- How Agentic Payments Work

- Comparing AI Paradigms in Payments: Agentic, Generative, and Traditional Models

- Key Features of Agentic Payments

- Key Advantages of Agentic Payments for Businesses

- Quickened Precision Transactions

- Improved Efficiency in Operation

- Cost Savings

- Greater Visibility and Control

- Scalability

- Better Management of Cash Flows

- Reduced Operational Risk

- Improved Customer and Supplier Experience

- Evidence-Based Knowledge and Statistics

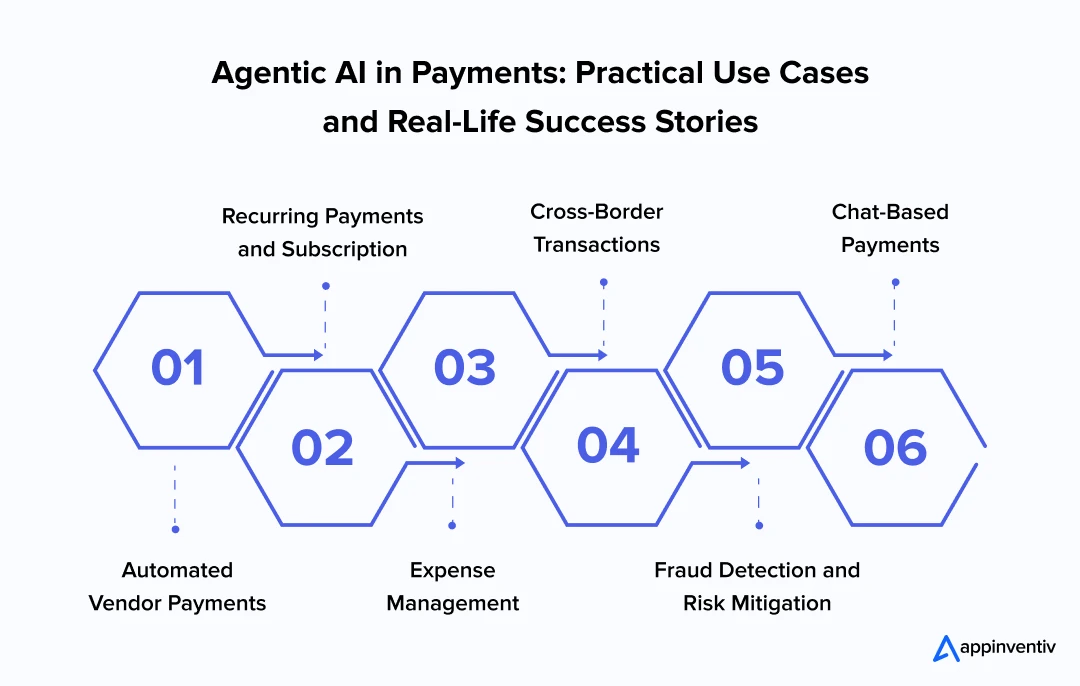

- Use Cases of Agentic AI in the Payment Industry With Real-Life Examples

- Automated Vendor Payments

- Recurring Payments and Subscription

- Expense Management

- Cross-Border Transactions

- Fraud Detection and Risk Mitigation

- Chat-Based Payments

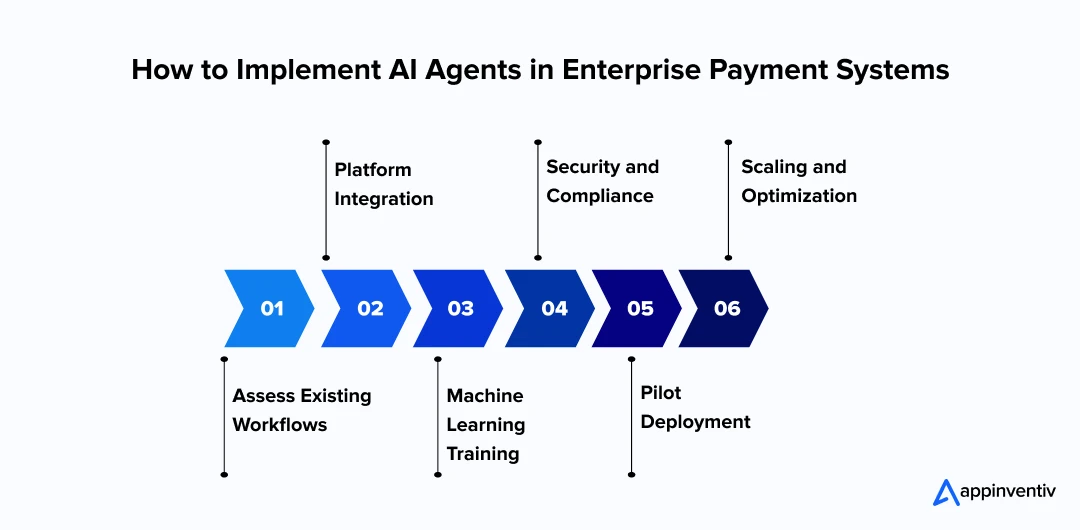

- Implementing AI Agents In Enterprise Payment Solutions: Quick Steps

- Assess Existing Workflows

- Platform Integration

- Machine Learning Training

- Security and Compliance

- Pilot Deployment

- Scaling and Optimization

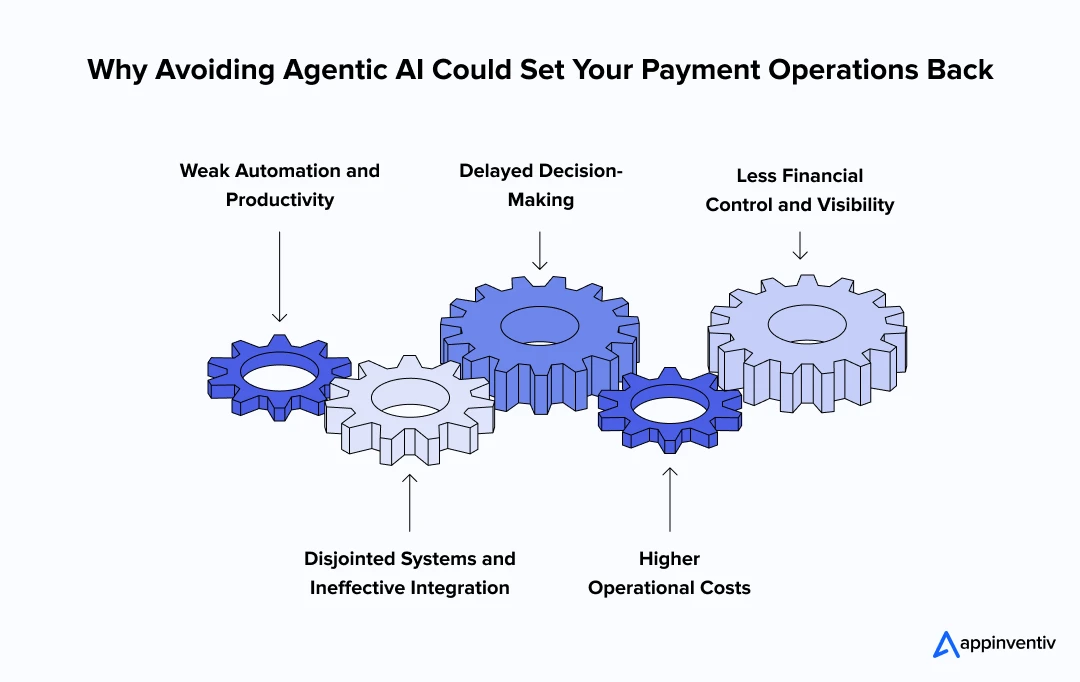

- The Risks & Challenges of Not Adopting Agentic AI in Payments

- Weak Automation and Productivity

- Disjointed Systems and Ineffective Integration

- Delayed Decision-Making

- Higher Operational Costs

- Less Financial Control and Visibility

- Implement Agentic Payment Solutions for Smarter Enterprise Finance with Appinventiv

- FAQs

Key takeaways:

- Agentic AI enables enterprises to handle payment processing automatically and intelligently.

- Businesses that adopt agentic payments benefit from faster processing, greater accuracy, and real-time oversight of their funds.

- The system scales effortlessly, integrating seamlessly while continuously learning to optimize operations.

- With clearer regulations and robust security in place, major companies are accelerating their adoption of agentic payments.

The landscape of corporate finance is undergoing a fundamental shift. When Google unveiled its Agent Payments Protocol (AP2) last month, it wasn’t just launching another fintech tool; it was essentially drawing the blueprint for how businesses will handle finances in the coming decade.

