- The Growing Need for Advanced Fraud Detection in Financial Services

- A Brief Overview of AI Agents in Fraud Detection

- Why AI Agents Are Ideal for Fraud Detection

- AI Agents vs. Traditional Fraud Detection Methods

- Types of Fraud Detected by AI Agents

- Payment and Transaction Fraud

- Account Takeover (ATO)

- Synthetic Identity Fraud

- Wire Transfer and Business Email Compromise

- Money Laundering and Mule Activity

- Insider and Behavioral Fraud

- Cost-Effectiveness and ROI of AI-Driven Fraud Detection Solutions

- Benefits of Using AI-Powered Fraud Detection in Financial Services

- 1. Earlier Risk Visibility, Not Just Faster Alerts

- 2. Fewer False Positives and Less Customer Friction

- 3. Better Use of Fraud Teams’ Time

- 4. Controls That Stay Relevant as Fraud Evolves

- 5. More Consistent Enterprise Risk Management

- 6. Stronger Support for Compliance and Governance

- 7. Long-Term Cost Efficiency

- Use Cases of AI Agents in Fraud Detection

- Real-World Applications of AI Agents for Fraud Detection in Financial Services

- Credit Card Fraud Detection

- Identity Theft Protection

- Wire Transfer Fraud Prevention

- Anti-Money Laundering (AML) and Know-Your-Customer (KYC) Enhancement

- Challenges, Solutions, and Opportunities in Implementing AI Agents for Fraud Prevention

- Challenges

- Solutions

- Opportunities

- How to Get Started with AI for Fraud Prevention in Your Organization

- Step 1: Assess Your Current Fraud Detection System

- Step 2: Define Your Goals and Fraud Prevention Needs

- Step 3: Choose the Right AI Development Company

- Step 4: Start Small and Scale Gradually

- Step 5: Train Your Team and Build Internal Support

- Step 6: Monitor, Measure, and Optimize

- Best Practices for Implementing AI Agents for Fraud Detection

- 1. Start with a Clear, Limited Scope

- 2. Fix the Data Before Fixing the Models

- 3. Make Decisions Easy to Explain

- 4. Keep Humans in the Loop

- 5. Introduce AI in Phases

- 6. Review, Retrain, and Adjust Regularly

- Key Technologies Driving AI-Based Fraud Detection

- 1. Machine Learning Built Around Behavioral Context

- 2. Graph Analysis for Network-Level Fraud

- 3. Behavioral Biometrics at the Interaction Layer

- 4. Generative and Simulation-Based Training

- 5. Real-Time Decisioning Infrastructure

- 6. Multi-Signal Fusion Across Channels

- The Future of AI Agents in Fraud Detection & Prevention for Financial Services

- Preparing for Tomorrow's Challenges

- Building a Fraud-Resilient Financial Future with Appinventiv

- FAQs

Key takeaways:

- AI agents are shaking up fraud detection, moving past old rule systems to offer smart, self-learning capabilities.

- The U.S. Treasury’s proven success in preventing significant fraud shows what AI agents in fraud detection can do.

- AI agents in financial fraud detection are super fast, accurate, and always getting better. This makes them vital for today’s financial security.

- Bringing in Agentic AI for fraud detection helps overcome the weaknesses of older systems, allowing for better real-time threat spotting and strong returns on investment.

- Partnering with an expert AI agent development company like Appinventiv is key to smooth integration and maximizing the benefits of AI in preventing fraud.

The financial world is a constant battleground against an invisible enemy: fraud. Every year, schemes grow more coordinated, more automated, and harder to detect, targeting institutions and individuals at unprecedented scale. What once relied on human judgment and static controls is now being challenged by adversaries moving at machine speed. This is precisely where AI agents for fraud detection and AI-powered fraud detection are beginning to redraw the lines of financial security.

Recent industry data underscores the urgency of this transformation. According to Alloy’s 2026 State of Fraud Report, a majority of financial institutions, 67%, experienced an increase in fraud in 2025, while 22% reported losses exceeding $5 million due to fraud last year. The most rapidly escalating threats include synthetic identity schemes and account takeover attacks, which exploit gaps in legacy detection systems and highlight the growing AI role in financial fraud detection.

These trends make clear that traditional, static rule-based systems are ill-equipped to cope with the ever-changing reality of financial crime. Today’s fraudsters leverage automation, identity spoofing, and machine-scale deception to overwhelm conventional defenses, making AI-based fraud detection and AI agents in fraud detection essential for real-time, adaptive protection across financial platforms.

In this comprehensive blog post, we explore how intelligent AI agents for fraud detection and fraud detection AI agents are reshaping financial security. We examine the scale of today’s fraud problem, the limitations of legacy systems, and why Agentic AI in Financial Services is becoming a strategic imperative for financial enterprises. We’ll also dive into real-world applications, the use cases of AI agents for fraud detection, and what the future holds for AI-powered fraud detection in financial services as organizations move toward stronger, more resilient risk management.

AI agents help detect risk in real time, adapt to new fraud patterns, and reduce unnecessary customer friction.

The Growing Need for Advanced Fraud Detection in Financial Services

Financial systems today move fast. Money changes hands in seconds, often across apps, devices, and countries. That speed is great for customers, but it leaves very little room for second guesses. This accelerated digital transformation in the FinTech sector, while convenient, has also created fertile ground for fraudsters, especially as AI agents for fraud detection in financial services become necessary to match transaction velocity. Once a transaction is through, there’s often no easy way back, making AI-powered fraud detection a critical line of defense.

What’s really shifted is where fraud begins. According to the 2026 State of Fraud Report, areas like digital onboarding, real-time payments, and account takeovers have become prime targets. Fraudsters know these moments are designed for convenience, not friction, and they exploit them. Controls built for slower processes simply struggle to keep up, which is why AI-driven fraud detection and AI-powered fraud detection systems are increasingly deployed at these high-risk entry points. This pressure is especially visible in markets like the United States, where AI agents for fraud detection in the United States are being adopted rapidly to handle high transaction velocity, advanced fraud tactics, and strict regulatory oversight.

Fraud itself has also become harder to recognize. Many attacks are carefully designed to look normal, blending in with everyday user behavior. Rule-based systems raise too many false alarms, manual reviews fall behind, and teams end up responding after the damage is already done. This growing gap explains why AI-powered fraud detection in financial services and AI fraud detection for enterprise risk management are no longer optional, but a baseline requirement for institutions aiming to stay in control as fraud tactics continue to evolve.

You may like Reading: AI in Legacy Application Modernization – A Complete Guide.

A Brief Overview of AI Agents in Fraud Detection

Fraud no longer follows a fixed pattern. It changes shape quickly, blends in with genuine activity, and often goes unnoticed until damage is already done. This is where AI agents for fraud detection are changing how financial institutions protect themselves. Instead of relying on static rules, a fraud detection AI agent observes how transactions and users typically behave and steps in when something simply feels off, strengthening AI-powered fraud detection across digital environments.

