- Why Choosing the Right FinTech Software Development Partner Matters

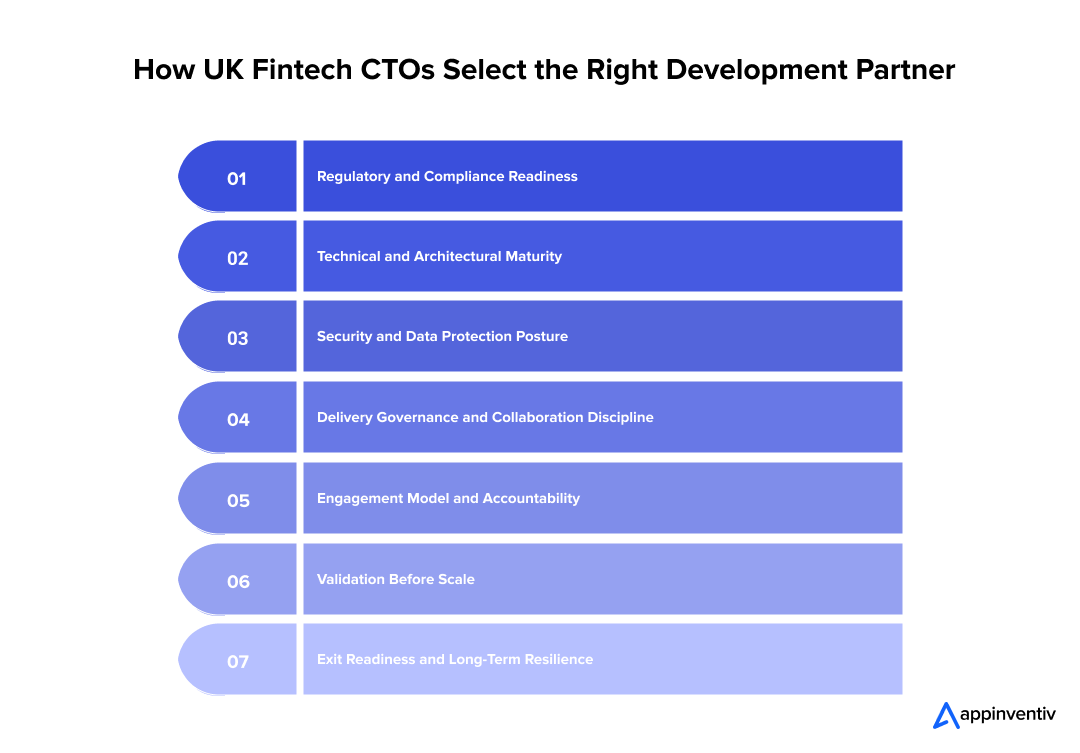

- How UK Fintech CTOs Evaluate and Select the Right Development Partner

- 1. Regulatory and Compliance Readiness

- 2. Technical and Architectural Maturity

- 3. Security and Data Protection Posture

- 4. Delivery Governance and Collaboration Discipline

- 5. Engagement Model and Accountability

- 6. Validation Before Scale

- 7. Exit Readiness and Long-Term Resilience

- How CTOs Should Use This Checklist

- What CTOs Must Clarify Before Shortlisting a Fintech Development Partner

- Technical Depth and Delivery Maturity: How to Evaluate a Fintech Partner Beyond the Stack

- What Engagement Model Works Best for Regulated Tech?