What makes AP2 particularly compelling is its collaborative foundation. Rather than building in isolation, Google worked directly with established payment processors and tech companies to create an open framework that actually works across different systems. The protocol leverages existing Agent2Agent and Model Context Protocol standards, which means AI systems can now initiate, process, and complete financial transactions without the usual friction between platforms (Source: Google).

But here’s what really caught the stakeholders’ attention: We are not dealing with glorifying automation anymore. We are talking about smart AI agents that can actually think through financial decisions. These agents can analyze spending patterns, spot cash flow opportunities, and execute complex payment strategies while you’re focused on running your business.

Imagine an AI that notices your supplier offers early payment discounts, calculates the impact on your cash position, and automatically takes advantage of the savings, all without a single email or approval workflow.

The regulatory piece is equally fascinating. The CFPB’s new Section 103324 guidelines aren’t trying to slow this down; they’re actually creating guardrails that could accelerate adoption. By establishing clear rules around AI access to financial data, they’re giving enterprises the confidence to lean into this technology without worrying about compliance nightmares down the road.

What we’re witnessing isn’t just technological evolution; it’s the emergence of truly intelligent financial infrastructure. Within the next few years, the companies that embrace agentic payments will likely gain significant competitive advantages in cash management, vendor relationships, and overall financial efficiency. The question isn’t whether this will happen; it’s how quickly forward-thinking finance teams will adapt to this new reality.

Businesses are moving towards an agentic AI in payments. The more they do it, the more they are not simply automating things but are radically redefining the way they do business in terms of their financial processes. This development is not only bound to bring about cost-saving but also new sources of revenue and better customer experiences.

Let’s take a quick walk through to understand the complete role of agentic payments in finance sector, covering its key features, advantages, use cases with real-life examples, implementation steps and lastly, risks and other associated challenges.

