- How Is Data Analytics Used in Banking?

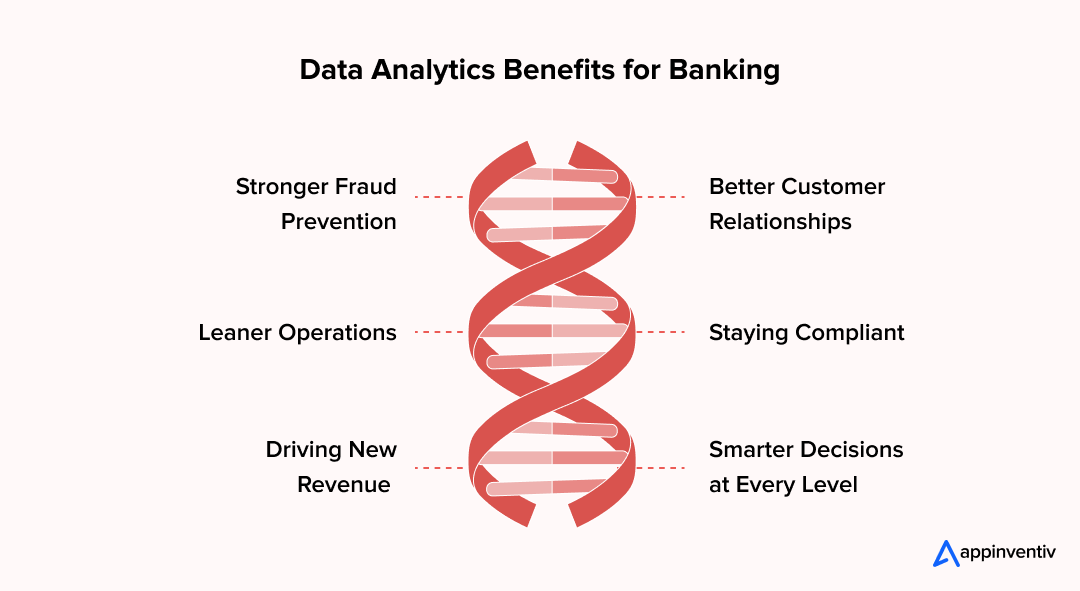

- Game-Changing Benefits of Data Analytics for Banking

- 1. Stronger Fraud Prevention

- 2. Better Customer Relationships

- 3. Leaner Operations

- 4. Staying Compliant

- 5. Driving New Revenue

- 6. Smarter Decisions at Every Level

- Cross-Team Execution: How Analytics Powers Everyday Banking Tasks

- How Banks Use Different Types of Data Analytics

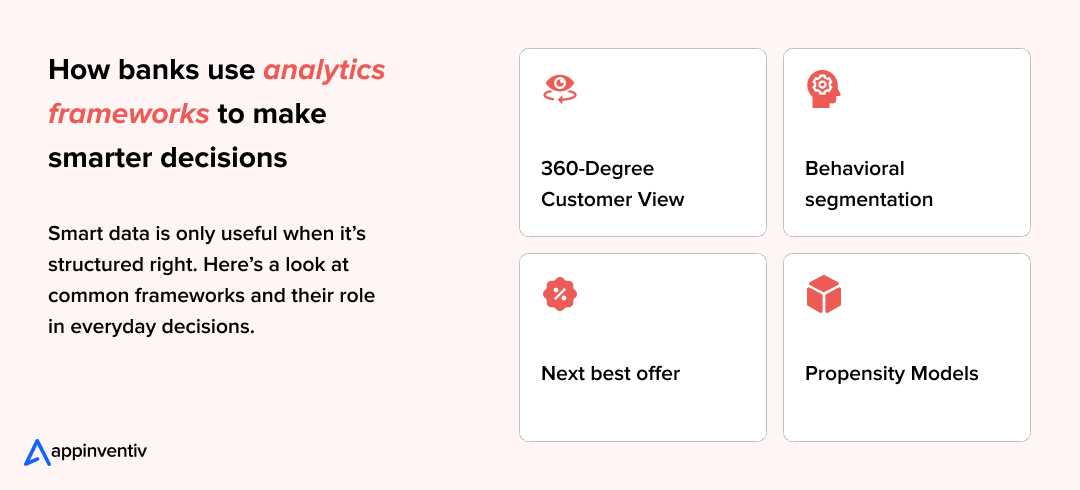

- How Banks Use Analytics Frameworks to Make Smarter Decisions

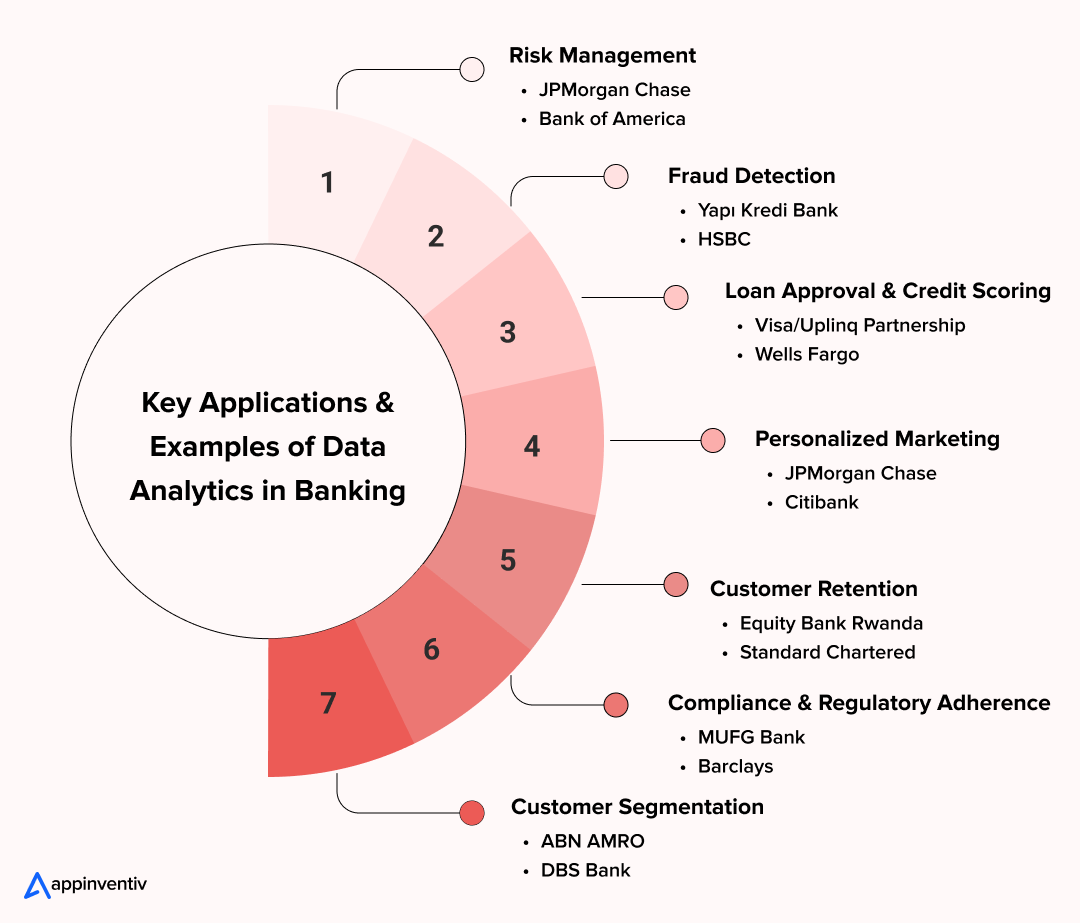

