- The state of AI in the Payments industry in 2026

- Evolution of AI: The Catalyst for a Smarter Payment Ecosystem

- 1. Scalability for Global Adoption

- 2. Interoperability: Connecting Different Systems

- 3. Processing Stuff Right Away

- 4. Better Protection

- 5. Taking User Experience Up a Notch

- AI Tools and Techs For the Payment Industry

- Machine Learning Algorithms

- Natural Language Processing (NLP)

- Generative AI in Payments

- Blockchain

- Decentralized Finance (DeFi) and AI Synergy

- Data Analysis

- Biometric Checks

- Computer Vision

- Quantum Computing

- AI-Driven Regular Tech (RegTech)

- AI Use Cases in Payments: 5 Applications of AI in Payments

- Fraud Detection

- Risk Assessment

- Cross-Border Payments

- Know Your Customer (KYC)

- IVR Payments

- How AI Works in IVR Payments

- How to Integrate AI into Your Existing Payment System

- Step 1 - Assess Your Current Infrastructure

- Step 2 - Define Clear Objectives

- Step 3 - Choose the Right AI Tools

- Step 4 - Ensure Data Readiness

- Step 5 - Start with a Pilot Project

- Step 6 - Integrate with Existing Systems

- Step 7 - Train Staff and Monitor Performance

- Step 8 - Scale and Optimize

- Challenges of AI in the Payments Industry & Their Solutions

- Data Privacy

- Need for Human Oversight

- Ethical Considerations

- Fraud Tricks

- Hiccups with Structured Data

- Implementation Costs

- AI Bias and Fairness

- How Appinventiv is Supporting AI in Payments

- FAQs

Key takeaways:

- Running a payment app or website without AI is risky, as it helps predict rushes, detect fraudulent behavior, and enhance customer satisfaction.

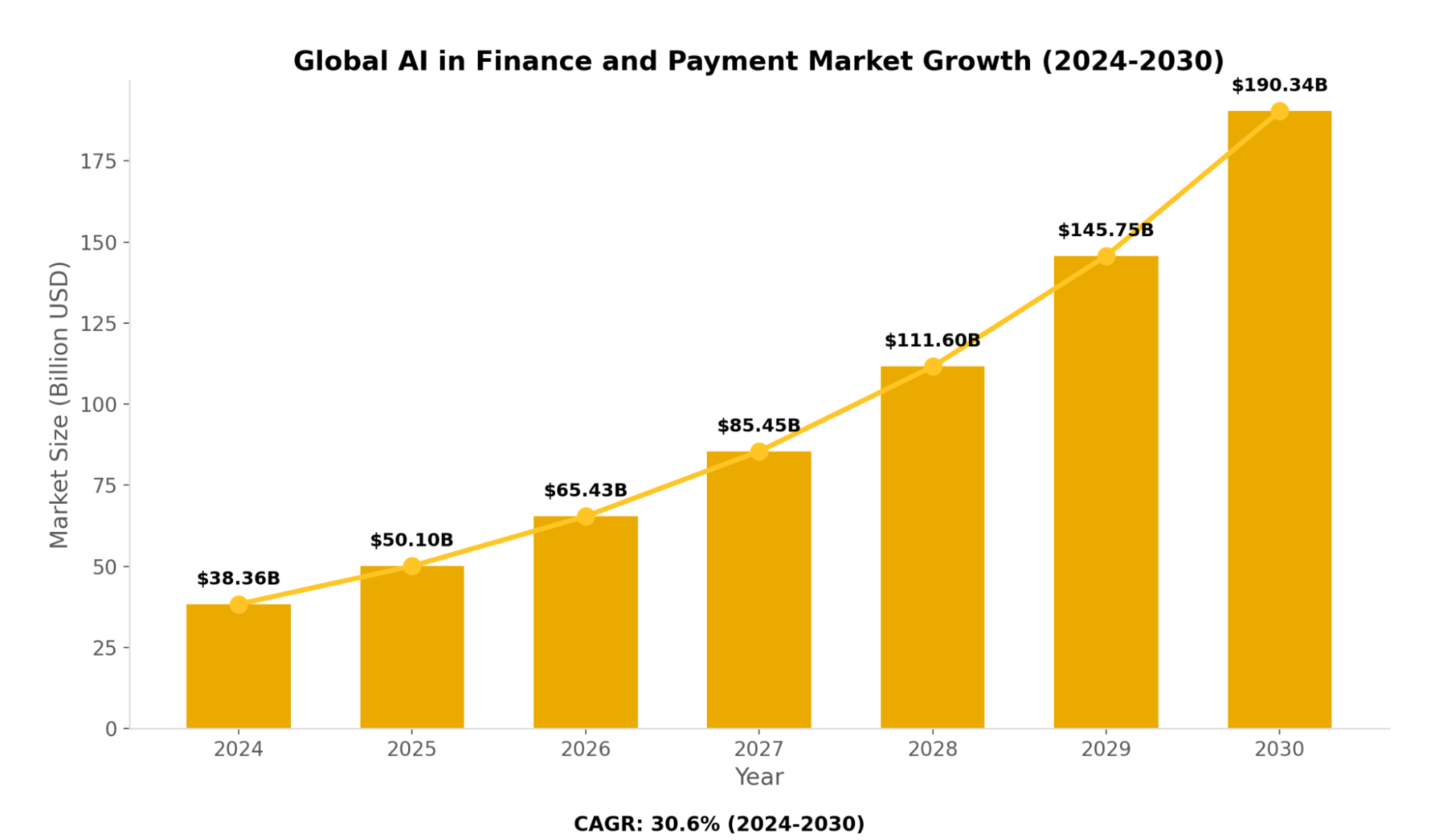

- The global AI in finance and payment market is projected to grow from $38.36 billion in 2024 to $90.33 billion in 2030, with a CAGR of 30.6%.

- AI empowers businesses with improved operations, fraud prevention, and better customer interaction, while offering consumers easier, safer, and more personalized payment experiences.