Turn this advantage into growth with intelligent automation that streamlines finance, procurement, and customer operations

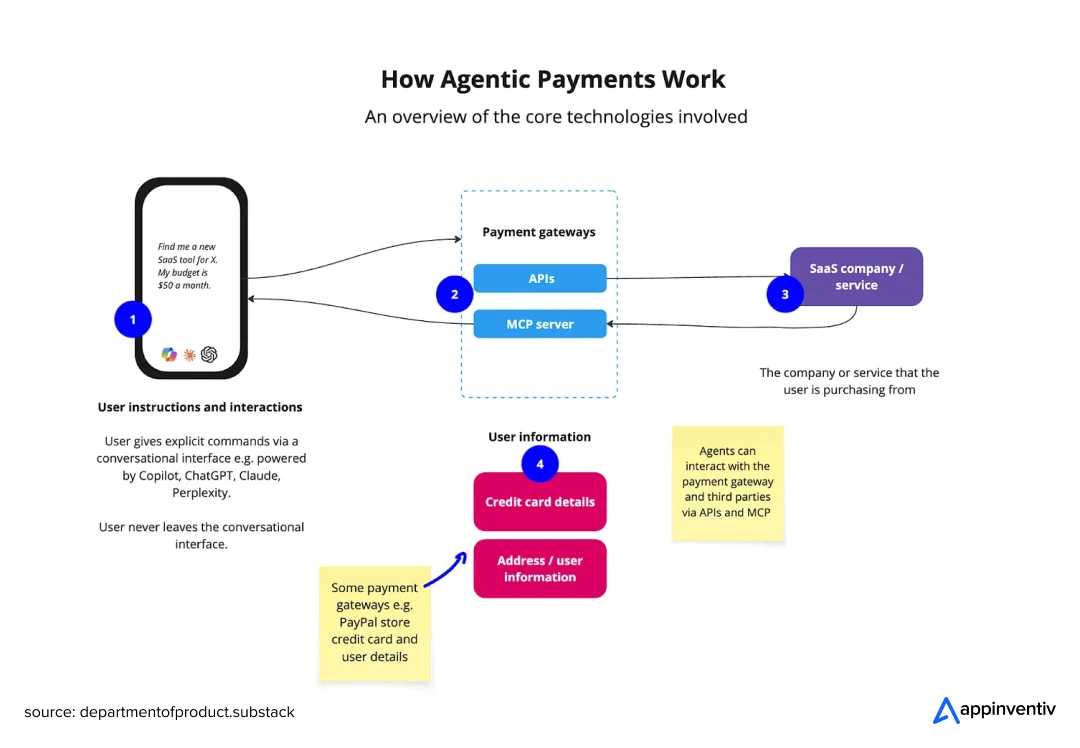

How Agentic Payments Work

Agentic payments happen when AI agents take control and handle money stuff all by themselves for a person or a company. These agents are programmed with rules for deciding things, and they can get into the company’s money systems. That lets them pay bills, manage invoices, or match up accounts without any person having to step in.

- Initiating the Payment Instruction: It all starts when a payment is triggered. This might be something that happens regularly, like a subscription fee, or maybe a bill from a vendor, or just a single expense. The instruction can come from a person, a system, or just a date on a schedule.

- Validating Rules and Compliance: The financial AI agent immediately checks the bank account to see what’s available. It also verifies that the transaction follows all of the company’s internal rules and that it meets all the proper security and legal standards.

- Optimizing Payment Execution: Using the rules it was given, plus smart insights from machine learning, the agent figures out the best way to pay: which method to use, when to send it, and how to route the payment correctly.

- Automated Transaction Processing: The AI agent then automatically makes the payment happen. It talks directly to the bank networks, payment processors, or the company’s main enterprise systems, whatever it needs to do.

- Comprehensive Transaction Logging: Every single action the agent takes is recorded immediately. These detailed logs make things totally transparent and simplify audits, ensuring a clear trail of accountability.

- Continuous Learning and Adaptation: The agent actually uses what happened in past payments to make better decisions next time. It constantly fine-tunes payment schedules, guesses future cash needs, and looks out for anything weird or fraudulent.

- Automated Reporting and Notifications: After the money is moved, the right people are automatically notified through push notifications, and all the reports are instantly created for tracking finances and doing analysis.

