- NatWest – Setting a Benchmark in the Digital Banking Age

- Key features that make NatWest a standout in digital banking include:

- NatWest App Development Cost - A Comprehensive Analysis

- Cost Breakdown by Complexity Levels

- Development Stages

- How to Estimate the Mobile Banking App Development Cost like NatWest

- Factors Impacting Mobile Banking App Development Cost

- UI/UX Design

- Backend Development

- Third-Party Integration

- Security Measures

- Compliance Requirements

- Platform Selection

- Technology Stack

- Complexity of Features

- Hidden Cost to Build a Banking App Like NatWest

- App Maintenance

- App Hosting

- App Marketing

- Legal and Licensing Fees

- How to Optimize Banking App Development Costs in the UK?

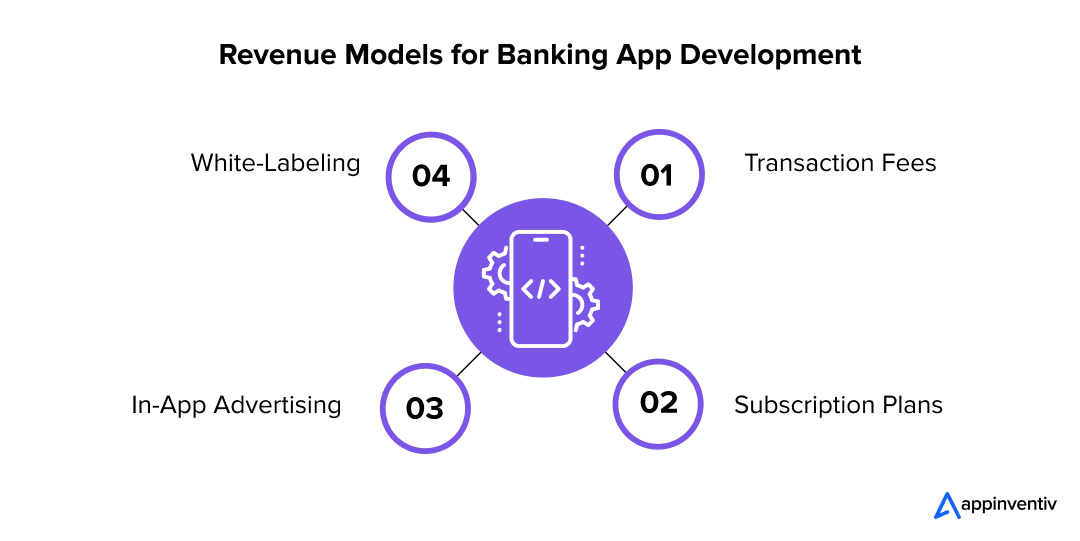

- How to Monetize Mobile Banking Apps like NatWest

- Transaction Fees

- Subscription Plans

- In-App Advertising

- White-Labeling

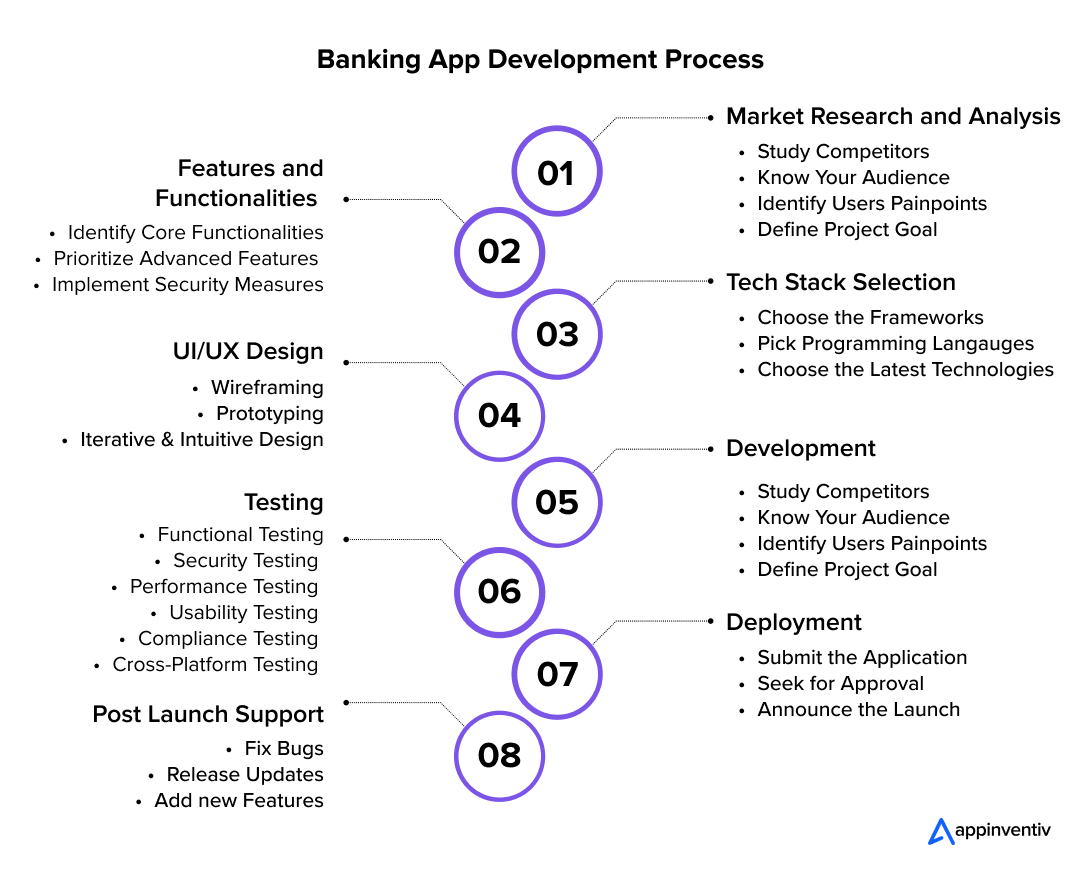

- How to Build a Banking App Like NatWest in the UK?

- 1. Conduct Market Research

- 2. Define Core Features

- 4. Choose the Tech Stack

- 5. Design UI/UX

- 6. Implement Compliance and Security Measures

- 7. Develop the App

- 8. Test the App

- 9. Deploy the App

- 10. Maintain and Update the App

- How to Build a Revolutionary Banking App that Can Outperform Industry Giants Like NatWest

- UI/UX Design

- Cutting-Edge Features

- Latest Technologies

- Bring Your Banking App Idea to Life with Appinventiv

- Why Makes Us Your Preferred Tech Partner?

- What’s more?

- FAQs

Banking has come a long way—from time-consuming manual processes to instant digital transactions that happen in just a few clicks. While mobile banking initially had some challenges (such as security concerns and limited functionality), today’s tech-savvy age has made digital banking the norm.

Currently, the FinTech industry is booming by leaps and bounds, with an increasing number of users embracing digital wallets and keeping pace with the latest advancements in the mobile banking landscape.

According to Statista, mobile banking adoption in the UK surged between 2019 and 2024, with 73% of bank account holders managing their banking affairs via mobile devices. In contrast, traditional banking has sharply declined, reflecting the shift towards digital banking applications like NatWest that offer convenience, security, and real-time financial insights.