- AI excels at identifying unusual patterns and suspicious activities, significantly improving fraud prevention and overall payment security.

- AI-powered tools like chatbots and personalized payment suggestions streamline the payment process, making it more seamless and tailored to individual preferences.

Did you know there is a costly connection between your payment services and your business revenue? Yes! According to Fintech Times, 45% of consumers won’t retry a payment following a false decline – and 42% are reluctant to return to an app or website after such an experience.

Thus, running your payment app or website without AI is like teetering your business on the edge of chaos, battling pain points that leave you in the dust, trying to figure out what hit you, and ultimately threatening your survival in the market.

A smart AI payment system is adept at predicting the rush, catching fishy behavior as it happens, and dishing out deals that make folks happy to hit pay. Fast-forward to 2026 in the payments realm—AI is no longer just a helpful gadget—it’s what separates the hotshots from the no-shots.

The global AI in finance and payment market was estimated at USD 38.36 billion in 2024 and is expected to reach USD 190.33 billion in 2030, with a compound annual growth rate (CAGR) of 30.6% from 2024 to 2030 (Source: Markets and Markets).

The state of AI in the Payments industry in 2026

By 2026, AI will become a key part of paying for things, changing how we make, process, and protect transactions. This change affects two main areas: how customers pay and how businesses handle payments.

- For businesses

AI gives them tools to improve their work, fight fraud, and connect with customers better. This helps them work more and make more money in a tough market.

- For customers

AI makes paying easier, safer, and more personal. It meets the growing need for smooth and customized money experiences.

These improvements show a big change. AI doesn’t just make payments faster – it changes how customers and businesses interact with each other and with the technology that links them.

This part looks at these two viewpoints, shedding light on the new ideas, hurdles, and future promises of AI in the payments industry as it keeps changing.

| Aspects | The Merchant Side | The Consumer Side |

|---|---|---|

| Use Case | AI impacts streamlining how transactions are processed, spotting fraud, and interacting with customers. | AI boosts ease with custom-made payment options, shields against cons, and smooths everything. |

| Personalization | AI uses what it knows about shoppers to sling deals on prices that change special offers made just for you. | AI digs into what you’ve bought before and the stuff you dig to suggest ways to pay, like ‘buy now, pay later’ or e-wallets. |

| Fraud Prevention | Those brainy AI computer thingies pick up on the bad guys’ tricks in your spending so your cash is kept safe. | AI helps you spot the shady stuff quickly by flagging anything fishy. It cuts down on scams and the hassles of returns. |

| Emerging Innovations | AI’s doing the grunt work, like sorting out where your payments go so things run smoother at the office. | Your techy wallet has some AI smarts—it tells you the best time to pay and what money to use when shopping from another country. |

| Impact on Experience | Store owners notice more sales going through and fewer bucks lost, which cranks up the profits and keeps customers returning. | Shoppers dig the smooth payments and tougher security, ramps up trust in online buys. |

Therefore, Artificial intelligence in Payments brings awesome new levels of quickness and safety, making things way more personal for everyone. Think about how we’re using digital wallets and cryptocurrencies; AI’s the big brain behind all the cool changes happening in the payment world. This post will dive into the journey of AI in the payments industry, the gear that’s making all this magic happen, the real-deal uses we’re seeing, and tips for companies looking to tap into this power.

Evolution of AI: The Catalyst for a Smarter Payment Ecosystem

Artificial intelligence in payments stands ready to tackle these obstacles, turning the payment field into a domain that’s slicker, safer, and easier for folks to use. Check out how:

1. Scalability for Global Adoption

AI examines how transactions flow, foresees busy times, and tweaks the process chain to make systems expand. Machine learning in banking & finance adjusts what resources go where on the fly, dodging slowdowns and letting platforms manage loads of transactions with no problem.

2. Interoperability: Connecting Different Systems

Systems need to work together – that’s what interoperability means. It’s super important for a payment system that makes sense together. If we don’t have it, people dealing with payments get all mixed up, and companies must deal with mismatched systems.

If you’re a shop owner trying to take CBDCs, good luck fitting that square peg into the round hole of your old credit card or PayPal setup at the cash register. This will ensure money can slide through different countries and tech without a hitch.

3. Processing Stuff Right Away

AI speeds up the check and completion of transactions with its knack for handling huge data sets. Neural networks can spot weird stuff or scams and say yes to good payments in a flash. At the same time, they call out iffy things to look at.

4. Better Protection

AI is top-notch at catching patterns that might slip by us. It monitors money moves for anything odd, like spending that suddenly skyrockets or logging in from a strange place. This helps stop scammers in their tracks. Also, stacking up top-end code scrambling with AI’s ability to sniff out dangers gives us a strong shield against online baddies.

5. Taking User Experience Up a Notch

AI-powered Chatbots take the hassle out of settling payment quarrels and tailor the way you pay, making things feel seamless and natural. It’s got a knack for guessing what you might not, nudging you towards Apple Pay for a speedy tap or a crypto wallet when you don’t want to get hit with fees. Plus, it’s all about cutting down on the bumps along the way.

AI Tools and Techs For the Payment Industry

The internet payment biz has changed with artificial intelligence in payments, joining forces with related tech. These gadgets make things safer, better the user experience, keep stuff running smoothly, and stick to the rules. Here’s a look at the usual AI stuff making waves in this field.

Machine Learning Algorithms

Machine Learning Algorithms—part of AI—let payment setups get smart on their own from tons of info without anyone telling them what to do. They’re a big deal in the online payment world, and here’s how:

- Fraud Detection: Machine learning tools sift through transactions, catching weird patterns that might scream scam. They pick up on where you are, the gadget you’re using, and what you buy to determine if something’s fishy. Then, they slap a risk number on it and wave a red flag at any dodgy dealings that need a closer look. This neat trick cuts down on mistakes and keeps things safer.

- Customer Segmentation: These smart programs group folks by what they buy, what they like, and who they are. That way, shops and card swipers can whip up custom deals, slash prices just for you, and make ads that might work.

