- RPA in Wealth Management: Market Scenario

- How RPA is Transforming Wealth Management?

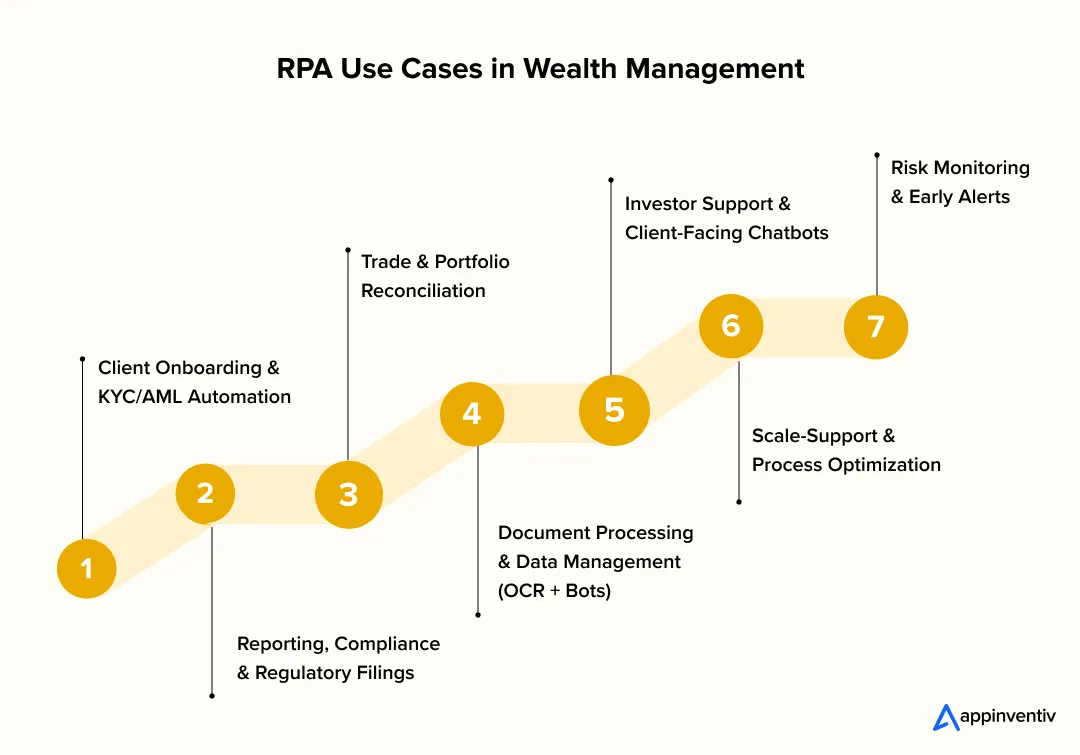

- RPA Use Cases in Wealth Management

- 1. Client Onboarding & KYC/AML Automation

- 2. Reporting, Compliance & Regulatory Filings

- 3. Trade & Portfolio Reconciliation

- 4. Document Processing & Data Management (OCR + Bots)

