- The AI Transformation: Why Traditional Underwriting Can't Compete

- The Current State of Insurance Underwriting: Time for a Reality Check

- What's Really Happening Behind the Scenes?

- How Artificial Intelligence for Insurance Underwriting Actually Works

- The Technology Stack That Makes It Possible

- Real-World Success Stories: Companies Getting It Right

- Allianz's BRIAN System

- Progressive's Data-Driven Approach

- Zurich's Property Intelligence Revolution

- The Wireframe for Automated Insurance Underwriting Process

- Key Technical Components

- The Impact: What AI in Insurance Underwriting Really Delivers

- Speed and Efficiency Gains

- Better Risk Assessment

- Customer Experience Revolution

- The Benefits of AI in Insurance Underwriting: Beyond the Obvious

- Consistency and Fairness

- Scalability Without Proportional Costs

- Automated Document Processing

- Predictive Claims Modeling

- Fraud Detection and Prevention

- Market Responsiveness

- Data-Driven Innovation

- Overcoming the Challenges of AI in Insurance Underwriting

- Data Quality and Integration Issues

- Regulatory and Compliance Concerns

- Change Management Resistance

- Vendor Selection Overwhelm

- Looking Forward: The Future of AI in Insurance Underwriting Automation

- Fully Autonomous Underwriting

- Real-Time Continuous Underwriting

- Integration with IoT and External Data

- Making the Business Case: ROI of Insurance Underwriting AI Solutions Development

- Quantifying the Benefits

- Implementation Timeline and Costs

- Getting Started: Your Next Steps

- Assessment and Planning

- Pilot Project Selection

- Building Internal Capabilities

- Conclusion: The Time for Action is Now

- Transform Your Underwriting Operations with Appinventiv's Proven AI Excellence

- Frequently Asked Questions

Key Takeaways

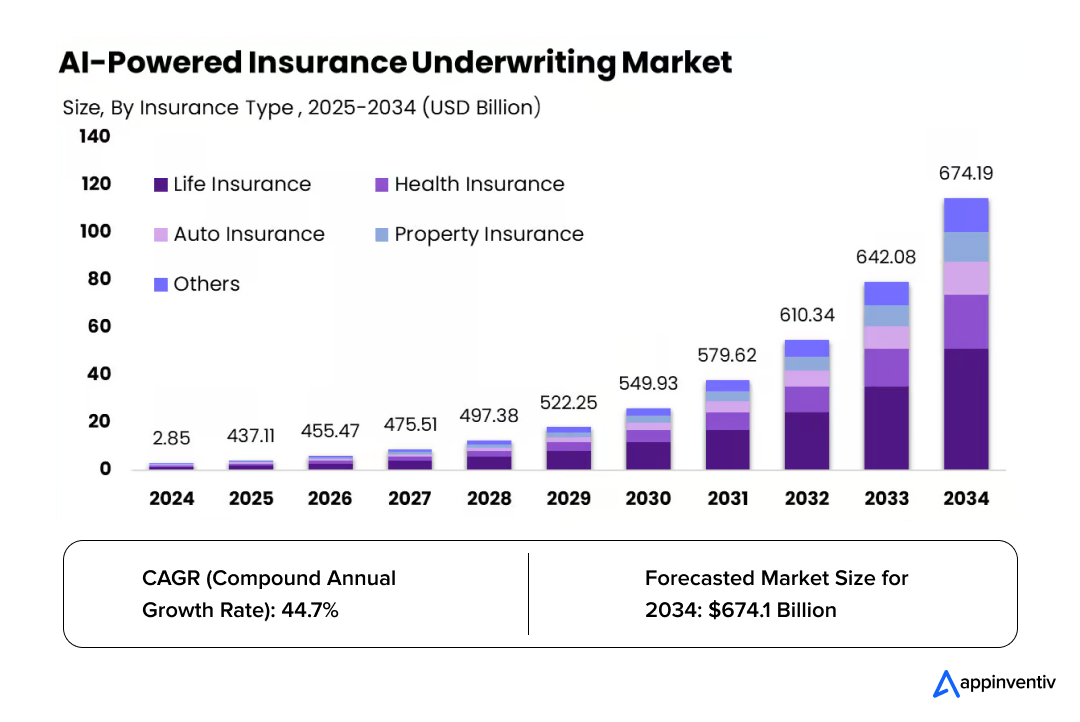

- AI adoption surged from 61% to 77% in one year, with the underwriting market exploding at 44.7% CAGR toward $674B by 2034.