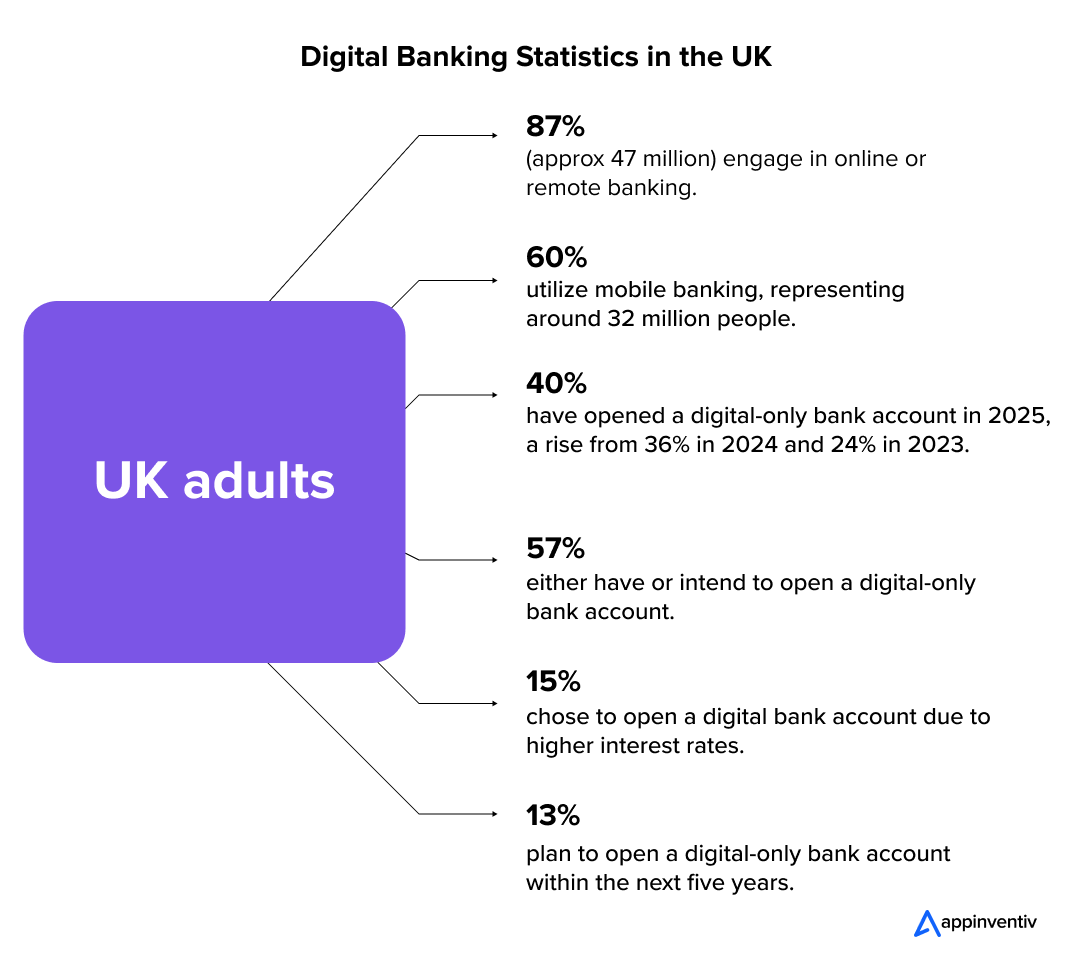

Unsurprisingly, digital banking in the UK has experienced significant growth. Here are some impressive statistics highlighting the increasing adoption of online and mobile banking services in the UK:

Digital Banking Statistics in the UK

These impressive stats exemplify that a mobile banking app like NatWest is more than just a digital wallet. It is a secure, feature-rich platform that handles everything from instant transactions to AI-driven financial insights and more.

But how much does it cost to build one? The answer depends on multiple factors, including feature complexity, security standards, system integrations, regulatory compliance, and so on (details later).

On average, the cost to build a banking app like NatWest ranges between $40,000 to $400,000 (£32,000 to £320,000) or more. In this blog, we will share in-depth insight on the cost-determining factors, the right strategy, and the development process. This will help you optimize banking app development costs efficiently while ensuring seamless performance.

So, without further ado, let’s break down all the critical components needed to develop a cutting-edge banking app in budget.

Discuss your project requirements with us and get a more accurate cost estimate.

NatWest – Setting a Benchmark in the Digital Banking Age

NatWest ranks among the top-rated banking apps in the UK, setting a high benchmark with its seamless, secure, and user-centric financial services. In 2024, NatWest reported a revenue of £14.6 billion, reflecting its dominance in digital banking. You might be surprised to know that over 10 million customers use the award-winning NatWest mobile banking app to access their accounts daily.

