- Introduction

- Enterprise eCommerce Fraud Landscape

- Essential Challenges Business Organizations Encounter in Preventing Fraud

- Detecting Fraud Before It Happens

- A. Key Indicators and Red Flags

- B. Enterprise Detection Techniques

- Enterprise eCommerce Fraud Prevention Best Practices

- A. Policy-Level Controls: Constructing the Governance Framework

- B. Process-Level Controls: Simplifying Enterprise Operations

- C. Technology-Level Controls: Scaling Intelligence and Speed

- D. Data & Analytics Governance: Creating an Intelligent Fraud Nerve Center

- E. Collaboration & Culture: Bolstering the Human Firewall

- Technology Stack for Fraud Management in eCommerce Enterprises

- Implementation Roadmap: 30/60/90-Day Enterprise Plan

- Phase 1 (0–30 Days): Audit and Visibility

- Phase 2 (31–60 Days): Pilot and Fine-Tuning

- Phase 3 (61–90 Days): Scale and Govern

- Future Vision: New Trends in Enterprise Fraud Prevention

- How Appinventiv Helps Enterprises Build Secure, Fraud-Resilient eCommerce Platforms

- Frequently Asked Questions

Key takeaways:

- Global eCommerce fraud losses are expected to exceed $107 billion by 2029.

- Digital growth, Buy Now Pay Later features, and rising automation are all opening up new avenues for fraudsters to exploit.

- First-party abuse and refund abuse have ended up being the greatest source of pain globally, affecting nearly half of all online merchants.

- Detecting fraud at enterprise scale these days involves utilizing AI-powered detection, aligning policies, and harmonizing everything in real time across your payment rails, CRM, and ERP systems.

- A phased 30/60/90-day plan, beginning with audits and gradually leading to full operations, provides organizations with a pragmatic means to effectively put fraud detection and governance in place.

- The eCommerce fraud prevention of the future will be about making AI-driven decisions transparent, data-sharing between industries, and being prepared for more stringent compliance under regimes such as PSD3 and DORA.

Introduction

The crisis of fraud management for eCommerce businesses is no longer a situation companies can overlook. Juniper Research cites a concerning trend: eCommerce fraud losses worldwide are projected to exceed $107 billion by 2029. Why? A perfect storm of digital growth acceleration, cross-border payments, and cybercriminals who quite frankly, are getting smarter at their jobs.

For business retailers, the threat environment has moved far beyond stolen credit cards or fake chargebacks. Businesses are now working with account takeovers, synthetic identities, and malicious bots that test payment systems for weaknesses.

With each innovation that the industry brings—whether it’s growing into international markets, implementing omnichannel shopping, or providing Buy Now, Pay Later—there are new chances for nefarious actors. And legacy infrastructure? It wasn’t even designed to handle this complexity.

But here’s the thing: the harm is deeper than mere monetary loss. When a breach occurs, your brand is damaged. Customer information is leaked. Regulatory fines mount up. Recovery can take years, not months.

And with regulations such as PCI DSS, PSD3, and GDPR bolstering their hold, businesses are caught in the dilemma of how to secure their business without making the checkout process feel like an interrogation.

The solution is found in what innovative companies are already doing— adopting AI-powered fraud detection software development that is compliance-oriented. These solutions gather risk information from all touchpoints, take milliseconds to decide, and continuously learn as threats evolve and change.

Today’s fraud management in eCommerce is no longer only about preventing losses. It’s about embedding resilience and trustworthiness into the very fabric of every transaction you process.

Join the growing network of enterprises implementing fraud prevention strategies that cut chargebacks, reduce revenue leakage, and protect customer trust across every channel.

Enterprise eCommerce Fraud Landscape

Enterprise eCommerce fraud is not what it was. It’s not a matter of catching stolen credit cards anymore—the types of eCommerce fraud now include this complex system of cybercrime, automated attacks, and psychological manipulation.

With AI in the hands of fraudsters now and consumer behaviour continuously changing, fraud has evolved from being a transaction headache to a pure business risk.

- First-Party Misuse: The New Leading Threat

The biggest fraud problem of today is not hackers, but actually your customers. According to the 2025 Global Fraud Report, first-party abuse-sometimes called “friendly fraud”-is the single biggest fraud issue in the world. Almost half of all merchants experience refund or policy abuse, while 62% have seen this increase over the past year. The challenge? Distinguishing between genuine complaints and those gaming the system.

- Card-Not-Present (CNP) Fraud Still Dominates

Even with the surge in first-party abuse, CNP fraud is still a crucial problem. It involves stolen payment information, which has been used online without any verification of card presence and identification. Ironically, innovations like secure digital wallet development and one-click checkout have made CNP fraud easier. Reports indicate these are the payment methods with the greatest fraud risk.

- Account Takeovers (ATO) and Credential Stuffing

Account takeovers have increased significantly, many of them caused by password reuse. Fraudsters have taken advantage of automated bots to try a thousand credentials, hence easily altering account information and placing orders. Large businesses with millions of accounts are more susceptible to this attack since traditional fraud filters fail to capture these events.

