- From Reactive to Proactive: The Strategic Advantage of Agentic AI

- What Proactive Agentic Systems Deliver

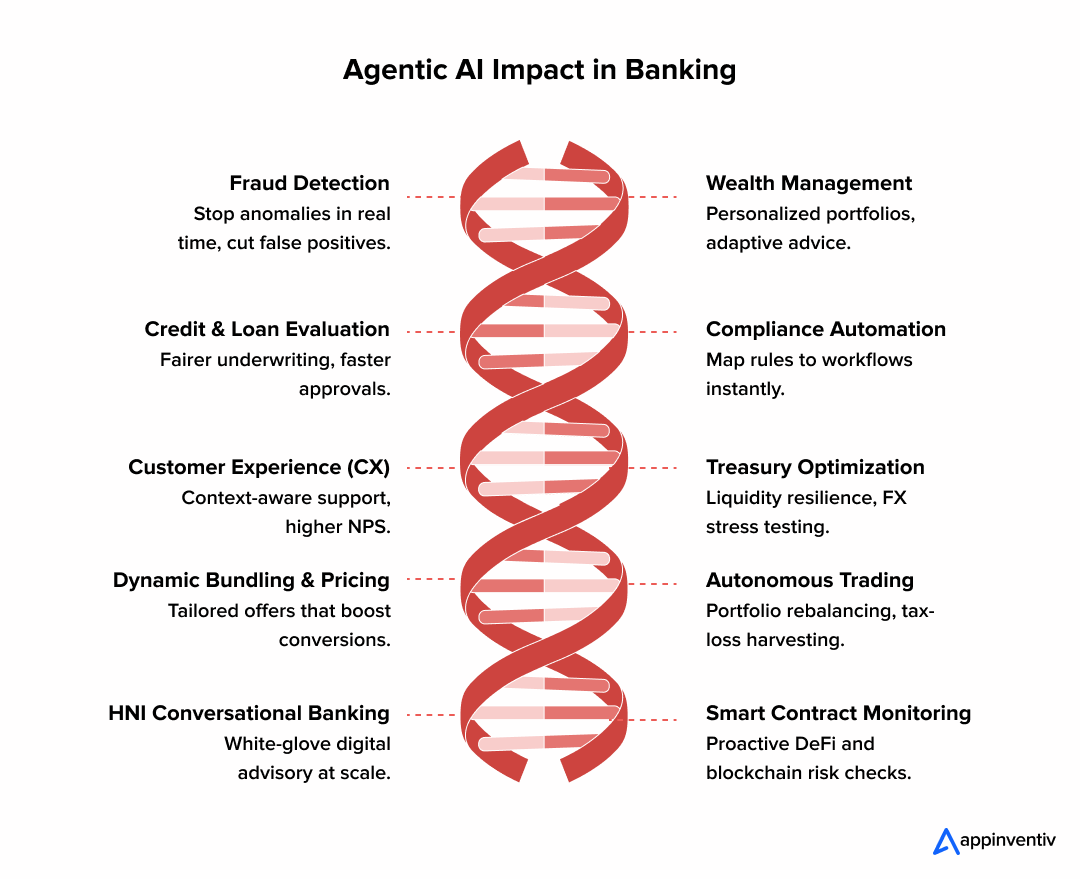

- 10 High-Impact Use Cases of Agentic AI in Banking (With Examples)