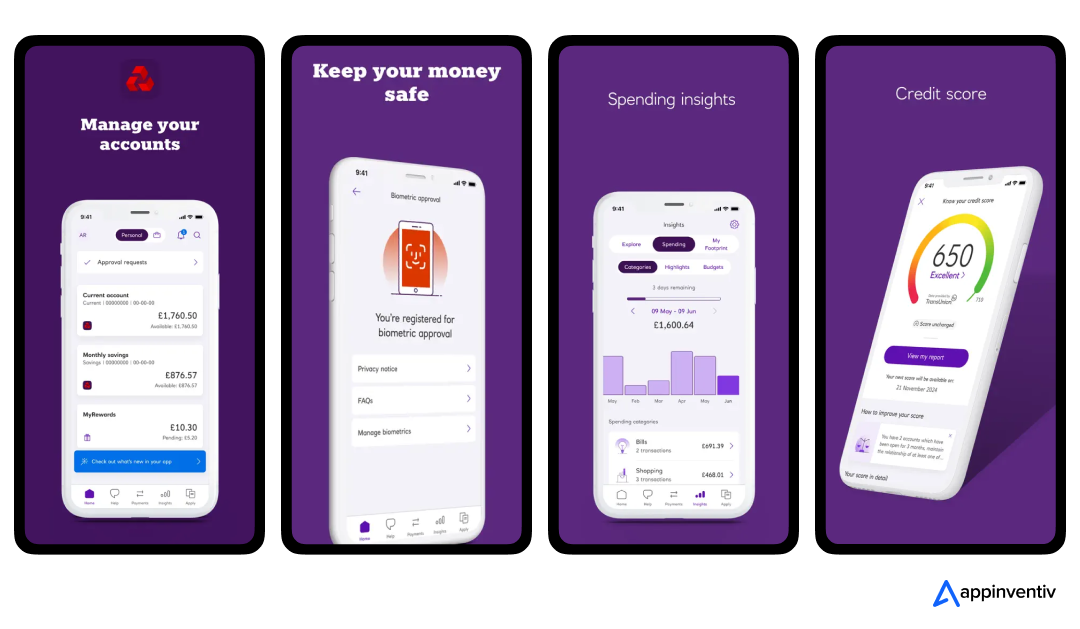

What makes the NatWest app stand out in today’s digitally driven age? It is its intuitive UI/UX and range of interesting features.

The app’s success is largely attributed to its intuitive UI/UX, designed for seamless navigation, accessibility, and security. It offers quick access to essential banking features and bridges the gap between traditional banking and the digital-first expectations of today’s users, enhancing users’ experience. Its commitment to customer satisfaction is reflected in its 4.8-star rating on the Apple App Store and 4.5-star rating on Google Play, based on thousands of user reviews.

Key features that make NatWest a standout in digital banking include:

- Quick balance check – Instantly view your account balance and recent transactions.

- Detailed transaction history – Track and review all past payments and deposits.

- Account personalization – Customize account names and settings for easy management.

- Bill payments & scheduling – Pay bills instantly or schedule future payments.

- Travel plan registration – Set up travel notices to avoid transaction issues abroad.

- Smart notifications – Manage alerts for transactions, spending, and account updates.

- 24/7 customer support – Get instant assistance via live chat and in-app support.

- Fraud detection and alerts – AI-driven security to prevent unauthorized transactions.

- Biometric security – Secure login with fingerprint, Touch ID, and Face ID support.

NatWest has set a high standard in the mobile banking industry, exemplifying how a well-executed digital strategy can drive user engagement, financial growth, and customer engagement.

NatWest App Development Cost – A Comprehensive Analysis

The cost of developing a mobile banking app like NatWest depends on three key elements: app complexity levels, development stages, and timeline. Understanding these components helps estimate the overall budget and make strategic decisions for cost optimization.

Cost Breakdown by Complexity Levels

The app’s complexity is the first and foremost element essential in determining the NatWest app development cost. The more complex the app, the higher the development cost. Here’s a breakdown of different complexity levels:

| Complexity Level | Estimated Cost (£) | Estimated Cost ($) | Development Time |

|---|---|---|---|

Basic App | £32,000 – £69,000 | $40,000 – $90,000 | 3-6 months |

Moderate App | £69,000 – £161,000 | $90,000 – $210,000 | 6-9 months |

Advanced App | £161,000 – £320,000+ | $210,000 – $400,000+ | 9-12+ m |

Development Stages

Mobile banking app development is a complex and multi-phase process, and each app development phase contributes to the overall cost. Therefore, before finalizing the budget, you must learn about the stage involved in banking app development.

