- Why Traditional Development Approaches Fail in Financial Services

- Top 12 Compliance Pitfalls in FinTech App Development and Tips to Avoid Them

- Treating AML Programs as Documentation Exercises

- Misunderstanding Money Services Business Registration

- Securities Law Blind Spots

- Consumer Protection Oversights

- Data Privacy Fragmentation

- Third-Party Risk Blindness

- Digital Asset Regulatory Confusion

- State Licensing Underestimation

- Record-Keeping System Failures

- Operational Resilience Neglect

- Inadequate Vendor Management and Due Diligence

- Mishandling Cross-Border Regulatory Complexity

- Risk-Based Implementation Priorities: A Decision Framework for Technical Leaders

- Critical Path Items (Weeks 1-4): Business Continuity Risks

- Foundational Systems (Months 2-6): Scalable Compliance Architecture

- Strategic Growth Enablers (Months 6-18): Expansion and Optimization

- Risk Assessment Matrix for Prioritization

- Avoiding Common Implementation Mistakes

- How Appinventiv Can Help You Battle Compliance Pitfalls in FinTech App Development

- Frequently Asked Questions (FAQs)

Key Takeaways

- Ignoring compliance early on leads to costly fixes later. Build compliance into your core architecture to avoid expensive retrofitting.

- Many FinTech apps fail due to recurring mistakes, like weak AML programs and gaps in data privacy. Identify and address these risks proactively to ensure success.

- Outsourcing doesn’t absolve you of regulatory responsibility. Stay in control by monitoring third-party vendors and maintaining backup relationships to mitigate risks.

- Tackle the most pressing compliance risks first (e.g., licensing, AML), and then scale your systems to handle ongoing monitoring, governance, and long-term compliance.

The global fintech boom has produced remarkable innovations. Still, seasoned industry observers know an uncomfortable truth: brilliant products fail not because of poor technology, but because teams miss critical regulatory requirements that should have been obvious from the start.

Walk through any fintech hub worldwide, and you’ll hear similar stories of compliance risks in fintech app development:

- A payments app that spent eighteen months in development, only to discover their transaction monitoring system couldn’t generate the reports that financial intelligence units actually wanted—a costly oversight in mobile app compliance design.

- A lending platform that built sophisticated algorithms but overlooked fundamental fair lending and consumer protection obligations.

- A digital wallet that handled encryption perfectly but failed to implement proper know-your-customer procedures.

The problem isn’t that regulations are unclear. Financial regulators across jurisdictions publish extensive guidance, anti-money laundering authorities provide detailed examples, and data protection legislation includes specific technical requirements. The challenge lies in translating these requirements into practical fintech app development regulatory compliance frameworks that work seamlessly with innovative technology.

Must Read: How to Develop Regulatory Compliance Software for the Financial Industry?

