- Why FinTech is Accelerating in the UAE

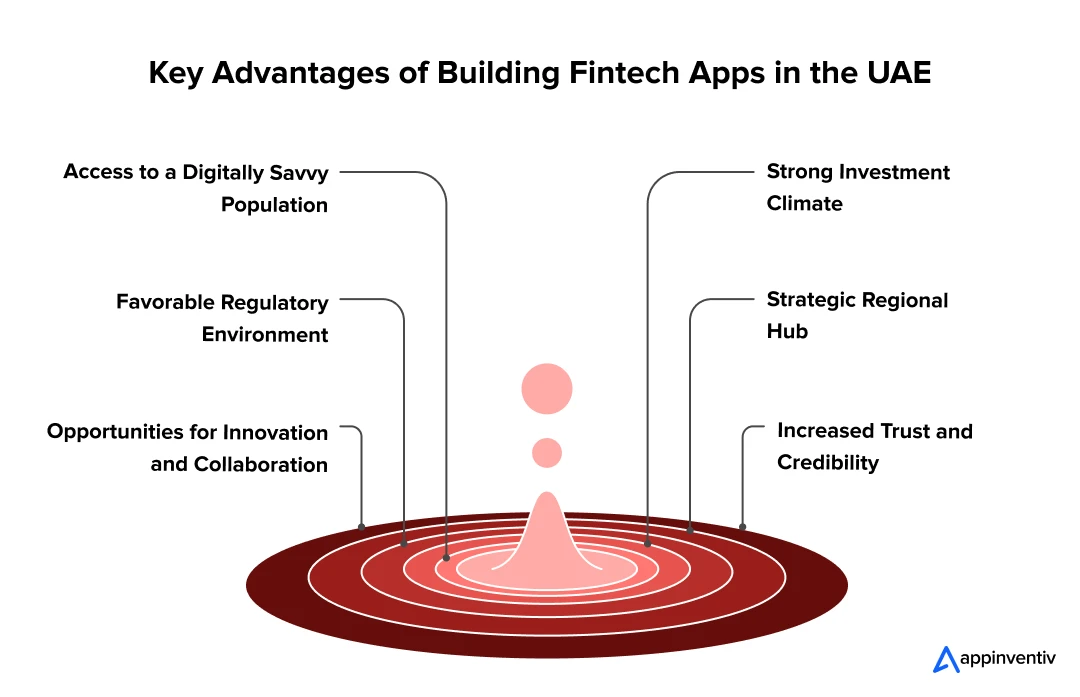

- Benefits of FinTech App Development in the UAE

- Access to a Digitally Savvy Population

- Favorable Regulatory Environment

- Opportunities for Innovation and Collaboration

- Strong Investment Climate

- Strategic Regional Hub

- Increased Trust and Credibility

- Steps to Build a Futuristic FinTech App in the Middle East

- Carry Out intensive Regional Market Research

- Identify Essential Features

- Navigate Regulatory Compliance and Licensing

- Choose a Future-Ready and Scalable Technology Stack

- Design a Culturally Sensitive and Intuitive UI/UX

- Conduct Rigorous Testing

- Launch Strategically

- Ongoing Improvement

- Factors Affecting the Cost of FinTech App Development in the UAE

- Scope and Features of the App

- Complexity of the Application

- Regulatory and Compliance Requirements

- Technology Stack and Integrations

- Security and Data Protection

- Design and User Experience

- Post-Launch Support and Maintenance

- Key Challenges and Solutions in Enterprise FinTech App Development in Dubai

- Regulatory Complexity and Compliance

- Integration with Legacy Banking Systems

- Cybersecurity and Data Protection

- Talent Shortages and Skill Gaps

- User Expectations and Market Competition

- Initiate Your FinTech App Development Journey in the Middle East With Appinventiv

- FAQs

Key takeaways:

- The UAE is a leading FinTech hub, driven by progressive regulations and high digital adoption.

- Building FinTech apps in the Middle East requires strong compliance and cultural understanding.

- Secure, scalable tech and user-friendly design are critical for market success.

- Strategic partnerships and ongoing innovation help enterprises stay ahead in a fast-evolving FinTech landscape.