- 90% faster processing (weeks to hours) + 54% accuracy improvement = instant competitive advantage.

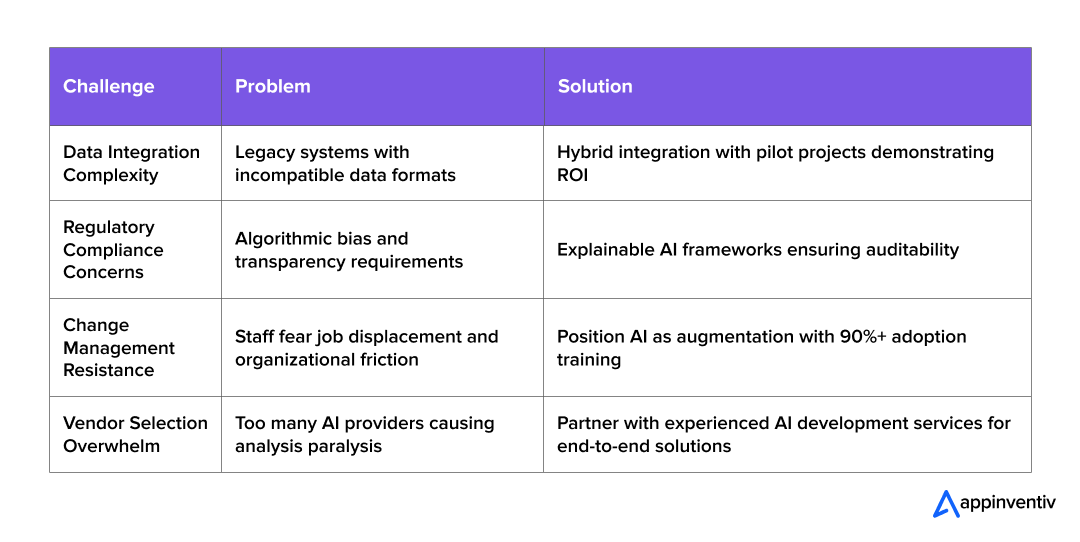

- Data integration, compliance, and change management challenges solved through hybrid architecture, explainable AI, and staff augmentation strategies.

- Progressive: 9% pricing accuracy gain | Allianz: 135 days saved | Zurich: superior risk detection = market share capture in progress.

Your underwriting department is probably your company’s biggest operational bottleneck. Every day, talented professionals spend hours on tasks that add zero strategic value – data entry, document review, cross-referencing information that already exists somewhere else. Meanwhile, customer expectations have shifted permanently. They want instant decisions, transparent pricing, and seamless experiences.

The insurance companies pulling ahead aren’t just faster or more efficient. They’ve fundamentally reimagined how underwriting works. AI in insurance underwriting has become their competitive moat, allowing them to make better decisions with less effort while their competitors burn resources on manual processes. The organizations that crack this transition first will own their markets. The ones that don’t will find themselves competing on price alone – a race to the bottom that nobody wins.

Must Read: How AI in Insurance is Transforming the Industry

The AI Transformation: Why Traditional Underwriting Can’t Compete

The underwriting revolution is already underway, and the numbers tell a compelling story. According to recent industry research, 77% of insurance companies are now in some stage of adopting AI in their value chain, representing a dramatic surge from just 61% in 2023. Meanwhile, the Global AI-Powered Insurance Underwriting Market is experiencing explosive growth, expanding from $2.85 billion in 2024 to a projected $674.1 billion by 2034 – a staggering 44.7% compound annual growth rate.

The early adopters are already seeing transformational results. Companies implementing AI underwriting systems have reduced processing times by up to 90%, from weeks to mere hours, while 88% of auto insurers and 70% of home insurers report using, planning to use, or exploring AI/ML models in their operations. The message is clear: AI adoption in underwriting via recommendation engines isn’t just a trend – it’s become an operational imperative that separates market leaders from companies struggling to keep pace.

The window for competitive advantage through AI adoption is rapidly closing. Organizations that hesitate while their competitors deploy intelligent automation risk finding themselves permanently disadvantaged in an increasingly data-driven marketplace.

The Current State of Insurance Underwriting: Time for a Reality Check

Let’s be honest – traditional underwriting has some real problems. Most insurance companies are still using old processes with tons of paperwork, weeks of waiting around, and decisions made with incomplete information. Your underwriters spend way too much time going through applications by hand, checking different databases, and making calls without having current information. Meanwhile, old-school methods are losing money through pricing mistakes, missed risks, and customers who just give up waiting.