Why Traditional Development Approaches Fail in Financial Services

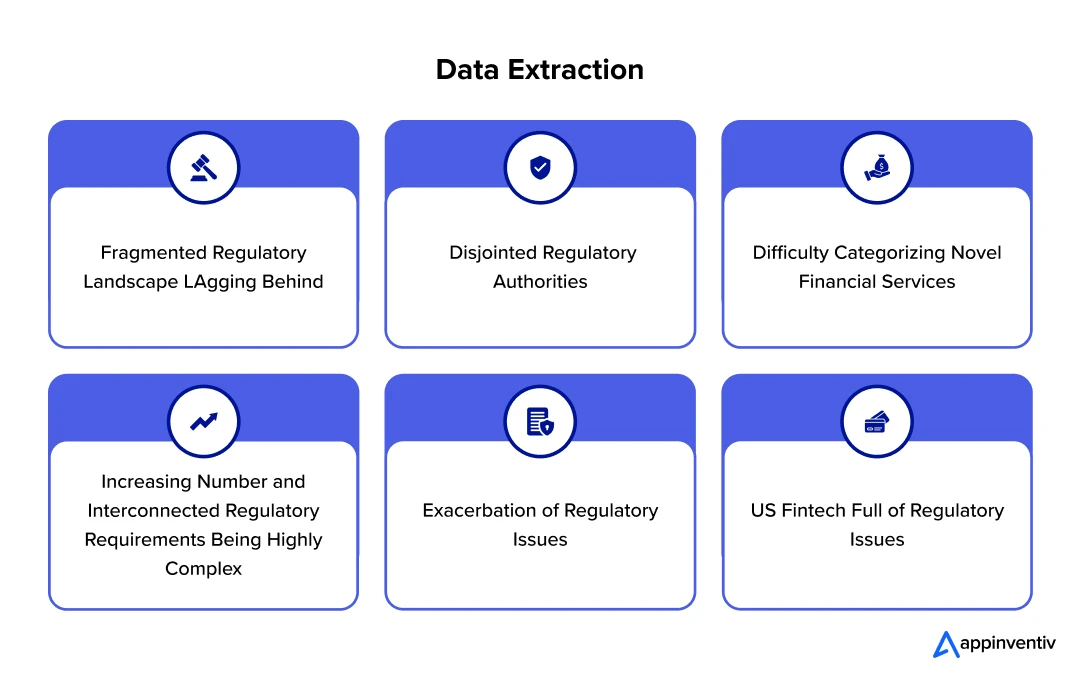

As per a ResearchGate publication, the U.S. FinTech sector grapples with significant fintech app development compliance challenges: a fragmented regulatory landscape that consistently lags behind technological innovation. This disjointed oversight often impedes development rather than fostering it, making it difficult to categorize novel financial services within existing frameworks and exacerbating fintech regulatory issues.

Here are the core compliance challenges for FinTechs:

- Licensing Maze: No unified federal framework means navigating costly, inefficient multi-state and multi-agency approvals.

- AML/KYC Strictness: One of the most critical compliance challenges for fintech app development demands robust identity and transaction monitoring, especially challenging with digital assets, with severe penalties for lapses.

- Data Privacy & Consumer Protection: Requires adherence to diverse state laws and transparent, secure data handling; failures bring reputational and legal fallout.

- Crypto & DeFi Ambiguity: Conflicting agency jurisdictions create significant legal risk and stifle innovation in digital asset markets.

Agile sprints can’t accommodate FinCEN’s complex reporting workflows that demand upfront database design decisions, highlighting key hurdles in fintech app development regulatory compliance. DevOps continuous deployment breaks down when every release requires regulatory impact assessments. The “fail fast” mentality directly contradicts federal banking regulators’ expectations of robust testing before market release, posing significant hurdles for compliance in fintech mobile apps.

US fintech regulations aren’t API endpoints you can patch later—they’re foundational requirements that shape system architecture, data flows, and user authentication from initial wireframes, underscoring the necessity of robust compliance for fintech. Teams treating compliance as technical debt discover that retrofitting regulatory requirements often costs more than complete rebuilds, highlighting the inherent compliance risks in FinTech app development, turning six-month projects into eighteen-month compliance exercises.

Also Read: DevOps Compliance – The Answer to Enterprise Compliance-Readiness Roadblocks

Let us now dive deeper, discussing the top 12 fintech app development compliance challenges and clarifying the murky waters of financial services:

Top 12 Compliance Pitfalls in FinTech App Development and Tips to Avoid Them

You’ve probably seen this pattern before: promising fintech startups that build incredible technology only to get blindsided by compliance issues they never saw coming. The same mistakes keep happening across different companies, different teams, and different product categories. These aren’t obscure regulatory edge cases related to fintech compliance regulations; they’re fundamental misunderstandings that cost companies millions in penalties and months of development time.

The most frustrating part? You can prevent nearly every one of these problems with proper planning during your initial architecture phase.

Bonus Read: How to Develop a PCI-Compliant Mobile App?

Treating AML Programs as Documentation Exercises

Walk into most fintech companies and ask to see their fintech AML compliance program. You’ll get handed a thick binder full of policies that nobody reads and procedures that don’t match what actually happens in the system. This disconnect between documentation and reality has cost companies like Block $80 million in penalties in 2025.

The Bank Secrecy Act doesn’t care about your elegant policy documents. It cares about whether your systems can actually detect suspicious transactions, whether your staff knows how to file suspicious activity reports, and whether your monitoring procedures catch real money laundering patterns.

Working with experienced fintech development partners ensures your AML policies align perfectly with your actual system capabilities. Professional development teams build sophisticated transaction monitoring systems that match their documentation, creating comprehensive programs that demonstrate real compliance effectiveness during regulatory reviews.