Investing in FinTech app development is one of the shrewdest calls an enterprise can make today. FinTech has grown alongside the shift to digital commerce, replacing clunky, manual financial processes with automated systems that just work. This covers everything from bankless money transfers to smooth payment processing for both startups and legacy businesses.

Forbes data shows the UAE’s FinTech market will likely reach $3.56 billion by 2025 and $6.43 billion by 2030, maintaining a compound annual growth rate (CAGR) of 12.56%. These figures position the UAE among the world’s fastest-growing FinTech markets, which is why enterprises seeking scalable financial solutions are taking notice.

The Middle East is turning into a genuine FinTech powerhouse, thanks to sensible regulations, a population comfortable with technology, and substantial infrastructure spending. For enterprises, this means plenty of opportunity, but you’ll face some unique hurdles too. Building FinTech apps here isn’t just about good code; you need to understand local market peculiarities, what regulators expect, and what actually matters to consumers.

Look at STC Pay as an example. Saudi Telecom Company (STC) rolled it out in 2018, and it now handles digital wallets, remittances, and bill payments, showing what happens when you match technology to what the region needs while staying compliant. Then there’s Tabby (UAE) and MyFawry (Egypt), which are changing how people pay through BNPL services and electronic payment networks throughout the Middle East.

This guide breaks down what matters most for FinTech app development in the Middle East, helping enterprises figure out how to build secure, scalable, and user-focused financial applications that can actually compete in this fast-moving market.

Lead in the Middle Eastern FinTech ecosystem by launching apps that balance innovation, compliance, and seamless user experience

Why FinTech is Accelerating in the UAE

The UAE has become a FinTech powerhouse, and that didn’t happen by chance; it’s been years of deliberate policy work combined with market timing. The government has implemented progressive regulations, introduced significant incentives, and invested heavily in digital infrastructure. That’s opened things up for everyone, from multinational corporations to local startups.

Look at programs like the Abu Dhabi Global Market (ADGM) RegLab or Dubai’s FinTech Hive; they’re giving companies actual sandbox environments to test ideas and get mentorship. Then you’ve got free-zone benefits: no tax, full foreign ownership. It’s no wonder the UAE has turned into a go-to destination for FinTech app development in the Middle East, pulling in innovators from all over.

Consumers here are primed for this, too. Smartphone penetration is incredibly high, and people genuinely prefer going cashless. Digital wallets, P2P payments, neobanks like Mashreq, they’re spreading fast. AI-driven features and strong cybersecurity in FinTech applications are what’s keeping trust levels up. The same mindset applies when you build an AI powered queue management system in Dubai and UAE to manage high-footfall service flows. The UAE is also tackling bigger goals: financial inclusion, cross-border payment networks, and open banking frameworks. What we’re seeing is a full-scale Middle East digital banking transformation, and the UAE is leading it.

Key Government Initiatives Fueling FinTech Growth in the UAE:

- DIFC FinTech Hive – The region’s original and largest FinTech accelerator.

- ADGM RegLab – Lets startups test products in a controlled regulatory environment.

- FinTech Saudi (regional collaboration) – Pushing cross-border innovation forward.

- VARA (Virtual Assets Regulatory Authority) – Setting up the rulebook for digital assets and blockchain finance.

- Free-zone policies – Zero corporate tax, 100% foreign ownership to bring in global players.

Benefits of FinTech App Development in the UAE

The UAE has emerged as a major FinTech player in the Middle East, driven by supportive government policies, tech-enthusiastic consumers, and a solid financial sector. For startups and established companies alike, developing FinTech applications here presents genuine strategic value:

Access to a Digitally Savvy Population

The UAE ranks among the top in the Middle East for smartphone usage and internet access, which creates excellent conditions for FinTech app development in the Middle East ventures. Most consumers already manage their banking, payments, and investments through mobile apps; it has become second nature. This familiarity with digital finance means new FinTech solutions can build momentum quickly and maintain loyal users while expanding across the region.

Businesses can leverage this opportunity to introduce sophisticated features like AI-based financial analysis or live payment monitoring, addressing what users genuinely expect from modern financial tools.