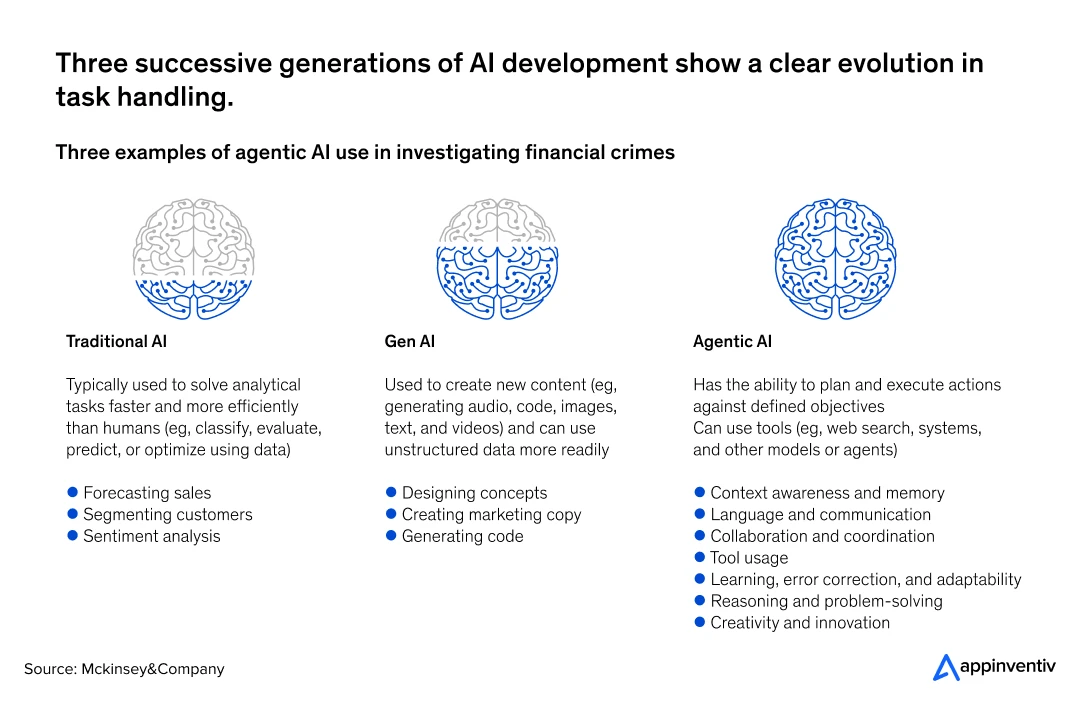

Comparing AI Paradigms in Payments: Agentic, Generative, and Traditional Models

The world of enterprise finance is moving past simple, rule-based automation and heading toward systems that are smart enough to direct themselves. When comparing Agentic AI vs. traditional AI in payments, the main difference is in autonomy and purpose.

Standard models just process data within workflows that someone set up, but agentic systems can figure out the context, make financial decisions, and send the payments all on their own. Meanwhile, Generative AI helps this move by creating new insights and responses, but it won’t actually make a transaction happen directly.

To understand this better, let’s analyze this comparison table below:

| Aspect | Traditional AI in Payments | Generative AI in Payments | Agentic AI in Payments |

|---|---|---|---|

| What It Does | It automates set tasks and just follows the logic someone coded. | It creates new insights, predictions, or responses based on the data it has. | It acts independently to both make the financial decision and send the money. |

| How Decisions Are Made | Depends on a person giving input and the workflow rules already coded. | It suggests things but doesn’t take action; it needs the user to prompt it. | It’s independent, understands the context, and can actually start the action itself. |

| Where It Connects | Only works within certain systems or for specific tasks. | Plugs into data sources mostly to help a person analyze things better. | Connects across everything, all enterprise systems using APIs and various protocols. |

| Typical Payment Use | Things like spotting fraud, matching up invoices, or balancing accounts. | Making personalized payment suggestions or handling customer chat/interaction. | Automated payment planning, settling with vendors, and making sure funds are used best. |

| What It Brings | Boosts efficiency because it automates stuff. | Adds intelligence and makes things feel personal. | Gives you end-to-end automation for all payments and real-time financial control. |

| People Needed | High—you have to set it up, keep an eye on it, and review its work. | Moderate—you still have to guide it with your prompts. | Minimal—it directs itself, and everything is audited and transparent. |

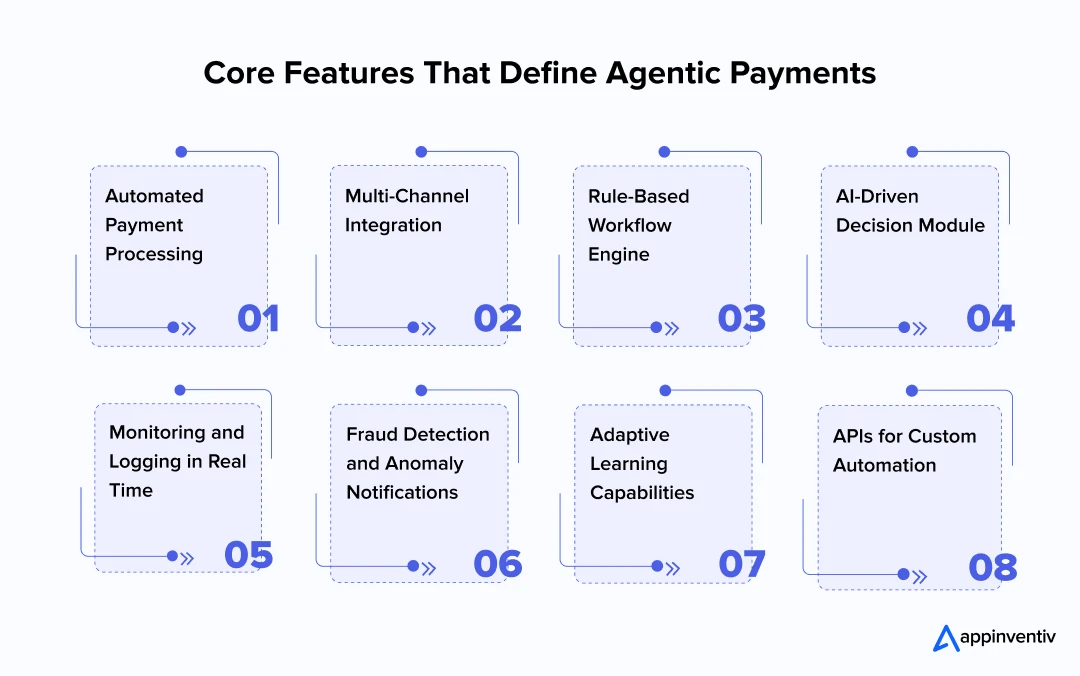

Key Features of Agentic Payments

Agentic AI in payments combines complete automation, smart decision-making, and real-time financial control. They interrelate among enterprise systems, make transactions independently, and constantly streamline workflows to ensure compliance and transparency. Here are some of its key features to look for:

Automated Payment Processing: AI agents can automatically create and close transactions without human assistance, such as one-time payments, recurring bills, and mass payments.