Fintech businesses avoid AML pitfalls by working with reliable development partners that:

- Build compliance-ready transaction monitoring into core app architecture

- Ensure system workflows reflect actual platform functionality

- Integrate automated suspicious activity detection and reporting features

- Design dashboards and tools that support ongoing AML compliance management

FinTech businesses avoid AML pitfalls and security vulnerabilities by partnering with development firms that build a comprehensive cybersecurity risk management plan into core app architecture from day one, ensuring regulatory compliance and threat protection work hand-in-hand.

Do have a read at: AML Software Development

Misunderstanding Money Services Business Registration

Every month, founders discover their payment app requires money services business registration with FinCEN. They’re usually making this discovery because they received a regulatory notice or because their banking partner demanded proof of registration before continuing the relationship.

The triggering activities seem obvious in hindsight: storing customer funds, facilitating transfers between parties, or providing cross-border payment services. But you might focus on user experience features like instant transfers and seamless fund storage without realizing these capabilities create regulatory obligations.

State money transmission licensing adds another layer of complexity to fintech app development compliance challenges. Each state has different requirements, different timelines, and different ongoing obligations. Some states require surety bonds, others demand specific compliance programs, and a few have capital requirements that can shock early-stage companies.

Partnering for Compliance Success

Fintech businesses avoid MSB registration oversights by working with reliable development firms that:

- Map regulatory implications into product design from day one

- Architect systems that meet federal and state reporting/data handling standards

- Integrate compliance-ready features such as KYC/identity verification workflows

- Build scalable fintech solutions that can adapt to multi-state licensing requirements

Securities Law Blind Spots

The SEC has filed over 200 cryptocurrency-related enforcement actions since 2013, and the pattern remains consistent: companies built products without understanding when they crossed into securities territory. This isn’t limited to crypto—traditional fintech companies make the same mistakes with investment features, advisory services, and trading platforms.

The Howey test seems straightforward until you try applying it to modern fintech products, a common area of focus for fintech app development regulatory compliance. Investment tracking apps that provide personalized recommendations can trigger investment adviser registration requirements. Savings apps that offer automatic investing features might constitute securities offerings. Even seemingly innocent portfolio analytics tools can cross the line into providing investment advice.

Partnering with experienced fintech development teams ensures comprehensive securities law analysis before adding any investment-related features. Professional developers implement clear boundaries between information tools and investment advice, helping companies navigate complex regulatory requirements while building innovative financial products.

Partnering for Compliance Success

Fintech businesses avoid securities law violations by working with reliable development firms that:

- Conduct compliance-driven feature planning during app development

- Implement clear boundaries in product design between informational tools and advisory features

- Develop secure and auditable frameworks for trading, portfolio tracking, or digital assets

- Ensure technical implementations align with compliance frameworks from the start

Consumer Protection Oversights

The CFPB collected over $3 billion in consumer relief last year, much of it from fintech companies that thought consumer protection laws didn’t apply to their ‘technology platforms,’ illustrating significant regulatory challenges in fintech mobile apps. This misconception has proven expensive for companies across the lending, payments, and debt collection sectors.

Fair lending requirements apply regardless of whether you use algorithms or human underwriters. Truth in Lending Act disclosures are mandatory whether customers apply through your app or your website. Electronic Fund Transfer Act requirements govern digital payments just as strictly as traditional bank transfers.

Experienced fintech development partners integrate consumer protection requirements into user interface design from day one, ensuring TILA disclosures and EFTA compliance are built seamlessly into the customer experience rather than added as compliance afterthoughts.

Partnering for Compliance Success

Fintech businesses avoid consumer protection violations by working with reliable development firms that:

- Embed disclosures and compliance-driven design into the app interface

- Build automated monitoring systems to track fair lending and dispute resolution

- Create customer support flows that align with regulatory timelines

- Develop fraud detection and prevention modules that exceed industry benchmarks

Data Privacy Fragmentation

American fintech companies face a patchwork of federal and state privacy laws that creates significant fintech app development regulatory compliance complexity that most teams underestimate. The Gramm-Leach-Bliley Act sets baseline requirements for financial institutions. Still, state laws, such as the California Consumer Privacy Act and the Illinois Biometric Information Privacy Act, as well as emerging privacy legislation in other states, create additional obligations.