Favorable Regulatory Environment

The UAE has a clear and progressive regulatory regime with bodies such as the Central Bank, DIFC, and ADGM. Regulatory sandboxes, licensing options, and similar initiatives enable startups and businesses to build high-quality solutions without undergoing irrelevant bureaucracy.

Particularly, enterprise FinTech application development in the Middle East is beneficial with this environment as it offers structured compliance assistance and allows the adoption of sophisticated functionality such as Open Banking, Sharia-compliant banking, and cross-border payment services. Adhering to these frameworks, the FinTech solutions will be able to earn the trust of the users and their market credibility at the very outset.

Opportunities for Innovation and Collaboration

In the UAE, events such as DIFC FinTech Hive and ADGM RegLab allow startups, financial institutions, and technology providers to collaborate. These projects enable businesses to prototype new services with oversight, incorporate third-party offerings, and experiment with artificial intelligence/machine learning-based capabilities, predictive analytics, and digital wallets.

The climate provides a good ecosystem for FinTech app development UAE, which allows new startups and businesses to provide advanced, customer-oriented services at minimal costs of operations and regulation. Joint ventures also shorten go-to-market timeframes and enhance access to expertise in banking, compliance, and enterprise-grade technology.

Strong Investment Climate

Financial technology receives a lot of venture capital and institutional investment in the UAE. Specifically, the government and the private sector are currently interested in FinTech innovation by funding programs, incubators, and accelerator programs.

Such an environment reinforces chances of both startups and enterprises by making it easy to access financial support in developing and promoting products and expanding. Availability of these resources will be beneficial to any company that aims at the wider region, such as FinTech app development in Saudi Arabia, and be able to plan on key expansion without compromising the quality of service delivery.

Strategic Regional Hub

The UAE is the gateway to the wider Middle East and North Africa (MENA) region, which provides access to new markets and a culturally diverse user base. The introduction of FinTech applications in this case can allow businesses to ride cross-border payment networks, multi-language, and collaborations with local banks or payment processors.

This placement is especially advantageous to enterprise FinTech solutions in the UAE, where companies can effectively scale and avoid local regulations and feature customization to meet the expectations of different consumers.

Increased Trust and Credibility

Working within the framework of the UAE laws will make users feel safer using FinTech apps because the consumers and business firms will see the proposed solutions as stable, secure, and legal. Enterprise adoption requires viable security features, encryption protocols, and transparent data-handling practices.

This is particularly crucial in the case of enterprise financial app development in the UAE, where there exist institutional clients and high-net-worth users who require enterprise-level application security, risk management, and regulatory compliance. By building trust through adherence and solid service provision, user retention and building the brand name will augment the competitive Middle East FinTech scene.

Appinventiv’s Insights

It is not only a necessity to align your FinTech solutions with the UAE regulations as well as the best practices in the industry, but also a pivotal strategy. High levels of security, full data transparency, and complete compliance with the regulations are signs of reliability. This assists the new businesses as well as the existing companies to trust your services.

Steps to Build a Futuristic FinTech App in the Middle East

The Middle East is fast becoming a global FinTech base, with the government policies, liberal regulatory systems, combined with a highly tech-savvy population. In order to create a successful FinTech application in this area, one must be able to work within the specific legal and compliance environments of a specific country and capitalize on government efforts that drive innovation. Here are some of the steps to build a FinTech app in the Middle East:

Carry Out intensive Regional Market Research

Start by thoroughly researching the financial habits, adoption of technology, and the regulatory climates of the countries you are targeting. An example of this is the focus on digital banking development in Saudi Arabia within the framework of FinTech, provided by SAMA and Open Finance, which the Central Bank encourages in the UAE. Similarly, Bahrain has rapidly evolved into a fintech leader, its sector is projected to grow twelvefold by 2032, driven by real-time payments and digital-first financial solutions. Partnering with a local mobile app development company in Bahrain can help you align your fintech app with Bahrain’s regulatory standards and user expectations.

Explore unmet needs in services, such as cross-border remittances, micro-investment platforms, or Sharia-compliant banking, and understand what motivates and influences consumer consumption. A target market approach will see that the app responds to real pain points in the region and distinguishes itself among its competitors.