- 1. Dynamic Fraud Detection & Financial Crime Prevention

- 2. Personalized Wealth Management Assistants

- 3. AI-Powered Loan & Credit Risk Evaluation

- 4. Compliance Orchestration & RegTech Agents

- 5. Hyper-Personalized CX Agents

- 6. Autonomous Treasury Optimization

- 7. Dynamic Product Bundling & Pricing Agents

- 8. Autonomous Trading & Portfolio Rebalancing

- 9. HNI Conversational Banking Interfaces

- 10. Smart Contract Auditing & DeFi Monitoring

- How Agentic AI Applications in Banking Drive Measurable Business Value

- Business Benefits of Agentic AI for Banks and FinTechs

- 1. Connects Disconnected Banking Systems

- 2. Improves Productivity Without Adding Headcount

- 3. Learns From Real Decisions Over Time

- 4. Makes AI Decisions Easier to Explain

- 5. Responds Faster to New Risk Patterns

- 6. Reduces False Positives Without Weakening Controls

- 7. Surfaces Hidden Risk Insights

- 8. Helps Control Compliance Costs

- 9. Shifts Risk Detection Earlier

- 10. Aligns Business, Risk, and Technology Teams

- Key Features of a Secure and Scalable Agentic AI System

- Core Architectural Features

- Security and Compliance Layers

- Integration With Legacy Banking Systems

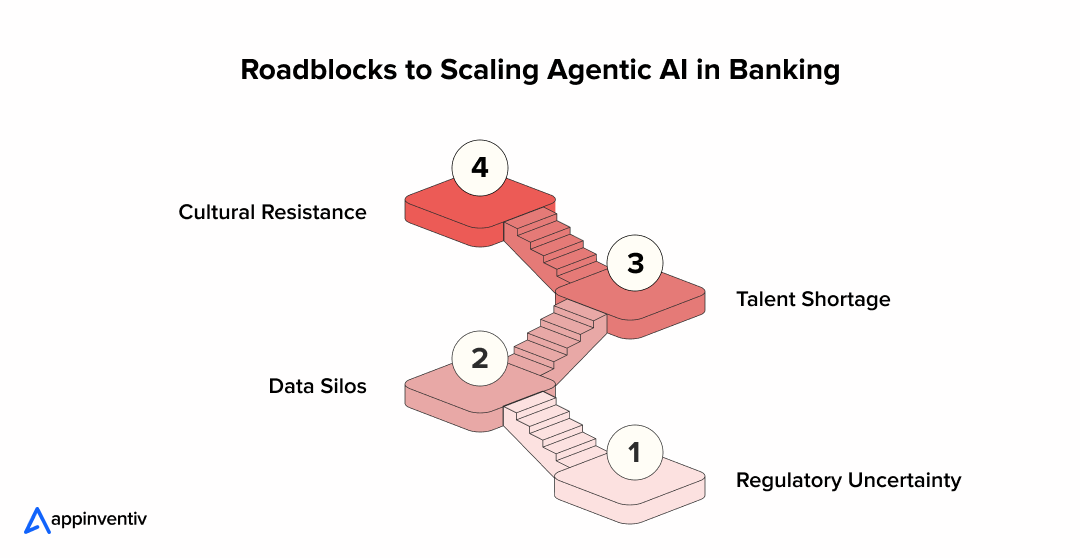

- Challenges of Agentic AI in Banking

- Regulatory Concerns of Agentic AI in Banking

- Data Quality and Silos

- Talent Shortages

- Cultural Resistance

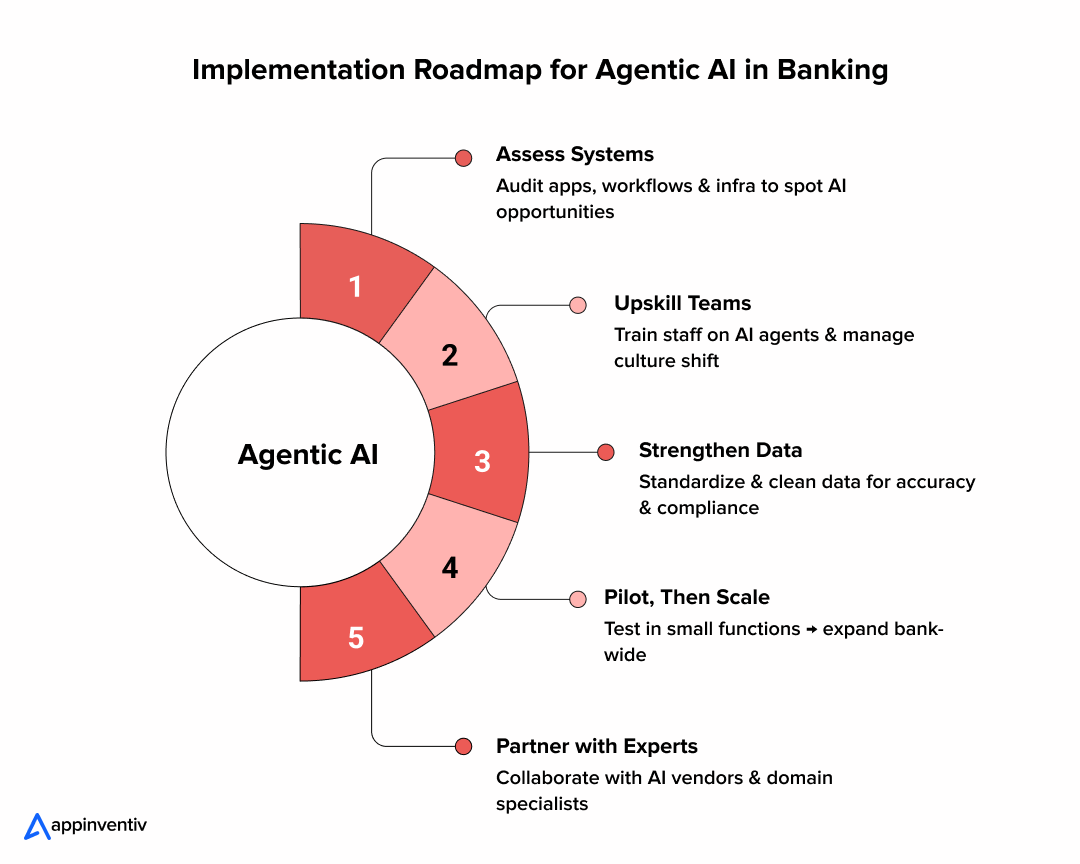

- Implementation Steps: Getting Agentic AI Ready in Banking

- Why Appinventiv Is the Right Partner to Build Agentic AI Systems for Banks

- FAQs

Key takeaways:

- Agentic AI in banking is no longer experimental, it’s a survival necessity in 2025.

- Banks use agentic AI for fraud detection, credit scoring, compliance, CX, trading, treasury optimization, and much more.

- Real deployments (HSBC, Citi, UBS, DBS, ING) show cost reductions of 20–40% and revenue uplifts of 10–30%.

- Beyond efficiency, agentic AI delivers faster decision cycles, real-time compliance, and stronger customer retention, making it a direct lever for growth and resilience.

- For CEOs and CIOs, the question is no longer if it’s how fast agentic AI can be scaled across banking operations before competitors take the lead.

Why Agentic AI in Banking Is the C-Suite’s New Obsession

Banking executives are no longer debating whether AI has a role in the industry that’s already settled. What they’re asking now is how quickly they can move beyond traditional AI and adopt agentic AI before competitors outpace them.

2025 is an inflection point for the BFSI sector: the role of agentic AI in banking isn’t a differentiator anymore, it’s a survival necessity. Customers no longer ask how AI is used in banking they expect intelligent, real-time services by default.

According to McKinsey, Agentic AI is already driving productivity gains of 200-to-2,000% in compliance domains like KYC/AML by autonomously executing end-to-end workflows rather than just assisting humans.

What’s Driving the Urgency?

- Rising compliance costs eating into margins.

