- How to Calculate White Label Insurance Quoting Software Development Costs?

- Factors Affecting the Cost to Build a White Label Insurance Quoting Software

- Core Features and Functionalities

- Third-Party API Integrations

- Focussing on UI/UX Design

- Security Measures

- Location of Development Team

- Scalability and Performance

- Types of Insurance Quoting Software

- Types of White Label Insurance Quoting Software for Different Industries

- Health Insurance

- Auto Insurance

- Travel Insurance

- Property Insurance

- Life Insurance

- Commercial Insurance

- Features of White Label Insurance Quoting Software

- Basic Features

- Advanced Features

- How Advanced Technologies like AI/ML Are Transforming Insurance Quoting Services

- Steps to Build White Label Insurance Quoting Software

- Define Business Goals and Software Requirements

- Select an Appropriate Technology Stack

- Design a User-Centric Interface

- Develop Essential Functionalities

- Conduct Rigorous Testing and Optimize Performance

- Deploy the Software with Precision

- Provide Continuous Support and Updates

- Mitigating Implementation Challenges for White Label Insurance Quoting Software

- Integration with Existing Systems

- Scalability for Growing Client Needs

- Accelerate Your Insurance Workflow with Appinventiv’s White-Label Quoting Software

- FAQs

The InsurTech market is witnessing a rapid surge in today’s digital landscape. This presents a lucrative opportunity for aspiring entrepreneurs to develop white-label insurance quoting software that can be rebranded and customized as per the different needs of insurance companies. With the global InsurTech market projected to reach $ 152,433.9 million by 2030 (Grand View Research), the demand for ready-to-use, customizable solutions is skyrocketing.

But how much does it actually cost to develop a white-label insurance quoting platform?

To give a rough range, insurance quoting software development can cost from $50,000 to $500,000, depending on the complexity and scope of the project.

From foundational quoting engines to cutting-edge AI features that personalize quotes in real-time, the cost depends on how far you want to take your platform. Add in the need for regulatory compliance, third-party API integrations, and mobile responsiveness, and the price tag begins to take shape.

In this blog, we’ll break down the cost factors and help you understand the investment needed to stay competitive in today’s digital insurance market. Whether you’re a fast-growing startup or an established provider, this guide will clarify what it takes to create quoting software that captures users’ attention and guarantees maximized returns.

Opportunity – You can capitalize on this pain point by building a white-label insurance quoting platform that’s quick, accurate, scalable, and ready to sell.

How to Calculate White Label Insurance Quoting Software Development Costs?

As mentioned, the cost to build white label insurance quoting software can range from $50,000 to $500,000. Several key factors influence this broad range, including the complexity of features, the technology stack, and necessary integrations. Expenses also depend on the expertise of the development team, compliance needs, and the level of customization required.

Here’s an easy formula to estimate the cost of building white-label insurance quoting software:

| Total Cost to Develop White-Label Insurance Quoting Software = Number of Development Hours × Hourly Rates of Developers |

Factors Affecting the Cost to Build a White Label Insurance Quoting Software

The white label insurance quote software development cost is influenced by several factors that impact the overall development process and timeline. By understanding these factors, you can ensure software is tailored to meet your business requirements.

Core Features and Functionalities

The complexity and breadth of features directly impact development costs. Basic features like a quoting engine and policy comparison are cost-effective, but advanced capabilities such as AI-powered insurance recommendations, real-time policy adjustments, and multi-policy bundling can significantly raise expenses.

Companies must balance feature requirements with their budget, focusing on delivering a seamless and efficient quoting experience. A feature-rich platform will require more development time and resources, increasing the overall investment.

Here’s a table that outlines the complexity levels and associated white label insurance quote software development cost:

| Complexity Level | Description | Estimated Cost |

|---|---|---|

| Basic | Developing smaller, general software solutions with essential quoting features and minimal customizations. Ideal for companies just starting with quoting software development. | $50,000 – $1500,000 |

| Moderate | Creating specialized software with moderately advanced quoting capabilities, such as custom pricing models, third-party tool integrations, and basic AI features. | $150,000 – $300,000 |

| Advanced | Building large-scale, highly customized software that includes full automation, AI-powered recommendations, advanced data analytics, and seamless integrations. | $300,000- $500,000+ |

Third-Party API Integrations

Integrating third-party services like payment gateways, customer portals, underwriting systems, and CRMs enhances functionality and user experience. CRMs are often implemented to streamline customer data management, enabling better follow-ups and policy tracking. Each integration, however, adds complexity to the development process.

For instance, real-time data integrations with policy databases or actuarial tools can increase the cost of building white label insurance quoting software due to API licensing fees and implementation challenges.

Additionally, ensuring seamless data flow between these systems requires meticulous planning and testing. The more integrations required, the higher the development, maintenance, and potential subscription expenses.

Focussing on UI/UX Design

A user-friendly design is critical for retaining users and ensuring a smooth quoting process. This involves creating intuitive navigation, responsive layouts, and visually appealing elements. Customizing the design to align with your brand adds to development costs, especially if you require advanced features like interactive dashboards or personalized user experiences.

