- What Makes Zip Pay App Stand Out in the BNPL Market

- What is the Cost to Build a Buy Now Pay Later App like Zip in Australia?

- Breaking Down the Cost to Develop a Buy Now Pay Later App like Zip in Australia

- The Key Features of a BNPL App like Zip in Australia

- 1. User-Centric Features

- 2. Merchant- Focused Features

- Why These Features Matter

- Designing a Seamless and Engaging BNPL App Experience with Intuitive UI/UX

- Why Thoughtful Design Matters?

- Step-by-Step Development Process for a BNPL App Like Zip Pay

- Tech Stack for Developing a BNPL App Like Zip Pay

- How to Monetize a BNPL App Like Zip Pay?

- Appinventiv’s Role in Your BNPL App Development

- FAQs.

The way people shop and pay has changed dramatically. Traditional credit cards are no longer the go-to financing option for many consumers, especially younger generations, who prefer flexibility and transparency in spending. This shift has fueled the rapid rise of Buy Now, Pay Later (BNPL) solutions, with apps like Zip, Afterpay, and Klarna leading the charge.

For businesses, BNPL isn’t just a payment alternative – it’s a growth driver. Merchants using BNPL solutions report higher conversion rates, larger order values, and increased customer retention. At the same time, consumers love the ability to split payments into manageable installments without the high interest rates of traditional credit.

With the BNPL Australia market projected to hit $54.87 billion by 2030, entrepreneurs have never had a better time to invest in buy now, pay later app development in Australia. But the big question remains: how much does it cost to build a Buy Now, Pay Later app like Zip?

Typically, BNPL app development costs range between AUD 60,000 to AUD 600,000 ($40,000 to $400,000) or more, depending on various factors.

In this blog, we’ll break down the factors affecting the cost to develop a buy now pay later app like Zip in Australia, key features, required technology, and cost-saving strategies to help you navigate the process of launching a competitive BNPL solution. Before moving into this booming market, keep reading to uncover everything you need to know.

What Makes Zip Pay App Stand Out in the BNPL Market

Zip Pay has carved a unique niche in the highly competitive Buy Now, Pay Later market with 1 M+ download on Google Play Store. The credit goes to its intuitive interface and innovative features.

From a feature standpoint, Zip stands out by integrating advanced security measures, seamless user experiences across platforms, and AI-driven personalized offers. Its additional services, like bill payments and Zip Loan for businesses, expand its use case beyond simple BNPL, making it a comprehensive FinTech platform.

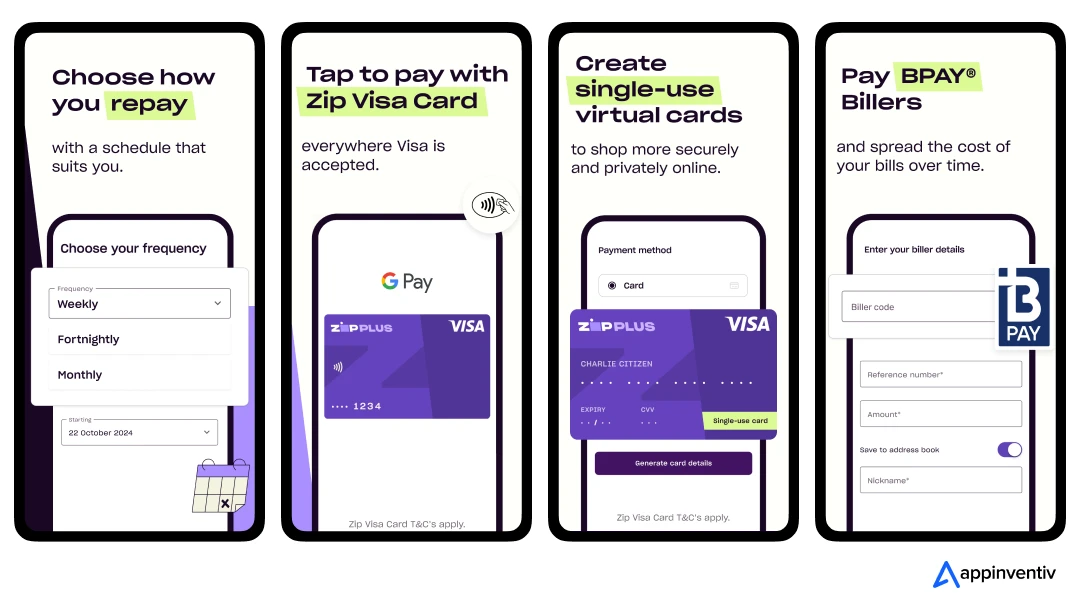

Unlike many traditional BNPL platforms, Zip offers flexible repayment options, allowing users to repay purchases on their terms—weekly, fortnightly, or monthly.