- Cybersecurity Ventures now forecasts that global cybercrime damages will reach $12.2 trillion annually by 2031

- Increased competition from digital-first banks and fintechs leveraging AI-native systems.

- Customer churn accelerates when banks fail to provide personalized, instant, multi-channel service.

CIOs, CTOs, and Chief Risk Officers see agentic AI in banking operations as the lever to cut costs, reduce risks, and enhance customer lifetime value, simultaneously.

Don’t let competitors set the pace—discover how your institution can unlock the same advantage.

From Reactive to Proactive: The Strategic Advantage of Agentic AI

Traditional banking automation has always been reactive: rules-based RPA scripts execute predefined tasks, while isolated ML models flag anomalies within narrow boundaries. These systems require constant manual updates and fail when faced with new fraud tactics, regulatory changes, or evolving customer expectations. The result is an “automation plateau,” incremental efficiency gains without strategic transformation.

Real-world agentic AI use cases in banking make it clear that financial institutions are shifting from reactive workflows to proactive, goal-driven systems. Instead of waiting for exceptions to trigger workflows, agents anticipate conditions, simulate outcomes, and act autonomously toward defined goals such as fraud reduction, compliance alignment, or customer retention.

What Proactive Agentic Systems Deliver

- Goal Orientation Over Rules Execution

- RPA automates “if-then” logic.

- Agentic AI aligns every action to enterprise KPIs: reducing non-performing loans (NPLs), maintaining liquidity ratios, or maximizing Net Promoter Score (NPS).

- Context-Aware Adaptation

- Agents interpret data from multiple streams simultaneously: structured (transactions, ledgers), semi-structured (emails, PDFs), and unstructured (voice, chat).

- Unlike traditional models, they integrate this context to make decisions in real time.

- Self-Learning Through Feedback Loops

- Reinforcement learning (RL) enables continuous improvement.

- Example: If a fraud detection agent misses a new anomaly, feedback updates its policy to prevent future misses without reprogramming.

- Cross-Functional Autonomy

- Agents no longer operate in silos. A compliance agent can trigger an onboarding adjustment, while a treasury agent can rebalance liquidity in response to a fraud alert.

- This cross-linking closes gaps that typically require days of human coordination.

10 High-Impact Use Cases of Agentic AI in Banking (With Examples)

Leaders are asking not just what are the use cases of agentic AI in banking but how quickly they can scale them across fraud detection, credit evaluation, compliance, and customer engagement. Below mentioned use cases and real-world agentic AI examples in banking highlight how leading institutions are moving from pilots to production

1. Dynamic Fraud Detection & Financial Crime Prevention

Fraud tactics evolve almost daily, and traditional rules-based systems struggle to keep up. Self-learning agents, however, don’t just follow static rules. They monitor transactions across millions of accounts, flagging unusual behaviors and updating their models as new fraud patterns appear.

The difference is speed and adaptability: what used to take hours of analyst review now happens in seconds with the help of AI agents in fraud detection. Instead of drowning compliance teams in false positives, agentic AI filters noise and highlights the anomalies that truly matter.

Example: Most banks still run on rigid AML systems that throw up alerts whenever a rule is broken, often overwhelming teams with noise. HSBC took a different route with its Dynamic Risk Assessment platform, built alongside Google. Instead of sticking to fixed thresholds, the system studies live transaction flows, updates its logic as fraud tactics change, and steadily reduces the number of false alarms. Investigators get fewer pointless alerts and can focus on cases that really matter.

This shift makes the platform more than just another AI tool it reflects the early traits of agentic AI, where the system adapts, learns, and works toward a clear business goal: catching real fraud while easing the compliance burden (HSBC).

2. Personalized Wealth Management Assistants

Wealth management has always been relationship-driven. Yet even the best human advisors can’t track every market shift or every subtle change in a client’s financial life. Autonomous wealth agents bridge that gap. They tailor portfolios to individual goals, rebalance when conditions change, and even nudge clients when they drift off course.

For banks, the impact is twofold: clients feel better served, and advisors can focus on high-value strategy instead of repetitive tasks.

Example: Citi has been rolling out AI tools in its wealth management arm that go beyond the usual dashboards and static reports. Their new platform combines conversational assistants with trading functions, so advisors don’t just see raw data they can actually ask the system questions and get scenario-based answers.

For example, if a client wants to know how their portfolio might react to a sudden interest rate hike, the assistant can simulate outcomes and suggest adjustments on the spot. This saves advisors from hours of manual analysis and gives them more time to focus on the client relationship. What stands out is how the system keeps adapting as it’s used, learning from market behavior and advisor feedback a move toward the kind of self-improving, goal-oriented decision support that agentic AI is all about (Citi Wealth AI rollout).

3. AI-Powered Loan & Credit Risk Evaluation

Credit decisions have long relied on rigid scoring systems that often exclude viable borrowers. Agentic AI changes the equation by pulling data from both traditional and alternative sources – income statements, transaction patterns, even behavioral signals.

The outcome isn’t just faster approvals; it’s smarter, fairer underwriting. More customers qualify for loans, while banks reduce default risks.

Example: During the COVID lending crisis, Upstart’s AI underwriting models stood out. They were as much as six times more accurate than FICO scores and helped partner banks keep defaults roughly 40% lower than the industry average when the credit market was under extreme pressure. That experience proved a point: drawing on alternative data and adaptive algorithms can beat rigid scoring systems.

The next step forward is agentic AI. Unlike static models, agentic systems wouldn’t just predict risk they would adjust lending policies in real time, rebalance portfolios as market conditions shift, and learn continuously from repayment patterns. For borrowers, that means faster approvals. For banks, it means far tighter control over non-performing loans.