Your challenge isn’t just understanding what each law requires; it’s building systems that can comply with multiple, sometimes conflicting requirements simultaneously. California requires opt-in consent for certain data uses, while federal law only requires opt-out options. Illinois has strict requirements for biometric data, while other states focus on personal identifiers.

Experienced fintech development partners implement privacy-by-design principles that handle multiple regulatory frameworks simultaneously. Professional teams build data governance systems that automatically comply with the strictest requirements across all jurisdictions, eliminating conflicts between different privacy regimes.

Partnering for Compliance Success

Fintech businesses avoid data privacy fragmentation issues by working with reliable development firms that:

- Implement privacy-by-design architectures from inception

- Build automated consent and preference management into apps

- Design robust data governance frameworks for multi-jurisdiction compliance

- Integrate breach detection and reporting systems that meet regulatory timelines

Third-Party Risk Blindness

Fintech companies frequently leverage specialized vendors to access advanced capabilities and accelerate development timelines. However, maintaining regulatory oversight of these partnerships requires strategic planning, as compliance responsibility ultimately remains with your organization regardless of third-party arrangements.

Banking-as-a-Service relationships offer tremendous opportunities for fintech companies to access traditional banking services and expand their service offerings. The key to success lies in establishing comprehensive oversight frameworks that ensure both your company and your banking partners maintain robust compliance standards throughout the partnership.

Smart fintech companies recognize that vendor management isn’t just about cost optimization; it’s about building resilient systems that maintain regulatory compliance even when third-party providers face challenges. This proactive approach prevents operational disruptions and maintains customer trust during vendor transitions or regulatory changes.

Partnering for Compliance Success

Fintech businesses avoid third-party risk issues by working with reliable development firms that:

- Integrate compliance safeguards into all third-party APIs and system integrations

- Build monitoring dashboards for third-party service performance and compliance

- Design failover and redundancy plans for critical vendor dependencies

Digital Asset Regulatory Confusion

Cryptocurrency and digital asset regulations remain unsettled, posing a dynamic landscape for fintech app development regulatory compliance, but enforcement actions provide clear guidance about regulatory expectations. The SEC has collected nearly $5 billion in penalties from digital asset companies, mostly for treating securities offerings as technology launches.

Token sales that fund company operations usually constitute securities offerings regardless of their marketing language. Staking services that promise returns often qualify as investment contracts. Digital asset trading platforms frequently operate as unregistered broker-dealers or exchanges.

State virtual currency licensing requirements add operational complexity. States like New York require BitLicenses for most digital asset businesses, while others have adopted money transmission frameworks or created new licensing categories specifically for virtual currencies.

Experienced fintech development partners focus on the economic substance of digital asset services rather than just the underlying technology. Professional teams conduct comprehensive securities law analysis and implement robust compliance frameworks that can adapt to evolving regulatory guidance while maintaining operational flexibility.

Partnering for Compliance Success

Fintech businesses avoid digital asset regulatory confusion by working with reliable development firms that:

- Build tokenization and crypto transaction systems with a compliance-first design

- Integrate AML/KYC and transaction monitoring into crypto workflows

- Create adaptable frameworks that support evolving digital asset regulations

State Licensing Underestimation

The United States operates under a dual banking system where both federal and state regulators have authority over different aspects of financial services, presenting distinct compliance challenges for fintech app development. You might focus on federal requirements while underestimating the complexity of state-level compliance.

Money transmission licensing represents the most common state compliance challenge. Each state has different application requirements, different timelines, and different ongoing obligations. Some states require surety bonds that can cost hundreds of thousands of dollars, others demand specific compliance programs, and many have capital requirements that surprise early-stage companies.

Consumer lending creates additional state licensing obligations. Marketplace lending platforms need licenses in most states where they originate loans. Buy-now-pay-later services may require consumer finance licenses depending on their specific terms and structures.

Experienced fintech development partners conduct comprehensive state-by-state regulatory mapping during the business planning phase, ensuring accurate licensing timelines and cost projections are built into launch strategies from the beginning.

