- Why is Building a Successful FinTech Product Critical for Modern Financial Businesses?

- How to Build a Successful FinTech Product? A Step-by-Step Development Guide

- 1. Check Market and Regulatory Feasibility First

- 2. Map the Product Scope and Lifecycle

- 3. Make Architecture Decisions That Hold Up Over Time

- 4. Treat Compliance and Security as Core Functionality

- 5. Build and Integrate in Small, Controlled Steps

- 6. Prepare for Day-to-Day Operations, Not Just Launch

- What Are the Key Challenges in FinTech Product Development and How Can You Overcome Them?

- 1. Balancing Speed With Regulatory and Risk Constraints

- 2. Managing Complex Integrations and Dependencies

- 3. Scaling Without Breaking Core Systems

- 4. Controlling Fraud and Misuse Without Hurting User Experience

- 5. Aligning Teams Around Long-Term Product Goals

- What are the Business and Operational Benefits of FinTech Product Development?

- What Key Features are Essential for Building a Scalable FinTech Product?

- Which FinTech Use Cases Are Driving Real Adoption Across Industries?

- What are Some Real-World Examples of Successful FinTech Products?

- How Do Compliance, Security, and Risk Shape FinTech Product Development from Day One?

- How Appinventiv Helps You Build a Future-Ready FinTech Product

- FAQs

Key takeaways:

- Fintech products succeed when strategy, compliance, and engineering move together from day one.

- Building for scale early reduces costly rework as users, transactions, and regulations grow.

- Strong fintech product management focuses on reliability and trust, not just feature speed.

- Real adoption comes from solving one clear financial problem before expanding further.

- The most resilient fintech platforms treat compliance and security as product foundations, not add-ons.

Building a fintech product today is rarely about being first to market. Regulations keep evolving, trust takes time to earn, and early shortcuts often surface later as costly operational issues. That reality has made fintech product development far more deliberate and planning-heavy than many teams initially expect.

The opportunity, however, is substantial. Analysts project the global fintech market could surpass $900 billion by 2030, driven by digital payments, embedded finance, and AI-led financial services reshaping how money moves. Growth is real, but only for products designed to scale within regulatory and technical boundaries.

In practice, fintech products struggle when the fintech product strategy stays theoretical instead of operational. Choices around architecture, data control, and third-party dependencies quietly shape the entire fintech product lifecycle. This guide is built for teams navigating fintech product management in real conditions, focused on building digital financial products that remain stable long after launch.

As fintech markets scale into the trillions, products that lack regulatory and architectural depth struggle to survive audits, scale, and real usage.

Why is Building a Successful FinTech Product Critical for Modern Financial Businesses?

In financial services, reliability matters more than promises. Users may never see what runs behind a fintech product, but they quickly notice when something feels slow, confusing, or broken. This is why fintech product development directly impacts trust and long-term relevance.

This is especially true for payment-focused platforms, where teams must understand how to create a money transfer app that performs reliably under regulatory and operational pressure.

Much of that trust is shaped early. A clear fintech product strategy guides decisions around architecture, data handling, and software integrations. When these choices are rushed, products often struggle to scale or meet regulatory expectations later. Strong fintech product management helps teams balance innovation with control.

By investing in thoughtful digital financial product development from the start, businesses reduce risk, manage costs more effectively, and build platforms that can scale across banking, payments, and lending without constant rework.

Why this matters today:

- Trust and reliability influence adoption more than features alone

- Regulatory readiness prevents delays and expensive redesigns

- Scalable foundations support growth across the full fintech product lifecycle

- Well-managed innovation enables the safe use of AI or blockchain in fintech without added risk

In short, successful fintech products are built to last. Businesses that invest in disciplined development early are better prepared to scale, adapt, and compete in an increasingly crowded market.

How to Build a Successful FinTech Product? A Step-by-Step Development Guide

Most fintech products fail not due to bad ideas, but because critical steps are rushed or skipped. A structured development process may feel slower initially, but it prevents costly fixes and ensures long-term stability..

Below is a practical approach to fintech product development, based on how real products are built and maintained in live environments.

1. Check Market and Regulatory Feasibility First

Before development begins, teams need to understand where the product can realistically operate. This step sets the direction for the entire fintech product strategy.

