- AI Governance for Agentic Autonomy in Financial Systems

- Agentic AI vs. Traditional AI in Finance: How Agentic AI Surpasses Traditional AI in Finance?

- Human-in-the-Loop Controls and Kill-Switch Safeguards

- What Are the Benefits of Agentic AI in the Financial Sector?

- Productivity Gains Through Improved Efficiency

- Revolutionized Customer Experience and Personalization

- Superior Accuracy and Real-time Responsiveness

- Proactive Risk Control and Improved Compliance

- Open New Revenue Streams

- Regulatory Accountability for Agentic AI in Finance

- Measuring Agentic AI Success Beyond Speed and Cost

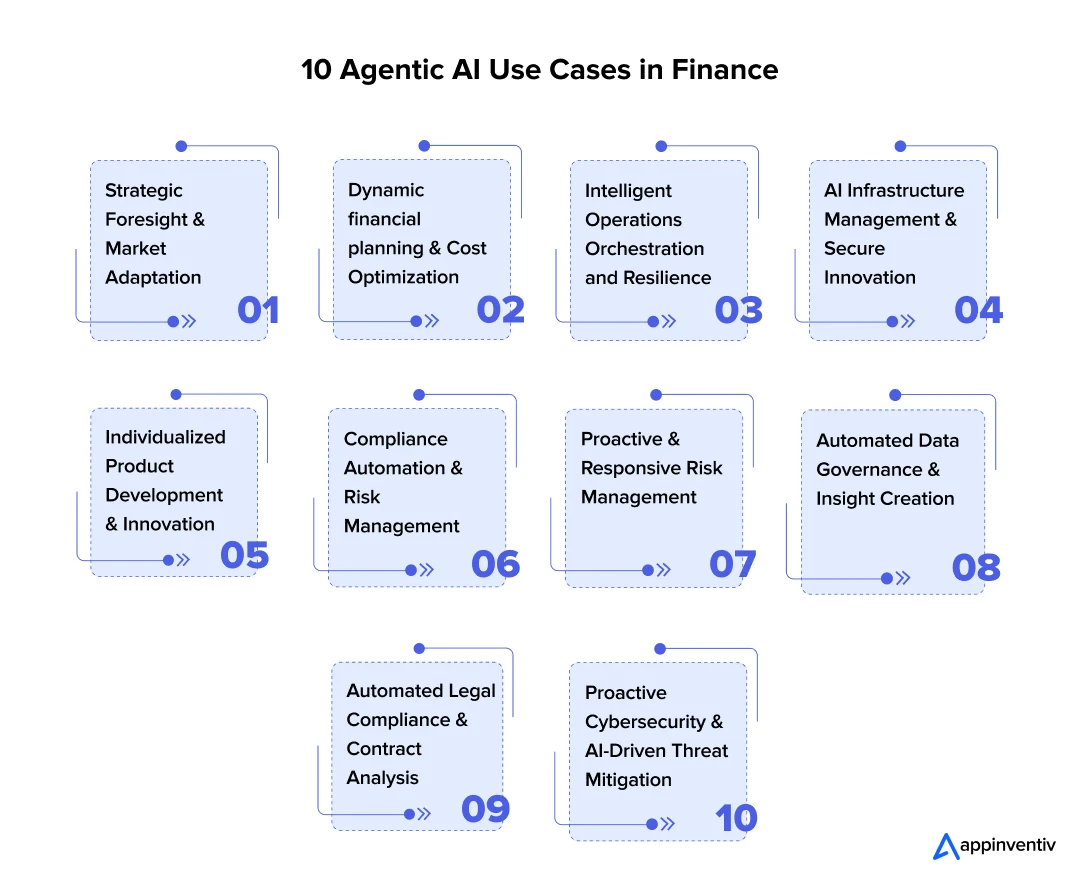

- Top 10 Agentic AI Use Cases in Finance (Empowering the Fintech C-Suite)

- Core C-Suite Roles (Foundational to most companies):

- Specialized C-Suite Roles (Common and growing in Fintech):