- Predictive Analytics: These clever systems give businesses the heads up by playing the fortune teller on things like who’s gonna bail on the service, who might miss their payments, or when folks will splash the cash. This helps them handle their dough better, stock up just right, and have enough people around when it gets busy.

Natural Language Processing (NLP)

NLP applications for modern enterprises allow computers to grasp and reply to what we say, causing a revolution in how customers interact within the money-moving world:

- Voice-Based Transactions (Talking to Pay): Thanks to NLP, people like Alexa and Siri can handle cash exchanges by listening to what we tell them. It’s like you can take care of bills with just your voice, which is super easy and hands-off.

- Chatbots (Automated Answer Givers): These smart chatbots are always available to solve common questions about cash movements, money-back deals, or how much dough you’ve got in your account, all while cutting down on costs and getting back to folks faster by dealing with the easy stuff on their own.

AI-Powered Chatbot App: Mudra Budget Management App Appinventiv’s AI experts have engineered an AI-powered Chatbot App – Mudra budget management solution. See how AI integration and automation align with advanced financial and banking principles by delivering personalized, efficient, and engaging user experiences:

Results Mudra: The Budget Management App turns budget management into a dynamic, user-focused experience. Its success, spanning 12+ countries, reflects this AI-aligned strategy, where technology solves practical problems while forging a trust-based bond with users. |

- Sentiment Analysis: NLP programs can tell how happy customers are by sifting through what people say in reviews, on social media, or during help chats. Companies use this info to fix what bugs people and make paying smoother.

Generative AI in Payments

Generative AI in finance is known for forming new stuff or solutions from patterns it learns and is getting pretty popular in the money-moving world:

- Content Creation: Generative AI in payments whips up personal marketing stuff, think emails or ads, to boost payment services or special deals to keep customers returning.

- Personalization: Putting together payment plans that fit you to a generative AI cranks up how much customers want to stick around.

- Enhanced Interaction: Generative AI in payments lets you have smoother talks about things like changing FAQs or fun payment step-by-step, making using it easier and making people like it more.

Blockchain

Now, blockchain in fintech, often seen hanging out with AI, sets up a tight and open-as-a-book base for systems that handle your cash:

- Secure Authentication: Blockchain’s no-nonsense way of checking who’s who and what’s what makes it tough for hackers to mess with the data or swipe information.

- Smart Contracts: These nifty contracts just do their thing handling cash exchanges, like when money gets shelled out after someone gets their package – it cuts out the wait and the extra people in the middle.

Decentralized Finance (DeFi) and AI Synergy

AI’s giving Decentralized Finance (DeFi) a big boost, what with making money work smarter, keeping an eye on the risky stuff, and playing by the rules:

- AI-Driven Yield Optimization: Algorithms predict the best investment strategies within DeFi protocols, maximizing user returns.

- Real-Time Risk Analysis in DeFi Transactions: It’s watching for wacky market swings and iffy smart contract spots so everyone’s money doesn’t go poof.

- Governance and Compliance in Decentralized Systems: AI secures rule following in decentralized setups, despite DeFi’s lack of central control, tipping the scales toward inventiveness while keeping responsibility in check.

Data Analysis

Analysis of data taps into big data piles to pull out useful clues that help crank up efficiency and make things super personal:

- Pattern Discovery: Scouring through all that buying and selling info analytic programs, pick up on what’s hot in how folks wanna pay or if someone’s trying to pull a fast one.

- Process Improvement: Analytics shine a light on dragging stuff (like when it takes ages to get the thumbs up) and cough up smart ways to make everything zip along much better.

- Personalization: Peeking at what peeps buy lets companies whip up deals, nudge them with payment heads-ups, or toss some bonus points that hit the spot for each person.

Biometric Checks

Biometric securities in digital banking lock things down tight with your one-of-a-kind body features, making sign-ins a breeze without any hitches:

- Facial Recognition: Apps such as Apple Pay and Alipay scan faces to confirm who’s using them, ditching passwords for a smoother, safer option.

- Fingerprint Scanning: This tech is all over mobile payments—it’s quick and trusts folks’ unique prints to check who they are.

- Voice Recognition: When you’re on the phone, your voice can prove it’s you giving transactions that add a secure touch and make things a bit easier.

Computer Vision

When it comes to visual info, computer vision is on the job. It makes sure payment stuff is tight and follows the rules.

- Identity Verification: The system checks passports or IDs to ensure it’s you when making a new account or during big-money moves.

- License & Document Scanning: Shops and money exchange platforms use the tech to check documents like driver’s licenses quickly and without mistakes.

- Anomaly Detection in Transactions: By peeking at visual hints (like messed-up receipts), the computer vision tech raises a flag on stuff that doesn’t look normal to take a closer look.

- Automated Compliance Checks: The tech keeps an eye on papers to make sure they’re up to the legal mark, cutting down on the need for people to double-check and the possible mess-ups.

Bonus Read: Financial Regulatory Compliance Software Development For Compliance Checks

Quantum Computing

Even though it’s kinda new, quantum computing is set to cause a revolution in how money matters work with mind-blowing speed in crunching numbers:

- Enhanced Cryptographic Security: Quantum algorithms make way for top-notch security in cryptography. They create secure codes no one can crack, keeping our deals safe from upcoming dangers.

- Faster Transaction Processing: Imagine if transactions were zipped by like lightning! That’s what quantum tech could do dealing with complicated math fast for stuff like instant worldwide payments.

- Future-Proofing Payment Systems: Getting a head start with quantum tech means setting ourselves up to stay in the game. We’ll be ready for when quantum becomes the big boss in the business.

AI-Driven Regular Tech (RegTech)

Mixing AI with rules and regulations? That’s RegTech for ya. It’s all about sticking to the law and being super efficient with our payment networks.

- Real-Time AML (Anti-Money Laundering) Monitoring: AI scans the cash flow immediately, looking for anything weird to stay in line with the Anti-Money Laundering rules on the spot.

