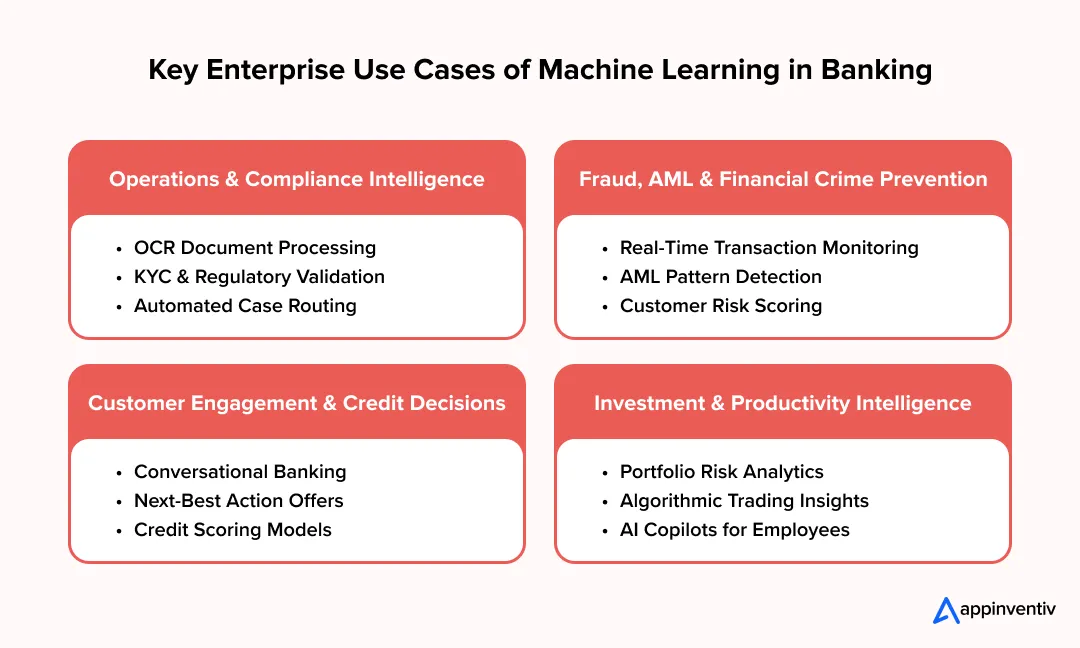

- Key Enterprise Use Cases of Machine Learning in Banking

- Operational Automation and Compliance Intelligence

- Machine Learning for Fraud Detection in Banking, AML, and Banking Crime Prevention