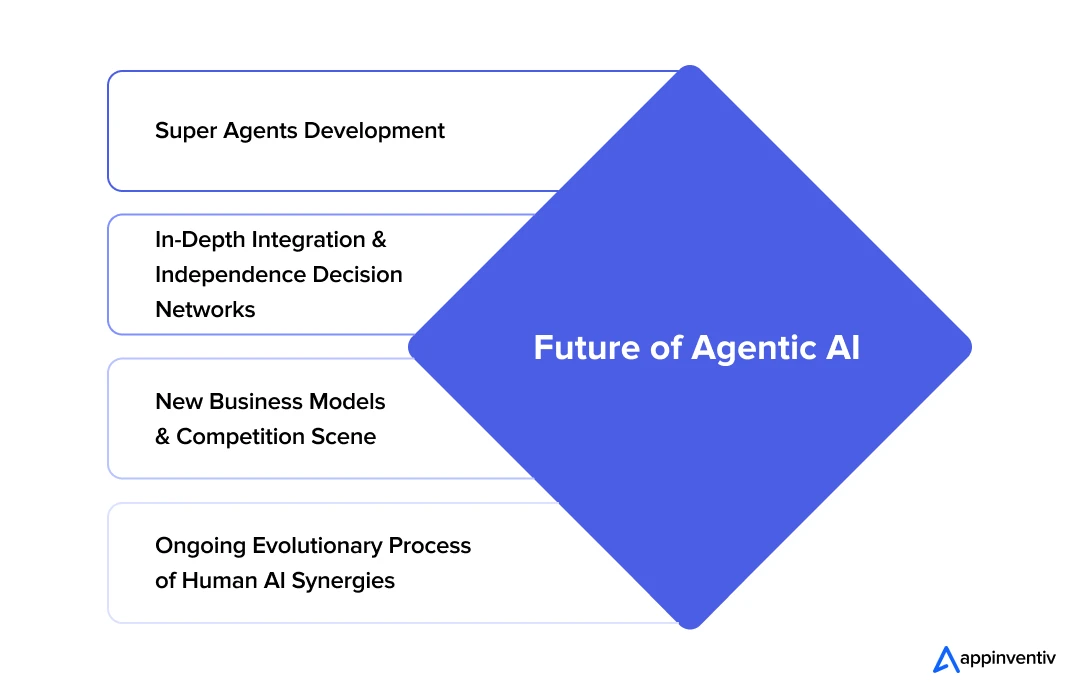

- The Future of Agentic AI in Finance: Emerging Trends and Strategic Outlook

- Super Agents Development

- In-Depth Integration & Independence Decision Networks

- New Business Models and Competition Scene

- Ongoing Evolutionary Process of Human AI Synergies

- Appinventiv: Your Trusted Partner For Agentic AI Development For Your Upcoming Fintech Project

- Our Innovative Fintech-Based Projects:

- FAQs

Key takeaways:

- Enhanced Efficiency: Agentic AI automates complex tasks, saving up to 90% time.

- Real-Time Decisions: Adapts instantly to market changes and fraud threats.

- Hyper-Personalization: Delivers tailored customer experiences 24/7.

- Proactive Compliance: Reduces risks with automated regulatory tracking.

- New Revenue Streams: Unlocks innovative business models for growth.

The financial services industry has been under pressure to deliver both security and efficiency for years. Manual, time-consuming, labor-intensive work, from complex compliance checks to large volumes of customer enquiries, has stressed resources and left room for expensive human error.

The speed at which information is moving in financial systems today, combined with the volume of data available, has put traditional automation and even early AI solutions under tremendous pressure, leaving institutions lagging rather than setting the pace. The fraudsters, ever adapting their approach, are constantly ahead of static fraud identification systems, which in turn costs you a significant amount of money and reputation.

Meanwhile, the shifting sands of regulatory compliance require vigilance and agility that are not worth the human capital. Customer demands have also skyrocketed to hyper-personalized, instant, always-on delivery, which legacy systems cannot match. This is what has been plaguing the C-suite and eating into its efficiency, security, and growth over the past few years.

Yet, a new power is on the rise, ready to disrupt the very thread in which financial transactions are woven: Agentic AI.

Agentic AI in finance is the intelligent being capable of sensing, deciding, and acting at a previously unimagined scale and pace. It eliminates complexity, automates multi-step processes, and responds in real-time to rapidly changing market dynamics or new threats — all with minimal human oversight. Agentic AI in financial services is not just about making processes faster; it’s about remaking how decisions are made and value is created throughout the company.

AI Governance for Agentic Autonomy in Financial Systems

Agentic AI operates with decision authority. In financial environments, this autonomy must be governed with the same rigor as any risk-bearing system.

1. Clear distinction between advisory agents (recommend actions) and execution agents (perform actions)

2. Defined autonomy levels:

- Observe → Recommend → Execute

3. Ownership of each agent mapped to Risk, Compliance, or Operations teams

4. Continuous monitoring for:

- Market regime shifts

- Data and model drift

- Abnormal agent behavior

5. Governance aligned to enterprise risk appetite and financial controls

Tap into the $140.8 billion agentic AI market by 2032 with Agentic AI Development.

Agentic AI vs. Traditional AI in Finance: How Agentic AI Surpasses Traditional AI in Finance?

To comprehend the peculiarities of Agentic AI in financial services, it is essential to draw a line separating this type of AI and its two forebears, traditional AI and generative AI:

- Traditional AI (Rule-Based/Predictive): In the financial industry, traditional AI has already established itself as a feature tool, mostly working within the limits previously set forward. It is also very useful for retrieving data needed in economic reports, transaction summaries, and workflow automation. They prove to be effective in routinized, foreseeable work but struggle with the fluidity and frequently ad hoc nature of real-time financial environments.