- 5. Investor Support & Client-Facing Chatbots

- 6. Risk Monitoring & Early Alerts

- 7. Scale-Support & Process Optimization

- Benefits of RPA in Wealth Management Firms

- 1. Time and Cost Efficiency

- 2. Accuracy and Risk Control

- 3. Seamless Client Experience

- 4. Scalability Without Growing Headcount

- 5. Empowered Workforce

- 6. Future-Ready Operations

- Implementation Considerations & Challenges of RPA in Wealth Management

- 1. Data Fragmentation and Integration Hurdles

- 2. Resistance to Change

- 3. Process Standardization

- 4. Security and Compliance Risks

- 5. Scaling Beyond the Pilot Phase

- 6. Balancing Human and Digital Workflows

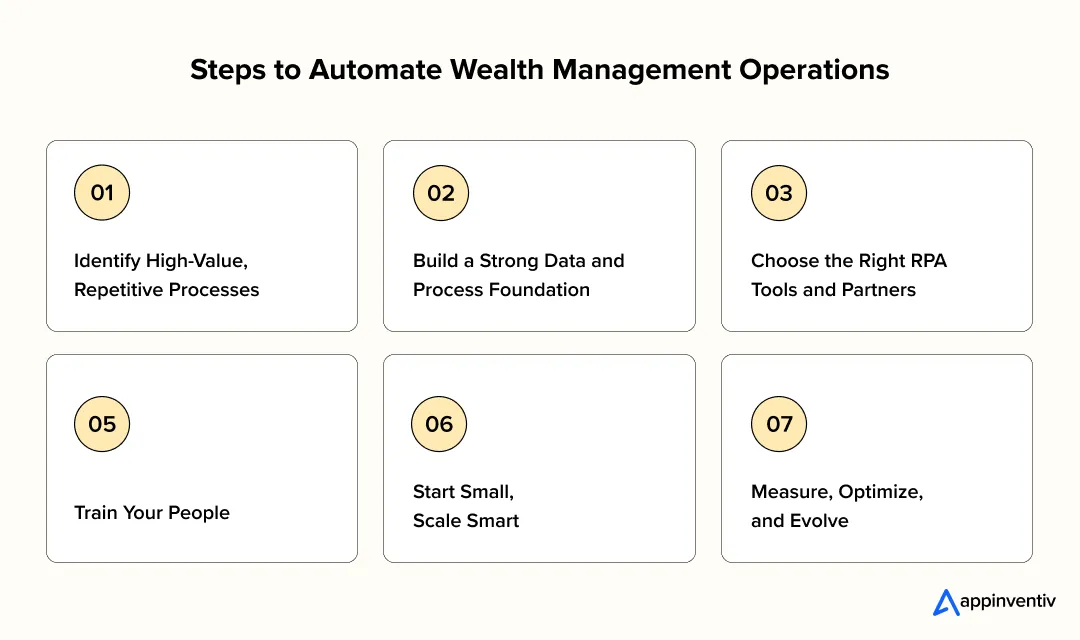

- Steps to Automate Wealth Management Operations

- 1. Identify High-Value, Repetitive Processes

- 2. Build a Strong Data and Process Foundation

- 3. Choose the Right RPA Tools and Partners

- 4. Train Your People

- 5. Start Small, Scale Smart

- 6. Measure, Optimize, and Evolve

- Where RPA Meets Intelligent Automation

- How Appinventiv Helps Wealth Management Firms Build an RPA System?

- FAQs

Key takeaways:

- RPA is no longer optional; it’s redefining how wealth management firms operate by automating manual, time-consuming processes and freeing advisors to focus on client strategy.

- Automation delivers faster, error-free client onboarding, smoother compliance reporting, and real-time trade reconciliation, driving efficiency across operations.

- Wealth firms using RPA are cutting costs, scaling operations without extra hires, and improving profitability through smarter process automation.

- The blend of RPA and AI is enabling predictive risk monitoring, personalized client experiences, and stronger regulatory compliance frameworks.

- Implementing RPA requires more than tools; it’s about building a strategy, training teams, and creating intelligent systems that make financial services faster, safer, and more client-centric.

Wealth management clients today want more than quarterly portfolio updates by mail. They expect digital-first experiences, personalized service, and instant access to their financial data. Meanwhile, most firms still operate on legacy systems built decades ago, process tasks manually, and deal with regulatory requirements that keep expanding. The result? Operations cost too much, everything takes too long, and clients get frustrated.

Today, Robotic Process Automation in wealth management tackles these problems head-on. RPA deploys software bots that handle repetitive, rules-based tasks, such as onboarding new clients, running compliance checks, and reconciling trades. Hence, your advisors spend time on actual advisory work instead of data entry. These bots aren’t experimental AI projects that might work someday. They’re practical tools you can deploy in weeks that improve efficiency without ripping out your entire technology stack.

RPA in wealth management moved from “interesting technology” to “competitive requirement.” The industry numbers tell the story. Current data shows that 53% of businesses already use automation in wealth management, and most plan to invest more over the next few years.

Firms that don’t adopt this risk are falling behind both operationally and in client experience. Cost pressures, regulatory changes, and digital service expectations are hitting at the same time. RPA needs to shift from pilot programs tucked away in innovation labs to core operations that run daily.

This guide explores how RPA for wealth management firms is reshaping operations, delivering personalized client experiences, and strengthening compliance frameworks. We’ll examine key applications of RPA in wealth management, core benefits, and practical challenges firms hit during implementation, plus how Appinventiv builds scalable automation systems designed specifically for modern wealth management operations.

Join the 53% using RPA in wealth management. Partner with Appinventiv to unlock automation that boosts efficiency, cuts costs, and enhances client experiences.