The real advantage comes from autonomy. With Agentic AI in Financial Services, these systems do not wait for manual approval to act. They can slow suspicious payments, request additional verification, or flag an account before losses pile up. Over time, AI agents in fraud detection learn from real outcomes, allowing AI-driven fraud detection to improve accuracy without creating unnecessary friction for legitimate customers.

For financial teams, this shift feels practical rather than experimental. AI-powered fraud detection in financial services helps organizations move away from constant firefighting and toward steady, adaptive protection. By embedding AI agents to prevent financial fraud into daily risk workflows, institutions gain defenses that evolve naturally alongside how fraud unfolds today. In practice, an Agentic AI solution for fraud detection allows financial institutions to shift from reactive controls to systems that observe, decide, and adapt continuously within defined risk boundaries.

Why AI Agents Are Ideal for Fraud Detection

AI agents work well in fraud detection, not because they are sophisticated on paper, but because they align with how fraud actually unfolds in real financial systems. Fraud moves fast, hides inside normal behavior, and rarely follows predictable paths. Traditional controls struggle with that reality. AI agents for fraud detection fit better because they operate at the same speed and scale as modern financial activity.

Here’s what makes AI agents in financial fraud detection a practical choice for banks and enterprises:

- Speed that matches transaction flow: Payments, logins, and account changes happen in seconds. AI agents for fraud prevention in banking evaluate risk almost instantly, allowing AI-powered fraud detection systems to intervene before customers or institutions feel the impact. This real-time response is essential for AI-powered financial fraud detection in banking, where delays can lead to irreversible losses.

- Learning from behavior, not static rules: With agentic AI in financial services, fraud detection is no longer tied to predefined thresholds. A fraud detection AI agent learns from historical activity, context, and outcomes. That enables AI-driven fraud detection to flag behavior that feels unusual for a specific user, even when no explicit rule is broken. This is where AI in financial fraud detection consistently outperforms legacy systems.

- Improvement that compounds over time: Fraud tactics evolve quietly. AI-based fraud detection systems adapt just as quietly. As new patterns emerge, AI agents in fraud detection refine their models, reducing false positives and improving accuracy without constant manual tuning. For businesses, this makes AI fraud detection solutions for enterprises far more sustainable in the long run.

- Decisions without unnecessary delay: High-risk moments don’t leave room for long review cycles. AI agents for fraud detection in financial services can pause a transaction, trigger step-up authentication, or automatically flag an account. Human teams remain in control, but AI-powered fraud detection ensures critical actions aren’t slowed down by operational bottlenecks.

- Seeing connections humans struggle to spot: Some fraud only becomes visible across accounts, devices, and timeframes. By using techniques such as graph analysis and deep learning, AI agents in fraud detection surface coordinated activity that manual reviews often miss. This capability is especially valuable for AI fraud detection for enterprise risk management, where threats rarely exist in isolation.

- Working alongside modern security signals: Modern fraud prevention does not rely solely on transactions. AI-powered fraud detection in financial services increasingly incorporates behavioral biometrics, device intelligence, and contextual signals. In advanced setups, LLM-based AI agents for fraud detection help interpret complex patterns across these inputs, adding clarity without adding friction.

Together, these strengths explain why AI agents for preventing financial fraud are becoming foundational rather than optional. They don’t replace human judgment. They handle the speed, volume, and complexity that human teams simply cannot manage consistently on their own.

Also Read: How to Ensure Cybersecurity in the Age of IoT

AI Agents vs. Traditional Fraud Detection Methods

Financial institutions are increasingly reassessing how fraud is detected and controlled. Traditional systems were designed for predictable threats, while modern fraud is adaptive, fast, and often engineered to look legitimate. This growing mismatch is where AI agents for fraud detection begin to separate clearly from legacy approaches.

| Aspect | Traditional Fraud Detection Methods | AI Agents for Fraud Detection |

|---|---|---|

| Detection approach | Relies on fixed rules and predefined thresholds that must be updated manually as fraud patterns change. | Uses AI agents in fraud detection that learn from behavior continuously and adjust as tactics evolve, reducing dependency on static rules. |

| Speed of response | Often reactive, flagging fraud after a transaction is completed or settled. | AI-powered fraud detection operates in real time, allowing suspicious activity to be slowed or stopped as it happens. |

| Adaptability | Struggles with new or unfamiliar fraud patterns and requires frequent rule tuning. | A fraud detection AI agent adapts automatically by learning from outcomes, improving accuracy without constant manual intervention. |

| False positives | High false-positive rates create customer friction and overload fraud teams with low-risk alerts. | AI-driven fraud detection reduces noise by understanding what “normal” looks like for each user, device, and channel. |

| Decision-making | Heavily dependent on human review, delaying responses during high-volume periods. | Agentic AI in Financial Services enables autonomous actions such as pausing transactions or triggering verification when risk is elevated. |

| Scalability | Difficult to scale as transaction volumes grow across digital channels and geographies. | AI-powered fraud detection systems scale easily across millions of transactions without linear increases in operational effort. |

| Operational effort | Requires large teams to monitor alerts, maintain rules, and investigate repetitive cases. | AI agents for preventing financial fraud automate routine checks, allowing analysts to focus on complex, high-impact investigations. |

| Effectiveness over time | Performance degrades unless rules are constantly revised. | AI agents in financial fraud detection improve steadily as models learn from new behavior and emerging fraud techniques. |

This comparison explains why many institutions are moving away from rule-heavy systems toward AI-powered fraud detection in financial services. The shift is not about replacing existing controls overnight, but about strengthening them where speed, adaptability, and scale matter most.

By layering AI agents for fraud detection in financial services into decision points where traditional tools fall short, organizations move from reactive cleanup to proactive risk control.