- Agentic AI: Agentic AI is a big step further and is a system that can smoothly combine the flexibility and versatility of LLMs in understanding complex situations with the rigidity and deterministic nature required in financial activities. The role of Agentic AI in your business goes beyond passive support, as dynamism is seen in problem-solving, systems can make decisions, and conduct other complex financial procedures with minimal human intervention.

| Characteristic | Augmented Intelligence (Rule-Based/Predictive) | Agentic AI in Finance |

|---|---|---|

| Decision-Making | Works with predefined rules and historical patterns, reacting to specific inputs. | Agentic AI in financial decision making enables autonomous action determination, plans multi-step workflows, and adapts to current data. |

| Learning Capabilities | Can only learn within a small set of typical situations/threats through manual retraining. | Continuous learning driven through experience and feedback; improves over time. |

| Adaptable | Fixed and inflexible; do not operate well dynamically or resiliently to new circumstances or unforeseen events. | Dynamic, adaptive of process flows in real-time, re-prioritizing and flagging anomalies. |

| Autonomy | Low; it needs some human inputs to come up with final decisions. | Highly automated; it can operate with minimal human involvement and take action independently. |

| Common Applications | Simple fraud and alerts, rule-based bot, tri-band credit score. | AI Agents in Finance enable fraud prevention (freeze accounts), dynamic lending, real-time portfolio, automated compliance, and customer engagement. |

Human-in-the-Loop Controls and Kill-Switch Safeguards

Autonomous systems in finance require explicit human control points to prevent unintended financial or regulatory exposure.

1. Mandatory human approval for:

- Account freezes

- Credit denials

- Large fund reallocations

- Trading halts

2. Confidence-threshold triggers that escalate decisions to humans

3. Real-time kill-switches to:

- Pause autonomous trading

- Isolate compromised AI agents

- Roll back AI-initiated actions

4. Clear escalation paths for Risk and Compliance teams

5. Override authority retained by CRO, CCO, and Security teams

What Are the Benefits of Agentic AI in the Financial Sector?

Several key benefits of agentic AI in banking are completely transforming the way banking is done, from increased efficiency to more satisfying customer experiences, mitigated risk and new growth opportunities. These benefits stem from Agentic AI’s ability to act independently, evolve in response to its environment, and learn through experience without requiring frequent human input.

Productivity Gains Through Improved Efficiency

Agentic AI revolutionizing the financial industry by dramatically increasing operational efficiency through the automation of complex, decision-intensive tasks that traditional machines could not previously handle. Through the automation of time-consuming back-end processes, such as data entry, transaction processing, and record-keeping, Agentic AI eliminates manual labor and reduces human error, freeing employees to be redeployed to more strategic, value-driven tasks.

- Time Savings: According to the PwC survey, Agentic AI in financial services can provide up to 90% time savings on key processes, freeing up to 66% of a team’s time for higher-value insight work and delivering accuracy in forecasting and pace. Furthermore, finance departments are already experiencing increased bandwidth for analysis and faster close cycles due to their use of AI.

- Reduced Time to Decision: 33% of PwC survey respondents say that with Agentic AI, the time from decision to execution is compressed, eliminating manual handoffs. Meanwhile, Outcome Acceleration means parallel processing speeds up and increases efficiency for your workflows.

- Cost Savings through Operations: According to the Basware News Report, automating processes such as digital account payable processing with Agentic AI can deliver a significant ROI over three years, enabling up to $1.36 million in savings for every $1 million invested.

Revolutionized Customer Experience and Personalization

Agentic AI in financial services is fundamentally redefining how customers engage with companies, providing tailored, always-on, responsible, and 24/7 customer support at scale, rather than simple chatbots with finite responses to queries.

- 24/7 Access & Responsiveness: AI agents in finance can handle simple inquiries and transactions as well as process forms and route next steps like dispute resolution and Know Your Customer (KYC) updates automatically, saving companies money and eliminating human error.

- Hyper-Personalization: With the use of advanced AI models, AI agents in finance can predict a customer’s intent, meet needs before they’re articulated, and offer personalized solutions, while also remembering every customer interaction, preference, and purchase history, so that no user feels “handled” but instead truly heard.

- Lower Wait Times and Costs: According to Gartner, by 2029, 80% conversations will be handled by customer support Agentic AI bots in the future delivering faster and more accurate outcomes while reducing operational costs by 30%.

Also Read: Guide to Building Intelligent AI Models

Superior Accuracy and Real-time Responsiveness

Enhanced AI in the form of agentic AI systems is characterized by the fact that optimal context decisions made in the world, which is a construction of new intelligence, will unfold based on specific requirements in the real-time environment and optimize performance by self-improving.

- Real-time agility: Unlike legacy models that require manual reconfiguration, Agentic AI in Finance automates its forecasts with a constant stream of new information, enabling institutions to anticipate and address periods of liquidity crises, geopolitical turbulence, and market shocks by optimizing their financial resilience during such stresses.

- Real-Time Processing: They have the capability to process massive amounts of data in milliseconds, identifying complex patterns and responding in real-time to environmental changes or other threats that human beings cannot perform.

- Improved Decisioning: Agentic AI provides a more precise and efficient level of decisioning, offering a pixel-speed response opportunity for fraud detection and compliance.

Proactive Risk Control and Improved Compliance

Agentic AI is uniquely effective at identifying and mitigating risks that a human team might overlook, detecting vulnerabilities before a malicious actor can exploit them, automating compliance with complex regulations, and limiting financial and reputational damage in the event of threats.