High-quality UI/UX design ensures customer satisfaction but can be a significant cost factor in the project. A seamless user experience can also improve conversion rates, making it a worthwhile investment in the long run.

Security Measures

Given the sensitive nature of customer data in the insurance industry, implementing strong security features is essential. This includes end-to-end encryption, multi-factor authentication, and protection against cyber threats.

Developing and maintaining these security measures increases the cost to build insurance quoting software but it ensures compliance and customer trust. Moreover, insurance quoting software must be designed with regular security updates and audits to prevent vulnerabilities as new threats emerge.

Security features include data breach detection, role-based access control, and secure data storage. These add protection layers but increase upfront and ongoing costs. Investing in robust security mitigates risks and can enhance the software’s reputation in a competitive market, making it a key priority.

Location of Development Team

The location of your development team plays a crucial role in determining the overall cost to build white label insurance quoting software. Teams in different regions have varying labor rates, with certain areas offering more cost-effective solutions than others.

However, factors such as time zone differences, communication challenges, and cultural alignment can influence the effectiveness and efficiency of the development process.

The location of the development team impacts both the cost and the ease of collaboration, requiring careful consideration based on your project’s needs and budget. Here’s a table presenting the hourly rates for development based on various regions:

| Region | Hourly Rates |

|---|---|

| US | $95-$100 |

| Western Europe | $80-$90 |

| Australia | $70-$90 |

| UAE | $60-$65 |

| Eastern Europe | $50-$55 |

| Asia | $25-$40 |

Scalability and Performance

As your business grows, the software must be capable of handling higher user demand and larger data volumes. Designing a strong backend architecture that guarantees quick response times, even during peak periods, requires additional development effort and resources. Investing in scalability ensures the software can handle future growth, but it also involves upfront costs for infrastructure and design.

Future-proofing the system is critical, especially if you plan to introduce new insurance products or expand into new geographic regions. Moreover, optimizing performance and scalability ensures smooth user experiences, crucial for maintaining customer satisfaction as the platform grows.

Types of Insurance Quoting Software

The cost of white-label insurance quoting software development largely depends on the industry it serves. Different sectors have different requirements, influencing the software’s complexity, features, and compliance needs. For instance, auto insurance quoting software focuses on vehicle data integration, while health insurance solutions require medical underwriting and policy comparisons (details below). Understanding these distinctions helps in estimating costs and building a solution that aligns with industry demands.

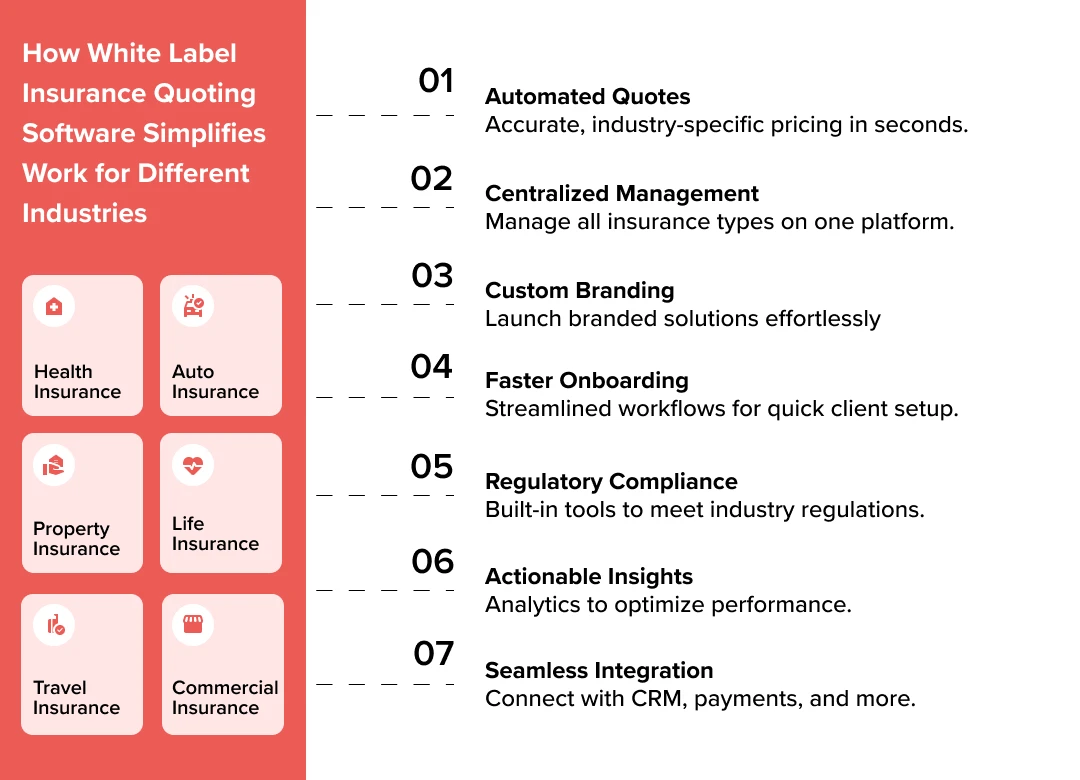

Types of White Label Insurance Quoting Software for Different Industries

The white label insurance quoting software provides flexible solutions for multiple industries, offering seamless integration and customizable features. This, in turn, boosts efficiency and delivers an enhanced customer experience across various sectors. However, it’s important to note that the white label insurance quoting software development cost can vary depending on the specific needs of each industry. Let’s have a look at those.