But here’s the thing – AI in underwriting insurance is already fixing these problems for companies that have switched over. The tech handles applications in minutes instead of days, catches risks that human underwriters could miss, and makes consistent decisions using complete data analysis.

Do Read: Digital Transformation in Insurance Industry

What’s Really Happening Behind the Scenes?

Think about your last underwriting review. How much time did your team waste collecting basic info that’s already sitting in some database somewhere? How many applications got stuck because someone was waiting around for a medical report or a credit check? These delays don’t just annoy customers – they’re costing your business actual money through missed opportunities and things just not running smoothly.

AI in underwriting insurance is revolutionizing the entire process through automation. Instead of your underwriters spending most of their time gathering data and doing basic analysis, intelligent systems handle these foundational tasks automatically. This strategic shift allows your team to focus on complex cases, build stronger client relationships, and make high-level decisions that drive actual business growth.

How Artificial Intelligence for Insurance Underwriting Actually Works

Let’s break down what happens when you implement AI underwriting systems. The process starts with automated data collection from multiple sources – credit bureaus, medical databases, property records, and even IoT devices. Machine learning algorithms analyze this information instantly, identifying patterns and risk factors that would take human underwriters hours to spot.

The machine learning insurance underwriting systems don’t just process faster – they get smarter over time. Every decision feeds back into the algorithm, improving accuracy and revealing new insights about risk assessment. This creates a competitive advantage that compounds over time.

Here’s a practical example: When a new auto insurance application comes in, AI powered insurance underwriting systems instantly access the applicant’s driving record, vehicle history, local accident data, weather patterns, and even traffic density in their area. The system processes all this information and provides a risk assessment with pricing recommendations in seconds.

The Technology Stack That Makes It Possible

Modern AI in insurance underwriting automation uses several different technologies that work together. Natural Language Processing reads and makes sense of messy documents like medical reports and claim histories. Computer Vision looks at photos and videos for property checks and damage reviews. Predictive Analytics tries to guess future claims based on what happened before, while Real-time Data Integration grabs information from different sources at the same time.

Must Read: Understanding Insurance Fraud Detection with AI and Big Data

While AI in underwriting insurance has transformed risk assessment and processing speed, the next evolution involves building AI agents for insurance that can autonomously manage complex workflows from claims processing to customer service interactions.

Real-World Success Stories: Companies Getting It Right

Let’s look at what smart companies are actually doing with AI underwriting in insurance. These aren’t theoretical examples – they’re real implementations delivering measurable results.

Allianz’s BRIAN System

Allianz UK developed an AI tool called BRIAN that helps underwriters navigate complex guidance documents. The tool has saved approximately 135 working days in information gathering since it was rolled out in January 2025. Instead of spending hours searching through 600-page documents, underwriters get instant answers to specific questions.

This is exactly the kind of agentic AI application in insurance underwriting that transforms daily operations. BRIAN doesn’t replace underwriters – it makes them dramatically more effective by handling routine information retrieval tasks.

Progressive’s Data-Driven Approach

Progressive has built its entire business model around intelligent risk assessment. Their Snapshot program collects real driving data from millions of customers, feeding machine learning algorithms that continuously improve risk assessment accuracy. Progressive’s AI-driven approach results in 9% more accurate risk pricing.

This superior accuracy lets Progressive offer better rates to safe drivers while appropriately pricing higher-risk customers. It’s a perfect example of how the role of AI in insurance underwriting creates win-win outcomes for insurers and policyholders.

Zurich’s Property Intelligence Revolution

Zurich North America recently integrated AI-powered property intelligence into their underwriting platform. During the initial rollout, Zurich underwriters were able to identify risks that may have been overlooked using conventional methods, enabling the company to classify risks with greater accuracy. The system uses high-resolution aerial imagery and AI analysis to assess property conditions without requiring physical inspections, reducing manual processes while centralizing updated property data in one system.

This practical shift demonstrates how insurers are moving beyond experimentation to full operational deployment, with results that prompted Zurich to expand the technology across its entire U.S. Middle Market underwriting offices.

Are you starting to see what’s happening here? These companies aren’t just testing AI – they’re using it to actually make their operations better.