- Real World Examples & Applications of Big Data Analytics in Banking

- Risk Management

- Fraud Detection

- Loan Approval & Credit Scoring

- Personalized Marketing

- Customer Retention

- Compliance and Regulatory Adherence

- Customer Segmentation

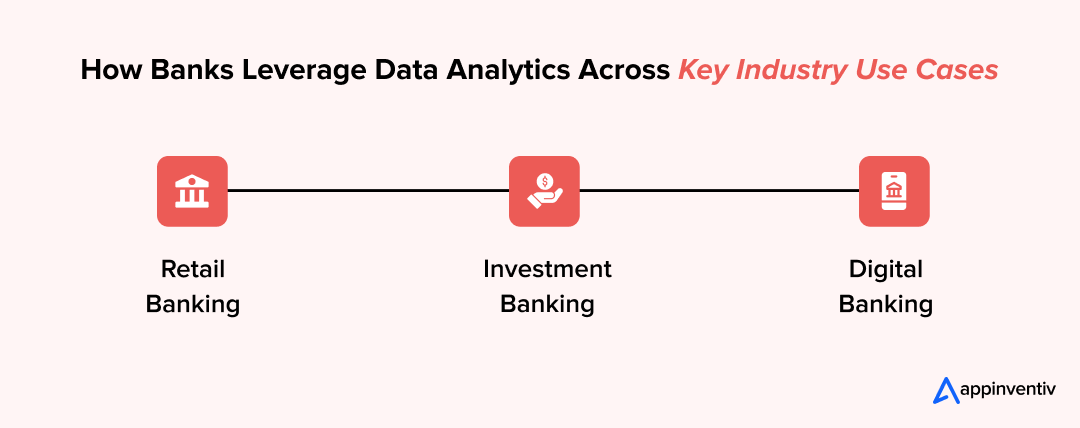

- Industry-Specific Use Cases of Data Analytics in the Banking Industry

- Data Analytics in Retail Banking

- Data Analytics in Investment Banking

- Data Analytics in Digital Banking

- How Appinventiv Helped a Leading Global Bank with a Custom AI-Powered Data Analytics Solution