Health Insurance

White label health insurance quoting software development allows businesses to offer customized, branded quoting tools that analyze factors such as age, medical history, and coverage preferences.

The healthcare quoting software provides personalized policy options, including basic health plans, critical illness coverage, or family packages, ensuring a seamless experience for customers and agents under your brand.

Auto Insurance

White label auto insurance quoting software development allows businesses to deliver personalized, branded solutions that evaluate factors like driver history, vehicle specifications, and usage patterns. This software generates customized coverage options, including liability, collision, or pay-as-you-go plans, offering a seamless quoting experience for customers and agents under your brand.

Travel Insurance

Perfect for frequent or occasional travelers, this software calculates quotes based on trip details such as destination, duration, and demographics. It also provides options for medical emergencies, trip cancellations, and baggage loss, ensuring hassle-free travel planning.

Property Insurance

Tailored for homeowners, landlords, or renters, this software considers property value, location, and risk factors like natural disasters. It provides comprehensive quotes to safeguard assets and belongings against potential damages.

Life Insurance

Life insurance quoting software development focuses on creating tools that assess personal factors such as age, health, and financial objectives to recommend the best policy options, including term life, whole life, or universal life insurance.

The life insurance quoting software streamlines the process, making it easier for customers to choose the right coverage to protect their family’s future.

Commercial Insurance

Commercial insurance quoting software development focuses on creating tailored solutions for businesses by evaluating factors such as industry type, company size, and operational risks. These solutions deliver customized policy options, including liability coverage, property insurance, and workers’ compensation, ensuring comprehensive protection for business operations.