Multi-Channel Integration: Enables banking network integration, payment gateway integration, ERP systems, and digital wallets integration to facilitate the smooth processing of transactions.

Rule-Based Workflow Engine: The transactions are anchored on business rules, compliance standards, and approvals to make correct and policy-compliant transactions.

AI-Driven Decision Module: Applies machine learning and predictive analytics to choose the best payment time, method, or channel.

Monitoring and Logging in Real Time: Record all activities in real time to create comprehensive audit trails, which will be used to promote transparency and comply with regulatory requirements.

Fraud Detection and Anomaly Notifications: Artificial intelligence is installed to monitor suspicious behavior or irregularities in the transaction pattern, thereby helping in fraud detection.

Adaptive Learning Capabilities: The system upgrades its operations with time, achieving even better accuracy, efficiency, and responsiveness depending on historical transaction information.

APIs for Custom Automation: Provides API access to businesses to streamline business operations, integrate with third-party applications, or activate payments in a programmatic way.

Appinventiv’s Insights

To utilize the full potential of agentic AI in payments, it is best to take advantage of its early capabilities, such as predictive schedules, automatic compliance, and real-time anomaly detection. Integrate it across systems to streamline workflows, reduce manual intervention, and optimize financial decision-making.

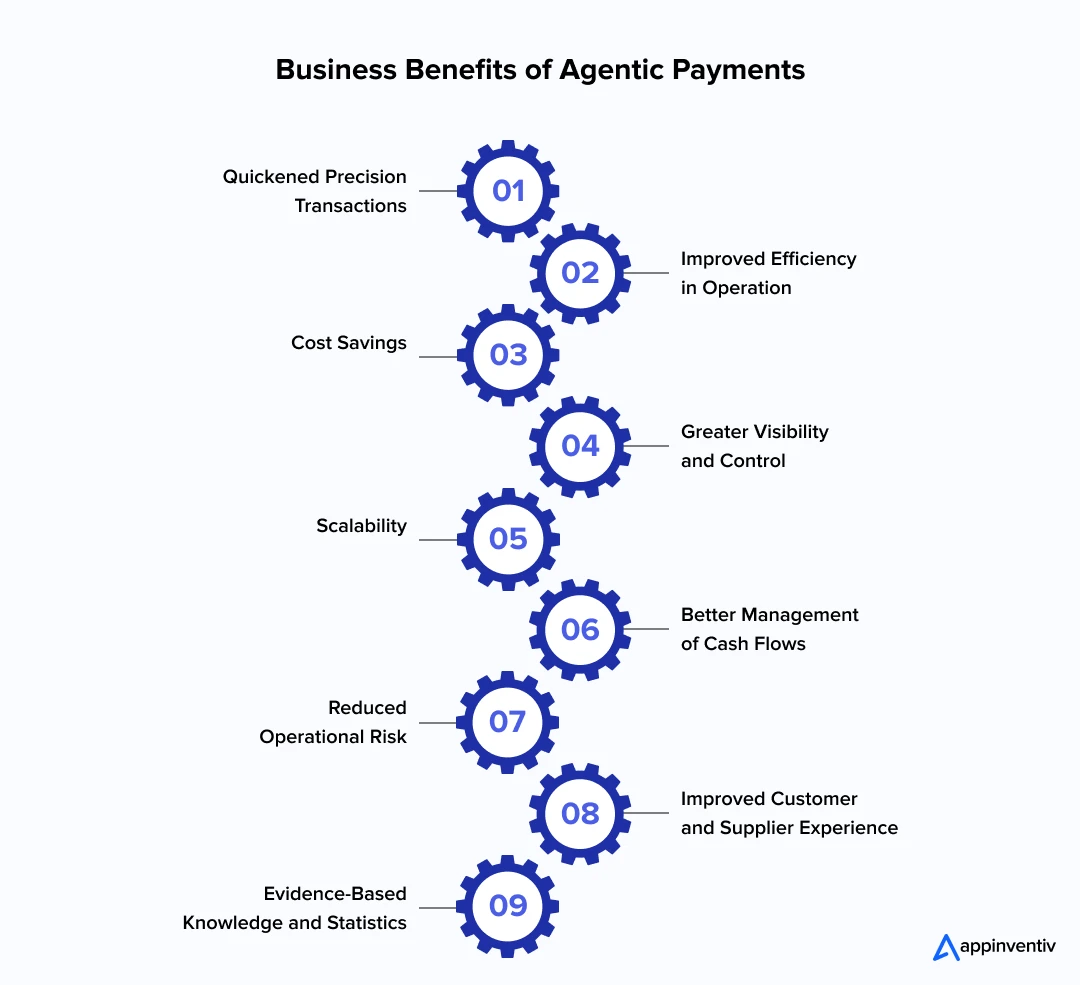

Key Advantages of Agentic Payments for Businesses

With agentic payments, operations are simple because the end-to-end workflow is automated, requiring minimal human intervention. They enhance financial transparency and offer businesses greater control and efficiency in managing payments, among other benefits. Here are some of the top benefits of agentic payment for businesses:

Quickened Precision Transactions

The agentic payments are automated and remove the manual processing from the transactional payment. This minimizes human mistakes like paying the same check or diverting money. Vendors and suppliers receive payments on time, which enhances relations. Large numbers of transactions can be processed quickly in enterprises, ensuring smooth operations. Automation ensures precision, dependability, and reduced time wastage or conflicts.