- Questions Every CTO Should Ask Before Selection

- Regulatory and Compliance Readiness

- Security and Risk Management

- Technical and Delivery Accountability

- Dependency and Subcontracting Transparency

- Exit Readiness and Continuity

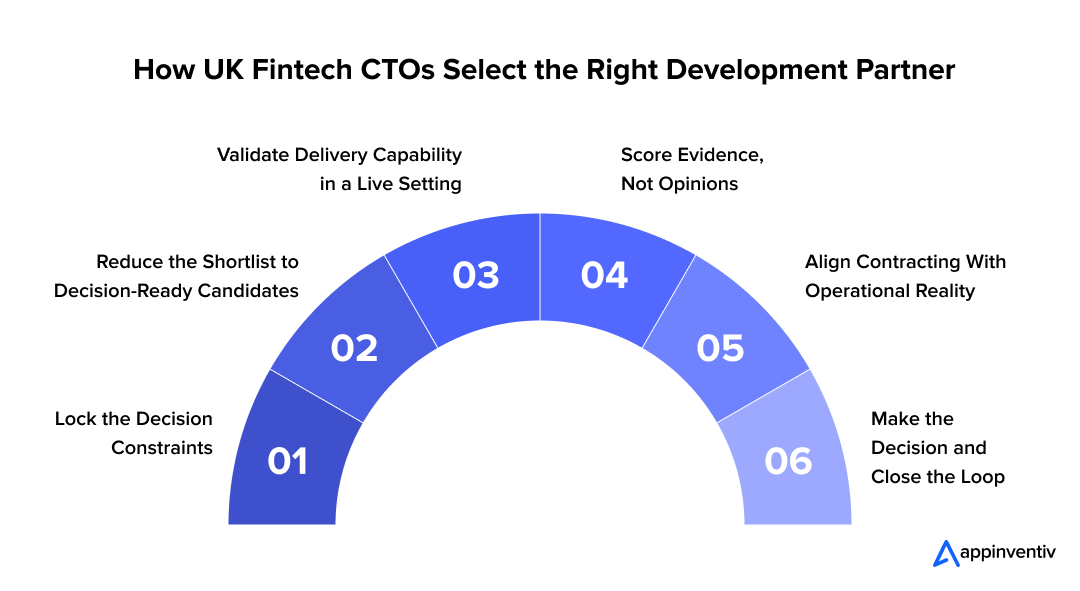

- A Practical, CTO-Led Framework for Selecting the Right Fintech Partner

- Step 1: Lock the Decision Constraints

- Step 2: Reduce the Shortlist to Decision-Ready Candidates

- Step 3: Validate Delivery Capability in a Live Setting

- Step 4: Score Evidence, Not Opinions

- Step 5: Align Contracting With Operational Reality

- Step 6: Make the Decision and Close the Loop

- What to Avoid When Choosing a Fintech Partner

- How Appinventiv Supports Fintech Teams Building in the UK

- FAQs

- Choosing a fintech development partner in the UK is a long-term risk decision, not just a delivery choice.

- Strong fintech partners are defined by regulatory readiness, delivery discipline, and exit clarity, not demos.

- Technical depth and maturity in collaboration matter most under audit pressure and system stress.

- Validation through limited engagement reveals more than sales conversations or case studies.

- A structured, CTO-led framework helps reduce compliance, security, and vendor lock-in risks early.

For most UK fintech CTOs, picking a development partner is no longer just a delivery decision. It is a bet on whether your platform will hold up when regulators ask hard questions, when volumes spike, or when something goes wrong at the worst possible time. The pressure is not only to build fast, but to build fintech software solutions in the UK that can stand up to scrutiny months or even years later.

This is why discussions around how to choose a fintech development partner in the UK have become far more cautious. A strong pitch or an impressive demo says very little about how a team handles audits, security reviews, or operational resilience checks. CTOs are increasingly expected to justify partner choices with evidence rather than instinct, especially as accountability for third-party risk continues to rise.

In that environment, relying on gut feel is risky. What helps is a practical fintech vendor evaluation checklist UK that goes beyond surface signals like portfolios or certifications. The goal is to understand how a partner actually performs when constraints tighten and trade-offs become unavoidable.

This guide is built as a fintech partner selection checklist for CTOs, shaped around real evaluation moments, real trade-offs, and decisions that need to make sense not just today, but under regulatory and operational pressure tomorrow.

A quick, structured review can surface hidden risks in architecture, delivery governance, and compliance readiness before they turn into costly rework.

Why Choosing the Right FinTech Software Development Partner Matters

In UK fintech, the impact of a development partner is felt long after the first release goes live. What looks like a delivery decision on paper often turns into a structural dependency that affects compliance posture, security confidence, and the ability to respond when regulators or customers start asking difficult questions.

For CTOs, this is where the real weight of a CTO’s guide to selecting a fintech development partner lies. A capable partner does more than write code. They influence how risks are managed, how incidents are handled, and how easily the platform can evolve without breaking regulatory alignment.

