- What is a Robo-Advisor and How Does it Work?

- Robo-Advisor Regulatory Compliance Regulatory Framework

- Technology Stack Selection for Enterprise Robo-Advisor Platform

- Core Platform Architecture

- Enterprise-Grade Operational Capabilities

- Third-Party API and Integration Ecosystem

- Benefits of Robo-Advisor Platform Development for an Investment Firm

- Cost-Effective Solutions

- No Minimum Account Balances

- Real-Time Analytics and Advice

- Emotion-Free Decision-Making

- Comprehensive Documentation

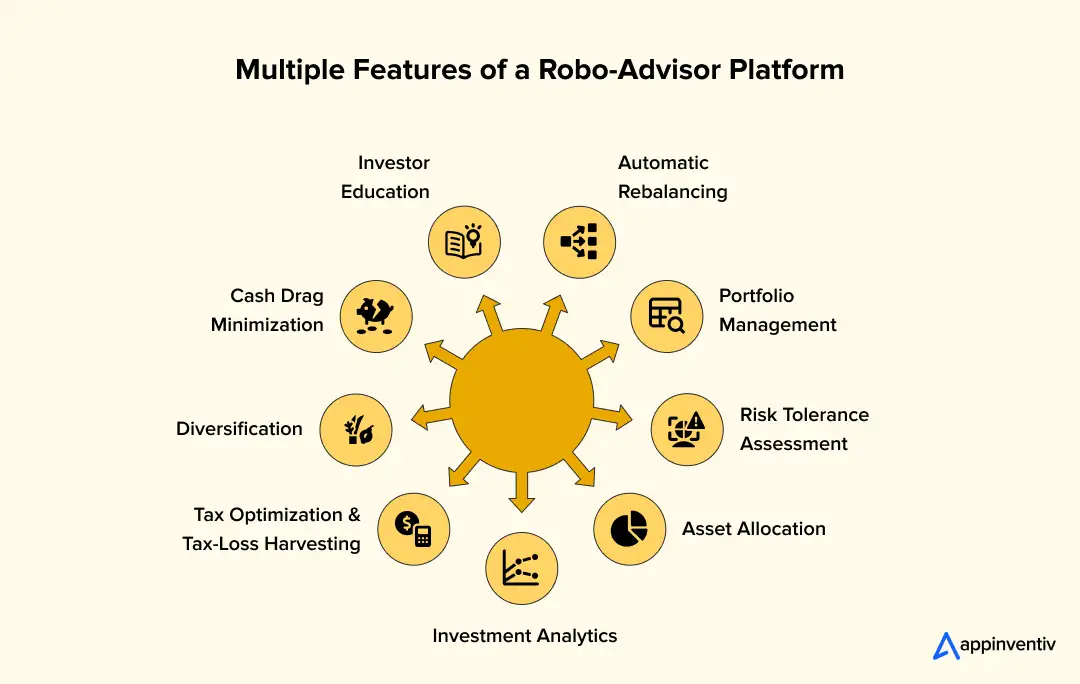

- Key Robo Advisor App Features of the Robo-Advisor Platform

- Automatic Rebalancing

- Portfolio Management

- Risk Tolerance Assessment

- Asset Allocation

- Investment Analytics

- Tax Optimization and Tax-Loss Harvesting

- Diversification

- Cash Drag Minimization

- Investor Education

- Components of a Robo-Advisor

- Frontend for Customers

- Money Management Algorithms

- Financial APIs

- Backend System Management

- Portal for Partners

- How to Build a Robo-Advisor Platform?

- Discovery Phase

- Proof of Concept

- Design

- Development

- Deployment and Maintenance

- How Much Does It Cost to Make a Robo-Advisor?