Focus on:

- Target markets and regulatory expectations

- Whether a license, banking partner, or payment provider is required

- Where the product fits among existing types of fintech products

Clarifying this early avoids major design changes once compliance teams get involved.

2. Map the Product Scope and Lifecycle

Successful teams think beyond the MVP. They plan how the product will behave as it grows through the full fintech product lifecycle.

At this stage:

- Outline core user journeys, such as onboarding and transactions

- Identify areas that carry a higher risk, like identity checks or fund movement

- Decide which features must scale from the beginning

Strong fintech product management keeps these decisions realistic and focused.

3. Make Architecture Decisions That Hold Up Over Time

Architecture is where many fintech products either gain flexibility or lock themselves into limitations. In digital fintech product development, these choices are hard to reverse.

Key considerations:

- How transactions and balances are recorded

- How systems communicate during high-volume activity

- How sensitive data is stored, encrypted, and logged

A solid foundation supports future product development and fintech innovations without constant rework.

4. Treat Compliance and Security as Core Functionality

Compliance in fintech is not a phase you reach later; it’s a core principle. It shapes how features behave from the start, especially in custom fintech product development.

This usually includes:

- Identity verification and access controls

- Clear approval flows for sensitive actions

- Transaction records that can be reviewed and audited

- Risk monitoring, including selective use of AI in fintech products

Building this in early reduces surprises during audits and reviews.

5. Build and Integrate in Small, Controlled Steps

Fintech systems depend heavily on external services. That is why fintech product development for payments, banking, lending, or wealth management benefits from steady, well-tested progress.

Good practice involves:

- Using sandboxes before live integrations

- Designing fintech APIs that handle retries safely

- Testing edge cases tied to real money movement

This approach strengthens overall fintech product development solutions.

6. Prepare for Day-to-Day Operations, Not Just Launch

Launching a fintech product is only the beginning. Long-term success depends on how well it performs under pressure.

Teams should plan for:

- Monitoring and alerts around transactions and failures

- Clear steps for handling incidents

- Backup and recovery processes

- Release controls as the product evolves

Following proven fintech product development best practices helps teams stay ahead of common fintech product development challenges.

What Are the Key Challenges in FinTech Product Development and How Can You Overcome Them?

Fintech products operate in an environment where small mistakes carry outsized consequences. Money moves in real time, regulations evolve quickly, and customer tolerance for failure is low. As a result, fintech product development challenges tend to surface not as isolated issues, but as connected operational problems. Addressing them early is a core part of building resilient products.

Below are the most common challenges teams face, along with practical ways to work through them.

1. Balancing Speed With Regulatory and Risk Constraints

Many teams feel pressure to launch quickly, especially in competitive markets. The challenge is that speed often conflicts with compliance and internal controls.

How to overcome it:

- Define compliance requirements as part of the initial fintech product strategy

- Break regulatory needs into product stories, not legal checklists

- Use phased rollouts instead of “big bang” launches

This keeps the fintech product development process moving without creating rework later.

2. Managing Complex Integrations and Dependencies

Most fintech platforms depend on external systems such as banks, payment processors, or credit bureaus. These dependencies introduce instability that teams often underestimate.

How to overcome it:

- Design integration layers that can absorb API changes

- Plan for downtime, retries, and reconciliation failures.

- Avoid tight coupling to a single provider where possible.

Strong integration discipline improves the reliability of fintech product development solutions across banking, payments, and lending use cases.

3. Scaling Without Breaking Core Systems

Early versions of products often work well at low volume but struggle as growth accelerates. This is a common issue in digital fintech product development.

How to overcome it:

- Design transaction and ledger logic with future volume in mind

- Monitor performance trends early, not after issues appear

- Revisit architectural assumptions as usage grows

This approach supports smoother progression through the fintech product lifecycle.

4. Controlling Fraud and Misuse Without Hurting User Experience

Fraud prevention is necessary, but aggressive controls can frustrate legitimate users. Finding the balance is one of the harder parts of fintech product management.

How to overcome it:

- Apply risk-based controls instead of blanket restrictions

- Use behavioral signals and selective AI in fintech products

- Introduce step-up verification only when risk increases

This reduces exposure while preserving usability.