Also Read: Cloud for Insurance Industry: Benefits and Use Cases

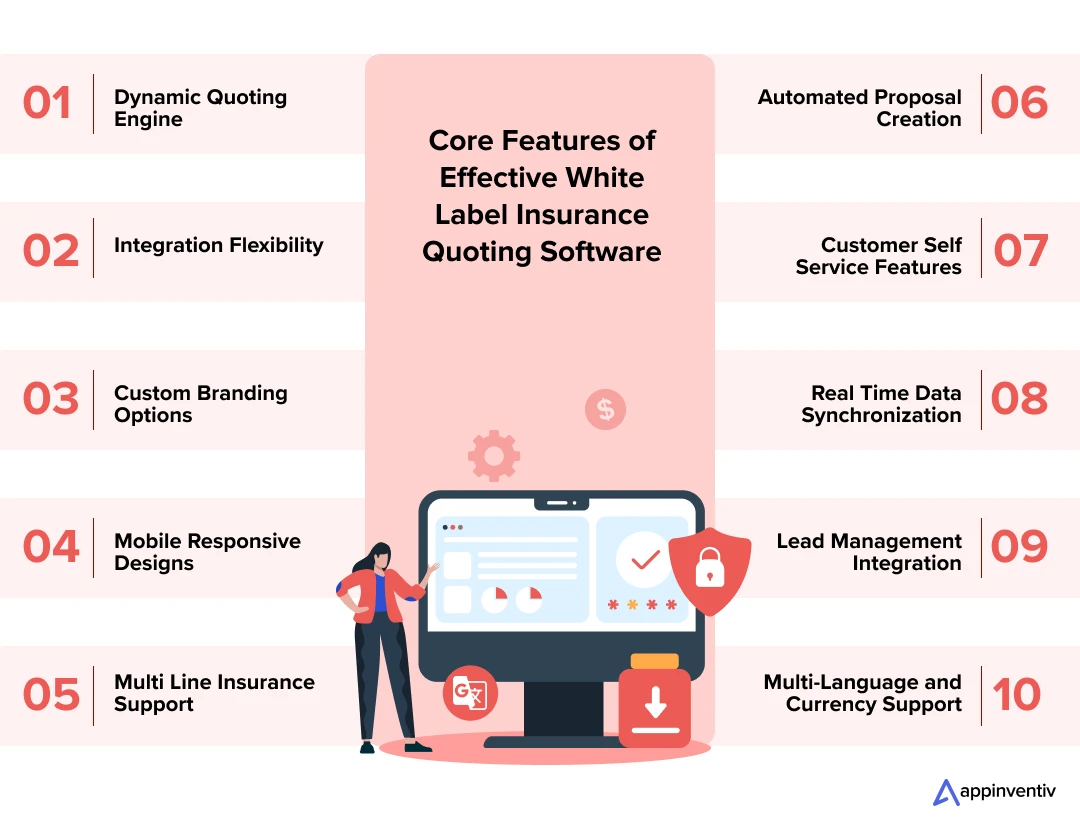

Features of White Label Insurance Quoting Software

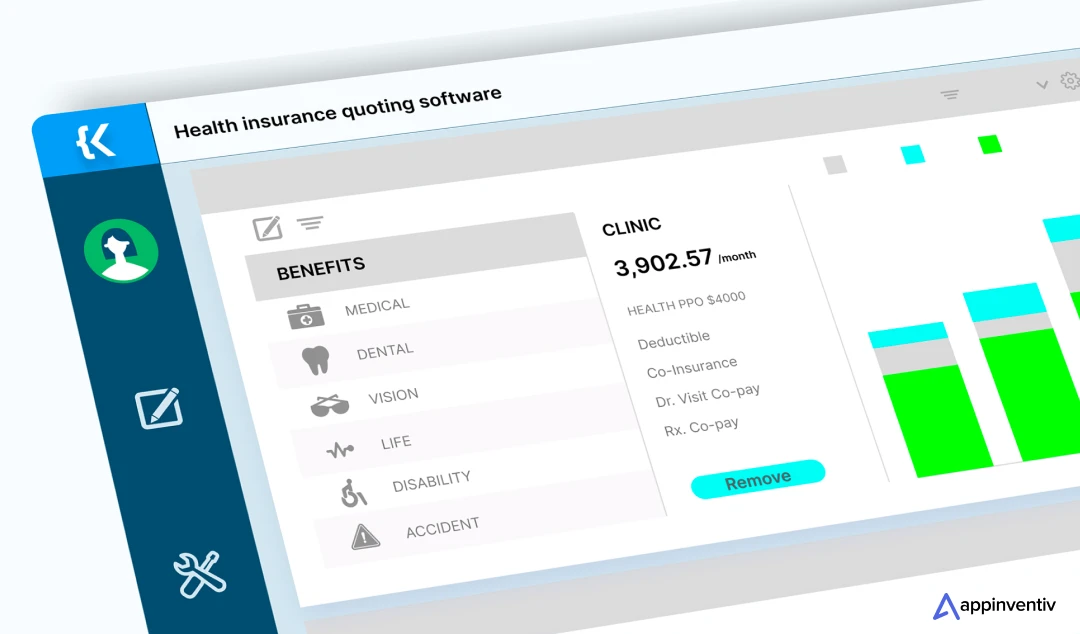

White-label insurance quoting software offers a range of basic and advanced features that support various functionalities and ensure precision and accuracy in insurance quotation processes. Let’s look at some of the basic and advanced features of the white label insurance quoting software.

Basic Features

White-label insurance quoting software offers a range of features that make it highly functional and easy to use. These features not only improve the user experience but also influence the cost to build white label insurance quoting software. More advanced functionalities and integrations demand additional time and resources for implementation.