- Synthetic Identities, Refund Abuse, and Insider Fraud

Synthetic identity fraud mixes real consumer information with fabricated information to build allegedly valid identities that can pass through undetected by most KYC screens. Refund and return abuse is also on the rise, with 90% of retailers now fighting back against first-party chargebacks. Insider fraud is often overlooked, yet still costly to businesses with widespread systems access.

- Evolving Payment Ecosystems and Rising Risks

82% of vendors in 2022 introduced new payment methods, including Real-Time Payments and Buy Now, Pay Later options. These increase conversion rates but simultaneously unlock new avenues for fraud. It becomes even tougher to sift through legitimate transactions because modern payment ecosystems have grown too complex for most traditional fraud detection systems.

- The Regulatory Context

Fraud management today needs to keep pace with strict compliance standards, including GDPR, PSD3, PCI DSS, and Strong Customer Authentication directives. Apart from exposing security gaps, non-compliance results in highly expensive fines, coupled with severe reputational damage.

- The Enterprise Reality

Fraud costs merchants an estimated 3% of yearly eCommerce sales, while an additional 6% of orders are rejected due to suspicion. But here is the kicker: 6-10% of those rejections are false positives, according to Cybersource and MRC data, meaning legitimate customers are being turned away. The key is creating an intelligent, evolving fraud system that balances security, compliance, and customer trust while protecting your bottom line.

Essential Challenges Business Organizations Encounter in Preventing Fraud

For enterprise-class eCommerce, the real issue isn’t a lack of technology; it is a lack of leadership. Multiple systems, channels, and teams create gaps fraudsters use to their advantage.

Here are the top challenges eCommerce fraud prevention teams face:

- Scaling Detection without Blocking Orders: A delicate balance to be made between fraud detection and the seamless checkout experience. Overly restrictive filters block valid customers, leading to lost sales and support headaches.

- Broken Technology Systems: Disconnected systems (old CRMs, ERPs, payment gateways) make it hard to see a unified view of the transactions, leaving businesses reactive to fraud.

- Handling Large Amounts of Data Requires Real Time: Advanced AI and machine learning to manage such vast amounts of data-transactions, activity, and location. Integrated systems are necessary for fraud to be fought effectively.

- Governance and Compliance Gaps: Compliance frameworks such as PCI DSS, GDPR, and PSD3 are in a constant state of evolution. A single slip in governance can bring about legal and reputational damage.

- Balancing Risk and Customer Experience: Fraud controls are important, but too much friction in the checkout process chases customers away. This is where adaptive authentication will help to balance security with convenience.

- Insufficient Fraud Analyst Talent: Expertise in fraud management, analytics, cybersecurity, and compliance remains hard to come by. Without skilled analysts, fraud detection and innovation would come to a grinding halt.

Also Read: Top 10 Pain Points of Ecommerce Customers and Their Possible Technology Solutions

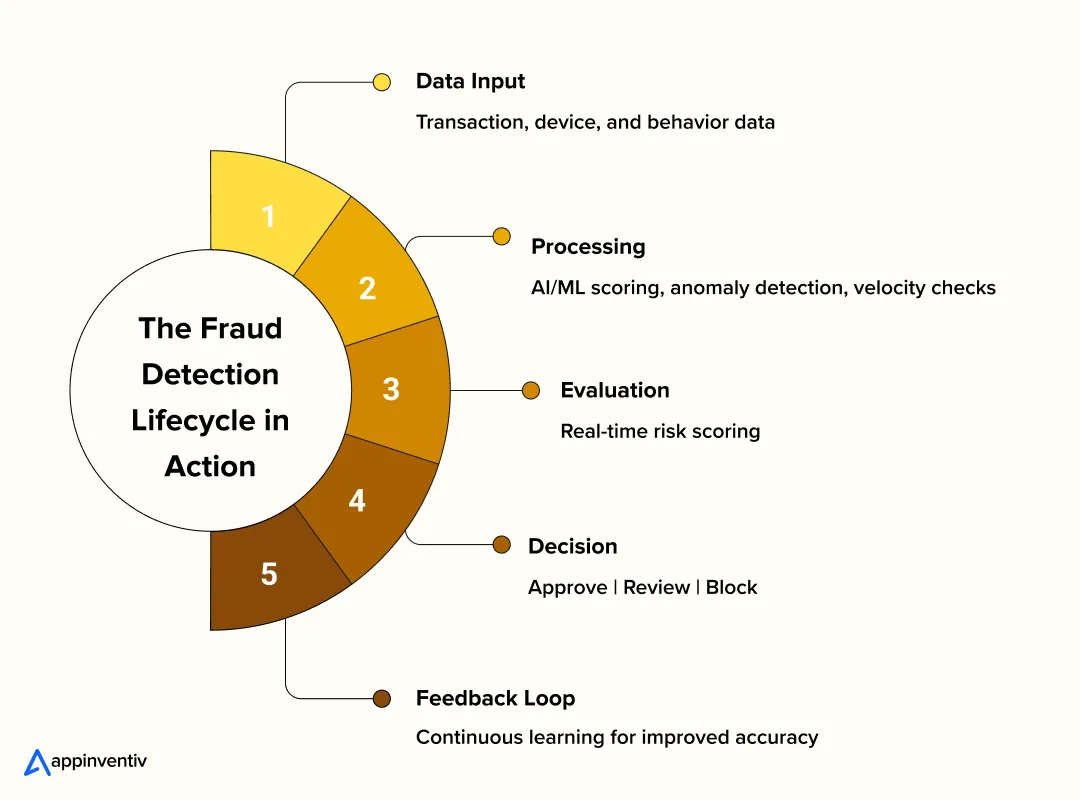

Detecting Fraud Before It Happens

Today’s businesses can’t just sit back and wait for fraudulent transactions to appear in their reports once they’ve occurred. The damage is done by then. The actual game is catching fraud early, developing mechanisms that can detect trouble forming before it becomes real losses.