Where the wrong choice creates friction:

- Regulatory reviews take longer because documentation is incomplete or inconsistent

- Security gaps surface late, often during audits or penetration testing

- Engineering teams become dependent on specific individuals instead of clear processes

- Exiting or replacing the partner becomes complex, expensive, and disruptive

This is why many leaders now approach partner selection as a form of fintech development partner evaluation in the UK, rather than a procurement exercise. The goal is not to find the fastest team, but a partner who understands regulated delivery and can work within it without slowing the business down.

Seen this way, choosing a fintech product development partner in the UK is about long-term stability. It is about ensuring that, as the product scales and compliance expectations increase, the technology foundation and the people behind it can keep pace without creating hidden risk.

How UK Fintech CTOs Evaluate and Select the Right Development Partner

For most CTOs, partner selection becomes risky not because teams skip steps, but because they evaluate vendors in isolation. Technology is reviewed separately from compliance. Delivery speed is measured without considering exit readiness. Collaboration is assumed rather than tested.

This checklist is designed to work as a CTO fintech decision framework, not a marketing filter. It reflects how experienced leaders approach how to choose a fintech development partner in the UK when regulatory exposure, data risk, and long-term scalability are part of the equation.

Think of it as a working fintech partner selection checklist for CTOs, not a one-time document.

1. Regulatory and Compliance Readiness

In the UK, fintech delivery is inseparable from regulation. A partner who treats compliance as a downstream activity introduces risk before the first sprint ends.

What CTOs should validate:

- Demonstrated experience working with FCA-regulated entities

- Familiarity with UK outsourcing expectations and third-party risk controls

- Clear understanding of audit support, documentation, and evidence handling

- Ability to operate within your existing compliance and risk framework

This is where fintech compliance evaluation and fintech regulatory risk assessment in the UK matter more than certifications. The real question is whether the partner has survived audits, not just prepared for them.

2. Technical and Architectural Maturity

Strong fintech teams explain trade-offs clearly. Weak ones hide behind tooling.

When conducting a fintech development partner evaluation in the UK, focus less on stacks and more on reasoning.

Key areas to assess:

- Architecture designed for resilience, not just scalability

- Approach to fintech architecture assessment under regulatory constraints

- Experience with platform evolution and fintech platform modernization

- Ability to balance innovation with stability in production systems

This is where fintech engineering best practices show up in decisions, not slide decks.

3. Security and Data Protection Posture

Security conversations should feel routine, not rehearsed. CTOs evaluating data security considerations for fintech should look for:

- Security-by-design practices embedded in delivery

- Clear access control and data ownership boundaries

- Incident response maturity, not just prevention claims

- Comfort discussing past security challenges and lessons learned

A trusted partner treats security as operational hygiene rather than a selling point.

Also Read: Cybersecurity in FinTech: Building Secure Financial Apps

4. Delivery Governance and Collaboration Discipline

Many fintech partnerships fail quietly due to weak execution habits, not bad intent. When how CTOs evaluate fintech vendors, collaboration practices matter as much as code quality.

Evaluate:

- Product ownership clarity on both sides

- Decision-making authority during delivery pressure

- Documentation discipline and knowledge continuity

- Ability to adapt to regulatory or scope changes without chaos

This is where a vendor becomes a fintech digital execution partner, not just an external team.

5. Engagement Model and Accountability

Not every engagement model suits regulated tech. As part of the fintech outsourcing partner in the UK considerations, CTOs should assess:

- Whether the engagement model supports auditability and control

- How accountability is maintained across distributed teams

- Governance overhead required to keep risk in check

- Fit for long-term evolution, not just initial delivery

The “best” model is the one that holds up under scrutiny, not the cheapest or fastest.

6. Validation Before Scale

Trust is built through evidence, not promises. Before committing fully, CTOs should insist on validation that reflects real delivery conditions.

Validation should test:

- Discovery quality and assumption clarity

- Architectural alignment with compliance needs

- Security thinking in practice, not theory

- Delivery hygiene and communication discipline

This step separates fintech implementation partners in the UK from short-term contractors.

7. Exit Readiness and Long-Term Resilience

If a partner cannot explain how clients leave, that is a risk signal. A complete fintech vendor evaluation checklist in the UK always includes:

- Data portability and handover clarity

- Knowledge transfer mechanisms

- Support during transition or exit

- Contractual safeguards for continuity

Resilience is not just about uptime. It is about optionality.

How CTOs Should Use This Checklist

This checklist is not meant to eliminate judgment. It is intended to structure it.