Below is a detailed table outlining the costs and key activities for each stage of development:

| Development Stage | Key Involvements | Estimated Cost (£) | Estimated Cost ($) |

|---|---|---|---|

Planning & Research |

| £1,600 – £16,000 | $2,000–$20,000 |

UI/UX Design |

| £4,000 – £24,000 | $5,000–$30,000 |

Development |

| £12,000 – £160,000 | $15,000–$200,000+ |

Testing and Launch |

| £2,400 – £16,000 | $3,000–$20,000 |

Post-Launch Maintenance |

| £4,000 – £16,000/year | $5,000–$20,000/year |

How to Estimate the Mobile Banking App Development Cost like NatWest

The cost of developing a banking app like NatWest primarily depends on two key factors: the total development hours required and the hourly rates of developers. A simple formula to estimate the cost is:

| Development Hours × Hourly Rate = Total Cost |

|---|

For instance, if a development team in Eastern Europe charges £32/hour ($40/hour) and the project requires 2,500 hours, the estimated cost would be £80,000 ($100,000)—excluding ongoing maintenance and future updates.

For example, if a development team charges £32/hour ($40/hour) to build a banking app like NatWest in the UK and the project takes 2,500 hours, the cost would be approximately £80,000 ($100,000)—excluding post-launch maintenance and future upgrades.

| £32/hour ($40/hour) x 2,500 hours = £80,000 ($100,000) |

|---|

Factors Impacting Mobile Banking App Development Cost

Calculating the total cost of mobile banking app development is not as easy as it seems. It is determined by several critical elements, especially one that is feature-rich and secure, such as NatWest. Interested in exploring the cost-determining factors that influence banking app development expenses? Scroll down to uncover them:

UI/UX Design

The design of the banking app plays a significant role in enhancing user experience and, thus, its success rate in the market. A clean, intuitive interface that prioritizes ease of use, accessibility, and engagement contributes to the development time and costs. The more customized and user-friendly the design, the higher the cost.

| Design Complexity | Estimated Cost (£) | Estimated Cost ($) |

|---|---|---|

Basic UI/UX (Minimalist design, simple navigation) | £4,000 – £8,000 | $5,000 – $10,000 |

Moderate UI/UX (Custom elements, interactive UI) | £8,000 – £16,000 | $10,000 – $20,000 |

Advanced UI/UX (Animated transitions, micro-interactions, dynamic themes) | £16,000 – £32,000 | $20,000 – $40,000 |

Backend Development

Backend development encompasses the server, database, and API integrations that power the app’s core functionalities. This layer is crucial for real-time transaction processing, account management, and secure data storage. More complex backend systems with higher scalability and integration requirements cost more.

| Backend Complexity | Estimated Cost (£) | Estimated Cost ($) |

|---|---|---|

Basic Architecture (Simple database, user authentication) | £3,000 – £9,000 | $5,000 – $15,000 |

Moderate Architecture (Data caching, real-time odds updates, API integration) | £12,000 – £24,000 | $20,000 – $40,000 |

Advanced Architecture (Scalability for millions of users, AI-driven analytics) | £24,000 – £48,000+ | $40,000 – $80,000+ |

Third-Party Integration

Mobile banking app development often relies on third-party services to enhance functionality. These include identity verification tools, financial data aggregation (Open Banking), payment gateway integration, and external security services. Each of these integrations requires additional development effort. Thus, mobile banking app development costs vary depending on the number of third-party service providers and the complexity of integration.

| Integration Type | Estimated Cost (£) | Estimated Cost ($) |

|---|---|---|

| Basic Integration (Payments, login authentication) | £3,000 – £6,000 | $5,000 – $10,000 |

| Advanced Integration (Multiple APIs, Real-Time Analytics) | £6,000 – £18,000 | $10,000 – $30,000 |

Security Measures

Security is a non-negotiable aspect of mobile banking apps. Implementing robust security features such as biometric authentication, data encryption, AI-driven fraud detection algorithms, multi-factor authentication (MFA), etc., are essential but enhance the cost to build a banking app like NatWest. The more advanced the security measures, the higher the mobile banking app development cost in the UK.