- Cybersecurity and Risk Monitoring

- Customer Engagement and Credit Risk Decisions

- Investment, Portfolio, and Internal Productivity Intelligence

- Executive Snapshot: Banking Leadership View

- Business ROI and Benefits of Machine Learning in Banking

- Challenges of ML in Banking Industry

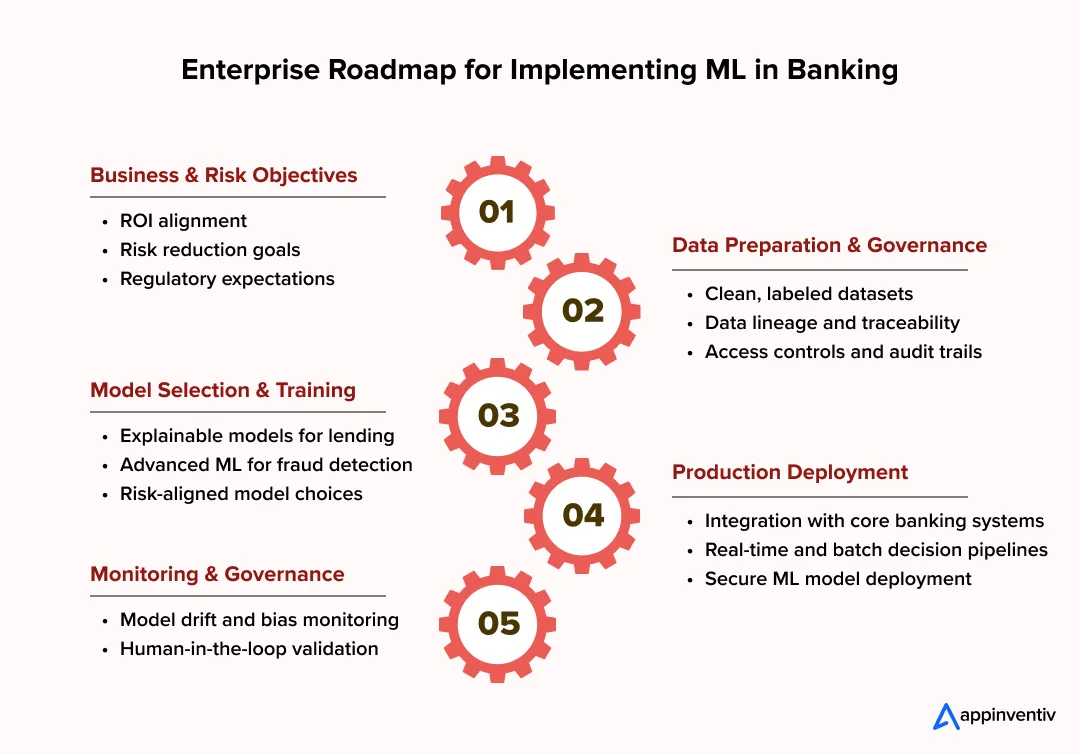

- Implementing ML in Banking Operations

- Define Business and Risk Objectives

- Prepare and Govern Banking Data

- Select and Train the Right Models

- Deploy and Monitor Models in Production

- Establish Ongoing Governance and Optimization

- Future Outlook: Where Machine Learning in Banking Is Headed

- How Appinventiv Helps Banks Implement Machine Learning at Scale

- Frequently Asked Questions

- Discover how machine learning is revolutionizing banking operations, from fraud detection to personalized financial experiences.

- Explore real-world ML use cases transforming back-office efficiency, customer engagement, and regulatory compliance in global banks.

- Learn a step-by-step roadmap for implementing machine learning in banking with measurable ROI and business impact.

- Understand key regulatory, ethical, and change management considerations for responsible AI adoption in financial institutions.

- Gain insights into future trends like explainable AI, synthetic data, and quantum ML shaping next-gen banking innovation.

Banks are feeling the pressure from every side. Customers expect instant decisions, regulators expect tighter controls, and data keeps piling up faster than legacy systems can handle. If your team is still leaning on rule-based workflows or manual reviews, scaling becomes difficult very quickly. That is why machine learning in banking has moved from experimentation to necessity.

The global AI in banking market size was estimated at $34.58 billion in 2025 and is expected to reach $379.41 billion by 2034, expanding at a compound annual growth rate of over 30 %. This rapid growth reflects increasing adoption of intelligent automation and data-driven decision systems across financial institutions worldwide, especially in areas such as risk management, fraud prevention, and customer engagement.

Across the banking industry, teams are using data-driven models to automate decisions, flag anomalies, and make sense of complex financial data. Fraud detection, credit assessments, and compliance checks now happen faster and with greater consistency. ML in the banking sector helps reduce delays while improving accuracy and resilience.

For regulated banks in machine learning in the banking industry, the challenge is different from that of fintechs, particularly under frameworks such as BCBS 239, SR 11-7 model risk management guidelines, and region-specific data protection regulations like GDPR and PDPL.

You are working within legacy platforms, strict governance rules, and ongoing regulatory oversight. Success depends less on model performance alone and more on how machine learning fits into daily workflows, risk controls, and decision processes.

This guide looks at practical machine learning use cases in banking and how ML in banking operations can deliver measurable results without compromising compliance, security, or scalability.

Banks using ML have achieved up to 60% fraud reduction and 50% faster loan approvals. See how enterprise-grade machine learning in banking translates into real operational ROI.

Key Enterprise Use Cases of Machine Learning in Banking

Most banks do not adopt machine learning in one big leap. It usually begins when a specific system starts slowing teams down or increasing risk exposure. Alert queues grow faster than compliance teams can clear them.

Loan approvals stretch from minutes to days. Advisors spend more time preparing for client conversations than engaging in them. As a result, adoption has accelerated across machine learning in the banking industry.