Used consistently, it helps CTOs:

- Compare partners on substance, not perception

- Document decisions defensibly

- Reduce long-term regulatory and operational exposure

- Choose trusted fintech technology partners UK teams can grow with

Whether evaluating a fintech technology partner for UK startups or a large-scale fintech product development partner in the UK, the goal stays the same: clarity before commitment.

What CTOs Must Clarify Before Shortlisting a Fintech Development Partner

Before evaluating vendors, CTOs need alignment on their own side of the table. Many fintech delivery problems do not start with the wrong partner. They begin with unclear goals, unstated assumptions, or responsibilities that were never fully defined. When that happens, even capable teams end up building the wrong things efficiently.

This step is not about producing heavy documentation. It is about setting clear boundaries. When how to choose a fintech development partner in the UK becomes a real decision, those boundaries protect against scope drift, compliance gaps, and mismatched expectations that only surface late in delivery.

A few fundamentals need to be clear upfront:

- Regulatory scope: Which frameworks apply today, and which are likely to apply as the product scales? This clarity anchors any meaningful fintech compliance evaluation in the UK later in the process.

- Product maturity: Are you building something new, extending an existing platform, or addressing fintech platform modernization? Each scenario demands a different partner profile and risk posture.

- Non-negotiables: Security controls, audit readiness, data handling, and reporting expectations should be fixed early, not negotiated sprint by sprint.

- Ownership lines: Define clearly what stays internal and what the partner owns. Blurred responsibility is one of the fastest ways fintech projects derail.

Once this internal alignment is in place, shortlisting becomes far more effective. The goal at this stage is not to find the most impressive vendor, but to eliminate those unlikely to hold up in a regulated UK environment.

For CTOs working through fintech outsourcing partner considerations, a strong shortlist is usually small, but defensible. Experience and structure matter more than ambition.

Signals that tend to predict long-term fit include:

- UK regulatory exposure: Has the partner worked with FCA-regulated fintechs, or are they learning alongside your project? Prior exposure shapes how teams think about evidence, documentation, and risk.

- Delivery transparency: Clarity around who actually delivers the work is critical. Hidden subcontracting or unclear team structures increase governance and security risk.

- Operational stability: Financial health, team continuity, and long-term client relationships matter more than claims of rapid growth.

- Contextual case studies: Strong partners explain the regulatory and operational context behind their work, not just the outcomes.

CTOs who invest time here find it much easier to apply a fintech vendor evaluation checklist in the UK consistently. It sharpens partner conversations and ensures that later stages of the fintech development partner evaluation UK focus on validation, not course correction.

