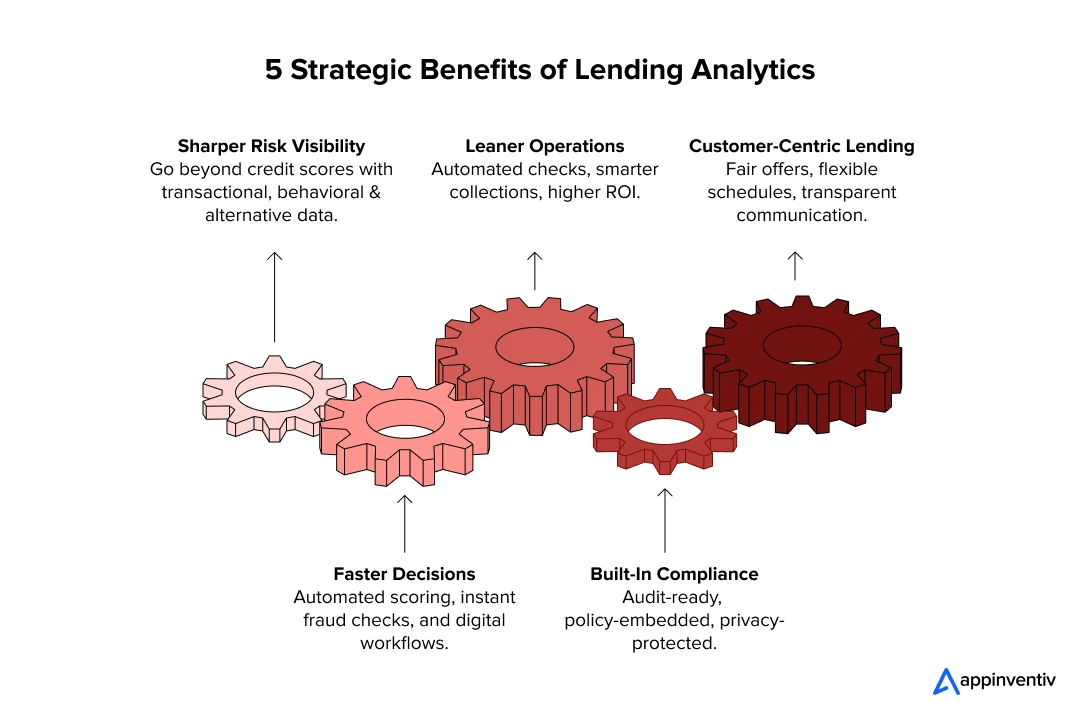

- The Strategic Benefits of Lending Analytics

- 1. Sharper Risk Visibility

- 2. Faster Decision Cycles

- 3. Leaner Operations and Higher ROI

- 4. Compliance Built In

- 5. Customer-Centric Lending

- Real-World Applications & Lending Analytics Use Cases

- Predictive Credit Scoring in Consumer Loans

- Mortgage & Auto Loans

- Loan Origination System (LOS) Optimization

- Fraud Detection & Prevention

- SME & Microfinance Lending

- Portfolio Stress Testing & Recovery Analytics

- Cross-Selling & Upselling Opportunities

- Sector-Specific Applications & Emerging Markets

- Features & System Design Principles of Lending Analytics Platforms

- Real-Time Data Pipelines

- Predictive and Prescriptive Models

- Integration with Existing Systems

- Compliance and Explainability

- Cloud-Enabled Scalability

- Portfolio Performance & Risk Forecasting

- Loan Pricing & Profitability Analytics

- Financial Analytics & Cash Flow Insights

- Fraud Analytics & Anomaly Detection

- Dashboards That Drive Action

- Monitoring and Governance

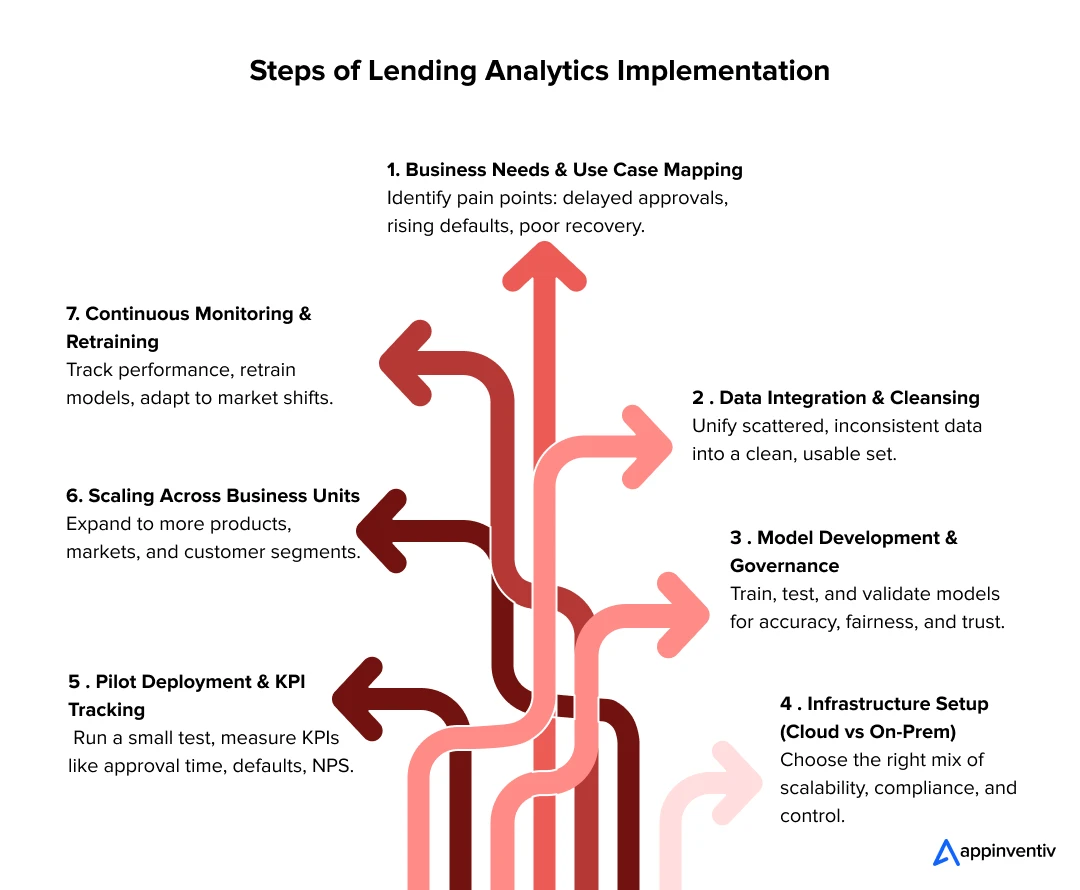

- Step of Lending Analytics Implementation

- Challenges & Limitations in Lending Analytics Adoption

- Regulatory and Compliance Complexity

- Data Quality and Access Issues

- Integration with Legacy Systems

- Talent and Skill Gaps

- Cultural and Organizational Resistance

- Model Bias, Drift, and Ethical Concerns

- High Initial Costs and ROI Delays

- Cost & ROI of Lending Analytics Software Development / Implementation