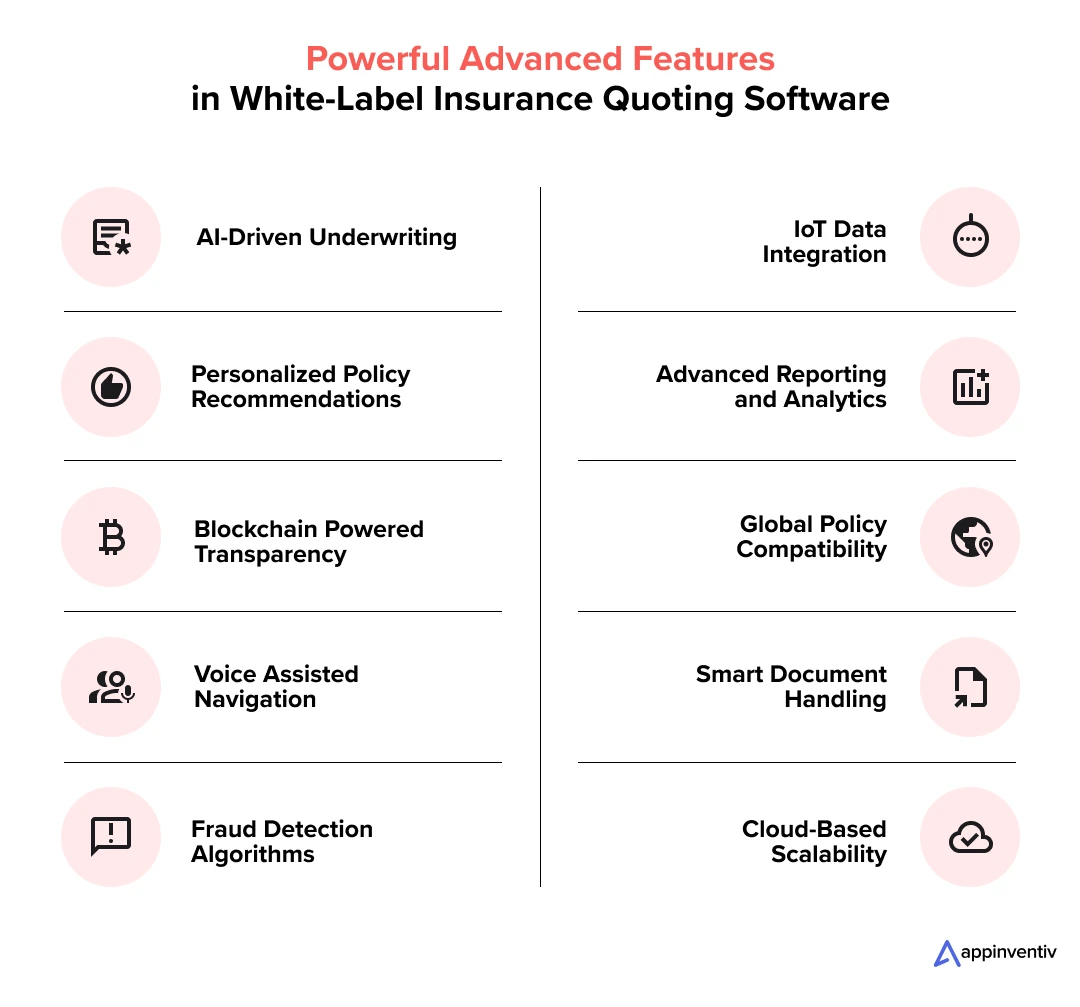

Advanced Features

Advanced features of white-label insurance quoting software enhance its functionality and performance, offering users more sophisticated solutions. While these features improve accuracy and efficiency, they can also increase the cost of insurance quote software development due to the need for specialized expertise, more complex integrations, and longer implementation timelines.

How Advanced Technologies like AI/ML Are Transforming Insurance Quoting Services

The insurance industry is undergoing remarkable transformation, thanks to the advent of AI/ML technologies that are making the quoting, underwriting, and claims processing easier. These advanced technologies are making insurance quoting processes more efficient and customer-centric. However, incorporating such technologies to the software also adds to the total cost of development.

The table below shows how the advanced insurance quoting method is different from the traditional ones.

| Aspect | Traditional Quoting | AI/ML- Enabled Quoting |

|---|---|---|

| Fraud Detection | Takes a reactive approach, and addresses issues only after they occur | Proactive in nature, detects fraud early |

| Customer Experience | Follows a generic customer approach with no personalization | Offers personalized customer experience tailored to individual needs |

| Speed | Slow, manual, and takes days to complete | Ensures instant processing, significantly reducing turnaround time |

| Scalability | Limited scalability with low-performance issues | Highly scalable, capable of handling an increasing number of requests |

| Accuracy | Prone to human error and inconsistencies | Highly accurate, ensuring precise outcomes |

| Cost | Higher costs due to manual labor and high processing time | Reduced operational costs through automation |

Bring your vision to life with our expert app developers who know how to build next-gen solutions that can seamlessly rebranded and customized for multipel clients.