| Security Features | Estimated Cost (£) | Estimated Cost ($) |

|---|---|---|

Basic Security (SSL encryption, secure login) | £3,000 – £6,000 | $5,000 – $10,000 |

Advanced Security (2FA, biometrics, blockchain-based transactions) | £9,000 – £18,000 | $15,000 – $30,000 |

Compliance Requirements

Regulatory compliance is a critical factor in banking app development. Banking apps must comply with industry regulations such as PCI DSS, GDPR, and the Financial Conduct Authority (FCA). Ensuring the app meets these legal requirements demands the proven expertise of app developers and additional development time, which impact the overall cost to build a banking app like NatWest.

| Compliance Type | Estimated Cost (£) | Estimated Cost ($) |

|---|---|---|

Basic Compliance (local licensing) | £3,000 – £9,000 | $5,000 – $15,000 |

Advanced Compliance (KYC, AML, PCI-DSS, GDPR) | £9,000 – £24,000 | $15,000 – $40,000 |

Platform Selection

Whether the app will be developed for iOS, Android, or both (cross-platform) significantly influences the mobile banking app development cost in the UK. Building a separate app for multiple platforms typically requires more resources, thus increasing costs. Conversely, cross-platform development reduces costs by using a single codebase that runs efficiently on numerous platforms.

| Platform Choice | Estimated Cost (£) | Estimated Cost ($) |

|---|---|---|

Single Platform (iOS or Android) | £3,000 – £12,000 | $5,000 – $20,000 |

Cross-Platform (Flutter, React Native) | £12,000 – £30,000 | $20,000 – $50,000 |

Technology Stack

The technology stack chosen for building the app plays a major role in determining the cost to build a banking app like NatWest. Popular frameworks and languages like Swift for iOS, Kotlin for Android, or cross-platform frameworks like Flutter or React Native will influence the development speed and cost. Additionally, the choice of backend technologies like Node.js, Python, or Java also impacts the overall expense.

| Technology Stack | Estimated Cost (£) | Estimated Cost ($) |

|---|---|---|

Basic Stack (Node.js, React, AWS) | £3,000 – £24,000 | $5,000 – $40,000 |

Advanced Stack (AI, Blockchain, Custom ML Models) | £24,000 – £48,000+ | $40,000 – $80,000+ |

Also Read: How is Blockchain in Banking Transforming the Industry

Complexity of Features

The more features the app has, the higher the NatWest Bank app development cost. Basic features such as account balance checking and transaction history are inexpensive. However, adding complex functionalities like AI-powered financial insights, real-time fraud detection, peer-to-peer payments, and personalized financial management requires more development hours and specialized skills, which can significantly increase costs.

| Features Complexity | Features of a Mobile Banking App like NatWest | Estimated Cost (£) | Estimated Cost ($) |

|---|---|---|---|

Basic Features |

| £8,000 – £16,000 | $5,000 – $20,000 |

Moderate Features |

| £16,000 – £24,000 | $20,000 – $30,000 |

Advanced Features |

| £24,000 – £40,000+ | $30,000 – $50,000+ |

Hidden Cost to Build a Banking App Like NatWest

Beyond the upfront factors that determine initial development cost, some hidden elements often come with ongoing expenses. These hidden costs significantly impact the total digital banking app development cost; thus, you must consider them when calculating the total cost to build a banking app like NatWest.

App Maintenance

Regular updates, bug fixes, and feature enhancements are essential to keep the app secure and functional but add to the total banking application development cost.

| App maintenance costs typically range between 15-20% of the initial development cost per year, which is approx £6,000–£36,000 / $10,000–$60,000 |

|---|

App Hosting

Hosting a banking app requires robust cloud infrastructure such as (AWS, Google Cloud, or Microsoft Azure) to ensure high uptime, data security, and scalability.

App hosting costs vary and can range from £1,500 – £10,000 ($2,000 – $12,500) per year, depending on user volume and storage needs.