- Cost Drivers

- Cost Ranges

- ROI Levers

- Why Appinventiv is the Right Partner for Your Lending Analytics Needs

- FAQ

- Q. What is lending analytics and why is it important?

- Q. How much does it cost to implement lending analytics?

- Q. How does predictive analytics improve credit risk assessment?

- Q. How does a loan origination system benefit from predictive analytics?

- Q. What are the biggest roadblocks we should plan for?

- Q. Build vs buy: what is the pragmatic route for lending analytics?

Key Takeaways

- Benefits: Faster approvals, clearer risk visibility, less manual work, built-in compliance, and a better experience for borrowers.

- Use Cases: Credit scoring, fraud detection, SME and microfinance inclusion, mortgage monitoring, stress testing, and cross-sell opportunities.

- Features: Real-time data, predictive and prescriptive models, explainable decisions, cloud scalability, strong security, and reliable governance.

- Implementation Steps: Spot the pain points, clean and unify data, build and test models, set up infrastructure, run a pilot, scale it out, and keep monitoring.

- Challenges: Messy data, legacy systems, strict regulations, skill gaps, cultural resistance, and slow ROI.

- Costs & ROI: SMBs spend $40k–$250k, enterprises $400k–$600k+. Payback comes in 12–24 months through quicker approvals, fewer defaults, and stronger trust.

Every second counts in lending. Customers drop off when approvals drag, regulators demand tighter oversight, and defaults keep lenders on edge. How do you balance it all?