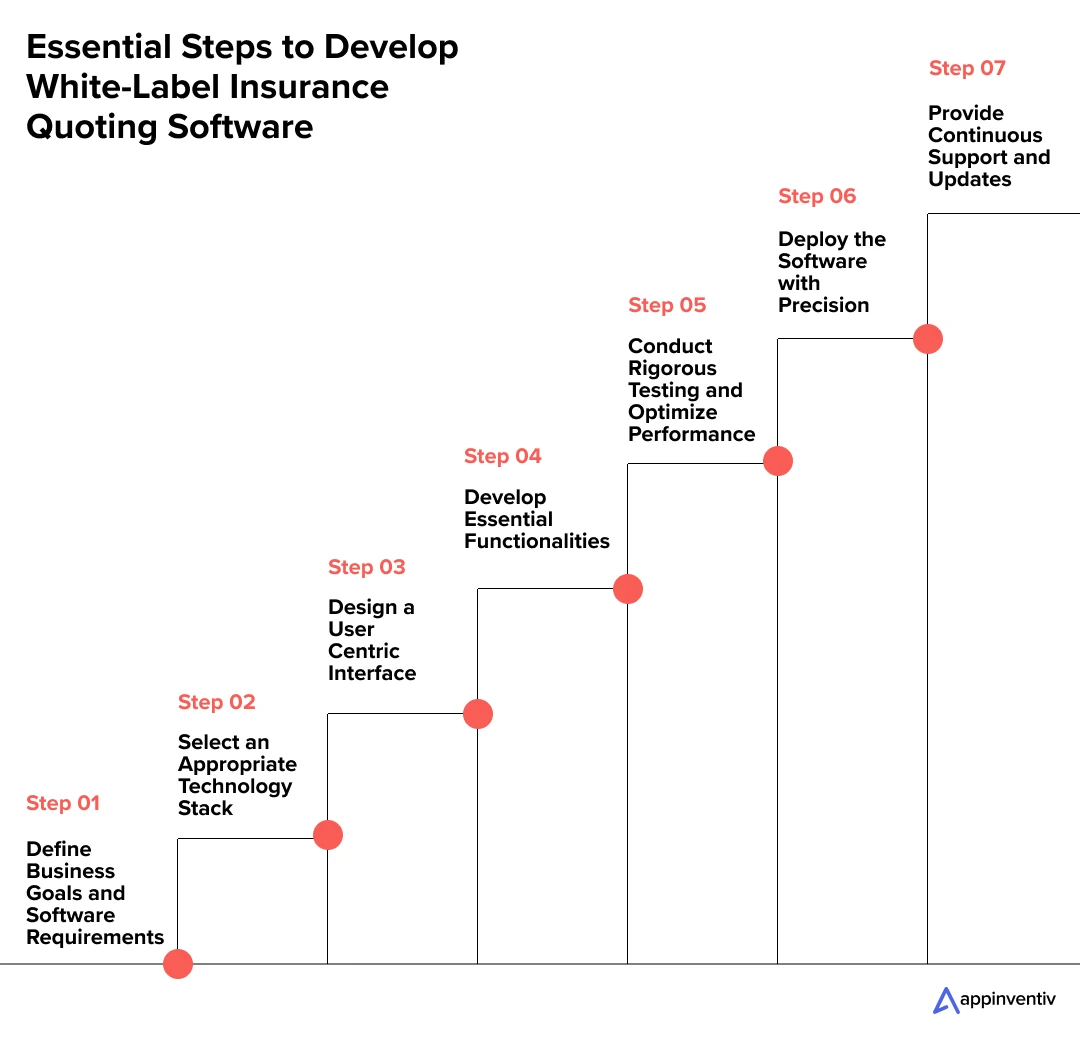

Steps to Build White Label Insurance Quoting Software

Creating a customizable, scalable solution that aligns with your business needs is essential. White-label insurance quoting software provides a tailored user experience while integrating seamlessly with existing systems, ensuring efficiency and flexibility for your business and customers. Let’s have a look at the steps.

Define Business Goals and Software Requirements

Start by outlining clear business objectives and understanding the specific needs of your target audience, including insurers, agents, and customers. Determine key features such as quoting engines, policy comparison tools, and secure payment gateways that align with these goals.

Consider compliance with industry regulations to ensure the software operates within legal standards. Collaborate with stakeholders to refine the requirements and identify opportunities to future-proof the solution. A well-defined foundation ensures your software is tailored for long-term success.

Select an Appropriate Technology Stack

Choose a technology stack that meets the demands of scalability, reliability, and integration. For a seamless user interface, leverage modern frameworks like React or Angular and backend development like Python, Node.js, or .NET.

Incorporate cloud platforms like AWS or Azure for enhanced performance and security. Evaluate the tech stack for ease of maintenance and future updates. A robust technology foundation enables faster development and long-term adaptability.

Design a User-Centric Interface

Focus on creating an intuitive, responsive interface that prioritizes device user experience. Ensure the design reflects your brand identity while offering easy quotes, comparisons, and payment navigation.

Use UX/UI principles to enhance accessibility and engagement, minimizing users’ learning curves. Integrate feedback loops for iterative design improvements. A user-friendly interface improves satisfaction and drives higher adoption rates.

Develop Essential Functionalities

Build core functionalities such as a reliable quoting engine, customizable templates, and policy comparison tools. Enhance these features with advanced options like real-time pricing adjustments, AI-powered recommendations, and multi-policy bundling. While this may result in higher white label insurance quoting software development costs, it undoubtedly ensures superior outcomes.

Ensure functionality is optimized for speed and accuracy to meet user expectations. Focus on modular development to enable easier updates and scalability. Implementing your software with comprehensive core features positions it as a competitive market solution.

Conduct Rigorous Testing and Optimize Performance

Thoroughly test the software for functionality, performance, and security under various scenarios. Identify and resolve bugs through unit, integration, and stress testing. Optimize performance to ensure fast load times and reliable operation, even during peak usage.

Utilize automated testing tools to streamline the process and improve efficiency. Continuous testing throughout development ensures a polished, high-performing final product.

Deploy the Software with Precision

Prepare for deployment by conducting beta testing to gather user feedback and address any remaining issues. Use modern deployment tools to ensure a seamless rollout and minimize downtime and disruptions.

Develop a comprehensive launch plan that includes user onboarding, marketing efforts, and technical support. Monitor the software closely post-launch to resolve initial challenges quickly. A well-executed launch sets the stage for strong user adoption and trust.

Provide Continuous Support and Updates

Offer ongoing technical support to address user issues and ensure smooth operation. Regularly update the software to introduce new features, improve performance, and adapt to industry changes. Collect and analyze user feedback to inform future enhancements.

Proactive support and iterative updates keep the platform competitive and relevant over time. Building strong relationships through support fosters customer loyalty.