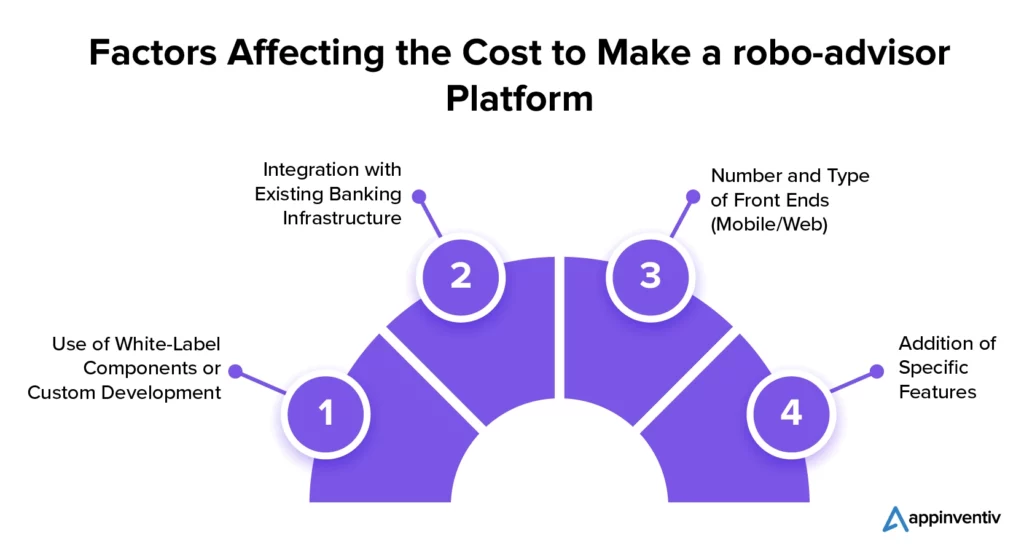

- Factors Affecting the Cost to Make a Robo-Advisor Platform

- Future Trends Shaping Robo-Advisor Platforms

- How Can Appinventiv Help You Empower Your Business with a Robo-Advisor Platform?

- FAQ’s

Key Takeaways

- AI-powered robo-advisors transform wealth management into scalable, automated digital investment infrastructure.

- Compliance-first architecture ensures regulatory readiness, auditability, and faster market licensing approvals.

- Cloud-native microservices enable secure scaling, real-time portfolio intelligence, and continuous availability.

- Integrated banking, trading, and KYC APIs accelerate deployment and reduce operational complexity.

- Advanced AI engines deliver automated rebalancing, tax optimization, and data-driven portfolio governance.

- Enterprise-grade platforms require $200K–$400K investment for full compliance and scalability.

Robo-advisor platform development is driving the shift toward AI-powered, automated investment advisory systems that deliver real-time portfolio intelligence at enterprise scale. This innovative technology has not only transformed the way we approach investments but is set to revolutionize the whole financial industry.

According to Statista, the robo-advisor market reached a valuation of $2.06 trillion in 2025 and is expected to reach $2.38 trillion by 2029, underscoring a clear surge in popularity for this cutting-edge investment approach.

In this era where businesses are compelled to adapt and leverage innovative solutions to stay ahead, investing in robo-advisor platform development has become not just an option but a strategic imperative. From enhancing operational efficiency, automating financial decision-making, and optimizing wealth management strategies, the advantages of a robo-advisor platform are manifold.

This blog will serve as a comprehensive guide that will help you understand the intricacies of developing a robo-advisor platform and its cost dynamics. On average, the robo-advisor platform development cost can range from $35,000 to $300,000 or more depending on multiple factors.

We will delve into all factors in detail, but first let us look into the basics and understand why building a robo-advisor application is important for your business.

What is a Robo-Advisor and How Does it Work?

A robo-advisor operates as an automated investment platform that utilizes algorithms, drawing on artificial intelligence and machine learning. Its main purpose is automated finance management, making it especially advantageous for newcomers or those with smaller portfolios.

Here is a comprehensive analysis of the functioning of robo-advisor platform development for investment firm operations.

- Investor Input: Users provide crucial information, such as their investment objectives, level of comfort with risk, and other pertinent details.

- Algorithmic Portfolio Creation: The algorithm then constructs a personalized investment portfolio tailored to meet the specific needs of the investor, drawing insights from the provided data.

- Continuous Monitoring and Adjustments: The robo-advisor consistently monitors investments, making necessary adjustments to uphold the desired balance between risk and return.

This automated approach relieves investors of the constant burden of making investment decisions, streamlining the entire process.

[Also Read: How to Develop an Investment App Successfully for Your Business?]

Many teams have the product vision ready, but the rules are still unclear. Before planning features or tech, you need to understand regulations around automated investment advice. In regulated markets, robo-advisor platforms must be built compliance-first, so licensing, audit readiness, and investor protection never become roadblocks.

Robo-Advisor Regulatory Compliance Regulatory Framework

Here is the reality. A robo-advisor platform does not live in the world of normal software products. The moment it starts giving investment advice or touching client money, regulators step in. Many teams only realize this after development is halfway done. That is when budgets stretch and timelines slip. Building with compliance in mind from the start saves painful rework later.