The Wireframe for Automated Insurance Underwriting Process

When you’re planning to implement AI in the insurance underwriting process, you need a clear roadmap. Here’s the wireframe that successful companies follow:

Phase 1: Data Foundation

- Audit existing data sources and quality

- Establish secure data integration protocols

- Set up real-time data feeds from external sources

- Create unified customer data repositories

Phase 2: AI Model Development

- Define specific use cases and success metrics

- Train machine learning models on historical data

- Test algorithms against known outcomes

- Implement feedback loops for continuous improvement

Phase 3: Integration and Automation

- Embed AI tools into existing underwriting workflows

- Create user-friendly interfaces for underwriters

- Establish exception handling protocols

- Set up monitoring and performance tracking

Phase 4: Scale and Optimize

- Expand AI coverage to additional product lines

- Refine algorithms based on real-world performance

- Train staff on AI-augmented processes

- Continuously update models with new data

Key Technical Components

Your insurance underwriting AI solutions development needs these essential elements:

- Risk Assessment Engine: Core AI algorithms that evaluate applications and assign risk scores

- Data Integration Layer: Connections to external databases, APIs, and real-time information sources

- Decision Support Interface: User-friendly dashboards that present AI insights to human underwriters

- Audit and Compliance Module: Tracking and documentation features that ensure regulatory compliance

The Impact: What AI in Insurance Underwriting Really Delivers

Let’s talk numbers. Machine learning in underwriting has improved accuracy by 54%, leading to more reliable and data-driven risk assessments. That’s not a marginal improvement – it’s a fundamental change in how accurately you can price risk.

Speed and Efficiency Gains

When you implement comprehensive automation solutions, you’re not just making things a little faster – you’re completely changing the game. Applications that used to take 2-3 weeks now get processed in hours. This doesn’t just improve customer satisfaction – it transforms your business capacity.

Here’s what the math looks like: If your team currently processes 100 applications per month with traditional methods, AI automation could help you handle 400-500 applications with the same resources. That’s not just efficiency – that’s exponential growth potential.

Recommended: How Much Does It Cost to Build a White Label Insurance Quoting Software?

Better Risk Assessment

Machine learning insurance underwriting doesn’t just work faster – it works smarter. AI systems can look at thousands of data points at once, finding small patterns and connections that human underwriters could miss. This helps with more accurate risk checks and better pricing choices.

For example, AI might figure out that customers with certain mixes of credit score, car type, and where they live have really different claim patterns than old models would expect. This detailed info helps you price policies better and avoid getting stuck with bad risks.

Customer Experience Revolution

Today’s customers want instant everything. When someone applies for insurance, they want an answer in minutes, not weeks. AI powered insurance underwriting makes this happen by handling routine decisions automatically and only sending complicated cases to human reviewers.

This gives you a competitive edge that’s tough to ignore. While your competitors are still making customers wait days or weeks for decisions, you can give instant quotes and same-day policies for simple applications.

The Benefits of AI in Insurance Underwriting: Beyond the Obvious

Sure, everyone talks about speed and efficiency, but the real advantages go much deeper. Let’s explore what really matters for your business success.

Consistency and Fairness

Human underwriters, no matter how good they are, can be all over the place. They have good days and off days, they might read guidelines differently, and personal bias can creep into decisions. AI underwriting gets rid of these inconsistencies by using the same analysis approach for every application.

This consistency isn’t just good for operations – it protects you legally too. With regulators watching fair lending and discrimination more closely, AI systems give you trackable, consistent decision processes that can help keep your organization out of compliance trouble.

Scalability Without Proportional Costs

Traditional underwriting needs more human underwriters to handle more applications. But automated insurance underwriting process systems can handle huge volume jumps without the costs going up the same way. This scaling advantage really matters during market growth or busy seasons.

Think about what happens when you launch a new product or move into a new area. Instead of hiring and training tons of new underwriters, your AI systems can right away handle the extra volume while keeping quality and consistency.

Automated Document Processing

Insurance applications involve tons of paperwork – medical records, financial statements, property appraisals, and more. Natural language processing technology can read and extract relevant information from these documents automatically, eliminating hours of manual data entry.

Must Read: Power of AI in Intelligent Document Processing

For example, when a life insurance application includes medical records, AI can automatically identify relevant health conditions, medication lists, and risk factors. This information gets structured and fed directly into the risk assessment process without human intervention.