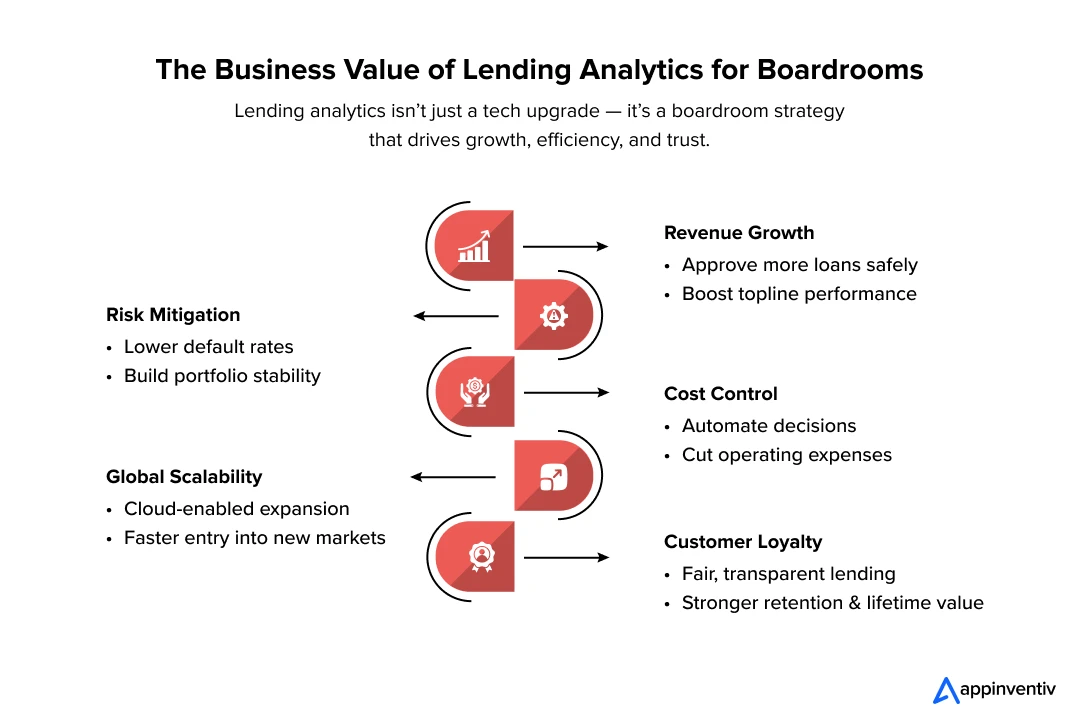

The lending market is evolving at breakneck speed. Rising customer expectations, tighter regulations, and digital-first competitors have pushed traditional lenders into a new reality where speed, accuracy, and compliance can’t be traded off against each other. Meeting these demands is no longer about scaling teams — it’s about scaling intelligence. That’s where Lending Analytics comes in, bringing predictive models, AI, and machine learning into the heart of loan origination, risk management, fraud detection, and customer engagement.

With predictive analytics in lending, institutions don’t stop at bureau scores. They can layer in signals like income flows, spending patterns, and behavioral data. Meanwhile, data analytics in loan management keeps loans under watch long after approval, ensuring performance and compliance over time.

For boardrooms, the impact is direct: faster decision cycles, fewer defaults, stronger customer confidence, and steady growth. In a world where speed and trust both matter, analytics based lending has become the foundation for building sustainable, competitive, and globally scalable lending businesses.

Banks modernizing their data and analytics platforms are cutting costs by up to 30% and speeding up decisions by nearly 30%

It’s not just efficiency – it’s a competitive edge in lending.

The Strategic Benefits of Lending Analytics

Every lender has the same pressure: expand the loan book without letting risk spiral out of control. That’s a tough balance even in stable times. Add digital-first competitors, rising customer expectations, and heavy regulatory scrutiny, and the challenge becomes even sharper. Lending analytics gives institutions a way to manage that balance by weaving intelligence into each stage of the lending cycle. Here’s where it moves the needle most:

1. Sharper Risk Visibility

A credit bureau score only tells part of the story. Analytics broadens that view by pulling from three main streams:

- Transactional data – how steady someone’s income is, how volatile their spending looks, whether they save consistently.

- Behavioral signals – repayment discipline, how often they miss deadlines, or if they’re constantly paying late fees.

- Alternative data – utility bills, mobile money records, online purchase history.

When all of this is connected, lenders can spot borrowers who look fine on paper but are actually risky, and they can also bring credit access to thin-file customers who deserve it. That combination lowers NPAs and improves the overall strength of the portfolio.

2. Faster Decision Cycles

In lending, time really is money. Borrowers don’t want to wait two weeks for an approval when another lender can say yes in ten minutes. Analytics helps by:

- Running automated scoring models that deliver risk profiles instantly.

- Carrying out real-time fraud checks before an approval is issued.

- Enabling fully digital workflows that take human bottlenecks out of the process.

That speed reduces drop-offs during applications, improves the borrowing experience, and cuts acquisition costs. For lenders, it’s a direct edge in a market where responsiveness often wins the customer.

3. Leaner Operations and Higher ROI

Manual underwriting and chasing repayments tie up resources. Analytics streamlines both.

- Document checks and verifications are automated.

- Predictive models highlight which overdue accounts are most likely to repay.

- Collections teams focus on those accounts first, instead of using static “days overdue” rules.

Lenders that have adopted predictive collections strategies report recovery rates jumping by 15–20%. Combine that with reduced manual effort and lower costs, and the return on every dollar of capital improves significantly.

4. Compliance Built In

Regulations aren’t easing up — they’re tightening. Whether it’s Basel III for capital, GDPR in Europe, RBI’s digital lending norms in India, or CFPB oversight in the US, every institution knows compliance is a moving target. Analytics platforms can reduce that burden by:

- Producing audit-ready reports as part of everyday operations.

- Embedding local and global policy rules into the approval flow.

- Protecting sensitive data with built-in privacy measures.

That means compliance stops being an afterthought. Instead, it becomes a core part of how the business runs, which lowers the risk of fines and builds credibility with both regulators and customers. Strong data analytics in loan management also ensures compliance reporting stays audit-ready across jurisdictions.

5. Customer-Centric Lending

Borrowers today expect fairness and transparency, not a black-box “yes” or “no.” Analytics helps lenders deliver on that by:

- Creating loan offers matched to individual profiles.

- Shaping repayment schedules around actual income cycles.

- Providing plain-language explanations for approvals and rejections.

The impact is more than just satisfaction scores. When customers feel understood and respected, they’re far more likely to return for their next loan, recommend the institution, and stay loyal over the long term.

Real-World Applications & Lending Analytics Use Cases

The shift from theory to practice is where lending analytics proves its worth. Across sectors, leading financial institutions are leveraging data analytics in FinTech to make smarter decisions, reduce losses, and improve customer outcomes. Below are several high-impact use cases with examples and authoritative backing.

Predictive Credit Scoring in Consumer Loans

Traditional credit scoring often fails to capture nuances like income volatility or changing behavior. Predictive credit scoring adds those dimensions, enabling lenders to uncover risk earlier and approve more safely. This is one of the strongest predictive analytics in lending applications.

- Example: A McKinsey & IACPM survey of over 40 global financial institutions found that more than 60% are increasing use of non-traditional data and advanced analytics in credit portfolio management. This leads to better default forecasting. McKinsey & Company

- Outcome: Lenders using these approaches report lower default rates and expanded approval to borrowers with thin credit histories, improving financial inclusion.