Identify Essential Features

Develop the app’s functionality based on local requirements and current trends. The main ones can be the AI-based budgeting approach, predictive finances, real-time digital payments, loyalty platforms, and investment advice.

Introduce services tailored to the region, such as Sharia-compliant banking or credit-scoring systems based on local financial practices. In the UAE, Open Banking projects and sandboxes in ADGM or DIFC can include integration of third-party services to provide innovative services without breaking the law.

Navigate Regulatory Compliance and Licensing

The Middle East is highly compliant. Get licenses with government bodies such as SAMA in Saudi Arabia or the Capital Market Authority (CMA) in the UAE, or DIFC and ADGM. Introduce Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) controls, ensure that user data is kept secure in accordance with local data protection regulations, and audit trails are kept to guarantee transparency.

The use of a regulatory sandbox could enable the safe testing of new features under regulatory oversight, thereby lessening the risk of lawsuits and establishing credibility with customers.

Banks and financial institutions across the region increasingly rely on enterprise software developers in Saudi Arabia who bring deep expertise in SAMA compliance, data sovereignty, and secure payment processing.

Choose a Future-Ready and Scalable Technology Stack

Select technologies that can support the fast growth and sophisticated financial operations. Cloud infrastructure should also abide by the regional regulations, API should enable a smooth enterprise payment gateway integration, and AI/ML models can suggest their predictive features and personalized recommendations.

Cross-platform frameworks like Flutter or React Native would make it easier to roll out quicker on both iOS and Android platforms, with high mobile penetration in the area. End-to-end encryption and multi-factor authentication are security measures that are required to protect sensitive financial data.

Design a Culturally Sensitive and Intuitive UI/UX

Make your application appealing to a diverse range of users. Add multi-language features with the right-to-left text support to the Arabic language, visual hierarchy, and both beginner and advanced usability.

The fact that complex financial processes are simplified and yet have advanced functionality promotes interaction. User trust and adoption may be increased by incorporating local aesthetic preferences, symbols, and color palettes familiar to the culture.

Conduct Rigorous Testing

It must be tested to ensure that the app functions properly under real-life conditions and complies with the strict regional financial regulations. The first step is to perform functional testing to ensure that all functions, including payments and account management, are functioning as expected.

A performance test to determine that the app can handle large volumes of transactions and peak usage without causing delays or crashing down is especially critical when entering an industry with a high rate of mobile and digital penetration, such as the UAE and Saudi Arabia.

The security testing involves penetration testing, vulnerability testing, and encryption testing to maintain confidential financial information. Lastly, usability testing is conducted to ensure that users of the app can navigate it easily, regardless of their demographics.

Also Read: Proven Mobile App Testing Strategies for Reliable Apps

Launch Strategically

It is a strategic rollout that minimizes the risk at the cost of enhanced adoption. A step-by-step implementation is an option, as the app could be introduced to a few users to see how it performs in the real world, and how it is affected, and any response could be obtained.

Partnerships with local banks, FinTech accelerators, and payment providers will help enhance the infrastructure, establish trust, and facilitate integration into existing financial networks with ease. It should be regulatorily fitting; the permission of the local authorities, including but not limited to SAMA, CMA, DIFC, or ADGM, not only contributes to the absence of any legal problems but also makes users more trusting.

Ongoing Improvement

Post-launch maintenance is also required to keep performance and security, as well as regulatory adherence. Monitor the performance of the transactions, the stability of the servers, and the engagement of the users to identify the areas that can be enhanced. The features continuously update themselves using analytics, user feedback, and evolving market needs to stay competitive.

Remain within regional compliance regulations by observing the financial legislation and AML/CFT regulations, along with government FinTech policies, including FinTech Saudi or government innovations in DIFC. The app will be reliable and secure, and responsive to new consumer demands and emerging technologies in the Middle East market due to constant security checks, bug fixes, and performance optimization.