RPA in Wealth Management: Market Scenario

Robotic process automation in wealth management isn’t happening slowly—it’s moving fast. According to Precedence Research, the global RPA market, encompassing financial services and other industries, is forecast to expand from about USD 35.27 billion in 2026 to roughly USD 247.34 billion by 2035, growing at around a 24.2% CAGR over that period.

What’s driving firms to adopt this quickly? Three problems are hitting simultaneously: operational costs keep rising and squeezing margins, regulatory requirements keep expanding and adding compliance work, and clients now expect digital-first, personalized service as standard rather than something special.

Wealth firms can’t compete on investment returns alone anymore. Client experience quality matters. Operational efficiency matters. Firms that integrate RPA in wealth management processes report sharper accuracy and stronger compliance readiness.

Several trends are changing how automation works. AI-enabled onboarding that finishes in hours instead of weeks. Document automation using OCR that pulls data from statements and forms without anyone typing manually. RPA is converging with generative AI to handle more complex tasks that need some judgment, not just simple rule-following.

In 2026 and beyond, the impact of RPA on wealth & asset management will define who scales efficiently. Automation shifted from a back-office efficiency project to a strategic necessity for wealth firms looking to scale operations while meeting increasingly stringent compliance requirements.

How RPA is Transforming Wealth Management?

The world of wealth management is evolving faster than ever, and AI automation, especially RPA in Wealth Management, is right at the heart of that transformation. What used to be manual, time-consuming, and heavily dependent on human effort is now becoming faster, smarter, and more precise, without losing the human touch that clients still value most.

AI-driven RPA for wealth management firms is enabling organizations to process vast amounts of data in real time, reduce operational costs, and drastically improve efficiency. AI-powered tools are rapidly transforming wealth management, automating everything from risk monitoring to hyper-personalized financial advice.

According to World Economic Forum, AI is designed to complement, not replace, human expertise. While algorithmic tools can analyze vast datasets and find patterns, they don’t replicate human judgment, empathy, and creativity.

In practice, wealth management business process automation enables advisors to spend less time on routine tasks and more time on what matters: client relationships, strategy, and meaningful guidance. RPA-driven compliance automation ensures firms meet regulatory standards without the constant manual oversight. Bots handle compliance checks, data extraction, and first-pass analysis, freeing human teams to focus on insight and strategy.

As firms scale robotic process automation in wealth management, they’re shifting from reaction to foresight, from “processing work” to “predicting outcomes.” This shift boosts speed, accuracy, and service quality across the business. The importance of RPA in wealth management cannot be overstated, as these intelligent automation tools are revolutionizing how firms operate and interact with clients.

The future of wealth management isn’t human versus machine, it’s human plus machine. The RPA in wealth management is giving firms the speed of algorithms, the insight of data, and the empathy of human advisors, a combination that’s redefining client relationships and setting new standards for personalized, data-driven financial care.

RPA Use Cases in Wealth Management

As wealth management firms continue to embrace RPA, the transformation is visible across various operations. Automation enables wealth firms to tackle challenges head-on, from client onboarding to compliance monitoring, while boosting operational efficiency. Here are some of the key applications of RPA in wealth management:

1. Client Onboarding & KYC/AML Automation

Imagine your back-office team no longer drowning in onboarding paperwork when a new client walks in. Instead, with RPA in wealth management processes, firms can now automatically verify documents, cross-check compliance data, and flag red flags in minutes. A bot checks ID documents, scans sanctions lists, populates client profiles, and flags unusual cases—all in minutes.

Example: State Street Bank

State Street Bank utilized RPA and intelligent automation to streamline its Know Your Customer (KYC) processes, reducing the time from account opening to trading by 49%. This initiative resulted in $2.5 million in cost avoidance and generated $1–2 million in additional revenue per customer.

2. Reporting, Compliance & Regulatory Filings

Regulatory filings and compliance checks can be complex and time-consuming. With robotic process automation in wealth management, these repetitive tasks can be streamlined. RPA systems automatically gather data, fill templates, and generate audit trails. These tools ensure timely, accurate reporting that reduces manual effort and ensures compliance.

Example: Nordea Bank

Deployed 380 digital workers (bots) in production, released the equivalent of ~1,500 full-time-employee hours back into the business via RPA.