Also Read: Predictive Analytics Software Development Guide

Mortgage & Auto Loans

Auto lending is another space where analytics can completely change outcomes. The right insights can show lenders exactly which customers are ready for refinancing — and which ones might slip away if not engaged in time.

- Example: Lanier Federal Credit Union (USA) — Partnering with SavvyMoney, Lanier FCU used credit data and share-of-wallet analytics to spot members who were paying higher rates elsewhere. Instead of sending generic offers, they launched a targeted refinancing campaign designed around these insights.

- Outcome: The campaign drove record-breaking auto loan growth, with 85% of new loans tied directly to the analytics-led strategy. For Lanier, it wasn’t just about adding volume — it built stronger relationships with members by offering timely, relevant financial solutions.

Loan Origination System (LOS) Optimization

Speed and accuracy in loan origination are vital. Integrating analytics into LOS helps reduce delays, improve fraud detection, and optimize decisions immediately as applications come in.

- Example: McKinsey’s work on AI-powered decision making for banks of the future notes that institutions adopting more sophisticated screening and early detection of risk behaviors (before full application processed) can significantly reduce defaults and costs.

- Outcome: Loans get approved more quickly (often moving from days to hours), underwriting workload drops, and applicant drop-off (due to waiting times) is reduced. Such efficiency is tied to lending analytics platform development.

Fraud Detection & Prevention

Digital lending exposes lenders to fraud from submitted documents, identity impersonation, and inconsistent data. Analytics helps detect suspicious patterns early. As explored in our “AI in Banking: Real Use Cases” blog, institutions are using AI to strengthen trust in Lending analytics software development outputs.

- Example: In “The Changing Landscape of Regulatory Stress Testing” by Deloitte, the discussion includes how banks are better using scenario analysis and advanced monitoring to identify stress and risk in portfolios — which is closely related to detecting fraud and anomalous behavior in loan volumes.

- Outcome: Losses from fraudulent applications decline, trust in digital channels increases, and risk exposure is reduced.

SME & Microfinance Lending

In many emerging markets, borrowers don’t have thick credit files or traditional records, which often shuts them out of formal lending. This is where lending data and analytics, fueled by alternative data, can make a real difference.

- Example: 4G Capital — Instead of relying on collateral, 4G Capital built a system that blends behavioral data with transaction history to underwrite micro and SME loans. Their analytics-driven approach means even small entrepreneurs, like shopkeepers and farmers, can get access to working capital that would have been impossible under traditional scoring.

- Outcome: This model has helped 4G Capital maintain repayment rates close to 94%, while also empowering thousands of small businesses to grow and sustain themselves. It shows how analytics can deliver both profitability and inclusion.

Portfolio Stress Testing & Recovery Analytics

Lenders don’t just need to react to stress — they need to anticipate it. Analytics is used to simulate adverse economic conditions to evaluate what could happen to loan portfolios under stress.

- Example: Deloitte’s Banking & Capital Markets Regulatory Trends covers how the latest stress tests (e.g. DFAST in the US) result in projected losses in harsh scenarios — for example, in 2024, 31 large US banks were tested under a hypothetical severe downturn, projecting combined losses of ~$685 billion, yet still surviving above capital minimums. Reuters

- Recovery Analytics: Also, banks are using predictive scoring to prioritize risk-based collections strategies rather than fixed age-bands of delinquency. For example, McKinsey notes “collections workflows becoming dynamic and rules-based, guided by predictive scores instead of static age-of-debt criteria.”

- Outcome: Reduced provisioning costs, better capital planning, lower loss rates, more resilient portfolios under stress.

Cross-Selling & Upselling Opportunities

Analytics not only helps mitigate risk but also uncovers revenue opportunities. By analyzing customer behavior and repayment patterns, lenders can intelligently offer additional financial products.

- Example: Although specific case studies are less common in the public domain, McKinsey’s research on credit portfolio management suggests that institutions which use analytics for customer behavior insights (beyond just risk) can improve cross-sell and upsell metrics.

- Outcome: Builds customer loyalty, increases lifetime value (LTV), improves product adoption and more diversified revenue streams.

Sector-Specific Applications & Emerging Markets

- In Emerging Markets, where credit bureau coverage is weak, using alternative data like mobile usage, utility payments, or digital wallet transactions helps build risk profiles and extend credit safely.

- In Commercial Lending, analytics allows examination of supply chains, industry risks, and macroeconomic factors to better price risk and anticipate downturns.

- Authoritative source: The McKinsey & IACPM survey shows global firms increasingly integrating non-traditional risk factors (ESG, supply-chain risks, climate risks) into portfolio management.

Features & System Design Principles of Lending Analytics Platforms

When people talk about lending analytics platforms, the focus usually goes straight to the dashboard: colorful charts, loan performance metrics, maybe a default heat map. But the real story lies under the hood. The effectiveness of any platform depends on the features it carries and the way it is designed to fit into a lender’s world. In practice, this comes down to a few non-negotiables features of lending analytics platforms.

Real-Time Data Pipelines

Real-time data is central when building lending analytics software. Lending decisions don’t have the luxury of time. Customers applying for a personal loan aren’t going to wait three days for a “manual review.” If one bank says yes in minutes, the other loses that customer.