Another key differentiator is Zip’s robust merchant network. By partnering with a wide range of online and in-store retailers, Zip provides users with greater freedom in where and how they shop.

What is the Cost to Build a Buy Now Pay Later App like Zip in Australia?

Buy now, pay later app development in Australia can be a significant investment, but the potential ROI is massive. As BNPL adoption continues to surge, businesses investing in this platform development experience higher conversions, increased customer retention, and greater average order values. Consumers, too, are increasingly favoring BNPL apps over traditional credit, drawn by their interest-free installments, seamless checkout experience, and financial flexibility. These Zip-like buy now pay later app development benefits are a definite sign of the high ROI potential your version of the app carries.

Breaking Down the Cost to Develop a Buy Now Pay Later App like Zip in Australia

A range of factors affect the cost to build an app like Zip, including app complexity, features, compliance requirements, and the selection of tech stack. Here’s a rough estimate of BNPL app development cost based on the products’ complexity levels:

| BNPL App Type | Key Features | Estimated Cost (AUD) | Estimated Cost (USD) |

|---|---|---|---|

| Basic BNPL App | User registration, merchant integration, simple installment plans | AUD 60,000 – AUD120,000 | $40,000 – $80,000 |

| Mid-Level BNPL App | Automated credit assessment, AI-based risk scoring, fraud prevention, multi-currency support | AUD 120,000 – AUD 225,000 | $80,000 – $150,000 |

| Advanced BNPL App | Regulatory compliance, global merchant partnerships, AI-driven personalization, blockchain security | AUD 225,000 – AUD 600,000+ | $150,000 – $400,000+ |

While these cost ranges to create an app like Zip in Australia may seem high, it’s important to remember that BNPL apps generate revenue through multiple streams – merchant fees, late payment charges, subscription plans, and data monetization (details later). With the right execution, a BNPL app can quickly become a profitable fintech venture and get you back the cost to build a buy now pay later app like Zip in Australia in a short time frame.

The cherry on the cake is there are some guaranteed ways to bring the cost down.

1. Start with an MVP – Focus on core features first and expand later.

2. Use Pre-Built APIs – Integrate existing payment gateways and fraud detection tools instead of building from scratch.

3. Choose Cross-Platform Development – Flutter or React Native can reduce the cost to build a buy now pay later app like Zip in Australia compared to separate native apps.

4. Outsource Smartly – Hiring an experienced offshore team can be 30-50% more cost-effective than in-house development.

5. Leverage Cloud Solutions – Using AWS, Google Cloud, or Azure reduces infrastructure-related cost to develop a buy now pay later app like Zip in Australia while ensuring scalability.

Next, let’s explore the core features that make a BNPL app successful and how they impact development.

The Key Features of a BNPL App like Zip in Australia

Apps built on the buy now pay later Australia model must strike a perfect balance between convenience, security, and flexibility. For consumers, the appeal lies in splitting payments into manageable installments without interest, while merchants’ Zip-like buy now pay later app development benefits span increased sales, higher average order values, and better customer retention.

Apps like Zip Pay Australia offer a feature-rich experience for both shoppers and businesses. To build a competitive BNPL app, here’s an in-depth look at the key features that drive its success.

1. User-Centric Features

Seamless Shopping Experience

- Brand Search Functionality – Allows users to easily find partnered stores and discover new brands that accept BNPL payments. A well-structured brand directory enhances usability and engagement.

- Virtual Card Integration – Provides users with a secure virtual card to shop anywhere, both online and in-store, eliminating the need for traditional credit cards.