Improved Efficiency in Operation

Automation of repetitive financial processes would enable finance departments to concentrate on strategic work such as cash flow planning, budgeting, and forecasting. Workflows are streamlined, leading to a reduction in the number of bottlenecks and generalized reconciliation. The teams are able to handle transactions in different accounts or regions without being manually involved. Less work in administration leads to fewer errors and an increase in the productivity of the department.

Cost Savings

Automation of payment operations saves on labor expenses and paperwork. Reduced mistakes result in reduced corrections involving high costs, and the minimized approvals eliminate late payments or fines. Businesses do not have to keep their staff in line with the expansion. These efficiencies over time will result in significant cost savings, enhancing the general financial status of the business.

Greater Visibility and Control

Agentic payment systems offer real-time reporting and monitoring of all financial transactions. Managers can monitor the payment status, identify anomalies, and make decisions in real time. Automated controls ensure compliance with internal policies and external regulations. Increased transparency makes audits and financial reporting easier and the leadership more confident in the accuracy of data.

Scalability

The agentic payments grow in line with the scale of the enterprise. They operate with increased transaction volumes without needing extra resources. Efficiency can be introduced in the processes of integration of new business units, regions, or payment channels. Businesses can react to the market dynamics or growth without interfering with the business’s current operations. The flexibility guarantees the agility of operations in the long run.

Better Management of Cash Flows

Automated payments also enable accurate monitoring of inflows and outflows, which offers the finance teams a clear view of the available money. The predictability of payment reduces the liquidity risks and facilitates a more effective short-term and long-term planning. Payments can be planned effectively to maximize working capital by the enterprises. Live information enables proactive management of outstanding accounts and receivables, maintaining healthy cash flow.

Reduced Operational Risk

Cash transactions are susceptible to fraud, human error, and compliance violations. The security measures, such as encryption, authentication, and audit trails, are incorporated in agentic payment systems. The automated checks minimize the risks of duplicate or wrong payments. Companies enjoy financial stability in regard to policy compliance and business regulations. The total exposure of risk is reduced and thus the finances and reputation are safeguarded.

Improved Customer and Supplier Experience

On-time and proper payments enhance good relations with suppliers and service providers. With reliable payments, vendors will be more willing to give good terms. In businesses that are involved in refunding or paying out customers, agentic payments are fast and error-free. This creates a sense of trust and establishes a professional image of the brand in the market.

Evidence-Based Knowledge and Statistics

Rich transactional data is collected through agentic payment platforms, enabling enterprises to examine spending habits and payment patterns. This knowledge can be used to make strategic decisions, such as contracts with vendors, budgets, and cost reduction. Trend analysis can be used to identify process improvements and areas of bottlenecks. Using this information, the business can constantly streamline its financial processes and become more efficient.

Use Cases of Agentic AI in the Payment Industry With Real-Life Examples

Agentic AI in payments powers real-world applications like automated vendor settlements, personalized customer payment experiences, and fraud detection. Let’s check out some of the top real-world use cases of AI agents in payments and analyze how some of the top industry behemoths have leveraged the same.

Automated Vendor Payments

Big companies have hundreds of suppliers, which can complicate and cause mistakes in the timely payment. AI-driven payment automation can schedule and autonomously process vendor settlements, balance accounts, and optimize cash flow, minimizing manual intervention and bottlenecks in operations.

Amazon uses AI agents in payments to process recurring supplier invoices and payments, as well as operational payments, without the need to see a human, simplifying the procurement process and thus making settlements precise and timely. This illustrates a real-life application of automation of enterprise payments in scale.

Recurring Payments and Subscription

Recurring customer subscriptions and invoices can be cumbersome and prone to errors. AI agents can check accounts, make recurrent payments, and keep extensive records to reduce overdue payments and administrative expenses.

PayPal applies the AI-powered solutions to the payment system to automate subscription billing and recurrent transactions by enhancing efficiency and reliability. This is one of the most salient examples of the use of an AI-based B2B payment system.

Expense Management

Filling and approving the expenditures of the employees and reimbursing them may also be time-consuming for the finance departments. AI in payment solutions development and improvement allows the use of AI to process expenses automatically, check policy compliance, and implement smart approval procedures.

The Mastercard Agent Pay service provides payments by implementing AI agents that send approvals and identify abnormalities. This allows companies to handle costs more quickly and comply with them. This illustrates automated payment automation of corporate finance using AI.

Cross-Border Transactions

Global payments have an exchange rate, charges, and regulatory issues. AI-powered B2B payment systems can choose the best payment routes, minimize transfer costs, and carry out transactions effectively.

Stripe is a payment platform that incorporates AI agents to process international payments on behalf of U.S. businesses. It automates payment routing and ensures regulatory compliance. This showcases enterprise payment automation in global financial operations.

Fraud Detection and Risk Mitigation

Frauds in financial transactions are an important concern to businesses and banks that need to be tracked. AI-driven payment automation enables AI agents to identify inconsistent activity and report it as suspicious, as well as prevent fraud within the framework of real-time transactions.

Walmart has AI agents managing payments through its chat-based payment system to identify anomalies to prevent possible fraud and safeguard its customers. This demonstrates the strength of the Agentic AI in risk mitigation payments.