In modern implementations, compliance monitoring, risk profiling, and portfolio supervision are increasingly handled through AI-powered governance and automated audit systems.

In the United States, robo-advisors are treated like investment advisory businesses. Platforms must show that advice is responsible, traceable, and properly supervised. If your product also executes trades, oversight becomes even stricter. Identity checks, transaction monitoring, and security audits are part of daily operations, not optional add-ons.

Typical US requirements include:

- SEC investment adviser registration

- Documented investment advice logic

- FINRA supervision for trade execution

- KYC and AML verification processes

- Security and audit certifications such as SOC 2

In Europe and the UK, the conversation shifts to suitability and data privacy. Regulators expect proof that your risk questionnaires work, that automated advice is recorded, and that users stay in control of their data.

Common requirements include:

- MiFID II suitability checks

- Stored records of automated advice

- GDPR and UK GDPR data controls

- Tested risk-profiling models

In Middle Eastern markets, platforms often require financial authority approval, local data hosting, and, sometimes, Sharia-compliant investment options.

Regional requirements usually involve:

- Licensing from financial regulators

- Data residency rules

- Local investment constraints

No matter the region, some basics never change:

- Built-in KYC and AML flows

- Encrypted data handling

- Role-based system access

- Clear, explainable portfolio decisions

- Full audit trails

When compliance is part of the foundation, approvals move faster, and enterprise trust comes much easier.

Technology Stack Selection for Enterprise Robo-Advisor Platform

For enterprise robo-advisor platform development, technology selection defines scalability, regulatory readiness, and total cost of ownership. The stack must support AI-powered portfolio intelligence, real-time financial operations, and automated compliance monitoring.

Core Platform Architecture

The following technology layers form the foundation of a secure and scalable robo-advisor platform.

| Layer | Recommended Technologies | Enterprise Purpose |

|---|---|---|

| Frontend (Web and Mobile) | React, Next.js, Flutter | Unified multi-channel user experience and faster release cycles |

| Backend Services | Java, Node.js, Microservices | Modular business logic and scalable transaction processing |

| AI and Portfolio Engine | Python, Scikit-learn, TensorFlow | Risk profiling, asset allocation, and explainable investment models |

| Data and Storage | PostgreSQL, MongoDB, Redis | Secure record keeping, audit logs, and real-time analytics |

| Integration Layer | REST and GraphQL APIs, Open Banking APIs, FIX | Connectivity with banks, custodians, and market data providers |

| Cloud Infrastructure | AWS, Azure, GCP | Compliance grade hosting, disaster recovery, and data residency |

| Security and Compliance | IAM, Encryption, SIEM, Audit Logs | Data protection, access control, and regulatory audit readiness |

Enterprise-Grade Operational Capabilities

These operational capabilities ensure the platform meets institutional performance and governance expectations.

| Capability | Enabled By | Business Impact |

|---|---|---|

| Horizontal Scalability | Microservices and Cloud | Supports growing investor volumes without downtime |

| Regulatory Audit Readiness | Immutable logs and Reporting APIs | Faster licensing and compliance verification |

| AI Model Governance | Explainable ML and Drift Monitoring | Reduces model risk and fiduciary exposure |

| System Resilience | Auto scaling and Disaster Recovery | Ensures continuous investment availability |

| Secure Integrations | Encrypted APIs and RBAC | Protects financial and identity data |

A cloud native, microservices-driven, compliance-first technology stack allows enterprises to launch robo-advisor platforms that scale securely, pass regulatory audits, and integrate seamlessly into existing financial ecosystems without long-term technical debt.

Third-Party API and Integration Ecosystem

Most enterprise teams discover this the hard way. A robo-advisor is not just a portfolio engine. It is a network of financial services stitched together, and the quality of those connections decides how fast you launch and how steady the platform feels once real money starts moving.

At scale, external infrastructure is unavoidable. The real differentiator is how cleanly your platform plugs into it.

- Banking and Account Aggregation: Open banking APIs pull customer account data into a single view, process fund transfers, and confirm balances instantly. Tools like Plaid, Yodlee, or Finicity keep transaction data in sync, so users do not have to refresh screens or upload statements to see where they stand.