- Continuous Monitoring System: By its nature, agentic AI does not fall asleep at the switch—it is constantly monitoring against a moving set of rules, weighing those rules against the complexity of institutional processes, and identifying compliance “blind spots” that other types of monitoring might miss.

- Fraud prevention: Agentic AI leverages Machine Learning for fraud detection and prevention by detecting patterns and abnormalities in large datasets to identify likely fraudulent behavior early on. This enables the detection of suspicious claims and triggers alerts, while also preventing fraud at the application level through preventive tools.

- Compliance cost savings: With the help of Agentic AI, more than a quarter of AI-driven solutions for financial services organizations expect to save over $4 million annually in compliance operations.

Bonus Read: How to Leverage AI in Fintech For Secure and Compliant Solutions?

Open New Revenue Streams

We’re making a significant investment in Agentic AI, and that investment is already yielding cost savings and revenue growth at scale across fintech.

- Revenue Amplification: Agentic AI has the potential to drive top-line growth in several ways, including amplifying existing revenue streams and unlocking new revenue streams altogether.

- New Business Models: Service firms can productize their in-house knowledge (e.g., legal thinking, tax analysis) into AI services sold to customers as SaaS (Software-as-a-Service) applications or APIs, thus generating revenue from the services they provide.

- Market Leadership: Agentic AI in Finance enhances competitive positioning and agility, allowing early adopters to respond rapidly to market shifts and customers’ evolving needs, ultimately becoming market-dominant players.

Also Read: Guide to Unlock the Power of FinTech APIs

Regulatory Accountability for Agentic AI in Finance

Agentic AI must produce decisions that regulators can inspect, explain, and audit.

1. End-to-end audit trails for:

- AI recommendations

- Autonomous executions

- Human overrides

2. Explainable decision logs for regulator review

3. Traceability from:

- Input data → model reasoning → final action

4. Alignment with:

- AML / KYC

- PCI-DSS

- PSD2

- Data protection regulations

5. Always-on documentation readiness for supervisory audits

Measuring Agentic AI Success Beyond Speed and Cost

Operational efficiency alone is not success. Agentic AI must deliver risk-adjusted outcomes.

- Reduction in fraud losses (not just detection speed)

- Lower false positives and reduced customer friction

- Risk-adjusted ROI, not raw automation savings

- Incident avoidance and near-miss reduction

- Compliance cost reduction and audit efficiency gains

- Stability during market volatility and stress scenarios

Top 10 Agentic AI Use Cases in Finance (Empowering the Fintech C-Suite)

Agentic AI in finance for executives is well-positioned to create enormous value in the financial industry, providing value through its ability to change fundamental financial processes and unlock new abilities. This revolution is characterized by moving from reactive to proactive/predictive processes.

Rather than react to fraud attacks, client inquiries, or market changes, agentic AI will enable corporations to predict, block, or seize on those occurrences at a never-before-seen degree of speed and accuracy. Let’s explore how Agentic AI in finance for executives works in a financial enterprise.

Core C-Suite Roles (Foundational to most companies):

Chief Executive Officer (CEO): The topmost executive of the company who gives a general vision of the company, strategy, and the affairs of the company. They are the company’s face to the outside world and are directly answerable to the Board of Directors.

Use Case 1: Strategic Foresight and Market Adaptation

- The Agentic AI equips the CEO with a data-driven, real-time understanding of market changes, competitor environments, and new trends, allowing them to adjust their strategic course.

- This empowers CEOs to independently review large amounts of information across financial markets, news feeds, and customer actions, seeking to make connections that might otherwise be obscure or that one might prefer not to see. It does not offer raw data; instead, of provides an amalgamation of intelligence.

- This will enable the CEO to make quicker, more informed decisions regarding the company’s overall focus, the resources it should utilize, and which markets it should target, ensuring that the organization itself remains agile and competitive.

Bonus Read: Unlock Actionable Insights with Causal AI for Strategic Agility

Chief Financial Officer (CFO): Oversees the financial aspects of the business, including budgeting, forecasting, cash flow management, investment strategies, and risk mitigation. The CFO plays a significant role in Fintech due to the complexities of regulatory requirements and fundraising.

Use Case 2: Dynamic financial planning and Cost Optimization

- Agentic AI transforms and digitises important financial workflows. This gives the CFO an accurate and real-time view of the company’s finances. It can optimize budgeting, forecasting, and cash flow analysis independently, considering continuous analysis of internal financial data, market indicators, and economic trends.

- This will enable the CFO to optimize resource allocation, identify cost-saving opportunities, and model various financial scenarios with unprecedented accuracy and speed.

- Accounts payable, reconciliation, and financial reporting can also be automated using agentic AI, freeing finance staff to concentrate on strategy-related analysis.

Bonus Read: How Much Does It Cost to Build an AI Agent?

According to PwC 2024 Finance Effectiveness Benchmarking Report, top finance organizations have cut their cost by an average of 20% over the past three years, and, with strategic changes to how they use technology, leading teams have improved efficiency by up to 90% on critical processes and by up to 40% in terms of upside or downside forecasting accuracy and response times.