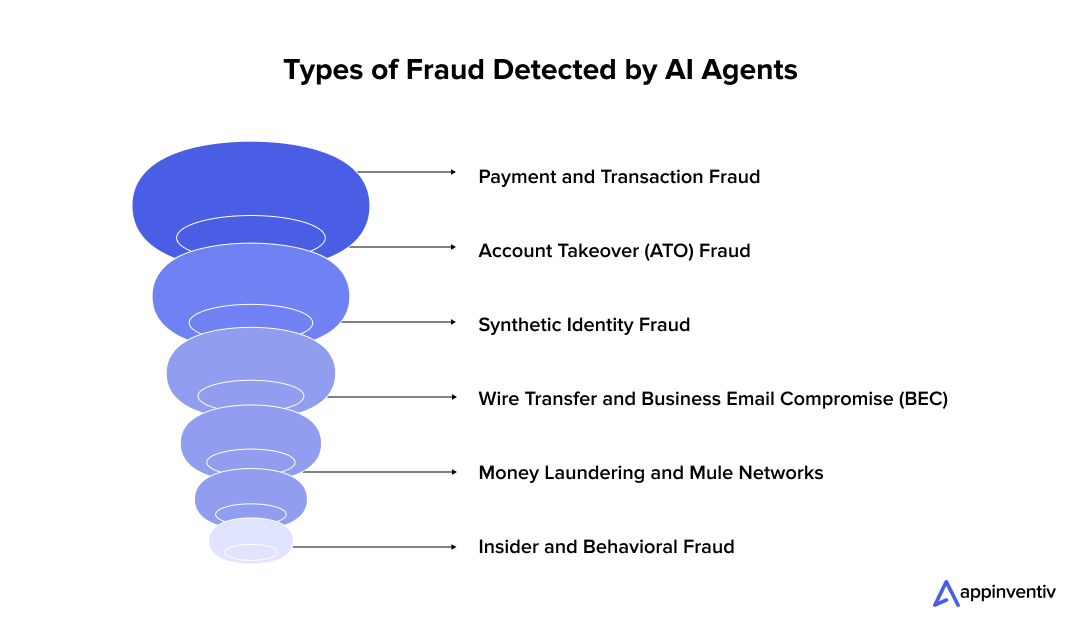

Types of Fraud Detected by AI Agents

Most fraud does not arrive with obvious warning signs. It hides inside normal activity and often looks legitimate until real damage has already occurred. This is exactly where AI agents for fraud detection prove their value. Instead of relying on rigid rules, a fraud detection AI agent learns how genuine users behave over time and flags subtle shifts that don’t align with established patterns.

Below are the fraud scenarios where AI-powered fraud detection consistently delivers strong results in real-world financial environments.

Payment and Transaction Fraud

Fraudulent transactions rarely start with a single large event. They usually appear as small behavioral changes, such as changes in spending frequency, unexpected locations, or rapid bursts of transactions. AI-powered fraud detection in financial services identifies these deviations in real time, allowing teams to intervene before funds are lost. This is one of the most mature and widely adopted use cases of AI agents in fraud detection.

Also read: 10 Benefits and Use Cases of Agentic AI in Banking

Account Takeover (ATO)

When attackers gain access to an account, their actions almost never match those of the legitimate user. Login timing shifts, devices change, and navigation patterns feel off. AI agents in financial fraud detection detect these behavioral mismatches early, significantly shrinking the window attackers have to cause harm.

Synthetic Identity Fraud

Synthetic identities often pass initial checks because they are built from valid-looking data fragments. The risk usually surfaces later. AI-based fraud detection works across the full account lifecycle, comparing onboarding details with long-term behavior to surface inconsistencies that static verification methods miss. This makes AI fraud detection for enterprise risk management especially valuable in high-volume onboarding environments.

Wire Transfer and Business Email Compromise

Wire transfers are high-risk because reversals are rarely possible. AI agents for fraud prevention in banking assess context before execution by reviewing beneficiary history, transaction timing, approval behavior, and past patterns. When something doesn’t fit established norms, AI-powered fraud detection systems can pause or challenge the transaction before it completes.

Money Laundering and Mule Activity

Illicit fund movement typically unfolds across multiple accounts and timeframes rather than a single transaction. AI-driven fraud detection connects these dispersed signals, helping uncover coordinated activity such as mule networks or layering schemes that manual reviews often overlook.

Insider and Behavioral Fraud

Not all threats originate outside the organization. AI agents for preventing financial fraud also help surface internal risks by identifying unusual access patterns, abnormal usage levels, or deviations from expected employee behavior. This supports more consistent internal controls without constant manual oversight.

Together, these scenarios highlight why AI agents for fraud detection have become a core part of modern financial risk strategies. They adapt to changing behavior, remain effective against evolving tactics, and reduce dependence on constant rule updates or noisy alerts.

Cost-Effectiveness and ROI of AI-Driven Fraud Detection Solutions

Investing in AI fraud detection applications for large enterprises requires upfront costs—think infrastructure upgrades, data cleansing, and vendor partnerships. But the long-term savings are staggering. AI-powered fraud detection in financial services slashes fraud losses, reduces manual review costs, and protects brand reputation.

Many business studies highlight that AI solutions significantly cut operational expenses by automating fraud reviews, with ROI often exceeding initial investments.

The ROI is often substantial, with savings from reduced fraud, lower operational costs, and improved fraud-detection accuracy more than compensating for the initial investment.

For financial enterprises, these savings translate into a competitive edge, making enterprise AI fraud detection solutions a no-brainer.

At scale, AI fraud detection solutions for enterprises and AI fraud detection applications for large enterprises consistently show stronger returns by reducing manual review effort, lowering false positives, and preventing losses before they compound.

| Metric | Traditional Systems | AI-Driven Systems |

|---|---|---|

| False Positive Rate | Up to 98% | Reduced by up to 90% |

| Detection Speed | Hours to days | Milliseconds |

| Annual Cost Savings | Limited | Millions (e.g., $9M for RBS) |

| Scalability | Poor | High |

Note: These figures are based on industry reports and case studies from leading financial institutions.

Benefits of Using AI-Powered Fraud Detection in Financial Services

For most financial institutions, the real value of AI-powered fraud detection in financial services is not that it feels advanced. It’s that it aligns far better with how fraud actually unfolds in modern systems. Instead of reacting after damage is done, teams can act while decisions are still in motion.

Here are the benefits that consistently matter in real operational environments.

1. Earlier Risk Visibility, Not Just Faster Alerts

Fraud rarely starts with a single obvious signal. It builds quietly through small behavioral changes. AI agents for fraud detection surface these early indicators by continuously learning what “normal” looks like for users, devices, and transactions. This allows teams to intervene sooner, often before losses occur.

2. Fewer False Positives and Less Customer Friction

One of the biggest weaknesses of legacy controls is noise. Static rules tend to flag legitimate behavior, leading to declined transactions and frustrated customers. AI-driven fraud detection reduces this friction by understanding individual behavior patterns, ensuring that genuine activity flows through without interruption.

3. Better Use of Fraud Teams’ Time

Manual review does not scale. When AI fraud detection solutions for enterprises handle routine, low-risk decisions, analysts can focus on complex investigations where human judgment actually adds value. This shift improves both efficiency and morale across fraud and compliance teams.

4. Controls That Stay Relevant as Fraud Evolves

Fraud tactics change constantly. Fixed rules age quickly. AI agents in fraud detection adapt as behavior shifts, learning from outcomes rather than waiting for manual updates. This keeps detection effective over time without forcing teams into endless rule maintenance cycles.

5. More Consistent Enterprise Risk Management

For large organizations, consistency matters. AI fraud detection for enterprise risk management applies the same decision logic across channels, products, and geographies. This reduces blind spots, supports audit readiness, and helps maintain a uniform risk posture as operations scale.

6. Stronger Support for Compliance and Governance

Explainable models and detailed audit trails make AI-based fraud detection easier to justify during regulatory reviews. When decisions can be traced back to behavioral signals and historical context, compliance and regulations conversations become clearer and less reactive.