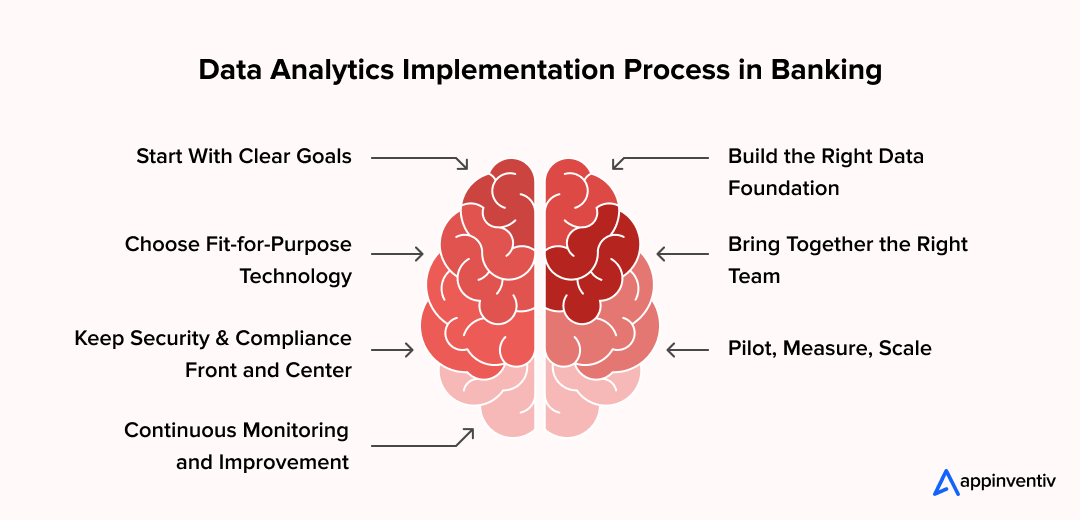

- How to Implement Data Analytics in Banking

- 1. Start With Clear Goals

- 2. Build the Right Data Foundation

- 3. Choose Fit-for-Purpose Technology

- 4. Bring Together the Right Team

- 5. Keep Security and Compliance Front and Center

- 6. Pilot, Measure, Scale

- 7. Continuous Monitoring and Improvement

- Major Challenges of Data Analytics in the Banking Industry & How to Overcome Them

- How Appinventiv Helps Banks Harness Analytics to Innovate, Scale, and Thrive

- FAQs

Key takeaways:

- Real-time data analytics in banking can drastically reduce fraud losses, improve risk detection, and improve customer outcomes.

- Banking analytics is being adopted not just for fraud/risk, but across credit, operations, customer experience, and personalization.

- Implementation requires strong data infrastructure, governance, security, and often cultural shifts.

- Mid-size banks face particular challenges around cost, talent, and compliance.

Every day, over 402.74 million terabytes of data are created across the globe. For banks, this explosion of information is both a challenge and an opportunity. With the right tools, this data can be a powerful asset, helping banks prevent fraud, streamline operations, and drive growth. This is where data analytics come in.

In 2024, the U.S. Department of the Treasury reported saving over $4 billion in fraud and improper payments, thanks to machine learning-based fraud detection systems. That’s a huge jump from just $652.7 million the year before. This highlights how essential data analytics has become in the fight against financial crime.

From spotting suspicious activity in real-time to offering more personalized services, data analytics is helping banks improve security and create better experiences for customers. The use of data analytics in banking is transforming how this data is interpreted and applied. Banks are using this data to make decisions that matter for crucial activities like fraud checks, loan approvals, or marketing campaigns.

But how exactly are banks applying these capabilities? And what does integrating data analytics in the banking sector look like in day-to-day operations? In this blog, we’ll answer all these questions and also share common challenges and implementation strategies.

Switch to real-time analytics and cut fraud losses by up to 90% while boosting customer trust.

How Is Data Analytics Used in Banking?

First, let’s take a strategic look at what data analytics is in practice. How is data analytics in banking really used?

Modern banks apply structured analytics to turn everyday data, from account usage to external signals, into actionable insights across teams.

This includes internal data like account activity, support logs, or payment behaviour. It also brings in external signals such as location patterns, credit history, and even social media feedback. What matters is how everything connects to build a 360-degree view of the customer and the business.