That requires real-time monitoring, machine learning that works, and intelligence sharing throughout the whole fraud management in the eCommerce ecosystem.

A. Key Indicators and Red Flags

Here’s the catch: fraud doesn’t necessarily make a lot of noise. It tends to blend in with good customer behaviour. What distinguishes companies that get ahead from those always playing catch-up? The power to detect small, quirky things that don’t quite add up.

Your systems should be looking for things like:

- Uncommon transaction speed: If someone’s buying multiple things in seconds, or the same payment method’s getting slammed over and over, something’s wrong.

- Billing and shipping mismatch: This one pops up all the time with stolen credentials or when a person’s using proxies to mask their actual location.

- Failed payment attempts: May be legitimate, but too often, it’s card testing or bots running through stolen credential lists.

- Multiple orders from one IP or device: Unless your customer is really keen on your products, this tends to indicate automated scripts or sophisticated fraud schemes.

- Unusual cross-border activity from old accounts: When an account that’s remained silent for months suddenly reactivates and begins putting up high-value international orders? Account takeover, pure and simple.

The issue is, catching one of these signals on its own doesn’t say a whole lot. The real problem is collecting these weak signals and stringing them together into an accurate risk score that correctly identifies the fraudsters without inadvertently blocking your good customers who happen to be shopping from a coffee shop in another town.

B. Enterprise Detection Techniques

Large organizations require more than a simple rulebook that states “block this, permit that.” Inactive rules are no longer sufficient. The fraud detection solutions for eCommerce that work today rely heavily on sophisticated analytics and, frankly, cross-company learning from what other businesses are observing as well.

1. Device Fingerprinting and Behavioural Biometrics

Fraudsters figured out how to slip past traditional security checks years ago, so now tracking device behaviour’s and user interactions at a detailed level became non-negotiable. Device fingerprinting looks at unique device traits—browser quirks, device type, IP address—to spot sketchy activity.

- How It Works: Behavioural biometrics digs even deeper by watching how people actually use your site. How fast they type. How their mouse moves. Which pages they jump between. Everything gets monitored.

- Why It Matters: Someone’s typing rhythm suddenly changes? Their location doesn’t line up with past behaviour? System flags it immediately. These subtle behaviour patterns catch fraud without forcing legitimate customers through those maddening extra verification steps everyone hates.

2. Velocity Checks and Anomaly Detection

Fraudsters operate at speed. Five transactions in ten minutes, bizarre order amounts, frantic activity bursts. Velocity checks track how fast things happen—how quickly someone places orders, for example—and catch weird patterns based on what normally happens.

- How It Works: Real-time algorithms watch for changes in transaction speed or sudden location jumps. User logs in from Thailand when they’ve always been in Texas? Places a $5,000 order after six months of zero activity? System tags these for review.

- Why It Matters: Velocity checks beat static rules because they adapt. High-risk transactions get flagged instantly, stopping fraud before it snowballs into bigger losses.

3. AI and Machine Learning-Based Scoring Models

AI and ML scoring models became absolutely critical for fraud detection because they predict risk using mountains of historical data. These models automatically tag each transaction with a risk level by analysing patterns from thousands of past orders.

- How It Works: Feed these models more data and they get sharper. They learn to separate legitimate purchases from fraudulent ones with scary accuracy. The models adapt to brand-new fraud tactics constantly and keep refining how they catch bad actors.

- Why It Matters: This predictive setup keeps businesses ahead of fraudsters instead of always playing catch-up. Decisions happen in milliseconds based on smart insights, not some rulebook written three years ago. Manual review needs to drop dramatically.

4. Consortium Data Sharing and Network-Level Intelligence

Spotting fraud patterns requires way more than just your company’s data. Consortium data sharing lets businesses tap into network-level intelligence where information from entire merchant networks—think Visa Risk Manager, Mastercard Decision Intelligence—gets pooled together and analyzed.

- How It Works: Combining data from hundreds of sources reveals fraud patterns that individual transaction histories would never show. This shared intelligence helps catch fraud earlier and predict threats based on what’s hitting other companies right this minute.

- Why It Matters: Collective intelligence provides a massively broader view of what fraudsters are doing and supercharges detection capabilities. Companies can respond to emerging scams that wouldn’t appear in their own data for weeks or months.

5. Account Takeover (ATO) Detection

Account takeovers pose a huge threat to enterprise eCommerce. Fraudsters swipe login credentials and hijack accounts. Automated ATO detection monitors behaviour to spot weird login activity—attempts from strange devices, dodgy IP addresses, login times totally different from normal patterns.