- Trading and Custody Execution: Trading APIs place orders, manage settlement, and maintain asset custody. Providers such as Alpaca, DriveWealth, Interactive Brokers, and institutional custodians keep execution, reconciliation, and reporting aligned with regulatory expectations. This removes the need for manual back-office intervention when volumes grow.

- Market Data Feeds: Allocation engines live on real-time price and benchmark data. Market data providers and exchange feeds stream continuous updates, keeping valuations accurate during calm sessions and during sudden intraday swings.

- KYC and AML Verification: Identity and compliance APIs automate onboarding, sanctions checks, and transaction monitoring. Services like Onfido, Trulioo, and ComplyAdvantage help you verify customers quickly without creating friction at signup.

- Tax and Regulatory Reporting: Tax and reporting services translate portfolio activity into jurisdiction-specific statements and audit records. This becomes essential once you expand across regions with different disclosure rules.

A thoughtful integration layer shortens build time, smooths regulatory reviews, and keeps operations stable as you scale. In enterprise robo-advisory, architecture at the integration level often determines whether growth feels controlled or chaotic.

Benefits of Robo-Advisor Platform Development for an Investment Firm

Investment firms investing into robo-advisor development gain operational efficiency, data-driven insights, and enhanced client interactions. This allows them to position themselves as agile leaders in the ever-evolving financial landscape. Let us look at the multiple benefits in detail below:

Cost-Effective Solutions

Digital advisors offer a range of advantages, and one of the most significant is their affordability. When it comes to annual fees, they come in at a much lower cost compared to personal finance managers. In fact, the fees typically amount to just a fraction of what a traditional finance manager would charge: around 0.2-0.4% of the client’s balance. This cost-effectiveness is what makes robo-advisors a compelling choice for individuals seeking financial guidance without the burden of high fees typically associated with traditional wealth management.

No Minimum Account Balances

Robo-advisors provide financial advice without minimum account balance requirements. Human wealth managers often set high minimums, as their income depends on clients’ assets under management. Thus, they find advising low-balance accounts unprofitable. However, robo-advisors’ digital platforms scale easily. So they can profitably serve clients of all asset levels. This greater accessibility makes robo-advisors uniquely valuable for beginning investors with limited capital.

Real-Time Analytics and Advice

Automated financial advisors, known as robo-advisors, offer a valuable advantage with their real-time analytics and advisory capabilities. Unlike human finance managers, who are limited by their inability to monitor markets constantly, robo-advisors are accessible 24/7. They swiftly respond to market fluctuations, rapidly adjusting their recommendations for all clients, ensuring timely responses to dynamic market conditions.

Emotion-Free Decision-Making

Emotions can negatively impact financial decisions, resulting in less than ideal outcomes. Robo-advisors excel in supplying investment recommendations free from emotional influence. Their suggestions derive from the impartial, goal-oriented analysis so that each investor receives guidance grounded in the rational examination, not subjective biases.

Comprehensive Documentation

In order to effectively manage investment advice, it is essential to have a system in place. Robo-advisors streamline this process, unlike traditional finance managers requiring clients to record advice across channels. The mobile app conveniently provides all recommendations in an organized, documented manner, simplifying access and tracking for clients. This persuasively shows how robo-advisors assist in easily monitoring financial guidance.

Key Robo Advisor App Features of the Robo-Advisor Platform

Robo-advisor platforms combine AI-powered financial intelligence, automation, and data-driven decisioning to deliver scalable wealth management. For enterprises, these features define investment consistency, regulatory reliability, and platform operating efficiency.

Automatic Rebalancing

Rebalancing engines continuously monitor portfolio drift against target allocations using real-time market data feeds. Threshold-based and time-based triggers initiate automated trade execution through integrated brokerage or custody APIs. Order-routing logic accounts for transaction costs, liquidity constraints, and tax impact before execution, ensuring disciplined portfolio alignment at scale.

Portfolio Management

Portfolio management services orchestrate the full investment lifecycle. Core services maintain investor profiles, track goals, record holdings, and document transaction histories. Event-driven architectures process market movements and investor actions, while optimization services recalibrate portfolios based on risk limits, exposure caps, and liquidity requirements.

Risk Tolerance Assessment

Digital onboarding workflows combine structured risk questionnaires with behavioral scoring models. Suitability engines map investor responses to risk bands using rule-based and probabilistic scoring logic. Results are stored as immutable compliance records and continuously validated against evolving portfolio risk exposure.