Partnering for Compliance Success

Fintech businesses avoid state licensing underestimation by working with reliable development firms that:

- Design platforms to be adaptable to diverse state compliance requirements

- Integrate reporting modules aligned with state-specific standards

- Provide scalable architectures that support phased, compliant geographic rollouts

Record-Keeping System Failures

Financial regulators expect comprehensive documentation that demonstrates ongoing compliance efforts. You’ll inevitably struggle during regulatory examinations and enforcement investigations if you treat record-keeping as an afterthought.

The Bank Secrecy Act requires specific transaction records and monitoring documentation. Securities laws mandate communication preservation and trading records. Consumer protection regulations demand complaint handling documentation and decision-making records.

Electronic communication preservation has become a particular enforcement focus. The SEC has assessed millions in penalties against companies that failed to preserve text messages, instant messages, and other business communications. Employees using personal devices for business purposes create additional complications.

Experienced fintech development partners implement automated documentation capture systems and centralized compliance repositories during initial architecture planning, ensuring comprehensive record-keeping capabilities are built into core operations rather than added retroactively.

Partnering for Compliance Success

Fintech businesses avoid record-keeping failures by working with reliable development firms that:

- Build automated record capture and storage into core systems

- Create centralized repositories with audit trails and advanced search

- Develop compliance reporting tools that generate regulator-ready documentation

Operational Resilience Neglect

Financial services regulations increasingly emphasize operational resilience—your ability to maintain critical functions during disruptions. This includes cybersecurity incidents, natural disasters, vendor failures, and technology outages.

Cyber incident response planning has become mandatory rather than optional. Recent regulatory guidance requires specific notification timelines, detailed incident documentation, and recovery procedures that minimize customer impact.

Cloud dependency creates particular operational resilience challenges. If you rely heavily on single cloud providers, you face concentration risks that regulators view skeptically. Others use multiple cloud services without understanding their interdependencies or failure modes.

Experienced fintech development partners build operational resilience into system architecture from day one, implementing redundant systems and comprehensive business continuity plans that address all critical functions while maintaining regulatory compliance during disruptions.

Partnering for Compliance Success

Fintech businesses avoid operational resilience issues by working with reliable development firms that:

- Implement redundant systems and disaster recovery into the app infrastructure

- Create comprehensive incident response procedures

- Ensure cloud and vendor dependencies are backed by robust continuity planning

Inadequate Vendor Management and Due Diligence

Your fintech startup likely leverages dozens of third-party vendors, from cloud infrastructure providers to specialized compliance software companies.However, many development teams approach vendor selection by prioritizing features and pricing while overlooking the strategic importance of regulatory alignment in their choices.

A comprehensive vendor evaluation process ensures that your chosen partners can fully support your compliance obligations from day one. Smart fintech companies select cloud providers based on both technical capabilities and their ability to provide the data residency guarantees needed for specific customer segments. Similarly, they choose payment processors not just for attractive API documentation, but for robust transaction monitoring capabilities that enhance their AML programs.

Partnering for Compliance Success

Fintech businesses avoid vendor management pitfalls by working with reliable development firms that:

- Integrate vendor compliance checks into the third-party API onboarding system

- Create ongoing monitoring systems for vendor compliance health

- Build modular architectures that make it easy to swap non-compliant vendors

Mishandling Cross-Border Regulatory Complexity

Your fintech app might start as a domestic service, but customer demand inevitably pushes you toward international expansion, amplifying regulatory challenges in fintech mobile apps. The regulatory complexity of cross-border financial services often catches companies unprepared, especially when they attempt to apply domestic compliance approaches to international markets.

Here is what follows:

- Firstly, European markets present particular challenges with GDPR requirements that go far beyond American privacy laws. You can’t simply add cookie banners and privacy notices to your existing app—GDPR requires fundamental changes to how you collect, process, and store customer data.

- Secondly, anti-money laundering requirements vary significantly across jurisdictions. What constitutes adequate customer due diligence in the United States might be insufficient in the European Union or completely inappropriate in certain Asian markets.

- Thirdly, you might assume that partnering with local financial institutions solves your regulatory problems, but this approach often creates new compliance obligations. Local partnerships can trigger licensing requirements in foreign jurisdictions, subject you to local consumer protection laws, or create complex reporting obligations to multiple regulatory agencies.

Experienced fintech development partners conduct comprehensive regulatory analysis before international expansion and implement data governance frameworks that comply with the strictest international requirements from the initial build, eliminating the need for costly system overhauls during expansion phases.