- Multi-Platform Compatibility – Ensures the BNPL Australia app works across iOS, Android, and web platforms, making transactions accessible anywhere.

Flexible Payment and Installment Options

- Customizable Installment Plans – Enables users to choose between different installment structures, such as 4 or 8, based on their financial flexibility.

- Payment Management Dashboard – Gives users a clear view of their transactions, due dates, and remaining balances to avoid missed payments.

- Integration with Google Pay & Apple Pay – Allows seamless in-store and online purchases without manually entering card details.

- Automated Reminders and Notifications – Keeps users informed about upcoming payments, cashback offers, and spending limits to ensure timely repayments.

Enhanced Shopping and Rewards

- Chrome Browser Extension – When you create an app like Zip in Australia, you should allow users to apply for BNPL payments directly while shopping online, improving merchant conversion rates.

- Cashback & Rewards – Encourages spending by providing cashback on selected merchants and exclusive promotional offers, driving user loyalty.

- Bill Payment Options – This enables users to pay their bills directly through the app, expanding its functionality beyond shopping and supporting broader financial management.

2. Merchant- Focused Features

Comprehensive Merchant Portal

- Business Dashboard & Analytics – Helps merchants track sales, buy now, pay later Australia transactions, customer behavior insights, and revenue growth.

- E-commerce Plugin Integration – Offers ready-to-use plugins for Shopify, Magento, WooCommerce, and other platforms, making BNPL implementation seamless.

Increased Merchant Visibility and Marketing

- App Directory & In-App Placements – Merchants can gain more exposure by being featured in the BNPL apps like Zip Pay Australia’s store directory and promotional sections.

- Email & Mobile App Marketing – Merchants benefit from targeted email campaigns, push notifications, and in-app promotions to attract more users.

- Custom Branding & Promotional Materials – Provides merchants with ready-to-use brand assets, advertising kits, and marketing materials to promote BNPL offers.

Additional Merchant Benefits

- Flexible Financing with Zip Loan – Merchants can access financial support through Zip Loan, allowing them to manage business expansion and inventory costs.

- Automated Payment Settlements – When you make a BNPL app in Australia, ensure that businesses receive timely payments from those transactions, reducing cash flow disruptions.

Why These Features Matter

The success in the buy now pay later Australia market would depend on the app’s ability to offer a frictionless experience for consumers and merchants. While users want a simple, secure, and flexible way to make purchases without worrying about hidden fees or long credit approval processes, merchants seek higher conversions, bigger cart sizes, and increased customer retention, all of which a well-built BNPL platform can provide.

By using these features of a BNPL app like Zip in Australia, businesses can position themselves as key players in the booming BNPL market while ensuring a strong return on investment.

Designing a Seamless and Engaging BNPL App Experience with Intuitive UI/UX

The design of a Buy Now, Pay Later app plays a crucial role in user adoption and engagement. It is also one of the critical factors affecting the cost to build an app like Zip. A well-crafted UI/UX enhances usability and builds trust, which is essential for financial applications. Since users interact with BNPL apps frequently – to browse merchants, check payments, and manage installments- the design must be intuitive, frictionless, and visually appealing.

Here’s how to approach the design of a BNPL app to ensure maximum usability and engagement.

1. Prioritizing Simplicity & Intuitive Navigation

Creating an app like Zip in Australia should feel effortless, with a clean interface, minimal clutter, and intuitive navigation.

- Clear Hierarchy & Layout – Place the most important features, such as payment management, installment tracking, and brand search, front and center.

- Fewer Clicks, Faster Actions – Users should be able to check their payment schedules, upcoming dues, and available credit in just a few taps.

- Seamless Onboarding – Reduce friction with one-tap sign-ups using Google/Apple authentication and a guided walkthrough to introduce key features.

2. Designing for Trust & Transparency

Since BNPL Australia apps handle financial transactions, users must feel confident that they’re making informed decisions.

- Clear Breakdown of Payments – Show a detailed installment breakdown with due dates, total repayment amounts, and any applicable fees in an easy-to-read format.

- Upfront Credit Limit Display – Communicate available spending limits to prevent confusion and avoid overspending.