5. Aligning Teams Around Long-Term Product Goals

Fintech initiatives often involve product, engineering, compliance, and operations teams with different priorities. Misalignment slows progress and increases errors.

How to overcome it:

- Establish shared ownership across the product roadmap

- Revisit assumptions regularly as regulations and markets change

- Treat governance as part of delivery, not an external review

Following these fintech product development best practices helps teams turn friction into structure rather than delay.

Scaling issues, integration failures, and audit delays usually stem from early technical and product decisions, not market demand.

What are the Business and Operational Benefits of FinTech Product Development?

When a fintech product is built the right way, the benefits show up quietly but consistently across the business. Teams spend less time putting out fires and more time improving what already works. A strong fintech product development company creates a sense of control, especially once real users and real money are involved.

From a business perspective, a clear fintech product strategy makes growth more predictable. Roadmaps are easier to follow, budgets are easier to manage, and decisions feel deliberate rather than rushed. As usage grows, this stability becomes a major advantage.

Some benefits that teams notice early on include:

- Fewer disruptions during releases: A well-defined fintech product development process reduces last-minute fixes and unexpected outages.

- Less operational pressure as volume increases: Products designed to scale handle growth more smoothly across the full fintech product lifecycle.

- Simpler audits and reviews: Thoughtful digital fintech product development makes it easier to explain how data moves and how controls are applied.

- Safer innovation over time: Solid foundations support product development, fintech innovations, including the careful use of AI in fintech products, without increasing risk.

- Stronger user confidence: Reliable systems and transparent workflows build trust, which matters more than novelty in financial products.

On the operational side, good fintech product management improves how teams work together. Responsibilities are clearer, handoffs are smoother, and decisions are grounded in how the product behaves in real conditions. Over time, this leads to fintech platforms that grow steadily without constant rework or instability.