4. Compliance Orchestration & RegTech Agents

Keeping pace with changing regulations is one of the heaviest cost burdens for banks. Manual updates to workflows create lag, errors, and audit risks. Compliance agents change that. They continuously scan regulatory updates, map them to internal processes, and trigger adjustments in real time.

This proactive model reduces surprises during audits and keeps the bank’s operations aligned with evolving laws.

Example: Kodex AI operates multiple specialized regulatory agents that help financial institutions stay ahead of evolving compliance demands. One agent monitors regulatory bodies globally and builds a curated inventory of relevant rule changes. Another transforms raw updates into formal compliance briefs or executive summaries with full audit trails so every change is traceable. Together, these agents cut a compliance team’s time digging through regulatory journals from dozens of hours a week to just a few minutes of review, enabling faster policy updates and reducing exposure to regulatory risk.

5. Hyper-Personalized CX Agents

Banking customers today expect the same level of personalization they get from streaming platforms or e-commerce giants, which is now being delivered through AI agents for digital banking. CX agents learn from past interactions, understand customer preferences, and adapt across channels, whether mobile app, call center, or chat.

This isn’t just about efficiency; it’s about trust. When a customer receives proactive insights or a reminder that actually fits their needs, it deepens the relationship.

Example: BBVA has used AI to power financial health tools that recommend personalized bundles and savings strategies, significantly improving customer engagement. It’s one of the fastest-growing agentic AI use cases in banking, especially as customer expectations move toward real-time, context-aware interactions.

6. Autonomous Treasury Optimization

Treasury teams juggle liquidity, FX, and cash flow exposures that shift by the minute. Agentic AI can run continuous simulations, predict stress points, and make real-time adjustments.

The real advantage is resilience: agents help banks respond to market volatility in seconds, not days, reducing risk exposure and ensuring capital is put to work efficiently.

Example: Citi’s AI Lab has been exploring treasury forecasting as a proving ground for simulation-based agents. Instead of relying on a single forecast that can be outdated the moment markets shift, these agents run continuous “what-if” scenarios testing how liquidity, cash flow, or currency exposures might change under different conditions.

For treasury teams, this isn’t just about crunching numbers faster. It’s about gaining a clearer view of upcoming risks and opportunities, so they can adjust positions before volatility hits. Citi’s work shows how agentic AI can move forecasting from a backward-looking exercise to a forward-looking advantage, helping banks stay steady even when markets turn unpredictable.

7. Dynamic Product Bundling & Pricing Agents

Banks often struggle to align product pricing with customer behavior and market conditions. Agents solve this by analyzing individual journeys, competitor pricing, and external signals. They can dynamically bundle loans, cards, or savings products that best match customer needs.

The result: better conversion, improved margins, and happier customers.

Example: Bradesco, one of Brazil’s largest banks, turned to agentic AI to fix a long-standing pain point: slow and inconsistent pricing. In the past, adjusting loan offers or updating bundled products could take days, sometimes weeks, as teams ran manual reviews and debated margin trade-offs. By layering in agentic AI, Bradesco cut that cycle down by about 22% and improved pricing accuracy by 17%.

The agents don’t just crunch spreadsheets; they continuously pull signals from central bank updates, competitor rates, and customer behavior to test scenarios and suggest the best move. Once validated, those changes flow quickly across digital channels and branches. The payoff is clear customers see offers that feel timely and relevant, while the bank gains tighter margins and faster response to market shifts.

8. Autonomous Trading & Portfolio Rebalancing

Markets move quickly, and even advanced trading desks can’t keep pace with every micro-shift. Autonomous trading agents use reinforcement learning to rebalance portfolios within set guardrails, optimize tax-loss harvesting, and adjust exposures instantly.

The advantage is clear: portfolios stay aligned with client goals without requiring constant manual intervention.

Example: Wealthfront’s suite of automation already shows how near-agentic systems can reshape portfolio management. Their software doesn’t just rebalance portfolios when allocations drift it watches portfolios every single day in search of tax loss harvesting opportunities. If an investment has fallen below its cost basis, the system evaluates whether selling it and replacing it with a highly correlated alternative (so you don’t change the risk/return profile) makes sense.

Over 2024, for clients with taxable automated investing accounts, Wealthfront harvested more than $145 million in losses, estimating tax savings that exceed the advisory fee in nearly 96% of cases, and generating over $1 billion in tax benefit over the past decade.

9. HNI Conversational Banking Interfaces

High-net-worth clients expect white-glove service, but also convenience. Conversational agents designed for HNI banking bring both. They understand context, execute complex transactions, and integrate seamlessly with wealth dashboards.

For banks, this means stronger retention in their most profitable segments.

Example: Citi Wealth has started piloting two tools, AskWealth and Advisor Insights, that bring AI directly into the private banking workflow. AskWealth acts like a smart conversational assistant, giving relationship managers quick answers to client queries about portfolios, markets, or research without the usual delays. Advisor Insights goes a step further, surfacing timely alerts on market movements and client portfolios so advisors can act before the client even calls.

Right now, these platforms are being tested with Citigold and Citi Private Client users in North America, with plans to expand globally over the next year. What’s notable is how they shift from simple automation to something more agentic: learning from advisor interactions, adapting to client behavior, and supporting proactive financial guidance instead of just reactive service. (Citi rollout).

10. Smart Contract Auditing & DeFi Monitoring

As banks explore custodianship in decentralized finance, the risks multiply. Smart contract agents autonomously review code, monitor transactions, and flag vulnerabilities before they are exploited.

This use case is still emerging but is quickly moving from experiment to necessity as traditional banks interact with DeFi ecosystems, with generative AI in finance playing a growing role in strengthening risk monitoring and compliance across digital assets.