3. Trade & Portfolio Reconciliation

When trade mismatches or settlement delays occur, human teams often scramble. With RPA, bots compare settlement records and portfolio data in real time, flagging only exceptions for human review.

The Banking Industry Guide 2025 reports that RPA usage in reconciliation and portfolio/trade matching is significantly improving speed and accuracy.

Significance: While not wealth-firm specific, the parallels directly apply to wealth management firms reconciling client portfolios/transactions.

4. Document Processing & Data Management (OCR + Bots)

Many wealth firms still rely on scanned forms and manual data entry. Today, RPA, combined with Optical Character Recognition (OCR) and AI-driven document processing, automates the extraction of information from PDFs, distributes data across systems, and keeps everything in sync.

Example: Canadian Wealth Manager

A Canadian-rooted wealth-management institution automates KYC document and intake forms, streamlining onboarding for 25,000 customers annually under a heavy document load.

Significance: Highlights the back-office “data extraction” problem that many wealth firms face, and how automation resolves it.

5. Investor Support & Client-Facing Chatbots

Clients hate waiting for simple answers: “When’s my statement ready?” “What’s my current balance?” With RPA-powered procurement chatbots, these queries are answered instantly, 24/7. This means advisors can focus more on meaningful conversations and less on repetitive questions.

Example: Banking/Wealth Industry Overview, 2025

Outcome: Industry articles note that RPA + AI chatbots in banking handle routine client queries around the clock, freeing human teams for strategic tasks.

This directly connects to wealth management, where clients now expect faster, more digital-first support, and automation is the key to making that expectation a reality.

6. Risk Monitoring & Early Alerts

By monitoring internal and external data, robotic process automation in wealth management enables early identification of risks and anomalies, helping firms proactively manage portfolio risks, market fluctuations, and compliance issues.

HSBC implemented RPA to automate risk-monitoring and fraud-detection processes, enabling faster decision-making and stronger defenses against financial fraud. This approach was part of their broader digital transformation strategy in commercial banking.

7. Scale-Support & Process Optimization

As wealth management firms expand—acquiring more clients, handling increased account volumes, and navigating evolving regulatory landscapes—scaling operations through traditional hiring becomes unsustainable. Robotic Process Automation (RPA) automates repetitive, rules-based tasks, enabling firms to manage growth efficiently without proportional increases in headcount.

Example: UBS’s AI-Driven Productivity Enhancement

UBS has significantly increased its use of artificial intelligence (AI) to enhance productivity and efficiency in its U.S. wealth management operations. Approximately 60% of the firm’s AI initiatives are focused on streamlining tasks such as client onboarding, Know Your Customer (KYC) checks, and generating prompts to guide adviser-client conversations.

Also Read: RPA in Banking – How Robotic Process Automation

Ready to see real results? Discover how RPA is already revolutionizing wealth management and how our tailored automation solutions can transform your workflows.

Benefits of RPA in Wealth Management Firms

Robotic Process Automation isn’t just a trend in finance; it’s becoming the new foundation for how wealth management firms operate. Beyond saving time, RPA is helping firms deliver faster service, reduce risk, and improve overall client satisfaction. Let’s dive into the specific benefits of integrating RPA for wealth management firms:

1. Time and Cost Efficiency

RPA in wealth management processes helps firms save time and money by eliminating the need for manual data entry and routine administrative work, and by automating repetitive tasks that used to consume hours—such as updating client records, reconciling transactions, and processing forms. Your team stops spending afternoons on data entry and instead focuses on strategic decisions, client conversations, and portfolio management.

The payoff isn’t just speed. It’s leaner operations that can actually respond to opportunities, rather than being buried in administrative tasks nobody enjoys anyway.

2. Accuracy and Risk Control

Manual data entry goes wrong sometimes. Compliance checks get missed. Even small mistakes trigger expensive problems—regulatory penalties, client complaints, and operational losses that could have been avoided.

RPA executes tasks identically every time. No variation and no forgetting steps. It also logs everything automatically, so when auditors arrive asking questions, you’ve got complete records ready rather than scrambling through files trying to reconstruct what happened three months ago.

3. Seamless Client Experience

Clients expect quick responses now—not paperwork that takes a week or updates that arrive eventually. With RPA-powered chatbots, clients can receive instant responses to their questions 24/7 and complete onboarding in days rather than weeks. Reports generate instantly when clients request them. Questions get answered same-day rather than “we’ll follow up next week.”