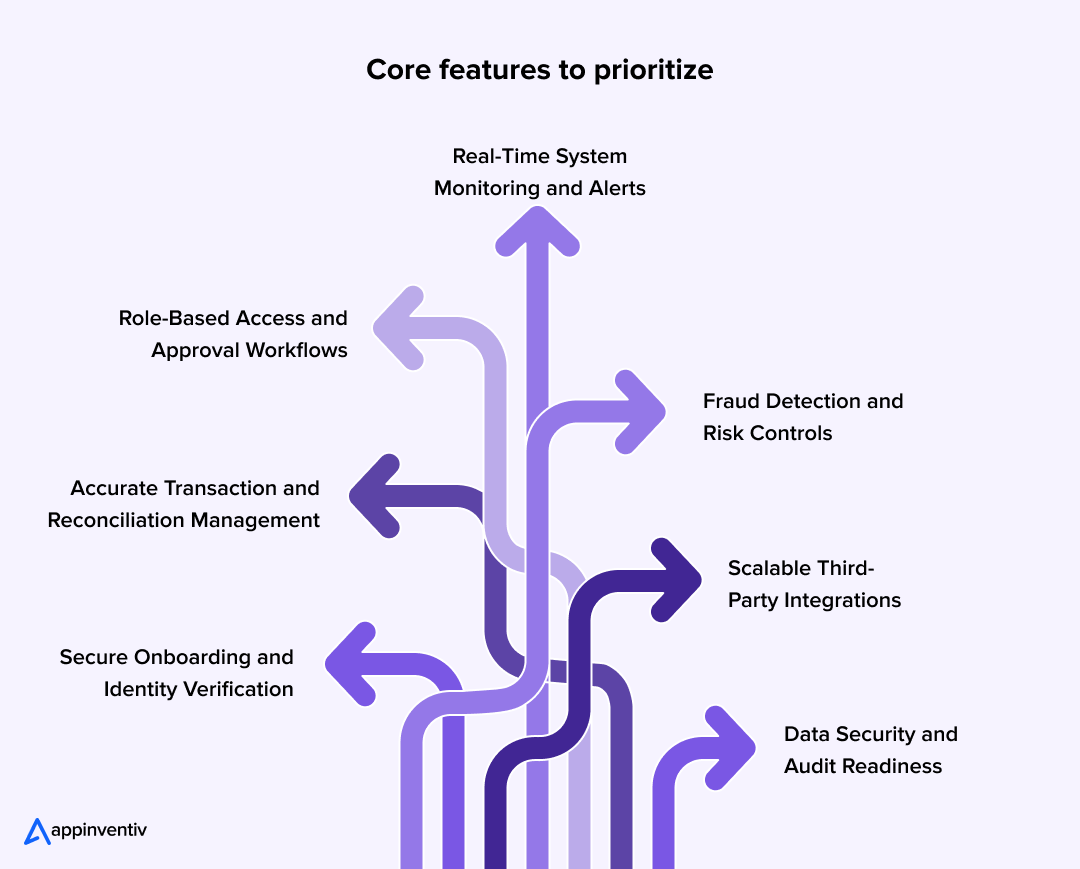

What Key Features are Essential for Building a Scalable FinTech Product?

In fintech, features do more than define what a product can do. They determine how well it holds up once real users, real transactions, and real risks come into play. Teams that focus only on surface-level functionality often feel the strain later. Strong fintech product development places greater emphasis on features that keep the system stable as usage grows.

Experienced fintech product management teams usually start small, but they choose their foundations carefully. These are the features that tend to matter most over time.

Core features to prioritize include:

- Onboarding with built-in checks: Identity verification, document uploads, and step-up checks help manage risk without overwhelming new users.

- Reliable transaction handling: For fintech product development for payments, banking, or lending, accurate transaction records and clean reconciliation are essential to avoid confusion and disputes.

- Clear access and approval flows: Role-based permissions and approval steps protect sensitive actions and make internal accountability easier.

- Visibility into system activity: Dashboards and alerts give teams early signals when something is not working as expected.

- Fraud and misuse controls: Simple rules, combined with selective AI in fintech products, help flag unusual behavior without blocking everyday users.

- Flexible integrations: Most fintech platforms rely on outside services. Designing integrations that can handle change reduces the risk of long-term dependency.

- Data protection and audit support: Encryption, logs, and traceable actions are part of everyday digital fintech product development, not optional extras.

Some teams later explore options like blockchain in fintech products or advanced analytics. The important part is timing. When the core features are solid, adding new capabilities becomes far easier and far less risky.

Also Read: How will Fintech Affect Your Business

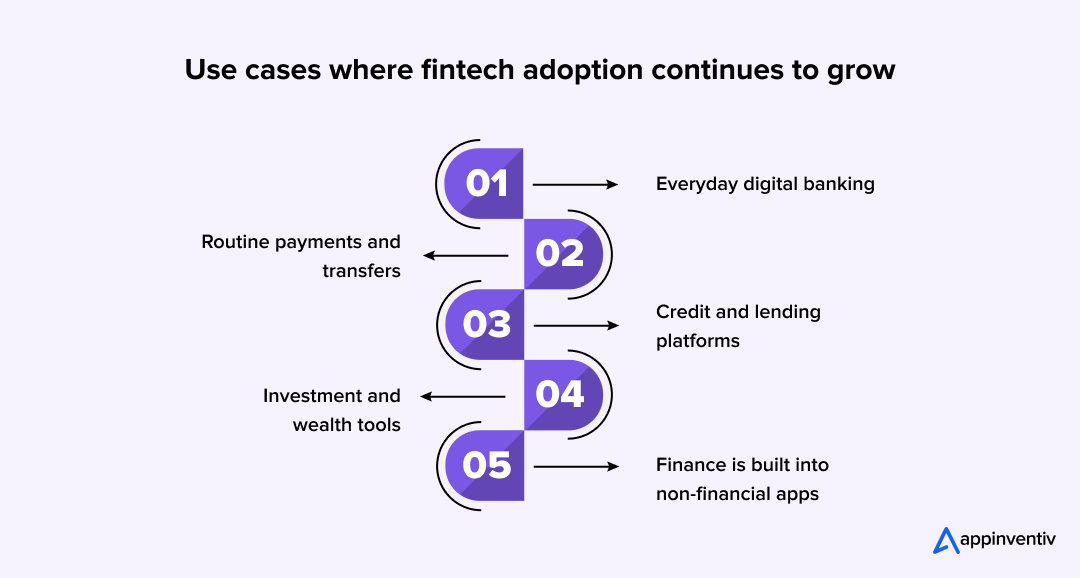

Which FinTech Use Cases Are Driving Real Adoption Across Industries?