Here’s what that shift looks like:

| Old Setup | Modern Banking Analytics |

|---|---|

| Siloed reporting by department | Unified insights across teams |

| Data pulled monthly or weekly | Real-time, always-on analytics |

| Limited to internal data | Blended with third-party and behavioral data |

| Used mainly for reporting | Embedded into decisions across the business |

This shift is part of a larger trend: one where digital transformation in banking is reshaping how data, decisions, and customer expectations align.

Now that we know the core functions of data analytics in banking, let’s explore its multifarious benefits for businesses:

Game-Changing Benefits of Data Analytics for Banking

The shift from traditional banking to data-driven models is not just a technology upgrade. It is reshaping how banks prevent fraud, serve customers, and stay profitable. Below are some of the most impactful benefits:

1. Stronger Fraud Prevention

Banks lose billions each year to fraudulent activity. With real-time analytics, suspicious transactions can be flagged instantly, helping institutions stop losses before they spiral. Some financial institutions, like Visa’s new AI fraud detection mechanism, have cut phishing losses by 90%.

2. Better Customer Relationships

A customer who feels understood is far more likely to stay loyal. Data makes that possible. By looking at spending patterns and behavioral cues, banks can offer personalized credit products, savings suggestions, and investment advice.

3. Leaner Operations

Back-office processes like compliance checks, loan approvals, and customer support have long been cost heavy. With analytics and automation, many of these tasks are completed faster and at a fraction of the expense.

4. Staying Compliant

Regulators are demanding stricter transparency and audit trails. Data systems can automatically log activity, generate reports, and highlight potential compliance issues before they become fines. For global banks, this reduces the enormous risk of non-compliance penalties.

5. Driving New Revenue

Analytics doesn’t just cut costs; it also uncovers fresh opportunities. For instance, examining transaction data can reveal when a customer might need insurance, a home loan, or an investment product. That means smarter cross-selling and more consistent revenue growth.

6. Smarter Decisions at Every Level

From deciding where to open a new branch to forecasting loan demand, data replaces guesswork with evidence. Leaders can move faster, respond to changing markets, and make choices that hold up under scrutiny.

Cross-Team Execution: How Analytics Powers Everyday Banking Tasks

Analytics is built into how teams work. Risk teams cut delinquencies, product heads improve ROI, and marketing teams run sharper campaigns. The impact is real, measurable, and baked into everyday execution.

Here’s how different banking roles are using data to drive results:

| Role | What They Use | What It Solves |

|---|---|---|

| Risk Manager | Scoring models, early-warning dashboards | Catches risk signals early, like sudden spending changes or regional default spikes, before they become losses. |

| Product Head | Usage trends, lifetime value metrics | Reveals which products bring returns, which users drive growth, and where to double down. |

| Compliance Lead | KYC alerts, AML monitoring, audit automation | Keeps checks running in real time and logs every step so nothing falls through the cracks. |

| Marketing Team | Segmentation data, churn triggers, response insights | Helps focus spend on the right users with offers they’re more likely to act on. |

| CTO/CIO | Tech performance dashboards, integration tracking | Highlights system bottlenecks, gaps in analytics coverage, and where to streamline infrastructure. |

How Banks Use Different Types of Data Analytics

There’s no single way banks use data. It depends on the strategic objectives being pursued. That’s why data-led banking usually falls into a few clear types, each with a specific role in how decisions get made across departments.

| Type | What It Does | How Banks Use It |

|---|---|---|

| Descriptive Analytics | Looks at what already happened | Tracks transaction trends, branch performance, or churn over time; common in data analytics in retail banking and data analytics use cases in banking. |

| Diagnostic Analytics | Explains why something happened | Used across the data-led banking sector to understand service drop-offs or product issues. |

| Predictive Analytics | Identifies what’s likely to happen next | Powers big data analytics in banking to flag fraud, predict loan defaults, or assess credit risk. |

| Prescriptive Analytics | Recommends what action to take based on patterns | Applied in data analytics for banking to support decisions in pricing, loan approvals, and campaign planning. |

These types of banking data analytics aren’t used in isolation. Most banks combine them based on the situation. That’s where the real benefits of data analytics in banking become evident, especially in dynamic areas like digital or investment banking.

So how are banks using this in real scenarios?

That’s what we’ll cover in the next section. But before that, it’s important to understand how banks leverage analytics frameworks to transform raw data into actionable insights.

How Banks Use Analytics Frameworks to Make Smarter Decisions

Raw data holds little value without the structure to operationalize it. That’s why banks turn to proven analytics frameworks that bring order to large datasets and give teams a clear direction across credit, risk, marketing, and beyond.