- How It Works: The system watches the whole login process, looking for shifts in device, IP reputation, or timing that break from typical behaviour. Catching this early blocks unauthorized access before fraudsters can rack up fraudulent orders.

- Why It Matters: Early ATO detection stops criminals from stealing money through compromised accounts and protects both customers and company revenue from getting hammered.

When businesses bake these eCommerce fraud prevention techniques directly into their payment infrastructure, they can catch issues at the edge, long before revenue starts to slip and customers begin to distrust.

What you’re actually creating here is an adaptive ecosystem. One that doesn’t merely detect bad behaviour but learns from each and every transaction, continuously improving how it reacts to threats.

Enterprise eCommerce Fraud Prevention Best Practices

Fraud prevention in eCommerce for modern businesses is not something you work on and then leave behind. It’s a continuous practice that combines good governance, effective processes, and intelligent automation.

As payments become quicker and more diverse online, the emphasis has changed. It’s no longer merely about blocking suspicious transactions but creating an environment for fraud management for eCommerce businesses that actually learns from what it observes, grows alongside new attacks, and expands with your company.

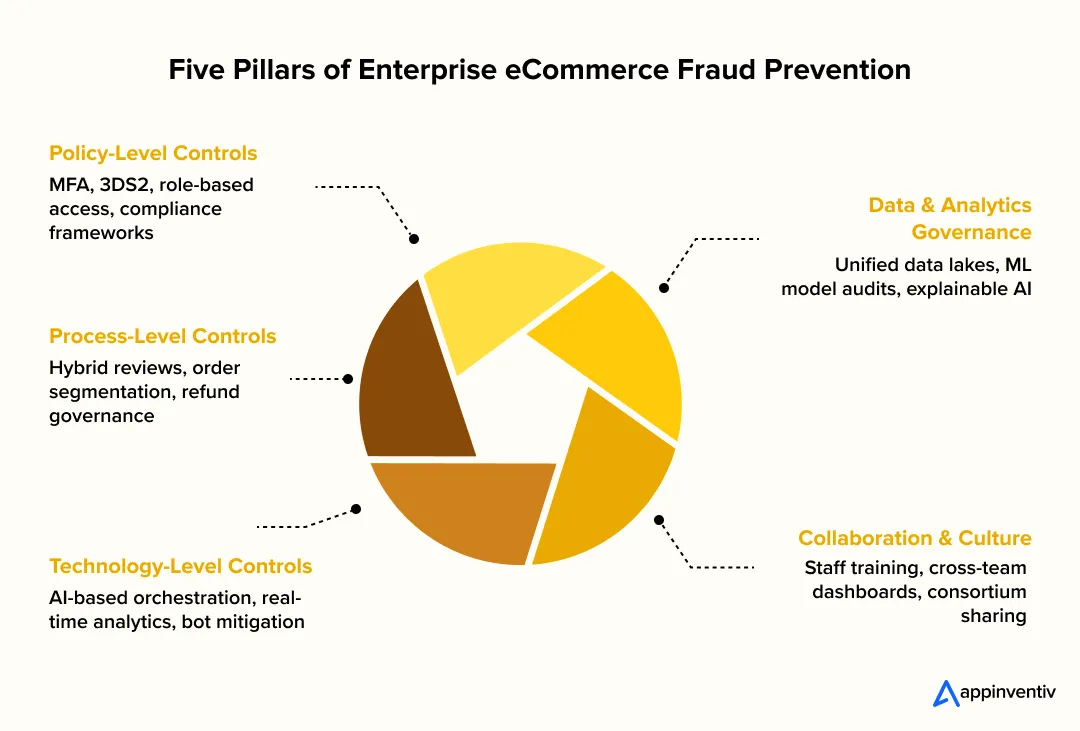

The following eCommerce fraud prevention best practices represent five essential pillars that top global businesses are now employing to safeguard their businesses and maintain customer trust.

A. Policy-Level Controls: Constructing the Governance Framework

Prevention starts with clear policies: who’s responsible, what risks are owned, what’s your compliance posture?

- 2FA, MFA, 3DS2: Protect login, checkout, and other high-value transactions with multi-factor authentication.

- Role-based access: Limit data access to reduce insider threats.

- Chargeback SLAs: Establish timelines for disputing false claims.

- Regulatory Compliance: Stay up to speed on PCI-DSS, GDPR, PSD3, and SOC 2.

B. Process-Level Controls: Simplifying Enterprise Operations

Operational discipline ensures policies translate into consistent action without complicating the checkout process. Key fraud prevention best practices include:

- Regular audits: Keep fraud filters updated to avoid stale thresholds blocking legitimate orders.

- Hybrid review models: Automate most transactions and use human judgment for high-risk or ambiguous cases.

- Order segmentation: Classify transactions by risk level to tailor your response.

- Refund and return governance: Use verification and digital receipts to prevent abuse.

- Escalation workflows: Establish clear communication among fraud, compliance, and support teams.

Strong governance makes fraud prevention a continuous part of decision-making, not just a reactive measure.