Chat-Based Payments

The conversational AI gives users the option to make transactions in the messaging platforms. AI in payment solutions development enables AI agents to determine the methods of payment, check the accounts, and document the transactions without any inconvenience.

The Instant Checkout by OpenAI allows people to browse and pay in ChatGPT, which makes the process easier without compromising security. It is an innovative AI-based B2B payment system and a glimpse of how AI automation of payments can occur in the future.

Appinventiv’s Insights

Begin on a small scale by using agentic AI in payments to accelerate high-volume and repetitive processes tenfold. This will enable your team to quantify the effect, streamline processes, and progressively automate increasing numbers of financial activities with certainty.

Implementing AI Agents In Enterprise Payment Solutions: Quick Steps

The deployment of AI agents in enterprise payments involves identifying major workflows, connecting them to current systems, and setting up rules and compliance controls. Here are some of the key steps you need to follow during the implementation process of AI agents in enterprise payment solutions.

Assess Existing Workflows

The initial step towards realizing agentic AI in payments is a full evaluation of the current financial processes. Businesses should identify repetitive, high-volume payment or manual payment jobs that can be automated. Formulating explicit business rules, approval levels, and compliance policies is the surest step towards smooth AI agent operation.

Such a test also identifies areas of inefficiency and where automation will have the most significant effect, establishing the step towards quantifiable gains in speed and accuracy.

Platform Integration

The AI agents should be integrated with ERP systems, banking networks, payment gateways, and internal financial systems with seamless connections. This makes intelligent payment orchestration possible, where the AI plans, implements, and reconciles payments using numerous systems in real time.

The appropriate integration will guarantee that the information circulates freely among the systems, minimize operational obstacles, and provide complete visibility on all the processes related to payments in the enterprise.

Machine Learning Training

The AI agents need solid training on past transaction data to make the correct forecasts and workflow optimization. By leveraging machine learning algorithms, the agents will be able to predict cash flow needs, choose the best time to pay, and identify suspicious behavior.

Using this power offers AI-powered risk management in payments to minimize possible errors, detect anomalies, and limit financial risks to the organization.

Security and Compliance

Enterprise deployments should have good monitoring, auditing, and reporting systems. It has detailed logs, compliance checks, and real-time dashboards to ensure that all transactions are monitored, auditable, and in line with fintech regulatory standards.

These characteristics allow measuring results and estimating the RoI of agentic AI in payments, which proves to stakeholders cost reduction, as well as an increase in the efficiency of operations.

Pilot Deployment

A pilot program is the first step made by an organization; it involves a few workflows or a few departments. This would enable the teams to track performance, improve AI rules, and verify results without impacting key operations.

This stepwise solution will allow AI-powered automation in payments, which will allow enterprises to maximize transaction speed, accuracy, and reliability prior to a large-scale implementation.

Scaling and Optimization

AI agents may be implemented through various departments, business units, and geographies after the successful pilots. Constant optimization makes sure algorithms get better as new data is gathered, decision-making is enhanced, security is enhanced, and operational efficiency is enhanced.

Scaled deployments make enterprise payment management a fully automated system capable of processing complex, high-volume transactions with minimal human intervention.

Let us implement AI agents to handle payments autonomously, improve speed, and maintain full visibility

The Risks & Challenges of Not Adopting Agentic AI in Payments

Businesses that do not move promptly to the use of agentic AI experience delayed payment periods, increased operational expenses, and disjointed financial systems. In the absence of self-directed workflows and risk management based on AI in payments, the decision-making system is manual, less transparent, and efficiency and anti-fraud opportunities are missed. Let’s check those challenges in detail:

Weak Automation and Productivity

In the absence of Agentic AI in payments, numerous payment processes are either more or less manual (or based on simple automation). Human supervision of tasks such as invoice reconciliation, payments to vendors, and fraud detection delays the workflow, risks more errors, and does not allow enterprises to scale payment processes productively.

Disjointed Systems and Ineffective Integration

AI agents in payments are developed to bridge in a seamless manner across several enterprise systems through APIs and diverse protocols. Those organizations that fail to embrace these agents tend to have an integrated platform, data-entry duplication, and record inconsistency. This complicates having a centralized opinion on financial operations and creates operational inefficiencies.

Delayed Decision-Making

Even deep generative AI in finance can offer information or recommendations; however, decisions have to be made by humans. Companies lacking autonomous mechanisms face the possibility of slower financial decision-making, sluggish fund distributions, missed payment dates, as well as lost cash flow optimization opportunities, which may influence the relationship with the vendors as well as the strategic financial planning.

Higher Operational Costs

Manual oversight and semi-automated systems require more staff to monitor, validate, and correct workflows. Applying agentic AI reduces human intervention, as transactions are handled autonomously, audited, and maintained. Without it, businesses face higher payroll and administrative expenses, missing out on cost efficiency through AI-driven payment systems.

Less Financial Control and Visibility

Risk-reduction payment processing is an AI-based technology that offers round-the-clock, real-time monitoring of financial transactions, cash flows, and possible weaknesses. In the absence of such systems, organizations find it difficult to be transparent with limited visibility, which complicates the identification of fraud, the prevention of unauthorized transactions, the maximization of liquidity, and responsiveness to the dynamic market or operational environments.

Implement Agentic Payment Solutions for Smarter Enterprise Finance with Appinventiv

The future of AI-driven payment systems is closely tied to the evolution of agentic AI in payments. Businesses that adopt agentic payments will enjoy complete autonomy in the workflow, real-time financial control, and intelligent risk control that facilitate quicker transactions, efficiency in fund allocation, and operational overhead.