Today, nearly nine out of ten financial services organizations already use AI or ML tools, and about half have increased their investment by more than 25% in recent years as these operational bottlenecks intensify.

This is typically the point where machine learning in banking earns its place as a core operational capability rather than an experimental initiative.

Below, each enterprise use case is paired with a real example to keep the impact concrete and grounded.

Operational Automation and Compliance Intelligence

Document processing and compliance workflows are often the first pressure points. Volume increases, rules change, and manual reviews become fragile.

Machine learning is applied to:

- Extract and classify data from KYC files, loan documents, and regulatory records using OCR, computer vision solutions, and NLP-based entity extraction pipelines with confidence scoring

- Validate data consistency across systems before it reaches compliance teams

- Route edge cases for human review while clean cases move through automatically via case management systems that maintain full audit trails and decision logs.

Machine learning in banking examples in practice

HSBC replaced its rule-based AML tooling with a machine learning system called Dynamic Risk Assessment, built with Google Cloud. The platform identifies suspicious behavioral patterns, such as rapid fund movement across accounts. Since rollout, HSBC reduced false positives by 60% and detected two to four times more financial crime incidents, while maintaining strict responsible AI controls.

For banks modernizing compliance and transaction-heavy workflows, machine learning alone is not enough. The supporting cloud architecture must be resilient, cost-efficient, and capable of handling fluctuating workloads without introducing operational risk. This is especially true for challenger and digital-first banks operating at scale.

Machine Learning for Fraud Detection in Banking, AML, and Banking Crime Prevention

Financial crime is where ML in the banking sector maturity is most visible. Static rules struggle to keep up with evolving fraud patterns and generate large volumes of low-quality alerts.

The application of machine learning in banking includes:

- Enable real-time fraud detection with ML-based transaction scoring and event-driven architectures to monitor transactions

- Detect complex AML patterns through anti-money laundering machine learning that learns normal transaction behavior at scale using network analytics, behavioral typologies, and anomaly detection across transaction graphs.

- Continuously update customer risk scores as behavior changes

This shifts compliance teams from alert management to investigation.

As fraud and compliance use cases mature, banks quickly realize that siloed models do not scale. Real impact comes from integrating machine learning across fraud detection, customer risk profiling, and decision workflows, while maintaining explainability and regulatory alignment.

Cybersecurity and Risk Monitoring

Security teams in the ML in the banking sector face a different scale problem. Millions of signals arrive daily, far beyond what humans can triage manually.

Machine learning supports:

- Detection of unusual access behavior and credential misuse using User and Entity Behavior Analytics (UEBA)

- Early identification of phishing attempts and internal threats

- Risk-based prioritization of security incidents integrated with SIEM platforms and SOC workflows.

The value is often invisible. Issues are contained quietly, before escalation or regulatory reporting becomes necessary.

Customer Engagement and Credit Risk Decisions

On the customer side, ML in the banking sector balances speed with control. Decisions need to feel instant, but they still need to hold up under scrutiny.

Banks apply ML and AI to improve customer experience by:

- Power conversational assistants and in-app decision support

- Deliver next best product or service recommendations in real time

- Improve credit scoring through credit scoring machine learning models using both traditional and alternative data

Examples in practice

Santander uses machine learning to assess auto loan default risk in its US financing arm, speeding approvals while dynamically adjusting pricing as market conditions change.

JPMorgan Chase integrated a digital assistant into its Chase app, helping customers lock cards, check balances, and navigate services without human intervention.

Wells Fargo demonstrates the impact of machine learning in banking through an ML-driven engagement engine that suggests next best conversations for bankers, increasing engagement rates by up to 10x across digital and branch channels.

Investment, Portfolio, and Internal Productivity Intelligence

Machine learning also supports decision makers behind the scenes.

Firms use ML to:

- Analyze portfolios and market risk in real time using scenario analysis, stress testing, and factor-based models

- Optimize trading strategies and investment allocation

- Support employees with summarization and content generation

Examples in practice

BlackRock’s Aladdin platform applies machine learning to portfolio analytics and risk management, now enhanced with GenAI to summarize complex analyses for advisors.