Research on DeFAI (Decentralized Finance + AI) shows how intelligent agents are being used to safeguard smart contracts. Instead of one-time audits, these systems keep scanning for vulnerabilities, watching transaction flows, and flagging issues before they become losses. What makes them different is that they learn as new attack patterns appear, adapting their responses over time. Most of this work is still happening inside the decentralized finance ecosystem, but it offers a preview of where traditional banks may be headed as they move into digital asset custody and tokenized finance. Regulatory sandboxes in Europe and Asia are already piloting similar monitoring setups, showing how agentic AI could make compliance and risk control in DeFi more proactive and reliable.

Explore our AI services and see how Appinventiv can help you turn innovation into ROI.

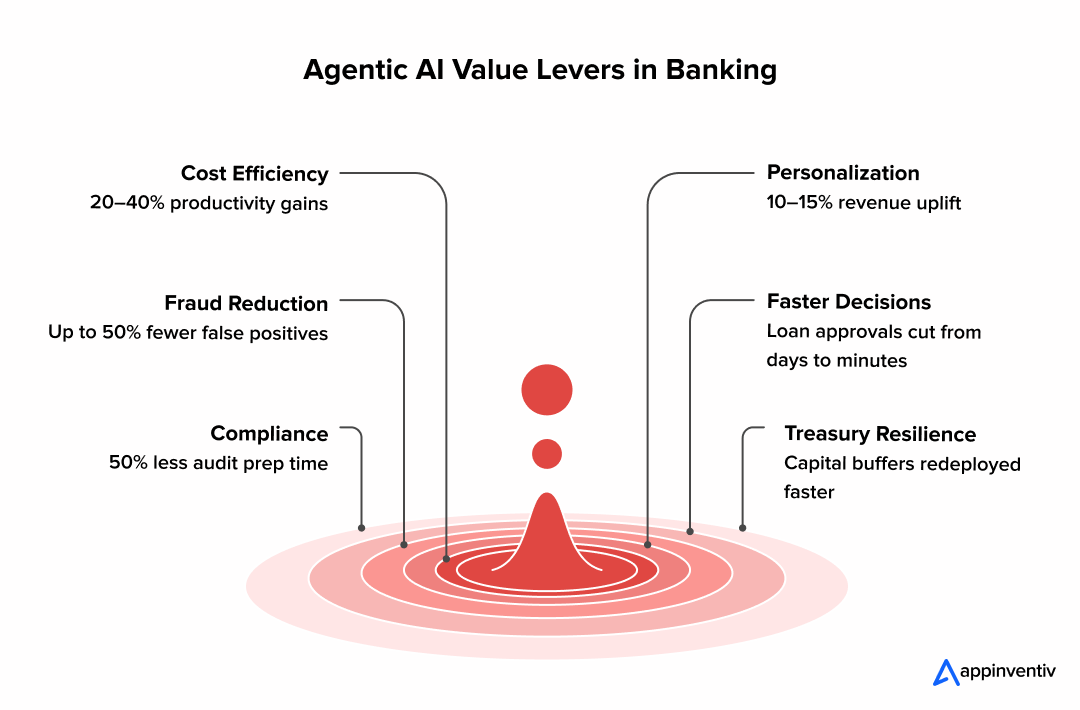

How Agentic AI Applications in Banking Drive Measurable Business Value

Agentic AI is no longer a technology experiment; it is a financial lever delivering outcomes that banks can measure in the P&L. From fraud prevention to treasury forecasting, agentic AI applications in banking are increasingly tied to measurable operational and strategic outcomes. The most effective agentic AI use cases in banking are those that show direct correlation to board-level outcomes cost reduction, fraud savings, and improved NPS.

For years, automation in banking promised efficiency but delivered mostly incremental wins. Agentic AI is different. It shows up in board-level numbers, cost savings, fraud recovery, compliance readiness, and customer retention. The results are visible, not just theoretical.

- Cost Efficiency That Scales Beyond RPA

Most banks already know what RPA can do: cut repetitive tasks. The problem is, savings taper off once the easy processes are automated. Agentic AI extends automation into complex, judgment-heavy areas. It doesn’t need reprogramming every time a variable changes.

- Deloitte notes that scaled intelligent automation can bring 25–40% operational savings. With adaptive agents, the curve doesn’t flatten, they keep learning, so efficiencies compound instead of stalling.

- Cutting Fraud Losses in Real Time

Fraud eats into banking profits every single day, making agentic AI for risk management in banking a critical priority. Static models can’t keep up with fast-changing schemes. Self-learning agents track patterns across huge data sets and update themselves the moment new threats appear.

- HSBC reported 50% fewer false positives after deploying anomaly-detection agents with Google Cloud. That means fewer wasted investigations and a higher hit rate on real fraud cases.

- Compliance Without the Drag

Compliance costs are unavoidable, but the manual work around it slows banks down. Agents continuously map regulations to internal workflows. Instead of waiting for audit season, compliance becomes part of day-to-day operations.

- Capgemini estimates that automation in compliance can cut audit prep time by half or more. For large institutions, that’s not just about avoiding penalties, it’s freeing teams to focus on higher-value risk strategies.

- Stronger Lifetime Value and NPS

Customer value doesn’t grow by offering generic products. Agentic CX systems learn customer behavior and adapt interactions in real time, whether it’s a loan offer, a budgeting tip, or a fraud warning.

- McKinsey data shows personalization can lift banking revenue by 10–15% and improve satisfaction scores by 20–30%. Put simply: when customers feel understood, they stay, and they spend more.

- Speed Where It Matters: Decisions and Service

Loan approvals used to take days, sometimes weeks. With agentic credit agents, the same process can drop to minutes. The agents don’t just check boxes, they analyze structured and unstructured data side by side.