C. Technology-Level Controls: Scaling Intelligence and Speed

Fraud detection in enterprises requires intelligent systems that grow with the volume of transactions and adapt to ever-changing threats. Basic rule-based systems are no longer adequate. Advanced fraud prevention uses AI and machine learning in eCommerce, with real-time analytics, for effective and scalable fraud management.

- AI-Driven Data Orchestration

Fraud detection starts with organizing your data. AI platforms pull together information from everywhere—transaction history, customer behaviours, payment data—and unify it. Real-time analysis spots weird patterns, flags sketchy activity instantly, and keeps learning from each transaction. The system gets sharper over time.

- Behavioural Analytics and Device Fingerprinting

Behavioural analytics tracks how users actually interact with your site. Typing speed, how they navigate pages, and what device they’re using. When someone’s behaviour suddenly shifts from their normal pattern, the system catches it, even when fraudsters try mimicking legitimate activity. Device fingerprinting tracks specific details like IP addresses and operating systems, helping identify when the same fraudster tries hitting you repeatedly.

- Real-Time Transaction Monitoring

Stopping fraud requires watching transactions constantly, not reviewing logs next Tuesday. Real-time monitoring analyzes purchase volumes, transaction frequency, and geographic weirdness. Transaction size suddenly jumps from $50 to $5,000? User’s location bounces between New York and Nigeria in 10 minutes? Alerts fire off immediately, blocking unauthorized transactions before they go through.

- Bot and Credential Detection

Automated bots and credential stuffing attacks pose serious threats. Machine learning algorithms examine login patterns, IP reputation, device consistency to spot and block bots as they operate. This proactive defence stops account takeovers and unauthorized access before damage happens.

- System Integration for Unified Detection

Fraud detection tools need to talk to your existing systems—ERP, CRM, payment gateways, everything. A unified platform gives you visibility across all touchpoints instead of checking five different dashboards. Faster responses, more accurate fraud identification. Integrated systems streamline detection and reporting, making decisions clearer across departments.

- Machine Learning Models

Fraud tactics evolve constantly, so detection systems must evolve too. Machine learning models analyze both historical and live data to refine their algorithms, adapting as new fraud methods emerge. These models predict potential fraud based on shifting transaction patterns, staying ahead of criminals instead of reacting after losses pile up.

These advanced fraud detection techniques, powered by AI and automation, help enterprises handle the complexity and scale of modern eCommerce. With Appinventiv’s expertise in AI-driven fraud prevention, enterprises can build customized platforms that adapt to emerging fraud tactics, protect revenue, and maintain compliance with industry standards.

D. Data & Analytics Governance: Creating an Intelligent Fraud Nerve Center

Clean, unified data speeds up fraud detection. When data is well-governed, fraud solutions can learn faster and identify discrepancies more accurately.

- Unified Data Lakes: Collect payment, behaviour, and identity data across systems for thorough analysis.

- Machine Learning Governance: Continuously train models to adapt to new fraud trends, minimizing bias and false positives.

- Feature Engineering Pipelines: Leverage real-time data like transaction speed, geolocation, and device reputation to refine predictions.

- Explainable AI: Ensure transparency in model decisions for audits and compliance.

By treating fraud data as a strategic asset, businesses can shift from merely detecting fraud to predicting it, easing operational challenges and reducing compliance risks.

E. Collaboration & Culture: Bolstering the Human Firewall

A secure, progressive environment among teams, vendors, and industry networks is paramount to long-term fraud prevention.

- Cross-team Collaboration: Share dashboards to monitor the risk indicators in real time across all teams.

- Consortium Data Sharing: It enables intelligence networks to share global threat data and enhance detection.

- Staff training: Employees must be trained on social engineering, phishing, and insider threats to reduce human vulnerabilities.

- Partner audits: Auditing third-party integrations regularly for security standard alignment.

Companies can build at least the frontiers with teamwork and knowledge transfer so that a robust internal defence system secures them.

Strategic Takeaway

Leading organizations treat fraud management as an integrated, end-to-end system that transcends silos. They can address these threats before they scale by aligning policy, process, technology, data, and culture. This protects revenue, maintains conversions, and preserves customer trust at any scale.

Now that you know a bit about the best practices for fraud prevention for eCommerce, let’s understand the current enterprise fraud landscape.