Chief Operating Officer (COO): This individual is responsible for overseeing daily activities and ensuring that the company’s objectives are achieved in an economical manner. Other Fintechs, particularly those that are young, may start without a COO, and the COO role may be consolidated with that of a CFO, as financial sustainability becomes a priority in young firms.

Use Case 3: Intelligent Operations Orchestration and Resilience

- Agentic AI can enhance the activities your company undertakes by automating complex and multi-layered work processes that require numerous interactions, as well as making adjustments in response to changing situations.

- The COO can utilize Agentic AI to streamline workflows, reprioritize tasks, and identify irregularities across multiple operational capabilities, including back-office processing and customer service delivery.

- These systems can save time by avoiding delays and operating in parallel, making operations smarter, faster, and more resilient to interruption. Additionally, they enable the handling of workloads, forecasting potential bottlenecks, and automating optimizations themselves.

Bonus Read: Enterprise Guide to Start with Intelligent Automation

Chief Technology Officer (CTO) / Chief Information Officer (CIO): These are the most important positions in Fintech. The CTO emphasizes technology strategy, innovation, product development, and external technology partnerships. A CIO typically manages IT systems, infrastructure, and data internally.

Use Case 4: AI Infrastructure Management and Secure Innovation

- CTO/CIO would need to develop and support the technological infrastructure that allows the implementation of Agentic AI. This includes planning the computational resources (GPUs, TPUs) successfully, minimizing the cost of cloud infrastructure to a minimum, and ensuring all systems work smoothly with the complicated legacy systems.

- The possibility of automating IT operations, controlling the entire system, detecting cyber threats in real-time, and ensuring data governance and privacy across the entire tech stack is made possible with agentic AI.

- In the case of the CTO, this involves expedited product development and innovation by offering developers good self-optimizing AI tools. To the CIO, it provides stability, security, and affordability of an internal IT system and data infrastructure.

Also Read: How AI in Cloud is Transforming Enterprises?

BlackRock, a financial investment management company, leverages ‘Aladin’, a proprietary platform that incorporates AI to facilitate the investment management process. Addressing the issue of AI-related security risks. (Source: Hedge School of Applied Economics)

Specialized C-Suite Roles (Common and growing in Fintech):

The Chief Product Officer (CPO): Is in charge of product vision, strategy, design, and development. Since Fintech companies are naturally product-driven, a CPO is a key hire, particularly as the company grows.

Use Case 5: Individualized Product Development and Innovation

- The CPO utilizes Agentic AI to drive product innovation and deliver personalized financial products. Your AI agents in finance can continuously view customer behavior, preferences, and market patterns to identify uncovered demand and recommend new product features or even entirely new offerings.

- They can optimize financial products such as loans, insurance plans, or investment portfolios according to the situational and personal aspects of a financial profile, and offer tailored guidance free of human intervention.

- Agentic AI, in addition to supporting rapid prototyping and iteration, can automate parts of the design and testing process, reducing time-to-market for new fintech offerings.

Bonus Read: Role of AI in Product Development

Capital One’s Chat Concierge, a multi-agent conversational AI assistant that enhances the auto purchasing experience – including booking test drives and comparing vehicles – showcases a product-focused application of Agentic AI.

Chief Compliance Officer (CCO): The CCO is crucial in Fintech because it is a highly regulated business, particularly in financial services. The CCO is responsible for the business’s compliance with applicable laws, rules, and regulations, as well as industry standards, and preventing violations of laws and regulations.

Use Case 6: Compliance Automation and Risk Management

- AI agents will continuously track changing regulatory regimes, meticulously map new rules to institutional operations, and instantly highlight gaps between operations.

- They may be able to auto-generate compliance reports, retain extensive audit trails, or even serve as virtual experts, answering intricate regulatory questions and ensuring that the code is aligned with policy.

- AI in risk management helps slash manual work by orders of magnitude, which speeds up decision-making cycles and reduces compliance violations, thereby decreasing legal and reputational risks for the organization.

Chief Risk Officer (CRO): Oversees all risks for the enterprise, including financial, operational, and cybersecurity risk. Fintech, being data and digital transaction-heavy, feeds on strong risk management.

Automate regulatory tracking and reporting to save time and avoid penalties.

Use Case 7: Proactive and Responsive Risk Management

- Agentic AI empowers the CRO to advance real-time risk identification and mitigation for financial, operational, and cyber risk management.

- AI agents continuously monitor transaction records, market prices, and external indicators to identify abnormal behaviors and new types of fraud, and react swiftly, such as initiating an account freeze.

- They are also able to continuously recalibrate risk models using new data to anticipate liquidity risks, geopolitical shocks, or market shocks, and, in addition, to simulate different intervention strategies to determine which one is most effective.

- This forward-looking approach ensures that financial losses are kept to a bare minimum while building a strong Bank, even in a challenging environment.

According to The Silicon Review, JPMorgan Chase’s Artificial intelligence fraud detection has reportedly cut fraud losses by 40% and reduced the time it takes to identify a fraud attack.