Citigroup introduced Stylus, an internal AI agent that helps employees draft emails, generate presentations, and summarize documents, freeing time for higher-value work.

Together, these examples show the use cases of machine learning in banking that deliver real enterprise value, not as isolated models, but as systems embedded into workflows, controls, and decision-making where scale and accountability matter most.

At enterprise scale, banks prioritize machine learning use cases that reduce risk exposure, accelerate regulated decision-making, and remain explainable under audit.

Executive Snapshot: Banking Leadership View

- Reduced regulatory exposure through explainable decisions

- Faster risk adjudication without increasing oversight burden

- Measurable loss prevention with audit-safe automation

[Also Read: How AI is transforming the stock trading market]

Business ROI and Benefits of Machine Learning in Banking

Most banks do not invest in machine learning in banking for novelty. The question that comes up quickly is simple. Is this improving margins, reducing risk, or helping teams operate at scale? That focus is becoming more visible across machine learning in the banking industry.

The share of banks that have actively launched or soft-launched generative AI applications has climbed steadily, rising from 61% in 2023 to 77% in 2025.

This shift reflects a broader realization that the business ROI of machine learning in banking only materializes when ML is tied directly to financial performance and operational outcomes, not treated as a collection of isolated models.

- Reduce Operational Costs with ML at Scale: High-volume banking workflows are expensive to run manually. Machine learning automates repeatable tasks across operations, compliance, and reporting. This reduces cost while keeping accuracy and audit trails intact, which matters when regulators review decisions months later.

- Improved Risk Economics: In the ML in the banking sector, faster detection changes the economics of risk. Banking machine learning solutions shorten response cycles for fraud, AML, and operational issues. That speed limits exposure and reduces losses before they compound across systems.

- Higher Decision Accuracy in Lending: Credit teams feel the impact directly through ML-powered credit scoring. Credit scoring machine learning improves approval precision and portfolio performance without adding more manual reviews. Decisions get faster, and risk-adjusted returns improve at the same time.

- Scalable Growth Without Linear Cost Increase: Machine learning lets banks handle more transactions, customers, and compliance checks without hiring at the same rate. Growth becomes operationally sustainable instead of cost-heavy.

When ML is embedded into core workflows, the return is not abstract. It shows up in cleaner operations, tighter risk control, and growth that does not break the system.

Challenges of ML in Banking Industry

Most banks in the machine learning banking industry discover the hard part only after the first pilot. The models may work, but getting them into real banking operations is where friction shows up. In regulated, large-scale environments, ML success depends on handling constraints early, before progress slows or stalls.

- Data Privacy and Regulatory Compliance: Banks handle highly sensitive financial and personal data every day. Regulations like GDPR (EU), CCPA (US), PCI DSS, and region-specific banking mandates from bodies such as the FCA, EBA, and Central Bank of the UAE are not optional. If data governance is weak or unclear, machine learning in banking loses effectiveness and increases regulatory exposure instead of reducing it.

[Also Read: How to develop a PCI-compliant application?]

- Model Explainability and Bias Risk: Many fraud and credit scoring machine learning models behave like black boxes, creating friction during SR 11-7 reviews, fair lending audits, and regulatory examinations. That becomes a problem during audits or fair lending reviews. Without clear explanations, banks face higher compliance risk and tougher regulatory scrutiny, even when model outcomes look strong.

- Legacy System Integration: Modern ML models rarely plug cleanly into legacy core banking systems. Data silos, batch processing, and rigid architectures slow deployments and limit real-time decision making. This gap often delays value far more than model development itself.

- Operationalizing ML at Scale: Moving beyond pilots requires more than accuracy. Banks need monitoring for model drift, performance drops, and changing customer behavior. Without this, ML systems degrade quietly in production.

- Organizational Readiness and Change Management: Technology alone is not enough. Skills gaps, unclear ownership, and resistance across business, risk, and IT teams can stall progress. When teams are not aligned, even well-built ML initiatives struggle to scale.

Address data governance, explainability, and legacy integration challenges with proven machine learning development services built for regulated banking environments.

Implementing ML in Banking Operations

Most banks do not struggle with building models. In machine learning in the banking industry, the real challenge begins when those models need to survive audits, scale across teams, and deliver consistent results in production. That shift in focus is already visible across the industry.