Bonus Read: AML Software Development – A Detailed Guide for CEOs

- Automated Tax Compliance: Machines handle the tax by themselves, getting it right and reducing the chance of messing up audits.

- Adaptive Regulatory Updates: As the rules change up, AI just shifts gears to stay on track, so no one’s got to stress over doing it by hand.

Put it all together; these smart tools are a big deal; they make online money moves quick, tight, and more tuned into what folks need while figuring out the crazy rule maze. As this tech keeps improving, it will switch up the game on handling cash online, making it cooler, slicker, and much safer.

AI Use Cases in Payments: 5 Applications of AI in Payments

Use cases of AI in payments change how we deal with transactions in the payments world. It’s making sure things are safe and personalizing how customers experience everything. AI’s bringing some big-time shifts to all things money-related. We will talk about five major use cases of AI in payments that shake the industries. These applications of AI in payments are all about making stuff easier, getting better results, and leading the charge into a new wave of dealing with cash.

Fraud Detection

Machine learning algorithms are part of AI for payment fraud prevention. They’re built to handle loads of data quickly and precisely, perfect for watching over transactions as they happen. Let’s break it down bit by bit:

How AI works

1. AI for payment fraud detection kicks off by collecting crucial details. This includes people’s purchases, their identities, locations, and when they buy stuff. These pieces of information lay the groundwork to identify fishy actions.

2. The next step is machine learning, which takes two forms: supervised and unsupervised. It scours past data to nail down what’s considered ‘normal.’ Think about someone who drops $50 to $100 on grub weekly in their city. That’s our comparison standard.

3. After that, AI in B2B payments starts checking out stuff, and as it happens, it keeps an eye out for weird things. For example, if someone goes wild with a $5,000 blow-out while they’re chilling abroad, The neat part is it isn’t just about basic rules. It dives headfirst into the nitty-gritty — things like how fast the transaction happens, what kind of gadget is used, IP location, etc.

The system halts fraud the second it spots it. It also keeps getting smarter with new info, improving its scam-catching skills as time passes.

Real Example: PayPal

Being a big shot in internet cash moves, PayPal sees tons of action with billions of deals. That puts it in cheaters’ crosshairs. However, PayPal has AI-based trick-spotting tech that handles the huge workload. Here’s their tech play:

- Transaction Velocity: The AI monitors transaction pace and frequency. If a bunch of spendy buys happens in a flash, it’s gonna wave some red flags.

- IP Addresses: It peeks at where your internet connection’s coming from. Is someone popping up in Russia right after using a U.S. login? That smells fishy.

- Device Fingerprints: The system spots devices with unique bits and bobs, like what operating system they run or browser tweaks. Spotting a fresh gadget on an old profile might scream, “hijack!”

- Holistic Analysis: PayPal’s brainy AI in B2B payments doesn’t just eyeball a single clue—it squishes heaps of hints together to judge if something’s iffy, so it keeps the good guys from getting pegged as bad.

Results Scored

PayPal’s AI-powered setup has shown great success:

- PayPal processed about $1.7 trillion in payment volume last year across over 400 million active accounts.

- PayPal’s use of machine learning has kept its fraud rate remarkably low, at 0.32%, better than the 1.32 percent average that other merchants see.

Risk Assessment

Risk assessment is all about identifying, analyzing, and evaluating potential dangers. It’s big in areas like finance, e-commerce, insurance, and more, helping to dodge losses from fraud not paying back loans or bad surprises. Throw AI into the mix, and you’ve got yourself a quicker risk assessment process and nail the accuracy without breaking a sweat.

The Scoop of AI in banking and payments for Risk Assessment

- Gathering Info: AI in banking and payments scoops up crucial stuff such as credit past, how often you make transactions, and danger signs from outside (think tweets, scammer alerts).

- Crafting Features: This process spins the plain old data into nifty numbers we care about—how much money you throw around, how long it’s been since you last paid up where you are—that influence riskiness.

- Ranking Risks: It slaps a number on each deal or person, trying to guess troubles like scamming, ditching the bill, or returns.

- How It Functions:

- Supervised Learning: Picks up on past info, like fraud or not, to pinpoint dangers.

- Unsupervised Learning: It spots unusual activity nailing fresh schemes without old cases as examples.

- Predictive Modelling: It juggles math and codes like logistic regression and neural networks to guess stuff like when folks can’t repay loans or dispute transactions.

- Continuous Learning: It keeps learning with fresh info to remain on point and correct.

Real Example: Stripe

Stripe is a big deal regarding online payments, and they use AI in B2B payments to determine if a business is risky when it first signs up. This part’s important to ensure the companies that hop on their platform aren’t about to pull any shady moves or rack up a bunch of chargebacks. Let’s check out how they pull it off:

Data Examined: Stripe’s AI looks at different clues, including:

- Website Stuff: Is the seller’s online store trustworthy, or does it give off a sketchy vibe with bad design and dodgy items?

- Payment Past: Do they show a steady streak of good sales, or are there hints of shaky dealings?

- Business Buzz: How dicey is the seller’s line of work (like pretty chancy gambling games versus normal stores that are safe)?

Method: When a seller asks to join Stripe, the AI slaps a risk number on these bits of info. Sellers on the risky side could get extra eyeballing or the boot, but the safer bets get the green light quicker.

Results Scored

The AI in banking and payments achieves 70% greater precision in identifying legitimate transactions that have been falsely declined. This increased precision allowed us to recover more revenue than ever last year while reducing retry attempts by 35%. (Stripe)

Cross-Border Payments

Sending money across national borders involves different parties in distinct countries. This includes folks wiring cash to relatives overseas, firms settling bills with foreign vendors, or big-time company transactions.

Getting cash across borders has been a drag, costing an arm and a leg and taking forever due to dealing with different money types, following the rules, and sneaky extra charges. It takes 3-5 workdays and might munch away 5-7% of the cash you’re sending in charges and rate hikes. This hassle has sparked serious brainwaves among fintech whizzes who use tech and AI to make things smoother.