Chief Data Officer (CDO): Responsible for the company’s data strategy, data governance, management, analytics, and data security. As Fintech is highly data-driven and analytics require the involvement of various kinds of data with different categories, this role becomes increasingly relevant for manipulating data and gaining insights, as well as a competitive advantage.

Use Case 8: Automated Data Governance and Insight Creation

- The CDO utilizes Agentic AI to define and initiate effective data governance structures, ensuring the quality, privacy, and security of data throughout the enterprise. Smart data discovery and classification, as well as the tracing of data lineage, can be automated through AI agents in finance. Additionally, data pipelines can be monitored in real-time to detect anomalies or regulatory violations.

- They are capable of analyzing massive amounts of data in milliseconds to reveal complex patterns and provide timely, data-driven insights, which are used to inform strategic-level corporate decisions.

- This will enable raw data to become a compounding asset, creating intelligence and accelerating value creation through a “data flywheel” effect via the CDO.

Chief Legal Officer (CLO) / General Counsel: Offers legal guidance to the firm and handles the legal proceedings of the organization, which includes intellectual property rights, contracts, and regulatory issues.

Use Case 9: Automated Legal Compliance and Contract Analysis

- The CLO leverages the fact that Agentic AI will automate Regulation and Compliance, legal research, contract analysis, and compliance trend monitoring. AI agents may then quickly scan voluminous legal documents and extract the words indicating the most important clauses of these documents, report inconsistencies, and compare contracts with internal policies or regulatory demands.

- They can track legislative changes in real-time, notify the legal team of new requirements, and even help create policies of compliance. This saves a significant amount of manual work in the legal due diligence process and ensures the organization’s compliance with complex laws, thereby reducing the likelihood of litigation and fines.

Also Read: Why and how to develop legally compliant AI products

Chief Security Officer (CSO) / Chief Information Security Officer (CISO): Although security falls within the CTO/CIO most of the time, CSOs/CISOs are increasingly common due to the high risks of cyber attacks and the regulation of data protection in the Fintech environment.

Use Case 10: Proactive Cybersecurity and AI-Driven Threat Mitigation

- The CSO/CISO utilizes Agentic AI to establish an active and flexible cybersecurity framework in Fintech. The AI agents continuously test network traffic, user behavior, and system logs to identify any anomalous threat patterns that indicate cyber threats, such as more advanced AI-powered attacks, like prompt injection.

- They can also self-react to an event in isolation, deactivating compromised systems and notifying security teams in real-time.

- The data security that agentic AI offers is also provided through a mechanism of data access that is strictly controlled, coupled with adherence to data privacy laws. This is what changes cybersecurity into a proactive dynamic shield.

The Future of Agentic AI in Finance: Emerging Trends and Strategic Outlook

The future of Agentic AI in finance is heading towards a more advanced and interconnected environment, with a fundamental, transformational impact on how institutions conduct business, innovate, and compete. The development of the most sophisticated AI applications, further unification throughout the financial ecosystems, the introduction of new business models, and an improved symbiosis between human experience and artificial intelligence will be among the defining characteristics of such an evolution.

Super Agents Development

The next level of the financial sector is poised to experience the emergence of so-called Super Agents, highly intelligent AI systems that can orchestrate and organize a variety of highly specialized subsystems, assembling them into a complex, multi-functional problem-solving system.

Such multi-agent systems will no longer be used to automate individual tasks, but will enable the transformation of the entire organization to work together across the enterprise. For example, a Super Agent may manage a comprehensive M&A due diligence project by coordinating the assistance of specialist agents to perform financial analysis, review contracts for legal compliance, and assess risk, and by integrating these various inputs into a strategic recommendation.

Such staging of intelligence will leverage a data flywheel, where intelligence created by one agent is used to power and enrich the intelligence creation of others, resulting in an exponentially increasing intelligence and growing value creation efficiency over time.

In-Depth Integration & Independence Decision Networks

The next kid on the block is agentic AI, which aims to become an invisible, ubiquitous overlay for every financial operation within a network. It inherently works with other systems and APIs to create autonomous decision-making networks.

Bonus Read: API Development Guide: Build, Test, Deploy like a Pro

This higher infiltration will enable financial institutions to step out of individual endeavors in AI to intelligent systems that learn and act together across business units. The networks will also streamline cross-protocol decision-making, asset tracking, and liquidity management, enabling firms to leverage this complexity to scale their presence in new digital markets with unmatched dexterity.

With increased execution speed, the removal of delays between processes, and the potential for parallel processes, Agentic AI will significantly reduce the latency of decision-making and data transfer, not only making workflows faster but also smarter and more resilient.

New Business Models and Competition Scene

The agentic AI will become an agent of driving growth to the top line, and will not only magnify an existing revenue base, but also enable previously unforeseen revenue bases in the financial industry. For example, embedded AI agents in finance, within digital banking applications, can actively assess user habits, spending trends, and life events to present real-time, hyper-personalized offers of suitable financial products, including loans, insurance plans, or investment portfolios, all under their guidance and without human supervision.