Predictive Claims Modeling

Machine learning insurance underwriting systems can predict not just whether someone is likely to file a claim, but what type of claims they might file and when. This granular insight helps you price policies more accurately and identify customers who might benefit from risk reduction programs.

For instance, AI might identify that customers with certain characteristics are likely to file auto claims in their first six months of coverage. This insight lets you implement targeted safety programs or adjust pricing to account for this pattern.

Fraud Detection and Prevention

Advanced AI powered insurance underwriting systems excel at identifying potential fraud during the application process. By analyzing patterns across thousands of applications, AI can spot red flags that human underwriters might miss.

These systems can identify suspicious patterns like multiple applications from the same address, inconsistent information across different data sources, or application details that match known fraud schemes. Early fraud detection saves money and prevents problematic policies from being issued.

Must Read: Stepwise 2026 Guide to Fraud Detection Software Development Cost

Market Responsiveness

AI-enabled underwriting systems can adapt to market changes much faster than traditional approaches. When new risk factors emerge – like climate change impacts or cyber threats – you can quickly update your models and pricing without completely overhauling your processes.

This agility becomes crucial in today’s rapidly changing risk environment. Companies that can quickly adapt their underwriting to new realities will consistently outperform those stuck with rigid, slow-to-change systems.

Data-Driven Innovation

Organizations that successfully implement AI in the insurance underwriting process gain access to insights that drive product innovation. AI systems can identify unmet market needs, reveal new risk factors, and suggest opportunities for new insurance products.

For example, AI analysis might reveal that certain customer segments have risk profiles that don’t fit traditional insurance categories. This insight could lead to innovative product development that creates new revenue streams.

The practical applications you’ve seen represent proven capabilities that forward-thinking insurers are using right now to gain competitive advantages. When exploring AI underwriting use cases, these examples demonstrate tangible benefits.

Overcoming the Challenges of AI in Insurance Underwriting

Let’s be honest – implementing AI in underwriting isn’t without obstacles. It is the same genre as adopting AI in any business. However, understanding these challenges upfront helps you plan better solutions and avoid common pitfalls.

Data Quality and Integration Issues

Your AI systems are only as good as the data they receive. Many insurance companies struggle with fragmented data sources, inconsistent formats, and data quality issues. Before you can fully leverage AI in underwriting insurance, you need clean, comprehensive, and well-integrated data.

The solution isn’t just about technology – it’s about processes and governance. You need clear data standards, regular quality audits, and robust integration protocols. Companies that get this right see much better AI performance and faster implementation timelines.

Regulatory and Compliance Concerns

Insurance operates under strict regulatory frameworks, and regulators are still developing comprehensive AI governance standards. The challenges of AI in insurance underwriting include ensuring compliance with multiple critical regulations:

- Fair Credit Reporting Act (FCRA) – governing automated credit-based decisions

- Equal Credit Opportunity Act (ECOA) – preventing discriminatory lending practices

- Fair Housing Act – ensuring unbiased property insurance underwriting

- State insurance codes – maintaining transparent algorithmic decision-making

- GDPR and state privacy laws – protecting customer data in AI processing

Smart companies address these requirements by building explainable AI frameworks that provide clear decision rationales, maintain comprehensive audit trails, and demonstrate regulatory compliance from implementation.

Smart companies address this by building explainability into their AI systems from the start. Your AI tools should be able to provide clear explanations for their decisions, maintain audit trails, and demonstrate compliance with regulatory requirements.

Must Read: Navigating Responsible AI Principles

Change Management Resistance

Staff often fear job displacement when AI initiatives are announced, creating organizational friction that derails promising projects.

Position AI as augmentation rather than replacement, showing underwriters how automation eliminates tedious tasks and elevates their role to strategic risk analysis. Comprehensive training programs that upskill existing talent typically achieve 90%+ adoption rates.

Vendor Selection Overwhelm

Organizations face dozens of AI solution providers, creating analysis paralysis that delays critical implementation decisions.

Partner with experienced AI development services providers who understand insurance-specific requirements and can deliver end-to-end transformation rather than point solutions. Focus on partners with proven track records in the insurance industry.

Do you see how addressing these challenges proactively sets you up for success? The companies that struggle with AI implementation are usually the ones that underestimate these human and organizational factors.

Looking Forward: The Future of AI in Insurance Underwriting Automation

The current state of intelligent automation is just the beginning. Here’s where the technology is heading and what it means for your strategic planning.