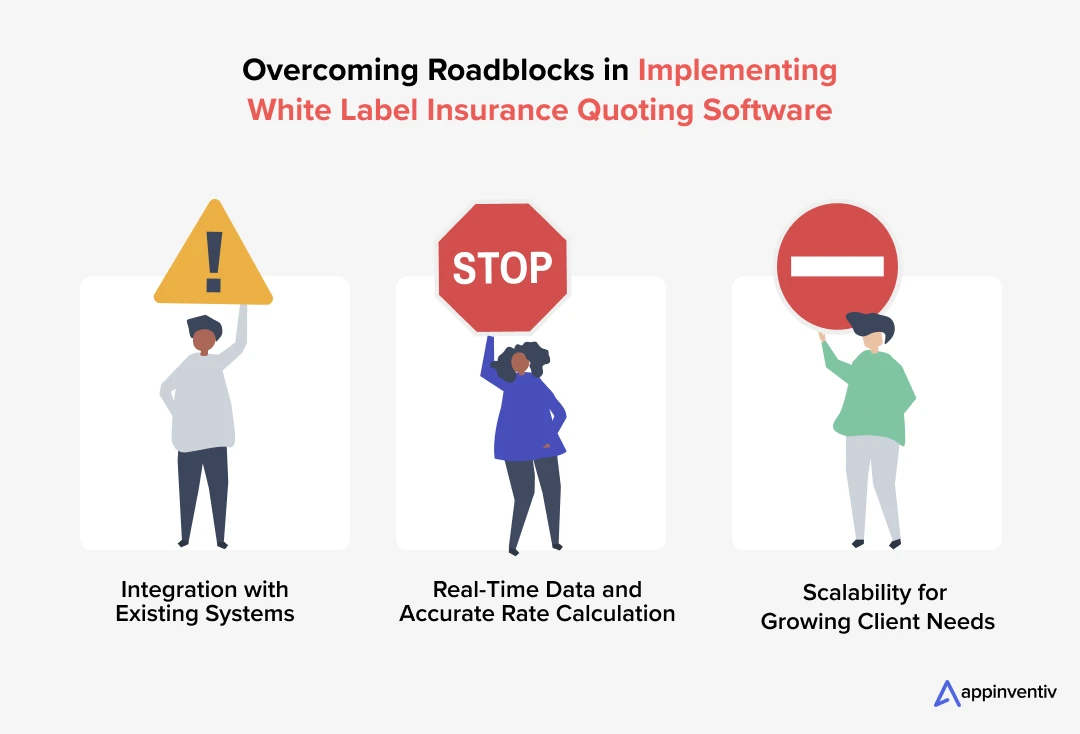

Mitigating Implementation Challenges for White Label Insurance Quoting Software

Building and implementing white-label insurance quoting software presents certain challenges. However, the right strategies and solutions can effectively address these challenges. Let’s explore how to overcome them.

Integration with Existing Systems

Problem

Many insurance companies still rely on legacy systems that might not be compatible with modern software solutions. Integrating white-label quoting software with these older systems can present technical challenges, causing delays and affecting system performance.

Solution

Develop the white-label software with robust, flexible API capabilities, allowing seamless integration with existing third-party systems, legacy software, and other insurance providers. Providing comprehensive documentation and offering a dedicated support team to assist clients during the integration process can mitigate the risks associated with legacy system compatibility and facilitate smooth integration.

Real-Time Data and Accurate Rate Calculation

Problem

Insurance quoting software relies on up-to-date data to provide accurate and competitive quotes. However, it can be difficult to manage real-time data from various insurance carriers and integrate it into the quoting engine. Delays in data synchronization or inaccuracies in the rate calculations can negatively impact the customer experience and the insurance providers’ trust in the software.

Solution

Implement reliable API integrations with insurance carriers to pull real-time data for pricing, risk factors, and underwriting guidelines. Create a robust data pipeline that ensures accurate rate calculations and smooth data synchronization between the software and external systems. Regularly monitor and optimize the data flow to avoid latency issues and ensure accurate pricing is consistently displayed to users.

Scalability for Growing Client Needs

Problem

As businesses grow, so do their needs for software solutions. Insurance companies and brokers may experience significant growth in customer base, policy volume, and data storage requirements. Unscalable white-label quoting software may become sluggish or prone to system failures as usage increases.

Solution

Build the software on a scalable cloud-based infrastructure to easily accommodate clients’ growing data needs. Offer customizable hosting solutions that can grow with clients’ needs and scale quickly without compromising performance. Incorporating cloud services also helps ensure high availability and disaster recovery options, which are crucial for businesses relying on the software.

Partner with our expert development team to bring your software vision to life. We specialize in crafting tailored solutions that meet your needs and outshine the competition.

Accelerate Your Insurance Workflow with Appinventiv’s White-Label Quoting Software

Quoting software is vital in the insurance industry to meet customer expectations, reduce errors, and streamline processes. Traditional methods are time-consuming and inefficient, while automated quoting solutions ensure faster, more accurate results, giving insurers a competitive edge.

The future of quoting software lies in integrating AI and predictive analytics. This technology will enable real-time updates, personalized quotes, and seamless customer interactions, redefining how insurers operate and engage with clients.

At Appinventiv, we excel in delivering advanced white-label quoting software tailored to your unique requirements. Our experts craft software designed to automate and optimize quoting workflows, ensuring accuracy, speed, and scalability. Leveraging innovative technologies, we create systems that adapt to market dynamics and enhance customer experiences.

Whether you’re looking to improve operational efficiency, integrate personalized quoting capabilities, or ensure compliance with industry standards, our team of experts provides end-to-end support from development to deployment.

Our commitment to excellence as an insurance software development services provider ensures that our white-label software is not just effective but transformative, tailored to meet the unique challenges of the insurance industry. Don’t just take our word for it—explore our testimonials and discover how we’ve helped insurers streamline their processes, elevate customer experiences, and achieve measurable success.