Partnering for Compliance Success

Fintech businesses avoid cross-border regulatory complexity by working with reliable development firms that:

- Build apps with data privacy frameworks compatible with GDPR and global standards

- Architect solutions to manage multi-jurisdiction compliance simultaneously

- Design scalable systems that support expansion into new geographies without overhauls

Risk-Based Implementation Priorities: A Decision Framework for Technical Leaders

After identifying common fintech app development compliance challenges, the next critical step for technical leaders becomes strategic prioritization. You can’t solve everything simultaneously, and attempting to do so often leads to poorly implemented solutions that fail during regulatory scrutiny. Technical leaders need a systematic approach to sequence compliance investments based on actual risk exposure and business impact, which is among the fundamental regulatory compliance best practices for FinTech app.

This framework organizes Fintech app development compliance best practices into four categories: immediate critical actions that prevent business shutdown, foundational systems that enable scalable compliance, strategic investments that support growth, and optimization efforts that improve efficiency. Each category of regulatory challenges for fintech app development companies has different timelines, resource requirements, and risk profiles.

Critical Path Items (Weeks 1-4): Business Continuity Risks

These items can shut down your operations or trigger immediate enforcement actions. Delay is not an option—regulatory agencies don’t provide grace periods for “learning about” basic requirements.

Money Services Business Registration and Core Licensing

Complete FinCEN MSB registration before processing your first customer transaction. State money transmission licensing takes 6-18 months, so initiate applications immediately in your launch states. Budget $500K-$2M for multi-state licensing costs.

Anti-Money Laundering Program Framework

Establish your AML program structure by appointing compliance officers, establishing board-approved policies, and implementing basic transaction monitoring. This doesn’t need to be sophisticated initially, but it must exist and function before you handle customer funds.

Customer Identification Procedures

Implement KYC workflows that collect required identification documents and perform basic verification. Focus on meeting minimum regulatory standards rather than optimizing user experience—you can improve the interface later.

Securities Law Boundaries

Define clear boundaries between informational tools and investment advice to ensure transparency and accountability. If your product provides personalized recommendations, obtain investment adviser registration as soon as possible. The SEC doesn’t distinguish between “tips” and “advice.”

Foundational Systems (Months 2-6): Scalable Compliance Architecture

These systems enable efficient compliance as your business grows. Poor foundation choices here create expensive technical debt that becomes increasingly difficult to rectify as your customer base expands.

Transaction Monitoring Infrastructure

Build monitoring capabilities into your core database architecture rather than adding them as overlays. Implement machine learning algorithms that baseline normal customer behavior patterns. Create automated alert generation with human review workflows.

Data Governance Framework

Establish data governance systems that handle multiple privacy regimes simultaneously. Implement privacy-by-design principles with automated consent management. Create data residency controls and breach notification capabilities.

Record-Keeping Systems

Design comprehensive audit trails that capture all business communications and decision-making processes. Implement automated documentation capture with centralized compliance data repositories. Build regulatory reporting systems that generate required documentation on demand.

Vendor Management Program

Create vendor assessment frameworks that evaluate compliance capabilities, not just technical features. Establish ongoing monitoring procedures with quarterly compliance reviews. Maintain backup vendor relationships for critical functions.

Strategic Growth Enablers (Months 6-18): Expansion and Optimization

These investments support business growth while maintaining compliance efficiency. Prioritize based on your expansion timeline and market opportunities.

Advanced Analytics and Monitoring

Implement sophisticated transaction monitoring with behavioral analytics and pattern recognition. Create synthetic transaction testing capabilities. Build customer risk scoring models that improve both compliance effectiveness and user experience.

Multi-Jurisdictional Compliance Management

Develop systems that handle varying state and international requirements. Develop geographic launch strategies that align with licensing timelines. Establish local legal entities and banking relationships in target markets.

Automated Compliance Reporting

Build systems that generate regulatory reports automatically rather than requiring manual compilation. Implement real-time compliance dashboards for management oversight. Create exception management workflows that handle unusual situations efficiently.

Operational Resilience Enhancement

Develop comprehensive business continuity plans with redundant systems for critical functions. Implement advanced fintech cybersecurity monitoring with incident response automation to enhance your security posture. Create vendor failure response procedures that minimize customer impact.