7. Long-Term Cost Efficiency

While there is an upfront investment, AI-powered fraud detection systems typically lower total cost over time. Reduced fraud losses, fewer manual reviews, and lower customer support overhead all contribute to a healthier cost structure. For many institutions, this makes AI-powered financial fraud detection in banking one of the faster ROI-generating technology initiatives.

Taken together, these benefits of AI agents for fraud detection explain why they are no longer viewed as optional enhancements. For financial services operating at scale, they have become a practical foundation for staying secure without slowing everything else down.

Reduce false positives, speed up investigations, and strengthen risk operations with AI-powered fraud detection.

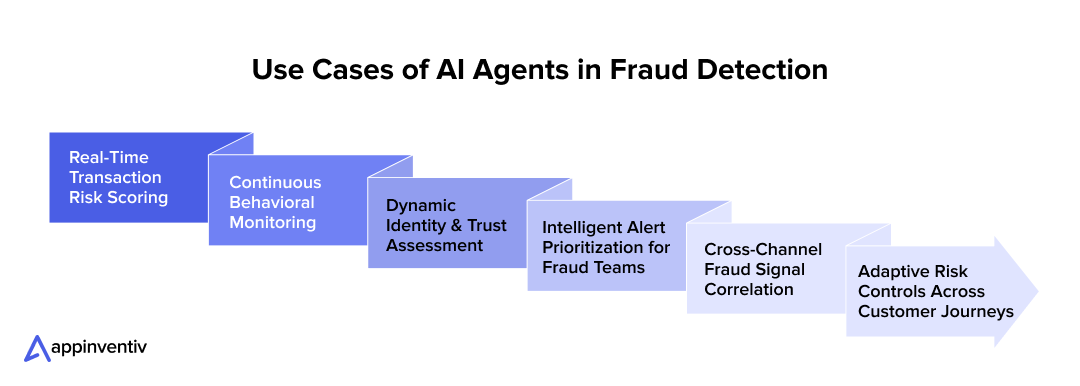

Use Cases of AI Agents in Fraud Detection

At a practical level, AI agents for fraud detection are used wherever decisions need to be made quickly and with limited context. Key use cases include:

- Real-Time Transaction Risk Assessment: One of the most critical use cases of AI-powered fraud detection is decision-making at the exact moment a transaction occurs. A fraud detection AI agent evaluates behavior, context, device signals, and historical patterns instantly. This allows systems to approve legitimate activity while slowing or challenging suspicious actions before funds move.

- Continuous Behavioral Monitoring: Fraud does not always happen in a single event. Many schemes unfold gradually. AI-driven fraud detection continuously monitors accounts, sessions, and transactions over time, making it effective at spotting behavior that slowly drifts away from normal. This approach is especially useful in long-running account takeover and insider fraud scenarios.

- Dynamic Identity and Trust Scoring: Identity risk changes over time. AI agents for fraud detection in financial services reassess trust continuously rather than relying on one-time verification. Signals such as device consistency, behavioral patterns, and usage history feed into a living risk profile, helping teams adjust controls as risk increases or stabilizes.

- Alert Prioritization for Fraud Teams: Not all alerts deserve equal attention. One practical use case of AI-powered fraud detection systems is ranking and prioritizing cases so analysts focus on what truly matters. By scoring risk more accurately, AI fraud detection solutions for enterprises reduce alert fatigue and improve investigation efficiency.

- Cross-Channel Risk Correlation: Fraud signals often live in separate systems. AI agents for preventing financial fraud help connect activity across cards, payments, logins, and accounts. This cross-channel visibility enables organizations to detect patterns that would otherwise remain fragmented, thereby supporting stronger AI-based fraud detection for enterprise risk management.

- Adaptive Fraud Strategy Tuning: Fraud environments change quietly. AI agents in fraud detection help teams adjust thresholds, controls, and responses based on evolving behavior rather than fixed assumptions. This makes fraud strategies more flexible without requiring constant manual reconfiguration.

Taken together, these use cases of AI agents for fraud detection show why they are becoming embedded into everyday financial operations. They do not replace existing systems overnight. Instead, they strengthen decision-making exactly where traditional approaches struggle most: speed, scale, and uncertainty.

Real-World Applications of AI Agents for Fraud Detection in Financial Services

Once fraud detection systems are deployed, theory gives way to reality. Volumes fluctuate, edge cases appear without warning, and every decision must hold up under audit, customer scrutiny, and regulatory review. This is where AI agents for fraud detection demonstrate real value, operating quietly inside day-to-day financial workflows.

Credit Card Fraud Detection

Credit card fraud remains one of the most active threat areas in banking and payments. In production environments, AI-powered fraud detection systems monitor behavior continuously rather than evaluating transactions in isolation.

They typically focus on:

- Transaction velocity: Sudden bursts of activity across locations or merchants often signal early fraud. AI agents in fraud detection surface these patterns far faster than manual reviews.

- Merchant behavior alignment: Spending outside a customer’s usual categories or price ranges increases risk when combined with other signals.

- Device consistency: A familiar account appearing on new or untrusted devices stands out quickly to a fraud detection AI agent.

- Geolocation context: Location data is assessed in context, not just checked against basic rules.

This layered approach allows AI-powered fraud detection in financial services to stop fraud early while minimizing disruption to legitimate cardholders.

Also Read: Guide to Detect Credit Card Fraud with Machine Learning

Identity Theft Protection

Identity-related fraud has grown more sophisticated, especially with the rise of synthetic identities and deepfake-enabled impersonation. In real systems, AI agents in financial fraud detection analyze identity signals continuously rather than relying solely on onboarding checks.

Common applications include:

- Document verification using computer vision to spot subtle inconsistencies.

- Biometric validation that adapts to changing user behavior.

- Cross-source correlation to identify identity elements that don’t stay consistent over time.

This makes AI-based fraud detection especially effective in environments where identity trust must persist beyond initial verification.

Wire Transfer Fraud Prevention

Wire transfers carry a high risk because recovery is rarely possible once funds move. In live banking systems, AI fraud detection for enterprise risk management emphasizes context and history over speed alone.

Key applications include:

- Beneficiary analysis that distinguishes between long-standing and unfamiliar recipients.

- Authorization behavior monitoring to detect unusual approval flows.

- Real-time risk scoring that evaluates multiple signals before a transfer is finalized.

These safeguards help AI agents for fraud prevention in banking intervene before irreversible losses occur.

Anti-Money Laundering (AML) and Know-Your-Customer (KYC) Enhancement

AML and KYC processes benefit significantly from pattern recognition across time and accounts. AI agents for preventing financial fraud help compliance teams move beyond isolated alerts.

In practice, this improves:

- Transaction monitoring across linked accounts and timeframes.

- Ongoing customer due diligence, where behavioral shifts trigger reassessment.

- Sanctions screening, with fewer false positives and clearer matches.