- Secure & Familiar UI Elements – Use trust signals like padlock icons for transactions, biometric login options, and well-recognized payment gateway logos to enhance credibility.

3. Personalization & Adaptive UI

A buy now pay later Australia app should adapt to user preferences and behaviors, making the experience more engaging.

- Personalized Merchant Recommendations – Suggest relevant stores based on past transactions and shopping behavior.

- Dark & Light Mode Options – Allow users to switch between themes for a more comfortable viewing experience.

- Location-Based Customization – Adapt currency formats, language settings, and regional offers based on the user’s location.

4. Ensuring Mobile-First & Cross-Platform Optimization

Most users interact with the app on their smartphones, but web compatibility is equally important. Thus, it is a key consideration for buy now, pay later app development in Australia.

- Responsive UI for All Devices – The design should work flawlessly across iOS, Android, tablets, and desktop browsers.

- One-Handed Usability – Key actions should be thumb-friendly, considering users primarily navigate apps with one hand.

- Seamless Web-to-App Transition – For users who browse merchants via desktop, a QR code or deep link can redirect them to the mobile app for a smooth checkout experience.

5. Frictionless Checkout & Payment Management

A well-designed BNPL app should make transactions feel effortless while ensuring users stay in control of their spending. It can also impact the cost to develop a buy now pay later app like Zip in Australia.

- One-Tap Checkout – Minimize checkout steps by integrating Google Pay, Apple Pay, and biometric authentication.

- Real-Time Notifications – Keep users informed with instant payment confirmations, upcoming due dates, and cashback updates.

- Interactive Payment Calendar – A visual calendar to track installment schedules makes payment planning more intuitive.

Why Thoughtful Design Matters?

Even though it can increase the cost to build a buy now pay later app like Zip in Australia, it is an integral element you can overlook. A great app design isn’t just about aesthetics; it’s about making the user experience smooth, engaging, and trustworthy. Users should be able to shop, pay, and manage finances effortlessly while feeling in control of their purchases. Businesses can create a high-adoption BNPL platform that keeps users coming back by prioritizing simplicity, trust, personalization, and efficiency.

Step-by-Step Development Process for a BNPL App Like Zip Pay

The buy now pay later app development process culminates multiple stages that involve careful planning, execution, and optimization. Each phase impacts the project’s overall cost, timeline, and success. However, well-structured steps to build an app like Zip in Australia ensure a seamless user experience while keeping costs in check.

Here’s how to approach the process of buy now, pay later app development in Australia while balancing quality and budget.

1. Brainstorming & Market Research

Before you start making a BNPL app in Australia, a deep understanding of the market, competitors, target audience, and your project goal is crucial.

- Identify the Core Features – Decide on the must-have features (e.g., virtual cards, installment plans, payment integrations).

- Analyze Competitors – Study BNPL leaders like Zip Pay, Klarna, and Affirm to identify what works and can be improved.

- Understand Compliance Requirements – Since BNPL apps deal with financial transactions, adhering to regulations like PCI DSS and local financial laws is essential.

Impact on Cost: This phase determines the app’s scope, directly influencing development hours, required expertise, and compliance-related expenses.

2. UI/UX Design and Prototyping

A BNPL app’s success heavily depends on its ease of use and visual appeal. The design should be intuitive, engaging, and mobile-friendly.

- Wireframing & Prototyping – Creating interactive wireframes to test the user journey before full-scale development.

- User-Friendly Interface – Prioritizing simple navigation, clear payment breakdowns, and secure login options.

- A/B Testing Designs – Gathering user feedback to optimize the interface and conversion pathways.

Impact on Cost: Investing in a well-researched UI/UX design reduces the risk of expensive revisions later and enhances user retention.

Also Read: Importance of UI UX Design in an App Development Process

3. App Development (Front-End & Back-End)

This is one of the core steps to build an app like Zip in Australia, where the app is coded, tested, and brought to life.

- Front-End Development – Ensuring a smooth, responsive UI with a seamless checkout experience.

- Back-End Development – Creating a scalable, high-performance infrastructure for handling user data, transactions, and security.

- Third-Party Integrations – Connecting with payment gateways, merchant APIs, Google Pay, Apple Pay, and credit assessment tools.