These structured systems help banks move faster with precision across risk, marketing, and product decisions.

| Framework | What It Helps With | Examples of Banking Analytics |

|---|---|---|

| 360-Degree Customer View | Personalization & cross-sell | Uses banking CRM, app usage, and transaction history to recommend the right product. |

| Next Best Offer (NBO) | Campaign targeting | Identifies the most relevant offer based on spending patterns and engagement. |

| Behavioral Segmentation | Customer retention | Clusters users by habits to predict churn or upsell opportunities. |

| Propensity Models | Risk scoring & upsell | Predicts the chance of product adoption, repayment, or default. |

Real World Examples & Applications of Big Data Analytics in Banking

The use of data analytics in banking is most visible in day-to-day tasks. A sudden spike in loan defaults. Unusual login activity. A drop in card usage. Analytics helps teams catch these changes early. Here’s how data analytics plays out across banking functions:

Risk Management

Let’s say a customer’s payment pattern changes. Or loan defaults rise in a region. Risk teams catch these signals through banking analytics. They use transaction data, loan history, and even market trends to manage exposure. This is common in both retail and investment banking, where timing and accuracy matter.

Real Example 1 – JPMorgan Chase: JPMorgan Chase uses a platform called Athena to manage risk across its trading and investment operations. The system runs about 5 billion calculations a day and completes 10,000 batch jobs daily. It helps teams track market positions, measure exposure, and act quickly when needed. Athena combines pricing, trade management, and analytics in one system to support real-time decision-making.

The bank also uses machine learning within Athena to improve how it predicts and handles risk. These models study past data and market trends to flag potential issues early. This allows JPMorgan to adjust faster and limit risk more effectively.

Real Example 2 – Bank of America: Bank of America uses predictive analytics to check loan default risk. By studying customer transaction data and spending habits, the system spots early warning signs of financial trouble, letting the bank take action early and offer help to at-risk customers.

Fraud Detection

If someone logs in from a new device and transfers money out of pattern, it gets flagged. That’s big data analytics at work. One global bank used AI-driven models to improve fraud detection. The result? ATM service levels went up by 92%. That’s how fast systems can react when they’re set up right.

Real Example 1 – Yapı Kredi Bank: Yapı Kredi uses AI to scan over 40 million transactions every day. Its fraud detection system flags around 500 suspicious activities in real time, with a response speed of just 4 milliseconds. The bank built over 1,000 detection rules and trained custom machine learning models to catch fraud early, even across new channels like crypto and open banking.

In seven years, Yapı Kredi reduced fraud losses by 98.7% and cut false positives from 200:1 to 10:1. It now holds one of Turkey’s lowest card fraud ratios, 50% lower than the industry average. In 2025, Yapı Kredi won the FICO® Decision Award for its results.

Real Example 2 – HSBC: HSBC runs an AI-driven fraud detection system that studies both transactional and behavioral data. It spots anomalies in real-time, like unusual spending patterns or transactions from unfamiliar locations. This system helped HSBC reduce fraud and improve customer experience by cutting false positives.

Loan Approval & Credit Scoring

Approvals no longer rely on credit scores. With data-led banking and financial services, banks look at income flow, spending habits, and employment status. These models help teams decide faster and with fewer delays.

Real Example 1 – Visa/Uplinq Partnership: Visa worked with Uplinq to help banks approve more small business loans using AI. The system looked beyond credit scores. It analyzed income trends, local market data, and customer behavior. This gave lenders a fuller view of each applicant and helped them make faster decisions.

Banks cut underwriting costs by 50% and reduced credit losses 15 times. Profitability in small business lending tripled. With Uplinq’s system, banks approved more loans without adding risk.

Real Example 2 – Wells Fargo: Wells Fargo uses alternative credit scoring models that assess potential borrowers based on their financial behavior rather than just traditional credit scores. This includes looking at spending patterns, payment histories, and cash flow. By doing this, Wells Fargo is able to approve loans for customers who might have been overlooked by traditional credit scoring systems.

Personalized Marketing

Ever wondered how a bank knows when to offer a loan or new card? That’s banking data analytics doing the work behind the scenes. Banks track product usage, spending habits, and channel preferences to group users by behavior. These segments help teams deliver offers that are timely relevant, and more likely to convert.

Real Example 1 – JPMorgan Chase: In 2024, JPMorgan Chase launched Chase Media Solutions. This new platform helps brands reach 80 million US customers through personalized, cashback offers. It uses Chase’s own transaction data to target users based on how they spend.

During the pilot, Chase ran 30-day campaigns for brands like Air Canada and Whataburger. These campaigns aimed to boost sales and bring in new customers. Air Canada saw strong results. Their team said the targeted offer from Chase worked better than expected. It increased both awareness and revenue. The campaign showed how smart targeting can make a real impact.