This creates noticeably smoother experiences. Clients see their requests handled promptly, rather than sitting in queues, wondering what’s taking so long. That builds trust through consistent, reliable service over time.

4. Scalability Without Growing Headcount

Your firm grows. Transaction volume increases. Compliance requirements expand. The old approach meant hiring slowly and at disproportionately high cost when talent is scarce.

RPA-powered systems improve the speed and accuracy of regulatory filings, making the process more efficient. Bots process increasing volumes without burning out your existing team or requiring six months to recruit and train new analysts. You grow revenue without growing costs at the same rate. Margins stay healthy.

5. Empowered Workforce

AI doesn’t replace people—it stops wasting their time on work that computers should handle. Remove data entry and form processing, and your team can focus on analysis, problem-solving, and client strategy—work that requires actual expertise and judgment.

Productivity increases measurably. Morale improves substantially, too, because people see their skills used for things that matter rather than being stuck entering numbers into systems for 8 hours a day.

6. Future-Ready Operations

Wealth management depends on trust and accuracy. You need to adapt as regulations shift and technology changes. RPA creates operational foundations flexible enough to integrate new systems, handle updated compliance rules, and work alongside AI tools getting deployed across the industry.

Firms that have automated basic operations can adopt new capabilities faster than competitors still running manual workflows. That agility matters more each year as industry changes accelerate.

Implementation Considerations & Challenges of RPA in Wealth Management

Adopting RPA in wealth management looks straightforward on paper: deploy some bots, automate workflows, and watch efficiency improve. Reality is messier. Real transformation requires planning, collaboration, and a clear understanding of both your data infrastructure and your people. Here are the biggest challenges firms face when implementing robotic process automation, along with practical ways to address them.

1. Data Fragmentation and Integration Hurdles

A smooth RPA implementation hinges on the quality of your data. Wealth management platforms typically run on legacy systems that don’t communicate with each other. Client data lives in CRMs. Compliance records sit in shared drives. Transaction logs exist in back-office software. RPA development services can help clean, standardize, and organize data, but integrating data from multiple ERPs or CRM systems into a unified RPA platform is often a major hurdle.

Start with data cleanup—standardize fields, eliminate duplicates, ensure consistent formats across systems before deploying any bots. Trying to automate messy data just automates the mess faster.

2. Resistance to Change

The adoption of RPA by wealth management firms can trigger employee resistance, as employees fear automation will replace their jobs. People wonder quietly: “Does this replace me?” or “Do I need to learn coding now?” Successful RPA adoption depends on transparency from the beginning.

Communicate early about what bots will handle and what stays with humans. Involve employees in designing the automated processes. When people see automation supporting their work rather than threatening their jobs, adoption becomes easier and resistance drops substantially.

3. Process Standardization

RPA for wealth management firms works best with predictable processes. If your team handles the same task five different ways, automation replicates that inconsistency at a higher speed, which is not helpful.

Before automating anything, map out how each workflow should ideally function. Standardize steps. Define who owns what and identify exceptions. This upfront work prevents months of problems later when bots behave unpredictably because nobody standardized the underlying processes first.

4. Security and Compliance Risks

RPA operates in heavily regulated financial environments where small mistakes invite regulatory scrutiny. Firms need strict governance around bot access, data handling, and audit logging.

Every bot action should be traceable. Compliance teams need full visibility into what bots are doing. This isn’t about slowing innovation—it’s about building automation that can withstand audits.

5. Scaling Beyond the Pilot Phase

Many wealth firms launch small pilots—automating client onboarding or trade reconciliation—then struggle to expand beyond that initial success. The problem usually comes down to ownership. Without clear leadership and ROI tracking, pilots stay pilots indefinitely.

Building an RPA center of excellence or cross-functional team helps track performance, refine use cases based on results, and scale proven successes across other departments systematically.

6. Balancing Human and Digital Workflows

RPA’s goal isn’t full automation—it’s smart coordination between humans and machines. Define clearly which tasks remain human-led: financial advising, relationship management, and compliance oversight that require judgment. Identify what bots can handle autonomously: data entry, routine calculations, document processing.

This balance creates synergy instead of friction. Technology enhances human expertise rather than trying to replace it entirely, which never works well in relationship-driven businesses like wealth management anyway.