- Suspicious activity reporting, producing cleaner and more defensible filings.

This application of AI-powered fraud detection in financial services supports stronger compliance outcomes without overwhelming teams.

Enterprise Impact in Practice

Beyond detection metrics, outcomes matter. Appinventiv partnered with Edfundo to build a secure and scalable financial literacy platform. The work focused on strengthening the platform’s foundation while supporting growth. As a result, the client was able to:

- Secure $500,000 in pre-seed funding

- Prepare for a $3 million seed round

- Build partnerships with Visa and NymCard

- Transition the product into a SaaS model

- Expand through a white-label approach

Challenges, Solutions, and Opportunities in Implementing AI Agents for Fraud Prevention

Most financial organizations don’t struggle to understand the promise of AI agents for fraud detection. The real challenge lies in making them work inside complex systems, strict regulatory environments, and teams that already carry heavy operational responsibility. The technology is capable, but adoption brings friction that has little to do with algorithms and everything to do with execution.

That said, institutions that work through these constraints often unlock long-term advantages that traditional approaches simply cannot deliver.

Challenges

Implementing AI-powered fraud detection in financial services is rarely a plug-and-play exercise. Several obstacles tend to surface early.

- Legacy systems not designed for AI: Many banks and financial platforms still run on infrastructure built long before real-time decisioning was possible. Data flows are slow, AI integrations are brittle, and introducing a fraud detection AI agent often requires careful orchestration rather than direct insertion. This is one of the most common barriers for AI agents for fraud prevention in banking.

- Data privacy and regulatory pressure: Fraud detection relies on sensitive behavioral and identity data. Regulations such as GDPR and CCPA make governance unavoidable. When AI agents in fraud detection operate across regions or platforms, teams must be deliberate about data access, retention, and explainability.

- Internal skepticism and trust gaps: Fraud analysts may worry about losing control over investigations. Leadership teams may hesitate to rely on automated decisions that feel opaque. These “black box” concerns are common, especially when AI-driven fraud detection begins to influence high-value transactions.

Solutions

Organizations that move forward successfully tend to do so with patience and structure, not speed alone.

- Phased integration with clear boundaries: Rather than large-scale rollouts, many teams begin with narrow pilots tied to a specific workflow. This allows AI agents for fraud detection to demonstrate value early, while API-first integration limits disruption to existing systems.

- Strong data governance and explainability: Trust improves when decisions are explainable. Embedding transparency into AI-powered fraud detection systems makes reviews easier and compliance discussions more productive. Clear audit trails and model visibility reduce resistance from both regulators and internal teams.

- Positioning AI as support, not replacement: Adoption improves when AI is framed as an assistant rather than an authority. When analysts remain involved in edge cases and feedback loops, AI agents for preventing financial fraud feel like tools rather than threats. Training and hands-on exposure play a critical role here.

Opportunities

Once these hurdles are addressed, the upside becomes hard to ignore.

- Faster and more accurate detection: Well-trained models allow AI-powered fraud detection to evaluate risk in milliseconds. This enables intervention before losses occur, shifting fraud prevention from reactive cleanup to proactive control.

- Automation of routine checks: High-volume, low-risk activity can be handled automatically by AI agents in fraud detection, freeing human teams to focus on complex investigations. Many organizations see meaningful efficiency gains once manual queues shrink.

- Real-time threat response: Modern AI fraud detection solutions for enterprises continuously monitor behavior across devices, transactions, and channels. When risk rises, systems can trigger additional verification, slow activity, or apply temporary controls without waiting for human input.

For institutions willing to work through the adoption curve, Agentic AI in Financial Services offers more than incremental improvement. It provides a path toward fraud prevention that scales with volume, adapts to new tactics, and remains effective as financial ecosystems continue to evolve.

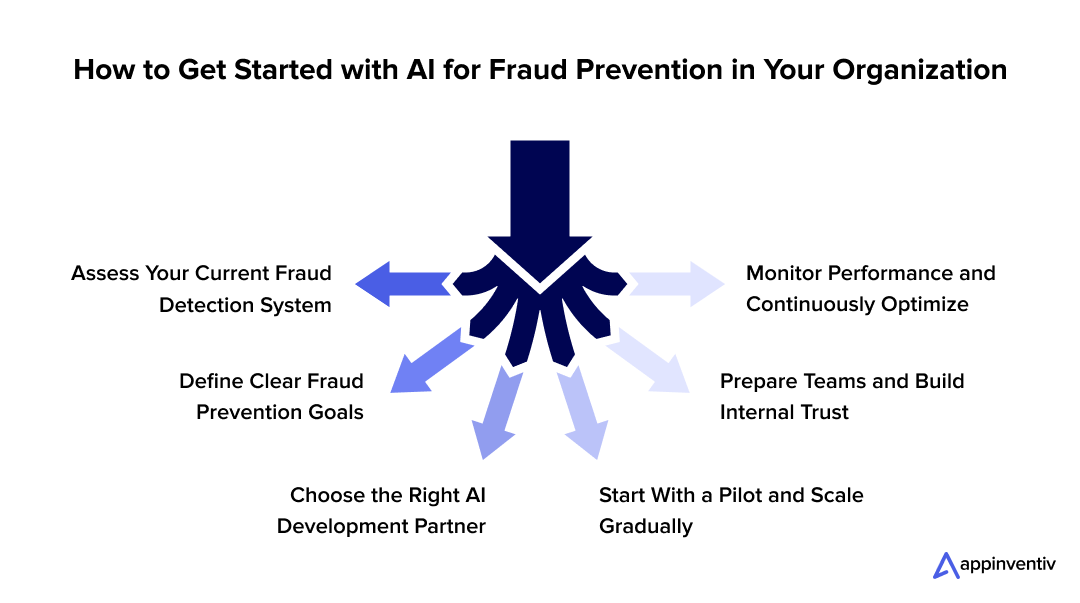

How to Get Started with AI for Fraud Prevention in Your Organization

Most organizations don’t struggle with why they need AI agents for fraud detection. They struggle with the first few steps. The failures usually aren’t technical. They happen when AI is treated like a switch you flip instead of a capability you grow into. Teams that do this well tend to move slowly at first, learning where AI helps and where it needs to be restrained.

Here’s how that usually plays out in practice.

Step 1: Assess Your Current Fraud Detection System

Before introducing AI-powered fraud detection, it’s worth spending time with the systems already in place. Not the dashboards. The real workflow.

- Where do analysts spend their time?

- Which alerts feel useful, and which ones feel like noise?

- Where does fraud get caught too late?

In most environments, the same patterns show up. Manual reviews pile up. Rules trigger too often. And some fraud still slips through because it looks ordinary on the surface. These are often the first places where AI agents in fraud detection can help without forcing a full system overhaul.

Step 2: Define Your Goals and Fraud Prevention Needs

AI works best when expectations are narrow. Trying to solve every fraud problem at once usually leads to confusion, not results.