- Security Features – Implementing end-to-end data encryption, fraud detection, and authentication mechanisms.

Impact on Cost: The complexity of features like real-time payment tracking, security layers, and multiple integrations significantly affect development time and budget.

4. Quality Assurance & Testing

Testing ensures a flawless user experience, prevents security loopholes, and optimizes app performance.

- Functional Testing – Ensuring all features work as intended across devices and operating systems.

- Security Testing – Running penetration tests to protect against fraud, data leaks, and cyber threats.

- Usability Testing – Gathering feedback from real users to fine-tune the experience.

- Load & Performance Testing – Ensure the app can handle high traffic volumes without slowing down.

Impact on cost to build a buy now pay later app like Zip in Australia: Detecting and fixing issues early prevents expensive fixes after deployment and ensures a smooth launch.

5. Deployment & Launch

Once tested, the app is ready for release on app stores and integration with business systems.

- App Store Submission – Ensuring compliance with Google Play and Apple App Store policies.

- Marketing & Onboarding Strategy – Creating a strong user acquisition campaign to boost adoption.

- Monitoring & Bug Fixes – Tracking performance metrics, user feedback, and potential issues post-launch.

Impact on Cost: A well-executed launch strategy minimizes early-stage technical failures, reducing the need for immediate patches and updates.

6. Post-Launch Maintenance & Scaling

To stay competitive, a BNPL app requires ongoing updates, new feature additions, and performance optimizations.

- Bug Fixes & Security Patches – Addressing any post-launch issues quickly.

- Feature Enhancements – Adding functionalities like AI-based credit risk assessment, advanced analytics, and personalized merchant offers.

- Scalability Planning – Optimizing the infrastructure for growing user demand and international expansion.

Impact on Cost: The cost to maintain a buy now pay later app like Zip in Australia typically ranges from 15% to 20% of the initial development cost per year. However, proactive scaling can reduce future development expenses.

Tech Stack for Developing a BNPL App Like Zip Pay

Choosing the right tech stack ensures seamless performance, security, and scalability for a Buy Now, Pay Later app. However, this is a critical component that directly impacts the cost to build a buy now pay later app like Zip in Australia. Below is a recommended tech stack that is usually followed or suggested by every mobile app development company in Australia:

| Category | Technologies/Tools |

|---|---|

| Programming Languages |

|

| Backend Development |

|

| Frameworks & Libraries |

|

| Database Management |

|

| Cloud & Hosting |

|

| Payment Gateway Integration |

|

| Third-Party APIs & Services |

|

| Security & Compliance |

|

How to Monetize a BNPL App Like Zip Pay?

Buy now, pay later app development in Australia is a long-term investment, but the right monetization strategies can ensure steady revenue. Here’s how you can generate profits:

Merchant Fees

BNPL providers charge merchants a transaction fee (typically 2-8% per purchase) to offer their customers installment options. In return, merchants benefit from higher conversions and larger order values.

Late Payment Charges

Users who miss installment deadlines incur late fees, creating an additional revenue stream. However, these fees should be regulated to maintain trust and compliance.

Interest on Loans

Some BNPL apps offer extended installment plans with 10-30% interest rates. This model works similarly to traditional credit but remains more flexible.

Subscription Plans

Premium membership plans can provide perks like lower interest rates, exclusive merchant deals, and extended repayment options for a monthly or yearly fee.

Affiliate Partnerships & Advertisements

Partnering with brands and displaying targeted promotions within the app can generate additional income. Cashback rewards, exclusive discounts, and sponsored placements are other common monetization tactics you can explore.

Data Monetization

Aggregated, anonymized user spending data can be valuable for market research firms and merchants seeking consumer insights. However, strict compliance with data privacy laws (GDPR, CCPA) is essential.

By combining these strategies, a BNPL app can achieve a profitable and sustainable business model while keeping the service appealing to both users and merchants. All this while guaranteeing a lucrative return on the invested cost to develop a buy now pay later app like Zip in Australia.

Appinventiv’s Role in Your BNPL App Development

At Appinventiv, we specialize in fintech app development, helping businesses build secure, scalable, and high-performing Buy Now, Pay Later solutions. Whether you are a startup looking to launch an MVP or an established company aiming to expand your fintech offerings, our tech experts provide end-to-end support for buy now, pay later app development in Australia tailored to your needs.