Asset Allocation

Allocation engines apply mean-variance optimization, factor modeling, and correlation analysis to construct diversified portfolios. Market data services feed volatility metrics, expected return curves, and covariance matrices into optimization solvers. Outputs are converted into executable allocation strategies through portfolio construction services.

Investment Analytics

Investment analytics layers aggregate portfolio performance, benchmark comparisons, drawdown metrics, and exposure breakdowns. Stream-processing pipelines handle real-time valuation updates, while reporting services generate compliance-ready statements and performance dashboards for investors and internal oversight teams.

Tax Optimization and Tax-Loss Harvesting

Tax engines scan portfolios for unrealized losses, evaluate wash-sale constraints, and generate tax-efficient trade proposals. Execution workflows place offsetting trades through custody APIs to maintain market exposure. Tax impact simulators project post-trade liabilities and feed compliance reporting modules for audit readiness.

Diversification

Diversification logic enforces asset class, sector, geography, and instrument-level exposure limits. Constraint engines validate portfolio construction against concentration thresholds and regulatory investment guidelines before trade execution.

Cash Drag Minimization

Liquidity engines monitor idle cash balances and automatically allocate surplus funds into short-duration instruments or money market products. Treasury services handle settlement timing, redemption logic, and liquidity risk controls.

Investor Education

Knowledge modules integrate portfolio explainers, risk visualizations, and scenario simulators. Content services personalize educational material based on investor behavior and portfolio events, reinforcing transparency and trust in automated decision systems.

Components of a Robo-Advisor

To build an effective robo-advisor, several key components must come together. By integrating the right elements, one can craft a streamlined financial platform that truly serves each client. The core elements include:

Frontend for Customers

A robo-advisory platform leads with a user-friendly interface, typically a web dashboard or mobile/web apps. Here, clients complete onboarding like Know Your Customer(KYC) and profiling. This space also enables users to monitor and manage investments conveniently. The accessible design provides a valuable interaction point.

Money Management Algorithms

When you look behind the easy-to-use customer interface, you’ll find the core of the robo-advisor: a machine learning platform with AI algorithms. This key component enables personalized portfolio options, with potentially hundreds of choices matched to different user needs and preferences.

The algorithms carefully analyze customer information – goals, risk tolerance, and investing ability – to build and manage optimal portfolios. Plus, additional algorithms can enable extra functions like tax loss harvesting or student loan management, further strengthening the value of the robo-advisor’s offerings.

Financial APIs

Financial Application Programming Interfaces (APIs) are essential for the smooth functioning of robo-advising platforms. By connecting to bank accounts, these APIs enable the automation of long-term investments and deliver guidance on optimal money management approaches.

Specifically, financial APIs handle critical operations like trade execution, portfolio balancing, and integration with supplementary financial systems. Overall, they form the backbone of robo-advisor functionalities through systematic portfolio management and personalized financial planning suggestions.

Backend System Management

An efficient and accurate robo-advisory system requires a robust back-end foundation. This workspace enables financial advisors to refine and validate portfolio balancing strategies. Additionally, it facilitates the robo-advisor development and oversight of investing algorithms, promoting continuous enhancements. By tracking overall financial performance, the back-end verifies that the robo-advisor meets rigorous reliability and efficacy standards.

Portal for Partners

For employers seeking to offer competitive 401(K) plans through a robo-advisory platform, a dedicated portal for partners is crucial. This dashboard allows employers to track payroll, balances, earnings, and other relevant metrics. It ensures a comprehensive view of the performance and engagement of their employees within the robo-advisory framework, enabling effective management of retirement plans and financial well-being initiatives.

How to Build a Robo-Advisor Platform?

To ensure the efficiency and effectiveness of a robo-advisor, the process of its creation requires strategic planning. We recommend partnering with a dedicated robo-advisor fintech app development firm as their expertise can bring a specialized focus to the robo-advisor platform, ensuring optimal development and implementation.

Here, we outline the key steps involved in robo-advisor platform development.

Discovery Phase

This robo-investment platform’s development phase primarily involves setting ROI goals and making informed technology estimates. To ensure a smooth transition, it is recommended to conduct a pre-flight workshop. This workshop serves as a platform to identify priority features, align business goals, and establish the technical architecture required for the optimal solution.