That is why real-time data flow is critical, often powered by real-time cloud data analytics that can scale across high-volume lending operations. Apart from that modern lending platforms stream data from credit bureaus, bank statements, payment gateways, even non-traditional sources like utility bills or mobile wallets. Some of that arrives in daily batches, but much of it needs to be instant. Fraud checks, for example, cannot wait.

The principle is speed with accuracy. A good platform balances both, delivering decisions quickly without cutting corners.

Predictive and Prescriptive Models

Analytics in lending is more than number crunching. It is about anticipating outcomes and suggesting what to do next.

- Predictive models answer the question: what is the likelihood this borrower will default or prepay?

- Prescriptive models push further: given this risk, what should the bank actually do? Approve at a lower amount? Change repayment terms? Flag for manual review?

This combination allows lenders to go beyond “approve or reject.” With these capabilities, lenders can personalize credit terms such as interest rates, limits, and repayment schedules to borrower segments rather than applying a single policy for everyone.

Integration with Existing Systems

This is where many projects stumble. A brilliant analytics tool is useless if it cannot connect to the systems banks already run: loan origination, core banking, compliance, and collections.

Most banks don’t have the luxury of replacing their entire tech stack. So a good platform needs strong APIs, middleware, and connectors that let it plug into existing workflows. Without this, analytics becomes an isolated tool that never scales beyond a pilot project, making integrating lending analytics solutions into legacy systems a top priority for lenders.

Compliance and Explainability

Lending is heavily regulated, and regulators are asking harder questions. Why was this loan rejected? What data was used? Is the decision fair?

That’s where AI explainability comes in. It is no longer acceptable to say “the model decided.” Platforms must translate decisions into plain language: “Loan declined due to high debt-to-income ratio and irregular repayment history.” This is now a non-negotiable in lending analytics software development.

On top of that, compliance rules (GDPR, RBI mandates, CFPB guidelines) need to be built into the workflow. A mature platform ensures meeting lending analytics regulatory compliance automatically, not as an afterthought.

Cloud-Enabled Scalability

Loan demand isn’t steady. It spikes during festivals, shopping seasons, or even unexpected market shifts. On-premise infrastructure struggles to keep up with these waves.

Cloud-enabled systems solve this with elastic capacity. Banks can scale up resources when volumes surge and scale down when things quiet down. Many use a hybrid approach, keeping sensitive data in private servers but leaning on the cloud for heavy lifting.

The goal is flexibility, scaling without losing control of compliance and security. And elastic scaling is a hallmark of lending analytics platform development

Portfolio Performance & Risk Forecasting

A loan book is never still. Markets shift, interest rates rise or fall, and entire sectors can slow down overnight. Leaders cannot rely only on what happened last quarter; they need a forward view.

That is where risk forecasting comes in. Metrics like Probability of Default (PD), Loss Given Default (LGD), and Exposure at Default (EAD) show how much is actually at stake if things go wrong. Scenario modeling adds another layer, letting lenders test “what if” events such as a rate hike, a sudden slowdown in a key industry, or unexpected credit stress.

It is not about predicting the future perfectly. It is about being ready. With these tools, banks can set aside the right reserves, rethink exposure early, and keep the balance sheet steady even when the market turns.

Loan Pricing & Profitability Analytics

Pricing loans used to be static and slow. Now, conditions change too quickly for that.

Modern platforms let lenders run quick “what if” checks: what happens to margins if risk goes up, repayments slow down, or market rates shift? Instead of fixed tables, pricing can move with reality.

The payoff is better balance. Lenders can stay competitive to win good borrowers while keeping profit targets in sight, even when the environment is volatile.

Financial Analytics & Cash Flow Insights

Healthy lending is not only about risk. It is also about knowing where the money flows and how it sustains growth.

Cash flow models help forecast payments coming in and out under different scenarios. Banks can see which products, regions, or customer groups actually generate profit. For global players, multi-currency tracking helps avoid surprises.

The outcome is control. With clear visibility on revenue and liquidity, leaders can plan capital better, fund growth safely, and stay ready for market shifts.

Fraud Analytics & Anomaly Detection

Fraud is a moving target. Tactics evolve and manual checks alone cannot catch them fast enough.

AI-driven analytics look for subtle warning signs such as odd spending behavior, mismatched details, and unusual repayment activity and flag them as soon as they appear. Alerts go straight to the right teams before losses build up.

That speed is what protects both the lender and the borrower’s trust.

Dashboards That Drive Action

Data is not useful if it is hard to read.

Good dashboards make the important things obvious: early warning signs, non-performing asset (NPA) patterns, risk pockets, pricing impact, and collection priorities. They give a crisp snapshot instead of a wall of charts.

The idea is simple. Decision-makers should not need a data scientist sitting next to them to act on what they see.

Monitoring and Governance

Models are not “set and forget.” Borrower behavior changes, economic conditions shift, and regulations evolve. Over time, even the best model drifts.

That is why governance features matter: version control, audit trails, performance monitoring, bias detection. Lenders need to know which model was live at any given time, who approved it, and how accurate it was.

Without this, compliance audits become nightmares, and trust in the system erodes.

Step of Lending Analytics Implementation

Implementing lending analytics isn’t a plug-and-play task. It’s a journey that moves from asking the right business questions to building models, scaling them, and keeping them sharp over time. Each step builds the foundation for the next, ensuring analytics delivers real business impact.