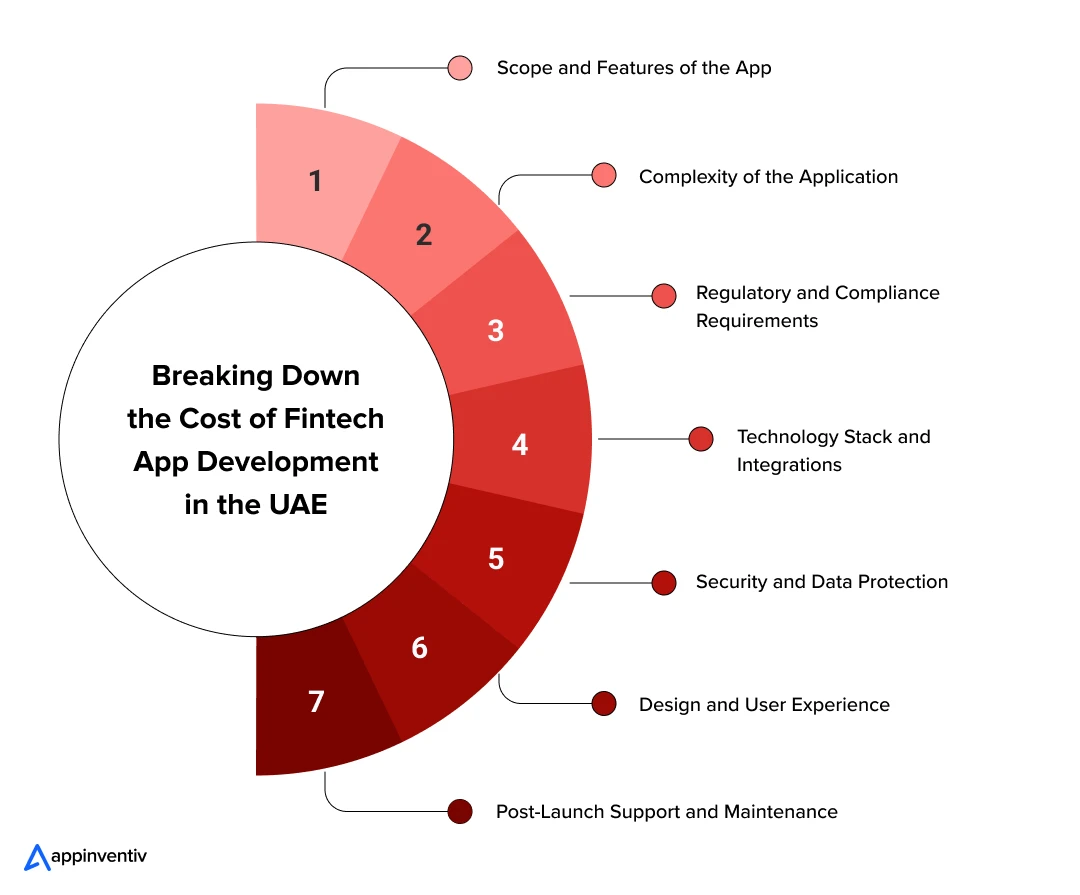

Factors Affecting the Cost of FinTech App Development in the UAE

Building a FinTech app in the UAE isn’t something you can jump into without a solid plan. There are multiple factors that will directly impact your budget. Everything from meeting regulatory standards to choosing the right technology stack plays a role in determining what enterprises need to spend. Here are the key elements that affect the cost of FinTech app development in UAE.

Scope and Features of the App

What you want your app to do is probably the biggest factor in determining cost. A straightforward app that handles payment processing and fund transfers won’t break the bank compared to a full-scale enterprise platform equipped with AI analytics, digital wallets, and blockchain integration.

The more functionality you pack in, the steeper the cost to build a FinTech app in the Middle East becomes, particularly when you’re dealing with complex integrations and need the system to scale.

Complexity of the Application

How complex your application is matters just as much as what it does. Simple FinTech apps with basic features can be built fairly quickly without excessive costs, but enterprise-level solutions are a different story. If you need open banking APIs, real-time compliance monitoring, or AI-powered insights, you’re going to need more resources.