Teams that succeed tend to focus on a few questions:

- Which fraud scenarios cause the most loss or disruption today?

- Where does speed matter more than certainty?

- What decisions are hardest for humans to make consistently?

Answering these questions early makes the implementation of AI agents for fraud detection far more grounded. It also prevents disappointment later, when AI behaves exactly as designed, but not as imagined.

Step 3: Choose the Right AI Development Company

Building AI inside financial systems is less about clever models and more about context. Organizations that want to build AI agents for fraud detection usually need the best AI agent development company for business that understands legacy infrastructure, compliance pressure, and operational realities.

In practice, strong partners:

- Know how fraud teams actually work

- Can integrate AI-powered fraud detection systems without breaking existing flows

- Support phased adoption instead of big-bang launches

- Stay involved after launch to adjust models based on real outcomes

This becomes especially important in AI agent app development for fraud detection, where poor integration can create more risk than protection.

At this stage, teams also begin evaluating delivery formats and the scope of investment. For organizations considering AI agent fraud detection mobile app development or an AI-powered app for fraud detection, the cost to build an AI agent app for fraud detection typically depends on data readiness, real-time decisioning needs, and regulatory complexity. A focused approach to AI agent app development for fraud detection helps balance speed, cost, and long-term scalability without overengineering the first release.

Step 4: Start Small and Scale Gradually

Most effective rollouts begin quietly. One flow. One signal. One decision point.

That might be a specific transaction type or a narrow slice of account behavior. Once the system proves it can support decisions reliably, AI-powered fraud detection in financial services expands naturally into adjacent areas.

Over time, teams extend AI into:

- Broader behavioral monitoring

- Early detection of new fraud patterns

- Risk scoring for high-value or time-sensitive actions

This gradual approach gives AI agents for preventing financial fraud room to earn trust instead of demanding it upfront.

Step 5: Train Your Team and Build Internal Support

Fraud prevention doesn’t work without people. Analysts need to feel in control of decisions, not overridden by them.

Teams adapt more easily when:

- AI is positioned as decision support, not authority

- Analysts can challenge outcomes and feed results back into the system

- Human judgment is clearly preserved for complex cases

When this balance is right, AI-powered fraud detection systems stop feeling like black boxes and start feeling like dependable tools.

Step 6: Monitor, Measure, and Optimize

Fraud doesn’t change overnight. It shifts quietly. AI systems need the same kind of attention.

Most teams keep things simple:

- Are alerts becoming more useful over time?

- Is the review effort actually going down?

- Are fraud losses trending in the right direction?

Small adjustments made regularly tend to matter more than major rewrites. That’s how AI-driven fraud detection stays relevant instead of fading into background noise.

For organizations planning deeper adoption, following a structured approach to fraud detection software development can help ensure systems stay reliable, scalable, and aligned with how fraud continues to evolve.

Best Practices for Implementing AI Agents for Fraud Detection

Implementing AI agents for fraud detection rarely fails because the models are weak. It fails when teams expect instant certainty from systems that still need context, tuning, and trust. Organizations that see real impact tend to approach implementation as an operational shift, not a one-time technology rollout. Successful implementation of AI agents for fraud detection depends less on model sophistication and more on how well these systems are introduced, governed, and trusted within everyday fraud operations.

A few practices consistently make the difference.

1. Start with a Clear, Limited Scope

The temptation to cover every fraud scenario at once is strong, but it usually backfires. The most effective implementations begin where signals are strong and consequences are immediate.

Many teams start with transaction monitoring or account access controls. These areas give a fraud detection AI agent clear behavioral patterns to learn from and measurable outcomes to track early on. Once confidence builds, expanding the scope feels far less risky.

2. Fix the Data Before Fixing the Models

Even the best AI agents for fraud detection systems struggle when data is fragmented or inconsistent. In practice, a significant portion of implementation effort goes into aligning transaction histories, identity signals, device data, and prior fraud outcomes.

This groundwork is rarely visible from the outside, but it determines whether AI-powered fraud detection systems improve accuracy or simply repeat old mistakes at scale.

3. Make Decisions Easy to Explain

Accuracy alone does not earn trust. Fraud teams, compliance officers, and auditors all need to understand why something was flagged.

Building explainability into AI agents in fraud detection helps analysts review cases faster and reduces friction during regulatory reviews. When outcomes can be traced back to behavior shifts or contextual signals, AI stops feeling opaque and starts feeling dependable.

4. Keep Humans in the Loop

The most resilient setups don’t remove people from decisions. They reposition them.

AI handles speed and volume. Humans handle judgment. Analysts review edge cases, challenge outcomes, and feed results back into the system. This balance strengthens AI-powered fraud detection in financial services without creating internal resistance or blind trust in automation.

5. Introduce AI in Phases

A gradual rollout matters more than a perfect architecture. Pilots allow teams to see how AI agents for preventing financial fraud behave under real conditions, not just test scenarios.

Phased adoption helps:

- Tune thresholds without harming customer experience

- Reduce false positives before scaling

- Build confidence across fraud, risk, and compliance teams

Once the system proves stable, expanding coverage becomes a natural next step.

6. Review, Retrain, and Adjust Regularly

Fraud patterns shift quietly. What works today can lose effectiveness without warning.

Ongoing monitoring and retraining keep AI-driven fraud detection aligned with changing behavior. Small, frequent adjustments usually outperform large, infrequent overhauls and help systems evolve alongside real-world threats.

When these practices are followed, AI-based fraud detection stops feeling like an experiment. It becomes part of daily operations, improving gradually and earning trust through consistent outcomes rather than promises.