1. Business Needs & Use Case Mapping – The first step is about asking the right questions. Where are the cracks showing — delayed approvals, rising defaults, poor recovery? Pinpointing these gaps sets the direction for building a solution that actually solves real problems.

1. Business Needs & Use Case Mapping – The first step is about asking the right questions. Where are the cracks showing — delayed approvals, rising defaults, poor recovery? Pinpointing these gaps sets the direction for building a solution that actually solves real problems.

2. Data Integration & Cleansing – This is usually the hardest lift. Data isn’t just scattered across silos, it’s often inconsistent and incomplete. Bringing it together, cleaning it up, and making it usable is what lays the groundwork for every model that follows.

3. Model Development & Governance – With clean data in place, you can start building. Models are trained, tested, and stress-checked — not just for accuracy, but also for fairness and explainability. A model no one can trust is as bad as no model at all.

4. Infrastructure Setup (Cloud vs On-Prem) – Where the system runs matters. Cloud gives speed and scalability, on-premises offers more control. Most lenders settle somewhere in between, balancing compliance with flexibility.

5. Pilot Deployment & KPI Tracking – Instead of jumping in headfirst, the smarter move is to start small. Run a pilot with a limited portfolio, measure things like approval time, default rates, and NPS, and see what sticks before scaling.

6. Scaling Across Business Units – Once the proof is there, it’s time to widen the net. Extend the platform across products, geographies, and customer types — making sure the learnings from the pilot guide the rollout.

7. Continuous Monitoring & Retraining – Models aren’t “set and forget.” Borrower behavior shifts, markets change, and regulations evolve. Ongoing monitoring and retraining keeps the system sharp and relevant.

The top financial institutions are already using analytics to outsmart competitors. Talk to our specialists to gain competitive edge with the same powerful tools.

Challenges & Limitations in Lending Analytics Adoption

On paper, lending analytics looks like a silver bullet. Faster approvals, sharper risk controls, better compliance. In reality, adoption is messier. Banks and fintechs find themselves slowed down not just by technology gaps, but also by regulation, people, and culture. Here are the hurdles that come up most often.

Regulatory and Compliance Complexity

Finance is one of the most regulated industries, and lending is right at the center of it.

- In Europe, GDPR already forces lenders to explain how they use customer data. The EU’s AI Act now goes further, classifying credit scoring as “high risk.” That means banks will need to justify every decision made by a model.

- In the United States, the Equal Credit Opportunity Act and CFPB rules demand proof that decisions are fair. Remember the Apple Card case in 2019? Women reported getting smaller credit lines than men with similar profiles. Regulators asked tough questions, and the lack of model transparency put Apple and Goldman Sachs on the defensive.

- In India, the RBI has tightened digital lending rules. Lenders now need explicit borrower consent and clear disclosures baked into their systems.

What this means: Analytics can’t just be accurate; it has to be explainable. Black-box models may work in the lab, but in production they create regulatory and reputational risk.

Data Quality and Access Issues

Analytics depends on data, but financial institutions rarely have clean, unified datasets.

- At one US retail bank, five different systems managed customer data: onboarding, servicing, fraud checks, collections, and compliance. Each held slightly different records, so credit scoring often contradicted itself. Deloitte notes that more than 60 percent of banks cite this type of fragmentation as their top barrier.

- In emerging markets, the problem is different. Credit bureau coverage is thin, so lenders turn to mobile wallet history, utility bills, and other alternative sources. These datasets help extend credit to underserved groups, but they are inconsistent and difficult to standardize.

What this means: Before analytics can deliver value, lenders end up spending months (and most of the budget) just cleaning and connecting data. It is the unglamorous part of the work, but unavoidable.

Integration with Legacy Systems

Even when the data is ready, old systems slow everything down. Many banks still rely on decades-old mainframes.

- A European bank spent more than a year trying to connect its core platform to a modern analytics tool. Because the old system had no APIs, the project required expensive custom middleware. In the end, integration cost more than the analytics solution itself.

- McKinsey points out that some banks spend nearly 40 percent of their analytics budget just on integration with legacy infrastructure.

What this means: Unless lenders modernize their core systems or adopt a phased approach with APIs and middleware, analytics will remain siloed instead of enterprise-wide.

Talent and Skill Gaps

Advanced analytics needs people who understand both machine learning and the realities of banking. That combination is rare.

- A US credit union outsourced its credit scoring model to a vendor. When the contract ended, the in-house team couldn’t maintain or retrain the system. Accuracy fell, and defaults crept up.

- In Asia, a large bank hired data scientists with impressive technical backgrounds, but they lacked knowledge of Basel norms or lending rules. Risk officers didn’t trust the outputs, creating constant friction.

- Gartner predicts that nearly half of AI projects in financial services will stall in the next few years because of this skills gap. The shortage of hybrid teams is one reason why machine learning in banking talent gap remains a persistent barrier for institutions adopting lending analytics.

What this means: Lenders need hybrid teams, data scientists who can speak risk, and risk experts who can work with AI. That usually requires retraining, cross-functional teams, and in many cases outside partners often help with tailored lending analytics solution development.

Cultural and Organizational Resistance

Numbers aren’t the only issue. People can be skeptical, even hostile, toward machine-driven decisions.

- A North American lender introduced an AI system that cut loan approval times by 70 percent. Underwriters kept overriding its recommendations, preferring their own judgment.

- A European insurer tried predictive scoring in collections. The collectors ignored it and stuck to “gut feel” until leadership tied adoption to incentives and retrained staff.