AI in Cross-Border Payments

AI in cross-border payments is causing a revolution. It analyzes data, makes everything smoother, and reduces mistakes. It uses past data and patterns to predict currency changes, which improves exchange rates and reduces risks. AI in cross-border payments also picks out the best ways to send money, choosing options like SEPA that are quicker and cheaper than old-school methods.

It checks that payments stick to rules like AML, KYC, and sanctions super fast by reviewing transactions and understanding the legal stuff with NLP. AI looks at payments as they happen, dodging problems and spotting scams in the nick of time. AI chops costs and moves your money faster by ditching the intermediaries, tuning the rates, and using machine learning tricks.

Real Example: Wise (TransferWise)

Wise, this fintech biz shook up how we do cross-border payments for real. These AI programs are watching and guessing where currency pairs, like USD to EUR, are headed. The AI at Wise checks out all their bank buddies and payment pals across the globe to spot the route that’s gonna cost you the least and get your money there quickly.

Plus, it does all that KYC stuff, like looking at IDs on autopilot, peeking at transactions to ensure they’re not on any no-no lists, and keeping everything up and running without dragging its feet.

Results Scored

According to the Wise:

- In the past year, just 300 folks at Wise handled 1.2 billion transactions.

- A whopping 150+ machine learning systems dig through seven million deals daily. Each second, these brainy algorithms run 80 reviews to spot possible scams, breaking sanction rules, and risks tied to money laundering.

Know Your Customer (KYC)

Banks, fintech companies, and tons of other businesses need to know who their customers are, right? That’s where Know Your Customer (KYC) comes in super handy. It’s all about making sure people are who they say they are so that no one’s pulling a fast one—like doing fraud, washing dirty money, funneling cash to bad guys, or other sketchy stuff.

How AI Works in KYC

OCR powered by AI zaps through the job of pulling text out—stuff like names, digits, and MRZ deets—from IDs, including snaps of passports that aren’t top-notch. Then NLP jumps in to check the OCR’s work for goofs, ensuring things like where you live add up when you look at different documents.

The tech gets super smart when it comes to matching your fresh selfie with the one on your ID, and it even keeps an eye out for natural moves, like a blink, to make sure you’re the real deal. As it digs deeper, the AI in banking and payments gives a once-over to info with sources outside its backyard, think government files or those PEP lists just to catch any shady business.

Real Example: Revolut

Revolut hails from the UK and is deemed a fintech unicorn. It stands out as a leading instance of AI-enhanced KYC. Kicked off in 2015, this powerhouse provides banking solutions, including accounts, cards, and a platform for crypto trading. Here’s a look at how it leverages AI to run KYC:

- Onboarding Process

New folks downloading the app toss in a photo of their ID, like a passport or driver’s license, and snap a selfie in the Revolut app.

- AI Tools in Action

- OCR snaps up all the text from the ID.

- The face-scanning tech double-checks the selfie with the ID’s pic. -The system runs a thorough security check of the details against global lists to watch out for fraud or no-go zones.

- Automation

The verification stuff sorts itself out on the spot; no people are needed, though the tricky ones might get a human taking a peep.

Results Scored

Revolut noticed a 30% drop in the money lost to fraud from card scams linked to fake investment chances (Revolut).

IVR Payments

IVR Payments are things where people pay bills over the phone, right? They just hit numbers on their phone to follow the robot voice’s commands, like hitting “1” to fork over cash for a bill. You ring a number, wade through some options, punch in your card details, and boom, your payment’s done. You don’t even have to chat with a real person!

This fancy system hooks up to a payment gateway that keeps everything up-and-coming, sticking to these super-tight security rules called PCI DSS. Many companies use IVR to handle lots of payments super-fast, slash the cash they spend on operations, and let folks pay any time they want.

How AI Works in IVR Payments

AI takes IVR payments to the next level by making them more intuitive and user-friendly. Here’s how it works:

- Natural Language Understanding (NLU): AI with NLU can figure out what we mean when we talk, even with different ways of saying stuff like “I wanna settle my bill” or “Use the card I’ve got on file.” It’s way better than old-school IVR systems that can’t handle the variety.

- Voice Recognition: With speech-to-text technology, AI changes what we say into info so it can work with it, so we don’t have to mess with buttons. It makes stuff happen faster and cuts out blunders, like when you punch in the wrong card number.

- Conversational Flow: AI keeps the chat going smoothly. It throws back questions like “Which card?” or double-checks with “You talking ’bout March?” It’s like talking to someone rather than banging your head against preset options.

- Integration with Payment Gateways: AI moves your spoken or confirmed payment info to the gateways. It handles stuff like credit card payments and gets confirmation back to you. It’s all super secure because it uses encryption and scrambles sensitive details for safety.

- Personalization and Context: AI’s like your shopping buddy; it gets you. With your OK, it uses what it knows about you to make everything easier. It remembers your accounts, suggests how to pay, and even gives you a nudge about when bills are due. The more you chat with it, the more it learns from your past talks and gets even better at helping you out.

Real Example: American Express

American Express has a knack for staying on the consumer’s mind. They’ve made their rewards program so alluring that folks often sign up without a second thought. Plus, American Express is at the top of the list for cool promotions and partnerships that keep things fresh.

American Express uses AI well in IVR payments. It mixed AI with its IVR to let folks with their cards handle their stuff, like paying bills, by just talking.

Say someone with an Amex card rings them up, the AI helper pops up, tunes into what they wanna do (‘I’d like to pay my balance’), and then helps them out. It might say, “Wanna use the card ending with 1234?” or ask, “How much are you paying?” This thing is smart—it grabs your account info on the spot, gets the payment done through something super safe, and tells you it’s all good, so you don’t even need to chat with a real person.

Amex brought this into play to make things smoother and make folks happy with their cards using smart stuff like NLP and machine learning.

Results Scored

AI’s role in updating Amex’s phone service led to noticeable improvements (DestinationCRM):

- AI-powered IVR was passed to the agent to help resolve the issue quickly.