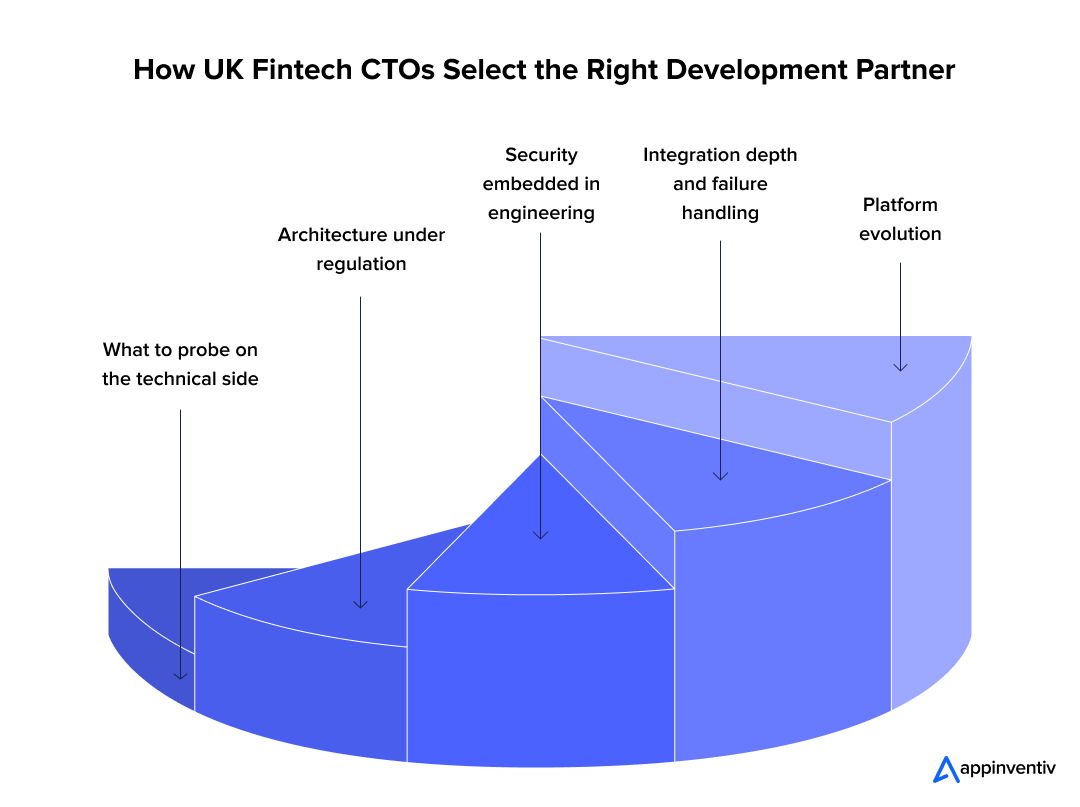

Technical Depth and Delivery Maturity: How to Evaluate a Fintech Partner Beyond the Stack

Once a shortlist is in place, technical evaluation should move past resumes, frameworks, and buzzwords. In fintech, strong engineering only matters if it holds up under regulatory pressure, production incidents, and constant change. This is why technical strength and delivery maturity need to be assessed together, not as separate dimensions.

A proper fintech architecture assessment starts with how a partner thinks, not what they build. CTOs should listen closely to how teams explain decisions, constraints, and trade-offs, especially in areas where regulation limits ideal technical choices.

- Architecture under regulation: How is the system designed for resilience, audit visibility, and data segregation? Strong teams can explain why certain architectural patterns were chosen, how failure domains are isolated, and what risks were consciously accepted or avoided.

- Security embedded in engineering: Look for evidence that security is part of everyday workflows, not a final checklist. This includes threat modeling during design, secure defaults in services, and clear ownership for remediation. These practices directly address real data security considerations for fintech CTOs.

- Integration depth and failure handling: Experience with payments, core banking systems, or Open Banking should include a clear approach to retries, reconciliation, idempotency, and handling dependency failures. A partner’s comfort discussing what happens when fintech integrations fail is often more revealing than success stories.

- Platform evolution: Teams with fintech platform modernization experience tend to think in phases. They plan for backward compatibility, data migration, and incremental rollout without disrupting regulated operations.

Technical strength alone, however, is not enough. In regulated environments, delivery pressure, audit requests, and scope changes are part of normal operations. How a partner collaborates during these moments determines whether technical quality holds up in real-world conditions.

What to assess on delivery and collaboration maturity:

- Clear ownership and decision-making: Who decides when priorities conflict between speed, compliance, and stability? Vague ownership often leads to delays or to silent acceptance of risk.

- Communication discipline: Updates are expected, but the signal lies in how issues are raised. Strong teams surface risks early, document decisions, and close loops consistently.

- Documentation as a living asset: In fintech, knowledge must survive people changes. Partners with delivery maturity document architecture, decisions, and controls continuously, not just at handover.

- Response to change: Regulatory updates and requirement shifts are inevitable. The real test is whether the team adapts methodically or reacts defensively under pressure.

For CTOs evaluating fintech implementation partner options in the UK, this combined view often reveals the most. Teams that can reason clearly about complex systems and work calmly in the face of uncertainty tend to perform better over time. That ability, more than any specific tool or framework, is what separates reliable partners from short-term delivery teams in fintech.

Assess technical depth, resilience, and compliance alignment with experienced fintech engineers.

What Engagement Model Works Best for Regulated Tech?

Once technical strength and delivery maturity are clear, the next question is how that capability is actually engaged. In regulated fintech, the engagement model is not a commercial afterthought. It directly affects governance, auditability, and accountability.

Many issues that surface later, under audits or delivery pressure, can be traced back to an engagement model chosen for convenience rather than control. This is a common blind spot in fintech outsourcing partners in the UK, especially when teams move quickly.

A few realities CTOs should factor in:

- Fixed-scope models can work when requirements are stable and well-defined. In fast-moving fintech environments, they often struggle to accommodate regulatory changes without friction or constant renegotiation.