App Marketing

Acquiring new users and retaining the existing ones demands a well-planned marketing strategy, including paid ads, SEO, and referral programs.

| Based on promotional campaigns and user acquisition goals, app marketing expenses can range from £8,000 – £40,000+ ($10,000 – $50,000+) annually. |

|---|

Legal and Licensing Fees

Complying with financial regulations and data protection laws requires licensing, audits, legal consultations, and skilled developers who are experienced in building a banking app.

| Legal and licensing fees for banking app development can range from £5,000 – £50,000+ ($6,500 – $65,000+). |

|---|

By carefully considering these upfront and hidden factors, businesses can better plan their budget and choose the right strategy to develop a secure, scalable, and feature-rich mobile banking app in the UK that meets user needs and industry standards.

How to Optimize Banking App Development Costs in the UK?

Though there are several upfront and hidden elements that can influence the cost to build a banking app like NatWest, the good news is by following some simple strategies, you can optimize the cost and keep the development expenses within budget. Yes, you read it right. Building a mobile banking app like NatWest requires a significant investment, but strategic planning can help optimize costs without compromising quality, security, or user experience.

So, why wait? Let’s explore some tried and tested techniques that significantly reduce the total cost of development:

| Cost Saving Techniques | Impact on Development Costs |

|---|---|

Build an MVP | 25-50% reduction in initial costs |

Prioritize Essential Features | 20-50% reduction in unnecessary costs |

Use Cross-Platform Development | 20-40% reduction in costs |

Outsource to Cost-Effective Regions | 30-60% lower hourly rates |

How to Monetize Mobile Banking Apps like NatWest

While mobile banking apps primarily serve as a digital extension of financial services, they also present multiple revenue-generating opportunities. Banks and FinTech companies can implement proven monetization strategies to increase ROI and customer experience.

Transaction Fees

Banks can charge minimal fees on certain transactions, such as international money transfers, expedited payments, or peer-to-peer (P2P) transfers. This model ensures revenue generation and user convenience.

Subscription Plans

It is another impressive revenue model for banking apps. In this model, you can offer a monthly, quarterly, or annual subscription model, allowing users to access some premium banking services.

In-App Advertising

Banks can collaborate with third-party service providers like insurance companies, investment platforms, or mortgage providers to offer relevant financial products within the app. Banks can generate a lucrative commission for every successful referral in this model.

White-Labeling

Banks with advanced digital infrastructure can monetize their apps by offering white-label banking solutions, enabling other financial institutions or FinTech startups to use their platform. This allows banks to generate revenue through licensing fees.

Now that we know all the ins and outs of the banking app development cost and revenue models, let’s learn how to develop a banking app like Natwest in the UK.

How to Build a Banking App Like NatWest in the UK?

Creating a cutting-edge mobile banking application that can keep pace with industry giants like NatWest requires a well-structured, focused roadmap addressing every development facet—from initial research to post-launch support. Here, we have broken down the mobile banking app development process into key phases that ensure your app meets regulatory standards and delights users. Let’s explore these critical stages that turn your vision into a groundbreaking FinTech product:

1. Conduct Market Research

Conduct thorough market research to understand your target audience’s needs, know competitors, and define project goals.

2. Define Core Features

Identify must-have features like secure login, payments, account management, and fraud detection to set the right foundation for banking app development.

4. Choose the Tech Stack

Select the right technologies, such as React Native, Swift, Kotlin, Node.js, cloud services, AI, blockchain, etc.

5. Design UI/UX

Create a mobile banking app like NatWest with an intuitive, user-friendly interface that enhances accessibility and user engagement.

6. Implement Compliance and Security Measures

Incorporate encryption, multi-factor authentication, biometric login, and fraud prevention tools.

7. Develop the App

Follow an agile approach to bring your product to life. At this stage, your FinTech app development company in the UK integrates core functionalities, builds a secure backend, and integrates third-party APIs.

8. Test the App

Conduct comprehensive testing, including functional, security, and performance assessments, to ensure the app performs unabruptly and meets all industry requirements.

9. Deploy the App

Submit the app to the Google Play Store and Apple App Store, following all the essential guidelines to ensure a successful launch.

10. Maintain and Update the App

Regularly update the app, enhance security, fix bugs, and introduce new features to ensure uninterrupted app performance and gain competitive advantages.

Don’t miss out on this growing app adoption trend. Build your next-gen banking app now!