- This has improved customer experience and reduced the need for human intervention.

How to Integrate AI into Your Existing Payment System

AI in payment processing is causing a revolution in how companies manage their money moves. It gives a chance to make things smoother, beef up security, and make customers happier. Slipping AI into what you’ve got for payments might sound scary, but tackle it with a plan, and it’ll switch things up. Okay, let’s break it down into steps to get it done.

Step 1 – Assess Your Current Infrastructure

Start by taking a good look at what’s already in place. Find the scope of embedding AI in payment processing setup as it stands. You wanna know the nuts and bolts so that when AI steps in, it feels right at home. This doesn’t have to be a headache—just a solid check-up.

Kick things off by figuring out your current position. Start by checking out the payment processes you’ve got going—zero in on how you handle business, spot fraud, and manage reconciliations. Look for trouble spots holding you back or hitting your wallet, such as slow deals or fraud rates that are going up. After that, see if your setup is ready to buddy up with AI. Got your APIs in the latest shape? Is your info the kind that AI can jive with? Doing this assessment lays the groundwork.

Step 2 – Define Clear Objectives

AI’s no fairy tale fix; it demands clear orders. Aim for precise outcomes you want to nail. You could be looking to chop down fraud figures by 20% or slash the time deals take right down the middle. Connect those aims to the big picture, like making clients happier or reducing what it costs to run your show. Solid targets ensure the team’s on the same page and make it simple to check how well you did when it’s all said and done.

Step 3 – Choose the Right AI Tools

Every AI tool varies in capability. Pair the tech with your requirements. Machine learning models are top-notch requirements for detecting tricky fraud trends, and natural language processing amps up chatbots to provide better customer help. Mind how well the tool can expand. Is it built to develop along with your business? Also, think about cloud solutions that are quick and easy to implement versus having your setup on-site, which offers more command but costs more at the start. The assistance you get from sellers is super important as well. Choose allies who will stay the course.

Step 4 – Ensure Data Readiness

Make sure your data’s ready for AI because it needs it. You gotta scoop up all that historical payment stuff – we’re talking records of transactions, reports of sketchy things, chats with customers – and give it a good scrub to eliminate any double entries or missing bits. And hey, you can’t ignore privacy rules like GDPR or CCPA, so keep the personal details down and play by the rules. To make your AI super snappy in real-time, get data pipelines going that zap all the new info straight into your algorithms the moment money moves.

Step 5 – Start with a Pilot Project

Ease into it; don’t just dive in headfirst. Start small, like trialing AI to catch fraud in just one type of transaction, for example, those done with credit cards. You should keep an eye on things that tell you how well it’s doing, like how often it flags that it’s okay or how quick it is. This mini-test will help you find problems, fine-tune things, and get confident before you go big.

Step 6 – Integrate with Existing Systems

Time to hook up the AI with your current cash-moving tech. Use APIs or go-betweens to connect your cool new tools to the old stuff you have. Try not to shake things up too much—bring it in bit by bit and make sure it can play nice with old tech so you don’t break anything. Testing is super important because messing up here could cost you money or make customers mad.

Step 7 – Train Staff and Monitor Performance

Make sure your crew gets the hang of the AI. Show them the ins and outs, what the AI looks for, and how to step up when it’s called for. Don’t just leave the AI alone—establish observation methods to catch when model drift happens (like when it starts missing the mark because patterns change) and maintain strong performance. It’s key to touch base to confirm it’s living up to expectations.

Step 8 – Scale and Optimize

After the pilot shows its value, it’s time to level up. Apply AI to more areas—consider sorting out how folks can pay or guessing upcoming cash flow. Craft feedback loops for consistent enhancements: as your customers’ habits transform, your algorithms should, too. The work to perfect the system never stops—remain adaptable and persist in polishing your approach.

Putting AI to work in your payment setup is more than just a tech move—it’s a savvy step for your biz. Check out what you’ve got, figure out where you wanna go, and grow with care. Kick things off on the down-low, pick up the pace, and peek at how your payment process gets slicker.

Challenges of AI in the Payments Industry & Their Solutions

In the payment world, AI is causing a revolution, speeding up transactions, improving the ability to spot fraud, and making the shopping experience super personal. Yet, there are many big problems when you mix AI with money. We’ll dive into these challenges of AI in the payments industry and devise some smart ways to fix them.