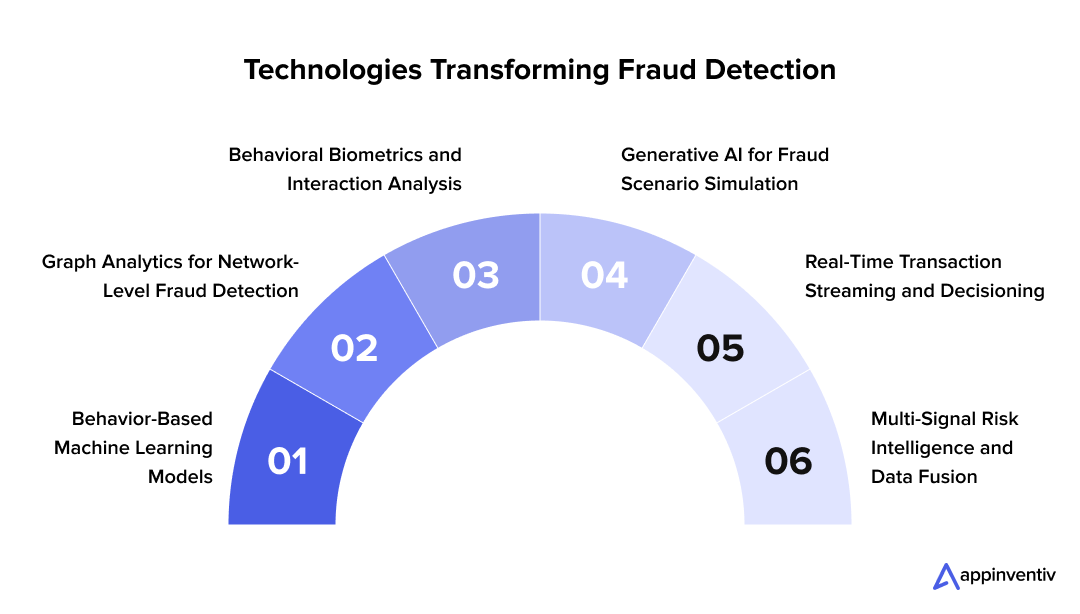

Key Technologies Driving AI-Based Fraud Detection

Fraud detection hasn’t changed because of one breakthrough model. It’s changed because several technologies matured at the same time and finally began to work well together in production environments. The real shift isn’t theoretical capability. It’s what now holds up under live traffic, regulatory scrutiny, and constant adversarial pressure.

Below are the technologies quietly reshaping how AI agents for fraud detection operate day-to-day.

1. Machine Learning Built Around Behavioral Context

Traditional systems look for violations. Modern AI-powered fraud detection looks for deviation.

Most fraud detection AI agents today rely on a mix of supervised and unsupervised learning models trained on transaction history, session behavior, device usage, and timing patterns. Instead of asking whether a rule was broken, these models ask whether something feels out of place compared to how a user or account normally behaves.

This approach is particularly effective against slow-moving fraud that stays deliberately below static thresholds. It’s one of the reasons AI-driven fraud detection catches issues that legacy systems consistently miss.

Also Read: How Machine Learning in Banking Is Transforming Banking

2. Graph Analysis for Network-Level Fraud

Many high-impact fraud cases don’t involve a single account acting suspiciously. They involve networks.

Graph-based techniques allow AI agents in fraud detection to map relationships between accounts, devices, IP addresses, payment instruments, and identities. Once those relationships are visible, patterns like mule networks, synthetic identity rings, and coordinated fund movement become far easier to detect.

This kind of analysis is especially important for AI fraud detection for enterprise risk management, where fraud often spans products, regions, and timeframes rather than appearing as isolated events.

3. Behavioral Biometrics at the Interaction Layer

Credentials alone no longer prove identity. Fraud systems now pay close attention to how users interact with applications.

Behavioral biometrics analyzes signals such as typing rhythm, touch pressure, navigation flow, and cursor movement. These patterns are difficult to replicate consistently, even when credentials are compromised.

For AI-powered fraud detection in financial services, this adds a quiet layer of security that operates continuously without interrupting genuine users or adding friction.

Closely related to behavioral biometrics, AI voice agents for fraud detection are gaining traction in call centers and customer verification flows. By analyzing speech patterns, timing, and conversational cues, these systems help detect social engineering, impersonation attempts, and account manipulation without disrupting legitimate customer interactions.

4. Generative and Simulation-Based Training

One of the biggest challenges in fraud detection is that real fraud data arrives late and incomplete. To compensate, teams increasingly use generative AI techniques to simulate realistic fraud scenarios.

These synthetic datasets help LLM-based AI agents for fraud detection train against attack patterns that haven’t fully emerged yet. They also allow models to improve without exposing sensitive customer data, which helps address regulatory and privacy concerns.

Used defensively, generative AI becomes a stress-testing tool rather than a risk.

5. Real-Time Decisioning Infrastructure

Fraud decisions lose value when they arrive too late.

Modern AI-powered fraud detection systems are built to score risk while transactions are still in motion. This requires streaming architectures, low-latency scoring pipelines, and tight integration with payment and identity systems.

For use cases like instant payments or wire transfers, real-time analysis is what allows AI agents for fraud prevention in banking to prevent losses instead of documenting them after the fact.

6. Multi-Signal Fusion Across Channels

No single signal tells the full story. Effective fraud detection depends on combining many weak signals into a strong conclusion.

AI agents today fuse transaction data, identity attributes, device signals, behavioral biometrics, and historical outcomes into a single risk view. This cross-signal approach is what allows AI agents for preventing financial fraud to make consistent decisions across apps, channels, and products.

The strength lies not in any single model, but in how these signals reinforce one another.

Taken together, these technologies explain why fraud detection feels fundamentally different today. AI agents for fraud detection aren’t just faster. They’re more contextual, more adaptive, and far better suited to the way modern fraud actually unfolds.

The Future of AI Agents in Fraud Detection & Prevention for Financial Services

Here’s what keeps fraud prevention leaders awake at night: just when you think you’ve got fraudsters figured out, they evolve. The good news? AI agents for preventing financial fraud are evolving even faster. We’re entering an era where your fraud prevention system won’t just detect threats – it’ll predict them, prevent them, and adapt to new ones before they even happen. Let’s throw light on some game-changing trends:

Generative AI is Revolutionizing Defense

Beyond ChatGPT for enterprises writing poetry, generative AI is creating synthetic training data that protects customer privacy while building smarter fraud models. These systems simulate thousands of potential fraud scenarios, letting your AI practice against attacks that haven’t even been invented yet.

Predictive Protection

The next generation won’t just spot fraud in progress – it’ll recognize criminal intent before any crime occurs. AI systems will analyze communication patterns, device behaviors, and contextual clues to identify when someone is planning fraudulent activity. Imagine your system automatically adjusting security based on emerging threats before fraudsters even strike.

Autonomous AI Revolution

Future systems will manage themselves – continuously learning, evolving detection methods, and updating policies based on new threats and regulations. Think of it as having a fraud expert who never sleeps and gets smarter every day.

Customer-First Security

The best fraud prevention is invisible. Future AI will provide seamless, personalized security that adapts to individual customer behaviors and preferences, delivering protection that feels like premium service by utilizing AI agents in customer service.

Preparing for Tomorrow’s Challenges

Federal Reserve Governor Michael Barr emphasizes that banks must evolve their AI to combat deepfake attacks using facial recognition, voice analysis, and behavioral biometrics (source: Banking Dive).

Smart organizations aren’t waiting they’re building AI foundations now that can evolve with tomorrow’s threats. Don’t let your financial services fall behind. Opt for Appinventiv’s AI Software Development Services to ensure your fraud detection systems remain effective against evolving threats.

Explore how autonomous AI agents can predict fraud, adapt to new attack patterns, and strengthen prevention without adding friction.

Building a Fraud-Resilient Financial Future with Appinventiv

AI agents in fraud detection have moved from being an advantage to a necessity. As fraud becomes more automated and harder to detect, financial institutions need systems that can adapt in real time without slowing operations. That’s where AI-powered fraud detection in financial services is proving its value, not just by reducing false positives, but by helping teams stay ahead of emerging risks.