- McKinsey research consistently shows cultural pushback as one of the top three reasons AI projects in banks fail.

What this means: Analytics adoption is a change management exercise as much as a tech rollout. Staff need to be involved early, trained thoroughly, and shown that AI is there to support, not replace, them.

Model Bias, Drift, and Ethical Concerns

AI models aren’t neutral. If trained on biased data, they reproduce that bias. And even fair models drift over time.

- Bias: The Apple Card case is a prime example. If women and men with the same profile receive different credit limits, regulators and customers will push back hard.

- Drift: During COVID-19, models trained on pre-pandemic data broke quickly. Borrowers who looked safe suddenly defaulted, while others prioritized repaying loans over other bills. Models had to be retrained almost overnight.

- Ethics: In some developing markets, lenders experiment with using social media data for credit scoring. Should a person’s Facebook posts or WhatsApp activity determine their ability to borrow? Many argue this crosses a line.

What this means: Bias detection, fairness checks, and retraining can’t be one-off exercises. They must be part of ongoing governance, or the risks—legal, financial, and reputational—pile up quickly.

High Initial Costs and ROI Delays

Finally, there is the issue of cost.

- A multinational bank spent $25 million on a lending analytics rollout. Year one was dominated by data cleaning and integration, with little visible ROI. Executives started questioning the spend, though results improved in year two.

- Accenture notes that the hidden costs of compliance and integration often exceed the price of the analytics software itself.

- Smaller lenders face even more risk. A Canadian credit union built a predictive collections tool, but without staff to maintain it, the model drifted and the project was abandoned in less than two years.

What this means: ROI takes time. For most institutions, the real benefits show up only after 12 to 24 months. Leaders need to set clear expectations upfront to avoid disillusionment. Costs are especially high in lending analytics software development.

Cost & ROI of Lending Analytics Software Development / Implementation

The first thing executives ask when lending analytics comes up is simple: what will it cost, and when do we see results? There’s no one-size-fits-all answer. Costs swing depending on how complex the data environment is, whether the institution leans on cloud or on-premise systems, and how much custom modeling is required. But in practice, most projects end up spending on the same five areas.

Cost Drivers

- Data integration & cleansing: This is usually where the biggest surprise comes in. Banks often realize their data isn’t just messy, it’s spread across onboarding, servicing, collections, and compliance silos. Pulling it together and making it usable eats up a chunk of the budget before any model can run.

- Model complexity & retraining: A simple scoring tool won’t cut it for enterprise lending. Sophisticated models demand more effort upfront and, more importantly, constant retraining. Borrower behavior shifts with the economy, and if models aren’t updated, accuracy falls apart.

- Compliance modules: Regulations don’t care how sleek the tech is. Embedding audit trails, explainability, and fairness checks is non-negotiable if you want regulators on your side. It adds cost, but it’s cheaper than fines or public backlash later.

- Infrastructure choices: Cloud looks lighter at the start — faster to deploy, scalable as volumes grow. On-premise requires heavier upfront spend but sometimes is unavoidable for institutions with strict data-residency rules. Most end up with a hybrid mix.

- Skilled talent: Even the best software won’t run itself. Data scientists, risk officers, compliance experts — without them, the platform becomes shelfware. Talent is often the hidden cost that drags budgets upward.

Cost Ranges

- SMBs: Implementations tend to land in the $40k–$250k range. These are usually cloud-based, leaner setups with lighter compliance requirements.

- Enterprises: Large-scale rollouts start around $400k–$600k+. That figure climbs quickly if multiple legacy systems need integration, or if custom-built models and advanced compliance modules are required. Global banks with strict governance can easily spend beyond this band.

ROI Levers

So what do institutions get back for that investment? The returns typically show up in three main areas:

- Faster approvals: Automating credit checks and fraud detection shortens decision cycles dramatically. Customers stop dropping out mid-process, and loan volumes rise — often by 20–40%.

- Reduced defaults: Predictive models catch risks bureau scores miss, trimming losses by 25–30%. That’s not theory; it’s based on how global banks have applied alternative data to flag risky borrowers before defaults spike.

- Improved customer experience: A borrower who gets a quick decision and clear reasoning is far more likely to trust the institution. That translates into higher satisfaction scores, repeat borrowing, and stronger cross-sell opportunities.

| Feature | Legacy Lending (Manual/Rule-Based) | Analytics-Driven Lending | Business Impact |

|---|---|---|---|

| Approval Time | Days to Weeks | Minutes to Hours | 30% faster decisions, lower customer drop-off |

| Risk Assessment | Static Credit Scores | Dynamic, multi-source data models | 25-30% reduction in defaults |

| Decision Logic | Subjective “Gut Feel” / Rigid Rules | Explainable, data-driven recommendations | Audit-ready, reduced bias |

| Operational Cost | High (manual underwriting) | Low (automated workflows) | Up to 30% reduction in operational costs |

| Customer Exp. | Opaque, slow, impersonal | Transparent, fast, personalized | Higher NPS and customer lifetime value |

Why Appinventiv is the Right Partner for Your Lending Analytics Needs

Rolling out lending analytics isn’t just about picking the right tech stack. It’s about choosing a lending software development company that understands how banks actually work, the messy data, the strict regulations, and the pressure to show results quickly. That’s where Appinventiv has built its edge.