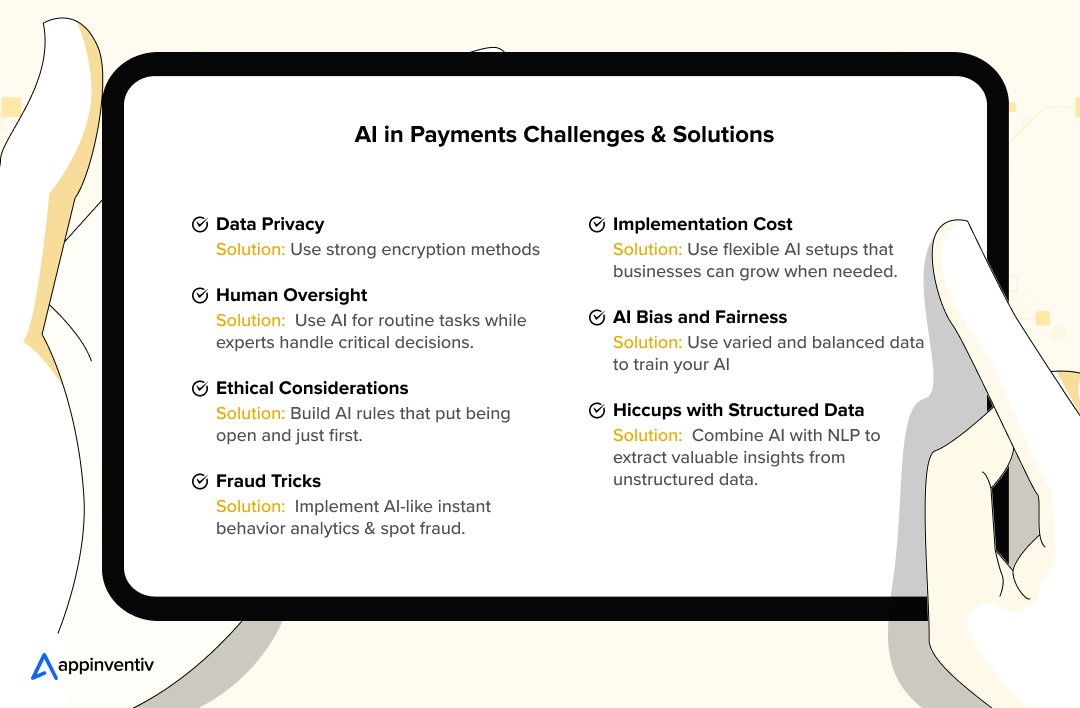

Data Privacy

AI must gobble up lots of information about us to do its job right. But folks are kinda worried about who’s grabbing their personal and bank details, where that data’s lounging around, and what people are doing with it. Plus, with all these rules like GDPR and CCPA, if you mess up, it’s gonna cost a ton and make you look bad.

Solution: Use strong encryption methods and make personal data anonymous to keep it safe. Stick to privacy-first ideas, ensuring they fit worldwide data protection rules. Regular checks and clear data methods can also make customers trust you more.

Need for Human Oversight

Even though AI can do some stuff independently, it can sometimes mess up. If we rely too much without people checking on it, we can make mistakes, get things wrong, or cause stuff we didn’t mean to happen in how we pay for things.

Solution: Go for a mixed plan where AI takes care of the easy stuff, but people with know-how keep an eye on the big choices and jump in if weird stuff pops up. Always watching how things are going and giving feedback can improve AI and keep everyone informed about who’s responsible.

Ethical Considerations

AI handling payments needs to deal with tricky moral issues. It’s gotta make sure everyone has the same chance to use financial stuff and not do anything shady. Like, there’s a chance that robots might leave out people who don’t get these services, or they might care more about making money than being fair.

Solution: Build AI rules that put being open and just first. Get people involved when you’re making it, and do ethics checks often. This way, AI will match up with what people think is right and not cause trouble.

Fraud Tricks

While AI is getting better at spotting cheats, the bad guys also use AI for trickier stuff. They’re coming up with things like fake identities or scams using deepfakes. It’s like a constant battle, with security and crooks always trying to one-up each other.

Solution: Implement cutting-edge AI-like instant behavior analytics and spot oddities to get the jump on new threats. Team up with IT security whizzes and exchange know-how industry-wide to get ready to block scam tricks.

Hiccups with Structured Data

Systems for making payments mess with neat data like transaction logs, but AI is all about mixing it up with varied, messy info. Wonky or not, whole data can mess with AI’s game by giving spot-on hints or guesses about what’s coming.

Solution: Roll out data prep moves to tidy up and make the data consistent. Mix AI with cool tools such as NLP to pull out the good stuff from messy sources, such as what customers say or help requests, making the whole system work better.

Implementation Costs

Setting up and keeping AI systems for payments can cost a lot. There are bills for skilled gear people and for keeping the system current. Small companies might have a hard time getting these techs.

Solution: Start with small, flexible AI setups that businesses can grow when needed. Work with other companies or use open-source tech to keep early expenses low while staying on top of the latest innovations.

AI Bias and Fairness

Sometimes, AI systems pick up biases from the data they learn from. This can lead to not-so-fair decisions like who gets a loan approved or who gets flagged for fraud. It’s not cool since it can hit some groups of people harder than others, making folks doubt the system is fair.

Solution: Use varied and balanced data to train your AI and keep checking to make sure it’s not biased by using tests designed to measure fairness. Go for AI that explains its choices so you can spot and fix biases if they pop up.

How Appinventiv is Supporting AI in Payments

We at Appinventiv lead the way in fusing artificial intelligence (AI) into the payments scene. This move is shaking things up, making how companies and people deal with their money moves differently. Our payment software development services perfectly blend AI expertise and digital acumen to help businesses lock things down tight, make their work smoother, and give customers something just for them.

Having a solid history of working with huge brands like KFC, Domino’s, and IKEA, creating payment systems that grow with the market and keep things safe and fresh for the fast-paced online world.

Let’s dive into how we make a splash in AI for payments, showing off our top-notch skills and services.

- AI-Driven Payment Processing: We harness AI to develop intelligent payment processing systems by incorporating machine learning algorithms. These systems help you analyze real-time transaction data to ensure faster processing, minimize errors, and easily handle high volumes.

- Advanced Fraud Detection: Our dynamic team of AI experts focuses on spotting fraud quickly and keeping payments safe. Our smart AI-powered payment system picks up on weird stuff, catches sneaky patterns, and uses fingerprint scans to watch how people behave to stop scams before they even start. This strong way of keeping things safe helps companies stay secure.

- Smart Automation Boosts Productivity: Our AI development services speed up monotonous jobs such as creating invoices, matching payments, and handling subscription bills. This cuts down on the need for hands-on work and upsets the game for how exact operations are.

- Backing for Various Payment Options: We see the worldwide need for flexible payment choices and build AI-enhanced systems to handle tap-and-go payments with NFC, deals in multiple currencies, and even digital money.

- Industry-Leading Expertise: Having 1,600 tech whizzes and winning “Tech Company of the Year” at the Times Business Awards 2023 make us an ideal AI Development Company. We bring deep fintech smarts to our AI-powered payment solutions to ensure each job—from payment gateways to POS systems—fits the business’s goal.

We at Appinventiv take a well-rounded approach to AI in payments, blending cutting-edge tech with a focus on client needs. We first put security, growth potential, and adaptability, creating answers that tackle today’s requirements and prepare businesses for what’s coming.

From protecting transactions to streamlining processes and tailoring experiences, Appinventiv stands as a reliable ally in dealing with the ins and outs of today’s payment scene. Contact us now!