Fully Autonomous Underwriting

We’re moving toward systems that can handle routine underwriting decisions completely autonomously, with human oversight only for complex or unusual cases. Insurance leaders see a major role in particular for agentic AI – autonomous systems capable of performing even complex tasks almost independently.

This doesn’t mean eliminating underwriters – it means elevating them to focus on strategic work, complex risk assessment, and customer relationship management. The routine work gets handled automatically, freeing your team for higher-value activities.

Real-Time Continuous Underwriting

Instead of underwriting policies once at issuance, AI systems will enable continuous risk assessment throughout the policy lifecycle. This means pricing can adjust based on changing circumstances, and risk mitigation can be proactive rather than reactive.

Imagine auto insurance that adjusts monthly based on actual driving behavior, or property insurance that updates based on real-time weather and maintenance data. This dynamic approach creates fairer pricing and better risk management.

Integration with IoT and External Data

The future involves integration with Internet of Things devices and vast external data sources. Experts estimate that there will be up to one trillion connected devices by 2026 end.

This data explosion will enable unprecedented insight into risk factors and customer behavior. Smart homes will provide real-time property risk data, wearable devices will offer health insights for life insurance, and connected cars will deliver precise driving behavior information.

What questions should you be asking yourself about your organization’s readiness for these changes? How will you position your company to take advantage of these emerging capabilities?

Making the Business Case: ROI of Insurance Underwriting AI Solutions Development

Let’s talk about what really matters to leadership: return on investment. Developing comprehensive AI solutions requires significant upfront investment, but the returns can be substantial and measurable.

Quantifying the Benefits

The AI for Insurance market’s growth reflects the significant value that AI delivers to insurance operations.

Here’s how to calculate your potential ROI: multiply your current processing costs by the 80-90% reduction in processing time, calculate cost savings from reduced pricing errors and better risk selection, estimate revenue gains from faster response times and improved customer experience via chatbots, and quantify savings from improved fraud detection capabilities.

Implementation Timeline and Costs

Most successful implementations follow a phased approach over 12-18 months. Initial costs typically include software licensing and development, data integration and cleanup, training and change management, plus ongoing maintenance and optimization.

However, many companies see positive ROI within the first year of implementation, with benefits accelerating as the system learns and improves.

Getting Started: Your Next Steps

If you’re convinced that AI in insurance underwriting is right for your organization, here’s your practical roadmap for getting started.

Assessment and Planning

Begin with a comprehensive assessment of your current underwriting processes. Identify bottlenecks, quantify manual effort, and catalog your data sources. This baseline helps you prioritize AI applications and measure improvement.

Work with experienced AI development service providers to assess your technical infrastructure and identify integration requirements. The right development partner can help you avoid common pitfalls and accelerate implementation.

Pilot Project Selection

Choose a focused pilot project that can demonstrate clear value without overwhelming your organization. Good candidates include automated document processing for specific product lines, risk scoring for straightforward applications, and fraud detection for new applications.

Start small, prove value, then expand to additional use cases.

Building Internal Capabilities

Successful AI implementation requires ongoing internal capabilities. Consider investing in training for existing staff on AI-augmented processes, hiring data scientists and AI specialists, partnerships with insurance software development services, and change management programs.

When examining different AI underwriting use cases, focus on applications that deliver immediate value while building toward more sophisticated implementations.

Conclusion: The Time for Action is Now

The transformation of insurance underwriting through artificial intelligence isn’t a future possibility – it’s happening right now. Companies like Allianz, Progressive, and Zurich are already seeing dramatic improvements in efficiency, accuracy, and customer satisfaction.

Understanding the full scope of Artificial Intelligence for Insurance Underwriting capabilities shows why this technology represents such a significant opportunity. The benefits of AI in insurance underwriting – faster processing, better accuracy, improved customer experience, and enhanced fraud detection – create compelling competitive advantages.

But these advantages only come to organizations that act decisively to implement AI solutions. Your next step is clear: partner with a company known for its experience in providing AI development services and insurance software development services to begin your transformation. The companies that move quickly will establish market advantages that become harder for competitors to overcome over time.

The future of insurance underwriting is intelligent, automated, and customer-focused. When you consider the expanding role of AI in insurance underwriting, the question isn’t whether this technology will reshape the industry – it’s how quickly your organization will embrace it.

The winners will be those who recognize that artificial intelligence for insurance underwriting isn’t just about technology – it’s about reimagining what’s possible in risk assessment, customer service, and business growth.