Bonus Read: 9 Fintech Sectors That Are Attracting Investors’ Attention

Ongoing Evolutionary Process of Human AI Synergies

More importantly, the future of Agentic AI in finance is not about replacing human beings with machines, but having them synergise in a drastically new way. The agentic AI is poised to redesign the role of humans, and the concept of a human employee may evolve into that of an AI trainer, risk auditor, and AI ethicist who monitors and regulates such smart systems.

The agents will prove crucial in decision-making, as they will enhance human intelligence by providing real-time information, automating the multi-faceted analysis of data, and performing repetitive tasks, thereby releasing human talent.

This enables financial professionals to devote more attention to high-quality work that involves creative, strategic changes, understanding client relationships that require emotional intelligence, and informed decision-making.

Boost efficiency, supercharge decisions, and unlock new revenue with cutting-edge Agentic AI.

Appinventiv: Your Trusted Partner For Agentic AI Development For Your Upcoming Fintech Project

It is observed that the financial sector is at the threshold of an autonomous revolution, and its driving force is agentic AI. As financial institutions approach the full potential of Agentic AI in their new production and projects, collaboration with an expert in rapidly changing technology is not only advisable but also essential.

At Appinventiv, we embody experience and trust that can take fintech organizations into this new age of radical change. With vast experience under our belt, serving our clients through a workforce of over 1,600 professionals and having completed more than 3,000 projects across different verticals (software, embedded systems, mobile, and hybrid applications), we have secured some of the best solutions in the market.

We developed bespoke AI Agent Development Services holistically through all the important stages:

- Agentic AI Consultancy: We offer consultations to help clients establish a clear path for integrating AI, identifying the most high-impact use cases, and formulating a strategic approach.

- AI Agent Design: From conversation flows to interface elements, our AI Agent Design is tailored to ensure your agent communicates naturally and delivers consistent value across all touchpoints.

- Agentic AI App Development: The creation of smart, autonomous applications that self-construct to your exclusive financial requirements.

- AI Agent Integration: Whether it’s a CRM, ERP, or internal dashboard, our team ensures your AI agents connect seamlessly with your existing tools, platforms, and data systems.

- Advanced AI Agent Model Optimization: Our optimization process ensures the agent remains relevant, accurate, and aligned with user behavior over time.

Your Agentic AI programs gain a solid, enterprise-level foundation through our long-term relationships with industry giants, including AWS, Azure, and Google Cloud Platform.

We not only make your mission-critical Agentic AI structures secure but also highly interoperable within the highly regulated financial context, where we attentively comply with stringent standards such as GDPR and ISO 27001. Additionally, we ensure that your financial tools are secure, compliant, and capable of withstanding all relevant regulatory risks, including FinCEN, FINTRAC, PSD2, PCI-DSS, AML, and KYC, so you can have peace of mind.

Using our expertise and status as edge leaders, experienced cloud integrators, and intelligent analytics leaders, we know how to de-risk the most complex Agentic AI projects. Whether it is retrofitting complex legacy systems or enabling the rollout of enterprise-wide Agentic AI deployments, we handle it effortlessly and deliver results.

Agentic AI in finance requires more than autonomy—it demands governance-first design.

- Governed autonomy for AI agents

- Human-controlled execution and kill-switch safeguards

- Explainable, auditable financial decision systems

- Regulatory-ready AI aligned with financial risk frameworks

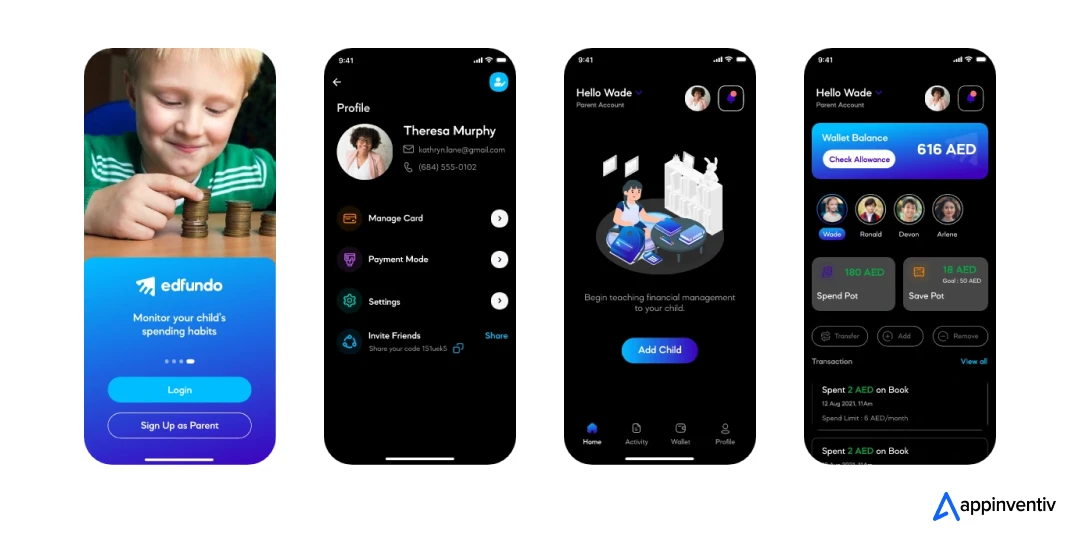

Our Innovative Fintech-Based Projects:

These projects also prove that our Fintech Software Development Services are exceptional:

- Mudra: We also created an AI-enabled budget app, specifically designed for the millennial market, which has been launched and built in over 12 countries to date, showcasing our global presence and influence in the consumer fintech space.