Partner with Appinventiv and see why we’re the trusted choice for revolutionizing insurance quoting systems.

FAQs

Q. How much does it cost to develop a white-label insurance quoting software?

A. The white label insurance quoting software development costs typically cost $50,000 for a basic version with essential features. More advanced platforms, incorporating AI-driven quoting engines, real-time data integration, and multi-policy bundling, can range from $500,000 or higher. Costs depend on software complexity, required features, technology stack, and development timeline.

Q. How long does it take to build white-label insurance quoting software?

A. The timeline for developing white-label insurance quoting software depends on its complexity and feature set. A basic solution with standard quoting functionalities can be completed within 4 to 6 months, focusing on essential capabilities and minimal customizations.

However, a sophisticated platform with advanced features like AI-powered recommendations, real-time data processing, and integrations with multiple third-party systems may take 8 to 12 months or more.

Additional factors influencing the timeline include the development team’s size, the complexity of integrations, and the time required for rigorous testing and quality assurance to ensure a reliable and scalable product.

Q. What is insurance quoting software?

A. Insurance quoting software provides an end-to-end quoting management solution that automates the generation of insurance quotes, transforming how agents, brokers, and insurance companies serve their customers.

By quickly processing user inputs and applying predefined underwriting guidelines, this software enables insurance professionals to generate precise and competitive quotes for various policy types effortlessly. It streamlines the quoting process, providing customers with personalized, accurate options in no time and significantly improving overall efficiency and satisfaction.

Q. How does insurance quoting software work?

A. Here’s a step-by-step breakdown of how insurance quoting software simplifies and accelerates the process of providing accurate, customized insurance quotes for both agents and customers:

- User Inputs: The process starts when the customer or agent inputs essential information into the software, such as personal details, desired coverage options, or specifics about the property, vehicle, or business.

- Integration with Insurance Providers: The software effortlessly connects with multiple insurance carriers through APIs or direct integrations, allowing it to pull real-time data and up-to-date pricing from various insurers.

- Data Processing & Calculation: Once the data is entered, the software processes it using sophisticated algorithms, factoring in risk assessments, the insurer’s underwriting guidelines, and relevant local regulations. It then calculates the most accurate premium rates for each policy option based on this analysis.

- Displaying Quotes: The software generates and displays various quote options, clearly breaking down coverage, premiums, deductibles, and additional terms or conditions.

- Comparing & Customizing: Users, whether customers or agents, can easily compare multiple quotes from different providers and adjust coverage levels to suit individual needs.

- Proposal Generation: After selecting a preferred quote, the software generates a formal proposal or offer letter. This document is ready to be shared with the customer for final approval and payment processing.

Q. Why is it critical to integrate AI/ML capabilities in an insurance quoting software?

A. Here is how AI/ML-powered insurance quoting softwrae transforms the industry:

Accurate Quote Predictions: With AI/ ML algorithms analyzing vast amounts of data, like custom profiles, historical claims, economic trends, and other related factors, insurers can now deliver more precise and accurate quotes.

Automated Underwriting: By utilizing machine learning, insurers can easily automate intricate underwriting tasks. This speeds up the policy issuance and ensures accuracy and consistency in underwriting decisions.

NLP for Advanced Policy Analysis: NLP equips AI systems to interpret and extract information from policy documents and user queries. This capability extends the comparison process beyond structured data, incorporating unstructured text for a more thorough and insightful evaluation.

Enhanced Fraud Detection: AI systems excel at identifying irregularities in claims or applications that may signal potential fraud. By detecting unusual patterns in real-time, these technologies enable insurers to mitigate fraudulent activities effectively, resulting in substantial cost savings.

Optimized Scalability and Efficiency: AI and ML minimize dependence on manual processes, enabling insurers to expand their operations seamlessly. Automated workflows empower them to manage higher application volumes while maintaining exceptional service quality.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Custom Development or White Label Solutions: Which is Right for Your Business?

Key takeaways: 77% of companies are prioritizing digital transformation; the right tech approach is crucial for staying competitive. Custom development offers tailored solutions for unique needs, flexibility, and long-term scalability. Whereas, white-label solutions provide quick market entry, cost-efficiency, and easy customization for standard needs. Appinventiv’s expertise helps you navigate custom development vs white-label to choose…

ERP Integration in Australia - Why It Is Essential and How to Do It Right

Key takeaways: ERP integration enables operational efficiency, reduced costs, and enhanced decision-making. Healthcare, finance, manufacturing, retail, and all the other sectors are benefiting from ERP integrations in Australia. While ERP integration can be costly, ranging from AUD 45,000 - AUD 450,000, it leads to significant long-term savings and scalability. Compliance with Australian regulations is critical,…

Predictive Analytics Software Development - Features, Benefits, Use Cases, Process, and Cost

Key Takeaways Predictive analytics helps businesses shift from “what has happened” to "what will happen," enabling proactive strategies rather than reactive ones. Real-time analytics and AI integration are driving the growth of predictive analytics, making it more accurate, accessible, and critical for business success. Custom predictive analytics solutions can enhance customer satisfaction, reduce costs, and…