Real Example 2 – Citibank: Citibank utilizes data analytics to track customer behavior across various channels and predict when they might be interested in a new product or service. By analyzing transaction history and engagement levels, Citibank can deliver personalized offers at the right time, improving conversion rates and customer satisfaction.

Customer Retention

If a customer logs in less, stops using their card, or pulls money from accounts, that’s a sign. Data analytics for banking tracks these changes.

Real Example 1 – Equity Bank Rwanda: Equity Bank Rwanda focused on three things: service quality, pricing, and product variety. The bank trained staff to respond quickly to complaints. It followed up to make sure issues were resolved. Mobile tools like EazzyPay helped customers bank faster and more easily.

A 2021 study showed strong results. These retention strategies explained 65.3% of the change in customer loyalty. More customers stayed because the service met their needs. The bank turned better service into higher satisfaction and steady growth.

Real Example 2 – Standard Chartered: Standard Chartered uses data analytics to identify customers who may be at risk of leaving. By analyzing transaction patterns and engagement levels, the bank can offer personalized incentives, such as tailored loan options or special rates, resulting in improved customer retention rates.

Compliance and Regulatory Adherence

Regulations keep shifting, and banks have to keep up. With data analytics in the banking sector, teams automate KYC, monitor AML, and generate audit-ready reports. Analytics also strengthens cybersecurity by tracking anomalies and building fraud prevention layers.

Real Example 1 – MUFG Bank: MUFG Bank adopted Databricks to unify its AI model development and strengthen internal compliance systems. The platform helps 30,000 employees access and analyze data faster. It also supports fraud detection, AI-driven investigations, and risk monitoring across business units.

Databricks’ governance tools help MUFG meet strict compliance requirements. The platform supports secure data handling, real-time analytics, and automated tracking, which allows the bank to improve control while reducing delays in reporting and audits.

Real Example 2 – Barclays: Barclays employs big data analytics to automate its Anti-Money Laundering (AML) monitoring systems, detecting suspicious activities across billions of transactions. The system flags potential AML violations in real-time and helps Barclays comply with global regulations, reducing delays in audit and reporting processes.

Customer Segmentation

Some customers use cards daily, while others prefer net banking. Some respond to emails, and others ignore them. Banks use analytics to group users based on actual behavior; how they spend, where they log in, and what products they use. These segments help teams target the right users with the right actions.

Real Example 1 – ABN AMRO: ABN AMRO built a 360-degree view of customer behavior to improve targeting and engagement. The bank tracks how users interact with tools like mobile banking and the Tikkie app. Based on these patterns, such as login frequency, spending habits, and response to offers, customers are grouped into actionable segments. These insights help teams deliver more relevant messages and services.

In 2024, ABN AMRO launched new AI features like a chatbot for Tikkie and a voicebot for credit card support. These tools addressed common user needs and made digital support more accessible. The bank also doubled its “Help with Banking” advisors to guide customers who prefer human support. These changes improved the overall digital experience and boosted satisfaction scores.

As a result, ABN AMRO saw strong business growth. It crossed 10 million active users on Tikkie and increased fee income by over 7%. Many businesses started using Tikkie for invoicing, strengthening the bank’s position in digital payments.

Real Example 2 – DBS Bank: DBS Bank uses data analytics to understand the preferences of its customers. By grouping customers into different segments, the bank can offer tailored financial products, such as personalized savings plans or investment advice, based on each customer’s behavior and needs. This strategy has led to increased cross-selling success and customer loyalty.

If your analytics strategy is slowing you down, we can empower you to build integrated, real-time systems that deliver actionable insights—fast and at scale

Industry-Specific Use Cases of Data Analytics in the Banking Industry

The use of big data analytics in banking shifts depending on its focus on retail, investment, or digital, and each brings its own priorities and data needs. Here’s how banking analytics looks in action across these domains:

Data Analytics in Retail Banking

Retail banks deal with scale: millions of accounts, high transaction volume, and a need to stay relevant to individual customers.

- Customers say tailored experiences affect their banking loyalty.

- Data analytics in retail banking is used to segment users by behavior, detect churn early, and deliver timely product offers

- Declining logins, reduced usage, or missed payments are all tracked to prompt re-engagement

Data Analytics in Investment Banking

Timing and precision matter more than volume here. Most decisions are driven by predictive models that run on deep data.