Steps to Automate Wealth Management Operations

Implementing RPA in wealth management doesn’t mean flipping a switch and automating everything overnight. You build momentum gradually—one process, one workflow, one small win at a time. Here’s how firms actually do this:

1. Identify High-Value, Repetitive Processes

Start small and concrete. Find tasks that are eating up the most staff time but require minimal judgment, client onboarding forms, compliance documentation, and trade reconciliation.

These make perfect pilot projects. Early wins show teams immediate results and build confidence fast. Nothing convinces skeptical operations managers better than watching a bot finish in twenty minutes what previously took their team three hours manually.

2. Build a Strong Data and Process Foundation

Automation works only as well as the data you feed it. Before deploying bots anywhere, ensure your data is accurate, up to date, and consistently formatted across all systems.

Standardize workflows first—really standardize them, not just document what people claim they do. Map every step clearly. This groundwork prevents RPA bots from processing garbage data and causing downstream problems and expenses.

3. Choose the Right RPA Tools and Partners

No single solution works for everyone. Evaluate platforms based on how they integrate with your existing systems, whether they’ll scale as you grow, how they handle financial data security, and what regulatory compliance support they provide.

Most firms partner with experienced RPA implementation teams rather than build everything internally from scratch. External expertise makes deployment smoother and provides ongoing maintenance support when things break.

4. Train Your People

Even sophisticated bots can’t replace human judgment and experience. Your advisors, analysts, and operations staff need to understand working alongside automation, not just watching it run.

Run hands-on training sessions. Let people experiment with the system in test environments where mistakes don’t matter. This builds comfort, generates curiosity, and fosters ownership rather than the resistance you get when you just drop new tools on people’s desks.

5. Start Small, Scale Smart

Implementing RPA for wealth management firms should be done gradually. Don’t attempt to automate 10 processes simultaneously. Launch one pilot with clear KPIs—time saved per transaction, manual error reduction, faster client response times, whatever matters most operationally.

Use that actual performance data to refine your approach before expanding anywhere else. Scaling isn’t about moving fast. It’s about proving consistent, measurable value before committing serious resources to a wider rollout.

6. Measure, Optimize, and Evolve

RPA isn’t “install once and forget” technology. Track performance metrics constantly. Collect feedback from teams actually using these systems daily. Find new processes where automation adds genuine value.

Continuous improvement keeps your automation investment growing in value rather than becoming outdated infrastructure that everyone works around because nobody wants the headache of updating it. This helps ensure that automated wealth management operations remain compliant, reducing risks associated with automation errors or regulatory violations.

Start small, scale smart. Appinventiv helps you identify key processes for RPA deployment and ensures a smooth integration.

Where RPA Meets Intelligent Automation

Wealth management is entering an era where automation no longer just “does tasks.” It thinks ahead, learns from experience, and collaborates with humans. The next wave of innovation will blend robotic process automation (RPA), artificial intelligence (AI), and predictive analytics into a single intelligent ecosystem, where every process continually improves.

1. The Rise of Intelligent Automation

Traditional RPA is evolving fast. What started as simple task bots handling data entry or reconciliation is now becoming intelligent automation, where AI adds reasoning and adaptability. Instead of following rigid rules, these systems recognize patterns, anticipate client needs, and make recommendations. Wealth firms are already using them to detect anomalies, monitor transactions in real time, and make compliance smoother — without extra human strain.

2. Generative AI Becomes the New Assistant

Generative AI is quietly transforming the back office. It’s drafting investor summaries, rewriting compliance updates, and generating customized client communications in minutes — not hours. Combine that with wealth management business process automation, and you get systems that don’t just automate routine work but actually create value: saving time, maintaining consistency, and improving personalization across portfolios.

3. Agentic Bots: The Future Co-Advisors

The future belongs to agentic AI — self-learning bots capable of acting independently within predefined boundaries. Imagine a digital co-advisor that monitors markets, simulates outcomes, and proactively suggests adjustments to client portfolios. It doesn’t replace your advisors; it gives them superpowers. These agentic bots will make wealth management not only faster but also smarter and more responsive to each client’s needs.

4. From Efficiency to Personalization

Automation’s biggest evolution will be personalization. Instead of every client getting a similar experience, intelligent systems will tailor insights, investment recommendations, and communication styles to each individual’s preferences. It’s not just about faster service — it’s about deeper relationships built through smarter, data-driven interactions.