Developing custom FinTech software solutions at this level naturally requires a bigger investment in both development time and specialized expertise. The table below illustrates this:

| Complexity Level | Features Included | Estimated Cost (USD) | Estimated Cost (AED) |

|---|---|---|---|

| Basic | Core payment features, simple transfers, limited integrations | $80,000 – $120,000 | AED 293,000 – 440,000 |

| Medium | Digital wallets, multi-currency support, stronger compliance, basic AI features | $150,000 – $250,000 | AED 550,000 – 918,000 |

| High / Enterprise | AI-driven analytics, blockchain integration, open banking APIs, advanced security | $300,000+ | AED 1.1 million+ |

Regulatory and Compliance Requirements

The UAE’s regulatory framework, encompassing the Central Bank, DFSA, and ADGM, incurs significant costs for any FinTech project. Meeting Anti-Money Laundering (AML), Know Your Customer (KYC), and data protection requirements means investing in solid infrastructure and legal expertise.

Shariah-compliant features or VARA approvals can push timelines out considerably. These costs aren’t something you can skip; they’re core to building credible FinTech compliance solutions in the Middle East that users and regulators will trust.

Appinventiv’s Insights

Obtaining those VARA approvals and incorporating Shariah-compliant features will likely stretch your timelines and potentially increase your costs. But here’s the thing: these steps aren’t optional; they are essential. They literally form the backbone of any credible FinTech solutions operating here in the Middle East, and they are what earn you trust from both the users and the regulators.

Technology Stack and Integrations

The technology you build with, native, hybrid, or cross-platform, affects your budget substantially. Connecting to banks, payment gateways, and open banking platforms brings real technical hurdles.

Legacy system integrations often need custom APIs and middleware, which drives expenses up quickly. This dimension of FinTech app development Middle East determines whether your product can handle future tech shifts and stay competitive over time.

Security and Data Protection

In FinTech, security can’t be an afterthought. End-to-end encryption, fraud detection systems, biometric authentication, and round-the-clock monitoring all contribute to the cost, but there’s no way to avoid them if you want to protect user data properly. Regular penetration tests and security audits are mandatory under UAE cybersecurity laws. When it comes to enterprise FinTech app development in Middle East, these protections aren’t just checkboxes; they’re what separates trusted platforms from risky ones.

Design and User Experience

Dubai’s FinTech crowd won’t settle for clunky interfaces. They expect apps that look sharp, work in multiple languages, and feel intuitive from the first tap. Building that experience means bringing in skilled UI/UX designers, running usability tests, and fine-tuning performance until it’s right.

Yes, good design costs more, but it pays off in adoption rates. Companies that treat design as a priority tend to outperform competitors in the demanding world of VARA-compliant FinTech development.

Post-Launch Support and Maintenance

FinTech applications need 24/7 monitoring, updates, and compliance upgrades to be in line with changing regulatory requirements. Continuous expenditures are on bug fixes, the addition of features, and keeping up with changes like open banking requirements.

Businesses need to allocate budget towards long-term maintenance; failure to do so will affect the performance and security. The maintenance of healthy custom FinTech software solutions in the UAE secures long-term competitiveness.

Partner with our experts to craft enterprise-grade solutions that maximize value and minimize surprises

Key Challenges and Solutions in Enterprise FinTech App Development in Dubai

It is vital for FinTech enterprises in the Middle East to stay ahead of the curve by navigating various obstacles. Here are some of the challenges enterprises face in FinTech app development in Dubai and solutions to overcome those.

Regulatory Complexity and Compliance

Challenge: Dubai’s financial sector comes with demanding licensing processes, anti-money laundering rules, and data protection standards that can slow down FinTech launches.

Solution: For enterprise financial app development in the Middle East, bringing in local legal and compliance advisors from the beginning makes a real difference. Using regulatory sandboxes like ADGM RegLab or DIFC FinTech Hive lets you test your product under regulatory oversight, which means you can iron out compliance issues before going live.

Integration with Legacy Banking Systems

Challenge: Plenty of banks and financial institutions in Dubai still run on older systems, which creates headaches when you’re trying to connect modern FinTech services.

Solution: For payment app development Dubai, the smart move is building solid API layers and middleware that can bridge the gap between old and new systems. Running technical audits with partner banks early on helps spot potential integration problems and map out smoother processes for handling real-time payments and transactions.

Cybersecurity and Data Protection

Challenge: Protecting financial and personal data from cyber attacks is critical for any enterprise application; there’s no room for compromise here.