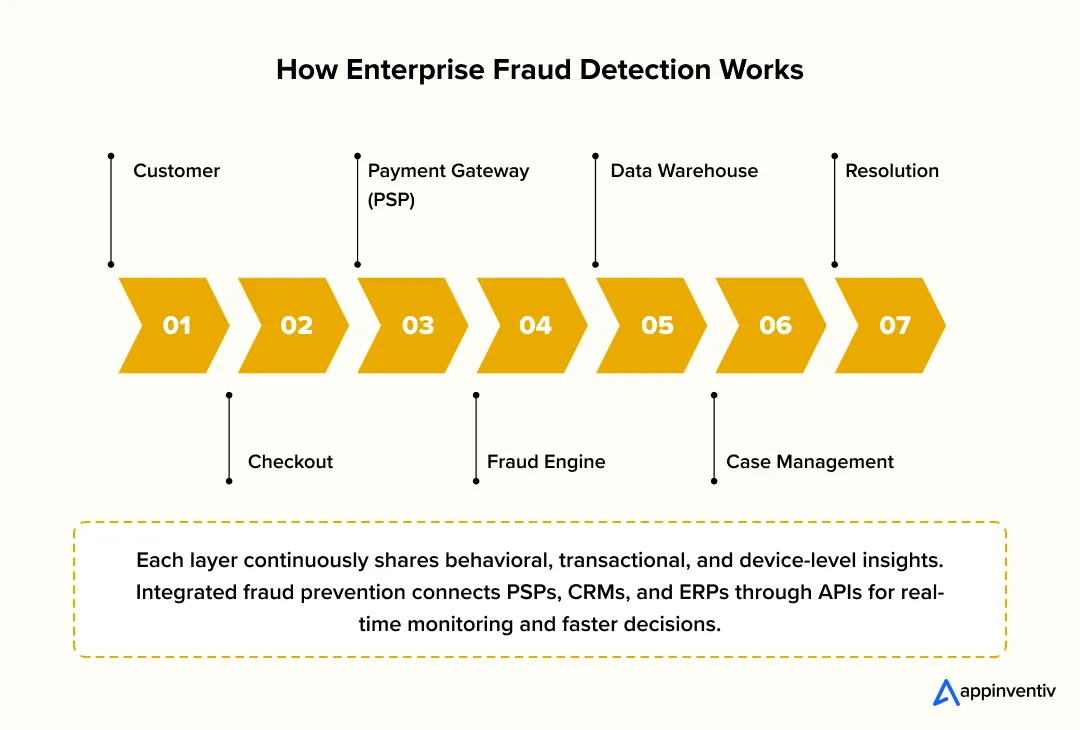

Technology Stack for Fraud Management in eCommerce Enterprises

The strength of fraud management for eCommerce businesses lies in its technology stack. Modern organizations require an ecosystem that combines intelligence, scalability, and automation to manage risks in real time.

Here are a few technological stacks that can help manage fraud:

- AI and Machine Learning

AI models enable predictive risk scoring by analyzing behavioural, transactional, and device data. Machine learning algorithms adapt continuously to new fraud patterns, helping enterprises prevent emerging threats with minimal manual intervention.

- Data Lakes and Advanced Analytics

Centralized data repositories consolidate inputs from multiple systems such as PSPs, CRMs, and ERP platforms. This unified view enhances anomaly detection, trend analysis, and performance benchmarking across the entire eCommerce fraud prevention system.

- Blockchain and Smart Contracts

Blockchain app development technology for secure transactions provides immutable transaction verification and auditable trails. For high-value or cross-border commerce, smart contracts add an extra layer of trust by executing only after compliance and payment conditions are validated.

- APIs and Orchestration Layers

Well-designed API integration for fintech systems connects payment gateways, order management systems, and CRMs into one cohesive fraud management architecture. This orchestration ensures consistent data flow, enabling faster and more accurate decision-making.

- Automation and RPA

Robotic Process Automation (RPA) accelerates fraud response by automatically flagging suspicious patterns, generating reports, and initiating chargeback reviews. Automation reduces analyst workload and improves fraud resolution timelines.

Suggested Architecture Flow:

Checkout → Payment Gateway (PSP) → Fraud Engine → Data Warehouse → Case Management System

Enterprises investing in eCommerce fraud prevention software development gain not only stronger protection but also operational efficiency through intelligent orchestration. The result is a seamless, compliant, and future-ready eCommerce fraud prevention solution built for scalability.

From secure payment integrations to AI-driven fraud detection systems, our eCommerce software development team builds scalable, compliance-ready solutions that keep your enterprise protected and profitable.

Implementation Roadmap: 30/60/90-Day Enterprise Plan

Creating a working fraud prevention software for eCommerce or a system at an enterprise scale isn’t something you do over a weekend. It requires a phased approach that balances speed, accuracy, and compliance.

This is a feasible 90-day plan that gets you from “where are we now?” to fully operational.

Phase 1 (0–30 Days): Audit and Visibility

The first month is about getting your arms around what you’re working with. What does fraud look like in your organization today? Where are the vulnerabilities? You can’t do anything about it if you can’t see it, so this stage is about shining a light.

Key Actions:

- Create a map of each and every transaction touch point, determine where your data is trapped in silos, and map integration gaps in your payment systems, CRMs, and ERPs.

- Run a baseline e-commerce fraud analysis and prevention in eCommerce transactions to identify your riskiest areas.

- Achieve some quick wins in eCommerce credit card fraud prevention and other types of online fraud by implementing simple velocity rules, Address Verification System (AVS), Card Verification Value (CVV) verification, and bot filtering. These will not fix all of it, but they will stem the most nakedly obvious threats.

- Ensure you’re up to speed on compliance with PCI DSS and data protection standards. Better to identify holes now than in an audit.

Objective: At month one’s end, you should have a very clear view of your vulnerabilities and some quantifiable fraud KPIs to monitor improvement in the subsequent phases.