Transform Your Underwriting Operations with Appinventiv’s Proven AI Excellence

Ready to revolutionize your insurance underwriting process? Appinventiv, a globally recognized AI development powerhouse, has been transforming financial services for nearly a decade. Our excellence is validated by multiple prestigious recognitions:

- Consecutive Deloitte Technology Fast 50 Awards in both 2023 and 2024, ranking #1 in the Digital & Cloud Tech category

- “The Leader in AI Product Engineering & Digital Transformation 2025” by The Economic Times

- “Tech Company of the Year” at the Times Business Awards 2023

- Clutch Global Award 2025 winner for unmatched customer excellence

- ISO-certified company ensuring highest security standards

This brings unmatched expertise in AI development services to the insurance sector. We’ve successfully delivered AI-powered solutions for industry leaders, including Slice, Edfundo, Mudra, and Asian Bank. Our other clients include gians like KFC, Pizza Hut, and Adidas.

With 1,600+ tech experts specializing in AI, machine learning, and blockchain technologies, Appinventiv offers comprehensive insurance software development services that streamline your entire underwriting workflow:

- AI-powered claims verification and fraud detection systems

- Intelligent risk assessment and predictive analytics platforms

- Automated document processing and data extraction solutions

- Custom underwriting workflow automation tools

Our clients in the financial sector have experienced transformational results – from reducing processing times by up to 80% to improving risk assessment accuracy by over 50%.

Partner with Appinventiv to unlock the competitive advantages that AI-driven underwriting can deliver for your organization.

Frequently Asked Questions

Q. How is AI used in insurance underwriting?

A. AI makes insurance underwriting smoother through automatic data gathering, risk checking algorithms, and prediction modeling. Machine learning systems look through huge datasets including credit reports, medical records, and property info to create risk scores and pricing suggestions. Natural language processing pulls out useful information from documents, while computer vision checks images for property reviews, helping make underwriting decisions faster and more accurate.

Q. How Is AI Impacting Insurance Underwriting?

A. AI is changing insurance underwriting by cutting processing times from weeks down to hours, making risk checks more accurate by over 50%, and letting you make decisions in real-time. It handles routine stuff automatically, lets underwriters work on tough cases, and gives consistent, fair evaluations. AI also helps catch fraud better, allows for flexible pricing models, and makes customers happier through instant quotes and faster policy setup.

Q. How AI improves underwriting efficiency in insurance?

A. AI really improves underwriting efficiency by handling manual work like data entry and document checking automatically, getting rid of the need for time-eating information gathering. Machine learning programs process applications right away, while prediction analytics spot risks and pricing chances automatically. This automation cuts operating costs, reduces human mistakes, and lets underwriting teams handle way more applications without hiring more people.

Q. How does AI reduce underwriting turnaround time?

A. AI reduces underwriting turnaround time by automating data collection from multiple sources simultaneously, instantly analyzing risk factors that would take human underwriters hours to assess, and providing immediate decisions for routine applications. Advanced algorithms can process applications in minutes rather than days, while automated workflows route complex cases to appropriate specialists, eliminating delays and enabling same-day policy issuance for straightforward applications.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

From Chatbots to AI Agents: Why Kuwaiti Enterprises are Investing in AI-Powered App Development

Key Takeaways Kuwaiti organizations are moving beyond basic chatbots to deploy AI agents that handle tasks, analyze data, and support operations intelligently. National initiatives such as Vision 2035 and CITRA regulations are creating a structured environment for AI-powered app development in Kuwait. Businesses in key sectors like banking, oil and gas, retail, and public services…

Beyond the Hype: Practical Generative AI Use Cases for Australian Enterprises

Key takeaways: Enterprises in Australia are adopting Gen AI to address real productivity gaps, particularly in reporting, analysis, and service delivery. From banking and pharmaceutical to mining and agriculture, Gen AI is applied across industries to modernise legacy systems and automate knowledge-intensive and documentation-heavy workflows. The strongest outcomes appear where Gen AI is embedded into…

The ROI of Accuracy: How RAG Models Solve the "Trust Problem" in Generative AI

Key takeaways: RAG models in generative AI attach real, verifiable sources to model outputs, which sharply cuts hallucinations and raises user confidence. Accuracy directly impacts ROI, driving fewer escalations, faster decision cycles, and lower support costs. RAG vs fine-tuning: RAG allows real-time updates without retraining, offering faster deployment and lower maintenance. Vector databases for RAG…