- Seamless User Experience – As a premium mobile application development company in Australia, we craft intuitive, conversion-optimized UI/UX designs that enhance user adoption and retention.

- Deep Fintech Expertise – We have developed award-winning fintech solutions that comply with global financial regulations, including PCI-DSS, GDPR, and CCPA.

- Custom BNPL Development – We build feature-rich, high-security BNPL apps with functionalities like AI-driven risk assessment, automated credit scoring, fraud detection, and seamless merchant integrations.

- Cost-Effective Development – With agile development practices and a strategic tech stack, we optimize costs while ensuring a robust and scalable product.

- Compliance & Security First Approach – We integrate bank-grade security measures such as multi-factor authentication, biometric verification, and encrypted transactions to protect user data.

As one of the leading teams of mobile app developers in Brisbane, Australia, and worldwide, we help businesses bring innovative BNPL solutions to market. Whether you want to know the cost to develop a buy now pay later app like Zip in Australia or create your own BNPL app like Zip, we are here to help. Discuss your vision and bring it to life with a tailored fintech development approach.

FAQs.

Q. How does the Zip app work for users?

A. Zip Pay allows users to make purchases immediately and pay later in flexible installments. Users sign up, undergo a quick credit check, and receive an approved spending limit. They can shop online or in-store using Zip’s virtual card, repay in interest-free installments, and manage payments via the app. Late fees apply if payments are missed.

Q. Why should businesses invest in developing a BNPL app like Zip?

A. The category has surged in popularity, offering businesses multiple Zip like buy now pay later app development benefits:

- Higher Conversions & AOV (Average Order Value): Customers are more likely to make larger purchases when given flexible payment options.

- Increased Customer Loyalty: A smooth BNPL experience encourages repeat purchases.

- Revenue from Merchant Fees & Interest: Businesses can generate income through transaction fees, interest on extended loans, and late fees.

- Competitive Differentiation: As digital wallet payments evolve, BNPL solutions help businesses stay ahead in fintech innovation.

Q. How long does it take to make an app like Zip in Australia?

A. The development timeline for BNPL app development depends on app complexity and features:

- Basic MVP: 3-6 months (Core functionalities like user onboarding, installment payments, and payment gateway integration)

- Full-Scale BNPL App: 8-12+ months (Includes advanced features like AI-driven credit checks, fraud detection, and merchant portals)

Using pre-built fintech APIs and agile development can help accelerate the process.

Q. How much does it cost to develop a BNPL app?

A. Developing a BNPL app like Zip typically costs between $40,000 to $400,000, depending on complexity:

- Basic MVP: AUD 60,000 – AUD 120,000 / $40,000 – $80,000

- Mid-Range App: AUD 120,000 – AUD 225,000 / $100,000 – $180,000

- High-End App: AUD 225,000 – AUD 600,000+ / $200,000 – $400,000+

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does It Cost To Build a Chat App Like Arattai?

Key takeaways: Creating a chat app like Arattai will cost you anywhere from $40,000 to $400,000, depending on how complex you want it to be. The essential features you need are real-time messaging, multimedia sending, and user authentication. Layering advanced features such as voice/video calls, group messaging, AI-driven bots, and end-to-end encryption takes the app…

How Much Does It Cost to Build a Car Rental App like Hertz?

Key takeaways: The cost to build a Hertz-like app ranges roughly $40,000–$300,000+. Complexity, automation, and scale matter more than just the number of features. Real costs continue after launch: infra, maintenance, support, and compliance. Smart planning and MVP-first approach help keep budgets under control. Revenue comes from rentals, add-ons, subscriptions, partnerships, and fleet sales. You…

How Much Does It Cost to Build a Banking App like Barclays?

Key takeaways: Barclays sets the bar: Its speed, security, and money management tools show what EU users expect from modern banking apps. Costs vary a lot: A basic, compliant app can start around $40,000 (≈€30,000), while a feature-rich build can reach $400,000+ or more (≈€298,000+). Rules add real work: Meeting PSD2, GDPR, and instant payment…