Risk Assessment Matrix for Prioritization

Effective compliance prioritization requires systematic risk evaluation that considers both the likelihood of regulatory issues and their potential business impact, forming the bedrock of successful regulatory fintech app compliance. This matrix helps technical leaders allocate limited resources by categorizing compliance risks across four quadrants, each requiring a different response strategy and timeline.

You can use this framework to justify compliance investments to stakeholders and ensure that critical vulnerabilities receive immediate attention, while longer-term risks are monitored and addressed through planning.

| Risk Category | Timeline | Key Compliance Issues | Required Action |

|---|---|---|---|

| High Probability, High Impact | Immediate | Missing required registrations, Inadequate AML programs, Securities law violations, Consumer protection failures | Address immediately – these can shut down operations or trigger enforcement |

| High Probability, Medium Impact | Within 6 Months | Inefficient transaction monitoring, Poor vendor oversight, Inadequate record-keeping, Basic cybersecurity gaps | Plan systematic remediation to reduce operational risk and regulatory exposure |

| Medium Probability, High Impact | Plan and Prepare | Major vendor failures, Cross-border regulatory complexity, Emerging digital asset regulations, State enforcement actions | Develop contingency plans and monitoring systems before issues occur |

| Low Probability, Variable Impact | Monitor and Adapt | Federal regulatory changes, New international requirements, Technology-specific guidance, Industry enforcement trends | Stay informed through counsel and industry sources, and adapt strategies as needed |

Avoiding Common Implementation Mistakes

Even experienced technical teams make predictable mistakes when implementing compliance systems, often due to treating regulatory requirements as secondary concerns rather than core architectural decisions. These implementation errors typically stem from applying standard software development practices to compliance contexts where different priorities and constraints apply. Understanding these common pitfalls helps technical leaders avoid expensive redesigns and ensures compliance systems actually work when regulatory scrutiny arrives.

| Common Pitfall | What Teams Do Wrong | Correct Approach |

|---|---|---|

| Premature Optimization | Focus on elegant user experience before ensuring regulatory compliance | Build systems that meet regulatory requirements first, then optimize for user experience. A compliant but clunky process is better than an elegant process that violates regulations. |

| Underestimating Integration Complexity | Treat compliance as separate applications that can be bolted onto existing systems | Compliance systems must integrate with your core business logic, not operate as separate applications. Plan for compliance requirements to influence database design, API architecture, and user interface workflows. |

| Assuming Vendor Solutions Are Complete | Rely on third-party vendors to handle all compliance responsibilities | Third-party compliance vendors provide tools, not complete solutions. You remain responsible for configuring, monitoring, and maintaining compliance effectiveness regardless of what vendors promise. |

How Appinventiv Can Help You Battle Compliance Pitfalls in FinTech App Development

Navigating fintech app development compliance challenges doesn’t have to derail your innovation timelines. At Appinventiv, we bring deep regulatory expertise directly into the development process, ensuring compliance in fintech mobile apps requirements shape architecture from day one rather than becoming expensive retrofits later.

As a Clutch Global Leader and GoodFirms Top App Development Company, we combine technical excellence with real-world compliance experience across AML program implementation, multi-state licensing strategies, and securities law navigation. Our portfolio includes successful partnerships with industry leaders like KFC, Domino’s, and IKEA.

Our Core Compliance Solutions:

- Transaction monitoring and KYC workflows built into the core architecture

- Automated reporting systems that satisfy regulatory requirements

- Multi-jurisdictional compliance frameworks for scalable growth

- Data governance systems that handle multiple privacy regimes

Through our custom fintech application development services, we integrate essential compliance frameworks directly into platform architecture, eliminating costly technical debt from compliance afterthoughts.

Why Industry Leaders Choose Us:

- Top App Development Company award from GoodFirms

- Clutch Global Leader recognition for development excellence

- Trusted by Fortune 500 companies, including KFC and IKEA

- Proven track record in regulatory-compliant fintech solutions

We’ve helped fintech organizations avoid the costly mistakes outlined in this guide, turning regulatory requirements into competitive advantages through thoughtful system design that positions companies for sustainable growth.

Ready to build compliance-first fintech solutions that scale? Contact our experts today.