- Upstart’s AI-driven model has shown that smarter underwriting can open doors for more borrowers. By going beyond traditional credit scores, it has delivered approval rates more than 40% higher than many legacy lenders, while also taking much of the manual work out of the process.

- Capital and Liquidity Resilience

A treasury desk lives on speed. Delayed visibility into cash flow or FX exposure can cost millions. Agents run liquidity scenarios constantly and make adjustments intraday, not at the end of the week.

- Capgemini points out that many banks are now turning to AI-powered predictive liquidity forecasting and scenario modeling to get a clearer picture of their cash positions. By knowing earlier where risks and gaps might appear, treasury teams don’t need to park as much money in idle buffers “just in case.” Instead, they can put that capital to work—funding short-term lending, supporting investments, or simply improving day-to-day liquidity planning.

This proves the benefits of agentic AI in banking aren’t theoretical they’re already reshaping balance sheets.

Business Benefits of Agentic AI for Banks and FinTechs

Agentic AI stands out in banking because it does more than generate insights. It connects systems, decisions, and follow-up actions that are usually spread across teams and tools. That is where most operational friction sits today.

1. Connects Disconnected Banking Systems

Most banks run risk, compliance, and operations on separate platforms. Agentic AI helps work move across them instead of stopping at alerts.

- Pulls data from core banking, AML, CRM, and external sources

- Triggers next steps automatically

- Reduces manual handoffs

2. Improves Productivity Without Adding Headcount

The main constraint in banking teams is workload, not tools. Agentic AI takes over coordination work so people can focus on decisions.

- Automates data collection and enrichment

- Speeds up investigations

- Reduces back and forth

3. Learns From Real Decisions Over Time

Rules go stale quickly. Agentic AI improves by learning from what happens after decisions are made.

- Adjusts based on false positives and confirmed risks

- Adapts to changing customer behavior

4. Makes AI Decisions Easier to Explain

Trust matters. Agentic AI helps by keeping decisions traceable.

- Clear decision paths

- Easier audit and regulator conversations

5. Responds Faster to New Risk Patterns

New fraud tactics emerge constantly. Agentic AI adapts sooner than static models.

- Rebalances signals quickly

- Limits early exposure

6. Reduces False Positives Without Weakening Controls

Compliance teams lose time to noise. Agentic AI filters alerts before they reach people.

- Cross checks signals

- Keeps teams focused on high risk cases

7. Surfaces Hidden Risk Insights

When data sits in silos, patterns stay hidden.

- Reveals trends across products and regions

- Highlights recurring control gaps

8. Helps Control Compliance Costs

Regulatory scope keeps growing. Agentic AI absorbs complexity without linear cost increases.

- Automates recurring checks

- Reduces manual reconciliation

9. Shifts Risk Detection Earlier

Most damage happens before alerts are raised.

- Flags issues earlier in workflows

- Supports preventive action

10. Aligns Business, Risk, and Technology Teams

Shared visibility reduces friction between teams.

- One view of system behavior

- Faster, clearer decisions

Also Read: IoT in Banking Industry: Use Cases, Examples, ROI

Key Features of a Secure and Scalable Agentic AI System

For banking executives, the rule is clear: if you scale without compliance, you’re inviting disaster. Agentic AI may be autonomous by design, but in banking it has to follow controlled autonomy always within the boundaries of governance and regulation. To get there, banks need three things in place: a strong core architecture, uncompromising security and compliance, and integration that respects the reality of legacy systems.

Core Architectural Features

Agentic AI isn’t just another machine learning model. It’s a framework where decisions are tied to business goals, tested before execution, and refined through feedback.

- Goal-driven models with guardrails: Agents must be aligned with strategic objectives; approving loans, monitoring liquidity, detecting fraud; but within thresholds set by risk and compliance teams. The “guardrails” prevent autonomy from becoming unpredictable.

- Simulation before action: No bank should allow an agent to act blindly. Running scenarios in a safe, simulated environment ensures that outcomes are understood before changes hit live systems.

- Reinforcement learning in practice: Instead of static rules, agents improve over time. Each fraud case caught or compliance check passed feeds back into the system, making the agent smarter without a manual update cycle.

Security and Compliance Layers

Banking is one of the most regulated industries in the world. That means every agentic decision has to be explainable and auditable.

- Encryption and access control: All data moving in and out of agents must be locked down, with permissions that define exactly who can override or review decisions.

- Auditability by default: Regulators won’t accept “black box” answers. Every decision, why a transaction was blocked, why a credit application was declined, should have a transparent trail.

- Compliance frameworks baked in: Basel IV, MiFID II, GDPR, these aren’t checklists at the end of the process. Agentic AI needs to map its logic to these frameworks in real time, so compliance is not an afterthought but a built-in safeguard. This is especially important as agentic AI applications in banking begin to handle sensitive workflows like KYC verification, loan adjudication, and transaction blocking.

Also read: AI Agent Security: Risks, Solutions & Business Benefits

Integration With Legacy Banking Systems

No large bank is starting from scratch. Any scalable agentic system has to work with infrastructure that’s often decades old, which is why a strong legacy application modernization strategy becomes critical for successful integration.

- APIs for connectivity: Open APIs let agents plug into core banking systems, payment networks, and risk management tools without tearing everything apart.

- Cloud-native where possible: Elastic, cloud-based deployment gives banks the ability to handle spikes in transaction volume without compromising performance.

- Hybrid when necessary: Because of data residency laws, not all information can move to the cloud. A hybrid model, sensitive data kept on-premise, with agents running in secure cloud environments, provides a workable middle ground.

These design features determine whether AI agents remain proof-of-concept toys or become mission-critical AI agents for digital banking.