In 2025, banks are applying AI and GenAI primarily to data-driven insights and personalization (85%), operational efficiency and automation (79%), security management and fraud prevention (78%), and regulatory compliance and risk prevention (71%).

These priorities underline a clear reality: implementing ML in banking operations succeeds only when execution is disciplined, production-ready, and aligned with regulatory and operational constraints from day one.

Define Business and Risk Objectives

Most ML initiatives struggle when the goal is vague. From the start, your team needs to be clear on what success looks like.

Effective machine learning in banking begins by:

- Defining outcomes such as cost reduction, lower risk exposure, or better decision accuracy

- Aligning business, risk, compliance, and IT teams early in the process

- Setting shared expectations that match regulatory and operational realities

This early alignment reduces rework later and keeps machine learning for banks focused on results that hold up under scrutiny.

Prepare and Govern Banking Data

Data issues surface fast once models move into production. If the inputs are unclear, the outputs will be questioned.

Effective banking data analytics with ML depends on:

- Clean, well-labeled datasets that teams can trust

- Full data traceability, so every decision can be explained later

- Strong governance, including access controls, lineage, and audit trails

These foundations matter most when regulators revisit decisions months after they were made.

Select and Train the Right Models

Complex models are not always the right answer. What matters is how well the approach fits the risk and review process.

In banking, model selection should:

- Match explainability needs and regulatory expectations

- Reflect the risk tolerance of the use case

- Favor interpretable models for credit scoring

- Use advanced techniques for fraud or anomaly detection where patterns are more complex

The goal is balance. Strong performance without creating issues during audits or reviews.

Deploy and Monitor Models in Production

Enterprise-grade ML model deployment in banking focuses on a few essentials:

- Seamless integration with core banking systems and decision pipelines, whether real-time or batch

- Continuous monitoring to catch model drift, bias, and performance decline early

- Human-in-the-loop checks for sensitive decisions where oversight matters

- Clear retraining schedules to adapt to changing customer behavior and regulatory expectations

When these pieces are in place, models stay accurate, explainable, and ready for audit, not just impressive in testing. Mature banking deployments also include human-in-the-loop validation, defined retraining cadences, and monitoring frameworks aligned with internal model risk management policies.

Establish Ongoing Governance and Optimization

Once a model is alive, the work does not stop. Conditions change faster than most teams expect. To keep ML systems reliable, banks need:

- Ongoing validation as regulations and policies evolve

- Regular retraining to reflect new data and customer behavior

- Continuous oversight to maintain explainability and compliance

This ongoing discipline keeps models aligned with business goals, not just accurate on day one.

When these steps are treated as part of daily operations, machine learning moves from isolated pilots to systems banks can rely on at scale.

In practice, successful ML adoption in banking depends less on model complexity and more on governance, explainability, and integration into daily decision workflows.

Future Outlook: Where Machine Learning in Banking Is Headed

Banks that have moved past early pilots are already looking ahead. The next phase of machine learning in banking is less about trying new ideas and more about making systems durable, accountable, and efficient over the long term. What matters now is how well innovation holds up under regulation and day-to-day operational pressure.

- Explainable AI and Auditable ML Systems: Regulators are pushing for clearer answers, especially in risk and lending decisions. Explainable AI models will become a baseline requirement for machine learning in banking and finance. Teams will need to show not just what a model decided, but why it reached that outcome.

- Synthetic Data and Privacy-First Modeling: Access to usable data remains a constraint. To work around this, banks are turning to synthetic data to train models without exposing sensitive information. This approach strengthens banking data analytics with ML while staying within strict privacy rules.

- Real-Time, Event-Driven Decisioning: As infrastructure improves, ML in the banking sector is shifting toward event-based architectures. This enables faster responses to fraud signals, risk events, and customer actions, often in seconds rather than hours.

- Responsible and Sustainable AI Adoption: Future banking machine learning solutions will place greater emphasis on ethical use, energy-efficient training, and strong governance. These practices are increasingly tied to ESG goals and long-term trust.

Banks that invest early in these areas will be better prepared to scale machine learning for banks responsibly, while maintaining compliance, resilience, and competitive advantage.