Phase 2 (31–60 Days): Pilot and Fine-Tuning

Having gained sight of what is occurring, it is time to pilot some solutions. This phase is for eCommerce fraud prevention tools and techniques and ensuring new tools do indeed operate within your ecosystem without inadvertently blocking legitimate customers or inserting friction.

Key Actions:

- Pilot machine learning-driven fraud scoring on a tiny fraction of your transactions (perhaps 10–20%). Get a sense of how well the detection is working before you implement it everywhere.

- Implement multi-factor authentication (MFA) for high-risk transactions and whenever anyone attempts to update account information.

- Begin automating chargeback processes. Hunting for evidence and submitting disputes manually is a waste of time that no one needs.

- Monitor how your rules are performing and tweak detection thresholds according to what you’re discovering from the pilot.

Objective: Confirm that your AI models truly function, reduce false positives that irritate clients, and prepare everything for broader deployment.

Phase 3 (61–90 Days): Scale and Govern

This is where fraud prevention is no longer a project, but an integrated part of the way your business works. Systems become deeply integrated, insights are shared across departments, and you make continuous improvement a habit.

Key Actions:

- Deploy AI-powered orchestration on all your payment channels and digital touchpoints.

- Bring fraud performance metrics directly into your customer experience dashboards and management reports. This stuff doesn’t need to exist in silos.

- Establish regular monthly KPI check-ins. Target chargeback percentages, how frequently you are rejecting valid orders, and general approval percentages.

- Establish a fraud governance committee. Task them with policy changes, compliance checks, and ensuring teams remain up to date on fresh threats.

Objective: Within day 90, you will have scalable, proactive fraud protection that evolves as new threats arise and regulations shift.

A guided roadmap such as this makes fraud prevention a continuing process, not a special project. Before you reach 90 days, you’re not only lowering your vulnerability to fraud. You’re establishing the foundation for smart, long-term resiliency that continues to pay dividends year in and year out.

Our experts can help you design a fraud management ecosystem tailored to your business model — built for resilience, compliance, and customer confidence.

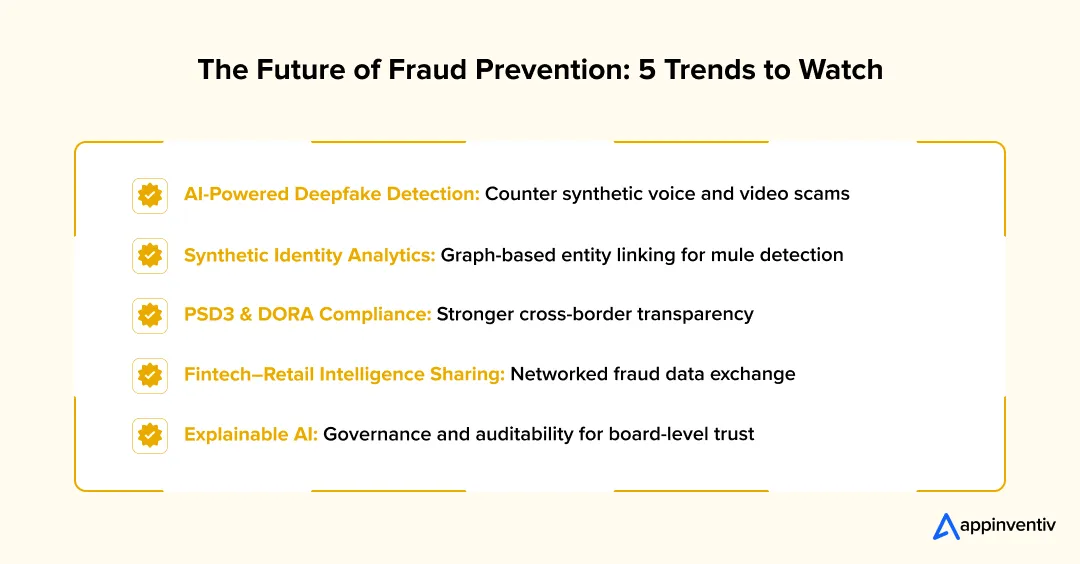

Future Vision: New Trends in Enterprise Fraud Prevention

The future of fraud prevention is reduced to three: intelligence, collaboration, and accountability. As online commerce becomes increasingly interconnected and everything occurs in real time, businesses must be smarter and more open to transparently keep pace with threats that are changing just as rapidly.

- AI-Facilitated Social Engineering and Deepfake Attacks

The future of fraud is becoming increasingly human-like. The attackers are already testing AI-generated voices, deepfakes, and synthetic identities to bypass identity verification and trick customer support teams.

Sophisticated fraud management in eCommerce strategies are going to depend heavily on artificial intelligence models that are capable of noticing little things like voice patterns, biometric anomalies, and behavioural idiosyncrasies that don’t quite make sense—all in real time.

- Synthetic Identity and Mule Account Detection

Companies are leveraging graph analytics and entity-linking technologies to reveal insider relationships among users, devices, and accounts. This assists them in identifying synthetic accounts and “money mule” accounts, which money thieves prefer using to launder proceeds of theft or execute refund attacks.

- Regulatory Tightening Under PSD3 and DORA follows

Compliance is set to become a whole lot tougher. The Payment Services Directive 3 (PSD3) and Digital Operational Resilience Act (DORA) are already complicating life for financial and retail organizations.