Take our work with a lending fintech platform that was struggling with fraud. Every spike in fake transactions slowed growth. We built an AI-driven module using tokenization and anomaly detection that cut fraud by almost 40%. Just as important, the platform could finally scale cross-border without regulators breathing down its neck. And this is just one example of effective lending analytics platform development.

In another case, a European bank asked us to dig into its home loan portfolio. On paper, everything looked fine, but churn was creeping up. By applying predictive analytics, we gave the bank early warning on which borrowers were most likely to refinance elsewhere. With that visibility, they stepped in early and retained nearly 20% more customers.

These aren’t one-off wins. They show how we approach every project:

- Build for scale, not just pilots. A proof-of-concept is easy; making it work across markets is harder. That’s why tailored lending analytics solution development matters.

- Move fast with cloud-first designs. Integration headaches don’t have to slow you down.

- Bake in compliance from the start. GDPR, RBI, Basel III, CFPB — we’ve seen how costly it is to bolt compliance on later.

- Support adoption, not just deployment. Training underwriters and compliance teams is as important as writing the code.

For lenders, analytics isn’t a “nice to have” anymore — it’s how you lend responsibly in a tougher, faster market. As a leading lending software development company, Appinventiv helps you make this transition seamlessly while keeping risk, regulation, and results in clear focus.

Ready to build smarter lending analytics systems? Leverage our data analytics services to speed up approvals, cut risk, and stay compliant..

Work with our BFSI experts to build secure, compliant, and scalable lending analytics platforms that cut risk, speed up approvals, and improve customer trust.

FAQ

Q. What is lending analytics and why is it important?

A. Lending analytics is the use of predictive models, AI and ML to guide credit decisions from the first application through servicing, collections, and portfolio management. Why it matters: bureau scores only tell part of the story. With analytics, you see real cashflow patterns, behavior over time, and early risk signals. The result is quicker, clearer decisions, fewer surprises in the loan book, and audits that go smoothly. For leaders, that translates into lower NPAs, higher approval rates for the right customers, and decisions you can defend to regulators.

Q. How much does it cost to implement lending analytics?

A. It depends on how clean your data is, how ambitious your models are, and how many systems you need to integrate.

- SMBs: roughly $40k–$250k for a lean, cloud-first rollout with lighter compliance needs

- Enterprises: $400k–$600k+ when you add legacy integrations, custom models, and hybrid infrastructure

Most of the spend lands in data integration and cleanup, compliance features like explainability and audit trails, infrastructure, and talent. Expect year one to focus on plumbing and pilots. Real ROI typically starts to show in months 12–24 once the models are live and teams are using them.

Q. How does predictive analytics improve credit risk assessment?

A. It looks beyond a static bureau score and brings in what actually drives risk: cash-in, cash-out, spending volatility, repayment habits, late fees, and where allowed, alternative signals like utilities or mobile wallet data. This lets you spot trouble earlier and also find solid borrowers who are thin-file on paper. In practice you get cleaner risk tiers, fewer false declines and approvals, and pricing that matches real risk. That means fewer charge-offs without putting the brakes on growth.

Q. How does a loan origination system benefit from predictive analytics?

A. Analytics turns LOS into a smart decision engine.

- Speed: instant scoring plus KYC, AML, and fraud checks cut cycle time from days to minutes

- Quality: edge cases go to underwriters, straightforward files go straight through

- Consistency: rules and explainable models reduce judgment drift across teams

The payoff is less abandonment, higher straight-through processing, better unit economics on acquisition, and fewer approvals you regret later.

Q. What are the biggest roadblocks we should plan for?

A. There are five challenges that can hinder your plan. You should anticipate:

- Data that is messy and scattered across systems

- Legacy platforms with few or no APIs

- Compliance and explainability needs that rule out black-box models

- Talent gaps across data science, risk, and governance

- Adoption pushback from underwriters and collectors

Plan for them upfront with a data roadmap, phased integrations, explainable AI and governance, blended teams, and a change-management plan that includes training and incentives.

Q. Build vs buy: what is the pragmatic route for lending analytics?

A. Buy when speed and proven integrations matter. Customize the parts that reflect your policy and risk appetite.

Build when you need proprietary models, unusual data sources, or complex multi-market compliance baked in.

Most lenders do a hybrid, they adopt a modular platform to move quickly, then co-develop custom scoring and policy logic so your edge stays yours. This keeps time-to-value short without giving up differentiation.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How to Hire Data Engineers for Your Enterprise? All You Need to Know

Key takeaways: Hiring data engineers individually slows execution and increases delivery risk at enterprise scale. Partnerships give faster access to senior talent without long recruitment cycles or retention issues. Cost depends more on capability and responsibility than salary alone. The right hiring model directly affects business speed, stability, and ROI. Partnering with experienced teams converts…

How Data Analytics is Shaping the Future of UK Businesses Across Sectors

Key Takeaways Data has moved from support to strategy. UK companies no longer treat analytics as an add-on; it’s shaping how they forecast demand, design products, and compete for customers. Every sector is finding its own rhythm. From retail and healthcare to energy and education, organizations are using data differently, but the goal is the…

Is Your Business Model Compliant with the EU Data Act? A Checklist for C-Suite Executives

Data has quietly become the backbone of modern business. Whether it’s a retailer predicting what you’ll buy next week or a car maker tracking vehicle performance in real time, every decision today leans on streams of information. But with that power comes a tough question: who really owns the data, and who gets to use…