Proof of Concept

A proof of concept will be developed to assess the efficiency of machine learning algorithms in the context of a robo-advisor. This entails the creation of ML algorithms that analyze customer data and generate portfolios tailored to individual client preferences. Multiple portfolio models will be formulated and evaluated using historical stock market data.

[Also Read: POC vs. MVP vs. Prototype: The Strategy Closest to Product Market Fit]

Design

This robo-investment platform’s development task involves designing the front ends of consumer-facing mobile and web applications. This includes working on user flows, creating low-fidelity UI wireframes, and later advancing to high-fidelity UI screens. It is important to develop an interactive prototype, test it with users, and make adjustments to the UX/UI based on their feedback. Moreover, it is crucial to involve developers in the design process to ensure its practicality and feasibility.

Development

Once the proof of concept and design have been validated, the next step is to progress into the development phase. In this phase, one must write code and perform automated as well as manual tests to identify and resolve any glitches or issues. It is advisable to follow an agile development approach, releasing updates every two weeks to enhance the product-market fit.

To ensure smooth coordination among the development team of robo advisor app developers, which includes front-end developers, mobile engineers, back-end coders, testers, and UX/UI engineers, it is essential to have a dedicated product manager and project manager.

Deployment and Maintenance

The deployment of the robo-advisor to the public involves transitioning the platform to the production environment. Additionally, if applicable, mobile apps will be uploaded to the App Store and Google Play. Ongoing maintenance includes monitoring system performance, addressing issues, and evaluating user engagement patterns. This process informs the next development cycle, ensuring that updates introduce new features and also address any unnoticed user concerns.

How Much Does It Cost to Make a Robo-Advisor?

When it comes to developing an MVP , one can expect the robo-advisor app development cost to range from $35,000 to $300,000 or more. Various factors influence the cost of developing the FinTech platform

To simplify planning, typical robo-advisor development cost levels fall into three tiers.

| Product Level | Typical Cost (USD) | Platform Scope |

|---|---|---|

| MVP Platform | $40,000 – $120,000 | Core onboarding, basic portfolio logic, web interface |

| Mid-Level Platform | $120,000 – $250,000 | Advanced features, mobile apps, API integrations |

| Enterprise Platform | $250,000 – $400,000+ | Full compliance, AI engines, banking and custody integrations |

Here is a cost breakdown by development phase:

| Development Phase | Cost Range (USD) | Focus Area |

| Discovery and Architecture | $10,000 – $30,000 | Business and technical planning |

| UX and Risk Profiling | $15,000 – $40,000 | Onboarding and suitability flows |

| Core Platform Development | $60,000 – $180,000 | Backend services and APIs |

| AI and Portfolio Intelligence | $25,000 – $70,000 | Risk and allocation engines |

| Compliance and Security | $20,000 – $60,000 | KYC, AML, audit logs |

| Web and Mobile Applications | $30,000 – $90,000 | Investor interfaces |

| Integrations | $15,000 – $50,000 | Banking and data feeds |

| Cloud and DevOps | $10,000 – $40,000 | Hosting and monitoring |

| Testing and Validation | $10,000 – $30,000 | QA and compliance checks |

Factors Affecting the Cost to Make a Robo-Advisor Platform

Several technical, regulatory, and product design decisions directly influence the total investment required to build and scale a robo-advisor platform.

- White-Label Robo-Advisor Platform vs Custom Robo-Advisor Development: White-label solutions reduce initial development costs but limit control over compliance logic and platform differentiation. Custom development increases upfront investment if compared with a white-label robo-advisor platform but supports long-term scalability and regulatory flexibility.

- Integration with Banking and Custody Infrastructure: Costs rise with the number of banking APIs, custody platforms, payment rails, and market data feeds that must be integrated and certified.

- Number and Type of User Interfaces: Developing both web and mobile applications increases cost, particularly when supporting secure onboarding, biometric authentication, and real-time portfolio views.

- Feature and Compliance Depth: Advanced capabilities such as tax optimization, automated rebalancing, explainable AI, and regulatory reporting modules significantly influence total cost.

Future Trends Shaping Robo-Advisor Platforms

Most wealth platforms are hitting a turning point. The old robo advisory software development model still works, but it no longer feels enough for markets that shift by the hour and clients who expect instant clarity. Your platform has to respond fast, stay compliant, and still feel simple to use.

Robo-advisors are evolving into AI-native wealth infrastructure. A few technology shifts are shaping where this is heading.

