At this point, I am sure you must be wondering about our exact role in this partnership. Well, it will be end-to-end.

At Appinventiv, we understand that building fraud detection software tools is an intensive process involving high development costs, specialized technology, and a clear understanding of fraud patterns. However, the investment pays off significantly for businesses aiming to protect their assets and reputation in an increasingly digital landscape.

We will work with you based on your requirements—as a software development company that manages everything from ideation and design to development and launch or as partners who would work alongside you as you build your business model, handle post-launch activities, and act as your team.

The end goal would remain the same: developing reliable, secure, and robust software.

There are some very evident reasons why businesses trust us with their complex fraud detection solutions development.

- Our subject matter experts who specialize in fraud detection system development

- Our timely delivery guarantee

- Our very strong hold on the fraud detection market movements.

Moreover, by leveraging advanced technologies, focusing on key industries, and designing a flexible business model, we can help entrepreneurs create fraud detection solutions that offer unique value in a competitive market. Contact us if you want to invest in financial fraud detection software development.

FAQs

Q. What’s the cost of developing enterprise-level fraud detection software?

A. Creating a fraud detection system can cost anywhere between $100,000 and $300,000, depending on its scale and technology stack.

Here’s how the cost usually breaks down:

- Planning & Ideation: $5,000–$15,000, defines goals, scope, and required fraud types.

- Design & Prototyping: $10,000–$20,000, dashboard design and alert visualization.

- Core Development: $50,000–$150,000, backend, frontend, and model development.

- Integrations & APIs: $10,000–$30,000, connecting payment, KYC, or data systems.

- Testing & QA: $10,000–$25,000, validating accuracy and system security.

- Maintenance: $5,000–$15,000/month, includes hosting, updates, and model retraining.

Adding AI or blockchain components can push costs higher, but these technologies make the system more accurate and future-ready. For most enterprises, a modular approach to fraud detection software development helps balance cost with long-term scalability.

Q. How can AI reduce financial fraud in my organization?

A. AI will have your system thinking quicker than fraudsters. It analyses transaction information, identifies suspicious actions and responds within seconds. It gets to know what normal is over time in your business, hence, when something out of the ordinary occurs, it raises a flag immediately. This minimizes the financial losses and false alarms and enables teams to concentrate on actual risks.

Q. What are the core technologies and components in the fraud detection software development process?

A. A strong fraud detection setup combines several moving parts:

- Machine learning models that learn from past data to spot patterns.

- Data analytics engines (like Spark or Hadoop) to process huge transaction volumes.

- Cloud infrastructure for scaling up during heavy activity.

- APIs and integration tools that connect fraud modules with your existing systems.

- Security features such as encryption and access controls to protect sensitive data.

Together, these make up the backbone of modern fraud detection software development — built to catch fraud in real time and keep your business running smoothly.

Q. What’s the ROI of developing custom fraud detection software vs buying off-the-shelf?

A. Tailor-made software is often expected to be more expensive in the short term but will be rewarded in the long term. It best suits your business, is flexible to your data, and it scales up easily. Off-the-shelf tools are also quicker to implement, but usually have customization restrictions and hidden long-term costs. When your transaction volumes are high, or you have special compliance requirements, it can be more cost-effective to develop your own solution to achieve greater ROI in 12-24 months.

Q. How do I integrate fraud detection tools with legacy systems?

A. Integration doesn’t have to be messy. Most teams use APIs or middleware to connect new fraud detection tools with older CRMs, banking cores, or ERPs. The trick is to plan in phases — start with data synchronization and then move to full automation once stability is proven. This approach avoids downtime and keeps both systems talking to each other seamlessly.

Q. How do I ensure compliance and data privacy in fraud detection systems?

A. Start with strong encryption and clear access controls. Follow region-specific frameworks such as GDPR, PCI DSS, SOX, or RBI guidelines. Audit logs, regular security testing, and policy reviews are key to staying compliant as laws evolve. Data privacy isn’t just a checkbox — it’s how you maintain trust with customers and regulators alike.

Q. What are the key AI models used for fraud detection today?

A. The most common ones include:

- Neural Networks (LSTM, CNN): Ideal for spotting transaction sequences and unusual user activity.

- Decision Trees and Random Forests: Great for quick, rule-based risk scoring.

- Gradient Boosting Models (XGBoost, LightGBM): Useful for processing structured financial data efficiently.

- Graph Neural Networks (GNNs): Detect connected fraud rings and hidden relationships.

Each model serves a different purpose — most systems use a mix to get the best of speed, accuracy, and adaptability.

Q. What is fraud detection software?

A. Fraud detection software is a specialized tool designed to identify, analyze, and prevent fraudulent activities within digital transactions or data processing systems. When fraud detection system development happens using machine learning, artificial intelligence, and data analytics, it can recognize suspicious behavior or patterns, helping companies reduce financial loss, secure customer data, and ensure compliance. Common applications include detecting credit card fraud, identity theft, and account takeover fraud.

Q. How do you choose a fraud detection software development company?

A. To choose the right fraud app detection software development company, consider these key factors:

- Expertise in fraud detection: Look for a company with a strong portfolio in fraud prevention, data security, and relevant technologies like AI, ML, and data analytics.

- Customization and scalability: Ensure the company can tailor solutions to fit your specific industry needs and that the software can scale as your business grows.

- Proven track record: Check their past projects, client testimonials, and case studies to gauge the company’s experience and success rate.

- Security and compliance standards: To ensure data protection, the company should adhere to strict security and compliance standards (e.g., GDPR, PCI-DSS).

- Support and maintenance: Opt for a provider that offers ongoing support, regular updates, and a clear maintenance plan.

Q. How long does it take to develop a fraud detection software?

A. The development timeline for fraud detection software depends on its complexity, features, and technology stack. A basic solution might take 3-6 months, while a more advanced system with machine learning capabilities, real-time analytics, and integrations with other business systems could take 6-12 months or longer. Additionally, time may vary depending on whether it’s a custom-built solution or a modification of an existing platform and next on the software type, whether you want to invest in fraud detection software development for banks or insurance fraud detection software development or something else altogether.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

The ROI of Strategic Insurance Technology Consulting for Legacy Modernization

Key takeaways: Insurance technology consulting delivers ROI only when modernization is tied to real workflows, not system replacement. Most legacy modernization failures stem from weak ROI definition and tracking, not from technology limitations. The strongest returns come from reduced operational friction, faster change cycles, and tighter claims and underwriting control. Delaying modernization incurs hidden costs…

Key Takeaways Use a scorecard-driven RFP and a technical assessment to compare vendors on capability, compliance, and delivery risk. Local partners provide regulatory and cultural alignment; hybrid teams often pair that with offshore cost efficiency. Start with a scoped pilot or MVP, milestone-based contracts, and clear IP/SLAs to reduce procurement risk. Require demonstrable security controls,…

A Strategic Framework for Proof of Concept Software Development

Key takeaways: Most enterprise PoCs fail due to a lack of decision clarity, not technical feasibility or innovation potential. A disciplined PoC framework reduces delivery risk before budgets, teams, and timelines are committed. Enterprise-grade PoCs validate feasibility, compliance, and scale assumptions under realistic operating constraints. Clear success metrics and governance turn PoCs into reliable inputs…