These rules squeeze tightly on transparency, multi-factor authentication, and operational resilience in digital payment systems. For large international businesses with high transaction volumes, the compliance hurdle just got higher.

- Fintech–Retail Collaboration for Shared Intelligence

Here’s something that’s now changing at last: fraud no longer happens in a silo, and fraud prevention shouldn’t either. We’re witnessing more fintech’s, merchants, and payment service providers establishing cooperative networks where they exchange anonymized fraud information and behavioural data.

This collective intelligence model makes detection much more precise and fills gaps that are present when platforms are working in silos.

- AI Governance and Explainability

Now that AI is handling the heavy lifting for fraud prevention, AI in governance and explainability frameworks are becoming things the board genuinely cares about.

Enterprises must be capable of explaining how their algorithms arrive at risk decisions and demonstrating that they’re adhering to changing data ethics frameworks. Transparent AI systems don’t only make regulators happy—they also help create customer trust, which is more important than ever.

Companies that recognize these changes on the horizon and adapt their fraud management tools in response will have a tangible competitive edge. The future of retail fraud prevention doesn’t lie with some silver bullet solution.

It’s about integrating predictive intelligence, remaining compliant with regulations, and constructing defence cooperative networks while ensuring that customer experience is not compromised.

How Appinventiv Helps Enterprises Build Secure, Fraud-Resilient eCommerce Platforms

Appinventiv empowers global enterprises through specialized eCommerce app development services that integrate fraud management for eCommerce businesses that combine intelligence, compliance, and scalability.

We’ve helped leading brands like Adidas, 6th Street, and BodyShop develop secure applications and websites, ensuring their digital platforms remain safe and compliant. Our solutions are designed to detect threats in real-time, automate responses, and maintain customer trust through continuous innovation and adherence to international standards.

With expertise in AI- and ML-driven fraud detection systems, payment gateway and ERP integration, and compliance-first architecture (PCI-DSS, GDPR, PSD3-ready), Appinventiv helps enterprises achieve stronger security and seamless digital commerce operations.

Partner with Appinventiv to build intelligent, compliant, and adaptive eCommerce fraud prevention strategies that scale with your business.

Read Next: The Comprehensive eCommerce Application Development Guide: Everything You Need to Know

Frequently Asked Questions

Q. How to prevent eCommerce fraud?

A. Businesses can combat eCommerce fraud by implementing layered security controls such as multi-factor authentication, AI-powered risk scoring, and real-time transaction monitoring. Policy checks and audits on a regular basis also assist, as does maintaining compliance with standards such as PCI DSS and GDPR. It’s all about having multiple barriers working in conjunction.

Q. How to integrate eCommerce fraud prevention?

A. You can integrate fraud prevention into your payment gateways, CRMs, and ERP systems directly with APIs and orchestration layers. This provides you with single-platform visibility across all transactions and automates risk scoring at all points in the customer journey, so nothing falls between the cracks.

Q. How can eCommerce businesses detect fraudulent transactions early?

A. Early identification in fraud management for ecommerce businesses is all about behavioural analytics, device fingerprinting, and speed checks. AI-driven models scan for unusual patterns in location history, transaction values, and user activities to point out suspicious activity before anything gets approved.

Q. What steps should businesses take after identifying a fraudulent transaction?

A. The moment you’ve identified a fraudulent transaction, act quickly. Instantly stop the order, alert your payment processor, preserve all the logs as evidence, and initiate the chargeback or dispute process. Then, a post-incident analysis will be conducted to determine how it occurred and plug those security loopholes.

Q. How important is PCI DSS compliance for eCommerce platforms?

A. PCI DSS compliance is a complete necessity for protecting payment information. It mandates practices such as encryption, access controls, and ongoing monitoring that prevent cardholder data compromises. And, it generates customer trust when individuals know you are serious about security.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does It Cost to Build an eCommerce Marketplace App Like Poshmark?

Key takeaways: Poshmark-like marketplaces enable unlocking new sources of revenue through transforming social interaction into low-capital-intensity repeat purchases. A marketplace app would cost between $40,000 and $400,000 to develop, depending on its features, platform and enterprise scalability needs. Special implementation, beginning with tests or single categories, confirms supply, demand, and monetization in 6-12 months. Trust,…

How Much Does It Cost to Build a Fashion Marketplace App Like Depop in the UK?

Key takeaways: A Depop-style fashion marketplace in the UK usually costs £32,000 to £320,000, depending on how simple or advanced you want the app to be. The UK’s resale-fashion scene is growing quickly, so demand for social, pre-loved fashion apps is only going up. Costs increase when you add things like AI recommendations, logistics integrations,…

How Much Does It Cost to Develop an eCommerce Platform like The Iconic in Australia?

Key takeaways: Building an eCommerce platform like The Iconic in Australia can cost anywhere from AUD $46,500 to AUD $775,000+ depending on scale and sophistication. The real eCommerce cost drivers are backend architecture, integrations, compliance, and system reliability, not just design screens. Platforms like The Iconic succeed because they combine shopping experience, logistics, and payments…