Build explainable, compliant, and scalable ML systems that align with evolving regulations and real-time banking demands.

How Appinventiv Helps Banks Implement Machine Learning at Scale

Most banks come to us when ambition meets reality. You want to move faster with machine learning, but regulation, legacy systems, and risk controls cannot be an afterthought. That is where Appinventiv fits in as a trusted banking software development company for regulated financial institutions.

We work hands-on with regulated banks across the US and the Middle East, supporting you from early evaluation to secure, production-ready ML systems. This includes enterprise adoption of AI, ML, blockchain, and advanced computing inside compliance-heavy environments, backed by proven machine learning development services designed for scale and audit readiness.

What that looks like in practice

- Modernizing core banking workflows without disrupting audits or controls

- Building fintech platforms designed for scale and user trust, such as Mudra, a chatbot-driven finance app launched in 12+ countries

- Delivering measurable outcomes, including up to 60% reduction in fraud and 50% faster loan approvals

We also help ML-driven platforms gain market confidence. Our work with Edfundo supported $500K in pre-seed funding, a $3M seed roadmap, and a strategic Visa partnership.

If you are aiming for real results, not pilots, Appinventiv delivers enterprise-ready machine learning solutions built to scale, comply, and perform for mid-to-large banks and regulated financial institutions.

Frequently Asked Questions

Q. How can machine learning improve banking operations?

A. Machine learning improves banking operations by automating repetitive work, reducing manual errors, and supporting faster data-driven decisions. It helps your teams streamline fraud checks, risk reviews, customer support, and compliance monitoring. By finding patterns in large datasets, ML enables quicker responses, smoother workflows, and more efficient day-to-day operations at scale.

Q. What are the key benefits of using machine learning in banking?

A. The main benefits show up in practical areas. ML automates document processing, KYC, and loan approvals to lower operating costs. It detects fraud in real time by spotting abnormal behavior. It also improves credit and investment decisions, personalizes customer experiences, and supports continuous compliance monitoring as regulations evolve.

Q. What are the cost implications of implementing machine learning in banking?

A. Machine learning requires upfront investment in platforms, data pipelines, and model development, along with ongoing costs for training and maintenance. Over time, banks recover these costs through automation, reduced fraud losses, and better decision quality. When applied well, ML improves operational efficiency and delivers a stronger long-term ROI.

Q. How does machine learning enhance fraud detection in banking?

A. Preventing banking fraud with machine learning is easier than ever. ML strengthens fraud detection by analyzing transaction data in real time and learning what normal behavior looks like. When spending patterns, locations, or transfer values change suddenly, models flag the activity immediately. This helps banks stop fraud earlier, limit losses, and protect both customers and the institution from financial crime.

Q. How can Appinventiv help with AI integration in banking?

A. Appinventiv helps banks integrate machine learning across fraud detection, compliance, customer engagement, and operations. The team designs solutions that fit regulated environments and existing systems. With experience across AI, ML, and emerging technologies, Appinventiv supports secure deployment, reduced risk, and measurable improvements in banking performance.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Top Machine Learning Trends the C-Suite Needs To Watch in 2026

Key takeaways: C-suite focus shifts from “doing AI” to providing clear P&L, risk, and efficiency impact from machine learning in 2026. Nine ML trends matter most: agentic AI, multimodal, decision intelligence, governance, edge, MLOps, responsible AI, domain models, and AI security. Executives should treat ML as a portfolio: near-term run-the-business bets, change-the-business bets, and non-negotiable…

10 Use Cases and Examples of How Machine Learning is Transforming the Logistics Industry

The widespread adoption of ML has resulted in the explosion of data from sensors, customer interactions, and digital platforms across different domains. More and more businesses are leveraging machine learning in logistics to improve their strategic decision-making expertise centered around tailoring customer experience, improving productivity, increasing engagement, and preventing fraud. According to the McKinsey Global…

Key takeaways: Machine learning in retail is reshaping the industry through smarter recommendations, dynamic pricing, and real-time personalization. AI & ML deliver measurable ROI, helping brands boost conversions by up to 40% and unlock multiple operational advantages. Successful ML implementation in retail requires high-quality data, scalable infrastructure, and continuous model optimization. With 10+ years of…