Fintech products rarely succeed because they try to cover every financial need at once. The ones that stick usually start with a clear, everyday problem and handle it well. Over time, that focus turns into steady usage and trust. This is a pattern many teams see when working on real fintech product development projects.

Adoption also depends heavily on context. Different industries expect different things from financial tools, and products gain traction when they fit naturally into existing habits rather than forcing new ones.

Use cases where fintech adoption continues to grow include:

- Everyday digital banking: In fintech product development for banking, people value simplicity. Quick onboarding, easy access to account details, and clear transaction histories matter more than advanced features.

- Routine payments and transfers: Fintech product development for payments supports use cases where reliability is non-negotiable. Users expect transfers and settlements to happen without delays or confusion.

- Credit and lending platforms: With fintech product development for lending, accuracy and consistency shape user confidence. Clear repayment tracking and timely updates often matter more than flashy design.

- Investment and wealth tools: In fintech product development for wealth management, adoption grows slowly. Users want transparency and steady performance rather than constant change.

- Finance built into non-financial apps: Many businesses now include payments or financing inside products that were never meant to feel “financial.” This form of digital fintech product development works best when it stays invisible and intuitive.

Across these areas, products gain momentum when they respect how people already manage money. When a fintech product strategy is guided by real behavior instead of assumptions, adoption tends to follow naturally.

What are Some Real-World Examples of Successful FinTech Products?

When you look closely at fintech products that have stood the test of time, their early stories are usually quieter than expected. Most didn’t launch with bold promises or complicated plans. They picked one clear problem, solved it well, and focused on being dependable. Trust came first. Growth followed later.

A few well-known products clearly show this pattern.

- PayPal gained traction at a time when online payments made people nervous. Sending money over the internet felt risky, and hesitation was common. Instead of chasing scale right away, PayPal focused on protection, dispute resolution, and reliability. Once users felt safe using it, adoption grew on its own.

- Cash App followed a similar path, but with a simpler goal. It made person-to-person payments quick and easy, without friction. That single use case drove repeat usage. Only after people trusted the core experience did features like investing and crypto enter the picture.

- Coinbase entered a market where confusion and skepticism were everywhere. Crypto felt intimidating, even to curious users. Coinbase didn’t try to change perceptions overnight. It focused on clear design, strong security, and regulatory compliance. By helping users feel informed and in control, it grew steadily alongside a volatile market.

- Robinhood lowered the barrier to investing by removing commissions and simplifying the trading experience. For many users, it was their first exposure to the stock market. As usage increased, so did scrutiny and responsibility. Its journey shows how success in fintech often brings new operational and regulatory challenges.

- PhonePe succeeded by fitting naturally into daily life in India. It didn’t ask users to change their habits. Instead, it worked seamlessly with UPI, bill payments, and everyday merchant transactions. That familiarity made it easy to adopt and hard to replace.

Across all of these examples, the pattern is consistent. They stayed focused early, avoided unnecessary complexity, and earned user trust before expanding. In fintech, patience and restraint often matter more than speed. Products that respect that reality are the ones that last.

How Do Compliance, Security, and Risk Shape FinTech Product Development from Day One?

In fintech, compliance and security are not checkpoints you reach near launch. They influence how products are designed, built, and operated from the very beginning. Teams that treat them as afterthoughts often end up rebuilding core flows under pressure. In contrast, disciplined fintech product development weaves risk controls into everyday product decisions.

From a planning standpoint, this starts with understanding how regulations affect product behavior. Data storage, consent flows, transaction limits, and audit visibility all shape the fintech product lifecycle. These are not legal concerns alone. They are product and engineering choices that determine whether a platform can scale or stall.

Where compliance and risk shape product design early:

- Onboarding and identity flows: Risk-based KYC decisions affect conversion rates, fraud exposure, and operational costs.

- Transaction handling and limits: Controls around velocity, approvals, and reversals are essential in payments and lending.

- Data management and access: Encryption, retention policies, and role-based access influence both security and audits.

Security follows a similar pattern. In digital fintech product development, protecting systems is about preventing everyday misuse, not just defending against rare attacks. Threats such as account takeover, social engineering, and API abuse are far more common than high-profile breaches.