Frequently Asked Questions (FAQs)

Q. How to Ensure Compliance in Fintech Apps Development?

A. Ensuring FinTech app compliance necessitates a deeply integrated and proactive approach from development inception. Organizations must weave robust security measures, such as advanced encryption and multi-factor authentication, into the core architecture. Regular, independent audits and continuous monitoring are vital, complemented by thorough penetration testing. Crucially, fostering a strong, compliance-aware culture ensures that all personnel understand their critical role in safeguarding user data and adapting effectively to the complex, ever-evolving regulatory landscape.

Q. What Are the Financial Regulations for App Developers?

A. Financial regulations for app developers vary, depending on the app’s function and region. They fundamentally involve robust data protection (e.g., GDPR, CCPA) and payment security standards like PCI-DSS if transactions occur. Developers must also implement AML/KYC protocols to prevent financial crime and adhere to consumer protection laws, ensuring fair practices. Navigating complex licensing requirements across various jurisdictions is crucial. The evolving nature of cryptocurrency regulations adds another layer of compliance complexity, demanding constant vigilance.

Q. How Do We Ensure Legal Compliance in Fintech App Development?

A. Ensuring legal compliance in FinTech app development starts at the design phase. It mandates close collaboration with legal and regulatory experts to interpret evolving financial laws. Developers must implement robust security protocols, including encryption and access controls, for data protection. Regular third-party audits and continuous internal monitoring are crucial for identifying vulnerabilities promptly. Moreover, fostering a strong, company-wide compliance culture ensures all personnel remain vigilant and proactive in adhering to current and emerging regulations.

Q. How to Overcome Fintech Compliance Issues?

A. Overcoming FinTech compliance issues demands a proactive, integrated strategy. Organizations must adopt a risk-based framework, diligently identifying and prioritizing specific regulatory challenges like AML/KYC and data privacy. Strategic investment in RegTech solutions is crucial, automating processes for efficiency and real-time insights. Early engagement with regulatory experts and fostering clear communication with authorities helps clarify complex guidelines. Ultimately, building a robust internal compliance culture ensures continuous vigilance, embedding adherence into every operational layer, and facilitating agile adaptation to evolving legal landscapes.

Q. Why Fintech Companies Choose Appinventiv for Regtech Fintech App Development?

A. FinTech companies frequently choose Appinventiv for RegTech app development due to their proven expertise in marrying financial innovation with stringent compliance. They emphasize integrating advanced security and automated compliance frameworks (like PCI-DSS, GDPR, AML/KYC) from the outset. Their focus on leveraging technologies such as AI and blockchain for real-time risk assessment and reporting, coupled with a track record of delivering secure, scalable, and audit-ready solutions across diverse financial services, instills client confidence in navigating complex regulatory landscapes effectively.

Q. What Are the Primary Regulatory Challenges Fintech App Development Face?

A. FinTech app development confronts significant regulatory challenges. These primarily involve navigating fragmented federal and state licensing requirements, creating high costs. Ensuring robust data privacy and cybersecurity, adhering to strict AML/KYC protocols for financial crime prevention, and meeting consumer protection mandates are crucial. The volatile regulatory landscape surrounding cryptocurrencies and DeFi presents unique legal uncertainties. Additionally, rapidly evolving regulations demand continuous adaptation, posing ongoing compliance hurdles for innovators.

Q. Why Is Investing in Compliance Technology (Regtech) Crucial for Fintechs?

A. Investing in compliance technology, or RegTech, is crucial for FinTechs facing a dynamic and complex regulatory landscape. These solutions automate cumbersome processes like AML/KYC, transaction monitoring, and reporting, significantly boosting efficiency and accuracy while minimizing human error. RegTech reduces the risk of costly penalties and reputational damage from non-compliance. Furthermore, it provides real-time insights for better risk management and allows FinTechs to adapt swiftly to evolving regulations, enabling sustainable growth and fostering greater trust within the financial ecosystem.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does Accounting Practice Management Software Development Cost in Australia 2026?

Key takeaways: Custom accounting practice management software development in Australia for mid-to-large firms generally falls between AUD 70,000 and AUD 700,000. Adherence to the Privacy Act 1988 and ATO operational frameworks is a primary cost driver, not an add-on. A modular architecture and structured development approach ensure that the platform evolves with changing laws and…

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…