- Data analytics in investment banking is used for trade simulations, risk scoring, and market modeling

- Banks pull from real-time feeds, internal research, and external financial indicators to run what-if scenarios

- Investment banks using generative AI could boost front-office productivity by 27–35% by 2026. (Deloitte)

Data Analytics in Digital Banking

This is where real-time decisions meet everyday user behavior

- More than 74% of banking activity now happens on mobile (Statista, 2023)

- Data analytics in digital banking tracks taps, swipes, and drop-offs to guide credit offers, trigger fraud alerts, and shape product flows

- Behavioral data feeds into dynamic pricing, smart onboarding, and customer support routing

How Appinventiv Helped a Leading Global Bank with a Custom AI-Powered Data Analytics Solution

A leading European bank partnered with Appinventiv to build a custom AI platform that could improve customer retention, automate support, and optimize ATM operations. The solution was delivered in 10 weeks and integrated into the bank’s daily systems.

Key functional outcomes:

- 20% increase in customer retention

Appinventiv built a churn prediction model that ranked home loan customers by risk and gave reasons behind the scores. This helped teams intervene early and reduce customer loss. - 92% improvement in ATM uptime

Using 10 million+ data points, the platform forecasted cash needs for each ATM, helping the bank restock machines efficiently and avoid downtime. - 20% drop in customer support costs

A multilingual chatbot was deployed to handle over half of routine service requests, freeing up staff for more complex issues. - Faster service recovery

AI models monitored performance in real time and flagged system issues before they affected customers.

This project shows how banks can apply FinTech data analytics to improve operations at scale.

How to Implement Data Analytics in Banking

Rolling out analytics in a bank isn’t a one-day job. It’s a mix of strategy, tech, and culture change. Here’s how most successful banks make it work:

1. Start With Clear Goals

Don’t buy tools just because competitors are. Ask: Are we trying to reduce fraud? Improve cross-selling? Speed up loan approvals? Setting clear outcomes keeps the project grounded.

2. Build the Right Data Foundation

Banks deal with data scattered across branches, apps, ATMs, and third-party providers. Consolidating that into a clean, secure, and accessible system is the foundation. Without this, analytics will only highlight messy inputs.

3. Choose Fit-for-Purpose Technology

For some banks, cloud-based platforms with real-time processing make sense. Others may need hybrid setups due to compliance. The key is to pick tools that match your goals, not the flashiest tech available.

4. Bring Together the Right Team

It takes more than data scientists. Successful projects include IT, compliance officers, product managers, and even branch staff who understand customer behavior. Collaboration prevents “black-box” solutions that don’t work in the real world.

5. Keep Security and Compliance Front and Center

Every step, from data collection to model deployment, must follow data protection laws and internal governance. Encryption, anonymization, and audit trails aren’t optional; they’re the cost of doing business.

6. Pilot, Measure, Scale

Banks that succeed don’t try to change everything at once. They launch a small pilot (say, real-time fraud detection in credit cards), measure results, refine the model, and then expand across products and regions.

7. Continuous Monitoring and Improvement

Analytics isn’t a “set it and forget it” exercise. Models need retraining, dashboards need updating, and regulations shift. A long-term commitment to iteration ensures the system stays accurate and valuable.

Major Challenges of Data Analytics in the Banking Industry & How to Overcome Them

Even the most data-focused banks run into roadblocks. Some are technical. Others are structural. Here’s what teams often deal with and what’s working to move past it.

| Challenges of Data Analytics in Banking Industry | What’s Really Happening | What’s Working |

|---|---|---|

| Legacy systems | Core platforms are too old to support modern analytics | Add cloud-native layers that pull data without disrupting the core |

| Data silos | Teams store info in different systems, making it hard to connect the dots | Use APIs or build centralized data hubs so insights are shared, not scattered |

| Regulatory complexity | Teams are unsure what’s allowed, especially with privacy laws and cross-border data | Set up compliance-first models with clear tracking, consent, and anonymization |

| Talent gaps | Banks don’t always have enough internal analytics skills to scale what they’ve started | Upskill internal teams and partner with banking analytics companies that |

| Vendor lock-in | Hidden vendor lock-ins and legacy tech often inflate the cost of data analytics in banking. Explore banking app development costs to plan budgets better. | Use open frameworks and build models that can move across platforms if needed |

| Cybersecurity risks | The more data flows through analytics engines, the bigger the target for hackers | Layer in strong encryption, role-based access, continuous monitoring, and regular penetration tests |

| Cost of implementation for mid-size banks | Infrastructure, tools, and talent can run into millions, making it harder for smaller institutions to compete | Start with focused pilots that prove ROI, explore cloud pay-as-you-go models, and seek strategic partnerships to share costs |

These are the most common challenges of data analytics in the banking industry but none are deal-breakers. With the right approach, they’re solvable. For banks without internal analytics teams, outsourcing is a strong option. See how fintech firms are outsourcing analytics effectively.