Solution: AI in FinTech apps Middle East helps catch threats early and block fraud before it happens. Combine this with multi-factor authentication, strong encryption, and regular penetration testing. This isn’t about ticking boxes, it’s about proving to users you take their data seriously.

Talent Shortages and Skill Gaps

Challenge: Finding developers and FinTech specialists in Dubai who understand AI, blockchain, and local regulations isn’t easy.

Solution: For Shariah-compliant FinTech apps, mix your internal team with regional partners who’ve spent real time working in Islamic finance. Train your staff on regulatory requirements, user experience basics, and the specific technologies FinTech demands. When your team has these skills, they can build products that work properly and align with cultural values.

User Expectations and Market Competition

Challenge: Users in Dubai expect apps that are smooth, quick, and tailored to them, and the competition here is fierce.

Solution: For FinTech app development in the Middle East, focus on user-centered design, utilize analytics to personalize experiences, and continually refine features based on user feedback. Collaborating with banks, payment providers, and accelerators enhances credibility and accelerates traction in this challenging market.

Initiate Your FinTech App Development Journey in the Middle East With Appinventiv

The Middle East is right at the edge of a FinTech revolution. Progressive regulations, a population that’s comfortable with technology, and substantial funding flowing into digital infrastructure are all converging at once. As the region moves toward becoming cashless, demand for fresh financial solutions has never been higher. Enterprises need partners who can handle this shifting landscape and deliver applications that are secure, scalable, and built around what users actually need.

Appinventiv, a leading mobile application development firm in Dubai, specializes in turning FinTech ideas into market-ready solutions. Their award-winning expertise, recognized by The Economic Times as a Leader in AI Product Engineering & Digital Transformation, highlights their ability to blend innovation, compliance, and design excellence.

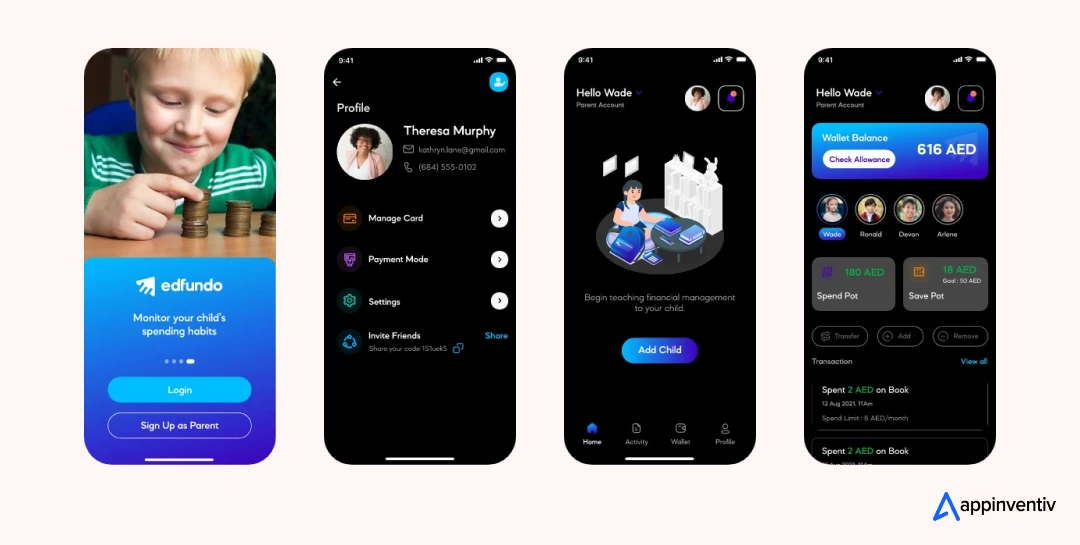

Our partnership with Edfundo demonstrates their capabilities. Edfundo is the world’s first financial intelligence hub built specifically for children. It combines a prepaid debit card with an interactive learning platform. The idea is to teach financial literacy early, giving kids, parents, and educators the tools they need to handle money in today’s digital world.

Appinventiv handled everything for Edfundo: the initial concept, design work, development, and launch. What they built was smooth, engaging, and genuinely educational. Users responded well, and so did investors. Edfundo pulled in $500,000 in pre-seed funding and is now lining up a $3 million seed round, largely because of the solid platform Appinventiv created.