Teams that manage this well focus on:

- Strong authentication and session controls

- Clear separation between user and admin actions

- Continuous monitoring for unusual behavior

- Selective use of AI in fintech products to flag anomalies early

Risk also extends beyond internal systems. Most fintech platforms rely on banking APIs, payment processors, or credit bureaus. Each dependency introduces exposure that must be actively managed throughout the fintech product development process.

Key risk considerations include:

- Third-party outages and downtime handling

- API version changes and breaking updates

- Data sharing responsibilities and audit boundaries

When compliance, security, and risk are built into the foundation, teams move faster with fewer surprises. This approach turns regulation from a blocker into a design constraint that supports stable growth and stronger trust across modern financial products.

Security and regulatory missteps often surface after launch, when fixes are costlier, and timelines are tighter. Building compliance into the product lifecycle changes that outcome.

How Appinventiv Helps You Build a Future-Ready FinTech Product

Most fintech ideas sound simple at the start. You sketch the flow, define the features, and everything feels manageable. The real test comes later, when compliance reviews slow things down, transaction volumes climb, and users expect every tap to work instantly. That’s usually where teams realize the early choices matter more than they thought.

Appinventiv works with fintech teams that want to get those decisions right from the beginning. Our fintech software development services are built around real operating conditions, not just launch-day requirements. Product strategy, engineering, and compliance are handled together, so nothing critical gets patched in as an afterthought.

Our experience includes platforms like Slice, where we simplified real estate investing without compromising on security or scalability, and Mudra, a budgeting app designed to make everyday money tracking easy while staying compliant. Together, these projects reflect our focus on building practical fintech products that work in real-world conditions.

If you are planning a fintech product and want to move forward with clarity instead of assumptions, a conversation with Appinventiv can help you set the right foundation for what comes next.

FAQs

Q. How is fintech product development different from fintech app development?

A. Think of the app as what users see and tap every day. Fintech product development goes much deeper. It covers the thinking behind the product, how systems talk to each other, how data is protected, how regulations are handled, and how the product will scale. The app is important, but it’s only one part of the puzzle.

Q. How long does it usually take to build a fintech product?

A. Timelines vary more than people expect. A lean MVP can take a few months if the scope is tight. Once compliance, integrations, and deeper testing come into play, six months or more is common. Products tied to banking or payments often take longer because approvals and audits are part of the process.

Q. What does fintech product development typically cost?

A. Cost depends on complexity. A straightforward product with limited regulatory requirements costs far less than one that requires advanced security, multiple integrations, and compliance workflows. Most teams approach fintech development in stages, investing gradually as the product proves its value.

Q. Which compliance controls are essential in fintech products?

A. Some basics can’t be skipped. Identity verification, encrypted data, transaction monitoring, clear audit trails, and strict access controls are expected. These need to be designed in from the start, not bolted on later when issues appear.

Q. What monetization models work best in fintech?

A. There’s no single right answer. Some products earn through transaction fees, others through subscriptions, interest margins, or partnerships. What works best depends on your product’s purpose, your users’ behavior, and where they see real value.

Q. How should businesses approach technology selection and integration in fintech product development?

A. Most teams learn quickly that chasing the latest tech trend rarely pays off. A better approach is to think a few years ahead. Start with a stack that is stable, secure, and flexible enough to grow as usage increases and regulations evolve. Advanced tools like AI or machine learning work best when they solve a clear problem, such as risk checks or smarter insights, rather than being added for novelty. The same goes for blockchain. It makes sense only when transparency or data integrity truly matter. A cloud-first setup usually keeps integrations with banks, APIs, and partners easier to manage as the product expands.

Q. How do user experience and personalization affect fintech product success?

A. In fintech, user experience can make or break adoption. If onboarding feels confusing or slow, users tend to leave before they see value. Clear flows, simple language, and thoughtful design help people complete financial tasks with confidence. Personalization builds on that foundation. When a product reflects a user’s behavior, goals, or spending patterns, it feels useful rather than generic. Well-timed alerts, relevant insights, and small adjustments based on feedback go a long way. When done right, the product feels supportive and intuitive, not overwhelming.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…