With the increasing complexity of payment systems, the capacity to make autonomous choices and operate in a multi-platform environment will become a quality of efficiency and competitiveness.

Appinventiv, as leaders in AI agent development services, is positioned well to assist enterprises in going through this digital transformation. As a well-established player in the fintech field, we have already worked on projects such as Mudra, Edfundo, Slice, and an AI-based banking platform for a global bank, helping them develop scalable, secure, and intelligent financial platforms that increased user engagement and app visibility.

Let’s consider Mudra. Our experts built a user-friendly, AI-powered budget management application, Mudra, that simplifies the challenges of personal finance. This chatbot-driven platform guides users through budgeting with ease.

Following six months of careful design and development, Mudra is now prepared for deployment in more than 12 countries, providing an intuitive and effective way for users to take control of their finances.

Our experience will guarantee the smooth implementation of agentic payments, a high level of compliance, and the quantifiable positive changes in efficiency and visibility.

The value we add is always emphasized by clients, which is well showcased in our client testimonials. We have also received industry awards, such as the Leader in AI Product Engineering and Digital Transformation with The Economic Times.

As your trusted payment software development partner, we enable your business to advance to new levels in payment systems without hesitation, transforming complicated financial processes into dynamic, smart, and fully automated systems prepared to meet the needs of the contemporary market.

FAQs

Q. How are AI agents transforming enterprise payments?

A. Enterprise financial business is being transformed by agentic AI in payments, which automatically performs repetitive and high-volume tasks like settlement to vendors, processing financial invoices, and reconciling.

With the minimization of manual labor, organizations achieve greater accuracy and efficiency and free the finance staff to concentrate on strategic planning. This automation also improves decision-making speeds and transparency, eventually leading to better performance in the enterprise’s operational activities.

Q. How do agentic payments work?

A. AI agents in payments operate automatically by implementing payment directives based on business regulations and compliance standards. They authenticate payments, select the best payment types, manage money, and maintain comprehensive audit records.

Machine learning enables these agents to continually improve, identify anomalies, and optimize transaction timing, thereby creating a healthy, accurate, and scalable payment process.

Q. How can AI agents automate end-to-end payment workflows?

A. With enterprise payment automation, AI agents have access to the entire payment lifecycle, including invoice approvals, recurring payments, cross-border transfers, and reconciliation. Integration with ERP systems, banking networks, and payment gateways allows payments to be made with minimal human intervention, enhancing speed, accuracy, and efficiency in the organization’s operations.

Q. What are the compliance and risk implications of AI-driven payments?

A. AI-powered payments should be implemented with special attention to risk and compliance management. AI-powered automation in payments assists in ensuring regulatory compliance by creating risk approval hierarchies, justifying transactions, and creating comprehensive audit trails. Constant transaction tracking also overcomes the risks of fraud or errors and offers security and transparency of operations.

Q. How secure are agentic payment systems under financial regulations (PCI DSS, SOC2, ISO)?

A. Security is a cornerstone of agentic payment systems. AI in transaction management helps to keep all payments encrypted and track anomalies, and perform them in accordance with the regulatory standards such as PCI DSS, SOC2, and ISO. Auditing, in-built logging, and access controls guard the sensitive financial information and ensure compliance and prevent fraud.

Q. What are the main regulations that are guiding Agentic AI in payments right now?

A. The EU AI Act analyzes agentic finance tools as “high risk,” meaning they have to be explainable, have human supervision, and pass audits by outside groups. In the US, the CFPB Section 103324 is also setting up clear systems for how AI can even get to financial data. Beyond that, countries in the Asia-Pacific area are also putting out their own guidelines to encourage new ideas while still keeping things secure and compliant.

Q. What are the key enterprise applications of agentic AI in payments?

A. Here are some of the key enterprise applications of agentic payment:

- Automated Payment Processing

- Real-Time Financial Decision-Making

- Fraud Detection and Risk Management

- Seamless System Integration

- Enhanced Customer and Vendor Experience

- Regulatory Compliance and Auditability

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

AI-Powered Booking Optimization for Beauty Salons in Dubai: Costs, ROI & App Development

Key Highlights AI booking optimization improves utilization, reduces no-shows, and stabilizes predictable salon revenue streams. Enterprise salon platforms enable centralized scheduling, customer insights, and scalable multi-location operational control. AI-enabled booking platforms can be designed to align with UAE data protection regulations and secure payment standards. Predictive scheduling and personalization increase customer retention while significantly reducing…

Data Mesh vs Data Fabric: Which Architecture Actually Scales With Business Growth?

Key takeaways: Data Mesh supports decentralized scaling, while Data Fabric improves integration efficiency across growing business environments. Hybrid architectures often deliver flexibility, governance, and scalability without forcing premature enterprise-level complexity decisions. Early architecture choices directly influence reporting accuracy, experimentation speed, and future AI readiness across teams. Phased adoption reduces risk, controls costs, and allows architecture…

Governance vs. Speed: Designing a Scalable RPA CoE for Enterprise Automation

Key takeaways: Enterprise RPA fails at scale due to operating model gaps, not automation technology limitations. A federated RPA CoE balances delivery speed with governance, avoiding bottlenecks and audit exposure. Governance embedded into execution enables faster automation without introducing enterprise risk. Scalable RPA requires clear ownership, defined escalation paths, and production-grade operational controls. Measuring RPA…