How to Build a Revolutionary Banking App that Can Outperform Industry Giants Like NatWest

Developing a banking app that outperforms industry giants like NatWest requires a strategic focus on three key areas: UI/UX Design, cutting edge Features, and Latest Technologies. Below is a table outlining essential considerations for each area:

| Aspect | Key Considerations |

|---|---|

UI/UX Design |

|

Cutting-Edge Features |

|

Latest Technologies |

|

Bring Your Banking App Idea to Life with Appinventiv

Now that you are well acquainted with banking app development costs, factors affecting them, ways to optimize your budget, and other vital elements, it is time to bring your app idea to life with Appinventiv on your side.

We are a leading mobile app development company in the UK, offering comprehensive services to transform your vision into a robust, user-friendly banking application. With around a decade of experience, we have delivered 3,000+ successful projects with an impressive 95% client satisfaction rate.

Why Makes Us Your Preferred Tech Partner?

- Technical Excellence: Our team of 1600+ tech experts stays updated with the latest FinTech trends, ensuring your app is built with cutting-edge technologies.

- Security and Compliance: We adhere to industry standards like PCI-DSS and GDPR, ensuring your app is secure and compliant.

- Agile Development: Our agile development approach allows flexibility and iterative improvements, aligning with your evolving business needs and industry standards.

What’s more?

We have successfully collaborated with leading and emerging FinTech companies like Mudra, EdFundo, etc., and have delivered tangible outcomes.

For instance, our collaboration with Edundo, a financial literacy platform, led the brand to bag a pre-seed funding of $500,000 and prepare for a seed funding round of $3 million.

For another client, Mudra, we built a budget management application with AI capabilities launched in 12+ countries globally and received immense engagement from users.

We chose Appinventiv to build our financial literacy and money management app from start to finish. From the first call, we were very impressed with Appinventiv’s professionalism, expertise, and commitment to delivering top-notch results. Their developers were extremely talented and delivered an amazing final product that exceeded our expectations. Our app is now live and the feedback that we are receiving from users is fantastic.

By collaborating with us, you gain access to a team of dedicated developers who are well-versed in bringing your banking app idea to fruition.

So, why wait? Partner with us now and embark on your banking app development journey.

FAQs

Q. How much does it cost to build a banking app in the UK?

A. There is no pre-defined formula to quote the exact cost to build a mobile banking app in the UK. On average, banking application development cost ranges between $40,000 to $400,000 (£32,000 to £320,000) or more.

However, it is just a rough estimate; the actual cost varies depending on several factors (detailed above). Discuss your project requirements with us for a more accurate estimate tailored to your needs.

Q. What is the timeline for building an app like NatWest mobile banking app?

A. The timeline to building a banking app typically falls between 4 months to 1 year or more, depending on your project’s complexity and the expertise of the FinTech app development company. The more complex your app idea, the more time it will take to be developed.

Q. How do you keep banking app development costs within budget?

A. Here are some tried and tested strategies that will help manage and reduce mobile banking app development costs.

- Developing an MVP

- Prioritizing necessary features

- Opt for cloud-based infrastructure

- Leveraging cross-platform

- Outsourcing to cost-effective regions

10 Industry-Wise 5G Use Cases Transforming Australian Businesses

Key takeaways: Industry Transformation: 5G is revolutionizing key sectors in Australia, including healthcare, manufacturing, agriculture, and logistics, by enabling real-time data processing, enhanced connectivity, and automation that improve operational efficiency and customer experiences. Enhanced Connectivity for Regional Areas: 5G technology bridges the connectivity gap in remote and regional areas of Australia, supporting industries like agriculture…

How to Build a Secure App in Australia in 2025? All You Need to Know

In today’s hyper-connected world, mobile apps aren’t just conveniences; they are the baseline of modern business. From banking and healthcare to retail and government services, apps power our daily lives. But this digital revolution has a dangerous downside: cyberattacks are escalating alarmingly. More than data exposure, this security breach costs businesses a lot, destroys customer…

How to Build a Ride-Hailing App Like Yango Ride?

Dubai's streets are buzzing with innovation. The city is fast becoming a playground for smart mobility, from AI-driven traffic systems to autonomous taxis. In the middle of it all, the decision to build an app like Yango has brought serious traction, offering seamless, affordable, and tech-savvy transport alternatives. But here’s the thing: success in this…