Continuous Portfolio Intelligence

Rebalancing is no longer a monthly routine. Modern engines absorb live market data and economic signals, then adjust allocations as conditions change. Think of a sudden market swing mid-day. Instead of waiting for overnight processing, the portfolio responds while timing still matters.

Explainable and Governed Ai

Strong returns are only part of the equation. Compliance teams need visibility into how models make decisions. New AI operations focus on explainability, validation trails, and bias checks, so when regulators ask for evidence, your team already has it.

Conversational Wealth Interfaces

Dashboards are being joined by natural language interfaces. Investors and advisors can ask direct questions about performance, risk, or tax impact and get immediate answers from portfolio-connected AI, not static reports.

Tokenized and Fractionalized Assets

Blockchain-based custody is expanding what portfolios can hold. Robo-advisors are beginning to manage traditional securities and tokenized assets inside the same compliance and reporting structure, without disrupting back-office operations.

Teams that design for these shifts now will define the next generation of digital wealth platforms.

How Can Appinventiv Help You Empower Your Business with a Robo-Advisor Platform?

Custom robo-advisor development has the potential to revolutionize the financial industry, benefiting banks, startups, and financial institutions alike. It can have a positive impact on budgets, expedite returns, and enhance data analysis and client investment management efficiency. This tailored solution aims to automate routine operations and streamline processes, resulting in a more effective and seamless financial experience.

To unlock the full benefits of robo-advisor application development, consider entrusting the skilled team at Appinventiv. Our FinTech software development services not only align with your specific needs and objectives but also ensure a seamless integration of cutting-edge technologies for a robust and future-ready solution.

You can also explore the success we have achieved together with our clients in shaping the future of finance through AI and automation. For example, we built Mudra, an AI-powered budgeting app helping millennials better manage their money. We also collaborated with Bajaj Finserv to create a next-generation financial marketplace improving access. Our robo-advisor app developers can assist visionary clients like yourself in leveraging automation and AI to transform financial services, enhancing both customer experiences and business outcomes. Connect with us!

FAQ’s

Q. What is a robo-advising platform?

A. A robo-advising platform is a software or an application that leverages AI algorithms and automation to offer financial guidance to FinTech businesses and oversee their investment portfolios in a digital format. Its primary objective is to simplify and automate the investment process, providing users with increased accessibility and cost efficiency.

Q. How much does it cost to develop a robo-advisor app?

A. Robo-advisor app development cost can vary between $40,000 and $400,000. There are several factors that can impact the overall cost of development, such as the location of the hired app development firm, the overall app complexity, time frame for development, the features to be integrated into the app, etc. It is advised to get in touch with a dedicated app development company to get custom quotes based on your custom business requirements.

Q. Do robo-advisors make money?

A. Robo-advisors typically generate revenue through management fees, often calculated as a percentage (0.25% to 0.75%) of the assets under management (AUM). The fees are usually lower than those charged by traditional financial advisors, making robo-advisors an attractive and cost-effective option for investors.

Q. How long does it take to develop a robo-advisor app?

A. The time required for robo-advisor platform development can vary based on factors such as the desired features, complexity, and technology involved. On average, it typically takes anywhere from 6 to 12 months to create a fully functional and user-friendly robo-advisor fintech application.

Q. Should we build or buy a robo-advisory platform?

A. Buying a white-label robo-advisory platform accelerates time to market and reduces upfront costs. Building a custom AI-powered robo-advisor offers greater control over compliance logic, data ownership, and differentiation. Enterprises typically adopt a hybrid approach, starting with pre-built components and evolving toward a fully customized platform as scale and regulatory needs grow.

Q. How do robo advisors integrate with core banking systems?

A. Robo-advisors integrate with core banking systems through secure APIs and open banking frameworks. These connections enable account aggregation, fund transfers, transaction verification, and real-time balance updates. Middleware and integration layers handle data normalization, encryption, and reconciliation, ensuring seamless interoperability between AI-powered portfolio engines and existing banking infrastructure.

Q. What features are essential for an enterprise robo advisor MVP?

A. An enterprise robo-advisor platform requires AI-driven risk profiling, automated portfolio allocation, basic rebalancing, KYC and AML onboarding, secure user authentication, core banking integration, and compliance-ready audit logs. A web-based investor dashboard and reporting module are also essential for validating usability, regulatory alignment, and early-stage investor engagement before scaling.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…