- Managed capacity or dedicated teams tend to offer more flexibility, but only when governance is strong. Without clear controls, accountability can blur over time.

- Pure staff augmentation places most responsibility on internal teams. This can be effective for mature organisations, but it often weakens audit traceability and delivery ownership if not carefully managed.

- Hybrid models are common in practice, combining predictability with flexibility. These work best when roles, decision rights, and escalation paths are explicitly defined.

For CTOs evaluating a fintech product development partner in the UK, the right model is the one that supports regulated delivery without creating blind spots. That means clear ownership, traceable decisions, and enough structure to withstand scrutiny, even when priorities shift.

The engagement model should make it easier to manage risk, not introduce new layers of it.

Questions Every CTO Should Ask Before Selection

By the time you reach this stage, the goal is no longer discovery. It is validation. These questions are not meant to test how well a partner presents themselves, but how they think when responsibility is real and stakes are high.

Regulatory and Compliance Readiness

- How have you supported clients during FCA or internal audits, and what artefacts did you provide?

- How do you approach fintech regulatory risk assessment in the UK when requirements evolve mid-delivery?

- Where do you typically draw the line between engineering responsibility and compliance ownership?

Strong partners can explain their role without overstepping or deflecting accountability.

Also Read: Regulatory Compliance Software for the Financial Services

Security and Risk Management

- How do you identify and prioritise security risks during development, not just before release?

- What does incident response look like in the first 24 hours, and who leads it?

- How do you balance speed with security in environments handling sensitive financial data?

These conversations should feel routine. If security feels scripted, that is usually a warning sign for fintech compliance evaluation in the UK.

Also Read: AI in Risk Management: Key Use Cases

Technical and Delivery Accountability

- Who makes the final call when architectural or delivery trade-offs affect compliance or stability?

- How do you document and track key technical decisions over time?

- What signals do you use internally to detect delivery risk early?

This is where CTOs evaluate fintech vendors: less about confidence and more about discipline.

Dependency and Subcontracting Transparency

- Which parts of delivery rely on third parties, and how is that governed?

- How do you maintain oversight and quality across distributed teams?

- What happens if a critical dependency becomes unavailable?

Clear answers here are essential for any evaluation of fintech development partners in the UK process.

Exit Readiness and Continuity

- How have clients transitioned away from you in the past, and what support was provided?

- What guarantees exist around data portability, documentation, and knowledge transfer?

- How do you ensure continuity during handover or replacement?

Partners who struggle with exit questions often create long-term lock-in risk.

Taken together, these questions form a practical layer of a fintech partner selection checklist for CTOs. They help surface how a partner behaves when control, transparency, and accountability are required, not just promised. For regulated fintech teams, that distinction is often the difference between confidence and constant course correction.

A Practical, CTO-Led Framework for Selecting the Right Fintech Partner

This framework is designed for the final stretch of the decision-making process. It assumes evaluation has already taken place and acts as a CTO guide to selecting a fintech development partner when the priority is to move from shortlisted options to a clear, defensible choice without reopening earlier debates.

Step 1: Lock the Decision Constraints

Document the non-negotiables that cannot change during selection:

- Regulatory obligations that apply at launch and at scale

- Security and data handling controls that must be enforced

- Internal ownership boundaries and approval authority

This prevents late-stage trade-offs from being reframed as “flexibility.”

Step 2: Reduce the Shortlist to Decision-Ready Candidates

Remove any partner that:

- Cannot demonstrate audit support in practice

- Relies on unclear subcontracting arrangements

- Avoids exit, transition, or data portability discussions

At this stage, fewer options improve decision quality.

Step 3: Validate Delivery Capability in a Live Setting

Run a limited engagement focused on:

- Discovery quality and assumption clarity

- Architectural alignment with regulatory constraints

- Documentation discipline and communication cadence

This step replaces promise-based confidence with observable behavior.

Step 4: Score Evidence, Not Opinions

Use a structured scoring model to compare partners across:

- Regulatory readiness

- Technical execution

- Security posture

- Governance and accountability

Artefacts, not narratives, should back scores.

Step 5: Align Contracting With Operational Reality

Ensure contracts explicitly cover:

- Audit access and compliance support

- Data ownership and portability

- Transition and exit obligations

Anything left implicit becomes a future risk.

Step 6: Make the Decision and Close the Loop

Select the partner, document the rationale, and close out other candidates cleanly.