Appinventiv works with financial organizations to build fraud-detection systems that meet real-world constraints. As an artificial intelligence development company with deep experience in financial services, the focus is on delivery, integration, and long-term reliability. Our AI Agent Development Service is designed to help enterprises deploy fraud detection capabilities that scale, comply, and improve over time.

This approach has supported fintech platforms like Mudra in building secure, production-ready systems while preparing for growth. From credit card fraud and AML workflows to identity verification, the goal stays the same: create fraud detection that works quietly in the background and holds up under pressure.

The question for most enterprises isn’t whether to adopt AI-driven fraud detection, but how quickly they can put the right foundations in place. With the right partner, fraud prevention becomes a steady capability rather than a constant firefight.

Ready to secure your financial future? Partner with Appinventiv today to build a fraud-resilient enterprise.

FAQs

Q. What is Agentic AI in fraud detection?

A. Agentic AI in fraud detection means using intelligent systems that act autonomously to spot and stop financial fraud.

These AI agents analyze transactions in real time, learn from new patterns, and make quick decisions. The most interesting part? They do all this without human input.

In short, they are like sharp, tireless guards, adapting to tricky fraud tactics to keep your money safe.

Q. How can AI agents improve fraud detection in financial services?

A. Think of AI agents as your fraud team’s superpower. They never sleep, never miss a pattern, and can spot suspicious activity faster than any human analyst. Here’s how AI agents in fraud detection make a difference:

- Lightning-fast analysis – Process thousands of transactions instantly

- Pattern recognition – Catch subtle fraud signals humans might miss

- Real-time blocking – Stop fraudulent transactions before they complete

- Learning capability – Get smarter with every fraud attempt they encounter

The biggest win? Your customers enjoy smoother transactions while fraudsters face tougher barriers.

Q. What is the role of AI agents in preventing fraud in the financial sector?

A. AI agents in financial fraud detection act as tireless digital sentinels. They continuously:

- Monitor: Watch over financial activities across all channels.

- Analyze: Use smart algorithms to uncover complex fraud schemes.

- Predict: Anticipate potential fraud before it happens.

- Adapt: Learn from new tactics in real-time to stay ahead of criminals.

- Protect: Automatically put safeguards in place when threats are detected.

Q. How can financial enterprises leverage AI agents to combat fraud?

A. Smart enterprises don’t try to transform everything overnight. Here’s the winning approach to use financial enterprise AI solutions for fraud detection:

Start Small, Think Big

- Launch pilot programs in high-risk areas

- Focus on transaction monitoring first

- Learn what works before expanding

Build Gradually

- Add account opening fraud detection

- Integrate AML compliance monitoring

- Scale to full autonomous systems

Prepare Your Foundation

- Clean up your data sources

- Train your team on new processes

- Ensure smooth integration with existing systems

Success comes from patience and proper planning, not rushing into complex deployments.

Q. What are the biggest challenges in integrating AI agents for fraud prevention?

A. Let’s be honest – implementing AI fraud detection isn’t always smooth sailing. Here are the main hurdles:

- Technical Headaches: Most banks run on decades-old systems that weren’t built for AI integration. Getting everything to work together can be like fitting a smartphone into a rotary phone.

- Privacy Concerns: AI needs lots of data to work effectively, but regulations like GDPR make data handling tricky. Balancing effectiveness with privacy protection requires careful planning.

- Staff Problems: Your fraud analysts might worry about job security, while executives question whether they can trust AI decisions. Change management becomes crucial for success.

- Ongoing Maintenance: AI models need constant tuning and updates. It’s not a “set it and forget it” solution.

Q. What benefits do AI fraud detection tools offer to financial decision-makers?

A. AI fraud detection applications for large enterprises deliver benefits that directly impact your bottom line and competitive position:

Financial Impact

- Dramatically reduce fraud losses

- Cut operational costs through automation

- Faster ROI than most technology investments

Operational Excellence

- Fewer false alarms mean happier customers

- Automated compliance reporting saves time

- Staff can focus on complex investigations instead of routine checks

Strategic Advantages

- Superior security becomes a competitive differentiator

- Better customer experience drives loyalty

- Regulatory compliance becomes easier to maintain

The real value isn’t just in stopping fraud – it’s in transforming how your entire organization thinks about security and customer protection.

Q. Who provides AI-based fraud detection systems?

A. AI-based fraud detection systems are typically provided by a mix of specialized AI vendors, enterprise software companies, and custom development partners. Large institutions often work with firms that build AI agents for fraud detection tailored to their data, risk models, and regulatory environment. These providers focus on creating scalable AI-powered fraud detection systems that integrate with existing banking, payments, or compliance platforms rather than offering one-size-fits-all tools.

Q. How AI Agents Are Transforming Fraud Detection and Financial Security?

A. AI agents are changing fraud detection by shifting it from reactive monitoring to continuous risk assessment. Instead of relying on fixed rules, AI agents in fraud detection learn from behavior, context, and outcomes over time. This allows AI-powered fraud detection in financial services to identify threats earlier, reduce false positives, and respond in real time. As a result, financial security becomes more adaptive, consistent, and better aligned with how modern fraud actually unfolds.

Q. What solutions exist for AI agents in education application fraud detection?

A. In education platforms, AI agents are increasingly used to detect application fraud, identity misuse, and account manipulation. AI-based fraud detection solutions analyze application data, document authenticity, device signals, and usage behavior to flag inconsistencies. Similar to financial use cases, AI agents for preventing fraud in education focus on continuous monitoring rather than one-time checks, helping institutions protect admissions, assessments, and digital learning environments without adding unnecessary friction for genuine users.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How AI Chatbots for eCommerce are Driving 3x More Sales in 2026

Key takeaways: AI chatbots for eCommerce have a direct impact on revenue. When aligned with buying intent, they lift conversions, increase order value, and drive repeat purchases. The strongest impact comes from personalization and guided selling, helping shoppers decide faster and buy with greater confidence. Abandoned cart recovery is a major revenue driver in 2026.…

AI-Powered Booking Optimization for Beauty Salons in Dubai: Costs, ROI & App Development

Key Highlights AI booking optimization improves utilization, reduces no-shows, and stabilizes predictable salon revenue streams. Enterprise salon platforms enable centralized scheduling, customer insights, and scalable multi-location operational control. AI-enabled booking platforms can be designed to align with UAE data protection regulations and secure payment standards. Predictive scheduling and personalization increase customer retention while significantly reducing…

Data Mesh vs Data Fabric: Which Architecture Actually Scales With Business Growth?

Key takeaways: Data Mesh supports decentralized scaling, while Data Fabric improves integration efficiency across growing business environments. Hybrid architectures often deliver flexibility, governance, and scalability without forcing premature enterprise-level complexity decisions. Early architecture choices directly influence reporting accuracy, experimentation speed, and future AI readiness across teams. Phased adoption reduces risk, controls costs, and allows architecture…