FAQs

Q. What is AI in Payments?

A. AI in digital payments means incorporating smart computer systems like machine learning, language understanding, and data analysis into how we handle money transactions. It uses AI to improve financial processes, including how payments work, staying secure, spotting fraud, and improving customer interactions.

AI in digital payments looks at huge amounts of information, which allows payment systems to get smarter, work faster, and run more. These systems adapt to how people use them and what’s happening in the market, all while following rules and keeping things safe. In simple terms, AI changes old-school payment methods into clever automatic solutions that fit what people want in today’s digital world.

Q. How is AI Being Used in Payments?

A. AI in digital payments transforming the payments sector through diverse cutting-edge solutions. It enhances transaction efficiency by detecting patterns and refining processes, delivering quicker and more dependable payment services. AI in digital payments tracks payment activities for potential threats, employing advanced algorithms and user behavior monitoring to combat fraud and minimize financial exposure.

Moreover, the role of AI in digital payment simplifies billing management, subscription processing, and payment matching operations, enhancing accuracy and productivity. It creates customized payment experiences by delivering relevant recommendations based on transaction history. From enabling tap-to-pay solutions and cross-border transfers to facilitating digital currency adoption, AI boosts versatility and performance throughout payment operations.

Q. What Businesses Should Use AI for Payments?

A. Understanding the role of AI in digital payment offers significant advantages to organizations across sectors, with particular value for specific business types.

Digital retailers processing numerous transactions can utilize AI for payment fraud activity instantly and streamline payment operations. Financial technology companies and banks must implement AI to deliver robust payment platforms, including digital payment solutions and specialized processing systems.

Companies operating on recurring revenue models, like media streaming platforms or cloud software companies, can deploy AI to streamline payment collection and boost client loyalty through customized solutions. Multi-national retail operations can leverage AI to handle multiple payment types and international currencies.

Organizations seeking to boost productivity, strengthen payment security, and provide exceptional user experiences in today’s digital marketplace should explore AI payment technology integration.

Q. How does artificial intelligence in the payments industry improve security?

A. Artificial intelligence in the payments industry enhances security by deploying advanced algorithms to continuously monitor and analyze transaction data. Machine learning technology in payment processing strengthens protection through sophisticated algorithms that constantly evaluate transaction patterns.

Artificial intelligence in digital payments recognizes irregularities, spots fraudulent behavior, and identifies questionable activities instantly, reducing monetary risks. Capabilities such as biometric verification and user behavior monitoring add extra layers of security against unwanted entry. By dynamically responding to new security challenges, machine learning in payment systems delivers comprehensive safeguards for companies and consumers, building confidence in electronic payments.

Q. Which businesses benefit from artificial intelligence in the payments industry?

A. Artificial intelligence in the payments industry benefits many businesses, particularly those with high transaction volumes or complex payment needs. E-commerce platforms, fintech companies, and global retailers use AI to streamline payment processing and support diverse payment methods. Subscription-based services leverage it for automated billing and customer insights, while financial institutions rely on AI for payment fraud prevention and compliance. Any business seeking to optimize operations, enhance security, and stay competitive in the digital marketplace can gain significant advantages from artificial intelligence in the payments industry.

Q. How does AI in payment processing reduce transaction costs?

A. AI in payment processing lowers transaction costs by automating repetitive tasks and minimizing errors that lead to financial losses. AI streamlines operations like payment reconciliations, currency conversions, and chargeback management, reducing the need for manual intervention and associated labor costs.

Q. Why should small businesses adopt artificial intelligence in digital payments?

A. Small businesses should adopt artificial intelligence in digital payments to stay competitive and meet customer expectations in a digital-first world. AI offers cost-effective solutions like automated invoicing and fraud detection, reducing operational overheads and financial risks.

It also enables small businesses to provide secure, modern payment options—such as mobile wallets or QR codes—that appeal to tech-savvy customers. By leveraging artificial intelligence in digital payments, small enterprises can enhance efficiency, build trust, and expand their reach without requiring extensive resources.

Q. What are some generative AI use cases in payments to improve customer support?

A. Generative AI use cases in payments include enhancing customer support through advanced automation and personalization. For instance, generative AI powers intelligent chatbots to resolve payment-related queries—like transaction disputes or refund requests—in real time by generating human-like responses. It can also create tailored troubleshooting guides or payment instructions based on user input, reducing response times and improving customer satisfaction in payment systems.

Q. How will the future of AI in payments impact transaction speed and scalability?

A. The future of AI in payments promises to revolutionize transaction speed and scalability by leveraging advanced algorithms and real-time data processing. Thanks to predictive analytics and automated optimization, AI will enable payment systems to handle exponentially higher transaction volumes with minimal latency.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How AI Chatbots for eCommerce are Driving 3x More Sales in 2026

Key takeaways: AI chatbots for eCommerce have a direct impact on revenue. When aligned with buying intent, they lift conversions, increase order value, and drive repeat purchases. The strongest impact comes from personalization and guided selling, helping shoppers decide faster and buy with greater confidence. Abandoned cart recovery is a major revenue driver in 2026.…

AI-Powered Booking Optimization for Beauty Salons in Dubai: Costs, ROI & App Development

Key Highlights AI booking optimization improves utilization, reduces no-shows, and stabilizes predictable salon revenue streams. Enterprise salon platforms enable centralized scheduling, customer insights, and scalable multi-location operational control. AI-enabled booking platforms can be designed to align with UAE data protection regulations and secure payment standards. Predictive scheduling and personalization increase customer retention while significantly reducing…

Data Mesh vs Data Fabric: Which Architecture Actually Scales With Business Growth?

Key takeaways: Data Mesh supports decentralized scaling, while Data Fabric improves integration efficiency across growing business environments. Hybrid architectures often deliver flexibility, governance, and scalability without forcing premature enterprise-level complexity decisions. Early architecture choices directly influence reporting accuracy, experimentation speed, and future AI readiness across teams. Phased adoption reduces risk, controls costs, and allows architecture…