This creates a defensible decision trail for boards, regulators, and future leadership.

Also Read: Hire Fintech Software Developers: Process, Tips, and Costs

What to Avoid When Choosing a Fintech Partner

Most fintech partnerships do not fail loudly at the start. They fail quietly, through small compromises that only surface under audit, scale, or incident pressure. Knowing what to avoid is often as valuable as knowing what to look for.

CTOs should be cautious of partners who:

- Claim compliance without evidence. Certifications and policies mean little if teams cannot show how compliance is applied in day-to-day delivery.

- Rely heavily on generic fintech case studies. Context matters. Outcomes without regulatory and operational detail rarely translate cleanly to your environment.

- Resist audit or exit conversations. Hesitation about audit support, documentation, or transition planning usually signals future lock-in risk.

- Optimise for speed over control. Fast delivery that bypasses governance often creates downstream remediation work.

- Depend on individuals rather than processes. In regulated fintech, resilience comes from repeatable practices, not key people.

Avoiding these patterns helps CTOs reduce hidden risk early and keeps the fintech vendor evaluation checklist in the UK focused on long-term stability rather than short-term momentum.

Get an independent view on delivery maturity, compliance readiness, and exit risk.

How Appinventiv Supports Fintech Teams Building in the UK

For many UK fintech CTOs, the real challenge starts after a partner is chosen. Delivery needs to remain steady when audits begin, priorities shift, or systems operate at scale. When building fintech software solutions in the UK, there is little room for shortcuts or assumptions.

Appinventiv works closely with fintech teams at this stage of execution. The focus is on building platforms that stand up under scrutiny, not just shipping features. Architecture decisions, security controls, and documentation are treated as part of everyday engineering. Across 300+ projects delivered across the UK and Europe, including 200+ fintech products, teams have supported both new builds and complex platform evolution. A 97% client satisfaction rate in the EU market reflects an emphasis on reliability over quick wins.

For CTOs reviewing potential partners or reassessing an existing setup, an outside perspective can help clarify what is working and what needs attention. Appinventiv supports these conversations around delivery readiness, governance, and long-term resilience, helping fintech teams move forward with confidence as regulatory and operational demands grow. Let’s connect!

FAQs

Q. How should a CTO choose a fintech development partner?

A. A CTO should start by looking beyond delivery speed or technical depth. In the UK, the right fintech development partner understands regulated environments, works comfortably with compliance teams, and can support the product as it scales, not just at launch.

Q. What makes a good fintech technology partner?

A. A good fintech technology partner is reliable under pressure. They make trade-offs visible, document decisions clearly, and don’t treat security or compliance as separate workstreams. Over time, they feel less like an external vendor and more like an extension of the internal team.

Q. How to evaluate fintech software vendors in the UK?

A. To evaluate fintech software vendors in the UK, CTOs should focus on how teams operate day to day. That includes how they explain architectural decisions, handle audits, respond to change, and communicate when things don’t go as planned.

Q. What risks should CTOs consider when hiring fintech partners?

A. The biggest risks usually aren’t technical. They come from unclear ownership, weak compliance practices, poor documentation, or hidden dependencies. CTOs should also pay close attention to how partners handle incidents and regulatory questions, not just how they pitch solutions.

Q. How to assess fintech compliance capabilities?

A. The simplest way is to ask for real examples. CTOs should look at how a partner has supported audits, adapted to regulatory updates, and worked alongside compliance teams in the past. Comfort with these conversations often says more than any policy document.

Q. How important are reputation and track record when choosing a fintech partner?

A. A partner’s reputation often reveals what delivery looks like after the contract is signed. CTOs should look beyond polished case studies and review customer references, independent reviews, and long-term client relationships. A consistent track record of successful fintech implementations, industry recognition, and repeat partnerships usually signals reliable execution, user-centric design, and systems that hold up as a system of record over time.

Q. How should CTOs assess scalability and flexibility when choosing a fintech partner?

A. CTOs should look beyond today’s feature set and assess whether a partner can support continuous innovation without locking the business into rigid systems. This includes clarity on data ownership, direct API access, and the ability to integrate new functionalities as regulatory requirements and customer expectations evolve. A flexible technology stack, financial stability, and experience working with both hosted solutions and modular platforms are strong indicators that a partner can scale with the organisation over time.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…