Appinventiv prioritizes user experience, regulatory compliance, and the ability to scale. Every FinTech app they build is innovative but also fits within regional regulations and market realities. Their capabilities cover AI, blockchain, cybersecurity, and compliance, making them a strong choice for enterprises wanting to succeed in the Middle Eastern FinTech space.

Start your FinTech app development journey in the Middle East with Appinventiv. Use their award-winning expertise to turn your concepts into solutions that actually compete and lead in the market.

Check Appinventiv’s UAE Google Business profile for verified operational details

FAQs

Q. How much does enterprise FinTech app development cost in Dubai or Abu Dhabi?

A. Enterprise FinTech app development cost in Dubai or Abu Dhabi will depend on the scope, features, and compliance requirements. The entry-level applications with simple payment options may cost between 80,000 and 120,000 (average AED 293,000 – AED 440,000). When an AI, blockchain, or open banking-related feature is required in an enterprise-scale application, prices may be over 300,000 (approximately AED 1.1 million). There are also regulatory approvals, third-party integrations, and actual maintenance, which contribute to the investment.

Hire FinTech app developers in the UAE, like Appinventiv, to get a detailed cost estimation.

Q. What are the compliance requirements for building a FinTech app in the UAE?

A. FinTech app development in the Middle East must be in accordance with the guidelines of the UAE Central Bank, Dubai Financial Services Authority (DFSA), and Abu Dhabi Global Market (ADGM).

There are also significant requirements that are Anti-Money Laundering (AML), Counter-Terrorism Financing (CFT), and Know Your Customer (KYC). There are also significant laws regarding cybersecurity and protection of data, and other concerns should be addressed when it concerns Shariah-compliant FinTech products.

Q. How does Appinventiv handle data security and compliance in FinTech apps?

A. Appinventiv incorporates compliance-by-design in its FinTech products. These include AES-256 encryption, multi-factor authentication, compliance with GDPR, data protection in the UAE, and continuous monitoring. Enterprise FinTech applications are safe and compliant with the financial laws of the UAE, which is ensured by regular security scans, pen testing, and adherence to the financial laws of the state.

Q. Can AI and blockchain be integrated into FinTech apps for UAE enterprises?

A. Yes. AI can be used to detect fraud, for predictive analytics, and to personalize user experiences, whereas blockchain enables secure smart contracts, transparent transactions, and tokenized assets. These technologies also support regional agendas such as open banking, faster settlements, as well as increased financial transparency for UAE-based businesses.

Q. How do enterprises choose between regional FinTech developers vs. global partners like Appinventiv?

A. Regional FinTech developers are equipped with great local regulatory experience and cultural fit, whereas partners worldwide, such as Appinventiv, can provide scalability, established venturing experience, and emerging technologies.

Businesses tend to use both methods, with global partners offering sophisticated functionality and regional ones ensuring compliance with legal regulations, and localization and bilingual UI/UX design of FinTech.

Q. How can FinTech apps be future-proofed for upcoming UAE regulations and open banking frameworks?

A. Modular architecture, API-first development, and constant monitoring of the regulatory changes by the UAE Central Bank, DFSA, and ADGM are necessary to future-proof them. An open-based construction will ensure the rapid integration of new services in the apps, and the agile approach to maintenance will enable them to handle the changing financial landscape in the UAE.

Q. What are the most popular FinTech app use cases for enterprises in the Middle East?

A. Key use cases for FinTech app use cases for enterprises in the Middle East include:

- Digital payments and mobile wallets for seamless transactions.

- Buy Now Pay Later (BNPL) solutions for e-commerce platforms.

- Neobanking and digital account management.

- Remittance and cross-border payment services.

- Financial management and analytics tools for enterprise decision-making.

Q. What FinTech monetization models are commonly used in the UAE?

A. Common FinTech monetization models in the UAE include:

- Subscription-based services for premium financial tools.

- Transaction fees or commissions on payments and lending.

- Value-added services such as analytics, advisory, or loyalty programs.

- Partnerships with banks or FinTech platforms for revenue sharing.

- Freemium models offer basic services free and charge for advanced features.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…