- Smart AI-Based Banking Solution: We have developed a smart AI-based banking solution for one of Europe’s leading banks, which has increased customer retention by 20% and significantly reduced manual work by 35%.

- EdFundo: We have developed the world’s first financial intelligence platform for children, which we are very proud of, and it is called EdFundo. The revolutionary project not only attracted the pre-seed funding of $500K but was also awarded the best start of the year, FinTech Startup, which proves our ability to innovate.

Our unwavering focus on the flawless AI development process and our passion for people have earned us acclaim worldwide and the most prestigious awards in the field. These are luxurious awards:

- Spring 2025 Global Clutch Awards

- Top 100 Fastest-Growing Companies list for 2025

- Top Custom Software Development Firm 2025

- Fastest Growing AI Development Companies of 2024

- Deloitte Fast 50 India 2023 Award

These awards are concrete testimonies that we are indeed highly committed to providing the best possible results to our clients.

To succeed realistically, jump confidently into the world of Agentic AI, and to become a competitive firm, we invite you to join our development team. We would like to partner with you to undertake the comprehensive digitalization of your financial company and establish your leadership in this emerging digital revolution.

FAQs

Q. How can Agentic AI improve financial decision-making?

A. Agentic AI in financial decision-making would improve financial decision-making because it will analyze huge datasets on its own, notice the patterns, and define practical instructions in real-time. It analyzes market trends, historical statistics, and economic data to provide individual investment recommendations, efficiently manage the portfolio, and forecast market changes with utmost precision. Bypassing the human element and utilizing predictive analytics, Agentic AI enables quicker decisions based on data, rather than emotion and opinion, which will make a significant difference in the lives of individuals and institutions.

Q. How does Agentic AI revolutionize banking operations?

A. The agentic AI transforms the entire banking practice by decentralizing services and increasing operational flexibility. It automates work in the back office, including loan processing, KYC (Know Your Customer) verification, and contract management, resulting in a considerable reduction in turnaround time. Its ability to merge with legacy systems streamlines processes, reducing the incidence of errors. Additionally, Agentic AI promotes better cybersecurity activities through the prior detection of threats and improves customer service using artificial intelligence chatbots and predictive analytics, while also enhancing the efficiency of operations.

Q. How does Agentic AI support financial institutions?

A. Financial institutions rely on agentic AI to increase the level of advanced analytics and AI-powered automation in finance tools as well as customer engagement. It enables real-time risk management and monitors market volatility, as well as regulatory changes. Additionally, it will help ensure compliance by automating reporting and ensuring that complex regulations are followed. In customer-facing activities, Agentic AI offers hyper-conventional services, including customer-specific offerings such as loans or investment schemes. Its predictive functions aid institutions in foreseeing the requirements of customers and the market.

Q. What impact will Agentic AI have on the future of finance?

A. There is a reason why agentic AI will become the key to transforming finance in the future to be more imaginative, individualized, and stable. It will enable the development of hyper-efficient markets where transactions, risk measurements, and portfolio balancing will occur in real-time. The technology will make advanced financial products more accessible, providing people with access to advisory services powered by AI. Additionally, with Agentic, AI regulatory compliance and fraud detection will improve, thereby cultivating trust. In its evolution, it will establish a universal, dynamic, and predictive financial environment, serving as the basis for how the world creates and manages wealth.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Data Mesh vs Data Fabric: Which Architecture Actually Scales With Business Growth?

Key takeaways: Data Mesh supports decentralized scaling, while Data Fabric improves integration efficiency across growing business environments. Hybrid architectures often deliver flexibility, governance, and scalability without forcing premature enterprise-level complexity decisions. Early architecture choices directly influence reporting accuracy, experimentation speed, and future AI readiness across teams. Phased adoption reduces risk, controls costs, and allows architecture…

Governance vs. Speed: Designing a Scalable RPA CoE for Enterprise Automation

Key takeaways: Enterprise RPA fails at scale due to operating model gaps, not automation technology limitations. A federated RPA CoE balances delivery speed with governance, avoiding bottlenecks and audit exposure. Governance embedded into execution enables faster automation without introducing enterprise risk. Scalable RPA requires clear ownership, defined escalation paths, and production-grade operational controls. Measuring RPA…

How AI Overhauling Industrial Automation in Australia

Key takeaways: AI is shifting industrial automation from rule-based to data-driven decision ecosystems Predictive and autonomous operations are improving efficiency and cost optimisation Australian industries are leveraging AI to solve workforce, sustainability, and compliance challenges Enterprises adopting AI early gain competitive, operational, and economic advantages Industrial automation in Australia is no longer just an engineering…