Challenges of Agentic AI in Banking

Rolling out agentic AI inside a bank isn’t frictionless. Technology can be built, pilots can be launched, but getting to scale is another story. What slows most institutions down isn’t the algorithm, it’s everything around it: governance, data, people, and culture.

Regulatory Concerns of Agentic AI in Banking

The regulatory concerns of agentic AI in banking remain the first roadblock, and probably the toughest. Most of today’s frameworks weren’t designed for autonomous systems making real financial decisions. That creates two problems:

- AI Explainability: Supervisors won’t sign off on a loan decision if the only answer is “the model said so.” Basel IV, MiFID II, GDPR, all require a clear audit trail. If an agent can’t explain itself, the bank carries the risk.

- Accountability: Who takes the fall if an AI agent missteps? Is it the technology vendor, the IT team, or the board? Until accountability frameworks are clearer, legal and compliance departments will keep a firm handbrake on adoption.

Data Quality and Silos

Agentic AI is only as strong as the data it learns from. For most banks, that data is still fragmented. Customer information lives in multiple systems, onboarding, risk, CRM, and those silos make it hard to build a full picture.

- In practice, this means incomplete training sets, higher bias, and weaker accuracy.

- Even when data is pulled together, mixing structured records with unstructured inputs like call logs or scanned documents remains a messy, expensive process.

Talent Shortages

There’s no shortage of AI engineers globally, but finding ones who understand banking is another matter. For banks, knowing how to hire an AI developer with both technical expertise and domain knowledge can make the difference between a stalled pilot and a scalable solution.

- Reinforcement learning experts rarely know Basel rules. Compliance professionals rarely know model training. Bridging the two requires a rare hybrid skill set.

- And when banks do find the right people, they’re competing with fintechs and tech giants who can often pay more and move faster. Among all the challenges of agentic AI in banking, the talent gap may be the most underrated, and the hardest to solve at scale.

Cultural Resistance

Even if the tech is solid and the models perform well, people inside the bank have to trust the system. That’s often harder than it sounds.

- Loan officers may feel sidelined when decisions come from a machine. Compliance teams may fear losing control. Frontline staff may distrust what they can’t see or explain to customers.

- Moving from rules-based systems to autonomous agents is a culture shift as much as a technology shift. Without strong change management and internal champions, projects tend to stall at pilot stage.

Implementation Steps: Getting Agentic AI Ready in Banking

- Assess Systems: Start with an honest look at your current systems and workflows. Where are people still stuck with repetitive tasks? Where do decisions get delayed? Where does risk management feel reactive instead of proactive? Those pressure points usually show you where agentic AI can make the most impact.

- Upskill Teams: Technology alone won’t change how a bank runs. Your teams need to see how AI agents make decisions, what data feeds them, and how governance keeps them in check. When people understand the “why” and the “how,” adoption feels less like a threat and more like an upgrade.

- Strengthen Data: No AI agent can succeed with scattered or unreliable data. Standardize how information is collected, clean it up, and make sure it flows across departments. Good data builds trust in the system, poor data undermines it before it even starts.

- Pilot, Then Scale: Don’t roll out agentic AI across the entire bank on day one. Pick one area fraud detection, loan approvals, onboarding—and run a pilot. Learn what works, adjust what doesn’t, and use those wins to build confidence for the next rollout.

- Partner with Experts: Banks don’t need to reinvent the wheel. External experts who understand both banking and agentic AI can accelerate progress and help avoid common pitfalls. With the right support, you can focus on results rather than wrestling with the technical heavy lifting. For instance, our banking technology consulting team helps shape this journey by aligning AI initiatives with real operational needs, compliance expectations, and measurable business outcomes

Why Appinventiv Is the Right Partner to Build Agentic AI Systems for Banks

If you’re a banking executive, you’re looking for two non-negotiables in an AI partner: deep domain experience and reliable delivery. Over the last 10 years, Appinventiv has proven both. We combine BFSI-expertise, technical maturity, and real-world impact to move beyond pilots into enterprise-scale agentic AI systems. We have delivered agentic AI solutions that go beyond automation to deliver measurable outcomes. These solutions include enterprise-grade agentic AI in banking use cases.

In one engagement, we helped a leading bank cut manual processes by over 30%, improve ATM service availability to 92%, and boost customer retention by 20% through AI-driven churn prediction and multilingual conversational agents. In another, we engineered a multi-agent RAG system that delivered real-time strategic insights, reduced data-to-decision cycles, and scaled across industries while maintaining compliance and accuracy. Together, these projects show our ability to build compliance-first, scalable, and high-impact agentic AI in banking that directly enhances customer experience, operational efficiency, and decision-making at the enterprise level.

Why Banks Choose Appinventiv

- Domain-Specific Accelerators: AML, CX, onboarding, fraud detection.

- Compliance-First AI Engineering: Built for Basel, GDPR, MiFID, HIPAA.

- Proven BFSI Experience: Case studies of agentic AI in banking, from reduced claim turnaround to fraud detection improvements.

- Full Lifecycle Delivery: Strategy → Deployment → Scaling.

Discover how Appinventiv’s AI development services can help your bank deploy agentic AI systems that are secure, compliant, and ROI-driven.

Talk to our BFSI AI experts and start building secure, compliant, and scalable agentic AI systems that drive measurable impact.

FAQs

Q. How is agentic AI different from traditional AI and RPA in banking?

A. RPA in banking and older AI models do one thing well: they follow rules. They’re great at repetitive work but fall apart when something changes. Agentic AI doesn’t wait for new scripts. It works toward business goals like reducing fraud losses or cutting down non-performing loans. And it learns as it goes. Instead of “if-then” rules, it adjusts on its own getting smarter without constant human fixes.