5. Humans Still at the Center

Even as technology gets sharper, the real value in wealth management remains human judgment and trust. Automation is not replacing that — it’s amplifying it. By removing the noise of repetitive work, RPA allows advisors to do what no machine can: understand ambition, fear, and the human side of wealth. The firms that embrace this human-plus-machine model will set the standard for what “personalized wealth management” truly means in the years ahead.

How Appinventiv Helps Wealth Management Firms Build an RPA System?

At Appinventiv, we don’t treat automation as just another tech initiative; we see it as a complete shift in how financial institutions operate, adapt, and grow. Through our financial services technology consulting, we help wealth management firms move beyond manual tasks and into a world of precision, speed, and intelligence.

Our AI and RPA-powered wealth management solutions simplify what once felt impossible, automating KYC verification, streamlining risk assessment, and managing compliance workflows that used to take entire teams. These systems don’t just save time; they give your people the space to focus on clients, strategy, and growth.

You can see this in our AI in Banking case study, where we built a predictive risk and fraud detection platform that boosted decision accuracy by 45% and dramatically cut response times for a major financial enterprise. This same foundation underpins our RPA development services, where automation is designed around real financial workflows, not generic process scripts.

Every RPA solution we build comes with compliance, scalability, and transparency baked in, from GDPR and FINRA alignment to ISO 27001-certified data security. Whether you’re automating onboarding, scaling risk analytics, or creating predictive insights for advisors, our goal stays the same: to make your systems smarter and your operations more human.

Let’s turn your wealth management processes into an intelligent ecosystem that runs faster, cleaner, and more compliantly. Connect with Appinventiv’s automation experts to explore how we can build the next-generation RPA framework for your firm, one that blends efficiency, trust, and innovation in every workflow.

FAQs

Q. What exactly is RPA in wealth management, and how does it help?

A. Imagine all the tedious tasks your team deals with—whether it’s onboarding clients, checking documents, or going through long reports—automated in an instant. That’s what RPA (Robotic Process Automation) does for wealth management. It’s like having a digital assistant who handles all the repetitive, rule-based tasks, leaving your team free to focus on the more important stuff. Whether it’s KYC, AML checks, or trade reconciliations, RPA in wealth management processes ensures everything is done faster and with fewer errors.

Q. How does RPA make things easier for wealth management firms?

A. By cutting out the busywork. RPA for wealth management firms automates routine processes that traditionally took hours or even days. No more scrambling through paperwork or waiting for reports to be manually filled in. The result? Faster wealth management business process automation, more time for personalized client care, and a smoother, less stressful workflow for your team. It’s about letting the bots handle the small stuff so your people can focus on what matters most—your clients.

Q. What are the key benefits of using RPA in wealth management?

A. There are some pretty clear benefits of RPA in wealth management. First off, RPA solutions for wealth management help firms run more efficiently. Think faster client onboarding, more accurate compliance checks, and automated data processing that saves hours each week. All of this means less manual effort, fewer errors, and happier clients. Plus, with RPA for wealth management processes, you can scale without constantly adding headcount, making your operations leaner and smarter.

Q. Can you share some real-world examples of how RPA is being used?

A. Definitely! Take State Street Bank, for example. By automating their client onboarding and KYC/AML processes, they cut the time to get clients set up by almost half and even boosted their revenue. Then, there’s Nordea Bank, which rolled out bots to handle regulatory reporting, saving the company the equivalent of 1,500 full-time employee hours. These are just a couple of examples that show RPA in wealth management isn’t just a trend—it’s a game-changer for the industry.

Q. How does Appinventiv help wealth management firms with RPA?

A. At Appinventiv, we don’t just build technology for technology’s sake. We help wealth management firms adopt RPA development services that actually work for them. Whether it’s automating your KYC verification process, improving risk assessments, or streamlining client onboarding, we design RPA-powered wealth management solutions that fit your needs. Our solutions are not only built with compliance in mind but also ensure scalability and data security, so you can keep operations smooth, safe, and future-ready.

Q. What does RPA cost in wealth management, and is it worth it?

A. Implementing RPA in wealth management is an investment that typically pays for itself. Sure, there’s an initial setup cost, but think about all the time and money you’ll save once routine tasks are automated. From reducing human errors to freeing up your team for higher-value work, the ROI of RPA in wealth management is clear. It helps firms get more done without increasing headcount, which in turn leads to better margins and happier clients. It’s a long-term win for both your business and your clients.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…