See how Appinventiv can help your bank overcome analytics friction at scale

How Appinventiv Helps Banks Harness Analytics to Innovate, Scale, and Thrive

Banks are done waiting on scattered reports and siloed insights. They want systems that give answers when decisions are being made. Appinventiv helps banking teams connect the dots across legacy infrastructure, product systems, and customer data.

500+ legacy systems modernized

Banks often start with older tech that can’t scale. We help upgrade these systems to cloud-first models that support real-time analytics without slowing teams down.

3000+ solutions delivered across industries

We’ve delivered solutions that address core operational challenges. Our data analytics services are created to fit real banking use cases.

1600+ data and tech experts

Our cross-functional teams bring analytics, engineering, and product together, so banks don’t have to manage 10 vendors to get one system working.

35+ industries mastered

We work across banking, finance, and investment workflows. Our banking software development services are built to meet compliance, speed, and integration needs.

At Appinventiv, we combine our 10+ years of industry expertise with advanced technologies to help banks innovate, scale, and stay ahead of the competition. With our tailored data-driven solutions, banks can unlock new growth opportunities, enhance customer experiences, and drive operational efficiency.

So, why wait? Partner with us now and redefine the future of banking together.

FAQs

Q. What tools support big data analytics in the banking industry?

A. Banks use tools like Tableau, Power BI, and cloud-based platforms to process and visualize data. These tools help teams track patterns and make faster, smarter decisions. Many banks also build custom analytics platforms tailored to their systems, workflows, and compliance requirements.

Q. What are the key benefits of data analytics in banking?

A. Here are some of the major benefits of data analytics in the banking sector:

- Faster credit decisions using live income and spending insights

- Early fraud detection by spotting unusual activity in real time

- Higher product engagement through personalized offers

- Stronger compliance with automated KYC/AML tracking

- Better retention by identifying at-risk customers sooner

Q. What is the difference between traditional banking vs. data-driven banking?

A. Here are the key differences between traditional banking and data driven banking:

Traditional Banking: Traditional banking relies heavily on manual processes, limited data, and human judgment for decisions. Customer service and loan approvals are slower, with less personalization.

Data-Driven Banking: Modern banking uses AI, advanced analytics, and real-time data to improve decision-making. It offers personalized services, faster loan approvals, better risk management, and a more proactive approach to customer interactions.

Q. Is data analytics in banking safe and compliant?

A. Yes, data analytics in banking can be safe and compliant if implemented properly. Banks must adhere to data protection regulations (e.g., GDPR, CCPA) and implement security measures like encryption, anonymization, and secure access controls.

Additionally, strong data governance practices ensure that analytics are conducted responsibly and transparently.

Q. How much does it cost to implement data analytics in a bank?

A. The cost of implementing data analytics in a bank can vary greatly depending on several factors:

- Size of the Bank: Larger banks with multiple branches and complex operations will require more extensive infrastructure and resources, thus increasing costs.

- Technology Stack: The choice of tools, such as whether the bank opts for cloud solutions, AI technologies, or custom-built systems, will impact the cost.

- Integration Needs: The complexity of integrating data analytics with existing banking systems (e.g., CRM, core banking systems, etc.) also affects costs.

- Staffing and Expertise: Hiring or training data scientists, analysts, and IT staff will contribute to operational costs.

On average, the cost to implement data analytics in banking ranges between $40,000 to $400,000 or more.

Q. What role does AI play in banking analytics?

A. AI plays a critical role in banking analytics by enabling banks to process large volumes of data quickly, make smarter decisions, and enhance customer experiences. Some of the key roles AI plays include:

- Fraud Detection

- Customer Personalization

- Risk Management

- Automation

- Operational Efficiency

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How to Hire Data Engineers for Your Enterprise? All You Need to Know

Key takeaways: Hiring data engineers individually slows execution and increases delivery risk at enterprise scale. Partnerships give faster access to senior talent without long recruitment cycles or retention issues. Cost depends more on capability and responsibility than salary alone. The right hiring model directly affects business speed, stability, and ROI. Partnering with experienced teams converts…

How Data Analytics is Shaping the Future of UK Businesses Across Sectors

Key Takeaways Data has moved from support to strategy. UK companies no longer treat analytics as an add-on; it’s shaping how they forecast demand, design products, and compete for customers. Every sector is finding its own rhythm. From retail and healthcare to energy and education, organizations are using data differently, but the goal is the…

Is Your Business Model Compliant with the EU Data Act? A Checklist for C-Suite Executives

Data has quietly become the backbone of modern business. Whether it’s a retailer predicting what you’ll buy next week or a car maker tracking vehicle performance in real time, every decision today leans on streams of information. But with that power comes a tough question: who really owns the data, and who gets to use…