Q. What Are the Key Features of Agentic Treasury Systems?

A. Agentic treasury systems are designed to move beyond monitoring and into execution. They combine intelligence with action across cash, liquidity, and risk workflows.

Key features typically include:

- Autonomous cash positioning and forecasting across accounts

- Policy-driven decision engines for liquidity and funding actions

- Real-time integration with payments, FX, and risk systems

- Explainable decision logs for audit and treasury oversight

These features allow treasury teams to respond faster without losing control or visibility.

Q. How Do Businesses Integrate Agentic Infrastructure With Core Banking Systems?

A. Integration usually happens through a layered approach rather than direct system replacement. Agentic infrastructure sits on top of existing platforms and orchestrates workflows through secure interfaces.

Most integrations involve:

- API and event-based connections with core banking and payment systems

- Read and write controls governed by role-based access and approvals

- Gradual rollout starting with advisory actions before full automation

This approach allows businesses to adopt agentic capabilities without disrupting core banking operations or compliance controls.

Q. How much does it cost to develop an agentic AI system as a bank?

A. The cost of building an agentic AI system in banking depends on scale, compliance requirements, and use-case complexity. Typical cost factors include:

- Overall investment: Enterprise-grade agentic AI systems typically cost $1M–$5M+.

- Strategy & discovery: $20K–$100K for use-case definition, regulatory assessment, and architecture design.

- Data readiness & infrastructure: $100K–$500K+ for secure data pipelines, preparation, and real-time access.

- AI agent development: $200K–$1M+ for autonomous agents, decision logic, and orchestration.

- System integration: $150K–$750K+ to connect with core banking, fraud, AML, CRM, and payments.

- Security, governance & compliance: $100K–$400K+ for explainability, auditability, and controls.

- Testing & deployment: $50K–$250K for validation and pilot rollouts.

- Ongoing operations: $150K–$600K+ annually for monitoring, updates, and compliance.

Q. What future trends should banks expect with agentic AI?

A. Over the next few years, agentic AI will move from small pilots to running at scale across the bank. We’ll see agents working together across compliance, risk, treasury, and customer service cutting delays and breaking down silos. Regulators are also moving toward continuous oversight, so every decision an agent makes will need to be explainable and auditable. On the customer side, AI will play a bigger role in everyday banking—nudging people with smarter savings tips, real-time fraud alerts, and even instant portfolio adjustments. The real leap will come when agents start collaborating with each other, turning banking systems into living networks that adapt and respond in real time.

Q. How banks use agentic AI for automation?

The strongest results are in areas where fast, accurate calls make all the difference:

- Fraud detection and AML monitoring.

- Loan and credit decisioning.

- Personalized customer engagement.

- Treasury and liquidity forecasting.

- Real-time compliance.

- DeFi contract monitoring.

These aren’t experiments anymore. Tier-one banks are already running them.

Q. How to choose the right agentic AI partner in banking?

A. CIOs and CTOs know most failures come from weak vendor selection.

Evaluation Checklist

- Domain Expertise: BFSI-specific accelerators like AML and onboarding.

- Regulatory Fluency: Proven delivery in highly regulated markets.

- Security-by-Design: Encryption, compliance audits, and explainability.

- Lifecycle Support: From ideation to optimization.

Partnering with leaders in banking software development services ensures banks deploy secure, scalable solutions aligned with global regulations.

Q. How do banks make agentic AI work with legacy systems and siloed data?

The answer isn’t ripping everything out. It’s layering intelligence on top of what exists. API-driven platforms let agents plug into core banking, payments, and risk engines without a rebuild. Many banks run hybrid setups: sensitive data stays on-prem, while agents handle heavy processing in the cloud. This mix lets them pull from both structured data and messy sources like voice logs or PDFs – breaking silos that used to block progress.

Q. What is agentic AI in banking?

A. It’s AI that doesn’t just “do tasks.” It understands goals. In banking, that could be spotting fraud, keeping compliance aligned, or improving customer retention. Unlike traditional automation, it adapts when conditions shift instead of waiting for an update.

Q. How to implement agentic AI in banking?

A. Start with areas where the value is easy to measure fraud, credit, compliance, treasury, or CX. Then move step by step:

- Tie each agent to a business outcome.

- Fix data silos before scaling.

- Test in sandbox environments first.

- Expand gradually with APIs and hybrid cloud.

- Keep governance front and center with audit trails.

The banks that succeed don’t treat it like a side project. They make it part of how the business runs.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Proving the ROI of Copilot AI Sales Enablement Software for Global Teams

Key Takeaways The ROI of Copilot AI sales enablement software shows up in revenue moments, not in generic productivity reports. Organizations that treat Copilot as an AI-powered sales enablement platform tied to sales process maturity see measurable outcomes within two quarters. Global sales teams require region-aware deployment models to avoid uneven adoption and misleading ROI…

Real Estate Chatbot Development: Adoption and Use Cases for Modern Property Management

Key takeaways: Generative AI could contribute $110 billion to $180 billion in value across real estate processes, including marketing, leasing, and asset management. AI chatbots can improve lead generation outcomes by responding instantly and qualifying prospects. Early adopters report faster response times and improved customer engagement across digital channels. Conversational automation is emerging as a…

AI Fraud Detection in Australia: Use Cases, Compliance Considerations, and Implementation Roadmap

Key takeaways: AI Fraud Detection in Australia is moving from static rule engines to real-time behavioural risk intelligence embedded directly into payment and identity flows. AI for financial fraud detection helps reduce false positives, accelerate response time, and protecting revenue without increasing customer friction. Australian institutions must align AI deployments with APRA CPS 234, ASIC…